Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Rexnord Corp | regalrexnordjointrelease.htm |

| 8-K - 8-K - Rexnord Corp | rxn-20210216.htm |

©2021 Regal Beloit Corporation 1 F e b r u a r y 1 6 , 2 0 2 1 Regal Beloit to Combine with Rexnord’s Process & Motion Control Segment CREATING A PREMIE R GLO BAL POWER TRANSMIS S I O N PROVID ER

©2021 Regal Beloit Corporation 2 Additional Information This communication does not constitute an offer to buy, or a solicitation of an offer to sell, any securities of Regal Beloit Corporation (“Regal”), Rexnord Corporation (“Rexnord”) or Land Newco, Inc. (“Land”) In connection with the proposed transaction, Regal and Land will file registration statements with the SEC registering shares of Regal common stock and Land common stock in connection with the proposed transaction. Regal’s registration statement will also include a joint proxy statement and prospectus relating to the proposed transaction. Rexnord shareholders are urged to read the joint proxy statement/prospectus-information statement that will be included in the registration statements and any other relevant documents when they become available, and Regal shareholders are urged to read the joint proxy statement/prospectus-information statement and any other relevant documents when they become available, because they will contain important information about Regal, Rexnord, Land and the proposed transaction. The joint proxy statement/prospectus-information statement and other documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. The joint proxy statement/prospectus-information statement and other documents (when they are available) can also be obtained free of charge from Rexnord upon written request to Rexnord Corporation, Investor Relations, 511 Freshwater Way, Milwaukee, WI 53204, or by calling (414) 643-3739 or upon written request to Regal Beloit Corporation, Investor Relations, 200 State Street, Beloit, WI 53511 or by calling (608) 364-8800. Forward Looking Statements This communication contains forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which reflect Regal’s current estimates, expectations and projections about Regal’s future results, performance, prospects and opportunities. Such forward-looking statements may include, among other things, statements about the proposed acquisition of Rexnord’s PMC business (the “PMC Business”), the benefits and synergies of the proposed transaction, future opportunities for Regal, the PMC Business and the combined company, and any other statements regarding Regal’s, the PMC Business’s or the combined company’s future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition and other expectations and estimates for future periods. Forward-looking statements include statements that are not historical facts and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “plan,” “may,” “should,” “will,” “would,” “project,” “forecast,” and similar expressions. These forward-looking statements are based upon information currently available to Regal and are subject to a number of risks, uncertainties, and other factors that could cause Regal’s, the PMC Business’s or the combined company’s actual results, performance, prospects, or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Important factors that could cause Regal’s, the PMC Business’s or the combined company’s actual results to differ materially from the results referred to in the forward-looking statements Regal makes in this communication include: the possibility that the conditions to the consummation of the transaction will not be satisfied; failure to obtain, delays in obtaining or adverse conditions related to obtaining shareholder or regulatory approvals or the IRS ruling to be sought in connection with the proposed transaction; changes in the extent and characteristics of the common shareholders of Rexnord and Regal and its effect pursuant to the merger agreement for the transaction on the number of shares of Regal common stock issuable pursuant to the transaction, magnitude of the dividend payable to Regal shareholders pursuant to the transaction and the extent of indebtedness to be incurred by Regal in connection with the transaction; the ability to obtain the anticipated tax treatment of the transaction and related transactions; risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; the possibility that Regal may be unable to achieve expected synergies and operating efficiencies in connection with the transaction within the expected time-frames or at all and to successfully integrate the PMC Business; expected or targeted future financial and operating performance and results; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintain relationships with employees, customers, clients or suppliers) being greater than expected following the transaction; failure to consummate or delay in consummating the transaction for other reasons; Regal’s ability to retain key executives and employees; risks associated with litigation related to the transaction; the continued financial and operational impacts of and uncertainties relating to the COVID- 19 pandemic on customers and suppliers and the geographies in which they operate; uncertainties regarding the ability to execute restructuring plans within expected costs and timing; actions taken by competitors and their ability to effectively compete in the increasingly competitive global electric motor, drives and controls, power generation and power transmission industries; the ability to develop new products based on technological innovation, such as the Internet of Things, and marketplace acceptance of new and existing products, including products related to technology not yet adopted or utilized in geographic locations in which we do business; fluctuations in commodity prices and raw material costs; dependence on significant customers; risks associated with global manufacturing, including risks associated with public health crises; issues and costs arising from the integration of acquired companies and businesses and the timing and impact of purchase accounting adjustments; Regal’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the proposed transaction; prolonged declines in one or more markets, such as heating, ventilation, air conditioning, refrigeration, power generation, oil and gas, unit material handling or water heating; economic changes in global markets, such as reduced demand for products, currency exchange rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration, customs, border actions and the like, and other external factors that Regal cannot control; product liability and other litigation, or claims by end users, government agencies or others that products or customers’ applications failed to perform as anticipated, particularly in high volume applications or where such failures are alleged to be the cause of property or casualty claims; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; unanticipated costs or expenses that may be incurred related to product warranty issues; dependence on key suppliers and the potential effects of supply disruptions; infringement of intellectual property by third parties, challenges to intellectual property, and claims of infringement on third party technologies; effects on earnings of any significant impairment of goodwill or intangible assets; losses from failures, breaches, attacks or disclosures involving information technology infrastructure and data; cyclical downturns affecting the global market for capital goods; and other risks and uncertainties including, but not limited, to those described in Regal’s Annual Report on Form 10-K on file with the Securities and Exchange Commission and from time to time in other filed reports including Regal’s Quarterly Reports on Form 10-Q. For a more detailed description of the risk factors associated with Regal, please refer to Regal’s Annual Report on Form 10-K for the fiscal year ended December 28, 2019 on file with the Securities and Exchange Commission and its Quarterly Report on Form 10-Q for the period ended September 26, 2020 and subsequent SEC filings. Shareholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this communication are made only as of the date of this communication, and Regal undertakes no obligation to update any forward-looking information contained in this communication or with respect to the announcements described herein to reflect subsequent events or circumstances. Participants in the Solicitation This communication is not a solicitation of a proxy from any security holder of Regal. However, Rexnord, Regal and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of Rexnord and Regal in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Rexnord may be found in its Annual Report on Form 10- K filed with the SEC on May 12, 2020 and its definitive proxy statement relating to its 2020 Annual Meeting filed with the SEC on June 5, 2020. Information about the directors and executive officers of Regal may be found in its Annual Report on Form 10-K filed with the SEC on February 26, 2020, and its definitive proxy statement relating to its 2020 Annual Meeting filed with the SEC on March 19, 2020. CAUTIONARY STATEMENTS

