Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - IDEX CORP /DE/ | iex-20210203xex991.htm |

| 8-K - 8-K - IDEX CORP /DE/ | iex-20210203.htm |

1 Fourth Quarter & Full Year 2020 Earnings February 4, 2021

2IDEX Proprietary & Confidential Agenda IDEX Business Overview • IDEX Overview • IDEX Culture • Orders & End Market Update Financials • Q4 & Full Year Performance • Operating Profit 2021 Guidance Q&A

3IDEX Proprietary & Confidential Replay Information • Dial toll–free: 877.660.6853 • International: 201.612.7415 • Conference ID: #13712088 • Log on to: www.idexcorp.com

4IDEX Proprietary & Confidential Cautionary Statement Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This presentation and discussion will include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the anticipated effects of the coronavirus pandemic, including with respect to the Company’s revenues, facility closures and access to capital, capital expenditures, acquisitions, cost reductions, cash flow, cash requirements, revenues, earnings, market conditions, global economies, plant and equipment capacity and operating improvements, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: the duration of the coronavirus pandemic and the effects of the coronavirus on our ability to operate our business and facilities, on our customers and on the U.S. and global economy generally; economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries – all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the company’s most recent annual report on Form 10-K filed with the SEC and the other risks discussed in the company’s filings with the SEC. The forward-looking statements included in this presentation and discussion are only made as of today’s date, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information in this presentation and discussion. This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the nine-month period ending December 31, 2020, which is available on our website.

5IDEX Proprietary & Confidential Business Update

6IDEX Proprietary & Confidential IDEX Overview Executed in a Challenging Environment • Our people safe, our customers supported • 80/20 Led Innovation • Record Free Cash Flow performance 2021 - Cautiously Bullish • End markets continue to improve • COVID still present, but pivoting operations and commercial focus • Continued evolution of our culture • Diversity Equity & Inclusion Capital Deployment Acceleration • Balance traditional profile with higher growth assets • Incremental resources to support M&A • Technology bets

7IDEX Proprietary & Confidential Diversity, Equity & Inclusion IDEX Foundation Expands Mission • “Equity & Opportunity” added as foundation pillar • Increase funding for enhanced mission • Driving increased engagement across the globe DE&I Worldwide Focus Groups • Listening to frontline employees' perspectives • Developing strategic framework for DE&I • Hiring DE&I leader in 2021

