Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Golden Minerals Co | aumn-20201231ex3212f42c9.htm |

| EX-31.2 - EX-31.2 - Golden Minerals Co | aumn-20201231ex31258d804.htm |

| EX-31.1 - EX-31.1 - Golden Minerals Co | aumn-20201231ex3111c4096.htm |

| EX-23.3 - EX-23.3 - Golden Minerals Co | aumn-20201231ex2336b17fc.htm |

| EX-23.2 - EX-23.2 - Golden Minerals Co | aumn-20201231ex232ef6bd5.htm |

| EX-23.1 - EX-23.1 - Golden Minerals Co | aumn-20201231ex231010229.htm |

| EX-21.1 - EX-21.1 - Golden Minerals Co | aumn-20201231ex211a00b6c.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

⌧ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

◻ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13627

GOLDEN MINERALS COMPANY

(Exact Name of Registrant as Specified in its Charter)

DELAWARE |

| 26-4413382 |

(State of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

350 Indiana Street, Suite 650 | | |

Golden, Colorado | | 80401 |

(Address of principal executive offices) | | (Zip Code) |

(303) 839-5060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, $0.01 par value | AUMN | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ⌧

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻ No ⌧

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non accelerated filer ☒ Smaller reporting company ☒ Emerging growth company ◻ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by checkmark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ◻ No ⌧

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2020 was approximately $36.4 million, based on the closing price of the registrant’s common stock of $0.43 per share on the NYSE American on June 30, 2020. For the purpose of this calculation, the registrant has assumed that its affiliates as of June 30, 2020 included all directors and officers and one shareholder that held approximately 32.8% of its outstanding common stock. The number of shares of common stock outstanding on February 17, 2021 was 162,469,612.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2020 Annual Meeting of Stockholders are incorporated by reference in Part III of this annual report on Form 10-K.

GOLDEN MINERALS COMPANY

FORM 10-K

YEAR ENDED DECEMBER 31, 2020

2

References to “Golden Minerals, the “Company,” “our,” “we,” or “us” mean Golden Minerals Company, its predecessors and consolidated subsidiaries, or any one or more of them, as the context requires. Many of the terms used in our industry are technical in nature. We have included a glossary of some of these terms below.

FORWARD-LOOKING STATEMENTS

Some information contained in or incorporated by reference into this annual report on Form 10-K may contain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable securities laws. We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions (including negative and grammatical variations) to identify forward-looking statements. These statements include comments relating to our plans, expectations and assumptions concerning the Rodeo project, including anticipated timing and impact of future mining activities, and the assumptions and projections contained in the Rodeo PEA (including life of mine, grade and production expectations); the updated Velardeña PEA; the El Quevar project, including assumptions and projections contained in the El Quevar PEA (including life of mine, grade and production expectations); the Santa Maria property, including the assumptions and projections contained in the updated Santa Maria PEA (including life of mine, grade and production expectations) and other expectations regarding the project, including the potential exercise by Fabled Silver Gold Corp. of its option to acquire the Company’s 100% interest in the property; future evaluation and drilling plans and exploration activities at Sand Canyon; the Yoquivo project, including future drilling plans and exploration activities; our financial outlook in 2021, including anticipated income from the use of our ATM Program and LPC Program (each defined herein) and expenditures during the year; and potential need for external financing and statements concerning our financial condition, business strategies and business and legal risks. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Our actual results could differ materially from those expressed or implied in these forward-looking statements as a result of various factors described in this annual report on Form 10-K, including:

● | Timing, duration and overall impact of the COVID-19 pandemic, including potential future suspension of mining activities at the Rodeo property or processing activities at our Velardeña mill as a result of future orders of the Mexican Federal Government; |

● | Deviations from the projected timing and amount of estimated production at Rodeo due to unanticipated variations in grade, unexpected challenges associated with our proposed mining plan, volatility in commodity prices, variations in expected recoveries, increases in projected operating or capital costs or interruptions in production; |

● | Decreases in silver and gold prices; |

● | Whether we are able to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely negative effect of volatility in silver and gold prices or unfavorable exploration results; |

3

● | Unfavorable results from exploration at the Santa Maria, Yoquivo, Sand Canyon or other exploration properties and whether we will be able to advance these or other exploration properties; |

● | Risks related to the El Quevar project in Argentina, including unfavorable results from our evaluation activities, the feasibility and economic viability and unexpected costs of maintaining the project, and whether we will be able to find a joint venture partner or secure adequate financing to further advance the project; |

● | The Rodeo project, including assumptions and projections contained in the Rodeo PEA (including life of mine and production expectations), and our plans regarding further advancement of the project; |

● | Variations in the nature, quality and quantity of any mineral deposits that are or may be located at the Rodeo and Velardeña properties or our exploration properties, changes in interpretations of geological information, and unfavorable results of metallurgical and other tests; |

| ● | Whether we will be able to mine and sell minerals successfully or profitably at any of our current properties at current or future silver and gold prices and achieve our objective of becoming a mid-tier mining company; |

● | Potential delays in our exploration activities or other activities to advance properties towards mining resulting from environmental consents or permitting delays or problems, accidents, problems with contractors, disputes under agreements related to exploration properties, unanticipated costs and other unexpected events; |

● | Our ability to retain key management and mining personnel necessary to successfully operate and grow our business; |

● | Economic and political events affecting the market prices for gold, silver, zinc, lead and other minerals that may be found on our exploration properties; |

● | Political and economic instability in Argentina, Mexico and other countries in which we conduct our business and future actions of any of these governments with respect to nationalization of natural resources or other changes in mining or taxation policies; |

| ● | Our ability to acquire additional concessions in Mexico based on the economic and environmental policies of Mexico’s current or future governmental authorities; |

| ● | Volatility in the market price of our common stock; and |

● | The factors set forth under “Risk Factors” in Item 1A of this annual report on Form 10-K. |

Many of these factors are beyond our ability to control or predict. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risks and uncertainties. You should not unduly rely on any of our forward-looking statements. These statements speak only as of the date of this annual report on Form 10-K. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this annual report on Form 10-K.

4

CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL

“Mineralized material” as used in this annual report on Form 10-K, although permissible under the United States Securities and Exchange Commission’s (“SEC”) Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any deposits at the Velardeña Properties, the El Quevar, Santa Maria or Rodeo properties or any deposits at our other exploration properties, will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the disclosed mineralized material estimates will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted. In addition, in this annual report on Form 10-K we also modify our estimates made in compliance with National Instrument 43-101 to conform to SEC Industry Guide 7 for reporting in the United States. Mineralized material is substantially equivalent to measured and indicated mineral resources (exclusive of reserves) as disclosed for reporting purposes in Canada, except that the SEC only permits issuers to report “mineralized material” in tonnage and average grade without reference to contained ounces.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. The mineral property disclosure set forth in this Annual Report on Form 10-K was prepared pursuant to SEC Industry Guide 7 and not the SEC Modernization Rules.

CONVERSION TABLE

In this annual report on Form 10-K, figures are presented in both United States standard and metric measurements. Conversion rates from United States standard measurement systems to metric and metric to United States standard measurement systems are provided in the table below. All currency references in this annual report on Form 10-K are to United States dollars, unless otherwise indicated.

| U.S. Unit |

| Metric Measure |

| Metric Unit |

| U.S. Measure |

|

| 1 acre |

| 0.4047 hectares | | 1 hectare | | 2.47 acres | |

| 1 foot |

| 0.3048 meters | | 1 meter | | 3.28 feet | |

| 1 mile |

| 1.609 kilometers | | 1 kilometer | | 0.62 miles | |

| 1 ounce (troy) |

| 31.103 grams | | 1 gram | | 0.032 ounces (troy) | |

| 1 ton |

| 0.907 tonnes | | 1 tonne | | 1.102 tons | |

GLOSSARY OF SELECTED MINING TERMS

“Base Metal” means a classification of non-ferrous metals usually considered to be of low value and higher chemical activity when compared with the precious metals (gold, silver, platinum, etc.). This nonspecific term generally refers to the high-volume, low-value metals copper, lead, tin, and zinc.