©2021 Regal Beloit Corporation 3 NON-GAAP FINANCIAL MEASURES; CERTAIN FINANCIAL METRICS In this presentation, we disclose the following non-GAAP financial measures: adjusted EBITDA, EBITDA margin, return on invested capital (ROIC), unlevered free cash flow, net leverage, net debt and cash earnings per share (EPS). As used in this communication, we define: (i) “adjusted EBITDA” to mean: earnings before interest, taxes, depreciation, acquisition related amortization, acquisition related costs, restructuring and related costs, stock-based compensation, asset impairment and other income or charges that management does not consider to be directly related to operating performance, (ii) “EBITDA margin” to mean: adjusted EBITDA as a percentage of net sales, (iii) “return on invested capital” to mean: after-tax adjusted operating income before amortization divided by invested capital, (iv) “unlevered free cash flow” to mean net cash provided by operating activities less additions to property, plant and equipment, excluding interest expenses and taxes thereon, (v) “net leverage” to mean net debt divided by adjusted EBITDA, (vi) “net debt” to mean the sum of financial liabilities less cash and cash equivalents and (vii) “cash earnings per share” to exclude acquisition related amortization, acquisition related costs, restructuring and related costs, asset impairment and other income or charges that management does not consider to be directly related to operating performance. Not all companies use these terms in consistent ways and you should not assume that the manner in which we use these terms is consistent with any other company. This additional information is not meant to be considered in isolation or as a substitute for results of operations prepared and presented in accordance with GAAP. Certain Financial Metrics: The transaction described in this presentation is structured to provide an economic allocation to Regal and Rexnord shareholders of 61.4% and 38.6%, respectively, and to ensure tax-free treatment. To ensure the tax free-treatment, the parties have agreed that, taking into account overlapping shareholder ownership that may be used for tax purposes, post- transaction Rexnord shareholders would, for tax purposes, own 50.8% of the combined company. Because the amount of shareholder overlap that may be used for tax purposes depends on a number of factors that will not be known until closing, the transaction includes an adjustment mechanism to achieve that tax ownership level. Any adjustment would result in a change to the 61.4%/38.6% ownership allocation and preserve the 61.4/38.6 economic allocation by increasing the number of shares issued to Rexnord shareholders and providing a corresponding dividend to Regal shareholders. For purposes of this presentation, based on current information, we have used the illustrative mid-point of an assumed range of a $100 million to $500 million dividend adjustment and corresponding ownership adjustment. The following financial metrics included in this presentation are based on that illustrative mid-point $300 million.”