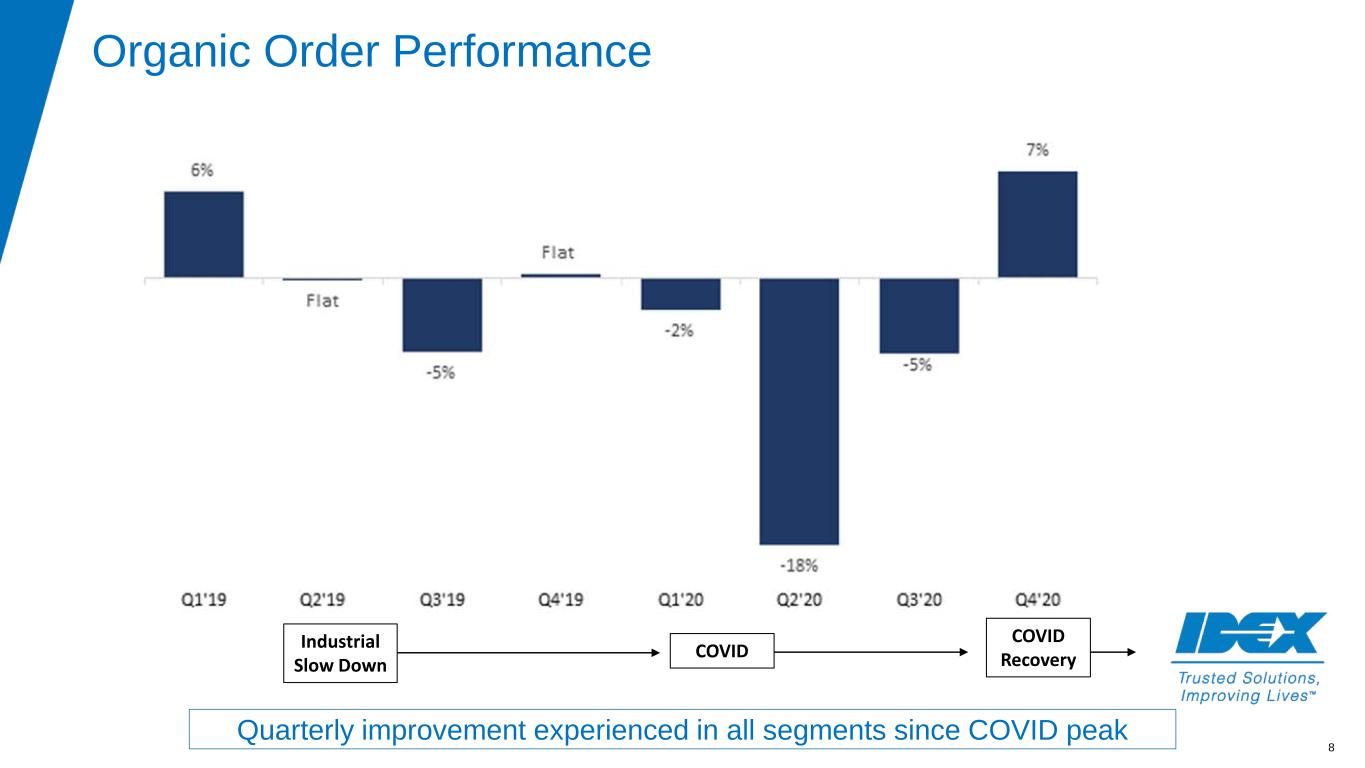

8 Organic Order Performance Quarterly improvement experienced in all segments since COVID peak Industrial Slow Down COVID COVID Recovery

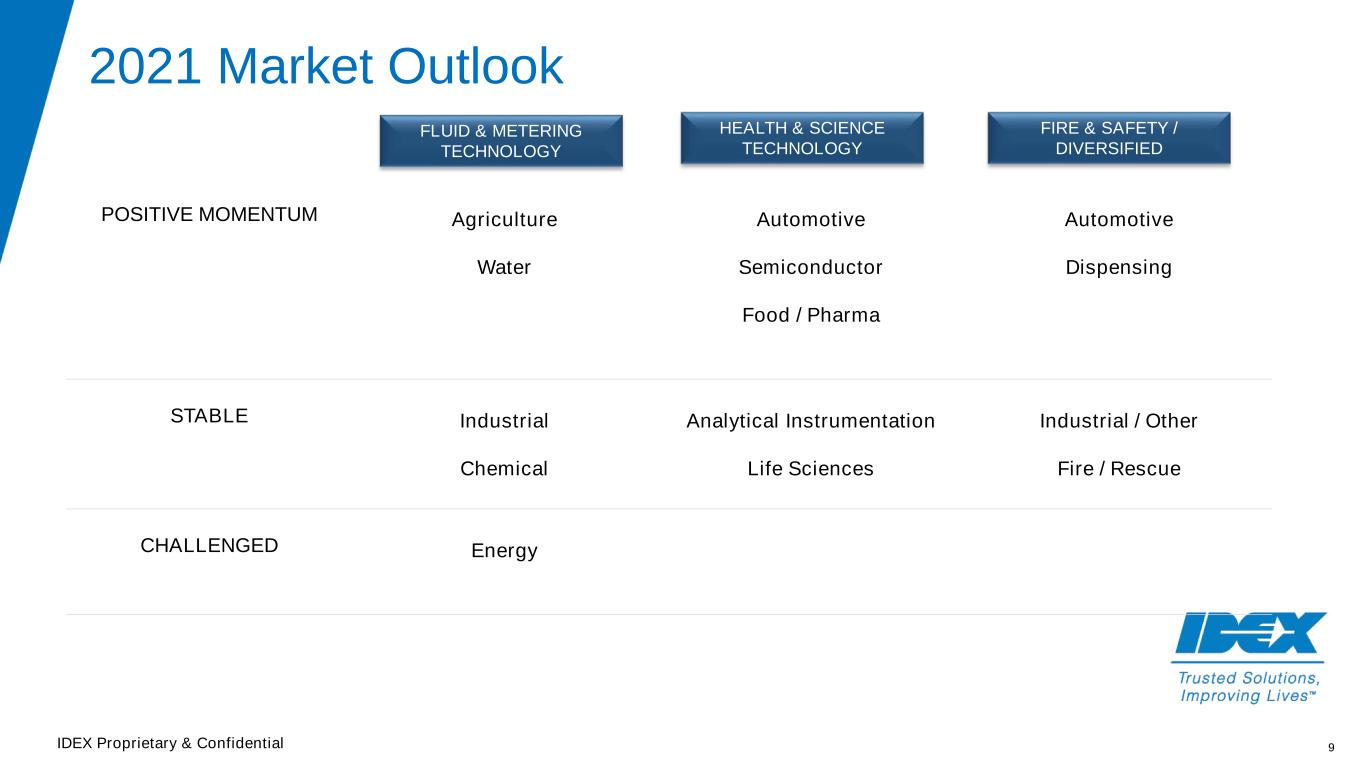

9IDEX Proprietary & Confidential 2021 Market Outlook POSITIVE MOMENTUM Agriculture Water Automotive Semiconductor Food / Pharma Automotive Dispensing STABLE Industrial Chemical Analytical Instrumentation Life Sciences Industrial / Other Fire / Rescue CHALLENGED Energy FLUID & METERING TECHNOLOGY HEALTH & SCIENCE TECHNOLOGY FIRE & SAFETY / DIVERSIFIED

