Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Apria, Inc. | d62545dex232.htm |

| EX-23.1 - EX-23.1 - Apria, Inc. | d62545dex231.htm |

| EX-10.36 - EX-10.36 - Apria, Inc. | d62545dex1036.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 9, 2021.

Registration No. 333-252146

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Apria, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 8082 | 82-4937641 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

7353 Company Drive

Indianapolis, Indiana 46237

Telephone: (800) 990-9799

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Raoul Smyth

Executive Vice President, General Counsel and Secretary

Apria, Inc.

7353 Company Drive

Indianapolis, Indiana 46237

Telephone: (800) 990-9799

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Edgar J. Lewandowski William R. Golden III Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 Telephone: (212) 455-2000 |

Michael Kaplan Deanna L. Kirkpatrick Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 Telephone: (212) 450-4000 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after the Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.01 per share |

8,625,000 | $21.00 | $181,125,000 | $19,760.74 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,125,000 shares of common stock that are subject to the underwriters’ option to purchase additional shares. |

| (2) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated February 9, 2021

Preliminary Prospectus

7,500,000 Shares

Apria, Inc.

Common Stock

This is the initial public offering of shares of common stock of Apria, Inc. No public market currently exists for our common stock. The selling stockholders are offering 7,500,000 shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. We anticipate that the initial public offering price will be between $19.00 and $21.00 per share. We intend to list our shares of common stock on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “APR.”

After the completion of this offering, affiliates of The Blackstone Group Inc. will continue to own a majority of the voting power of shares eligible to vote in the election of our directors. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of Nasdaq. See “Management—Controlled Company Exception” and “Principal and Selling Stockholders.”

Investing in shares of our common stock involves risks. See “Risk Factors” beginning on page 23 to read about factors you should consider before buying shares of our common stock.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to selling stockholders |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

To the extent that the underwriters sell more than 7,500,000 shares of our common stock, the underwriters have the option to purchase up to an additional 1,125,000 shares of our common stock from the selling stockholders at the initial public offering price less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock against payment in New York, New York on or about , 2021.

Joint Book-Running Managers

| Citigroup | Goldman Sachs & Co. LLC |

| BofA Securities | J.P. Morgan |

| UBS Investment Bank |

Co-Managers

| Piper Sandler |

| Citizens Capital Markets | Fifth Third Securities | TD Securities |

| Academy Securities

|

Blaylock Van, LLC | Penserra Securities LLC | Stern |

The date of this prospectus is , 2021.

Table of Contents

Neither we nor the selling stockholders, nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Neither we nor the selling stockholders, nor the underwriters take any responsibility for, or can provide any assurance as to the reliability of, any information other than the information in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: Neither we nor the selling stockholders, nor the underwriters have done anything that would permit our initial public offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

i

Table of Contents

About This Prospectus

Financial Statement Presentation

This prospectus includes certain historical consolidated financial and other data for Apria Healthcare Group Inc. (“Apria Healthcare Group”) and its subsidiaries. At or prior to the completion of this offering, we will undertake certain reorganization transactions (the “pre-IPO reorganization transactions”) so that Apria, Inc. will directly or indirectly own all of the equity interests in Apria Healthcare Group and become the holding company of our business.

Apria, Inc. will be the financial reporting entity following this offering. Other than the balance sheets as of September 30, 2020, December 31, 2019 and December 31, 2018, financial information of Apria, Inc. has not been included in this prospectus as since its formation on March 22, 2018 it has not entered into any business transactions or activities, has no capitalization, and had no assets or liabilities during the periods presented in this prospectus.

Certain Definitions

As used in this prospectus, unless otherwise noted or the context requires otherwise:

| • | “Apria,” the “Company,” “we,” “us” and “our” refer (1) prior to the consummation of this offering and the pre-IPO reorganization transactions, to Apria Healthcare Group, the existing holding company of our business, and its consolidated subsidiaries and (2) after the consummation of this offering and the pre-IPO reorganization transactions, to Apria, Inc. and its consolidated subsidiaries, including Apria Healthcare Group. |

| • | “Blackstone” or “Sponsor” refer to investment funds associated with, or managed or designated by, The Blackstone Group Inc., which funds are our current majority owners, and their permitted successors and assigns. |

| • | “CBP” and “DMEPOS CBP” refers to the DMEPOS competitive bidding program. |

| • | “CMS” refers to the Centers for Medicare and Medicaid Services. |

| • | “DMEPOS” refers to Medicare durable medical equipment, prosthetics, orthotics and supplies. |

| • | “GAAP” refers to generally accepted accounting principles in the United States of America. |

| • | “Medicare patients” refers to Medicare patients other than those participating in Medicare through the Medicare Advantage program. |

| • | “Payors” refers to third-party healthcare payors, including government and commercial payors. |

| • | “pre-IPO owners” refer to our Sponsor together with other owners of Apria Healthcare Group prior to this offering. |

| • | “The Joint Commission” refers to a nationally recognized, independent organization that develops standards for various healthcare industry segments and monitors compliance with those standards through voluntary surveys of participating providers. |

Unless indicated otherwise, the information included in this prospectus assumes no exercise by the underwriters of their option to purchase up to an additional 1,125,000 shares of common stock from us and the selling stockholders and that the shares of common stock to be sold in this offering are sold at $20.00 per share of common stock, which is the midpoint of the price range indicated on the front cover of this prospectus.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in shares of our common stock. You should read this entire prospectus carefully, including the section entitled “Risk Factors” and the financial statements and the related notes thereto included elsewhere in this prospectus, before you decide to invest in shares of our common stock.

Apria

We are a leading provider of integrated home healthcare equipment and related services in the United States. We offer a comprehensive range of products and services for in-home care and delivery across three core service lines: (1) home respiratory therapy (including home oxygen and non-invasive ventilation (“NIV”) services); (2) obstructive sleep apnea (“OSA”) treatment (including continuous positive airway pressure (“CPAP”) and bi-level positive airway pressure devices, and patient support services); and (3) negative pressure wound therapy (“NPWT”). Additionally, we supply a wide range of home medical equipment and other products and services to help improve the quality of life for patients with home care needs. Our revenues are generated through fee-for-service and capitation arrangements with Payors for equipment, supplies, services and other items we rent or sell to patients. Through our offerings, we also provide patients with a variety of clinical and administrative support services and related products and supplies, most of which are prescribed by a physician as part of a care plan. We are focused on being the industry’s highest-quality provider of home healthcare equipment and related services, while maintaining our commitment to being a low-cost operator. We offer a compelling value proposition to patients, providers and Payors by allowing patients to receive necessary care and services in the comfort of their own home, while, at the same time, reducing the costs of treatment. We generated over $1 billion of net revenue in 2019, of which approximately 80% was from home respiratory therapy and OSA treatment, service categories in which we believe we have a leading market position.