©2021 Regal Beloit Corporation 4 TODAY’S PRESENTERS Louis Pinkham Chief Executive Officer Rob Rehard Chief Financial Officer Todd Adams Chairman, President & Chief Executive Officer

©2021 Regal Beloit Corporation 5 THE NEW REGAL – TRANSFORMED STRATEGICALLY AND FINANCIALLY Together, a new Regal creating increased value for customers, investors, and associates Creates world-class power transmission provider Will combine with Regal PTS; maintain Rexnord name and HQ in Milwaukee, WI Compelling value creation and financial returns* ROIC >10%1 by Year 5, EPS accretion2, a path to >500bps of EBITDA margin expansion and leverage of ~1.1x $120M in cost synergies and significant customer benefits Additional upside from cross-marketing opportunities; customers benefit from complete drive train solutions and accelerated R&D and digital solutions Heavy-weight and critical power transmission applications, with established IOT offering Light-weight power transmission space, with strong distributor and e-commerce channels Global leader in electric motors and controls & power generation Process & Motion Control (PMC) 1 Including cost and cross-selling synergies 2 Calculated using adjusted EPS pre intangible amortization *EPS accretion and leverage are based on the illustrative mid-point of the assumed adjustment mechanism range described in this presentation

©2021 Regal Beloit Corporation 6 1 Adjusted EBITDA excluding stock-based compensation. Pro forma Adjusted EBITDA includes $70M of cost synergies in 2022E and $120M in 2024E 2 Numbers shown at the $300M dividend midpoint case. Pre-dividend, accretion to non-GAAP adj. cash EPS expected to be ~3% in full year 1 post closing. In the expected dividend range, cash EPS expected to be ~2% accretive plus a ~$2 dividend at the low end, and ~2% dilutive plus a ~$12 dividend at the high end. Expecting meaningful accretion to cash EPS in year 2 across the expected dividend range of ~$100 - $500M. 3 Non-GAAP adjusted “Cash” EPS is adjusted for amortization of intangibles and restructuring expenses 4 Including cost and cross-selling synergies COMPELLING VALUE CREATION FOR ALL SHAREHOLDERS $4.1B Sales ~$740M Adj. EBITDA1 ~18% EBITDA Margin Attractive Financial Impact Pro Forma 2020Pro Forma 2019 Pro Forma 2022 $4.5B Sales ~$940M Adj. EBITDA1 ~21% EBITDA Margin $4.6B Sales ~$800M Adj. EBITDA1 ~18% EBITDA Margin + Process & Motion Control (PMC) 33%+ Combined 2022E gross margin >500bps Adj. EBITDA1 margin expansion by 2024E Accretive2 + Dividend Accretive to cash EPS in year 13, increasing thereafter, plus ~$7 / share dividend2 ~1.1x2 Pro forma 2021E net leverage $120M Synergies anticipated by year 3; $70M in year 1 >10%4 ROIC by year 5

