Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ALLSTATE CORP | allcorp123120earningsrelea.htm |

| 8-K - 8-K - ALLSTATE CORP | all-20210203.htm |

Investor Supplement Fourth Quarter 2020 The condensed consolidated financial statements and financial exhibits included herein are unaudited. These condensed consolidated financial statements and exhibits should be read in conjunction with the consolidated financial statements and notes thereto included in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The results of operations for interim periods should not be considered indicative of results to be expected for the full year. Measures used in these financial statements and exhibits that are not based on generally accepted accounting principles ("non-GAAP") are denoted with an asterisk (*). These measures are defined on the pages "Definitions of Non-GAAP Measures" and are reconciled to the most directly comparable generally accepted accounting principles ("GAAP") measure herein. The Allstate Corporation

Condensed Consolidated Statements of Operations 1 Segment Results and Other Statistics 15 Contribution to Income 2 Return on Equity 16 Segment Results 3,4 Book Value per Common Share and Debt to Capital 5 Return on Common Shareholders' Equity 6 Segment Results and Other Statistics 17 Policies in Force 7 Return on Equity 18 Results 8 Segment Results and Other Statistics 19 Return on Equity 20 Allstate Brand Profitability Measures 9 Allstate Brand Statistics 10 Encompass Brand Profitability Measures and Statistics 11 Net Investment Income, Yields and Realized Capital Gains (Losses) (Pre-tax) 21 Auto Profitability Measures by Brand 12 Net Investment Income, Yields and Realized Capital Gains (Losses) (Pre-tax) by Segment 22,23 Homeowners Profitability Measures by Brand 13 Performance-Based Investments 24 25,26 Segment Results 14 The Allstate Corporation Investor Supplement - Fourth Quarter 2020 Table of Contents Consolidated Operations Definitions of Non-GAAP Measures Allstate Benefits Allstate Life Property-Liability Allstate Annuities Investments Allstate Protection Protection Services (previously Service Businesses)

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 9,279 $ 9,336 $ 9,223 $ 9,235 $ 9,194 $ 9,094 $ 8,986 $ 8,802 $ 37,073 $ 36,076 603 620 604 617 627 625 621 628 2,444 2,501 271 272 257 265 260 273 271 250 1,065 1,054 1,191 832 409 421 689 880 942 648 2,853 3,159 674 440 704 (462) 702 197 324 662 1,356 1,885 12,018 11,500 11,197 10,076 11,472 11,069 11,144 10,990 44,791 44,675 5,366 6,072 5,222 5,341 5,749 6,051 6,356 5,820 22,001 23,976 - - 738 210 - - - - 948 - 518 727 497 501 518 513 511 497 2,243 2,039 156 150 200 132 153 169 156 162 638 640 1,388 1,492 1,349 1,401 1,382 1,425 1,362 1,364 5,630 5,533 1,502 1,380 1,451 1,399 1,516 1,414 1,380 1,380 5,732 5,690 (371) (71) 73 318 (251) 225 125 15 (51) 114 40 200 14 5 14 - 9 18 259 41 30 31 29 28 30 32 32 32 118 126 - - - - 51 - 55 - - 106 80 78 79 81 82 80 82 83 318 327 8,709 10,059 9,652 9,416 9,244 9,909 10,068 9,371 37,836 38,592 1 1 1 1 3 - 2 1 4 6 3,310 1,442 1,546 661 2,231 1,160 1,078 1,620 6,959 6,089 686 289 296 112 458 229 227 328 1,383 1,242 2,624 1,153 1,250 549 1,773 931 851 1,292 5,576 4,847 26 27 26 36 66 42 30 31 115 169 $ 2,598 $ 1,126 $ 1,224 $ 513 $ 1,707 $ 889 $ 821 $ 1,261 $ 5,461 $ 4,678 $ 8.54 $ 3.62 $ 3.90 $ 1.62 $ 5.32 $ 2.71 $ 2.47 $ 3.79 $ 17.53 $ 14.25 304.3 311.2 313.7 317.4 320.7 327.7 332.0 332.6 311.6 328.2 $ 8.45 $ 3.58 $ 3.86 $ 1.59 $ 5.23 $ 2.67 $ 2.44 $ 3.74 $ 17.31 $ 14.03 307.6 314.1 317.0 322.4 326.3 333.0 336.9 337.5 315.5 333.5 $ 0.54 $ 0.54 $ 0.54 $ 0.54 $ 0.50 $ 0.50 $ 0.50 $ 0.50 $ 2.16 $ 2.00 (1) (2) (3) (4) ($ in millions, except per share data) Revenues Property and casualty insurance premiums (1) The Allstate Corporation Condensed Consolidated Statements of Operations Three months ended Life premiums and contract charges (2) Other revenue (3) Net investment income Realized capital gains (losses) Total revenues Costs and expenses Property and casualty insurance claims and claims expense Shelter-in-Place Payback expense Life contract benefits Interest credited to contractholder funds Amortization of deferred policy acquisition costs Operating costs and expenses Pension and other postretirement remeasurement (gains) losses Restructuring and related charges Amortization of purchased intangibles Impairment of purchased intangibles Interest expense Total costs and expenses Gain