Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANNALY CAPITAL MANAGEMENT INC | nly-20210210.htm |

| EX-99.1 - EX-99.1 - ANNALY CAPITAL MANAGEMENT INC | a2020q4nlyex991.htm |

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Fourth Quarter 2020 Financial Summary February 10, 2021

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. 1 Important Notices This presentation is issued by Annaly Capital Management, Inc. ("Annaly"), an internally managed publicly traded company that has elected to be taxed as a real estate investment trust for federal income tax purposes, and is being furnished in connection with Annaly’s Fourth Quarter 2020 earnings release. This presentation is provided for investors in Annaly for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Such statements include those relating to our future performance, macro outlook, the interest rate and credit environments, tax reform and future opportunities. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, risks and uncertainties related to the COVID-19 pandemic, including as related to adverse economic conditions on real estate-related assets and financing conditions; changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our commercial, middle market lending and residential credit businesses; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights ("MSR"); our ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act of 1940. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We routinely post important information for investors on our website, www.annaly.com. We intend to use this webpage as a means of disclosing material information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. Annaly encourages investors, analysts, the media and others interested in Annaly to monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information we post from time to time on our website. To sign-up for email-notifications, please visit the “Email Alerts” section of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of source, information is believed to be reliable for purposes used herein, but Annaly makes no representation or warranty as to the accuracy or completeness thereof and does not take any responsibility for information obtained from sources outside of Annaly. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including core earnings excluding the premium amortization adjustment (“PAA”). We believe the non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating our performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, we may calculate our non-GAAP metrics, such as core earnings (excluding PAA), or the PAA, differently than our peers making comparative analysis difficult. Please see the section entitled “Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures.

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Portfolio Efficiency GAAP Key Statistics Income Statement Balance Sheet For the quarters ended 12/31/2020 9/30/2020 GAAP net income (loss) per average common share (1) $0.60 $0.70 Core earnings (excluding PAA) per average common share *(1) $0.30 $0.32 Annualized GAAP return (loss) on average equity 24.91% 29.02% Annualized core return on average equity (excluding PAA)* 13.03% 13.79% Book value per common share $8.92 $8.70 Leverage at period-end (2) 5.1x 5.1x Economic leverage at period-end (3) 6.2x 6.2x Capital ratio at period-end (4) 13.6% 13.6% Securities $75,652,396 $76,098,985 Loans, net 3,083,821 2,788,341 Mortgage servicing rights 100,895 207,985 Assets transferred or pledged to securitization vehicles 6,910,020 7,269,402 Real estate, net 656,314 790,597 Total residential and commercial investments $86,403,446 $87,155,310 Net interest margin (5) 2.14% 2.15% Average yield on interest earning assets (6) 2.61% 2.70% Average GAAP cost of interest bearing liabilities (7) 0.51% 0.60% Net interest spread 2.10% 2.10% Net interest margin (excluding PAA) *(5) 1.98% 2.05% Average yield on interest earning assets (excluding PAA) *(6) 2.80% 2.86% Average economic cost of interest bearing liabilities *(7) 0.87% 0.93% Net interest spread (excluding PAA) * 1.93% 1.93% Operating expenses to core earnings (excluding PAA) *(8) 9.78% 9.54% Annualized operating expenses as a % of average total assets (8) 0.20% 0.20% Annualized operating expenses as a % of average total equity (8) 1.27% 1.32% Unaudited, dollars in thousands except per share amounts 2 Financial Snapshot Non-GAAP Key Statistics ______________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation.

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Portfolio- Related Data Residential Securities Summary Portfolio Statistics Unaudited, dollars in thousands 3 Portfolio Data For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Agency mortgage-backed securities $74,067,059 $74,915,167 $76,761,800 $78,456,846 $112,893,367 Residential credit risk transfer securities 532,403 411,538 362,901 222,871 531,322 Non-agency mortgage-backed securities 972,192 717,602 619,840 585,954 1,135,868 Commercial mortgage-backed securities 80,742 54,678 61,202 91,925 273,023 Total securities $75,652,396 $76,098,985 $77,805,743 $79,357,596 $114,833,580 Residential mortgage loans $345,810 $152,959 $1,168,521 $1,268,083 $1,647,787 Commercial real estate debt and preferred equity 498,081 573,504 618,886 649,843 669,713 Corporate debt 2,239,930 2,061,878 2,185,264 2,150,263 2,144,850 Total loans, net $3,083,821 $2,788,341 $3,972,671 $4,068,189 $4,462,350 Mortgage servicing rights $100,895 $207,985 $227,400 $280,558 $378,078 Agency mortgage-backed securities transferred or pledged to securitization vehicles $620,347 $623,650 $1,832,708 $1,803,608 $1,122,588 Residential mortgage loans transferred or pledged to securitization vehicles 3,249,251 3,588,679 2,832,502 3,027,188 2,598,374 Commercial real estate debt investments transferred or pledged to securitization vehicles 2,166,073 2,174,118 2,150,623 1,927,575 2,345,120 Commercial real estate debt and preferred equity transferred or pledged to securitization vehicles 874,349 882,955 874,618 913,291 936,378 Assets transferred or pledged to securitization vehicles $6,910,020 $7,269,402 $7,690,451 $7,671,662 $7,002,460 Real estate, net $656,314 $790,597 $746,067 $751,738 $725,638 Total residential and commercial investments $86,403,446 $87,155,310 $90,442,332 $92,129,743 $127,402,106 Total assets $88,455,103 $89,192,411 $93,458,653 $96,917,274 $130,295,081 Average TBA contract and CMBX balances $20,744,672 $20,429,935 $18,628,343 $9,965,142 $6,878,502 % Fixed-rate 98% 98% 98% 99% 97% % Adjustable-rate 2% 2% 2% 1% 3% Weighted average experienced CPR for the period 24.7% 22.9% 19.5% 13.6% 17.8% Weighted average projected long-term CPR at period-end 16.4% 17.1% 18.0% 17.7% 13.9% Net premium and discount balance in Residential Securities $3,883,229 $3,702,466 $3,679,639 $3,815,149 $5,185,797 Net premium and discount balance as % of stockholders' equity 27.72% 26.11% 26.68% 30.03% 32.84%

