Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LCI INDUSTRIES | lcii2020q4results.htm |

| 8-K - 8-K - LCI INDUSTRIES | lcii-20210209.htm |

LCI INDUSTRIES 1 LCI Industries Fourth Quarter and Full Year 2020 Earnings Conference Call February 9, 2021

LCI INDUSTRIES 2 Forward-Looking Statements and Non-GAAP Financial Measures This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, retail and wholesale demand, integration of acquisitions, R&D investments, and industry trends, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, the impacts of COVID-19, or other future pandemics, on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, and in the Company’s subsequent filings with the Securities and Exchange Commission. Readers of this presentation are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure is included in this presentation. 2

LCI INDUSTRIES 3 Fourth Quarter and Full-Year 2020 Highlights Achieved $2.8 billion in annual revenue, the highest in LCI’s history, along with double-digit adjusted EBITDA growth, supported by strong performance across the business Reached a milestone in LCI’s long-term diversification strategy, with non-RV revenues now accounting for over 50% of total net revenue in FY 2020 Completed three strategic acquisitions totaling $182.1 million, further strengthening LCI’s presence in adjacent and international markets Returned $70.4 million to shareholders through payment of dividends

LCI INDUSTRIES 4 RV OEM • Retail demand continued its strong momentum throughout the quarter, expected to remain at elevated levels into 2021 and beyond ◦ Q4 2020 RV OEM revenues up 29% YoY (wholesale shipments up 38% YoY) ◦ FY 2020 RV OEM revenues up 3% YoY (wholesale shipments up 9% YoY) • New product innovation and market share gains drove improvement in content per towable RV, partially offset by high volume of entry-level units ◦ Content per towable RV: $3,390, +1% YoY(1) ◦ Content per motorhome: $2,479, +8% YoY(1) • Record amount of new buyers drive the long-term growth prospects of the RV lifestyle ◦ Consumer desire to find safe, alternative outdoors activities that enable social distancing will help to drive sustainable growth, supported by trending services including peer-to-per RV rentals ◦ Industry wholesale RV shipments for the year totaled ~430,300 units, expected to grow further in 2021 (1) For trailing twelve months ended December 31, 2020, adjusted to remove impact of Furrion sales from all prior periods 4

LCI INDUSTRIES 5 Expanding Markets Executing on our diversification strategy to reach goal of 40% North American RV OEM by 2022 Adjacent Markets Aftermarket International ◦ Q4 2020 sales up 129% YoY ◦ Further invested into our customer service initiatives, appointing a Director of Customer Experience and launching Lippert Scouts group along with the Campground Project ◦ CURT business demonstrating strong performance, exceeding pre-COVID forecasts and realizing better-than expected cost synergies ◦ Q4 2020 sales up 20% YoY ◦ Completed acquisitions of Challenger Door and Veada Industries, serving as additional growth drivers in these markets as integration progresses ◦ Launched collaboration with TRACKER Marine, aiming to launch several new facilities as part of partnership in marine furniture production ◦ Q4 2020 sales up 60% YoY ◦ Demand in European markets ramping back up as recovery continues, supported by similar secular trends driving growth in the U.S. ◦ Expanding LCI’s international footprint through opportunities created by our Polyplastic, Lewmar Marine, Lavet, Femto, and Ciesse acquisitions 5

LCI INDUSTRIES 6 Innovation Highlights Innovation: a critical part of our strategy ◦ R&D expertise and innovation remains a core component of LCI’s long-term strategy ◦ Expanding OneControl capabilities to integrate into customer support; success continues as customers increasingly seek technologically sophisticated products ◦ Announced new Vice President of Innovation, responsible for overseeing LCI’s new product innovation and driving improvements across existing offerings 6

LCI INDUSTRIES 7 Growth Strategy Integrating and Realizing Synergies from New Acquisitions ◦ LCI remains focused on realizing new synergies from our most recent acquisitions, preserving cash, and paying down debt in the near-term ◦ Maintaining a robust pipeline of M&A targets split evenly across all market segments and are open to small and strategic tuck-in acquisitions Capitalizing on Ability to Win Market Share ◦ Growing market leadership in adjacent markets, international markets, and the aftermarket segment through enhanced engineering and innovation Continued Focus on Stated Capital Allocation Goals ◦ Investment in the business ◦ Reduce leverage ◦ Return capital to shareholders ◦ Execute strategic acquisitions 7