on disposition of operations Income from operations before income tax expense Twelve months ended In accordance with GAAP, the quarter and year-to-date per share amounts are calculated discretely. Therefore, the sum of each quarter may not equal the year-to-date amount. Other revenue primarily represents fees collected from policyholders relating to premium installment payments, commissions on sales of non-proprietary products, sales of identity protection services, fee-based services and other revenue transactions. Life premiums and contract charges are reported in the Allstate Life, Allstate Benefits and Allstate Annuities results and include life insurance, voluntary accident and health insurance, and annuity products. Property and casualty insurance premiums are reported in the Property-Liability and Protection Services results and include auto, homeowners, other personal lines and commercial lines insurance products, as well as consumer product protection plans, roadside assistance, and finance and insurance products. Income tax expense Net income Preferred stock dividends Net income applicable to common shareholders Net income applicable to common shareholders per common share - Diluted Weighted average common shares - Diluted Cash dividends declared per common share Earnings per common share (4) Net income applicable to common shareholders per common share - Basic Weighted average common shares - Basic The Allstate Corporation 4Q20 Supplement 1

($ in millions, except per share data) Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 Contribution to income Net income applicable to common shareholders $ 2,598 $ 1,126 $ 1,224 $ 513 $ 1,707 $ 889 $ 821 $ 1,261 $ 5,461 $ 4,678 Realized capital (gains) losses, after-tax (529) (346) (554) 366 (553) (155) (256) (524) (1,063) (1,488) Pension and other postretirement remeasurement (gains) losses, after-tax (292) (56) 58 251 (199) 179 99 11 (39) 90 Curtailment (gains) losses, after-tax - (7) - - - - - - (7) - Valuation changes on embedded derivatives that are not hedged, after-tax 9 - 41 (14) - 10 2 3 36 15 DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax (4) 4 (11) 3 3 (1) 1 2 (8) 5 Premium deficiency for immediate annuities, after-tax - 178 - - - - - - 178 - Reclassification of periodic settlements and accruals on non- hedge derivative instruments, after-tax - - - - - (1) - (1) - (2) Business combination expenses and the amortization of purchased intangibles, after-tax 24 24 23 22 24 25 26 25 93 100 Impairment of purchased intangibles, after-tax - - - - 40 - 43 - - 83 Gain on disposition of operations, after-tax (1) - (1) (1) (2) - (1) (1) (3) (4) Adjusted net income * $ 1,805 $ 923 $ 780 $ 1,140 $ 1,020 $ 946 $ 735 $ 776 $ 4,648 $ 3,477 Income per common share - Diluted Net income applicable to common shareholders $ 8.45 $ 3.58 $ 3.86 $ 1.59 $ 5.23 $ 2.67 $ 2.44 $ 3.74 $ 17.31 $ 14.03 Realized capital (gains) losses, after-tax (1.72) (1.10) (1.75) 1.13 (1.69) (0.47) (0.76) (1.55) (3.37) (4.46) Pension and other postretirement remeasurement (gains) losses, after-tax (0.95) (0.18) 0.18 0.78 (0.61) 0.54 0.29 0.03 (0.12) 0.27 Curtailment (gains) losses, after-tax - (0.02) - - - - - - (0.02) - Valuation changes on embedded derivatives that are not hedged, after-tax 0.03 - 0.13 (0.04) - 0.03 - 0.01 0.11 0.05 DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax (0.02) 0.01 (0.03) 0.01 0.01 - - - (0.03) 0.01 Premium deficiency for immediate annuities, after-tax - 0.57 - - - - - - 0.56 - Reclassification of periodic settlements and accruals on non- hedge derivative instruments, after-tax - - - - - - - - - (0.01) Business combination expenses and the amortization of purchased intangibles, after-tax 0.08 0.08 0.07 0.07 0.07 0.07 0.08 0.07 0.30 0.30 Impairment of purchased intangibles, after-tax - - - - 0.12 - 0.13 - - 0.25 Gain on disposition of operations, after-tax - - - - - - - - (0.01) (0.01) Adjusted net income * $ 5.87 $ 2.94 $ 2.46 $ 3.54 $ 3.13 $ 2.84 $ 2.18 $ 2.30 $ 14.73 $ 10.43 Weighted average common shares - Diluted 307.6 314.1 317.0 322.4 326.3 333.0 336.9 337.5 315.5 333.5 The Allstate Corporation Contribution to Income Three months ended Twelve months ended The Allstate Corporation 4Q20 Supplement 2

