Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - 1ST SOURCE CORP | source-20210210.htm |

FOURTH QUARTER 2020 INVESTOR PRESENTATION NASDAQ: SRCE www.1stsource.com

DISCLOSURES PAGE 2 Forward-Looking Statements Except for historical information, the matters discussed may include “forward-looking statements.” Those statements are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. The audience is advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Please refer to our press releases, Form 10-Qs, and 10-Ks concerning factors that could cause actual results to differ materially from any forward-looking statements of which we undertake no obligation to publicly update or revise. Non-GAAP Financial Measures The accounting and reporting policies of 1st Source conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non-GAAP performance measures are used by management to evaluate and measure the Company’s performance. Although these non-GAAP financial measures are frequently used by investors to evaluate a financial institution, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. These include taxable-equivalent net interest income (including its individual components), net interest margin (including its individual components), the efficiency ratio, tangible common equity-to-tangible assets ratio, pre-tax pre-provision income and tangible book value per common share. Management believes that these measures provide users of the Company’s financial information a more meaningful view of the performance of the interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures differently. See the slides titled “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of certain non-GAAP financial measures used by the Company with their most closely related GAAP measures.

CORPORATE OVERVIEW $7.3 billion Community Bank with International Reach headquartered in South Bend, Indiana Community Banking: ■ Locations throughout Northern Indiana and Southwestern Michigan ■ Business and personal banking, payment services, lending, mortgage, and leasing ■ Investment management, wealth advisory, estate planning, and retirement planning services ■ Business and consumer insurance sales Specialty Finance: ■ National and international footprint ■ Construction machinery ■ Corporate and personal aircraft ■ Auto rental and leasing, shuttle buses, motor coaches, funeral cars, and step vans ■ Truck rental and leasing PAGE 3

MISSION AND VISION Mission To help our clients achieve security, build wealth and realize their dreams by offering straight talk, sound advice and keeping their best interests in mind for the long-term. Vision ■ Offer our clients the highest-quality service ■ Support a proud family of colleagues who personify the 1st Source spirit of partnership ■ Be the financial institution of choice in each market we serve ■ Remain independent and nurture pride of ownership among all 1st Source colleagues ■ Achieve long-term, superior financial results PAGE 4

MARKET AREA Specialty Finance Loans and Leases $2.53 billion Community Bank Loans and Leases $3.02 billion PAGE 5

BUSINESS MIX (LOANS AND LEASES) Business Community Banking 79% Personal Community Banking 21% Specialty Finance 46% 54% PAGE 6

COMMUNITY BANKING ■ 79 Banking Centers ■ 100 Twenty-four hour ATMs ■ 8 Trust & Wealth Advisory locations with approximately $4.7 billion of assets under management ■ 10 1st Source Insurance offices In person Online Over the phone Mobile PAGE 7

SPECIALTY FINANCE GROUP SERVICES Aircraft Division — $861MM Aircraft division provides financing primarily for new and used general aviation aircraft (including helicopters) for private and corporate users, some for aircraft distributors and dealers, air charter operators, air cargo carriers, and other aircraft operators. See Appendix for NAICS industry detail. Construction Equipment Division — $715MM Construction equipment division provides financing for infrastructure projects (i.e., asphalt and concrete plants, bulldozers, excavators, cranes, and loaders, etc.) Auto and Light Truck Division — $542MM Auto/light truck division provides financing for automobile rental and leasing companies, light truck rental and leasing companies, and special purpose vehicle users: buses, funeral cars and step vans. Medium and Heavy Duty Truck Division — $279MM The medium and heavy duty truck division finances highway tractors and trailers and delivery trucks for the commercial trucking industry and trash and recycling equipment for municipalities and private businesses as well as equipment for landfills. PAGE 8

EXPERIENCED AND PROVEN TEAM Executive Team ■ 4 executives with an average 38 years each of banking experience and 26 years with 1st Source Business Banking Officers ■ 39 business banking officers with an average 18 years each of lending experience and with 1st Source from 1 to 31 years Specialty Finance Group Officers ■ 26 specialty finance officers with an average 24 years each of lending experience and with 1st Source from 1 to 33 years PAGE 9

PAGE ELEVEN PERFORMANCE – CLIENT ■ #1 deposit share in our 15 contiguous county market ■ #1 SBA Lender in our Indiana footprint ■ #1 SBA Lender Headquartered in State of Indiana ■ Indiana SBA Community Lender Award – 2013 – 2019 ■ Indiana SBA Rural Lender of the Year Award – 2019 ■ Honored for highest total dollars and number of SBA 504 Loans – Business Development Corporation, 2019 ■ #12 on Forbes’ 150 Best Employers for Veterans 2020 List ■ #22 on Monitor Magazine’s 2020 Top 50 Bank Finance/Leasing Companies in the U.S. ■ #37 on Monitor Magazine’s 2020 Top 100 Largest Equipment Finance/Leasing Companies in the U.S. PAGE 10

OUR RESPONSE TO COVID-19 Employees Clients Communities ▪ High-risk employees are working remotely ▪ Virtual meetings and conference calls have replaced in-person meetings ▪ Department teams are separated to ensure that infection can not spread across entire units ▪ Business travel is restricted ▪ Adhering to CDC guidelines of social distancing, frequent hand washing and mask wearing ▪ Installed plexiglass barriers at banking center counters and desks, as well as providing masks to all employees ▪ Banking center drive-ups, ATMs and online/mobile banking services continue to operate ▪ Most banking center lobbies are open by appointment only. 12 banking center doors are fully open ▪ Over 4,700 PPP loans for over $740 million have been disbursed in support of our communities ▪ As of December 31, 2020, over $230 million in PPP forgiveness had been secured for our clients ▪ Granted approximately $1 billion in loan modifications. $168 million in modification as of December 31, 2020 ▪ Grant of $600,000, in two phases, made by 1st Source Foundation to the United Ways of the 18 counties in northern Indiana and southwestern Michigan ▪ Grant of $320,000 made by 1st Source Foundation to 23 hospitals across our footprint providing assistance with PPE supplies, child care needs and meals for frontline staff ▪ Other contributions have been made to assist our communities during the COVID outbreak ▪ Employees served our communities by sewing masks for nursing homes and hospitals PAGE 11

