Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ARROW ELECTRONICS INC | q42020pressreleaseex991.htm |

| 8-K - 8-K - ARROW ELECTRONICS INC | arw-20210204.htm |

Fourth Quarter 2020 investor.arrow.com CFO Commentary As reflected in our earnings release, there are a number of items that impact the comparability of our results with those in the trailing quarter and prior quarter of last year. The discussion of our results may exclude these items to give you a better sense of our operating results. As always, the operating information we provide to you should be used as a complement to GAAP numbers. For a complete reconciliation between our GAAP and non-GAAP results, please refer to our earnings release and the earnings reconciliation found at the end of this document. The following reported and non-GAAP information included in this CFO commentary is unaudited and should be read in conjunction with the company’s 2020 Annual Report on form 10-K as filed with the Securities and Exchange Commission. Full-year 2020 cash provided by operating activities of $1.36 billion.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 2 Record fourth- quarter sales, net income, and earnings per share on a diluted basis. Fourth-Quarter Summary Record fourth-quarter sales were above the high end of our prior expectation as demand for electronic components and information technology solutions strengthened. Arrow is continuing to help customers and suppliers solve complex multi-region supply chain challenges. Customers are choosing to do more business with Arrow to drive growth, reduce time to market for their products, and help securely capture valuable insights from their data. Higher sales and focused execution produced record fourth-quarter net income and earnings per share. During the fourth quarter, demand for electronic components increased in all three regions compared to the prior quarters of 2020. Demand was exceptionally strong in the Asia region where Arrow’s long-term efforts to gain scale have led sales to double over the last five years. Strong transportation demand continued in all regions, and nearly all key industries showed improvement. Operational controls helped operating margin increase year over year. For the enterprise computing solutions business, work and learn from home drove demand for infrastructure software and security solutions, resulting in sales that were above the midpoint of our prior expectation. Operating income increased year over year, and operating margin returned to the highest level since 2017, aided by a more favorable mix of products and solutions for margins. Proactive working capital and balance sheet management resulted in return on working capital and return on invested capital increasing year over year in both the fourth quarter and the full year. Cash flows from operating activities totaled $200 million for the quarter and $1.36 billion for the year. In 2020, cash flows were used to reduce debt by $715 million and return a record $475 million to shareholders through our share repurchase program. At the end of 2020, remaining repurchase authorization totaled approximately $463 million.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 3 P&L Highlights* Q4 2020 Y/Y Change Y/Y Change Adjusted for Wind Down & Currency Q/Q Change Sales $8,454 15% 13% 17% Gross Profit Margin 10.9% (30) bps (50) bps flat Operating Income $321 35% 25% 35% Operating Margin 3.8% 60 bps 40 bps 50 bps Non-GAAP Operating Income $336 18% 14% 37% Non-GAAP Operating Margin 4.0% 10 bps flat 60 bps Net Income $236 111% 60% 42% Diluted EPS $3.08 126% 72% 45% Non-GAAP Net Income $243 34% 28% 50% Non-GAAP Diluted EPS $3.17 44% 37% 52% Consolidated Overview Fourth Quarter 2020 * $ in millions, except per share data; may reflect rounding. • Consolidated sales were $8.45 billion – Above the high end of the prior expectation of $7.45-$8.05 billion – Changes in foreign currencies positively impacted sales growth by $161 million year over year – The prior sales expectation included an anticipated $110 million benefit to growth; the weakening of the U.S. dollar within the quarter resulted in an additional $51 million benefit • Consolidated gross profit margin was 10.9% – Down 30 basis points year over year due to a higher mix of Asia components sales and customer mix in Europe components partially offset by higher enterprise computing solutions gross margin from product and solution mix • Operating income margin was 3.8% and non-GAAP operating income margin was 4.0% – Operating expenses as a percentage of sales were 7.0%, down 70 basis points year over year – Non-GAAP operating expenses as a percentage of sales were 7.0%, down 40 basis points year over year • Interest and other expense, net was $32 million – Slightly below our prior expectation of $33 million

