Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PHX MINERALS INC. | phx-ex991_16.htm |

| 8-K - 8-K - PHX MINERALS INC. | phx-8k_20210208.htm |

February 2021 Corporate Presentation Exhibit 99.2

Cautionary Statement Regarding Forward-Looking Statements This presentation is not a prospectus and is not an offer to sell, nor a solicitation of an offer to buy securities. The issuer has filed a registration statement (including a prospectus) and a prospectus supplement with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus and the prospectus supplement and the documents incorporated by reference therein for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Cautionary Statement Regarding Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this presentation that address activities, events or developments that Panhandle Oil and Gas Inc. (“Panhandle” or the “Company”) expects, believes or anticipates will or may occur in the future are forward looking statements. The words “anticipates”, “plans”, “estimates”, “believes”, “expects”, “intends”, “will”, “should”, “may” and similar expressions may be used to identify forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to: our ability to execute our business strategies; the volatility of realized natural gas and oil prices; the level of production on our properties; estimates of quantities of natural gas, oil and NGL reserves and their values; general economic or industry conditions; legislation or regulatory requirements; conditions of the securities markets; our ability to raise capital; changes in accounting principles, policies or guidelines; financial or political instability; acts of war or terrorism; title defects in the properties in which we invest; and other economic, competitive, governmental, regulatory or technical factors affecting our properties, operations or prices. Although the Company believes the expectations reflected in these and other forward-looking statements are reasonable, the Company can give no assurance such statements will prove to be correct. Such forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. These forward-looking statements involve certain risks and uncertainties that could cause the results to differ materially from those expected by the Company’s management. Information concerning these risks and other factors can be found in the Company’s filings with the Securities and Exchange Commission, including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, available on the Company's website or the SEC’s website at www.sec.gov. Readers are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. The forward-looking statements in this presentation are made as of the date hereof, and the Company does not undertake any obligation to update the forward-looking statements as a result of new information, future events or otherwise. Use of Non-GAAP Financial Information This presentation includes certain non-GAAP financial measures. Adjusted EBITDA and discretionary cash flow are supplemental non-GAAP measures that are used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Panhandle defines “Adjusted EBITDA” as net income (loss) plus interest expense, provision for impairment, depreciation, depletion and amortization of properties and equipment, including amortization of other assets, provision (benefit) for income taxes and unrealized (gains) losses on derivative contracts. Panhandle defines “discretionary cash flow” as Adjusted EBITDA minus interest expense plus gain on sale. Panhandle references Adjusted EBITDA and discretionary cash flow in this presentation because it recognizes that certain investors consider Adjusted EBITDA and discretionary cash flow useful means of measuring our ability to meet our debt service obligations and evaluating our financial performance. Adjusted EBITDA and discretionary cash flow have limitations and should not be considered in isolation or as a substitute for net income, operating income, cash flow from operations or other consolidated income or cash flow data prepared in accordance with GAAP. Because not all companies use identical calculations, the Company’s calculations of Adjusted EBITDA or discretionary cash flow may not be comparable to similarly titled measures of other companies. Oil and Gas Reserves The SEC generally permits oil and gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. The Company discloses only estimated proved reserves in its filings with the SEC. The Company’s estimated proved reserves as of September 30, 2020, referenced in this presentation were prepared by DeGolyer and MacNaughton, an independent engineering firm, and comply with definitions promulgated by the SEC. Additional information on the Company’s estimated proved reserves is contained in the Company’s filings with the SEC.

Why Invest in PHX? 1 2 3 4

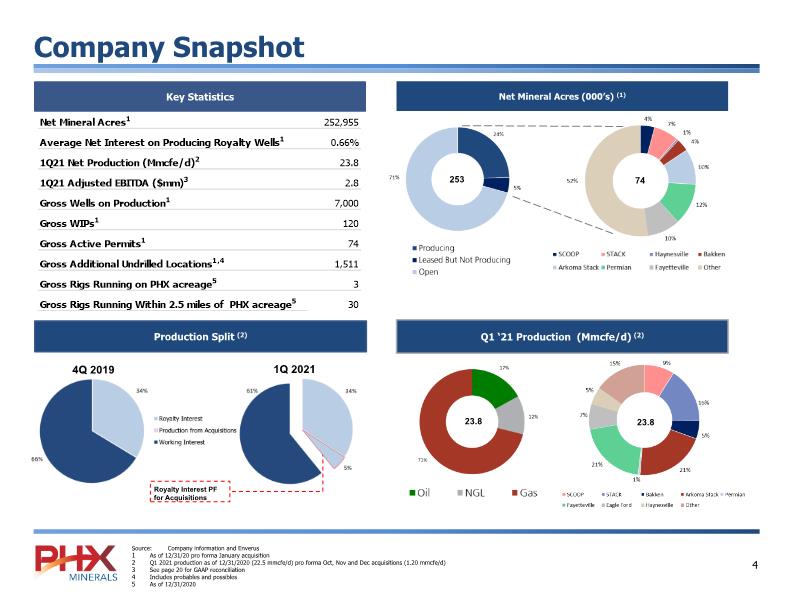

Company Snapshot 4Q 2019 1Q 2021 Key Statistics Source: Company information and Enverus As of 12/31/20 pro forma January acquisition Q1 2021 production as of 12/31/2020 (22.5 mmcfe/d) pro forma Oct, Nov and Dec acquisitions (1.20 mmcfe/d) See page 20 for GAAP reconciliation Includes probables and possibles As of 12/31/2020 253 74 23.8 23.8 Q1 ‘21 Production (Mmcfe/d) (2) Production Split (2) Net Mineral Acres (000’s) (1) Royalty Interest PF for Acquisitions