PAYCHECK PROTECTION PROGRAM LOANS PAGE 12 • Over 55% of 2020 loans for less than $50,000 • Over 60% of the total PPP loan amounts funded during 2020 were submitted for forgiveness as of December 31, 2020 • The SBA has remitted payment for over $230 million of submissions as of December 31, 2020 Phase Number of Loans $ of Loans (000's) Average Loan Size 2020 3,540 597,451$ 169,000$ 2021* 1,371 162,339 118,000 Total 4,911 759,790$ 155,000$ PPP Highlights * Approved by SBA as of early February 2021

COVID-19 RELATED LOAN DEFERRALS PAGE 13 Modifications at December 31, 2020: • $40 million to bus clients or 56% of our total bus loan balances. Included in the Specialty vehicle category above. • $80 million to hotel industry clients or 51% of our total hotel loan balances. Included in the Commercial category above. As of December 31, 2020 (Dollars in millions) Principal Deferrals Principal and Interest Deferrals Total Modifications in Deferment Additional Modifications Expected (1) Total Modifications Recorded Investment at December 31, 2020 Modifications as a % of December 31, 2020 Balance Auto and light truck rental 1$ 4$ 5$ 1$ 6$ 409$ 1% Specialty vehicle(2) 19 2 21 20 41 133 31% Medium and heavy duty truck - - - - - 279 —% Aircraft 13 - 13 - 13 861 2% Construction equipment 7 - 7 - 7 715 1% Commercial 20 63 83 18 101 2,449 4% Residential RE and home equity - - - - - 511 —% Consumer - - - - - 132 —% Total loans and leases 60$ 69$ 129$ 39$ 168$ 5,489$ 3% PPP loans, net of unearned discount (3) - - - - - 352 —% Total loans and leases less PPP loans 60$ 69$ 129$ 39$ 168$ 5,137$ 3% (1) Repesents modifications which ended deferment during December 2020 and are in the process of receiv ing or expected to receiv e an extension. (2) Includes buses, step v ans, and funeral cars. (3) PPP loan balances are located within the Commercial category abov e.

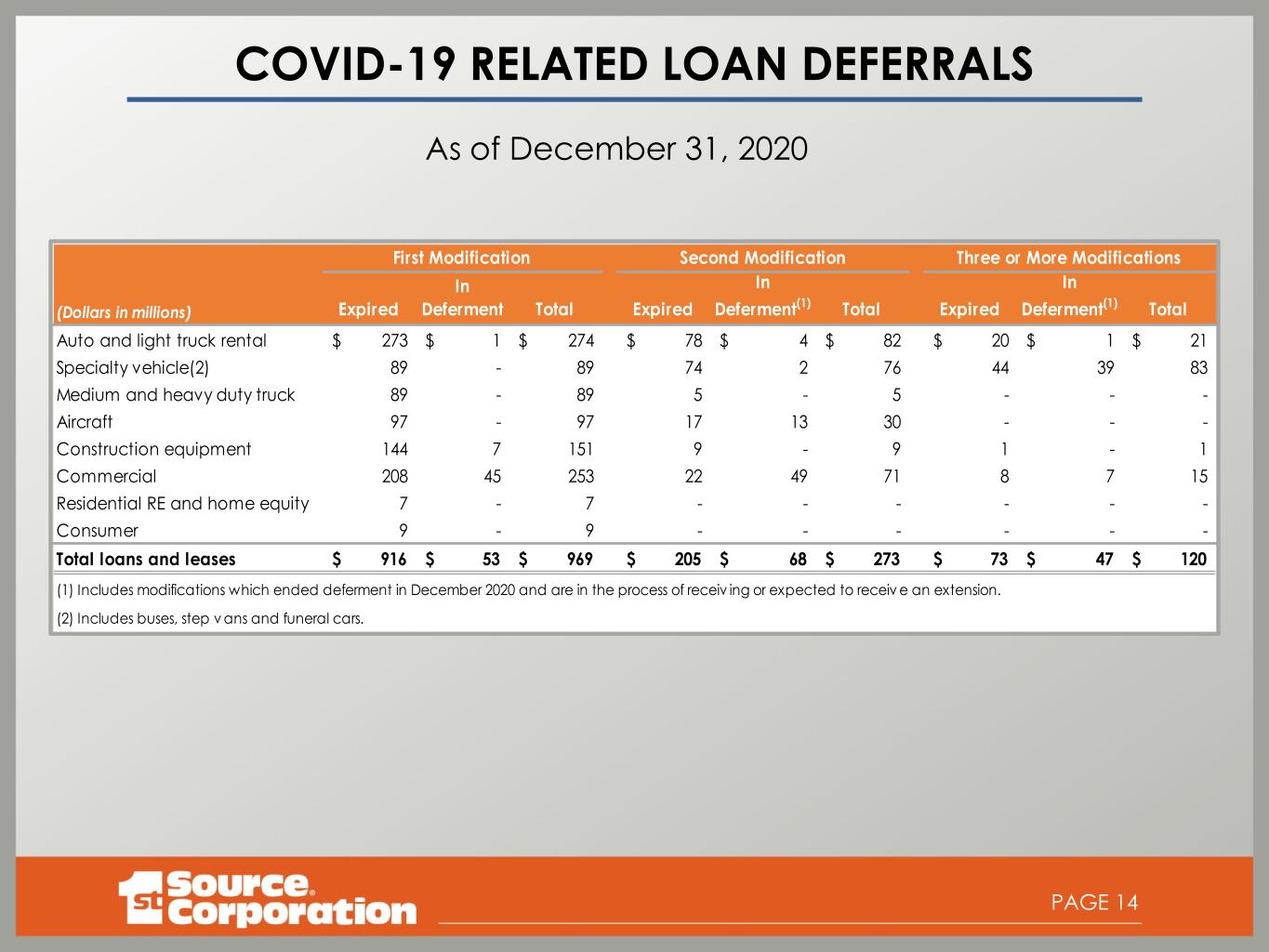

COVID-19 RELATED LOAN DEFERRALS PAGE 14 As of December 31, 2020 (Dollars in millions) Expired In Deferment Total Expired In Deferment (1) Total Expired In Deferment (1) Total Auto and light truck rental 273$ 1$ 274$ 78$ 4$ 82$ 20$ 1$ 21$ Specialty vehicle(2) 89 - 89 74 2 76 44 39 83 Medium and heavy duty truck 89 - 89 5 - 5 - - - Aircraft 97 - 97 17 13 30 - - - Construction equipment 144 7 151 9 - 9 1 - 1 Commercial 208 45 253 22 49 71 8 7 15 Residential RE and home equity 7 - 7 - - - - - - Consumer 9 - 9 - - - - - - Total loans and leases 916$ 53$ 969$ 205$ 68$ 273$ 73$ 47$ 120$ (1) Includes modifications which ended deferment in December 2020 and are in the process of receiv ing or expected to receiv e an extension. (2) Includes buses, step v ans and funeral cars. First Modification Second Modification Three or More Modifications

