Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - BioCrude Technologies USA, Inc. | e2459_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - BioCrude Technologies USA, Inc. | e2459_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - BioCrude Technologies USA, Inc. | e2459_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-55818

BIOCRUDE TECHNOLOGIES USA, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 81-2924160 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 605-1255 Phillips Square, Montreal, QB, Canada | H3B 3G5 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: 514-840-9719

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Trading Symbol | Name of each exchange on which registered | ||

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “an accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

| Non Accelerated Filer | ☐ | Smaller Reporting Company | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The number of shares of Common Stock, $0.001 par value, outstanding on December 31, 2020 was 50,621,336 shares.

Explanatory Note

This amendment on Form 10K is being filed for the sole purpose of correcting a premature disclosure in the initial 10K in which same disclosed the Cote d’Ivoire engagement by and between the governmental authorities of Cote d’Ivoire and BioCrude Technologies USA, Inc., which, due to a delay with some of the signatories (Ministers), was unveiled prior to being fully executed.

BIOCRUDE TECHNOLOGIES USA, INC.

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2019

Index to Report on Form 10-K

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements and involves risks and uncertainties that could materially affect expected results of operations, liquidity, cash flows, and business prospects. These statements include, among other things, statements regarding:

| ● | our ability to diversify our operations; | |

| ● | our ability to implement our business plan; | |

| ● | our ability to attract key personnel; | |

| ● | our ability to operate profitably; | |

| ● | our ability to efficiently and effectively finance our operations, and/or purchase orders; | |

| ● | inability to achieve future sales levels or other operating results; | |

| ● | inability to raise additional financing for working capital; | |

| ● | inability to efficiently manage our operations; | |

| ● | the inability of management to effectively implement our strategies and business plans; | |

| ● | the unavailability of funds for capital expenditures and/or general working capital; | |

| ● | the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain; | |

| ● | deterioration in general or regional economic conditions; | |

| ● | changes in U.S. GAAP or in the legal, regulatory and legislative environments in the markets in which we operate; | |

| ● | adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations; |

as well as other statements regarding our future operations, financial condition and prospects, and business strategies. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 10-K, and in particular, the risks discussed under the heading “Risk Factors” in Part I, Item 1A and those discussed in other documents we file with the Securities and Exchange Commission. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Throughout this Annual Report references to “we”, “our”, “us”, “the Company”, and similar terms refer to Biocrude Technologies USA, Inc.

ii

General Business Development

Company Formation

The Company was formed on August 4, 2015 in the State of Nevada, under the name of “BioCrude Technologies, Inc. On November 8, 2016, the Company received its “Certificate of Amendment to Articles of Incorporation” pursuant to NRS 78.385 and 78.390 to its request for a name change from “BioCrude Technologies, Inc.” to “BioCrude Technologies USA, Inc.”, whilst doing business as “BioCrude Technologies, Inc.”, as well. All of the afore-stated have been filed with SEC as part of the Company’s S-1(/A) registration statement(s). The Company is construed as a startup company and our auditors have issued a going concern opinion.

Corporate Mission and Strategy

The Company is a resource management expertise and services provider, catering to commercial, municipal, and industrial customers, primarily in the areas of solid waste management and recycling services.

BioCrude Technologies USA, Inc. has developed efficient, cost-effective, and environmentally friendly products, processes and systems for the reformation of waste material, waste management and creation of renewable energy.

The versatility and potential of the BioCrude Technology has been demonstrated by the many uses that our R & D department has already tested and verified. The avenues they have explored include sustainable and cost efficient methods that will enlarge composting and biomethanation yields and rates of decomposition while increasing output and providing a higher quality of end product. Their focus is on waste treatment protocols for MSW, cellulose, all organic waste and all manure types; renewable energy sources such as biogas, ethanol and biodiesel; waste water treatment, and multiple other applications.

One very important area that BioCrude Technologies USA, Inc. excels in is the reformation of MSW into renewable energy and marketable end-by-products, using its intrinsic intellectual property and know how in its “Integrated Municipal Solid Waste to Energy Proposed Complexes” for municipal applications. Understanding the non-homogenous nature and characteristics of the waste, we can define distinct processes to optimally handle the procurement of the varied categories of waste (MSW can be classified into organics, fuels, recyclables, inerts and others), once segregated with an efficient separation process and materials recovery facility (“MRF”). There is no intellectual property protection as of yet. BioCrude will be filing for certain Intellectual property and know how protection via a patent for “Integrated Municipal Solid Waste to Energy Systems”. In addition to patent applications, the Company will apply for trademark protection where appropriate.

The long-term vision of the organization is to build a highly sustainable and profitable company by transforming traditional solid waste streams into renewable energy resources and marketable by-products. Conventionally, people, entities, etc.…, view solid waste streams as not only worthless refuse requiring monetary resources in order to get rid of. BioCrude, on the contrary, views this so-called refuse “as a valuable commodity”, with a negative product cost, i.e., PRODUCT COST is ZERO, with an implicit REVENUE received PER UNIT OF WASTE given for disposal (people, governments will pay entities/companies in order to get rid of the undesired waste, in the form of a “Tipping” or “Gate” fee. Global competition for limited resources is, the Company believes, creating significant business opportunities for companies that can sustain and extract value in the form of renewable energy and other marketable by-products, i.e., fertilizer, raw materials (primary feedstock for building materials), etc.…, from resources previously considered an irretrievable waste stream. BioCrude’s business strategy has been firmly tied to creating a sustainable resource management model and the Company continues to be rooted in these same tenets today. Each day the Company strives to create long-term value for all stakeholders: customers, employees, communities, and shareholders, by helping customers and communities manage their resources in a sustainable and financially sound manner.

1

Industry Analysis

Environmental issues (solid waste management, terrain and water contamination, air pollution [greenhouse gas emissions]) have taken the forefront globally, creating solid expectations for investments in green technology (enhanced by governmental incentives (monetary, capitalized stimuli, tax reductions, and carbon credits, amongst other persuasions).

Conventional practices of waste management (landfilling, mass-burn or incineration), are NOT sound and innovative technologies, but practices that have been around since the beginning of time with negative environmental repercussions, without mentioning the interrelated health implications resulting from contaminated land, water tables and air pollution.

Municipal Solid Waste is defined to include refuse from households, non-hazardous solid waste from industrial, commercial and institutional establishments (including hospitals), market waste, yard waste and street sweepings. MSWM encompasses the functions of collection, transfer, treatment, recycling, resource recovery and disposal of municipal solid waste.

Municipal Solid Waste Management is the collection, transport, processing (waste treatment), recycling or disposal of waste materials, usually ones produced by human activity, in an effort to reduce their effect on human health or local aesthetics or amenity.

Municipal Solid Waste Management is major responsibility of local government. It is a complex task which requires appropriate organizational capacity and cooperation between numerous stakeholders in the private and public sectors.

The first goal of MSWM is to protect the health of the population, particularly that of low-income groups. Other goals include promotion of environmental quality and sustainability, support of economic productivity and employment generation.

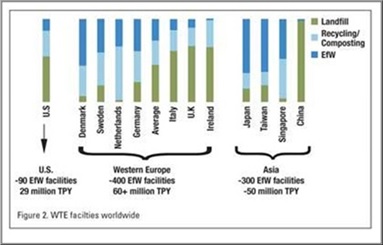

Waste-to-Energy (“W2E”) or Energy-from-Waste (“EfW”) is the process of creating energy in the form of electricity or heat from the incineration of waste source.

