Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 PRESS RELEASE - Priority Technology Holdings, Inc. | prthagppressrelease2-3x202.htm |

| 8-K - 8-K - Priority Technology Holdings, Inc. | prth-20210203.htm |

A.G.P. Technology Conference February 4, 2021 P R IO R IT Y T E C H N O L O G Y H O L D IN G S

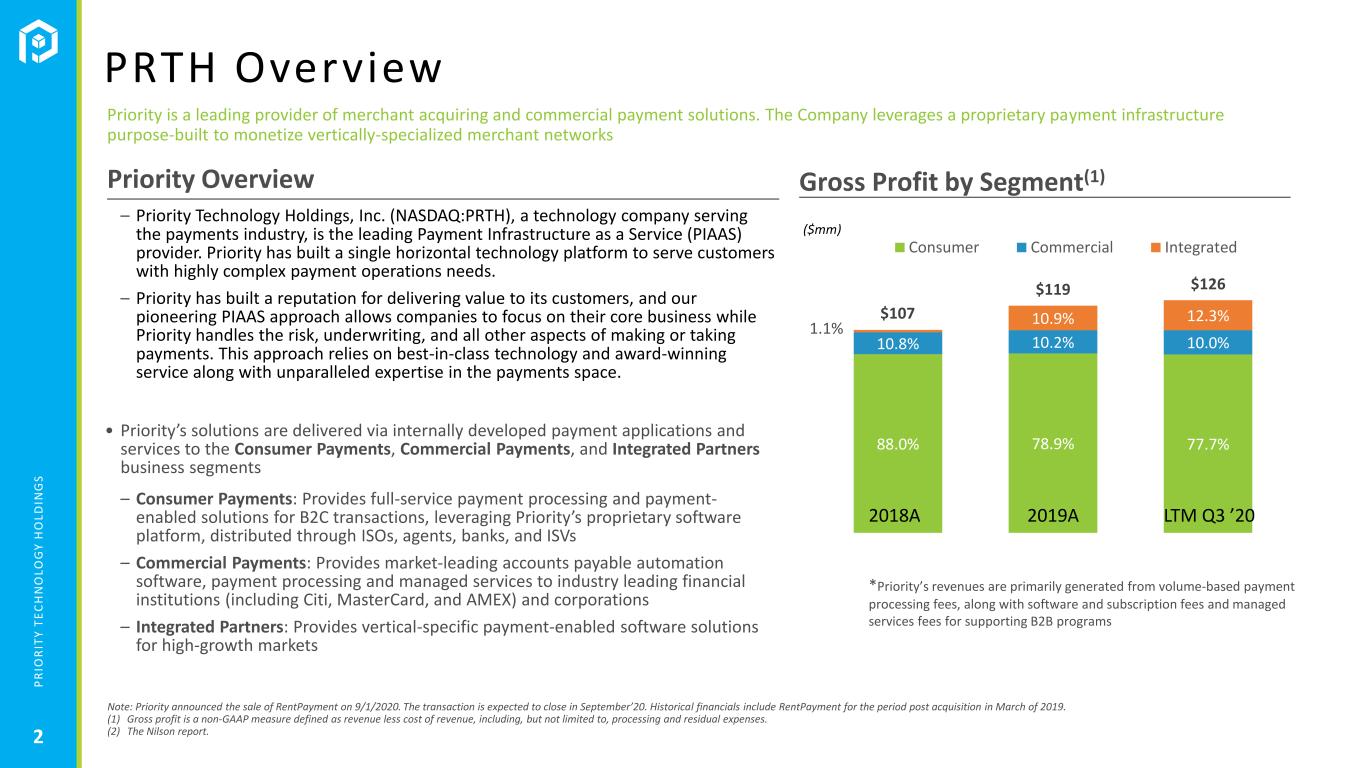

P R IO R IT Y T E C H N O L O G Y H O L D IN G S 88.0% 78.9% 77.7% 10.8% 10.2% 10.0% 1.1% 10.9% 12.3%$107 $119 $126 Consumer Commercial Integrated Priority is a leading provider of merchant acquiring and commercial payment solutions. The Company leverages a proprietary payment infrastructure purpose-built to monetize vertically-specialized merchant networks – Priority Technology Holdings, Inc. (NASDAQ:PRTH), a technology company serving the payments industry, is the leading Payment Infrastructure as a Service (PIAAS) provider. Priority has built a single horizontal technology platform to serve customers with highly complex payment operations needs. – Priority has built a reputation for delivering value to its customers, and our pioneering PIAAS approach allows companies to focus on their core business while Priority handles the risk, underwriting, and all other aspects of making or taking payments. This approach relies on best-in-class technology and award-winning service along with unparalleled expertise in the payments space. • Priority’s solutions are delivered via internally developed payment applications and services to the Consumer Payments, Commercial Payments, and Integrated Partners business segments – Consumer Payments: Provides full-service payment processing and payment- enabled solutions for B2C transactions, leveraging Priority’s proprietary software platform, distributed through ISOs, agents, banks, and ISVs – Commercial Payments: Provides market-leading accounts payable automation software, payment processing and managed services to industry leading financial institutions (including Citi, MasterCard, and AMEX) and corporations – Integrated Partners: Provides vertical-specific payment-enabled software solutions for high-growth markets Priority Overview PRTH Overview ($mm) Gross Profit by Segment(1) Note: Priority announced the sale of RentPayment on 9/1/2020. The transaction is expected to close in September’20. Historical financials include RentPayment for the period post acquisition in March of 2019. (1) Gross profit is a non-GAAP measure defined as revenue less cost of revenue, including, but not limited to, processing and residual expenses. (2) The Nilson report. 2018A 2019A LTM Q3 ’20 *Priority’s revenues are primarily generated from volume-based payment processing fees, along with software and subscription fees and managed services fees for supporting B2B programs 2