©2021 Regal Beloit Corporation 7 Structure & Ownership • Regal to combine with Rexnord’s PMC business in a tax-efficient Reverse Morris Trust (RMT) transaction valued at $3,688M1 • Economic allocation of 61.4% for Regal shareholders and 38.6% for Rexnord shareholders with potential for an ownership and dividend adjustment to preserve tax-free treatment (“Adjustment Mechanism”) − Significant shareholder overlap, together with an ownership adjustment mechanism, ensures that the RMT hurdle of 50%+ for Rexnord shareholders, measured at closing, is met − Regal assumes $370M in net debt2 − Transaction values PMC at 14.2x 2020 Adjusted EBITDA3 or 9.7x including run-rate cost synergies Adjustment Mechanism • The adjustment mechanism will ensure the transaction meets applicable RMT requirements − The dividend and corresponding ownership will be adjusted based on shareholder overlap at close to ensure that the RMT threshold is met • Based on current information, we have assumed a $100M – $500M dividend4 to Regal shareholders and a corresponding adjustment of the ownership − At the illustrative $300M midpoint dividend, ownership split would be 60.0% / 40.0% − In the event that all overlap disappears or in the absence of a tax ruling from the IRS, the dividend4 could be as high as ~$1,950M with a corresponding ownership change to 49.9% for Regal shareholders and 50.1% for Rexnord shareholders Merged Company • Company name: Regal; Listing: NYSE (RBC) − Combined Regal PTS segment and Rexnord PMC to operate with a diverse portfolio of iconic brands, including Rexnord − Group headquarters to remain in Beloit, WI − Segment headquarters to be established in Milwaukee, WI; presence in Florence, KY, will remain a strategic site Management & Board of Directors • Regal CEO, CFO, and joint management team to lead the combined entity • Rakesh Sachdev to continue as non-Executive Chairman of the Board • Regal to enlarge its Board by two members to be nominated by Rexnord Timing • Expected to close in fourth quarter 2021 • Subject to regulatory approvals, Regal and Rexnord shareholder approvals, and customary closing conditions TRANSACTION SUMMARY 1 Excludes post-tax pension liability of $73M to be assumed by Regal 2 Assumed net debt includes new debt on PMC to fund a dividend to Rexnord of $487M intended to reduce the leverage at Rexnord’s RemainCo business, capital leases of $76M and cash of $193M 3 Adjusted EBITDA excluding stock-based compensation 4 With a corresponding ownership for Regal shareholders of 60.9% to 59.0%. Dividend to be based on Regal’s 15-day VWAP as of $128.82 as of February 12, 2021

©2021 Regal Beloit Corporation 8 SIGNIFICANT VALUE UNLOCKED FOR REXNORD SHAREHOLDERS Significant ownership in highly-attractive combined PT business Compelling value creation opportunity for all stakeholders Strong cultural fit between logical partners Creates standalone best-in-class water management business Regal the clear “best fit” partner for Rexnord PMC

©2021 Regal Beloit Corporation 9 STRATEGIC TRANSACTION WITH COMPELLING VALUE CREATION Creates a premier power transmission player, combining highly complementary portfolios Generates significant cost synergies, worth at least $120M annually Cross marketing opportunities improve growth potential and provide upside beyond cost synergies ROIC expected to exceed 10% by year 5 Accretive to cash EPS in year 1, increasing meaningfully thereafter. In addition, ~$7 dividend per share Accelerates digital strategy, better situating Regal for the future Rebalances Regal portfolio, investing in power transmission and ESG-related business Robust free cash flow generation and a strong balance sheet Rooted in a strong shared culture, focused on serving customers and driving efficiency