“Breccia” means rock consisting of fragments, more or less angular, in a matrix of finer-grained material or of cementing material.

“Calcareous Clastic” means sedimentary rock composed of siliciclastic particles usually of conglomerate, sand, or silt-size and cemented by calcium carbonate in the form of calcite.

“Claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

5

“Concentrates” means the partially cleaned product of potentially economically interesting metal-bearing minerals separated from its containing rock or earth by froth flotation or other methods of mineral separation.

“Concession” means a grant or lease of a tract of land made by a government or other controlling authority in return for stipulated services or a promise that the land will be used for a specific purpose.

“Core Drill” means a rotary type of rock drill that cuts a core of rock and is recovered in long cylindrical sections, usually two centimeters or more in diameter.

“Deposit” means an informal term for an accumulation of minerals.

“Development Stage” means a project with an established resource, not in production, engaged in the process of additional studies preparing for completion of a feasibility study or for commercial extraction.

“Diorite” means a grey to dark grey intermediate intrusive igneous rock composed principally of plagioclase feldspar, biotite, hornblende, and/or pyroxene.

“Euhedral” means a well-developed degree of which mineral grains show external crystal faces.

“Exploration Stage” means a project that is not yet in either the Development Stage or Production Stage.

“Feasibility Study” means an engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

“Flotation” means the separating of finely crushed minerals from one another by causing some to float in a froth and others to remain in suspension in the pulp. Oils and various chemicals are used to activate, make floatable, or depress the minerals.

“Formation” means a distinct layer of sedimentary or volcanic rock of similar composition.

“Fracture System” means a set or group of contemporaneous fractures formed by a stress system.

“Grade” means the metal content of mineralized material which for precious metals is usually expressed in troy ounces per ton (2,000 pounds) or in grams per metric tonnes, which contain 2,204.6 pounds or 1,000 kilograms.

“Laramide Orogeny” means a period of mountain building in western North America, which started in the Late Cretaceous age, 70 to 80 million years ago, and ended 35 to 55 million years ago.

“Mineralization” means the concentration of metals within a body of rock.

“Mineralized Material” means a mineralized body that has been defined by appropriate drilling and/or underground sampling to establish continuity and support an estimate of tonnage and an average grade of the selected metals.

“Mining” means the process of extraction and beneficiation of mineral reserves or mineral deposits to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves or mineral deposits are expanded during the life of the mine activities as the exploration potential of the deposit is realized.

“Monzodiorite” means coarse-grained igneous rock consisting of essential plagioclase feldspar, orthoclase feldspar, hornblende and biotite, with or without pyroxene, with plagioclase being the dominant feldspar making up 6% to

6

90% of the total feldspar and varying from oligoclase to andesine in composition. The presence of the orthoclase feldspar distinguishes this rock from a diorite.

“National Instrument 43-101” or “NI 43-101” means the standards of disclosure for mineral projects prescribed by the Canadian Securities Administrators.

“Net Smelter Return Royalty” or “NSR Royalty” means a defined percentage of the gross revenue from a resource extraction operation, less a proportionate share of transportation, insurance, and processing costs.

“Open Pit” means a mine working or excavation open to the surface.

“Ore” means material containing minerals that can be economically extracted.

“Outcrop” means that part of a geologic formation or structure that appears at the surface of the earth.

“Oxide” means mineralized rock in which some of the original minerals have been oxidized (i.e., combined with oxygen).

“Precious Metal” means any of several relatively scarce and valuable metals, such as gold and silver.

“Preliminary Economic Assessment” or “PEA” means a study, other than a pre-Feasibility or Feasibility Study, that includes an economic analysis of the potential viability of mineral resources.

“Probable Mineral Reserves” means mineral reserves for which quantity and grade and/or quality are computed from information similar to that used for Proven Mineral Reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Mineral Reserves, is high enough to assume continuity between points of observation.

“Production Stage” means a project that is actively engaged in the process of extraction and beneficiation of mineral reserves or mineral deposits to produce a marketable metal or mineral product.

“Proven Mineral Reserves” means mineral reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well established.

“Reclamation” means the process of returning land to another use after mining is completed.

“Recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, expressed as a percentage.

“Mineral Reserves” means that part of a mineral deposit that could be economically and legally extracted or produced at the time of mineral reserve determination.

“Sampling” means selecting a fractional part of a mineral deposit for analysis.

“Sediment” means solid fragmental material that originates from weathering of rocks and is transported or deposited by air, water, or ice, or that accumulates by other natural agents, such as chemical precipitation from solution or secretion by organisms, and that forms in layers on the earth’s surface at ordinary temperatures in a loose, unconsolidated form.

7

“Sedimentary” means formed by the deposition of Sediment.

“Skarn” means a coarse-grained metamorphic rock formed by the metamorphism of carbonate rock often containing garnet, pyroxene, epidote and wollastonite.

“Stock” means discordant igneous intrusion having a surface exposure of less than 40 square miles.

“Sulfide” means a compound of sulfur and some other metallic element or elements where sulfur is in the unoxidized form.

“Tailings Pond” means a low-lying depression used to confine tailings, the prime function of which is to allow enough time for processed minerals to settle out or for cyanide to be destroyed before water is reused, evaporates, or is discharged into the local watershed.

“Tertiary” means the first period of the Cenozoic Era (after the Cretaceous of the Mesozoic Era and before the Quaternary) thought to have covered the span of time between 2 to 3 million years ago and 65 million years ago.

“Vein” means a fissure, fault or crack in a rock filled by minerals that have traveled upwards from some deep source.

“Waste” means rock lacking sufficient grade and/or other characteristics of ore.

ITEMS 1 AND 2: BUSINESS AND PROPERTIES

Overview

We are a mining company holding a 100% interest in the Rodeo property in Durango State, Mexico, a 100% interest in the Velardeña and Chicago precious metals mining properties and associated oxide and sulfide processing plants in the state of Durango, Mexico (the “Velardeña Properties”), a 100% interest in the El Quevar advanced exploration silver property in the province of Salta, Argentina (subject to the terms of the April 9, 2020, earn-in agreement (the “Earn-in Agreement”) pursuant to which Barrick Gold Corporation (“Barrick”) has the option to earn a 70% interest in the El Quevar project), and a diversified portfolio of precious metals and other mineral exploration properties located primarily in or near historical precious metals producing regions of Argentina, Nevada and Mexico. The Rodeo property, the Velardeña Properties and the El Quevar advanced exploration property are the Company’s only material properties.

We are primarily focused on mining operations at the Rodeo property as well as further studies of a restart plan for Velardeña, including use of bio-oxidation to improve the payable gold recovery. We are also focused on (i) advancing our El Quevar exploration property in Argentina through the Earn-in Agreement with Barrick and (ii) continuing to evaluate and search for mining opportunities in North America (including Mexico) with near term prospects of mining, and particularly for properties within reasonable haulage distances of our processing plants at the Velardeña Properties. The Company is also reviewing strategic opportunities, focusing primarily on development or operating properties in North America, including Mexico.

Our management team is comprised of experienced mining professionals with extensive expertise in mineral exploration, mine construction and development, and mine operations. Our principal office is located in Golden, Colorado at 350 Indiana Street, Suite 650, Golden, CO 80401, and our registered office is the Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801. We also maintain an office at the Velardeña Properties in Mexico and exploration offices in Argentina and Mexico.

8

No Proven or Probable Mineral Reserves/Exploration Stage Company

We are considered an exploration stage company under the SEC criteria since we have not demonstrated the existence of proven or probable mineral reserves at any of our properties. In SEC Industry Guide 7, the SEC defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Proven or probable mineral reserves are those reserves for which (a) quantity is computed and (b) the sites for inspection, sampling, and measurement are spaced so closely that the geologic character is defined and size, shape and depth of mineral content can be established (proven) or the sites are farther apart or are otherwise less adequately spaced but high enough to assume continuity between observation points (probable). Mineral reserves cannot be considered proven or probable unless and until they are supported by a feasibility study, indicating that the mineral reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable.

