Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Apollo Commercial Real Estate Finance, Inc. | d32845d8k.htm |

| EX-99.1 - EX-99.1 - Apollo Commercial Real Estate Finance, Inc. | d32845dex991.htm |

Q4 & FY 2020 Financial Results February 10, 2021 Exhibit 99.2

Forward Looking Statements and Other Disclosures This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond management’s control. These forward-looking statements may include information about possible or assumed future results of Apollo Commercial Real Estate Finance, Inc.’s (the “Company,” “ARI,” “we,” “us” and “our”) business, financial condition, liquidity, results of operations, plans and objectives. When used in this presentation, the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: the macro- and micro-economic impact of the COVID-19 pandemic; the severity and duration of the COVID-19 pandemic; actions taken by governmental authorities to contain the COVID-19 pandemic or treat its impact; the impact of the COVID-19 pandemic on our financial condition, results operations, liquidity and capital resources; ARI’s business and investment strategy; ARI’s operating results; ARI’s ability to obtain and maintain financing arrangements; the timing and amounts of expected future fundings of unfunded commitments; and the return on equity, the yield on investments and risks associated with investing in real estate assets including changes in business conditions and the general economy. The forward-looking statements are based on management’s beliefs, assumptions and expectations of future performance, taking into account all information currently available to ARI. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ARI. Some of these factors are described under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in ARI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and other filings with the Securities and Exchange Commission (“SEC”), which are accessible on the SEC’s website at www.sec.gov. If a change occurs, ARI’s business, financial condition, liquidity and results of operations may vary materially from those expressed in ARI’s forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for management to predict those events or how they may affect ARI. Except as required by law, ARI is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation contains information regarding ARI’s financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), including Distributable Earnings and Distributable Earnings per share. Please refer to page 18 for a definition of “Distributable Earnings” and the reconciliation of the applicable GAAP financial measures to non-GAAP financial measures set forth on page 17. This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. ARI makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness or completeness of such information. Past performance is not indicative nor a guarantee of future returns. Index performance and yield data are shown for illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters, volatility, credit or other factors (such as number and types of securities). Indices are unmanaged, do not charge any fees or expenses, assume reinvestment of income and do not employ special investment techniques such as leveraging or short selling. No such index is indicative of the future results of any investment by ARI. Unless the context requires otherwise, references in this presentation to “Apollo” refer to Apollo Global Management, Inc., together with its subsidiaries, and references in this presentation to the “Manager” refer to ACREFI Management, LLC, an indirect subsidiary of Apollo Global Management, Inc.

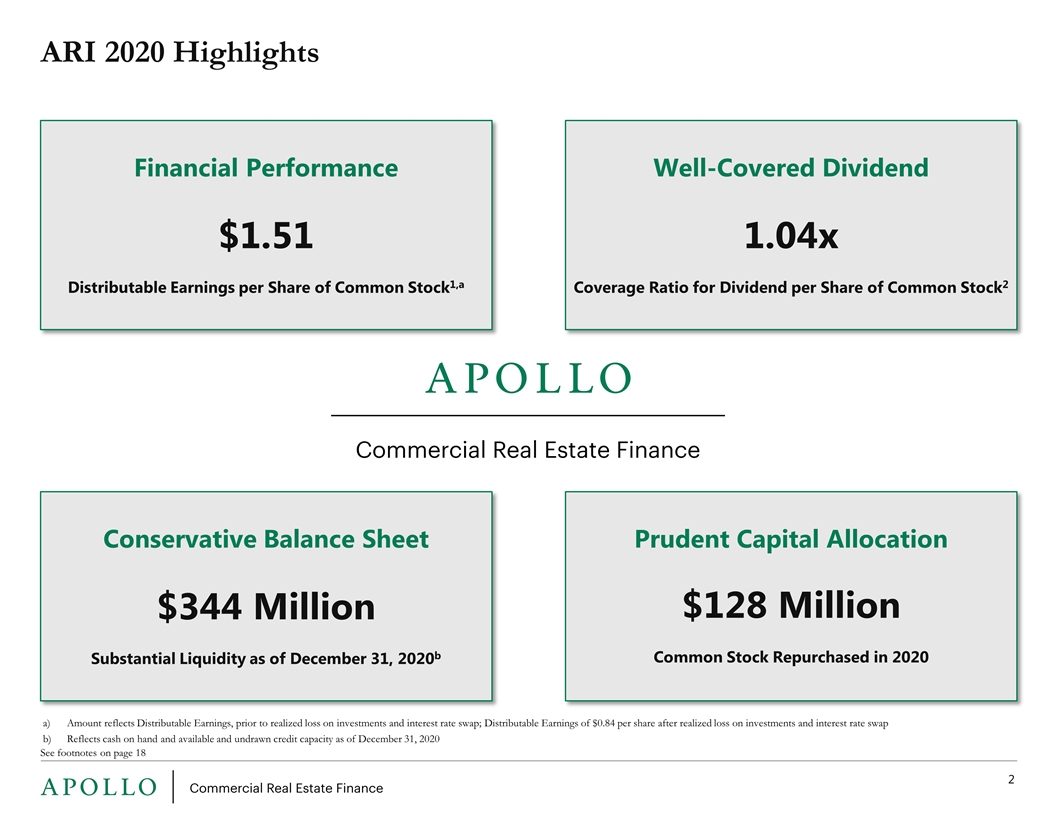

ARI 2020 Highlights See footnotes on page 18 Financial Performance $1.51 Distributable Earnings per Share of Common Stock1,a Well-Covered Dividend 1.04x Coverage Ratio for Dividend per Share of Common Stock2 Conservative Balance Sheet $344 Million Substantial Liquidity as of December 31, 2020b Prudent Capital Allocation $128 Million Common Stock Repurchased in 2020 Amount reflects Distributable Earnings, prior to realized loss on investments and interest rate swap; Distributable Earnings of $0.84 per share after realized loss on investments and interest rate swap Reflects cash on hand and available and undrawn credit capacity as of December 31, 2020