We believe our integrated product and service offerings, combined with our national scale and strong reputation, provide us with a strategic advantage in being a preferred home healthcare provider for patients, providers and Payors. Our Payors include substantially all of the national and regional insurers, managed care organizations and government Payors in the United States. We benefit from long-standing relationships with a community of providers and referral sources for post-acute services across the acuity spectrum because of the consistency and reliability of our high quality clinical support, our national distribution footprint and our breadth of Payor relationships.

Our product and service offerings are distinguished by the complexity and sophistication required in their clinical delivery, logistical coordination and payment arrangements. We offer patients and providers differentiated clinical service, leveraging our protocols and expertise to improve outcomes across our service lines. With an expansive network of delivery technicians and therapists that is not readily replicated, we are able to provide home healthcare therapies that require high-touch service, providing a bridge from the acute care setting to the home. Our services include:

| • | providing in-home delivery, set-up and maintenance of equipment and supplies; |

| • | educating patients and caregivers about health conditions or illnesses and providing instructions about home safety, self-care and the proper use of equipment; |

| • | therapy compliance monitoring and intervention to enhance compliance; |

| • | clinical monitoring of complex respiratory service patients’ individualized treatment plans; |

| • | reporting patient progress and status to the physician, national and regional insurers and/or managed care organizations; and |

| • | processing claims to Payors on behalf of patients. |

1

Table of Contents

In 2019, we served nearly 2 million patients, made nearly 2.4 million deliveries and conducted over 744,000 clinician interactions with our patients. In addition, in 2019, we generated $1.1 billion of net revenue, $15.6 million in net income, $174.0 million of Adjusted EBITDA and $80.5 million of Adjusted EBITDA less Patient Equipment Capex. Through various strategic and operational initiatives, we have improved profitability despite reimbursement rate pressure, improving our Adjusted EBITDA margin by 110 basis points from 2017 through 2019 on a basis that excludes the impact of new accounting policies adopted in 2018 and 2019. For reconciliations of Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex to net income, the most directly comparable financial measure prepared in accordance with GAAP, see “—Summary Historical Financial and Other Data.”

Strong Industry Fundamentals Support Our Business Model

The U.S. home healthcare market comprises a broad range of products and services—including respiratory therapy, OSA therapy, negative pressure wound therapy, home medical equipment, infusion therapy, home healthcare nursing, orthotics and prosthetics, diabetic supplies and general medical supplies. CMS estimates that the total revenue of the U.S. home healthcare market was $108.9 billion in 2019, and forecasts this market to grow at a compound annual growth rate (“CAGR”) of approximately 7% between 2020 and 2028. We operate in the durable medical equipment sub-segment of the home healthcare industry. CMS forecasts the durable medical equipment sub-segment to grow at a CAGR of approximately 6% between 2019 and 2028. The broader U.S. markets for respiratory devices and OSA devices, which align with our home respiratory and OSA treatment product lines, two of our core product lines and which represent over 80% of 2019 net revenue, are expected by industry analysts to grow at CAGRs of approximately 6% and approximately 8%, respectively, between 2018 and 2025. In 2018, industry analysts estimated that the market size for respiratory devices and OSA devices was approximately $6.2 billion and approximately $2.2 billion, respectively, in North America. The U.S. market for negative pressure wound therapy devices is expected by industry analysts to grow at a CAGR of approximately 5% between 2018 to 2023, and in 2018, the global market size of negative pressure wound therapy devices was estimated by industry analysts to be approximately $2.1 billion. Our sub-segment of the U.S. home healthcare industry is highly fragmented. The five largest players in this sub-segment accounted for approximately 50% of this sub-segment’s revenues in 2019. The remaining market revenues are attributable to thousands of other companies that primarily operate in local markets or regions.

We expect to benefit from the following continuing trends within the home healthcare market:

| • | aging population; |

| • | rising incidence of chronic diseases; |

| • | continued shift toward home healthcare driven by the compelling economic value proposition to key stakeholders and technological developments making remote monitoring more feasible; |

| • | increased prevalence of in-home treatments and preference for in-home care where available; and |

| • | consolidation of the highly fragmented market to the benefit of national players. |

Our Value Proposition

We believe we offer a compelling value proposition for patients, providers and Payors.

Value Proposition for Patients: We are committed to improving the experience and clinical outcome for each patient we serve. We believe our patients prefer the convenience and typical cost advantages of home healthcare over institutional care and the greater independence, increased responsibility and improved responsiveness to treatment that comes with it. By providing in-home delivery and equipment set-up, patient and caregiver education, as well as patient monitoring and compliance services, we enable the patient to move from

2

Table of Contents

or avoid an acute care setting and remain in or return to the home, which is the lowest cost, and overwhelmingly the patient-preferred, setting.

Value Proposition for Providers: Physicians, hospital professionals and other providers refer patients to us because of the consistent, high quality and reliable services we offer them and their patients. We seek to be a trusted advocate and provider of patient clinical needs in patients’ homes, while fostering lasting doctor-patient relationships. Additionally, the reliability of our clinical support, quality equipment and data collection facilitate a clinically adept transition to a lower-cost setting, which we believe benefits healthcare professionals, and helps to put them at ease regarding their patients’ ongoing treatments. We believe our services improve patient compliance and clinical outcomes, reduce hospital re-admissions and enable hospital providers to have greater control over timely patient discharges.

Value Proposition for Payors: We offer Payors access to an extensive national footprint, national logistics systems, respiratory clinical expertise, competitive pricing, alternative payment arrangements, including fee-for-service and capitation for defined patient populations, and our ability to connect electronically with Payors’ systems. We seek to effectively manage the transition from the acute care setting to a low-cost home setting with a high reliability of clinical support, data collection and quality equipment to lower readmission rates.

Our Competitive Strengths

National Scale with Local Presence. Our platform combines local market presence with the advantages and efficiencies of national scale, clinical expertise and reputation. As one of the largest providers of home healthcare services in the United States, we enjoy long-tenured relationships with the majority of the major commercial Payors, who value an expansive geographic footprint that can service their entire patient populations, in addition to our reputation for reliable and quality care.

Expansive Offering with Exposure to Attractive Product Markets. We seek to offer high quality, clinically appropriate care across a broad spectrum of services and treatments amenable to the home setting. Our extensive offering helps make us an attractive and convenient choice for our patients, providers and Payors. With top two market positions in the United States in home respiratory therapy, OSA treatment and NPWT, we are aligned with large and growing addressable markets across our core service lines.

Strong Relationships with Payors and Referral Sources Developed with Differentiated Sales Model. We enjoy deep and long-standing relationships with national and regional insurers and managed care organizations, many of whom we have been contracted with for over 20 years. We believe Payors value the breadth of our entire platform, including our geographic reach and the range of conditions our service offerings cover through both our fee-for-service and capitation arrangements. Furthermore, we believe they value our flexibility in payment arrangements and competence in managing value as well as volume under capitation for defined patient populations.

