Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Matterport, Inc./DE | d42860dex991.htm |

| EX-10.2 - EX-10.2 - Matterport, Inc./DE | d42860dex102.htm |

| EX-10.1 - EX-10.1 - Matterport, Inc./DE | d42860dex101.htm |

| EX-2.1 - EX-2.1 - Matterport, Inc./DE | d42860dex21.htm |

| 8-K - 8-K - Matterport, Inc./DE | d42860d8k.htm |

Exhibit 99.2

MatterportTM 1

Disclaimer We have prepared this document solely for informational purposes. You should not definitively rely upon it or use it to form the definitive basis for any decision, contract, commitment or action whatsoever, with respect to any proposed business combination or otherwise. You and your directors, officers, employees, agents and affiliates must hold this document and any oral information provided in connection with this document in strict confidence and may not communicate, reproduce, distribute or disclose it to any other person, or refer to it publicly, in whole or in part at any time except with our prior written consent. You acknowledge that you are (a) aware that the United States securities laws prohibit any person who has material, non-public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably likely that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that you will neither use, nor cause any third party to use, this document or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. If you are not the intended recipient of this document, please delete and destroy all copies immediately. In connection with the proposed business combination, Gores Holdings VI intends to file a registration statement on Form S-4 (the “Registration Statement”) that will include a proxy statement of Gores Holdings VI, an information statement of Matterport, Inc. (“Matterport”) and a prospectus of Gores Holdings VI. The proxy statement/information statement/prospectus will be sent to all Gores Holdings VI and Matterport stockholders as of a record date to be established for voting on the proposed business combination and the other matters to be voted upon at a meeting of the Gores Holding VI’s stockholders to be held to approve the proposed business combination and other matters (the “Special Meeting”). Gores Holding VI may also file other documents regarding the proposed business combination with the Securities and Exchange Commission (the “SEC”). The definitive proxy statement/information statement/prospectus will contain important information about the proposed business combination and the other matters to be voted upon at the Special Meeting and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. Before making any voting decision, investors and security holders of Gores Holding VI and Matterport are urged to read the registration statement, the proxy statement/information statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement/information statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Gores Holdings VI through the website maintained by the SEC at www.sec.gov, or by directing a request to Gores Holdings VI, Inc., 6260 Lookout Road, Boulder, CO 80301, attention: Jennifer Kwon Chou or by contacting Morrow Sodali LLC, Gores Holdings VI’s proxy solicitor, for help, toll-free at (800) 662-5200 (banks and brokers can call collect at (203) 658-9400). Gores Holdings VI and Matterport and their respective directors and officers may be deemed to be participants in the solicitation of proxies from the Gores Holdings VI’s stockholders in connection with the proposed business combination. Information about Gores Holdings VI’s directors and executive officers and their ownership of Gores Holdings VI’s securities is set forth in Gores Holdings VI’s filings with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the proxy statement/information statement/prospectus regarding the proposed business combination when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination between Gores Holdings VI and Matterport, Inc., including statements regarding the benefits of the proposed business combination, the anticipated timing of the proposed business combination, the services offered by Matterport and the markets in which Matterport operates, business strategies, debt levels, industry environment, potential growth opportunities, the effects of regulations and Gores Holdings VI’s or Matterport’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions). Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of Gores Holdings VI’s securities; (ii) the risk that the proposed business combination may not be completed by Gores Holdings VI’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Gores Holdings VI; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by Gores Holdings VI’s stockholders, the satisfaction of the minimum trust account amount following redemptions by Gores Holdings VI’s public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the effect of the announcement or pendency of the proposed business combination on Matterport’s business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts current plans of Matterport and potential difficulties in Matterport employee retention as a result of the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against Gores Holdings VI or Matterport related to the agreement and plan of merger or the proposed business combination; (vii) the ability to maintain the listing of Gores Holdings VI’s securities on the NASDAQ; (viii) the price of Gores Holdings VI’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Matterport plans to operate, variations in performance across competitors, changes in laws and regulations affecting Matterport’s business and changes in the combined capital structure; and (ix) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in Gores Holdings VI’s final proxy statement/information statement/prospectus contained in the Registration Statement, including those under “Risk Factors” therein, and other documents filed by Gores Holdings VI from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Gores Holdings VI and Matterport assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Gores Holdings VI nor Matterport gives any assurance that either Gores Holdings VI or Matterport will achieve its expectations. This presentation contains financial forecasts for Matterport with respect to certain financial results for the Company’s fiscal years 2020 through 2025. Neither Gores Holdings VI’s nor Matterport’s (collectively, the “Companies”) independent auditors have audited, studied, compiled or performed any procedures with respect to the projections for the purposes of their inclusion in this document and, accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this document. These projections are forward-looking statements and should not be relied upon as being necessarily indicative of future results. In this document, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Matterport or that actual results will not differ materially from those presented in the prospective information. Inclusion of the projected information in this document should not be regarded as a representation by any person that the results contained in the prospective information will be achieved. 2

Disclaimer cont’d This document relates to a proposed business combination between Gores Holdings VI and Matterport. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. ADDITIONAL INFORMATION REGARDING THIS PRESENTATION AND CERTAIN FINANCIAL AND OTHER COMPANY METRICS CONTAINED HEREIN IS INCLUDED IN THE APPENDIX TO THIS PRESENTATION, AND RECIPIENTS ARE ENCOURAGED TO READ THE APPENDIX CAREFULLY. We have prepared this document and the analyses contained in it based, in part, on certain assumptions and information obtained by us from the recipient, its directors, officers, employees, agents, affiliates and/or from other sources. Our use of such assumptions and information does not imply that we have independently verified or necessarily agree with any of such assumptions or information, and we have assumed and relied upon the accuracy and completeness of such assumptions and information for purposes of this document. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. We and our affiliates and our and their respective officers, employees and agents expressly disclaim any and all liability which may be based on this document and any errors therein or omissions therefrom. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any representation or warranty, express or implied, that any business combination has been or may be effected on the terms or in the manner stated in this document, or as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any. Any views or terms contained herein are preliminary only, and are based on financial, economic, market and other conditions prevailing as of the date of this document and are therefore subject to change. We undertake no obligation or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance. This document includes certain historical and forward-looking non-GAAP financial measures, including EBITDA. Matterport defines EBITDA as non-GAAP earnings before income taxes, depreciation and amortization. These non-GAAP measures are in addition to and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to revenue, net income, operating income or any other performance measures derived in accordance with GAAP. Matterport prepared these non-GAAP measures of financial results and believes that they provide useful supplemental information to investors about Matterport. Matterport’s management uses these non-GAAP measures to evaluate its historical and projected financial and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance and therefore Matterport’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. This document also contains certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Matterport is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated GAAP measures is included and no reconciliation of non-GAAP financial measures is included. Further, the financial information and data contained in this document does not conform to Regulation S-X. Such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement to be filed in connection with any proposed business combination. In this document, the Companies rely on and refer to certain information and statistics obtained from third-party sources which they believe to be reliable. Neither of the Companies has independently verified the accuracy or completeness of any such third-party information. This document may contain certain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this document may be listed without the TM, SM, © or ® symbols, but the Companies will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Please see the Appendix for key risks relating to Matterport. 3

Investment highlights Massive, unpenetrated $240B+ Total Available Market Market leader fueling the digital transformation of the built world Unrivaled software & data platform with significant expansion oppor Global, blue chip customers spanning diverse end markets Rapid growth, efficient customer acquisition, and expanding margins Proven leadership team with large-scale platform experience TAM estimate from Savills World Research and the Company 4