Allstate Protection Discontinued Lines Property- Liability Protection Services Allstate Life Allstate Benefits Allstate Annuities Corporate and Other Intersegment Eliminations Consolidated $ 8,884 $ - $ 8,884 $ 395 $ 338 $ 262 $ 3 $ - $ - $ 9,882 - - - 38 - - - - (38) - 181 - 181 53 37 - - - - 271 (5,266) (2) (5,268) (102) - - - - 4 (5,366) - - - - - - - - - - - - - - (349) (131) (194) - - (674) (1,168) - (1,168) (176) (5) (38) (1) - - (1,388) (1,167) (1) (1,168) (167) (89) (69) (6) (37) 34 (1,502) - - - - - - - 371 - 371 (36) - (36) (2) (1) - - (1) - (40) (5) - (5) (25) - - - - - (30) - - - - - - - (80) - (80) $ 1,423 $ (3) 1,420 619 11 128 20 403 10 - 1,191 419 21 (7) 8 191 42 - 674 - - - - 1 - - 1 (506) (13) (8) (11) (84) (64) - (686) - - - - - (26) - (26) $ 1,952 $ 33 $ 44 $ 41 $ 313 $ 215 $ - $ 2,598 (327) (16) 6 (7) (151) (34) - (529) - - - - - (292) (292) - - - - - - - - - - 10 - (1) - - 9 - - (4) - - - - (4) - - - - - - - - 3 21 - - - - - 24 - - - - (1) - - (1) $ 1,628 $ 38 (1) $ 56 (1) $ 34 (1) $ 160 (1) $ (111) (1) $ - $ 1,805 $ 8,873 $ - $ 8,873 $ 321 $ 342 $ 282 $ 3 $ - $ - $ 9,821 - - - 44 - - - - (44) - 180 - 180 46 34 - - - - 260 (5,658) (2) (5,660) (92) - - - - 3 (5,749) - - - - (295) (160) (216) - - (671) (1,155) - (1,155) (143) (32) (50) (2) - - (1,382) (1,172) (1) (1,173) (181) (95) (74) (7) (27) 41 (1,516) - - - - - - - 251 - 251 (12) - (12) - (1) - (1) - - (14) (1) - (1) (29) - - - - - (30) (51) - (51) - - - - - - (51) (1) - (1) - - - - (81) - (82) $ 1,003 $ (3) 1,000 323 12 134 22 180 18 - 689 554 11 - 4 122 11 - 702 - - - - 3 - - 3 (387) (1) (14) (6) (16) (34) - (458) - - - - - (66) - (66) $ 1,490 $ (12) $ 73 $ 18 $ 66 $ 72 $ - $ 1,707 (437) (8) - (2) (97) (9) - (553) - - - - - (199) - (199) - - - - - - - - - - 3 - - - - 3 - - - - - - - - 1 23 - - - - - 24 40 - - - - - - 40 - - - - (2) - - (2) $ 1,094 $ 3 (1) $ 76 (1) $ 16 (1) $ (33) (1) $ (136) (1) $ - $ 1,020 (1) The Allstate Corporation Three months ended December 31, 2020 Claims and claims expense Shelter-in-Place Payback expense Contract benefits and interest credited to contractholder funds ($ in millions) Premiums and contract charges Intersegment insurance premiums and service fees Other revenue Consolidating Segment Results Interest expense Underwriting income (loss) Net investment income Realized capital gains (losses) Amortization of deferred policy acquisition costs Operating costs and expenses Pension and other postretirement remeasurement gains (losses) Restructuring and related charges Amortization of purchased intangibles Pension and other postretirement remeasurement (gains) losses, after-tax Valuation changes on embedded derivatives that are not hedged, after-tax Premium deficiency for immediate annuities, after-tax DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax Gain on disposition of operations Income tax expense Preferred stock dividends Net income applicable to common shareholders Realized capital (gains) losses, after-tax Three months ended December 31, 2019 Business combination expenses and the amortization of purchased intangibles, after-tax Gain on disposition of operations, after-tax Adjusted net income (loss) * Curtailment (gains) losses, after-tax Premiums and contract charges Intersegment insurance premiums and service fees Other revenue Claims and claims expense Contract benefits and interest credited to contractholder funds Amortization of deferred policy acquisition costs Operating costs and expenses Pension and other postretirement remeasurement gains (losses) Restructuring and related charges Amortization of purchased intangibles Impairment of purchased intangibles Interest expense Underwriting income (loss) Net investment income Realized capital gains (losses) Gain on disposition of operations Income tax expense Preferred stock dividends Net income (loss) applicable to common shareholders Realized capital (gains) losses, after-tax Impairment of purchased intangibles, after-tax Gain on disposition of operations, after-tax Adjusted net income (loss) * Adjusted net income is the segment measure used for each business. Pension and other postretirement remeasurement (gains) losses, after-tax Valuation changes on embedded derivatives that are not hedged, after-tax DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax Business combination expenses and the amortization of purchased intangibles, after-tax The Allstate Corporation 4Q20 Supplement 3