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 4 • Effective tax rate was 20.0%, and non-GAAP effective tax rate was 19.4% – Non-GAAP effective tax rate was below the prior expectation of 23.5% and the target long-term target range of 23% - 25% due to timing of discrete tax items • Diluted shares outstanding were 77 million – In line with the prior expectation • Diluted earnings per share were $3.08 – Above the prior expectation of $2.42 - $2.58 • Non-GAAP diluted earnings per share were $3.17 – Above the prior expectation of $2.57 - $2.73 – Changes in foreign currencies positively impacted earnings per share by approximately $.11 compared to the fourth quarter of 2019 – The prior earnings per share expectation included an anticipated $.07 million benefit to growth; the weakening of the U.S. dollar within the quarter resulted in an additional $.04 benefit A reconciliation of non-GAAP financial measures, including sales, sales for each segment and in each region, gross profit, operating income, income before income taxes, provision for income taxes, net income, net income attributable to shareholders, net income per share, return on working capital, and return on invested capital to GAAP financial measures is presented in the reconciliation tables included herein.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 5 $150 $165 $182 $204 $230 $172 $171 $177 $208 $236 GAAP Non-GAAP Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $100 $120 $140 $160 $180 $200 $220 $240 Components Global Global components fourth-quarter sales increased 25% year over year. Operating Income ($ in millions) • Fourth-quarter sales increased 25% year over year – Sales increased 23% year over year adjusted for changes in foreign currencies and for the wind down of the PC and mobility asset disposition business • Lead times increased year over year and increased slightly compared to the third quarter • Backlog increased year over year • Book-to-bill was above parity in all regions • Operating margin of 3.9% increased 70 basis points year over year • Non-GAAP operating margin of 4.0% increased 40 basis points year over year – Margins increased in Asia, Americas, and Europe year over year • Return on working capital increased year over year

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 6 • Fourth-quarter sales decreased 1% year over year – Sales were flat year over year adjusted for the wind down of the PC and mobility asset disposition business – Consumer products and industrial sales increased year over year – Computer/data processing, aerospace and defense, consumer and transportation sales increased significantly compared to the third quarter $1,645 $1,553 $1,489 $1,516 $1,625$1,626 $1,553 $1,489 $1,516 $1,625 GAAP Non-GAAP Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 Components Americas Sales ($ in millions) Americas components sales decreased 1% year over year.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 7 $1,905 $1,688 $2,114 $2,595 $2,935 Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 $2,600 $2,800 $3,000 Components Asia • Fourth-quarter sales increased 54% year over year – Sales increased 53% year over year adjusted for changes in foreign currencies – Record fourth-quarter sales – Earlier onset of the COVID-19 pandemic and a rapid return to manufacturing operations drove strong demand for electronic components – Transportation, wireless, and power management sales increased significantly year over year and compared to the third quarter Asia components sales increased 54% year over year. Sales ($ in millions)

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 8 $1,189 $1,310 $1,118 $1,197 $1,362 Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 Components Europe Europe components sales increased 15% year over year. • Fourth-quarter sales increased 15% year over year – Sales increased 7% year over year adjusted for changes in foreign currencies and for the wind down of the PC and mobility asset disposition business – Transportation and lighting sales increased year over year – Transportation increased significantly compared to the third quarter Sales ($ in millions)

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 9 $149 $42 $73 $83 $156$156 $45 $80 $85 $158 GAAP Non-GAAP Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $20 $40 $60 $80 $100 $120 $140 $160 $180 Enterprise Computing Solutions Global • Fourth-quarter sales decreased 3% year over year – Sales decreased 5% year over year adjusted for changes in foreign currencies • Billings increased at a low-single-digit rate year over year • Operating income increased 5% year over year – Non-GAAP operating income increased 2% year over year • Operating margin of 6.2% increased 50 basis points year over year; non-GAAP operating margin of 6.3% increased 30 basis points year over year • Return on working capital remains favorable Enterprise computing solutions operating income increased 5% year over year. Operating Income ($ in millions)