Leveraging our broad market access to patients through our centralized Payor relationships, we cultivate individual relationships with thousands of local referral sources, including hospitals, outpatient facilities, physicians and sleep centers, through a field sales force of approximately 380 in-market sales representatives and approximately 200 front-line managers. We believe this differentiated approach of combining Company-wide Payor relationships with in-market referral relationships enhances the efficiency and productivity of our marketing efforts.

Leadership in Clinical Delivery. We specialize in certain complex home healthcare services and treatments that require deep technical and clinical expertise in addition to frequent patient interaction. We believe we are distinguished from e-commerce and logistics platforms by our ability to meet patient needs directly through our

3

Table of Contents

highly trained technicians and therapists who deliver and provide these services, as well as our ability to bill a patient’s insurance provider. We utilize differentiated clinical expertise and protocols to drive optimal outcomes across our core service lines and all of these operations are accredited by The Joint Commission.

Leading Revenue Cycle Management. We manage medical claims and patient collections on a single operating platform that allows for capitation and fee-for-service arrangements. We believe we lead the industry in (1) ease of use for our key referral sources, (2) regulatory compliance and (3) revenue cycle management and billing and collections efficiency. We offer several advantages to our key referral sources and Payors, which we believe improve our ability to win new business and capture share from our competitors.

Strong and Experienced Management Team. We are led by a team of talented industry veterans, comprising individuals with long tenures at Apria and deep knowledge of our history and operations, as well as individuals who joined us more recently and bring fresh perspectives, insights and best practices developed through experience in other industries and at other companies. With an average of over 20 years of industry experience and over ten years with Apria, our senior leadership team has expertise spanning nearly every segment of the healthcare industry.

Growth Strategy

Our goal is to be the market leader in the provision of high quality, cost-efficient home healthcare services, creating value for all stakeholders—patients, providers and Payors. We seek to achieve this goal through the following growth strategies:

Maintain leadership in markets with favorable industry dynamics. The broader U.S. markets for respiratory devices and OSA devices, which align with our home respiratory and OSA treatment product lines, two of our core product lines and which represent over 80% of 2019 net revenue, are expected by industry analysts to grow at CAGRs of approximately 6% and approximately 8%, respectively, between 2018 and 2025. With a national distribution platform that is difficult to replicate, deep and long-standing relationships with national and regional insurers and managed care organizations and a reputation for quality and reliability of service, we believe we are well positioned to maintain leadership in these attractive and growing markets. Industry groups suggest that approximately 80% of moderate and severe sleep-disordered breathing cases remain undiagnosed. We have been educating primary care physicians about the proper diagnosis and treatment of OSA. As the first line of care, these primary care physicians are more likely to encounter undiagnosed instances of OSA. In addition to traditional solutions, we coordinate an end-to-end virtual solution that includes home sleep testing (rather than testing at an offsite sleep clinic) which is convenient for the patient and safer, especially in the current pandemic environment. We believe that facilitating the diagnosis and treatment of this condition will lead to increased growth in OSA sales and increase revenue synergies as newly acquired OSA patients will have access to our other product and service lines when clinically indicated.

Enable the transition to value-based healthcare. Government and commercial Payors are increasingly seeking ways to shift from traditional fee-for-service to a value-based model. We believe the ability to transition patients from the acute care setting to the home, as well as to prevent unnecessary readmissions, represents a critical part of this effort. As a leading provider of home healthcare equipment and related services, we believe we will increasingly benefit from this ongoing paradigm shift in the industry. In addition, we believe our demonstrated expertise in non-traditional payment models, such as capitation arrangements, will position us well to take advantage of this trend.

Expand product and service offerings. We continue to focus on expanding into new product lines and services both organically and through strategic acquisition to continue to grow and diversify our revenue with a patient-centric view centered on the long term value of each patient. For example, we are pursuing products and services related to the treatment of diabetes and the provision of diabetic supplies. Technological advances in continuous glucose monitoring and insulin pump delivery (creating an “artificial pancreas”) have changed the

4

Table of Contents

diabetes treatment paradigm and enabled providers to better treat patients in the home healthcare setting. Moreover, diabetic patients often suffer from many co-morbidities, including OSA, respiratory ailments and heart disease, many of which we already treat through our sleep and respiratory product lines. We believe we are well positioned to leverage our national platform and scalable infrastructure to help diabetic patients benefit from new diabetes treatment technologies as well as treatments for co-morbidities.

Leverage patient interactions. Our business model provides for frequent interaction with our patients and a direct entry point into the home, allowing our technicians, therapists and customer service agents to assess whether the patients are in need of additional services, supplies or convenience items. Where appropriate, our technicians, therapists and customer service agents can assist our patients in obtaining these additional services, supplies or convenience items through Apria. In addition, existing patients and potential patients may utilize our e-commerce platform to access additional items that are not covered by Payors and are purchased directly by patients.

Grow e-commerce through a patient-centric approach. Our e-commerce platform is primarily focused on supplies, accessories and additional items that are not covered by Payors and are purchased directly by patients. E-commerce is a convenient way to provide products and services to our existing patients and also serves as an additional acquisition channel for new patients. Through direct-to-patient marketing focused on service and clinical support, we believe we can continue to grow volume through our e-commerce channel. For example, we frequently acquire patients to meet a single product need even though they typically have additional home healthcare needs. Through patient interaction and education, they can discover and access other products and services that we offer through e-commerce that can address their needs. In addition, we believe the broader home healthcare trends discussed below will also enable us to grow our revenue and product and service offerings through e-commerce. Given that the supplies and accessories that are its primary focus are less capital intensive, we believe growing our e-commerce channel represents an attractive opportunity to increase cash flows and profitability.

Grow with new home healthcare trends. Telemedicine and remote provider care have been gaining traction in recent years and have been significantly accelerated given the recent COVID-19 pandemic. We believe that these trends will help accelerate growth in home healthcare and we are well positioned to benefit from these trends given our national footprint and scalable infrastructure. Moreover, due to the impacts of the COVID-19 pandemic, we expect accelerated and sustainable demand for home healthcare solutions including respiratory and other medical conditions that we treat regularly. These trends in telemedicine and the emphasis on treating patients in the home, outside the traditional medical clinic and hospital, will enable us to grow our revenue and product and service offerings further.

Strategic acquisitions. We believe there is also opportunity to accelerate our growth rate, market share gains and expand into new product markets through strategic acquisitions. We will continue to evaluate such opportunities through a disciplined approach, seeking only acquisitions that will complement our existing operations and businesses and/or create synergies. The various markets we participate in remain highly fragmented and ripe for consolidation and we believe that our nationally integrated platform, scale and strong reputation position us well to be a consolidator in our industry. We have a relatively unburdened balance sheet with low debt levels and meaningful debt capacity for acquisitions. Moreover, as a public company, we will have greater access to capital markets and we will be able to use our stock as an acquisition currency or to raise additional capital for strategic acquisitions.

