Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Shutterstock, Inc. | a2020-q4_exx991xpressrelea.htm |

| 8-K - 8-K - Shutterstock, Inc. | sstk-20210211.htm |

Please remember this information is confidential. Fourth Quarter and Full Year 2020 February 11, 2021

2 This presentation contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on our management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include information concerning Shutterstock, Inc.’s (the “Company’s”) possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, effects of COVID-19, the effects of competition and guidance for the full year 2021. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “guidance,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve estimates, known and unknown risks, uncertainties and other factors that may or may not prove to be correct, and that are subject to contingencies outside our control and that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date made, and readers are cautioned not to place undue reliance on such statements. You should read our public filings with the Securities and Exchange Commission, including the Risk Factors set forth therein and the documents that we have filed as exhibits to those filings, completely and with the understanding that our actual future results may be materially different from what we currently expect. You should not place undue reliance on any forward- looking statements contained on this site. Except as required by law, we assume no obligation to update these forward-looking statements to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. The information contained on this site does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or the solicitation of any vote or approval. Any such offer or solicitation would be made only by means of a registration statement (including a prospectus) filed with the U.S. Securities and Exchange Commission, after such registration statement becomes effective. Forward-Looking Statements

3 To supplement our consolidated financial statements presented in accordance with the accounting principles generally accepted in the United States, or GAAP, Shutterstock's management considers certain financial measures that are not prepared in accordance with GAAP, collectively referred to as non-GAAP financial measures, including adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth on a constant currency basis (expressed as a percentage), billings and free cash flow. We define adjusted EBITDA as net income adjusted for depreciation and amortization, non-cash equity-based compensation, foreign currency transaction gains and losses, expenses related to long-term incentives and contingent consideration related to acquisitions, interest income and expense and income taxes; adjusted EBITDA margin as the ratio of adjusted EBITDA to revenue; adjusted net income as net income adjusted for the impact of non-cash equity-based compensation, the amortization of acquisition-related intangible assets, expenses related to long-term incentives and contingent consideration related to acquisitions and the estimated tax impact of such adjustments; adjusted net income per diluted common share as adjusted net income divided by weighted average diluted shares; revenue growth on a constant currency basis (expressed as a percentage) as the increase in current period revenues over prior period revenues, utilizing fixed exchange rates for translating foreign currency revenues for all periods in the comparison; billings as revenue adjusted for the change in deferred revenue during the period; and free cash flow as cash provided by operating activities, adjusted for capital expenditures, content acquisition, and, and with respect to the year ended December 31, 2020, a payment associated with long-term incentives related to our 2017 acquisition of Flashstock Technology, Inc. ("Flashstock"). These figures have not been calculated in accordance with GAAP and should be considered only in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results. We caution investors that non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Shutterstock's management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth on a constant currency basis (expressed as a percentage), billings and free cash flow are useful to investors because these measures enable our investors to analyze our operating results on the same basis as that used by management. Additionally, management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income and adjusted net income per diluted share provide useful information to investors about the performance of the Company’s overall business because such measures eliminate the effects of unusual or other infrequent charges that are not directly attributable to Shutterstock's underlying operating performance; and revenue growth on a constant currency basis (expressed as a percentage) provides useful information to investors by eliminating the effect of foreign currency fluctuations that are not directly attributable to Shutterstock’s operating performance. Management also believes that providing these non-GAAP financial measures enhances the comparability for investors in assessing Shutterstock's financial reporting. Shutterstock's management believes that free cash flow is useful for investors because it provides them with an important perspective on the cash available for strategic measures, after making necessary capital investments in property and equipment to support the Company’s ongoing business operations and after excluding the impact of nonrecurring payments associated with long-term incentives related to our 2017 acquisition of Flashstock, and provides them with the same measures that management uses as the basis for making resource allocation decisions. Shutterstock's management also uses the non-GAAP financial measures adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted net income per diluted share, revenue growth on a constant currency basis (expressed as a percentage), billings and free cash flow, in conjunction with GAAP financial measures, as an integral part of managing the business and to, among other things: (i) monitor and evaluate the performance of Shutterstock’s business operations, financial performance and overall liquidity; (ii) facilitate management’s internal comparisons of the historical operating performance of its business operations; (iii) facilitate management’s external comparisons of the results of its overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (iv) review and assess the operating performance of Shutterstock’s management team and, together with other operational objectives, as a measure in evaluating employee compensation and bonuses; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. Reconciliations of the differences between adjusted EBITDA, adjusted net income, billings and free cash flow, and the most comparable financial measures calculated and presented in accordance with GAAP, is presented immediately following the "Liquidity and Capital Allocation" slide. We do not provide a reconciliation of adjusted EBITDA guidance to net income guidance or a reconciliation of adjusted net income per diluted share guidance to net income per diluted share guidance, because we are unable to calculate with reasonable certainty the impact of potential future transactions, including, but not limited to, capital structure transactions, restructuring, acquisitions, divestitures or other events and asset impairments, without unreasonable effort. These amounts depend on various factors and could have a material impact on net income and net income per diluted share, but may be excluded from adjusted EBITDA and adjusted net income per diluted share. In addition, we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. Non-GAAP Financial Measures