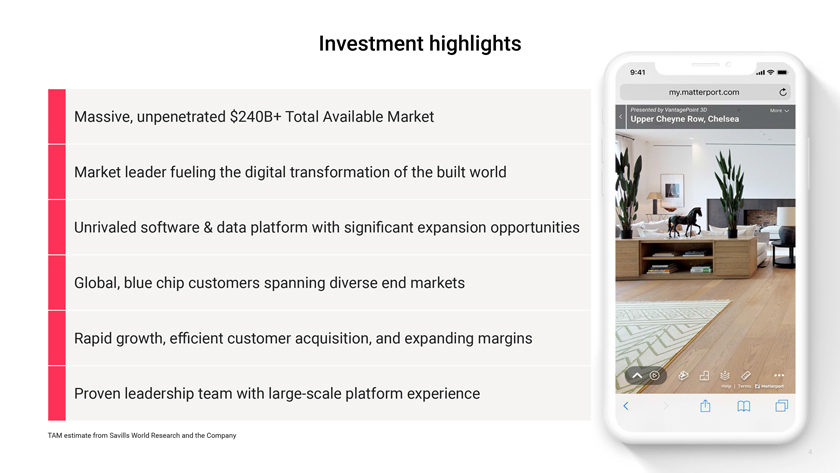

Proven leadership team with large-scale platform experience RJ Pittman JD Fay Jay Remley Jean Barbagelata Chief Executive Officer Chief Financial Officer Chief Revenue Officer Chief People Officer Dave Gausebeck Robin Daniels ulsi Dave Lippman Co-founder, Chief Scientist Chief Marketing Officer Chief Technology Officer Chief Design Officer 5

Company Overview 6

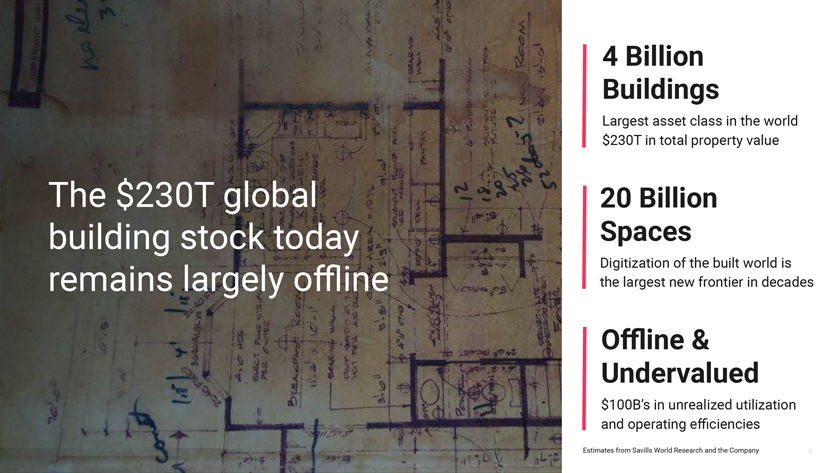

4 Billion Buildings Largest asset class in the world $230T in total property value 20 Billion Spaces Digitization of the built world is the largest new frontier in decades Offline & Undervalued $100B’s in unrealized utilization and operating efficiencies Estimates from Savills World Research and the Company 7

Take your building online with Matterport to design, build, promote, and manage your most valuable asset at your fingertips 8

Tomorrow our data will increase the value of every building 9

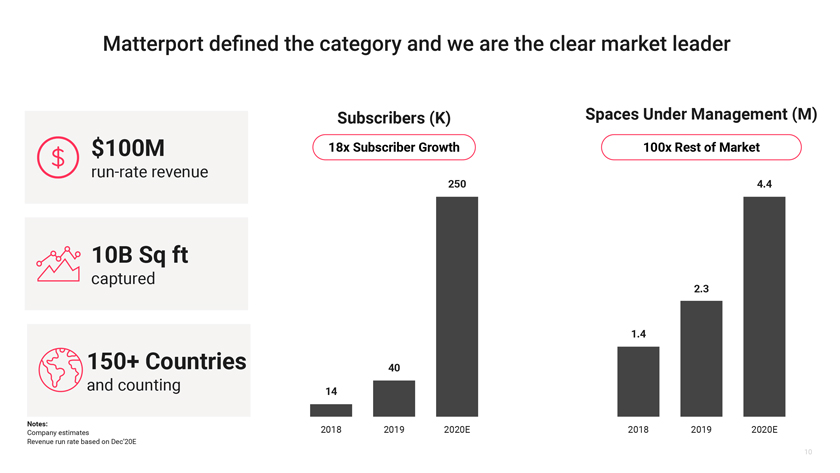

Matterport defined the category and we are the clear market leader $ 100M run-rate revenue 10B Sq ft captured 150+ Countries and counting Notes: Company estimates Revenue run rate based on Dec’20E Subscribers (K) 18x Subscriber Growth 250 40 14 2018 2019 2020E Spaces Under Management (M) 100x Rest of Market 4.4 2.3 1.4 2018 2019 2020E 10

Matterport delivers value across the property lifecycle for diverse end markets Hospitality Retail Commercial Real Estate Industrial Travel Corporate Construction 11

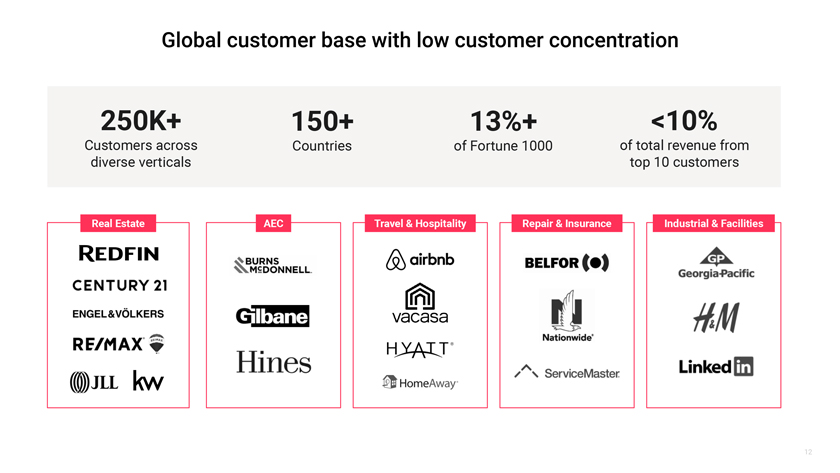

Global customer base with low customer concentration 250K+ 150+ 13%+ <10% Customers across Countries of Fortune 1000 of total revenue from diverse verticals top 10 customers Repair & Insurance 12

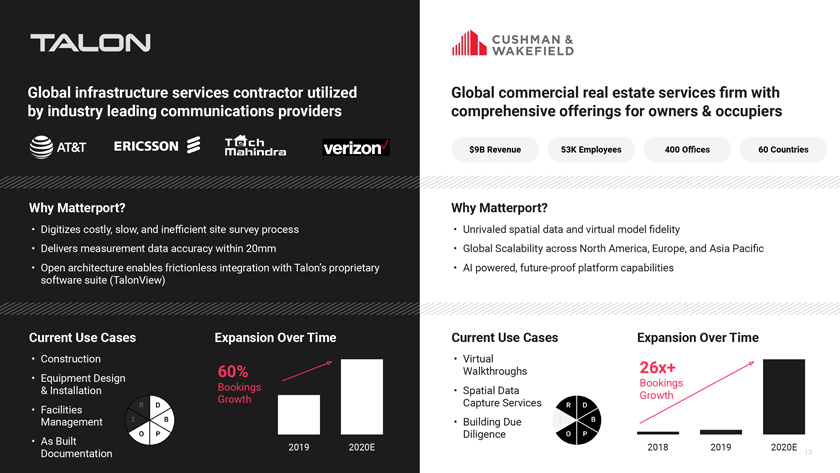

60% Bookings Growth Global commercial real estate services firm with comprehensive offerings for owners & occupiers $9B Revenue 53K Employees 400 Offices 60 Countries Why Matterport? • Unrivaled spatial data and virtual model fidelity • Global Scalability across North America, Europe, and Asia Pacific • AI powered, future-proof platform capabilities Current Use Cases Expansion Over Time • Virtual Walkthroughs 26x+ • Spatial Data Bookings Capture Services Growth • Building Due Diligence 2018 2019 2020E 13

