Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CHART INDUSTRIES INC | ex991q42020.htm |

| 8-K - 8-K - CHART INDUSTRIES INC | gtls-20210218.htm |

Chart Industries FOURTH QUARTER AND FULL YEAR 2020 RESULTS Exhibit 99.2

Forward-Looking Statements CERTAIN STATEMENTS MADE IN THIS PRESENTATION ARE FORW ARD -LOOKING STATEMENTS W ITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORW ARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING THE COMPANY’S BUSINESS PLANS, INCLUDING STATEMENTS REGARDING COMPLETED DIVESTITURES, ACQUISITIONS, COST SYNERGIES AND EFFICIENCY SAVINGS, OBJECTIVES, FUTURE ORDERS, REVENUES, MARGINS, EARNINGS OR PERFORMANCE, LIQUIDITY AN D CASH FLOW , CAPITAL EXPENDITURES, BUSINESS TRENDS, GOVERNMENTAL INITIATIVES, INCLUDING EXECUTIVE ORDERS AND OTHER I NFORMATION THAT IS NOT HISTORICAL IN NATURE. FORW ARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY TERMINOLOGY SUCH AS "MAY," "W ILL ," "SHOULD," "COULD," "EXPECTS," "ANTICIPATES," "BELIEVES," "PRO JECTS," "FORECASTS," “OUTLOOK,” “GUIDANCE,” "CONTINUE," “TARGET,” OR THE NEGATIVE OF SUCH TERMS OR COMPARABLE TERMINOLOGY. FORW ARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION OR IN OTHER STATEMENTS MADE BY THE COMPANY ARE MADE BASED ON MANAGEMENT'S EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS I MPACTING THE COMPANY AND ARE SUBJECT TO UNCERTAINTIES AND FACTORS RELATING TO THE COMPANY'S OPERATIONS AND BUSINESS ENVIRO NMENT, ALL OF W HICH ARE DIFFICULT TO PREDICT AND MANY OF W HICH ARE BEYOND THE COMPANY'S CONTROL, THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE MATTERS EXPRESSED OR IMPLIED BY FORW ARD-LOOKING STATEMENTS. FACTORS THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORW ARD -LOOKING STATEMENTS INCLUDE: THE COMPANY’S ABILITY TO SUCCESSFULLY INTEGRATE RECENT ACQUISITIONS AND ACHIEVE THE ANTICIPATED REVENUE, EARNING S, ACCRETION AND OTHER BENEFITS FROM THESE ACQUISITIONS; RISKS RELATING TO THE RECENT OUTBREAK AND CONTINUED UNCERTAINTY ASSOCI ATED W ITH THE CORONAVIRUS (COVID-19) AND THE OTHER FACTORS DISCUSSED IN ITEM 1A (RISK FACTORS) IN THE COMPANY’S MOST RECENT ANNUAL REPORT ON FORM 10-K AND QUARTERLY REPORTS ON FORM 10 -Q FILED W ITH THE SEC, W HICH SHOULD BE REVIEW ED CAREFULLY. THE COMPANY UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORW ARD - LOOKING STATEMENT. THIS PRESENTATION CONTAINS NON-GAAP FINANCIAL INFORMATION, INCLUDING ADJUSTED EPS, ADJUSTED FREE CASH FLOW , AND Q4 AND FULL YEAR 2020 FREE CASH FLOW . FOR ADDITIONAL INFORMATION REGARDING THE COMPANY'S USE OF NON-GAAP FINANCIAL INFORMATION, AS W ELL AS RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO THE MOST DIRECTLY COMPARABLE FINANCIAL MEASURES CALCULATED AND PRESENTED IN ACCORDANCE W ITH ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN THE UNITED STATES ("GAAP"), PLEASE SEE THE PAGES AT THE END OF THIS NEW S RELEASE. W ITH RESPECT TO THE COMPANY’S 2021 FULL YEAR EARNINGS OUTLOOK, THE COMPANY IS NOT ABLE TO PROVIDE A RECONCILIATION OF THE ADJUSTED EARNINGS PER DILUTED SHARE AND ADJUSTED FREE CASH FLOW BECAUSE CERTAIN ITEMS MAY HAVE NOT YET OCCURRED OR ARE OUT OF THE COMPANY’S CONTROL AND/OR CANNOT BE REASONABLY PREDICTED. FURTHERMORE, NON-GAAP FINANCIAL MEASURES SHOW N IN THE PRESENTATION SLIDE LABELED “EXTERNAL SEGMENTATION” W ERE NOT RECONCILED TO THE COMPARABLE GAAP FINANCIAL MEASURES BECAUSE THE GAAP MEASURES W OULD REQUIRE SIGNIFICANT EFFORT TO PREPARE AND THEREFORE ARE NOT AVAILABLE AS OF THE TIME OF THIS NEW S RELEASE. CHART INDUSTRIES, INC. IS A LEADING INDEPENDENT GLOBAL MANUFACTURER OF HIGHLY ENGINEERED EQUIPMENT SERVICING MULTIPLE APPLICATIONS IN THE ENERGY AND INDUSTRIAL GAS MARKETS. OUR UNIQUE PRODUCT PORTFOLIO IS USED IN EVERY PHASE OF THE LIQUID GAS SUPPLY CHAIN, INCLUDING UPFRONT ENGINEERING, SERVICE AND REPAIR. BEING AT THE FOREFRONT OF THE CLEAN ENERGY TRANSITION, CHART IS A LEADING PROVIDER OF TECHNOLOGY, EQUIPMENT AND SERVICES RELATED TO LIQUEFIED NATURAL GAS, HYDROGEN, BIOGAS AND CO2 CAPTURE AMONGST OTHER APPLICATIONS. W E ARE COMMITTED TO EXCELLENCE IN ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE (ESG) ISSUES BOTH FOR OUR COMPANY AS W ELL AS OUR CUSTOMERS. W ITH OVER 25 GLOBAL LOCATIONS FROM THE UNITED STATES TO ASIA, AUSTRALIA, INDIA, EUROPE AND SOUTH AMERICA, W E MAINTAIN ACCOUNTABILITY AND TRANSPARENCY TO OUR TEAM MEMBERS, SUPPLIERS, CUSTOMERS AND COMMUNITIES. TO LEARN MORE, VISIT WWW.CHARTINDUSTRIES.COM. © 2021 Chart Industries, Inc. Confidential and Proprietary 2

External Segmentation 3 Cryo Tank Solu t ions Heat Transfer Sys tems • Air Cooled Heat Exchangers (ACHX), • Brazed Aluminum Heat Exchangers (BAHX) • Cold Boxes • Nitrogen Rejection Units (NRU) • Integrated systems • High Efficiency Flow Fans • Bulk and Micro Bulk Storage Tanks • ISO Containers • Packaged Gas Systems • Non-specialty mobile equipment • Vaporizers • Dosing equipment • HLNG vehicle tanks • LNG by Rail (Gas By Rail Offering) • Hydrogen equipment • Cannabis products • FEMA Valves / FLOW Meters • Fueling stations Spec ia l ty Products Repa ir, Service & Leas ing • Repair and service • Aftermarket parts and maintenance • Global Leasing • Installations • Full lifecycle Global Commercial Team Global Engineering Team © 2021 Chart Industries, Inc. Confidential and Proprietary