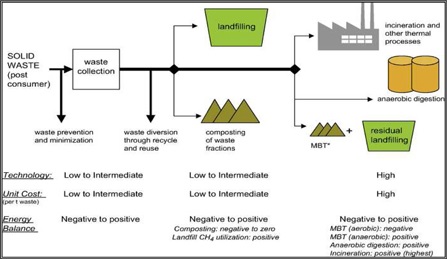

Conventional Municipal Solid Waste Management employs one or more of the following processes:

| Ø | Waste prevention, including reuse of products |

| Ø | Recycling, including composting |

| Ø | Combustion with energy recovery |

| Ø | Disposal through land-filling |

2

Landfilling is one of the most common ways of municipal solid waste disposal in developing countries. Air pollutants emitted from landfills contributes to the emission in the atmosphere of greenhouse gases and cause serious problems to human health.

Methane emissions from landfills are a serious environmental global concern, as it accounts for approximately 15% of current greenhouse gas emissions. Landfilling is a significant contributor to greenhouse gas emissions (GHG) accountable for approximately 5% of total GHG releases which consists of methane from anaerobic decomposition of solid waste and carbon dioxide from wastewater decomposition.

In the past, MSW management used either landfilling or mass burn/incinerators, had no pollution control and energy recovery and, sanitary landfills were rare. MSW management uses more integrated and complex approaches, the waste to energy facilities have minimal environmental burden and the sanitary landfills have requirements for designing operation and monitoring and gas collection.

The past 20 years has seen a change in how we look at our environment. There has been a greater understanding of the economic, social and environmental risks of not managing waste.

Environmental Factors

The Stern report, first published in 2006, created an authoritative and eye-opening scientific report on the challenges of climate change. The report highlighted the need to decarbonize the power sector by 60% and reduce CO2 emissions by 80% of current levels to ensure increases in global temperature do not exceed two degrees Celsius.

Regulations and Legislation

Scientific evidence, public awareness and increased levels of participation in environmental campaigning have led to governments’ worldwide implementing regulations and legislation. Examples include:

| ● | EU Landfill Diversion Directive |

| ● | recycling targets |

| ● | climate change regulations |

Nota Bene: It is only in the last two decades that governments world wide have been working together to come to a consensus of standardized, environmentally friendly waste management directives, in order to become recognized and implemented practices.

Economics

Economic drivers to developing the waste and renewable energy sector have included:

| ● | waste disposal and landfill gate fees/landfill tax |

| ● | penalties/avoidance schemes (e.g. landfill allowance schemes and fines, carbon trading) |

| ● | energy prices |

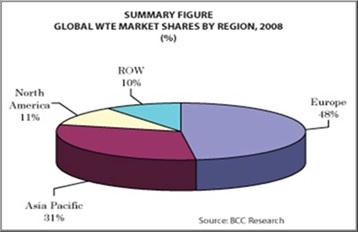

Waste to Energy Market Size and Trend

3

Renewable Energy: According to the most recent data available from the International Energy Agency, global waste to energy power production from municipal and industrial wastes increased from 283 terawatt hours to 383 terawatt hours, a 35% increase over that period. In-depth analyses of the global market, forecasts the market will increase from approximately $27 billion in 2018 to $450 billion by 2030.

MSW Management (Tipping/Gate fees): As long as there are people in our world, there will be waste generation. Depending on the demographics of people clusters (nations), the amount of waste generated on a per capita (person) basis can vary from 0.6 kg (persons in destitute third world countries (e.g., Niamey [Niger], Juba [South Sudan], Freetown [Sierra Leone], Port-au-Prince [Haiti])) to 1.8 kg (advanced societies with flourishing economies (e.g., New York City [US], Toronto [Canada], Paris [France], Dubai [UAE]) per person per day. With an approximate current world population (census 2020) of 7.8 billion persons, there is a minimum quantum (weighted average) of about 6,000,000 tons of waste generated on a per day basis. Depending on the national budget for the level of waste management treatment implemented by a certain nation, analyses of the global market, forecasts the market will increase from approximately $45 billion in 2020 to $60 billion by 2030.

Nota Bene: The Market potential for Waste Management is not only “HUGE”, but at its infancy stage, ready to “EXPLODE”, with few credible corporations, capable of servicing same!

Source : http://www.waste-management-world.com

4

Defining Waste Management for Municipal Applications

The provision of municipal solid waste services is a costly and troubling problem for local authorities everywhere. In many cities, service coverage is low, resources are insufficient, and uncontrolled dumping is widespread, with resulting environmental and health related problems, which are recognized worldwide, and cannot be neglected! Moreover, substantial inefficiencies are typically observed. Typically, worldwide, governmental waste management ordinance, surprisingly enough, encompasses inefficient waste collection, landfilling until over exhaustion, and incineration.

Out of concern for the quality of life of their residents, local municipalities bear primary responsibility for waste management. Municipalities will work with other municipal levels to identify the best collection, transportation, treatment and disposal methods for their respective jurisdictions. This includes identifying suitable sites for municipal, or regional waste management facilities, and managing and operating collection, transportation and treatment systems. To increase the environmental and economic efficiency of waste management, local municipalities will be responsible for planning waste management infrastructure and systems at the urban community and regional county municipality levels.

Biocrude, with its upgraded technologically advanced systems, can improve quality of environment, ergo, life.

Waste management planning, as well as the production of renewable energy resources, are vital issues facing any city or municipality today. We are at a time where all level of governments recognize the importance and need for waste management. Be it for financial, environmental, or health issues. Room for improvement exists for the following:

| 1. | Reduction, and eventually, the elimination of landfilling, as opposed to over exhausting (substituting proposed landfill sites with other forms of development (commercial, industrial, residential, agricultural, and community developments, amongst others – real estate value). |

| 2. | Reduction of Greenhouse Gases, and environmental pollutants with reference to ground and surface water contamination (percolation of contaminated leachate) alongside with the elimination of odors. |

| 3. | Further enhanced separation process for MSW, which could prelude to a more optimal recycling program. |

Nota Bene: Landfilling is NOT a solution (contaminates the land forever, cost of construction, waste creation), but a deferral of a problem for future generation to handle. In essence, it is what it is; a PRACTICE that has been utilized for the longest period of time! Nothing more!

The myth that landfilling is a cost-effective solution is what it is; a myth. There are long term ramifications, especially when the landfills are not proper “Scientific Landfills” (environmental implications; rainfall, leachate, percolation, contamination (soil and water table). Even the fact that, if a Scientific Landfill is deployed (with membrane linings) at an astronomical cost (the cost of construction of a Scientific landfill, which could host approximately 2,000 TPD of waste for 25 years could costs approximately 100 MUSD), after a few earth tremors or shifting of land, the membrane could crack, or over time, the membrane will deteriorate, thus yielding the same negative environmental impacts, only deferred in time.

Another issue to address is the continual use of landfills. As time goes on, and waste is continuously generated by the populous and its activities, more and more landfills have to be created, to a point where a good part of the country will become a cemetery for garbage. Municipalities/governments must plan to integrate their waste management from a strategic and financial perspective.

When a need will arise to reclaim back certain land (certain countries like Pakistan, India, Bangladesh, amongst others have already started requesting proposals for same) from being host to a landfill, the cleansing process for reclamation can cost a minimum of 120 USD/m3 (do the math on a landfill that hosted 1,000 TPD of waste for 25 years, as well as cleansing all other soils to the point of the bedrock, as well as the lateral distance from the perimeter of the landfill).

5

Remember: the landfill gas (from the organic portion of the MSW) extracted from a landfill is a “mise en cause“, to landfilling and a onetime event, with the consequence of the balance of the waste left in the landfill. Landfill gas extraction is not 100% efficient, with a certain percentage escaping into the atmosphere and another percentage trapped in pockets of the landfill.

If one was to do a Macro-economic and Cost-Benefit analysis and of same, incorporating all of the aforesaid, especially all of the negative environmental impacts, one would find that a properly engineered solution today outweighs the so-called norm of landfilling by a minimum of 300 to 1 (I did not even incorporate the negative effects to health implications).

