Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AMERICOLD REALTY TRUST | q42020-pressrelease.htm |

| 8-K - 8-K - AMERICOLD REALTY TRUST | art-20210218.htm |

Exhibit 99.2

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Table of Contents | |||||

| Overview | PAGE | ||||

| Corporate Profile | |||||

| Earnings Release | |||||

| Selected Quarterly Financial Data | |||||

| Financial Information | |||||

| Condensed Consolidated Balance Sheets | |||||

| Condensed Consolidated Statements of Operations | |||||

| Reconciliation of Net (Loss) Income to NAREIT FFO, Core FFO and AFFO | |||||

| Reconciliation of Net (Loss) Income to EBITDA, NAREIT EBITDAre, and Core EBITDA | |||||

| Acquisition, Litigation and Other | |||||

| Debt Detail and Maturities | |||||

| Operations Overview | |||||

| Revenue and Contribution by Segment | |||||

| Global Warehouse Economic and Physical Occupancy Trend | |||||

| Global Warehouse Portfolio | |||||

| Fixed Commitment and Lease Maturity Schedules | |||||

| Maintenance Capital Expenditures, Repair and Maintenance Expenses and External Growth, Expansion and Development Capital Expenditures | |||||

| Total Global Warehouse Segment Financial and Operating Performance | |||||

| Global Warehouse Segment Financial Performance | |||||

| Same-store Financial Performance | |||||

| Same-store Key Operating Metrics | |||||

| External Growth and Capital Deployment | |||||

| Unconsolidated Joint Ventures (Investment in Partially Owned Entities) | 39 | ||||

| 2021 Guidance | |||||

| Notes and Definitions | |||||

2

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Corporate Profile

We are the world’s largest publicly traded REIT focused on the ownership, operation, acquisition and development of temperature-controlled warehouses. We are organized as a self-administered and self-managed REIT with proven operating, development and acquisition expertise. As of December 31, 2020, we operated a global network of 238 temperature-controlled warehouses encompassing over 1.4 billion cubic feet, with 194 warehouses in North America, 26 in Europe, 15 warehouses in Asia-Pacific, and three warehouses in South America. In addition, we hold two minority interests in Brazilian-based joint ventures, one with SuperFrio, which owns or operates 22 temperature-controlled warehouses and one with Comfrio, which owns or operates 13 temperature-controlled warehouses.

Corporate Headquarters

10 Glenlake Parkway South Tower, Suite 600

Atlanta, Georgia 30328

Telephone: (678) 441-1400

Website: www.americold.com

Senior Management

Fred W. Boehler: Chief Executive Officer, President and Trustee

Marc J. Smernoff: Chief Financial Officer and Executive Vice President

Carlos V. Rodriguez: Chief Operating Officer and Executive Vice President

Robert S. Chambers: Chief Commercial Officer and Executive Vice President

James A. Harron: Chief Investment Officer and Executive Vice President

James C. Snyder, Jr.: Chief Legal Officer and Executive Vice President

Sanjay Lall: Chief Information Officer and Executive Vice President

Khara L. Julien: Chief Human Resources Officer and Executive Vice President

David K. Stuver: Executive Vice President, Supply Chain Solutions

Thomas C. Novosel: Chief Accounting Officer and Senior Vice President

Board of Trustees

Mark R. Patterson: Chairman of the Board of Trustees

George J. Alburger, Jr.: Trustee

Kelly H. Barrett: Trustee

Fred W. Boehler: Chief Executive Officer, President and Trustee

Antonio F. Fernandez: Trustee

James R. Heistand: Trustee

Michelle M. MacKay: Trustee

David J. Neithercut: Trustee

Andrew P. Power: Trustee

Investor Relations

To request more information or to be added to our e-mail distribution list, please visit our website: www.americold.com

(Please proceed to the Investors section)

| Analyst Coverage | ||||||||

| Firm | Analyst Name | Contact | ||||||

| Baird Equity Research | David B. Rodgers | 216-737-7341 | ||||||

| Bank of America Merrill Lynch | Joshua Dennerlein | 646-855-1681 | ||||||

| Berenberg Capital Markets | Nate Crossett | 646-949-9030 | ||||||

| Citi | Emmanuel Korchman | 212-816-1382 | ||||||

| Green Street Advisors | Vince Tibone | 949-640-8780 | ||||||

| J.P. Morgan | Michael W. Mueller | 212-622-6689 | ||||||

| Raymond James | William A. Crow | 727-567-2594 | ||||||

| RBC | Michael Carroll | 440-715-2649 | ||||||

| Truist | Ki Bin Kim | 212-303-4124 | ||||||

3

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Stock Listing Information

The shares of Americold Realty Trust are traded on the New York Stock Exchange under the symbol “COLD”.

Credit Ratings

| DBRS Morningstar | ||||||||

| Credit Rating: | BBB | (Under Review with Positive Implications) | ||||||

| Fitch | ||||||||

| Issuer Default Rating: | BBB | (Stable Outlook) | ||||||

| Moody’s | ||||||||

| Issuer Rating: | Baa3 | (Stable Outlook) | ||||||

These credit ratings may not reflect the potential impact of risks relating to the structure or trading of the Company’s securities and are provided solely for informational purposes. Credit ratings are not recommendations to buy, hold or sell any security, and may be revised or withdrawn at any time by the issuing rating agency at its sole discretion. The Company does not undertake any obligation to maintain the ratings or to advise of any change in ratings. Each agency’s rating should be evaluated independently of any other agency’s rating. An explanation of the significance of the ratings may be obtained from each of the rating agencies.

4

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

AMERICOLD REALTY TRUST ANNOUNCES FOURTH QUARTER 2020 RESULTS

Atlanta, GA, February 18, 2021 - Americold Realty Trust (NYSE: COLD) (the “Company”), the world’s largest publicly traded REIT focused on the ownership, operation, acquisition and development of temperature-controlled warehouses, today announced financial and operating results for the fourth quarter ended December 31, 2020.

Fred Boehler, President and Chief Executive Officer of Americold Realty Trust, stated, “Against the challenging backdrop of the COVID-19 pandemic, we are extremely proud of the consistency and the stability of our core business throughout 2020 and our ability to deliver results in line with our pre-COVID guidance. For the full year, we generated total company revenue growth and NOI growth of 11.4% and 15.3%, respectively, driven by our continued organic growth and acquisition activity. Within our global warehouse segment, we drove same store revenue and NOI growth of 2.3% and 5.6%, respectively, on a constant currency basis. We also delivered AFFO per share growth of 10.3%, while maintaining a low levered balance sheet. We attribute these strong results to our portfolio’s diversity and scale, as well as the effectiveness of the Americold Operating System and our commercialization efforts, which enabled us to overcome the supply chain disruption and financial impact of COVID-19.”

Mr. Boehler continued, “2020 was also a momentous year for external growth at Americold. In the fourth quarter, we completed the acquisitions of Agro Merchants Group, previously the fourth largest temperature controlled warehouse company globally, as well as New Jersey based Hall’s Warehouse Corporation. In total, we closed on $2.6 billion of acquisitions in 2020 and added 62 facilities totaling 342 million cubic feet to our global network. We entered key strategic markets in Europe and Canada through platform transactions and in Brazil through two joint ventures. We bolstered our presence in our legacy markets through deliberate and purposeful tuck-in acquisitions. At this point, our platform supports customers in 13 countries across four continents. We also grew our strategic development program, with seven projects totaling 62 million cubic feet under construction as of year end. We believe these projects materially enhance the value of our network at key logistics nodes. Finally, we executed on our stated ESG priorities, with over 95% of our facilities, excluding our 2020 acquisitions, receiving third-party gold or silver designations for energy excellence. Safety remains a top priority at Americold, and we had our sixth consecutive year with a reduction in our total recordable incident rate. We also continue to invest in training and advancement programs to further develop our employees.”

“As we look ahead to 2021 and beyond, we will continue to focus on driving internal growth, integrating our recent acquisitions and executing strategic growth initiatives. Above all, we will continue to support our customers as an integral part of the global food supply chain, and our success in doing so should result in lasting shareholder value creation.”

Fourth Quarter 2020 Highlights

•Total revenue increased 7.8% to $523.7 million.

•Total NOI increased 11% to $152.4 million.

•Core EBITDA increased 7.5% on an actual basis, and 7.0% on a constant currency basis, to $117.2 million.

•Net loss of $44.0 million, or $0.21 per diluted common share.

•Core FFO of $81.9 million, or $0.39 per diluted common share.

•AFFO of $76.9 million, or $0.37 per diluted common share.

•Global Warehouse segment revenue increased 6.3% to $407.8 million.

5

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

•Global Warehouse segment NOI increased 12% to $145.7 million.

•Global Warehouse segment same store revenue decreased 0.5%, or 1.4% on a constant currency basis, same store segment NOI increased by 4.0%, or increased by 3.3% on a constant currency basis.

•Completed the acquisitions of Hall’s for cash consideration of $481 million and Agro Merchants for total consideration of $1.7 billion.

•Completed a public offering, including the green shoe, for net proceeds of approximately $1.35 billion. This funded growth initiatives, including the Agro and Hall’s acquisitions.

•Closed an institutional private placement offering consisting of (i) €400 million senior unsecured notes with a coupon of 1.62% due January 7, 2031 (“Series D”) and (ii) €350 million senior unsecured notes with a coupon of 1.65% due January 7, 2033 (“Series E”).

•Announced and broke ground on the expansion of our Russellville, Arkansas facility with an expected cost of $84 million to create a highly-automated build for one of our top tier customers, Conagra, with expected completion by the fourth quarter of 2022.

•Announced and broke ground on the expansion of our Calgary, Canada facility with an expected cost of C$15 million for a conventional, multi-tenant use, with expected completion by the fourth quarter of 2021.

•Ended the year with 161 facilities certified either Gold or Silver by the Global Cold Chain Alliance as part of its Energy Excellence Recognition Program, with over 95% of legacy Global Warehouse segment portfolio (which excludes all 2020 acquisitions) being certified by this program.

Full Year 2020 Highlights

•Total revenue increased 11.4% to $1.99 billion.

•Total NOI increased 15.3% to $551.5 million.

•Core EBITDA increased 16.0% to $425.9 million, or 16.3% on a constant currency basis.

•Net income of $24.6 million, or $0.11 per diluted common share.