10IDEX Proprietary & Confidential Financials

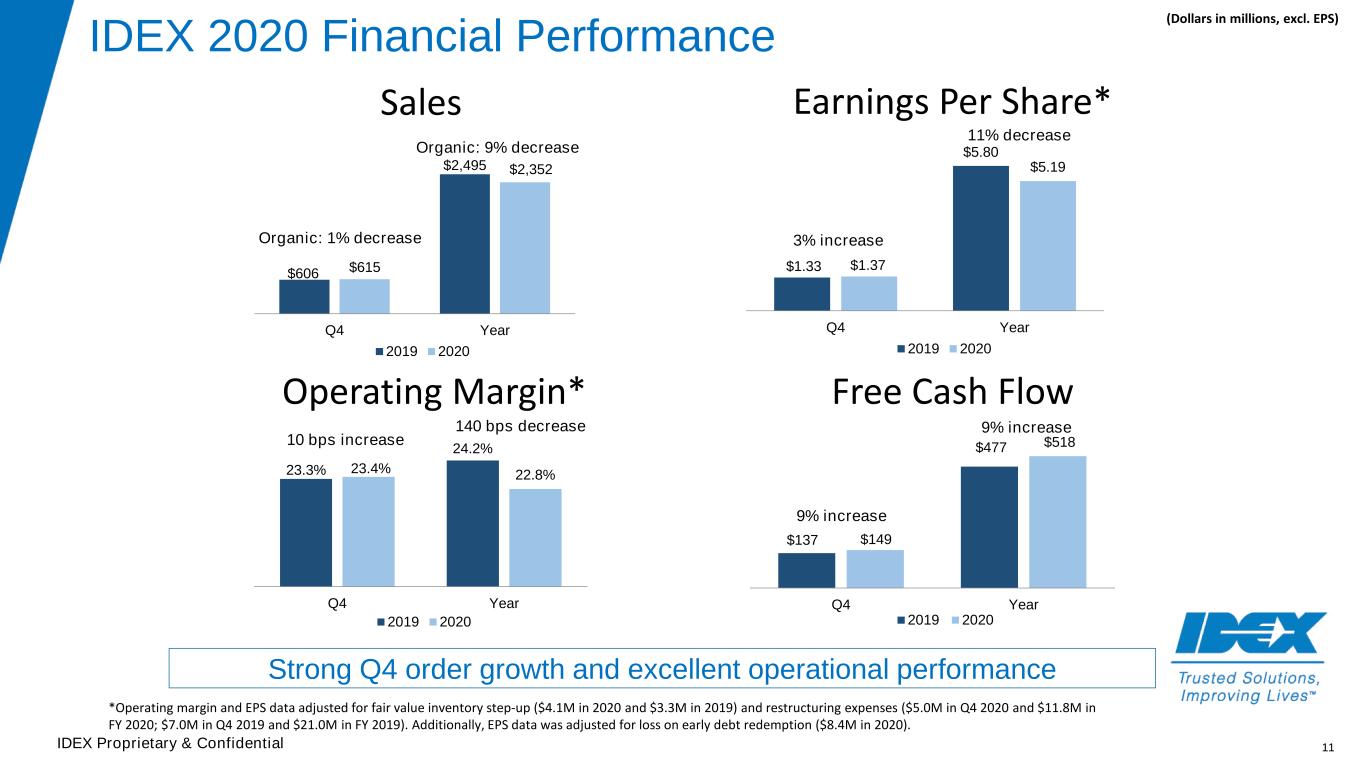

11IDEX Proprietary & Confidential IDEX 2020 Financial Performance Strong Q4 order growth and excellent operational performance $606 $2,495 $615 $2,352 Q4 Year 2019 2020 $1.33 $5.80 $1.37 $5.19 Q4 Year 2019 2020 23.3% 24.2% 23.4% 22.8% Q4 Year 2019 2020 $137 $477 $149 $518 Q4 Year 2019 2020 Organic: 9% decrease 11% decrease 140 bps decrease 9% increase (Dollars in millions, excl. EPS) Sales Operating Margin* Earnings Per Share* Free Cash Flow *Operating margin and EPS data adjusted for fair value inventory step-up ($4.1M in 2020 and $3.3M in 2019) and restructuring expenses ($5.0M in Q4 2020 and $11.8M in FY 2020; $7.0M in Q4 2019 and $21.0M in FY 2019). Additionally, EPS data was adjusted for loss on early debt redemption ($8.4M in 2020). Organic: 1% decrease 3% increase 10 bps increase 9% increase

