Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - FIRSTENERGY CORP | ex991-q42020pressrelease.htm |

| 8-K - 8-K - FIRSTENERGY CORP | fe-20210218.htm |

4Q 2020 Strategic & Financial Highlights February 18, 2021 Chris Pappas, Executive Director Steven E. Strah, President and Acting CEO K. Jon Taylor, SVP and CFO

Forward-Looking Statements February 18, 20212 Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the results of our ongoing internal investigation matters and evaluation of our controls framework and remediation of our material weakness in internal control over financial reporting; the risks and uncertainties associated with government investigations regarding Ohio House Bill 6 and related matters including potential adverse impacts on federal or state regulatory matters including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation and similar proceedings; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity; the ability to accomplish or realize anticipated benefits from strategic and financial goals, including, but not limited to, maintaining financial flexibility, overcoming current uncertainties and challenges associated with the ongoing governmental investigations, executing our transmission and distribution investment plans, controlling costs, improving our credit metrics, strengthening our balance sheet and growing earnings; economic and weather conditions affecting future operating results, such as a recession, significant weather events and other natural disasters, and associated regulatory events or actions in response to such conditions; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; the extent and duration of COVID-19 and the impacts to our business, operations and financial condition resulting from the outbreak of COVID-19 including, but not limited to, disruption of businesses in our territories, volatile capital and credit markets, legislative and regulatory actions, the effectiveness of our pandemic and business continuity plans, the precautionary measures we are taking on behalf of our customers, contractors and employees, our customers’ ability to make their utility payment and the potential for supply-chain disruptions; the potential of non-compliance with debt covenants in our credit facilities due to matters associated with the government investigations regarding Ohio House Bill 6 and related matters; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, the impact of climate change or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions affecting us and/or our major industrial and commercial customers or others with which we do business; the risks associated with cyber-attacks and other disruptions to our information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts and other trust funds, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our SEC filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in our filings with the SEC, including but not limited to the most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy expressly disclaims any current intention to update or revise, except as required by law, any forward-looking statements contained herein or the information incorporated by reference as a result of new information, future events or otherwise.

Non-GAAP Financial Matters February 18, 2021 This presentation contains references to non-GAAP financial measures including, among others, Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP). Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment are not calculated in accordance with GAAP to the extent they exclude the impact of “special items.” Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items also reflect the adjustment to include the full impact of share dilution from the $2.5 billion equity issuance in January 2018. FirstEnergy Corp. (FE or the Company) management cannot estimate on a forward-looking basis the impact of these items in the context of Operating earnings (loss) per share, which could be significant, are difficult to predict and may be highly variable. Special items are not necessarily non-recurring. Operating earnings (loss) per share and Operating earnings (loss) per share for each segment are calculated by dividing Operating earnings (loss), which excludes special items as discussed above, by 543 million shares for the fourth quarter of 2020, 542 million shares for full-year 2020, 540 million shares for the fourth quarter of 2019 and 539 million shares in full-year 2019, which reflects the full impact of share dilution from the equity issuance in January 2018. Basic earnings per share (EPS) (GAAP) is based on 543 million shares for the fourth quarter of 2020 and 542 million shares for full-year 2020, and 540 million and 535 million shares for the fourth quarter and full-year 2019, respectively. Basic EPS (GAAP and Non-GAAP) is based on 544 million shares for the first quarter and full-year 2021. Management uses non-GAAP financial measures such as Operating earnings (loss) and Operating earnings (loss) per share to evaluate the Company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating earnings (loss) per share by segment to further evaluate the Company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment provide consistent and comparable measures of performance of the Company’s businesses on an ongoing basis. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FE has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non- GAAP financial measures to the most directly comparable GAAP financial measures. 3

Critical Focus on Compliance, Ethics and Integrity February 18, 20214 Steve Strah, President and Acting CEO The ratings agencies have taken numerous actions, and w ■ We are deeply committed to creating a culture in which compliance is endemic and second-nature, and where our leaders prioritize and encourage open and transparent communications with all stakeholders ■ At the same time, we’re taking decisive actions to rebuild our reputation and brand and focus on the future ■ We will continue to cooperate fully with the government investigations and remain focused on the matters we control Management and the Board will be relentless, and take the steps needed, to position our Company for long-term success Building a world-class compliance function • Hired Hyun Park as our new senior vice president and chief legal officer in January • Plan to appoint a Chief Ethics and Compliance Officer; dedicated team of compliance professionals • Shifting from a decentralized to a more centralized compliance model • Designating compliance ambassadors throughout the Company Making significant changes to our political and legislative approach • Activity will be much more limited than the past, with closer alignment to our strategic goals • Activity will include additional oversight and significantly more robust disclosure • Goal is to make it crystal clear exactly what efforts we support

Strategic Overview February 18, 20215 Steve Strah, President and Acting CEO The ratings agencies have taken numerous actions, and w ■ Reported 2020 GAAP earnings of $1.99 per share and Operating (non-GAAP) earnings of $2.39 per share ■ On Tuesday, announced several proactive steps to resolve a range of Ohio regulatory proceedings, including our previously announced agreement with the Ohio Attorney General and the decision to not seek recovery of lost distribution revenues – This resulted in a charge of $0.15 per share in 4Q 2020 – Absent this charge, our 2020 Operating (non-GAAP) earnings would have been $2.54 per share; well above the midpoint of our guidance range and reflective of our strong performance ■ We believe resolving these matt rs in a comprehensive manner is a critical step demonstrating our commitment to transparency and integrity – To provide additional transparency, today’s investor materials include more information about ROEs in each of the states we serve ■ We remain excited about the significant investment opportunities that we expect will continue to drive solid earnings and growth in the years ahead – When we have further clarity in Ohio and with the ongoing government investigations, we intend to resume providing a longer-term growth rate – Introducing 2021 Operating (non-GAAP) earnings guidance range of $2.40 - $2.60 per share Focus Areas for Today’s Call: • To review our solid operational performance last year, even in the face of the pandemic • To review our strategy for 2021 and beyond, including our commitment to building shareholder value • The work we’re doing to position FirstEnergy for the future

Additional Focus Areas – 2020 & Beyond February 18, 20216 Steve Strah, President and Acting CEO The ratings agencies have taken numerous actions, and w ■ Our fundamental performance continues to be excellent; reflecting our commitment to strong operations, as well as the stability provided by our diverse footprint and our wires- focused platform – Demonstrable progress on our strategic goals – Exceptional safety performance – Remaining laser-focused on providing safe and reliable service to our 6 million customers – Successfully executed our 2020 plan to invest ~$3B in our distribution and transmission systems ■ We believe our long-term organic growth opportunities are well-aligned with the focus on electrification and the transition to a carbon-neutral economy – Our Strategic Plan, published last month and available on our website: – Addresses our unwavering commitment to transparency and accountability – Identifies bold goals for key areas of our business, including our pledge to achieve carbon neutrality by 2050 – Addresses our continued commitment to building a more diverse and inclusive workplace ■ We want employees to feel empowered to voice their opinion on important issues – We view employee empowerment and accountability as central to strengthening our compliance program and a culture of ethics, integrity and accountability Relentlessly focused on making FirstEnergy a better company as we work to rebuild trust, achieve successful financial results, and deliver for our customers and investors