Continue to capture efficiencies through scale and operational improvement. Our existing distribution network of approximately 275 branch locations can reach more than 90% of the U.S. population across both high-density urban markets and rural markets. Coupled with scalable technology and centralized operations, including revenue cycle management, we believe we can continue to grow beyond our nearly 2 million patients

5

Table of Contents

served in 2019 without significant incremental capital investment in infrastructure. As we maintain our strong position in growing product markets, we believe the ability to scale our operations and leverage fixed costs represents a significant opportunity for growth in profitability. In addition, we believe we can continue to improve the cost-efficiency of our operations and support functions through new and recently completed technology initiatives, such as robotic desktop automation (“RDA”) to simplify agent workflow, robotic process automation technology (“RPA”) for certain repetitive and volume staff tasks and automating activities such as new employee onboarding and equipment provisioning, and enhanced workflow to improve ease of use and direct activity to the appropriately skilled staff. We have also invested in DMEhub, a cloud-based e-prescribing platform that allows providers to submit medical equipment orders more efficiently and accurately, which we believe drives ease of use, enables more efficient order processing and reduces administrative burden.

Continue to improve cash profile. We continually evaluate opportunities to enhance our cash flow and return on investment. We see opportunities in this regard both to increase our exposure to less capital intensive products and to benefit from recent investment in our longer-lived, complex equipment fleet. Patients on OSA therapy and NPWT require periodic replenishment of supplies and accessories in order to remain in compliance with their prescribed therapies. These supplies are less capital intensive and we believe represent a multi-billion dollar market with an attractive growth profile. The opportunity to increase our exposure to this market is enhanced by our growing e-commerce distribution channel, which is primarily focused on these supplies and accessories, offering patients speed and convenience and helping us to continue to grow our volume.

Our Strategic Transformations

Since we were acquired by Blackstone in 2008, the home healthcare industry has experienced a number of significant changes, including reimbursement, regulatory and technological changes. We have continually worked to adapt our business and organizational structure to best meet the current needs of patients, providers and Payors.

Our most recent business initiative, which we call Simplify, focused on retaining clear customer ownership at our local branch level with support from our scalable national platform to greatly improve the patient and referral source experience. With a goal of optimizing the end-to-end customer experience while enabling us to increase our growth rate at lower cost, we evaluated local, regional and centralized processes to foster local branch customer ownership, supported by regional shared services where scale, consistency and process expertise is needed, and our national platform where scale can be leveraged. This transformation has led to significant improvement in profitability and lower operating costs and has positioned us well for future growth. Our patient-centric growth plan begins with an improved customer experience, which we believe will support increased cross-sell opportunities and growth across product lines to the over 2 million unique patients we serve annually.

In addition to Simplify, we have also made other substantial changes to our business since our acquisition by Blackstone:

| • | we brought on a management team of individuals with extensive expertise and experience in the workings of our industry and regulatory environment and others who specialize in designing and developing scalable business infrastructures and business transformation; |

| • | we improved our business and revenue mix by growing our relationships with commercial Payors; |

| • | we expanded our service offerings to include more complex respiratory services, including NIV therapy, and we shifted our focus to three core service lines including less capital intensive products and services which complement our core offerings; |

| • | we invested in patient monitoring and outcomes data collection to differentiate our service offerings and provide enhanced value to patients, providers and Payors; |

6

Table of Contents

| • | we improved sales productivity through changes in the sales force hiring profile and implementation of a new sales customer relationship management system; |

| • | we formed strategic relationships with our suppliers to help optimize equipment costs and provide state-of-the art patient equipment; |

| • | we streamlined our management structure and further optimized our branch network by reducing our locations open to the public from over 400 to approximately 275 without materially reducing the coverage of our service areas or the quality of our service; |

| • | we built a scalable infrastructure with data analytics and forecasting capabilities to more efficiently leverage the favorable trends of an aging population and the paradigm shift in healthcare from the acute setting to the home; and |

| • | we consolidated regional and branch level billing, collections and aspects of the customer service function, reorganized their work flows and adopted new technology and processes to help us improve productivity, monitor performance and more effectively manage important aspects of our business in real-time. |

Our Sponsor

Blackstone (NYSE: BX) is one of the world’s leading investment firms. Blackstone’s asset management businesses include investment vehicles focused on real estate, private equity, public debt and equity, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds, all on a global basis. Through its different businesses, Blackstone had total assets under management of approximately $584 billion as of September 30, 2020.

After the completion of this offering, our Sponsor will beneficially own approximately 72.0% of our common stock (or 68.8% if the underwriters exercise their option to purchase additional shares in full). As a result, we will be a “controlled company” within the meaning of the Nasdaq corporate governance standards. Under these corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including the requirements (1) that a majority of our board of directors consist of independent directors, (2) that our board of directors have a compensation committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities and (3) that our director nominations be made, or recommended to our full board of directors, by our independent directors or by a nominations committee that is comprised entirely of independent directors and that we adopt a written charter or board resolution addressing the nominations process. For at least some period following this offering, we intend to utilize these exemptions. As a result, immediately following this offering, we do not expect a majority of our directors will have been affirmatively determined to be independent or that our compensation committee or nominating and corporate governance committee of the board will be comprised entirely of directors who have been affirmatively determined to be independent. Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of these corporate governance requirements. In the event that we cease to be a “controlled company” and our common stock continues to be listed on Nasdaq, we will be required to comply with these provisions within the applicable transition periods.

7

Table of Contents

Summary Risk Factors

An investment in shares of our common stock involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our Company include, among other things, the following:

| • | the recent coronavirus (COVID-19) pandemic and the global attempt to contain it may harm our business, results of operations and ability to execute on our business plan; |

| • | our capitation arrangements may prove unprofitable if actual utilization rates exceed our assumptions; |

| • | our Payor contracts, including those with organizations that represent a significant portion of our business, are subject to renegotiation or termination which could result in a decrease in our revenue and profits; |

| • | we depend on reimbursements by Payors, which could lead to delays and uncertainties in the reimbursement process; |

| • | possible changes in the mix of patients and products and services provided, as well as Payor mix and payment methodologies, could have a material adverse effect on our business, financial condition, results of operations, cash flow, capital resources and liquidity; |

| • | if we are unable to provide consistently high quality of care, our business will be adversely impacted; |

| • | our reliance on relatively few vendors for the majority of our patient equipment and supplies and excise taxes which are to be imposed on certain manufacturers of such items could adversely affect our ability to operate; |

| • | the home healthcare industry is highly competitive and fragmented, with limited barriers to entry which may make it susceptible to vertical integration by manufacturers, Payors, providers (such as hospital systems) or disruptive new entrants; |

| • | we may be adversely affected by consolidation among health insurers and other industry participants; |

| • | there is an inherent risk of liability in the provision of healthcare services; damage to our reputation or our failure to adequately insure against losses, including from substantial claims and litigation, could have an adverse impact on our operations, financial condition, or prospects; |

| • | the current economic downturn, deepening of the economic downturn, continued deficit spending by the federal government or state budget pressures may result in a reduction in payments and covered services; |

| • | changes in home healthcare technology and/or product and therapy innovations may make the services we currently provide obsolete or less competitive; |

| • | reductions in Medicare, Medicaid and commercial Payor reimbursement rates could have a material adverse effect on our results of operations and financial condition; |

| • | if we fail to comply with applicable laws and regulations, we could suffer penalties or be required to make significant changes to our operations; |

| • | we have been, are and could become the subject of federal and state investigations and compliance reviews; |

| • | if we fail to maintain required licenses, certifications, or accreditation, or if we do not fully comply with requirements to provide notice to or obtain approval from regulatory authorities due to changes in our ownership structure or operation, it could adversely impact our operations; |