Allstate Protection Discontinued Lines Property- Liability Protection Services Allstate Life Allstate Benefits Allstate Annuities Corporate and Other Intersegment Eliminations Consolidated $ 35,580 $ - $ 35,580 $ 1,493 $ 1,340 $ 1,094 $ 10 $ - $ - $ 39,517 - - - 147 - - - - (147) - 736 - 736 208 121 - - - - 1,065 (21,485) (141) (21,626) (386) - - - - 11 (22,001) (948) - (948) - - - - - - (948) - - - - (1,293) (549) (1,039) - - (2,881) (4,642) - (4,642) (658) (149) (177) (4) - - (5,630) (4,428) (3) (4,431) (651) (329) (322) (25) (110) 136 (5,732) - - - - - - - 51 - 51 (235) - (235) (3) (6) (1) (2) (12) - (259) (12) - (12) (106) - - - - - (118) - - - - - - - (318) - (318) $ 4,566 $ (144) 4,422 1,421 44 502 78 761 47 - 2,853 990 30 (10) 8 279 59 - 1,356 - - - - 4 - - 4 (1,382) (26) (17) (28) 7 63 - (1,383) - - - - - (115) - (115) $ 5,451 $ 92 $ 159 $ 103 $ (9) $ (335) $ - $ 5,461 (774) (23) 9 (7) (221) (47) - (1,063) - - - - - (39) - (39) - - - - - (7) - (7) - - 34 - 2 - - 36 - - (8) - - - - (8) - - - - 178 - - 178 9 84 - - - - - 93 - - - - (3) - - (3) $ 4,686 $ 153 (1) $ 194 (1) $ 96 (1) $ (53) (1) $ (428) (1) $ - $ 4,648 $ 34,843 $ - $ 34,843 $ 1,233 $ 1,343 $ 1,145 $ 13 $ - $ - $ 38,577 - - - 154 - - - - (154) - 741 - 741 188 125 - - - - 1,054 (23,517) (105) (23,622) (363) - - - - 9 (23,976) - - - - (1,154) (635) (890) - - (2,679) (4,649) - (4,649) (543) (173) (161) (7) - - (5,533) (4,412) (3) (4,415) (661) (354) (285) (29) (91) 145 (5,690) - - - - - - - (114) - (114) (38) - (38) - (2) - (1) - - (41) (4) - (4) (122) - - - - - (126) (51) - (51) (55) - - - - - (106) (1) - (1) - - - - (326) - (327) $ 2,912 $ (108) 2,804 1,533 42 514 83 917 70 - 3,159 1,470 32 1 12 346 24 - 1,885 - - - - 6 - - 6 (1,196) 18 (53) (35) (73) 97 - (1,242) - - - - - (169) - (169) $ 4,611 $ (77) $ 247 $ 124 $ 282 $ (509) $ - $ 4,678 (1,161) (25) - (9) (274) (19) - (1,488) - - - - - 90 - 90 - - 9 - 6 - - 15 - - 5 - - - - 5 (2) - - - - - - (2) 3 97 - - - - - 100 40 43 - - - - - 83 - - - - (4) - - (4) $ 3,491 $ 38 (1) $ 261 (1) $ 115 (1) $ 10 (1) $ (438) (1) $ - $ 3,477 (1) The Allstate Corporation Twelve months ended December 31, 2020 Claims and claims expense Shelter-in-Place Payback expense Contract benefits and interest credited to contractholder funds ($ in millions) Premiums and contract charges Intersegment insurance premiums and service fees Other revenue Consolidating Segment Results Interest expense Underwriting income (loss) Net investment income Realized capital gains (losses) Amortization of deferred policy acquisition costs Operating costs and expenses Pension and other postretirement remeasurement gains (losses) Restructuring and related charges Amortization of purchased intangibles Gain on disposition of operations Income tax (expense) benefit Preferred stock dividends Net income (loss) applicable to common shareholders Realized capital (gains) losses, after-tax Twelve months ended December 31, 2019 Business combination expenses and the amortization of purchased intangibles, after-tax Gain on disposition of operations, after-tax Adjusted net income (loss) * Pension and other postretirement remeasurement (gains) losses, after-tax Curtailment (gains) losses, after-tax Valuation changes on embedded derivatives that are not hedged, after-tax Premium deficiency for immediate annuities, after-tax DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax Premiums and contract charges Intersegment insurance premiums and service fees Other revenue Claims and claims expense Contract benefits and interest credited to contractholder funds Amortization of deferred policy acquisition costs Operating costs and expenses Pension and other postretirement remeasurement gains (losses) Restructuring and related charges Amortization of purchased intangibles Impairment of purchased intangibles Interest expense Underwriting income (loss) Net investment income Realized capital gains (losses) Gain on disposition of operations Income tax (expense) benefit Preferred stock dividends Valuation changes on embedded derivatives that are not hedged, after-tax Net income (loss) applicable to common shareholders Realized capital (gains) losses, after-tax Pension and other postretirement remeasurement (gains) losses, after-tax Adjusted net income is the segment measure used for each business. DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax Business combination expenses and the amortization of purchased intangibles, after-tax Gain on disposition of operations, after-tax Adjusted net income (loss) * Impairment of purchased intangibles, after-tax The Allstate Corporation 4Q20 Supplement 4