•Core FFO of $255.7 million, or $1.24 per diluted common share.

•AFFO of $267.9 million, or $1.29 per diluted common share.

•Global Warehouse segment revenue increased 12.5% to $1.55 billion.

•Global Warehouse segment NOI increased 16.3% to $520.3 million.

•Global Warehouse segment same store revenue increased 1.9%, or 2.3% on a constant currency basis, same store segment NOI increased 5.3%, or 5.6% on a constant currency basis.

•Completed $2.6 billion of acquisitions, including Nova Cold Logistics, Newport Cold, AM-C Warehouses, Caspers Cold Storage, Halls Warehouse Corporation, and Agro Merchants Group and acquired a 15% interest in SuperFrio for Brazil Reals of 118 million.

•Announced and broke ground on five development and expansion projects with an expected total cost of $461 million.

Subsequent Event Highlights

•On January 29, 2021, closed on an amendment to our existing unsecured credit facility, which increased the multicurrency line of credit from $800 million to $1 billion, and concurrently paid down Senior Unsecured Term Loan A Facility Tranche A-1 from $325 million to $125 million using cash on the balance sheet.

6

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Fourth Quarter 2020 Total Company Financial Results

Total revenue for the fourth quarter of 2020 was $523.7 million, a 7.8% increase from the same quarter of the prior year. This growth was primarily driven by the incremental revenue from acquisitions, recently completed development projects and revenue in our Managed segment driven by higher pass through of costs due to elevated retail volumes.

For the fourth quarter of 2020, the Company reported a net loss of $44.0 million, or $0.21 per diluted share, compared to net income of $20.8 million, or $0.10 per diluted share, for the same quarter of the prior year.

Total NOI for the fourth quarter of 2020 was $152.4 million, an increase of 11% from the same quarter of the prior year.

Core EBITDA was $117.2 million for the fourth quarter of 2020, compared to $109.1 million for the same quarter of the prior year. This reflects an 7.5% increase over prior year on an actual basis, and 7.0% on a constant currency basis, driven primarily from acquisition contribution, recently completed development projects, and organic growth in our core business. These increases were partially offset by the incremental costs incurred in response to COVID-19 and higher SG&A.

For the fourth quarter of 2020, Core FFO was $81.9 million, or $0.39 per diluted share, compared to $64.6 million, or $0.33 per diluted share, for same quarter of the prior year.

For the fourth quarter of 2020, AFFO was $76.9 million, or $0.37 per diluted share, compared to $59.7 million, or $0.30 per diluted share, for the same quarter of the prior year.

Please see the Company’s supplemental financial information for the definitions and reconciliations of non-GAAP financial measures to the most comparable GAAP financial measures.

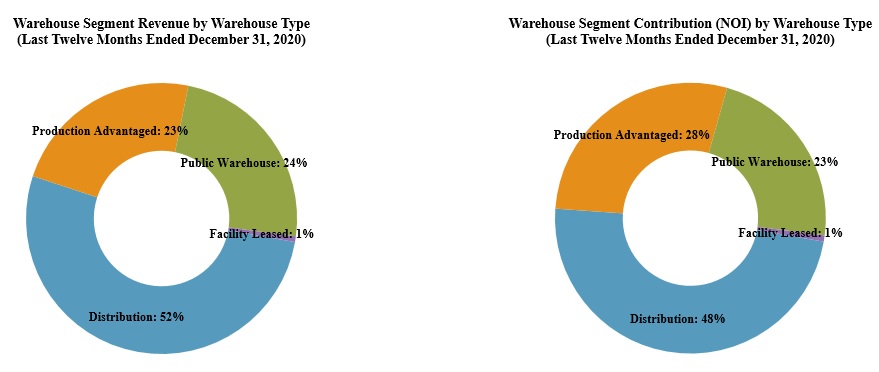

Fourth Quarter 2020 Global Warehouse Segment Results

For the fourth quarter of 2020, Global Warehouse segment revenue was $407.8 million, an increase of $24.0 million, or 6%, compared to $383.8 million for the fourth quarter of 2019. This growth was driven by the recently completed acquisitions and development projects, paired with contractual rate escalations, partially offset by lower throughput associated with the protein and food service sectors.

Warehouse segment NOI was $145.7 million for the fourth quarter of 2020, an increase of 12%. Global Warehouse segment margin was 35.7% for the fourth quarter of 2020, an 196 basis point increase compared to the same quarter of the prior year. The year-over-year growth in segment NOI was driven by the previously mentioned revenue trends. The Company continues to incur incremental expenses to address the risks and challenges of COVID-19. These incremental COVID-19 expenses primarily include higher sanitation costs of $1.0 million while personal protective equipment (“PPE”) costs were nominal. The Company has experienced certain inefficiencies due to social distancing, staggered schedules, and other changes to processes, all of which it expects to incur going forward. The Company expects to recover these costs through ongoing revenue as it signs new business and renews existing business. The Company’s results include the impact of these items. Additionally, the growth reflected favorable comparisons to costs incurred in the prior year, including both health insurance and Rochelle startup related costs, both incurred in the prior comparable period.

7

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

We had 135 same stores for the years ended December 31, 2020 and 2019. The following table presents revenues, cost of operations, contribution (NOI) and margins for our same stores and non-same stores with a reconciliation to the total financial metrics of our warehouse segment for the three and twelve months ended December 31, 2020 and December 31, 2019. Amounts related to the AM-C, Cloverleaf, Caspers, Hall’s, Lanier, MHW, Newport and Nova Cold acquisitions are reflected within non-same store results. The operational results from one day of ownership from the Agro acquisition is not material for the year ended December 31, 2020.

8

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Three Months Ended December 31, | Change | ||||||||||||||||||||||||||||

| Dollars in thousands | 2020 actual | 2020 constant currency(1) | 2019 actual | Actual | Constant currency | ||||||||||||||||||||||||

| TOTAL WAREHOUSE SEGMENT | |||||||||||||||||||||||||||||

Number of total warehouses(2) | 229 | 167 | n/a | n/a | |||||||||||||||||||||||||

| Global Warehouse revenue: | |||||||||||||||||||||||||||||

| Rent and storage | $ | 173,822 | $ | 173,135 | $ | 158,105 | 9.9 | % | 9.5 | % | |||||||||||||||||||

| Warehouse services | 233,989 | 231,590 | 225,673 | 3.7 | % | 2.6 | % | ||||||||||||||||||||||

| Total revenue | $ | 407,811 | $ | 404,725 | $ | 383,778 | 6.3 | % | 5.5 | % | |||||||||||||||||||

| Global Warehouse contribution (NOI) | $ | 145,672 | $ | 144,932 | $ | 129,547 | 12.4 | % | 11.9 | % | |||||||||||||||||||

| Global Warehouse margin | 35.7 | % | 35.8 | % | 33.8 | % | 196 bps | 205 bps | |||||||||||||||||||||

| Units in thousands except per pallet data | |||||||||||||||||||||||||||||

| Global Warehouse rent and storage metrics: | |||||||||||||||||||||||||||||

| Average economic occupied pallets | 3,368 | n/a | 3,185 | 5.7 | % | n/a | |||||||||||||||||||||||

| Average physical occupied pallets | 3,075 | n/a | 3,045 | 1.0 | % | n/a | |||||||||||||||||||||||

| Average physical pallet positions | 4,252 | n/a | 3,833 | 10.9 | % | n/a | |||||||||||||||||||||||

| Economic occupancy percentage | 79.2 | % | n/a | 83.1 | % | -389 bps | n/a | ||||||||||||||||||||||

| Physical occupancy percentage | 72.3 | % | n/a | 79.5 | % | -713 bps | n/a | ||||||||||||||||||||||

| Total rent and storage revenue per economic occupied pallet | $ | 51.61 | $ | 51.41 | $ | 49.64 | 4.0 | % | 3.6 | % | |||||||||||||||||||

| Total rent and storage revenue per physical occupied pallet | $ | 56.52 | $ | 56.30 | $ | 51.92 | 8.9 | % | 8.4 | % | |||||||||||||||||||

| Global Warehouse services metrics: | |||||||||||||||||||||||||||||

| Throughput pallets | 8,290 | n/a | 8,229 | 0.7 | % | n/a | |||||||||||||||||||||||

| Total warehouse services revenue per throughput pallet | $ | 28.23 | $ | 27.94 | $ | 27.43 | 2.9 | % | 1.9 | % | |||||||||||||||||||

| SAME STORE WAREHOUSE | |||||||||||||||||||||||||||||

| Number of same store warehouses | 135 | 135 | n/a | n/a | |||||||||||||||||||||||||

| Global Warehouse same store revenue: | |||||||||||||||||||||||||||||

| Rent and storage | $ | 129,459 | $ | 128,861 | $ | 128,722 | 0.6 | % | 0.1 | % | |||||||||||||||||||

| Warehouse services | 172,933 | 170,580 | 175,107 | (1.2) | % | (2.6) | % | ||||||||||||||||||||||

| Total same store revenue | $ | 302,392 | $ | 299,441 | $ | 303,829 | (0.5) | % | (1.4) | % | |||||||||||||||||||

| Global Warehouse same store contribution (NOI) | $ | 111,067 | $ | 110,357 | $ | 106,819 | 4.0 | % | 3.3 | % | |||||||||||||||||||

| Global Warehouse same store margin | 36.7 | % | 36.9 | % | 35.2 | % | 157 bps | 170 bps | |||||||||||||||||||||

| Units in thousands except per pallet data | |||||||||||||||||||||||||||||

| Global Warehouse same store rent and storage metrics: | |||||||||||||||||||||||||||||

| Average economic occupied pallets | 2,511 | n/a | 2,556 | (1.8) | % | n/a | |||||||||||||||||||||||

| Average physical occupied pallets | 2,246 | n/a | 2,433 | (7.7) | % | n/a | |||||||||||||||||||||||

| Average physical pallet positions | 3,037 | n/a | 3,030 | 0.2 | % | n/a | |||||||||||||||||||||||

| Economic occupancy percentage | 82.7 | % | n/a | 84.3 | % | -166 bps | n/a | ||||||||||||||||||||||

| Physical occupancy percentage | 73.9 | % | n/a | 80.3 | % | -634 bps | n/a | ||||||||||||||||||||||

| Same store rent and storage revenue per economic occupied pallet | $ | 51.55 | $ | 51.31 | $ | 50.37 | 2.3 | % | 1.9 | % | |||||||||||||||||||

| Same store rent and storage revenue per physical occupied pallet | $ | 57.65 | $ | 57.38 | $ | 52.92 | 8.9 | % | 8.4 | % | |||||||||||||||||||

| Global Warehouse same store services metrics: | |||||||||||||||||||||||||||||

| Throughput pallets | 6,243 | n/a | 6,672 | (6.4) | % | n/a | |||||||||||||||||||||||

| Same store warehouse services revenue per throughput pallet | $ | 27.70 | $ | 27.32 | $ | 26.25 | 5.5 | % | 4.1 | % | |||||||||||||||||||