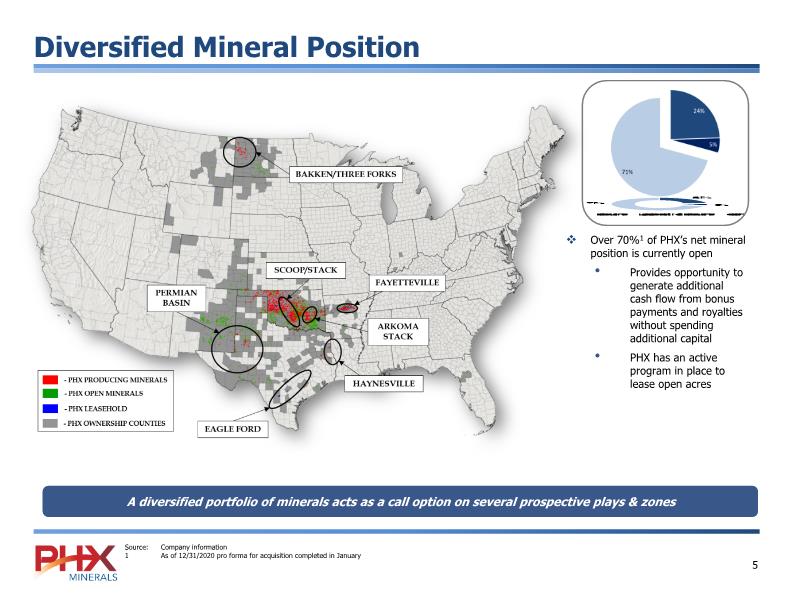

Diversified Mineral Position Over 70%1 of PHX’s net mineral position is currently open Provides opportunity to generate additional cash flow from bonus payments and royalties without spending additional capital PHX has an active program in place to lease open acres A diversified portfolio of minerals acts as a call option on several prospective plays & zones Source: Company information 1 As of 12/31/2020 pro forma for acquisition completed in January

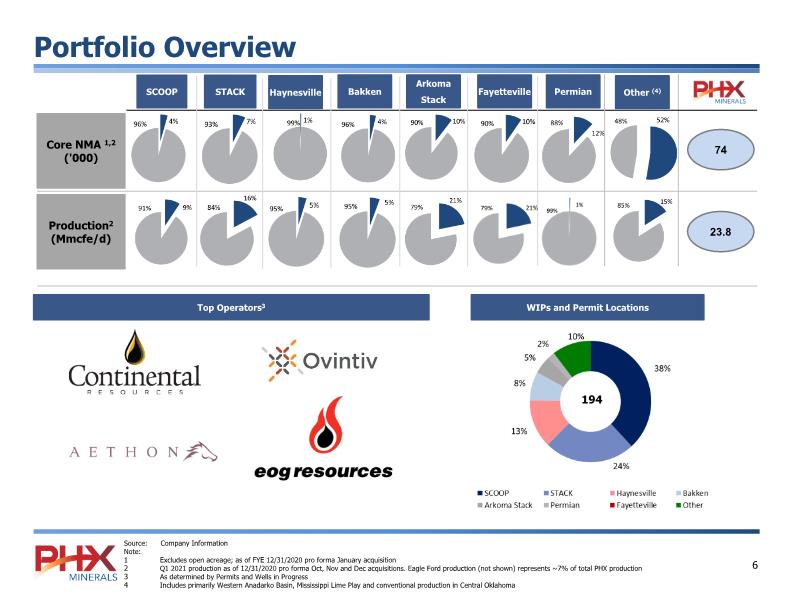

Portfolio Overview SCOOP Core NMA 1,2 ('000) Production2 (Mmcfe/d) Top Operators3 WIPs and Permit Locations 194 Source: Company Information Note: 1 Excludes open acreage; as of FYE 12/31/2020 pro forma January acquisition Q1 2021 production as of 12/31/2020 pro forma Oct, Nov and Dec acquisitions. Eagle Ford production (not shown) represents ~7% of total PHX production As determined by Permits and Wells in Progress Includes primarily Western Anadarko Basin, Mississippi Lime Play and conventional production in Central Oklahoma Permian STACK Haynesville Bakken Arkoma Stack Fayetteville Other (4)