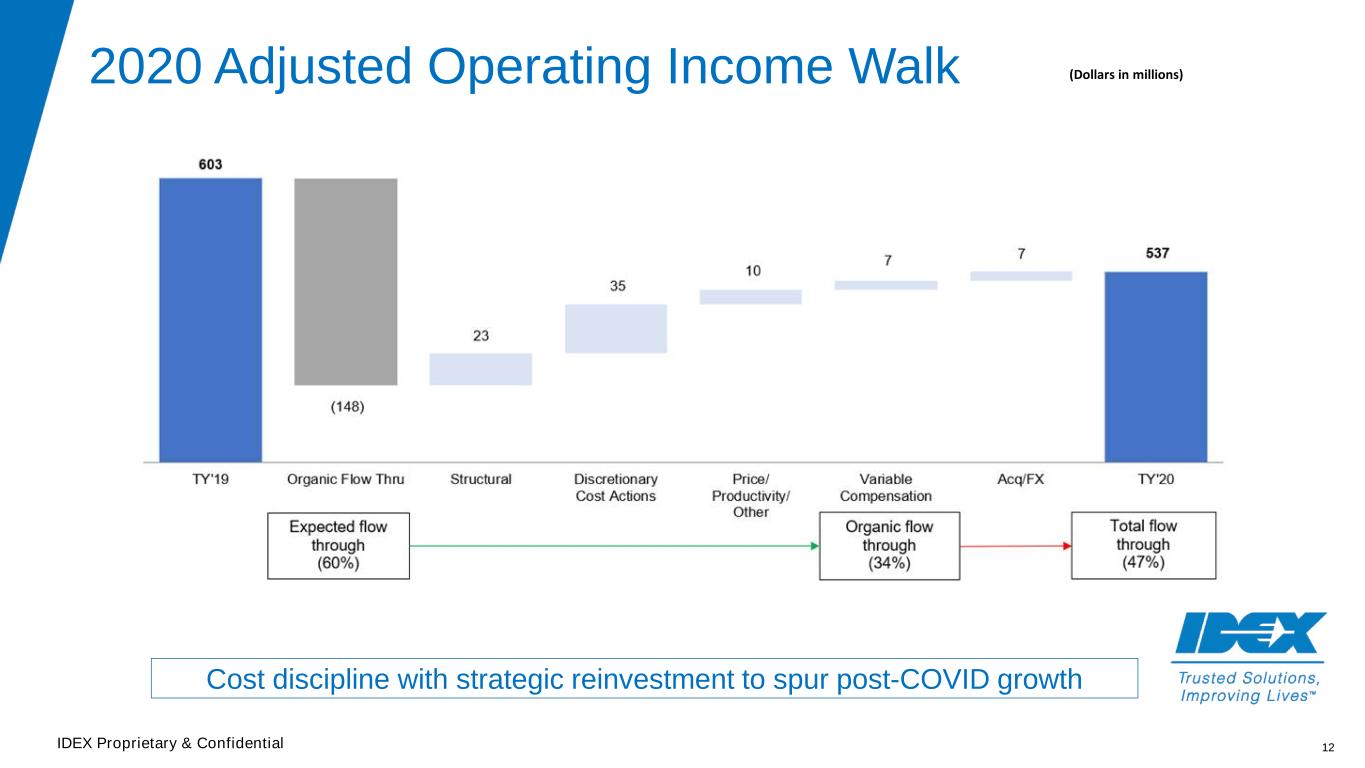

12IDEX Proprietary & Confidential 2020 Adjusted Operating Income Walk Cost discipline with strategic reinvestment to spur post-COVID growth (Dollars in millions)