Chart’s Transformation 4 Before 2018 THEN 2021 TODAY High customer concentration & low geographic diversity Heavy reliance on single large LNG projects Few long-term contracts in place Limited to no aftermarket, service and repair Disparate cost structures / silos High end-market (specialty) and geographic diversity (+India, Europe) Big LNG is a “nice to have” whereas before it was a “necessity” Multiple long-term agreements, MOUs in place Aftermarket parts, service and repair revenue continues to increase Centralized business services and agile, quick cost rationalization Now, we serve the clean power, clean water, clean food, clean industrial transition and destination © 2021 Chart Industries, Inc. Confidential and Proprietary A BD C 1. Market Trends 2. Profitable Growth E Community & Employees • Environmental, Social & Governance • Building capabilities to support other strategic pillars • Branding Thinking Disruptive • Alternative business models • Smart products (IOT) Margin Expansion • Strategic location manufacturing • International manufacturing for traditional US products • 80/20 • Strategic sourcing Innovative Solutions • Upfront Engineering • Partnerships for new turnkey solutions • Retrofit for efficiencies existing brownfield sites Broadest Product Offering for Industrial Gas & Energy • Application and Customer Expansion • Cryo-pump opportunity • Repair & Service • Specialty Markets

Chart’s Strategic Investment / Partnering Approach 2020 Development Agreement for LH2 automotive Completed master supply agreement Acquisition of cryogenic and H2 trailer business and former microbulk business 30M Euro investment with commercial MOU Acquisition of water treatment business Investment in Canadian H2 integrator Acquisition of SES, carbon capture technology 2018 / 2019 Divestiture of cryobio product line to Cryoport for $320M cash 2018: Acquires VRV 2018: Acquires Skaff Cryogenics 2018: Completes BAHX capacity expansion in La Crosse, WI 2018: Divestiture of oxygen concentrator business 2019: Acquisition of Air-X-Changers 2021 Brings access to: (1) customers and commercial projects that could not be accessed without significant organic investment (2) geographies that otherwise could not readily be accessed due to lack of product experience in the region, certification requirements, or government funding and relationships. Acquisition of Cryo Technologies for $55 million cash (Feb 16, 2021) Joint development MOU February 10, 2021 $15M Investment and commercial MOU Completed Feb 2, 2021 5© 2021 Chart Industries, Inc. Confidential and Proprietary

2020 Chart Industries Investor Day 6

Full Year 2020 Records 7 Total Chart Records: • New customers (472) • Long-term agreements executed (33) • 53 new leases signed (vs. 18 in 2019) • Adjusted earnings per share ($2.73) • Lowest total SG&A as a % of sales (15.1% reported; 14.3% normalized) • Operating income as a percent of sales (10.9%) • Year-end 2020 backlog is a record high ($810 million) • Lowest Total Recordable Incident Rate (TRIR) and # of accidents in our history $530.4 $679.7 1H FY20 2H FY20 +28% 28% Increase in Second Half 2020 Orders Over First Half 2020 Chart consolidated total includes ($5M) intra-company eliminations for 2H FY20 and ($10M) for 1H FY20 © 2021 Chart Industries, Inc. Confidential and Proprietary

Strong Q4 and Second Half 2020 Orders and Margin 8 Q4 2020 / Year-End 2020 Records: • Other Record Q4 2020 Orders • HLNG vehicle tanks (Specialty) • Hydrogen (Specialty) • Food & beverage (Specialty) • Engineered systems (CTS) • Mobile equipment (CTS) • Medical oxygen equipment (CTS) • VRV (HTS) • Air cooled heat exchangers (HTS) • 80 orders greater than $1 million in Q4 2020 $122 $158 1H FY20 2H FY20 Specialty Products $147 $184 1H FY20 2H FY20 Heat Transfer Systems $186 $231 1H FY20 2H FY20 Cryo Tank Solutions 24% 25% 30% 84 112 1H FY20 2H FY20 Repair, Service, & Leasing 33%

Our Specialty Markets Keep Growing 700M 750M 2,100M Space ▪ Cryogenic liquid propellants are used as fuel for rocket propulsion Drivers of Size Opportunity ▪ Proliferation of private space travel industry Industrial Lasers ▪ High purity liquid nitrogen (gas assist) provides a faster cut and superior edge, free of impurities Drivers of Size Opportunity ▪ Uptime requirements in manufacturing ▪ Reducing steps in production Cannabis ▪ Liquid CO2 storage and supply / delivery systems ▪ Used in grow houses, CBD oil extraction and packaging Drivers of Size Opportunity ▪ Legalization of cannabis ▪ Regulatory approval for CBD. Food & Beverage ▪ Food preservation equipment ▪ Nitrogen dosing equipment Drivers of Size Opportunity ▪ Nitro-beverage changeover Water Treatment ▪ Improving water quality and wastewater reuse utilize liquid oxygen and CO2 in purification process Drivers of Size Opportunity ▪ Regulation on water treatment ▪ Population growth Over The Road Trucking ▪ LNG as alternative fuel to diesel for heavy duty vehicles (lower emissions, engine noise, etc.) Drivers of Size Opportunity ▪ Regulations Hydrogen ▪ H2 vehicle fueling stations, transport equipment and liquefaction storage at H2 production sites ▪ H2 storage and mobility equipment ▪ BAHX for H2 liquefaction ▪ H2 liquefaction Drivers of Size Opportunity ▪ Buildout of hydrogen fueling infrastructure ▪ Development of “green hydrogen” industry ▪ Government stimulus packages ▪ Brand name fast followers500M 250M 200M 200M 200M Molecules By Rail ▪ Gas by rail tender cars approved for use Drivers of Size Opportunity ▪ Legalization of LNG by train in the U.S. ▪ Expected growth in EU 600M Carbon & Direct Air Capture ▪ Air cooled heat exchangers ▪ Storage tanks ▪ BAHX and cold boxes Drivers of Size Opportunity ▪ Carbon emissions reduction targets ▪ CO2 supply shortage +$1 billion 250M Helium Liquefaction ▪ Helium Liquefaction ▪ Storage ▪ ISO Containers ▪ Transport Drivers of Size Opportunity • Differentiated process • Helium consistently in high demand • Russia vast natural resources 9© 2021 Chart Industries, Inc. Confidential and Proprietary