FINANCIAL REVIEW PAGE 15

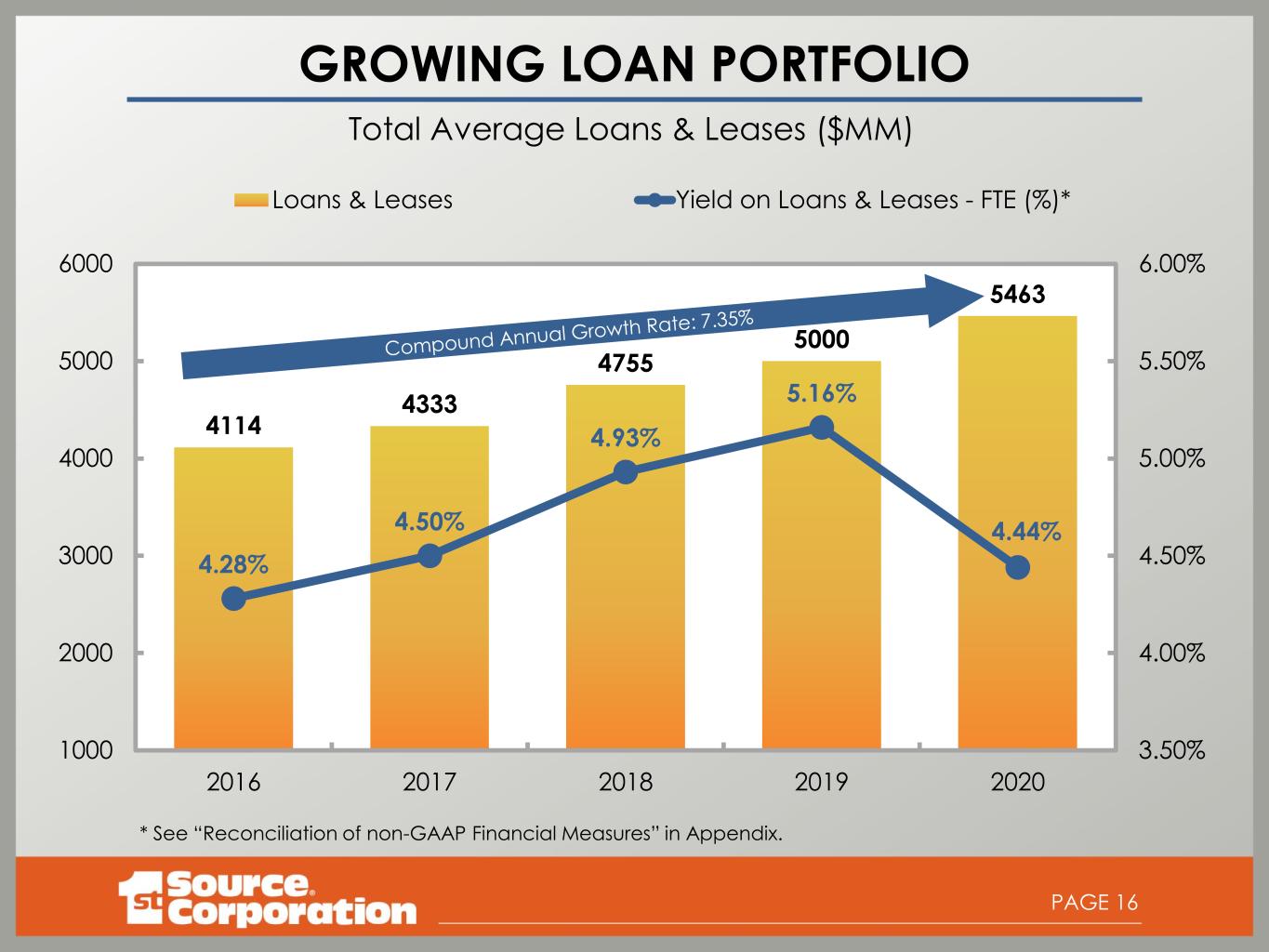

GROWING LOAN PORTFOLIO 4114 4333 4755 5000 5463 4.28% 4.50% 4.93% 5.16% 4.44% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% 1000 2000 3000 4000 5000 6000 2016 2017 2018 2019 2020 Loans & Leases Yield on Loans & Leases - FTE (%)* Total Average Loans & Leases ($MM) PAGE 16 * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

DIVERSIFIED LOAN PORTFOLIO 2020 Average Loans by Type PAGE 17 Commercial Real Estate 17% Residential Real Estate 10% Consumer 3% Medium and Heavy Duty Truck 5% Auto and Light Truck 10% Construction Equipment 13% Aircraft 14% Commercial and Agricultural 20% PPP Loans 8%

PRE-TAX, PRE-PROVISION INCOME PAGE 18 95.0 110.3 124.5 136.0 142.3 $0 $35 $70 $105 $140 $175 2016 2017 2018 2019 2020 ($MM) * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

STRONG CREDIT QUALITY PAGE 19 2.11% 2.10% 2.08% 2.19% 2.56% 2016 2017 2018 2019 2020 % of Net Loans and Leases Loan & Lease Loss Reserve Nonperforming Assets Net Charge-Offs Solid Reserves 0.70% 0.67% 0.71% 0.37% 1.16% 2016 2017 2018 2019 2020 Low Nonperforming Assets 0.13% 0.06% 0.29% 0.10% 0.17% 2016 2017 2018 2019 2020 Limited Losses