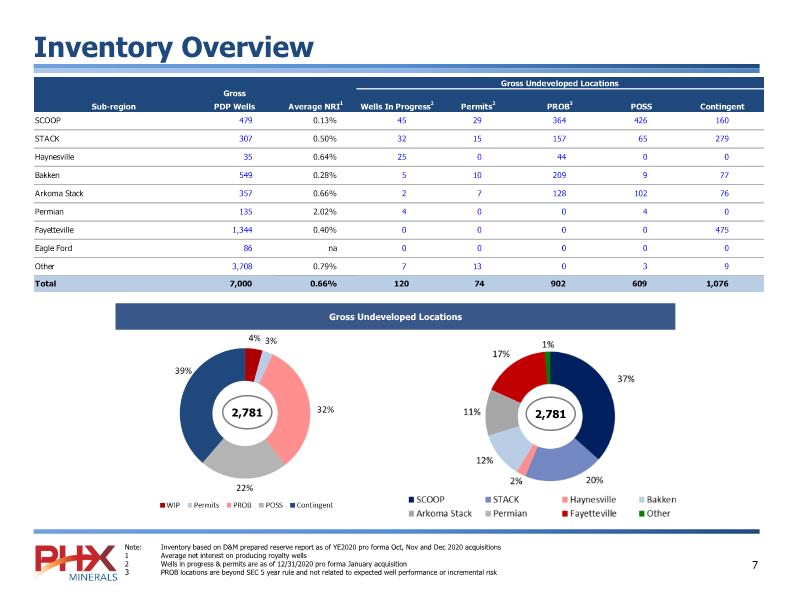

Inventory Overview Note: Inventory based on D&M prepared reserve report as of YE2020 pro forma Oct, Nov and Dec 2020 acquisitions 1 Average net interest on producing royalty wells 2 Wells in progress & permits are as of 12/31/2020 pro forma January acquisition PROB locations are beyond SEC 5 year rule and not related to expected well performance or incremental risk Gross Undeveloped Locations

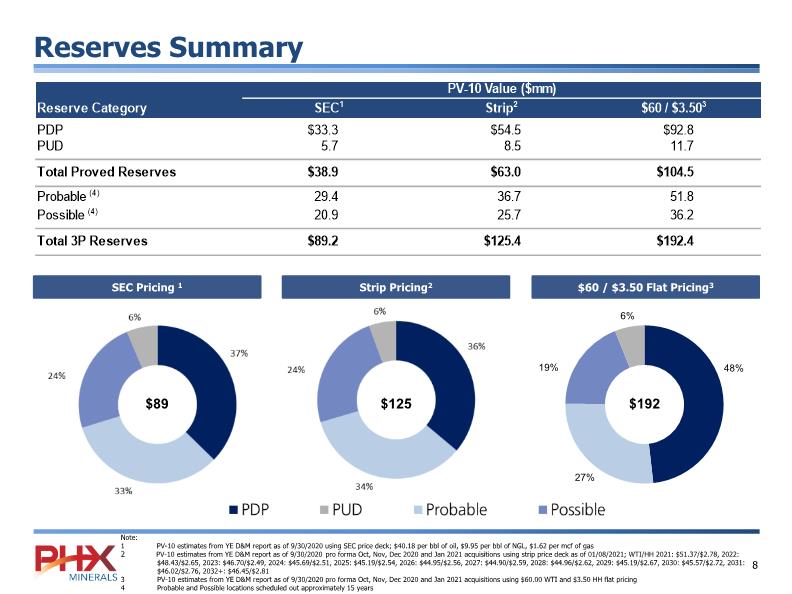

Reserves Summary SEC Pricing 1 $60 / $3.50 Flat Pricing3 Strip Pricing2 Note: 1 PV-10 estimates from YE D&M report as of 9/30/2020 using SEC price deck; $40.18 per bbl of oil, $9.95 per bbl of NGL, $1.62 per mcf of gas PV-10 estimates from YE D&M report as of 9/30/2020 pro forma Oct, Nov, Dec 2020 and Jan 2021 acquisitions using strip price deck as of 01/08/2021; WTI/HH 2021: $51.37/$2.78, 2022: $48.43/$2.65, 2023: $46.70/$2.49, 2024: $45.69/$2.51, 2025: $45.19/$2.54, 2026: $44.95/$2.56, 2027: $44.90/$2.59, 2028: $44.96/$2.62, 2029: $45.19/$2.67, 2030: $45.57/$2.72, 2031: $46.02/$2.76, 2032+: $46.45/$2.81 3 PV-10 estimates from YE D&M report as of 9/30/2020 pro forma Oct, Nov, Dec 2020 and Jan 2021 acquisitions using $60.00 WTI and $3.50 HH flat pricing 4 Probable and Possible locations scheduled out approximately 15 years $89 $125 $192

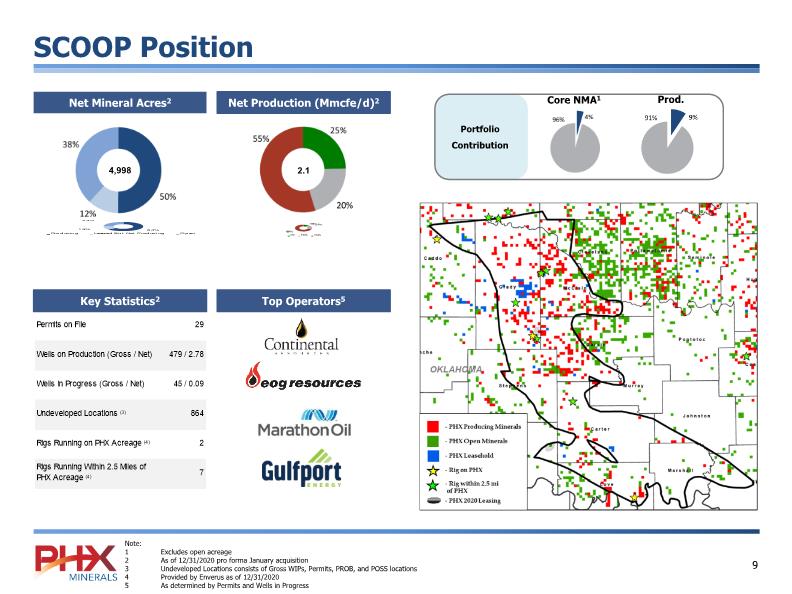

Key Statistics2 Top Operators5 Net Mineral Acres2 4,998 2.1 Core NMA1 Prod. Portfolio Contribution SCOOP Position Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 12/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress