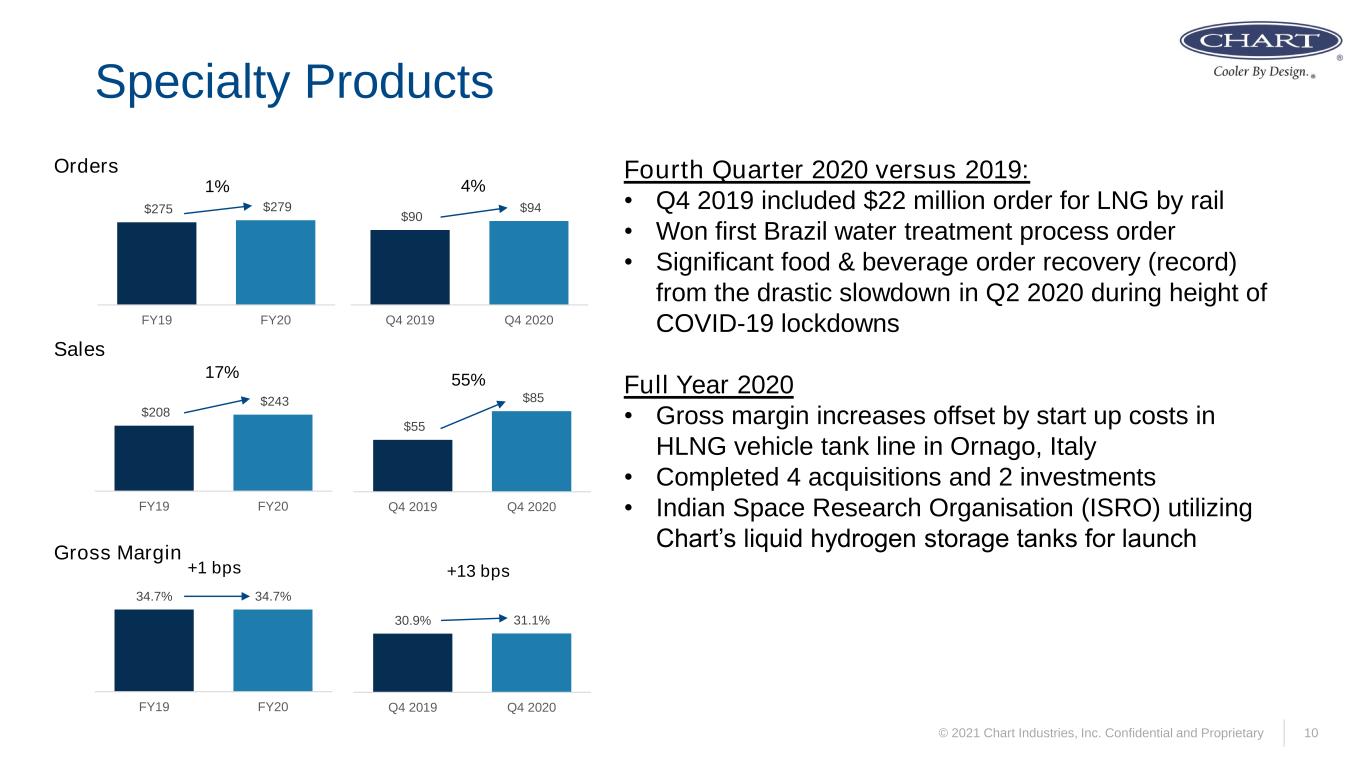

$275 $279 FY19 FY20 1% 10 Specialty Products Orders Sales Gross Margin $55 $85 Q4 2019 Q4 2020 $208 $243 FY19 FY20 30.9% 31.1% Q4 2019 Q4 2020 34.7% 34.7% FY19 FY20 17% $90 $94 Q4 2019 Q4 2020 4% 55% +13 bps+1 bps Fourth Quarter 2020 versus 2019: • Q4 2019 included $22 million order for LNG by rail • Won first Brazil water treatment process order • Significant food & beverage order recovery (record) from the drastic slowdown in Q2 2020 during height of COVID-19 lockdowns Full Year 2020 • Gross margin increases offset by start up costs in HLNG vehicle tank line in Ornago, Italy • Completed 4 acquisitions and 2 investments • Indian Space Research Organisation (ISRO) utilizing Chart’s liquid hydrogen storage tanks for launch © 2021 Chart Industries, Inc. Confidential and Proprietary

Hydrogen NPD: Production Ready in 2021 11 Liquid Hydrogen Onboard Vehicle Tank being tested at our Canton, Georgia (USA) facility Hydrogen Test Facility in New Prague, Minnesota (USA) includes a liquid hydrogen bulk tank, a LH2 run tank, pumps and other related components for testing and a fully instrumented test building © 2021 Chart Industries, Inc. Confidential and Proprietary

Q4 2020 First of a Kinds (FOAKs) & New Customer Examples 12 Squeezable DipsNitro Beer Water desalination “Just Egg” bottled egg alternative Ophthalmic research Canned wine Partnering with Pepsi to upgrade their CO2 capacity at one of Pepsi’s USA facilities (Q4 2020 order) Chart and O2 are collaborating on O2’s unique oxygen water, a hydration and recovery drink © 2021 Chart Industries, Inc. Confidential and Proprietary

