Attached files

| file | filename |

|---|---|

| EX-32 - CareClix Holdings, Inc. | ex32.htm |

| EX-31 - CareClix Holdings, Inc. | ex31.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019 |

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to _____________ |

Commission file number 000-55987

| CareClix Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

Solei Systems, Inc.

(Former Name if Changed Since Last Report)

| Florida | 20-1801530 | |

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |

1709 N. Harbor City Boulevard, Suite 520 Melbourne, FL |

32935 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (703) 832-4473

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol |

Name of each exchange on which registered |

| Not Applicable | Not Applicable |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Note –Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

oYes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

| Emerging growth company | x | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).oYes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter

$25,417,362.

Note--If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRESEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ). oYes .o No

APPLICABLE ONLY TO CORPORATE REGISTRANTS

As of December 31, 2019, there were 183,631,052 common shares, $0.001 par value, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the documents is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 31, 1980)

| Item 1. | Business. | 1 |

| Item 1A. | Risk Factors. | 8 |

| Item 1B. | Unresolved Staff Comments. | 19 |

| Item 2. | Properties. | 19 |

| Item 3. | Legal Proceedings. | 19 |

| Item 4. | Mine Safety Disclosure. | 19 |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

20 |

| Item 6. | Selected Financial Data | 21 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 21 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 26 |

| Item 8. | Financial Statements and Supplementary Data. | 26 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 27 |

| Item 9A. | Controls and Procedures. | 29 |

| Item 9B. | Other Information. | 29 |

| Item 10. | Directors, Executive Officers and Corporate Governance. | 29 |

| Item 11. | Executive Compensation. | 31 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

35 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 35 |

| Item 14. | Principal Accounting Fees and Services. | 36 |

| Item 15. | Exhibits, Financial Statement Schedules. | 38 |

| Item 16 | Summary | 39 |

| SIGNATURES | 39 |

PART I

FORWARD LOOKING STATEMENTS

This Form 10-K contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| · | the uncertainty of profitability based upon our history of losses; |

| · | risks related to our operations and |

| · | other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

COVID-19 FILING EXTENSION: By Current Report on Form 8-K filed with the Securities and Exchange Commission on March 30, 2020, we advised the Commission that we were currently unable to complete and file our Form 10-K Annual Report on a timely basis as a result of the impact of the COVID-19 pandemic on our business and operations, as provided in SEC Release No. 34-88465 (March 25, 2020).

GENERAL

The following is a summary of some of the information contained in this document. Unless the context requires otherwise, references in this document to “our Company,” “us,” “we,” “our,” “CareClix Holdings,” or the “Company” are to CareClix Holdings, Inc., formerly named Solei Systems, Inc., and its subsidiaries.

DESCRIPTION OF BUSINESS

CareClix Holdings, Inc. was organized on October 26, 2004 under the laws of the State of Florida as Eli Enterprises, Inc. Our name was changed in 2008 to Solei Systems, Inc. Effective April 9, 2020, the corporate name was changed to CareClix Holdings, Inc.

On October 20, 2017, we acquired Clinical & Herbal Innovations, Inc. (CHII), a Georgia corporation, in a share exchange. CHII is an Internet-based nutritional supplement company with a proprietary product.

| 1 |

In March 2019, we initiated a private offering of convertible debt notes with an original principal amount of $10,000 each, with a total offering of up to $3,000,000 in original principal amount. The offering was made to accredited investors and up to 35 non-accredited investors in reliance on the exemption from registration afforded by SEC Regulation D, Section 506. The Company closed on a total of $1,680,000 in convertible notes, and the offering was closed in May 2019. As issued, the convertible notes bear interest at 6% per annum and may be converted at the election of the holder into common stock of the Company at a conversion price per share equal to 50 % of the three lowest closing prices of the stock out of the ten trading days prior to the time of a conversion election. No conversions were permitted during the first 6 months after issuance. The notes originally matured one year after issuance, but subsequently were extended in 2020 for one year on the same terms. As of December 31, 2019, a total of $1,230,000 in principal amount of the notes, plus accrued interest, had been converted into 12,967,862 common shares.

In April 2019, we completed the acquisition of certain assets of KB Medical Systems, LLC, an unaffiliated Company, for a total consideration of $1,900,000, of which $1,000,000 was paid in cash at closing and the balance of which was paid in October 2019 in shares of unregistered common stock of the Company valued at $900,000, based on the five day trailing average closing market price of the common stock on the date of issuance. In October 2019, the Company issued a total of 2,694,612 common shares at an average price of $0.335 per share, as the final payment of $900,000 for the acquisition of the CareClix® assets.

The assets acquired did not include all of the assets of KB Medical as reported on its closing date balance sheet and were acquired free of any and all liabilities of KB Medical Systems, LLC. The primary assets acquired were the CareClix® software, the CareClix® trademark and domain name and the patent pending on the CareClix® software.

Following the acquisition, the acquired assets were contributed by the Company to a newly formed Virginia subsidiary corporation, CareClix, Inc., incorporated for that purpose. CareClix, Inc. commenced new operations at the offices of the Company in Virginia with new marketing, management and finance staff; and one of the two founders and only one other former employee of KB Medical Systems, LLC were employed by CareClix, Inc. immediately after the closing.

We commenced a new convertible note offering in October 2019 and issued a total of $100,000 in face amount notes in 2019, and issued a total of $1,550,000 in the offering, which closed during the First Quarter of 2020. The convertible notes bear interest at 6% per annum and may be converted at the election of the holder into common stock of the Company at a conversion price per share equal to the average of the three lowest closing prices out of the ten days prior to the time of issue. No conversions are permitted during the first 6 months after issuance. The notes also mature one year after issue, but subsequently in 2020 were extended for one year on the same terms.

As a result of the acquisition of the CareClix® software assets, the Company became primarily engaged in the telemedicine market. CHII continued operations throughout 2019 but engaged in minimal business in 2020 and was sold effective October 1, 2020.