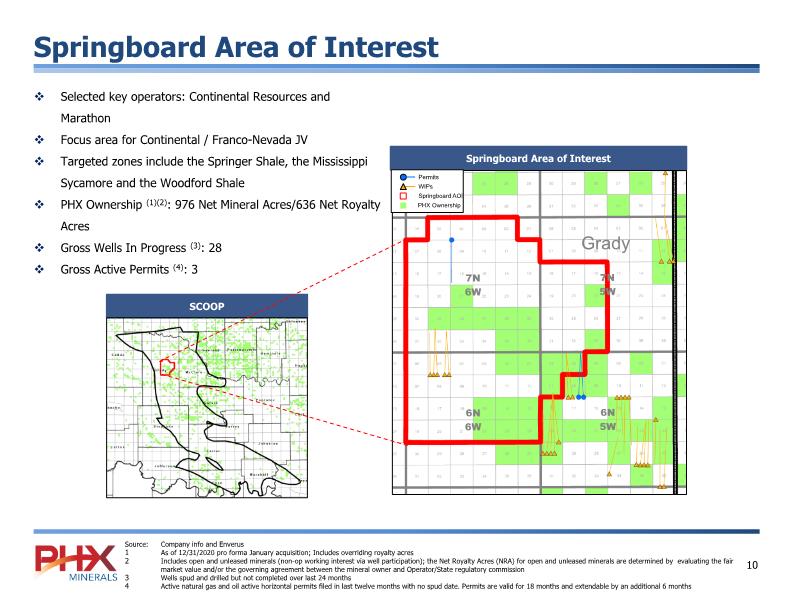

Springboard Area of Interest SCOOP Springboard Area of Interest Source: Company info and Enverus As of 12/31/2020 pro forma January acquisition; Includes overriding royalty acres Includes open and unleased minerals (non-op working interest via well participation); the Net Royalty Acres (NRA) for open and unleased minerals are determined by evaluating the fair market value and/or the governing agreement between the mineral owner and Operator/State regulatory commission Wells spud and drilled but not completed over last 24 months Active natural gas and oil active horizontal permits filed in last twelve months with no spud date. Permits are valid for 18 months and extendable by an additional 6 months Selected key operators: Continental Resources and Marathon Focus area for Continental / Franco-Nevada JV Targeted zones include the Springer Shale, the Mississippi Sycamore and the Woodford Shale PHX Ownership (1)(2): 976 Net Mineral Acres/636 Net Royalty Acres Gross Wells In Progress (3): 28 Gross Active Permits (4): 3

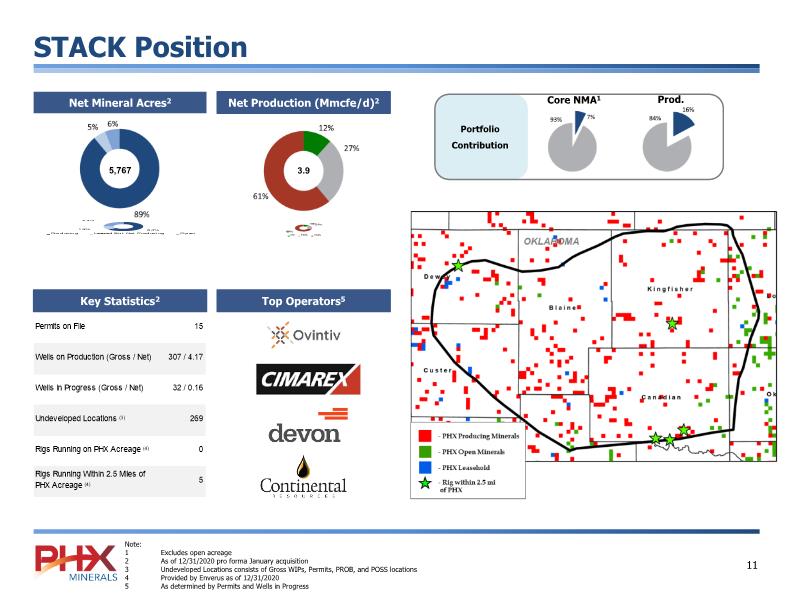

Key Statistics2 Top Operators5 Net Mineral Acres2 5,767 3.9 Core NMA1 Prod. Portfolio Contribution STACK Position Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 12/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress