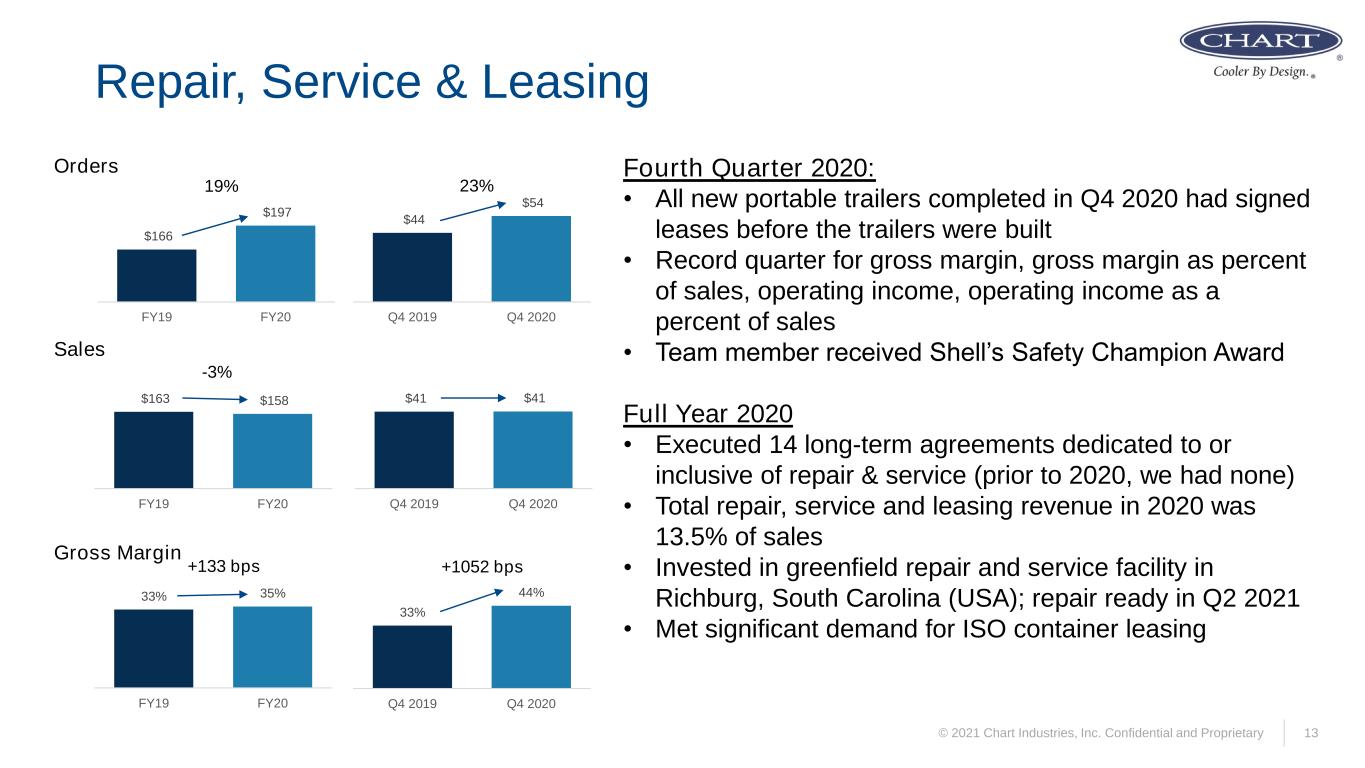

$41 $41 Q4 2019 Q4 2020 13 Repair, Service & Leasing Orders Sales Gross Margin $44 $54 Q4 2019 Q4 2020 $163 $158 FY19 FY20 33% 44% Q4 2019 Q4 2020 33% 35% FY19 FY20 $166 $197 FY19 FY20 19% 23% -3% +133 bps +1052 bps Fourth Quarter 2020: • All new portable trailers completed in Q4 2020 had signed leases before the trailers were built • Record quarter for gross margin, gross margin as percent of sales, operating income, operating income as a percent of sales • Team member received Shell’s Safety Champion Award Full Year 2020 • Executed 14 long-term agreements dedicated to or inclusive of repair & service (prior to 2020, we had none) • Total repair, service and leasing revenue in 2020 was 13.5% of sales • Invested in greenfield repair and service facility in Richburg, South Carolina (USA); repair ready in Q2 2021 • Met significant demand for ISO container leasing © 2021 Chart Industries, Inc. Confidential and Proprietary

14 Cryo Tank Solutions Orders Sales Gross Margin $103 $132 Q4 2019 Q4 2020 $410 $416 FY19 FY20 16.1% 21.6% Q4 2019 Q4 2020 18.8% 23.9% FY19 FY20 $409 $418 FY19 FY20 2% 28% $109 $111 Q4 2019 Q4 2020 1% +507 bps 2% +550 bps Fourth Quarter 2020: • Highest medical oxygen order quarter of 2020 • Year end record backlogs for all regions within CTS • Recovery in industrial gas major purchasing in Q4, still below pre-COVID levels • Margin improvement reflects removal of luxury layers, operational efficiencies, continued benefits from integration and utilization of global engineering Full Year 2020 • China posted highest operating income in our history • Completed the divestiture of the cryobiological product line for $320 million (all cash) Oct 1, 2020 • Expected continued growth in bulk tanks and trailers (trailer orders YTD February 17, 2021 = 114) © 2021 Chart Industries, Inc. Confidential and Proprietary

22.8% 24.8% Q4 2019 Q4 2020 $84 $140 Q4 2019 Q4 2020 15 Heat Transfer Systems Orders Sales Gross Margin $477 $331 FY19 FY20 $120 $79 Q4 2019 Q4 2020 $442 $370 FY19 FY20 21.3% 25.4% FY19 FY20 -31% -16% +404 bps +201 bps 67% -34% Fourth Quarter 2020: • $70M air cooled heat exchanger order for downstream terminal application; engineering in first half 2021, expect revenue to begin being recognized in Q4 2021 • $30M shell & tube heat exchangers order for processing facilities outside of North America Full Year 2020 • 2019 included $136 million Venture Global (VG) Calcasieu Pass order • Built world’s largest brazed core (138”) • ~$98 million revenue associated with VG’s Calcasieu Pass • Lifecycle record operating income • Relocated Tulsa, OK air-cooled heat exchanger manufacturing to Texas and created flexible manufacturing facility in Tulsa • Expanded carbon capture and direct air capture capabilities (each uses air coolers and air movers as 20%-50% of application) © 2021 Chart Industries, Inc. Confidential and Proprietary

LNG Remains a Significant Opportunity for GTLS 16 • LNG Cargoes rebounded sharply from fall cancellations • Transit issues through Panama Canal, global demand pushing day rates from ~60K/d to ~300+ K/d • LNG supply disruptions (GC Hurricanes, Hammerfest, Gorgon, Qatar) coupled with cold winters in Europe & North Asia # Project Size GTLS Content Expected Order Timing Length of Revenue Recognition 1 Venture Global Plaquemines Phase 1 = 10 MTPA $125 million 1H 2021 2 years 2 Cheniere Corpus Christi Stage 3 7 trains $250+ million 2021 3 years 3 Tellurian Driftwood project Phase 1 = 16.6 MTPA $375+ million 2021 3 years 2021 Big LNG Order Opportunities Not Included in Guidance = $750M 2021 ssLNG and Utility-Scale LNG Order Opportunities # Project Description GTLS Content ($M) Expected Order Timing In Guidance 1 Eagle Jacksonville 500 gpd liquefier $36 1H 2021 Yes 2 NEC 250 gpd liquefier $25 1H 2021 Yes 3 EU Client 10 TPD Biogas liquefier $4 2021 No 4 Gasum 3 individual LBG (bio) $4.8 each 2021 No 5 Confidential 1 MTPA liquefier $30 2021 No 6 SW USA Utility 280k storage/regas $2.2 2021 No 7 S. Africa 300 TPD $6.4 Q4 ‘21/Q1 ‘22 No 8 USA Confidential 1 MTPA liquefier $40 Q2 2021 No