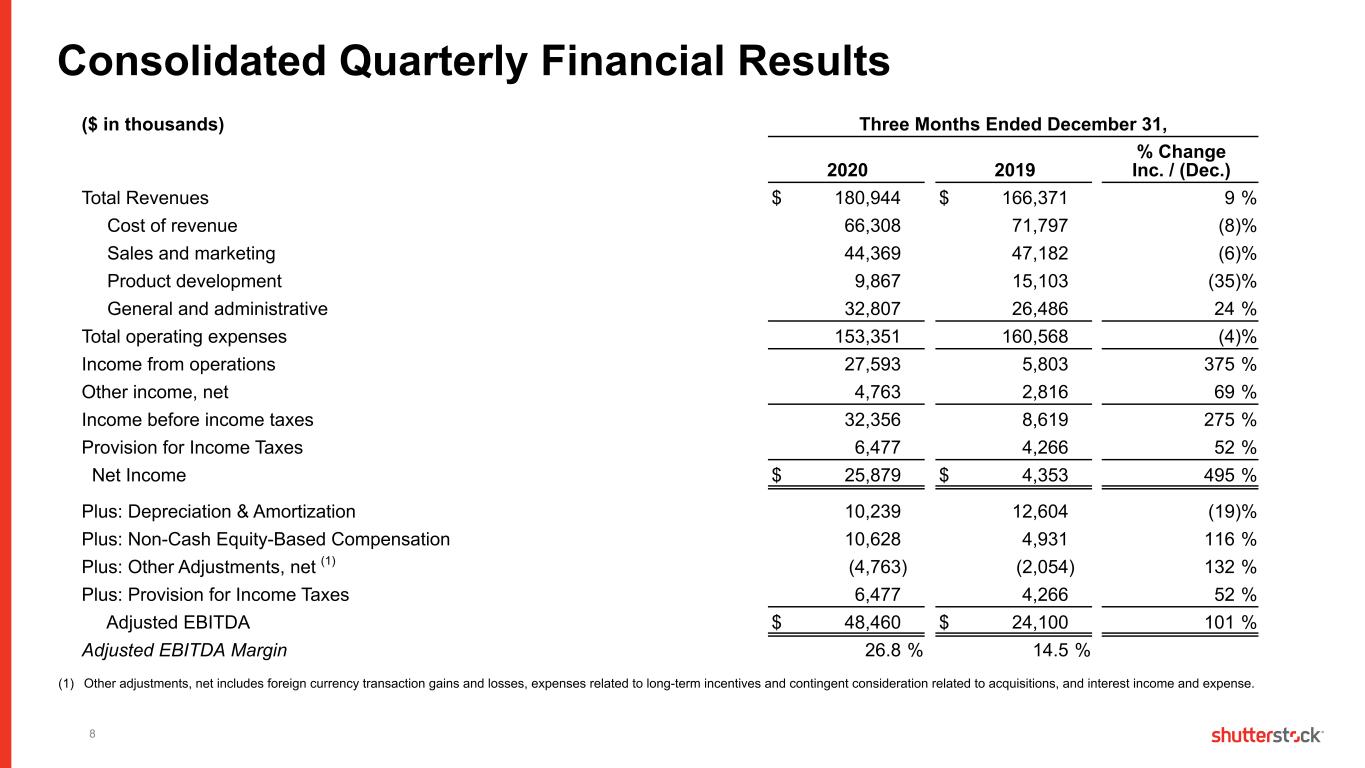

4 Compared to Fourth Quarter 2019: • Revenue increased 9% to $180.9 million. ▪ On a constant currency basis, revenue increased 7%. • Net income increased 495% to $25.9 million. • Adjusted EBITDA increased 101% to $48.5 million. • Net income per diluted share increased by $0.58 to $0.70. • Adjusted net income per diluted share increased by $0.67 to $0.93. • Cash provided by operating activities of $64.8 million in 2020 compared to $25.6 million in 2019. • Free cash flow was $58.6 million in 2020 compared to $17.6 million in 2019. Fourth Quarter 2020 Financial Highlights

5 Compared to Fourth Quarter 2019: • Subscribers increased 45%, to 281,000. • Subscriber revenue increased 18%, to $71.1 million. • Average revenue per customer (LTM) increased 0.9% to $333. • Paid downloads decreased 4% to 45.8 million. • Image library expanded to over 360 million images, up 15%. • Footage library expanded to over 21 million footage clips, up 24%. • More than 1.6 million contributors made their images, footage clips and music tracks available on Shutterstock’s platform, compared to over 1.1 million in the prior year. • More than 2.0 million customers contributed to revenue over the past 12 months, up from over 1.9 million last year. Fourth Quarter 2020 Operating Highlights