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 $ 28,247 $ 25,293 $ 25,016 $ 22,203 $ 23,750 $ 23,088 $ 22,546 $ 21,488 308.7 307.0 315.8 318.7 324.8 330.6 335.1 337.9 $ 91.50 $ 82.39 $ 79.21 $ 69.67 $ 73.12 $ 69.84 $ 67.28 $ 63.59 $ 28,247 $ 25,293 $ 25,016 $ 22,203 $ 23,750 $ 23,088 $ 22,546 $ 21,488 3,185 2,750 2,610 534 1,893 2,028 1,658 975 $ 25,062 $ 22,543 $ 22,406 $ 21,669 $ 21,857 $ 21,060 $ 20,888 $ 20,513 308.7 307.0 315.8 318.7 324.8 330.6 335.1 337.9 $ 81.19 $ 73.43 $ 70.95 $ 67.99 $ 67.29 $ 63.70 $ 62.33 $ 60.71 $ 7,825 $ 6,635 $ 6,634 $ 6,633 $ 6,631 $ 6,630 $ 6,628 $ 6,453 $ 38,042 $ 33,898 $ 33,620 $ 30,806 $ 32,629 $ 32,770 $ 31,104 $ 29,871 25.9 % 24.3 % 24.6 % 27.4 % 25.5 % 25.4 % 27.1 % 27.6 % 20.6 % 19.6 % 19.7 % 21.5 % 20.3 % 20.2 % 21.3 % 21.6 % (1) (2) ($ in millions, except per share data) Book value per common share Numerator: The Allstate Corporation Book Value per Common Share and Debt to Capital Common shareholders' equity (1) (2) Denominator: Common shares outstanding and dilutive potential common shares outstanding Book value per common share Book value per common share, excluding the impact of unrealized net capital gains and losses on fixed income securities Numerator: Common shareholders' equity Less: Unrealized net capital gains and losses on fixed income securities Adjusted common shareholders' equity Denominator: Excludes equity related to preferred stock of $1,970 million at December 31, 2020, September 30, 2020, June 30, 2020 and March 31, 2020, $2,248 million at December 31, 2019, $3,052 million at September 30, 2019, and $1,930 million at June 30, 2019 and March 31, 2019. Common shares outstanding were 304,192,788 and 318,791,191 as of December 31, 2020 and December 31, 2019, respectively. Total capital resources Ratio of debt to shareholders' equity Common shares outstanding and dilutive potential common shares outstanding Total debt Ratio of debt to capital resources Book value per common share, excluding the impact of unrealized net capital gains and losses on fixed income securities * The Allstate Corporation 4Q20 Supplement 5

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 $ 5,461 $ 4,570 $ 4,333 $ 3,930 $ 4,678 $ 2,386 $ 2,439 $ 2,296 $ 23,750 $ 23,088 $ 22,546 $ 21,488 $ 19,382 $ 21,356 $ 20,819 $ 20,970 28,247 25,293 25,016 22,203 23,750 23,088 22,546 21,488 $ 25,999 $ 24,191 $ 23,781 $ 21,846 $ 21,566 $ 22,222 $ 21,683 $ 21,229 21.0 % 18.9 % 18.2 % 18.0 % 21.7 % 10.7 % 11.2 % 10.8 % $ 4,648 $ 3,863 $ 3,886 $ 3,841 $ 3,477 $ 3,009 $ 2,822 $ 2,797 $ 23,750 $ 23,088 $ 22,546 $ 21,488 $ 19,382 $ 21,356 $ 20,819 $ 20,970 1,887 2,023 1,654 972 (2) (16) 54 187 21,863 21,065 20,892 20,516 19,384 21,372 20,765 20,783 28,247 25,293 25,016 22,203 23,750 23,088 22,546 21,488 3,180 2,744 2,602 530 1,887 2,023 1,654 972 25,067 22,549 22,414 21,673 21,863 21,065 20,892 20,516 $ 23,465 $ 21,807 $ 21,653 $ 21,095 $ 20,624 $ 21,219 $ 20,829 $ 20,650 19.8 % 17.7 % 17.9 % 18.2 % 16.9 % 14.2 % 13.5 % 13.5 % (1) (2) (3) (4) ($ in millions) Return on common shareholders' equity Return on Common Shareholders' Equity The Allstate Corporation Twelve months ended Numerator: Net income applicable to common shareholders (1)(2) Denominator: Beginning common shareholders' equity Ending common shareholders' equity (3) Average common shareholders' equity (4) Return on common shareholders' equity Adjusted net income return on common shareholders' equity Numerator: Adjusted net income * (1) Denominator: Beginning common shareholders' equity Less: Unrealized net capital gains and losses Adjusted beginning common shareholders' equity Average common shareholders' equity and average adjusted common shareholders' equity are determined using a two-point average, with the beginning and ending common shareholders' equity and adjusted common shareholders' equity, respectively, for the twelve-month period as data points. Excludes equity related to preferred stock of $1,970 million at December 31, 2020, September 30, 2020, June 30, 2020 and March 31, 2020, $2,248 million at December 31, 2019, $3,052 million at September 30, 2019, and $1,930 million at June 30, 2019 and March 31, 2019. Includes a $2 million Tax legislation expense for the period ended September 30, 2019 and $29 million Tax legislation benefit for the period ended June 30, 2019 and March 31, 2019. Net income applicable to common shareholders and adjusted net income reflect a trailing twelve-month period. Ending common shareholders' equity Less: Unrealized net capital gains and losses Adjusted ending common shareholders' equity Average adjusted common shareholders' equity (4) Adjusted net income return on common shareholders' equity * The Allstate Corporation 4Q20 Supplement 6