9

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Three Months Ended December 31, | Change | ||||||||||||||||||||||||||||

| Dollars in thousands | 2020 actual | 2020 constant currency(1) | 2019 actual | Actual | Constant currency | ||||||||||||||||||||||||

| NON-SAME STORE WAREHOUSE | |||||||||||||||||||||||||||||

Number of non-same store warehouses(3) | 94 | 32 | n/a | n/a | |||||||||||||||||||||||||

| Global Warehouse non-same store revenue: | |||||||||||||||||||||||||||||

| Rent and storage | $ | 44,363 | $ | 44,274 | $ | 29,383 | 51.0 | % | 50.7 | % | |||||||||||||||||||

| Warehouse services | 61,056 | 61,010 | 50,566 | 20.7 | % | 20.7 | % | ||||||||||||||||||||||

| Total non-same store revenue | $ | 105,419 | $ | 105,284 | $ | 79,949 | 31.9 | % | 31.7 | % | |||||||||||||||||||

| Global Warehouse non-same store contribution (NOI) | $ | 34,605 | $ | 34,575 | $ | 22,728 | 52.3 | % | 52.1 | % | |||||||||||||||||||

| Global Warehouse non-same store margin | 32.8 | % | 32.8 | % | 28.4 | % | 440 bps | 441 bps | |||||||||||||||||||||

| Units in thousands except per pallet data | |||||||||||||||||||||||||||||

| Global Warehouse non-same store rent and storage metrics: | |||||||||||||||||||||||||||||

| Average economic occupied pallets | 856 | n/a | 629 | 36.1 | % | n/a | |||||||||||||||||||||||

| Average physical occupied pallets | 829 | n/a | 613 | 35.4 | % | n/a | |||||||||||||||||||||||

| Average physical pallet positions | 1,214 | n/a | 803 | 51.2 | % | n/a | |||||||||||||||||||||||

| Economic occupancy percentage | 70.5 | % | n/a | 78.4 | % | -788 bps | n/a | ||||||||||||||||||||||

| Physical occupancy percentage | 68.3 | % | n/a | 76.3 | % | -805 bps | n/a | ||||||||||||||||||||||

| Non-same store rent and storage revenue per economic occupied pallet | $ | 51.80 | $ | 51.70 | $ | 46.69 | 10.9 | % | 10.7 | % | |||||||||||||||||||

| Non-same store rent and storage revenue per physical occupied pallet | $ | 53.49 | $ | 53.38 | $ | 47.95 | 11.6 | % | 11.3 | % | |||||||||||||||||||

| Global Warehouse non-same store services metrics: | |||||||||||||||||||||||||||||

| Throughput pallets | 2,047 | n/a | 1,557 | 31.5 | % | n/a | |||||||||||||||||||||||

| Non-same store warehouse services revenue per throughput pallet | $ | 29.83 | $ | 29.81 | $ | 32.48 | (8.2) | % | (8.2) | % | |||||||||||||||||||

10

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Year Ended December 31, | Change | ||||||||||||||||||||||||||||

| Dollars in thousands | 2020 actual | 2020 constant currency(1) | 2019 actual | Actual | Constant currency | ||||||||||||||||||||||||

| TOTAL WAREHOUSE SEGMENT | |||||||||||||||||||||||||||||

Number of total warehouses(2) | 229 | 167 | n/a | n/a | |||||||||||||||||||||||||

| Global Warehouse revenue: | |||||||||||||||||||||||||||||

| Rent and storage | $ | 666,150 | $ | 669,154 | $ | 582,509 | 14.4 | % | 14.9 | % | |||||||||||||||||||

| Warehouse services | 883,164 | 885,728 | 794,708 | 11.1 | % | 11.5 | % | ||||||||||||||||||||||

| Total revenue | $ | 1,549,314 | $ | 1,554,882 | $ | 1,377,217 | 12.5 | % | 12.9 | % | |||||||||||||||||||

| Global Warehouse contribution (NOI) | $ | 520,333 | $ | 521,883 | $ | 447,591 | 16.3 | % | 16.6 | % | |||||||||||||||||||

| Global Warehouse margin | 33.6 | % | 33.6 | % | 32.5 | % | 109 bps | 106 bps | |||||||||||||||||||||

| Units in thousands except per pallet data | |||||||||||||||||||||||||||||

| Global Warehouse rent and storage metrics: | |||||||||||||||||||||||||||||

| Average economic occupied pallets | 3,233 | n/a | 2,865 | 12.8 | % | n/a | |||||||||||||||||||||||

| Average physical occupied pallets | 2,966 | n/a | 2,728 | 8.7 | % | n/a | |||||||||||||||||||||||

| Average physical pallet positions | 4,095 | n/a | 3,604 | 13.6 | % | n/a | |||||||||||||||||||||||

| Economic occupancy percentage | 79.0 | % | n/a | 79.5 | % | -55 bps | n/a | ||||||||||||||||||||||

| Physical occupancy percentage | 72.4 | % | n/a | 75.7 | % | -327 bps | n/a | ||||||||||||||||||||||

| Total rent and storage revenue per economic occupied pallet | $ | 206.03 | $ | 206.96 | $ | 203.31 | 1.3 | % | 1.8 | % | |||||||||||||||||||

| Total rent and storage revenue per physical occupied pallet | $ | 224.60 | $ | 225.61 | $ | 213.52 | 5.2 | % | 5.7 | % | |||||||||||||||||||

| Global Warehouse services metrics: | |||||||||||||||||||||||||||||

| Throughput pallets | 32,124 | n/a | 30,090 | 6.8 | % | n/a | |||||||||||||||||||||||

| Total warehouse services revenue per throughput pallet | $ | 27.49 | $ | 27.57 | $ | 26.41 | 4.1 | % | 4.4 | % | |||||||||||||||||||

| SAME STORE WAREHOUSE | |||||||||||||||||||||||||||||

| Number of same store warehouses | 135 | 135 | n/a | n/a | |||||||||||||||||||||||||

| Global Warehouse same store revenue: | |||||||||||||||||||||||||||||

| Rent and storage | $ | 507,848 | $ | 510,614 | $ | 494,273 | 2.7 | % | 3.3 | % | |||||||||||||||||||

| Warehouse services | 668,717 | 671,079 | 660,843 | 1.2 | % | 1.5 | % | ||||||||||||||||||||||

| Total same store revenue | $ | 1,176,565 | $ | 1,181,693 | $ | 1,155,116 | 1.9 | % | 2.3 | % | |||||||||||||||||||

| Global Warehouse same store contribution (NOI) | $ | 401,287 | $ | 402,643 | $ | 381,209 | 5.3 | % | 5.6 | % | |||||||||||||||||||

| Global Warehouse same store margin | 34.1 | % | 34.1 | % | 33.0 | % | 110 bps | 107 bps | |||||||||||||||||||||

| Units in thousands except per pallet data | |||||||||||||||||||||||||||||

| Global Warehouse same store rent and storage metrics: | |||||||||||||||||||||||||||||

| Average economic occupied pallets | 2,440 | n/a | 2,405 | 1.5 | % | n/a | |||||||||||||||||||||||

| Average physical occupied pallets | 2,204 | n/a | 2,282 | (3.4) | % | n/a | |||||||||||||||||||||||

| Average physical pallet positions | 3,031 | n/a | 3,028 | 0.1 | % | n/a | |||||||||||||||||||||||

| Economic occupancy percentage | 80.5 | % | n/a | 79.4 | % | 110 bps | n/a | ||||||||||||||||||||||

| Physical occupancy percentage | 72.7 | % | n/a | 75.4 | % | -265 bps | n/a | ||||||||||||||||||||||

| Same store rent and storage revenue per economic occupied pallet | $ | 208.10 | $ | 209.23 | $ | 205.53 | 1.3 | % | 1.8 | % | |||||||||||||||||||

| Same store rent and storage revenue per physical occupied pallet | $ | 230.45 | $ | 231.70 | $ | 216.62 | 6.4 | % | 7.0 | % | |||||||||||||||||||

| Global Warehouse same store services metrics: | |||||||||||||||||||||||||||||

| Throughput pallets | 25,133 | n/a | 25,842 | (2.7) | % | n/a | |||||||||||||||||||||||

| Same store warehouse services revenue per throughput pallet | $ | 26.61 | $ | 26.70 | $ | 25.57 | 4.1 | % | 4.4 | % | |||||||||||||||||||