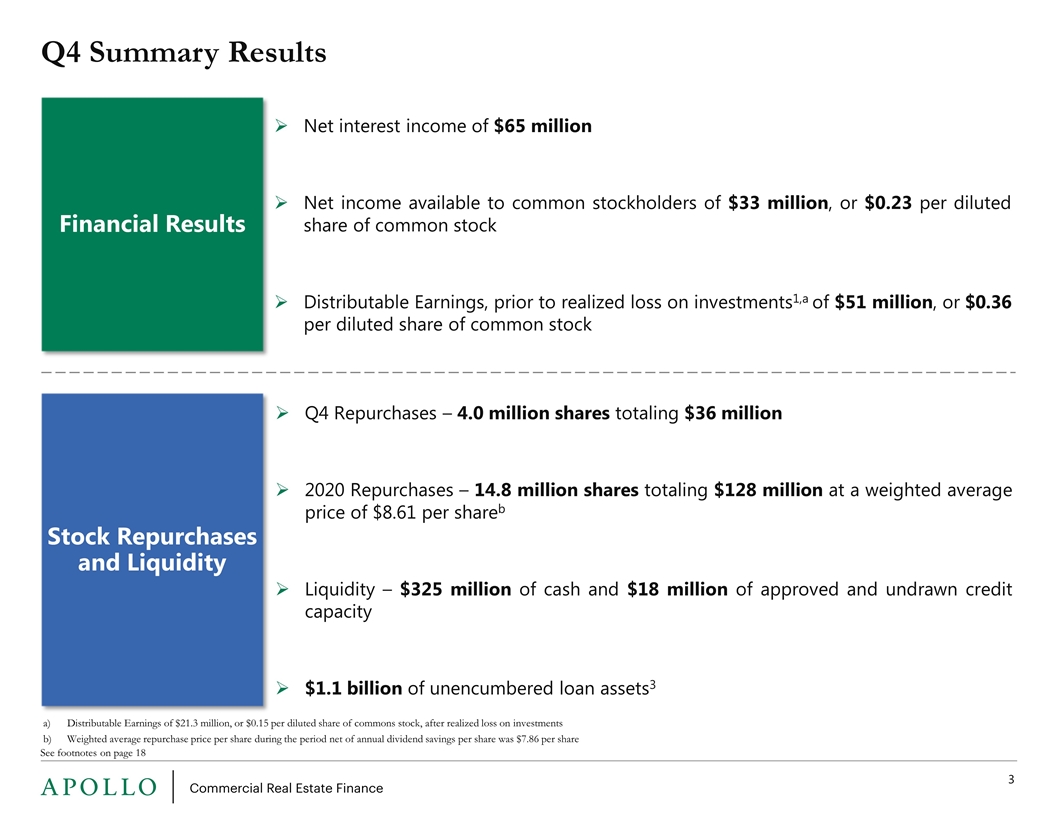

Q4 Summary Results Financial Results Net interest income of $65 million Net income available to common stockholders of $33 million, or $0.23 per diluted share of common stock Distributable Earnings, prior to realized loss on investments1,a of $51 million, or $0.36 per diluted share of common stock Stock Repurchases and Liquidity Q4 Repurchases – 4.0 million shares totaling $36 million 2020 Repurchases – 14.8 million shares totaling $128 million at a weighted average price of $8.61 per shareb Liquidity – $325 million of cash and $18 million of approved and undrawn credit capacity $1.1 billion of unencumbered loan assets3 See footnotes on page 18 Distributable Earnings of $21.3 million, or $0.15 per diluted share of commons stock, after realized loss on investments Weighted average repurchase price per share during the period net of annual dividend savings per share was $7.86 per share

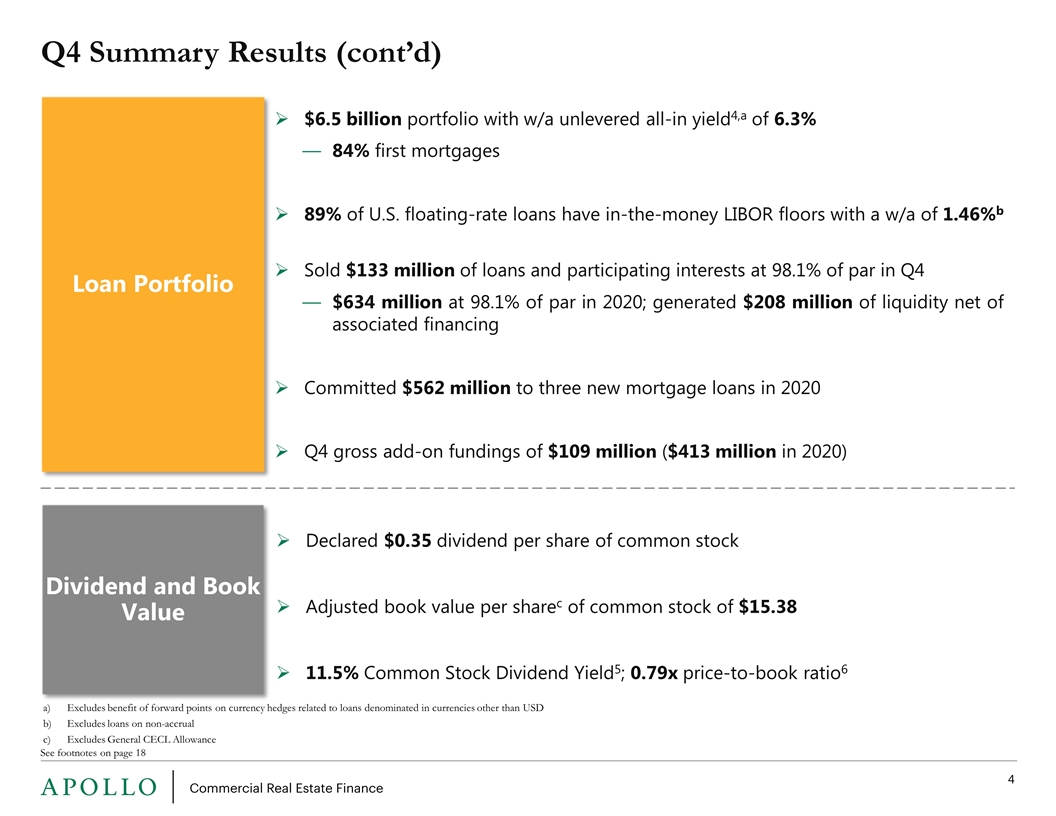

Q4 Summary Results (cont’d) Loan Portfolio $6.5 billion portfolio with w/a unlevered all-in yield4,a of 6.3% 84% first mortgages 89% of U.S. floating-rate loans have in-the-money LIBOR floors with a w/a of 1.46%b Sold $133 million of loans and participating interests at 98.1% of par in Q4 $634 million at 98.1% of par in 2020; generated $208 million of liquidity net of associated financing Committed $562 million to three new mortgage loans in 2020 Q4 gross add-on fundings of $109 million ($413 million in 2020) Dividend and Book Value Declared $0.35 dividend per share of common stock Adjusted book value per sharec of common stock of $15.38 11.5% Common Stock Dividend Yield5; 0.79x price-to-book ratio6 Excludes benefit of forward points on currency hedges related to loans denominated in currencies other than USD Excludes loans on non-accrual Excludes General CECL Allowance See footnotes on page 18

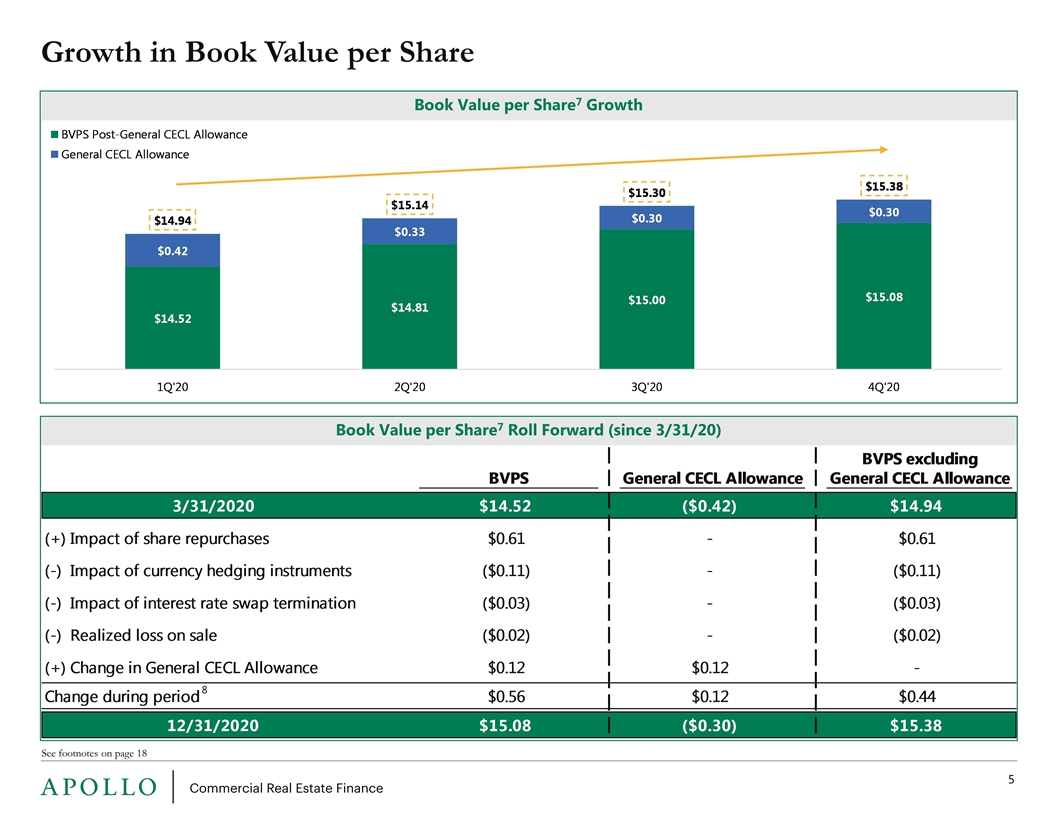

Book Value per Share7 Growth Growth in Book Value per Share See footnotes on page 18 Book Value per Share7 Roll Forward (since 3/31/20) 8