Large municipalities and metropolitan regions are encouraged to routinely undertake citywide strategic planning to design and implement integrated solid waste systems that are responsive to dynamic demographic and industrial growth. Strategic planning starts with the formulation of long-term goals based, on the local urban needs, followed by a medium- and short-term action plan to meet these goals. The strategy and action plans should identify a clear set of integrated actions, responsible parties and needed human, physical and financial resources. Opportunities and concepts for private sector involvement are commonly included among the examined options, as the private sector’s costs and productivity output require special consideration.

BioCrude, having set as its objective the “PROFITABILITY” of the activities inherent within the realms of this sector, whilst building business relationships and addressing social implications within the collectivity’s / communities that BioCrude is called upon to serve, beyond the environmental and social implications, and beyond the business imperatives, has set as one of its priorities, the optimization of waste management and, treatment thereof, all in conformity to the boundaries of economies, efficiency and adherence to environmental wellbeing initiatives. BioCrude has been involved in the R&D of Environmental Technologies, both process and product based, whereby it has enhanced and optimized conventional technology, thus giving credence to environmental, economic, social and technological well-beings, too numerous to mention (all can be referenced, in its entirety, within BioCrude’s Integrated MSW-Energy Proposal. Shortlists of the aforesaid well-beings are summarized herein under:

| 1. | Secure, cost effective long-term processing capacity for recyclables and organics. |

| 2. | Improvement of effectiveness and efficiency of current waste systems/practices. |

| 3. | Elimination of MSW from going to landfills. |

| 4. | Procurement of Renewable Energy and Marketable by-products (fertilizer, primary feedstock for building materials, etc.…) from the exploitation of the calorific value inherent within the realms of the MSW |

| 5. | Reduction of Greenhouse Gases and other environmental pollutants emitted into the atmosphere. |

| 6. | Municipalities do not have to undergo cost of implementation; privatized via BOOT (Build, Own, Operate & Transfer), whereby BioCrude Technologies USA, Inc. will be lobbying to get the MSW, Land, Sewage treated Effluent and Resale of Electricity Concessions (with Sovereign Guaranties from the Ministry of Finance of the Government in question). |

| 7. | Due to the profitability of the proposal, significant savings could be passed onto the Municipalities, to reduce their day to day on going expenses for Municipal Waste Management, for the duration of the BOOT (30 years), by approximately 50% per annum, via MSW Tipping (Gate) Fees (favorably outbidding the competition and still having better bottom lines than same) and the Transport of the MSW to neighboring cities/provinces (states), without forgetting to mention the reduced GHG emissions from the substitution effect of BioCrude’s Integrated MSW to Energy proposal from landfilling and/or incineration. This surplus in savings can be used for other municipal social and infrastructural programs. |

6

8. |

Employment opportunities are created during the EPC (Engineering, Procurement & Construction) phase of the project (a few hundred jobs) and for the day-to-day operations of the project (approximately 86 jobs per shift per 2,000 TPD Plant plus 11 persons for administration X 3 shifts per day, equating to a total quantum of a minimum of 269 persons). |

| 9. | The proposed solution is an integrated MSW management system based on energy recovery that respects the norms of a Clean Design Mechanism (“CDM”) inherent within the realms of article 12 of the Kyoto Protocol (“UNFCCC”) or any future proposed legislation regarding same, and qualifies for Carbon Emissions Reduction Credits (“CER’s”). |

We firmly believe that our products and processes are viable, beneficial, and cost effective ingredients in any Residual (Waste) Management Plans or Systems of implementation. Our technology is easily scalable and can be customized for all individual needs.

To further put things into perspective, I would like to address the following: we are addressing the Municipal Solid Waste (MSW) issues and same is not a homogenous feedstock (cute waste). There are different types of waste (MSW, agricultural, sewage sludge, toxic waste, tires, automotive shredded refuse and medical waste, amongst others). Each type of waste requires a treatment process, tailor made to optimally treat same in an environmentally benign manner. BioCrude’s proposal is geared to remedy the Municipal Solid Waste (MSW) generated on a day to day basis.

Understanding the non-homogenous nature and characteristics of the waste, we can define distinct processes to handle the varied categories of waste, once segregated with an efficient separation process. BioCrude stands out from the competition in its knowhow, composting and fungal technologies, in order to maximize the outputs of procurement, as well as minimize actual energy inputs with respect to the ongoing concern of MSW-Energy procurement process complex.

Municipal Solid Waste

All solid waste generated in an area except industrial and agricultural wastes, typically from residences, commercial or retail establishments. Sometimes includes construction and demolition debris and other special wastes that may enter the municipal waste stream. The EPA (1998c) defined municipal solid waste as “a subset of solid waste and as durable goods (e.g., appliances, tires, and batteries), non-durable goods (e.g., newspapers, books, and magazines), containers and packaging, food wastes, yard trimmings, and miscellaneous organic wastes from residential, commercial and industrial non-process sources.

The MSW can be classified in the following categories:

| a) | Organics |

| b) | Fuels |

| c) | Recyclables |

| d) | Inerts |

| e) | Miscellaneous |

Each category has its own distinct composite classification. To achieve an optimal Waste to Energy procurement, one has to analyze separately the inherent category contributions to energy yield and its correlated technological process of extraction in obtaining same in the most economical sense available; thus, the importance of segregating the MSW into the appropriate categories of distinct feedstock is of principal importance for optimal performance in the appropriate technological processes.

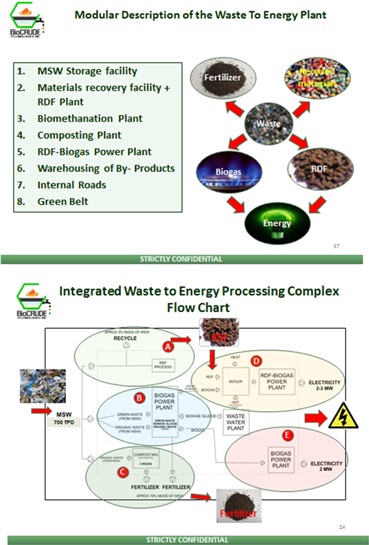

In BioCrude’s MSW-Energy initiative, BioCrude Technologies USA, Inc. incorporated the following technologies in the Integrated Municipal Waste Processing (Waste to Energy) Complex in order to optimize the treatment process in an environmentally friendly manner by whilst optimizing the Revenue Model of same, and in turn, pass some of the savings back to the municipalities while still earning an impressive bottom line in juxtaposition to what the competition has to offer with regards to landfilling and incineration:

| 1. | Separation of Waste Facility (Materials Recovery Facility) |

| 2. | Refuse Derived Fuel (“RDF”) Plant in order to handle the fuels of the MSW and produce Energy with an ash by-product |

7

| 3. | Bio-Methanation Plant in order to handle the organic fraction of the MSW (OFMSW) to produce Energy with a fertilizer by-product |

| 4. | Composting Facility (maximum 50 TPD) in order to handle a percentage of the OFMSW alongside with the small particles (plastics, ceramics...) that could not be efficiently separated within the separation process of the MSW (fuels in the Bio Methanation plant (plug flow digester) inhibit the process). The economies are no longer apparent in Composting facilities surpassing the 50 TPD capacities. |

| 5. | Power Plant |

With BioCrude’s Integrated MSW to Energy proposal/initiative, BioCrude attempts to service each category of the MSW in order to optimally utilize all renewable resources from same to procure renewable energy and marketable by-products (fertilizer, ash, etc.).

