Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BENCHMARK ELECTRONICS INC | bhe-ex991_6.htm |

| 8-K - 8-K - BENCHMARK ELECTRONICS INC | bhe-8k_20210204.htm |

Benchmark Electronics Q4-20 and CY2020 Earnings Results February 4, 2021 Exhibit 99.2

Forward-Looking Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words "expect," "estimate," "anticipate," "could" "predict" and similar expressions, and the negatives thereof, often identify forward-looking statements, which are not limited to historical facts. Forward-looking statements include, among other things, the estimated financial impact of the COVID-19 pandemic, the outlook and guidance for first quarter 2021 results, the company’s anticipated plans and responses to the COVID-19 pandemic, statements (express or implied) concerning future operating results or margins, the ability to generate sales and income or cash flow, and expected revenue mix; and Benchmark’s business and growth strategies. Although the company believes these statements are based upon reasonable assumptions, they involve risks and uncertainties relating to operations, markets and the business environment generally. These statements also depend on the duration and severity of the COVID-19 pandemic and related risks, including government and other third-party responses to it and the consequences for the global economy, our business and the businesses of our suppliers and customers. Events relating to or resulting from the COVID-19 pandemic, including the possibility of customer demand fluctuations, supply chain constraints, or the ability to utilize our manufacturing facilities at sufficient levels to cover our fixed operating costs, may have resulting impacts on the company’s business, financial condition, results of operations, and the company’s ability (or inability) to execute on its plans to respond to the COVID-19 pandemic. If one or more of these risks or uncertainties materializes, or underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. Readers are advised to consult further disclosures on these risks and uncertainties, particularly in Part 1, Item 1A, "Risk Factors" of the company's Annual Report on Form 10-K for the year ended December 31, 2019 and in Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 and in its subsequent filings with the Securities and Exchange Commission. All forward-looking statements included in this document are based upon information available to the company as of the date of this document, and it assumes no obligation to update them. Non-GAAP Financial Information This document includes certain financial measures that exclude items and therefore are not in accordance with U.S. generally accepted accounting principles (“GAAP”). A detailed reconciliation between GAAP results and results excluding special items (“non-GAAP”) is included in the Appendix of this document. In situations where a non-GAAP reconciliation has not been provided, the company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

