Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - IES Holdings, Inc. | q12021pressrelease.htm |

| 8-K - 8-K - IES Holdings, Inc. | iesc-20210205.htm |

IES Holdings, Inc. First Quarter 2021 Update February 5, 2021 Exhibit 99.2

2 Disclosures Forward-Looking Statements Certain statements in this release may be deemed "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, all of which are based upon various estimates and assumptions that the Company believes to be reasonable as of the date hereof. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "could," "should," "expect," "plan," "project," "intend," "anticipate," "believe," "seek," "estimate," "predict," "potential," "pursue," "target," "continue," the negative of such terms or other comparable terminology. These statements involve risks and uncertainties that could cause the Company's actual future outcomes to differ materially from those set forth in such statements. Such risks and uncertainties include, but are not limited to, the impact of the COVID-19 outbreak or future epidemics on our business, including the potential for job site closures or work stoppages, supply chain disruptions, construction delays, reduced demand for our services, or our ability to collect from our customers; the ability of our controlling shareholder to take action not aligned with other shareholders; the possibility that certain tax benefits of our net operating losses may be restricted or reduced in a change in ownership or a change in the federal tax rate; the potential recognition of valuation allowances or write-downs on deferred tax assets; the inability to carry out plans and strategies as expected, including our inability to identify and complete acquisitions that meet our investment criteria in furtherance of our corporate strategy, or the subsequent underperformance of those acquisitions; competition in the industries in which we operate, both from third parties and former employees, which could result in the loss of one or more customers or lead to lower margins on new projects; fluctuations in operating activity due to downturns in levels of construction or the housing market, seasonality and differing regional economic conditions; and our ability to successfully manage projects, as well as other risk factors discussed in this document, in the Company's annual report on Form 10-K for the year ended September 30, 2020 and in the Company’s other reports on file with the SEC. You should understand that such risk factors could cause future outcomes to differ materially from those experienced previously or those expressed in such forward-looking statements. The Company undertakes no obligation to publicly update or revise any information, including information concerning its controlling shareholder, net operating losses, borrowing availability, or cash position, or any forward-looking statements to reflect events or circumstances that may arise after the date of this release. Forward-looking statements are provided in this press release pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of the estimates, assumptions, uncertainties, and risks described herein. Non-GAAP Financial Measures and Other Adjustments This document includes adjusted net income per share and backlog, and, in the non-GAAP reconciliation tables included herein, adjusted net income attributable to IES, adjusted earnings per share attributable to IES, adjusted EBITDA and adjusted net income before taxes, each of which is a financial measure not calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Management believes that these measures provide useful information to our investors by, in the case of adjusted net income per share, adjusted net income attributable to IES, adjusted earnings per share attributable to IES, adjusted EBITDA and adjusted net income before taxes, distinguishing certain nonrecurring events such as litigation settlements or significant expenses associated with leadership changes, or noncash events, such as our valuation allowances release and write-down of our deferred tax assets, or, in the case of backlog, providing a common measurement used in IES’s industry, as described further below, and that these measures, when reconciled to the most directly comparable GAAP measures, help our investors to better identify underlying trends in the operations of our business and facilitate easier comparisons of our financial performance with prior and future periods and to our peers. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures, which has been provided in the financial tables included in this document. Remaining performance obligations represent the unrecognized revenue value of our contract commitments. While backlog is not a defined term under GAAP, it is a common measurement used in IES’s industry and IES believes this non-GAAP measure enables it to more effectively forecast its future results and better identify future operating trends that may not otherwise be apparent. IES’s remaining performance obligations are a component of IES’s backlog calculation, which also includes signed agreements and letters of intent which we do not have a legal right to enforce prior to work starting. These arrangements are excluded from remaining performance obligations until work begins. IES’s methodology for determining backlog may not be comparable to the methodologies used by other companies. For further details on the Company’s financial results, please refer to the Company’s annual report on Form 10-Q for the quarter ended December 31, 2020, to be filed with the Securities and Exchange Commission (“SEC”) by February 5, 2021, and any amendments thereto. General information about IES Holdings, Inc. can be found at http://www.ies-co.com under "Investor Relations." The Company's annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments to those reports, are available free of charge through the Company's website as soon as reasonably practicable after they are filed with, or furnished to, the SEC.