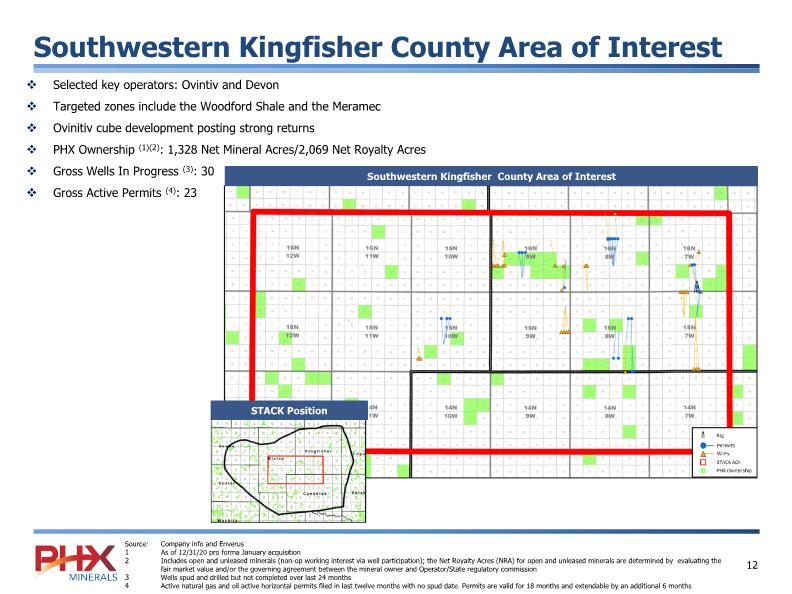

Southwestern Kingfisher County Area of Interest STACK Position Southwestern Kingfisher County Area of Interest Source: Company info and Enverus As of 12/31/20 pro forma January acquisition Includes open and unleased minerals (non-op working interest via well participation); the Net Royalty Acres (NRA) for open and unleased minerals are determined by evaluating the fair market value and/or the governing agreement between the mineral owner and Operator/State regulatory commission Wells spud and drilled but not completed over last 24 months Active natural gas and oil active horizontal permits filed in last twelve months with no spud date. Permits are valid for 18 months and extendable by an additional 6 months Selected key operators: Ovintiv and Devon Targeted zones include the Woodford Shale and the Meramec Ovinitiv cube development posting strong returns PHX Ownership (1)(2): 1,328 Net Mineral Acres/2,069 Net Royalty Acres Gross Wells In Progress (3): 30 Gross Active Permits (4): 23

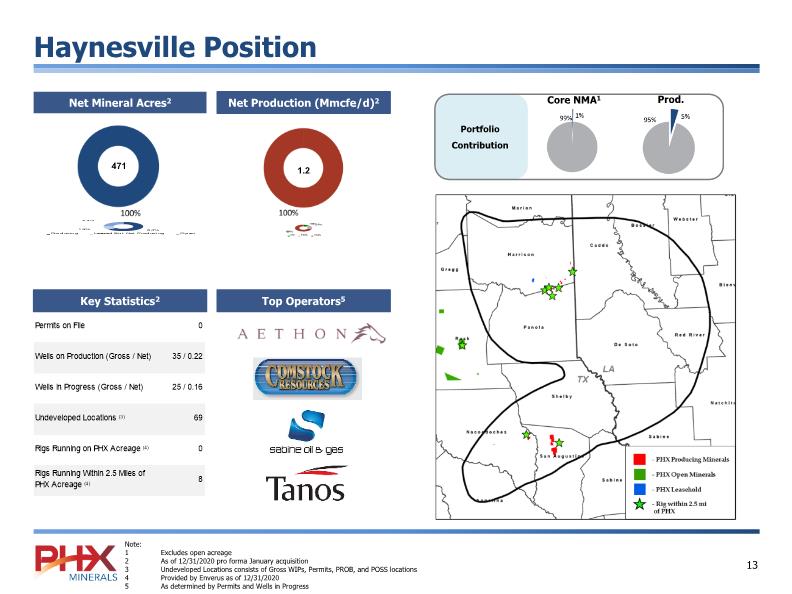

Key Statistics2 Top Operators5 Net Mineral Acres2 471 1.2 Core NMA1 Prod. Portfolio Contribution Haynesville Position Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 12/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress

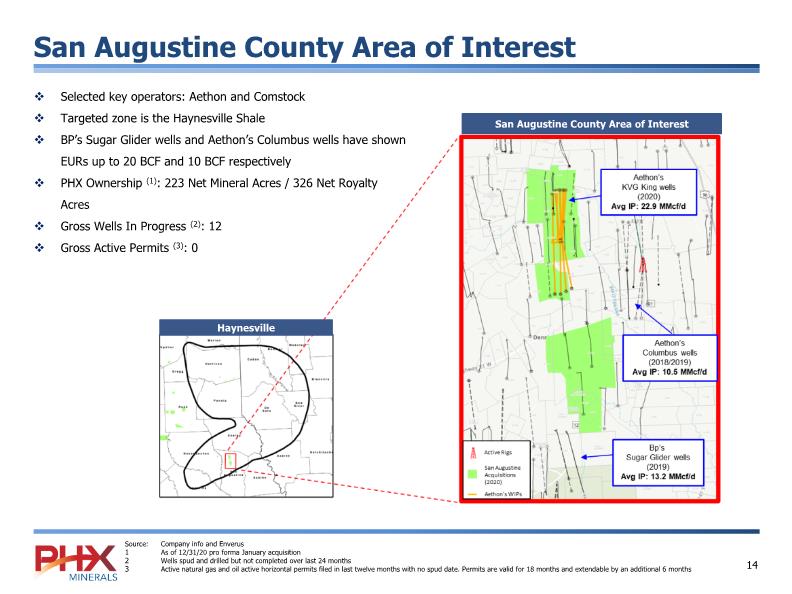

San Augustine County Area of Interest Haynesville San Augustine County Area of Interest Selected key operators: Aethon and Comstock Targeted zone is the Haynesville Shale BP’s Sugar Glider wells and Aethon’s Columbus wells have shown EURs up to 20 BCF and 10 BCF respectively PHX Ownership (1): 223 Net Mineral Acres / 326 Net Royalty Acres Gross Wells In Progress (2): 12 Gross Active Permits (3): 0 Source: Company info and Enverus As of 12/31/20 pro forma January acquisition Wells spud and drilled but not completed over last 24 months Active natural gas and oil active horizontal permits filed in last twelve months with no spud date. Permits are valid for 18 months and extendable by an additional 6 months