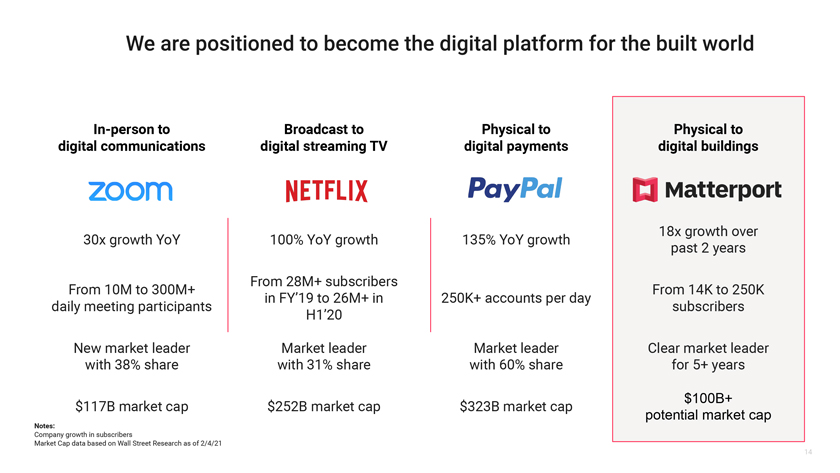

We are positioned to become the digital platform for the built world In-person to Broadcast to Physical to Physical to digital communications digital streaming TV digital payments digital buildings 18x growth over 30x growth YoY 100% YoY growth 135% YoY growth past 2 years From 28M+ subscribers From 10M to 300M+ From 14K to 250K in FY’19 to 26M+ in 250K+ accounts per day daily meeting participants subscribers H1’20 New market leader Market leader Market leader Clear market leader with 38% share with 31% share with 60% share for 5+ years $100B+ $117B market cap $252B market cap $323B market cap potential market cap Notes: Company growth in subscribers Market Cap data based on Wall Street Research as of 2/4/21 14

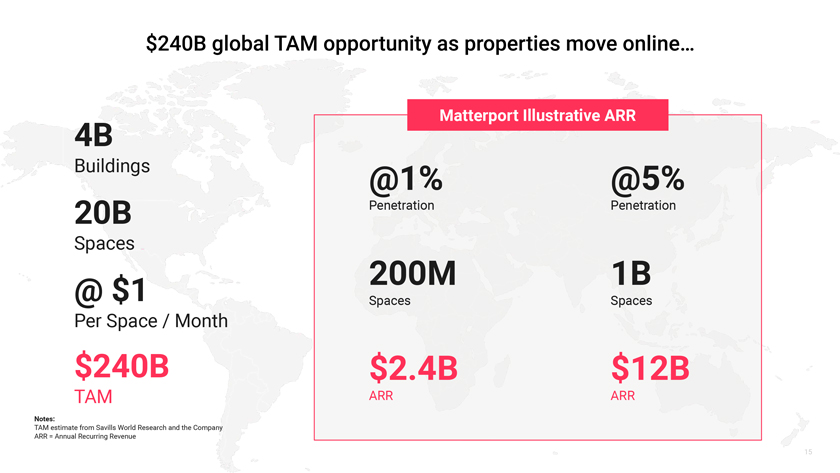

$240B global TAM opportunity as properties move online… 4B Buildings @1% @5% 20B Penetration Penetration Spaces 200M 1B @ $1 Spaces Spaces Per Space / Month $240B $2.4B $12B TAM ARR ARR Notes: TAM estimate from Savills World Research and the Company ARR = Annual Recurring Revenue 15

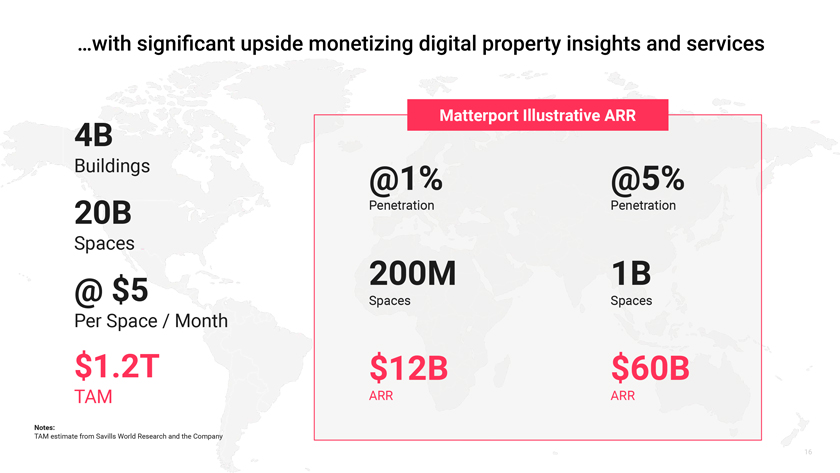

…with significant upside monetizing digital property insights and services 4B Buildings @1% @5% 20B Penetration Penetration Spaces 200M 1B @ $5 Spaces Spaces Per Space / Month $1.2T $12B $60B TAM ARR ARR Notes: TAM estimate from Savills World Research and the Company 16

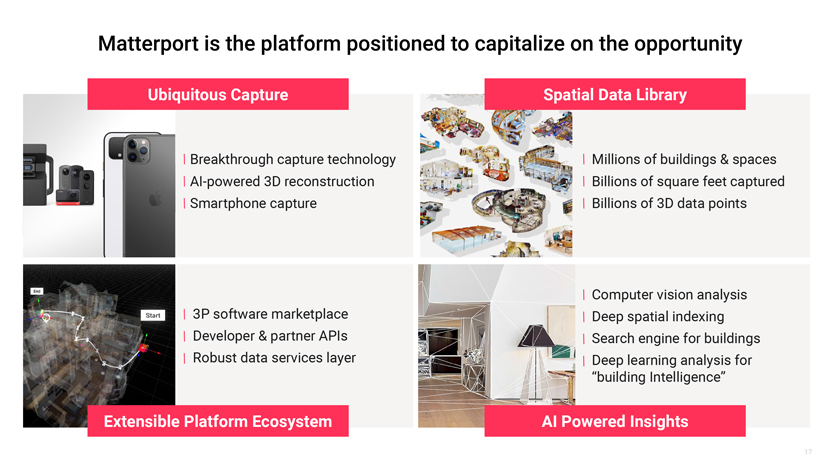

Matterport is the platform positioned to capitalize on the opportunity spaces captured for 17

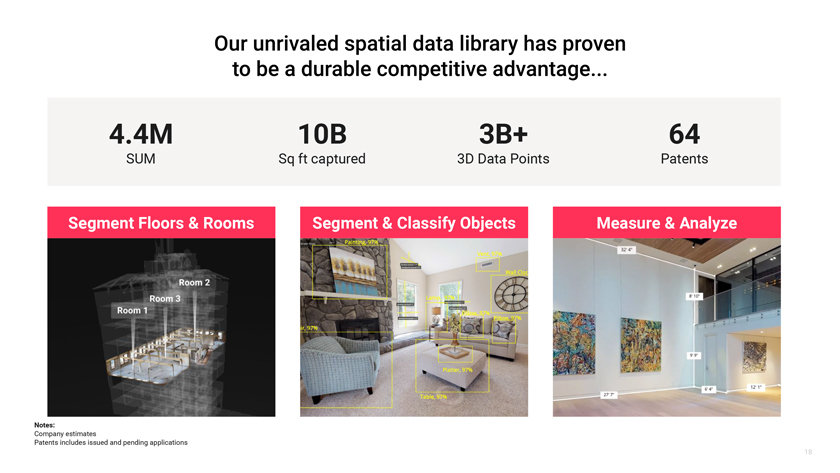

Our unrivaled spatial data library has proven to be a durable competitive advantage… 4.4M 10B 3B+ 64 SUM Sq ft captured 3D Data Points Patents Notes: Company estimates Patents includes issued and pending applications 18