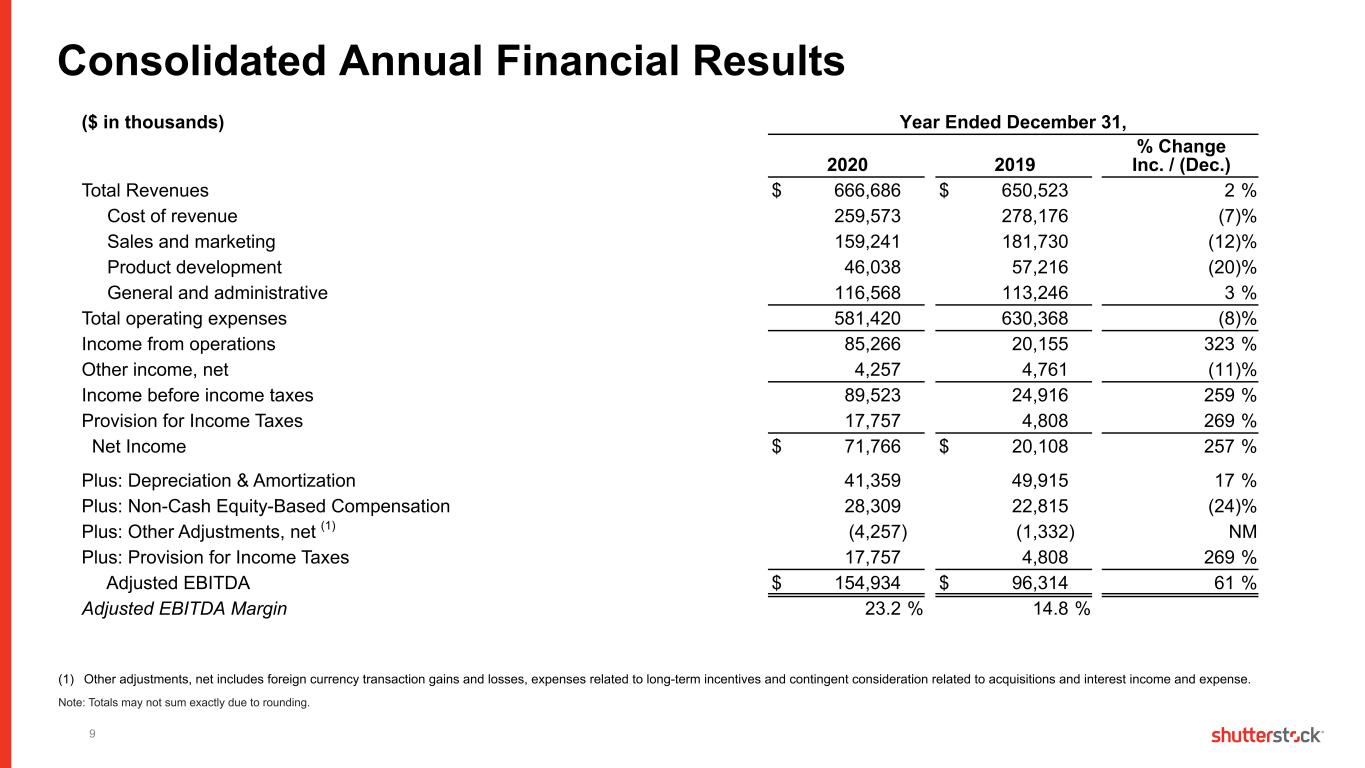

6 Full Year 2020 Financial Highlights Compared to full year 2019: • Revenue increased 2% to $666.7 million. ◦ Foreign currency fluctuations did not have a significant impact on full year 2020 revenues. • Net income increased 257% to $71.8 million. • Adjusted EBITDA increased 61% to $154.9 million. • Net income per diluted share increased by $1.40 to $1.97. • Adjusted net income per diluted share during the year increased by $1.39 to $2.62. • Cash provided by operating activities of $165.1 million compared to $102.6 million. • Free cash flow was $144.2 million in 2020 compared to $73.2 million in 2019.

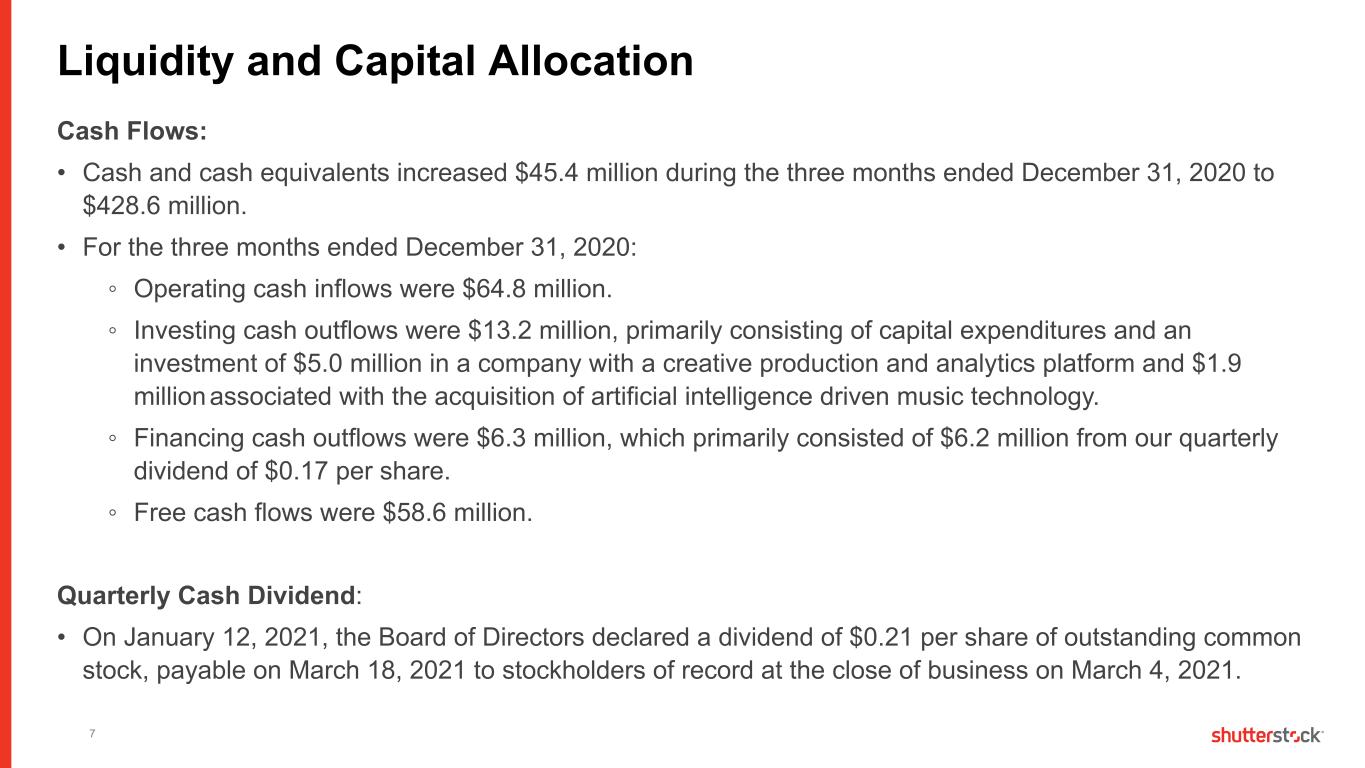

7 Liquidity and Capital Allocation Cash Flows: • Cash and cash equivalents increased $45.4 million during the three months ended December 31, 2020 to $428.6 million. • For the three months ended December 31, 2020: ◦ Operating cash inflows were $64.8 million. ◦ Investing cash outflows were $13.2 million, primarily consisting of capital expenditures and an investment of $5.0 million in a company with a creative production and analytics platform and $1.9 million associated with the acquisition of artificial intelligence driven music technology. ◦ Financing cash outflows were $6.3 million, which primarily consisted of $6.2 million from our quarterly dividend of $0.17 per share. ◦ Free cash flows were $58.6 million. Quarterly Cash Dividend: • On January 12, 2021, the Board of Directors declared a dividend of $0.21 per share of outstanding common stock, payable on March 18, 2021 to stockholders of record at the close of business on March 4, 2021.