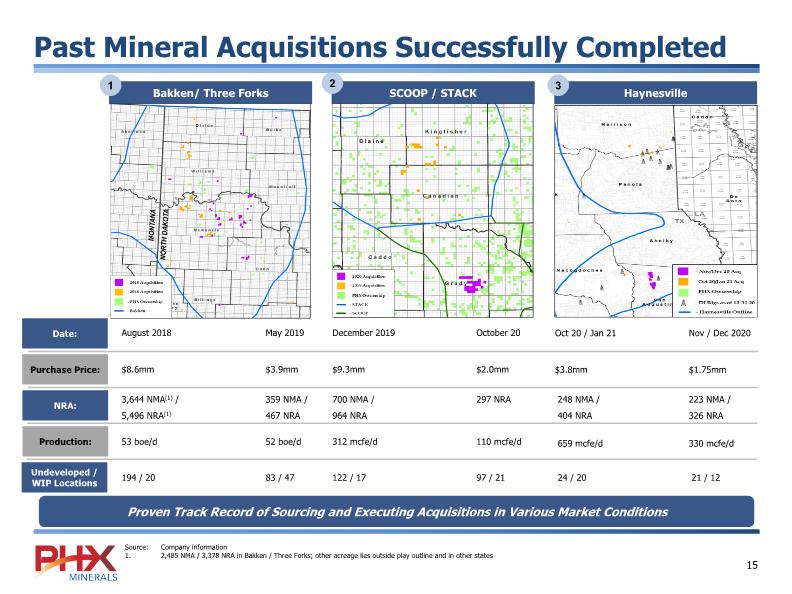

Past Mineral Acquisitions Successfully Completed Haynesville SCOOP / STACK Bakken/ Three Forks 1 2 3 Date: Purchase Price: NRA: Production: Undeveloped / WIP Locations August 2018 May 2019 $8.6mm $3.9mm 3,644 NMA(1) / 359 NMA / 5,496 NRA(1) 467 NRA 53 boe/d 52 boe/d 194 / 20 83 / 47 December 2019 October 20 $9.3mm $2.0mm 700 NMA / 297 NRA 964 NRA 312 mcfe/d 110 mcfe/d 122 / 17 97 / 21 Oct 20 / Jan 21 Nov / Dec 2020 $3.8mm $1.75mm 248 NMA / 223 NMA / 404 NRA 326 NRA 659 mcfe/d 330 mcfe/d 24 / 20 21 / 12 Source: Company information 1. 2,485 NMA / 3,378 NRA in Bakken / Three Forks; other acreage lies outside play outline and in other states Proven Track Record of Sourcing and Executing Acquisitions in Various Market Conditions

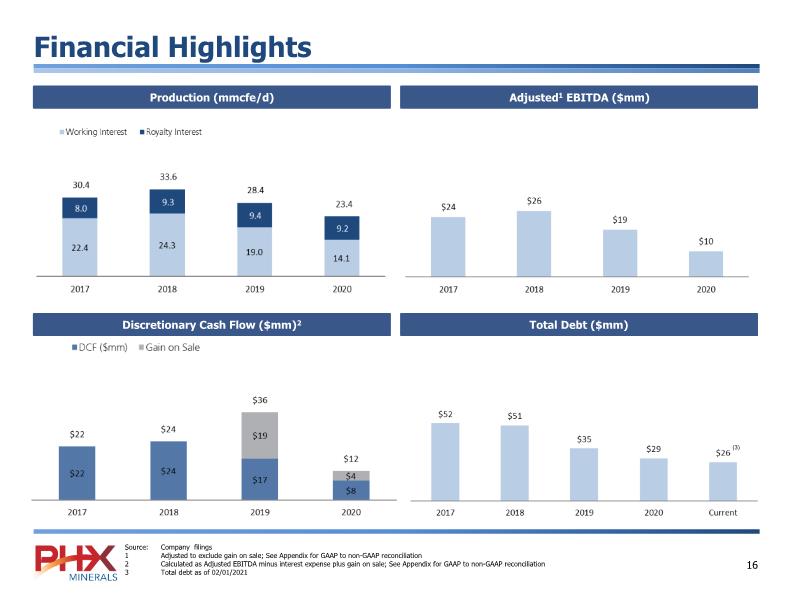

Financial Highlights Production (mmcfe/d) Adjusted1 EBITDA ($mm) Discretionary Cash Flow ($mm)2 Total Debt ($mm) Source: Company filings 1 Adjusted to exclude gain on sale; See Appendix for GAAP to non-GAAP reconciliation 2 Calculated as Adjusted EBITDA minus interest expense plus gain on sale; See Appendix for GAAP to non-GAAP reconciliation 3 Total debt as of 02/01/2021 (3)