© 2021 Chart Industries, Inc. Confidential and Proprietary 17 Q4 and Full Year 2020 EPS (1) Other one-time items were related to: Stabilis investment mark-to-market and Liberty LNG investment adjustment of $0.07 in Q4 2019, $0.15 in Q1, ($0.02) in Q2,and ($0.01) in Q3 and Q4 2020; COVID-19 related costs of $0.03 and $0.02 in Q1 and Q3 2020 respectively; Commercial and legal settlements of $0.06 in Q3 2019 and $0.02 in Q1,$0.03 in Q3, and $0.02 in Q4 2020 respectively; and Tax Reform / transition tax related adjustments $0.02 in Q1 2019, and accelerated tax impacts related to China facility closure of $0.01 in Q4 2019. (2) Tax effect reflects adjustment at normalized periodic rates. (3) Adjusted EPS (a non-GAAP measure) is as reported on a historical basis. $ millions, except per share amounts Q4 2020 Q4 2019 Change v. PY FY 2020 FY 2019 Change v. PY Continuing Operations Net income from continuing operations $49.5 $16.5 $33.0 $80.9 $31.4 $49.5 Reported Diluted EPS $1.28 $0.46 $0.82 $2.22 $0.89 $1.33 1 Restructuring and transaction-related costs 0.04 0.37 (0.33) 0.57 1.23 (0.66) 2 Gain on sale of a facility in China - - - (0.07) - (0.07) 3 Gain on bargain purchase (0.13) - (0.13) (0.14) - (0.14) 3 Other one-time items (1) 0.01 0.08 (0.07) 0.21 0.15 0.06 4 Tax effects (2) 0.01 (0.07) 0.08 (0.10) (0.21) 0.11 5 Dilution impact of convertible notes 0.06 - 0.06 0.04 0.02 0.02 Adjusted Diluted EPS (3) $1.27 $0.84 $0.43 $2.73 $2.08 $0.65 6 Strategic McPhy investment mark-to-market (0.46) - (0.46) (0.47) - (0.47) 7 Tax effect (2) 0.10 - 0.10 0.10 - 0.10 Adjusted Diluted EPS excluding strategic investment (3) $0.91 $0.84 $0.07 $2.36 $2.08 $0.28 Not included in the above financial results is the potential impairment of the Air-X-Changers (“AXC”) tradename (as of October 1, 2020) which has book value of $55 million. The impairment under review is ~$12 million of the total $55 million. This issue was raised last evening (February 17, 2021) by our external audit firm, and thus, the conclusion has not been confirmed. The final determination regarding this impairment analysis will be included in our Annual Report on Form 10-K to be filed within the next few days. Note that if the resolution is different than management’s position, earnings per share would be correspondingly reduced; however, adjusted earnings per diluted share would be unchanged from what is shown as it would be a one-time non-cash, non- operational item.

© 2021 Chart Industries, Inc. Confidential and Proprietary 18 Q4 and Full Year 2020 Financial Summary Full Year 2020 Vs. 2019 Q4 2020 Vs. Q4 2019 FY20 Q4 FY19 Q4 Change % Net Sales $312 $321 -3% Operating Margin % 12% 5% 750 bps Adjusted Operating Margin % 13% 8% 510 bps Diluted EPS $1.28 $0.46 178% Adjusted Diluted EPS $1.38 $0.84 64% Net Cash Provided By Operating Activities $60 $79 -24% Free Cash Flow $50 $69 -28% FCF % of Sales 16% 21% -545 bps FY20 FY19 Change % Net Sales $1,171 $1,216 -4% Operating Margin % 9% 4% 490 bps Adjusted Operating Margin % 11% 8% 330 bps Diluted EPS $2.22 $0.89 149% Adjusted Diluted EPS $2.73 $2.08 31% Net Cash Provided By Operating Activities $173 $134 29% Free Cash Flow $135 $98 38% FCF % of Sales 12% 8% 350 bps

December 31, 2020 Net Leverage Ratio 19© 2021 Chart Industries, Inc. Confidential and Proprietary Q4 2002 Free Cash Flow (FCF) of $49.6 million, including $10.6 million of capital expenditures FY 2020 Free cash Flow (FCF) of $134.8 million, including $37.9 million of capital expenditures 1.59 1.65 1.88 1.71 1.78 2.02 Net leverage ratio Net leverage ratio pro forma for Svante investment Net leverage ratio pro forma for Svante, Cryo Technologies Net leverage ratio Net leverage ratio pro forma for Svante investment Net leverage ratio pro forma for Svante, Cryo Technologies As Reported Excluding MTM from McPhy Investment

2020 Actual Sales to 2021 Sales (to Low End of Range) © 2021 Chart Industries, Inc. Confidential and Proprietary 20 (A) VG Calacasieu Pass ~$98 million in 2020, $21 million in 2021 forecast (B) Expect two small-scale LNG projects to move to notice to proceed in 2021, resulting in a portion of revenue recognition in the second half of 2021 (C) A portion of the $70 million ACHX order that was booked in Q4 2020 should begin to ship in Q4 2021 (D) Expect ~$5 million of orders in Q1 2021 that would be shipped within the year. Other orders expected but are for 2022 revenue recognition (E) Addition of Cryo Technologies (acquisition closed February 16, 2021) (F) Incremental BlueInGreen revenue in 2021 A, B C D, E F 2020 Sales Actual % Growth Est. 2021 Specific Projects (1) Specific Projects (2) Acquisition Impacts 2021 Sales at low end of range % growth at low end of range Heat Transfer Systems 370 3% 381 (77) 67 - 371 0% Heat exchangers/cold boxes/systems 220 3% 226 (77) 47 196 -11% ACHX/Fans 152 3% 156 20 176 16% Eliminations (2) 0% (2) (2) 0% Cryo Tank Solutions 416 6% 440 - - - 440 6% Storage equipment 223 8% 240 240 8% Engineered systems 90 7% 96 96 7% Mobile Equipment 108 0% 108 108 0% Eliminations (5) 0% (5) (5) 0% Specialty Products 242 22% 296 - 5 38 339 40% Hydrogen & Helium 22 70% 38 5 30 73 228% HLNG 74 25% 93 93 25% Food & Beverage 39 10% 43 43 10% Other 107 15% 123 8 131 22% Repair, Service, Leasing 158 13% 179 - - - 179 13% Repair, Service, Leasing 90 15% 104 104 15% ACHX and Fans Aftermarket 69 10% 76 76 10% Eliminations (1) 0% (1) (1) 0% Corporate Eliminations (9) 0% (9) - - (9) 0% Total Chart 1,177 9% 1,287 (77) 72 38 1,320 12%

Full Year 2021 Guidance (Continuing Operations) 21© 2021 Chart Industries, Inc. Confidential and Proprietary Revenue $1.26B to $1.335B Includes $23M of Calcasieu Pass Diluted Adjusted EPS $3.10 to $3.45 Assumes 18% ETR & 35.3M shares outstanding Capital Expenditures $32M to $37M Prior Guidance Current Guidance Adjusted Free Cash Flow $185 to $210M Revenue $1.32 to $1.38B Includes $21M of Calcasieu Pass Includes $30M from CT Non-Diluted Adjusted EPS $3.50 to $4.00 Assumes 18% ETR & 35.5M shares outstanding Capital Expenditures $40 to $50M Adjusted Free Cash Flow $190 to $220M # Capex ($M) Amount 1 Maintenance $27-30 2 Leasing fleet expansion 4-5 3 S.C. USA Repair Shop 3-4 4 Teddy Multi-Product Expansion 3-4 5 Hydrogen Product Development 2-3 6 Tulsa Flex Manufacturing 2-3 7 Total $40- $50