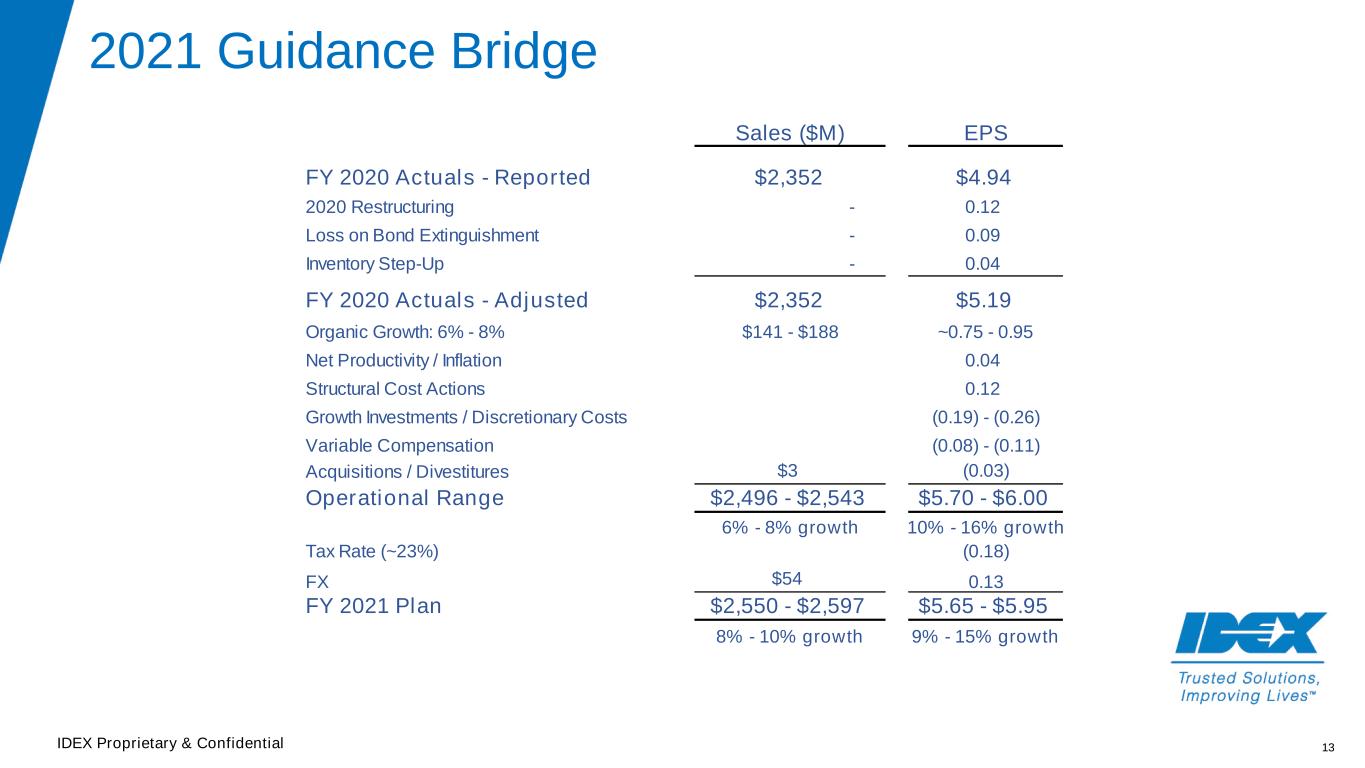

13IDEX Proprietary & Confidential 2021 Guidance Bridge Sales ($M) EPS FY 2020 Actuals - Reported $2,352 $4.94 2020 Restructuring - 0.12 Loss on Bond Extinguishment - 0.09 Inventory Step-Up - 0.04 FY 2020 Actuals - Adjusted $2,352 $5.19 Organic Growth: 6% - 8% $141 - $188 ~0.75 - 0.95 Net Productivity / Inflation 0.04 Structural Cost Actions 0.12 Growth Investments / Discretionary Costs (0.19) - (0.26) Variable Compensation (0.08) - (0.11) Acquisitions / Divestitures $3 (0.03) Operational Range $2,496 - $2,543 $5.70 - $6.00 6% - 8% growth 10% - 16% growth Tax Rate (~23%) (0.18) FX $54 0.13 FY 2021 Plan $2,550 - $2,597 $5.65 - $5.95 8% - 10% growth 9% - 15% growth