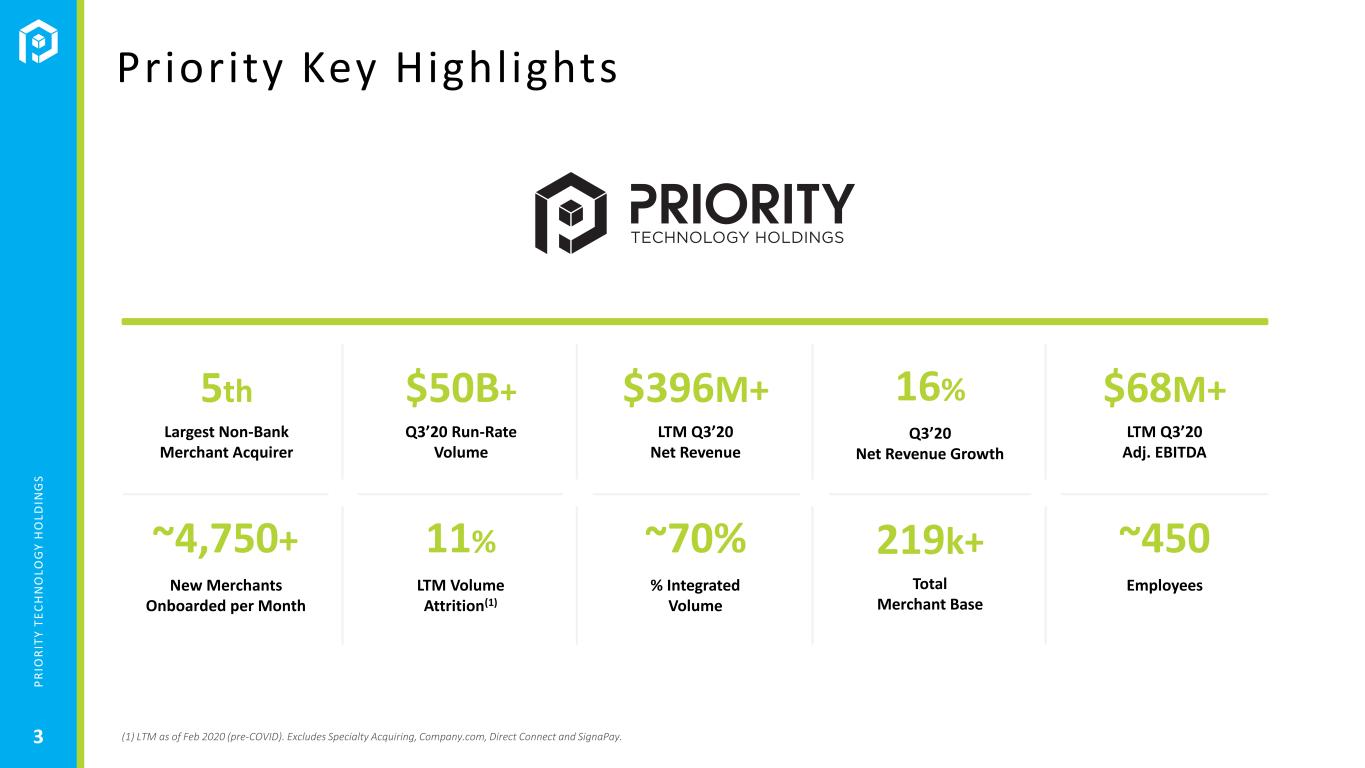

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Priority Key Highlights ~70% % Integrated Volume $68M+ LTM Q3’20 Adj. EBITDA 16% Q3’20 Net Revenue Growth 11% LTM Volume Attrition(1) $396M+ LTM Q3’20 Net Revenue 5th Largest Non-Bank Merchant Acquirer ~450 Employees 219k+ Total Merchant Base $50B+ Q3’20 Run-Rate Volume New Merchants Onboarded per Month ~4,750+ (1) LTM as of Feb 2020 (pre-COVID). Excludes Specialty Acquiring, Company.com, Direct Connect and SignaPay. P R IO R IT Y T E C H N O L O G Y H O L D IN G S 3

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Priority’s purpose-built payment technology and operating platform is designed to monetize vertically focused merchant networks Infrastructure Resource Group Operations Resource Group Technology Resource Group Business Resource Group Priority Enterprise Overview Curated Cloud Infrastructure Vortex.Cloud Enterprise Operating System Vortex.EOS Enterprise CRM / Data Management Vortex.Connect Resellers FIs ISVs & VARs Monetizing Powerful Distribution Networks Real Estate Healthcare Hospitality Consumer Finance Commercial Payments SMB Payments Vertical Software / Payments Leveraging Back-End Payment Processors, Bank Sponsors and Networks BIN Sponsors 4 P R IO R IT Y T E C H N O L O G Y H O L D IN G S