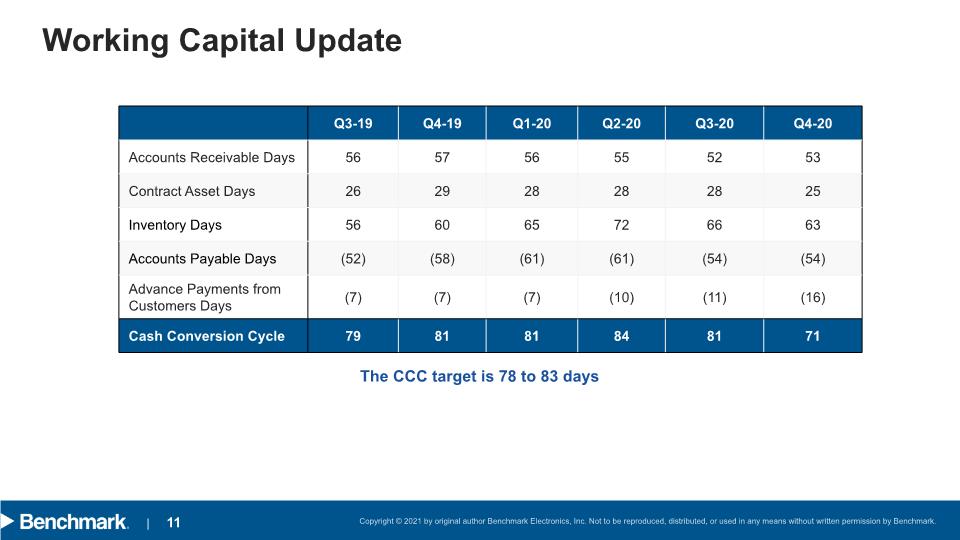

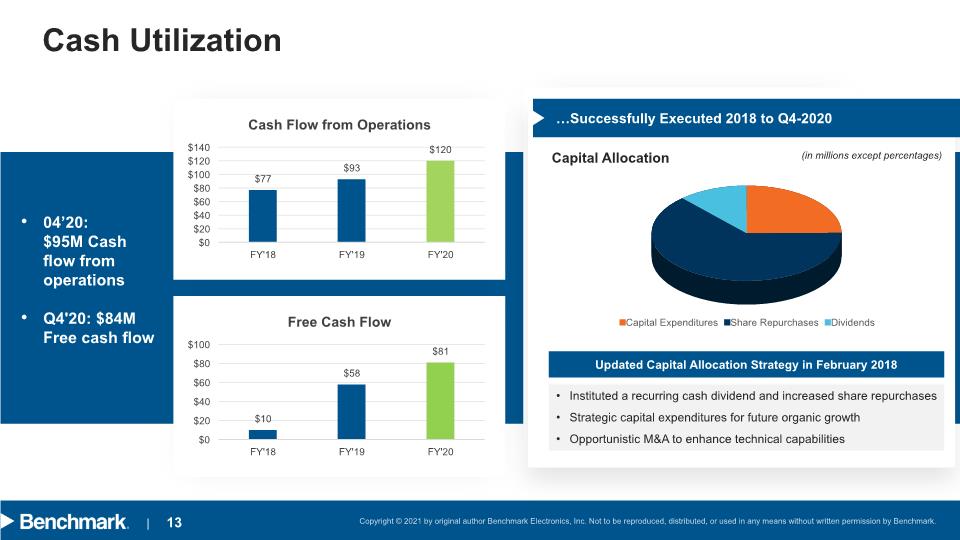

Q4-20 Overview Achieved revenue of $521 million Realized Non-GAAP gross margin of 9.6% and Non-GAAP operating margin of 3.4% Global facilities remain at near normal operating capacity Non-GAAP earnings per share of $0.34 Operating and free cash flow of $95 million and $84 million respectively Cash conversion cycle of 71 days

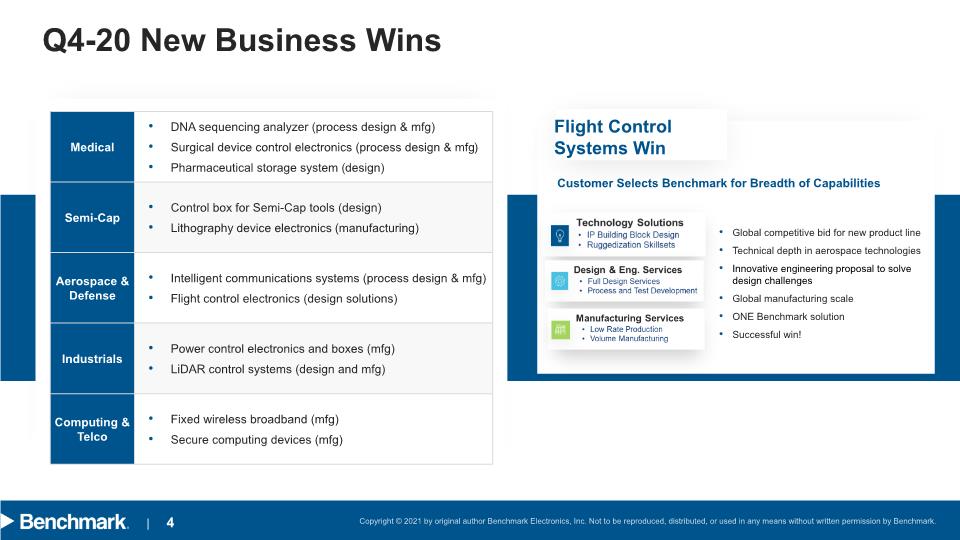

Q4-20 New Business Wins Flight Control Systems Win

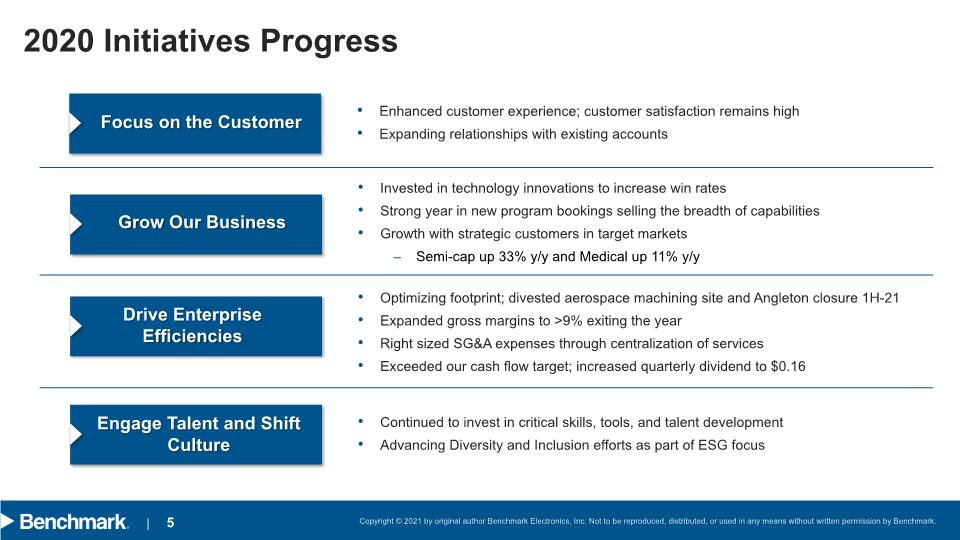

2020 Initiatives Progress Focus on the Customer Grow Our Business Drive Enterprise Efficiencies Engage Talent and Shift Culture Enhanced customer experience; customer satisfaction remains high Expanding relationships with existing accounts Invested in technology innovations to increase win rates Strong year in new program bookings selling the breadth of capabilities Growth with strategic customers in target markets Semi-cap up 33% y/y and Medical up 11% y/y Optimizing footprint; divested aerospace machining site and Angleton closure 1H-21 Expanded gross margins to >9% exiting the year Right sized SG&A expenses through centralization of services Exceeded our cash flow target; increased quarterly dividend to $0.16 Continued to invest in critical skills, tools, and talent development Advancing Diversity and Inclusion efforts as part of ESG focus