It is very important to note that the Separation Process of the MSW into the appropriate feedstock categories for each distinct process (organics for biomethanation (as well as for composting), and polymer based hydro-carbons and cellulose based products for RDF process) is of the utmost importance. Failure to do so can lead to complications and inevitable failure of each process in question. Evidence of Success and failure stories (especially with biomethanation plants, whereby the feedstock generated from MSW (organic fraction) had traces of more than 10% of polymer based products and/or inerts, thus inhibiting and/or limiting the viability of same) as can be found all over the world, and each outcome, in essence, can be summarized by Plant Technology Implementation and Feedstock Preparation (do not mix up technology viability with technology implementation and operation).

Nota Bene: With gasification and/or incineration (mass burn), MSW is dumped into the boiler “as is” and combusted at temperatures ranging from 800 – 12000C (minimum; plasma arc gasification temperatures range from 7,000 – 10,0000C). All waste is burned yielding an approximate net yield of energy for reuse (after self-consumption) of 30 – 40%. The organic fraction of the MSW (OFMSW) is burned, whereby the fertilizer potential via a biomethanation process (cooking) is substituted for an ash from the gasification/incineration process(es). Let us not even entertain what happens to the methane potential of same via gasification/incineration in lieu of biomethanation; LOST! Bottom line, “Potential Revenues” lost and operational costs of gasification/incineration processes are increased dramatically, up to the point where one has to substitute more energy (fuel) in order to sustain continuity of operation and/or to substitute the self-consumption energy requirements of the processes when the varying calorific value of a sample of the waste is deficient for same. One can do their own sensitivity analysis to evaluate same and come to their own conclusions! BioCrude’s Integrated MSW-Energy Solution evolves from first principles of Science, Chemistry, Engineering, Economics and Common Sense!

The Organics portion of the MSW is treated via a biomethanation process, whereby all methane gas is extracted for the eventual realization of renewable energy creation, and a fertilizer procured as an additional by-product, which can be marketed to the agricultural industry.

The polymer-based (hydro-carbon chain), cellulose and textiles portion of the MSW will be treated via an RDF process (a derivative of gasification, but with the incorporation of a Materials Recovery Facility (MRF) [Separation process], where we have the luxury of operating at lower temperatures (350 – 4000C) because of the separation of the MSW, i.e. lower temperatures reflects less operational self-consumption, hence more outputs (energy) for resale), whereby the thermal combustion will generate renewable energy and the by-product of ash can be marketed to the construction industry for the following purposes:

| ● | Concrete production, as a substitute material for Portland cement and sand | |

| ● | Embankments and other structural fills (usually for road construction) | |

| ● | Grout and Flowable fill production | |

| ● | Waste stabilization and solidification | |

| ● | Cement clinkers production - (as a substitute material for clay) | |

| ● | Mine reclamation | |

| ● | Stabilization of soft soils | |

| ● | Road sub base construction |

8

| ● | As Aggregate substitute material (e.g. for brick production) | |

| ● | Mineral filler in asphaltic concrete | |

| ● | Agricultural uses: soil amendment, fertilizer, cattle feeders, soil stabilization in stock feed yards, and agricultural stakes | |

| ● | Loose application on rivers to melt ice | |

| ● | Loose application on roads and parking lots for ice control | |

| ● | Other applications include cosmetics, toothpaste, kitchen counter tops, floor and ceiling tiles, bowling balls, flotation devices, stucco, utensils, tool handles, picture frames, auto bodies and boat hulls, cellular concrete, geopolymers, roofing tiles, roofing granules, decking, fireplace mantles, cinder block, PVC pipe, Structural Insulated Panels, house siding and trim, running tracks, blasting grit, recycled plastic lumber, utility poles and cross arms, railway sleepers, highway sound barriers, marine pilings, doors, window frames, scaffolding, sign posts, crypts, columns, railroad ties, vinyl flooring, paving stones, shower stalls, garage doors, park benches, |

The fly ash can also be marketed to the agricultural industry for the following purposes:

| ● | It improves permeability status of soil | |

| ● | Improves fertility status of soil (soil health) / crop yield | |

| ● | Improves soil texture | |

| ● | Reduces bulk density of soil | |

| ● | Improves water holding capacity / porosity | |

| ● | Optimizes pH value | |

| ● | Improves soil aeration and reduces crust formation | |

| ● | Provides micro nutrients like Fe, Zn, Cu, Mo, B, Mn, etc. | |

| ● | Provides macro nutrients like K, P, Ca, Mg, S etc. | |

| ● | Works as a part substitute of gypsum for reclamation of saline alkali soil and lime for reclamation of acidic soils | |

| ● | Surface cover of bio reclaimed vegetated ash pond get stabilized and can be used as recreational park | |

| ● | Ash ponds provides suitable conditions and essential nutrients for plant growth, helps improve the economic condition of local inhabitants | |

| ● | Works as a liming agent | |

| ● | Helps in early maturity of crop & improves the nutritional quality of food crop | |

| ● | Reduces pest incidence | |

| ● | Conserves plant nutrients / water |

There is a definite market for the fly ash by-product; the industry players in the global market place have to be clearly identified for the realization of commercialization. BioCrude can even offer this ash by-products pro-bono to the industry or landfill, for there is no environmental hazard of same.

The recyclables can be easily sold to the recyclable industry milieu (metals, glass, ceramics, etc.).

The balance of the inerts (Construction and Demolition Debris, gravel, sand, bricks, etc.) can either be landfilled with no negative environmental impacts, or crushed and given to companies specializing in the fabrication of construction materials (if a market is identified, BioCrude can offer them these by-products (crushed or uncrushed).

9

BioCrude’s Integrated MSW to Energy Complex for Municipal Applications

BioCrude’s solution of an Integrated Municipal Solid Waste to Energy complex is in line with the present trends in the Municipal Solid Waste (“MSW”) industry and the main advantage of same is that it is comprised of a Materials Recovery Facility (“MRF”) and different modular waste treatment processes and a power station.

The material components (modules) of an Integrated Municipal Solid Waste to Energy Complex are detailed as follows:

| 1. | Entrance to complex: Kiosk and weighbridge (reception/departure and weighing of garbage trucks (pre-and-post deposit of MSW at the MSW Storage facility). |

| 2. | MSW Storage facility: Closed and properly ventilated warehouse facility for receiving and storing just in time (JIT) 3 days’ inventory of MSW. MSW is moved from the storage facility and moved via machinery and conveyor belts to the Materials Recovery facility. | |

3. |

Materials Recovery facility (MRF): a properly ventilated facility that houses different types of machinery/equipment (either procured from suppliers or built in-situ according to plan specifications) requisite for different facets of the separation process of the MSW into the distinct categories of the waste (organics, hydro-carbon polymer based, cellulose, inerts, miscellaneous (batteries, cadavers, etc.…)) and prepare same as the distinct feedstock for the different waste treatment processes (Composting, Biomethanation and Refuse Derived Fuel (RDF)), as well as separate the recyclables for resale and the inerts (elements of construction and demolition debris that are not recyclable) for landfilling or to be crushed and given/sold (negligible in nature in comparison to the revenue model established by the tipping fees, and resale of electricity and compost) to the secondary markets for the manufacturing of building materials. |

| 4. | Composting facility: A portion of the land concession will host a type of composting system, depending on BioCrude’s evaluation of the waste analysis. A fertilizer will be procured, dried and stored in a warehousing facility for by-products. |

| 5. | Biomethanation facility: Modular digesters (to handle the organic fraction of the MSW) are constructed in series and, synchronized in operation, in order to receive organic waste and process same to extract and capture the methane gas which will be piped to the power plant (will be combusted for the procurement of renewable energy), and yield a cured fertilizer, which will be dried and stored in the warehousing facility for by-products. |

| 6. | RDF facility: A “Refuse Derived Fuel” system (gasification derivative) will be procured and installed. The RDF facility will receive the nonorganic and noninert (hydro-carbon polymer and cellulose based waste) products, that will be used to make RDF pellets (compressed and dried bricks [fuel pellets]) that will be used as the primary feedstock for combustion within same, to generate renewable energy within the power plant. |

| 7. | RDF – Biogas power plant: will be procured and installed within a certain section of the Complex with a dedicated Distributed Control System (DCS) for the MSW-Energy (RDF & Biogas based) power plant & fuel processing plant (controls & instrumentation for the boiler and turbine, instrumentation for the balance of the power plant and control room). |

10

| 8. | Internal roads: will be constructed within the complex for vehicle/truck transport/passage within the complex. |

| 9. | Green Belt: will be developed for aesthetic purposes and municipal environmental conformities. |

11

Business Model

The Company’s business model is designed to create a profitable revenue stream through the direct acquisition of Concession Agreements from different Governments for the implementation of BioCrude’s integrated MSW-Energy Complexes. Our products, processes and services, marketed to the relevant target audience, enable us, to generate multiple revenue streams and consistent profitability derived from the high gross profit inherent within the realms of our proprietary products, services and applications.