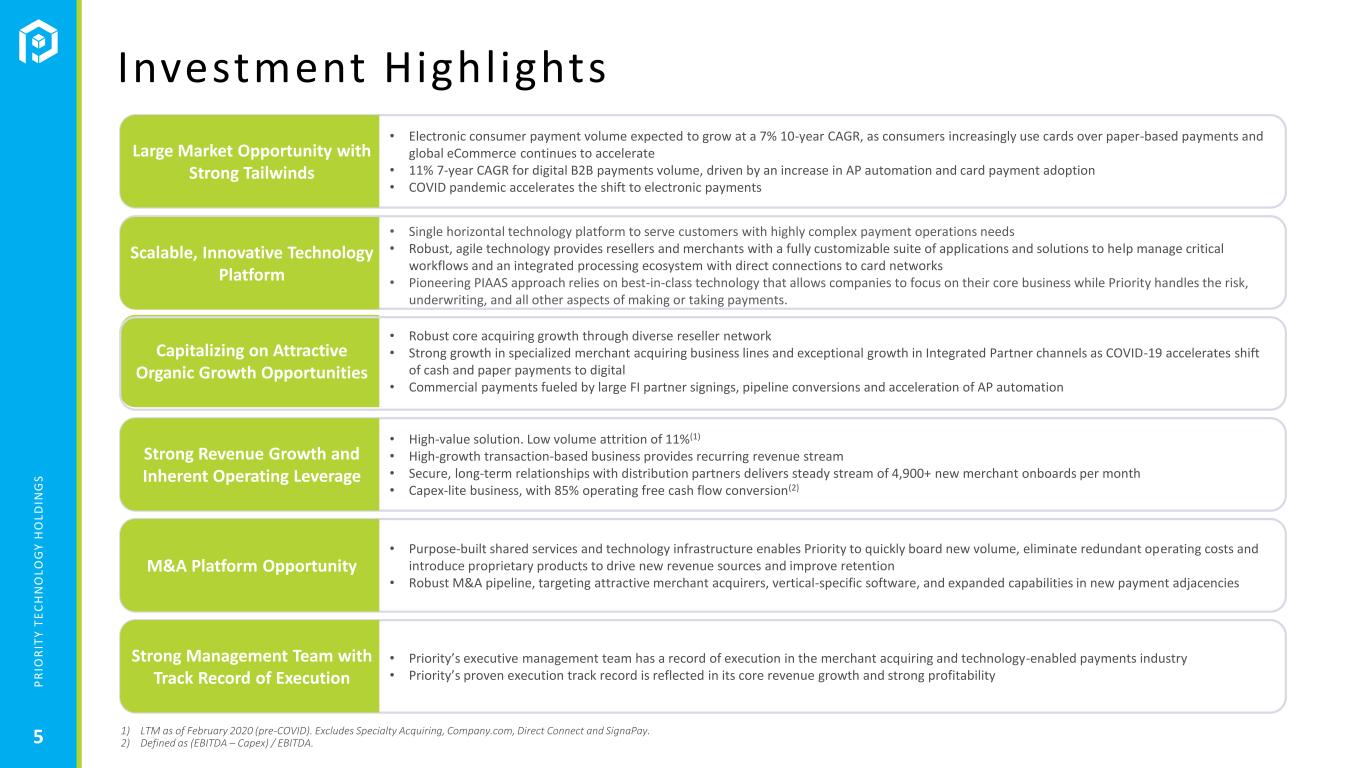

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Investment Highlights Large Market Opportunity with Strong Tailwinds • Electronic consumer payment volume expected to grow at a 7% 10-year CAGR, as consumers increasingly use cards over paper-based payments and global eCommerce continues to accelerate • 11% 7-year CAGR for digital B2B payments volume, driven by an increase in AP automation and card payment adoption • COVID pandemic accelerates the shift to electronic payments Capitalizing on Attractive Organic Growth Opportunities • Robust core acquiring growth through diverse reseller network • Strong growth in specialized merchant acquiring business lines and exceptional growth in Integrated Partner channels as COVID-19 accelerates shift of cash and paper payments to digital • Commercial payments fueled by large FI partner signings, pipeline conversions and acceleration of AP automation Scalable, Innovative Technology Platform • Single horizontal technology platform to serve customers with highly complex payment operations needs • Robust, agile technology provides resellers and merchants with a fully customizable suite of applications and solutions to help manage critical workflows and an integrated processing ecosystem with direct connections to card networks • Pioneering PIAAS approach relies on best-in-class technology that allows companies to focus on their core business while Priority handles the risk, underwriting, and all other aspects of making or taking payments. Strong Revenue Growth and Inherent Operating Leverage • High-value solution. Low volume attrition of 11%(1) • High-growth transaction-based business provides recurring revenue stream • Secure, long-term relationships with distribution partners delivers steady stream of 4,900+ new merchant onboards per month • Capex-lite business, with 85% operating free cash flow conversion(2) M&A Platform Opportunity • Purpose-built shared services and technology infrastructure enables Priority to quickly board new volume, eliminate redundant operating costs and introduce proprietary products to drive new revenue sources and improve retention • Robust M&A pipeline, targeting attractive merchant acquirers, vertical-specific software, and expanded capabilities in new payment adjacencies Strong Management Team with Track Record of Execution • Priority’s executive management team has a record of execution in the merchant acquiring and technology-enabled payments industry • Priority’s proven execution track record is reflected in its core revenue growth and strong profitability 1) LTM as of February 2020 (pre-COVID). Excludes Specialty Acquiring, Company.com, Direct Connect and SignaPay. 2) Defined as (EBITDA – Capex) / EBITDA. P R IO R IT Y T E C H N O L O G Y H O L D IN G S 5