8

Table of Contents

| • | a cyber-attack, a security breach, or the improper disclosure or use of protected health information could cause a loss of confidential data, give rise to remediation and other expenses, expose us to liability under the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), consumer protection, common law or other legal theories, subject us to litigation and federal and state governmental inquiries, damage our reputation, and otherwise be disruptive to our business; and |

| • | our Sponsor and its affiliates control us and their interests may conflict with ours or yours in the future. |

Please see “Risk Factors” for a discussion of these and other factors you should consider before making an investment in shares of our common stock.

Our Organizational Structure

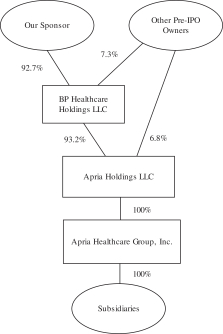

Existing Organizational Structure

The following diagram depicts our current organizational structure and equity ownership. Apria, Inc. is not pictured, as it was incorporated in connection with this offering and does not have any outstanding shares of capital stock. We currently conduct our business through Apria Healthcare Group and its subsidiaries. As described below, Apria, Inc. will become the holding company for Apria Healthcare Group. This diagram is provided for illustrative purposes only and does not show all of our legal entities.

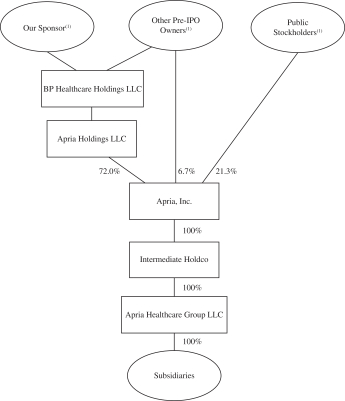

Organizational Structure Following This Offering

At or prior to the completion of this offering, we will undertake the pre-IPO reorganization transactions so that Apria, Inc. will, through a newly formed direct subsidiary of Apria, Inc. (“Intermediate Holdco”), own all of the equity interests in Apria Healthcare Group and become the holding company of our business. More specifically, a newly formed direct subsidiary of Intermediate Holdco will merge with and into Apria Healthcare Group, with Apria Healthcare Group surviving. As a result, Apria Healthcare Group will become an indirect

9

Table of Contents

wholly owned subsidiary of Apria, Inc. Our pre-IPO owners, through their ownership of Apria Holdings LLC as the 100% direct owner of Apria Healthcare Group prior to such transaction, will receive an aggregate of 35,210,915 shares of newly issued common stock of Apria, Inc., assuming an offering price of $20.00 per share of common stock, which is the midpoint of the range on the front cover of this prospectus. However, the precise number of shares of common stock issued to our pre-IPO owners, and accordingly the total number of our outstanding shares of stock, will differ if the actual initial offering price per share differs from this assumed price. For example, if the initial offering price of common stock in this offering is (i) $19.00 per share, which is the low point of the price range indicated on the front cover of this prospectus, we would issue 35,210,795 shares of common stock to our pre-IPO owners and (ii) $21.00 per share, which is the high point of the price range indicated on the front cover of this prospectus, we would issue 35,211,020 shares of common stock to our pre-IPO owners.

In connection with this offering, the stock appreciation rights (“SARs”) that are issued by Apria Healthcare Group will remain outstanding and will continue to vest and settle pursuant to their original terms, but will be amended to track the shares of Apria, Inc. common stock rather than the shares of common stock of Apria Healthcare Group. Following the completion of this pre-IPO reorganization, the SARs outstanding at Apria, Inc. will be 3,766,228, assuming an offering price of $20.00 per share of common stock, which is the midpoint of the range on the front cover of this prospectus. However, the precise number of SARs in Apria, Inc. issued to our pre-IPO owners will differ if the actual initial offering price per share differs from this assumed price in order to preserve the value due to each holder. For example, if the initial offering price of common stock in this offering is (i) $19.00 per share, which is the low point of the price range indicated on the front cover of this prospectus, we would issue 3,766,397 SARs to our pre-IPO owners and (ii) $21.00 per share, which is the high point of the price range indicated on the front cover of this prospectus, we would issue 3,766,045 SARs to our pre-IPO owners.

Prior to the consummation of this offering, Apria Healthcare Group will be converted into a Delaware limited liability company.

Apria Holdings LLC, an entity controlled by our Sponsor, will be the direct and indirect 100% owner of Apria, Inc. and Apria Healthcare Group immediately prior to and immediately following the consummation of the merger. For this reason, the merger will be accounted for as a reorganization of entities under common control. As a result, the consolidated financial statements of Apria, Inc. will recognize the assets and liabilities received in the merger at their historical carrying amounts, as reflected in the historical consolidated financial statements of Apria Healthcare Group, the accounting predecessor. Following the consummation of these transactions in accordance with a master reorganization agreement, the form of which has been filed as an exhibit to the registration statement of which this prospectus forms a part, the selling stockholders will complete the offer and sale of Apria, Inc.’s common stock to investors in this offering.

We believe there are financing benefits in having an organizational structure with a holding company issuer above the entities that are subject to debt covenants and such structures are frequently used by corporate issuers. We do not expect that there will be any material benefit or detriment to our stockholders from our organizational structure after giving effect to the pre-IPO reorganization transactions, as all stockholders, including our pre-IPO owners and public stockholders, will hold their respective interest in a single class of our common stock and will be entitled to the same relative benefits or detriments.

The following diagram depicts our organizational structure and equity ownership immediately following

the pre-IPO reorganization transactions and this offering. This diagram is provided for illustrative purposes only and does not show all of our legal entities or ownership percentages of such entities.