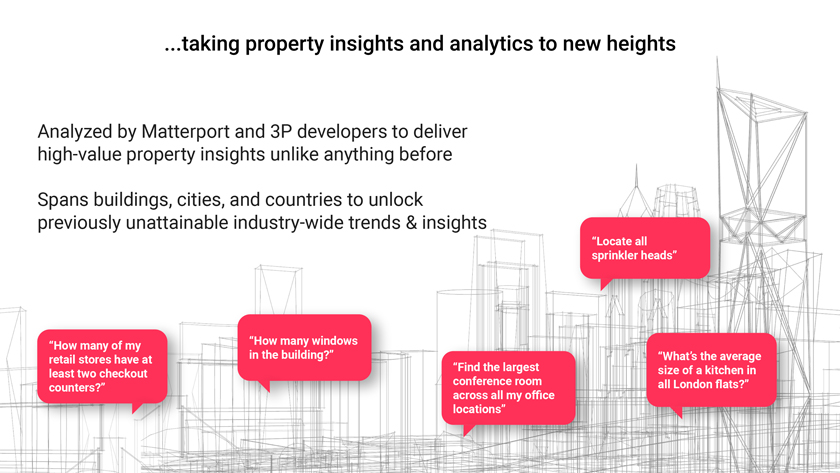

...taking property insights and analytics to new heights Analyzed by Matterport and 3P developers to deliver high-value property insights unlike anything before Spans buildings, cities, and countries to unlock previously unattainable industry-wide trends & insights 19

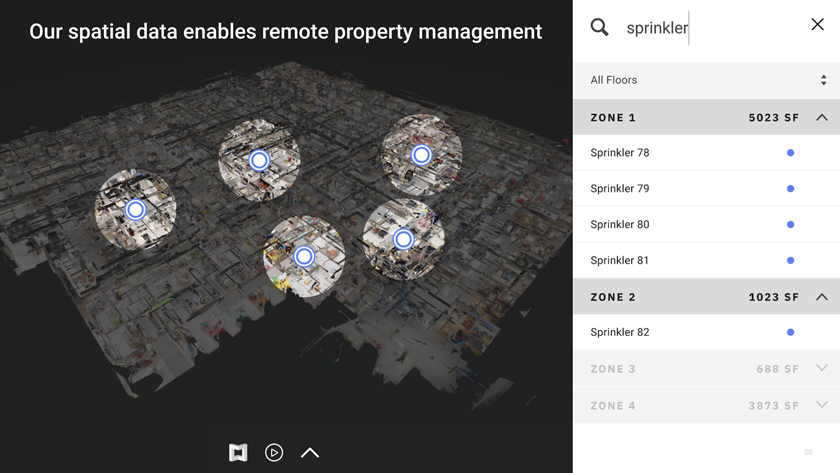

Our spatial data enables remote property management sprinkler 20

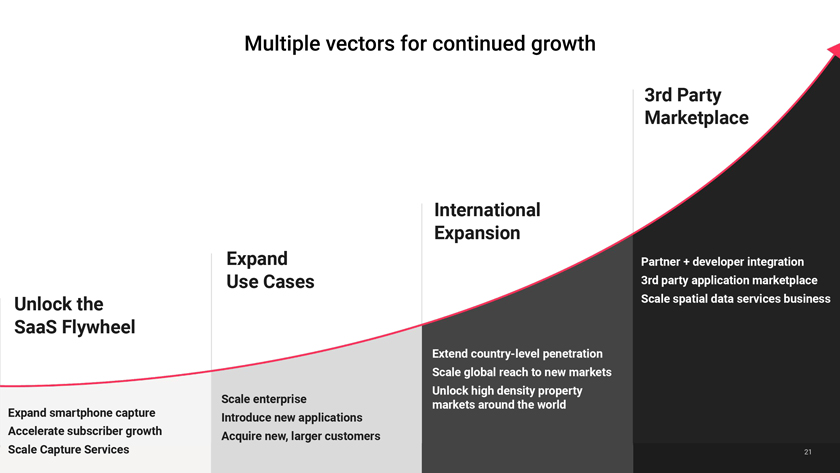

Multiple vectors for continued growth 3rd Party Marketplace International Expansion Expand Use Cases Unlock the SaaS Flywheel Scale enterprise Expand smartphone capture Introduce new applications Accelerate subscriber growth Acquire new, larger customers Scale Capture Services 21

Financial Overview 22

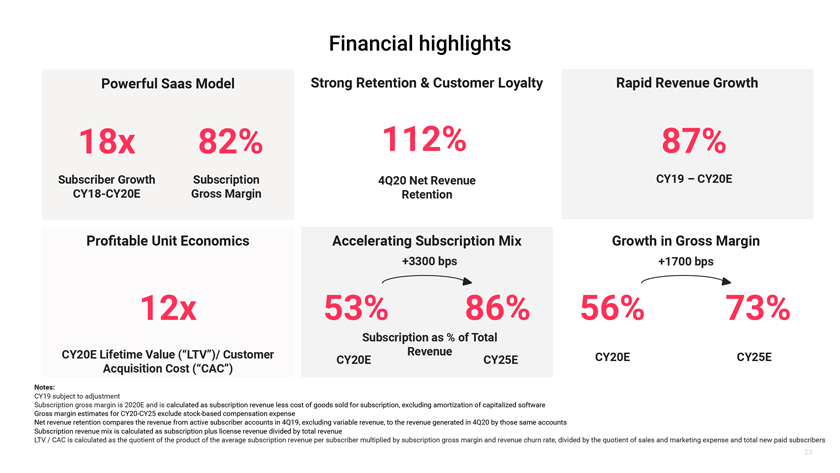

Financial highlights Powerful Saas Model Strong Retention & Customer Loyalty Rapid Revenue Growth 18x 82% 112% 87% Subscriber Growth Subscription 4Q20 Net Revenue CY19 – CY20E CY18-CY20E Gross Margin Retention Profitable Unit Economics Accelerating Subscription Mix Growth in Gross Margin +3300 bps +1700 bps 12x 53% 86% 56% 73% Subscription as % of Total CY20E Lifetime Value (“LTV”)/ Customer Revenue CY20E CY25E CY20E CY25E Acquisition Cost (“CAC”) Notes: CY19 subject to adjustment Subscription gross margin is 2020E and is calculated as subscription revenue less cost of goods sold for subscription, excluding amortization of capitalized software Gross margin estimates for CY20-CY25 exclude stock-based compensation expense Net revenue retention compares the revenue from active subscriber accounts in 4Q19, excluding variable revenue, to the revenue generated in 4Q20 by those same accounts Subscription revenue mix is calculated as subscription plus license revenue divided by total revenue LTV / CAC is calculated as the quotient of the product of the average subscription revenue per subscriber multiplied by subscription gross margin and revenue churn rate, divided by the quotient of sales and marketing expense and total new paid subscribers 23