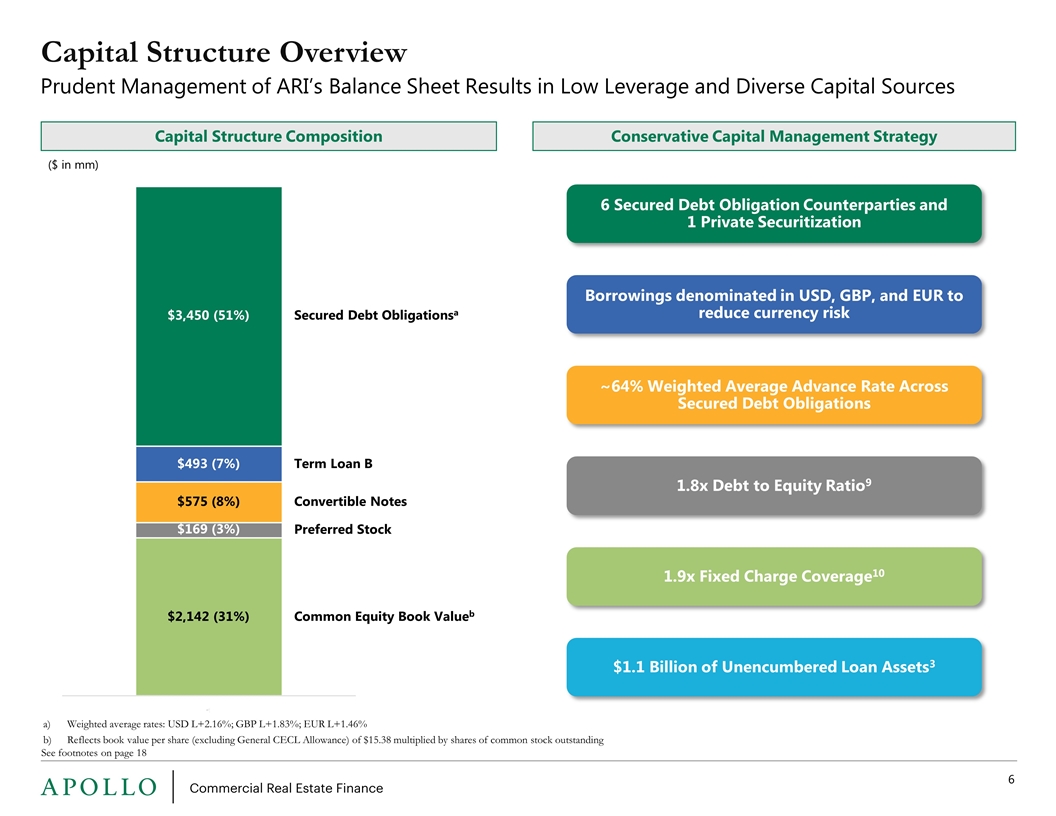

Capital Structure Overview See footnotes on page 18 ($ in mm) Secured Debt Obligationsa Common Equity Book Valueb Convertible Notes Term Loan B Preferred Stock $3,450 (51%) $493 (7%) $575 (8%) $169 (3%) Prudent Management of ARI’s Balance Sheet Results in Low Leverage and Diverse Capital Sources Capital Structure Composition Conservative Capital Management Strategy 6 Secured Debt Obligation Counterparties and 1 Private Securitization ~64% Weighted Average Advance Rate Across Secured Debt Obligations Borrowings denominated in USD, GBP, and EUR to reduce currency risk 1.8x Debt to Equity Ratio9 1.9x Fixed Charge Coverage10 $1.1 Billion of Unencumbered Loan Assets3 Weighted average rates: USD L+2.16%; GBP L+1.83%; EUR L+1.46% Reflects book value per share (excluding General CECL Allowance) of $15.38 multiplied by shares of common stock outstanding $2,142 (31%)

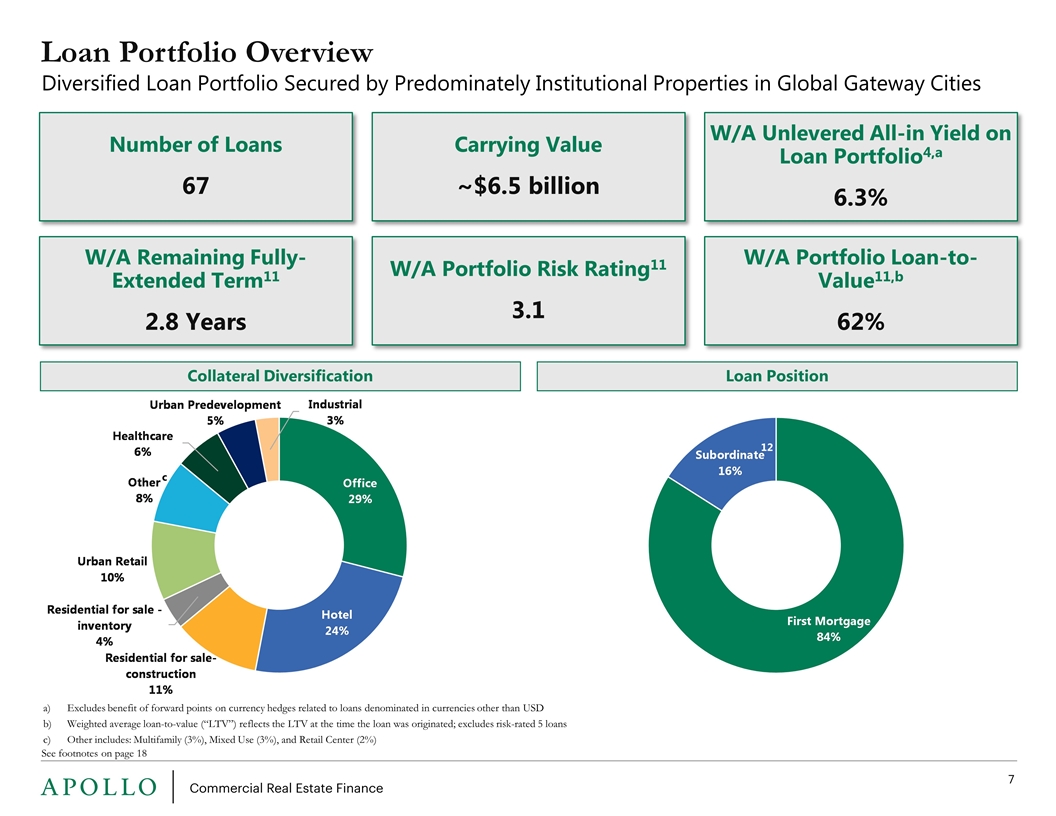

Loan Portfolio Overview See footnotes on page 18 Diversified Loan Portfolio Secured by Predominately Institutional Properties in Global Gateway Cities Collateral Diversification c Loan Position W/A Unlevered All-in Yield on Loan Portfolio4,a 6.3% W/A Remaining Fully-Extended Term11 2.8 Years W/A Portfolio Risk Rating11 3.1 Number of Loans 67 Carrying Value ~$6.5 billion W/A Portfolio Loan-to-Value11,b 62% 12 Excludes benefit of forward points on currency hedges related to loans denominated in currencies other than USD Weighted average loan-to-value (“LTV”) reflects the LTV at the time the loan was originated; excludes risk-rated 5 loans Other includes: Multifamily (3%), Mixed Use (3%), and Retail Center (2%)