10

Table of Contents

| (1) | After the completion of this offering, our Sponsor will beneficially own 72.0% of our outstanding common stock (or 68.8% if the underwriters exercise their option to purchase additional shares in full), our other pre-IPO owners will beneficially own 6.7% of our outstanding common stock (or 6.7% if the underwriters exercise their option to purchase additional shares in full) and public stockholders will beneficially own 21.3% of our outstanding common stock (or 24.5% if the underwriters exercise their option to purchase additional shares in full) assuming an offering price of $20.00 per share of common stock, which is the midpoint of the range on the front cover of this prospectus. For additional information, see “Principal and Selling Stockholders.” |

In connection with this offering we intend to enter into (i) a stockholders agreement which among other rights, will provide our Sponsor with the right to require us to nominate a number of individuals designated by our Sponsor for election as our directors for as long as it retains significant ownership of us and (ii) a registration rights agreement, which will provide our Sponsor an unlimited number of “demand” registration rights and customary “piggyback” registration rights. The stockholders agreement will require us to nominate a number of individuals designated by our Sponsor (the “Sponsor Directors”) based on the beneficial ownership of our pre-IPO owners and their affiliates of our common stock entitled to vote generally in the election of our directors. The number of such Sponsor Directors will be the lowest whole number that is greater than 50% of the total number of directors comprising our board of directors if our pre-IPO owners and their affiliates beneficially own at least 50% of the shares of our outstanding common stock (and any securities convertible into, or exchangeable or exercisable for, such shares) entitled to vote generally in the election of our directors as of the record date for such meeting and such number will generally decrease proportionally as the beneficial ownership of our pre-IPO owners and their affiliates decrease, except that our Sponsor will continue to have the right to nominate the lowest whole number of directors that is at least 10% of the total number of directors for so long as our pre-IPO owners and their affiliates own at least 5% of our outstanding common stock. Accordingly, our Sponsor will have the right to designate 10% of the board of directors even though the pre-IPO owners and their affiliates may own less than 10% of the outstanding common stock (so long as they own at least 5%). After the completion of this offering, we expect that our Sponsor will have the right, but be under no obligation, to designate five members of our nine member board of directors as their nominees for election at our first meeting of stockholders

11

Table of Contents

following this offering (or such greater or lesser number of directors that would constitute the lowest whole number of directors that is greater than 50% of the total number of directors then comprising the board). See “Certain Relationships and Related Person Transactions” for additional information.

Apria, Inc. was incorporated in Delaware on March 22, 2018. Our principal executive offices are located at 7353 Company Drive, Indianapolis, Indiana 46237 and our telephone number is (800) 990-9799.

Recent Developments

Preliminary Estimated Unaudited Financial Results of Operations for the Year Ended December 31, 2020

The data presented below reflects our preliminary estimated unaudited financial results for the year ended December 31, 2020 based upon information available to us as of the date of this prospectus. In preparing our preliminary estimated unaudited financial results, we have utilized accounting estimates in a manner consistent with the description in Note 1 in our unaudited condensed consolidated financial statements included elsewhere in this prospectus. However, this data is not a comprehensive statement of our financial results for the year ended December 31, 2020, and our actual results may differ materially from this preliminary estimated data, as our closing process and related audit have not been completed. During the preparation of our financial statements and related notes additional adjustments to the preliminary estimated financial information presented below may be identified. Any such adjustments may be material. Our independent registered public accounting firm, Deloitte & Touche LLP, has not audited, reviewed, compiled or performed any procedures with respect to this preliminary financial data and, accordingly, Deloitte & Touche LLP does not express an opinion or any other form of assurance with respect thereto.

Based upon such preliminary estimated financial results, we expect various key metrics for the year ended December 31, 2020, to be between the ranges set out in the following table, as compared to the year ended December 31, 2019:

| Year Ended December 31, | ||||||||||||

| 2020 | 2019 | |||||||||||

| (Estimated) | ||||||||||||

| (in thousands) | Low | High | ||||||||||

| Net revenues: |

||||||||||||

| Home respiratory therapy |

$ | 451,726 | $ | 453,826 | $ | 435,680 | ||||||

| OSA treatment |

452,407 | 454,407 | 438,572 | |||||||||

| NPWT |

42,766 | 42,966 | 42,122 | |||||||||

| Other equipment and services |

156,818 | 157,518 | 172,501 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net revenues |

$ | 1,103,717 | $ | 1,108,717 | $ | 1,088,875 | ||||||

| Net income |

$ | 41,956 | $ | 44,156 | $ | 15,622 | ||||||

| EBITDA |

$ | 183,378 | $ | 186,378 | $ | 138,991 | ||||||

| Adjusted EBITDA |

$ | 223,858 | $ | 226,858 | $ | 173,972 | ||||||

| Adjusted EBITDA less Patient Equipment Capex |

$ | 131,223 | $ | 134,223 | $ | 80,523 | ||||||

As of December 31, 2020, we expect cash and cash equivalents to be approximately $195 million and approximately $401 million of debt to be outstanding under the Term Loan A Facility after giving effect to the Incremental Term Loans. This amount is not presented net of unamortized debt issuance costs.

Estimated net income for the year ended December 31, 2020 of $42.0 million to $44.2 million is significantly greater than our net income for the nine months ended September 30, 2020 of $20.3 million

12

Table of Contents

primarily due to incurrence of one-time costs in the first nine months of the year for (x) an estimated probable loss recorded in relation to a series of civil investigative demands and (y) a special recognition bonus for front-line and other non-leadership employees. These costs were recorded in selling, distribution and administrative expenses in the first nine months of 2020.

EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex are non-GAAP measures and should not be considered in isolation, or as a substitute for our results as reported under GAAP. See “—Summary Historical Financial and Other Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Information” for discussion on how we define and calculate EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex and why we believe these measures are important.

The following table reconciles net income, the most directly comparable GAAP measure, to EBITDA, Adjusted EBITDA and Adjusted EBITDA less Patient Equipment Capex:

| Year Ended December 31, | ||||||||||||

| 2020 | 2019 | |||||||||||

| (Estimated) | ||||||||||||

| (in thousands) | Low | High | ||||||||||

| Net income |

$ | 41,956 | $ | 44,156 | $ | 15,622 | ||||||

| Interest expense, net and other |

5,810 | 5,810 | 3,666 | |||||||||

| Income tax expense |

20,382 | 21,182 | 8,127 | |||||||||

| Depreciation and amortization |

115,230 | 115,230 | 111,576 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

$ | 183,378 | $ | 186,378 | $ | 138,991 | ||||||

| Strategic transformation initiatives: |

||||||||||||

| Simplify(a) |

1,159 | 1,159 | 11,775 | |||||||||

| Financial system(b) |

1,846 | 1,846 | — | |||||||||

| Other initiatives(c) |

465 | 465 | 834 | |||||||||

| Stock-based compensation and other(d) |

4,839 | 4,839 | 9,024 | |||||||||

| Legal settlement(e) |

28,891 | 28,891 | 12,200 | |||||||||

| Offering costs(f) |

3,280 | 3,280 | 1,148 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 223,858 | $ | 226,858 | $ | 173,972 | ||||||

|

|

|

|

|

|

|

|||||||

| Patient Equipment Capex |

(92,635 | ) | (92,635 | ) | (93,449 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA less Patient Equipment Capex |