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Financing Data Key Capital and Hedging Metrics ______________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands except per share amounts 4 Financing and Capital Data For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Repurchase agreements $64,825,239 $64,633,447 $67,163,598 $72,580,183 $101,740,728 Other secured financing 917,876 861,373 1,538,996 1,805,428 4,455,700 Debt issued by securitization vehicles 5,652,982 6,027,576 6,458,130 6,364,949 5,622,801 Participations issued 39,198 — — — — Mortgages payable 426,256 507,934 508,565 484,762 485,005 Total debt $71,861,551 $72,030,330 $75,669,289 $81,235,322 $112,304,234 Total liabilities $74,433,307 $74,997,739 $79,661,050 $84,209,744 $114,498,737 Cumulative redeemable preferred stock $1,536,569 $1,982,026 $1,982,026 $1,982,026 $1,982,026 Common equity(1) 12,471,747 12,200,180 11,811,440 10,721,399 13,809,991 Total Annaly stockholders' equity 14,008,316 14,182,206 13,793,466 12,703,425 15,792,017 Non-controlling interests 13,480 12,466 4,137 4,105 4,327 Total equity $14,021,796 $14,194,672 $13,797,603 $12,707,530 $15,796,344 Weighted average days to maturity of repurchase agreements 64 72 74 48 65 Weighted average rate on repurchase agreements, for the quarter(2)(3) 0.35% 0.44% 0.79% 1.78% 2.09% Weighted average rate on repurchase agreements, at period-end(3) 0.32% 0.42% 0.49% 1.23% 2.03% Leverage at period-end 5.1x 5.1x 5.5x 6.4x 7.1x Economic leverage at period-end 6.2x 6.2x 6.4x 6.8x 7.2.x Capital ratio at period-end 13.6% 13.6% 13.0% 12.3% 12.0% Book value per common share $8.92 $8.70 $8.39 $7.50 $9.66 Total common shares outstanding 1,398,241 1,402,928 1,407,662 1,430,424 1,430,106 Hedge ratio(4) 61% 48% 40% 19% 75% Weighted average pay rate on interest rate swaps, at period-end 0.92% 0.91% 1.01% 1.63% 1.84% Weighted average receive rate on interest rate swaps, at period-end 0.37% 0.48% 0.75% 1.16% 1.89% Weighted average net rate on interest rate swaps, at period-end 0.55% 0.43% 0.26% 0.47% (0.05%)

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. ______________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands except per share amounts 5 Income Statement Data For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Total interest income $527,344 $562,443 $584,812 $555,026 $1,074,214 Total interest expense 94,481 115,126 186,032 503,473 620,058 Net interest income $432,863 $447,317 $398,780 $51,553 $454,156 Total economic interest expense *(1) $161,288 $177,655 $250,593 $517,453 $574,837 Economic net interest income * $366,056 $384,788 $334,219 $37,573 $499,377 Total interest income (excluding PAA) * $566,445 $596,322 $636,554 $845,748 $990,322 Economic net interest income (excluding PAA) * $405,157 $418,667 $385,961 $328,295 $415,485 GAAP net income (loss) $878,635 $1,015,548 $856,234 ($3,640,189) $1,209,742 GAAP net income (loss) available (related) to common stockholders (2) $841,707 $980,165 $820,693 ($3,675,764) $1,174,165 GAAP net income (loss) per average common share (2) $0.60 $0.70 $0.58 ($2.57) $0.82 Core earnings (excluding PAA) * $459,046 $482,323 $424,580 $330,218 $409,157 Core earnings (excluding PAA) available to common stockholders *(2) $423,537 $446,814 $389,071 $294,709 $373,648 Core earnings (excluding PAA) per average common share *(2) $0.30 $0.32 $0.27 $0.21 $0.26 PAA cost (benefit) $39,101 $33,879 $51,742 $290,722 ($83,892) Summary Income Statement

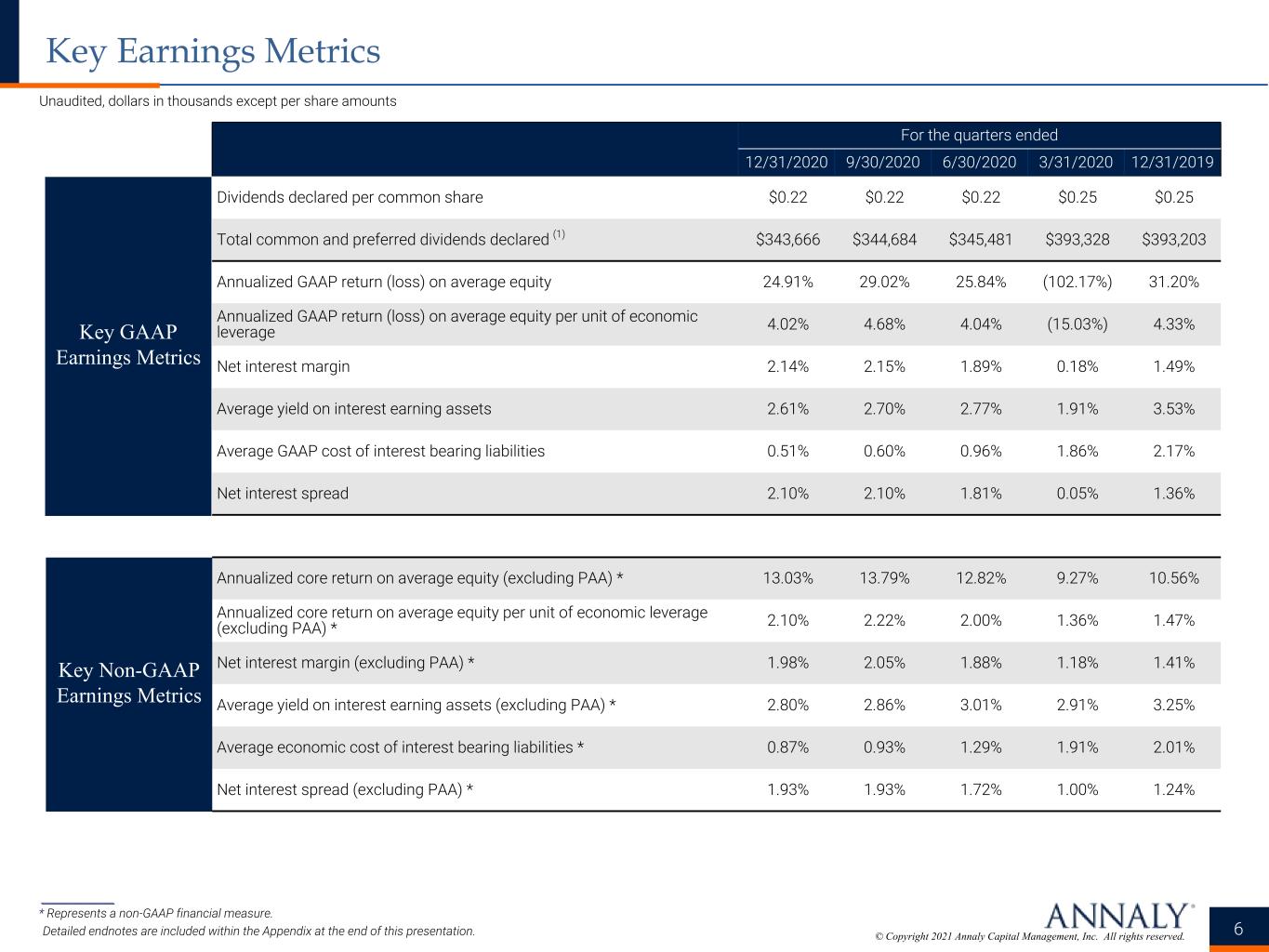

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Dividends declared per common share $0.22 $0.22 $0.22 $0.25 $0.25 Total common and preferred dividends declared (1) $343,666 $344,684 $345,481 $393,328 $393,203 Annualized GAAP return (loss) on average equity 24.91% 29.02% 25.84% (102.17%) 31.20% Annualized GAAP return (loss) on average equity per unit of economic leverage 4.02% 4.68% 4.04% (15.03%) 4.33% Net interest margin 2.14% 2.15% 1.89% 0.18% 1.49% Average yield on interest earning assets 2.61% 2.70% 2.77% 1.91% 3.53% Average GAAP cost of interest bearing liabilities 0.51% 0.60% 0.96% 1.86% 2.17% Net interest spread 2.10% 2.10% 1.81% 0.05% 1.36% Annualized core return on average equity (excluding PAA) * 13.03% 13.79% 12.82% 9.27% 10.56% Annualized core return on average equity per unit of economic leverage (excluding PAA) * 2.10% 2.22% 2.00% 1.36% 1.47% Net interest margin (excluding PAA) * 1.98% 2.05% 1.88% 1.18% 1.41% Average yield on interest earning assets (excluding PAA) * 2.80% 2.86% 3.01% 2.91% 3.25% Average economic cost of interest bearing liabilities * 0.87% 0.93% 1.29% 1.91% 2.01% Net interest spread (excluding PAA) * 1.93% 1.93% 1.72% 1.00% 1.24% Key GAAP Earnings Metrics ______________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands except per share amounts 6 Key Earnings Metrics Key Non-GAAP Earnings Metrics