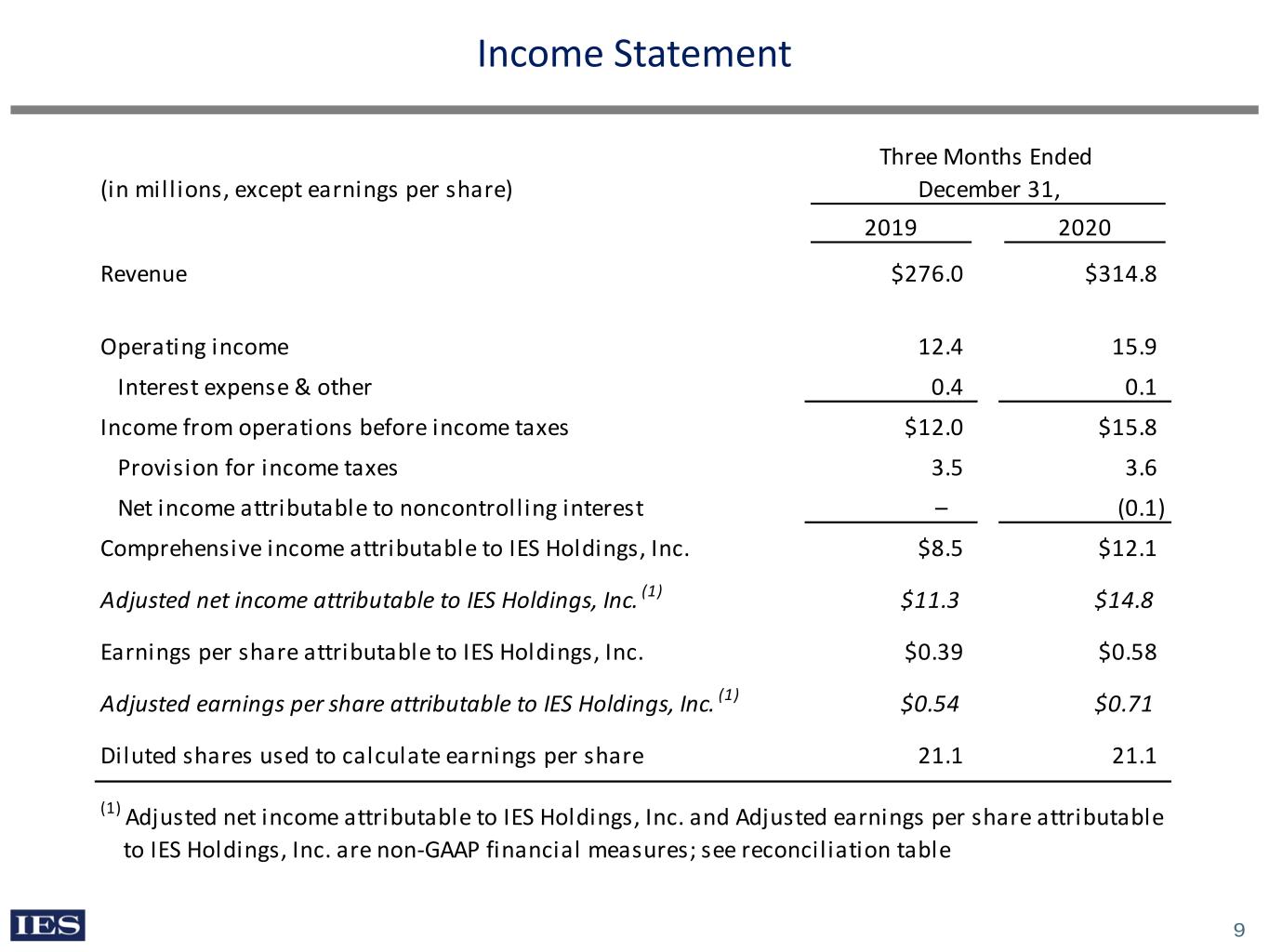

3 First Quarter 2021 Highlights ♦ Revenue of $315 million, an increase of 14% year-over-year (“y-o-y”) ♦ Operating Income of $15.9 million, an increase of 28% y-o-y ♦ Net Income per Share of $0.58 (+49%) and Adjusted Net Income per Share* of $0.71 (+31%) ♦ Remaining Performance Obligations, a GAAP measure of future revenue to be recognized from current contracts with customers, of $525 million ♦ Record Backlog* of $632 million ♦ Completed the acquisitions of K.E.P. Electric, Inc., Wedlake Fabricating, Inc., and Bayonet Plumbing, Heating, and Air-Conditioning, LLC * Non-GAAP financial measure; see reconciliation table

4 $12.4 $15.9 12/31/19 12/31/20 Three Months Ended $276 $315 12/31/19 12/31/20 Three Months Ended 1Q FY’21 Revenue and Operating Income Financial measures presented herein are in millions, except for earnings per share or as otherwise noted REVENUE OPERATING INCOME +14% +28%