Key Board Updates February 18, 20217 Chris Pappas, Executive Director The ratings agencies have taken numerous actions, and w ■ The Board and management team are focused on a critical objective: To move forward from the past actions of certain former executives and take the steps necessary to improve the tone at the top, our culture of ethics and integrity, and the way we do business ■ The Board is committed to strengthening every part of FirstEnergy’s culture and taking the necessary steps to reestablish credibility – Together, we have made much progress and recognize there is more work to do ■ Management has initiated a project called FE Forward; a transformational effort to provide near-term financial flexibility and transform the Company for the future Recap of key steps to drive improvements in our culture of compliance • Promptly put in place an Independent Committee with external counsel to oversee the internal investigation and to monitor the status of the various regulatory and legal matters facing the Company • Acted swiftly in the removal of five ex cutives, appointed Steve Strah as A ting CEO, established an Executive Director role, and expanded the role of Board Chair to assist management and the Board • Endorsed the principle of full cooperation with both the DOJ and the SEC on investigation related matters, and through our own internal investigation, led by independent counsel • Established a Compliance Oversight Sub-Committee of the Audit Committee of the Board with independent counsel and leading compliance advisors • Established a number of working groups to oversee and support various work streams including communications, recruiting, and financial flexibility

Key Board Updates (Continued) February 18, 20218 Chris Pappas, Executive Director The ratings agencies have taken numerous actions, and w ■ Our internal investigation continues to be thorough and robust and includes assistance from external law firms who are supported by several other consultants – Ongoing investigation has not resulted in any new material items not previously disclosed – We did recently identify certain transactions that were either improperly classified, misallocated to certain companies, or lacked proper supporting documentation – This resulted in amounts collected from customers that were immaterial to FirstEnergy and the companies will be working with the appropriate regulatory agencies to address these amounts – Our internal investigation will also continue to address any new developments in connection with the ongoing DOJ and SEC investigations ■ We are increasing our focus on another critical aspect: moving FirstEnergy forward ■ As announced this morning, we hired John Somerhalder as Vice Chairman of the Board – He will also join the executive team on a transitional basis as executive director – I will return to my regular duties as an independent Board member by April 1st ■ We will continue to fully support the management team as it transitions FirstEnergy to the future as a more resilient company Together, the management team and Board have put in place a robust plan to move forward and transform FirstEnergy into the industry leader we know it can be

2020 Results Overview Year-over-Year: Basic EPS / Operating EPS(1) ■ Reconciliations and detailed information are available on our website ■ Reported 4Q 2020 GAAP earnings of $0.45 per share and Operating (non-GAAP) earnings of $0.32 per share – Operating results include a $0.15 charge at our Ohio utilities – Absent this charge, our results reflect continued rate base growth, a favorable mix of customer usage, and higher operating costs mostly associated with the pandemic ■ Reported 2020 GAAP earnings of $1.99 per share and Operating (non-GAAP) earnings of $2.39 per share – Versus 2019 GAAP earnings of $1.70 per share and Operating (non-GAAP) earnings of $2.58 per share February 18, 2021 Regulated Distribution: – Primarily impacted by the charge at our Ohio utilities, the absence of Ohio Rider DMR, and higher operating costs, partially offset by higher residential usage and investments in rider programs – Special items: include MTM adjustments on Pension/OPEB actuarial assumptions, regulatory charges, and credits associated with the exit of generation Regulated Transmission: – Earnings growth from continued Energizing the Future investments, partially offset by the absence of 2019 tax benefits Corporate / Other: – Results reflect higher costs and tax benefits – Special items: include MTM adjustments on Pension/OPEB actuarial assumptions and credits associated with the exit of generation Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period assuming full impact of dilution from the $2.5 billion equity issuance in January 2018. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in 2020 and 2019. (1) Refer to the Earnings Supplement to the Financial Community section for reconciliations between GAAP and Operating (non-GAAP) earnings 2020 vs. 2019 EPS Variance (GAAP) Basic EPS (Non-GAAP) Operating EPS(1) Regulated Distribution ($0.24) ($0.20) Regulated Transmission $0.02 $0.03 Corporate / Other $0.51 ($0.02) FE Consolidated $0.29 ($0.19) 9 Jon Taylor, SVP and CFO

Financial Updates ■ Providing 2021 GAAP and Operating (non-GAAP) earnings guidance of $2.40 - $2.60 per share – 1Q 2021 GAAP and Operating (non-GAAP) earnings guidance of $0.62- $0.72 per share ■ Expect 2021 capital investments of up to $3B ■ We expect continued Transmission growth from our Energizing the Future program – On February 2, 2021, JCP&L filed an uncontested settlement agreement with FERC in our forward-looking formula rate case – In December 2020, FERC accepted our proposed tariff revisions for the transmission assets of West Penn Power, Mon Power and Potomac Edison, as well as the new Keystone Appalachian Transmission Company (KATCO), pending the outcome of the settlement and hearing process – Entities moved to a forward-looking formula rate structure effective January 1, 2021, subject to refund ■ Other key drivers for 2021 include the full-year impact from the base distribution case at JCP&L, continued investment in our distribution enhancement programs and lower operating costs – We expect these positive drivers to be partially offset by higher interest expense from our liquidity management strategy and a conservative load forecast 2021 Outlook February 18, 202110 Jon Taylor, SVP and CFO

Financial Updates (Continued) ■ Equity remains a part of our overall financing plan, and we are affirming our plan to issue up to $600M in equity annually in 2022 and 2023 and will flex our equity plan as needed ■ We remain committed to maintaining adequate liquidity for our subsidiaries – Year-end liquidity of ~$3B; $1.7B of cash and $1.3B of undrawn capacity under our credit facilities ■ We currently have $2.2B of short-term borrowings, of which ~$2.1B was incurred in November as a proactive measure to preserve financial flexibility – As we work through our financing plan, we expect to reduce short-term borrowings – Current long-term debt maturities remain manageable, with only $74M maturing in 2021 ■ We remain in close contact with the ratings agencies, who are intensely focused on governance and actions we are taking to strengthen compliance – We are targeting future consolidated FFO-to-Debt metrics in the 12-13% range as we work to address some of the uncertainties mentioned earlier ■ In accordance with our target payout ratio of 55 to 65% of Operating (non-GAAP) earnings, the Board declared a quarterly dividend of $0.39 per share in December, payable March 1st – Intend to hold the dividend flat in 2021, subject to ongoing Board review and approval – The Board will consider the entire landscape of the investigation process before each quarterly dividend is declared Financial Updates February 18, 202111 Jon Taylor, SVP and CFO