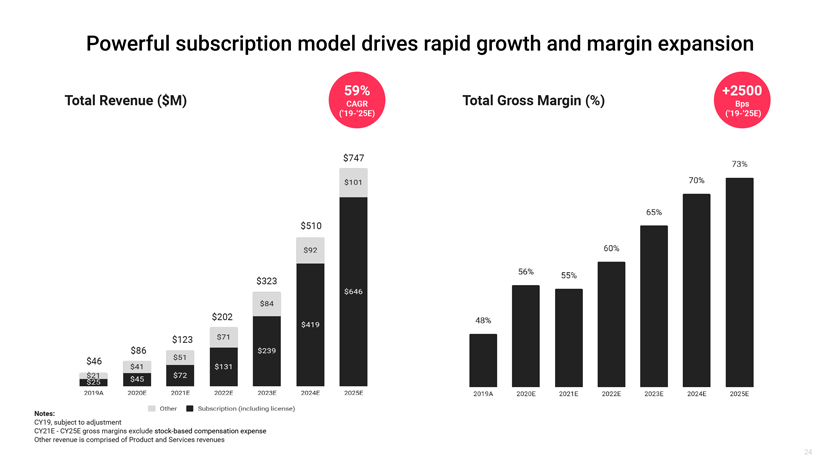

Powerful subscription model drives rapid growth and margin expansion Total Revenue ($M) Total Gross Margin (%) $747 $510 $323 $202 $123 $86 $46 Notes: CY19, subject to adjustment CY21E—CY25E gross margins exclude stock-based compensation expense Other revenue is comprised of Product and Services revenues 24

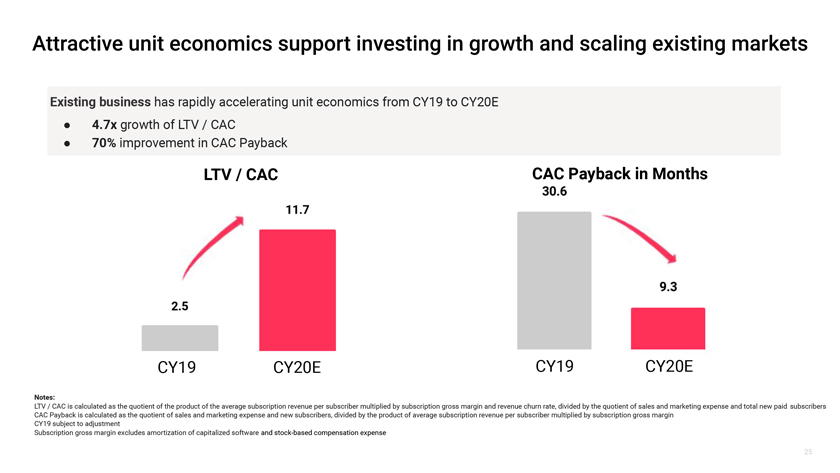

Attractive unit economics support investing in growth and scaling existing markets Existing business has rapidly accelerating unit economics from CY19 to CY20E • 4.7x growth of LTV / CAC • 70% improvement in CAC Payback LTV / CAC CAC Payback in Months CY19 CY20E CY19 CY20E Notes: LTV / CAC is calculated as the quotient of the product of the average subscription revenue per subscriber multiplied by subscription gross margin and revenue churn rate, divided by the quotient of sales and marketing expense and total new paid subscribers CAC Payback is calculated as the quotient of sales and marketing expense and new subscribers, divided by the product of average subscription revenue per subscriber multiplied by subscription gross margin CY19 subject to adjustment Subscription gross margin excludes amortization of capitalized software and stock-based compensation expense 25

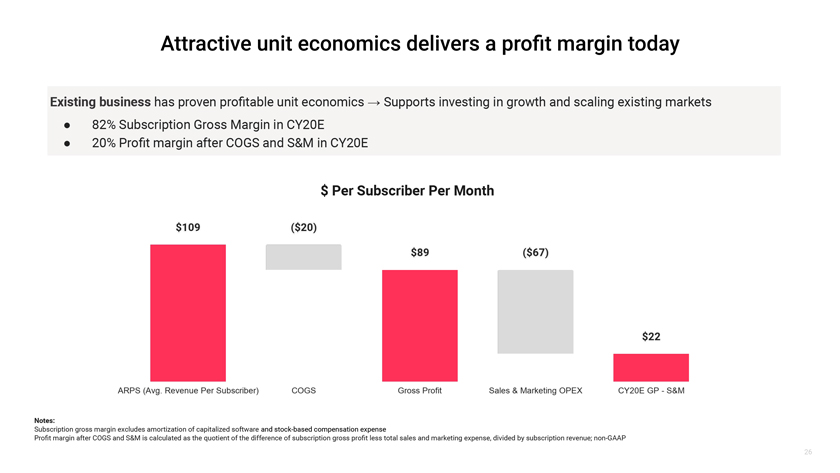

Attractive unit economics delivers a profit margin today Existing business has proven profitable unit economics → Supports investing in growth and scaling existing markets • 82% Subscription Gross Margin in CY20E • 20% Profit margin after COGS and S&M in CY20E $ Per Subscriber Per Month Notes: Subscription gross margin excludes amortization of capitalized software and stock-based compensation expense Profit margin after COGS and S&M is calculated as the quotient of the difference of subscription gross profit less total sales and marketing expense, divided by subscription revenue; non-GAAP 26

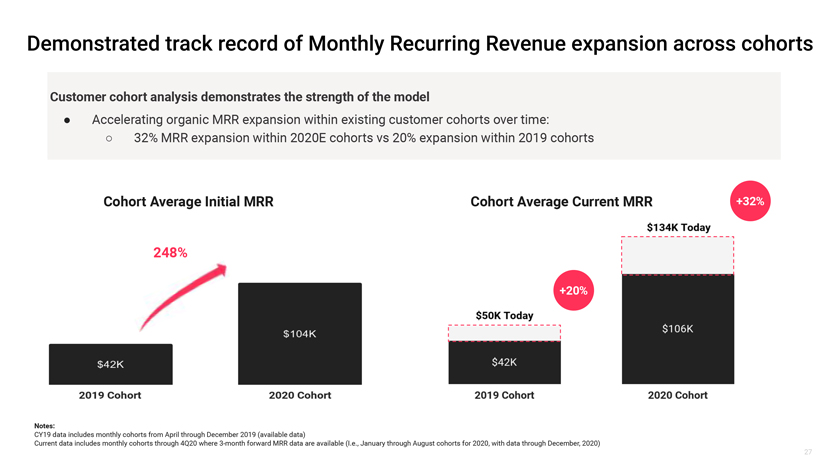

Demonstrated track record of Monthly Recurring Revenue expansion across cohorts Customer cohort analysis demonstrates the strength of the model • Accelerating organic MRR expansion within existing customer cohorts over time: â—‹ 32% MRR expansion within 2020E cohorts vs 20% expansion within 2019 cohorts Cohort Average Initial MRR Cohort Average Current MRR 248% Notes: CY19 data includes monthly cohorts from April through December 2019 (available data) Current data includes monthly cohorts through 4Q20 where 3-month forward MRR data are available (I.e., January through August cohorts for 2020, with data through December, 2020) 27

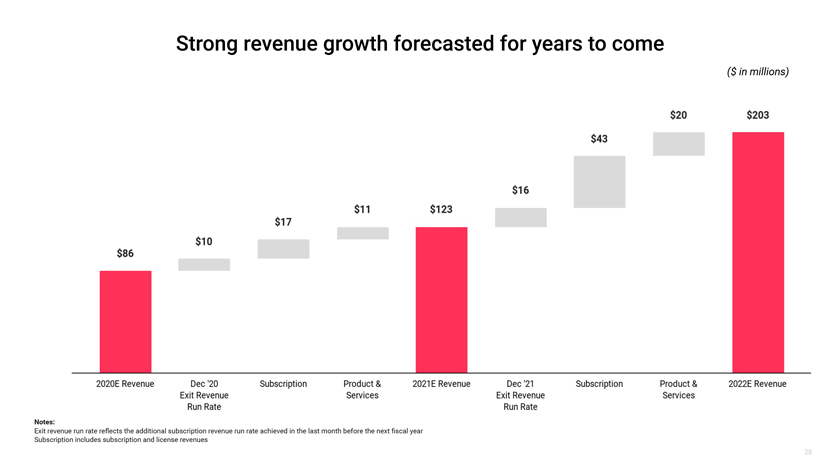

Strong revenue growth forecasted for years to come ($ in millions) Notes: Exit revenue run rate reflects the additional subscription revenue run rate achieved in the last month before the next fiscal year Subscription includes subscription and license revenues 28