5 $0.54 $0.71 12/31/19 12/31/20 Three Months Ended $0.39 $0.58 12/31/19 12/31/20 Three Months Ended 1Q FY’21 Net Income Per Share and Adjusted Net Income Per Share* * Non-GAAP financial measure; see reconciliation table NET INCOME PER SHARE ADJUSTED NET INCOME PER SHARE* +49% +31%

6 1Q FY’21 Segment Results ♦ Revenue: $98.4 million (17% increase from 1Q FY’20) ♦ Operating Income: $9.2 million (+31%) Communications ♦ Revenue: $119.5 million (+29%) ♦ Operating Income: $6.2 million (-3%) Residential ♦ Revenue: $34.4 million (+10%) ♦ Operating Income: $5.3 million (+63%) Infrastructure Solutions ♦ Revenue: $62.6 million (-8%) ♦ Operating Loss: $0.7 million Commercial & Industrial

7 Strong Backlog* Ba ck lo g ($ in m ill io ns ) $509 $587 $597 $602 $632 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 Remaining Performance Obligations: $505 $525$430 $469 * Non-GAAP financial measure; see reconciliation table $523

APPENDIX

9 Income Statement Three Months Ended (in mill ions, except earnings per share) December 31, 2019 2020 Revenue $276.0 $314.8 Operating income 12.4 15.9 Interest expense & other 0.4 0.1 Income from operations before income taxes $12.0 $15.8 Provision for income taxes 3.5 3.6 Net income attributable to noncontroll ing interest – (0.1) Comprehensive income attributable to IES Holdings, Inc. $8.5 $12.1 Adjusted net income attributable to IES Holdings, Inc. (1) $11.3 $14.8 Earnings per share attributable to IES Holdings, Inc. $0.39 $0.58 Adjusted earnings per share attributable to IES Holdings, Inc. (1) $0.54 $0.71 Diluted shares used to calculate earnings per share 21.1 21.1 (1) Adjusted net income attributable to IES Holdings, Inc. and Adjusted earnings per share attributable to IES Holdings, Inc. are non-GAAP financial measures; see reconcil iation table

10 (in mill ions) 12/31/19 9/30/20 12/31/20 Cash $27.3 $53.6 $27.3 Other Current Assets 262.4 317.9 331.6 Deferred Tax Assets 38.1 33.8 29.8 Non-Current Assets 142.1 155.3 220.7 Total Assets $469.9 $560.5 $609.4 Current Liabil ities $185.9 $242.4 $249.0 Other Liabil ities 25.9 32.7 37.8 Debt 0.3 0.2 14.5 Total Liabil ities $212.2 $275.4 $301.3 Noncontroll ing interest 2.9 1.8 12.6 Equity 254.8 283.3 295.5 Total Liabil ities & Equity $469.9 $560.5 $609.4 Select Balance Sheet Data

11 Segment Results Three Months Ended (in mill ions) December 31, 2019 2020 Revenue Communications $84.3 $98.4 Residential 92.7 119.5 Infrastructure Solutions 31.3 34.4 Commercial & Industrial 67.7 62.6 Total Revenue $276.0 $314.8 Operating Income (Loss) Communications $7.0 $9.2 Residential 6.4 6.2 Infrastructure Solutions 3.3 5.3 Commercial & Industrial (0.5) (0.7) Corporate (3.8) (4.1) Total Operating Income $12.4 $15.9