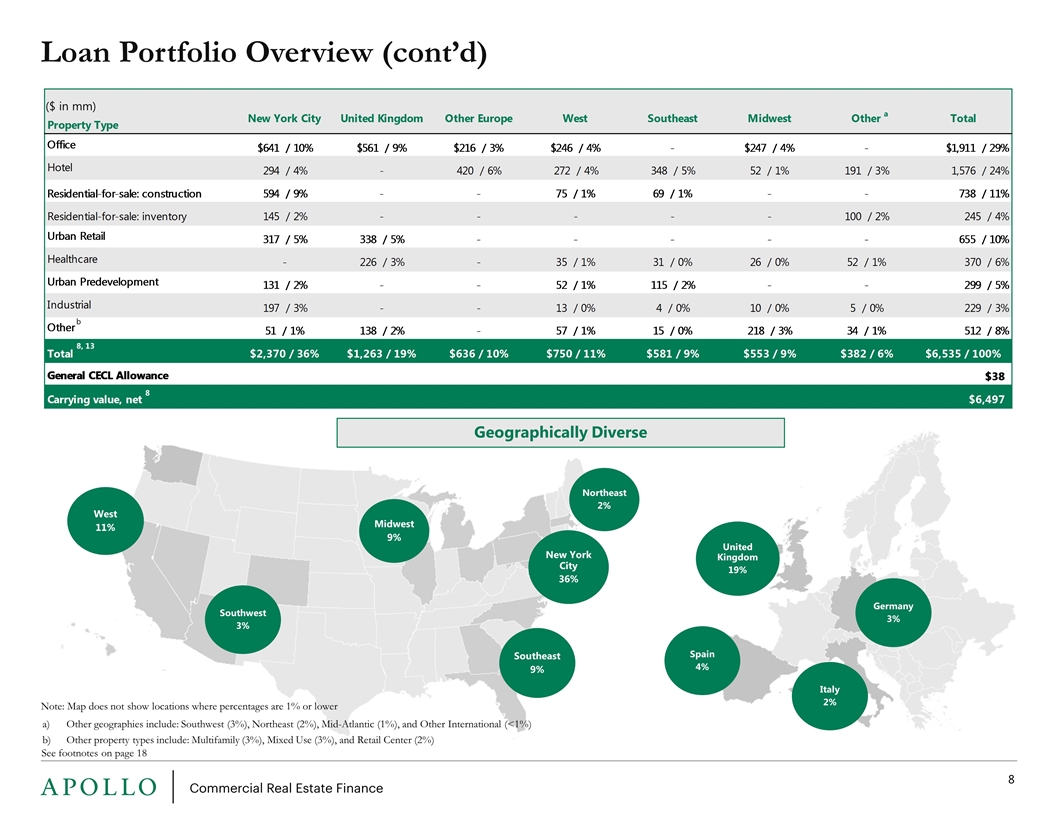

Loan Portfolio Overview (cont’d) See footnotes on page 18 ($ in mm) b a 8, 13 New York City 36% West 11% Midwest 9% Southeast 9% Southwest 3% Northeast 2% Geographically Diverse Note: Map does not show locations where percentages are 1% or lower Italy 2% United Kingdom 19% Spain 4% Germany 3% 8 Other geographies include: Southwest (3%), Northeast (2%), Mid-Atlantic (1%), and Other International (<1%) Other property types include: Multifamily (3%), Mixed Use (3%), and Retail Center (2%)

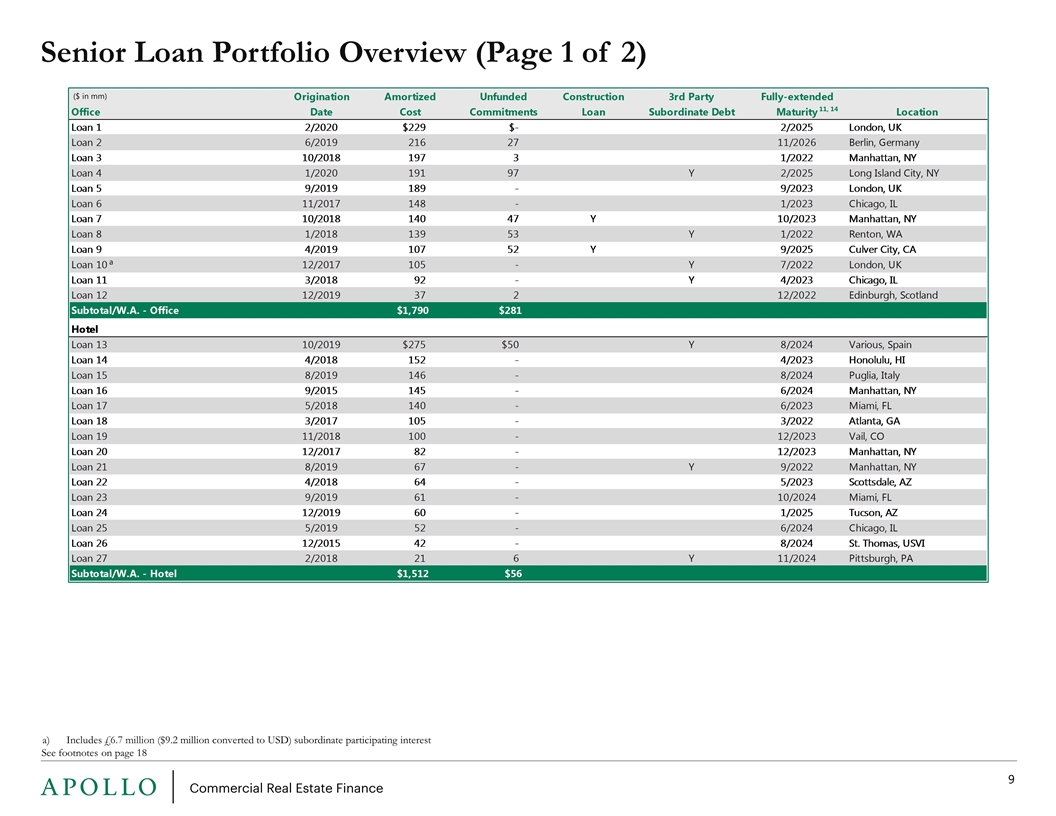

See footnotes on page 18 Senior Loan Portfolio Overview (Page 1 of 2) ($ in mm) 11, 14 Includes £6.7 million ($9.2 million converted to USD) subordinate participating interest a