CORE DEPOSIT FRANCHISE Total Average Deposits ($MM) PAGE 20 3872 4049 4277 4502 5128 431 444 687 775 609 0.35% 0.43% 0.70% 0.96% 0.53% 0.00% 0.50% 1.00% 1.50% 2.00% 500 1500 2500 3500 4500 5500 6500 2016 2017 2018 2019 2020 Non-core Deposits Core Deposits Effective Rate on Deposits (%) * Non-core deposits include CDs over $250,000, brokered CDs, and national listing service CDs. 4303 4493 4964 5277 5737

ATTRACTIVE CORE DEPOSIT FRANCHISE 2020 Average Deposits By Type Noninterest Bearing Demand 27% CD and IRA 25% Savings and Interest Bearing Demand 48% PAGE 21

DEPOSIT MARKET SHARE – 15 COUNTY CONTIGUOUS MARKET* $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 June 14 June 15 June 16 June 17 June 18 June 19 June 20 1st Source Chase Lake City Bank Horizon Bank Fifth Third *Includes Allen, Elkhart, Fulton, Huntington, Kosciusko, LaPorte, Marshall, Porter, Pulaski, St. Joseph, Starke, Wells, and Whitley counties in the State of Indiana, and Berrien and Cass counties in the State of Michigan. 2020 Data as of June 2020 – FDIC (via S&P Global Market Intelligence) Leading Market Share in Community Banking Markets ($000) PAGE 22 14.87% 10.59% 9.45% 5.02% 4.98%

57.5 57.8 68.1 82.4 92.0 81.4 2.17 2.22 2.60 3.16 3.57 3.17 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $0 $15 $30 $45 $60 $75 $90 $105 2015 2016 2017 2018 2019 2020 Net Income EPCS (Diluted) ($MM) NET INCOME & EARNINGS PER SHARE PAGE 23

NET INTEREST MARGIN (FTE)* PAGE 24 171.5 187.4 214.7 224.6 226.4 3.43% 3.57% 3.73% 3.68% 3.39% 3.20% 3.40% 3.60% 3.80% 4.00% $0 $50 $100 $150 $200 $250 2016 2017 2018 2019 2020 Net Interest Income ($MM) Net Interest Margin (%) ($MM) * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

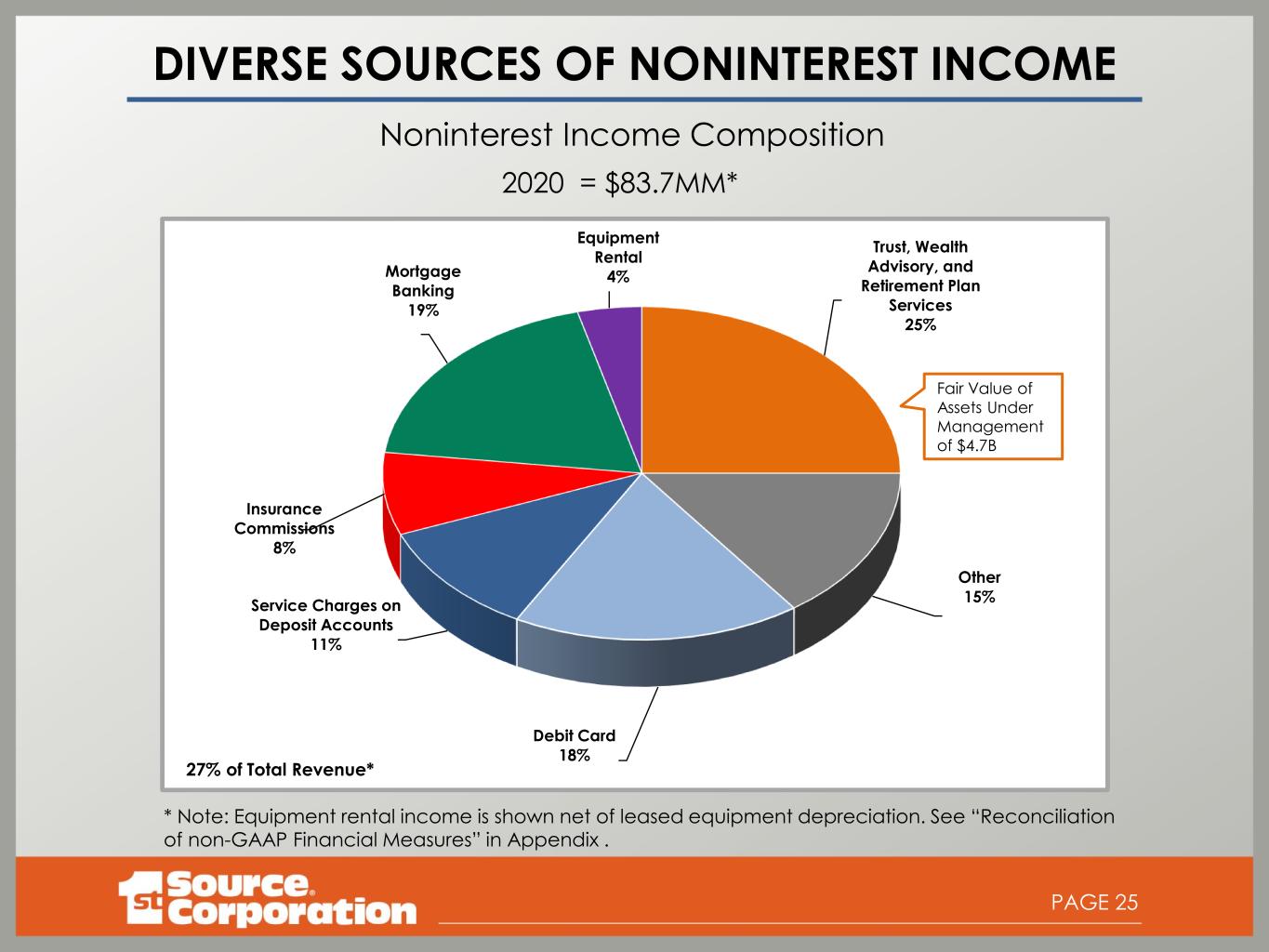

DIVERSE SOURCES OF NONINTEREST INCOME Noninterest Income Composition 2020 = $83.7MM* PAGE 25 * Note: Equipment rental income is shown net of leased equipment depreciation. See “Reconciliation of non-GAAP Financial Measures” in Appendix . Trust, Wealth Advisory, and Retirement Plan Services 25% Other 15% Debit Card 18% Service Charges on Deposit Accounts 11% Insurance Commissions 8% Mortgage Banking 19% Equipment Rental 4% Fair Value of Assets Under Management of $4.7B 27% of Total Revenue*

OPERATING EXPENSES PAGE 26 142.0 148.8 160.2 163.9 167.2 60.2% 57.7% 56.2% 54.7% 54.2% 45.0% 55.0% 65.0% 75.0% $0.0 $40.0 $80.0 $120.0 $160.0 $200.0 2016 2017 2018 2019 2020 Noninterest Expense ($MM)* Efficiency - Adjusted (%)* ($MM) * Note: Noninterest expense is shown net of leased equipment depreciation. See “Reconciliation of non-GAAP Financial Measures” in Appendix.