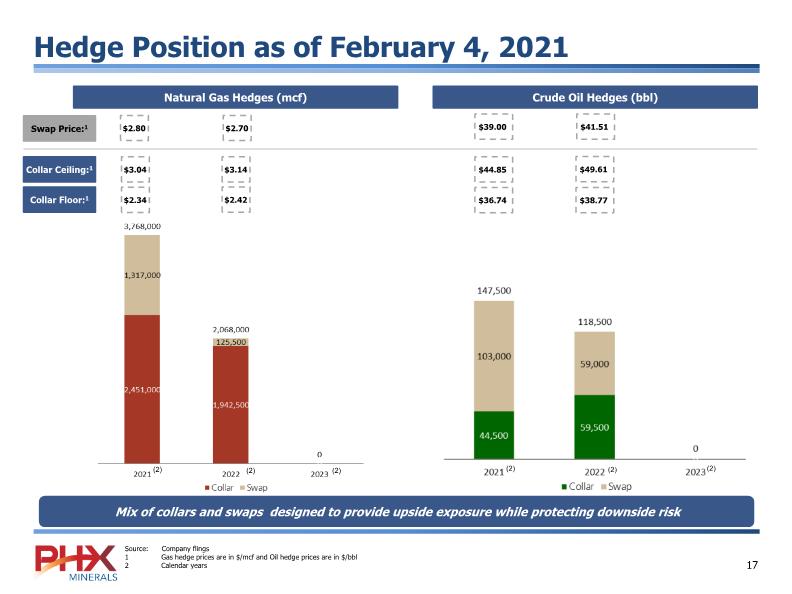

Hedge Position as of February 4, 2021 Natural Gas Hedges (mcf) Crude Oil Hedges (bbl) Swap Price:1 Collar Floor:1 Collar Ceiling:1 Source: Company flings 1 Gas hedge prices are in $/mcf and Oil hedge prices are in $/bbl 2 Calendar years (2) (2) (2) (2) (2) (2) Mix of collars and swaps designed to provide upside exposure while protecting downside risk

Why Invest in PHX? 1 2 3 4

Appendix

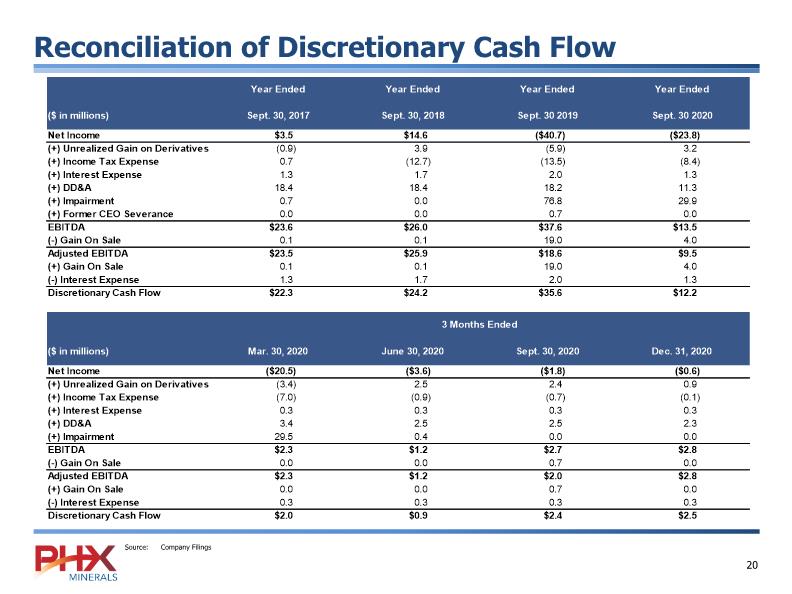

Reconciliation of Discretionary Cash Flow Source: Company Filings

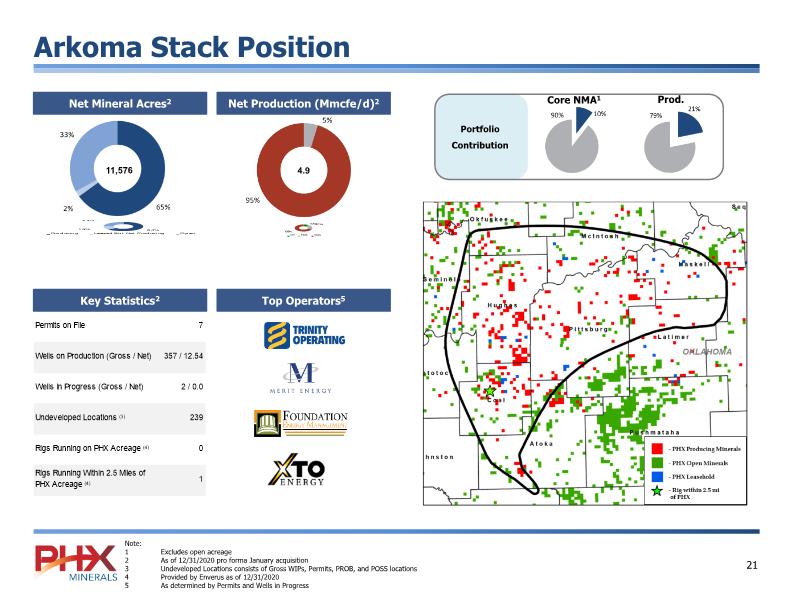

11,576 4.9 Prod. Portfolio Contribution Arkoma Stack Position Top Operators5 Core NMA1 Key Statistics2 Net Mineral Acres2 Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 12/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress