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 10 $1,640 $1,129 $1,223 $1,274 $1,484 Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $600 $750 $900 $1,050 $1,200 $1,350 $1,500 $1,650 $1,800 Enterprise Computing Solutions Americas Enterprise Computing Solutions Americas sales decreased 10% year over year. Sales ($ in millions) • Fourth-quarter sales decreased 10% year over year – Growth in infrastructure software across the portfolio, security, storage, and industry- standard servers year over year – Proprietary servers and networking decreased year over year

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 11 $959 $702 $662 $650 $1,047 Q4-'19 Q1-'20 Q2-'20 Q3-'20 Q4-'20 $400 $500 $600 $700 $800 $900 $1,000 $1,100 Enterprise Computing Solutions Europe • Fourth-quarter sales increased 9% year over year – Sales increased 2% year over year adjusted for changes in foreign currencies – Strong growth in services and industry- standard servers year over year – Growth in infrastructure software across the portfolio, security, storage, and networking year over year – Proprietary servers decreased year over year – Operating income increased year over year Enterprise Computing Solutions Europe sales increased 9% year over year. Sales ($ in millions)

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 12 • Consolidated full-year sales were flat year over year adjusted for the wind down of the PC and mobility asset disposition business – Sales decreased 1% year over year as reported • GAAP gross margin decreased 30 basis points year over year; non-GAAP gross margin decreased 50 basis points year over year – Gross margin decreased principally due to higher mix of sales from the Asia components region • Reported operating income margin increased 270 basis points due to the wind down of the PC and mobility asset disposition business and an impairment of goodwill and other long-lived assets in 2019 by global components in the Americas and Asia-Pacific regions – Non-GAAP operating income margin decreased 40 basis points year over year – Lower operating expenses partially offset lower gross profit P&L Highlights* 2020 Y/Y Change Y/Y Change Adjusted for Wind Down, Dispositions, & Currency Sales $28,673 (1)% flat Gross Profit Margin 11.1% (30) bps (40) bps Non-GAAP Gross Profit Margin 11.1% (50) bps (50) bps Operating Income $895 731% 216% Operating Margin 3.1% 270 bps 210 bps Non-GAAP Operating Income $937 (11)% (12)% Non-GAAP Operating Margin 3.3% (40) bps (40) bps Net Income $584 NM NM Diluted EPS $7.43 NM NM Non-GAAP Net Income $610 (4)% (6)% Non-GAAP Diluted EPS $7.75 3% 1% Consolidated Overview Full-Year 2020 * $ in millions, except per share data; may reflect rounding • Interest and other expense, net was $137 million – Decreased $67 million year over year primarily due to lower debt balances and lower interest rates • Effective tax rate was 22.8% • Non-GAAP effective tax rate was 22.9% – Slightly below our long-term target range of 23% to 25% due to the timing of discrete items that were recognized during the fourth quarter