By acquiring the necessary Concession (MSW, Land and Supply of Treated Effluent) and Power Purchase Agreements (PPA), from the respective governmental authorities of a certain country, with Sovereign Guarantees (with right of subrogation), the Company will develop its Integrated Municipal Solid Waste to Energy Complex, under “BOOT” (Build, Own, Operate & Transfer) basis.

The following contractual understandings are the key prerequisite elements for establishing a mutual meeting of the minds, by and between BioCrude Technologies USA, Inc. and the governmental authorities of a municipality/country, for the successful realization of BioCrude’s MSW-Energy Complexes:

| 1. | MSW Concession for the guaranteed delivery of MSW to the Complex with an implied base tipping fee per ton (“Put or Pay”) with annual escalations for the term (30 years) of the project with an option of renewal for an additional term (30 years) and Sovereign Guarantees from the Minister of Finance endorsing same. |

| 2. | Land Lease Concession for the delivery of the required amount of land for project term (30 years), at an annual symbolic lease rate of $1/amount of land delivered/annum, with an option of renewal for an additional term (30 years). |

| 3. | Supply of Treated Effluent Concession whereby the governmental authorities will supply the necessary treated water in order to fulfill the operational requirements of the MSW to Energy complex at a negligible symbolic annual rate for the term of the project with an option of renewal for an additional term (30 years). |

| 4. | Power Purchase Agreement (PPA) [resale of procured electricity to the Power Corporation of the country in question], whereby the Power Corporation of a certain country will buy back the electricity produced by the MSW to Energy Complex at a base rate per kW-hr (“Take or Pay”), with annual escalations for the term (30 years) of the project with an option of renewal for an additional term (30 years) and Sovereign Guarantees from the Minister of Finance endorsing same. |

| 5. | Assistance from the Appropriate Governmental Ministries and Municipalities in obtaining all necessary permits and clearances for the Construction and Operation of the MSW-Energy Complex (stipulations in contracts). |

Nota Bene: Depending on country policy on foreign investment, the Company may request or be granted an exemption of taxes, levies, duties and all other relevant taxes applicable to the importation of all plant, materials, equipment and rolling stock for the Construction of the MSW-Energy complex, from the appropriate Ministries, related thereto.

All of the aforesaid Concession agreements have to be granted at the same time in order for BioCrude to successfully realize the development (Engineering, Procurement and Construction) and operation of the MSW to Energy complex (the “Sovereign Guarantees” and right of subrogation are critical and paramount for the funding requirements of the MSW to Energy complex).

Target Market

The global Waste to Energy segment of the waste management industry is the target market BioCrude addresses. Management is confident it will succeed in having its integrated systems and processes widely implemented across Africa, Asia, the Balkans, the GULF and North America with a view to expanding to other international markets (Latin America). The Company’s first step in penetrating its target market has been taken with the signing of Concession Agreements with the country of the Union of the Comoros (Autonomous Island of Grande Comore); signed January 11, 2016.

12

Strategies of the Company

BioCrude’s strategy is designed to create a “PROFITABLE” revenue stream through the direct acquisition of Concession Agreements from different Governments, for the implementation of BioCrude’s integrated MSW-Energy Complexes, or through the establishment of unique and strategic alliances via licensing arrangements and/or joint ventures within the industry milieu.

BioCrude has developed what we believe is a highly effective marketing strategy, built on a proactive direct marketing campaign with Government, large corporate facility management that target the sector for waste product treatment and reformation. The Company believes that this will result in a development of a marketing and distribution network with extensive coverage of the Company’s target market at a minimal expense, allowing the Company to reach profitability. We believe that our marketing strategy will permit us to generate an extensive customer/end user base; however, there can be no assurance that our estimate regarding acceptance of our products and services will be correct.

The Company's long-term strategy is to create economically beneficial uses for waste streams through resource transformation solutions. Since the value of marketable by-products (commodities; renewable energy, fertilizer, primary feedstock for building materials, etc.…), after processing costs, is a significant and absolute amount, in juxtaposition to disposal options (ZERO), such as landfilling or incineration, the Company believes this strategy is effective long-term. The Company believes that as carbon taxes or cap and trade systems are implemented and the demand for commodities rises, economics will further favor this strategy. The Company is also focusing on lowering the cost of resource transformation solutions by reducing its recycling processing operating costs, examining ways to mitigate commodity price fluctuations (forward contracts for marketable by-products), and developing new processing technologies. These steps will help to build an effective business model at lower commodity pricing levels.

The Company is focused on four main areas to improve the performance of base operations and hence, increase cash flow generation. They are Pricing initiatives, Cost controls and operating efficiencies, Integrated Waste to Energy development initiatives with long term Concession Agreements and, Asset Management

BioCrude has developed a number of Lobbying (Sales/Solicitation) programs and the standardization of same. We believe that the pricing logic used in our fee structures, with implied “Put or Pay” and “Take or Pay” provisions for the supply of feedstock and resale of outputs (renewable energy), respectively, is not only reasonable, but competitive. We expect to continue to add valued ameliorations to our structured fee-based pricing of products and services. The goal of our pricing program is to generate price increases in excess of CPI, whilst being competitive in nature. BioCrude will derive revenues from a combination of commodity sales (Marketable by-products – fertilizer and energy resale), carbon credits (CER’s under the auspices of a “Clean Development Mechanism” (CDM project)) and tipping (gate) and material processing fees. Fluctuations in commodity pricing are managed by a number of risk mitigation strategies including: financial hedging instruments (transfer of foreign exchange risk), floor prices, forward sales contracts, and index purchases. The goal is to optimize and stabilize the revenue stream, while still being competitive, net of cost of operations, and generate consistent positive cash flows.

The Company continues to search for the best continuous improvement practices and programs as solutions to then implement as part of its corporate governance. The goals of these practices and programs are to enhance customer service, increase safety for employees, and to reduce operating and administrative costs. The Company has implemented continuous improvement strategies, and as such, as of date, the Company has introduced select operating efficiency initiatives in safety, productivity, maintenance, customer service, environmental compliance, and procurement

Prior Activities of BioCrude Canada

Within certain countries, if an entity wants to pursue certain specialized works, it is recommended that the entity establish a presence within same (establish a corporation with a civic address). As an example, in 2009, this was done in Romania with the anticipation that BioCrude Canada would be successful in acquiring the concession agreements from the governmental authorities of Romania. BioCrude was not successful in meeting its objective in Romania for same and stopped its lobbying works for the pursuit of said engagement by and between the Governmental authorities of Romania and BioCrude for the implementation of BioCrude’s proposed MSW to Energy complex in Romania, closed its preliminary office and the corporation became dormant.

13

Since July 2008, BioCrude Canada has taken the initiative to market and promote its intellectual property and specialized technical expertise throughout the market place, both nationally and globally (we have introduced our technology to Governments and major Conglomerates in the Waste to Energy sector) in over 30 Countries worldwide, whereby BioCrude has successfully opened up dialogue with Governmental Authorities and respectable corporations for near future contractual negotiations.