11

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Year Ended December 31, | Change | ||||||||||||||||||||||||||||

| Dollars in thousands | 2020 actual | 2020 constant currency(1) | 2019 actual | Actual | Constant currency | ||||||||||||||||||||||||

| NON-SAME STORE WAREHOUSE | |||||||||||||||||||||||||||||

Number of non-same store warehouses(3) | 94 | 32 | n/a | n/a | |||||||||||||||||||||||||

| Global Warehouse non-same store revenue: | |||||||||||||||||||||||||||||

| Rent and storage | $ | 158,302 | $ | 158,540 | $ | 88,236 | 79.4 | % | 79.7 | % | |||||||||||||||||||

| Warehouse services | 214,447 | 214,649 | 133,865 | 60.2 | % | 60.3 | % | ||||||||||||||||||||||

| Total non-same store revenue | $ | 372,749 | $ | 373,189 | $ | 222,101 | 67.8 | % | 68.0 | % | |||||||||||||||||||

| Global Warehouse non-same store contribution (NOI) | $ | 119,046 | $ | 119,240 | $ | 66,382 | 79.3 | % | 79.6 | % | |||||||||||||||||||

| Global Warehouse non-same store margin | 31.9 | % | 32.0 | % | 29.9 | % | 205 bps | 206 bps | |||||||||||||||||||||

| Units in thousands except per pallet data | |||||||||||||||||||||||||||||

| Global Warehouse non-same store rent and storage metrics: | |||||||||||||||||||||||||||||

| Average economic occupied pallets | 793 | n/a | 460 | 72.2 | % | n/a | |||||||||||||||||||||||

| Average physical occupied pallets | 762 | n/a | 446 | 70.8 | % | n/a | |||||||||||||||||||||||

| Average physical pallet positions | 1,065 | n/a | 576 | 84.8 | % | n/a | |||||||||||||||||||||||

| Economic occupancy percentage | 74.5 | % | n/a | 79.9 | % | -542 bps | n/a | ||||||||||||||||||||||

| Physical occupancy percentage | 71.6 | % | n/a | 77.5 | % | -586 bps | n/a | ||||||||||||||||||||||

| Non-same store rent and storage revenue per economic occupied pallet | $ | 199.67 | $ | 199.97 | $ | 191.67 | 4.2 | % | 4.3 | % | |||||||||||||||||||

| Non-same store rent and storage revenue per physical occupied pallet | $ | 207.69 | $ | 208.00 | $ | 197.71 | 5.0 | % | 5.2 | % | |||||||||||||||||||

| Global Warehouse non-same store services metrics: | |||||||||||||||||||||||||||||

| Throughput pallets | 6,990 | n/a | 4,249 | 64.5 | % | n/a | |||||||||||||||||||||||

| Non-same store warehouse services revenue per throughput pallet | $ | 30.68 | $ | 30.71 | $ | 31.51 | (2.6) | % | (2.5) | % | |||||||||||||||||||

(1) The adjustments from our U.S. GAAP operating results to calculate our operating results on a constant currency basis are the effect of changes in foreign currency exchange rates relative to the comparable prior period.

(2) Total warehouse count of 229 includes 46 warehouses acquired through the Agro acquisition on December 30, 2020, eight warehouses acquired through the Hall’s acquisition on November 2, 2020, three warehouses acquired through the Casper’s and AM-C warehouse acquisitions on August 31, 2020, and five warehouses acquired through the Nova Cold and Newport acquisitions on January 2, 2020. The results of these acquisitions are reflected in the results above since date of ownership. The operational results from one day of ownership of the Agro warehouses is immaterial to the three months and year ended December 31, 2020.

(3) Non-same store warehouse count of 94 includes 46 warehouses acquired through the Agro acquisition on December 30, 2020, eight warehouses acquired through the Hall’s acquisition on November 2, 2020, three warehouses acquired through the Casper’s and AM-C warehouse acquisitions on August 31, 2020, and five warehouses acquired through the Nova Cold and Newport acquisitions on January 2, 2020. The results of these acquisitions are reflected in the results above since date of ownership. The operational results from one day of ownership of the Agro warehouses is immaterial to the three months and year ended December 31, 2020.

(n/a = not applicable)

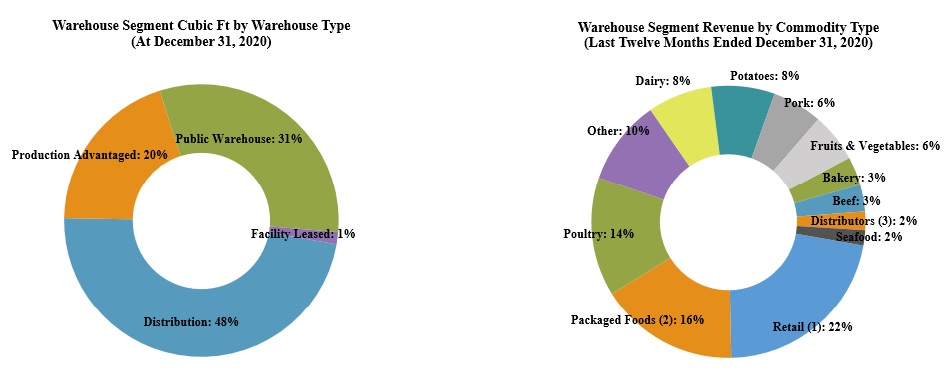

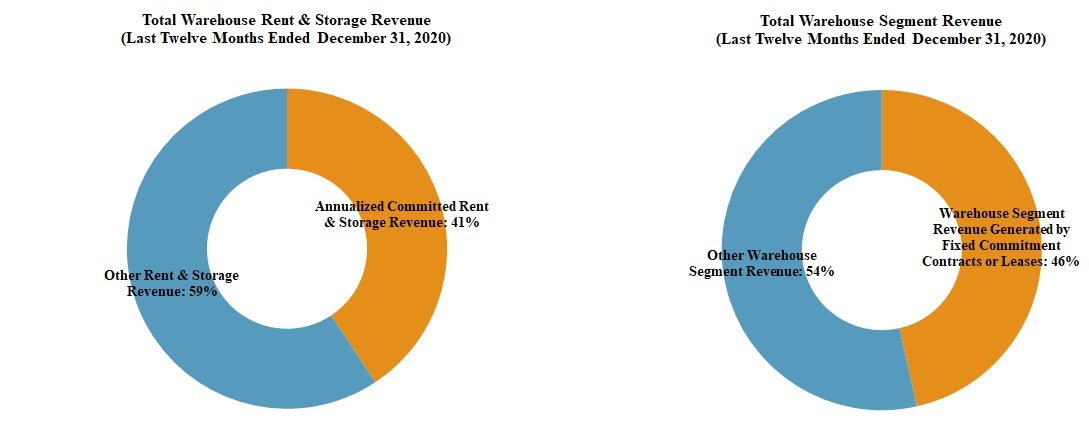

Fixed Commitment Rent and Storage Revenue

As of December 31, 2020, $283.6 million of the Company’s annualized rent and storage revenue were derived from customers with fixed commitment storage contracts. This compares to $279.7 million at the end of the third quarter of 2020 and $251.1 million at the end of the fourth quarter of 2019. The Company’s recent acquisitions had a lower percentage of fixed committed contracts as a percentage of rent and storage revenue. On a combined pro forma basis, assuming a full twelve months of acquisitions revenue, 40.7% of rent and storage revenue were generated from fixed commitment storage contracts, which is a 140 basis point decrease over the third quarter of 2020. The Agro acquisition is excluded from the fixed commitment rent and storage revenue metrics.

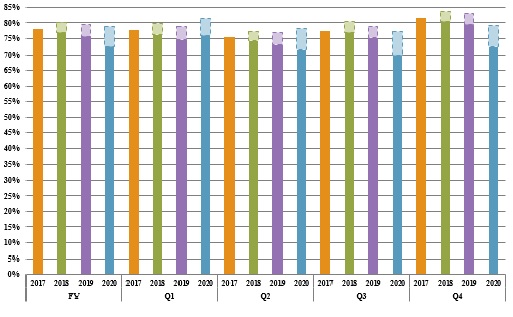

Economic and Physical Occupancy

Contracts that contain fixed commitments are designed to ensure the Company’s customers have space available when needed. For the fourth quarter of 2020, economic occupancy for the total warehouse segment was 79.2% and warehouse segment same store pool was 82.7%, representing a 688 basis point and 874 basis point increase above physical occupancy, respectively. For the fourth

12

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

quarter of 2020, physical occupancy for the total warehouse segment was 72.3% and warehouse segment same store pool was 73.9%.

Real Estate Portfolio

As of December 31, 2020, the Company’s portfolio consists of 238 facilities. The Company ended the fourth quarter of 2020 with 229 facilities in its Global Warehouse segment portfolio and nine facilities in its Third-party managed segment. During the fourth quarter of 2020, the Company added eight facilities through the acquisition of Hall’s and 46 facilities in connection with the Agro acquisition. Additionally, the Company exited the operations of one Third-party managed facility in Canada. The same store population consists of 135 facilities for the quarter ended December 31, 2020. The remaining 94 non-same store population includes the 88 facilities that were acquired since the beginning of 2019 and six legacy facilities.

Balance Sheet Activity and Liquidity

As of December 31, 2020, the Company had total liquidity of approximately $1.7 billion, including cash and capacity on its revolving credit facility and $392 million of net proceeds available from equity forward contracts. Total debt outstanding was $3.0 billion (inclusive of $311.0 million of financing leases/sale lease-backs and exclusive of unamortized deferred financing fees), of which 80% was in an unsecured structure. The Company has no material debt maturities until 2023. At quarter end, its net debt to pro forma Core EBITDA was approximately 4.4x. Of the Company’s total debt outstanding, $2.7 billion relates to real estate debt, which excludes sale-leaseback and capitalized lease obligations. The Company’s real estate debt has a remaining weighted average term of 7.6 years and carries a weighted average contractual interest rate of 3.00%. As of December 31, 2020, 82% of the Company’s total debt outstanding was at a fixed rate.

The Company’s equity forwards, the respective contractual latest settlement dates, and net proceeds are detailed in the table below:

| Outstanding Equity Forward Data | |||||||||||||||||

| in millions, except share price amounts | |||||||||||||||||

| Quarter Raised | Forward Shares | Net Share Price1 | Net Proceeds | Contractual Outside Settlement Date | Target Use of Net Proceeds | ||||||||||||

| 3Q 2018 | 6.000 | $21.73 | $130.4 | 3/18/2022 | Fund the Ahold Development | ||||||||||||

| 2Q 2020 - 3Q 2020 | 2.429 | $35.97 | $87.4 | 7/1/2021 | Fund the Calgary and Arkansas expansions | ||||||||||||

| 4Q 2020 | 4.785 | $36.43 | $174.3 | 10/13/2021 | Fund future growth initiatives | ||||||||||||

| 13.214 | $29.67 | $392.1 | |||||||||||||||

(1) Net of underwriter fee, forward costs and dividends paid. | |||||||||||||||||

Dividend

On December 8, 2020, the Company’s Board of Trustees declared a dividend of $0.21 per share for the fourth quarter of 2020, which was paid on January 15, 2021 to common shareholders of record as of December 31, 2020.

2021 Outlook

The Company announced guidance as follows:

•Global warehouse segment same store revenue growth to range between 2% and 4% on a constant currency basis and same store NOI growth to be 100 to 200 basis points higher than the associated revenue growth on a constant currency basis.

13

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

•Managed and Transportation NOI is expected in the range of $46-$54 million.