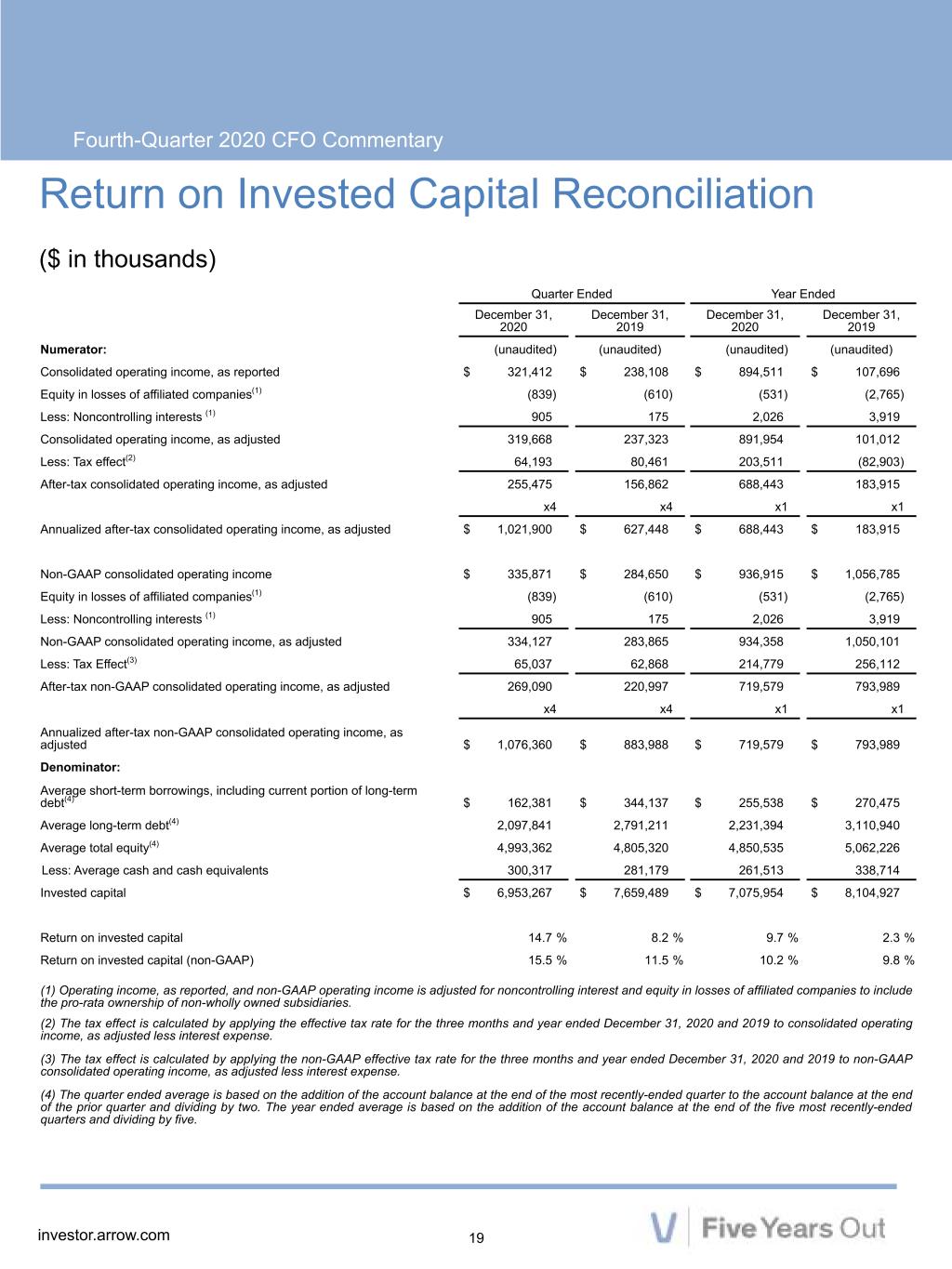

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 13 Repurchased approximately $100 million of stock in the fourth quarter, bringing total cash returned to shareholders in 2020 to approximately $475 million. Cash Flow from Operations Cash flow from operating activities was $200 million in the fourth quarter and was $1.36 billion in 2020. Working Capital The company reports return on working capital ("ROWC") and ROWC (non-GAAP) to provide investors an additional method for assessing working capital. The company uses ROWC to measure economic returns to help the company evaluate the effectiveness of investments in the inventories we chose to buy and the business arrangements we have with our customers and suppliers. ROWC was 28.2% in the fourth quarter, up 880 basis points year over year, and was 19.7% in 2020, up 1760 basis points from 2019. ROWC (non-GAAP) was 29.5% in the fourth quarter, up 630 basis points year over year, and was 20.6% in 2020, up 40 basis points from 2019. Return on Invested Capital The company reports return on invested capital ("ROIC") and ROIC (non-GAAP) to provide investors an additional method for assessing operating income. Among other uses, the company uses ROIC to measure economic returns relative to our cost of capital in evaluating overall effectiveness of our business strategy. ROIC was 14.7% in the fourth quarter, up 650 basis points year over year, and was 9.7% in 2020, up 740 basis points from 2019. ROIC (non-GAAP) was 15.5% in the fourth quarter, up 400 basis points year over year, and was 10.2% in 2020, up 40 basis points from 