Financial Updates (Continued) ■ Kicked off FE Forward, a project designed to transform FirstEnergy into a more efficient and effective industry leader, delivering superior customer value and shareholder returns ■ Employees across FirstEnergy, in partnership with McKinsey, are challenging organizational traditions, conventional wisdom and cultural norms – Focused on modernizing our management practices, processes and digital/technology platforms to deliver a superior customer experience and a more nimble organization for the future – While we view this as a transformational effort, we expect to naturally deliver efficiencies – We expect that this transformation will provide us the ability to reinvest in our business, our customers and our employees to become a better technology-enabled leader in the industry – The eight-week information-gathering phase of the project included intense and robust employee engagement to better understand how we work – and how we can do it better – As we enter the next phase, we will again engage employees throughout the company to review and assess each opportunity and build out the plans to transform FirstEnergy FE Forward February 18, 202112 Over the next few months, we will build out specific actions for the future which we look forward to sharing Jon Taylor, SVP and CFO

Earnings Supplement to the Financial Community 14. 4Q Earnings Summary and Reconciliation 15. YTD Earnings Summary and Reconciliation 16. 4Q Earnings Drivers by Segment 17. Special Items Descriptions 18. 4Q 2020 Earnings Results 19. 4Q 2019 Earnings Results 20. Quarter-over-Quarter Earnings Comparison 21. YTD 2020 Earnings Results 22. YTD 2019 Earnings Results 23. Year-over-Year Earnings Comparison February 18, 2021 TABLE OF CONTENTS (Slide) Irene M. Prezelj, Vice President prezelji@firstenergycorp.com 330.384.3859 Gina E. Caskey, Senior Advisor caskeyg@firstenergycorp.com 330.761.4185 Jake M. Mackin, Consultant mackinj@firstenergycorp.com 330.384.4829 13