Reports to Security Holders

We are subject to the reporting requirements of Section 12(g) of the Exchange Act, and as such, we intend to file all required disclosures.

You may read and copy any materials we file with the SEC in the SEC’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

| 2 |

Jumpstart Our Business Startups Act

We qualify as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (“JOBS Act”) as we did not have more than $1,000,000,000 in annual gross revenue and did not have such amount as of December 31, 2019, our last fiscal year.

We may lose our status as an emerging growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds $1,000,000,000 or (ii) we issue more than $1,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an emerging growth company if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company on the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement.

As an emerging growth company, we may take advantage of specified reduced reporting and other burdens that are otherwise applicable to generally reporting companies. These provisions include:

| - | A requirement to have only two years of audited financial statement and only two years of related Management Discussion and Analysis Disclosures: |

| - | Reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| - | No non-binding advisory votes on executive compensation or golden parachute arrangements. |

As an emerging growth company, we are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934. Such sections are provided below:

Section 404(b) of the Sarbanes-Oxley Act of 2002 requires a public company’s auditor to attest to, and report on, management’s assessment of its internal controls.

Sections 14A(a) and (b) of the Securities and Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation.

We have already taken advantage of these reduced reporting burdens in this Form 10-K, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As long as we qualify as an emerging growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We are choosing to irrevocably opt-in to the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act.

HISTORY

CareClix Holdings, Inc. was organized October 26, 2004 under the laws of the State of Florida as Eli Enterprises, Inc. Our name was changed in 2008 to Solei Systems, Inc. Effective April 9, 2020, the corporate name was changed to CareClix Holdings, Inc. Our common shares currently trade under the symbol SOLI.

In June 2017, the control block of SOLI was purchased by Charles Scott in a private sale, at which time the old company management was removed, and new management put in place. No members of prior management are currently or will be involved in management of the Company. In July 2019, an application was filed on Form 15c-211 by a market maker seeking to allow trading activity for our common stock on the OTC Markets and the application was accepted by FINRA on December 12, 2019.

| 3 |

On October 20, 2017, we acquired Clinical & Herbal Innovations, Inc. (CHII), a Georgia corporation, in a share exchange. We issued 8,751,000 shares to the shareholders of Clinical & Herbal Innovations, Inc. for the share exchange. The transaction was a capital transaction in which the Company was treated as a non-business entity; therefore, the accounting for the merger was identical to that resulting from a reverse merger except no goodwill or other intangible assets were recorded. For accounting purposes, CHII was treated as the accounting acquirer and was presented as the continuing entity. The historical financial statements are those of CHII.

In April 2019, the Company acquired the proprietary CareClix® operating software, and pending patent for that software, the domain name and trademark for the software and certain tangible assets of KB Medical Systems, LLC, an unrelated company which was the developer of the CareClix® operating systems for telemedicine providers. Under the terms of the acquisition agreement, the Company formed a new, wholly owned subsidiary CareClix, Inc., to acquire the CareClix following the acquisition. One of the two founders of KB Medical, Dr. John Korangy, and one other employee of KB Medical also joined CareClix, Inc. Although undertaken as an asset acquisition, in the accompanying financial statements, the acquisition has been treated as a business combination under ASC 805. (See, Footnote 1: Business Combination, to the accompanying Financial Statements)

Following the closing of the acquisition of the CareClix® software and related assets, Dr. John Korangy was appointed as a member of the Board of Directors of the Company and as CEO of the CareClix, Inc. subsidiary.

In April 2020, the SEC issued SEC Release 88620, suspending trading activity for two weeks in a number of telehealth related company shares, including our common shares, due to concerns over disclosures regarding COVID-19 activities. The temporary trading suspension ended after two weeks and we have received a letter form the SEC confirming that the Company is not under any SEC investigation; however, as a result of the temporary suspension, our common shares were relegated to “grey market” status.

Our principal executive offices are located at 1709 North Harbor City Boulevard, Suite 520, Melbourne, FL 32935 and our office telephone number is (703) 832-4473. We maintain websites for the holding company at www.soleihealth.com and www.careclix.com, and such websites are not incorporated into or a part of this filing. We have included our website addresses in this filing solely as an inactive textual reference.

CURRENT BUSINESS

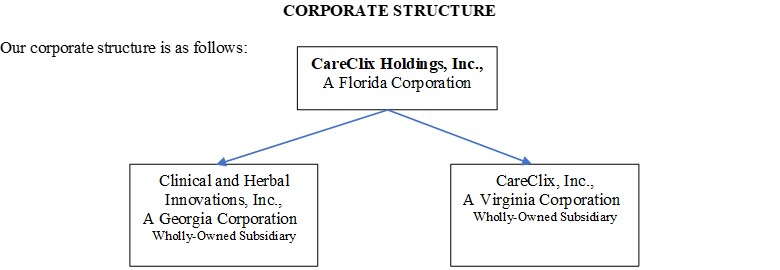

The Company is a holding company which had a wholly owned subsidiary, Clinical and Herbal Innovations, Inc. (CHII), for the full year ended December 31, 2019 and a second wholly owned subsidiary, CareClix, Inc. commencing April 12, 2019. CHII is an Internet-based nutritional supplement company with a proprietary product. CareClix, Inc. is a Virginia corporation formed by the Company in April 2019 to receive proprietary and patent pending telemedicine operating software acquired by the Company.

| 4 |

The Company has determined to focus all of its efforts on its wholly-owned subsidiary CareClix, Inc and telemedicine solutions within that provider space. As a result, we planned to sell CHII during the fiscal year 2020. This will allow company leadership to focus on the rapidly growing telehealth industry. Mr. Josh Flood, our former President and CFO tendered his resignation as an officer and director of the Company to continue with CHII, effective upon the closing of the sale of CHII, which was effective October 1, 2020.

We have been in operation since 2011.