2019. Share Buyback We repurchased approximately 1.1 million shares for $100 million in the fourth quarter. Total cash returned to shareholders in 2020 was approximately $475 million. Debt and Liquidity Net debt totaled $1.88 billion. Total liquidity was $3.6 billion when including cash of $374 million.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 14 Arrow Electronics Outlook Guidance We are expecting the average USD-to-Euro exchange rate for the first quarter of 2021 to be $1.23 to €1 compared to $1.10 to €1 in the first quarter of 2020. We estimate changes in foreign currencies to have positive impacts on growth of approximately $235 million on sales, and $.12 on earnings per share on a diluted basis compared to the first quarter of 2020. First-Quarter 2021 Guidance Consolidated Sales $7.625 billion to $8.225 billion Global Components $5.825 billion to $6.125 billion Global ECS $1.8 billion to $2.1 billion Diluted Earnings Per Share* $2.02 to $2.18 Non-GAAP Diluted Earnings Per Share* $2.17 to $2.33 Interest and other expense, net $31 million Diluted shares outstanding 76 million * Assumes an average tax rate of approximately 24.5% compared to the 23% to 25% long-term target range. First-Quarter 2021 Guidance Reconciliation Reported GAAP measure Intangible amortization expense Restructuring & integration charges Non-GAAP measure Net income per diluted share $2.02 to $2.18 $.09 $.06 $2.17 to $2.33 Quarter Closing Dates Beginning and ending dates may impact comparisons to prior periods Quarter Closing Dates First Second Third Fourth 2020 Mar. 28 Jun. 27 Sep. 26 Dec. 31 2021 Apr. 3 Jul. 3 Oct. 2 Dec. 31