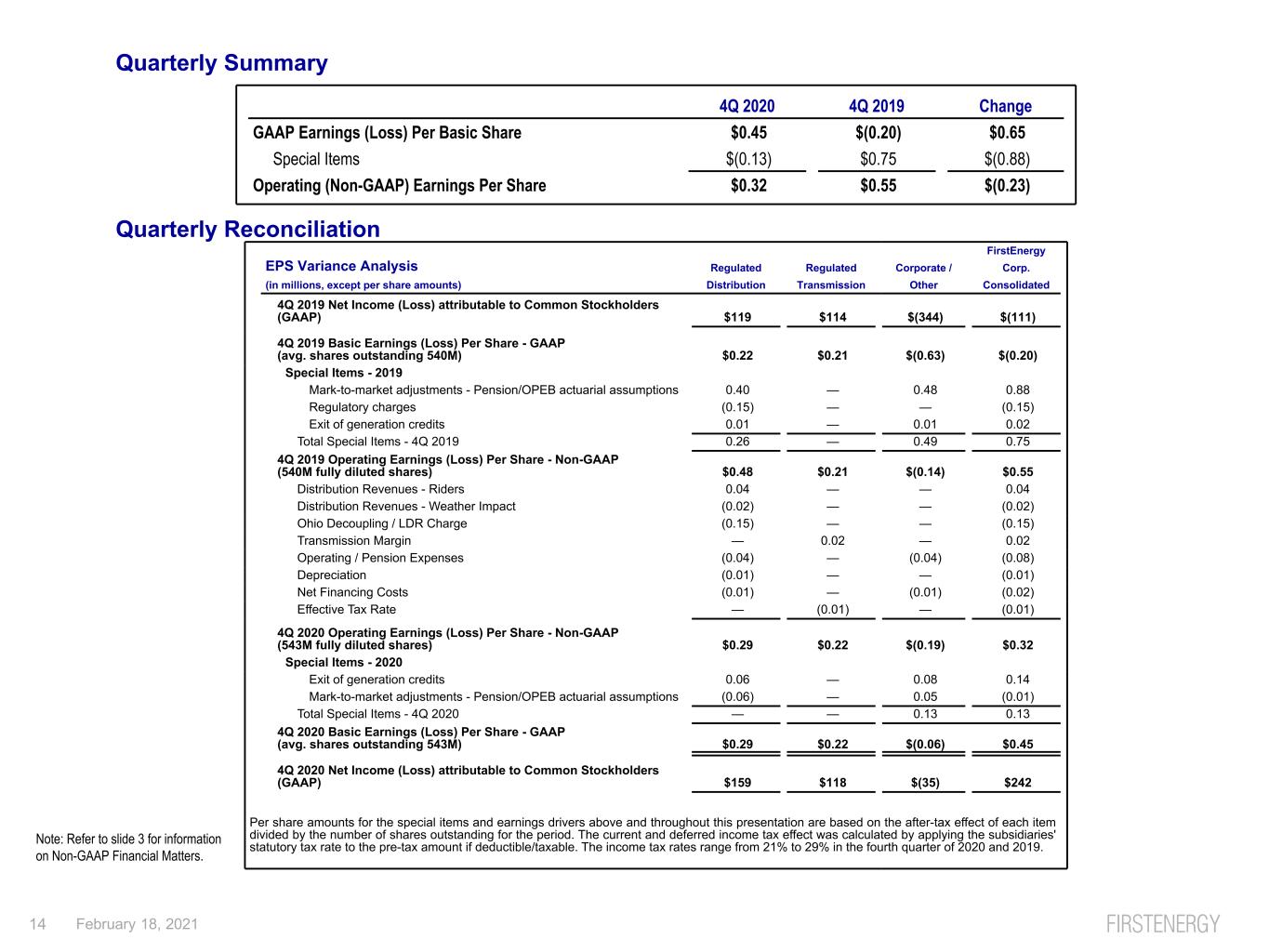

FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 4Q 2019 Net Income (Loss) attributable to Common Stockholders (GAAP) $119 $114 $(344) $(111) 4Q 2019 Basic Earnings (Loss) Per Share - GAAP (avg. shares outstanding 540M) $0.22 $0.21 $(0.63) $(0.20) Special Items - 2019 Mark-to-market adjustments - Pension/OPEB actuarial assumptions 0.40 — 0.48 0.88 Regulatory charges (0.15) — — (0.15) Exit of generation credits 0.01 — 0.01 0.02 Total Special Items - 4Q 2019 0.26 — 0.49 0.75 4Q 2019 Operating Earnings (Loss) Per Share - Non-GAAP (540M fully diluted shares) $0.48 $0.21 $(0.14) $0.55 Distribution Revenues - Riders 0.04 — — 0.04 Distribution Revenues - Weather Impact (0.02) — — (0.02) Ohio Decoupling / LDR Charge (0.15) — — (0.15) Transmission Margin — 0.02 — 0.02 Operating / Pension Expenses (0.04) — (0.04) (0.08) Depreciation (0.01) — — (0.01) Net Financing Costs (0.01) — (0.01) (0.02) Effective Tax Rate — (0.01) — (0.01) 4Q 2020 Operating Earnings (Loss) Per Share - Non-GAAP (543M fully diluted shares) $0.29 $0.22 $(0.19) $0.32 Special Items - 2020 Exit of generation credits 0.06 — 0.08 0.14 Mark-to-market adjustments - Pension/OPEB actuarial assumptions (0.06) — 0.05 (0.01) Total Special Items - 4Q 2020 — — 0.13 0.13 4Q 2020 Basic Earnings (Loss) Per Share - GAAP (avg. shares outstanding 543M) $0.29 $0.22 $(0.06) $0.45 4Q 2020 Net Income (Loss) attributable to Common Stockholders (GAAP) $159 $118 $(35) $242 Per share amounts for the special items and earnings drivers above and throughout this presentation are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in the fourth quarter of 2020 and 2019. Quarterly Summary Quarterly Reconciliation 4Q 2020 4Q 2019 Change GAAP Earnings (Loss) Per Basic Share $0.45 $(0.20) $0.65 Special Items $(0.13) $0.75 $(0.88) Operating (Non-GAAP) Earnings Per Share $0.32 $0.55 $(0.23) Note: Refer to slide 3 for information on Non-GAAP Financial Matters. February 18, 202114

FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2019 Net Income (Loss) attributable to Common Stockholders (GAAP) $1,076 $447 $(615) $908 2019 Basic Earnings (Loss) Per Share - GAAP (avg. shares outstanding 535M) $2.01 $0.84 $(1.15) $1.70 Special Items - 2019 Impact of full dilution (0.02) (0.01) 0.02 (0.01) Mark-to-market adjustments - Pension/OPEB actuarial assumptions 0.40 — 0.49 0.89 Regulatory charges (0.16) — — (0.16) Exit of generation credits 0.03 — 0.13 0.16 Total Special Items - 2019 0.25 (0.01) 0.64 0.88 2019 Operating Earnings (Loss) Per Share - Non-GAAP (539M fully diluted shares) $2.26 $0.83 $(0.51) $2.58 Distribution Revenues - Riders 0.18 — — 0.18 Distribution Revenues - Weather-Adjusted Sales 0.05 — — 0.05 Distribution Revenues - Weather Impact (0.07) — — (0.07) Absence of Ohio DMR (0.12) — — (0.12) Ohio Decoupling / LDR Charge (0.15) (0.15) Transmission Margin — 0.08 — 0.08 Operating / Pension Expenses (0.02) — (0.05) (0.07) Depreciation (0.05) — — (0.05) General Taxes (0.01) — — (0.01) 2019 Rate True-Ups — (0.01) — (0.01) Net Financing Costs (0.01) (0.01) — (0.02) Effective Tax Rate — (0.03) 0.03 — 2020 Operating Earnings (Loss) Per Share - Non-GAAP (542M fully diluted shares) $2.06 $0.86 $(0.53) $2.39 Special Items - 2020 Regulatory charges (0.01) — — (0.01) Exit of generation credits 0.16 — 0.05 0.21 Mark-to-market adjustments - Pension/OPEB actuarial assumptions (0.44) — (0.16) (0.60) Total Special Items - 2020 (0.29) — (0.11) (0.40) 2020 Basic Earnings (Loss) Per Share - GAAP (avg. shares outstanding 542M) $1.77 $0.86 $(0.64) $1.99 2020 Net Income (Loss) attributable to Common Stockholders (GAAP) $959 $464 $(344) $1,079 Per share amounts for the special items and earnings drivers above and throughout this presentation are based on the after-tax effect of each item divided by the number of shares outstanding for the period assuming the full impact of dilution from the $2.5 billion equity issuance in January 2018. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/ taxable. The income tax rates range from 21% to 29% in 2020 and 2019. Year-to-Date Summary Year-to-Date Reconciliation 2020 2019 Change GAAP Earnings Per Basic Share $1.99 $1.70 $0.29 Special Items $0.40 $0.88 $(0.48) Operating (Non-GAAP) Earnings Per Share $2.39 $2.58 $(0.19) Note: Refer to slide 3 for information on Non-GAAP Financial Matters. February 18, 202115

Earnings Drivers: 4Q 2020 vs. 4Q 2019 Regulated Distribution (RD) ▪ Distribution Revenues - Riders: Incremental rider revenues in Ohio and PA increased earnings $0.04 per share. ▪ Distribution Revenues - Weather Impact: Lower weather-related usage decreased earnings $0.02 per share. Heating Degree Days were ~8% lower than the fourth quarter of 2019 and ~9% below normal. ▪ Ohio Decoupling / LDR Charge: The charge at our Ohio utilities decreased earnings $0.15 per share, resulting from the partial settlement with the Ohio Attorney General and the decision to forego collection of lost distribution revenues from residential and commercial customers as authorized under the current Electric Security Plan. ▪ Operating / Pension Expenses: Higher expenses decreased earnings $0.04 per share, primarily due to timing of projects and planned generation outages, partially offset by lower pension and OPEB costs. ▪ Depreciation: Higher expense decreased earnings $0.01 per share, primarily due to a higher asset base. ▪ Net Financing Costs: Higher interest expense decreased earnings $0.01 per share. ▪ Special Items: In the fourth quarter of 2019, special items totaled $0.26 per share. Regulated Transmission (RT) ▪ Transmission Margin: Higher transmission margin increased earnings $0.02 per share, primarily due to higher rate base at Mid-Atlantic Interstate Transmission, LLC (MAIT), American Transmission Systems, Incorporated (ATSI), and JCP&L. ▪ Effective Tax Rate: The absence of a tax benefit recognized in the fourth quarter of 2019 decreased earnings $0.01 per share. Corporate / Other (Corp) ▪ Operating / Pension Expenses: Higher expenses decreased results $0.04 per share, primarily due to higher investigation-related costs. ▪ Net Financing Costs: Higher interest expense decreased earnings $0.01 per share. ▪ Special Items: In the fourth quarter of 2020 and 2019, special items totaled ($0.13) per share and $0.49 per share, respectively. 3.8% (4.1)% (5.0)% (1.5)% Residential Commercial Industrial Total 0.5% (5.4)% (5.1)% (3.1)% Residential Commercial Industrial Total Q-o-Q Weather-Adjusted Distribution Deliveries Q-o-Q Actual Distribution Deliveries February 18, 202116