15.12% 14.70% 14.68% 14.90% 15.99% 2016 2017 2018 2019 2020 13.80% 13.44% 13.42% 13.64% 14.73% 2016 2017 2018 2019 2020 12.11% 12.17% 12.06% 12.19% 12.15% 2016 2017 2018 2019 2020 STRONG CAPITAL POSITION PAGE 27 Total Risk Based Capital Ratio Tier 1 Leverage Ratio Tier 1 Risk Based Ratio Tangible Common Equity / Tangible Assets* 10% Well Capitalized 5% Well Capitalized 8% Well Capitalized 10.89% 10.94% 10.92% 11.38% 11.10% 2016 2017 2018 2019 2020 * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

$18.65 $20.16 $21.49 $22.75 $24.47 $26.30 $29.18 $31.62 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 2013 2014 2015 2016 2017 2018 2019 2020 TANGIBLE BOOK VALUE PER COMMON SHARE* Consistent Growth PAGE 28 * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

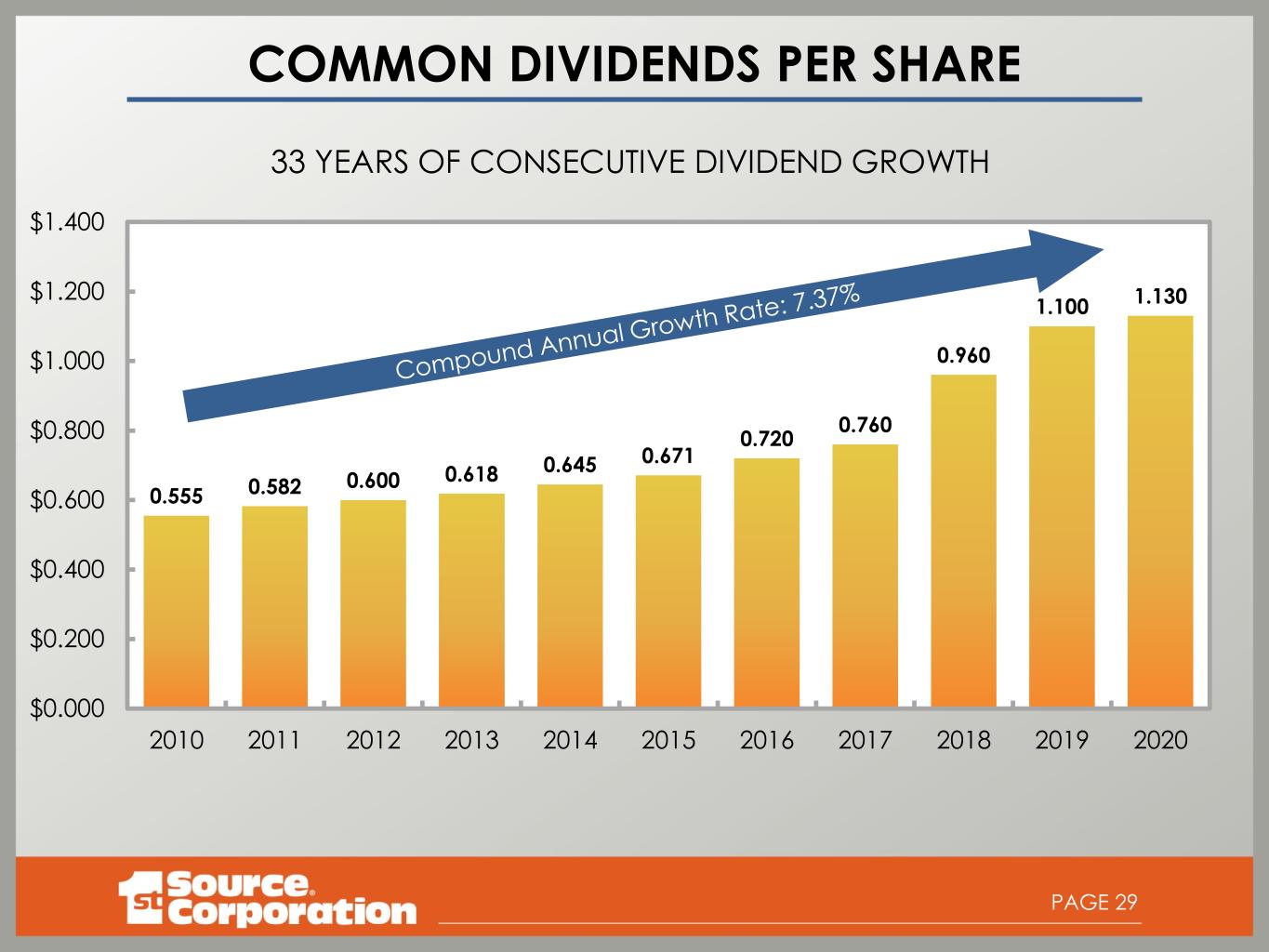

0.555 0.582 0.600 0.618 0.645 0.671 0.720 0.760 0.960 1.100 1.130 $0.000 $0.200 $0.400 $0.600 $0.800 $1.000 $1.200 $1.400 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 COMMON DIVIDENDS PER SHARE 33 YEARS OF CONSECUTIVE DIVIDEND GROWTH PAGE 29

