Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - COMSTOCK RESOURCES INC | exhibit994.htm |

| EX-99.2 - EX-99.2 - COMSTOCK RESOURCES INC | exhibit992.htm |

| EX-99.1 - EX-99.1 - COMSTOCK RESOURCES INC | exhibit991.htm |

| EX-32.2 - EX-32.2 - COMSTOCK RESOURCES INC | crk-20201231x10kexx322.htm |

| EX-32.1 - EX-32.1 - COMSTOCK RESOURCES INC | crk-20201231x10kexx321.htm |

| EX-31.2 - EX-31.2 - COMSTOCK RESOURCES INC | crk-20201231x10kexx312.htm |

| EX-31.1 - EX-31.1 - COMSTOCK RESOURCES INC | crk-20201231x10kexx311.htm |

| EX-23.3 - EX-23.3 - COMSTOCK RESOURCES INC | exhibit233.htm |

| EX-23.2 - EX-23.2 - COMSTOCK RESOURCES INC | exhibit232.htm |

| EX-23.1 - EX-23.1 - COMSTOCK RESOURCES INC | exhibit231.htm |

| EX-21 - EX-21 - COMSTOCK RESOURCES INC | exhibit21.htm |

| EX-10.20 - EX-10.20 - COMSTOCK RESOURCES INC | exhibit1020.htm |

| EX-10.7 - EX-10.7 - COMSTOCK RESOURCES INC | exhibit107.htm |

| EX-4.12 - EX-4.12 - COMSTOCK RESOURCES INC | exhibit412.htm |

| 10-K - 10-K - COMSTOCK RESOURCES INC | crk-20201231.htm |

Exhibit 99.3

LEE KEELING AND ASSOCIATES, INC.

International Petroleum Consultants

115 West 3rd Street, Suite 700

Tulsa, Oklahoma 74103-3410

(918) 587-5521

www.lkaengineers.com

February 11, 2021

Comstock Resources, Inc.

5300 Town and Country Boulevard, Ste. 500

Frisco, Texas 75034

Attention: Mr. David Terry

SVP – Corporate Development

RE: Exhibit Audit Letter

Proved Reserves and

Future Net Revenue

Comstock Resources, Inc.

Alternate Prices & Non-Escalated Expenses

Gentlemen:

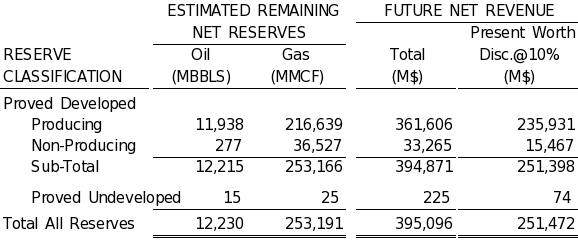

In accordance with your request, Lee Keeling and Associates, Inc. (LKA) have audited the estimates prepared by Comstock Resources, Inc. (Comstock), as of December 31, 2020, of the proved reserves and future revenue to the Comstock interest in certain oil and gas properties located in the states of Louisiana, Montana, New Mexico, North Dakota, Oklahoma, Texas, and Wyoming. It is our understanding that the proved reserves’ estimates shown herein constitute approximately 5% percent of all proved reserves owned by Comstock. In addition to being in compliance with requirements established by the Society of Petroleum Engineers (SPE), American Association of Petroleum Geologists (AAPG), World Petroleum Congress (WPC) and the Society of Petroleum Evaluation Engineers (SPEE) this report also complies with the Securities and Exchange Commission (SEC) guidelines as published in the Federal Register January 14, 2009 with the exception that alternate pricing is used. This report has been prepared for Comstock’s use in filing with the SEC; in our opinion the assumptions, data, methods and procedures used in the preparation of this report are appropriate for such purpose. This audit was completed January 21, 2021. The following table sets forth Comstock’s estimates of the net reserves and future net revenue, as of December 31, 2020 for the audited properties:

The audited numbers are within 2% of the Comstock totals. This result is inside of the 10% tolerance as recommended by SPE.

Future net revenue is the amount, exclusive of state and federal income taxes, which will accrue to Comstock’s interest from continued operation of the properties to depletion. It should not be construed as a fair market or trading value.

No attempt has been made to quantify or otherwise account for any accumulative gas production imbalances that may exist. Neither has an attempt been made to determine whether the wells and facilities are in compliance with various governmental regulations, nor have costs been included in the event they are not.

CLASSIFICATION OF RESERVES

Reserves assigned to the various leases and/or wells have been classified as either “Proved Developed” in accordance with the definitions of the proved reserves as promulgated by the Securities and Exchange Commission (SEC). See the attached Appendix: SEC Petroleum Reserve Definitions.

Developed Producing (Petroleum Resources Management System (PRMS) Definitions)

Although not required for disclosure under SEC regulations, Proved Oil and Gas Reserves may be further sub-classified as Producing or Non-Producing according to PRMS definitions set out below:

•Developed Producing (PDP) Reserves are expected to be recovered from completion intervals that are open and producing at the time of the estimate. Improved recovery reserves are considered producing only after the improved recovery project is in operation.

•Developed Non-Producing (PDNP) Reserves include shut-in and behind-pipe reserves.

◦Shut-In Reserves are expected to be recovered from:

i.Completion intervals which are open at the time of the estimate but which have not yet started producing.

ii.Wells which were shut-in for market conditions or pipeline connections; or

iii.Wells not capable of production for mechanical reasons.