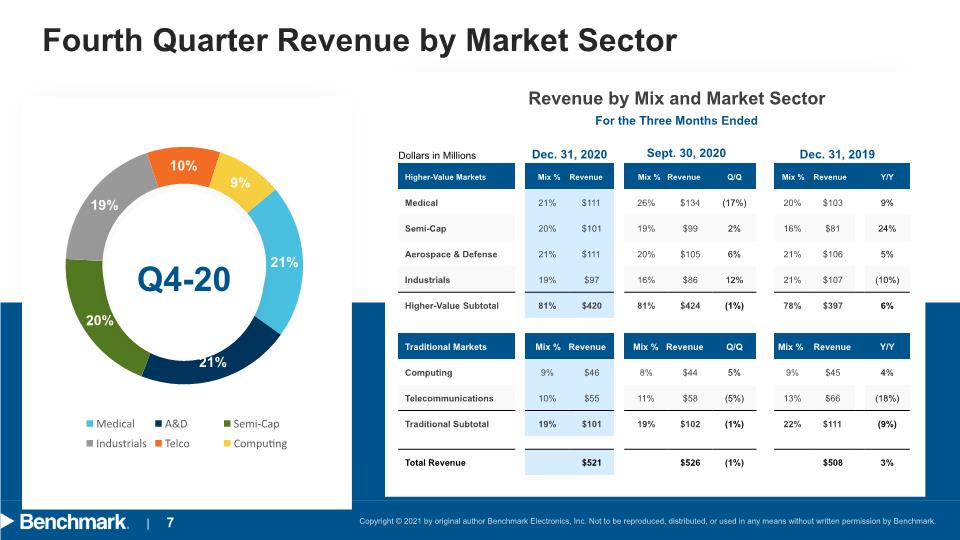

Fourth Quarter Revenue by Market Sector Q4-20 Dec. 31, 2020 Revenue by Mix and Market Sector Sept. 30, 2020 Dec. 31, 2019 For the Three Months Ended Dollars in Millions

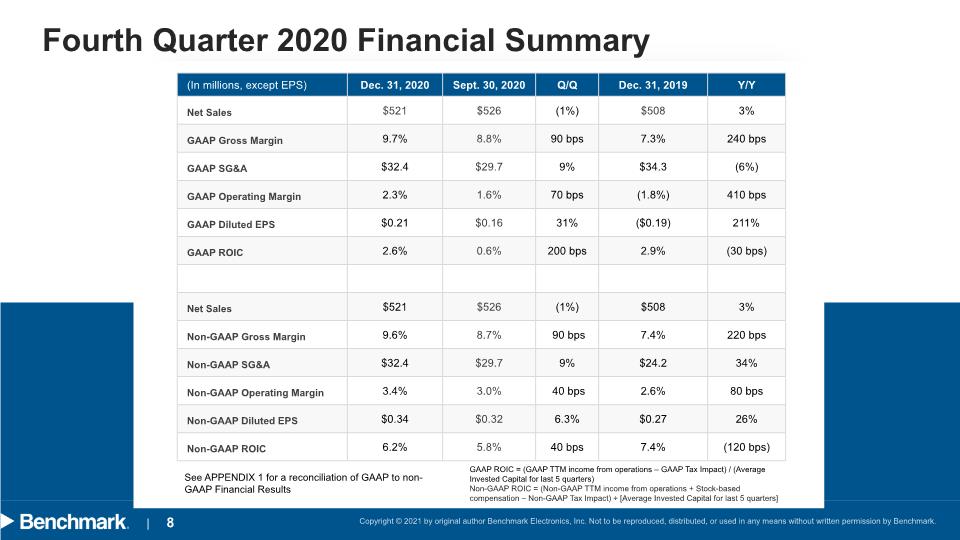

Fourth Quarter 2020 Financial Summary See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (Non-GAAP TTM income from operations + Stock-based compensation – Non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

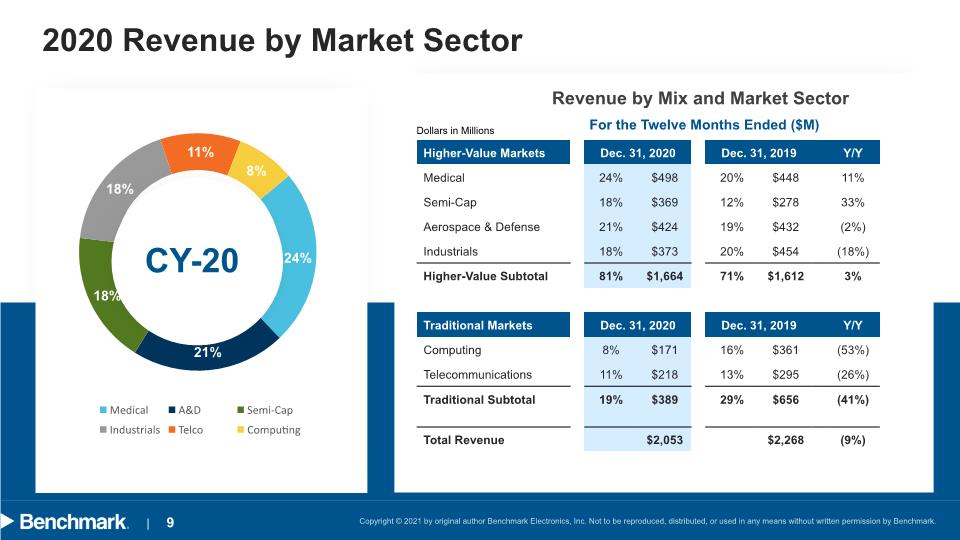

2020 Revenue by Market Sector CY-20 Revenue by Mix and Market Sector For the Twelve Months Ended ($M) Dollars in Millions