Telemedicine

In April 2019, the Company purchased certain software and related assets from KB Medical Systems, LLC primarily its industry proven, full-spectrum, robust CareClix® software. The Company estimated the timeframe to develop similar software would hamper its ability to participate in the projected growth of telemedicine. The Company also estimated the cost of development would be much greater than the $1,900,000 price paid in the asset acquisition. We formed a new corporation, “CareClix, Inc” to undertake our entry into the telehealth market. The Company has employed the co-founder of KB Medical Systems, LLC, Dr. John Korangy, who assumed the role of CEO of the newly formed subsidiary. The Company plans to expand its areas of focus including, but not limited to Hospital Systems, Third Party Administrators, Multinational Employer Groups, International Services, US Government, direct-to-consumer, and home healthcare. The Company has registered with the US Government and began responding to government requests for proposals. We expect to expand sales in this sector as we increase our working capital. We launched a direct-to-consumer offering in late 2020 under the name MyCareClix.com. The Company completed its Service Organization Control Type 2 non-financial reporting audit. Our current business plan will require additional working capital to expand our business operations and staff. We also plan on continuing our merger and acquisition efforts.

The Bipartisan Budget Act of 2018, signed into law by the President on February 16, 2018, introduced “the most significant changes ever made to Medicare law to use telehealth,” according to Senator Brian Schatz: "Key elements of the bill include: (1) expanding stroke telemedicine coverage; (2) improving access to telehealth-enabled home dialysis oversight; (3) enabling patients to be provided with free at-home telehealth dialysis technology without the provider violating the Civil Monetary Penalties Law; (4) allowing Medicare Advantage (MA) plans to include delivery of telehealth services in a plan’s basic benefits; and (5) giving Accountable Care Organizations (ACOs) the ability to expand the use of telehealth services." We anticipate this change in the reimbursement policy will have a dramatic effect on the telemedicine industry. The Company is aggressively pursuing readiness for this incredible opportunity and the acquisition of the CareClix® software was an initial step in that process.

In April 2019, U.S. Centers for Medicare Medicaid Services (CMS) announced the 2020 Rate Announcement and Final Call Letter that gives Medicare Advantage plans flexibility to offer chronically ill patients a broader range of supplemental telehealth benefits. These changes represent an incredible new opportunity for the Company to increase its business as the industry is projected to grow. A recent report is projecting that the global telemedicine market will expand from its current $38.3 billion valuation to $130.5 billion by 2025.

COVID-19 has had a major impact on our business and the industry. We prepared for the expansion of telehealth beginning January 1, 2020 due to the expanded CMS coverage, but the combination of that expansion and COVID-19 has resulted in an industry wide shift to telehealth. COVID-19 has dramatically increased the demand for telehealth services across the globe. We have had increased demand for our services from our existing clients and their patients as well as many new clients who have approached us to help deal with their medical needs going forward. As COVID reshapes the healthcare industry focus on telehealth, CareClix has been able to enjoy some of the benefits domestically and internationally with our distribution channels and our client base; however, the increased workload has put a substantial burden on our small staff. The Company has responded by increasing staff in operations, development, security, and sales.

| 5 |

Plan of Operations

Our plan of operations is as follows:

We expect to continue to expand our telehealth network in the United States as well as internationally and have already implemented service in many countries. These efforts will continue and expand.

Company leadership has developed a direct-to-consumer product in response to the increased demand for telemedicine. The new product is called, “MyCareClix” and was launched in late 2020. MyCareClix is a product for individuals who are seeking telemedicine for themselves or their family. The product will offer primary care as well as specialty and behavior health care directly to consumers.

The Company has launched a Chronic Care Remote Patient Monitoring program targeting providers and provider groups with a turn-key solution for their Medicare patients.

In the First Quarter of 2020, we created an outbound independent reseller team with a performance-based compensation plan. We have built a team of over 200 sales professionals as independent resellers and account executives. We have a lot of confidence and high expectations that our sales force will deliver significant results over the next year as we seek to help fill the enormous demand for telehealth services across the globe. Our pipeline continues to grow.

We have also expanded operations internationally and currently have operations in Mexico, Thailand, Malaysia, Spain and Italy, and many other countries.

Milestones:

First Quarter 2020

- Recruit, Train and Mobilize independent sales force

- Continued expansion into multi-national employer groups

- Expanding our commercial billing capabilities

- Increased the staffing at CareClix including Development, Operations, Implementation and Sales.

- Added native language support within our platform for Arabic and Malaysian, in addition to Spanish and English

- Update CareClix.com website

Second Quarter 2020

- Direct to Consumer website “MyCareClix” development and prelaunch

- Release Chronic Care Remote Patient Monitoring platform integrated within the CareClix Telemedicine Platform

- Expansion into Mexico, UAE Lebanon, Egypt, Jordan, Singapore, Malaysia Thailand, Netherlands, Belgium, Luxembourg, Spain, Canada and Italy.

- Increased staff in Operations, Development Operations, Security and Sales

Third and Fourth Quarters, 2020

- Direct to Consumer website “MyCareClix” launch

- Increase partnerships and distribution channels for sales within our verticals

- Integrations with third party applications and electronic health record systems improving our integration with other systems

- Adding Dutch native language within the application

- Continue international expansion into: United Kingdom, France, Qatar, Kuwait, India, Hong Kong, Panama, Costa Rica, Guatemala, and Honduras

- Launch Chronic Care Remote Patient Monitoring Product

- Expand staffing for compliance, customer service, financial services, and remote patient monitoring

- Continue to expand our medical service providers

- Pursue NCQA Credentialing

| 6 |

2021 Goals

- We will continue to pursue opportunities for M&A focusing on the provider space in telehealth.

As funds become available for expansion of our current activities, through revenues or capital infusions, we expect to increase the budget for expansion and development activities.

We typically update our budget on a quarterly basis to adjust for the current market conditions. Any or all of the budget categories may change. None of the line items are to be considered fixed or unchangeable. In connection with our business plan, management anticipates additional increases in operating expenses and capital expenditures relating to: (i) increasing key staff, expanded direct to public offering, international expansion, remote patient monitoring expansion across US, increased marketing and continued technical integration. We may change any or all of the budget categories in the execution of our business model. None of the line items are to be considered fixed or unchangeable. We may need additional capital to support optimal growth.