We have not completed a feasibility study with regard to any of our properties to date. Any mineralized material discovered or extracted by us should not be considered proven or probable mineral reserves. As of December 31, 2020, none of our mineralized material met the definition of proven or probable mineral reserves. We expect to remain an exploration stage company for the foreseeable future. We will not exit the exploration stage until such time, if ever, that we demonstrate the existence of proven or probable mineral reserves that meet the guidelines under SEC Industry Guide 7, even if we successfully produce material from our properties, as we expect to do in 2021.

Company History

We were incorporated in Delaware under the Delaware General Corporation Law in March 2009. From March 2009 through September 2011, we focused on the advancement of our El Quevar silver project in Argentina. In September 2011, we completed a business combination transaction with ECU Silver Mining Inc. (“ECU”), resulting in our ownership of the Velardeña and Chicago silver, gold and base metals mines located in the Velardeña mining district in the State of Durango, Mexico as further described below under “—Velardeña Properties”.

Corporate Structure

Golden Minerals Company, headquartered in Golden, Colorado, is the operating entity through which we conduct our business. We have a number of wholly-owned subsidiaries organized throughout the world, including in Mexico, Central America, South America, the Caribbean and Europe. We generally hold our exploration rights and properties through subsidiaries organized in the countries in which our rights and properties are located.

Our Competitive Strengths and Business Strategy

Our business strategy is to establish Golden Minerals as a mid-tier precious metals mining company focused in North America and Argentina. We also review strategic opportunities from time to time.

Rodeo Property. As a result of our decision to seek to commence mining operations at our Rodeo project, we now consider the Rodeo property to be one of our material properties, along with the Velardeña Properties and the El Quevar project. We began mining at the Rodeo project in late December 2020 and began processing mined material from the Rodeo project in January 2021. Although short-lived, the Rodeo project is expected to provide free cash flow through at least 2023 that will enable us to continue to evaluate a potential restart of mining at the Velardeña Properties as well as to evaluate our other exploration properties.

Velardeña Properties. Due to continuing net operating losses, we suspended mining and sulfide processing activities at the Velardeña Properties during the first half of November 2015. The Velardeña Properties include a 300-tonne per day flotation sulfide mill, which includes three flotation circuits in which we can process sulfide material to make lead, zinc and pyrite concentrates. The properties also include a conventional 550-tonne per day cyanide leach oxide

9

mill with a Merrill-Crowe precipitation circuit and flotation circuit located adjacent to our Chicago mine. We continue to evaluate and search for other oxide and sulfide feed sources, focusing on sources within haulage distance of our sulfide and oxide mills at the Velardeña Properties. The recent rise in precious metals prices, the advancement of alternative processing technologies in the industry, and the results of our testing activities prompted us to pursue the preparation of an updated Preliminary Economic Assessment of our Velardeña project. In April 2020 we announced positive results from the updated PEA (as more fully described herein under “Velardeña - Mine Plan and Metallurgy”).

El Quevar Project. We continue to advance our El Quevar silver project in Salta Province, Argentina. On April 9, 2020, we entered into the Earn-In Agreement with Barrick pursuant to which Barrick has the option to earn a 70% interest in the El Quevar project (as more fully described herein under “El Quevar – Title and Ownership Rights”).

Exploration Focus. We are focused on evaluating and searching for mining opportunities in North America with high precious metal grades and low development costs with near term prospects of mining, and particularly properties within reasonable haulage distances of our Velardeña processing plants. We are also continuing our exploration efforts on selected properties in our portfolio of approximately 12 exploration properties located in Mexico, Nevada and Argentina.

Experienced Management Team. We are led by a team of mining professionals with approximately 60 years of combined experience in exploration, project development, and operations management, primarily in the Americas. Our executive officers have held senior positions at various large mining companies including, among others, Cyprus Amax Minerals Company, INCO Limited, Meridian Gold Company, Barrick Gold Exploration and Noranda Exploration.

Rodeo Property

Location, Access and Facilities

Our Rodeo project is located approximately 2 kilometers east of the town of Rodeo in Durango State, Mexico. The city of Torreón is located 189 kilometers by road to the east of the project and the city of Durango is located 157 kilometers by road to the south. The property can be reached via gravel roads from the town of Rodeo. Basic amenities are available in the town of Rodeo. Facilities onsite at the Rodeo project will include fuel storage, a maintenance area, portable warehouses, mobile offices and other essential services and support units. No processing facilities will be located on site. We have obtained rights to extract water from the Nazas River which is within a few kilometers of the project. There is a power line that crosses the property and services the nearby villages however, we anticipate relying on generators to provide power for the minimal infrastructure required at the mine site.

We began mining at the Rodeo project in late December 2020. Our mine plan for the Rodeo project contemplates the processing of mined material at our Velardeña oxide mill, which is located approximately 115 kilometers via road from the Rodeo project. We began processing mined material from the Rodeo project in January 2021. Pursuant to the mine plan, we truck mined material to the plant using a commercial trucking contractor. Our Velardeña oxide plant is a typical agitated leach plant that is rated to handle up to 550 tonnes per day of throughput. The plant is equipped with a modern doré refinery, and the attached tailings facility recently underwent an expansion which is expected to be sufficient for the tailings that would be produced from operations at Rodeo. We have begun installation of a new regrind mill circuit at the plant specifically to process the harder mined material coming from the Rodeo property. The circuit, which will allow for increased throughput of material and the increased recovery of gold, is expected to be operational by the end of the first quarter 2021.

10

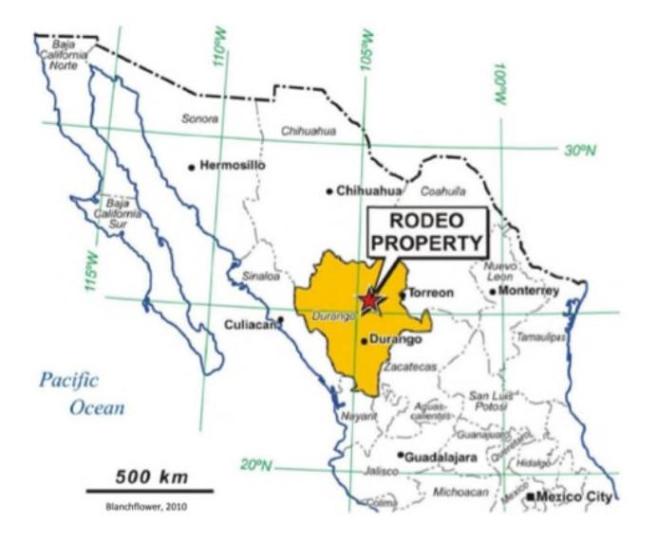

The following map shows the location of the Rodeo project.

Property History

Exploration and informal mining of the Rodeo property dates back over 25 years. Prior to 1994, two prospects, called the “Los Murcielagos” gold-silver-lead-copper and “Francisco Marquez” gold-copper prospects, were documented in the vicinity of the Los Murcielagos arroyo on the Rodeo property. Little information is available on these historic prospects other than gold- and silver-bearing mineralization was apparently extracted from short adits that are visible from surface. In the early 1990’s, exploration work, including geological mapping and drilling, on the property was carried out by La Cuesta International Inc. and Monarch Resources de Mexico, S.A. de C.V. The property was acquired by Canplats Resource Corporation in 2003, and it conducted a geochemical sampling program and multiple drilling programs during the mid-2000s. Canplats was acquired by Goldcorp Inc. in 2010 and the rights to the Rodeo concessions came to be held in Camino Minerals Corporation (“Camino”), a wholly-owned subsidiary of Goldcorp. In 2010, Camino issued a technical report on the property. In 2011, Camino conducted a 6,238-meter drilling program to investigate the extension of the known mineralization to the north and south of the main mineralized zone of the property, as well as its depth. In 2014, Camino relinquished its right to acquire the Rodeo concessions and the property reverted to La Cuesta. We acquired the Rodeo concessions from La Cuesta International Inc. in 2015.