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 21,809 21,900 21,978 21,826 21,913 21,882 21,849 21,693 6,427 6,414 6,391 6,360 6,359 6,341 6,322 6,296 4,459 4,455 4,415 4,385 4,390 4,389 4,375 4,354 216 219 221 224 227 228 229 230 32,911 32,988 33,005 32,795 32,889 32,840 32,775 32,573 451 460 473 485 493 496 497 499 216 220 225 230 234 235 236 237 71 73 74 75 76 77 77 78 738 753 772 790 803 808 810 814 33,649 33,741 33,777 33,585 33,692 33,648 33,585 33,387 128,982 125,831 120,301 107,124 99,632 89,783 83,968 77,866 7,290 7,123 6,975 6,604 6,315 6,159 6,148 6,154 136,272 132,954 127,276 113,728 105,947 95,942 90,116 84,020 1,863 1,874 1,892 1,902 1,923 1,926 1,933 1,936 3,950 4,092 4,410 4,309 4,183 4,287 4,296 4,322 177 181 185 188 192 197 201 206 175,911 172,842 167,540 153,712 145,937 136,000 130,131 123,871 (1) • • • • • (2) • • • Policies in force statistics (in thousands) (1) Allstate Protection Allstate brand Auto The Allstate Corporation Policies in Force and Other Statistics Homeowners Other personal lines Commercial lines Total Encompass brand Auto Homeowners Other personal lines Total Allstate Protection policies in force Protection Services Allstate Protection Plans Other Protection Services (2) Total Allstate Life Policy counts are based on items rather than customers. Allstate Benefits Allstate Annuities Total policies in force Commercial lines PIF for shared economy agreements typically reflect contracts that cover multiple drivers as opposed to individual drivers. A multi-car customer would generate multiple item (policy) counts, even if all cars were insured under one policy. Allstate Protection Plans represents active consumer product protection plans. Allstate Life insurance policies and Allstate Annuities in force reflect the number of contracts in force excluding sold blocks of business that remain on the balance sheet due to the dispositions of the business being effected through reinsurance arrangements. Other Protection Services includes: Roadside assistance, reflecting memberships in force Allstate Benefits reflects certificate counts as opposed to group counts. Finance and insurance products, reflecting service contracts and other products sold in conjunction with auto lending and vehicle sales transactions Identity protection products, reflecting individual customer counts, included free services provided to 200 thousand subscribers for the remainder of 2020 as part of the continued support during the Coronavirus pandemic The Allstate Corporation 4Q20 Supplement 7

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 8,609 $ 9,395 $ 9,172 $ 8,592 $ 8,737 $ 9,312 $ 9,043 $ 8,327 $ 35,768 $ 35,419 244 (470) (349) 370 129 (538) (384) 179 (205) (614) 31 27 40 (81) 7 8 22 1 17 38 8,884 8,952 8,863 8,881 8,873 8,782 8,681 8,507 35,580 34,843 181 192 182 181 180 195 190 176 736 741 (5,268) (5,968) (5,139) (5,251) (5,660) (5,960) (6,272) (5,730) (21,626) (23,622) - - (738) (210) - - - - (948) - (1,168) (1,158) (1,149) (1,167) (1,155) (1,167) (1,163) (1,164) (4,642) (4,649) (1,173) (1,078) (1,107) (1,085) (1,175) (1,114) (1,060) (1,071) (4,443) (4,420) (36) (187) (8) (4) (12) 1 (9) (18) (235) (38) - - - - (51) - - - - (51) 1,420 753 904 1,345 1,000 737 367 700 4,422 2,804 619 422 178 202 323 448 471 291 1,421 1,533 (414) (240) (209) (303) (270) (236) (179) (202) (1,166) (887) 327 230 299 (82) 437 127 204 393 774 1,161 $ 1,952 $ 1,165 $ 1,172 $ 1,162 $ 1,490 $ 1,076 $ 863 $ 1,182 $ 5,451 $ 4,611 $ 424 $ 990 $ 1,186 $ 211 $ 295 $ 510 $ 1,072 $ 680 $ 2,811 $ 2,557 $ 5 $ 3 $ 3 $ 1 $ 1 $ 1 $ 1 $ 1 $ 12 $ 4 59.3 66.7 58.0 59.1 63.8 67.9 72.3 67.4 60.8 67.8 24.7 24.9 31.8 25.8 24.9 23.7 23.5 24.4 26.8 24.2 84.0 91.6 89.8 84.9 88.7 91.6 95.8 91.8 87.6 92.0 59.3 66.7 58.0 59.1 63.8 67.9 72.3 67.4 60.8 67.8 Less: effect of catastrophe losses 4.8 11.1 13.4 2.4 3.3 5.8 12.3 8.0 7.9 7.3 effect of prior year non-catastrophe reserve reestimates - 0.8 (0.4) 0.3 (0.1) (0.5) (0.9) (0.4) 0.2 (0.4) 54.5 54.8 45.0 56.4 60.6 62.6 60.9 59.8 52.7 60.9 84.0 91.6 89.8 84.9 88.7 91.6 95.8 91.8 87.6 92.0 (4.8) (11.1) (13.4) (2.4) (3.3) (5.8) (12.3) (8.0) (7.9) (7.3) - (0.8) 0.4 (0.3) 0.1 0.5 0.9 0.4 (0.2) 0.4 - - - - (0.6) - - - - (0.1) (0.1) - - - - - - - (0.1) - 79.1 79.7 76.8 82.2 84.9 86.3 84.4 84.2 79.4 85.0 0.4 