Market Size – Telehealth

Competition

Our primary competitors are Teladoc Health, AmWell, MDLIVE, Doxy.me, Zoom and Doctor on Demand. Most of our competitors are providing broad-based primary care medicine. We provide a complete virtual care platform that includes primary care along with specialty specific integration. Many doctors are specialists who need specific telemedicine tools to treat their patients virtually. We create virtual clinics that are specialty specific to the doctors. This empowers them to become like a virtual hospital. It promotes cross referrals and allows them to each have tools specific to their specialty while all using the same platform.

Many of our competitors built their company upon their integration with one medical record company. We have been expanding our integrations with large and small medical record providers.

Markets.

The Company is the leading telemedicine provider in the corrections market within the US. The Company is currently working with its over 200 independent account executives to expand its footprint in the following markets: health plans, employer groups, third-party administrators, multi-specialty provider groups, ACOs, governments, post-acute care facilities, pharmaceutical, and hospitals.

Governmental Regulations.

We are subject to regulation by the US Securities and Exchange Commission, as a public reporting company. We are also subject to state securities regulation in the event of offerings or other activities in a particular state. We are also compliant with Federal Medicare and Medicaid rules and regulations.

Compliance with Environmental Laws and Regulations.

We intend to address this on an as needed basis, as and when any environmental issues arise. Since we do not now manufacture any product, the impact of any environmental laws and regulations is minimal.

Title to Properties.

Not applicable.

OFF BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements.

| 7 |

NUMBER OF PERSONS EMPLOYED

As of the filing date of this report, we have 20 full-time employees and 4 contract employees on a full or part--time basis. We also have an independent sales team of more than 200 and have contracted with a medical health care provider, CareClix Network, PC., to provide medical personnel for our telehealth operations.

DESCRIPTION OF PROPERTIES/ASSETS

The Company owns no real estate. For the year ended December 31, 2019, we subleased office space in Alexandria, Virginia from an affiliated company owned by our Chairman, CEO and majority shareholder on a one-year sublease commencing January 1, 2019 at $8,500 per month and expiring December 31, 2019. For the year ended December 31, 2020, we occupied the same space on a two-year sublease commencing January1, 2020 on the same terms.

Oil and Gas Properties - None

Patents – As part of the acquisition of the CareClix® software, we also acquired the rights to a pending patent application filed for the software by the two founders of KB Medical Systems, LLC. The USPTO has denied the patent application and the matter is currently on appeal.

Trademarks – CareClix® is a registered US trademark.

REPORTS TO SECURITIES HOLDERS

We provide an annual report that includes audited financial information to our shareholders. We will make our financial information and annual Form 10-K equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Securities Exchange Act of 1934. We are subject to disclosure filing requirements including filing Form 10K annually and Form 10Q quarterly. In addition, we will file Form 8K and other proxy and information statements from time to time as required. We do not intend to voluntarily file the above reports in the event that our obligation to file such reports is suspended under the Exchange Act. The public may read and copy any materials that we file with the Securities and Exchange Commission, (“SEC”), at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

FORWARD LOOKING STATEMENTS

THIS DOCUMENT INCLUDES FORWARD-LOOKING STATEMENTS, INCLUDING, WITHOUT LIMITATION, STATEMENTS RELATING TO CARECLIX’ PLANS, STRATEGIES, OBJECTIVES, EXPECTATIONS, INTENTIONS AND ADEQUACY OF RESOURCES. THESE FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES, AND OTHER FACTORS THAT MAY CAUSE OUR COMPANY’S ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THE FORWARD-LOOKING STATEMENTS. THESE FACTORS INCLUDE, AMONG OTHERS, THE FOLLOWING: OUR ABILITY OF TO IMPLEMENT OUR BUSINESS STRATEGY; ABILITY TO OBTAIN ADDITIONAL FINANCING; CARECLIX’ LIMITED OPERATING HISTORY; UNKNOWN LIABILITIES ASSOCIATED WITH FUTURE ACQUISITIONS; ABILITY TO MANAGE GROWTH; SIGNIFICANT COMPETITION; ABILITY TO ATTRACT AND RETAIN TALENTED EMPLOYEES; AND FUTURE GOVERNMENT REGULATIONS; AND OTHER FACTORS DESCRIBED IN THIS FILING OR IN OTHER OF SOLEI SYSTEMS’S FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. CARECLIX. IS UNDER NO OBLIGATION TO PUBLICLY UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

| 8 |

RISK FACTORS RELATING TO OUR COMPANY

LIMITED OPERATING HISTORY

There can be no assurance that our management will be successful in its attempts to implement our business plan, to build the corporate infrastructure required to support operations at the levels called for by our business plan or to generate sufficient revenues to meet expenses for planned expansion. We will encounter risks and difficulties that companies at a similar stage of development frequently experience, including the potential failure to:

| • | Obtain sufficient working capital to support our expansion; |

| • | Find and realize the asset management opportunities required to generate additional revenue; |

| • | Maintain adequate control of our expenses to allow us to realize anticipated income growth; and |

| • | Anticipate and adapt to changing conditions in the telehealth industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

OUR MANAGEMENT TEAM HAS LIMITED EXPERIENCE OPERATING A PUBLIC COMPANY. ANY FAILURE TO COMPLY OR ADEQUATELY COMPLY WITH FEDERAL AND STATE SECURITIES LAWS, RULES OR REGULATIONS COULD SUBJECT US TO FINES OR REGULATORY ACTIONS, WHICH MAY MATERIALLY ADVERSELY AFFECT OUR BUSINESS, RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Members of our management team have limited experience managing and operating a public company and may rely in many instances on the professional experience and advice of third parties including attorneys, financial and compliance experts and accountants. Failure to comply or adequately comply with any federal or state securities laws, rules, or regulations may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in achieving either the effectiveness of a registration statement or the development of an active and liquid trading market for our common stock.