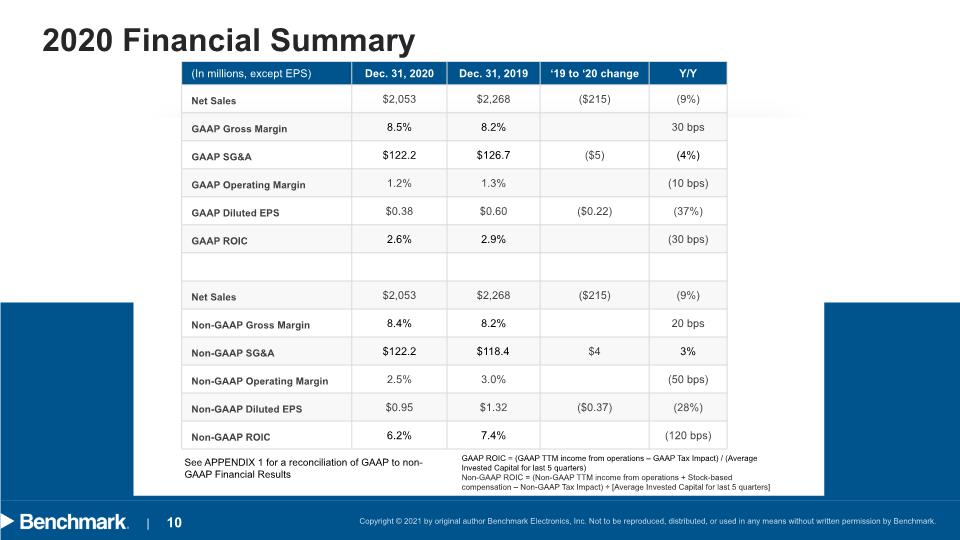

2020 Financial Summary See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (Non-GAAP TTM income from operations + Stock-based compensation – Non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

Working Capital Update The CCC target is 78 to 83 days

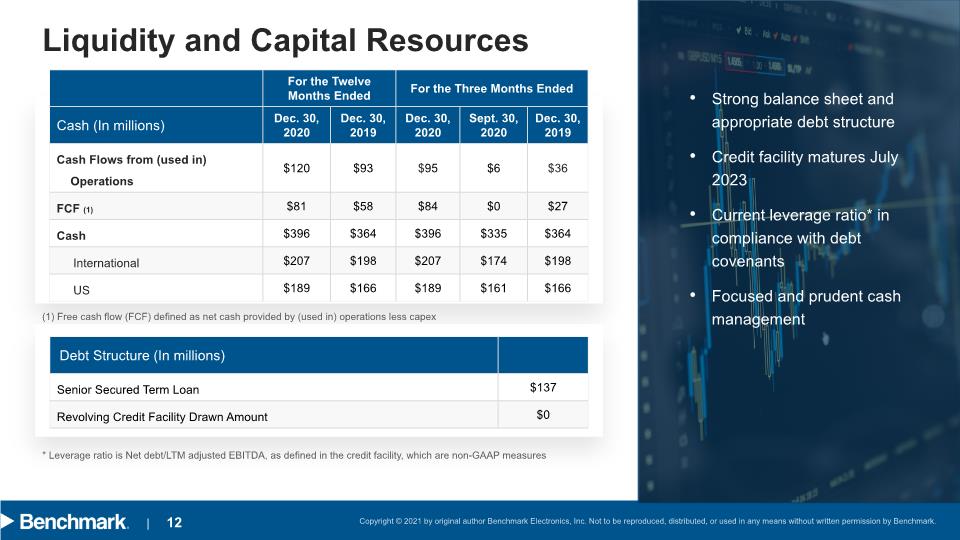

Liquidity and Capital Resources (1) Free cash flow (FCF) defined as net cash provided by (used in) operations less capex * Leverage ratio is Net debt/LTM adjusted EBITDA, as defined in the credit facility, which are non-GAAP measures Strong balance sheet and appropriate debt structure Credit facility matures July 2023 Current leverage ratio* in compliance with debt covenants Focused and prudent cash management

Cash Utilization Cash Flow from Operations Free Cash Flow Instituted a recurring cash dividend and increased share repurchases Strategic capital expenditures for future organic growth Opportunistic M&A to enhance technical capabilities Updated Capital Allocation Strategy in February 2018 (in millions except percentages) Capital Allocation