©2021 Regal Beloit Corporation 10 DELIVERING UNMATCHED CAPABILITIES ACROSS THE ENTIRE GENERAL INDU STRIAL DRIVE TRAIN Full drive train brings opportunity to increase value to customers Clutches Brakes Motors Mounted Bearings Sensing Fluid Couplings Gear Drives Grid Couplings Monitoring Mounted Bearings Shaft Lock Disc CouplingsComplementary offerings, adding real value to customers: • Engineered to work better together • Reduced complexity in certification • Integrated support and services Sensing

©2021 Regal Beloit Corporation 11 Regal Strength PMC Strength Couplings High-performance disc couplings Broad standard-purpose grid & gear couplings Gearing Right-angle worm gears Large parallel gear drives Mounted bearings Light/medium-duty ball bearings Heavy-duty roller bearings Aero Niche rotating wing critical application bearings General fixed wing bearings and seals Conveyance Expanding into unit material handling Expanding into food IOT Platform Strength in monitoring and diagnostics Proven commercialization muscle PORTFOLIOS WITH HIGHLY COMPLEMENTARY PRODUCTS AND SOLUTIONS Regal’s lighter-duty plus PMC’s heavier-duty portfolio create a more complete offering Product Segment

©2021 Regal Beloit Corporation 12 RESULTS IN PREMIER POWER TRANSMISSION PLAYER ~30% outside of N.A. Regal Brands PMC Brands 19% 11% 70% Europe Rest of World N.A. Pro Forma 2020 PT Revenue by End Market Pro Forma 2020 PT Revenue by Geography 26% 17% 11% 9% 7% 7% 6% 5% 4% 8% G.I. F&B Metals/mining A&D Non-res Alt. E Power Whse. O&G Other Brand strength across wide range of end markets and geographies Greater End Market Diversity