Special Items Descriptions ▪ Regulatory charges: Primarily reflects the impact of regulatory agreements or orders requiring certain commitments and/or disallowing the recoverability of costs, net of related credits. ▪ Exit of generation credits: Primarily reflects charges or credits resulting from the exit of competitive operations, the transfer of TMI-2 and impairments of certain non-core assets, including the impact of deconsolidating FES, its subsidiaries and FENOC, following their voluntary petitions for bankruptcy protection on March 31, 2018. ▪ Mark-to-market adjustments - Pension/OPEB actuarial assumptions: Primarily reflects the change in fair value of plan assets and net actuarial gains and losses associated with the Company's pension and other post-employment benefit plans. ▪ Impact of full dilution: Represents the dilutive impact of increasing weighted average shares outstanding to reflect the full impact of share dilution from the $2.5 billion equity issuance in January 2018, including preferred dividends and conversion of preferred stock to common shares. Note: Special items represent charges incurred or benefits realized, including share dilution, that management believes are not indicative of, or may obscure trends useful in evaluating, the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. February 18, 202117

4th Quarter 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,099 $ 428 $ (34) $ 2,493 $ — $ — $ — $ — $ 2,099 $ 428 $ (34) $ 2,493 (2) Other 57 4 (17) 44 — — — — 57 4 (17) 44 (3) Total Revenues 2,156 432 (51) 2,537 — — — — 2,156 432 (51) 2,537 (4) Fuel 93 — — 93 — — — — 93 — — 93 (5) Purchased power 625 — 3 628 — — — — 625 — 3 628 (6) Other operating expenses 833 81 (39) 875 — — (1) (a) (1) 833 81 (40) 874 (7) Provision for depreciation 224 80 16 320 — — — — 224 80 16 320 (8) Amortization (deferral) of regulatory assets, net (32) 5 — (27) (12) (a) — — (12) (44) 5 — (39) (9) General taxes 187 55 12 254 — — — — 187 55 12 254 (10) Total Operating Expenses 1,930 221 (8) 2,143 (12) — (1) (13) 1,918 221 (9) 2,130 (11) Operating Income (Loss) 226 211 (43) 394 12 — 1 13 238 211 (42) 407 (12) Miscellaneous income, net 86 9 34 129 (6) (a) — (14) (a) (20) 80 9 20 109 (13) Pension and OPEB mark-to-market adjustment (66) (21) 33 (54) 66 (b) — (33) (b) 33 — (21) — (21) (14) Interest expense (127) (57) (89) (273) — — — — (127) (57) (89) (273) (15) Capitalized financing costs 9 11 — 20 — — — — 9 11 — 20 (16) Total Other Expense (98) (58) (22) (178) 60 — (47) 13 (38) (58) (69) (165) (17) Income (Loss) Before Income Taxes (Benefits) 128 153 (65) 216 72 — (46) 26 200 153 (111) 242 (18) Income taxes (benefits) (31) 35 — 4 72 (a) (b) — (7) (a) (b) 65 41 35 (7) 69 (19) Income (Loss) From Continuing Operations 159 118 (65) 212 — — (39) (39) 159 118 (104) 173 (20) Discontinued operations, net of tax — — 30 30 — — (30) (a) (30) — — — — (21) Net Income (Loss) 159 118 (35) 242 — — (69) (69) 159 118 (104) 173 (22) Income Allocated to Preferred Stockholders — — — — — — — — — — — — (23) Net Income (Loss) Attributable to Common $ 159 $ 118 $ (35) $ 242 $ — $ — $ (69) $ (69) $ 159 $ 118 $ (104) $ 173 (24) Average Shares Outstanding 543 543 543 (25) Earnings (Loss) per Share $ 0.29 $ 0.22 $ (0.06) $ 0.45 $ — $ — $ (0.13) $ (0.13) $ 0.29 $ 0.22 $ (0.19) $ 0.32 Special Items (after-tax impact): (a) Exit of generation credits $ (35) $ — $ (41) $ (76) (b) Mark-to-market - Pension/OPEB 35 — (28) 7 Impact to Earnings $ — $ — $ (69) $ (69) February 18, 202118

4th Quarter 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,238 $ 420 $ (32) $ 2,626 $ — $ — $ — $ — $ 2,238 $ 420 $ (32) $ 2,626 (2) Other 59 3 (15) 47 — — — — 59 3 (15) 47 (3) Total Revenues 2,297 423 (47) 2,673 — — — — 2,297 423 (47) 2,673 (4) Fuel 115 — — 115 — — — — 115 — — 115 (5) Purchased power 733 — 4 737 — — — — 733 — 4 737 (6) Other operating expenses 720 67 22 809 12 (a) — (76) (c) (64) 732 67 (54) 745 (7) Provision for depreciation 219 73 18 310 — — — — 219 73 18 310 (8) Amortization of regulatory assets, net (168) 4 — (164) 95 (a) — — 95 (73) 4 — (69) (9) General taxes 188 53 10 251 — — — — 188 53 10 251 (10) Total Operating Expenses 1,807 197 54 2,058 107 — (76) 31 1,914 197 (22) 2,089 (11) Operating Income (Loss) 490 226 (101) 615 (107) — 76 (31) 383 226 (25) 584 (12) Miscellaneous income, net 46 3 3 52 2 (c) — 20 (c) 22 48 3 23 74 (13) Pension and OPEB mark-to-market adjustment (290) (47) (337) (674) 290 (b) — 337 (b) 627 — (47) — (47) (14) Interest expense (125) (50) (85) (260) — — — — (125) (50) (85) (260) (15) Capitalized financing costs 10 8 — 18 — — — — 10 8 — 18 (16) Total Other Expense (359) (86) (419) (864) 292 — 357 649 (67) (86) (62) (215) (17) Income (Loss) Before Income Taxes (Benefits) 131 140 (520) (249) 185 — 433 618 316 140 (87) 369 (18) Income taxes (benefits) 12 26 (106) (68) 46 (a)-(c) — 97 (b) (c) 143 58 26 (9) 75 (19) Income (Loss) From Continuing Operations 119 114 (414) (181) 139 — 336 475 258 114 (78) 294 (20) Discontinued operations, net of tax — — 70 70 — — (70) (b) (c) (70) — — — — (21) Net Income (Loss) 119 114 (344) (111) 139 — 266 405 258 114 (78) 294 (22) Income Allocated to Preferred Stockholders — — — — — — — — — — — — (23) Net Income (Loss) Attributable to Common $ 119 $ 114 $ (344) $ (111) $ 139 $ — $ 266 $ 405 $ 258 $ 114 $ (78) $ 294 (24) Average Shares Outstanding 540 540 540 (25) Earnings (Loss) per Share $ 0.22 $ 0.21 $ (0.63) $ (0.20) $ 0.26 $ — $ 0.49 $ 0.75 $ 0.48 $ 0.21 $ (0.14) $ 0.55 Special Items (after-tax impact): (a) Regulatory charges $ (83) $ — $ — $ (83) (b) Mark-to-market adjustments - Pension/OPEB 216 — 262 478 (c) Exit of generation credits 6 — 4 10 Impact to Earnings $ 139 $ — $ 266 $ 405 February 18, 202119