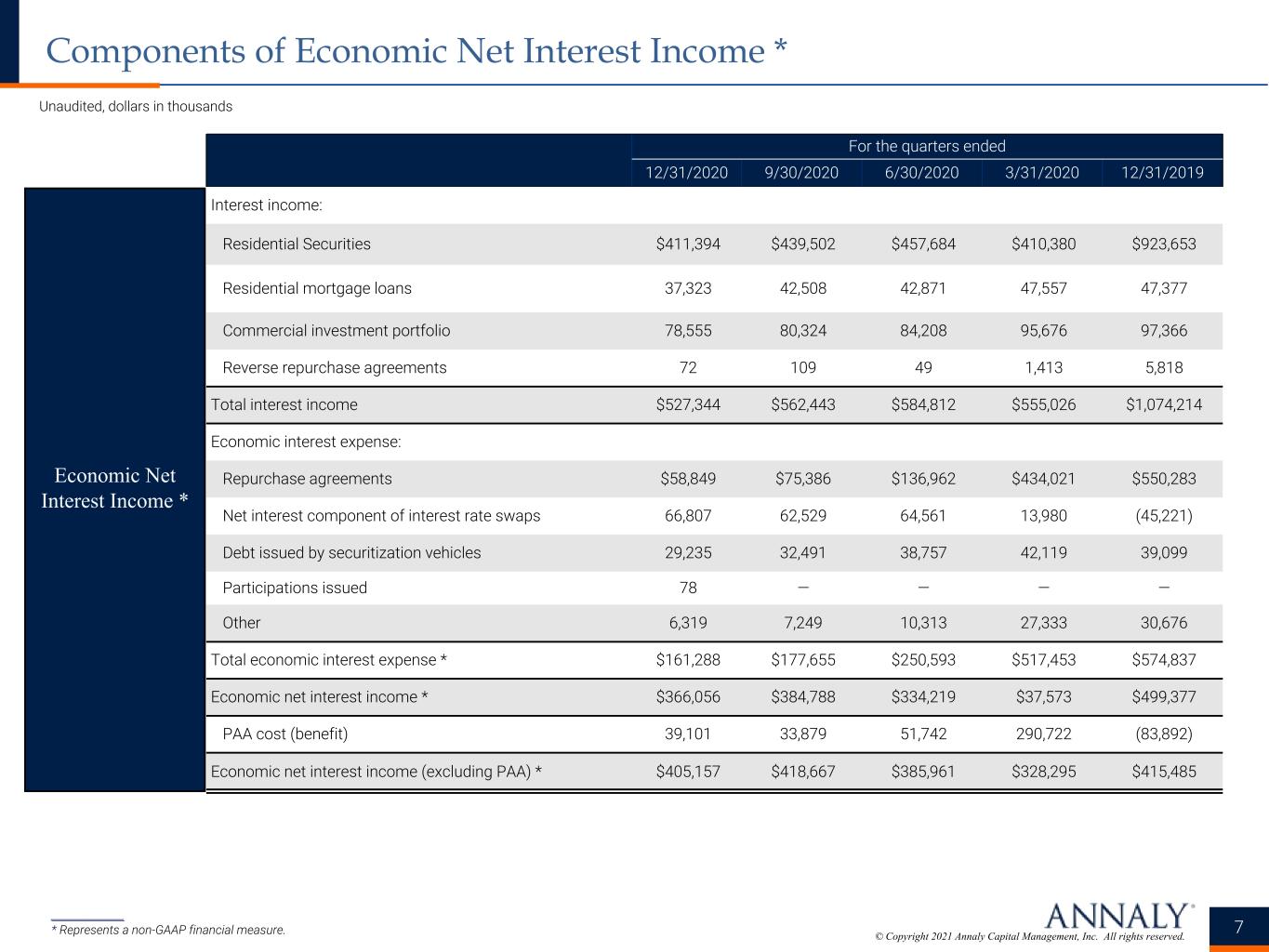

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Economic Net Interest Income * ______________ * Represents a non-GAAP financial measure. Unaudited, dollars in thousands 7 Components of Economic Net Interest Income * For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Interest income: Residential Securities $411,394 $439,502 $457,684 $410,380 $923,653 Residential mortgage loans 37,323 42,508 42,871 47,557 47,377 Commercial investment portfolio 78,555 80,324 84,208 95,676 97,366 Reverse repurchase agreements 72 109 49 1,413 5,818 Total interest income $527,344 $562,443 $584,812 $555,026 $1,074,214 Economic interest expense: Repurchase agreements $58,849 $75,386 $136,962 $434,021 $550,283 Net interest component of interest rate swaps 66,807 62,529 64,561 13,980 (45,221) Debt issued by securitization vehicles 29,235 32,491 38,757 42,119 39,099 Participations issued 78 — — — — Other 6,319 7,249 10,313 27,333 30,676 Total economic interest expense * $161,288 $177,655 $250,593 $517,453 $574,837 Economic net interest income * $366,056 $384,788 $334,219 $37,573 $499,377 PAA cost (benefit) 39,101 33,879 51,742 290,722 (83,892) Economic net interest income (excluding PAA) * $405,157 $418,667 $385,961 $328,295 $415,485