Title and Ownership Rights

The Rodeo project consists of two mineral concessions totaling approximately 1,866 hectares. The “Rodeo” concession, totaling 521 hectares, is held under a lease agreement dated May 18, 2015 pursuant to which we are required to make advanced royalty payments of $40,000 per year to La Cuesta International, S.A. de C.V., a wholly-owned subsidiary of La Cuesta International Inc (“La Cuesta”). We are required to pay a 2% net smelter return royalty from production to La Cuesta. After $5 million has been paid to La Cuesta under the royalty agreement, the royalty payment

11

will reduce to a 1% net smelter return. The mineralized material that has been identified to date and which forms the basis for the Preliminary Economic Assessment described below is located on the Rodeo concession.

The “Rodeo 2” concession, totaling approximately 1,345 hectares, was purchased from Rojo Resources, S.A. de C.V. under a purchase agreement dated July 22, 2015. Royalty payments of 2% of net smelter returns on material produced from Rodeo 2 are also due to La Cuesta.

We are also required to pay a 0.5% net smelter return royalty to the Mexican federal government from all production at the Rodeo property.

The following Rodeo property mine concessions are identified below by name and file number in the Federal government Public Registry of Mining.

Name of Mine Concession |

| Concession File Number |

|

Rodeo |

| 30748 |

|

Rodeo 2 |

| 31305 |

We are required to pay annual concession holding fees to the Mexican government to maintain our rights to the Rodeo mining concessions. In 2020, we made such payments totaling approximately $31,000 and expect to pay approximately $34,000 in 2021. Similar to our Velardeña Properties, the Rodeo property is subject to the Mexican ejido system requiring us to contract with the local communities, or ejidos, surrounding the property to access mineral claims needed in connection with our mining and exploration activities. The Rodeo deposit is located on a private ranch and is not a part of the ejido system. We have a surface use agreement with the private ranch owner that allows us to operate on the property. The surface use agreement requires us to make annual payments of approximately $70,000 to the private ranch owner. We also have an agreement with the local ejidos to allow access to the property that we believe will be sufficient to conduct our proposed mining activities. The local ejidos do not have a direct interest in the mineral claims and payments under the agreement are expected to be less than $25,000 per year.

Geology and Mineralization

The Rodeo concession lies on the eastern boundary of the Sierra Madre Occidental. The Rodeo fault system consists of three major parallel structures and wall-rock fracture systems that are the principal feeder conduits for a high-level, gold-silver epithermal mineral system. These major vein and breccia-filled structures appear to be feeder conduits responsible for the 1 kilometer by 4 kilometer area of silicified, clay-altered and gold-anomalous rocks that form a resistant north northwest-trending ridge. All three of the structures are wide, laterally and longitudinally persistent, well-developed feeder vein swarms with high-level, locally banded chalcedonic quartz veins, stockworks and silicified breccias. In the area of principal interest, the structures are strongly veined, silicified, brecciated, and mineralized for over 4 kilometers, and the shear fault zones and hydrothermal system can be traced for 8 kilometers along strike on the property. Individual feeder vein and breccia systems are up to 60 meters thick. Flexures in the vein swarms and/or structural intersections provide brecciation and open conduits for intense, episodic fluid flow and silica deposition with the potential for ore-grade concentrations of precious metals, especially gold.

The immediate Rodeo deposit area is approximately 300 meters along strike and 200 meters wide and extends to a depth of 200 meters below surface. The deposit strikes at 330° and dips to the northeast with various vein phases dipping from subvertical to 30°. The deposit is entirely hosted within Tertiary Rodeo volcanics that are strongly silicified and brecciated. The deposit is bound to the east by the Rodeo fault. Along strike to the north and south, the mineralization is offset slightly by near vertical faulting; mineralization does not terminate at these faults but the intensity of the trend is either diminished or has yet to be located.

12

2017 Mineralized Material Estimate

During January 2017, Tetra Tech, Inc. completed an estimate of mineralized material at the Rodeo deposit, prepared pursuant to Canada National Instrument 43-101. The estimate was prepared using a block model rotated to fit the deposit strike. Two different estimates were prepared based on alternative operating scenarios. The first operating scenario, which contemplates transportation of the mined material to the Velardeña oxide mill, is shown below. The alternative operating scenario would require the construction of a processing facility on-site, which we do not currently believe is attractive.

The following table shows the estimated mineralized material.

Cutoff AuEq g/t | Tonnes (M) | Au g/t | Ag g/t |

0.83 | 0.4 | 3.3 | 11 |

______

(1) | Cutoff grade and Au equivalent calculated using metal prices of $1,220 and $17 per troy ounce of Au and Ag, recoveries of 77% and 90% Au and Ag. |

(2) | The mineralized material estimate has been pit shell constrained using the Lerch Grossman algorithm with inputs of $7.50 mining, $10 trucking, and $20 processing costs per tonne. A breakeven cutoff including trucking and processing costs per block was applied to a block model within the optimized shell. |

See “Cautionary Statement Regarding Mineralized Material” above.

Mine Plan and Metallurgy

In April 2020 we announced the completion of a Preliminary Economic Assessment for the project. The PEA calls for an open pit mining operation with material transported to our Velardeña oxide plant. In August 2020, we completed a 35-hole 1400-meter drilling program to further verify the continuity of the high-grade core of the deposit. The results of this program enabled us to finalize the initial start-up mine plan and also provided further metallurgical data in order to confirm recovery assumptions and enable the appropriate setup of the oxide plant. Results from the drilling program were slightly better than the assumptions that were used in the PEA.

The PEA utilized metallurgical results from initial test work conducted in 2017, which confirmed good gold and silver metallurgical recoveries for milled material. Bottle roll cyanide leach testing of the high-grade samples conducted in 2017 resulted in gold extractions of 80 to 86 percent. Silver extractions ranged from 72 to 76 percent for all tests. Initial test work also indicated that the material is not suitable for gold and silver recovery by heap leaching. The results of metallurgical testing conducted during 2020 using samples obtained in the recently completed drilling program revealed the need for an additional regrind circuit in the oxide plant and a finer grind size to attain recoveries projected in the PEA. In the 2020 metallurgical testing, gold extractions averaged approximately 85 percent assuming a grind size of 80 percent passing 325 mesh. The potential need for a regrind circuit due to the harder characteristics of the Rodeo mined material was anticipated in the PEA and the estimated $600,000 capital cost of the regrind circuit has already been included in the total estimated $1.5 million of capital, pre-production drilling and other assessment activities, initial mining costs, working capital and other start-up related costs reflected in the PEA.

Certain Laws Affecting Mining in Mexico

13

Our current and proposed operations at the Rodeo project are subject to a variety of laws affecting mining operations in Mexico. For a discussion of these laws, see “Business and Properties – Velardeña Properties - Certain Laws Affecting Mining in Mexico”.

Taxes

For a discussion of the taxes that apply generally to mining projects in Mexico, see “Business and Properties – Velardeña Properties – Taxes in Mexico”.

Recent Activities and Operating Plans

For a discussion of recent activities and projected operating parameters, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – 2020 Highlights – Rodeo Property” below.

Velardeña Properties

Location, Access and Facilities

The Velardeña Properties are comprised of two underground mines and two processing plants within the Velardeña mining district, which is located in the municipality of Cuencamé, in the northeast quadrant of the State of Durango, Mexico, approximately 65 kilometers southwest of the city of Torreón, Coahuila and approximately 140 kilometers northeast of the city of Durango, which is the capital of the State of Durango. The mines are reached by a seven kilometer road from the village of Velardeña which is reached by highway from Torreón and Durango. The Velardeña mining district is situated in a temperate hot, semi-arid region.

Of the two underground mines comprising the Velardeña Properties, the Velardeña mine includes five different major vein systems including the Terneras, Roca Negra, San Mateo, Santa Juana and San Juanes systems. During 2015, we mined from the San Mateo, Terneras and Roca Negra vein systems as well as the Santa Juana vein system to augment grades as mining and processing rates ramped up.