8 Consolidated Quarterly Financial Results (1) Other adjustments, net includes foreign currency transaction gains and losses, expenses related to long-term incentives and contingent consideration related to acquisitions, and interest income and expense. ($ in thousands) Three Months Ended December 31, 2020 2019 % Change Inc. / (Dec.) Total Revenues $ 180,944 $ 166,371 9 % Cost of revenue 66,308 71,797 (8) % Sales and marketing 44,369 47,182 (6) % Product development 9,867 15,103 (35) % General and administrative 32,807 26,486 24 % Total operating expenses 153,351 160,568 (4) % Income from operations 27,593 5,803 375 % Other income, net 4,763 2,816 69 % Income before income taxes 32,356 8,619 275 % Provision for Income Taxes 6,477 4,266 52 % Net Income $ 25,879 $ 4,353 495 % Plus: Depreciation & Amortization 10,239 12,604 (19) % Plus: Non-Cash Equity-Based Compensation 10,628 4,931 116 % Plus: Other Adjustments, net (1) (4,763) (2,054) 132 % Plus: Provision for Income Taxes 6,477 4,266 52 % Adjusted EBITDA $ 48,460 $ 24,100 101 % Adjusted EBITDA Margin 26.8 % 14.5 %

9 Consolidated Annual Financial Results (1) Other adjustments, net includes foreign currency transaction gains and losses, expenses related to long-term incentives and contingent consideration related to acquisitions and interest income and expense. Note: Totals may not sum exactly due to rounding. ($ in thousands) Year Ended December 31, 2020 2019 % Change Inc. / (Dec.) Total Revenues $ 666,686 $ 650,523 2 % Cost of revenue 259,573 278,176 (7) % Sales and marketing 159,241 181,730 (12) % Product development 46,038 57,216 (20) % General and administrative 116,568 113,246 3 % Total operating expenses 581,420 630,368 (8) % Income from operations 85,266 20,155 323 % Other income, net 4,257 4,761 (11) % Income before income taxes 89,523 24,916 259 % Provision for Income Taxes 17,757 4,808 269 % Net Income $ 71,766 $ 20,108 257 % Plus: Depreciation & Amortization 41,359 49,915 17 % Plus: Non-Cash Equity-Based Compensation 28,309 22,815 (24) % Plus: Other Adjustments, net (1) (4,257) (1,332) NM Plus: Provision for Income Taxes 17,757 4,808 269 % Adjusted EBITDA $ 154,934 $ 96,314 61 % Adjusted EBITDA Margin 23.2 % 14.8 %