Transaction Overview 29

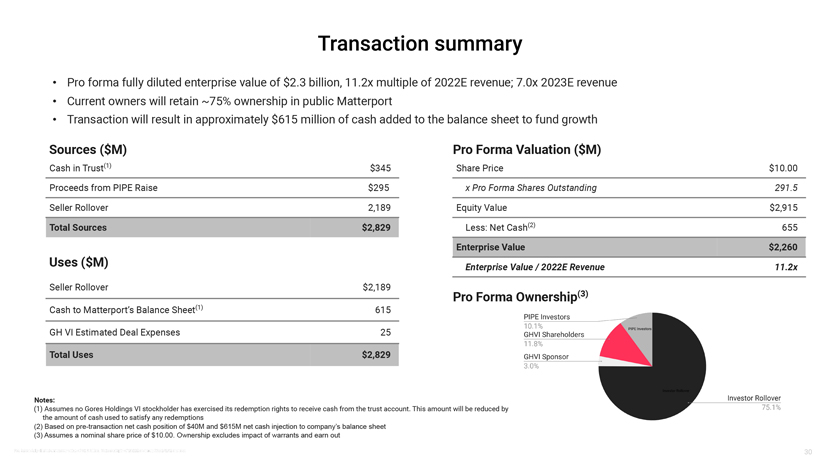

Transaction summary • Pro forma fully diluted enterprise value of $2.3 billion, 11.2x multiple of 2022E revenue; 7.0x 2023E revenue • Current owners will retain ~75% ownership in public Matterport • Transaction will result in approximately $615 million of cash added to the balance sheet to fund growth Sources ($M) Pro Forma Valuation ($M) Cash in Trust(1) $345 Share Price $10.00 Proceeds from PIPE Raise $295 x Pro Forma Shares Outstanding 291.5 Seller Rollover 2,189 Equity Value $2,915 Total Sources $2,829 Less: Net Cash(2) 655 Enterprise Value $2,260 Uses ($M) Enterprise Value / 2022E Revenue 11.2x Seller Rollover $2,189 (3) Pro Forma Ownership Cash to Matterport’s Balance Sheet(1) 615 GH VI Estimated Deal Expenses 25 Total Uses $2,829 Notes: (1) Assumes no Gores Holdings VI stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by the amount of cash used to satisfy any redemptions (2) Based on pre-transaction net cash position of $40M and $615M net cash injection to company’s balance sheet (3) Assumes a nominal share price of $10.00. Ownership excludes impact of warrants and earn out 30

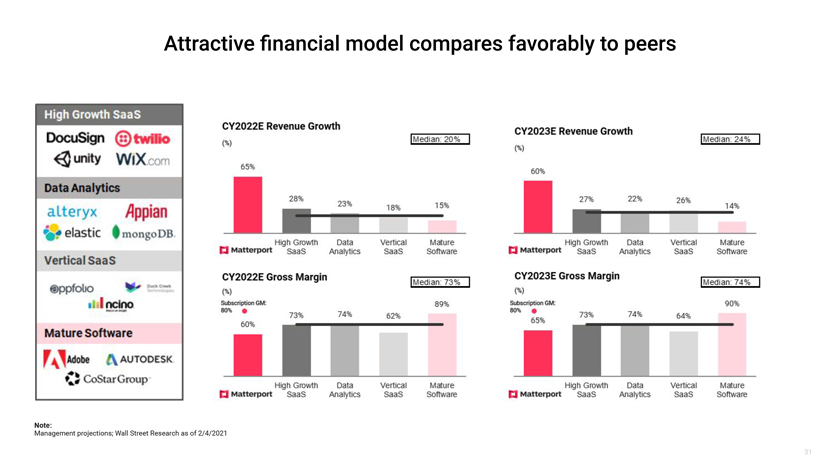

Attractive financial model compares favorably to peers Note: Management projections; Wall Street Research as of 2/4/2021 31

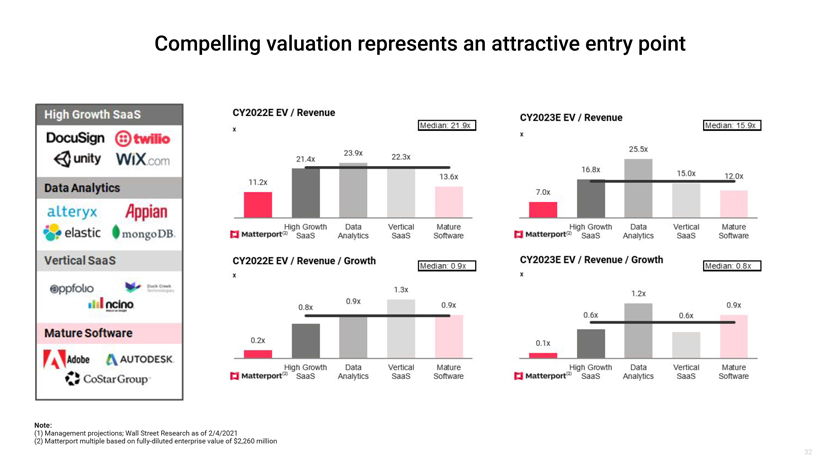

Compelling valuation represents an attractive entry point Note: (1) Management projections; Wall Street Research as of 2/4/2021 (2) Matterport multiple based on fully-diluted enterprise value of $2,260 million 32

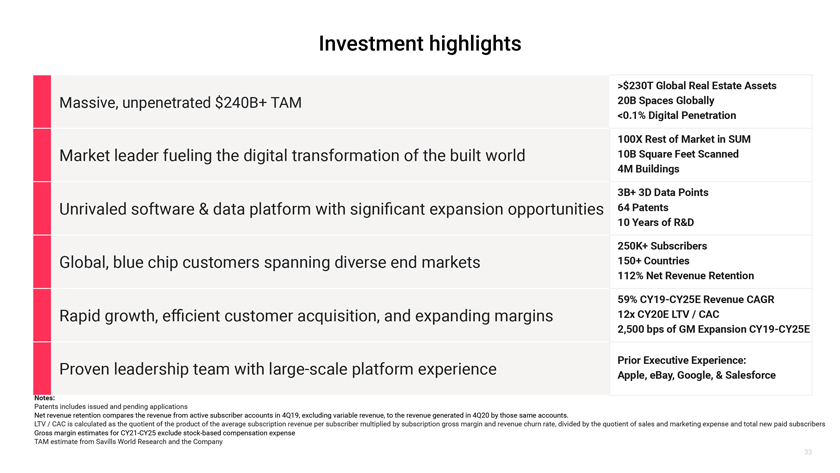

Investment highlights >$230T Global Real Estate Assets Massive, unpenetrated $240B+ TAM 20B Spaces Globally <0.1% Digital Penetration 100X Rest of Market in SUM Market leader fueling the digital transformation of the built world 10B Square Feet Scanned 4M Buildings 3B+ 3D Data Points Unrivaled software & data platform with significant expansion opportunities 64 Patents 10 Years of R&D 250K+ Subscribers Global, blue chip customers spanning diverse end markets 150+ Countries 112% Net Revenue Retention 59% CY19-CY25E Revenue CAGR Rapid growth, efficient customer acquisition, and expanding margins 12x CY20E LTV / CAC 2,500 bps of GM Expansion CY19-CY25E Prior Executive Experience: Proven leadership team with large-scale platform experience Apple, eBay, Google, & Salesforce Notes: Patents includes issued and pending applications Net revenue retention compares the revenue from active subscriber accounts in 4Q19, excluding variable revenue, to the revenue generated in 4Q20 by those same accounts. LTV / CAC is calculated as the quotient of the product of the average subscription revenue per subscriber multiplied by subscription gross margin and revenue churn rate, divided by the quotient of sales and marketing expense and total new paid subscribers Gross margin estimates for CY21-CY25 exclude stock-based compensation expense TAM estimate from Savills World Research and the Company 33