MARKET OPPORTUNITY P R IO R IT Y T E C H N O L O G Y H O L D IN G S

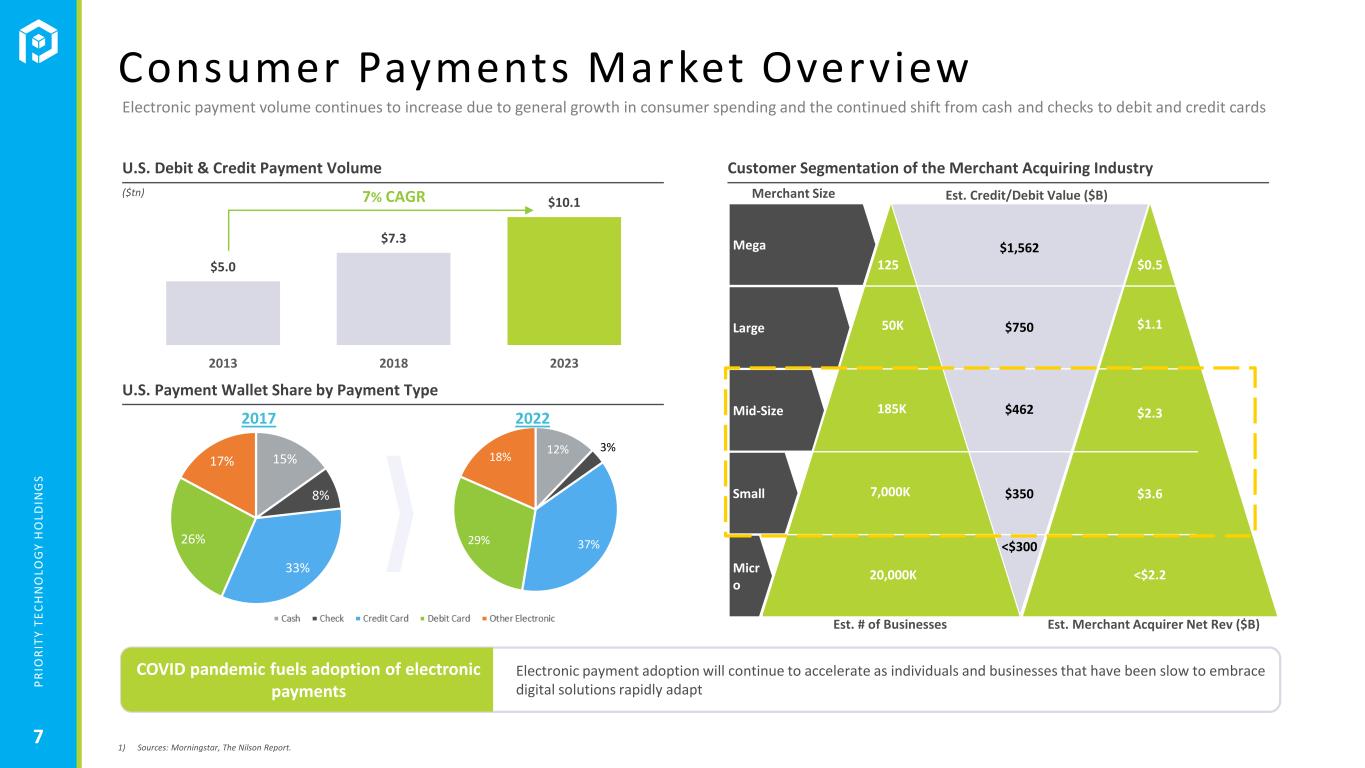

P R IO R IT Y T E C H N O L O G Y H O L D IN G S 15% 8% 33% 26% 17% 12% 3% 37%29% 18% $5.0 $7.3 $10.1 2013 2018 2023 Mega Large 1) Sources: Morningstar, The Nilson Report. Consumer Payments Market Overview Micr o Small Mid-Size $1,562 $750 $462 $350 <$300 $0.5 $1.1 $2.3 $3.6 <$2.2 125 50K 185K 7,000K 20,000K Merchant Size Est. Credit/Debit Value ($B) Est. # of Businesses Est. Merchant Acquirer Net Rev ($B) Customer Segmentation of the Merchant Acquiring Industry 2017 2022 U.S. Debit & Credit Payment Volume ($tn) Electronic payment volume continues to increase due to general growth in consumer spending and the continued shift from cash and checks to debit and credit cards 7% CAGR U.S. Payment Wallet Share by Payment Type COVID pandemic fuels adoption of electronic payments Electronic payment adoption will continue to accelerate as individuals and businesses that have been slow to embrace digital solutions rapidly adapt 7 P R IO R IT Y T E C H N O L O G Y H O L D IN G S