•Selling, general and administrative expense is expected in the range of $190-$196 million, inclusive of non-cash share-based compensation expense of $21-$23 million.

•Current income tax expense of $9-$13 million.

•Deferred income tax benefit from a range of $1-$2 million.

•Non-real estate depreciation and amortization of $85-$92 million.

•Total maintenance capital expenditures is expected in the range of $90-$100 million.

•Development starts of $175-$300 million.

•Anticipated AFFO per share of $1.36 to $1.46.

•Please refer to our supplemental for currency translation rates embedded in this guidance.

The Company’s guidance is provided for informational purposes based on current plans and assumptions and is subject to change. The ranges for these metrics do not include the impact of acquisitions, dispositions, or capital markets activity beyond that which has been previously announced.

Investor Webcast and Conference Call

The Company will hold a webcast and conference call on Thursday, February 18, 2021 at 5:00 p.m. Eastern Time to discuss fourth quarter 2020 results. A live webcast of the call will be available via the Investors section of Americold Realty Trust’s website at www.americold.com. To listen to the live webcast, please go to the site at least five minutes prior to the scheduled start time in order to register, download and install any necessary audio software. Shortly after the call, a replay of the webcast will be available for 90 days on the Company’s website.

The conference call can also be accessed by dialing 1-877-407-3982 or 1-201-493-6780. The telephone replay can be accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing the conference ID# 13714728. The telephone replay will be available starting shortly after the call until March 4, 2021.

The Company’s supplemental package will be available prior to the conference call in the Investors section of the Company’s website at http://ir.americold.com.

About the Company

Americold is the world’s largest publicly traded REIT focused on the ownership, operation, acquisition and development of temperature-controlled warehouses. Based in Atlanta, Georgia, Americold owns and operates 238 temperature-controlled warehouses, with over 1.4 billion refrigerated cubic feet of storage, in North America, Europe, Asia-Pacific, and South America. Americold’s facilities are an integral component of the supply chain connecting food producers, processors, distributors and retailers to consumers.

14

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including FFO, core FFO, AFFO, EBITDAre, Core EBITDA and same store segment revenue and contribution. A reconciliation from U.S. GAAP net (loss) income available to common shareholders to FFO, a reconciliation from FFO to core FFO and AFFO, and definitions of FFO, and core FFO are included within the supplemental. A reconciliation from U.S. GAAP net (loss) income available to common shareholders to EBITDAre and Core EBITDA, a definition of Core EBITDA and definitions of net debt to Core EBITDA are included within the supplemental.

Forward-Looking Statements

This document contains statements about future events and expectations that constitute forward-looking statements. Forward-looking statements are based on our beliefs, assumptions and expectations of our future financial and operating performance and growth plans, taking into account the information currently available to us. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties that may cause our actual results to differ materially from the expectations of future results we express or imply in any forward-looking statements, and you should not place undue reliance on such statements. Factors that could contribute to these differences include the following: uncertainties and risks related to public health crises, including the ongoing COVID-19 pandemic; adverse economic or real estate developments in our geographic markets or the temperature-controlled warehouse industry; general economic conditions; risks associated with the ownership of real estate and temperature-controlled warehouses in particular; acquisition risks, including the failure to identify or complete attractive acquisitions or the failure of acquisitions to perform in accordance with projections and to realize anticipated cost savings and revenue improvements; our failure to realize the intended benefits from our recent acquisitions, including the Agro acquisition, and including synergies, or disruptions to our plans and operations or unknown or contingent liabilities related to our recent acquisitions; risks related to expansions of existing properties and developments of new properties, including failure to meet budgeted or stabilized returns within expected time frames, or at all, in respect thereof; a failure of our information technology systems, cybersecurity attacks or a breach of our information security systems, networks or processes could cause business disruptions or loss of confidential information; risks related to privacy and data security concerns, and data collection and transfer restrictions and related foreign regulations; defaults or non-renewals of significant customer contracts, including as a result of the ongoing COVID-19 pandemic; uncertainty of revenues, given the nature of our customer contracts; increased interest rates and operating costs, including as a result of the ongoing COVID-19 pandemic; our failure to obtain necessary outside financing; risks related to, or restrictions contained in, our debt financings; decreased storage rates or increased vacancy rates; risks related to current and potential international operations and properties; difficulties in expanding our operations into new markets, including international markets; risks related to the partial ownership of properties, including as a result of our lack of control over such investments and the failure of such entities to perform in accordance with projections; our failure to maintain our status as a REIT; possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently or previously owned by us; financial market fluctuations; actions by our competitors and their increasing ability to compete with us; labor and power costs; changes in applicable governmental regulations and tax legislation, including in the international markets; additional risks with respect to the addition of European operations and properties; changes in real estate and zoning laws and increases in real property tax rates; the competitive environment in which we operate; our relationship with our employees, including the occurrence of any work stoppages or any disputes under our collective bargaining agreements and employment related litigation; liabilities as a result of our participation in multi-employer pension plans; losses in excess of our insurance coverage; the potential liabilities, costs and regulatory impacts associated with our in-house trucking services and the

15

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

potential disruptions associated with the use of third-party trucking service providers to provide transportation services to our customers; the cost and time requirements as a result of our operation as a publicly traded REIT; changes in foreign currency exchange rates; the impact of anti-takeover provisions in our constituent documents and under Maryland law, which could make an acquisition of us more difficult, limit attempts by our shareholders to replace our trustees and affect the price of our common shares of beneficial interest, $0.01 par value per share, of our common shares; the potential dilutive effect of our common share offerings; and risks related to any forward sale agreement, including the 2018 forward sale agreement, the 2020 ATM forward sale agreements and the 2020 forward sale agreements, or collectively, our forward sale agreements, including substantial dilution to our earnings per share or substantial cash payment obligations.

Words such as “anticipates,” “believes,” “continues,” “estimates,” “expects,” “goal,” “objectives,” “intends,” “may,” “opportunity,” “plans,” “potential,” “near-term,” “long-term,” “projections,” “assumptions,” “projects,” “guidance,” “forecasts,” “outlook,” “target,” “trends,” “should,” “could,” “would,” “will” and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements included in this document include, among others, statements about our expected acquisition and expected expansion and development pipeline and our targeted return on invested capital on expansion and development opportunities. We qualify any forward-looking statements entirely by these cautionary factors. Other risks, uncertainties and factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, in our Quarterly Report for the quarter ended March 31, 2020, in our Form 8-K filed April 16, 2020 and in our Form 8-K filed on October 13, 2020, could cause our actual results to differ materially from those projected in any forward-looking statements we make. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Contacts:

Americold Realty Trust

Investor Relations

Telephone: 678-459-1959

Email: investor.relations@americold.com

16

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Selected Quarterly Financial Data

| In thousands, except per share amounts - unaudited | As of | ||||||||||||||||

| Capitalization: | Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | ||||||||||||

Fully diluted common shares outstanding at quarter end(1) | 256,829 | 208,764 | 208,354 | 205,161 | 197,784 | ||||||||||||

| Common stock share price at quarter end | $37.73 | $35.75 | $36.30 | $34.04 | $35.06 | ||||||||||||

| Market value of common equity | $9,690,158 | $7,463,313 | $7,563,250 | $6,983,680 | $6,934,307 | ||||||||||||

Gross debt (2) | $2,975,204 | $2,034,087 | $2,025,246 | $2,011,027 | $1,882,372 | ||||||||||||

| Less: cash and cash equivalents | 621,051 | 173,913 | 298,709 | 262,955 | 234,303 | ||||||||||||

| Net debt | $2,354,153 | $1,860,174 | $1,726,537 | $1,748,072 | $1,648,069 | ||||||||||||

| Total enterprise value | $12,044,311 | $9,323,487 | $9,289,787 | $8,731,752 | $8,582,376 | ||||||||||||

| Net debt / total enterprise value | 19.5 | % | 20.0 | % | 18.6 | % | 20.0 | % | 19.2 | % | |||||||

Net debt to pro forma Core EBITDA(2) | 4.43x | 4.34x | 4.13x | 4.15x | 4.18x | ||||||||||||

| Three Months Ended | |||||||||||||||||

| Selected Operational Data: | Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | ||||||||||||

| Warehouse segment revenue | $407,811 | $388,024 | $372,411 | $381,068 | $383,778 | ||||||||||||

| Total revenue | 523,678 | 497,458 | 482,522 | 484,069 | 485,984 | ||||||||||||

Operating income (3) | 26,771 | 37,457 | 56,545 | 47,678 | 46,579 | ||||||||||||

| Net (loss) income | (43,992) | 12,374 | 32,662 | 23,511 | 20,809 | ||||||||||||

Total warehouse segment contribution (NOI) (4) | 145,672 | 127,756 | 120,132 | 126,773 | 129,547 | ||||||||||||

Total segment contribution (NOI) (4) | 152,439 | 135,319 | 128,338 | 135,402 | 137,754 | ||||||||||||

| Selected Other Data: | |||||||||||||||||

Core EBITDA (5) | $117,213 | $104,075 | $100,512 | $104,110 | $109,086 | ||||||||||||

Core funds from operations (1) | 81,907 | 58,626 | 55,108 | 60,060 | 64,621 | ||||||||||||

Adjusted funds from operations (1) | 76,882 | 62,741 | 61,103 | 67,151 | 59,716 | ||||||||||||

| Earnings Measurements: | |||||||||||||||||

| Net (loss) income per share - basic | $(0.21) | $0.06 | $0.16 | $0.12 | $0.11 | ||||||||||||

| Net (loss) income per share - diluted | $(0.21) | $0.06 | $0.16 | $0.11 | $0.10 | ||||||||||||

Core FFO per diluted share (5) | $0.39 | $0.28 | $0.27 | $0.29 | $0.33 | ||||||||||||

AFFO per diluted share (5) | $0.37 | $0.30 | $0.30 | $0.33 | $0.30 | ||||||||||||

Dividend distributions declared per common share (6) | $0.21 | $0.21 | $0.21 | $0.21 | $0.20 | ||||||||||||