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Core Earnings (excluding PAA)* Reconciliation 8 GAAP Net Income to Core Earnings (excluding PAA)* Reconciliation For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 GAAP net income (loss) $878,635 $1,015,548 $856,234 ($3,640,189) $1,209,742 Net income (loss) attributable to noncontrolling interests 1,419 (126) 32 66 68 Net income (loss) attributable to Annaly 877,216 1,015,674 856,202 (3,640,255) 1,209,674 Adjustments to exclude reported realized and unrealized (gains) losses: Realized (gains) losses on termination or maturity of interest rate swaps (2,092) 427 1,521,732 397,561 4,615 Unrealized (gains) losses on interest rate swaps (258,236) (170,327) (1,494,628) 2,827,723 (782,608) Net (gains) losses on disposal of investments and other (9,363) (198,888) (246,679) (206,583) (17,783) Net (gains) losses on other derivatives (209,647) (169,316) (170,916) (206,426) 42,312 Net unrealized (gains) losses on instruments measured at fair value through earnings (51,109) (121,255) (254,772) 730,160 5,636 Loan loss provision (1) 469 (21,818) 72,544 99,993 7,362 Other adjustments: Depreciation expense related to commercial real estate and amortization of intangibles (2) 11,097 11,363 8,714 7,934 9,823 Non-core (income) loss allocated to equity method investments (3) 28 (1,151) 4,218 19,398 (3,979) Transaction expenses and non-recurring items (4) 172 2,801 1,075 7,245 3,634 Income tax effect of non-core income (loss) items (10,984) 13,890 3,353 (23,862) (418) TBA dollar roll income and CMBX coupon income (5) 99,027 114,092 97,524 44,904 36,901 MSR amortization (6) (26,633) (27,048) (25,529) (18,296) (22,120) Plus: Premium amortization adjustment cost (benefit) 39,101 33,879 51,742 290,722 (83,892) Core earnings (excluding PAA) * 459,046 482,323 424,580 330,218 409,157 Dividends on preferred stock 35,509 35,509 35,509 35,509 35,509 Core earnings (excluding PAA) attributable to common stockholders * $423,537 $446,814 $389,071 $294,709 $373,648 ______________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Book Value Rollforward Net Interest Margin Unaudited 9 Quarter-Over-Quarter Changes in Key Metrics ______________ Detailed endnotes are included within the Appendix at the end of this presentation. For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Book value per common share, beginning of period $8.70 $8.39 $7.50 $9.66 $9.21 Net income (loss) available (related) to common stockholders 0.60 0.70 0.58 (2.57) 0.82 Other comprehensive income (loss) attributable to common stockholders (0.16) (0.18) 0.51 0.69 (0.12) Common dividends declared (0.22) (0.22) (0.22) (0.25) (0.25) Issuance / buyback of common stock / redemption of preferred stock — 0.01 0.02 — — Other adjustment (1) — — — (0.03) — Book value per common share, end of period $8.92 $8.70 $8.39 $7.50 $9.66 Prior quarter net interest margin 2.15% 1.89% 0.18% 1.49% 0.48% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets (0.10%) (0.17%) 0.03% (0.04%) 0.02% Net amortization of premiums 0.01% 0.10% 0.83% (1.58%) 0.62% GAAP interest expense 0.08% 0.33% 0.85% 0.31% 0.37% Current quarter net interest margin 2.14% 2.15% 1.89% 0.18% 1.49% Prior quarter net interest spread 2.10% 1.81% 0.05% 1.36% 0.31% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets (0.10%) (0.17%) 0.03% (0.04%) 0.02% Net amortization of premiums 0.01% 0.10% 0.83% (1.58%) 0.62% Average GAAP cost of interest bearing liabilities 0.09% 0.36% 0.90% 0.31% 0.41% Current quarter net interest spread 2.10% 2.10% 1.81% 0.05% 1.36% Net Interest Spread

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Net Interest Margin (excluding PAA)* Unaudited 10 Quarter-Over-Quarter Changes in Key Metrics (continued) ______________ * Represents a non-GAAP financial measure. For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Prior quarter net interest margin (excluding PAA) * 2.05% 1.88% 1.18% 1.41% 1.10% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets (including average TBA dollar roll and CMBX balances) (0.11%) (0.20%) (0.39%) (0.14%) 0.08% Net amortization of premiums (excluding PAA) 0.04% 0.03% 0.18% (0.26%) (0.04%) TBA dollar roll income and CMBX coupon income (0.05%) 0.06% 0.24% 0.03% 0.07% Interest expense and net interest component of interest rate swaps 0.05% 0.28% 0.67% 0.14% 0.20% Current quarter net interest margin (excluding PAA) * 1.98% 2.05% 1.88% 1.18% 1.41% Prior quarter net interest spread (excluding PAA) * 1.93% 1.72% 1.00% 1.24% 0.98% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets (0.10%) (0.17%) 0.03% (0.04%) 0.02% Net amortization of premiums (excluding PAA) 0.04% 0.02% 0.07% (0.30%) (0.03%) Average economic cost of interest bearing liabilities 0.06% 0.36% 0.62% 0.10% 0.27% Current quarter net interest spread (excluding PAA) * 1.93% 1.93% 1.72% 1.00% 1.24% Net Interest Spread (excluding PAA)*

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Annualized GAAP Return (Loss) on Average Equity Annualized Core Return on Average Equity (excluding PAA)* ______________ * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited 11 Quarter-Over-Quarter Changes in Annualized Return on Average Equity For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Prior quarter annualized GAAP return (loss) on average equity 29.02% 25.84% (102.17%) 31.20% (19.32%) Quarter-over-quarter changes in contribution: Coupon income (1.42%) (2.71%) (7.00%) 0.88% (1.36%) Net amortization of premiums and accretion of discounts 0.30% 1.14% 9.08% (13.00%) 5.29% Interest expense and net interest component of interest rate swaps 0.50% 2.49% 6.96% 0.30% 2.72% Realized gains (losses) on termination or maturity of interest rate swaps 0.07% 45.92% (34.77%) (11.04%) 17.54% Unrealized gains (losses) on interest rate swaps 2.46% (40.24%) 124.48% (99.56%) 28.62% Realized and unrealized gains (losses) on investments and other derivatives (6.33%) (6.31%) 29.20% (8.12%) (2.04%) Loan loss provision (0.67%) 2.70% 0.71% (2.60%) (0.10%) Other(1) 0.98% 0.19% (0.65%) (0.23%) (0.15%) Current quarter annualized GAAP return (loss) on average equity 24.91% 29.02% 25.84% (102.17%) 31.20% Prior quarter annualized core return on average equity (excluding PAA) * 13.79% 12.82% 9.27% 10.56% 8.85% Quarter-over-quarter changes in contribution: Coupon income (1.42%) (2.71%) (7.00%) 0.88% (1.36%) Net amortization of premiums (excluding PAA) 0.45% 0.54% 2.48% (2.68%) 0.09% Interest expense and net interest component of interest rate swaps 0.50% 2.49% 6.96% 0.30% 2.72% TBA dollar roll income and CMBX coupon income (0.45%) 0.32% 1.68% 0.31% 0.56% Other(2) 0.16% 0.33% (0.57%) (0.10%) (0.30%) Current quarter core return on annualized average equity (excluding PAA) * 13.03% 13.79% 12.82% 9.27% 10.56%

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. ______________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands 12 Residential Investments & TBA Derivative Overview as of December 31, 2020 Agency Fixed-Rate Securities (Pools) Original Weighted Avg. Years to Maturity Current Face Value % (3) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Weighted Avg. 3-Month CPR Estimated Fair Value <=15 years (1) $3,401,749 5.1% 2.73% 101.6% 107.5% 18.5% $3,656,509 20 years 2,489,098 3.7% 3.14% 103.3% 107.3% 25.1% 2,669,742 >=30 years (2) 61,132,987 91.2% 3.64% 105.2% 110.2% 24.7% 67,379,552 Total/Weighted Avg. $67,023,834 100.0% 3.58% 105.0% 110.0% 24.6% $73,705,803 TBA Contracts Type Notional Value % (4) Weighted Avg. Coupon Implied Cost Basis Implied Market Value 15-year $2,503,000 12.7% 1.85% $2,588,464 $2,603,995 30-year 17,132,000 87.3% 2.07% 17,688,624 17,769,202 Total/Weighted Avg. $19,635,000 100.0% 2.04% $20,277,088 $20,373,197 Agency Adjustable-Rate Securities Weighted Avg. Months to Reset Current Face Value % (3) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Weighted Avg. 3-Month CPR Estimated Fair Value 0 - 24 months $395,996 78.8% 2.76% 100.8% 105.2% 24.2% $416,757 25 - 40 months 37,393 7.4% 2.52% 98.9% 103.6% 40.9% 38,740 41 - 60 months 52,513 10.4% 2.97% 101.0% 105.6% 40.8% 55,442 61 - 90 months 17,358 3.4% 2.99% 101.2% 105.8% 58.2% 18,359 Total/Weighted Avg. $503,260 100.0% 2.77% 100.7% 105.2% 28.2% $529,298