Appendix 34

Presenters & Senior Leadership Matterport Gores Holdings VI RJ Pittman JD Fay CEO CFO Chairman CEO Currently board member of Jyve Corporation, Previously CFO at View (Nasdaq: CFII); SVP and Founder, Chairman and Chief Executive Officer of Senior Managing Director of The Gores Group and investor in Ember Technologies CFO at NeoPhotonics (NYSE: NPTN); SVP of The Gores Group @Road (Nasdaq: ATRD; acquired by Trimble); Currently CEO of Gores Holdings V, Inc. and Previously SVP of Product at eBay, Head of WW and Strategic Advisor at Sierra Instruments 40+ years of experience as an entrepreneur and Gores Holdings VI, Inc. E-Commerce Platform at Apple, and Advisor at dealmaker; invested in over 130 companies FLOR (acquired by TASI) across diverse sectors â–ª Previously CEO of Gores Holdings, Inc. in its Over 20 years of experience as acquisition of Hostess Brands; Gores Holdings II, Spent the last two decades building Internet globally-focused senior executive, lawyer, and â–ª Currently Chairman of Gores Holdings V, Inc. and Inc. in its acquisition of Verra Mobility; Gores software companies to accelerate the evolution advisor in public and private, global, technology Gores Holdings VI, Inc. and CEO of Gores Holdings III, Inc. in its acquisition of PAE; Gores of e-commerce companies Metropoulos II, Inc. Holdings IV, Inc. in its acquisition of UWM Has raised over $100M in venture capital in Named â–ª Board member of Luminar Technologies Previously served as President of Operations for “CFO of the Year” in 2016 by the Silicon companies for companies he has led, The Gores Group co-founded, or founded Valley Business Journal Previously Chairman of Gores Holdings, Inc., Gores Holdings II, Inc.,Gores Holdings III, Inc. and â–ª Previously worked at Boston Consulting Group Led two IPOs, raised over $1B in debt / equity Hands on executive, product leader, and Gores Holdings IV, Inc. and CEO of Gores entrepreneur capital, and executed numerous M&A Holds a B.S. from the University of Maine and an Metropoulos, Inc. M.B.A from The Wharton School of the University transactions Holds an M.S. from Stanford and a BSCE from from Harvard Law School, of Pennsylvania Holds a J.D. cum the University of Michigan laude, and two B.A. degrees from North Central College, summa cum laude 35

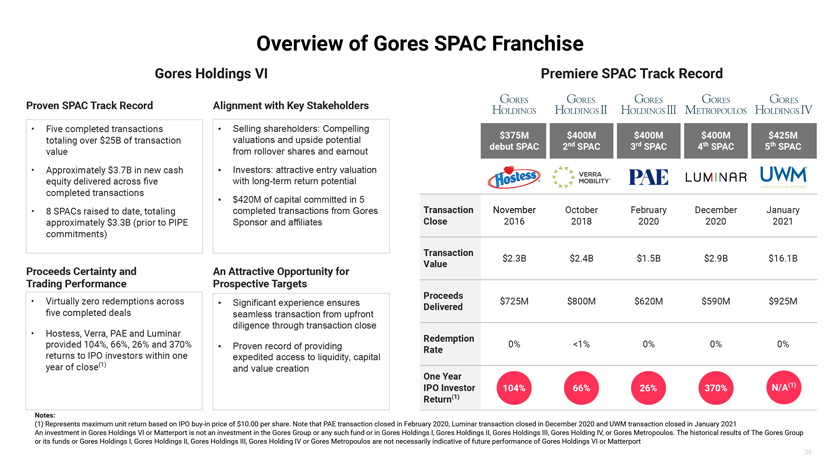

Overview of Gores SPAC Franchise Gores Holdings VI Premiere SPAC Track Record Proven SPAC Track Record Alignment with Key Stakeholders • Five completed transactions • Selling shareholders: Compelling totaling over $25B of transaction valuations and upside potential value from rollover shares and earnout • Approximately $3.7B in new cash • Investors: attractive entry valuation equity delivered across five with long-term return potential completed transactions • $420M of capital committed in 5 • 8 SPACs raised to date, totaling completed transactions from Gores Transaction November October February December January approximately $3.3B (prior to PIPE Sponsor and affiliates Close 2016 2018 2020 2020 2021 commitments) Transaction $2.3B $2.4B $1.5B $2.9B $16.1B Proceeds Certainty and An Attractive Opportunity for Value Trading Performance Prospective Targets Proceeds • Virtually zero redemptions across • Significant experience ensures $725M $800M $620M $590M $925M Delivered five completed deals seamless transaction from upfront diligence through transaction close • Hostess, Verra, PAE and Luminar Redemption provided 104%, 66%, 26% and 370% • Proven record of providing 0% <1% 0% 0% 0% Rate returns to IPO investors within one expedited access to liquidity, capital year of close(1) and value creation One Year IPO Investor Return(1) Notes: (1) Represents maximum unit return based on IPO buy-in price of $10.00 per share. Note that PAE transaction closed in February 2020, Luminar transaction closed in December 2020 and UWM transaction closed in January 2021 An investment in Gores Holdings VI or Matterport is not an investment in the Gores Group or any such fund or in Gores Holdings I, Gores Holdings II, Gores Holdings III, Gores Holding IV, or Gores Metropoulos. The historical results of The Gores Group or its funds or Gores Holdings I, Gores Holdings II, Gores Holdings III, Gores Holding IV or Gores Metropoulos are not necessarily indicative of future performance of Gores Holdings VI or Matterport 36

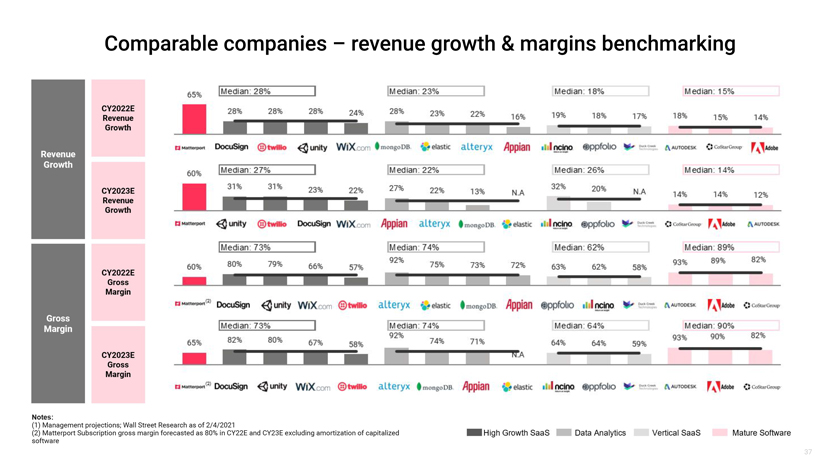

Comparable companies – revenue growth & margins benchmarking Notes: (1) Management projections; Wall Street Research as of 2/4/2021 (2) Matterport Subscription gross margin forecasted as 80% in CY22E and CY23E excluding amortization of capitalized software 37