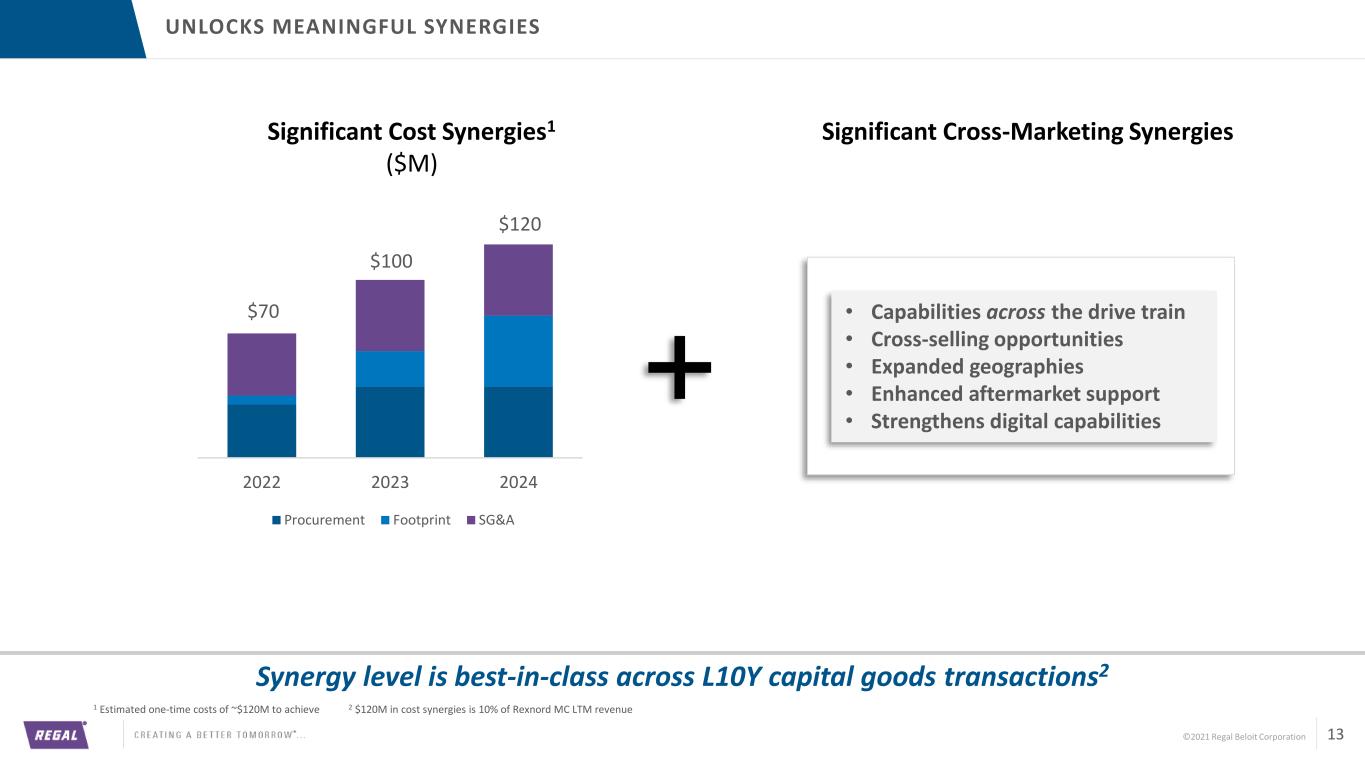

©2021 Regal Beloit Corporation 13 UNLOCKS MEANINGFUL SYNERGIES 2022 2023 2024 Procurement Footprint SG&A $70 $120 $100 Significant Cost Synergies1 ($M) • Capabilities across the drive train • Cross-selling opportunities • Expanded geographies • Enhanced aftermarket support • Strengthens digital capabilities Synergy level is best-in-class across L10Y capital goods transactions2 Significant Cross-Marketing Synergies 1 Estimated one-time costs of ~$120M to achieve 2 $120M in cost synergies is 10% of Rexnord MC LTM revenue

©2021 Regal Beloit Corporation 14 DRIVES GROWTH VIA IMPROVED VALUE PROPOSITION Combined capabilities accelerate innovation, new product introductions A better partner to distributors of all sizes Provide access to a larger installed base and the most complete power transmission product and solution set Enhanced service capabilities Better service levels through expanded flexible global manufacturing network, more robust aftermarket support Accelerate R&D to deliver better products faster Products engineered to work better together across entire drive train Cross-selling to shared customer base Harness proven technologies across combined customer base to support increased volume

©2021 Regal Beloit Corporation 15 COMPLEMENTARY OFFERINGS CREATE FULL-LIFECYCLE SUPPORT + Adds value for customers by: • Asset Management • Improved Asset Performance • Increased Component Reliability • Lower Operating Cost Diagnose Procure Install Monitor Repair Replace Operate Search Educate & Design Select Full digital coverage of customer lifecycle Maintain

©2021 Regal Beloit Corporation 16 BROADER CAPABILITIES TO DRIVE INNOVATION Make it Easier to Order Augmented Reality Predictive Analytics Seamless Transactions Guided digital handoffs between end user, channel partners, and Regal to minimize leakage Interactive Environment Provide real time insight on the Performance, Reliability, and Operation of assets and components Prognostic Action Deploy products and services Just-In- Time to keep the end user in operation Better leverage IT across various customer touch points

©2021 Regal Beloit Corporation 17 70% 30% OE AM Product Mix (2020 Sales) 55% 24% 21% Motors PT Niche / Specialty Regal CREATES MORE BALANCED REGAL PORTFOLIO Regal 38% 47% 15% Motors PT Niche / Specialty Regal + PMC Original Equipment vs. Aftermarket Mix (2020 Sales) 66% 34% OE AM Regal + PMC Power Transmission to contribute almost 50% of Regal sales

©2021 Regal Beloit Corporation 18 ESG Enabling Products & Solutions1 52-57% 43-48% Other ESG Regal EXPANDED ENERGY EFFICIENCY PLATFORM Regal + PMC Majority of Regal sales to come from ESG enabling products and services (2020 Sales) (2022E Sales) 40-45% 55-60% Other ESG Grove Gear Drive Helps save 30 megatons CO2 /year by increasing power production 15-25% Kop-Flex PowerlignTM Torque Monitoring Reduces power plant’s noxious emissions by 2-3% annually Dry Run Conveyance Systems In 2020, dry run solutions saved 163 million gallons of water globally Centa Couplings for Wind Couplings and related components enabled output equivalent of 36,000 wind turbines 1 Includes products and services that deliver energy efficiency, support renewable technologies, and deliver waste reduction