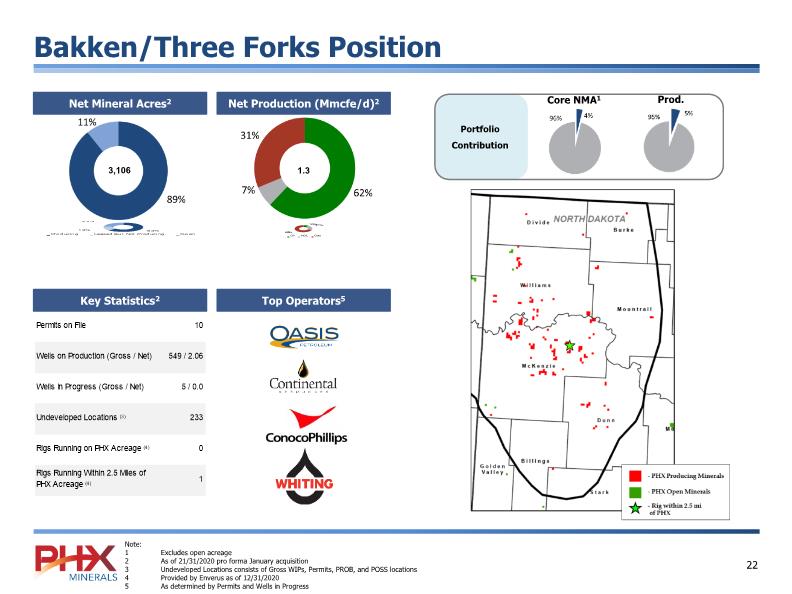

3,106 1.3 Prod. Portfolio Contribution Bakken/Three Forks Position Top Operators5 Core NMA1 Key Statistics2 Net Mineral Acres2 Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 21/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress

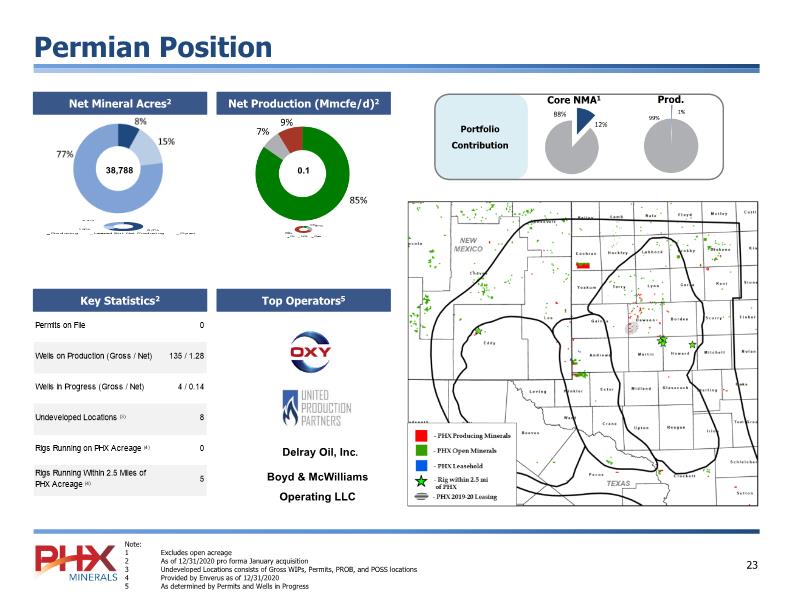

38,788 0.1 Prod. Portfolio Contribution Permian Position Top Operators5 Core NMA1 Key Statistics2 Net Mineral Acres2 Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 12/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress Delray Oil, Inc. Boyd & McWilliams Operating LLC

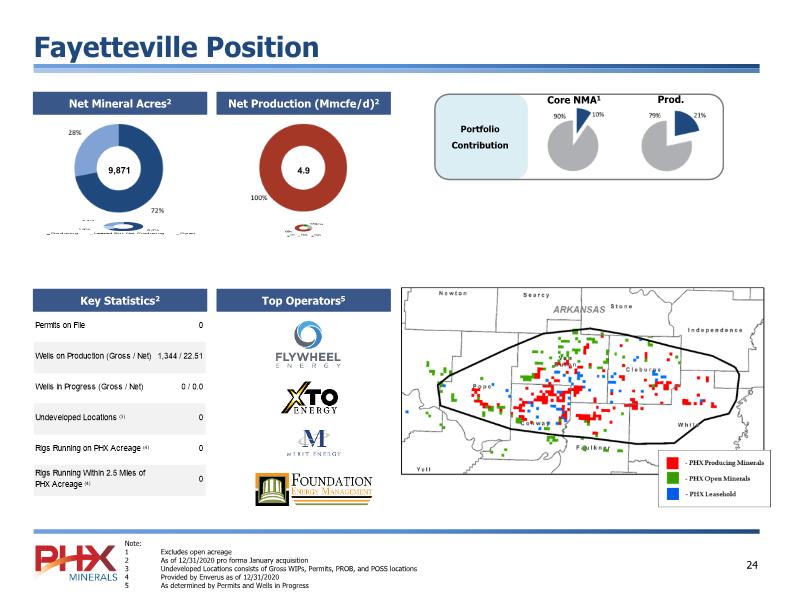

9,871 4.9 Prod. Portfolio Contribution Fayetteville Position Top Operators5 Core NMA1 Key Statistics2 Net Mineral Acres2 Net Production (Mmcfe/d)2 Note: 1 Excludes open acreage 2 As of 12/31/2020 pro forma January acquisition 3 Undeveloped Locations consists of Gross WIPs, Permits, PROB, and POSS locations 4 Provided by Enverus as of 12/31/2020 5 As determined by Permits and Wells in Progress