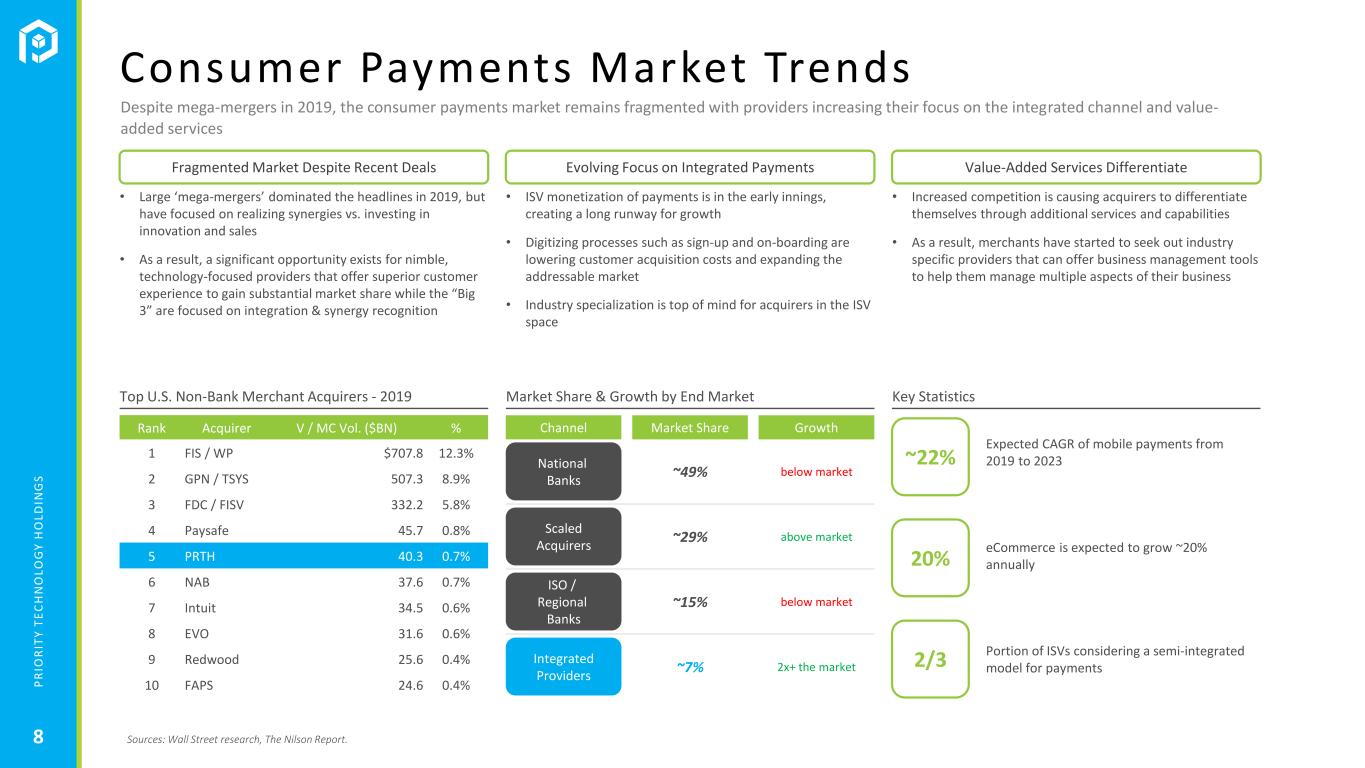

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Sources: Wall Street research, The Nilson Report. Consumer Payments Market Trends • Large ‘mega-mergers’ dominated the headlines in 2019, but have focused on realizing synergies vs. investing in innovation and sales • As a result, a significant opportunity exists for nimble, technology-focused providers that offer superior customer experience to gain substantial market share while the “Big 3” are focused on integration & synergy recognition • ISV monetization of payments is in the early innings, creating a long runway for growth • Digitizing processes such as sign-up and on-boarding are lowering customer acquisition costs and expanding the addressable market • Industry specialization is top of mind for acquirers in the ISV space Integrated Providers ~7% 2x+ the market National Banks ~49% below market ISO / Regional Banks ~15% below market Scaled Acquirers ~29% above market • Increased competition is causing acquirers to differentiate themselves through additional services and capabilities • As a result, merchants have started to seek out industry specific providers that can offer business management tools to help them manage multiple aspects of their business ~22% 20% eCommerce is expected to grow ~20% annually Expected CAGR of mobile payments from 2019 to 2023 2/3 Portion of ISVs considering a semi-integrated model for payments Despite mega-mergers in 2019, the consumer payments market remains fragmented with providers increasing their focus on the integrated channel and value- added services Rank Acquirer V / MC Vol. ($BN) % 1 FIS / WP $707.8 12.3% 2 GPN / TSYS 507.3 8.9% 3 FDC / FISV 332.2 5.8% 4 Paysafe 45.7 0.8% 5 PRTH 40.3 0.7% 6 NAB 37.6 0.7% 7 Intuit 34.5 0.6% 8 EVO 31.6 0.6% 9 Redwood 25.6 0.4% 10 FAPS 24.6 0.4% Fragmented Market Despite Recent Deals Channel Value-Added Services Differentiate Top U.S. Non-Bank Merchant Acquirers - 2019 Market Share & Growth by End Market Key Statistics Market Share Growth Evolving Focus on Integrated Payments 8

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Source: BottomLine, MasterCard, Visa, yStats, PYMNTS.com, Wall Street Research. B2B Payments Market Trends Massive Market Size & Expanding Electronic Penetration Key Statistics $130T Global B2B Payments Volume $22T U.S. TAM U.S. Card Penetration 2018: ~4% 2022: 10%+ 25%+ CAGR Of US B2B Payments volume is still paper based, with ACH & Card Payments rapidly taking share from traditional checks41% • Companies are becoming more familiar with the benefits of electronic Accounts Payable payments, removing barriers to vendor enrollment and driving adoption • The ability for providers to offer full payment file automation including cards, check, and ACH is becoming an increasingly popular option for companies looking to enhance their payables solutions • Additionally, companies are focused on technology solutions that offer UIs, vendor enrollment, configurable deployment and enhanced transparency, rather than only higher rebates • B2B payments is largely underserved and inefficient, creating an opportunity for sophisticated providers to capture market share • As a result, U.S. card penetration is expected to grow 25% annually from 2018 to 2022 Virtual card spend projected to increase from $136B in 2017 to $355B in 2022, at a 21% CAGR21% 57% of companies still perform manual invoice data entry, including 86% of SMBs86% of B2B SaaS platforms intend to expand their B2B processing relationships over the next three years68% <22% of B2B spend is processed at discounted interchange $200T global B2B payment flows are projected to increase to $200T by 2028 The corporate accounts payable market continues to grow as card penetration rises and providers seek to differentiate themselves with full payment file automation, closed-loop networks, and improved vendor enrollment 9

