Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HUMANA INC | hum-20210203.htm |

| EX-99.2 - EX-99.2 - HUMANA INC | hum-2020q48kxex99x2.htm |

| EX-99.1 - EX-99.1 - HUMANA INC | hum-2020q48kxex99x1.htm |

0 Cautionary Statement This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in investor presentations, press releases, Securities and Exchange Commission (SEC) filings, and in oral statements made by or with the approval of one of our executive officers, the words or phrases like "expects," "anticipates," "believes, " "intends," "likely will result," "estimates," "projects" or variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions, including, among other things, information set forth in the "Risk Factors" section of our SEC filings, as listed below. In making these statements, Humana is not undertaking to address or update these statements in future filings or communications regarding its business or results. In light of these risks, uncertainties and assumptions, the forward-looking events discussed herein might not occur. There also may be other risks that we are unable to predict at this time. Any of these risks and uncertainties may cause actual results to differ materially from the results discussed in the forward-looking statements. Humana advises investors to read the following documents as filed by the company with the SEC: – Form 10-K for the year ended December 31, 2019; – Form 10-Q for the quarter ended March 31, 2020, June 30, 2020, September 30, 2020; and – Form 8-Ks filed during 2020 and 2021. Investors are also advised to read Humana’s 4Q20 earnings press release dated February 3, 2021 which is available via the Investor Relations page of Humana’s website, humana.com. 1 Exhibit 99.3