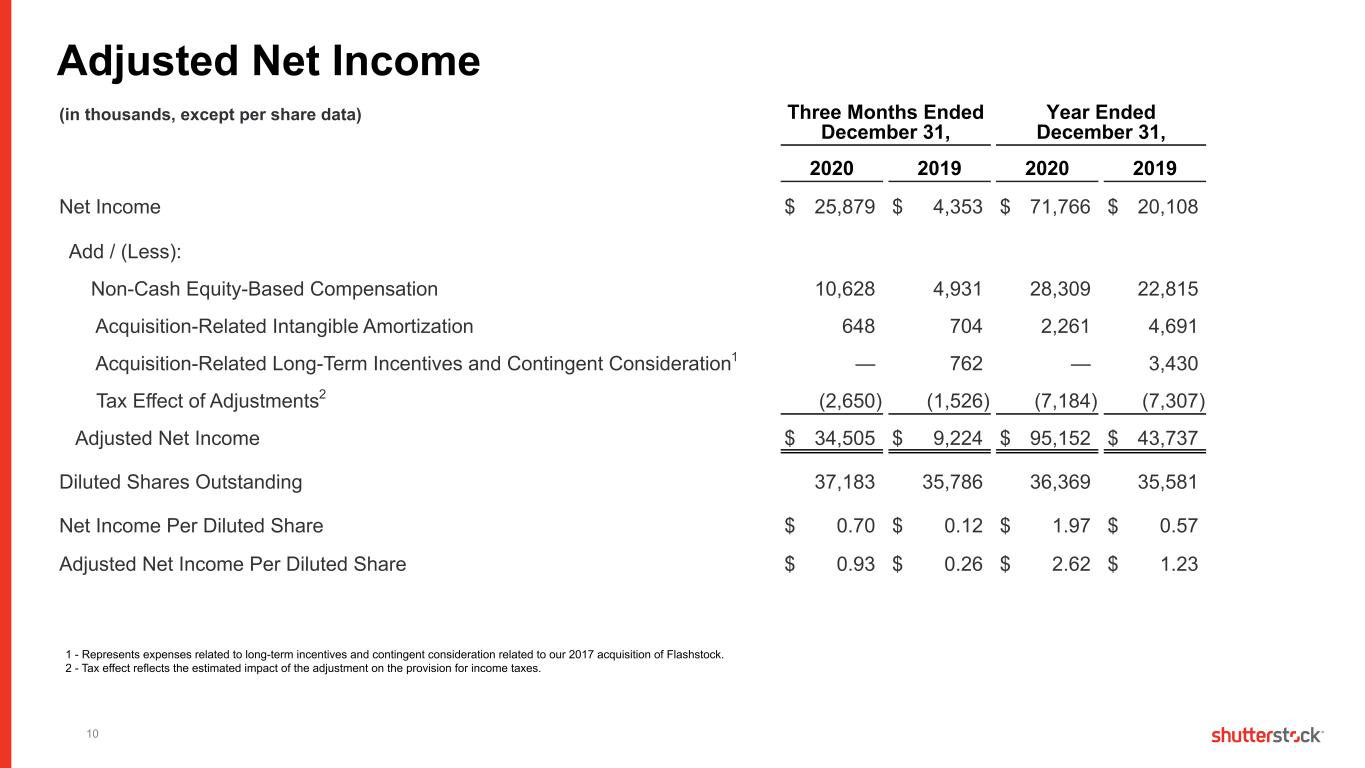

10 Adjusted Net Income (in thousands, except per share data) Three Months Ended December 31, Year Ended December 31, 2020 2019 2020 2019 Net Income $ 25,879 $ 4,353 $ 71,766 $ 20,108 Add / (Less): Non-Cash Equity-Based Compensation 10,628 4,931 28,309 22,815 Acquisition-Related Intangible Amortization 648 704 2,261 4,691 Acquisition-Related Long-Term Incentives and Contingent Consideration1 — 762 — 3,430 Tax Effect of Adjustments2 (2,650) (1,526) (7,184) (7,307) Adjusted Net Income $ 34,505 $ 9,224 $ 95,152 $ 43,737 Diluted Shares Outstanding 37,183 35,786 36,369 35,581 Net Income Per Diluted Share $ 0.70 $ 0.12 $ 1.97 $ 0.57 Adjusted Net Income Per Diluted Share $ 0.93 $ 0.26 $ 2.62 $ 1.23 1 - Represents expenses related to long-term incentives and contingent consideration related to our 2017 acquisition of Flashstock. 2 - Tax effect reflects the estimated impact of the adjustment on the provision for income taxes.

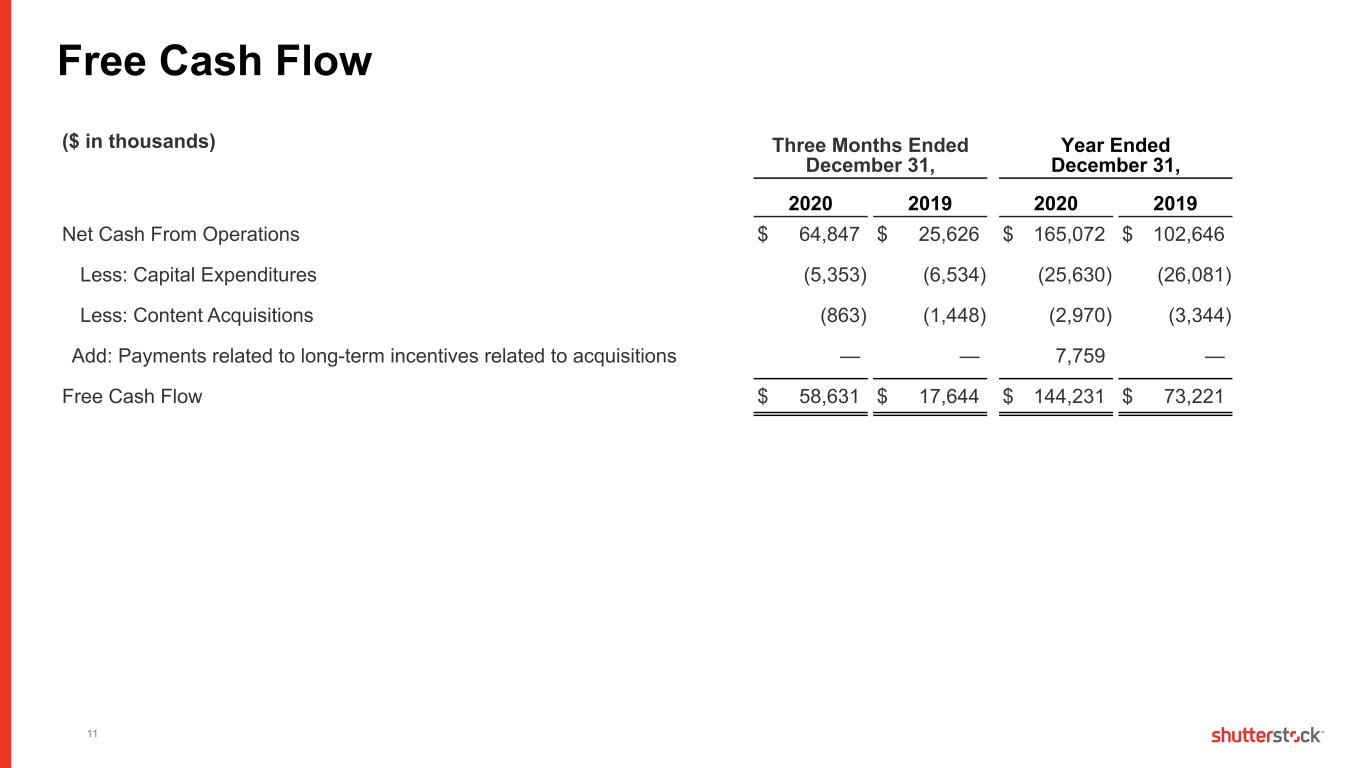

11 Free Cash Flow ($ in thousands) Three Months Ended December 31, Year Ended December 31, 2020 2019 2020 2019 Net Cash From Operations $ 64,847 $ 25,626 $ 165,072 $ 102,646 Less: Capital Expenditures (5,353) (6,534) (25,630) (26,081) Less: Content Acquisitions (863) (1,448) (2,970) (3,344) Add: Payments related to long-term incentives related to acquisitions — — 7,759 — Free Cash Flow $ 58,631 $ 17,644 $ 144,231 $ 73,221