We own a 300-tonne per day flotation sulfide mill situated near the town of Velardeña. The mill includes three flotation circuits in which we can process sulfide material to make lead, zinc and pyrite concentrates. We also own a conventional 550-tonne per day cyanide leach oxide mill with a Merrill-Crowe precipitation circuit and flotation circuit located adjacent to our Chicago mine. In July 2015, we leased the oxide plant to Minera Hecla S.A. de C.V. (“Hecla”), a Mexican corporation and wholly-owned subsidiary of Hecla Mining Company, to process its own material through the plant (the “Hecla Lease”). The Hecla Lease was subsequently extended and ultimately terminated in accordance with its terms on November 30, 2020. We continue to evaluate and search for other oxide and sulfide feed sources, focusing on sources within haulage distance of our sulfide and oxide mills at the Velardeña Properties.

Power for all of the mines and plants is provided through substations connected to the national grid.

Water is provided for all of the mines by wells located in the valley adjacent to the Velardeña Properties. In Mexico, water concessions are granted by the National Commission of Water (“CNA”). Currently no new water concessions are being granted by the CNA; however, companies can acquire water concessions through purchase or lease from current concession holders. We hold title to three wells located near the sulfide plant and hold certificates of registration to three wells located near the oxide plant. We are licensed to pump water from all six wells up to a permitted amount. We are required to make annual payments to the CNA to maintain our rights to these wells. In 2020 we made such payments totaling approximately $7,000 and expect to pay approximately $12,000 in 2021. We are required to pay a nominal additional fee to the CNA each year if we use too much water from a particular well or alternatively if we do not use a minimum amount of water from a particular well.

14

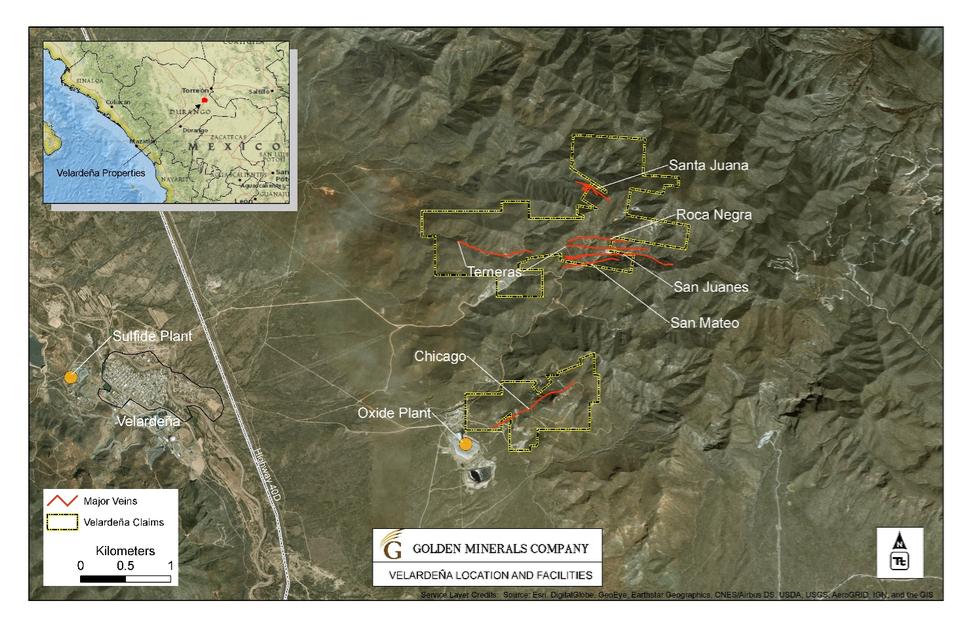

The following map shows the location of the Velardeña Properties.

Property History

Exploration and mining in the Velardeña district extended back to at least the late 1500s or early 1600s, with large scale mining beginning in 1888 with the Velardeña Mining and Smelter Company. In 1902, the mining properties were acquired by ASARCO, who mined the property until 1926 when the mines were closed. For the next 35 years, the mines were operated from time to time by small companies and local miners. The property was nationalized in 1961, and in 1968 the sulfide processing plant was built by the Mexican government. In 1994, William Resources acquired the concessions comprising the Velardeña Properties. In 1997, ECU Gold (the predecessor to ECU Silver Mining Inc.) purchased from William Resources the subsidiaries that owned the concessions and the sulfide processing plant. The oxide processing plant was acquired in 2004. In 2011, we acquired ECU Silver Mining Inc.

Title and Ownership Rights

We hold the concessions comprising the Velardeña Properties through our wholly-owned Mexican subsidiary Minera William S.A. de C.V. At present, a total of 28 mineral concessions comprise the Velardeña Properties. The Velardeña Properties concessions encompass approximately 316 hectares. The mineral concessions vary in size, and the concessions comprising each mineral property are contiguous within each of the Velardeña and Chicago properties. We are required to pay annual concession holding fees to the Mexican government to maintain our rights to the Velardeña mining concessions. In 2020, we made such payments totaling approximately $21,000 and expect to pay approximately $23,000 in 2021. We also own the surface rights to 144 hectares that contains the oxide plant, tailings area and access to the Chicago mine, along with surface lands that may be required for potential plant expansions.

15

The Velardeña Properties are in part subject to the Mexican ejido system requiring us to contract with the local communities, or ejidos, surrounding our properties to obtain surface access rights needed in connection with our mining and exploration activities. We currently have contracts with two ejidos to secure surface rights for our Velardeña Properties with a total annual cost of approximately $35,000. We have a ten-year contract with the Velardeña ejido, which provides surface rights to certain roads and other infrastructure at the Velardeña Properties through 2021, and a 25-year contract with the Vista Hermosa ejido, which provides exploration access and access rights for roads and utilities for our Velardeña Properties until 2038.

The following Velardeña Properties exploitation concessions are identified below by name and number in the Federal government Public Registry of Mining.

Mine/Area | | Name of Exploitation | | Concession |

|

Velardeña | | AMPL. DEL ÁGUILA MEXICANA | | 85580 | |

| | ÁGUILA MEXICANA | | 168290 | |

| | LA CUBANA | | 168291 | |

| | TORNASOL | | 168292 | |

| | SAN MATEO NUEVO | | 171981 | |

| | SAN MATEO | | 171982 | |

| | RECUERDO | | 171983 | |

| | SAN LUIS | | 171984 | |

| | LA NUEVA ESPERANZA | | 171985 | |

| | LA PEQUEÑA | | 171988 | |

| | BUEN RETIRO | | 172014 | |

| | UNIFICACIÓN SAN JUAN EVANGELISTA | | 172737 | |

| | UNIFICACIÓN VIBORILLAS | | 185900 | |

| | BUENAVENTURA No. 3 | | 188507 | |

| | EL PÁJARO AZÚL | | 188508 | |

| | BUENAVENTURA 2 | | 191305 | |

| | BUENAVENTURA | | 192126 | |

| | LOS DOS AMIGOS | | 193481 | |

| | VIBORILLAS NO. 2 | | 211544 | |

| | KELLY | | 218681 | |

| | | | | |

Chicago | | SANTA TERESA | | 171326 | |

| | SAN JUAN | | 171332 | |

| | LOS MUERTOS | | 171986 | |

| | EL GAMBUSINO | | 171987 | |

| | AMPLIACIÓN SAN JUAN | | 183883 | |

| | MUÑEQUITA | | 196313 | |

| | SAN AGUSTÍN | | 210764 | |

| | LA CRUZ | | 189474 | |

16

Geology and Mineralization

The Velardeña district is located at the easternmost limit of the Sierra Madre Occidental on the boundary between the Sierra Madre Oriental and the Mesa Central sub-provinces. Both of these terrains are underlain by Paleozoic and probably Precambrian basement rocks.

The regional geology is characterized by a thick sequence of limestone and minor calcareous clastic sediments of Cretaceous age, intruded by Tertiary plutons of acidic to intermediate composition. During the Laramide Orogeny, the sediments were folded into symmetrical anticlines and synclines that were modified into a series of asymmetrical overturned folds by a later stage of compression.

A series of younger Tertiary stocks have intruded the older Cretaceous limestone over a distance of approximately 15 kilometers along a northeast to southwest trend. The various mineral deposits of the Velardeña mining district occur along the northeast southwest axis and are spatially associated with the intrusions and their related alteration.