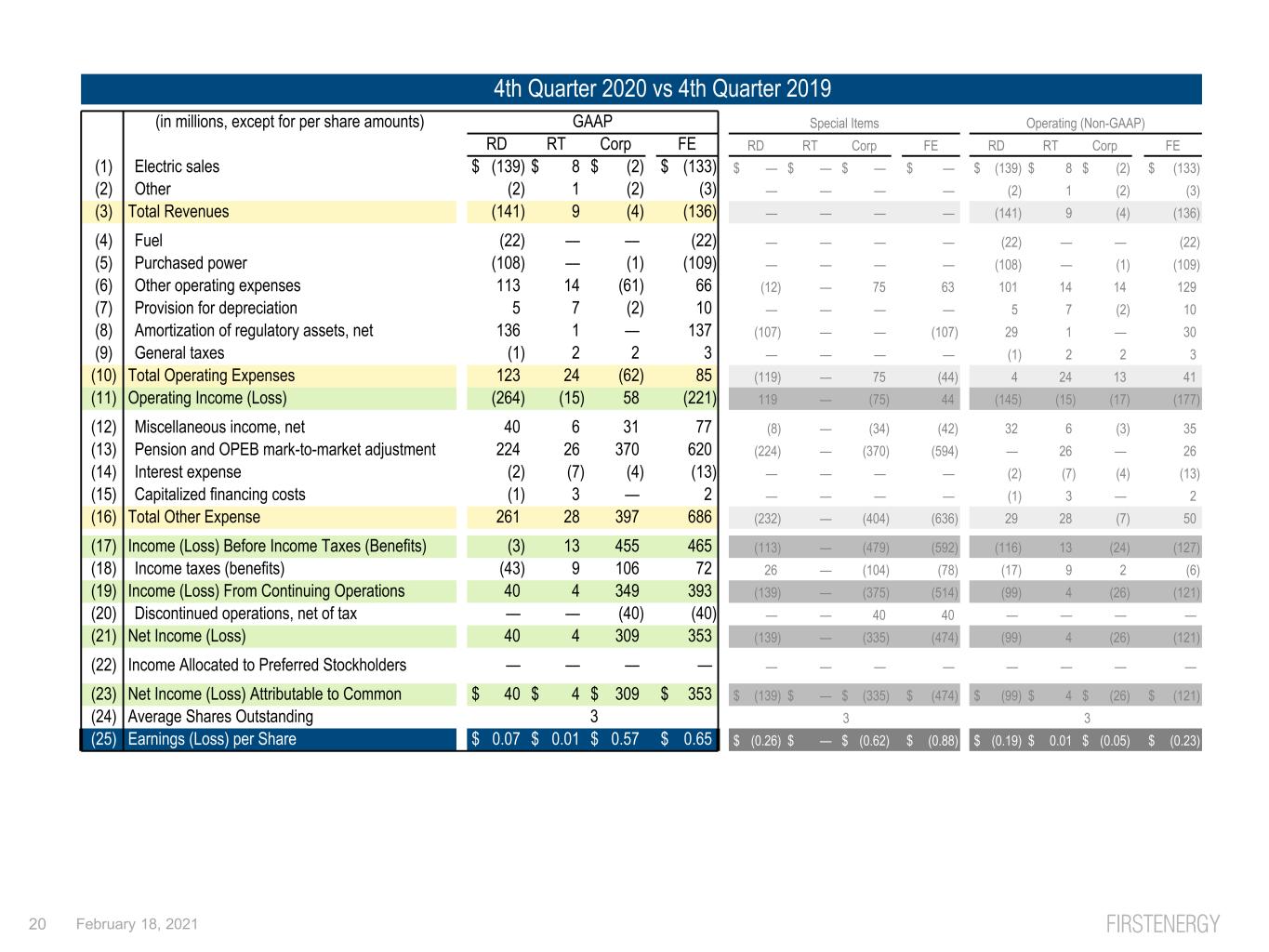

4th Quarter 2020 vs 4th Quarter 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ (139) $ 8 $ (2) $ (133) $ — $ — $ — $ — $ (139) $ 8 $ (2) $ (133) (2) Other (2) 1 (2) (3) — — — — (2) 1 (2) (3) (3) Total Revenues (141) 9 (4) (136) — — — — (141) 9 (4) (136) (4) Fuel (22) — — (22) — — — — (22) — — (22) (5) Purchased power (108) — (1) (109) — — — — (108) — (1) (109) (6) Other operating expenses 113 14 (61) 66 (12) — 75 63 101 14 14 129 (7) Provision for depreciation 5 7 (2) 10 — — — — 5 7 (2) 10 (8) Amortization of regulatory assets, net 136 1 — 137 (107) — — (107) 29 1 — 30 (9) General taxes (1) 2 2 3 — — — — (1) 2 2 3 (10) Total Operating Expenses 123 24 (62) 85 (119) — 75 (44) 4 24 13 41 (11) Operating Income (Loss) (264) (15) 58 (221) 119 — (75) 44 (145) (15) (17) (177) (12) Miscellaneous income, net 40 6 31 77 (8) — (34) (42) 32 6 (3) 35 (13) Pension and OPEB mark-to-market adjustment 224 26 370 620 (224) — (370) (594) — 26 — 26 (14) Interest expense (2) (7) (4) (13) — — — — (2) (7) (4) (13) (15) Capitalized financing costs (1) 3 — 2 — — — — (1) 3 — 2 (16) Total Other Expense 261 28 397 686 (232) — (404) (636) 29 28 (7) 50 (17) Income (Loss) Before Income Taxes (Benefits) (3) 13 455 465 (113) — (479) (592) (116) 13 (24) (127) (18) Income taxes (benefits) (43) 9 106 72 26 — (104) (78) (17) 9 2 (6) (19) Income (Loss) From Continuing Operations 40 4 349 393 (139) — (375) (514) (99) 4 (26) (121) (20) Discontinued operations, net of tax — — (40) (40) — — 40 40 — — — — (21) Net Income (Loss) 40 4 309 353 (139) — (335) (474) (99) 4 (26) (121) (22) Income Allocated to Preferred Stockholders — — — — — — — — — — — — (23) Net Income (Loss) Attributable to Common $ 40 $ 4 $ 309 $ 353 $ (139) $ — $ (335) $ (474) $ (99) $ 4 $ (26) $ (121) (24) Average Shares Outstanding 3 3 3 (25) Earnings (Loss) per Share $ 0.07 $ 0.01 $ 0.57 $ 0.65 $ (0.26) $ — $ (0.62) $ (0.88) $ (0.19) $ 0.01 $ (0.05) $ (0.23) February 18, 202120