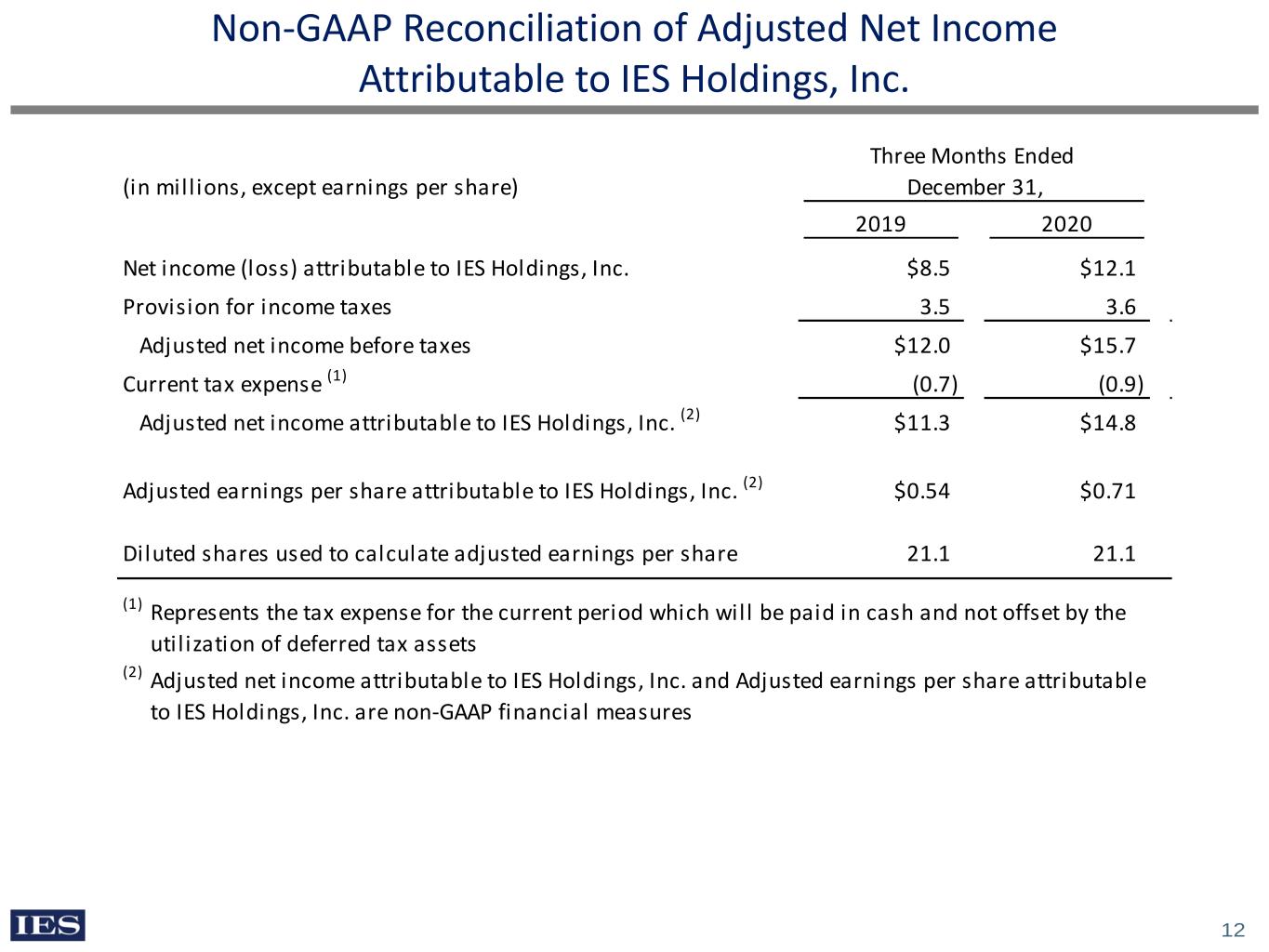

12 Non-GAAP Reconciliation of Adjusted Net Income Attributable to IES Holdings, Inc. Three Months Ended (in mill ions, except earnings per share) December 31, 2019 2020 Net income (loss) attributable to IES Holdings, Inc. $8.5 $12.1 Provision for income taxes 3.5 3.6 Adjusted net income before taxes $12.0 $15.7 Current tax expense (1) (0.7) (0.9) Adjusted net income attributable to IES Holdings, Inc. (2) $11.3 $14.8 Adjusted earnings per share attributable to IES Holdings, Inc. (2) $0.54 $0.71 Diluted shares used to calculate adjusted earnings per share 21.1 21.1 (1) Represents the tax expense for the current period which will be paid in cash and not offset by the uti l ization of deferred tax assets (2) Adjusted net income attributable to IES Holdings, Inc. and Adjusted earnings per share attributable to IES Holdings, Inc. are non-GAAP financial measures