An important northwest-southeast fracture system is associated with these intrusions and, in many cases, acts as the main focus of mineralization. The Velardeña Properties are underlain by a thick sequence of limestone that corresponds to rocks of the Aurora and Cuesta del Cura formations of Lower Cretaceous age.

Several types of Tertiary intrusive rocks are present in the Velardeña district. The largest of these intrusives outcrops on the western flank of the Sierra San Lorenzo and underlies a portion of the Velardeña Properties. It is referred to as the Terneras pluton and forms a northeast oriented, slightly elongated body, considered to represent a diorite or monzodiorite that outcrops over a distance of about 2.5 kilometers. The adjacent limestone has been altered by contact metamorphism (exoskarn), and locally the intrusive has been metamorphosed (endoskarn).

The following is a description of the individual geological characteristics and mineralization found on each of the properties comprising the Velardeña and Chicago mines.

Velardeña Mine

The Santa Juana, Terneras, San Juanes and San Mateo vein deposits on the Velardeña property are hosted by Aurora Formation limestone, the Terneras intrusion and related skarn. The limestone is intruded by a series of multiphase diorite or monzodiorite stocks (Terneras intrusion) and dikes of Tertiary age that outcrop over a strike length of approximately 2.5 kilometers.

Two main vein systems are present on the Velardeña property. The first is a northwest striking system as found in the Santa Juana deposit, while the second is east-west trending and is present in the Terneras, San Juanes and San Mateo deposits.

In the Santa Juana deposit, vein trends are steeply northeast dipping and northwest trending. The Terneras, San Juanes and San Mateo veins all strike east-west and dip steeply north. The most extensive of these is the Terneras vein, which was mined in the past over a strike length of 1,100 meters. All of these veins are observed to have extensive strike lengths and vertical continuity for hundreds of meters. The mineralogy of the east west system is somewhat different in that it contains less arsenic than the northwest Santa Juana veins.

Mineralization in the deposits located at the Velardeña mine occurs primarily in epithermal quartz-calcite veins with associated lead, zinc, silver, and copper minerals including gold hosted mostly in arsenopyrite and pyrite, typical of the polymetallic vein deposits of northern Mexico. The veins are usually thin, normally in the 0.2 meter to 0.5 meter range, but consistent along strike and down dip. Coxcomb and rhythmically banded textures are common.

17

2020 Technical Report

During the second quarter of 2020, the engineering firm of Tetra Tech, Inc. (“Tetra Tech”) completed a preliminary economic assessment (PEA) of the Velardeña Properties. The PEA included an updated estimate of mineralized material, which is set forth in the table below:

| | | | Silver | | Gold | | | | |

|

| | | | (Ag) | | (Au) | | | | |

|

| | | | Grade | | Grade | | Lead | | |

|

| | Tonnes | | (Grams | | (Grams | | (Pb) | | |

|

| | (in | | per | | per | | Grade | | Zinc (Zn) |

|

Mineralized Material | | thousands) | | tonne) | | tonne) | | % | | Grade % |

|

Mineralized Material at May 8, 2020 | | | | | | | | | | | |

Velardeña & Chicago Mines | | | | | | | | | | | |

Oxide |

| 436 |

| 253 |

| 5.1 |

| 1.71 |

| 1.49 | |

Sulfide |

| 915 |

| 333 |

| 4.8 |

| 1.46 |

| 1.92 | |

Total Mineralized Material |

| 1,351 |

| 307 |

| 4.9 |

| 1.54 |

| 1.78 | |

Note: Results may not tie precisely due to rounding.

The above mineralized material estimate was based on a cutoff grade of a net smelter return (“NSR”) of $125 per tonne and the following assumed prices:

| | | | |

| | | | |

| | | | |

Metal | | Metal Prices* | | |

Silver | | $ | 16.30 (oz) | |

Gold | | $ | 1,305 (oz) | |

Lead | | $ | 0.99 (lb) | |

Zinc | | $ | 1.27 (lb) | |

* Amounts represent three-year trailing average as of December 2019.

The cutoff grade of $125 NSR per tonne of mineralized material was determined by assessing the estimated average costs of mining, processing and general and administration, as well as metallurgical recoveries, including sulfide metallurgical recoveries of 67%, 90%, 72% and 77% for gold, silver, lead and zinc respectively. The average cost estimates are the same for both the Velardeña and Chicago mines.

For further detail regarding mineralized material, see “CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL”.

Velardeña Properties Activities

The recent rise in precious metals prices, the advancement of alternative processing technologies in the industry, and the results of our testing activities prompted us to pursue the preparation of an updated Preliminary Economic Assessment of our Velardeña project. In April 2020 we announced positive results from the updated PEA. The updated PEA was prepared to incorporate new and updated elements of the project database, mine plan and processing plan, most notably the inclusion of bio-oxidation treatment of gold-bearing pyrite concentrates. In late 2019, we obtained successful results from testing Velardeña gold concentrate material using Finnish firm Outotec’s “BIOX” process, a sustainable technology that was developed to pre-treat refractory ores and concentrates ahead of conventional cyanide leaching. The

18

gold in these types of mineralized materials, such as those found at Velardeña, is encapsulated in pyrite and arsenopyrite which prevents the gold from being successfully cyanide leached. BIOX utilizes bacteria to oxidize these sulfide minerals, thereby exposing the gold for subsequent cyanide leaching and increasing overall gold recoveries. The 2019 BIOX testing of Velardeña material achieved gold recoveries of 92% from the pyrite-arsenopyrite concentrate, compared to sub-30% gold recoveries realized when the Velardeña Properties last operated in 2015. During 2021, we plan to continue to optimize the mine plan and processing details in preparation for future test-mining and processing in advance of establishing a definite schedule for restarting commercial production at the Velardeña mines and the installation of the bio-oxidation circuit. No development decision has been made regarding a potential restart of the Velardeña mines, however, discussions are in progress regarding the potential to restart mining and flotation processing in late 2021 or early 2022 while awaiting design and possible construction of the bio-oxidation facility.

Mining and Processing

Aside from some minor test mining and crushing activities, there were no mining or processing activities, other than the Hecla Lease, at our Velardeña Properties in 2019 or 2020 as a result of the shutdown of the mining and sulfide processing activities in November 2015. Currently, we expect to incur approximately $0.2 million in quarterly holding costs for as long as mining and sulfide processing activities remain suspended.

Environmental Matters and Permitting

We hold environmental licenses and environmental impact assessments that allow us to run our mines, plants and tailing facilities at our Velardeña Properties. We are required to update our environmental licenses and environmental impact assessments for expansion of or modification to any of the existing two processing plants. The construction of new infrastructure beyond the current plant facilities also would require additional permitting, which could include environmental impact assessments and land use permits.

Certain Laws Affecting Mining in Mexico

Mexico, officially the United Mexican States, is a federal constitutional republic in North America and bordered by the United States of America, Belize and Guatemala. Mexico is a federal democratic republic with 31 states and Mexico City. Each state has its own constitution and its citizens elect a governor, as well as representatives, to their respective state congresses. The President of Mexico is the head of the executive federal government. Executive power is exercised by the President, while legislative power is vested in the two chambers of the Congress of the Union. The three constitutional powers are the Judiciary, the Executive and the Legislature which are independent of each other.

Legislation Affecting Mining

The Mining Law, originally published in 1992 and amended in 1996, 2005, 2006 and 2014, is the primary legislation governing mining activities in Mexico. Other significant legislation applicable to mining in Mexico includes the regulations to the Mining Law, the Federal Law of Waters, the Federal Labor Law, the Federal Law of Fire Arms and Explosives, the General Law on Ecological Balance and Environmental Protection and regulations, the Federal Law of Duties and the Federal Law on Metrology and Standards.