$ | 131,223 | $ | 134,223 | $ | 80,523 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Simplify represents one-time advisory fees and implementation costs associated with a key 2019 business transformation initiative focused on shifting to a patient-centric platform and optimizing end-to-end customer service. |

| (b) | Costs associated with the implementation of a new financial system. |

| (c) | Other initiatives include one-time third-party logistics advisory costs associated with a 24-month initiative launched in January 2018 designed to modify the branch network in order to reduce branch operating costs while maintaining or improving patient service levels, one-time costs associated with customer service initiatives, and one-time costs associated with implementation of an electronic sales, service and rental agreement. |

| (d) | Stock-based compensation has historically been granted to certain of our employees in the form of profit interest units of our parent and stock appreciation rights (“SARs”). For time-based vesting awards, we recognize a non-cash compensation expense based on the fair value of the awards determined at the date of grant over the requisite service period. In 2019, all outstanding performance Class B units were modified to |

13

Table of Contents

| accelerate vesting resulting in $7.0 million stock compensation expense. Other compensation includes long-term incentive compensation. |

| (e) | Represents the increase in the settlement amount in relation to a series of civil investigative demands from the United States Attorney’s Office for the Southern District of New York offset by a one-time unrelated $3.0 million recovery in 2020. See “Business—Legal Proceedings—Civil Investigative Demand Issued by the United States Attorney’s Office for the Southern District of New York” and Note 8 in our unaudited condensed consolidated financial statements included elsewhere in this prospectus for additional information. |

| (f) | Offering costs represent one-time costs relating to preparation for our initial public offering and accelerated implementation of new accounting standards. |

Settlement with SDNY Office

On December 18, 2020, a federal judge approved a civil and administrative settlement Apria recently entered into with the United States and state Medicaid programs, in a complaint filed by three relators under the qui tam provisions of the False Claims Act (“FCA”), 31 U.S.C. § 3729 et seq., as well as comparable state false claims laws, in connection with the rental of non-invasive ventilators (“NIVs”). Apria also entered into separate settlements to resolve the relators’ claims brought on behalf of the States of California and Illinois related to NIV covered by private insurers. The matter had been pending since 2017.

The government had alleged that Apria violated the FCA by submitting false claims seeking reimbursement for NIVs which were not being used, or not being used sufficiently, by patients, for NIVs which were being used pursuant to physician orders on a device setting which was available from other less expensive devices, and for improperly waiving co-pays to induce beneficiaries to rent NIVs. To resolve any potential liability, Apria agreed to enter a civil settlement agreement and to pay $40 million to the federal government and the states. Apria also agreed with the California Department of Insurance to pay $500,000 to resolve claims asserted by the relators under the California Insurance Frauds Prevention Act, Cal. Ins. Code § 1871 et seq. Apria separately agreed with the relators to settle all remaining claims from their complaint, including: (1) claims for retaliation in violation of federal and state laws; (2) claims for attorneys’ fees and costs available under federal and state law; and (3) claims under the Illinois Insurance Claims Fraud Prevention Act, 740 Ill. Comp. Stat. 92/1 et seq. Apria did not admit that any of its conduct was illegal or otherwise improper.

As part of the federal and state Medicaid settlement, Apria also entered into a five-year corporate integrity agreement (the “Corporate Integrity Agreement” or “CIA”) with the Office of Inspector General of the U.S. Department of Health and Human Services (“HHS OIG”). The CIA requires Apria to maintain its ongoing corporate compliance program and obligates Apria to implement or continue, as applicable, a set of defined corporate integrity activities for a period of five years from the effective date of the CIA. Among other things, the CIA requires Apria to impose certain oversight obligations on Apria’s board of directors; provide certain management certifications; continue or implement, as applicable, certain compliance training and education; and engage an Independent Review Organization to perform certain reviews. The CIA also includes certain reporting, certification, record retention, and notification requirements. In the event of a breach of the CIA, Apria could become liable for payment of certain stipulated penalties or could be excluded from participation in federal healthcare programs.

Credit Facility Amendment and Dividend

On December 11, 2020, we entered into an amendment (the “Credit Facility Amendment”) to our credit agreement to incur $260.0 million of incremental term loans (the “Incremental Term Loans”). Net proceeds from the Incremental Term Loans were used to fund a $200.3 million dividend payment to our stockholders and a $9.7 million distribution to SARs holders declared and paid in December 2020, with the remaining proceeds used to pay fees and expenses in connection with the Credit Facility Amendment and for general corporate purposes.

14

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

7,500,000 shares. |

| Option to purchase additional shares from the selling stockholders |

The selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to 1,125,000 additional shares of common stock from the selling stockholders. |

| Common stock outstanding after giving effect to this offering |

35,210,915 shares assuming an offering price of $20.00 per share of common stock, which is the midpoint of the range on the front cover of this prospectus. See “—Our Organizational Structure—Organizational Structure Following This Offering.” |

| Use of proceeds |

We will not receive any proceeds from the sale of the shares of common stock offered by the selling stockholders (including any sales pursuant to the underwriters’ option to purchase additional shares from the selling stockholders). |

| Dividend policy |

We have no current plans to pay dividends on our common stock following this offering. Any decision to declare and pay dividends in the future will be made at the sole discretion of our board of directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our board of directors may deem relevant. Because we are a holding company and have no direct operations, we will only be able to pay dividends from funds we receive from our subsidiaries. In addition, our ability to pay dividends will be limited by covenants in our existing indebtedness and may be limited by the agreements governing any indebtedness we or our subsidiaries may incur in the future. See “Dividend Policy.” |

| Risk factors |

See “Risk Factors” for a discussion of risks you should carefully consider before deciding to invest in our common stock. |

| Proposed trading symbol |

“APR” |

In this prospectus, unless otherwise indicated, the number of shares of common stock outstanding and the other information based thereon is based on 35,210,915 shares outstanding as of the date of this prospectus, after giving effect to the pre-IPO reorganization transactions and this offering, and does not reflect:

| • | 2,594,224 shares that would be issuable upon settlement of outstanding stock appreciation rights granted pursuant to the 2015 Plan (as defined herein) (“SARs”) if such SARs were vested and exercised at the time of this offering (assuming an offering price of $20.00 per share of common stock, which is the midpoint of the price range set forth on the cover of this prospectus). At the time of this offering, there will be 3,766,228 SARs outstanding under the 2015 Plan with a weighted average strike price of $6.22. See “Executive Compensation—Long-Term Equity Incentive Compensation—Stock Appreciation Rights of Apria Healthcare Group”; |