Due to lack of experience and resources as well as the impact of COVID-19, we were unable to file the audit of our financial statements for the year ended December 31, 2019 on a timely basis or to complete our Form 10-K annual report filing until the date of this report. That delay also delayed the filing of our First, Second and Third Quarter 10-Q reports We have added financial controls and retained independent compliance and financial experts to prevent further delays in the future and to assure we file all future reports on a timely basis.

OUR SUCCESS WILL DEPEND, TO A LARGE DEGREE, ON THE EXPERTISE AND EXPERIENCE OF THE MEMBERS OF OUR MANAGEMENT TEAM.

We will be heavily dependent upon the skills, talents, and abilities of our management directors, as well as several consultants, to implement our business plan, and may, from time to time, find that the inability of the officers, directors and consultants to devote their full-time attention to our business, results in a delay in implementing our business plan. Consultants may be engaged on a part-time or full-time basis under contracts to be determined.

We added five directors to our Board of Directors in 2020 and, as a result our current Board of Directors is made up of seven members, with two management members, one consultant member and four independent members. We also established an Audit Committee, currently made up of two independent directors.

Some of our directors and officers are, or may become, in their individual capacities, officers, directors, controlling shareholder and/or partners of other entities engaged in a variety of businesses. These officers and directors may have potential conflicts involving their time and efforts in participation with other business entities. Because investors will not be able to manage our business, they should critically assess all of the information concerning our officers and directors.

| 9 |

WE WILL BE DEPENDENT UPON KEY PERSONNEL FOR THE FORESEEABLE FUTURE.

At this time, we have no employment agreements with any of our key employees other than Dr. Korangy (See, Employment Agreement), though it is contemplated that the Company may enter into such agreements with certain of our key employees on terms and conditions usual and customary for our industry. We do not currently have any "key man" life insurance on any employees or officers.

WE WILL INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY AND TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to be approximately $150,000-$200,000 per year. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

WE ARE AN “EMERGING GROWTH COMPANY,” AND ANY DECISION ON OUR PART TO COMPLY ONLY WITH CERTAIN REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO “EMERGING GROWTH COMPANIES” COULD MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we expect and fully intend to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)2(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt-in to the extended transition period for complying with the revised accounting standards. We have elected to rely on these exemptions and reduced disclosure requirements applicable to “emerging growth companies” and expect to continue to do so.

WE MAY NOT BE ABLE TO MEET THE FILING AND INTERNAL CONTROL REPORTING REQUIREMENTS IMPOSED BY THE SEC WHICH MAY RESULT IN A DECLINE IN THE PRICE OF OUR COMMON SHARES AND AN INABILITY TO OBTAIN FUTURE FINANCING.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm

| 10 |

auditing a company’s financial statements may have to also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting. We may be required to include a report of management on its internal control over financial reporting. The internal control report must include a statement

| • | Of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting; |

| • | Of management’s assessment of the effectiveness of its internal control over financial reporting as of year-end; and |

| • | Of the framework used by management to evaluate the effectiveness of our internal control over financial reporting. |

Furthermore, our independent registered public accounting firm may be required to file its attestation on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm when that becomes required with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market price of our common stock and our ability to secure additional financing as needed.

REPORTING REQUIREMENTS UNDER THE EXCHANGE ACT AND COMPLIANCE WITH THE SARBANES-OXLEY ACT OF 2002, INCLUDING ESTABLISHING AND MAINTAINING ACCEPTABLE INTERNAL CONTROLS OVER FINANCIAL REPORTING, ARE COSTLY AND MAY INCREASE SUBSTANTIALLY.

The rules and regulations of the SEC require a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal, accounting, auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) requires, among other things, that we design, implement and maintain adequate internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically qualified personnel we have may make it difficult for us to design, implement and maintain adequate internal controls over financial reporting. In the event that we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls, we may not be able to produce reliable financial reports or report fraud, which may harm our overall financial condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

Due to inadequate and inexperienced financial and accounting staff, we were unable to file certain required periodic reports during 2019 and 2020 on a timely basis with the SEC, and this Annual Report is being filed late for the same reasons and due to the unexpected additional burdens placed on the Company by the COVID-19 pandemic. We have retained additional experienced personnel to undertake these duties and also have recently appointed an independent

| 11 |

Audit Committee of the Board of Directors to directly oversee these reporting functions. We are confident that these changes will allow us to meet all required filing deadlines for future filings.

We are working with our legal, accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas.

The increased costs associated with operating as a public company may decrease our net income or increase our net loss and may cause us to reduce costs in other areas of our business or increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

THE JOBS ACT ALLOWS US TO DELAY THE ADOPTION OF NEW OR REVISED ACCOUNTING STANDARDS THAT HAVE DIFFERENT EFFECTIVE DATES FOR PUBLIC AND PRIVATE COMPANIES.

Since we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act, this election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

FLORIDA CORPORATE LAW PROVIDES FOR INDEMNIFICATION OF OFFICERS AND DIRECTORS AT OUR EXPENSE AND LIMITS THEIR LIABILITY WHICH MAY RESULT IN A MAJOR COST TO US AND HURT THE INTERESTS OF OUR SHAREHOLDERS BECAUSE CORPORATE RESOURCES MAY BE EXPENDED FOR THE BENEFIT OF OFFICERS AND/OR DIRECTORS.

Our By-Laws also include provisions that limit the personal liability of the directors of the Company for monetary damages to the fullest extent possible under the laws of the State of Florida or other applicable law. These provisions eliminate the liability of directors to the Company and its stockholders for monetary damages arising out of any violation of a director of his fiduciary duty of due care. Under Florida law, however, such provisions do not eliminate the personal liability of a director for (i) breach of the director’s duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction from which the director derived an improper benefit. These provisions do not affect a director’s liabilities under the federal securities laws or the recovery of damages by third parties. The position of the SEC with regard to such indemnification and limitation provisions is that they are contrary to the intent of the federal securities laws and are not enforceable as written. We also maintain director and officer liability insurance.