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. ______________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands 13 Residential Investments & TBA Derivative Overview as of December 31, 2020 (continued) Agency Interest-Only Collateralized Mortgage-Backed Obligations Type Current Notional Value % (1) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Weighted Avg. 3-Month CPR Estimated Fair Value Interest-only $1,026,298 32.6% 3.37% 15.2% 8.5% 28.2% $87,419 Inverse interest-only 1,764,239 56.1% 5.95% 23.1% 19.0% 27.2% 334,490 Multifamily Interest-Only $354,562 11.3% 1.04% 8.4% 8.6% —% $30,396 Total/Weighted Avg. $3,145,099 100.0% 4.55% 18.9% 14.4% 27.5% $452,305 Mortgage Servicing Rights Type Unpaid Principal Balance Weighted Avg. Coupon Excess Servicing Spread Weighted Avg. Loan Age (months) Estimated Fair Value Total/Weighted Avg. $15,198,193 3.86% 0.24% 56 $100,895 Residential Credit Portfolio Sector Current Face / Notional Value % (2) Weighted Avg. Coupon Weighted Avg. Amortized Cost Weighted Avg. Fair Value Estimated Fair Value Residential Credit Risk Transfer $544,780 10.4% 4.07% 98.9% 97.7% $532,403 Alt-A 93,001 1.6% 3.73% 81.4% 86.4% 80,328 Prime 177,852 3.6% 4.44% 93.9% 102.1% 181,509 Prime Interest-only 194,687 0.1% 0.47% 1.0% 0.6% 1,240 Subprime 197,779 3.7% 1.85% 91.1% 95.3% 188,433 NPL/RPL 475,108 9.3% 4.32% 99.7% 100.2% 475,847 Prime Jumbo 44,696 0.8% 3.87% 88.6% 96.8% 43,283 Prime Jumbo Interest-only 291,624 —% 0.35% 2.3% 0.5% 1,552 Residential Mortgage Loans 3,482,865 70.5% 4.89% 100.8% 103.2% 3,595,061 Total/Weighted Avg. $5,502,392 100.0% 4.59% $5,099,656

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. ______________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited, dollars in thousands 14 Residential Credit Investments Detail as of December 31, 2020 (1) Product Estimated Fair Value Payment Structure Investment Characteristics Senior Subordinate Coupon Credit Enhancement 60+ Delinquencies 3M VPR Agency Credit Risk Transfer $508,685 $— $508,685 4.03% 1.28% 4.66% 44.40% Private Label Credit Risk Transfer 23,718 — 23,718 4.81% 0.97% 0.86% 43.63% Alt-A 80,328 25,286 55,042 3.73% 9.70% 17.40% 18.86% Prime 181,509 12,128 169,381 4.44% 7.02% 8.94% 30.73% Prime Interest-only 1,240 1,240 — 0.47% —% 5.21% 45.03% Subprime 188,433 96,468 91,965 1.85% 17.95% 14.08% 8.80% Re-Performing Loan Securitizations 467,702 227,558 240,144 4.34% 30.93% 28.12% 9.95% Non-Performing Loan Securitizations 8,145 8,145 — 3.67% 32.18% 82.18% 3.70% Prime Jumbo 43,283 — 43,283 3.87% 3.35% 4.23% 51.33% Prime Jumbo Interest-only 1,552 1,552 — 0.35% —% 4.59% 53.22% Total (2) $1,504,595 $372,377 $1,132,218 3.88% 13.86% 14.62% 28.20% Product Estimated Fair Value Bond Coupon ARM Fixed Floater Interest Only Agency Credit Risk Transfer $508,685 $— $— $508,594 $91 Private Label Credit Risk Transfer 23,718 — — 23,718 — Alt-A 80,328 18,133 48,629 13,566 — Prime 181,509 40,859 135,887 4,763 — Prime Interest-only 1,240 — — — 1,240 Subprime 188,433 7,486 71,776 108,939 232 Re-Performing Loan Securitizations 467,702 — 467,702 — — Non-Performing Loan Securitizations 8,145 — 8,145 — — Prime Jumbo 43,283 — 43,283 — — Prime Jumbo Interest-only 1,552 — — — 1,552 Total $1,504,595 $66,478 $775,422 $659,580 $3,115

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Unaudited, dollars in thousands ______________ Detailed endnotes are included within the Appendix at the end of this presentation. 15 Commercial Real Estate Overview as of December 31, 2020 Investment Portfolio Number of Investments GAAP Weighted Avg LTV (1) Weighted Avg Life (years) (2) Non-GAAP Book Values % of Portfolio Economic Interest (3) Levered Return (4) Loans Senior Mortgages 13 $373,925 8.7% 75.1% 3.1 $190,455 9.4% Mezzanine Loans 11 124,156 2.9% 73.9% 2.1 48,790 9.2% Total Loans 24 498,081 11.6% 74.8% 2.9 239,245 9.4% Securities CMBS (Credit) 2 31,603 0.7% 61.4% 5.4 14,907 23.8% SASB 16 45,254 1.1% 61.3% 3.6 4,720 11.8% CRT (MF) 1 3,885 0.1% 63.1% 8.2 3,885 4.3% Total Securities 19 $80,742 1.9% 61.4% 4.5 $23,512 18.3% Assets transferred or pledged to securitization vehicles NLY 2019 - FL2 25 797,495 18.7% 84.0% 2.8 170,845 17.2% NLY 2019 - OAKS 1 76,854 1.8% 74.0% 4.1 14,973 24.0% Commercial Trusts 64 2,166,073 50.6% 46.7% 4.1 125,007 10.9% Total Assets transferred or pledged to securitization vehicles 90 $3,040,422 71.1% 57.2% 3.8 $310,825 15.0% Total Debt Investments 133 $3,619,245 84.6% 59.7% 3.7 $573,582 12.8% Equity Investments Real Estate Held for Investment 37 563,765 13.2% 256,607 8.7% Investment in Unconsolidated Joint Ventures (5) 32 92,549 2.2% 167,705 8.1% Total Equity Investments 69 656,314 15.4% 424,312 8.5% Total Investment Portfolio 202 $4,275,559 100.0% $997,894 11.0% Derivatives Net Notional Range of Ratings Implied Market Value Net Weighted Average Coupon CMBX (6) $504,000 AAA to A $496,560 1.2%