Diluted AFFO payout ratio (7) | 56.8 | % | 70.0 | % | 70.0 | % | 63.6 | % | 66.7 | % | |||||||

| Portfolio Statistics: | |||||||||||||||||

| Total global warehouses | 238 | 185 | 183 | 183 | 178 | ||||||||||||

| Average economic occupancy | 79.2 | % | 77.2 | % | 78.2 | % | 81.3 | % | 83.1 | % | |||||||

| Average physical occupancy | 72.3 | % | 69.9 | % | 71.4 | % | 76.1 | % | 79.5 | % | |||||||

| Total global same-store warehouses | 135 | 135 | 135 | 136 | 137 | ||||||||||||

17

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

(1) Assumes the exercise of all outstanding stock options using the treasury stock method, conversion of all outstanding restricted stock units, and incorporates forward contracts using the treasury stock method | |||||||||||||||||

| As of | |||||||||||||||||

| (2) Net Debt to Core EBITDA Computation | 12/31/2020 | 12/31/2019 | |||||||||||||||

| Total debt | $ | 2,959,252 | $ | 1,869,376 | |||||||||||||

| Deferred financing costs | 15,952 | 12,996 | |||||||||||||||

| Gross debt | $2,975,204 | $1,882,372 | |||||||||||||||

| Adjustments: | |||||||||||||||||

| Less: cash and cash equivalents | 621,051 | 234,303 | |||||||||||||||

| Net debt | $ | 2,354,153 | $ | 1,648,069 | |||||||||||||

| Core EBITDA - last twelve months | $425,910 | $367,128 | |||||||||||||||

| Core EBITDA from acquisitions (a) | 105,362 | 26,745 | |||||||||||||||

| Pro forma Core EBITDA - last twelve months | $531,272 | $393,873 | |||||||||||||||

| Net debt to pro forma Core EBITDA | 4.43x | 4.18x | |||||||||||||||

| (a) As of December 31, 2020, amount includes eight months of Core EBITDA from the Caspers and AM-C Warehouse acquisitions, ten months of Core EBITDA from the Halls acquisition, and twelve months of Core EBITDA from the Agro acquisition prior to Americold’s ownership of the respective acquired entities. | |||||||||||||||||

| (4) Reconciliation of segment contribution (NOI) | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | |||||||||||||

| Warehouse segment contribution (NOI) | $145,672 | $127,756 | $120,132 | $126,773 | $129,547 | ||||||||||||

| Third-party managed segment contribution (NOI) | 1,767 | 3,393 | 3,299 | 3,769 | 3,115 | ||||||||||||

| Transportation segment contribution (NOI) | 5,043 | 4,187 | 4,772 | 4,805 | 4,865 | ||||||||||||

| Quarry segment contribution (NOI) | (43) | (17) | 135 | 55 | 227 | ||||||||||||

| Total segment contribution (NOI) | $152,439 | $135,319 | $128,338 | $135,402 | $137,754 | ||||||||||||

| Depreciation and amortization | (58,319) | (53,569) | (52,399) | (51,604) | (47,750) | ||||||||||||

| Selling, general and administrative | (39,536) | (35,969) | (32,340) | (36,893) | (33,048) | ||||||||||||

| Acquisition, litigation and other | (26,535) | (5,282) | (2,801) | (1,688) | (10,377) | ||||||||||||

| Gain (loss) from sale of real estate | 676 | (427) | 19,414 | 2,461 | — | ||||||||||||

| Impairment of long-lived assets | (1,954) | (2,615) | (3,667) | — | — | ||||||||||||

| U.S. GAAP operating income | $26,771 | $37,457 | $56,545 | $47,678 | $46,579 | ||||||||||||

| (5) See “Reconciliation of Net (Loss) Income to EBITDA, EBITDAre, and Core EBITDA” | |||||||||||||||||

| (6) Distributions per common share | Three Months Ended | ||||||||||||||||

| Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | |||||||||||||

| Distributions declared on common shares during the quarter | $53,820 | $43,282 | $43,271 | $42,568 | $38,796 | ||||||||||||

| Common shares outstanding at quarter end | 251,703 | 203,680 | 203,616 | 200,266 | 191,800 | ||||||||||||

| Distributions declared per common share of beneficial interest | $0.21 | $0.21 | $0.21 | $0.21 | $0.20 | ||||||||||||

| (7) Calculated as distributions declared on common shares divided by AFFO per fully diluted share | |||||||||||||||||

18

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Financial Information

| Americold Realty Trust and Subsidiaries | |||||||||||

| Consolidated Balance Sheets | |||||||||||

| (In thousands, except shares and per share amounts) | |||||||||||

| December 31, | |||||||||||

| 2020 | 2019 | ||||||||||

| Assets | |||||||||||

| Property, buildings and equipment: | |||||||||||

| Land | $ | 662,885 | $ | 526,226 | |||||||

| Buildings and improvements | 4,004,824 | 2,696,732 | |||||||||

| Machinery and equipment | 1,177,572 | 817,617 | |||||||||

| Assets under construction | 303,531 | 108,639 | |||||||||

| 6,148,812 | 4,149,214 | ||||||||||

| Accumulated depreciation | (1,382,298) | (1,216,553) | |||||||||

| Property, buildings and equipment – net | 4,766,514 | 2,932,661 | |||||||||

| Operating lease right-of-use assets | 291,797 | 77,723 | |||||||||

| Accumulated depreciation – operating leases | (24,483) | (18,110) | |||||||||

| Operating leases – net | 267,314 | 59,613 | |||||||||

| Financing leases: | |||||||||||

| Buildings and improvements | 60,513 | 11,227 | |||||||||

| Machinery and equipment | 109,416 | 76,811 | |||||||||

| 169,929 | 88,038 | ||||||||||

| Accumulated depreciation – financing leases | (40,937) | (29,697) | |||||||||

| Financing leases – net | 128,992 | 58,341 | |||||||||

| Cash, cash equivalents and restricted cash | 621,051 | 240,613 | |||||||||

Accounts receivable – net of allowance of $12,286 and $6,927 at December 31, 2020 and 2019, respectively | 324,221 | 214,842 | |||||||||

| Identifiable intangible assets – net | 797,423 | 284,758 | |||||||||

| Goodwill | 794,335 | 318,483 | |||||||||

| Investments in partially owned entities | 44,907 | — | |||||||||

| Other assets | 86,394 | 61,372 | |||||||||

| Total assets | $ | 7,831,151 | $ | 4,170,683 | |||||||

| Liabilities and equity | |||||||||||

| Liabilities: | |||||||||||

| Borrowings under revolving line of credit | $ | — | $ | — | |||||||

| Accounts payable and accrued expenses | 552,547 | 350,963 | |||||||||

Mortgage notes, senior unsecured notes and term loan – net of deferred financing costs of $15,952 and $12,996 in the aggregate, at December 31, 2020 and 2019, respectively | 2,648,266 | 1,695,447 | |||||||||

| Sale-leaseback financing obligations | 185,060 | 115,759 | |||||||||

| Financing lease obligations | 125,926 | 58,170 | |||||||||

| Operating lease obligations | 269,147 | 62,342 | |||||||||

| Unearned revenue | 19,209 | 16,423 | |||||||||

| Pension and postretirement benefits | 9,145 | 12,706 | |||||||||

| Deferred tax liability – net | 220,502 | 17,119 | |||||||||

| Multiemployer pension plan withdrawal liability | 8,528 | 8,736 | |||||||||

| Total liabilities | 4,038,330 | 2,337,665 | |||||||||

| Equity | |||||||||||

| Shareholders’ equity: | |||||||||||

Common shares of beneficial interest, $0.01 par value – 325,000,000 and 250,000,000 authorized shares; 251,702,603 and 191,799,909 issued and outstanding at December 31, 2020 and 2019, respectively | 2,517 | 1,918 | |||||||||

| Paid-in capital | 4,687,823 | 2,582,087 | |||||||||

| Accumulated deficit and distributions in excess of net earnings | (895,521) | (736,861) | |||||||||

| Accumulated other comprehensive loss | (4,379) | (14,126) | |||||||||

| Total shareholders’ equity | 3,790,440 | 1,833,018 | |||||||||

| Noncontrolling interests: | |||||||||||

| Noncontrolling interests in operating partnership | 2,381 | — | |||||||||

| Total equity | 3,792,821 | 1,833,018 | |||||||||

| Total liabilities and equity | $ | 7,831,151 | $ | 4,170,683 | |||||||

19

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Americold Realty Trust and Subsidiaries | |||||||||||||||||||||||

| Condensed Consolidated Statements of Operations (Unaudited) | |||||||||||||||||||||||

| (In thousands, except per share amounts) | |||||||||||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Rent, storage and warehouse services | $ | 407,811 | $ | 383,778 | $ | 1,549,314 | $ | 1,377,217 | |||||||||||||||

| Third-party managed services | 78,538 | 64,442 | 291,751 | 252,939 | |||||||||||||||||||

| Transportation services | 37,329 | 35,571 | 142,203 | 144,844 | |||||||||||||||||||

| Other | — | 2,193 | 4,459 | 8,705 | |||||||||||||||||||

| Total revenues | 523,678 | 485,984 | 1,987,727 | 1,783,705 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Rent, storage and warehouse services cost of operations | 262,139 | 254,231 | 1,028,981 | 929,626 | |||||||||||||||||||

| Third-party managed services cost of operations | 76,771 | 61,327 | 279,523 | 241,178 | |||||||||||||||||||

| Transportation services cost of operations | 32,286 | 30,706 | 123,396 | 126,777 | |||||||||||||||||||

| Cost of operations related to other revenues | 43 | 1,966 | 4,329 | 7,867 | |||||||||||||||||||

| Depreciation and amortization | 58,319 | 47,750 | 215,891 | 163,348 | |||||||||||||||||||

| Selling, general and administrative | 39,536 | 33,048 | 144,738 | 129,310 | |||||||||||||||||||

| Acquisition, litigation and other | 26,535 | 10,377 | 36,306 | 40,614 | |||||||||||||||||||

| Impairment of long-lived assets | 1,954 | — | 8,236 | 13,485 | |||||||||||||||||||

| (Gain) loss from sale of real estate | (676) | — | (22,124) | 34 | |||||||||||||||||||

| Total operating expenses | 496,907 | 439,405 | 1,819,276 | 1,652,239 | |||||||||||||||||||

| Operating income | 26,771 | 46,579 | 168,451 | 131,466 | |||||||||||||||||||

| Other (expense) income: | |||||||||||||||||||||||

| Interest expense | (21,367) | (23,827) | (91,481) | (94,408) | |||||||||||||||||||