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 15 Risk Factors The discussion of the company’s business and operations should be read together with the risk factors contained in Item 1A of its 2020 Annual Report on Form 10-K, filed with the Securities and Exchange Commission, which describe various risks and uncertainties to which the company is or may become subject. If any of the described events occur, the company’s business, results of operations, financial condition, liquidity, or access to the capital markets could be materially adversely affected. Information Relating to Forward-Looking Statements This press release includes “forward-looking” statements, as the term is defined under the federal securities laws, including but not limited to statements regarding: Arrow’s future financial performance, including its outlook on financial results for the first quarter of fiscal 2021, such as sales, net income per diluted share, non-GAAP net income per diluted share, average tax rate, average diluted shares outstanding, interest expense, average USD-to-Euro exchange rate, impact to sales due to changes in foreign currencies, intangible amortization expense per diluted share, restructuring & integration charges per diluted share, and expectation regarding market demand. These forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which could cause actual results or facts to differ materially from such statements for a variety of reasons, including, but not limited to: potential adverse effects of the ongoing global COVID-19 coronavirus pandemic, including actions taken to contain or treat COVID-19, the speed and effectiveness of COVID-19 vaccine and treatment developments and deployment, potential mutations of COVID-19, industry conditions, changes in product supply, pricing and customer demand, competition, other vagaries in the global components and global enterprise computing solutions markets, changes in relationships with key suppliers, increased profit margin pressure, changes in legal, tax and regulatory matters, non-compliance with certain regulations, such as export, anti-trust, and anti-corruption laws, foreign tax and other loss contingencies, and the company's ability to generate cash flow. For a further discussion of these and other factors that could cause the company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the company's Form 10-K and subsequent filings made with the Securities and Exchange Commission. Shareholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The company undertakes no obligation to update publicly or revise any of the forward-looking statements.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 16 Certain Non-GAAP Financial Information The company believes that such non-GAAP financial information is useful to investors to assist in assessing and understanding the company’s operating performance. In addition to disclosing financial results that are determined in accordance with accounting principles generally accepted in the United States (“GAAP”), the company also provides certain non-GAAP financial information relating to sales, operating income, net income attributable to shareholders, and net income per basic and diluted share. The company provides non-GAAP sales, sales for each segment and in each region, gross profit, operating income, income before income taxes, provision for income taxes, net income, net income attributable to shareholders, net income per share on a diluted basis, return on working capital, and return on invested capital which are GAAP measures adjusted for the impact of changes in foreign currencies (referred to as "changes in foreign currencies") by re-translating prior-period results at current-period foreign exchange rates, the impact of dispositions by adjusting the company’s operating results for businesses disposed, as if the dispositions had occurred at the beginning of the earliest period presented (referred to as "dispositions"), the impact of the company’s personal computer and mobility asset disposition business (referred to as "wind down"), the impact of inventory write-downs and recoveries related to the digital business (referred to as “digital inventory write-downs, net”), and the impact of notes receivable reserves and recoveries and inventory write-downs related to the AFS business (referred to as “AFS notes receivable reserves and recoveries” and “AFS inventory write-downs”, respectively). Non-GAAP operating income excludes identifiable intangible asset amortization, restructuring, integration, and other charges, loss on disposition of businesses, net, AFS notes receivable reserves and recoveries and inventory write-downs, digital inventory write-downs, net, the impact of non-cash charges related to goodwill, trade names, and long-lived assets, and the impact of wind down. Net income attributable to shareholders, and net income per basic and diluted share as adjusted to exclude identifiable intangible asset amortization, restructuring, integration, and other charges, loss on disposition of businesses, net, AFS notes receivable reserves and recoveries and inventory write- downs, digital inventory write-downs, net, gains and losses on investments, net, the impact of non-cash charges related to goodwill, trade names, and long-lived assets, certain tax adjustments, pension settlement gain (loss) and the impact of wind down. A reconciliation of the company’s non-GAAP financial information to GAAP is set forth in the tables below. Management believes that providing this additional information is useful to the reader, as a supplement to the GAAP measures, to better assess and understand the company's operating performance, especially when comparing results with previous periods. Management typically monitors these non-GAAP measures in addition to GAAP results to understand and compare operating results across accounting periods for forecasting purposes, operating plans, and evaluating our financial performance. However, analysis of results on a non-GAAP basis should be used as a complement to, and in conjunction with, data presented in accordance with GAAP.