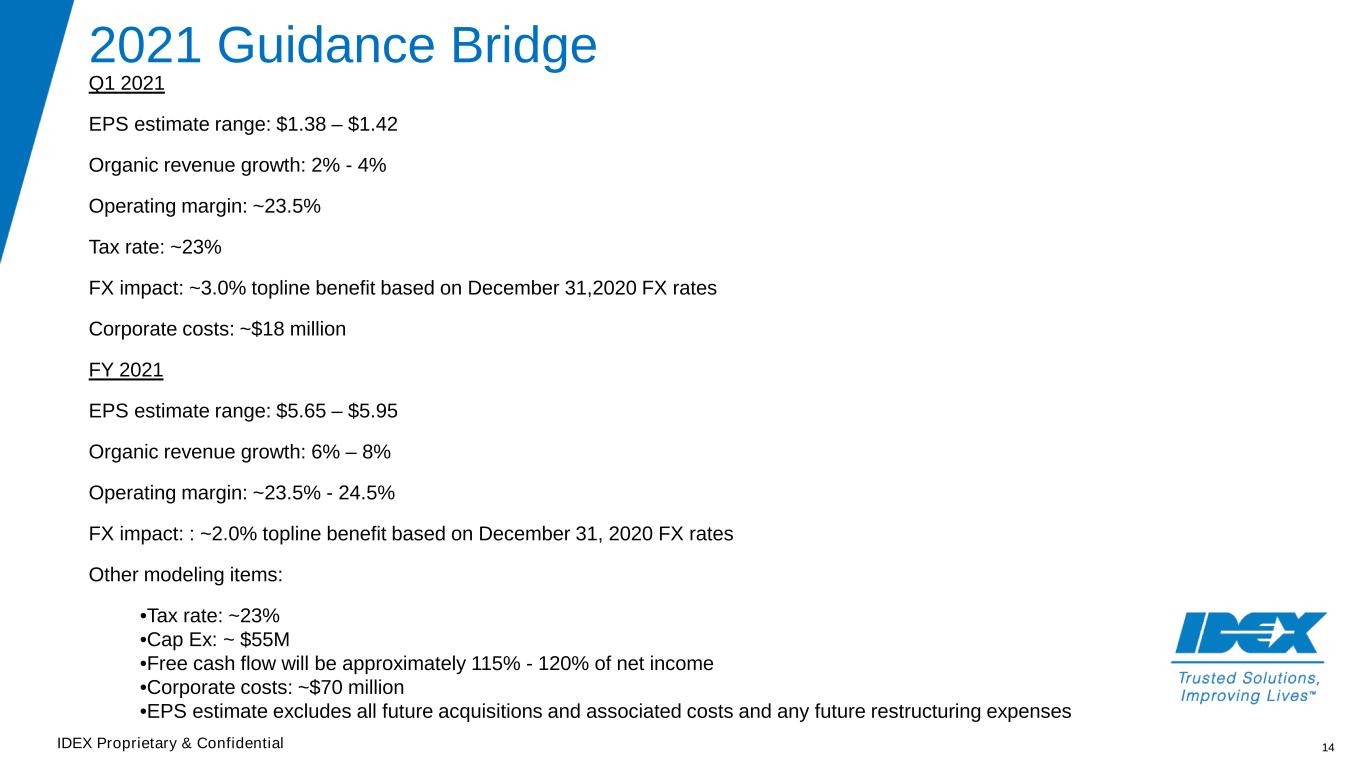

14IDEX Proprietary & Confidential 2021 Guidance Bridge Q1 2021 EPS estimate range: $1.38 – $1.42 Organic revenue growth: 2% - 4% Operating margin: ~23.5% Tax rate: ~23% FX impact: ~3.0% topline benefit based on December 31,2020 FX rates Corporate costs: ~$18 million FY 2021 EPS estimate range: $5.65 – $5.95 Organic revenue growth: 6% – 8% Operating margin: ~23.5% - 24.5% FX impact: : ~2.0% topline benefit based on December 31, 2020 FX rates Other modeling items: •Tax rate: ~23% •Cap Ex: ~ $55M •Free cash flow will be approximately 115% - 120% of net income •Corporate costs: ~$70 million •EPS estimate excludes all future acquisitions and associated costs and any future restructuring expenses