In 2020, Chart Industries’ Products Helped: © 2021 Chart Industries, Inc. Confidential and Proprietary 22 Treat over 2 billion gallons of water a day in the US Produce about 50 million tons of LNG to replace coal fired power generation (non-US) Reduce over 500 million liters of diesel used by over-the-road trucks Notes: (1) Natural gas emits between 45% and 55% lower greenhouse gas emissions than coal when used to generate electricity, and around 20% lower CO2 than oil according to IEA data. It also has a reduced impact on local air quality compared to diesel, which is currently used for power generation in many locations around the world. Compared to burning diesel, natural gas reduces NOx emissions by up to 85% and produces almost no SOx and particulate matter. (2) Although not considered in the figures above, for every megawatt of electricity produced using natural gas instead of coal, the amount of water withdrawn from local rivers and groundwater is reduced by 10,500 gallons. A year-over- year increase of more than 100%! A greater than 100% increase over 2019 ~7% increase year-over-year • Chart target: 30% carbon reduction by 2030 • 2021 short-term incentive (bonus) targets include ESG metric at 5% of potential payout • Diversity & inclusion committee • Women and diversity on Board of Directors • Supplier sustainability and diversity

Appendix 23

© 2021 Chart Industries, Inc. Confidential and Proprietary 24 Q4 and Full Year 2020 Free Cash Flow (1) “Net income, adjusted” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Reconciliation to Net Income (U.S. GAAP) is provided in accompanying press release financial tables. (2) “Free Cash Flow” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilitates useful period-to period comparisons of the Company’s operating results. $ millions, except per share amounts Consolidated Q4 2020 Q4 2019 Change v. PY FY 2020 FY 2019 Change v. PY Net income, adjusted (1) $7 $2 $5 $72 $52 $20 Depreciation and amortization 18 23 (5) 85 79 6 Accounts receivable (34) 22 (56) (6) 24 (30) Inventory (1) 16 (17) (31) 9 (40) Unbilled contract revenues and other assets 6 10 (4) 6 (2) 8 Accounts payable and other liabilities 73 (1) 74 58 (21) 79 Customer advances and billings in excess of contract revenue (9) 7 (16) (11) (7) (4) Net Cash Provided By Operating Activities $60 $79 ($19) $173 $134 $39 Capital expenditures (10) (10) - (38) (36) (2) Free Cash Flow (2) $50 $69 ($19) $135 $98 $37

© 2021 Chart Industries, Inc. Confidential and Proprietary 25 Re-segmented Financial Summary, As Reported (1/2) Cryo Tank Solutions $M Sales 98.6 103.0 99.7 108.6 409.9 98.0 105.3 102.0 110.5 415.8 Gross Profit 17.0 20.2 22.5 17.5 77.2 24.0 25.9 25.6 24.0 99.5 Gross Profit Margin 17.2% 19.6% 22.6% 16.1% 18.8% 24.5% 24.6% 25.1% 21.7% 23.9% SG&A 10.5 9.0 10.3 9.2 39.0 9.8 6.9 8.9 10.6 36.2 % / Sales 10.6% 8.7% 10.3% 8.5% 9.5% 10.0% 6.6% 8.7% 9.6% 8.7% Operating Income 4.7 9.4 11.1 7.4 32.6 12.9 17.6 15.3 12.2 58.0 % / Sales 4.8% 9.1% 11.1% 6.8% 8.0% 13.2% 16.7% 15.0% 11.0% 13.9% Heat Transfer Systems $M Sales 83.7 93.6 144.9 119.5 441.7 112.9 97.3 80.7 78.9 369.8 Gross Profit 13.2 17.1 36.6 27.2 94.1 26.2 26.7 21.3 19.5 93.7 Gross Profit Margin 15.8% 18.3% 25.3% 22.8% 21.3% 23.2% 27.4% 26.4% 24.7% 25.3% SG&A 11.3 11.7 11.0 11.2 45.2 9.2 8.5 6.0 7.3 31.0 % / Sales 13.5% 12.5% 7.6% 9.4% 10.2% 8.1% 8.7% 7.4% 9.3% 8.4% Operating Income -1.7 2.0 15.7 7.9 23.9 7.5 8.6 9.7 7.0 32.8 % / Sales -2.0% 2.1% 10.8% 6.6% 5.4% 6.6% 8.8% 12.0% 8.9% 8.9% Specialty Products $M Sales 52.1 50.7 50.3 54.8 207.9 52.9 48.6 56.0 85.1 242.6 Gross Profit 19.2 17.2 18.8 17.0 72.2 20.3 17.0 20.5 26.5 84.3 Gross Profit Margin 36.9% 33.9% 37.4% 31.0% 34.7% 38.4% 35.0% 36.6% 31.1% 34.7% SG&A 5.8 4.9 4.3 4.1 19.1 5.4 4.3 3.9 5.8 19.4 % / Sales 11.1% 9.7% 8.5% 7.5% 9.2% 10.2% 8.8% 7.0% 6.8% 8.0% Operating Income 13.0 11.9 14.1 12.4 51.4 14.5 12.3 16.2 20.5 63.5 % / Sales 25.0% 23.5% 28.0% 22.6% 24.7% 27.4% 25.3% 28.9% 24.1% 26.2% FY19 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 FY20Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 Q4 FY20 FY20Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q3 FY20Q1 FY19 Q2 FY19 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20FY19 FY20Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19

© 2021 Chart Industries, Inc. Confidential and Proprietary 26 Re-segmented Financial Summary, As Reported (2/2) Repair, Service & Leasing $M Sales 35.9 40.7 45.2 40.8 162.6 40.7 40.1 36.5 41.0 158.3 Gross Profit 8.2 17.2 15.0 13.6 54.0 11.8 13.7 11.2 17.9 54.6 Gross Profit Margin 22.8% 42.3% 33.2% 33.3% 33.2% 29.0% 34.2% 30.7% 43.7% 34.5% SG&A 4.8 4.0 4.6 3.5 16.9 3.8 3.0 2.7 3.5 13.0 % / Sales 13.4% 9.8% 10.2% 8.6% 10.4% 9.3% 7.5% 7.4% 8.5% 8.2% Operating Income 1.8 11.6 8.1 8.1 29.6 5.1 8.0 6.8 12.7 32.6 % / Sales 5.0% 28.5% 17.9% 19.9% 18.2% 12.5% 20.0% 18.6% 31.0% 20.6% Corporate & Eliminations $M Sales -1.3 -0.9 -2.1 -2.3 -6.6 -2.6 -1.7 -2.0 -3.1 -9.4 Gross Profit 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 SG&A 16.2 13.9 20.5 15.7 66.3 19.0 16.1 14.6 10.4 60.1 Global Commercial Sales SG&A 4.7 4.8 5.1 4.6 19.2 5.2 4.7 5.2 3.4 18.5 Operating Income -20.9 -18.7 -25.6 -20.3 -85.5 -24.2 -20.8 -19.8 -13.9 -78.7 Chart Industries Inc. $M Sales 269.0 287.1 338.0 321.4 1,215.5 301.9 289.6 273.2 312.4 1,177.1 Gross Profit 57.6 71.7 92.9 75.3 297.5 82.3 83.3 78.6 87.9 332.1 Gross Profit Margin 21.4% 25.0% 27.5% 23.4% 24.5% 27.3% 28.8% 28.8% 28.1% 28.2% SG&A 53.3 48.3 55.8 48.3 205.7 52.4 43.5 41.3 41.0 178.2 % / Sales 19.8% 16.8% 16.5% 15.0% 16.9% 17.4% 15.0% 15.1% 13.1% 15.1% Operating Income -3.1 16.2 23.4 15.5 52.0 15.8 25.7 28.2 38.5 108.2 % / Sales -1.2% 5.6% 6.9% 4.8% 4.3% 5.2% 8.9% 10.3% 12.3% 9.2% Q4 FY20 FY20Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q3 FY20Q1 FY19 Q2 FY19 FY19 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 FY20Q1 FY19 Q2 FY19 Q3 FY19 Q4 FY19 Q4 FY20 FY20Q3 FY19 Q4 FY19 FY19 Q1 FY20 Q2 FY20 Q3 FY20Q1 FY19 Q2 FY19