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Attractive Vertical Markets Large verticals that have been slow to adopt electronic payments and / or effective consumer engagement solutions represent massive opportunities $1T Volume Opportunity • Rent is one of the largest payments made by consumers • Highly fragmented and paper-based industry • Multi-family is market-resilient, with higher occupancy in poor economies and higher rent prices in strong economies • Single-family is the fastest growing segment Real Estate Rent payments made by cash or check 80%+ Rental properties owned by landlords with <10 units 60%+ Rental units in the U.S.100M+ • The current healthcare payments market is disjointed, complex and inefficient • From 2013-2017 the cost of healthcare increased 17% • From 2008 – 2018 patient responsibility increased 212% • 67% of providers cite patient receivables as primary revenue cycle concern & 69% say it is increasing Healthcare $4T Volume Opportunity Providers using paper and manual process for collections 90% Providers accept electronic payments 93% of consumers prefer electronic payment methods 83% • Consumer debt is the largest source of debt in the United States, and continues to grow • In a more challenging economy, lenders will be looking to more effective online collection solutions • FinTechs are leveraging cutting-edge technology, transforming the financial services landscape Consumer Finance $2.7T Volume Opportunity Growth of the debt settlement industry 30% Outstanding consumer debt$4T of consumers prefer to apply for loans online 72% • Guests increasingly crave a seamless experience • Payments are becoming embedded in the booking engine, with prepayment becoming more prevalent • Restaurants aim to enhance consumer engagement, as mobile payments and engagement increase in popularity Hospitality / Restaurants $863B Volume Opportunity Restaurant spend settled on card85% of restaurants see the ability to accept mobile payments as a must- have 49% 10