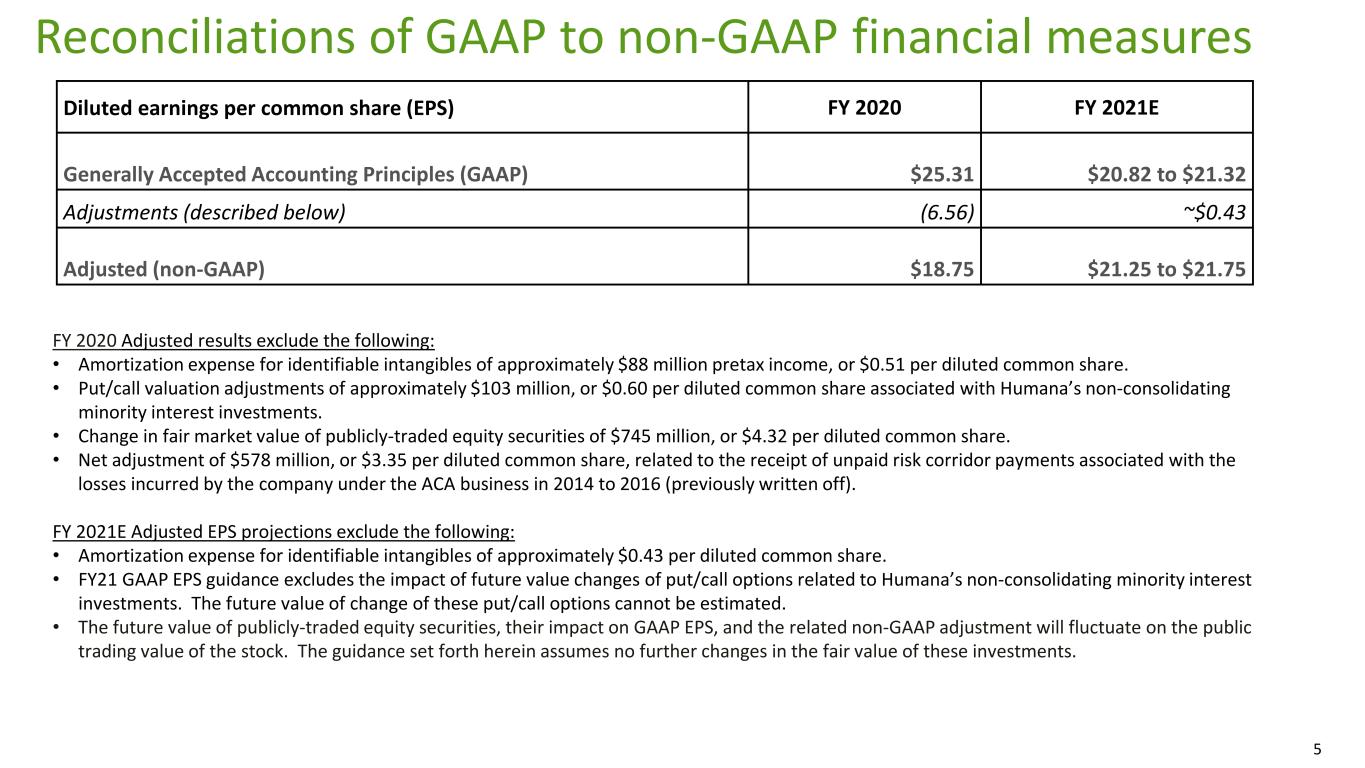

1 Non-GAAP Financial Measures This slide presentation includes financial measures which are not in accordance with Generally Accepted Accounting Principles (GAAP). Humana has included these non-GAAP (Adjusted) financial measures since management believes these measures, when presented in conjunction with the comparable GAAP measure, are useful to both management and its investors in analyzing the company’s ongoing business and operating performance. Consequently, management uses these non- GAAP (Adjusted) financial measures as indicators of business performance, as well as for operational planning and decision-making purposes. These non-GAAP (Adjusted) measures should be considered in addition to, but not as a substitute for, or superior to, the financial measures prepared in accordance with GAAP. Refer to slide 5 within this deck for a reconciliation of non-GAAP (Adjusted) measures to GAAP. 2