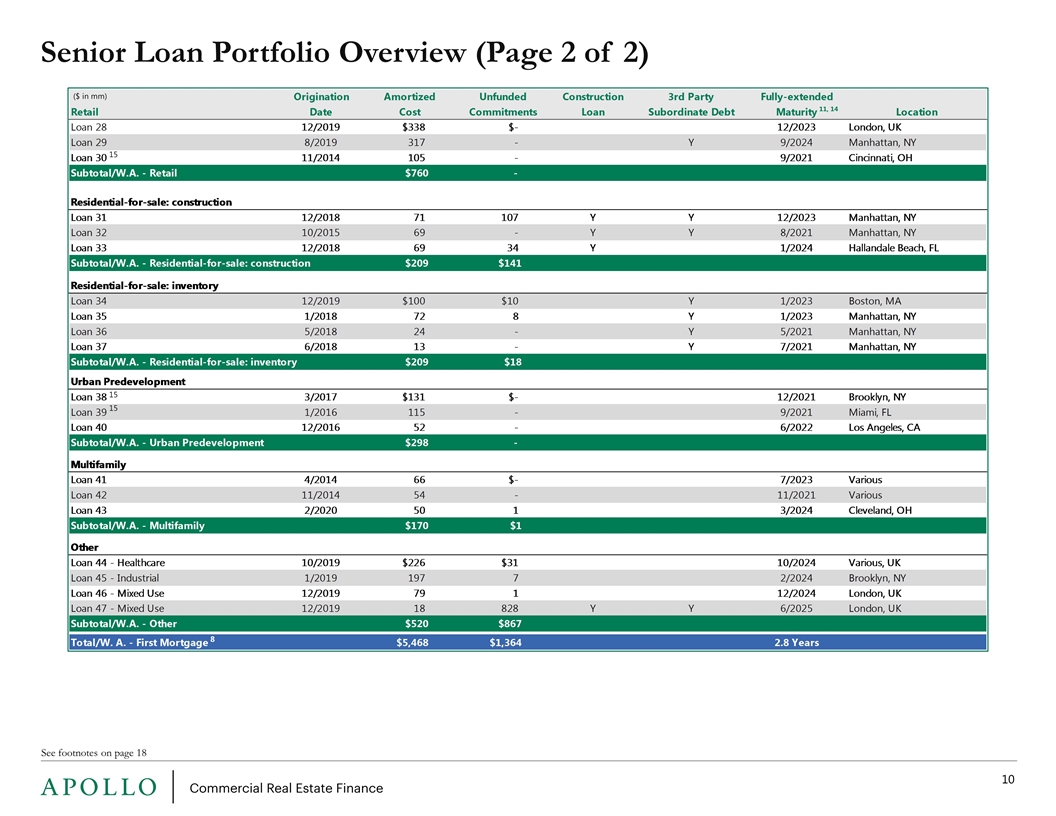

See footnotes on page 18 Senior Loan Portfolio Overview (Page 2 of 2) ($ in mm) 11, 14 15 15 15 8

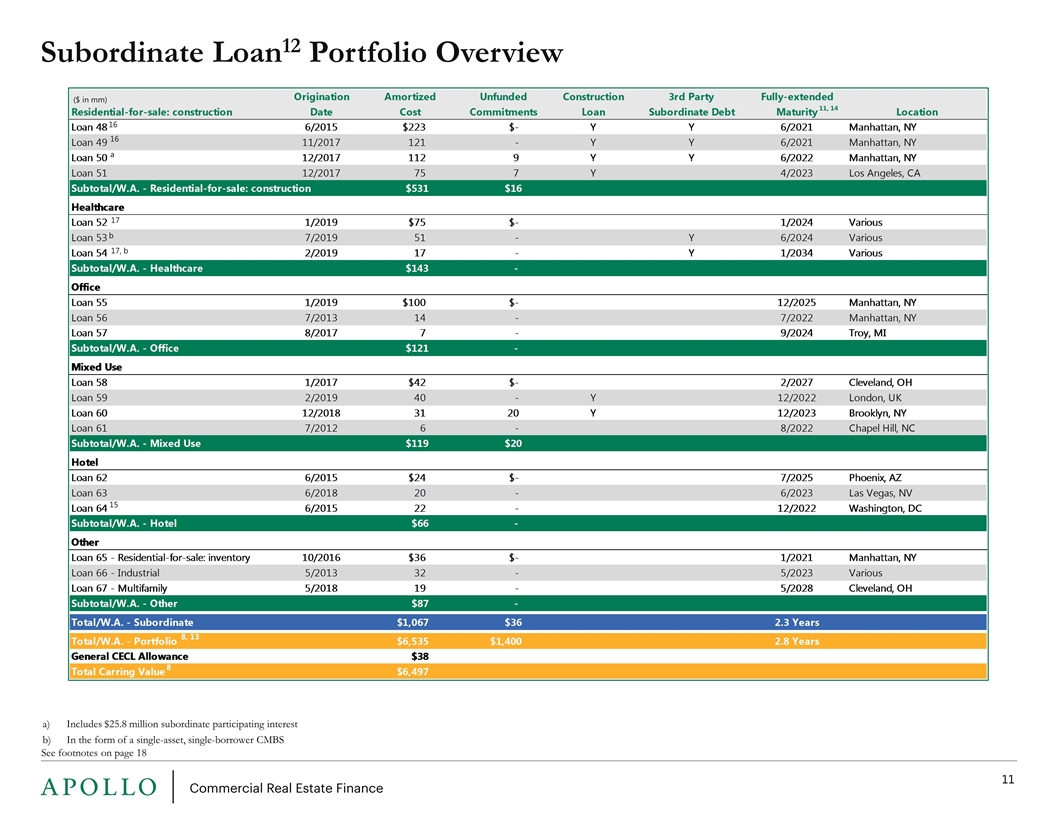

Subordinate Loan12 Portfolio Overview Includes $25.8 million subordinate participating interest In the form of a single-asset, single-borrower CMBS ($ in mm) See footnotes on page 18 17, b b 16 8, 13 11, 14 15 a 17 16 8