YTD December 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 9,130 $ 1,613 $ (139) $ 10,604 $ — $ — $ — $ — $ 9,130 $ 1,613 $ (139) $ 10,604 (2) Other 233 17 (64) 186 — — — — 233 17 (64) 186 (3) Total Revenues 9,363 1,630 (203) 10,790 — — — — 9,363 1,630 (203) 10,790 (4) Fuel 369 — — 369 — — — — 369 — — 369 (5) Purchased power 2,687 — 14 2,701 (5) (a) — — (5) 2,682 — 14 2,696 (6) Other operating expenses 3,178 282 (169) 3,291 (6) (b) — (59) (b) (65) 3,172 282 (228) 3,226 (7) Provision for depreciation 896 313 65 1,274 — — — — 896 313 65 1,274 (8) Amortization (deferral) of regulatory assets, net (64) 11 — (53) (12) (b) — — (12) (76) 11 — (65) (9) General taxes 770 232 44 1,046 — — — — 770 232 44 1,046 (10) Total Operating Expenses 7,836 838 (46) 8,628 (23) — (59) (82) 7,813 838 (105) 8,546 (11) Operating Income (Loss) 1,527 792 (157) 2,162 23 — 59 82 1,550 792 (98) 2,244 (12) Miscellaneous income, net 332 30 70 432 (6) (b) — (14) (b) (20) 326 30 56 412 (13) Pension and OPEB mark-to-market adjustment (323) (40) (114) (477) 323 (c) — 114 (c) 437 — (40) — (40) (14) Interest expense (501) (219) (345) (1,065) — — — — (501) (219) (345) (1,065) (15) Capitalized financing costs 37 39 1 77 — — — — 37 39 1 77 (16) Total Other Expense (455) (190) (388) (1,033) 317 — 100 417 (138) (190) (288) (616) (17) Income (Loss) Before Income Taxes (Benefits) 1,072 602 (545) 1,129 340 — 159 499 1,412 602 (386) 1,628 (18) Income taxes (benefits) 113 138 (125) 126 182 (a)-(c) — 38 (b) (c) 220 295 138 (87) 346 (19) Income (Loss) From Continuing Operations 959 464 (420) 1,003 158 — 121 279 1,117 464 (299) 1,282 (20) Discontinued operations, net of tax — — 76 76 — — (62) (b) (62) — — 14 14 (21) Net Income (Loss) 959 464 (344) 1,079 158 — 59 217 1,117 464 (285) 1,296 (22) Income Allocated to Preferred Stockholders — — — — — — — — — — — — (23) Net Income (Loss) Attributable to Common $ 959 $ 464 $ (344) $ 1,079 $ 158 $ — $ 59 $ 217 $ 1,117 $ 464 $ (285) $ 1,296 (24) Average Shares Outstanding 542 542 542 (25) Earnings (Loss) per Share $ 1.77 $ 0.86 $ (0.64) $ 1.99 $ 0.29 $ — $ 0.11 $ 0.40 $ 2.06 $ 0.86 $ (0.53) $ 2.39 Special Items (after-tax impact): (a) Regulatory charges $ 4 $ — $ — $ 4 (b) Exit of generation credits (83) — (29) (112) (c) Mark-to-market - Pension/OPEB 237 — 88 325 Impact to Earnings $ 158 $ — $ 59 $ 217 February 18, 202121

YTD December 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 9,452 $ 1,510 $ (128) $ 10,834 $ — $ — $ — $ — $ 9,452 $ 1,510 $ (128) $ 10,834 (2) Other 246 16 (61) 201 — — — — 246 16 (61) 201 (3) Total Revenues 9,698 1,526 (189) 11,035 — — — — 9,698 1,526 (189) 11,035 (4) Fuel 497 — — 497 — — — — 497 — — 497 (5) Purchased power 2,910 — 17 2,927 — — — — 2,910 — 17 2,927 (6) Other operating expenses 2,836 272 (156) 2,952 (4) (a) (c) — (79) (c) (83) 2,832 272 (235) 2,869 (7) Provision for depreciation 863 284 73 1,220 — — — — 863 284 73 1,220 (8) Amortization (deferral) of regulatory assets, net (89) 10 — (79) 104 (a) — — 104 15 10 — 25 (9) General taxes 760 209 39 1,008 — — (2) (c) (2) 760 209 37 1,006 (10) Total Operating Expenses 7,777 775 (27) 8,525 100 — (81) 19 7,877 775 (108) 8,544 (11) Operating Income (Loss) 1,921 751 (162) 2,510 (100) — 81 (19) 1,821 751 (81) 2,491 (12) Miscellaneous income, net 174 15 54 243 4 (c) — 22 (c) 26 178 15 76 269 (13) Pension and OPEB mark-to-market adjustment (290) (47) (337) (674) 290 (b) — 337 (b) 627 — (47) — (47) (14) Interest expense (495) (192) (346) (1,033) — — — — (495) (192) (346) (1,033) (15) Capitalized financing costs 37 33 1 71 — — — — 37 33 1 71 (16) Total Other Expense (574) (191) (628) (1,393) 294 — 359 653 (280) (191) (269) (740) (17) Income (Loss) Before Income Taxes (Benefits) 1,347 560 (790) 1,117 194 — 440 634 1,541 560 (350) 1,751 (18) Income taxes (benefits) 271 113 (171) 213 48 (a)-(c) — 98 (b) (c) 146 319 113 (73) 359 (19) Income (Loss) From Continuing Operations 1,076 447 (619) 904 146 — 342 488 1,222 447 (277) 1,392 (20) Discontinued operations, net of tax — — 8 8 — — (8) (b) (c) (8) — — — — (21) Net Income (Loss) 1,076 447 (611) 912 146 — 334 480 1,222 447 (277) 1,392 (22) Income Allocated to Preferred Stockholders — — 4 4 — — (4) (d) (4) — — — — (23) Net Income (Loss) Attributable to Common $ 1,076 $ 447 $ (615) $ 908 $ 146 $ — $ 338 $ 484 $ 1,222 $ 447 $ (277) $ 1,392 (24) Average Shares Outstanding 535 539 539 (25) Earnings (Loss) per Share $ 2.01 $ 0.84 $ (1.15) $ 1.70 $ 0.25 $ (0.01) $ 0.64 $ 0.88 $ 2.26 $ 0.83 $ (0.51) $ 2.58 Special Items (after-tax impact): (a) Regulatory charges $ (89) $ — $ — $ (89) (b) Mark-to-market adjustments - Pension/OPEB 216 — 262 478 (c) Exit of generation credits 19 — 72 91 (d) Impact of full dilution — — 4 4 Impact to Earnings $ 146 $ — $ 338 $ 484 February 18, 202122