DELIVERING RETURNS TO SHAREHOLDERS PAGE 30

DELIVERING RETURNS TO SHAREHOLDERS PAGE 31

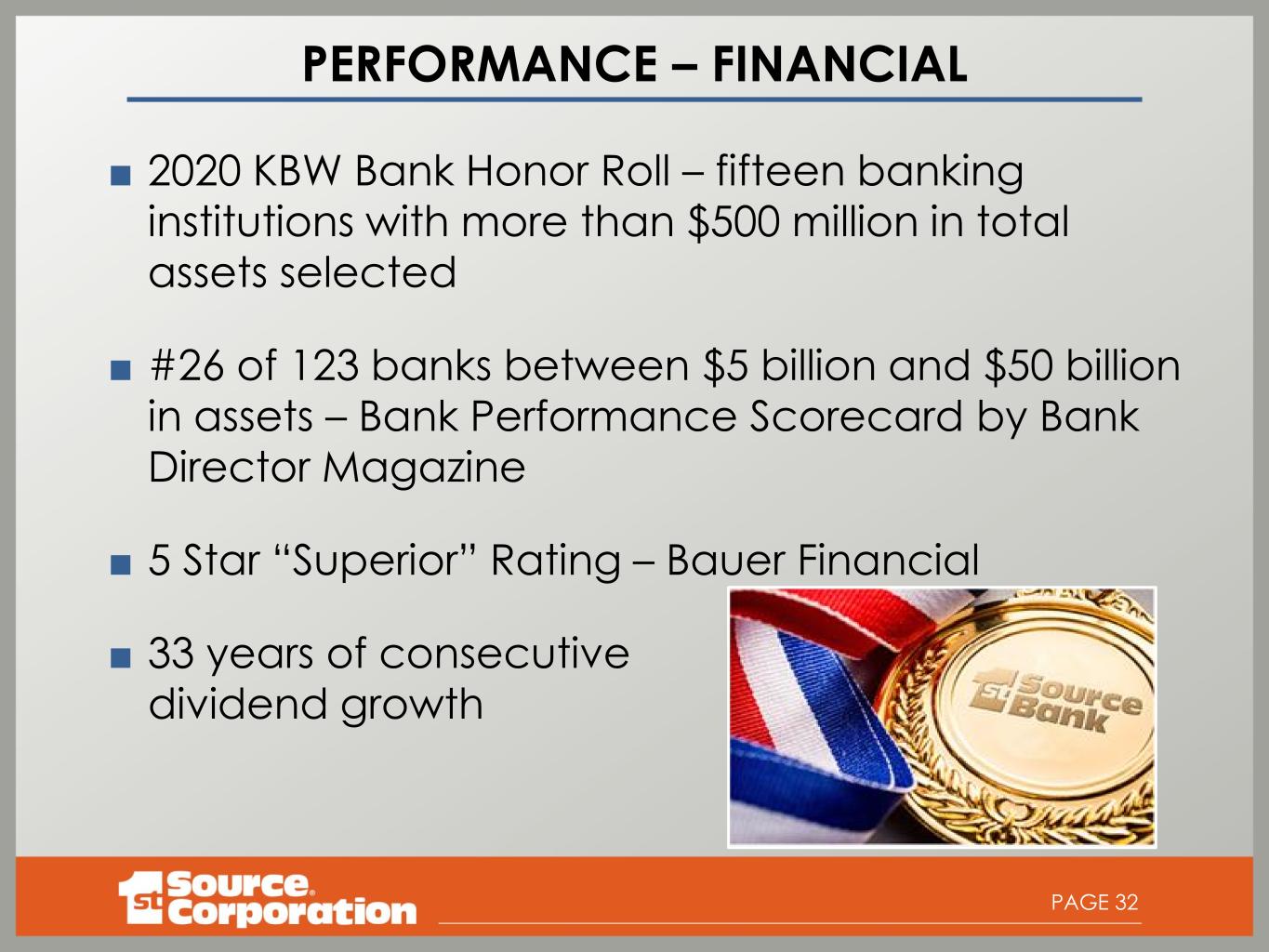

PERFORMANCE – FINANCIAL ■ 2020 KBW Bank Honor Roll – fifteen banking institutions with more than $500 million in total assets selected ■ #26 of 123 banks between $5 billion and $50 billion in assets – Bank Performance Scorecard by Bank Director Magazine ■ 5 Star “Superior” Rating – Bauer Financial ■ 33 years of consecutive dividend growth PAGE 32

INVESTMENT CONSIDERATIONS ■ Consistent and superior financial performance with a focus on long-term earnings per share and tangible book value growth ■ Experienced and proven team with significant investment in bank ■ Diversification of product mix and geography with asset generation capability ■ Leading market share in community banking markets ■ Stable credit quality, strongly reserved ■ Strong capital position and 33 consecutive years of dividend growth PAGE 33

CONTACT INFORMATION Christopher J. Murphy III Chairman of the Board, CEO and President (574) 235-2711 murphy-c@1stsource.com Andrea G. Short CFO and Treasurer (574) 235-2348 shorta@1stsource.com PAGE 34

APPENDIX PAGE 35

Consolidated Balance Sheet PAGE 36 (Dollars in millions) 2016 2017 2018 2019 2020 Cash and cash equivalents 108$ 78$ 99$ 83$ 243$ Investment securit ies and other investments 873 930 1,019 1,069 1,225 Loans and leases, net of unearned discount 4,204 4,541 4,847 5,106 5,502 Allowance for loan and lease losses (89) (95) (100) (111) (141) Equipment owned under operating leases, net 119 140 134 112 65 Other assets 271 293 295 364 422 Total assets 5,486$ 5,887$ 6,294$ 6,623$ 7,316$ Noninterest-bearing deposits 991$ 1,064$ 1,217$ 1,217$ 1,637$ Interest-bearing deposits 3,343 3,689 3,905 4,140 4,309 Total deposits 4,334 4,753 5,122 5,357 5,946 Total borrowings 424 342 329 276 291 Other liabilit ies 55 73 79 141 148 Total shareholders' equity 673 719 762 829 887 Noncontrolling interests - - 2 20 44 Total equity 673 719 764 849 931 Total liabilities and equity 5,486$ 5,887$ 6,294$ 6,623$ 7,316$