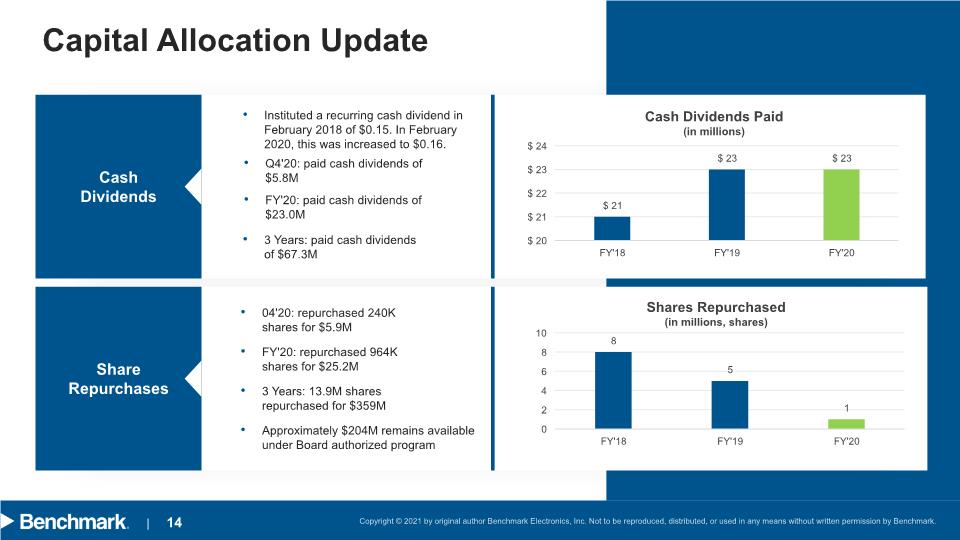

Capital Allocation Update Cash Dividends Share Repurchases Cash Dividends Paid (in millions) Shares Repurchased (in millions, shares)

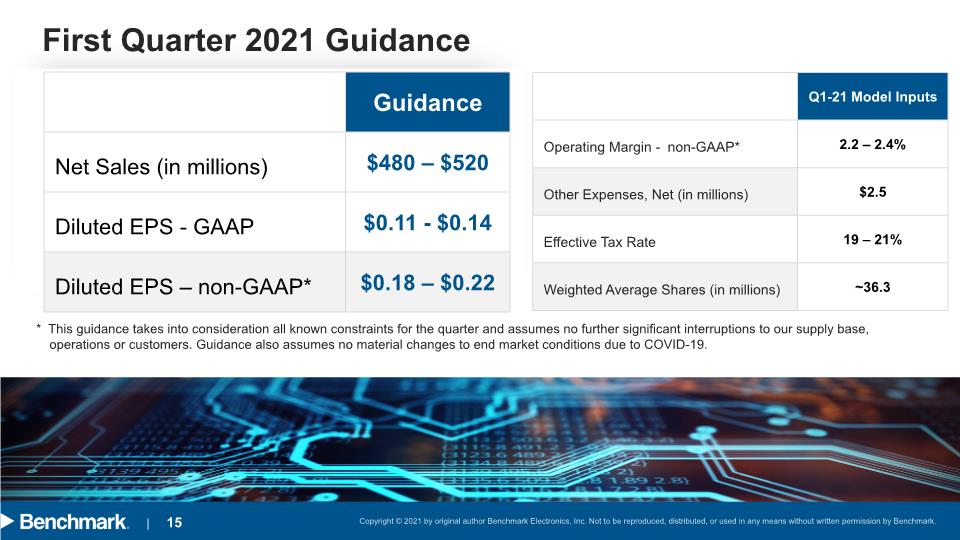

First Quarter 2021 Guidance * This guidance takes into consideration all known constraints for the quarter and assumes no further significant interruptions to our supply base, operations or customers. Guidance also assumes no material changes to end market conditions due to COVID-19.