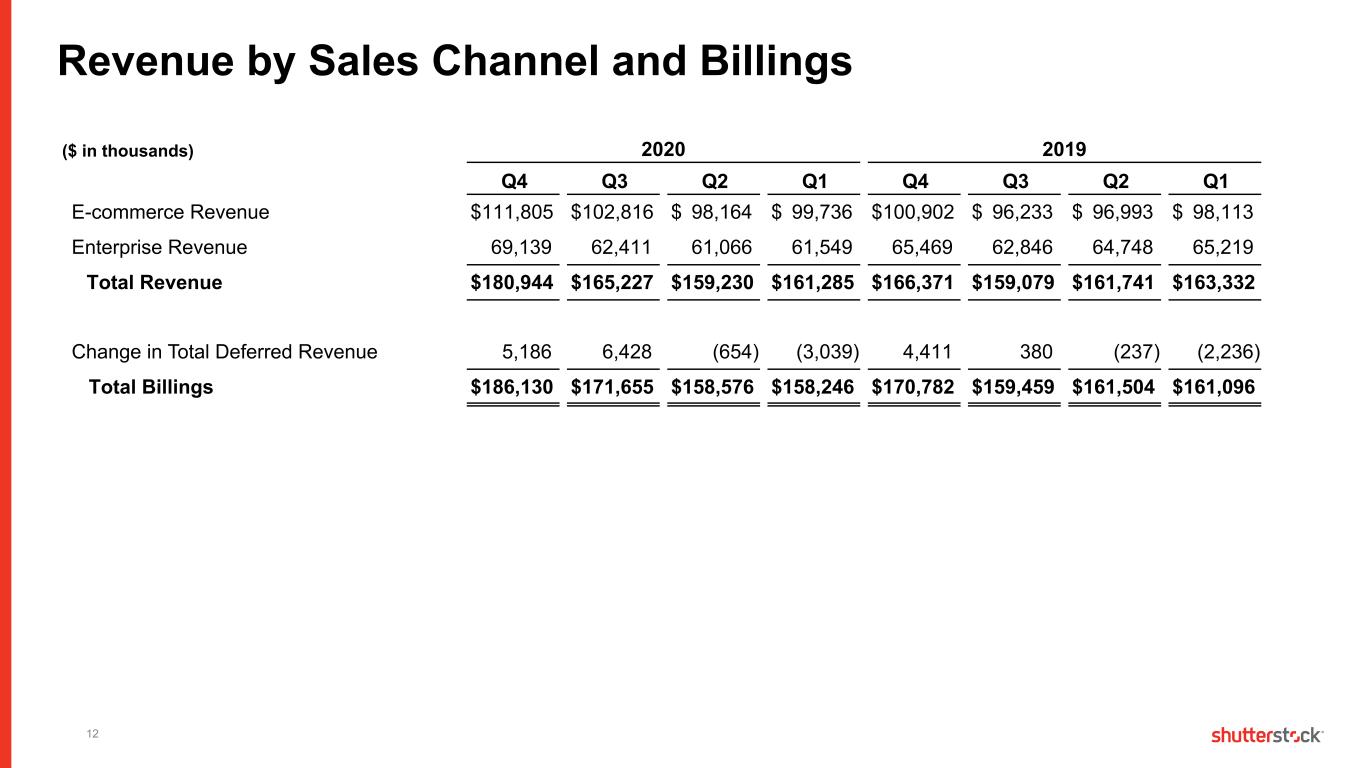

12 Revenue by Sales Channel and Billings ($ in thousands) 2020 2019 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 E-commerce Revenue $ 111,805 $ 102,816 $ 98,164 $ 99,736 $ 100,902 $ 96,233 $ 96,993 $ 98,113 Enterprise Revenue 69,139 62,411 61,066 61,549 65,469 62,846 64,748 65,219 Total Revenue $ 180,944 $ 165,227 $ 159,230 $ 161,285 $ 166,371 $ 159,079 $ 161,741 $ 163,332 Change in Total Deferred Revenue 5,186 6,428 (654) (3,039) 4,411 380 (237) (2,236) Total Billings $ 186,130 $ 171,655 $ 158,576 $ 158,246 $ 170,782 $ 159,459 $ 161,504 $ 161,096