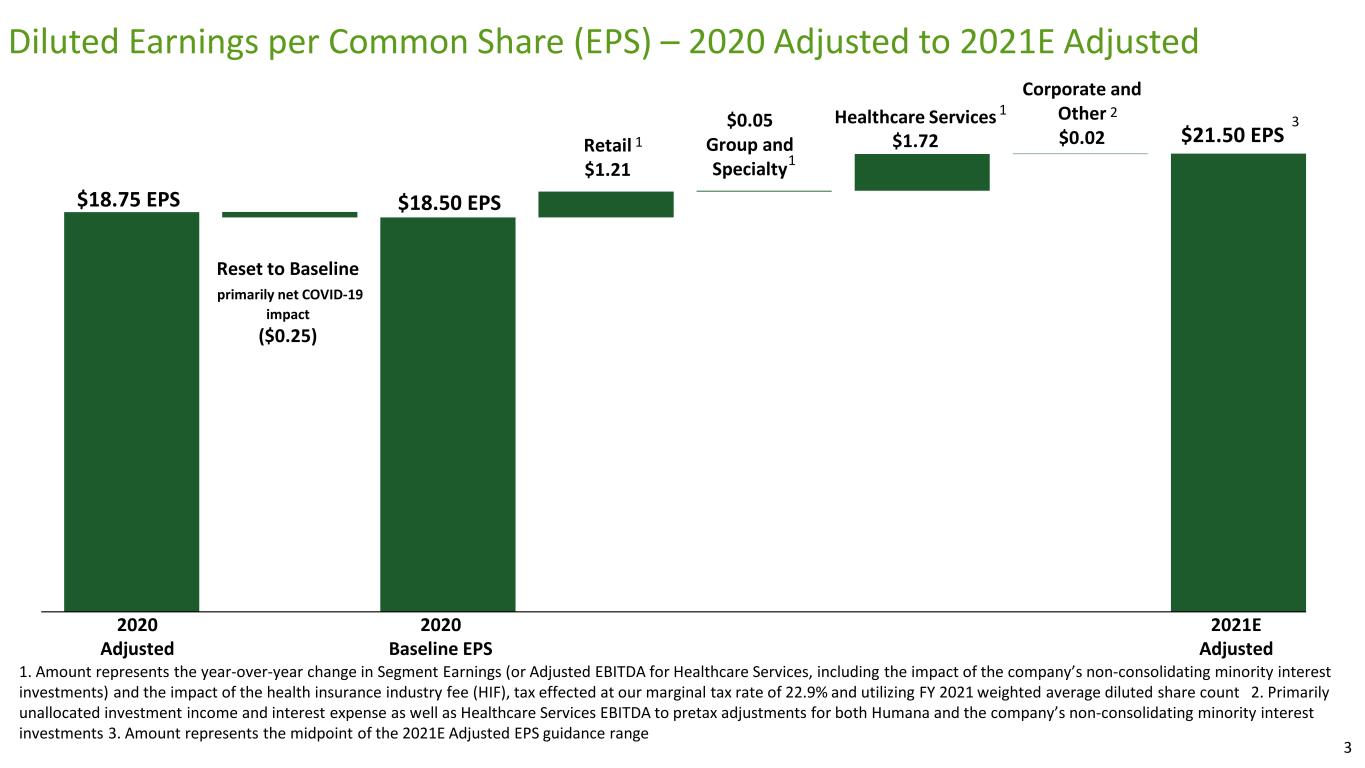

2 Diluted Earnings per Common Share (EPS) – 2020 Adjusted to 2021E Adjusted Reset to Baseline primarily net COVID-19 impact ($0.25) Retail $1.21 $0.05 Group and Specialty Corporate and Other $0.02 $21.50 EPS $18.75 EPS Healthcare Services $1.72 $18.50 EPS 2 2020 Adjusted 1. Amount represents the year-over-year change in Segment Earnings (or Adjusted EBITDA for Healthcare Services, including the impact of the company’s non-consolidating minority interest investments) and the impact of the health insurance industry fee (HIF), tax effected at our marginal tax rate of 22.9% and utilizing FY 2021 weighted average diluted share count 2. Primarily unallocated investment income and interest expense as well as Healthcare Services EBITDA to pretax adjustments for both Humana and the company’s non-consolidating minority interest investments 3. Amount represents the midpoint of the 2021E Adjusted EPS guidance range 2021E Adjusted 3 2020 Baseline EPS 1 1 1 3