| Interest income | 135 | 1,080 | 1,162 | 6,286 | |||||||||||||||||||

| Bridge loan commitment fees | (2,438) | — | (2,438) | (2,665) | |||||||||||||||||||

| Loss on debt extinguishment, modifications and termination of derivative instruments | (9,194) | — | (9,975) | — | |||||||||||||||||||

| Foreign currency exchange (loss) gain, net | (44,905) | 76 | (45,278) | 10 | |||||||||||||||||||

| Other expense, net | (2,395) | (863) | (2,563) | (1,870) | |||||||||||||||||||

| Gain from sale of partially owned entities | — | — | — | 4,297 | |||||||||||||||||||

| Gain (loss) from investments in partially owned entities | 4 | — | (250) | (111) | |||||||||||||||||||

| (Loss) income before income tax benefit (expense) | (53,389) | 23,045 | 17,628 | 43,005 | |||||||||||||||||||

| Income tax benefit (expense) | |||||||||||||||||||||||

| Current | 18 | (716) | (6,805) | (5,544) | |||||||||||||||||||

| Deferred | 9,379 | (1,520) | 13,732 | 10,701 | |||||||||||||||||||

| Total income tax benefit (expense) | 9,397 | (2,236) | 6,927 | 5,157 | |||||||||||||||||||

| Net (loss) income | $ | (43,992) | $ | 20,809 | $ | 24,555 | $ | 48,162 | |||||||||||||||

| Weighted average common shares outstanding – basic | 205,984 | 192,393 | 203,255 | 179,598 | |||||||||||||||||||

| Weighted average common shares outstanding – diluted | 209,928 | 197,922 | 206,940 | 183,950 | |||||||||||||||||||

| Net (loss) income per common share of beneficial interest - basic | $ | (0.21) | $ | 0.11 | $ | 0.11 | $ | 0.26 | |||||||||||||||

| Net (loss) income per common share of beneficial interest - diluted | $ | (0.21) | $ | 0.10 | $ | 0.11 | $ | 0.26 | |||||||||||||||

20

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Reconciliation of Net (Loss) Income to NAREIT FFO, Core FFO, and AFFO | ||||||||||||||||||||||||||

| (In thousands, except per share amounts - unaudited) | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | FY 2020 | FY 2019 | ||||||||||||||||||||

| Net (loss) income | $ | (43,992) | $ | 12,374 | $ | 32,662 | $ | 23,511 | $ | 20,809 | $ | 24,555 | $ | 48,162 | ||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Real estate related depreciation | 39,128 | 36,289 | 35,558 | 35,442 | 32,555 | 146,417 | 114,976 | |||||||||||||||||||

Net (gain) loss on sale of real estate, net of withholding taxes (b) | (676) | 427 | (19,414) | (2,096) | — | (21,759) | 34 | |||||||||||||||||||

| Net loss (gain) on asset disposals | 888 | 1,160 | (3) | — | 237 | 2,045 | 382 | |||||||||||||||||||

| Impairment charges on real estate assets | 2,449 | — | 3,181 | — | — | 5,630 | 12,555 | |||||||||||||||||||

| Real estate depreciation on partially owned entities | — | — | (34) | 34 | — | — | 790 | |||||||||||||||||||

| Our share of reconciling items related to partially owned entities | 182 | 111 | 156 | — | — | 449 | — | |||||||||||||||||||

| NAREIT Funds from operations | $ | (2,021) | $ | 50,361 | $ | 52,106 | $ | 56,891 | $ | 53,601 | $ | 157,337 | $ | 176,899 | ||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Net loss (gain) on sale of non-real estate assets | 1,112 | (100) | (252) | (165) | 227 | 595 | 488 | |||||||||||||||||||

| Non-real estate impairment | (495) | 2,615 | 486 | — | — | 2,606 | 930 | |||||||||||||||||||

| Acquisition, litigation and other | 26,535 | 5,282 | 2,801 | 1,688 | 10,377 | 36,306 | 40,614 | |||||||||||||||||||

| Share-based compensation expense, IPO grants | 200 | 196 | 203 | 373 | 492 | 972 | 2,432 | |||||||||||||||||||

| Bridge loan commitment fees | 2,438 | — | — | — | — | 2,438 | 2,665 | |||||||||||||||||||

| Loss on debt extinguishment, modifications and termination of derivative instruments | 9,194 | — | — | 781 | — | 9,975 | — | |||||||||||||||||||

| Foreign currency exchange loss (gain) | 44,905 | 196 | (315) | 492 | (76) | 45,278 | (10) | |||||||||||||||||||

| Gain from sale of partially owned entities | — | — | — | — | — | — | (4,297) | |||||||||||||||||||

| Our share of reconciling items related to partially owned entities | 39 | 76 | 79 | — | — | 194 | — | |||||||||||||||||||

| Core FFO applicable to common shareholders | $ | 81,907 | $ | 58,626 | $ | 55,108 | $ | 60,060 | $ | 64,621 | $ | 255,701 | $ | 219,721 | ||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Amortization of deferred financing costs and pension withdrawal liability | 1,202 | 1,203 | 1,196 | 1,546 | 1,524 | 5,147 | 6,028 | |||||||||||||||||||

| Amortization of below/above market leases | 37 | 39 | — | 76 | 37 | 152 | 151 | |||||||||||||||||||

| Straight-line net rent | (324) | (87) | (108) | (109) | (83) | (628) | (521) | |||||||||||||||||||

| Deferred income tax (benefit) expense | (9,379) | (1,284) | (967) | (2,102) | 1,520 | (13,732) | (10,701) | |||||||||||||||||||

| Share-based compensation expense, excluding IPO grants | 4,371 | 4,373 | 4,261 | 3,934 | 3,210 | 16,939 | 10,463 | |||||||||||||||||||

| Non-real estate depreciation and amortization | 19,191 | 17,280 | 16,841 | 16,162 | 15,194 | 69,474 | 48,372 | |||||||||||||||||||

| Non-real estate depreciation and amortization on partially owned entities | — | — | (22) | 22 | — | — | 317 | |||||||||||||||||||

Maintenance capital expenditures (a) | (20,291) | (17,534) | (15,284) | (12,438) | (26,307) | (65,547) | (59,300) | |||||||||||||||||||

| Our share of reconciling items related to partially owned entities | 168 | 125 | 78 | — | — | 371 | — | |||||||||||||||||||

| Adjusted FFO applicable to common shareholders | $ | 76,882 | $ | 62,741 | $ | 61,103 | $ | 67,151 | $ | 59,716 | $ | 267,877 | $ | 214,530 | ||||||||||||

21

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Reconciliation of Net (Loss) Income to NAREIT FFO, Core FFO, and AFFO (continued) | ||||||||||||||||||||||||||

| (In thousands except per share amounts - unaudited) | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | FY 2020 | FY 2019 | ||||||||||||||||||||

| NAREIT Funds from operations | $ | (2,021) | $ | 50,361 | $ | 52,106 | $ | 56,891 | $ | 53,601 | $ | 157,337 | $ | 176,899 | ||||||||||||

| Core FFO applicable to common shareholders | $ | 81,907 | $ | 58,626 | $ | 55,108 | $ | 60,060 | $ | 64,621 | $ | 255,701 | $ | 219,721 | ||||||||||||

| Adjusted FFO applicable to common shareholders | $ | 76,882 | $ | 62,741 | $ | 61,103 | $ | 67,151 | $ | 59,716 | $ | 267,877 | $ | 214,530 | ||||||||||||

| Reconciliation of weighted average shares: | ||||||||||||||||||||||||||

| Weighted average basic shares for net income calculation | 205,984 | 204,289 | 201,787 | 200,707 | 192,393 | 203,255 | 179,598 | |||||||||||||||||||

| Dilutive stock options, unvested restricted stock units, equity forward contracts | 3,944 | 4,211 | 3,511 | 3,076 | 5,529 | 3,685 | 4,352 | |||||||||||||||||||

| Weighted average dilutive shares | 209,928 | 208,500 | 205,298 | 203,783 | 197,922 | 206,940 | 183,950 | |||||||||||||||||||

| NAREIT FFO - basic per share | $ | (0.01) | $ | 0.25 | $ | 0.26 | $ | 0.28 | $ | 0.28 | $ | 0.77 | $ | 0.98 | ||||||||||||

| NAREIT FFO - diluted per share | $ | (0.01) | $ | 0.24 | $ | 0.25 | $ | 0.28 | $ | 0.27 | $ | 0.76 | $ | 0.96 | ||||||||||||

| Core FFO - basic per share | $ | 0.40 | $ | 0.29 | $ | 0.27 | $ | 0.30 | $ | 0.34 | $ | 1.26 | $ | 1.22 | ||||||||||||

| Core FFO - diluted per share | $ | 0.39 | $ | 0.28 | $ | 0.27 | $ | 0.29 | $ | 0.33 | $ | 1.24 | $ | 1.19 | ||||||||||||

| Adjusted FFO - basic per share | $ | 0.37 | $ | 0.31 | $ | 0.30 | $ | 0.33 | $ | 0.31 | $ | 1.32 | $ | 1.19 | ||||||||||||

| Adjusted FFO - diluted per share | $ | 0.37 | $ | 0.30 | $ | 0.30 | $ | 0.33 | $ | 0.30 | $ | 1.29 | $ | 1.17 | ||||||||||||

| (a) | Maintenance capital expenditures include capital expenditures made to extend the life of, and provide future economic benefit from, our existing temperature-controlled warehouse network and its existing supporting personal property and information technology. | ||||

| (b) | (Gain) loss on sale of real estate, net of withholding tax include withholding tax on the sale of Sydney land which is included in income tax expense on the Consolidated Statement of Operations. | ||||