The Concession System

Under Mexican law, mineral deposits are property of the Mexican republic, and a mining concession, granted by the executive branch of the federal government, is required for the exploration, exploitation and processing of mineral deposits. Mining concessions may only be granted to Mexican individuals domiciled in Mexico or companies incorporated and validly existing under the laws of Mexico. Mexican companies that have foreign shareholders must register with the National Registry of Foreign Investments and renew their registration on an annual basis. Mining concessions grant rights to explore and exploit mineral deposits but do not grant surface rights over the land where the concession is located. Mining

19

concession holders are required to negotiate surface access with the land owner or holder (e.g., agrarian communities) or, should such negotiations prove unsuccessful, file an application with the corresponding administrative authority (Ministry of Economy or Ministry of Agrarian-Territorial-Urban Development) to obtain an easement, temporary occupancy, or expropriation of the land, as the case may be. An application for a concession must be filed with the Mining Agency or Mining Delegation located closest to the area to which the application relates.

Mining concessions have a term of 50 years from the date on which title is recorded in the Public Registry of Mining. Holders of mining concessions are required to comply with various obligations, including the payment of certain mining duties based on the number of hectares of the concession and the number of years the concession has been in effect. Failure to pay the mining duties can lead to cancellation of the relevant concession. Holders of mining concessions are also obliged to carry out and prove assessment works in accordance with the terms and conditions set forth in the Mining Law and its regulations. The regulations to the Mining Law establish minimum amounts that must be spent or invested on mining activities. A report must be filed in May of each year regarding the assessment works carried out during the preceding year. The mining authorities may impose a fine on the mining concession holder if one or more proof of assessment work reports is not timely filed.

Pursuant to amendments to the federal corporate income tax law, effective January 2014, additional duties are imposed on mining concession holders; see “—Taxes in Mexico”.

Environmental Legislation

Mining projects in Mexico are subject to Mexican federal, state and municipal environmental laws and regulations for the protection of the environment. The principal legislation applicable to mining projects in Mexico is the federal General Law of Ecological Balance and Environmental Protection, which is enforced by the Federal Bureau of Environmental Protection, commonly known as “PROFEPA”. PROFEPA is the federal entity in charge of carrying out environmental inspections and negotiating compliance agreements. Voluntary environmental audits, coordinated through PROFEPA, are encouraged under the federal General Law of Ecological Balance and Environmental Protection. PROFEPA monitors compliance with environmental legislation and enforces Mexican environmental laws, regulations and official standards. If warranted, PROFEPA may initiate administrative proceedings against companies that violate environmental laws, which proceedings may result in the temporary or permanent closure of non-complying facilities, the revocation of operating licenses and/or other sanctions or fines. According to the Federal Criminal Code, PROFEPA must inform the relevant governmental authorities of any environmental crimes that are committed by a mining company in Mexico.

Concession holders under the exploration stage may submit themselves to comply with the Mexican Official Norm: NOM-120-SEMARNAT-1997, which provides, among other things, that mining exploration activities to be carried out within certain areas must be conducted in accordance with the environmental standards set forth in NOM-120-SEMARNAT-1997; otherwise, concession holders are required to file a preventive report or an environmental impact study prior to the commencement of the exploration, exploitation and processing of mineral resources. An environmental impact study is required for exploitation and processing of mineral resources activities.

In 2014 Mexico developed an energy policy applicable to private investment companies whereby new mining concessions are now subject to prior approval from the Ministry of Energy. Current mining concessions forming the Velardeña Properties are not subject to or affected by this approval requirement, but any new mining concessions acquired will be subject to this additional approval.

Taxes in Mexico

Mexico has a federal corporate income tax rate of 30%, and there are no state taxes on corporate net income. In determining their corporate income tax, entities are allowed to subtract from gross income various deductions permitted by law, and they are allowed a ten-year carry-forward of net operating losses. Pursuant to amendments to the federal tax

20

laws effective January 1, 2014, a 10% withholding tax is charged on dividends distributed to shareholders, regardless of the tax residence of the recipient, out of after tax profits. However, in the case of nonresident shareholders the limitations and tax rates provided in the treaties to avoid double taxation will prevail. A foreign resident company is subject to income tax if it has a permanent establishment in Mexico. In general, a permanent establishment is a place of business where the activities of an enterprise are totally or partially carried out and includes, among others, offices, branches and mining sites.

Under the 2014 amendments to the federal corporate income tax law, titleholders of mining concessions are required to pay an annual special duty of 7.5% of their mining related profits. Titleholders of mining concessions also are required to pay a 0.5% special mining duty, or royalty, on an annual basis, on revenues obtained from the sale of silver, gold and platinum. Both the 7.5% annual special duty and the 0.5% duty are due at the end of March each year. The special duty of 7.5% is generally applicable to earnings before income tax, depreciation, depletion, amortization, and interest. In calculating the special duty of 7.5%, there are no deductions related to depreciable costs from operational fixed assets, but exploration and prospecting depreciable costs are deductible when incurred. Both duties are tax deductible for income tax purposes.

Mexico has several taxes in addition to income tax that are relevant to most business operations, including (i) the Value Added Tax (“VAT”); (ii) import duties; (iii) various payroll taxes; and (iv) statutorily entitled employee profit sharing (“PTU”). In addition, annual mining concession fees are charged by the government.

VAT in Mexico is charged upon alienation of goods, performance of independent services, grant of temporary use or exploitation of goods, or import of goods or services that occur within Mexico’s borders, at a rate of 16%. There is no VAT in the case of export of goods or services or for the sale of gold, jewelry, and gold metalwork with a minimum gold content of 80%, excluding retail sale to the general public. The sale of mining concessions is subject to VAT as concessions are not considered to be land. VAT paid by a business enterprise on its purchases and expenses may usually be credited against its liability for VAT collected from customers on its own sales. This creditable VAT may also be directly refunded, but under new regulations beginning in January 2019, the creditable VAT can no longer offset other Mexican federal taxes.

Import duties apply for goods and services entering the country, unless specifically exempted due to a free trade agreement or registered under specific programs like IMMEX. Payroll taxes are payable in most states including Durango and Coahuila, and social security, housing and pension contributions must be made to the federal government when paying salaries.

Employees of Mexico entities are statutorily entitled to a portion of the employer’s pre-tax profits, called PTU. The rate of profit sharing is currently 10% of the employer’s taxable income as defined by the Income Tax law. A taxpayer may reduce its income tax base by an amount equal to the PTU. Certain companies are exempt from paying PTU, which include companies in the extractive industry (principally the mining industry) during the period of exploration.

El Quevar

Location and Access

Our El Quevar silver project is located in the San Antonio de los Cobres municipality, Salta Province, in the altiplano region of northwestern Argentina, approximately 300 kilometers by road northwest of the city of Salta, the capital city of the province. The project is also accessible by a 300-kilometer dirt and gravel road from the city of Calama in northern Chile. The small village of Pocitos, located about 20 kilometers to the west of El Quevar, is the nearest settlement. We have established a camp approximately 10 kilometers west of the project to house project workers. A high-tension power line is located approximately 40 kilometers from the site, and a high-pressure gas line devoted to the mining industry and subsidized by the Salta government is located within four kilometers of the El Quevar camp.

21

The El Quevar project is located near Nevado Peak with altitudes at the concessions ranging from 3,800 to 6,130 meters above sea level. The climate of the area is high mountain desert, with some precipitation in summer (such as snow) and little snow in winter.