RISK FACTORS RELATING TO OUR BUSINESS

WE HAVE INCURRED SIGNIFICANT LOSSES.

As of December 31, 2019, we had an accumulated deficit of ($24,144,620). We have been experiencing initial start-up losses in the telehealth business since the acquisition of the CareClix® software in April 2019 and have only recently) reached financial break even so we expect that any future losses will be attributable primarily to acquisitions and expansion rather than on-going operations. A large portion of that accumulated loss is from the non-cash stock compensation in 2019.

| 12 |

BECAUSE OUR CEO AND CHAIRMAN CONTROLS OUR ACTIVITIES, THAT MAY CAUSE US TO ACT IN A MANNER THAT IS MOST BENEFICIAL TO HIM AND NOT TO OUTSIDE SHAREHOLDERS WHICH COULD CAUSE US NOT TO TAKE ACTIONS THAT OUTSIDE INVESTORS MIGHT VIEW FAVORABLY

Our Chief Executive Officer and Chairman also is the majority shareholder of our issued and outstanding common stock and beneficially owns approximately 59% of our issued and outstanding common stock. As a result, he effectively controls all matters requiring director and stockholder approval, including the election of directors, and the approval of significant corporate transactions, such as mergers and related party transactions. This insider also has the ability to delay or perhaps even block, by his ownership of our stock, an unsolicited tender offer. This concentration of ownership could have the effect of delaying, deterring or preventing a change in control of our company that investors might view unfavorably.

WE MAY DEPEND UPON OUTSIDE ADVISORS, WHO MAY NOT BE AVAILABLE ON REASONABLE TERMS AND AS NEEDED.

To supplement the business experience of our officers and directors, we may be required to employ accountants, technical experts, appraisers, attorneys, or other consultants or advisors. Our Board without any input from stockholders will make the selection of any such advisors. Furthermore, it is anticipated that such persons may be engaged on an "as needed" basis without a continuing fiduciary or other obligation to us. In the event we consider it necessary to hire outside advisors, we may elect to hire persons who are affiliates, if they are able to provide the required services.

WE MAY BE SUBJECT TO LITIGATION IN THE FUTURE WHICH COULD IMPACT THE FINANCIAL HEALTH OF THE COMPANY.

Currently there are no material legal proceedings pending or threatened against our Company. However, from time to time, we may become involved in various lawsuits and legal proceedings that arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

Our ability to conduct telehealth services and expert medical services in a particular U.S. state or non-U.S. jurisdiction is directly dependent upon the applicable laws governing remote healthcare, the practice of medicine and healthcare delivery in general in such location which are subject to changing political, regulatory and other influences. With respect to telehealth services, in the past, state medical boards have established new rules or interpreted existing rules in a manner that has limited or restricted our ability to conduct our business as it was conducted in other states.

We conduct business in a heavily regulated industry and if we fail to comply with theapplicable laws and government regulations, we could incur penalties, be required to make significant changes to our operations or experience adverse publicity, which could have a material adverse effect on our business, financial condition, and results of operations.

The U.S. healthcare industry is heavily regulated and closely scrutinized by federal, state and local governments. Comprehensive statutes and regulations govern the manner in which we provide and bill for services and collect reimbursement from governmental programs and private payors, our contractual relationships with our providers, vendors and Clients, our marketing activities and other aspects of our operations. Because of the breadth of these laws and the narrowness of the statutory exceptions and safe harbors available, it is possible that some of our business activities could be subject to challenge under one or more of such laws. Achieving and sustaining compliance with these laws may prove costly. Failure to comply with these laws and other laws can result in civil and criminal penalties such as fines, damages, overpayment, recoupment, imprisonment, loss of enrollment status and exclusion from the Medicare and Medicaid programs. The risk of our being found in violation of these laws and regulations is increased by the fact that many of them have not been fully interpreted by the

Our business is subject to complex and evolving foreign laws and regulations regarding privacy, data protection and other matters relating to information collection.

There are numerous foreign laws, regulations and directives regarding privacy and the collection, storage, transmission, use, processing, disclosure and protection of personally identifiable information (“PII”) and other personal or customer data, the scope of which is continually evolving and subject to differing interpretations. We must

| 13 |

comply with such laws, regulations and directives and we may be subject to significant consequences, including penalties and fines, for our failure to comply. For example, as of May 25, 2018, the General Data Protection Regulation (“GDPR”) replaced the Data Protection Directive with respect to the processing of personal data in the European Union. The GDPR imposes several stringent requirements for controllers and processors of personal data, including, for example, higher standards for obtaining consent from individuals to process their personal data, more robust disclosures to individuals and a strengthened individual data rights regime, shortened timelines for data breach notifications, limitations on retention and secondary use of information, increased requirements pertaining to health data and pseudonymized (i.e., key-coded) data and additional obligations when we contract with third-party processors in connection with the processing of personal data. The GDPR provides that EU member states may make their own further laws and regulations limiting the processing of genetic, biometric or health data, which could limit our ability to use and share personal data or could cause our costs to increase and could harm our business and financial condition. Failure to comply with the requirements of GDPR and the applicable national data protection laws of the EU member states may result in fines of up to €20,000,000 or up to 4% of the total worldwide annual turnover of the preceding financial year, whichever is higher, and other administrative penalties operate, which impose similar accountability, transparency and security obligations. This may be onerous and adversely affect our business, financial condition, results of operations and prospects.