15

Table of Contents

| • | Awards granted under the 2019 LTIP (as defined herein) with a maximum value of $4.4 million (or 220,000 shares assuming an offering price of $20.00 per share of common stock, which is the midpoint of the price range set forth on the cover of this prospectus, which such shares will be issued pursuant to the Apria, Inc. 2021 Omnibus Incentive Plan (the “Omnibus Incentive Plan”)). See “Executive Compensation—Long-Term Cash Incentive Compensation—2019 LTIP”; and |

| • | 3,912,324 shares of common stock that may be granted under the Omnibus Incentive Plan. See “Executive Compensation—Equity Incentive Plans—Omnibus Incentive Plan,” including: |

| • | The award described under “Executive Compensation—Long-Term Equity Incentive Compensation—Chief Financial Officer RSU Award” with a value of $3.2 million (or 159,977 shares), assuming an offering price of $20.00 per share of common stock, which is the midpoint of the price range set forth on the cover of this prospectus. |

16

Table of Contents

Summary Historical Financial and Other Data

We derived the summary statement of income data for the years ended December 31, 2019, 2018 and 2017 and the summary balance sheet data as of December 31, 2019 and 2018 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary balance sheet data as of December 31, 2017 from our audited consolidated financial statements that are not included in this prospectus. The summary statement of income data for the nine months ended September 30, 2020 and 2019 and the summary balance sheet data as of September 30, 2020 were derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of our management, reflect all normal recurring adjustments necessary for the fair statement of our consolidated results for these periods. The results for any interim period are not necessarily indicative of the results that may be expected for the full year. Our historical results are not necessarily indicative of the results expected for any future period.

You should read the summary historical financial data below, together with the consolidated financial statements and related notes thereto appearing elsewhere in this prospectus, as well as “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the other financial information included elsewhere in this prospectus.

On January 1, 2019, we adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) No. 2016-02, Leases (“Topic 842”), using the modified retrospective transition method. For lessor accounting, upon adoption the provision for doubtful accounts associated with rental revenue of $34.5 million for the year ended December 31, 2019 is now charged to net rental revenue instead of general and administrative expense. For lessee accounting, upon adoption total assets and total liabilities increased $74.4 million as of January 1, 2019.

17

Table of Contents

The comparative information for periods prior to adoption has not been restated and continues to be reported under the accounting standards in effect for those periods.

| Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||

| (in thousands, except share and per share data) | 2020 | 2019 | 2019 | 2018 | 2017 | |||||||||||||||

| Summary Statement of Income Data: |

||||||||||||||||||||

| Net revenues: |

||||||||||||||||||||

| Fee-for-service arrangements(1)(2) |

$ | 646,630 | $ | 644,624 | $ | 870,344 | $ | 898,622 | $ | 866,397 | ||||||||||

| Capitation |

168,298 | 163,086 | 218,531 | 212,261 | 207,413 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total net revenues |

814,928 | 807,710 | 1,088,875 | 1,110,883 | 1,073,810 | |||||||||||||||

| Costs and expenses: |

||||||||||||||||||||

| Cost of net revenues |

||||||||||||||||||||

| Product and supply costs |

141,563 | 154,591 | 206,067 | 218,099 | 200,621 | |||||||||||||||

| Patient equipment depreciation |

75,840 | 72,588 | 97,386 | 108,340 | 101,724 | |||||||||||||||

| Home respiratory therapists costs |

12,848 | 14,844 | 19,560 | 20,371 | 20,802 | |||||||||||||||

| Other |

13,669 | 13,043 | 17,701 | 13,276 | 9,398 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of net revenues |

243,920 | 255,066 | 340,714 | 360,086 | 332,545 | |||||||||||||||

| Provision for doubtful accounts(1)(2) |

— | — | — | 31,719 | 42,672 | |||||||||||||||

| Selling, distribution and administrative |

534,110 | 537,546 | 720,746 | 698,681 | 672,442 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total costs and expenses |

778,030 | 792,612 | 1,061,460 | 1,090,486 | 1,047,659 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

36,898 | 15,098 | 27,415 | 20,397 | 26,151 | |||||||||||||||

| Interest expense |

4,047 | 3,345 | 5,112 | 1,338 | 1,246 | |||||||||||||||

| Interest income and other |

(451 | ) | (1,552 | ) | (1,446 | ) | (897 | ) | (486 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

33,302 | 13,305 | 23,749 | 19,956 | 25,391 | |||||||||||||||

| Income tax expense (benefit) |

13,034 | 3,465 | 8,127 | 6,829 | (71,560 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income(3)(4) |

$ | 20,268 | $ | 9,840 | $ | 15,622 | $ | 13,127 | $ | 96,951 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic and diluted earnings per share: |

||||||||||||||||||||

| Net income per share |

$ | 20.42 | $ | 9.91 | $ | 15.74 | $ | 13.22 | $ | 97.66 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic and diluted |

992,719 | 992,719 | 992,719 | 992,719 | 992,719 | |||||||||||||||

| Pro Forma Earnings Per Share Information(5): |

||||||||||||||||||||

| Pro forma basic earnings per share: |

$ | 0.58 | $ | 0.44 | ||||||||||||||||

| Pro forma diluted earnings per share |

$ | 0.54 | $ | 0.42 | ||||||||||||||||

| Pro forma basic weighted average shares outstanding |

35,210,915 | 35,210,915 | ||||||||||||||||||

| Pro forma diluted weighted average shares outstanding |

37,525,139 | 37,565,139 | ||||||||||||||||||

18

Table of Contents

| September 30, | December 31, | |||||||||||||||

| (in thousands) | 2020 | 2019 | 2018 | 2017 | ||||||||||||

| Summary Balance Sheet Data: |

||||||||||||||||

| Total assets |

$ | 645,051 | $ | 617,153 | $ | 576,222 | $ | 643,553 | ||||||||

| Total liabilities(3)(6) |

488,812 | 482,637 | 290,970 | 298,049 | ||||||||||||

| Total stockholders’ equity(7) |

156,239 | 134,516 | 285,252 | 345,504 | ||||||||||||

| Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||

| (in thousands) | 2020 | 2019 | 2019 | 2018 | 2017 | |||||||||||||||

| Operational and Other Data: |

||||||||||||||||||||

| EBITDA(8) |

$ | 123,813 | $ | 98,348 | $ | 138,991 | $ | 145,386 | $ | 145,448 | ||||||||||

| Adjusted EBITDA(8) |

162,765 | 118,963 | 173,972 | 155,727 | 153,340 | |||||||||||||||

| Adjusted EBITDA less Patient Equipment Capex(8) |

99,283 | 45,562 | 80,523 | 45,579 | 3,417 | |||||||||||||||

| (1) | The decrease in net revenue from fee-for-service arrangements for the year ended December 31, 2019 was primarily driven by the impact of adopting Topic 842. Upon adoption the provision for doubtful accounts associated with rental revenue of $34.5 million for the year ended December 31, 2019 is now charged to net rental revenue instead of general and administrative expense. |