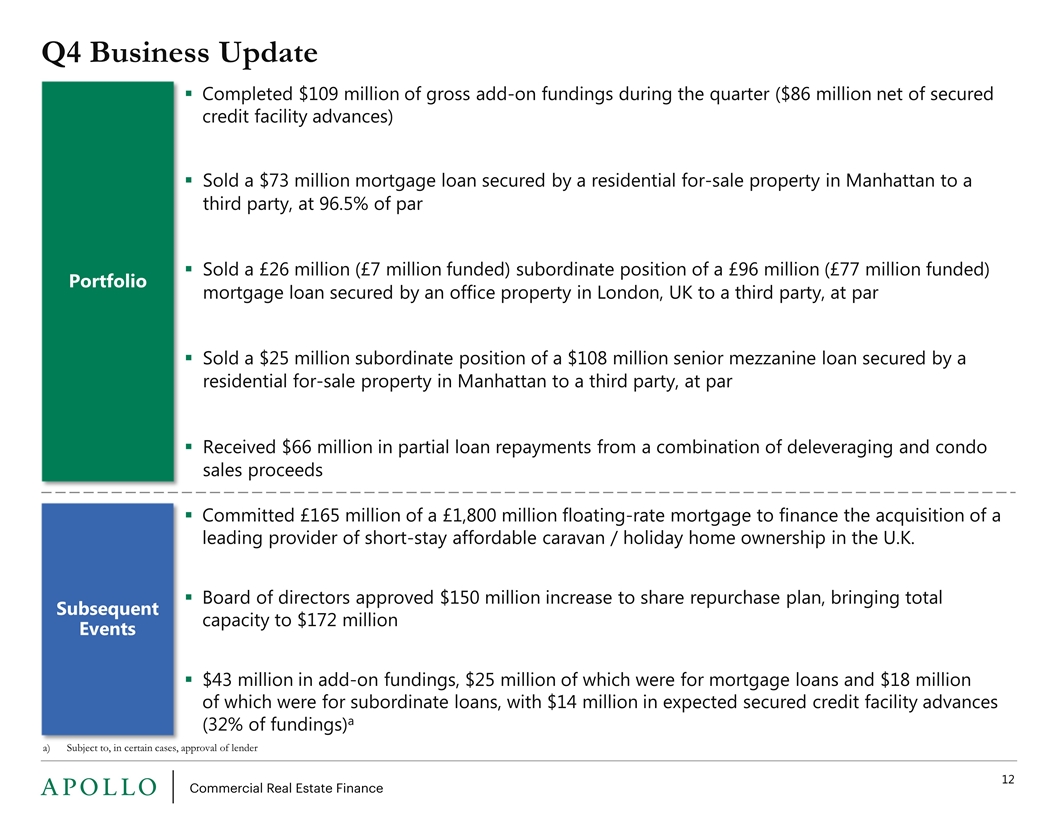

Q4 Business Update Subsequent Events Committed £165 million of a £1,800 million floating-rate mortgage to finance the acquisition of a leading provider of short-stay affordable caravan / holiday home ownership in the U.K. Board of directors approved $150 million increase to share repurchase plan, bringing total capacity to $172 million $43 million in add-on fundings, $25 million of which were for mortgage loans and $18 million of which were for subordinate loans, with $14 million in expected secured credit facility advances (32% of fundings)a Subject to, in certain cases, approval of lender Portfolio Completed $109 million of gross add-on fundings during the quarter ($86 million net of secured credit facility advances) Sold a $73 million mortgage loan secured by a residential for-sale property in Manhattan to a third party, at 96.5% of par Sold a £26 million (£7 million funded) subordinate position of a £96 million (£77 million funded) mortgage loan secured by an office property in London, UK to a third party, at par Sold a $25 million subordinate position of a $108 million senior mezzanine loan secured by a residential for-sale property in Manhattan to a third party, at par Received $66 million in partial loan repayments from a combination of deleveraging and condo sales proceeds

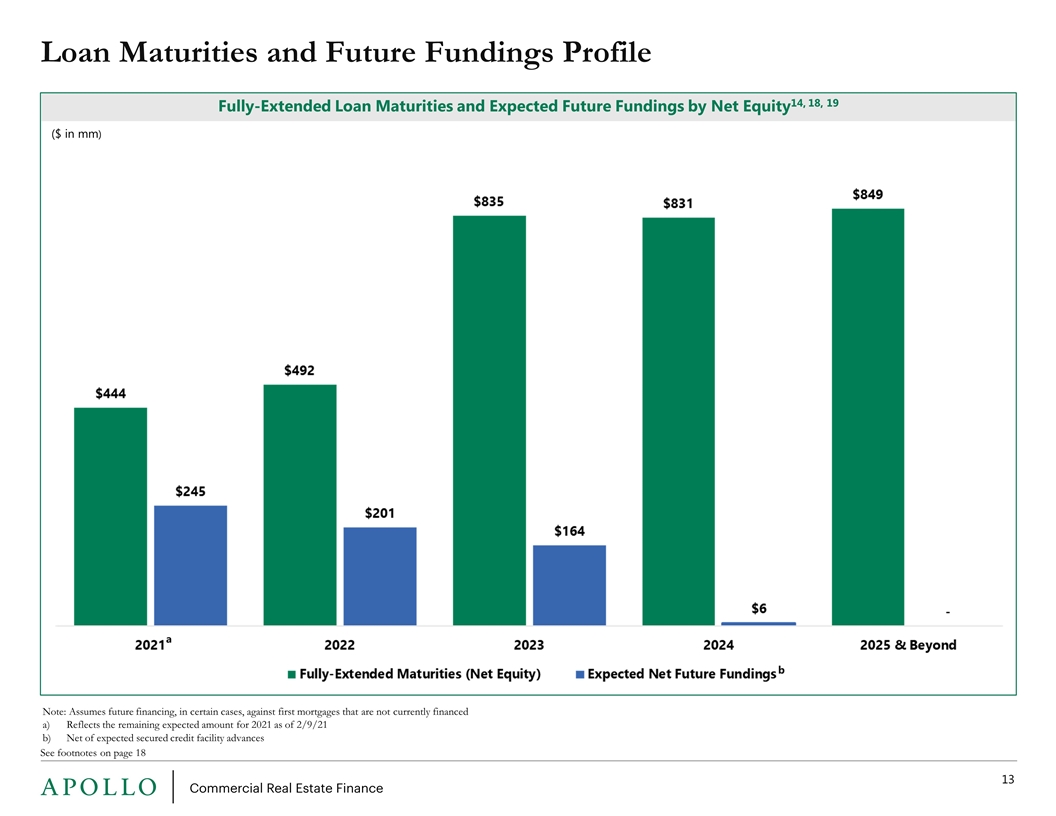

Loan Maturities and Future Fundings Profile See footnotes on page 18 Fully-Extended Loan Maturities and Expected Future Fundings by Net Equity14, 18, 19 ($ in mm) Note: Assumes future financing, in certain cases, against first mortgages that are not currently financed Reflects the remaining expected amount for 2021 as of 2/9/21 Net of expected secured credit facility advances a b