©2021 Regal Beloit Corporation 19 ROBUST CASH FLOW GENERATION 2020F ~$200 2020F Pro forma 2020E Pro forma 2024E ~$750 ~$590 ~$390 27% Accelerating Cash Flow Generation Continued Disciplined Capital Allocation Unlevered Free Cash Flow ($M) Investments for organic growth Continued return of capital to shareholders via dividends and share purchases Strategic bolt-on M&A with focus on fit, synergies, attractive returns Process & Motion Control (PMC) Synergy contribution1 Maintaining balanced approach to capital deployment 1 Net of cost to achieve

©2021 Regal Beloit Corporation 20 OWNERSHIP ADJUSTMENT MECHANISM 1 Dividend to be based on Regal’s 15-day VWAP of $128.82 as of February 12, 2021 2 Based on common shares 3 Adjusted EPS pre intangible amortization. EPS accretion refers to first year post closing 4 Including cost and cross-selling synergies 5 Net leverage inclusive of $193M of cash, $76M of capital leases, and debt to fund $487M dividend to Rexnord. PF 2021E EBITDA incl. of 50% of run-rate synergies. Excludes post-tax pension liability of $73M to be assumed by Regal. 6 In the event that all overlap disappears or the absence of a tax ruling from the IRS, the dividend could be as high as ~$1,950M with a corresponding ownership change to 49.9% for Regal shareholders and 50.1% for Rexnord shareholders • Transaction structure with dividend determined at closing ensures transaction meets RMT ownership requirements in all circumstances • The companies will seek a private letter ruling from the IRS − Size of dividend and corresponding ownership adjustment will depend on measuring identifiable overlapping shareholders at closing • Majority of overlapping shareholder base has been stable over time • Based on current information, we have used an assumed range of $100M – $500M dividend1 to Regal shareholders and a corresponding adjustment of the ownership6 Ownership and Dividend to be Adjusted Based on Available Shareholder Overlap at Closing Illustrative Dividend to Regal Shareholders (1) $100M $300M $500M Rexnord Shareholder Ownership (Pre-Dividend) (2) 38.6% 38.6% 38.6% Rexnord Shareholder Ownership (Post-Dividend) (2) 39.1% 40.0% 41.0% Regal Shareholder Ownership (Post-Dividend) (2) 60.9% 60.0% 59.0% PF Cash EPS Accretion 2022E (3) 1.8% + $2 / Dividend 0.2% + $7 / Dividend (1.5%) + $12 / Dividend 2023E (3) 8% 6% 4% 2024E (3) 10% 9% 7% Year 5 ROIC (4) 10%+ 10%+ 10%+ PF 2021 Net Leverage (5) 0.9x 1.1x 1.3x

©2021 Regal Beloit Corporation 21 STRONGLY ALIGNED CULTURES AND MISSION We create a better tomorrow by energy-efficiently converting power into motion Integrity Customer success Continuous improvement A passion to win

©2021 Regal Beloit Corporation 22 STRATEGIC TRANSACTION WITH COMPELLING VALUE CREATION Creates a premier power transmission player, combining highly complementary portfolios Generates significant cost synergies, worth at least $120M annually Cross marketing opportunities improve growth potential and provide upside beyond cost synergies ROIC expected to exceed 10% by year 5 Accretive to cash EPS in year 1, increasing meaningfully thereafter. In addition, ~$7 dividend per share Accelerates digital strategy, better situating Regal for the future Rebalances Regal portfolio, investing in power transmission and ESG-related business Robust free cash flow generation and a strong balance sheet Rooted in a strong shared culture, focused on serving customers and driving efficiency