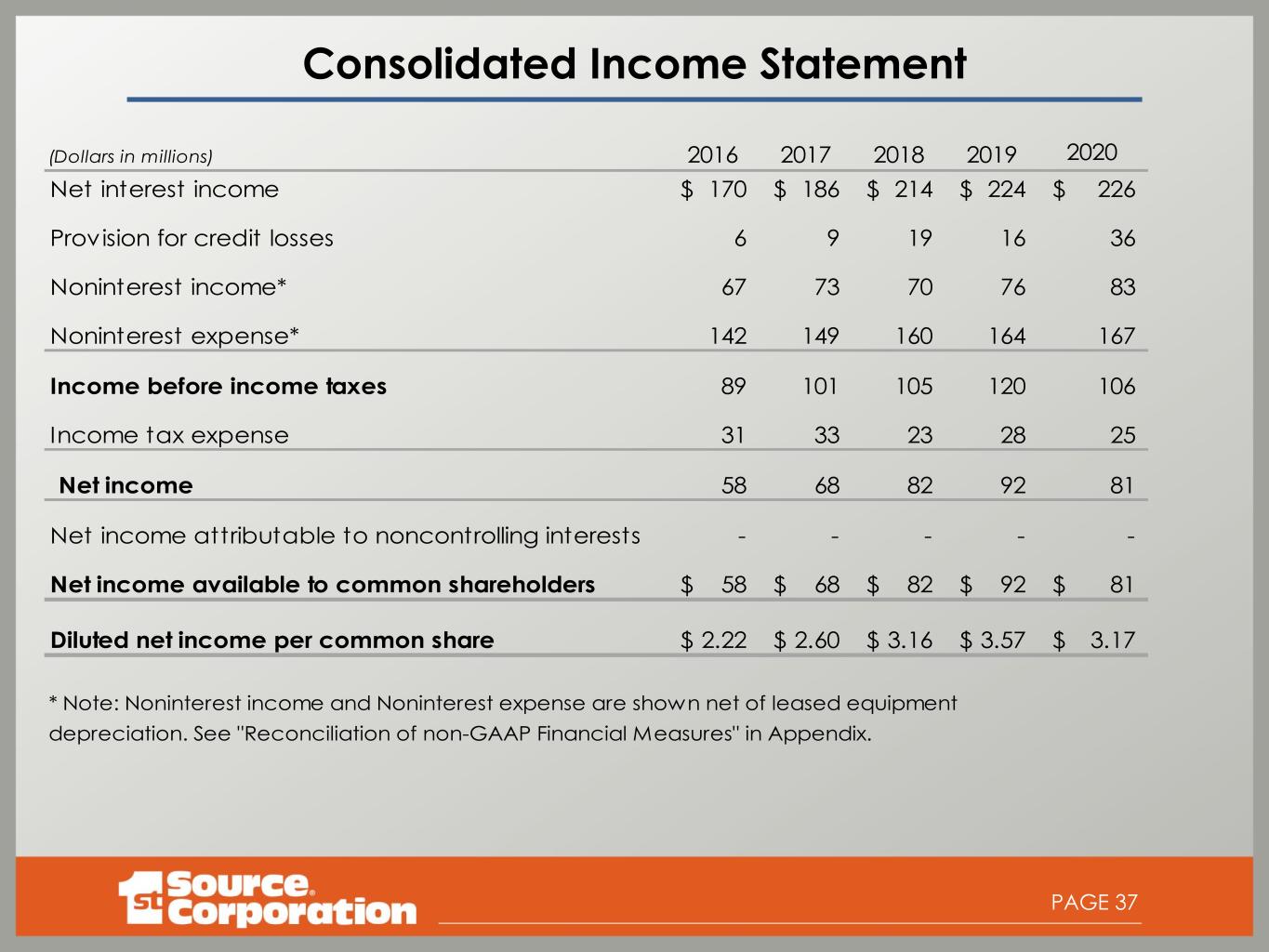

Consolidated Income Statement PAGE 37 (Dollars in millions) 2016 2017 2018 2019 2020 Net interest income 170$ 186$ 214$ 224$ 226$ Provision for credit losses 6 9 19 16 36 Noninterest income* 67 73 70 76 83 Noninterest expense* 142 149 160 164 167 Income before income taxes 89 101 105 120 106 Income tax expense 31 33 23 28 25 Net income 58 68 82 92 81 Net income attributable to noncontrolling interests - - - - - Net income available to common shareholders 58$ 68$ 82$ 92$ 81$ Diluted net income per common share 2.22$ 2.60$ 3.16$ 3.57$ 3.17$ * Note: Noninterest income and Noninterest expense are shown net of leased equipment depreciation. See "Reconciliation of non-GAAP Financial Measures" in Appendix.

Aircraft Portfolio – Industries by NAICS Transportation & Warehousing 17% Finance & Insurance and Real Estate 13% Services 19% Retail Trade 16% Construction 8% Manufacturing 10% Ag, Forestry, Fishing & Hunting 7% Wholesale Trade 5% Other* 5% PAGE 38 *Other includes: Mining & Utilities and Information

Ownership Summary Institutional 44.5% Insiders 32.7% Retail/Other 19.6% 1st Source ESOP 3.2% (1) As of December 31, 2020 (2) As of September 30, 2020 or most recently reported data Source: S&P Global Market Intelligence and Company filings PAGE 39 Shareholder Type Shares % of Total Institutional 11,296,899 44.5% Insiders 8,304,629 32.7% Retail/Other 4,963,123 19.6% 1st Source ESOP 824,466 3.2% Total Shares Outstanding (1) 25,389,117 100.0% Rank Institution (Top 10 Institutions) Shares % of Total 1 Dimensional Fund Advisors LP 1,894,451 7.5% 2 BlackRock Inc. 1,228,153 4.8% 3 Wellington Management Group LLP 1,008,595 4.0% 4 Vanguard Group Inc. 819,329 3.2% 5 AllianceBernstein LP 546,925 2.2% 6 Manulife Asset Management 429,598 1.7% 7 State Street Global Advisors Inc. 394,447 1.6% 8 Renaissance Technologies LLC 368,314 1.4% 9 Norges Bank Investment Management 313,949 1.2% 10 Boston Trust Walden Co. 287,698 1.1% Top 10 Institutions (2) 7,291,459 28.7% Other 4,005,440 15.8% Total Institutional Ownership (2) 11,296,899 44.5%