Appendix

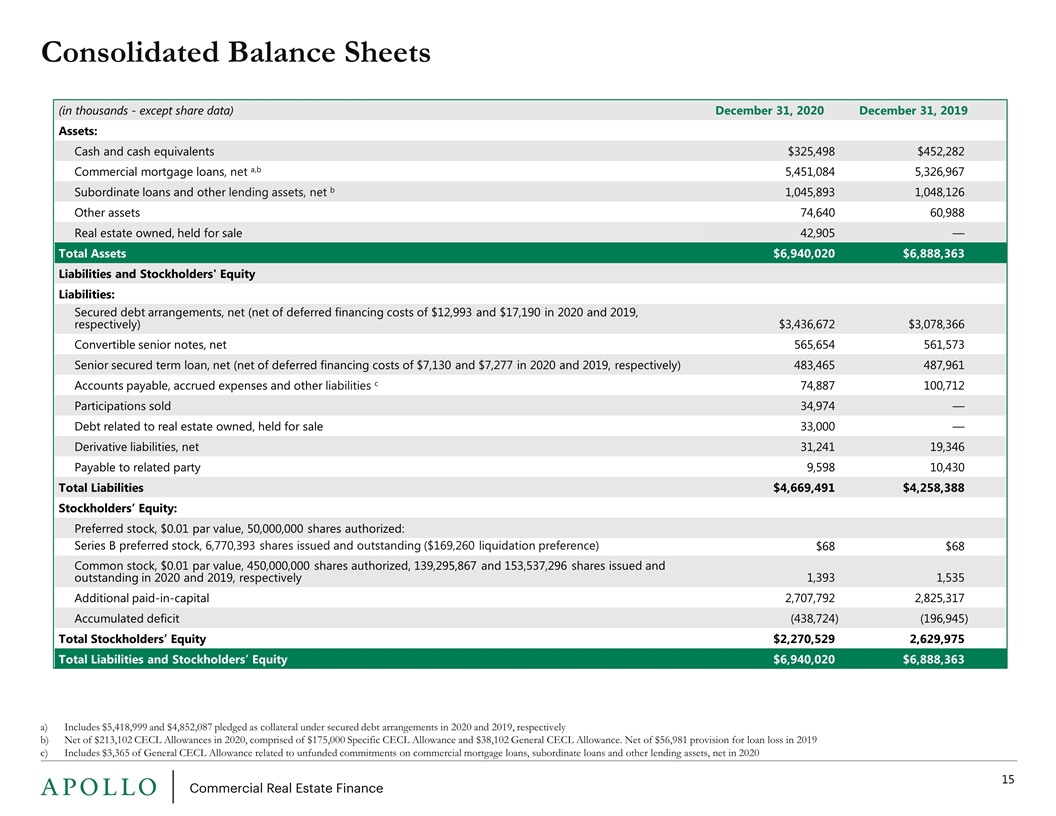

(in thousands - except share data) December 31, 2020 December 31, 2019 f Assets: Cash and cash equivalents $325,498 $452,282 Commercial mortgage loans, net a,b 5,451,084 5,326,967 Subordinate loans and other lending assets, net b 1,045,893 1,048,126 Other assets 74,640 60,988 Real estate owned, held for sale 42,905 — Total Assets $6,940,020 $6,888,363 Liabilities and Stockholders' Equity Liabilities: Secured debt arrangements, net (net of deferred financing costs of $12,993 and $17,190 in 2020 and 2019, respectively) $3,436,672 $3,078,366 Convertible senior notes, net 565,654 561,573 Senior secured term loan, net (net of deferred financing costs of $7,130 and $7,277 in 2020 and 2019, respectively) 483,465 487,961 Accounts payable, accrued expenses and other liabilities c 74,887 100,712 Participations sold 34,974 — Debt related to real estate owned, held for sale 33,000 — Derivative liabilities, net 31,241 19,346 Payable to related party 9,598 10,430 Total Liabilities $4,669,491 $4,258,388 Stockholders’ Equity: Preferred stock, $0.01 par value, 50,000,000 shares authorized: Series B preferred stock, 6,770,393 shares issued and outstanding ($169,260 liquidation preference) $68 $68 Common stock, $0.01 par value, 450,000,000 shares authorized, 139,295,867 and 153,537,296 shares issued and outstanding in 2020 and 2019, respectively 1,393 1,535 Additional paid-in-capital 2,707,792 2,825,317 Accumulated deficit (438,724 ) (196,945 ) Total Stockholders’ Equity $2,270,529 2,629,975 Total Liabilities and Stockholders’ Equity $6,940,020 $6,888,363 Consolidated Balance Sheets Includes $5,418,999 and $4,852,087 pledged as collateral under secured debt arrangements in 2020 and 2019, respectively Net of $213,102 CECL Allowances in 2020, comprised of $175,000 Specific CECL Allowance and $38,102 General CECL Allowance. Net of $56,981 provision for loan loss in 2019 Includes $3,365 of General CECL Allowance related to unfunded commitments on commercial mortgage loans, subordinate loans and other lending assets, net in 2020

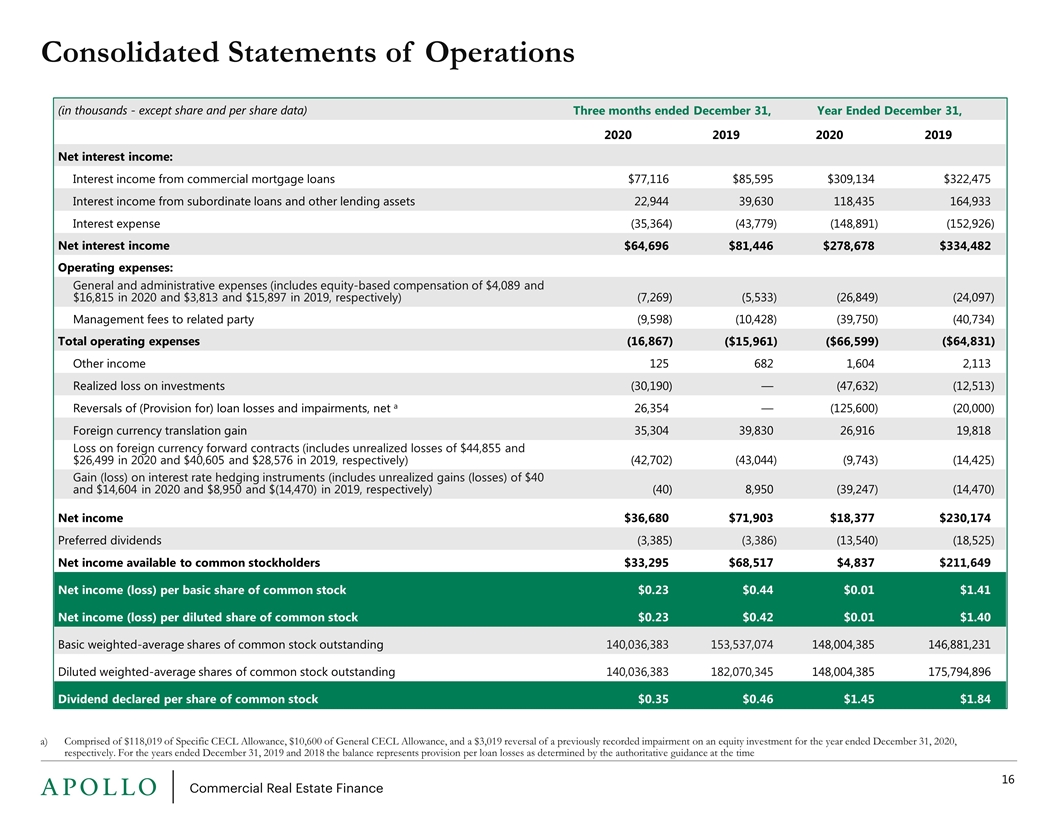

(in thousands - except share and per share data) Three months ended December 31, Year Ended December 31, 2020 2019 2020 2019 Net interest income: Interest income from commercial mortgage loans $77,116 $85,595 $309,134 $322,475 Interest income from subordinate loans and other lending assets 22,944 39,630 118,435 164,933 Interest expense (35,364 ) (43,779 ) (148,891 ) (152,926 ) Net interest income $64,696 $81,446 $278,678 $334,482 Operating expenses: General and administrative expenses (includes equity-based compensation of $4,089 and $16,815 in 2020 and $3,813 and $15,897 in 2019, respectively) (7,269 ) (5,533 ) (26,849 ) (24,097 ) Management fees to related party (9,598 ) (10,428 ) (39,750 ) (40,734 ) Total operating expenses (16,867 ) ($15,961 ) ($66,599 ) ($64,831 ) Other income 125 682 1,604 2,113 Realized loss on investments (30,190 ) — (47,632 ) (12,513 ) Reversals of (Provision for) loan losses and impairments, net a 26,354 — (125,600 ) (20,000 ) Foreign currency translation gain 35,304 39,830 26,916 19,818 Loss on foreign currency forward contracts (includes unrealized losses of $44,855 and $26,499 in 2020 and $40,605 and $28,576 in 2019, respectively) (42,702 ) (43,044 ) (9,743 ) (14,425 ) Gain (loss) on interest rate hedging instruments (includes unrealized gains (losses) of $40 and $14,604 in 2020 and $8,950 and $(14,470) in 2019, respectively) (40 ) 8,950 (39,247 ) (14,470 ) Net income $36,680 $71,903 $18,377 $230,174 Preferred dividends (3,385 ) (3,386 ) (13,540 ) (18,525 ) Net income available to common stockholders $33,295 $68,517 $4,837 $211,649 Net income (loss) per basic share of common stock $0.23 $0.44 $0.01 $1.41 Net income (loss) per diluted share of common stock $0.23 $0.42 $0.01 $1.40 Basic weighted-average shares of common stock outstanding 140,036,383 153,537,074 148,004,385 146,881,231 Diluted weighted-average shares of common stock outstanding 140,036,383 182,070,345 148,004,385 175,794,896 Dividend declared per share of common stock $0.35 $0.46 $1.45 $1.84 Consolidated Statements of Operations Comprised of $118,019 of Specific CECL Allowance, $10,600 of General CECL Allowance, and a $3,019 reversal of a previously recorded impairment on an equity investment for the year ended December 31, 2020, respectively. For the years ended December 31, 2019 and 2018 the balance represents provision per loan losses as determined by the authoritative guidance at the time