2021 Goals and Initiatives Jeff Benck - CEO

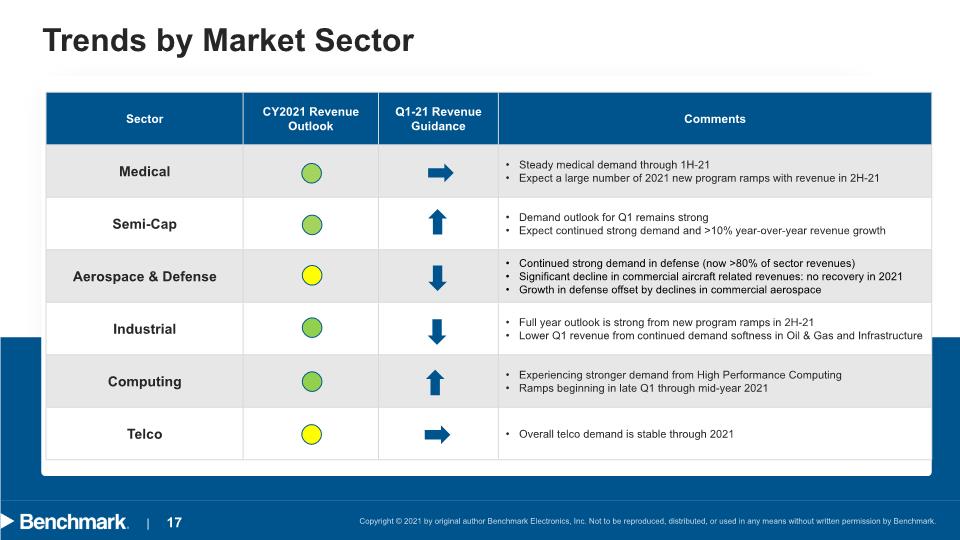

Trends by Market Sector

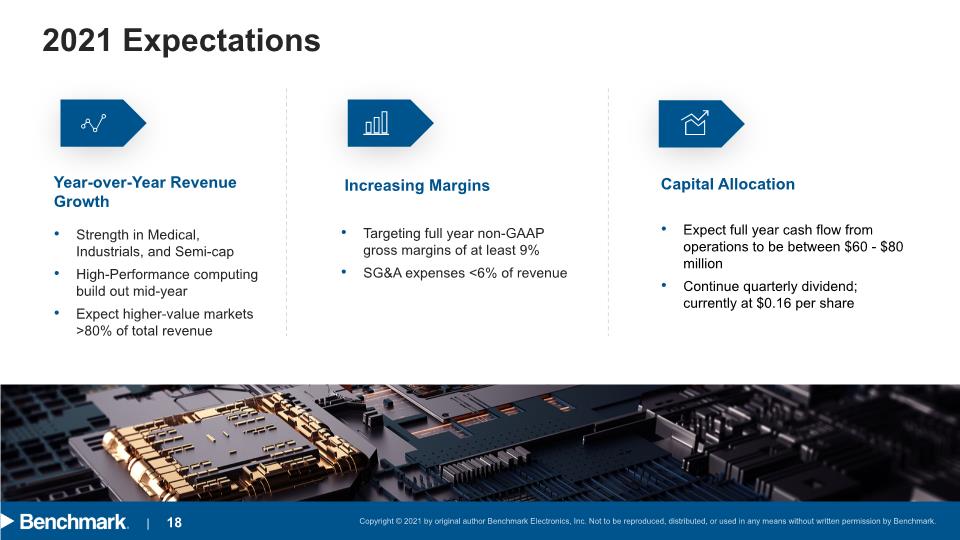

2021 Expectations Strength in Medical, Industrials, and Semi-cap High-Performance computing build out mid-year Expect higher-value markets >80% of total revenue Year-over-Year Revenue Growth

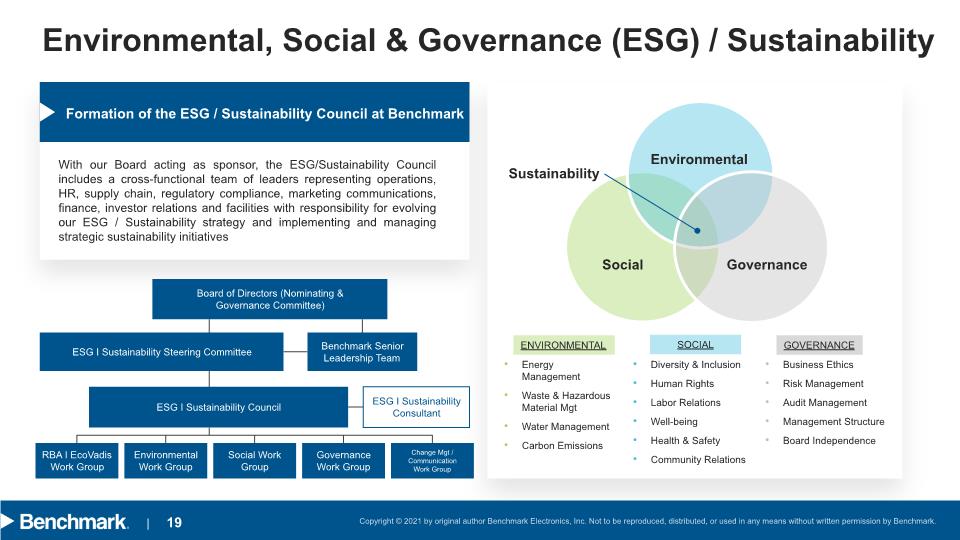

Environmental, Social & Governance (ESG) / Sustainability Formation of the ESG / Sustainability Council at Benchmark With our Board acting as sponsor, the ESG/Sustainability Council includes a cross-functional team of leaders representing operations, HR, supply chain, regulatory compliance, marketing communications, finance, investor relations and facilities with responsibility for evolving our ESG / Sustainability strategy and implementing and managing strategic sustainability initiatives Energy Management Waste & Hazardous Material Mgt Water Management Carbon Emissions Diversity & Inclusion Human Rights Labor Relations Well-being Health & Safety Community Relations Business Ethics Risk Management Audit Management Management Structure Board Independence Environmental Social Governance Sustainability Board of Directors (Nominating & Governance Committee) ESG I Sustainability Steering Committee Benchmark Senior Leadership Team ESG I Sustainability Council ESG I Sustainability Consultant RBA I EcoVadis Work Group EnvironmentalWork Group Social Work Group GovernanceWork Group Change Mgt / Communication Work Group ENVIRONMENTAL SOCIAL GOVERNANCE