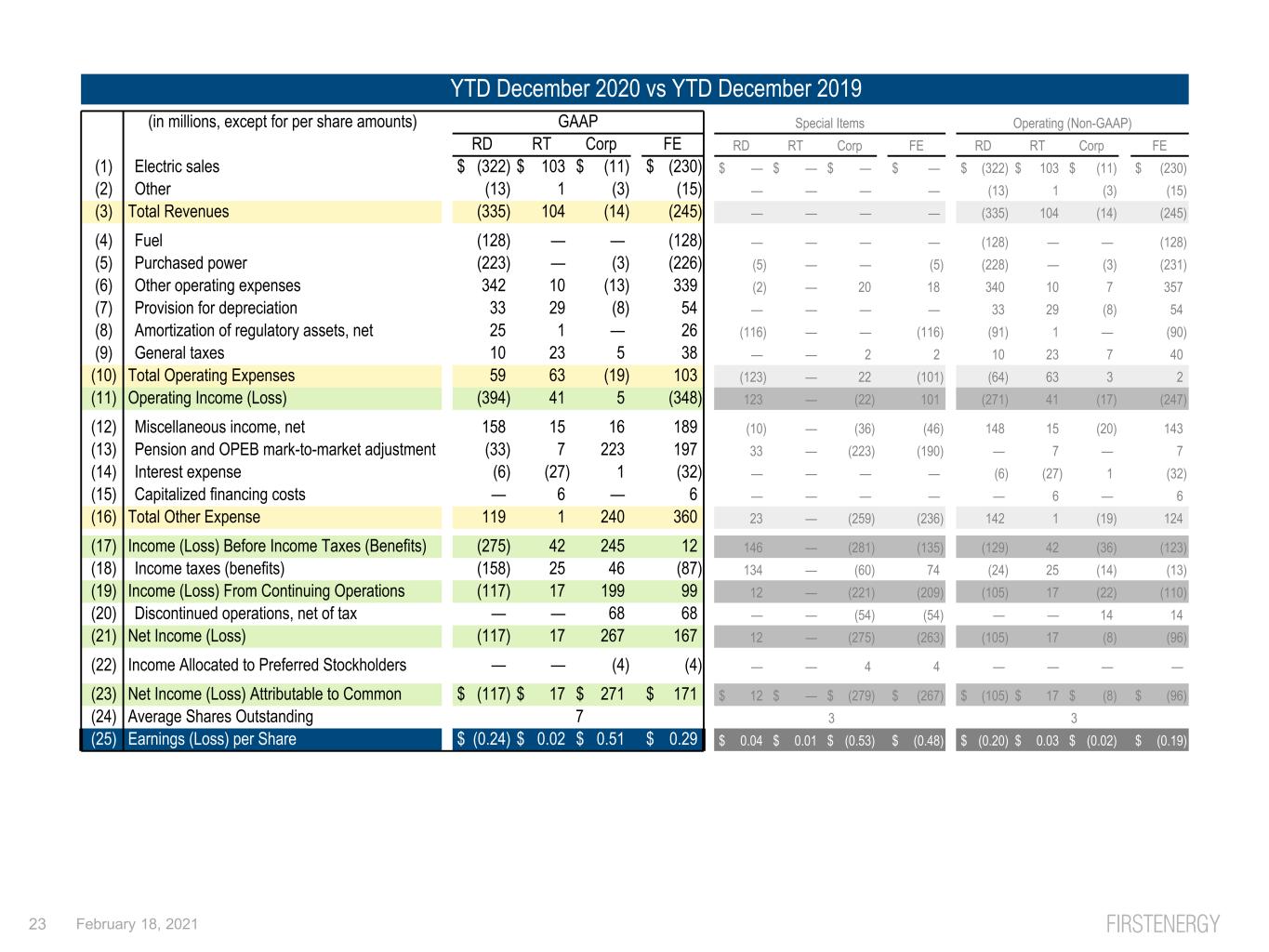

YTD December 2020 vs YTD December 2019 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ (322) $ 103 $ (11) $ (230) $ — $ — $ — $ — $ (322) $ 103 $ (11) $ (230) (2) Other (13) 1 (3) (15) — — — — (13) 1 (3) (15) (3) Total Revenues (335) 104 (14) (245) — — — — (335) 104 (14) (245) (4) Fuel (128) — — (128) — — — — (128) — — (128) (5) Purchased power (223) — (3) (226) (5) — — (5) (228) — (3) (231) (6) Other operating expenses 342 10 (13) 339 (2) — 20 18 340 10 7 357 (7) Provision for depreciation 33 29 (8) 54 — — — — 33 29 (8) 54 (8) Amortization of regulatory assets, net 25 1 — 26 (116) — — (116) (91) 1 — (90) (9) General taxes 10 23 5 38 — — 2 2 10 23 7 40 (10) Total Operating Expenses 59 63 (19) 103 (123) — 22 (101) (64) 63 3 2 (11) Operating Income (Loss) (394) 41 5 (348) 123 — (22) 101 (271) 41 (17) (247) (12) Miscellaneous income, net 158 15 16 189 (10) — (36) (46) 148 15 (20) 143 (13) Pension and OPEB mark-to-market adjustment (33) 7 223 197 33 — (223) (190) — 7 — 7 (14) Interest expense (6) (27) 1 (32) — — — — (6) (27) 1 (32) (15) Capitalized financing costs — 6 — 6 — — — — — 6 — 6 (16) Total Other Expense 119 1 240 360 23 — (259) (236) 142 1 (19) 124 (17) Income (Loss) Before Income Taxes (Benefits) (275) 42 245 12 146 — (281) (135) (129) 42 (36) (123) (18) Income taxes (benefits) (158) 25 46 (87) 134 — (60) 74 (24) 25 (14) (13) (19) Income (Loss) From Continuing Operations (117) 17 199 99 12 — (221) (209) (105) 17 (22) (110) (20) Discontinued operations, net of tax — — 68 68 — — (54) (54) — — 14 14 (21) Net Income (Loss) (117) 17 267 167 12 — (275) (263) (105) 17 (8) (96) (22) Income Allocated to Preferred Stockholders — — (4) (4) — — 4 4 — — — — (23) Net Income (Loss) Attributable to Common $ (117) $ 17 $ 271 $ 171 $ 12 $ — $ (279) $ (267) $ (105) $ 17 $ (8) $ (96) (24) Average Shares Outstanding 7 3 3 (25) Earnings (Loss) per Share $ (0.24) $ 0.02 $ 0.51 $ 0.29 $ 0.04 $ 0.01 $ (0.53) $ (0.48) $ (0.20) $ 0.03 $ (0.02) $ (0.19) February 18, 202123