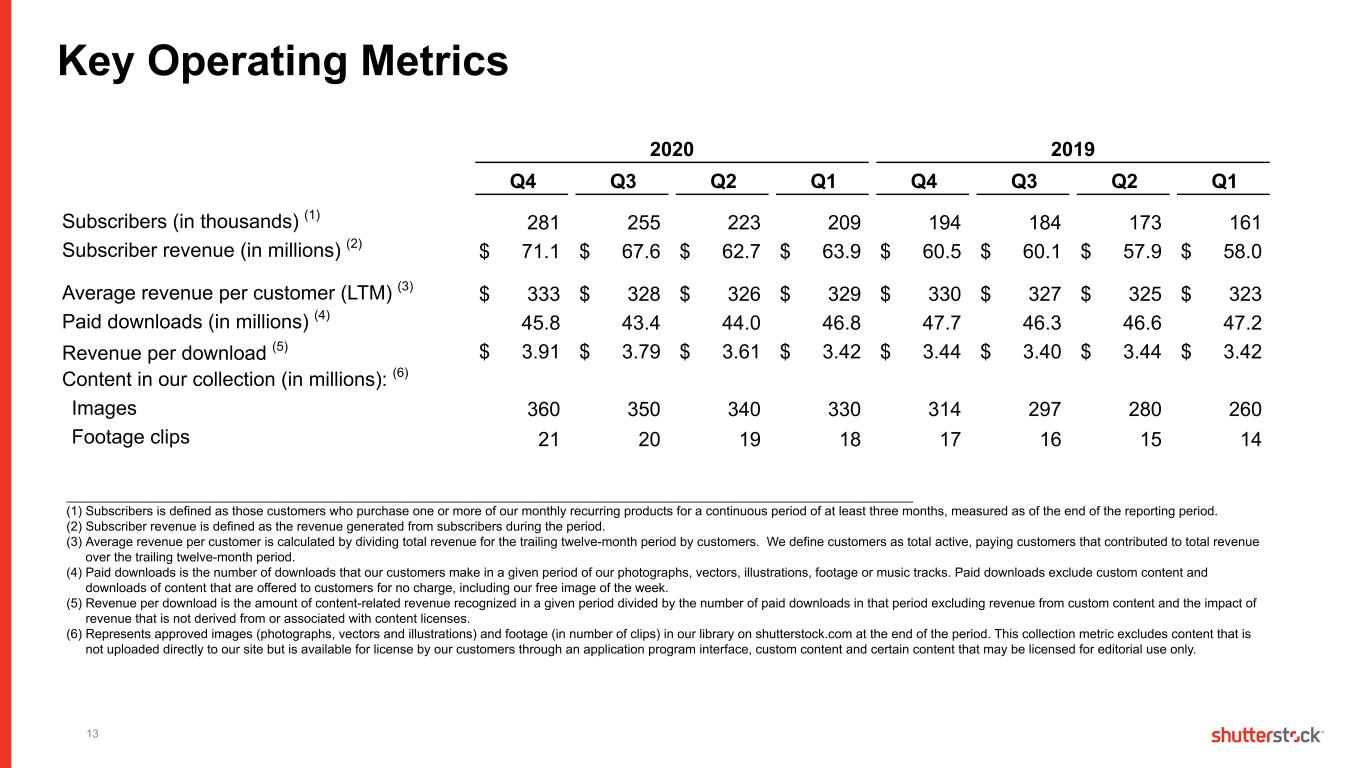

13 Key Operating Metrics 2020 2019 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Subscribers (in thousands) (1) 281 255 223 209 194 184 173 161 Subscriber revenue (in millions) (2) $ 71.1 $ 67.6 $ 62.7 $ 63.9 $ 60.5 $ 60.1 $ 57.9 $ 58.0 Average revenue per customer (LTM) (3) $ 333 $ 328 $ 326 $ 329 $ 330 $ 327 $ 325 $ 323 Paid downloads (in millions) (4) 45.8 43.4 44.0 46.8 47.7 46.3 46.6 47.2 Revenue per download (5) $ 3.91 $ 3.79 $ 3.61 $ 3.42 $ 3.44 $ 3.40 $ 3.44 $ 3.42 Content in our collection (in millions): (6) Images 360 350 340 330 314 297 280 260 Footage clips 21 20 19 18 17 16 15 14 _______________________________________________________________________________________________________________________ (1) Subscribers is defined as those customers who purchase one or more of our monthly recurring products for a continuous period of at least three months, measured as of the end of the reporting period. (2) Subscriber revenue is defined as the revenue generated from subscribers during the period. (3) Average revenue per customer is calculated by dividing total revenue for the trailing twelve-month period by customers. We define customers as total active, paying customers that contributed to total revenue over the trailing twelve-month period. (4) Paid downloads is the number of downloads that our customers make in a given period of our photographs, vectors, illustrations, footage or music tracks. Paid downloads exclude custom content and downloads of content that are offered to customers for no charge, including our free image of the week. (5) Revenue per download is the amount of content-related revenue recognized in a given period divided by the number of paid downloads in that period excluding revenue from custom content and the impact of revenue that is not derived from or associated with content licenses. (6) Represents approved images (photographs, vectors and illustrations) and footage (in number of clips) in our library on shutterstock.com at the end of the period. This collection metric excludes content that is not uploaded directly to our site but is available for license by our customers through an application program interface, custom content and certain content that may be licensed for editorial use only.