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Unaudited, dollars in thousands 16 Middle Market Lending Overview as of December 31, 2020 Industry Dispersion Industry Total (1) Computer Programming, Data Processing & Other Computer Related Services 483,142 Management and Public Relations Services 300,869 Industrial Inorganic Chemicals 156,391 Public Warehousing and Storage 132,397 Metal Cans & Shipping Containers 115,670 Offices and Clinics of Doctors of Medicine 104,781 Surgical, Medical, and Dental Instruments and Supplies 83,161 Electronic Components & Accessories 78,129 Engineering, Architectural, and Surveying 77,308 Miscellaneous Health and Allied Services, not elsewhere classified 77,163 Insurance Agents, Brokers and Services 67,193 Research, Development and Testing Services 62,008 Miscellaneous Food Preparations 58,857 Telephone Communications 58,450 Miscellaneous Equipment Rental and Leasing 49,587 Electric Work 41,128 Petroleum and Petroleum Products 33,890 Medical and Dental Laboratories 30,711 Schools and Educational Services, not elsewhere classified 29,040 Home Health Care Services 28,587 Metal Forgings and Stampings 27,523 Legal Services 26,399 Grocery Stores 22,895 Coating, Engraving and Allied Services 19,484 Chemicals & Allied Products 14,686 Miscellaneous Business Services 12,980 Drugs 12,942 Mailing, Reproduction, Commercial Art and Photography, and Stenographic 12,733 Machinery, Equipment, and Supplies 12,096 Offices and Clinics of Other Health Practitioners 9,730 Total $2,239,930 Size Dispersion Position Size Amount Percentage $0 - $20 million $166,536 7.4% $20 - $40 million 417,141 18.6% $40 - $60 million 391,676 17.5% Greater than $60 million 1,264,577 56.5% Total $2,239,930 100.0% Tenor Dispersion Remaining Term Amount Percentage One year or less $30,585 1.4% One to three years 401,878 17.9% Three to five years 680,217 30.4% Greater than five years 1,127,250 50.3% Total $2,239,930 100.0% Lien Position Amount Percentage First lien loans $1,489,125 66.5% Second lien loans 750,805 33.5% Total $2,239,930 100.0% ______________ Detailed endnotes are included within the Appendix at the end of this presentation.

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. ______________ Detailed endnotes are included within the Appendix at the end of this presentation. 17 Unaudited, dollars in thousands Hedging and Liabilities as of December 31, 2020 Principal Balance Weighted Average Rate Days to Maturity(5)At Period End For the Quarter Repurchase agreements $ 64,825,239 0.32 % 0.35 % 64 Other secured financing 917,876 2.22 % 2.96 % 1,353 Debt issued by securitization vehicles 5,649,190 2.13 % 1.95 % 9,013 Participations issued 37,365 4.47 % 4.70 % 11,664 Mortgages payable 513,180 4.25 % 4.07 % 4,046 Total indebtedness $ 71,942,850 Maturity Current Notional (1)(2) Weighted Avg. Pay Rate Weighted Avg. Receive Rate Weighted Avg. Years to Maturity(3) 0 to 3 years $ 23,680,150 0.27 % 0.11 % 1.96 > 3 to 6 years 3,600,000 0.18 % 0.09 % 4.21 > 6 to 10 years 5,565,500 1.40 % 0.62 % 7.76 Greater than 10 years 1,484,000 3.06 % 0.36 % 20.52 Total / Weighted Avg. $ 34,329,650 0.92 % 0.37 % 3.94 Type Current Underlying Notional Weighted Avg. Underlying Fixed Rate Weighted Avg. Underlying Floating Rate Weighted Avg. Underlying Years to Maturity Weighted Avg. Months to Expiration Long Pay $ 8,050,000 1.27 % 3M LIBOR 10.40 5.42 Long Receive $ 250,000 1.66 % 3M LIBOR 10.02 0.13 Type Long Contracts Short Contracts Net Positions Weighted Avg. Years to Maturity U.S. Treasury Futures - 5 year $ — $ (1,240,000) $ (1,240,000) 4.40 U.S. Treasury Futures - 10 year & Greater $ — $ (9,183,800) $ (9,183,800) 6.90 Total / Weighted Avg. $ — $ (10,423,800) $ (10,423,800) 6.60 Maturity Principal Balance Weighted Avg. Rate At Period End Within 30 days $ 30,841,837 0.29 % 30 to 59 days 10,567,655 0.42 % 60 to 89 days 8,568,836 0.30 % 90 to 119 days 2,154,733 0.23 % Over 120 days(4) 13,610,054 0.49 % Total / Weighted Avg. $ 65,743,115 0.35 % Interest Rate Swaps Interest Rate Swaptions Futures Positions Repurchase Agreements and Other Secured Financing Total Indebtedness

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. ______________ Detailed endnotes are included within the Appendix at the end of this presentation. Unaudited 18 Quarter-Over-Quarter Interest Rate and MBS Spread Sensitivity Assumptions: ▪ The interest rate sensitivity and MBS spread sensitivity are based on the portfolios as of December 31, 2020 and September 30, 2020 ▪ The interest rate sensitivity reflects instantaneous parallel shifts in rates ▪ The MBS spread sensitivity shifts MBS spreads instantaneously and reflects exposure to MBS basis risk ▪ All tables assume no active management of the portfolio in response to rate or spread changes Interest Rate Sensitivity (1) Interest Rate Change (bps) As of December 31, 2020 As of September 30, 2020 Estimated Percentage Change in Portfolio Market Value(2) Estimated Change as a % of NAV(2)(3) Estimated Percentage Change in Portfolio Market Value(2) Estimated Change as a % of NAV(2)(3) (75) (0.2%) (1.3%) —% (0.3%) (50) —% (0.2%) 0.1% 0.7% (25) 0.1% 0.7% 0.2% 1.5% 25 (0.1%) (0.5%) (0.1%) (0.9%) 50 (0.2%) (1.3%) (0.3%) (2.1%) 75 (0.4%) (2.7%) (0.6%) (3.9%) MBS Spread Sensitivity (1) MBS Spread Shock (bps) As of December 31, 2020 As of September 30, 2020 Estimated Change in Portfolio Market Value (2) Estimated Change as a % of NAV(2)(3) Estimated Change in Portfolio Market Value (2) Estimated Change as a % of NAV(2)(3) (25) 1.5% 9.0% 1.4% 8.9% (15) 0.9% 5.4% 0.9% 5.3% (5) 0.3% 1.8% 0.3% 1.8% 5 (0.3%) (1.8%) (0.3%) (1.7%) 15 (0.9%) (5.3%) (0.8%) (5.2%) 25 (1.5%) (8.9%) (1.4%) (8.7%)

Appendix

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. 20 Non-GAAP Reconciliations To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. While intended to offer a fuller understanding of the Company’s results and operations, non-GAAP financial measures also have limitations. For example, the Company may calculate its non-GAAP metrics, such as core earnings (excluding PAA), or the PAA, differently than its peers making comparative analysis difficult. Additionally, in the case of non-GAAP measures that exclude the PAA, the amount of amortization expense excluding the PAA is not necessarily representative of the amount of future periodic amortization nor is it indicative of the term over which the Company will amortize the remaining unamortized premium. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both GAAP and non-GAAP results. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Additional information pertaining to these non-GAAP financial measures and reconciliations to their most directly comparable GAAP results are provided on the following pages. A reconciliation of GAAP net income (loss) to non-GAAP core earnings (excluding PAA) for the quarters ended December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020 and December 31, 2019, is provided on page 8 of this financial summary. Core earnings (excluding PAA), a non-GAAP measure, is defined as the sum of (a) economic net interest income, (b) TBA dollar roll income and CMBX coupon income, (c) realized amortization of MSRs, (d) other income (loss) (excluding depreciation expense related to commercial real estate and amortization of intangibles, non-core income allocated to equity method investments and other non-core components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items) and (f) income taxes (excluding the income tax effect of non-core income (loss) items) and excludes (g) the premium amortization adjustment representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities ("PAA").