In December, 2007, Jaipuria Advanced Technologies, Inc. (http://www.jaipuria-group.com and http://www. smvjaipuria.com/waste.php) of India, and BioCrude Canada, announced their formation of a new division dedicated to Waste Reformation and Energy Procurement for the purpose of pursuing contracts in India. In many areas of the country, waste management and energy shortages are a serious problem. With Jaipuria’s construction and large project experience, and with the use of the intellectual property supplied by BioCrude in terms of waste management and production of renewable energy, we have, in January 2008, submitted a bid, in response to a tender for a Waste to Energy plant (2,000 TPD) in Okhla and Tymarpur, India (we were not the selected candidate) and Indore, India (Collection and Treatment of municipal waste; 600 TPD; we were not the selected candidate).

During this time, we have also negotiated with “Pepsi Co India” to build a 50 TPD prototype in the city of Panipat, India, in a strategic joint venture alliance. A few months later, Pepsi Co India’s New President/CEO had a change of corporate venue and put aside the Waste to Energy initiative. Ever since then, BioCrude Technologies, Inc. (Canada) decided not to pursue any more works in India.

Pricing initiatives

BioCrude has developed a number of sales/solicitation programs and the standardization of the sales/solicitation process and standardized the sales/solicitation process. We believe that the pricing logic used in our fee programs, with implied “Put or Pay” and “Take or Pay” provisions for the supply of feedstock and resale of outputs (renewable energy), respectively, is reasonable and competitive. We expect to continue to add to our fee-based pricing through additional administrative fees, recycling fees, late charges and further improvements to our existing fee structures. The goal of our pricing program is to generate price increases in excess of CPI. BioCrude will derive revenues from a combination of commodity sales (Marketable by-products – fertilizer and energy resale), carbon credits (CER’s under the “Clean Development Mechanism” established pursuant to article 12 of the “Kyoto Protocol” (CDM project)) and tipping fees paid for material processing. Fluctuations in commodity pricing are managed by a number of risk mitigation strategies including: financial hedging instruments (transfer of foreign exchange risk), Sovereign Guarantees, floor prices, forward sales contracts, index purchases, and tipping fees. The goal is to smooth revenue, net of cost of products purchased, and generate consistent cash flows.

Cost controls and operating efficiencies

The Company continues to search for the best practices throughout the entire organization and then implements these solutions through standardized continuous improvement programs. The goals of these programs are to enhance customer service, increase safety for employees, and to reduce operating and administrative costs. The Company has implemented continuous improvement strategies and the introduction of select operating efficiency initiatives in safety, productivity, maintenance, customer service, environmental compliance, and procurement.

Integrated Waste to Energy development initiatives with long term Concession Agreements

BioCrude excels is the reformation of MSW using its intrinsic intellectual property as well as its expertise in Integrated Waste to Energy Processing Complexes. BioCrude has and will continue to invest time, effort and valuable resources in the pursuit of Governmental Concession (MSW, Land, Supply of Treated Effluent and Power Purchase Agreements (PPA)) Agreements, for the duration of twenty-five to thirty years, for the implementation of same. The essence of the Concession Agreements, not only guarantees the MSW and implied tipping fees, related thereto (with annual indexing), but the resale of the marketable by-products (energy to grid via PPA) for the duration of the term, with Sovereign Guarantees. Investments in Waste to Energy facilities position the Company well for the evolution of the industry from waste management to resource management.

14

Company milestones and plan of execution

BioCrude’s MSW to Energy initiative is, by definition, an “en suite” of waste management and energy procurement, whereby the latter is a marketable byproduct derived from the intrinsic processes of the treatment of the MSW by procuring the necessary constituent feedstock (primary material) to produce the renewable energy in the modular section for power generation of the Integrated MSW to Energy complex.

BioCrude’s revenue model is based on revenue generation from the following: i) the operation of MSW to Energy complexes (tipping fees, resale of renewable energy, resale of other marketable by-products (compost, recyclables) and potential carbon credits, ii) Joint Venture license fees, whereby the prospective Joint Venture partner will buy a license from BioCrude (payment to be effected immediately after signature) for their participation in the consortium and will infuse its prorated share of equity capital for the potential MSW to Energy complex, and iii) EPC (“Engineering, Procurement & Construction) management fees (general contracting fees, approximately 20% of the capital cost of the project).

In order to realize an integrated MSW to Energy complex, as defined in the “Business Model”, all Concession Agreements (guarantee of MSW supply, Land and Supply of Treated Effluent) as well as a Power Purchase Agreement must be contracted concurrently, for they are “ALL” necessary constituent elements for the development of an integrated MSW to Energy complex.

In order to acquire the concessions for Biocrude waste management (MSW to Energy), major lobbying must be done in all levels of government and ministries (e.g., Biocrude’s waste management project is an environmental project thus requiring the intervention of the Ministry of Environment, renewable energy is procured, hence requiring the intervention of the Ministry of Energy/Power and Power Corporation (usually crown corporation), the municipalities usually are responsible for the granting of the MSW, Land and Supply of Treated Effluent Concessions and the Ministry of Finance is responsible for the signing of the Sovereign Guarantees, and in some instance, countries might have other intervening governmental agencies).

BioCrude has positioned itself, through its continual lobbying efforts (ongoing), for potential Joint Ventures (JV) with certain governments (countries/clients). Should any of these Joint Ventures prove to be realized because of the persistent lobbying activities, not only will BioCrude be able to realize the EPC management fee for the development of the MSW to Energy complex(es), but it will also receive its prorate share (50%) of the revenue stream of the developed MSW to Energy complex(es), with similar time frame frequencies as mentioned above, as well as a license fee (BioCrude already submitted offers) immediately following signature of the Joint Venture engagement and the Concession and Power Purchase agreements. BioCrude anticipates, that if the prospective JV partner(s) take the initiative to implement (not only entertain) a waste management solution for their country, possible engagement can be realized within 6 to 12 months following that initiative (being cognizant of bureaucracy and red tape procedures of government).

A vote of confidence has been bestowed to BioCrude by the governmental authorities of the Autonomous Island of Grande Comore on its proposed integrated waste management solution for the Autonomous Island of Grande Comore through the awarding of the necessary Concession Agreements (delivery of MSW, Land and Supply of Treated Effluent) for 30 years (with a renewal option of 30 years) with Sovereign Guarantees for the implementation (design, build, finance and operate) of a 700 TPD Municipal Solid Waste to Energy Complex, in the city of Moroni, Autonomous Island of Grande Comore, Union of the Comoros. Furthermore, a Power Purchase Agreement has been signed with the “Le Gestion de l’Eau et de l’Électricité aux Comores (MA-MWE)” whereby same will buy back all procured renewable energy from the MSW to Energy complex for the term of the Concessions (and renewal option).

BioCrude, subject to its contractual engagement with the Government of the Autonomous Island of Grande Comore for the implementation of a 700 TPD MSW to Energy complex in Moroni, Grande Comore, through the financing provisions of the MSW to Energy project, will earn the EPC management/general contracting fee of approximately twenty percent (20%) of the capital cost of the MSW to Energy project (prorated over the duration of the construction period), i.e., commencing within 6 to 8 months from these presences.

15

Nota Bene: For the Union of the Comoros, the Company is still awaiting documents from the Federal Governmental Authorities stating that the Federal Government is the new Intervening Party to the Concession(s) agreements previously signed with the Governorate (province; autonomous region) of Moroni, after the outcome of the Federal Referendum, whereby through same, contracting and economic powers are transferred from the Governorate (Province) level to that of Federal level. The Referendum outcome favored the Federal Government over that of the Governorate (Autonomous) Region of Moroni, i.e., authorizing documents are still pending.