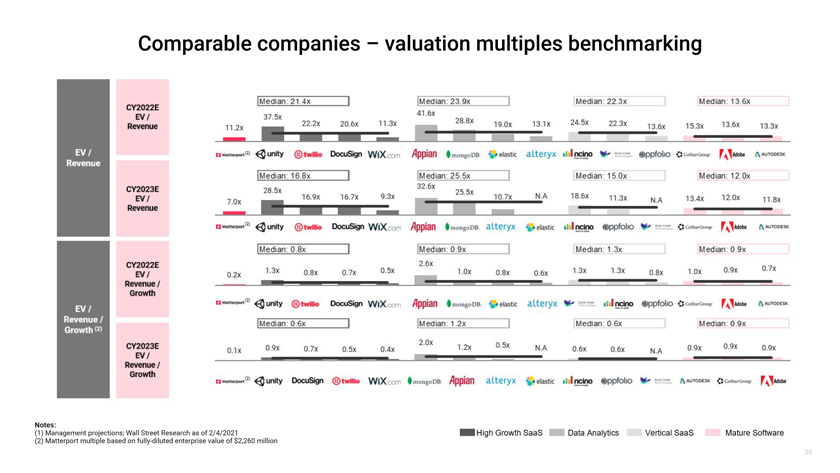

Comparable companies – valuation multiples benchmarking Notes: (1) Management projections; Wall Street Research as of 2/4/2021 (2) Matterport multiple based on fully-diluted enterprise value of $2,260 million 38

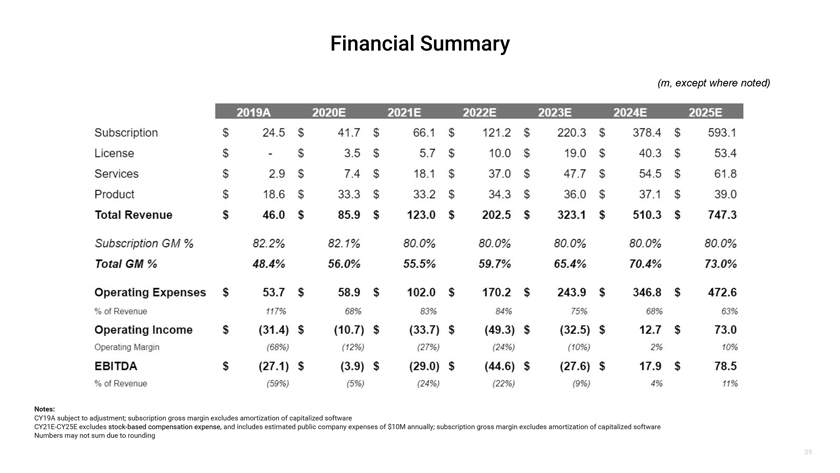

Financial Summary (m, except where noted) Notes: CY19A subject to adjustment; subscription gross margin excludes amortization of capitalized software CY21E-CY25E excludes stock-based compensation expense, and includes estimated public company expenses of $10M annually; subscription gross margin excludes amortization of capitalized software Numbers may not sum due to rounding 39

Risk Factors Matterport has experienced rapid growth and expects to invest in growth for the foreseeable future. If Matterport fails to manage growth effectively, its business, operating results and financial condition would be adversely affected. Matterport’s forecasts and projections are based upon assumptions, analyses and internal estimates developed by Matterport’s management. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, Matterport’s actual operating results may differ materially from those forecasted or projected. Matterport has a history of losses, and expects to incur significant expenses and continuing losses at least for the near term. Certain of Matterport’s estimates of market opportunity and forecasts of market growth may prove to be inaccurate. Matterport currently faces competition from a number of companies and expects to face significant competition in the future as the market for spatial data develops. Matterport operates in a new market, and global economic conditions and instability related to COVID-19 and otherwise may adversely affect our business if existing and prospective clients reduce or postpone discretionary spending significantly. Matterport relies on a limited number of suppliers for certain supplied hardware components, and availability of supplied hardware components may be affected by factors such as tariffs or supply disruptions caused by the COVID-19 pandemic. Matterport may not be able to obtain sufficient components to meet its needs, or obtain such materials on favorable terms or at all, which could impair Matterport’s ability to fulfill orders in a timely manner or increase Matterport’s costs of production. If Matterport is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be adversely affected. Matterport has received a voluntary request for information from the Division of Enforcement of the U.S. Securities and Exchange Commission in an investigation relating to certain sales and repurchases of Matterport’s securities in the secondary market. Although Matterport is cooperating fully with the request, Matterport cannot predict the duration or ultimate resolution of the investigation, and cooperating with the request may require significant management time and resources, which could have an adverse effect on Matterport’s business and financial position. Some of Matterport’s facilities are located in an active earthquake zone or in areas susceptible to wildfires and other severe weather events. An earthquake, wildfire or other natural disaster or resource shortage, including public safety power shut-offs that have occurred and will continue to occur in California or other states, could disrupt and harm its operations. If Matterport fails to retain current customers or add new customers, its business would be seriously harmed. Computer malware, viruses, ransomware, hacking, phishing attacks and other network disruptions could result in security and privacy breaches and interruption in service, which would harm Matterport’s business. While Matterport to date has not made material acquisitions, should it pursue acquisitions in the future, it would be subject to risks associated with acquisitions. Because Matterport stores, processes, and uses data, some of which contains personal information, Matterport is subject to complex and evolving federal, state and foreign laws and regulations regarding privacy, data protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in investigations, claims, changes to Matterport’s business practices, increased cost of operations, or declines in customers or retention, any of which could seriously harm Matterport’s business. Matterport’s products are highly technical and may contain undetected software bugs or hardware errors, which could manifest in ways that could seriously harm Matterport’s reputation and its business.· Matterport may need to raise additional funds and these funds may not be available when needed. Matterport’s future growth and success is dependent upon the continuing rapid adoption of spatial data. The spatial data market is characterized by rapid technological change, which requires Matterport to continue to develop new services, products and service and product innovations. Any delays in such development could adversely affect market adoption of its products and services and could adversely affect Matterport’s business and financial results. Matterport may need to defend against intellectual property infringement or misappropriation claims, which may be time-consuming and expensive, and adversely affect Matterport’s business. Matterport’s business may be adversely affected if it is unable to protect its spatial data technology and intellectual property from unauthorized use by third parties. Matterport expects to incur research and development costs in developing new products, which could significantly reduce its profitability and may never result in revenue to Matterport. Matterport’s financial condition and results of operations are likely to fluctuate on a quarterly basis in future periods, which could cause its results for a particular period to fall below expectations, resulting in a decline in the price of the post-combination company’s common stock. Changes to applicable U.S. tax laws and regulations or exposure to additional income tax liabilities could affect Matterport’s business and future profitability. As a result of plans to expand Matterport’s business operations, including to jurisdictions in which tax laws may not be favorable, Matterport’s tax rates may fluctuate, tax obligations may become significantly more complex and subject to greater risk of examination by taxing authorities and Matterport may be subject to future changes in tax law, the impacts of which could adversely affect Matterport’s after-tax profitability and financial results. Matterport’s reported financial results may be negatively impacted by changes in U.S. GAAP. New Matterport will be an “emerging growth company” and it cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make the post-combination company’s common stock less attractive to investors and may make it more difficult to compare performance with other public companies. New Matterport will incur significantly increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations. Privacy concerns and laws, or other regulations, may adversely affect Matterport’s business.Matterport may from time to time may be involved in lawsuits and other litigation matters that are expensive and time-consuming. If resolved adversely, lawsuits and other litigation matters could seriously harm Matterport’s business. Failure to comply with laws relating to employment could subject Matterport to penalties and other adverse consequences. 40