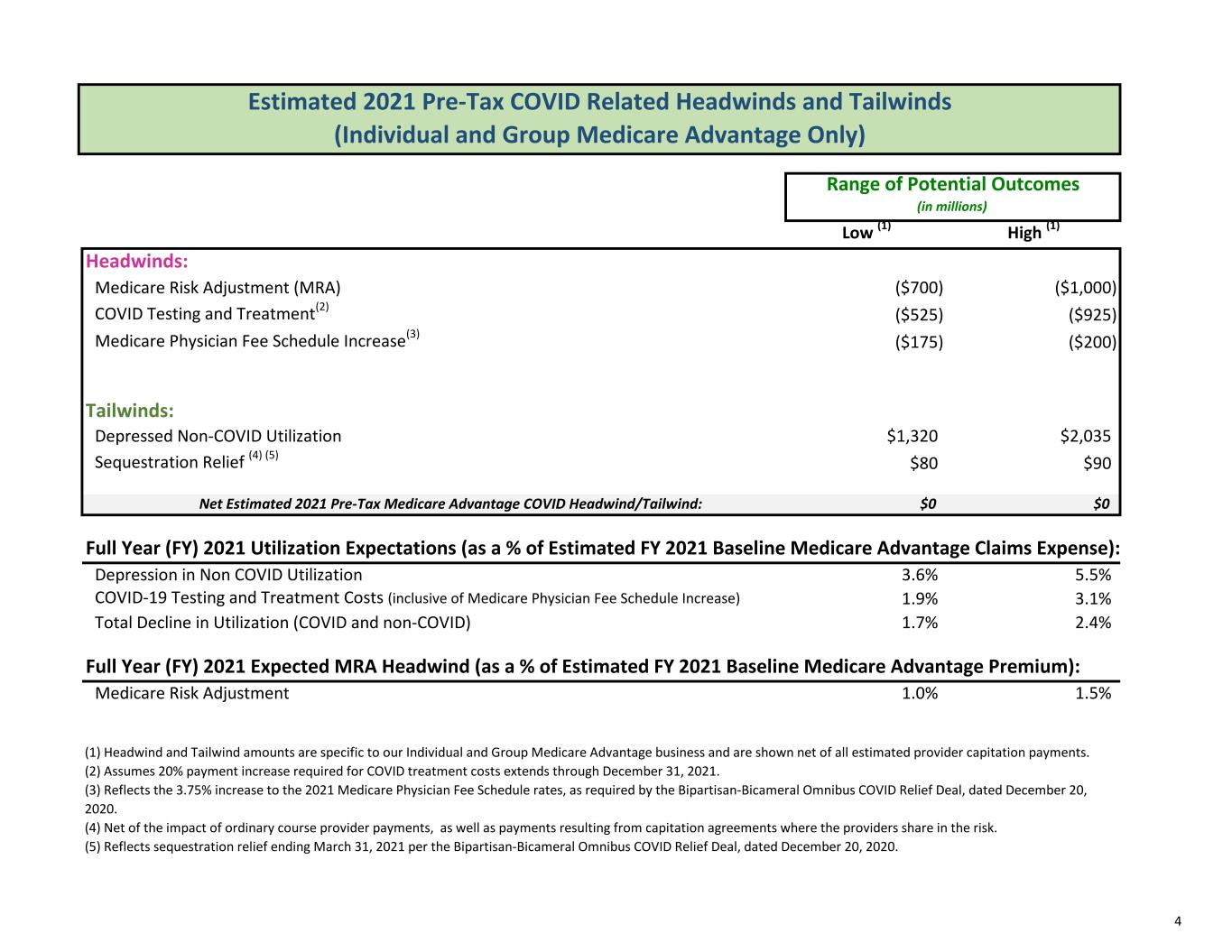

Low (1) High (1) Headwinds: Medicare Risk Adjustment (MRA) ($700) ($1,000) COVID Testing and Treatment(2) ($525) ($925) Medicare Physician Fee Schedule Increase(3) ($175) ($200) Tailwinds: Depressed Non-COVID Utilization $1,320 $2,035 Sequestration Relief (4) (5) $80 $90 Net Estimated 2021 Pre-Tax Medicare Advantage COVID Headwind/Tailwind: $0 $0 Full Year (FY) 2021 Utilization Expectations (as a % of Estimated FY 2021 Baseline Medicare Advantage Claims Expense): Depression in Non COVID Utilization 3.6% 5.5% COVID-19 Testing and Treatment Costs (inclusive of Medicare Physician Fee Schedule Increase) 1.9% 3.1% Total Decline in Utilization (COVID and non-COVID) 1.7% 2.4% Full Year (FY) 2021 Expected MRA Headwind (as a % of Estimated FY 2021 Baseline Medicare Advantage Premium): Medicare Risk Adjustment 1.0% 1.5% (2) Assumes 20% payment increase required for COVID treatment costs extends through December 31, 2021. (5) Reflects sequestration relief ending March 31, 2021 per the Bipartisan-Bicameral Omnibus COVID Relief Deal, dated December 20, 2020. (4) Net of the impact of ordinary course provider payments, as well as payments resulting from capitation agreements where the providers share in the risk. Range of Potential Outcomes (in millions) Estimated 2021 Pre-Tax COVID Related Headwinds and Tailwinds (Individual and Group Medicare Advantage Only) (3) Reflects the 3.75% increase to the 2021 Medicare Physician Fee Schedule rates, as required by the Bipartisan-Bicameral Omnibus COVID Relief Deal, dated December 20, 2020. (1) Headwind and Tailwind amounts are specific to our Individual and Group Medicare Advantage business and are shown net of all estimated provider capitation payments. 4

3 Reconciliations of GAAP to non-GAAP financial measures Diluted earnings per common share (EPS) FY 2020 FY 2021E Generally Accepted Accounting Principles (GAAP) $25.31 $20.82 to $21.32 Adjustments (described below) (6.56) ~$0.43 Adjusted (non-GAAP) $18.75 $21.25 to $21.75 FY 2020 Adjusted results exclude the following: • Amortization expense for identifiable intangibles of approximately $88 million pretax income, or $0.51 per diluted common share. • Put/call valuation adjustments of approximately $103 million, or $0.60 per diluted common share associated with Humana’s non-consolidating minority interest investments. • Change in fair market value of publicly-traded equity securities of $745 million, or $4.32 per diluted common share. • Net adjustment of $578 million, or $3.35 per diluted common share, related to the receipt of unpaid risk corridor payments associated with the losses incurred by the company under the ACA business in 2014 to 2016 (previously written off). FY 2021E Adjusted EPS projections exclude the following: • Amortization expense for identifiable intangibles of approximately $0.43 per diluted common share. • FY21 GAAP EPS guidance excludes the impact of future value changes of put/call options related to Humana’s non-consolidating minority interest investments. The future value of change of these put/call options cannot be estimated. • The future value of publicly-traded equity securities, their impact on GAAP EPS, and the related non-GAAP adjustment will fluctuate on the public trading value of the stock. The guidance set forth herein assumes no further changes in the fair value of these investments. 5