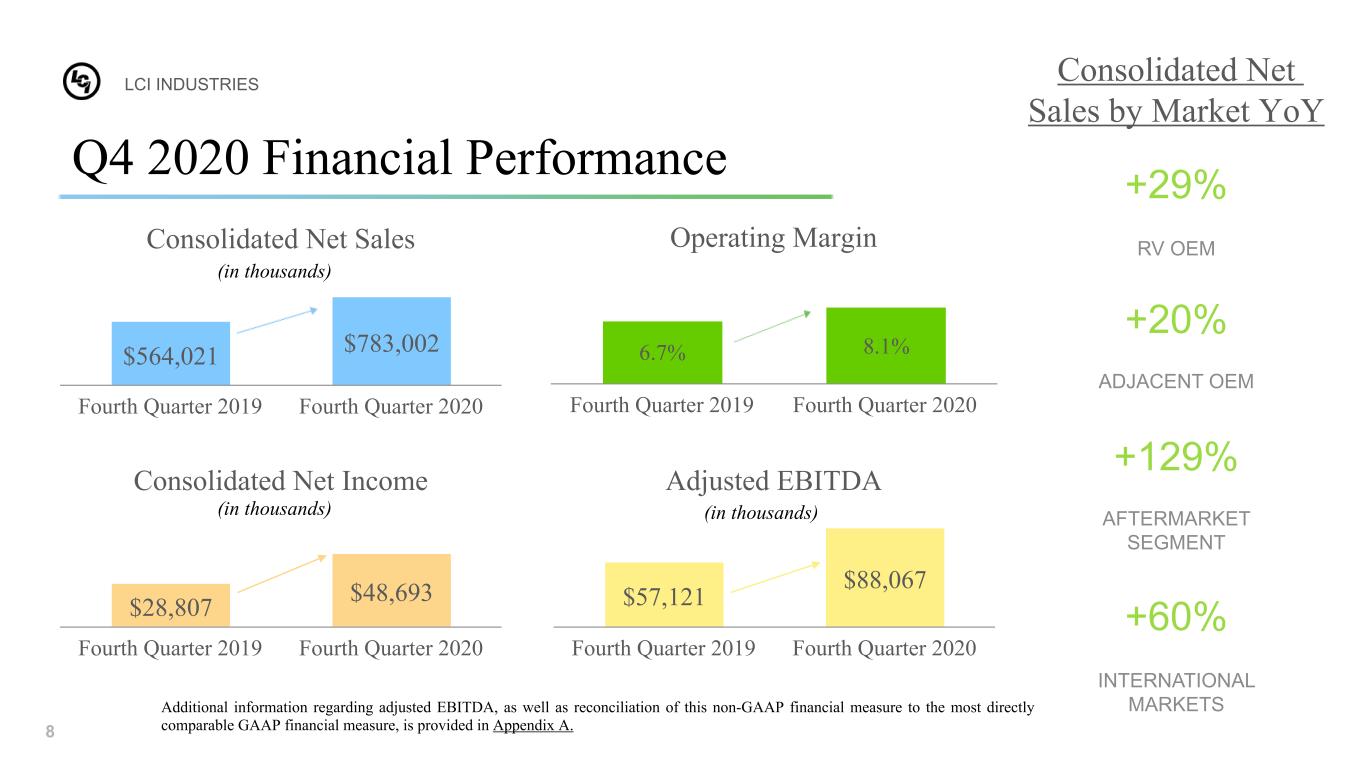

LCI INDUSTRIES 8 Consolidated Net Sales $564,021 $783,002 Fourth Quarter 2019 Fourth Quarter 2020 Operating Margin 6.7% 8.1% Fourth Quarter 2019 Fourth Quarter 2020 Q4 2020 Financial Performance Consolidated Net Sales by Market YoY (in thousands) +29% RV OEM +20% ADJACENT OEM +129% AFTERMARKET SEGMENT +60% INTERNATIONAL MARKETS Consolidated Net Income $28,807 $48,693 Fourth Quarter 2019 Fourth Quarter 2020 (in thousands) Adjusted EBITDA $57,121 $88,067 Fourth Quarter 2019 Fourth Quarter 2020 (in thousands) Additional information regarding adjusted EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in Appendix A.8