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Unaudited, dollars in thousands 21 Non-GAAP Reconciliations (continued) For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Premium Amortization Reconciliation Premium amortization expense $239,118 $248,718 $270,688 $616,937 $171,447 Less: PAA cost (benefit) 39,101 33,879 51,742 290,722 (83,892) Premium amortization expense (excluding PAA) $200,017 $214,839 $218,946 $326,215 $255,339 Interest Income (excluding PAA) Reconciliation GAAP interest income $527,344 $562,443 $584,812 $555,026 $1,074,214 PAA cost (benefit) 39,101 33,879 51,742 290,722 (83,892) Interest income (excluding PAA) * $566,445 $596,322 $636,554 $845,748 $990,322 Economic Interest Expense Reconciliation GAAP interest expense $94,481 $115,126 $186,032 $503,473 $620,058 Add: Net interest component of interest rate swaps 66,807 62,529 64,561 13,980 (45,221) Economic interest expense * $161,288 $177,655 $250,593 $517,453 $574,837 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) * $566,445 $596,322 $636,554 $845,748 $990,322 Less: Economic interest expense * 161,288 177,655 250,593 517,453 574,837 Economic net interest income (excluding PAA) * $405,157 $418,667 $385,961 $328,295 $415,485 ______________ * Represents a non-GAAP financial measure.

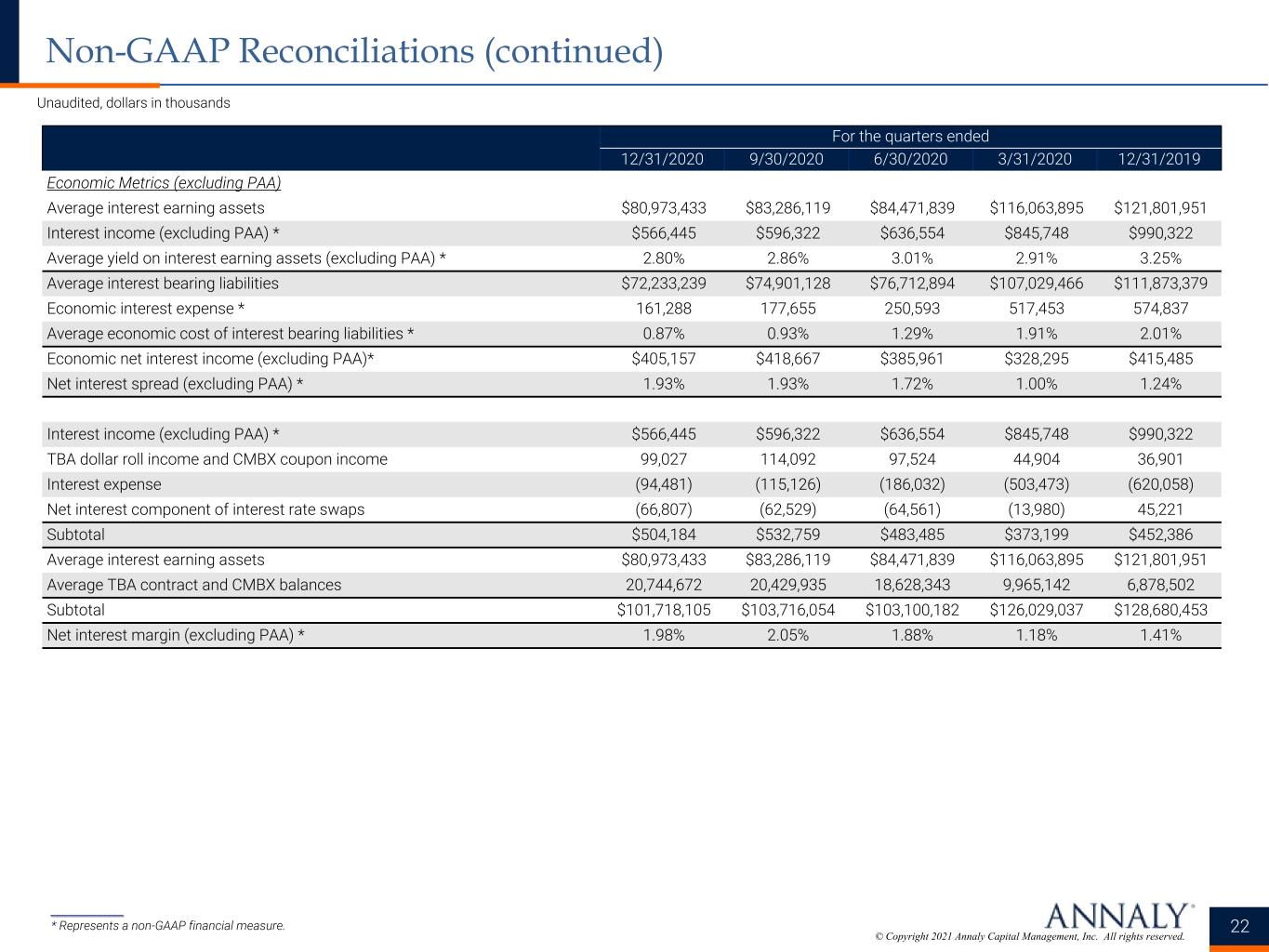

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. Unaudited, dollars in thousands 22 Non-GAAP Reconciliations (continued) For the quarters ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Economic Metrics (excluding PAA) Average interest earning assets $80,973,433 $83,286,119 $84,471,839 $116,063,895 $121,801,951 Interest income (excluding PAA) * $566,445 $596,322 $636,554 $845,748 $990,322 Average yield on interest earning assets (excluding PAA) * 2.80% 2.86% 3.01% 2.91% 3.25% Average interest bearing liabilities $72,233,239 $74,901,128 $76,712,894 $107,029,466 $111,873,379 Economic interest expense * 161,288 177,655 250,593 517,453 574,837 Average economic cost of interest bearing liabilities * 0.87% 0.93% 1.29% 1.91% 2.01% Economic net interest income (excluding PAA)* $405,157 $418,667 $385,961 $328,295 $415,485 Net interest spread (excluding PAA) * 1.93% 1.93% 1.72% 1.00% 1.24% Interest income (excluding PAA) * $566,445 $596,322 $636,554 $845,748 $990,322 TBA dollar roll income and CMBX coupon income 99,027 114,092 97,524 44,904 36,901 Interest expense (94,481) (115,126) (186,032) (503,473) (620,058) Net interest component of interest rate swaps (66,807) (62,529) (64,561) (13,980) 45,221 Subtotal $504,184 $532,759 $483,485 $373,199 $452,386 Average interest earning assets $80,973,433 $83,286,119 $84,471,839 $116,063,895 $121,801,951 Average TBA contract and CMBX balances 20,744,672 20,429,935 18,628,343 9,965,142 6,878,502 Subtotal $101,718,105 $103,716,054 $103,100,182 $126,029,037 $128,680,453 Net interest margin (excluding PAA) * 1.98% 2.05% 1.88% 1.18% 1.41% ______________ * Represents a non-GAAP financial measure.