REVENUE SEGMENTS P R IO R IT Y T E C H N O L O G Y H O L D IN G S

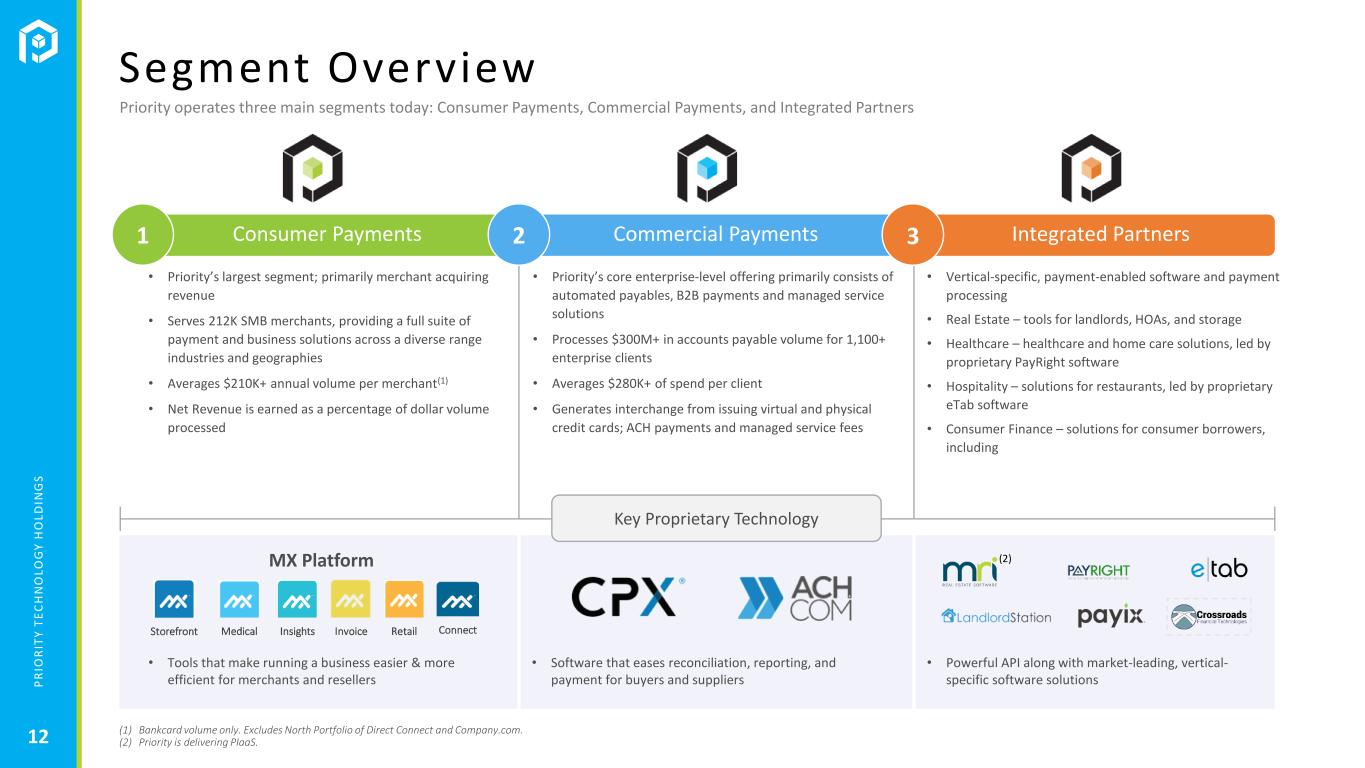

P R IO R IT Y T E C H N O L O G Y H O L D IN G S MX Platform Storefront Medical Insights Invoice Retail Connect Consumer Payments • Priority’s largest segment; primarily merchant acquiring revenue • Serves 212K SMB merchants, providing a full suite of payment and business solutions across a diverse range industries and geographies • Averages $210K+ annual volume per merchant(1) • Net Revenue is earned as a percentage of dollar volume processed • Tools that make running a business easier & more efficient for merchants and resellers Integrated Partners • Vertical-specific, payment-enabled software and payment processing • Real Estate – tools for landlords, HOAs, and storage • Healthcare – healthcare and home care solutions, led by proprietary PayRight software • Hospitality – solutions for restaurants, led by proprietary eTab software • Consumer Finance – solutions for consumer borrowers, including • Powerful API along with market-leading, vertical- specific software solutions Commercial Payments • Priority’s core enterprise-level offering primarily consists of automated payables, B2B payments and managed service solutions • Processes $300M+ in accounts payable volume for 1,100+ enterprise clients • Averages $280K+ of spend per client • Generates interchange from issuing virtual and physical credit cards; ACH payments and managed service fees • Software that eases reconciliation, reporting, and payment for buyers and suppliers Segment Overview Priority operates three main segments today: Consumer Payments, Commercial Payments, and Integrated Partners 1 2 3 (1) Bankcard volume only. Excludes North Portfolio of Direct Connect and Company.com. (2) Priority is delivering PIaaS. (2) 12 Key Proprietary Technology

P R IO R IT Y T E C H N O L O G Y H O L D IN G S MX ConnectMX Merchant The Consumer Payments segment provides full-service payment processing and payment-enabled solutions for B2C transactions, leveraging Priority’s proprietary MX platform Consumer Payments 5th Largest Us Non-bank Acquirer 219K+ Total Merchant Base Serviced ~4,750 New Merchant Onboards Per Month New $50B+ Q3’20 Run-Rate Volume Processed Overview Founded in 2005 with a mission to build a merchant-inspired payments platform MX Merchant: provides core processing and business solutions to SMB clients which help better manage work functions and revenue performance • Fully customizable platform through proprietary & 3rd party add-on applications MX Connect: powerful reseller CRM and business operating system for Priority’s reseller partners powered through web and mobile applications • Low-friction electronic onboarding to improve merchant acquisition • Superior data sharing capability, enabling resellers to better manage client service needs and retain merchants Priority supports a variable cost sales structure with low merchant acquisition expense • Independent ISOs and agents, FIs and vertical software resellers Proprietary Applications Storefront Medical Insights Invoice Retail Connect Merchant Resellers Consumer Commercial Integrated 13

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Priority’s Commercial Payments segment continues to build momentum as Priority penetrates the $130 trillion B2B payments market Overview Consists of Priority’s accounts payable automation and integrated payments platform, CPX and other managed services for enterprise customers Composed of four channels: CPX, ACH.com, B2B Acquiring and Managed services CPX fully automates a client’s accounts payable process through the CPX gateway • Intelligently routes payments via virtual card, ACH, or check to the vendor, based on the client’s pre-determined preference or through the method that optimizes rebate revenue for the buyer Priority earns interchange fees for payments sent via virtual cards and earns transaction fees for ACH and check payments CPX Direct automatically processes virtual card payments for suppliers that use Priority as its merchant acquirer, removing manual entry or additional intervention from the supplier Commercial Payments $10.5B B2B Spend (Annual) 37 Financial Institutions Supported ~50,000 Suppliers Enrolled on Virtual Card B2B Acquiring Managed Services 14 Consumer Commercial Integrated

P R IO R IT Y T E C H N O L O G Y H O L D IN G S The Priority Advantage Fully Integrated Payments vCard/ACH/Checks vCard: BIP/SIP/Ghost Early Pay Dynamic Discounting Split Payments Payment Approval Workflow API’s & Open Architecture Automated Supplier Enrollments Buyer/Supplier-Centric Networks Plug-in any Bank/Card Issuer 15 Consumer Commercial Integrated

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Priority’s Integrated Partners segment is executing on a significant opportunity to capitalize on the convergence of software and payments, leveraging its payment infrastructure-as-a-service platform Overview Priority’s Integrated Partners segment consists of proprietary, vertical-specific payment-enabled software companies that Priority partners with or has acquired Priority invests in and nurtures emerging companies in verticals that are early in the cycle of digital payment adoption Integrated Partners leverages Priority’s purpose-built, in-house cloud platform, Vortex OS, to access various applications and payment-enabled products, such as payment processing, MX Merchant, and MX Connect, to drive growth In addition to providing high utility revenue-generating resources, Priority offers business development services and other shared common services (e.g., underwriting, accounting, legal, etc.), enabling its Integrated Partners to focus on their core competencies of developing and selling leading software solutions Priority has focused on partnering with or acquiring software solutions within fast growing verticals such as Real Estate, Healthcare, Hospitality and Consumer Finance In September 2020, Priority divested its RentPayment business, and signed a multi-year MSA and processing agreement with MRI software, presenting significant upside VortexPayments Security Data Eventing Storage MX Connect ACH.com MX Merchant CPXchange Business Services Legal & HR Finance & Accounting Infrastructure & Development Risk & Underwriting Consumer Finance Healthcare Hospitality Integrated Partners Real Estate 16 Consumer Commercial Integrated

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Integrated Partners – Payment IaaS Priority Real Estate Technology Priority Healthcare Solutions Priority Hospitality Tech Provides Payment Integration & Infrastructure for Operations and Development Focus on Product UI & Sales Provides Business & Operational Support Proprietary Integrated Partner Software Channels Legal & HR Finance / Accounting Client Services and Relationship Management Infrastructure Development Business Resource Group Tech Resource Group Risk & Underwriting Priority Shared Services Vortex API & Cloud Priority Consumer Finance Priority IaaS (1) Priority is delivering PIaaS. (1) 17 Consumer Commercial Integrated