LCI INDUSTRIES 9 Consolidated Net Sales $2,371,482 $2,796,166 Full Year 2019 Full Year 2020 Operating Margin 8.4% 8.0% Full Year 2019 Full Year 2020 FY 2020 Financial Performance Consolidated Net Sales by Market YoY (in thousands) +3% RV OEM +4% ADJACENT OEM +125% AFTERMARKET SEGMENT +62% INTERNATIONAL MARKETS Consolidated Net Income $146,509 $158,440 Full Year 2019 Full Year 2020 (in thousands) Adjusted EBITDA $275,568 $328,200 Full Year 2019 Full Year 2020 (in thousands) Additional information regarding adjusted EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in Appendix A.9

LCI INDUSTRIES 10 ($ in millions) 2020 2019 Cash, Cash Equivalents $51.8 $35.4 Remaining availability under Debt Facilities(1) $352.2 $481.8 Capital Expenditures $57.3 $58.2 Dividends $70.4 $63.8 Debt / Net Income (TTM) 4.7x(2) 4.3x(3) Net Debt / EBITDA (TTM) 2.1x(2) 2.2x(3) Cash from Operating Activities $231.4 $269.5 (1) Remaining availability under the debt facilities is subject to covenant restrictions and, in the case of $150 million of such availability, the lender's discretion. (2) Net Debt/EBITDA ratio is a non-GAAP financial measure and is calculated as follows: Debt of $738M, less Cash of $52M, resulted in Net Debt of $686M at December 31, 2020, divided by Earnings Before Interest, Taxes, Depreciation, and Amortization, "EBITDA" (Net Income of $158M adding back Interest of $13M, Taxes of $51M, and Depreciation and Amortization of $98M), resulting in $321M EBITDA for the twelve months ended December 31, 2020. The GAAP debt / Net income ratio was $738M / $158M or 4.7x. (3) Net Debt/EBITDA ratio is a non-GAAP financial measure and is calculated as follows: Debt of $631M, less Cash of $35M, resulted in Net Debt of $595M at December 31, 2019, divided by Earnings Before Interest, Taxes, Depreciation, and Amortization, "EBITDA" (Net Income of $147M, adding back Interest of $9M, Taxes of $45M, and Depreciation and Amortization of $75M), resulting in $276M EBITDA for the twelve months ended December 31, 2019. The GAAP debt / Net income ratio was $631M / $147M or 4.3x. Liquidity and Cash Flow As of and for the Twelve Months Ended December 31, 10

LCI INDUSTRIES 11 Reconciliation of Non-GAAP Measures The following table reconciles net income to EBITDA and Adjusted EBITDA. Three Months Ended December 31, Twelve Months Ended December 31, 2020 2019 2020 2019 (In thousands) Net income $ 48,693 $ 28,807 $ 158,440 $ 146,509 Interest expense, net 2,610 2,290 13,453 8,796 Provision for income taxes 12,150 6,548 51,041 44,905 Depreciation expense 15,205 13,274 60,107 51,600 Amortization expense 9,409 6,202 37,873 23,758 EBITDA 88,067 57,121 320,914 275,568 Non-cash charge for inventory fair value step-up — — 7,286 — Adjusted EBITDA $ 88,067 $ 57,121 $ 328,200 $ 275,568 In addition to reporting financial results in accordance with U.S. GAAP, the Company has provided the non-GAAP performance measure of adjusted EBITDA to illustrate and improve comparability of its results from period to period. Adjusted EBITDA is defined as net income before interest expense, net, provision for income taxes, depreciation and amortization expense, and other adjustments made in order to present comparable results from period to period, which consisted of the inventory fair value step-up from the acquisition of CURT during the twelve month period ended December 31, 2020. The Company considers this non-GAAP measure, and the non-GAAP measure of Net Debt/EBITDA ratio, in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies. Appendix A 11

Q&A L C I I N D U S T R I E S