BioCrude, as well, is looking at approximately 24 to 26 months (development time frame for the realization of MSW to Energy complex) before it can start generating absolute, guaranteed revenues from the operation of the MSW to Energy complex(es) (tipping fees/fees from the resale of marketable by-products (compost, ash, primary feedstock for building materials (inerts), recyclables, etc…), resale of renewable energy and carbon emission reduction credits [CERs]), servicing the waste management needs of the Government of the Union of the Comoros, as per the provisions and stipulations of the contractual engagements with the government (with implied sovereign guarantees), for a minimum guaranteed term of 30 years (and an option for an additional 30 years).

BioCrude is evaluating additional options for funding (capital markets, financial institutions, contracting companies, pension funds, etc.…amongst other financially engineered hybrid scenarios thereof) and has already opened up dialogue regarding same. BioCrude has received a term sheet for the funding of the MSW to Energy project for the Union of the Comoros, ergo, BioCrude will shortly be able to commence works for ground breaking and start receiving its EPC management fee as its first projected revenue stream on a prorate schedule subject to a disbursement schedule in accordance to the terms and stipulations of the expected offer of funding.

Hereunder is a schedule of events (agenda) for the realization (full execution) of the MSW to Energy project in Moroni, Autonomous Island of Grande Comore (inclusive: contract realization process), in order for BioCrude to start realizing revenues as an ongoing concern, not taking into account any prospective joint ventures in the works.

Different facets and schedule of events for the pursuit and realization of MSW to Energy projects (excluding lobbying activities)

Contract Conclusion, Engineering, Procurement& Construction

A. Signature of the following Accords necessary for the realization of the MSW-Energy Complex in Moroni, Autonomous Island of Grande Comore

1. |

Deed of Assignment Agreement (“Protocol of Engagement”) by and between the Government of the Autonomous Island of Grande Comore and BioCrude Technologies USA, Inc. Contract was signed January 11, 2016. |

| 2. | The signing of the Concession Agreement for the Municipal Solid Waste, Land Lease Agreement and Agreement for the supply of treated Municipal Water on January 11, 2016 |

| 3. | The signing of the Power Purchase Agreement (PPA) with the “Le Gestion de l’Eau et de l’Électricité aux Comores (MA-MWE)” [ Power Corporation of the Autonomous Island of Grande Comore] on January 11, 2016 |

| 4. | Opening of a new Comorian Corporation (in the country in question) totally owned by BioCrude Technologies USA, Inc., opening of bank account and execution of all party obligations contained in the Deed of Assignment. This was done on January 12, 2016 |

| 5. | Reception of letter from new governmental administration of the Autonomous Island of the Grande Comore (after elections on May 2016) reaffirming their initiative and will to fully respect and execute the engagements signed on January 11, 2016; August 25, 2016 |

| 6. | Site selection (site Identification and legal designation (Cadastral, Lot, etc. ...)) for the MSW-Energy Complex, preparation of legal documents to annex same to the Land Lease Agreement and Assignment of selected parcel of land to BioCrude, as per the stipulations of the Land Concession agreement on November 12, 2016. | |

| 7. | Incorporating agreed to amendments and/or modifications to the contractual engagements of January 11, 2016 into the new agreements replacing those of January 11, 2016: December 9, 2016. |

| 8. | Granting of a Treasury Guarantee to BioCrude from the governmental administration of the Autonomous Island of the Grande Comore, as per the stipulations of the Concession and Power Purchase Agreements: December 10, 2016 |

16

(Fully executed; timeline: it took approximately 8 months)

B. Organizational Matrix: Construction, Management, Operations and Maintenance of Project

| 1. | Flowchart of management staff |

| 2. | Organization of the Waste Management (Collection, Transportation, Sorting and Treatment) | |

| 3. | Flowchart of Engineering, Procurement and Construction | |

4. |

Flowchart of Operations Complex and Maintenance |

| 5. | Flowchart for the influx of feedstock and the out flux (distribution) of by-products |

(Fully executed; timeline: The tasks identified above in B are part and parcel of the submitted preliminary proposal, which included the “Prefeasibility Study & Detailed Project Report” and the “Business Plan (with financial metrics)”, to the Governmental Authorities of the Autonomous Island of Grande Comore (September 2015) for the realization of the Concession and Power Purchase Agreements in accordance to the provisions of the Deed of Assignment pursuant to a Public-Private Partnership (PPP)).

C. Project implementation plan for the Integrated Municipal Solid Waste to Energy Complex

| 1. | Opening of the office in Moroni, Autonomous Island of Grande Comore: expected completion date September 2021 |

| 2. | Recruitment and training of human resources in Moroni, Autonomous Island of Grande Comore (for engineering, management, operation and maintenance): expected completion date September 2021 (preliminary core) |

| 3. | Recruitment of human resources in Canada (for key management positions): expected completion date September 2021 |

| 4. | Preliminary Engineering: completed in preliminary proposal (generic) |

| 5. | Analysis of Municipal Solid Waste: expected completion date September 2021 |

| 6. | Study of the site and soil studies: expected completion date October 2021 |

| 7. | Detailed Engineering plans: expected completion date October 2021 |

| 8. | Detailed plan of the development strategy of the complex: expected completion date October 2021 |

| 9. | Hiring of project manager(s) and subcontractors (either through reference or through tender): expected completion date September 2021 |

| 10. | Recruitment of Material and Equipment specialist suppliers, via reputation in the market place or tender: expected completion date October 2021 |

(Timeline: 6 to 8 months from time = present)

D. Human Resource List for Project Implementation

| 1. | Project management |

| 2. | Civil Engineers |

17

| 3. | Structural Engineers |

| 4. | Electrical Engineers | |

5. |

Mechanical Engineers |

| 6. | Environmental Engineers |

| 7. | Geological Engineers

| |

| 8. | Designers

| |

| 9. | Architects

| |

| 10. | Planners |

| 11. | Buyers |

| 12. | Supply Agents |

| 13. | Cost Controllers |

| 14. | Training Coach |

(Timeline: 2 to 4 months from time = present)

E. Development and implementation of the EPC project guide (Engineering, Procurement and Construction)

| 1. | Program Implementation Plan (Project Execution Plan "PEP") Completed |

| 2. | Preparation of studies and preliminary engineering plans Completed |

| 3. | Preparation of studies and detailed engineering design 3 months following task D |

| 4. | Planning and timetable for the project (Gantt Chart) 3 months following task D |

| 5. | Obtaining permits and governmental approvals and clearances for the construction and operation of the complex 2 months following submission of detailed engineering plans to the related Governmental Agencies of the Union of the Comoros (timeline provision in agreements and signed off by the Governmental Authorities of the Union of the Comoros) |

| 6. | Construction 10 to 14 months following the execution of E.5. above incorporating a startup synchronization period of approximately 1 to 2 months |

| 7. | Operation and Maintenance Complex NA for Development timeline |

F. Project Management and Control: Project Implementation Plan (PIP)

| 1. | A preliminary feasibility study and a detailed report of the complex Completed |

| 2. | Strategic planning and economic analysis Completed |

| 3. | The selection of the field Completed |

18

| 4. | Preliminary engineering Completed |

| Ø | Economic analysis and project risks |

| Ø | The estimate of the total capital investment as well as operating and maintenance costs |

| Ø | The preliminary assessment of environmental impact and permitting requirements |

| Ø | The technology research, analysis and conceptualization |

| 5. | Reliability analysis Completed | |

6. |

The technology selection, project configuration and sizing Concurrently with task E.3. and its timeline |

| 7. | The studies and engineering plans for the environmental permitting Concurrently with task E.3. and its timeline | |