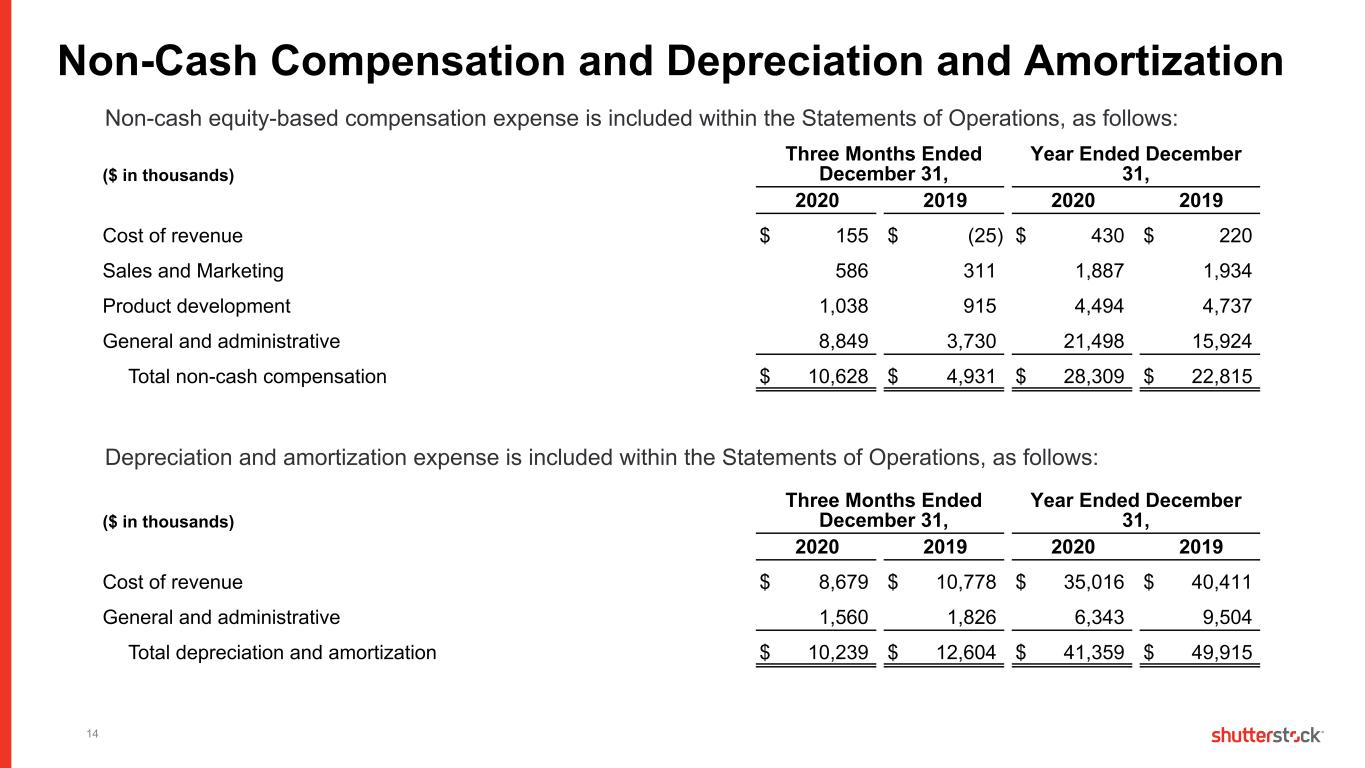

14 Non-Cash Compensation and Depreciation and Amortization Depreciation and amortization expense is included within the Statements of Operations, as follows: ($ in thousands) Three Months Ended December 31, Year Ended December 31, 2020 2019 2020 2019 Cost of revenue $ 8,679 $ 10,778 $ 35,016 $ 40,411 General and administrative 1,560 1,826 6,343 9,504 Total depreciation and amortization $ 10,239 $ 12,604 $ 41,359 $ 49,915 Non-cash equity-based compensation expense is included within the Statements of Operations, as follows: ($ in thousands) Three Months Ended December 31, Year Ended December 31, 2020 2019 2020 2019 Cost of revenue $ 155 $ (25) $ 430 $ 220 Sales and Marketing 586 311 1,887 1,934 Product development 1,038 915 4,494 4,737 General and administrative 8,849 3,730 21,498 15,924 Total non-cash compensation $ 10,628 $ 4,931 $ 28,309 $ 22,815

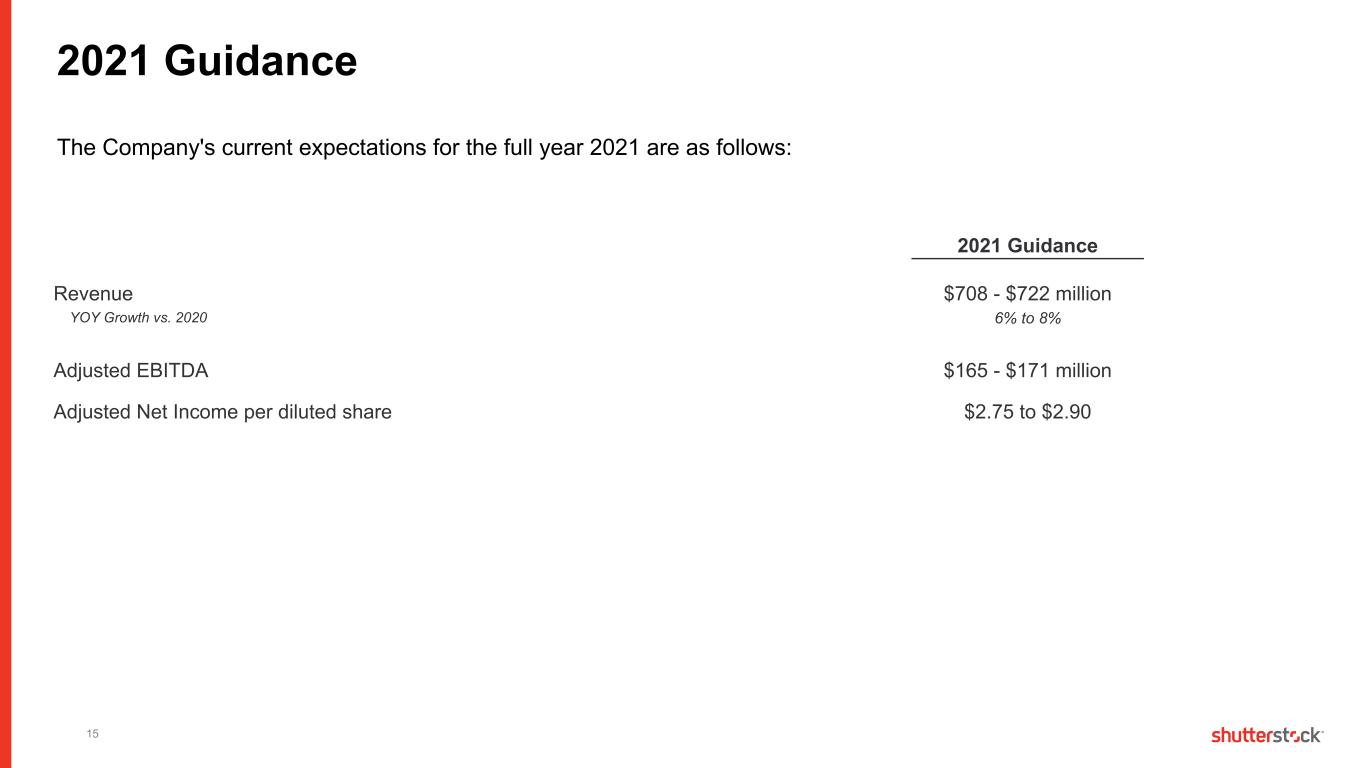

15 2021 Guidance Revenue $708 - $722 million YOY Growth vs. 2020 6% to 8% Adjusted EBITDA $165 - $171 million Adjusted Net Income per diluted share $2.75 to $2.90 The Company's current expectations for the full year 2021 are as follows: 2021 Guidance

Please remember this information is confidential. © 2021 Shutterstock, Inc. All rights reserved.