15IDEX Proprietary & Confidential Appendix

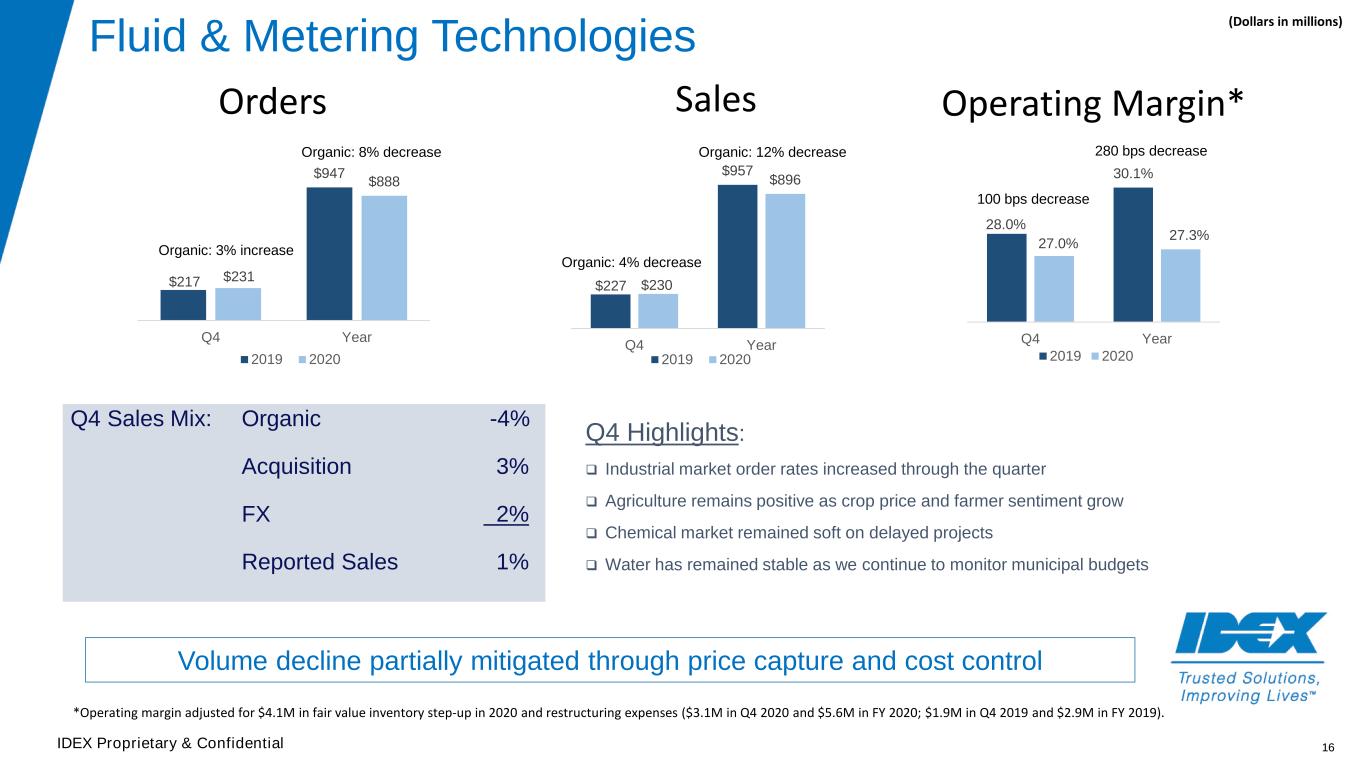

16IDEX Proprietary & Confidential Fluid & Metering Technologies $217 $947 $231 $888 Q4 Year 2019 2020 $227 $957 $230 $896 Q4 Year 2019 2020 28.0% 30.1% 27.0% 27.3% Q4 Year 2019 2020 Q4 Highlights: Industrial market order rates increased through the quarter Agriculture remains positive as crop price and farmer sentiment grow Chemical market remained soft on delayed projects Water has remained stable as we continue to monitor municipal budgets Volume decline partially mitigated through price capture and cost control Organic: 8% decrease Organic: 12% decrease 100 bps decrease (Dollars in millions) Orders Sales Operating Margin* Q4 Sales Mix: Organic -4% Acquisition 3% FX 2% Reported Sales 1% *Operating margin adjusted for $4.1M in fair value inventory step-up in 2020 and restructuring expenses ($3.1M in Q4 2020 and $5.6M in FY 2020; $1.9M in Q4 2019 and $2.9M in FY 2019). Organic: 3% increase Organic: 4% decrease 280 bps decrease

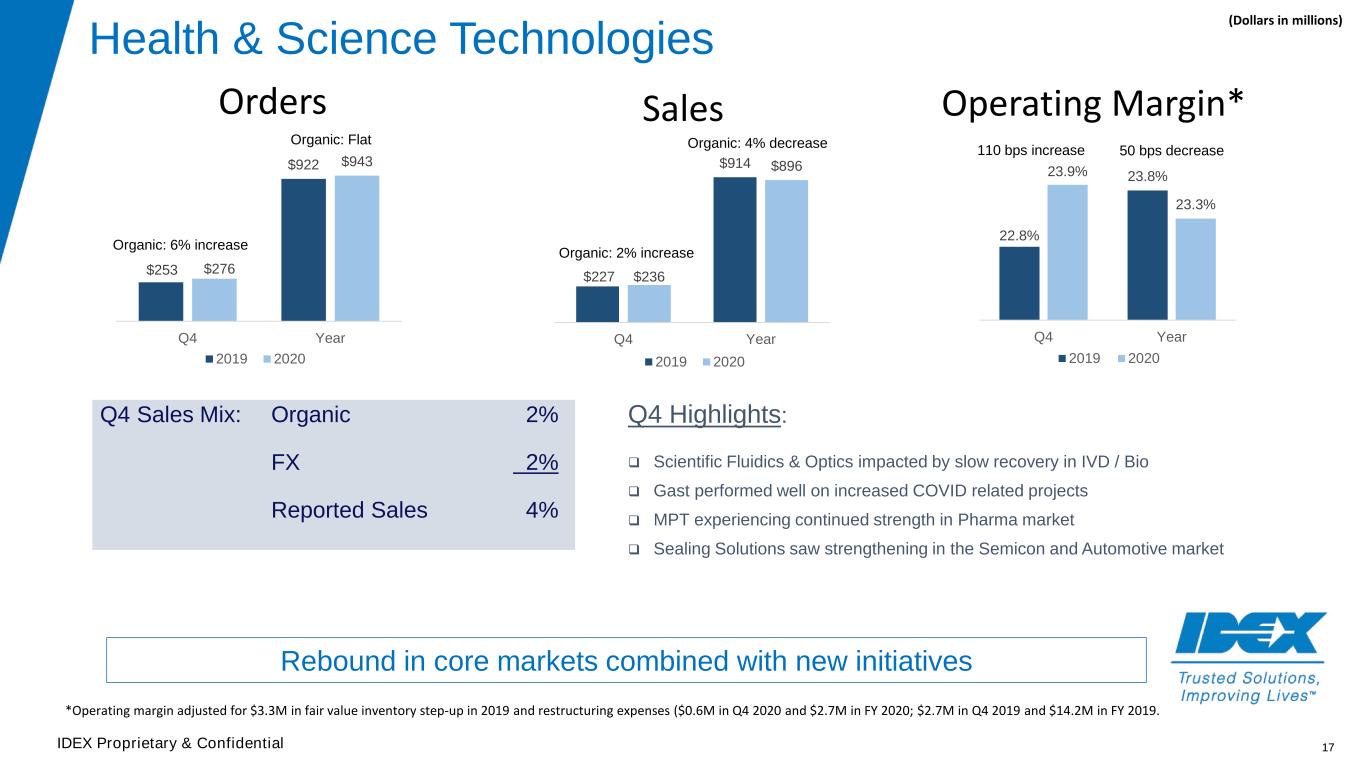

17IDEX Proprietary & Confidential Health & Science Technologies Q4 Sales Mix: Organic 2% FX 2% Reported Sales 4% Q4 Highlights: Scientific Fluidics & Optics impacted by slow recovery in IVD / Bio Gast performed well on increased COVID related projects MPT experiencing continued strength in Pharma market Sealing Solutions saw strengthening in the Semicon and Automotive market Rebound in core markets combined with new initiatives $253 $922 $276 $943 Q4 Year 2019 2020 $227 $914 $236 $896 Q4 Year 2019 2020 22.8% 23.8%23.9% 23.3% Q4 Year 2019 2020 Organic: 6% increase 110 bps increaseOrganic: 4% decrease (Dollars in millions) Orders Sales Operating Margin* *Operating margin adjusted for $3.3M in fair value inventory step-up in 2019 and restructuring expenses ($0.6M in Q4 2020 and $2.7M in FY 2020; $2.7M in Q4 2019 and $14.2M in FY 2019. Organic: Flat Organic: 2% increase 50 bps decrease