© 2021 Chart Industries, Inc. Confidential and Proprietary 27 Re-segmented Financial Summary, Adjusted (1/2) Cryo Tank Solutions $M, adjusted Sales 98.6 103.0 99.7 108.6 409.9 98.0 105.3 102.0 110.5 415.8 Gross Profit 22.0 25.8 24.1 20.0 91.9 24.1 26.1 25.6 24.7 100.5 Gross Profit Margin 22.3% 25.0% 24.2% 18.4% 22.4% 24.6% 24.8% 25.1% 22.4% 24.2% SG&A 10.1 8.8 9.5 8.8 37.2 8.9 8.7 8.9 10.5 37.0 % / Sales 10.2% 8.5% 9.5% 8.1% 9.1% 9.1% 8.3% 8.7% 9.5% 8.9% Operating Income 10.1 15.2 13.5 10.3 49.1 13.9 16.0 15.3 13.0 58.2 % / Sales 10.2% 14.8% 13.5% 9.5% 12.0% 14.2% 15.2% 15.0% 11.8% 14.0% Heat Transfer Systems $M, adjusted Sales 83.7 93.6 144.9 119.5 441.7 112.9 97.3 80.7 78.9 369.8 Gross Profit 14.8 17.5 38.2 29.5 100.0 28.2 27.7 22.6 20.2 98.7 Gross Profit Margin 17.7% 18.7% 26.4% 24.7% 22.6% 25.0% 28.5% 28.0% 25.6% 26.7% SG&A 10.9 11.6 10.3 9.7 42.5 8.1 7.0 6.0 7.1 28.2 % / Sales 13.0% 12.4% 7.1% 8.1% 9.6% 7.2% 7.2% 7.4% 9.0% 7.6% Operating Income 0.3 2.5 18.0 11.7 32.5 10.6 11.1 11.0 7.9 40.6 % / Sales 0.4% 2.7% 12.4% 9.8% 7.4% 9.4% 11.4% 13.6% 10.0% 11.0% Specialty Products $M, adjusted Sales 52.1 50.7 50.3 54.8 207.9 52.9 48.6 56.0 85.1 242.6 Gross Profit 19.2 17.2 18.8 20.4 75.6 21.3 17.1 21.4 26.5 86.3 Gross Profit Margin 36.9% 33.9% 37.4% 37.2% 36.4% 40.3% 35.2% 38.2% 31.1% 35.6% SG&A 5.8 4.9 4.3 4.1 19.1 4.9 4.1 3.7 5.8 18.5 % / Sales 11.1% 9.7% 8.5% 7.5% 9.2% 9.3% 8.4% 6.6% 6.8% 7.6% Operating Income 13.0 11.9 14.1 15.8 54.8 16.0 12.6 17.3 20.5 66.4 % / Sales 25.0% 23.5% 28.0% 28.8% 26.4% 30.2% 25.9% 30.9% 24.1% 27.4% Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q2 2020 Q3 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019

© 2021 Chart Industries, Inc. Confidential and Proprietary 28 Re-segmented Financial Summary, Adjusted (2/2) Repair, Service & Leasing $M, adjusted Sales 35.9 40.7 45.2 40.8 162.6 40.7 40.1 36.5 41.0 158.3 Gross Profit 10.6 15.6 15.0 13.6 54.8 12.5 14.2 11.7 18.4 56.8 Gross Profit Margin 29.5% 38.3% 33.2% 33.3% 33.7% 30.7% 35.4% 32.1% 44.9% 35.9% SG&A 4.0 3.9 4.5 3.4 15.8 3.1 2.4 2.7 3.5 11.7 % / Sales 11.1% 9.6% 10.0% 8.3% 9.7% 7.6% 6.0% 7.4% 8.5% 7.4% Operating Income 5.0 10.2 8.1 8.2 31.5 6.5 9.1 7.3 13.2 36.1 % / Sales 13.9% 25.1% 17.9% 20.1% 19.4% 16.0% 22.7% 20.0% 32.2% 22.8% Corporate & Eliminations $M, adjusted Sales -1.3 -0.9 -2.1 -2.3 -6.6 -2.6 -1.7 -2.0 -3.1 -9.4 Gross Profit 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 SG&A 13.1 11.1 14.4 12.7 51.3 17.6 14.3 11.8 10.5 54.2 Global Commercial Sales SG&A 4.7 4.8 5.1 4.6 19.2 5.2 4.7 5.2 3.4 18.5 Operating Income -17.8 -15.9 -19.5 -17.3 -70.5 -22.8 -19.0 -17.0 -14.0 -72.8 Chart Industries Inc. $M, adjusted Sales 269.0 287.1 338.0 321.4 1,215.5 301.9 289.6 273.2 312.4 1,177.1 Gross Profit 66.6 76.1 96.1 83.5 322.3 86.1 85.1 81.3 89.8 342.3 Gross Profit Margin 24.8% 26.5% 28.4% 26.0% 26.5% 28.5% 29.4% 29.8% 28.7% 29.1% SG&A 48.6 45.1 48.1 43.3 185.1 47.8 41.2 38.3 40.8 168.1 % / Sales 18.1% 15.7% 14.2% 13.5% 15.2% 15.8% 14.2% 14.0% 13.1% 14.3% Operating Income 10.6 23.9 34.2 28.7 97.4 24.2 29.8 33.9 40.6 128.5 % / Sales 3.9% 8.3% 10.1% 8.9% 8.0% 8.0% 10.3% 12.4% 13.0% 10.9% Q2 2020 Q3 2020 Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q2 2020 Q3 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020