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 17 Three months ended December 31, 2020 Reported GAAP measure Intangible amortization expense Restructuring & Integration charges AFS Reserves & Recoveries Digital Write Downs & Recoveries Impairments Impact of Wind Down Non-recurring tax items Other(1) Non-GAAP measure Sales $ 8,454,192 $ — $ — $ — $ — $ — $ — $ — $ — $ 8,454,192 Gross Profit 923,686 — — — — — (33) — — 923,653 Operating income 321,412 9,376 6,340 (840) — — (417) — — 335,871 Income before income taxes 296,318 9,376 6,340 (840) — — (412) — (8,531) 302,251 Provision for income taxes 59,342 2,405 (918) (201) — — 102 — (2,053) 58,677 Consolidated net income 236,976 6,971 7,258 (639) — — (514) — (6,478) 243,574 Noncontrolling interests 905 148 — — — — — — — 1,053 Net income attributable to shareholders $ 236,071 $ 6,823 $ 7,258 $ (639) $ — $ — $ (514) $ — $ (6,478) $ 242,521 Net income per diluted share(7) $ 3.08 $ 0.09 $ 0.09 $ (0.01) $ — $ — $ (0.01) $ — $ (0.08) $ 3.17 Effective tax rate 20.0 % 19.4 % Three months ended December 31, 2019 Reported GAAP measure Intangible amortization expense(2) Restructuring & Integration charges(2) AFS Reserves & Recoveries Digital Write Downs & Recoveries Impairments Impact of Wind Down(2) Non-recurring tax items(3) Other(4) Non-GAAP measure Sales $ 7,338,190 $ — $ — $ — $ — $ — $ (19,375) $ — $ — $ 7,318,815 Gross Profit 822,943 — — — 1,117 — 5,388 — — 829,448 Operating income 238,108 14,311 16,350 2,850 1,117 — 10,912 — 1,002 284,650 Income before income taxes 169,648 14,311 16,350 2,850 1,117 — 10,942 — 17,919 233,137 Provision for income taxes 57,460 4,050 3,042 607 156 — (18,380) 1,806 2,700 51,441 Consolidated net income 112,188 10,261 13,308 2,243 961 — 29,322 (1,806) 15,219 181,696 Noncontrolling interests 175 138 — — — — — — — 313 Net income attributable to shareholders $ 112,013 $ 10,123 $ 13,308 $ 2,243 $ 961 $ — $ 29,322 $ (1,806) $ 15,219 $ 181,383 Net income per diluted share(7) $ 1.36 $ 0.12 $ 0.16 $ 0.03 $ 0.01 $ — $ 0.36 $ (0.02) $ 0.18 $ 2.20 Effective tax rate 33.9 % 22.1 % Three months ended September 26, 2020 Reported GAAP measure Intangible amortization expense Restructuring & Integration credits AFS Reserves & Recoveries Digital Write Downs & Recoveries Impairments(5 ) Impact of wind down Non-recurring tax items Other(6) Non-GAAP measure Sales $ 7,231,260 $ — $ — $ — $ — $ — $ — $ — $ — $ 7,231,260 Gross Profit 788,590 — — — — — (475) — — 788,115 Operating income 238,182 9,352 (2,840) (233) — 2,305 (2,487) — — 244,279 Income before income taxes 211,103 9,352 (2,840) (233) — 2,305 (2,478) — (4,495) 212,714 Provision for income taxes 44,707 2,396 (665) (56) — 556 (583) 4,887 (1,090) 50,152 Consolidated net income 166,396 6,956 (2,175) (177) — 1,749 (1,895) (4,887) (3,405) 162,562 Noncontrolling interests 336 146 — — — — — — — 482 Net income attributable to shareholders $ 166,060 $ 6,810 $ (2,175) $ (177) $ — $ 1,749 $ (1,895) $ (4,887) $ (3,405) $ 162,080 Net income per diluted share(7) $ 2.13 $ 0.09 $ (0.03) $ — $ — $ 0.02 $ (0.02) $ (0.06) $ (0.04) $ 2.08 Effective tax rate 21.2 % 23.6 % (1)Other includes gain on investments, net. (2)Amounts for restructuring, integration, and other charges, identifiable intangible asset amortization, loss on disposition of businesses, net, certain tax adjustments, and impairments related to the personal computer and mobility asset disposition business are included in “impact of wind down” above. (3)Includes income tax expense related to legislation changes and other non-recurring tax adjustments. (4)Other includes loss on disposition of businesses, net, gain on investments, net, interest related to uncertain tax position related to legislation changes, and pension settlement loss. (5)Impairments includes $2,305 in impairment charges related to various other long-lived assets unrelated to the personal computer and mobility asset disposition business. (6) Other includes gain on investments, net and pension settlement gain. (7)The sum of the components for non-GAAP diluted EPS may not agree to totals, as presented, due to rounding. Earnings Reconciliation ($ in thousands, except per share data)