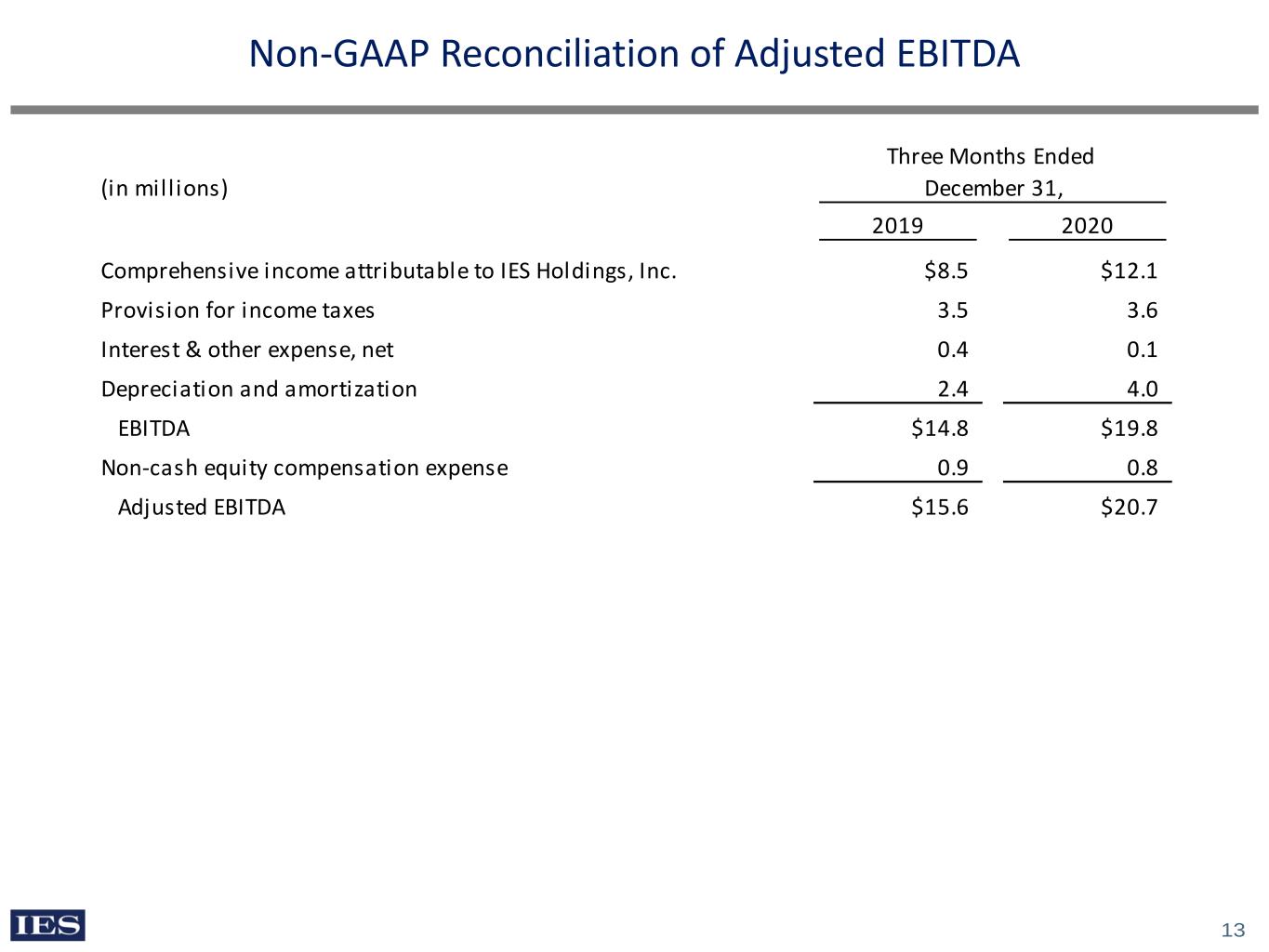

13 Non-GAAP Reconciliation of Adjusted EBITDA Three Months Ended (in mill ions) December 31, 2019 2020 Comprehensive income attributable to IES Holdings, Inc. $8.5 $12.1 Provision for income taxes 3.5 3.6 Interest & other expense, net 0.4 0.1 Depreciation and amortization 2.4 4.0 EBITDA $14.8 $19.8 Non-cash equity compensation expense 0.9 0.8 Adjusted EBITDA $15.6 $20.7

14 Non-GAAP Reconciliation of Remaining Performance Obligations to Backlog (in mill ions) December 31, 2020 September 30, 2020 December 31, 2019 Remaining performance obligations $525 $505 $430 Agreements without an enforceable obligation (1) 107 97 79 Backlog $632 $602 $509 (1) Our backlog contains signed agreements and letters of intent which we do not have a legal right to enforce prior to work starting. These arrangements are excluded from remaining performance obligations until work begins.

15 NOL Summary ♦ Estimated net operating loss carry forwards (“NOLs”) of approximately $217 million as of September 30, 2020, including approximately $128 million resulting from net operating losses on which a deferred tax asset is not recorded ♦ Rights Plan implemented in 2016 to deter new 5% shareholders and reduce risk of certain limitations on NOLs Note: Assumes no change, limitation or usage of existing NOLs prior to expiration dates NOL EXPIRATION SCHEDULE $19 $65 $24 $44 $37 $16 $5 $4 $3