8. |

Research Techniques Concurrently with task C and its timeline |

| 9. | The strategy and planning for the reduction of emissions of greenhouse gases (GHG) Concurrently with task C and its timeline |

| 10. | The preparation of the Clean Design Mechanism documents for submission to the CDM program (literature and the detailed report for project compliance with the standards and requirements established by the UNFCCC) Concurrently with task C and its timeline |

| 11. | Carbon capture and storage Concurrently with task C and its timeline |

| 12. | The carbon credit analysis Concurrently with task C and its timeline |

| 13. | Energy efficiency Concurrently with task C and its timeline |

| 14. | The analysis of the applicable regulations Concurrently with task C and its timeline |

| 15. | The economic and financial analysis (Business Plan) for the preparation of the application for funding Completed; we have already opened up dialogue with an EPC firm for not only engaging same for the EPC works, but also financing same under the proviso of BioCrude subrogating its right to the Sovereign Guarantees; waiting for proforma proposal from EPC firm |

| 16. | The selection for the companies to carry out the civil works, and procure materials and equipment required for the development of the project (initiate works) Completed; we have already opened up dialogue with an EPC firm for not only engaging same for the EPC works, but also financing same under the proviso of BioCrude subrogating its right to the Sovereign Guarantees; awaiting for proforma proposal from EPC firm |

| 17. | The management and supervision of the project 10 to 14 months; duration of EPC works |

| 18. | The operation and maintenance of the MSW-Energy complex NA for Development timeline |

| 19. | The invoice, receipt and payment collection NA for Development timeline |

| 20. | Organization of briefings to the public NA for Development timeline |

G. Environmental Impacts Analysis

The evaluation process:

| 1. | The assessment of critical elements used in the development of the project, emissions harmful to the environment, leaching into soil, drainage, etc.… |

19

| 2. | Potential erosion, the effects of the use and release of public waters on the tributaries, the adjacent ecological systems to the site, etc.… |

| 3. | The number of vehicles (trucks, cars, etc.…) and emissions of pollutants |

| 4. | The energy used in the complex and cooling of various buildings |

| 5. | Materials used for the manufacture of the floor |

| 6. | Building materials used for roofs |

| 7. | Management and treatment of municipal solid waste (MSW) | |

8. |

The quality of water and air | |

9. |

The negative environmental impacts and mitigation, thereof |

| 10. | Analysis of existing site and the impact of adverse effects thereon, for the development of the MSW-Energy complex so as to minimize the impact thereof |

| 11. | Effect of development on sensitive regional systems sent by either air or by ground water systems |

(Fully executed; timeline: Part and parcel of the submitted preliminary proposal (“Prefeasibility Study & Detailed Project Report” incorporating an “Environmental Impact Analysis”) to the Governmental Authorities of the Autonomous Island of Grande Comore for the realization of the Concession and Power Purchase Agreements in accordance to the provisions of the Deed of Assignment pursuant to a Public-Private Partnership (PPP); the Environmental Impact Analysis was acceptable to the Governmental Authorities of the Autonomous Island of Grande Comore, hence no caveats, provisions or stipulations related thereto are within the signed contractual agreements).

Planning and Timetable for the Project

The Summary forecast for the following tasks of the project planning encompasses a timeline of 6 to 8 months:

| Ø | Analysis of the composition and characteristics of municipal solid waste, |

| Ø | Study and preparation of plans for the preliminary engineering, |

| Ø | Study and preparation of detailed plans of Engineering. |

The Summary forecast for the Construction & synchronization of different modules in the MSW to Energy complex of the project planning encompasses a timeline of 16 to 18 months (incorporating approximately 4 months for project preparation for ground breaking ceremony).

Material Agreements

We have filed (with SEC as part of the Company’s S-1(/A) registration statement(s)) our Material Agreements (the Deed of Assignment pursuant to a Public-Private Partnership (PPP), the Power Purchase Agreement (PPA), and MSW, Land and Supply of Treated Effluent Concession Agreements), with SEC as part of the Company’s S-1(/A) registration statement(s), respectively by and between the Governmental Authorities of the Grande Comore and BioCrude.

January 2016 – Concluded Engagements: signed Deed of Assignment pursuant to a Public-Private Partnership (PPP), MSW, Land and Supply of Treated Effluent Concession Agreements and a Power Purchase Agreement (PPA), by and between the Government of the Autonomous Island of Grande Comore and BioCrude Technologies USA, Inc., for the implementation of the first Waste to Energy complex in the municipality of Moroni, which are as follows:

| Ø | Deed of Assignment pursuant to a Public-Private Partnership (PPP): exclusively assigning the rights of waste management treatment to BioCrude via the inter-related specific concession vehicles, all defining protocol and mode of engagement as well as rights, interests and obligations of each engaging entity for the term of engagement (30 years) with an option of renewal for an additional term (30 years). Contract was signed January 11, 2016 and amended on December 9, 2016. |

20

| Ø | MSW Concession* for the guaranteed delivery of MSW to the Complex with an implied base tipping fee per ton of MSW (“Put or Pay” for the minimum MSW guarantee of 700 TPD) with annual escalations for the term (30 years) of the project with an option of renewal for an additional term (30 years) and Sovereign Guarantees from the Minister of Finance endorsing same. Contract was signed January 11, 2016 and amended on December 9, 2016. | |

Ø

|

Land Lease Concession for the delivery of the required amount of land for project term (30 years), at an annual symbolic lease rate of $1/amount of land delivered/annum, with an option of renewal for an additional term (30 years). Contract was signed January 11, 2016 and amended on December 9, 2016. |

| Ø | Supply of Treated Effluent Concession whereby the governmental authorities will supply the necessary treated water in order to fulfill the operational requirements of the MSW to Energy complex at a negligible symbolic annual rate for the term of the project with an option of renewal for an additional term (30 years). Contract was signed January 11, 2016 and amended on December 9, 2016. |

| Ø | Power Purchase Agreement (PPA)* [resale of procured electricity to the Power Corporation of the country in question], whereby the Power Corporation of a certain country will buy back the electricity produced by the MSW to Energy Complex at a base rate per kW-hr (“Take or Pay” for all of the renewable energy procured less the self-consumption needs of the MSW-Energy complex), with annual escalations for the term (30 years) of the project with an option of renewal for an additional term (30 years) and Sovereign Guarantees from the Minister of Finance endorsing same. Contract was signed January 11, 2016 and amended on December 9, 2016. |

*A Revolving Letter of Credit (RLC), replenished quarterly (for the duration of the term of the contractual engagements) will be issued by the Governmental Authorities of the Autonomous Island of the Grande Comore (a temporary Treasury bond has been issued to BioCrude on December 10, 2016, which will be replaced by the RLC), as per the provisions and stipulations of the contractual engagements (submitted to the SEC), as a default payment mechanism guarantee, in the event of nonpayment of the tipping fees or for the purchase of the renewable energy, which can immediately, after default, be drawn upon, to remedy default. The face value of the RLC is to cover the tipping fees and resale of electricity payments for a whole year, multiplied by a factor of 1.5.

* On July 27, 2017, the Governmental Authorities of the Autonomous Island of the Grande Comore have issued to BioCrude a “Treasury Bond”, with supporting literature (indenture, resolutions, etc.…; as filed with SEC as part of the Company’s S-1(/A) registration statement(s), as well as other in other Form filings) baring a face value of twenty million United States Dollars (20,000,000 USD), in lieu of a “Revolving Letter of Credit (RLC)”, replenished quarterly (for the duration of the term of the contractual engagements), as per the provisions and stipulations of the contractual engagements (Concessions and Power Purchase Agreements). This Treasury Bond serves as a default payment mechanism guarantee, in the event of nonpayment of the Governmental Authorities of the Autonomous Island of the Grande Comore’s financial contractual obligations (tipping fees and/or fees due for the purchase of the renewable energy), which same can immediately, after default, be executed upon by BioCrude, to remedy default.