In addition, recent legal developments in Europe have created complexity and compliance uncertainty regarding certain transfers of information from the European Union to the United States. We cannot be certain of the legitimacy of previously authorized data export mechanisms, including Standard Model Contractual Clauses, on which we and our customers have relied in exporting data to servers located in the United States. For example, following a decision of the Court of Justice of the European Union in October 2015, transferring personal data to U.S. companies that had certified as Members of the U.S. Safe Harbor Scheme was declared invalid. In July 2016, the European Commission adopted the U.S.-EU Privacy Shield Framework which replaces the Safe Harbor Scheme. However, this Framework is under review and there is currently litigation challenging other EU mechanisms for adequate data transfers (i.e., the standard contractual clauses). It is uncertain whether the Privacy Shield Framework and/or the standard contractual clauses will be similarly invalidated by the European courts. We rely on a mixture of mechanisms to transfer personal data from our EU business to the United States, and could be impacted by changes in law as a result of a future review of these transfer mechanisms by European regulators under the GDPR, as well as current challenges to these mechanisms in the European courts. If one or more of the legal bases for transferring PII from Europe to the United States is invalidated, or if we are unable to transfer PII between and among countries and regions in which we operate, it could affect the manner in which we provide our services or could adversely affect our financial results. Furthermore, any failure, or perceived failure, by us to comply with or make effective modifications to our policies, or to comply with any federal, state, or international privacy, data-retention or data-protection-related laws, regulations, orders or industry self-regulatory principles could result in proceedings or actions against us by governmental entities or others, a loss of customer confidence, damage to our brand and reputation, and a loss of customers, any of which could have an adverse effect on our business. In addition, various federal, state and foreign legislative or regulatory bodies may enact new or additional laws and regulations concerning privacy, data-retention and data-protection issues, including laws or regulations mandating disclosure to domestic or international law enforcement bodies, which could adversely impact our business, our brand or our reputation with customers. For example, some countries have adopted laws mandating that PII regarding customers in their country be maintained solely in their country. Having to maintain local data centers and redesign product, service and business operations to limit PII processing to within individual countries could increase our operating costs significantly.

As we expand our international operations, we will increasingly face political, legal and compliance, operational, regulatory, economic and other risks that we do not face or are more significant than in our domestic operations. Our exposure to these risks is expected to increase.

As we expand our international operations, we will increasingly face political, legal and compliance, operational, regulatory, economic and other risks that we do not face or that are more significant than in our domestic operations. These risks vary widely by country and include varying regional and geopolitical business conditions and demands, government intervention and censorship, discriminatory regulation, nationalization or expropriation of assets and pricing constraints. Our international products need to meet country-specific client and member preferences as well as country-specific legal requirements, including those related to licensing, telehealth, privacy, data storage, location, protection and security. Our ability to conduct telehealth services internationally is subject to the applicable laws

| 14 |

governing remote healthcare and the practice of medicine in such location, and the interpretation of these laws is evolving and vary significantly from country to county and are enforced by governmental, judicial and regulatory authorities with broad discretion. We cannot, however, be certain that our interpretation of such laws and regulations is correct in how we structure our operations, our arrangements with physicians, services agreements and customer arrangements

Our international operations increase our exposure to and require us to devote significant management resources to implement controls and systems to comply with, the privacy and data protection laws of non-U.S. jurisdictions and the anti-bribery, anti-corruption and anti-money laundering laws of the United States (including the FCPA) and the United Kingdom (including the Bribery Act) and similar laws in other jurisdictions. Implementing our compliance policies, internal controls and other systems upon our expansion into new countries and geographies may require the investment of considerable management time and management, financial and other resources over a number of years before any significant revenues or profits are generated. Violations of these laws and regulations could result in fines, criminal sanctions against us, our officers or employees, restrictions or outright prohibitions on the conduct of our business, and significant brand and reputational harm. We must regularly reassess the size, capability and location of our global infrastructure and make appropriate changes, and must have effective change management processes and internal controls in place to address changes in our business and operations. Our success depends, in part, on our ability to anticipate these risks and manage these difficulties, and the failure to do so could have a material adverse effect on our business, operating results, financial position, brand, reputation and/or long-term growth.

WE MAY FACE INCREASED COMPETITION IN THE GROWING TELEHEALTH MARKET

While the telehealth market is in an early stage of development, it is competitive and we expect it to attract increased competition, which could make it difficult for us to succeed. We currently face competition in the telehealth industry for our solution from a range of companies, including specialized software and solution providers that offer similar solutions, often at substantially lower prices, and that are continuing to develop additional products and becoming more sophisticated and effective. These competitors include Teladoc Health, MDLive, Inc., American Well Corporation, and Grand Rounds, Inc. among other smaller industry participants. In addition, large, well-financed health plans have in some cases developed their own telehealth or expert medical service tools and may provide these solutions to their customers at discounted prices. Competition from specialized software and solution providers, health plans and other parties will result in continued pricing pressures, which is likely to lead to price declines in certain product segments, which could negatively impact our sales, profitability and market share.

Some of our competitors may have greater name recognition, longer operating histories and significantly greater resources than we do. Further, our current or potential competitors may be acquired by third parties with greater available resources. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements and may have the ability to initiate or withstand substantial price competition. In addition, current and potential competitors have established, and may in the future establish, cooperative relationships with vendors of complementary products, technologies or services to increase the availability of their solutions in the marketplace. Accordingly, new competitors or alliances may emerge that have greater market share, a larger customer base, more widely adopted proprietary technologies, greater marketing expertise, greater financial resources and larger sales forces than we have, which could put us at a competitive disadvantage. Our competitors could also be better positioned to serve certain segments of the telehealth market, which could create additional price pressure. In light of these factors, even if our solution is more effective than those of our competitors, current or potential Clients may accept competitive solutions in lieu of purchasing our solution. If we are unable to successfully compete in the telehealth market, our business, financial condition and results of operations could be materially adversely affected.

OUR INSURANCE COVERAGE OR THIRD-PARTY INDEMNIFICATION RIGHTS MAY NOT BE SUFFICIENT TO COVER OUR LEGAL CLAIMS OR OTHER LOSSES THAT WE MAY INCUR IN THE FUTURE.