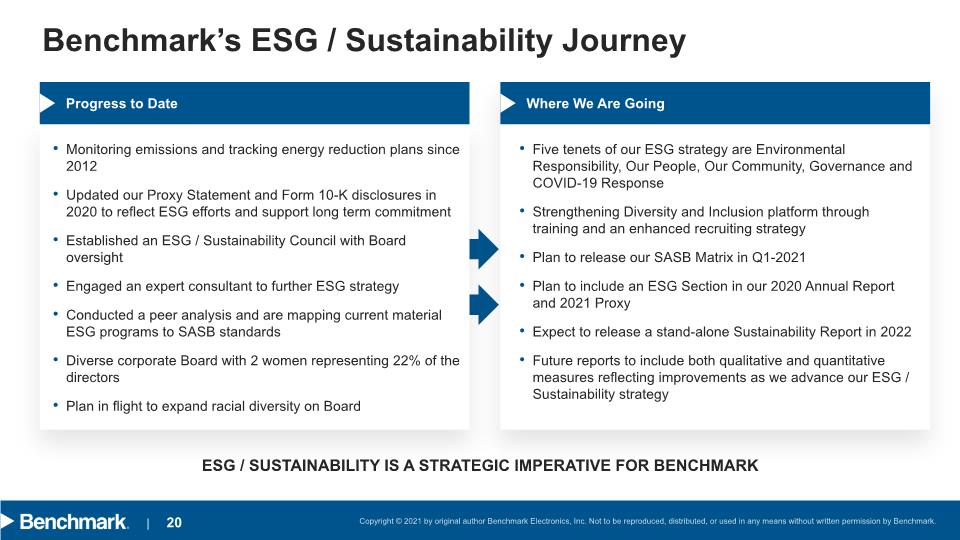

Benchmark’s ESG / Sustainability Journey Progress to Date Monitoring emissions and tracking energy reduction plans since 2012 Updated our Proxy Statement and Form 10-K disclosures in 2020 to reflect ESG efforts and support long term commitment Established an ESG / Sustainability Council with Board oversight Engaged an expert consultant to further ESG strategy Conducted a peer analysis and are mapping current material ESG programs to SASB standards Diverse corporate Board with 2 women representing 22% of the directors Plan in flight to expand racial diversity on Board Where We Are Going Five tenets of our ESG strategy are Environmental Responsibility, Our People, Our Community, Governance and COVID-19 Response Strengthening Diversity and Inclusion platform through training and an enhanced recruiting strategy Plan to release our SASB Matrix in Q1-2021 Plan to include an ESG Section in our 2020 Annual Report and 2021 Proxy Expect to release a stand-alone Sustainability Report in 2022 Future reports to include both qualitative and quantitative measures reflecting improvements as we advance our ESG / Sustainability strategy ESG / SUSTAINABILITY IS A STRATEGIC IMPERATIVE FOR BENCHMARK