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 18 Quarter Ended Year Ended December 31, 2020 December 31, 2019 December 31, 2020 December 31, 2019 Numerator: (unaudited) (unaudited) (unaudited) (unaudited) Consolidated operating income, as reported $ 321,412 $ 238,108 $ 894,511 $ 107,696 x4 x4 x1 x1 Annualized consolidated operating income, as reported $ 1,285,648 $ 952,432 $ 894,511 $ 107,696 Non-GAAP consolidated operating income $ 335,871 $ 284,650 $ 936,915 $ 1,056,785 x4 x4 x1 x1 Annualized non-GAAP consolidated operating income $ 1,343,484 $ 1,138,600 $ 936,915 $ 1,056,785 Denominator: Accounts receivable, net(1) $ 9,205,343 $ 8,482,687 $ 8,283,552 $ 8,229,824 Inventories(1) 3,287,308 3,477,120 3,351,088 3,638,159 Less: Accounts payable(1) 7,937,889 7,046,221 7,092,575 6,627,807 Working capital $ 4,554,762 $ 4,913,586 $ 4,542,065 $ 5,240,176 Return on working capital 28.2 % 19.4 % 19.7 % 2.1 % Return on working capital (non-GAAP) 29.5 % 23.2 % 20.6 % 20.2 % (1) The year ended balance is an average balance based on the addition of the account balance at the end of the five most recently-ended quarters and dividing by five. Return on Working Capital Reconciliation ($ in thousands)

investor.arrow.com Fourth-Quarter 2020 CFO Commentary 19 Quarter Ended Year Ended December 31, 2020 December 31, 2019 December 31, 2020 December 31, 2019 Numerator: (unaudited) (unaudited) (unaudited) (unaudited) Consolidated operating income, as reported $ 321,412 $ 238,108 $ 894,511 $ 107,696 Equity in losses of affiliated companies(1) (839) (610) (531) (2,765) Less: Noncontrolling interests (1) 905 175 2,026 3,919 Consolidated operating income, as adjusted 319,668 237,323 891,954 101,012 Less: Tax effect(2) 64,193 80,461 203,511 (82,903) After-tax consolidated operating income, as adjusted 255,475 156,862 688,443 183,915 x4 x4 x1 x1 Annualized after-tax consolidated operating income, as adjusted $ 1,021,900 $ 627,448 $ 688,443 $ 183,915 Non-GAAP consolidated operating income $ 335,871 $ 284,650 $ 936,915 $ 1,056,785 Equity in losses of affiliated companies(1) (839) (610) (531) (2,765) Less: Noncontrolling interests (1) 905 175 2,026 3,919 Non-GAAP consolidated operating income, as adjusted 334,127 283,865 934,358 1,050,101 Less: Tax Effect(3) 65,037 62,868 214,779 256,112 After-tax non-GAAP consolidated operating income, as adjusted 269,090 220,997 719,579 793,989 x4 x4 x1 x1 Annualized after-tax non-GAAP consolidated operating income, as adjusted $ 1,076,360 $ 883,988 $ 719,579 $ 793,989 Denominator: Average short-term borrowings, including current portion of long-term debt(4) $ 162,381 $ 344,137 $ 255,538 $ 270,475 Average long-term debt(4) 2,097,841 2,791,211 2,231,394 3,110,940 Average total equity(4) 4,993,362 4,805,320 4,850,535 5,062,226 Less: Average cash and cash equivalents 300,317 281,179 261,513 338,714 Invested capital $ 6,953,267 $ 7,659,489 $ 7,075,954 $ 8,104,927 Return on invested capital 14.7 % 8.2 % 9.7 % 2.3 % Return on invested capital (non-GAAP) 15.5 % 11.5 % 10.2 % 9.8 % (1) Operating income, as reported, and non-GAAP operating income is adjusted for noncontrolling interest and equity in losses of affiliated companies to include the pro-rata ownership of non-wholly owned subsidiaries. (2) The tax effect is calculated by applying the effective tax rate for the three months and year ended December 31, 2020 and 2019 to consolidated operating income, as adjusted less interest expense. (3) The tax effect is calculated by applying the non-GAAP effective tax rate for the three months and year ended December 31, 2020 and 2019 to non-GAAP consolidated operating income, as adjusted less interest expense. (4) The quarter ended average is based on the addition of the account balance at the end of the most recently-ended quarter to the account balance at the end of the prior quarter and dividing by two. The year ended average is based on the addition of the account balance at the end of the five most recently-ended quarters and dividing by five. Return on Invested Capital Reconciliation ($ in thousands)