2.1 0.1 - 0.1 - 0.1 0.2 0.7 0.1 - 1.5 - 0.1 - 1.1 0.1 0.1 0.4 0.4 - - 8.3 2.4 - - - - 2.7 - $ 1,411 $ 843 $ 901 $ 1,333 $ 987 $ 852 $ 364 $ 705 $ 4,488 $ 2,908 12 43 6 14 17 (15) 7 (2) 75 7 - 2 - 1 (1) (1) (1) - 3 (3) 1,423 888 907 1,348 1,003 836 370 703 4,566 2,912 (3) (135) (3) (3) (3) (99) (3) (3) (144) (108) $ 1,420 $ 753 $ 904 $ 1,345 $ 1,000 $ 737 $ 367 $ 700 $ 4,422 $ 2,804 (2) ($ in millions, except ratios) Premiums written The Allstate Corporation Property-Liability Results Three months ended Shelter-in-Place Payback expense Amortization of deferred policy acquisition costs Operating costs and expenses Restructuring and related charges Decrease (increase) in unearned premiums Other Premiums earned Other revenue Amortization of purchased intangibles Operating ratios Loss ratio Twelve months ended Realized capital gains (losses), after-tax Net income applicable to common shareholders Catastrophe losses Impairment of purchased intangibles Underwriting income (1) Net investment income Income tax expense on operations Claims and claims expense Expense ratio (2) Combined ratio Loss ratio Underlying loss ratio * Reconciliation of combined ratio to underlying combined ratio Combined ratio Effect of catastrophe losses Effect of prior year non-catastrophe reserve reestimates Effect of impairment of purchased intangibles Underlying combined ratio * Effect of amortization of purchased intangibles Effect of restructuring and related charges on combined ratio Effect of Discontinued Lines and Coverages on combined ratio Effect of Shelter-in-Place Payback expense on combined and expense ratios (1) Underwriting income (loss) Allstate brand Other revenue is deducted from other costs and expenses in the expense ratio calculation. Encompass brand Answer Financial Total underwriting income for Allstate Protection Discontinued Lines and Coverages Total underwriting income for Property Liability The Allstate Corporation 4Q20 Supplement 8

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 8,382 $ 9,135 $ 8,909 $ 8,370 $ 8,497 $ 9,034 $ 8,765 $ 8,103 $ 34,796 $ 34,399 $ 5,977 $ 6,081 $ 6,037 $ 6,020 $ 6,009 $ 5,944 $ 5,900 $ 5,796 $ 24,115 $ 23,649 1,993 1,974 1,955 1,936 1,922 1,896 1,859 1,836 7,858 7,513 465 466 459 451 451 449 442 439 1,841 1,781 207 183 159 218 237 236 226 183 767 882 $ 8,642 $ 8,704 $ 8,610 $ 8,625 $ 8,619 $ 8,525 $ 8,427 $ 8,254 $ 34,581 $ 33,825 $ 3,593 $ 3,631 $ 2,914 $ 3,737 $ 4,117 $ 4,093 $ 4,085 $ 3,852 $ 13,875 $ 16,147 1,091 1,625 1,651 940 974 1,102 1,539 1,269 5,307 4,884 245 301 293 244 227 277 282 294 1,083 1,080 183 153 125 171 185 197 196 139 632 717 $ 5,112 $ 5,710 $ 4,983 $ 5,092 $ 5,503 $ 5,669 $ 6,102 $ 5,554 $ 20,897 $ 22,828 $ 1,576 $ 1,628 $ 2,228 $ 1,705 $ 1,616 $ 1,511 $ 1,497 $ 1,510 $ 7,137 $ 6,134 471 452 433 440 465 444 421 432 1,796 1,762 167 171 153 148 159 156 147 143 639 605 41 45 47 43 41 39 39 38 176 157 28 28 29 26 12 30 28 27 111 97 $ 2,283 $ 2,324 $ 2,890 $ 2,362 $ 2,293 $ 2,180 $ 2,132 $ 2,150 $ 9,859 $ 8,755 $ 882 $ 897 $ 966 $ 659 $ 354 $ 420 $ 395 $ 511 $ 3,404 $ 1,680 442 (93) (118) 567 494 362 (90) 146 798 912 85 34 48 88 96 53 48 30 255 227 (16) (14) (11) 5 13 1 (7) 7 (36) 14 18 19 16 14 30 16 18 11 67 75 $ 1,411 $ 843 $ 901 $ 1,333 $ 987 $ 852 $ 364 $ 705 $ 4,488 $ 2,908 59.2 65.6 57.9 59.0 63.8 66.5 72.4 67.3 60.4 67.5 24.5 24.7 31.6 25.5 24.7 23.5 23.3 24.2 26.6 23.9 83.7 90.3 89.5 84.5 88.5 90.0 95.7 91.5 87.0 91.4 59.2 65.6 57.9 59.0 63.8 66.5 72.4 67.3 60.4 67.5 4.7 11.3 13.1 2.3 3.3 5.4 12.4 7.9 7.9 7.2 effect of prior year non-catastrophe reserve reestimates - (0.7) (0.4) 0.3 (0.2) (1.6) (0.9) (0.5) (0.2) (0.8) 54.5 55.0 45.2 56.4 60.7 62.7 60.9 59.9 52.7 61.1 83.7 90.3 89.5 84.5 88.5 90.0 95.7 91.5 87.0 91.4 (4.7) (11.3) (13.1) (2.3) (3.3) (5.4) (12.4) (7.9) (7.9) (7.2) - 0.7 0.4 (0.3) 0.2 1.6 0.9 0.5 0.2 0.8 - - - - (0.6) - - - - (0.2) (0.1) - - - - - - - - - 78.9 79.7 76.8 81.9 84.8 86.2 84.2 84.1 79.3 84.8 - (6.1) (0.1) 0.1 (0.2) (1.7) (0.9) 0.1 (1.5) (0.7) 3.7 2.3 2.4 2.3 3.0 2.4 2.3 2.3 2.7 2.5 - - 8.4 2.4 - - - - 2.7 - (1) (2) Other personal lines ($ in millions, except ratios) Net premiums written The Allstate Corporation Allstate Brand Profitability Measures Three months ended Commercial lines Total Expenses Twelve months ended Incurred losses Auto Homeowners Other personal lines Commercial lines Total Net premiums earned Auto Homeowners Auto Homeowners Other personal lines Commercial lines Other business lines Total