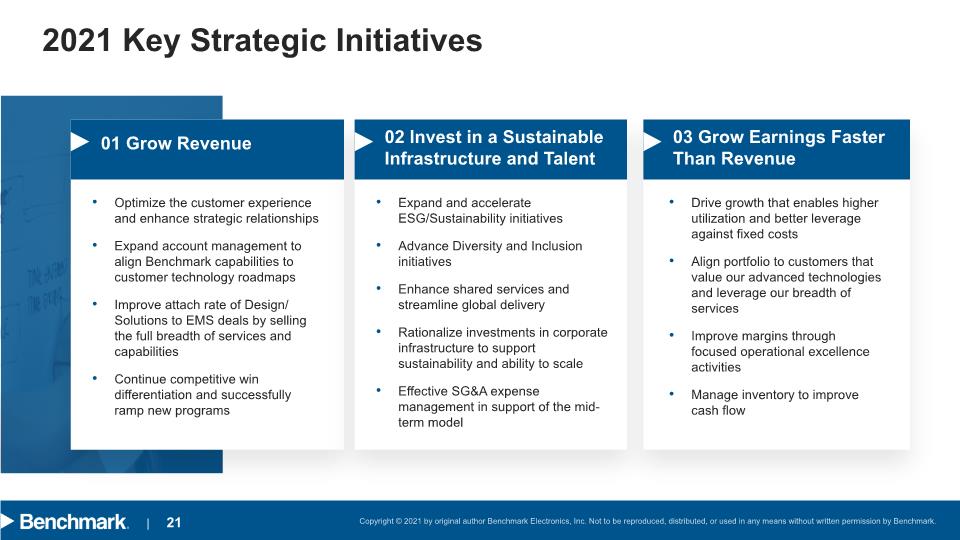

2021 Key Strategic Initiatives

Appendix

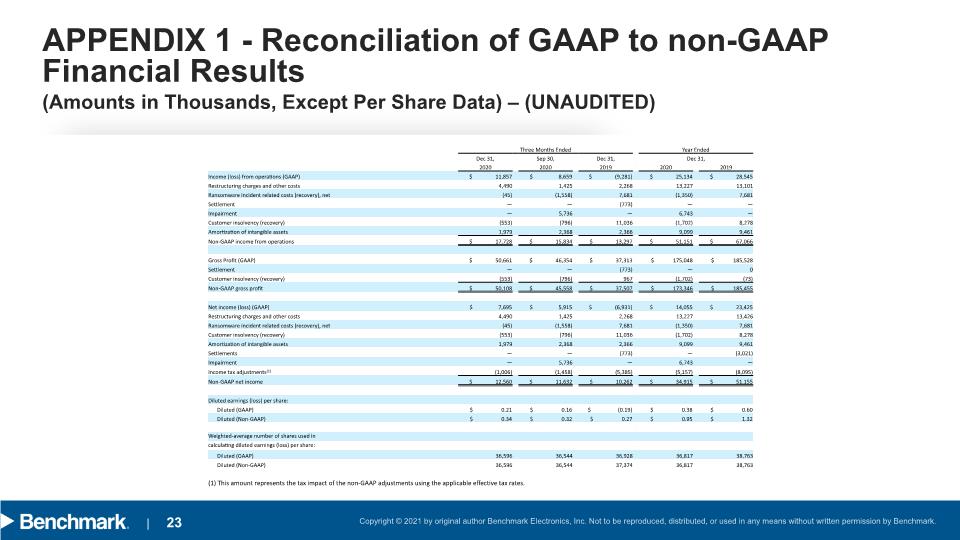

(Amounts in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results

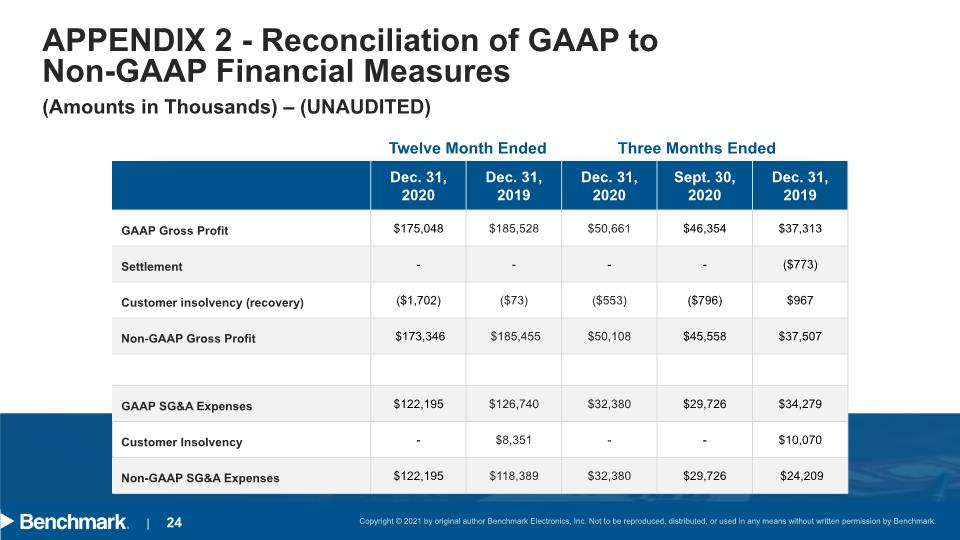

(Amounts in Thousands) – (UNAUDITED) APPENDIX 2 - Reconciliation of GAAP to Non-GAAP Financial Measures Twelve Month Ended Three Months Ended

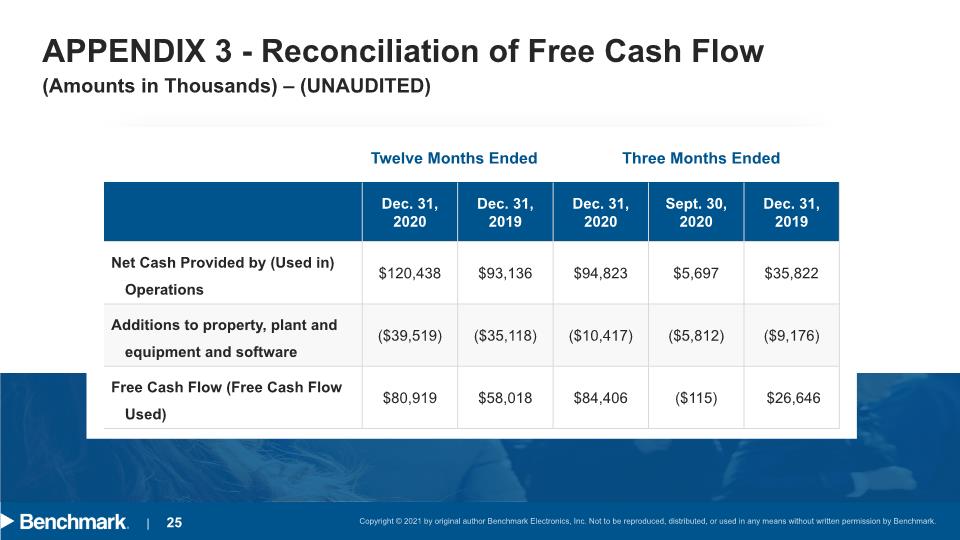

(Amounts in Thousands) – (UNAUDITED) APPENDIX 3 - Reconciliation of Free Cash Flow Twelve Months Ended Three Months Ended