Reconciliation of Non-GAAP Financial Measures PAGE 40 Calculation of Yield on Loans and Leases (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Loans and leases interest income (GAAP) $ 175,532 $ 194,297 $ 234,083 $ 257,738 $ 242,172 (B) Plus: loans and leases fully tax-equivalent adjustments 584 621 367 375 333 (C) Loans and leases interest income - FTE (A+B) 176,116 194,918 234,450 258,113 242,505 (D) Average loans and leases $ 4,113,508 $ 4,333,375 $ 4,755,256 $ 5,000,161 $ 5,463,436 Yield on loans and leases (GAAP) (A/D) 4.27% 4.48% 4.92% 5.15% 4.43% Yield on loans and leases - FTE (C/D) 4.28% 4.50% 4.93% 5.16% 4.44% Calculation of Net Interest Margin (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Interest income (GAAP) $ 191,760 $ 212,385 $ 257,316 $ 282,877 $ 263,031 (B) Plus: fully tax-equivalent adjustments 1,825 1,795 803 686 543 (C) Interest income - FTE (A+B) 193,585 214,180 258,119 283,563 263,574 (D) Interest expense (GAAP) 22,101 26,754 43,410 59,011 37,211 (E) Net interest income (GAAP) (A-D) 169,659 185,631 213,906 223,866 225,820 (F) Net interest income - FTE (C-D) 171,484 187,426 214,709 224,552 226,363 (G) Average earning assets $ 5,003,922 $ 5,251,094 $ 5,761,761 $ 6,104,673 $ 6,684,246 Net interest margin (GAAP) (E/G) 3.39% 3.54% 3.71% 3.67% 3.38% Net interest margin - FTE (F/G) 3.43% 3.57% 3.73% 3.68% 3.39% Pre-Tax, Pre-Provision Income (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Income before income taxes (GAAP) $ 89,126 $ 101,360 $ 105,027 $ 120,154 $ 106,341 (B) Plus: Provision for credit losses 5,833 8,980 19,462 15,833 36,001 (C) Pre-tax, pre-provision income (A+B) $ 94,959 $ 110,340 $ 124,489 $ 135,987 $ 142,342

Reconciliation of Non-GAAP Financial Measures PAGE 41 Noninterest Expense (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Noninterest expense (GAAP) $ 163,645 $ 173,997 $ 186,467 $ 189,009 $ 187,367 (B) Less: depreciation - leased equipment (21,678) (25,215) (26,248) (25,128) (20,203) Noninterest expense - adjusted (A-B) $ 141,967 $ 148,782 $ 160,219 $ 163,881 $ 167,164 Calculation of Efficiency Ratio (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Net interest income (GAAP) $ 169,659 $ 185,631 $ 213,906 $ 223,866 $ 225,820 (B) Net interest income - FTE 171,484 187,426 214,709 224,552 226,363 (C) Plus: noninterest income (GAAP) 88,945 98,706 97,050 101,130 103,889 (D) Less: gains/losses on investment securities and partnership investments (3,873) (4,569) (320) (653) (1,652) (E) Less: depreciation - leased equipment (21,678) (25,215) (26,248) (25,128) (20,203) (F) Total net revenue (GAAP) (A+C) 258,604 284,337 310,956 324,996 329,709 (G) Total net revenue - adjusted (B+C-D-E) 234,848 256,348 285,191 299,901 308,397 (H) Noninterest expense (GAAP) 163,645 173,997 186,467 189,009 187,367 (E) Less: depreciation - leased equipment (21,678) (25,215) (26,248) (25,128) (20,203) (I) Less: contribution expense limited to gains on investment securities in (D) (484) (959) - - - (J) Noninterest expense - adjusted (H-E-I) $ 141,483 $ 147,823 $ 160,219 $ 163,881 $ 167.164 Efficiency ratio (GAAP-derived) (H/F) 63.3% 61.2% 60.0% 58.2% 56.8% Efficiency ratio - adjusted (J/G) 60.2% 57.7% 56.2% 54.7% 54.2% Noninterest Income (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Noninterest income (GAAP) $ 88,945 $ 98,706 $ 97,050 $ 101,130 $ 103,889 (B) Less: depreciation - leased equipment (21,678) (25,215) (26,248) (25,128) (20,203) Noninterest income - adjusted (A-B) $ 67,267 $ 73,491 $ 70,802 $ 76,002 $ 83,686

Reconciliation of Non-GAAP Financial Measures PAGE 42 Calculation of Tangible Common Equity-to-Tangible Assets Ratio (Dollars in thousands) 2016 2017 2018 2019 2020 (A) Total common shareholders' equity (GAAP) $ 672,650 $ 718,537 $ 762,082 $ 828,277 $ 886,845 (B) Less: goodwill and intangible assets (84,102) (83,742) (83,998) (83,971) (83,948) (C) Total tangible common shareholders' equity (A-B) 588,548 634,795 678,084 744,306 802,897 (D) Total assets (GAAP) 5,486,268 5,887,284 6,293,745 6,622,776 7,316,411 (B) Less: goodwill and intangible assets (84,102) (83,742) (83,998) (83,971) (83,948) (E) Total tangible assets (D-B) $ 5,402,166 $ 5,803,542 $ 6,209,747 $ 6,538,805 $ 7,232,463 Common equity-to-assets ratio (GAAP-derived) (A/D) 12.26% 12.20% 12.11% 12.51% 12.12% Tangible common equity-to-tangible assets ratio (C/E) 10.89% 10.94% 10.92% 11.38% 11.10% Calculation of Tangible Book Value per Common Share (Dollars in thousands, except for per share data) 2013 2014 2015 2016 2017 2018 2019 2020 (A) Total common shareholders' equity (GAAP) $ 585,378 $ 614,473 $ 644,053 $ 672,650 $ 718,537 $ 762,082 $ 828,277 $ 886,845 (B) Less: goodwill and intangible assets (86,343) (85,371) (84,676) (84,102) (83,742) (83,998) (83,971) (83,948) (C) Total tangible common shareholders' equity (A-B) $ 499,035 $ 529,102 $ 559,377 $ 588,548 $ 634,795 $ 678,084 $ 744,306 $ 802,897 (D) Actual common shares outstanding 26,754,761 26,248,690 26,027,584 25,875,765 25,936,764 25,783,728 25,509,474 25,389,117 Book value per common share (GAAP-derived) (A/D)*1000 $ 21.88 $ 23.41 $ 24.75 $ 26.00 $ 27.70 $ 29.56 $ 32.47 $ 34.93 Tangible common book value per share (C/D)*1000 $ 18.65 $ 20.16 $ 21.49 $ 22.75 $ 24.47 $ 26.30 $ 29.18 $ 31.62