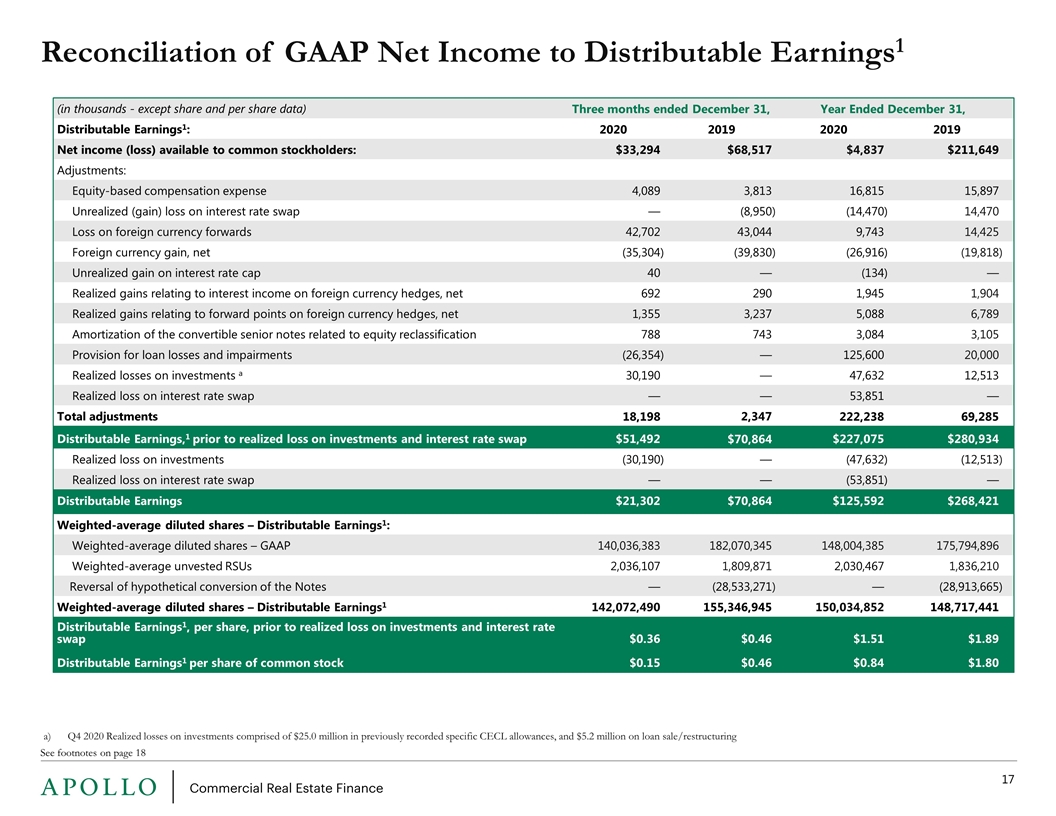

(in thousands - except share and per share data) Three months ended December 31, Year Ended December 31, Distributable Earnings1: 2020 2019 2020 2019 Net income (loss) available to common stockholders: $33,294 $68,517 $4,837 $211,649 Adjustments: Equity-based compensation expense 4,089 3,813 16,815 15,897 Unrealized (gain) loss on interest rate swap — (8,950 ) (14,470 ) 14,470 Loss on foreign currency forwards 42,702 43,044 9,743 14,425 Foreign currency gain, net (35,304 ) (39,830 ) (26,916 ) (19,818 ) Unrealized gain on interest rate cap 40 — (134 ) — Realized gains relating to interest income on foreign currency hedges, net 692 290 1,945 1,904 Realized gains relating to forward points on foreign currency hedges, net 1,355 3,237 5,088 6,789 Amortization of the convertible senior notes related to equity reclassification 788 743 3,084 3,105 Provision for loan losses and impairments (26,354 ) — 125,600 20,000 Realized losses on investments a 30,190 — 47,632 12,513 Realized loss on interest rate swap — — 53,851 — Total adjustments 18,198 2,347 222,238 69,285 Distributable Earnings,1 prior to realized loss on investments and interest rate swap $51,492 $70,864 $227,075 $280,934 Realized loss on investments (30,190 ) — (47,632 ) (12,513 ) Realized loss on interest rate swap — — (53,851 ) — Distributable Earnings $21,302 $70,864 $125,592 $268,421 Weighted-average diluted shares – Distributable Earnings1: Weighted-average diluted shares – GAAP 140,036,383 182,070,345 148,004,385 175,794,896 Weighted-average unvested RSUs 2,036,107 1,809,871 2,030,467 1,836,210 Reversal of hypothetical conversion of the Notes — (28,533,271 ) — (28,913,665 ) Weighted-average diluted shares – Distributable Earnings1 142,072,490 155,346,945 150,034,852 148,717,441 Distributable Earnings1, per share, prior to realized loss on investments and interest rate swap $0.36 $0.46 $1.51 $1.89 Distributable Earnings1 per share of common stock $0.15 $0.46 $0.84 $1.80 Reconciliation of GAAP Net Income to Distributable Earnings1 See footnotes on page 18 Q4 2020 Realized losses on investments comprised of $25.0 million in previously recorded specific CECL allowances, and $5.2 million on loan sale/restructuring

Footnotes Distributable Earnings, formerly known as Operating Earnings, is a non-GAAP financial measure that we define as net income available to common stockholders, computed in accordance with GAAP, adjusted for (i) equity-based compensation expense (a portion of which may become cash-based upon final vesting and settlement of awards should the holder elect net share settlement to satisfy income tax withholding), (ii) any unrealized gains or losses or other non-cash items included in net income available to common stockholders, (iii) unrealized income from unconsolidated joint ventures, (iv) foreign currency gains (losses), other than (a) realized gains/(losses) related to interest income, and (b) forward point gains/(losses) realized on our foreign currency hedges, (v) the non-cash amortization expense related to the reclassification of a portion of our convertible senior notes to stockholders’ equity in accordance with GAAP, and (vi) provision for loan losses and impairments. Please see page 17 for a reconciliation of GAAP net income to Distributable Earnings. Represents Distributable Earnings, prior to realized loss on investments and interest rate swap, per share to dividend per share for the fiscal year ended December 31, 2020. Represents loan assets with no asset-specific financing. Pursuant to our Term Loan B agreement, we are required to maintain a ratio of total unencumbered assets to total pari-passu indebtedness of at least 1.25:1. Unencumbered assets are comprised of unencumbered loan assets, cash and other assets. Weighted Average Unlevered All-in Yield on the loan portfolio is based on the applicable benchmark rates as of period end on the floating rate loans and includes accrual of origination, extension, and exit fees. For non-US deals, yield excludes incremental forward points impact from currency hedging. Reflects closing share price on February 9, 2021. Represents closing share price on February 9, 2021 to book value per share, excluding General CECL Allowance as of December 31, 2020. Book value per share of common stock is common stockholders’ equity divided by shares of common stock outstanding. Amounts and percentages may not foot due to rounding. Represents total debt, less cash and loan proceeds held by servicer divided by total stockholders' equity, adjusted to add back the General CECL Allowance in line with our covenants. Fixed charge coverage is EBITDA divided by interest expense and preferred stock dividends. Based on loan amortized cost. Includes two subordinate risk retention interests in securitization vehicles classified as Subordinate Loans. Gross of $38.1 million of General CECL Allowance. Assumes exercise of all extension options. Amortized cost for these loans is net of the recorded Specific CECL Allowances and impairments. Both loans are secured by the same property. Loan and single-asset, single-borrower CMBS are secured by the same properties. Future funding dates and amounts are based upon the Manager’s estimates, which are derived from the best information available to the Manager at the time. There is no assurance that the payments will occur in accordance with these estimates or at all, which could affect our operating results. Excludes risk-rated 5 loans.