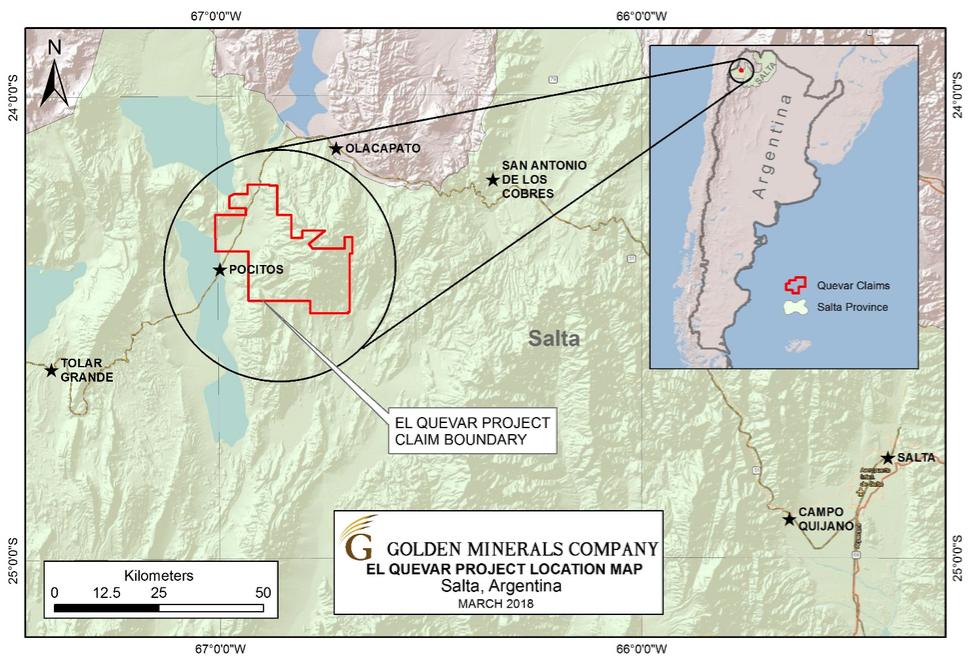

The following map shows the location of the El Quevar project.

Property History

Mining activity in and around the El Quevar project dates back at least 80 years. Between 1930 and 1950, there was lead and silver extraction of mineralized materials from small workings in the area, but we have no mining records from that period. The first organized exploration activities on the property occurred during the 1970s, although no data from that period remains. Over the last 30 years, several companies have carried out exploration activity in the area, including BHP Billiton, Industrias Peñoles, Mansfield Minerals and Hochschild Mining Group, consisting primarily of local sampling with some limited drilling programs.

Title and Ownership Rights

According to Argentine law, mineral resources are subject to regulation in the provinces where the resources are located. Each province has the authority to grant mining exploration permits and mining exploitation concession rights to applicants. The Federal Congress has enacted the National Mining Code and other substantive mining legislation, which is applicable throughout Argentina; however, each province has the authority to regulate the procedural aspects of the National Mining Code and to organize the enforcement authority within its own territory.

22

In the province of Salta, where the El Quevar project is located, all mining concessions are granted by a judge in the Salta Mining Court. The El Quevar project is comprised of exploitation concessions. Exploitation concessions are subject to a canon payment fee (maintenance fee) which is paid in advance twice a year (before June 30th and December 31st of each calendar year). Each time a new mining concession is granted, concession holders are exempt from the canon payment fee for a period of three years from the concession grant date. However, this exemption does not apply to the grant of vacant exploitation concessions; only to the grant of new mining concessions.

The El Quevar project is currently comprised of 31 mining concessions that we hold directly. In total, the El Quevar project encompasses approximately 57,000 hectares. The area of most of our exploration activities at El Quevar is within the concessions that are owned by Silex Argentina S.A., our wholly-owned subsidiary.

We are required to pay a 1% net smelter return royalty on the value of all minerals extracted from the El Quevar II concession and a 1% net smelter return royalty on one-half of the minerals extracted from the Castor concession to the third party from whom we acquired these concessions. We can purchase one half of the royalty for $1 million in the first two years of production. The Yaxtché deposit is located primarily on the Castor concession. We may also be required to pay a 3% royalty to the Salta Province based on the net smelter value of minerals extracted from any of our concessions less costs of processing. To maintain all of the El Quevar concessions, we paid canon payment fees to the Argentine government of approximately $36,000 and $22,000 in 2019 and 2020, respectively. In 2021 we expect to pay approximately $15,000.

23

The following El Quevar mine concessions are identified below by name and file number in the Salta Province Registry of Mines.

Name of Mine Concession | | Concession |

|

Quevar II | | 17114 | |

Quirincolo I | | 18036 | |

Quirincolo II | | 18037 | |

Castor | | 3902 | |

Vince | | 1578 | |

Armonia | | 1542 | |

Quespejahuar | | 12222 | |

Toro I | | 18332 | |

Quevar Primera | | 19534 | |

Quevar Novena | | 20215 | |

Quevar Decimo Tercera | | 20501 | |

Quevar Tercera | | 19557 | |

Quevar Vigesimo Tercero | | 21043 | |

Quevar 10 | | 20219 | |

Quevar Vigesimo Primera | | 20997 | |

Quevar Vigesimo Septima | | 22403 | |

Quevar IV | | 19558 | |

Quevar Vigesimo Cuarto | | 21044 | |

Quevar 11 | | 20240 | |

Quevar Quinta | | 19617 | |

Quevar 12 | | 20360 | |

Quevar Decima Quinta | | 20445 | |

Quevar Sexta | | 19992 | |

Quevar 19 | | 20706 | |

Quevar Vigesimo Sexta | | 22087 | |

Quevar Vigesimo Segundo | | 21042 | |

Quevar Séptima | | 20319 | |

Quevar Veinteava | | 20988 | |

Mariana | | 15190 | |

Arjona II | | 18080 | |

Quevar Vigesimo Quinto | | 21054 | |

The surface rights at El Quevar are controlled by the Salta Province. There are no private properties within the concession area. To date, no issues involving surface rights have impacted the project. Although we have unrestricted access to our facilities, we have been granted easements to further protect our access rights.

Barrick Earn-In Agreement

In April 2020, we entered into the Earn-In Agreement with Barrick, pursuant to which Barrick has acquired an option (the “Option”) to earn a 70% interest in the Company’s El Quevar project located in the Salta Province of Argentina.

24

Pursuant to the terms of the Earn-In Agreement, in order to earn an undivided 70% interest in the El Quevar project, Barrick must: (A) incur a total of $10 million in work expenditures over a total of eight years ($0.5 million per year in years one and two, $1.0 million per year in years three, four and five, and $2.0 million per year in years six, seven and eight); (B) deliver to the Company a National Instrument 43-101 compliant pre-feasibility study pursuant to the parameters set forth in the Earn-In Agreement; and (C) deliver a written notice to exercise the Option to us within the term of the Earn-In Agreement. Barrick may withdraw from the Earn-In Agreement at any time after spending a minimum of $1.0 million in work expenditures and upon providing us with 30 days’ notice.

We will form a new entity (“NewCo”) that will hold the El Quevar properties. Upon satisfaction of the earn-in conditions and exercise of the Option, NewCo will be 70% owned by Barrick and 30% owned by us. Funding of NewCo will be based on Barrick’s and our respective ownership, and industry standard dilution mechanisms will apply in the case of funding shortfalls by either shareholder.

During the earn-in period, originally scheduled from April 9, 2020 to April 9, 2028, in addition to the exploration spending, Barrick will fund the holding costs of the property, which will qualify as work expenditures. Barrick will reimburse us for expenses related to maintaining the exploration camp which will initially be run by us under a service agreement, which will also qualify as work expenditures. Through December 31, 2020, approximately $0.4 million of expenses incurred by us were reimbursable under the Earn-In Agreement.

Due to the COVID-19 pandemic and related legal restrictions on mining exploration in Salta, Argentina, Barrick declared a force majeure event under the Earn-In Agreement. As a result of the force majeure event, the earn-in period and other applicable deadlines in the Earn-In Agreement were extended by 119 days. The force majeure event is no longer in effect and Barrick has commenced activities at the site.

Geology and Mineralization

The geology of the El Quevar project is characterized by silver-rich veins and disseminations in Tertiary volcanic rocks that are part of an eroded stratovolcano. Silver mineralization at El Quevar is hosted within a broad, generally east-west-trending structural zone and occurs as a series of north-dipping parallel sheeted vein zones, breccias and mineralized faults situated within an envelope of pervasively silicified brecciated volcanic rocks. There are at least three sub-parallel structures that extend for an aggregate length of approximately 6.5 kilometers. Several volcanic domes (small intrusive bodies) have been identified and mineralization is also found in breccias associated with these domes, especially where they are intersected by the structures. The silver mineralization at the Yaxtché zone is of epithermal origin. The cross-cutting nature of the mineralization, the assemblage of sulfide and alteration minerals, and the presence of open spaces with euhedral minerals, all point to an origin at shallow to moderate depths (a few hundred meters below surface) from hydrothermal solutions.

Mineralized Material Estimate