© 2021 Chart Industries, Inc. Confidential and Proprietary 29 Appendix A: Reconciliation to Adjusted Financial Summary Cryo Tank Solutions $M Restructuring and transaction-related 5.0 5.6 0.3 0.0 10.9 0.1 0.1 0.1 0.0 0.3 Other one-time costs 0.0 0.0 1.3 2.5 3.8 0.0 0.1 -0.1 0.7 0.7 Gross Margin 5.0 5.6 1.6 2.5 14.7 0.1 0.2 0.0 0.7 1.0 Restructuring and transaction-related -0.4 -0.2 -0.8 -0.4 -1.8 -0.9 -0.8 1.8 -1.8 -1.7 Gain on sale of a facility in China 0.0 0.0 0.0 0.0 0.0 0.0 2.6 0.0 0.0 2.6 Other one-time costs 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -1.8 1.7 -0.1 SG&A -0.4 -0.2 -0.8 -0.4 -1.8 -0.9 1.8 0.0 -0.1 0.8 Heat Transfer Systems $M Restructuring and transaction-related 1.6 0.4 0.6 0.0 2.6 1.7 1.0 1.2 0.7 4.6 Other one-time costs 0.0 0.0 1.0 2.3 3.3 0.3 0.0 0.1 0.0 0.4 Gross Margin 1.6 0.4 1.6 2.3 5.9 2.0 1.0 1.3 0.7 5.0 Restructuring and transaction-related -0.4 -0.1 -0.7 -1.5 -2.7 -0.8 -1.4 0.0 -0.3 -2.5 Other one-time costs 0.0 0.0 0.0 0.0 0.0 -0.3 -0.1 0.0 0.1 -0.3 SG&A -0.4 -0.1 -0.7 -1.5 -2.7 -1.1 -1.5 0.0 -0.2 -2.8 Repair, Service & Leasing $M Restructuring and transaction-related 2.4 -1.6 0.0 0.0 0.8 0.7 0.4 0.5 0.5 2.1 Other one-time costs 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.1 Gross Margin 2.4 -1.6 0.0 0.0 0.8 0.7 0.5 0.5 0.5 2.2 Restructuring and transaction-related -0.8 -0.1 -0.1 -0.1 -1.1 -0.7 -0.6 0.0 0.0 -1.3 Other one-time costs 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 SG&A -0.8 -0.1 -0.1 -0.1 -1.1 -0.7 -0.6 0.0 0.0 -1.3 Q2 2020 Q3 2020 Q4 2020 FY 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Specialty Products $M Restructuring and transaction-related 0.0 0.0 0.0 3.4 3.4 0.2 0.1 0.0 0.0 0.3 Other one-time costs 0.0 0.0 0.0 0.0 0.0 0.8 0.0 0.9 0.0 1.7 Gross Margin 0.0 0.0 0.0 3.4 3.4 1.0 0.1 0.9 0.0 2.0 Restructuring and transaction-related 0.0 0.0 0.0 0.0 0.0 -0.5 -0.2 0.0 0.0 -0.7 Other one-time costs 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.2 0.0 -0.2 SG&A 0.0 0.0 0.0 0.0 0.0 -0.5 -0.2 -0.2 0.0 -0.9 Corporate & Eliminations $M Restructuring and transaction-related -3.1 -2.8 -6.1 -2.1 -14.1 -1.2 -1.7 -2.6 0.1 -5.4 Other one-time costs 0.0 0.0 0.0 -0.9 -0.9 -0.2 -0.1 -0.2 0.0 -0.5 SG&A -3.1 -2.8 -6.1 -3.0 -15.0 -1.4 -1.8 -2.8 0.1 -5.9 Chart Industries $M Restructuring and transaction-related 9.0 4.4 0.9 3.4 17.7 2.7 1.6 1.8 1.2 7.3 Other one-time costs 0.0 0.0 2.3 4.8 7.1 1.1 0.2 0.9 0.7 2.9 Gross Margin 9.0 4.4 3.2 8.2 24.8 3.8 1.8 2.7 1.9 10.2 Restructuring and transaction-related -4.7 -3.2 -7.7 -4.1 -19.7 -4.1 -4.7 -0.8 -2.0 -11.6 Gain on sale of a facility in China 0.0 0.0 0.0 0.0 0.0 0.0 2.6 0.0 0.0 2.6 Other one-time costs 0.0 0.0 0.0 -0.9 -0.9 -0.5 -0.2 -2.2 1.8 -1.1 SG&A -4.7 -3.2 -7.7 -5.0 -20.6 -4.6 -2.3 -3.0 -0.2 -10.1 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020

© 2021 Chart Industries, Inc. Confidential and Proprietary 30 Appendix B: Reconciliation to Global Commercial Sales SG&A SG&A, as reported $M Cryo Tank Solutions 12.6 10.7 11.9 10.7 45.9 11.1 8.5 10.5 11.6 41.7 Heat Transfer Systems 12.5 13.2 13.0 12.7 51.4 11.2 10.0 7.2 8.2 36.6 Specialty Products 6.7 5.8 5.0 4.9 22.4 6.1 5.0 4.7 6.4 22.2 Repair, Service & Leasing 5.2 4.5 5.0 3.9 18.6 4.4 3.5 3.3 4.1 15.3 Corporate 16.3 14.1 20.9 16.1 67.4 19.6 16.5 15.6 10.7 62.4 Chart Industries 53.3 48.3 55.8 48.3 205.7 52.4 43.5 41.3 41.0 178.2 Global Commercial Sales Adj $M Cryo Tank Solutions -2.1 -1.7 -1.6 -1.5 -6.9 -1.3 -1.6 -1.6 -1.0 -5.5 Heat Transfer Systems -1.2 -1.5 -2.0 -1.5 -6.2 -1.9 -1.5 -1.3 -0.9 -5.6 Specialty Products -0.9 -0.9 -0.7 -0.8 -3.3 -0.7 -0.6 -0.9 -0.6 -2.8 Repair, Service & Leasing -0.4 -0.5 -0.4 -0.4 -1.7 -0.6 -0.5 -0.6 -0.6 -2.3 Corporate -0.1 -0.2 -0.4 -0.4 -1.1 -0.7 -0.5 -0.8 -0.3 -2.3 Global Commercial Sales SG&A 4.7 4.8 5.1 4.6 19.2 5.2 4.7 5.2 3.4 18.5 SG&A under new segmentation $M Cryo Tank Solutions 10.5 9.0 10.3 9.2 39.0 9.8 6.9 8.9 10.6 36.2 Heat Transfer Systems 11.3 11.7 11.0 11.2 45.2 9.3 8.5 5.9 7.3 31.0 Specialty Products 5.8 4.9 4.3 4.1 19.1 5.4 4.4 3.8 5.8 19.4 Repair, Service & Leasing 4.8 4.0 4.6 3.5 16.9 3.8 3.0 2.7 3.5 13.0 Corporate 16.2 13.9 20.5 15.7 66.3 18.9 16.0 14.8 10.4 60.1 Global Commercial Sales SG&A 4.7 4.8 5.1 4.6 19.2 5.2 4.7 5.2 3.4 18.5 Chart Industries 53.3 48.3 55.8 48.3 205.7 52.4 43.5 41.3 41.0 178.2 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 FY 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2020 Q1 2020Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019