22

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

| Reconciliation of Net (Loss) Income to EBITDA, NAREIT EBITDAre, and Core EBITDA | ||||||||||||||||||||||||||

| (In thousands - unaudited) | ||||||||||||||||||||||||||

| Three Months Ended | Year Ended | |||||||||||||||||||||||||

| Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | FY 2020 | FY 2019 | ||||||||||||||||||||

| Net (loss) income | $ | (43,992) | $ | 12,374 | $ | 32,662 | $ | 23,511 | $ | 20,809 | $ | 24,555 | $ | 48,162 | ||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Depreciation and amortization | 58,319 | 53,569 | 52,399 | 51,604 | 47,750 | 215,891 | 163,348 | |||||||||||||||||||

| Interest expense | 21,367 | 23,066 | 23,178 | 23,870 | 23,827 | 91,481 | 94,408 | |||||||||||||||||||

| Income tax (benefit) expense | (9,397) | 819 | 1,196 | 90 | 2,236 | (7,292) | (5,157) | |||||||||||||||||||

| EBITDA | $ | 26,297 | $ | 89,828 | $ | 109,435 | $ | 99,075 | $ | 94,622 | $ | 324,635 | $ | 300,761 | ||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Net (gain) loss on sale of real estate, net of withholding taxes | (676) | 427 | (19,414) | (2,096) | — | (21,759) | 34 | |||||||||||||||||||

| Adjustment to reflect share of EBITDAre of partially owned entities | 432 | 293 | 237 | 60 | — | 1,022 | 1,726 | |||||||||||||||||||

| NAREIT EBITDAre | $ | 26,053 | $ | 90,548 | $ | 90,258 | $ | 97,039 | $ | 94,622 | $ | 303,898 | $ | 302,521 | ||||||||||||

| Adjustments: | ||||||||||||||||||||||||||

| Acquisition, litigation and other | 26,535 | 5,282 | 2,801 | 1,688 | 10,377 | 36,306 | 40,614 | |||||||||||||||||||

| Bridge loan commitment fees | 2,438 | — | — | — | — | 2,438 | 2,665 | |||||||||||||||||||

| (Income) loss from investments in partially owned entities | (4) | 98 | 129 | 27 | — | 250 | 111 | |||||||||||||||||||

| Gain from sale of partially owned entities | — | — | — | — | — | — | (4,297) | |||||||||||||||||||

| Asset impairment | 1,954 | 2,615 | 3,667 | — | — | 8,236 | 13,485 | |||||||||||||||||||

| Foreign currency exchange loss (gain) | 44,905 | 196 | (315) | 492 | (76) | 45,278 | (10) | |||||||||||||||||||

| Share-based compensation expense | 4,571 | 4,569 | 4,464 | 4,307 | 3,699 | 17,911 | 12,895 | |||||||||||||||||||

| Loss on debt extinguishment, modifications and termination of derivative instruments | 9,194 | — | — | 781 | — | 9,975 | — | |||||||||||||||||||

| Loss (gain) on real estate and other asset disposals | 1,999 | 1,060 | (255) | (164) | 464 | 2,640 | 870 | |||||||||||||||||||

| Reduction in EBITDAre from partially owned entities | (432) | (293) | (237) | (60) | — | (1,022) | (1,726) | |||||||||||||||||||

| Core EBITDA | $ | 117,213 | $ | 104,075 | $ | 100,512 | $ | 104,110 | $ | 109,086 | $ | 425,910 | $ | 367,128 | ||||||||||||

23

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Acquisition, Litigation and Other

Dollars in thousands

The Company reported a new financial statement line referred to as “Acquisition, litigation and other” within our Statements of Operations during 2019 due to various charges incurred in the current period and going forward. This caption represents certain corporate costs that are highly variable from period to period and will be further detailed in our Annual Report on Form 10-K.

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| Acquisition, litigation and other | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Acquisition related costs | $ | 18,188 | $ | 5,159 | $ | 26,466 | $ | 24,284 | |||||||||||||||

| Litigation | 52 | 2,978 | 310 | 4,553 | |||||||||||||||||||

| Severance, equity award modifications and acceleration | 67 | 1,824 | 1,089 | 9,789 | |||||||||||||||||||

| Non-offering related equity issuance expenses | — | 38 | — | 1,356 | |||||||||||||||||||

| Terminated site operations costs | 644 | 378 | 124 | 632 | |||||||||||||||||||

| Cyber incident related costs | 7,908 | — | 7,908 | — | |||||||||||||||||||

| Other | (324) | — | 409 | — | |||||||||||||||||||

| Total acquisition, litigation and other | $ | 26,535 | $ | 10,377 | $ | 36,306 | $ | 40,614 | |||||||||||||||

24

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Debt Detail and Maturities | |||||||||||||||||||||||

(In thousands - unaudited) | |||||||||||||||||||||||

As of December 31, 2020 | |||||||||||||||||||||||

Indebtedness: | Carrying Value | Contractual Interest Rate(3) | Effective Interest Rate(4) | Stated Maturity Date(5) | |||||||||||||||||||

Unsecured Debt | |||||||||||||||||||||||

2020 Senior Unsecured Revolving Credit Facility(1)(2)(6) | $ | — | L+0.85% | 0.23% | 3/2025 | ||||||||||||||||||

2020 Senior Unsecured Term Loan A Facility Tranche A-1(2)(6) | 325,000 | L+0.95% | 1.45% | 3/2025 | |||||||||||||||||||

2020 Senior Unsecured Term Loan A Facility Tranche A-2(2)(7) | 196,325 | C+0.95% | 1.55% | 3/2025 | |||||||||||||||||||

Series A notes | 200,000 | 4.68% | 4.77% | 1/2026 | |||||||||||||||||||

Series B notes | 400,000 | 4.86% | 4.92% | 1/2029 | |||||||||||||||||||

Series C notes | 350,000 | 4.10% | 4.15% | 1/2030 | |||||||||||||||||||

Series D notes(8) | 488,640 | 1.62% | 1.66% | 1/2031 | |||||||||||||||||||

Series E notes(8) | 427,560 | 1.65% | 1.69% | 1/2033 | |||||||||||||||||||

Total Unsecured Debt | 2,387,525 | 2.70% | 2.88% | 8.2 years | |||||||||||||||||||

2013 Mortgage Loans (15 cross-collateralized warehouses) | |||||||||||||||||||||||

Senior Note | 174,693 | 3.81% | 4.14% | 5/2023 | |||||||||||||||||||

Mezzanine A | 70,000 | 7.38% | 7.55% | 5/2023 | |||||||||||||||||||

Mezzanine B | 32,000 | 11.50% | 11.75% | 5/2023 | |||||||||||||||||||

Total 2013 Mortgage Loans | 276,693 | 5.60% | 5.88% | 2.3 years | |||||||||||||||||||

| Total Real Estate Debt | $ | 2,664,218 | 3.00% | 3.19% | 7.6 years | ||||||||||||||||||

Sale-leaseback financing obligations | 185,060 | 10.99% | |||||||||||||||||||||

Financing lease obligations | 125,926 | 3.60% | |||||||||||||||||||||

Total Debt Outstanding | $ | 2,975,204 | 3.52% | ||||||||||||||||||||

Less: unamortized deferred financing costs | (15,952) | ||||||||||||||||||||||

Total Book Value of Debt | $ | 2,959,252 | |||||||||||||||||||||

Rate Type | % of Total | ||||||||||||||||||||||

Fixed | $ | 2,453,879 | 82% | ||||||||||||||||||||

Variable | 521,325 | 18% | |||||||||||||||||||||

Total Debt Outstanding | $ | 2,975,204 | 100% | ||||||||||||||||||||

Debt Type | % of Total | ||||||||||||||||||||||

Unsecured | $ | 2,387,525 | 80% | ||||||||||||||||||||

Secured | 587,679 | 20% | |||||||||||||||||||||

Total Debt Outstanding | $ | 2,975,204 | 100% | ||||||||||||||||||||

(1)Revolver maturity assumes two six-month extension options. The borrowing capacity as of December 31, 2020 is $800 million less $21.7 million of outstanding letters of credit. The effective interest rate shown represents deferred financing fees allocated over the $800 million committed.

(2)L = one-month LIBOR; C = one-month CDOR.

(3)Interest rates as of December 31, 2020. At December 31, 2020, the one-month LIBOR rate on our Senior Unsecured Term Loan Tranche A-1 was 0.15%. At December 31, 2020, the one-month CDOR rate on our Senior Unsecured Term Loan Tranche A-2 was 0.46%. Subtotals of stated contractual interest rates represent weighted average interest rates. Rates for sale-leasebacks and financing lease obligations represent weighted average interest rates.

(4)The effective interest rates presented include the amortization of loan costs. Subtotals of stated effective interest rates represent weighted average interest rates.

(5)Subtotals of stated maturity dates represent remaining weighted average life of the debt.

(6)On January 29, 2021, the Company repaid $200 million USD of the Term Loan A Facility Tranche A-1 using cash on the balance sheet and increased the borrowing capacity of Revolver from $800 million to $1 billion.

(7)Assumes CAD/USD exchange rate of 0.785.

(8)Assumes an EUR/USD exchange rate of 1.2216.

25

| ||||||||

| Financial Supplement | Fourth Quarter 2020 | |||||||

Operations Overview

| Revenue and Contribution by Segment | |||||||||||||||||||||||

| (in thousands - unaudited) | |||||||||||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Segment revenues: | |||||||||||||||||||||||

| Warehouse | $ | 407,811 | $ | 383,778 | $ | 1,549,314 | $ | 1,377,217 | |||||||||||||||

| Third-party managed | 78,538 | 64,442 | 291,751 | 252,939 | |||||||||||||||||||

| Transportation | 37,329 | 35,571 | 142,203 | 144,844 | |||||||||||||||||||

| Other | — | 2,193 | 4,459 | 8,705 | |||||||||||||||||||

| Total revenues | 523,678 | 485,984 | 1,987,727 | 1,783,705 | |||||||||||||||||||

| Segment contribution: | |||||||||||||||||||||||

| Warehouse | 145,672 | 129,547 | 520,333 | 447,591 | |||||||||||||||||||

| Third-party managed | 1,767 | 3,115 | 12,228 | 11,761 | |||||||||||||||||||

| Transportation | 5,043 | 4,865 | 18,807 | 18,067 | |||||||||||||||||||

| Other | (43) | 227 | 130 | 838 | |||||||||||||||||||

| Total segment contribution | 152,439 | 137,754 | 551,498 | 478,257 | |||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||

| Depreciation and amortization | (58,319) | (47,750) | (215,891) | (163,348) | |||||||||||||||||||

| Selling, general and administrative | (39,536) | (33,048) | (144,738) | (129,310) | |||||||||||||||||||

| Acquisition, litigation and other | (26,535) | (10,377) | (36,306) | (40,614) | |||||||||||||||||||