◦Behind-Pipe Reserves are expected to be recovered from zones in existing wells, which will require additional completion work or future re-completion prior to start of production.

In all cases, production can be initiated or restored with relatively low expenditure compared to the cost of drilling a new well.

ESTIMATION OF RESERVES

The majority of the subject wells have been producing for a considerable length of time. Reserves attributable to wells with a well-defined production and/or pressure decline trend were based upon extrapolation of that trend to an economic limit and/or abandonment pressure.

Reserves anticipated from new wells were based upon volumetric calculations or analogy with similar properties, which are producing from the same horizons in the respective areas. Structural position, net pay thickness, well productivity, gas/oil ratios, water production, pressures, and other pertinent factors were considered in the estimation of these reserves.

2

Reserves assigned to behind-pipe zones and undeveloped locations have been estimated based on volumetric calculations and/or analogy with other wells in the area producing from the same horizon.

FUTURE NET REVENUE

Oil Income and Prices

Income from the sale of oil was estimated based on the alternate price of $50.00 per barrel. The Alternate price of $50.00 per barrel was held constant throughout the life of each lease. The alternate price was adjusted for historical differentials between posted prices and actual field prices to reflect quality, transportation fees and regional price differences. The average adjusted product price weighted by production over the remaining lives of the properties is $43.34 per barrel. Provisions were made for state severance and ad valorem taxes where applicable.

Gas Income and Prices

Income from the sale of gas was estimated based on the alternate price of $2.75 per MCF. The alternate price of $2.75 per MCF was held constant throughout the life of each lease. The alternate price was adjusted for basis differentials, marketing, and transportation costs. The average adjusted product price weighted by production over the remaining lives of the properties is $2.12 per MCF of gas. Provisions were made for state severance and ad valorem taxes where applicable.

Operating Expenses

Operating expenses were based upon actual operating costs charged by the respective operators as supplied by the staff of Comstock or were based upon the actual experience of the operators in the respective areas. For leases operated by Comstock, monthly operating costs included lease operating expenses and overhead charges. All expenses reflect known operational conditions throughout the life of each lease.

Future Expenses and Abandonment Costs

As provided by Comstock, provisions have been made for future expenses required for drilling, recompletion and/or abandonment costs. These costs have been held constant from current estimates.

QUALIFICATIONS OF LEE KEELING AND ASSOCIATES, INC.

Lee Keeling and Associates, Inc. has been offering consulting engineering and geological services to integrated oil companies, independent operators, investors, financial institutions, legal firms, accounting firms and governmental agencies since 1957. Its professional staff is experienced in all productive areas of the United States, Canada, Latin America and many other foreign countries. The firm’s reports are recognized by major financial institutions and used as the basis for oil company mergers, purchases, sales, financing of projects and for registration purposes with financial and regulatory authorities throughout the world. The technical persons primarily responsible for preparing the estimates presented herein meet the requirements regarding qualifications, independence, objectivity and confidentiality set forth in the SPE Standards. Phillip W. Grice, a Licensed Professional Engineer in the states of Oklahoma and Texas, has been a consulting petroleum engineer with LKA since 2005 and has over 20 years of prior industry experience. John R. Wheeler, a Certified Petroleum Geologist, has been a consulting geoscientist with LKA since 2001 and has over 15 years of prior industry experience. We do not own an interest in these properties nor are we employed on a contingent basis.

3

GENERAL

Information upon which this audit of net reserves and future net revenue has been based was furnished by the staff of Comstock or was obtained by us from outside sources we consider to be reliable. This information is assumed to be correct. No attempt has been made to verify title or ownership of the subject properties. Interests attributed to wells to be drilled at undeveloped locations are based on current ownership. Leases were not inspected by a representative of this firm, nor were the wells tested under our supervision; however, the performance of the majority of the wells was discussed with employees of Comstock.

This report has been prepared utilizing all methods and procedures regularly used by petroleum engineers to estimate oil and gas reserves for properties of this type and character, and we have used all methods and procedures necessary to prepare this report. The recovery of oil and gas reserves and projection of producing rates are dependent upon many variable factors including prudent operation, compression of gas when needed, market demand, installation of lifting equipment, and remedial work when required. The reserves included in this report have been based upon the assumption that the wells will be operated in a prudent manner under the same conditions existing on the effective date. Actual production results and future well data may yield additional facts, not presently available to us, which may require an adjustment to our estimates. The assumptions, data, methods and procedures used in connection with the preparation of this report are appropriate for the purpose served by this report.

The reserves included in this report are estimates only and should not be construed as being exact quantities. They may or may not be actually recovered and if recovered, the revenues therefrom and the actual costs related thereto could be more or less than the estimated amounts. As in all aspects of oil and gas estimation, there are uncertainties inherent in the interpretation of engineering data and, therefore, our conclusions necessarily represent only informed professional judgments.

The projection of cash flow has been made assuming constant prices. There is no assurance that prices will not vary. For this reason and those listed in the previous paragraph, the future net cash from the sale of production from the subject properties may vary from the estimates contained in this report.

It should be pointed out that regulatory authorities could, in the future, change the allocation of reserves allowed to be produced from a particular well in any reservoir, thereby altering the material premise upon which our reserve estimates may be based.

The information developed during the course of this investigation, basic data, maps and worksheets are available for inspection in our office.

We appreciate this opportunity to be of service to you.

Very truly yours,

| /s/ Lee Keeling and Associates, Inc. | ||

4