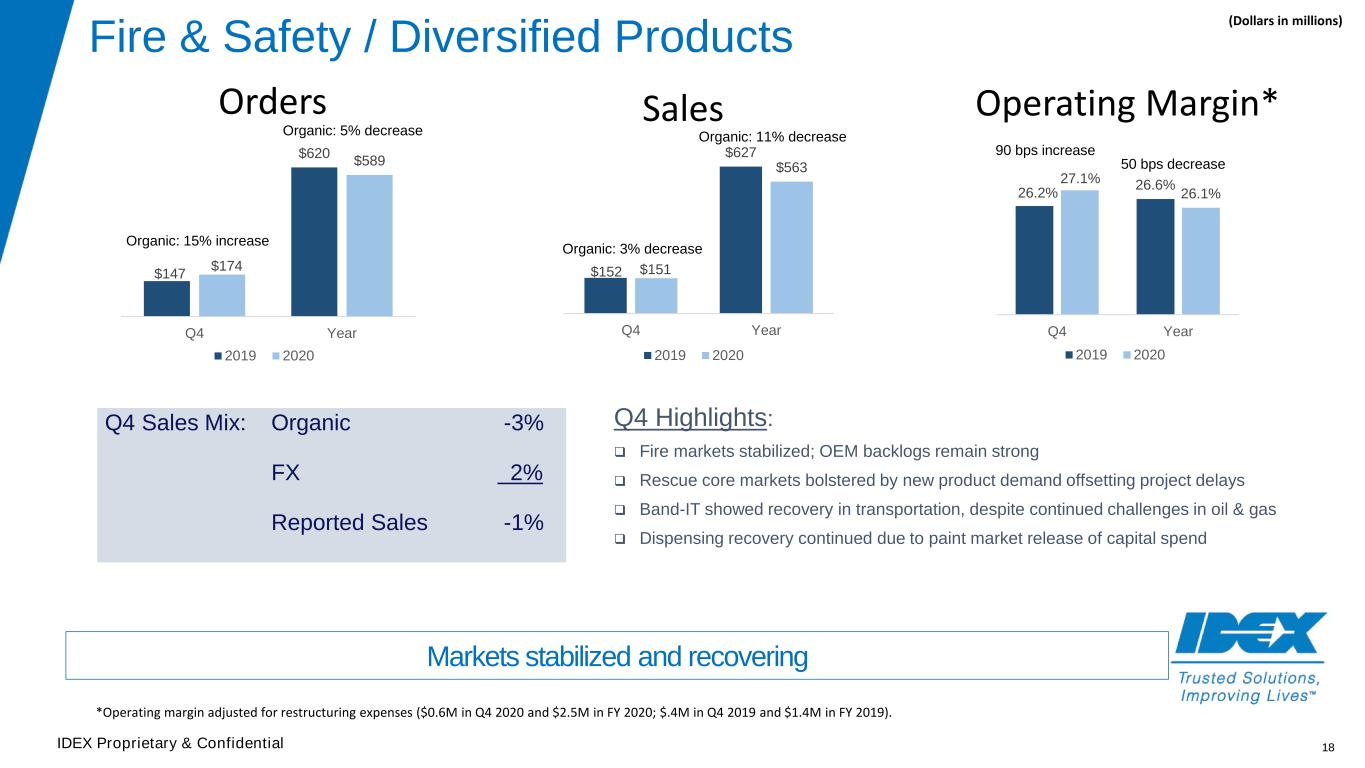

18IDEX Proprietary & Confidential Fire & Safety / Diversified Products Q4 Highlights: Fire markets stabilized; OEM backlogs remain strong Rescue core markets bolstered by new product demand offsetting project delays Band-IT showed recovery in transportation, despite continued challenges in oil & gas Dispensing recovery continued due to paint market release of capital spend Markets stabilized and recovering $147 $620 $174 $589 Q4 Year 2019 2020 $152 $627 $151 $563 Q4 Year 2019 2020 26.2% 26.6% 27.1% 26.1% Q4 Year 2019 2020 Organic: 5% decrease Organic: 11% decrease Q4 Sales Mix: Organic -3% FX 2% Reported Sales -1% (Dollars in millions) Orders Sales Operating Margin* *Operating margin adjusted for restructuring expenses ($0.6M in Q4 2020 and $2.5M in FY 2020; $.4M in Q4 2019 and $1.4M in FY 2019). Organic: 15% increase Organic: 3% decrease 90 bps increase 50 bps decrease