In the future, insurance coverage may not be available at adequate levels or on adequate terms to cover potential losses, including on terms that meet our customer’s requirements. If insurance coverage is inadequate or unavailable, we may face claims that exceed coverage limits or that are not covered, which could increase our costs and adversely affect our operating results. Currently, we maintain general liability coverage, cyber-security coverage, professional

| 15 |

malpractice, workmen’s compensation and director and officer liability coverage in amounts deemed to be adequate to cover potential losses.

DAMAGE TO OUR REPUTATION.

Failure to comply with local laws and regulations, to maintain an effective system of internal controls, to provide accurate and timely financial statement information, or to protect our information systems against service interruptions, misappropriation of data or breaches of security, could hurt our reputation. Damage to our reputation or loss of consumer confidence in our services for any of these or other reasons could result in decreased demand for our services and could have a material adverse effect on our business, financial condition and results of operations, as well as require additional resources to rebuild our reputation, competitive position and brand equity.

RISKS RELATING TO OWNERSHIP OF

OUR COMMON STOCK

NO ACTIVE PUBLIC MARKET EXISTS FOR OUR COMMON STOCK AT THIS TIME, AND THERE IS NO ASSURANCE OF A FUTURE MARKET. OUR COMMON SHARES CURRENTLY TRADE ON THE “GREY MARKET” WITH APPROXIMATELY 630 SHAREHOLDERS.

As a direct result of the SEC action in April 2020 temporarily suspending trading in our common shares, there is not an active public market for our common stock, although recently reported activity on the grey market has resulted in an increase in the average trading price of our stock, trading under the symbol SOLI, and in the volume of daily trades. Our common shares were admitted for trading on the OTC Link Market in March 2020 and traded up to one million shares or more daily until April 2020, when the SEC announced what we believe was its unwarranted suspension of trading. We have subsequently requested and received from the SEC a letter confirming that there is currently no investigation of the Company pending and the temporary suspension expired by its terms in 14 days. We intent to seek listing of our common stock in a more liquid market as soon as we are qualified to do so.

No assurance can be given that a liquid market will develop or that a shareholder ever will be able to liquidate his investment without considerable delay, if at all. If a market should develop, the price may be highly volatile. Factors such as those discussed in the “Risk Factors” section may have a significant impact upon the market price of the shares. Due to the low price of our securities, many brokerage firms may not be willing to effect transactions in our securities. Even if a purchaser finds a broker willing to effect a transaction in our shares, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of our shares as collateral for any loans.

OUR STOCK WILL, IN ALL LIKELIHOOD, BE THINLY TRADED AND AS A RESULT YOU MAY BE UNABLE TO SELL AT OR NEAR ASK PRICES OR AT ALL IF YOU NEED TO LIQUIDATE YOUR SHARES.

The shares of our common stock may be thinly traded unless and until a Form 15(c)-211 form is approved or we seek a listing on a more senior market. We are a small company which is still relatively unknown to stock analysts, stock brokers, institutional stockholders and others in the investment community that generate or influence sales volume, so unproven, early stage company such as ours or purchase or recommend the purchase of any of our securities until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our securities is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on securities prices. Although there were multiple days that our trading volume exceeded one million shares before the April temporary trading suspension, we cannot give you any assurance that a broader or more active public trading market for our common securities will redevelop or be sustained, or that any trading levels will be sustained. Due to these conditions, we can give stockholders no assurance that they will be able to sell their shares at or near ask prices or at all if they need money or otherwise desire to liquidate their securities.

| 16 |

OUR COMMON STOCK MAY BE VOLATILE, WHICH SUBSTANTIALLY INCREASES THE RISK THAT YOU MAY NOT BE ABLE TO SELL YOUR SECURITIES AT OR ABOVE THE PRICE THAT YOU MAY PAY FOR THE SECURITY.

Because of the possible price volatility, you may not be able to sell your shares of common stock when you desire to do so. The inability to sell your securities in a rapidly declining market may substantially increase your risk of loss because of such illiquidity and because the price for our securities may suffer greater declines because of our price volatility.

The price of our common stock that will prevail in the market may be higher or lower than the price you may pay to acquire it. Certain factors, some of which are beyond our control, that may cause our share price to fluctuate significantly include, but are not limited to the following:

| · | Variations in our quarterly operating results; |

| · | Loss of a key relationship or failure to complete significant transactions; |

| · | Additions or departures of key personnel; |

| · | Fluctuations in stock market price and volume; |

| · | Changes to the industry; and |

| · | Regulatory developments, particularly those affecting the telehealth market. |

Additionally, in recent years the stock market in general, has experienced extreme price and volume fluctuations. In some cases, these fluctuations are unrelated or disproportionate to the operating performance of the underlying company. These market and industry factors may materially and adversely affect our stock price, regardless of our operating performance. In the past, class action litigation often has been brought against companies following periods of volatility in the market price of those company’s common stock. If we become involved in this type of litigation in the future, it could result in substantial costs and diversion of management attention and resources, which could have a further negative effect on your investment in our stock.

THE REGULATION OF PENNY STOCKS BY THE SEC AND FINRA MAY DISCOURAGE THE TRADABILITY OF OUR SECURITIES.

We are a “penny stock” company, as our stock price is less than $5.00 per share. Although none of our securities currently trade in any market other than the grey market we intend to seek a listing on the OTC Markets or a more senior market as soon as possible. If that is approved and the shares again become available for trading, we may still be subject to a Securities and Exchange Commission rule that imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited stockholders. For purposes of the rule, the phrase “accredited stockholders” means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse’s income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Effectively, this discourages broker-dealers from executing trades in penny stocks. Consequently, the rule will affect the ability of purchasers in this offering to sell their securities in any market that might develop because it imposes additional regulatory burdens on penny stock transactions.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate “penny stocks". Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange Act of 1934, as amended. Because our securities constitute “penny stocks” within the meaning of the rules, the rules would apply to us and to our securities. The rules will further affect the ability of owners of shares to sell our securities in any market that might develop for them because it imposes additional regulatory burdens on penny stock transactions.

Stockholders should be aware that, according to the Securities and Exchange Commission, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired consequent

| 17 |

investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.