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. 23 Endnotes Page 2 (1) Net of dividends on preferred stock. (2) Debt consists of repurchase agreements, other secured financing, debt issued by securitization vehicles, participations issued and mortgages payable. Certain credit facilities (included within other secured financing), debt issued by securitization vehicles, participations issued and mortgages payable are non-recourse to the Company. (3) Computed as the sum of recourse debt, cost basis of to be announced ("TBA") derivatives and credit derivatives referencing the commercial mortgage-backed securities index ("CMBX") derivatives outstanding and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of repurchase agreements and other secured financing (excluding certain non-recourse credit facilities). Certain credit facilities (included within other secured financing), debt issued by securitization vehicles, participations issued and mortgages payable are non-recourse to the Company and are excluded from this measure. (4) Computed as the ratio of total equity to total assets (inclusive of total market value of TBA derivatives and CMBX positions and exclusive of debt issued by securitization vehicles). (5) Net interest margin represents interest income less interest expense divided by average interest earning assets. Net interest margin (excluding PAA) represents the sum of the Company's interest income (excluding PAA) plus TBA dollar roll income and CMBX coupon income less interest expense and the net interest component of interest rate swaps divided by the sum of average interest earning assets plus average TBA contract and CMBX balances. (6) Average yield on interest earning assets represents annualized interest income divided by average interest earning assets. Average interest earning assets reflects the average amortized cost of our investments during the period. Average yield on interest earning assets (excluding PAA) is calculated using annualized interest income (excluding PAA). (7) Average GAAP cost of interest bearing liabilities represents annualized interest expense divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average balances during the period. Average economic cost of interest bearing liabilities represents annualized economic interest expense divided by average interest bearing liabilities. Economic interest expense is comprised of GAAP interest expense and the net interest component of interest rate swaps. (8) The quarters ended December 31, 2020 and September 30, 2020 include costs incurred in connection with securitizations of residential whole loans. Page 4 (1) Consists of common stock, additional paid-in capital, accumulated other comprehensive income (loss) and accumulated deficit. (2) Utilizes an actual/360 factor. (3) The average and period-end rates are net of reverse repurchase agreements. Without netting reverse repurchase agreements, the average rate was 0.35%, 0.44%, 0.79%, 1.77% and 2.10% and the period-end rate was 0.32%, 0.42%, 0.49%, 1.23% and 2.03% for the quarters ended December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020 and December 31, 2019, respectively. Page 4 (continued) (4) Measures total notional balances of interest rate swaps, interest rate swaptions (excluding receiver swaptions) and futures relative to repurchase agreements, other secured financing and cost basis of TBA derivatives outstanding; excludes MSRs and the effects of term financing, both of which serve to reduce interest rate risk. Additionally, the hedge ratio does not take into consideration differences in duration between assets and liabilities. Page 5 (1) Includes GAAP interest expense and the net interest component of interest rate swaps. (2) Net of dividends on preferred stock. Page 6 (1) Includes dividend equivalents on share-based awards. Page 8 (1) Includes a $1.0 million reversal of loss provision on the Company’s unfunded loan commitments for the quarter ended December 31, 2020, and $0.2 million, $3.8 million and $0.7 million loss provision on the Company’s unfunded loan commitments for the quarters ended September 30, 2020, June 30, 2020 and March 31, 2020, respectively, which is reported in Other income (loss) in the Company’s Consolidated Statement of Comprehensive Income (Loss). (2) Amount includes depreciation and amortization expense related to equity method investments. (3) The Company excludes non-core (income) loss allocated to equity method investments, which represents the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is a component of Other income (loss). (4) The quarters ended December 31, 2020 and September 30, 2020 include costs incurred in connection with securitizations of residential whole loans. The quarter ended June 30, 2020 includes costs incurred in connection with the Internalization and costs incurred in connection with the CEO search process. The quarter ended March 31, 2020 includes costs incurred in connection with securitizations of Agency mortgage-backed securities and residential whole loans as well as costs incurred in connection with the Internalization and costs incurred in connection with the CEO search process. The quarter ended December 31, 2019 includes costs incurred in connection with securitizations of Agency mortgage-backed securities and residential whole loans. (5) TBA dollar roll income and CMBX coupon income each represent a component of Net gains (losses) on other derivatives. CMBX coupon income totaled $1.5 million, $1.5 million, $1.6 million, $1.2 million and $1.3 million for the quarters ended December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020 and December 31, 2019, respectively. (6) MSR amortization represents the portion of changes in fair value that is attributable to the realization of estimated cash flows on the Company’s MSR portfolio and is reported as a component of Net unrealized gains (losses) on instruments measured at fair value.

© Copyright 2021 Annaly Capital Management, Inc. All rights reserved. 24 Endnotes (continued) Page 9 (1) Represents the opening adjustment to retained earnings upon adoption of Accounting Standards Update 2016-13 Financial instruments - Credit losses (Topic 326): Measurement of credit losses on financial instruments, commonly referred to as CECL. Page 11 (1) Includes other income (loss), general and administrative expenses and income taxes. (2) Includes other income (loss) (excluding non-core items), MSR amortization (a component of Net unrealized gains (losses) on instruments measured at fair value through earnings), general and administrative expenses (excluding transaction related expenses) and income taxes (excluding non-core income tax). Page 12 (1) Includes Agency-backed multifamily securities with an estimated fair value of $2.3 billion ($0.6 billion of which have been transferred or pledged to securitization vehicles). (2) Includes fixed-rate collateralized mortgage obligations with an estimated fair value of $149.8 million. (3) Weighted by current face value. (4) Weighted by current notional value. Page 13 (1) Weighted by current notional value. (2) Weighted by estimated fair value. Page 14 (1) Excludes residential mortgage loans. (2) Total investment characteristics exclude interest-only securities. Page 15 (1) Based on an internal valuation or the most recent third party appraisal, which may be prior to loan origination/purchase date or at the time of underwriting. (2) Maturity dates assume all of the borrowers' extension options are exercised for the loan portfolio. (3) Economic interest is a non-GAAP measure to include gross asset values less related financings. Equity investments are adjusted to exclude depreciation and amortization and grosses up real estate investments accounted for under equity method accounting. (4) Levered returns for equity investments comprise a trailing twelve-month (“TTM”) distribution yield for joint venture investments and core return for wholly owned properties. (5) Includes investment in unconsolidated debt fund of $38.6 million, investments in Community Investment Impact Funds of $20.9 million and a portfolio of real estate properties of $33.1 million. (6) The Company sells/buys protection on CMBX tranches referencing baskets of Conduit CMBS bonds with various ratings. Positive net notional indicates selling protection and being long the exposure to the underlying CMBS. CMBX positions are accounted for as derivatives with changes in fair value presented in Net gains (losses) on other derivatives. Page 16 (1) All Middle Market Lending positions are floating rate. Page 17 (1) Current notional is presented net of receiver swaps. (2) As of December 31, 2020, 17%, 72% and 11% of the Company's interest rate swaps were linked to LIBOR, the Federal funds rate and the Secured Overnight Financing Rate, respectively. (3) The weighted average years to maturity of payer interest rate swaps is offset by the weighted average years to maturity of receiver interest rate swaps. As such, the net weighted average years to maturity for each maturity bucket may fall outside of the range listed. (4) 2% of the total repurchase agreements and other secured financing have a remaining maturity over one year. (5) Determined based on estimated weighted average lives of the underlying debt instruments. Page 18 (1) Interest rate and MBS spread sensitivity are based on results from third party models in conjunction with internally derived inputs. Actual results could differ materially from these estimates. (2) Scenarios include Residential Investment Securities, residential mortgage loans, MSRs and derivative instruments. (3) Net asset value (“NAV”) represents book value of common equity.