FINANCIAL OVERVIEW P R IO R IT Y T E C H N O L O G Y H O L D IN G S

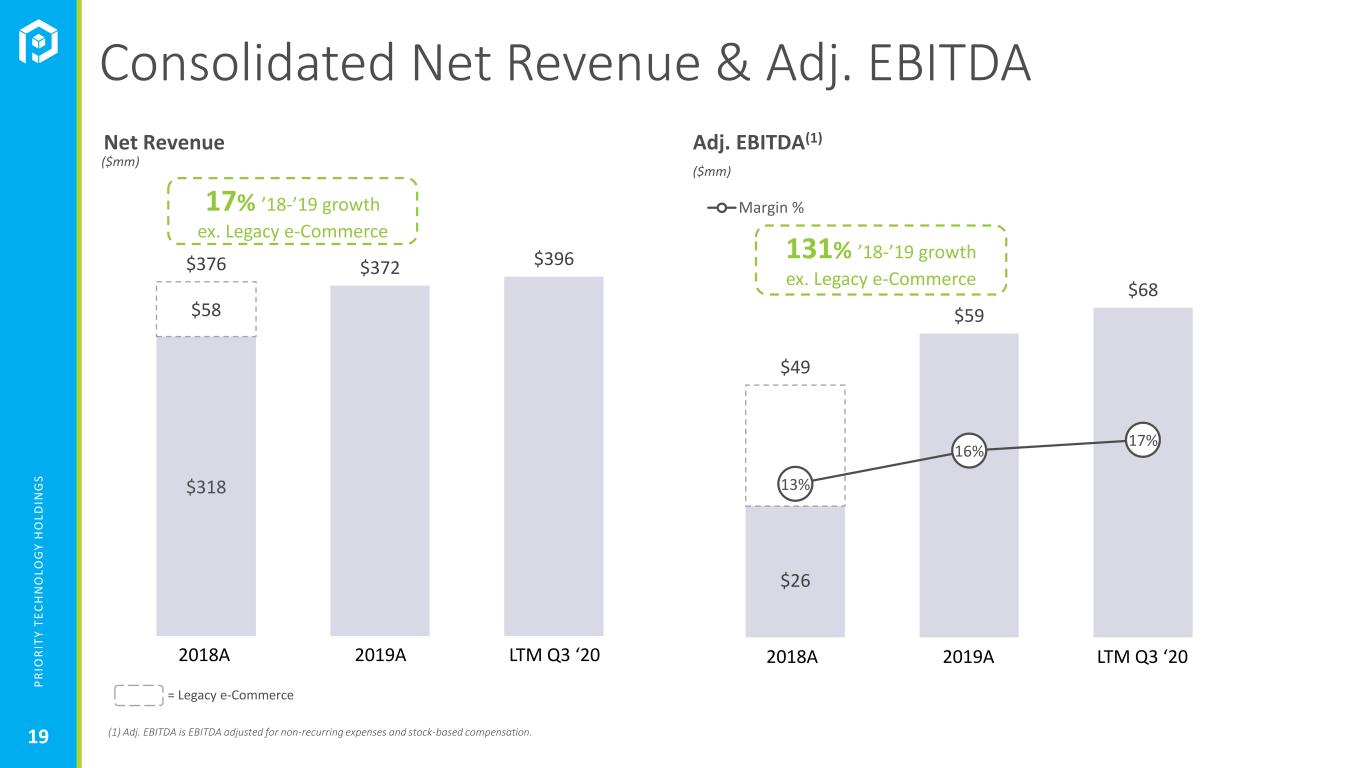

P R IO R IT Y T E C H N O L O G Y H O L D IN G S $26 $49 $59 $68 13% 16% 17% Margin % Net Revenue Adj. EBITDA(1) ($mm) Consolidated Net Revenue & Adj. EBITDA = Legacy e-Commerce (1) Adj. EBITDA is EBITDA adjusted for non-recurring expenses and stock-based compensation. 131% ’18-’19 growth ex. Legacy e-Commerce 17% ’18-’19 growth ex. Legacy e-Commerce 2018A 2019A LTM Q3 ‘20 ($mm) 2018A 2019A LTM Q3 ‘20 $318 $58 $376 $372 $396 19

P R IO R IT Y T E C H N O L O G Y H O L D IN G S Three and Nine Months Ended September 30, 2020 ($ in thousands Pro Forma Results (1) Historical financial figures pro forma for the sale of RentPayment. 20 (in thousands) (in thousands) Three Months Ended September 30, 2020 Nine Months Ended September 30, 2020 Consolidated RentPayment Pro Forma Consolidated RentPayment Pro Forma Revenues 108,963$ 3,883$ 105,079$ 298,251$ 12,118$ 286,133$ Operating Expenses: Costs of services 74,971 497 74,474 203,733 1,370 202,363 Salary and employee benefits 10,010 580 9,430 29,678 1,627 28,051 Depreciation and amortization 10,251 1,238 9,013 30,886 3,668 27,218 Selling, general and administrative 6,687 1,262 5,425 18,340 3,649 14,691 Total Operating expenses 101,919 3,577 98,342 282,638 10,313 272,324 Income from operations 7,044$ 307$ 6,737$ 15,614$ 1,805$ 13,809$ Adjusted EBITDA 19,635$ 2,557$ 17,078$ 52,101$ 8,320$ 43,781$

C o n t a c t : D a v e F a u p e l C h i e f M a r k e t i n g O f f i c e r D a v e . F a u p e l @ P RT H . c o m P R IO R IT Y T E C H N O L O G Y H O L D IN G S