Underwriting income (loss) Auto Homeowners Other personal lines Commercial lines Other business lines (1) Total Loss ratio Expense ratio (2) Combined ratio Loss ratio Less: effect of catastrophe losses Underlying loss ratio * Reconciliation of combined ratio to underlying combined ratio Combined ratio Effect of catastrophe losses Effect of prior year non-catastrophe reserve reestimates Effect of impairment of purchased intangibles Underlying combined ratio * Effect of amortization of purchased intangibles Other business lines primarily represent commissions earned and other costs and expenses for Ivantage. Other revenue is deducted from other costs and expenses in the expense ratio calculation. Effect of prior year reserve reestimates on combined ratio Effect of advertising expenses on combined ratio Effect of Shelter-in-Place Payback expense on combined and expense ratios The Allstate Corporation 4Q20 Supplement 9

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 830 888 868 881 813 902 900 920 3,467 3,535 218 247 230 204 202 235 236 204 899 877 621 621 612 616 612 607 598 596 617 603 1,342 1,334 1,324 1,310 1,300 1,304 1,292 1,263 1,328 1,291 87.2 87.9 87.6 87.4 87.5 87.9 88.3 88.2 87.5 88.0 87.4 87.8 87.3 87.6 88.1 88.4 88.1 88.3 87.5 88.2 (0.9) - 0.2 0.5 0.8 0.6 1.0 0.6 (0.2) 3.0 0.9 0.5 0.1 1.2 0.7 0.3 0.2 2.1 2.7 3.3 (28.7) (28.6) (46.4) (12.2) (1.8) 2.6 (0.3) (0.9) (29.1) (0.2) 5.1 7.9 20.4 8.1 6.2 5.3 8.7 5.7 10.0 6.4 3.6 3.5 (8.6) (13.2) (11.1) (8.8) (2.9) - (4.0) (5.6) 0.7 3.3 9.5 15.9 22.9 13.4 11.7 0.7 7.1 11.8 (1) (2) (3) (4) (5) (6) (7) The Allstate Corporation Allstate Brand Statistics (1) Three months ended Auto Twelve months ended Homeowners Average premium - gross written ($) (3) Auto Homeowners New issued applications (in thousands) (2) Renewal ratio (%) (4) Total brand rate changes (%) (5) Auto Auto Homeowners Homeowners Auto property damage (% change year-over-year) Gross claim frequency (6) Paid claim severity (7) Homeowners excluding catastrophe losses (% change year-over-year) Rate changes include changes approved based on our net cost of reinsurance. These rate changes do not reflect initial rates filed for insurance subsidiaries initially writing business. Rate changes do not include rating plan enhancements, including the introduction Gross claim frequency is calculated as annualized notice counts received in the period divided by the average of policies in force with the applicable coverage during the period. It includes all actual notice counts, regardless of their current status (open or closed) or their ultimate disposition (closed with a payment or closed without payment). Frequency statistics exclude counts associated with catastrophe events. The percent change in gross claim frequency is calculated as the amount of increase or decrease in the gross claim frequency in the current period compared to the same period in the prior year; divided by the prior year gross claim frequency. Paid claim severity is calculated by dividing the sum of paid losses and loss expenses by claims closed with a payment during the period. The percent change in paid claim severity is calculated as the amount of increase or decrease in paid claim severity in the current period compared to the same period in the prior year; divided by the prior year paid claims severity. Gross claim frequency (6) Paid claim severity (7) Statistics presented for Allstate brand exclude excess and surplus lines. New issued applications: Item counts of automobiles or homeowners insurance applications for insurance policies that were issued during the period, regardless of whether the customer was previously insured by another Allstate Protection brand. Allstate brand includes automobiles added by existing customers when they exceed the number allowed (currently 10) on a policy. Renewal ratio: Renewal policies issued during the period, based on contract effective dates, divided by the total policies issued 6 months prior for auto or 12 months prior for homeowners. Average premium - gross written: Gross premiums written divided by issued item count. Gross premiums written include the impacts from discounts, surcharges and ceded reinsurance premiums and exclude the impacts from mid-term premium adjustments and premium refund accruals. Average premiums represent the appropriate policy term for each line, which is 6 months for auto and 12 months for homeowners. The Allstate Corporation 4Q20 Supplement 10

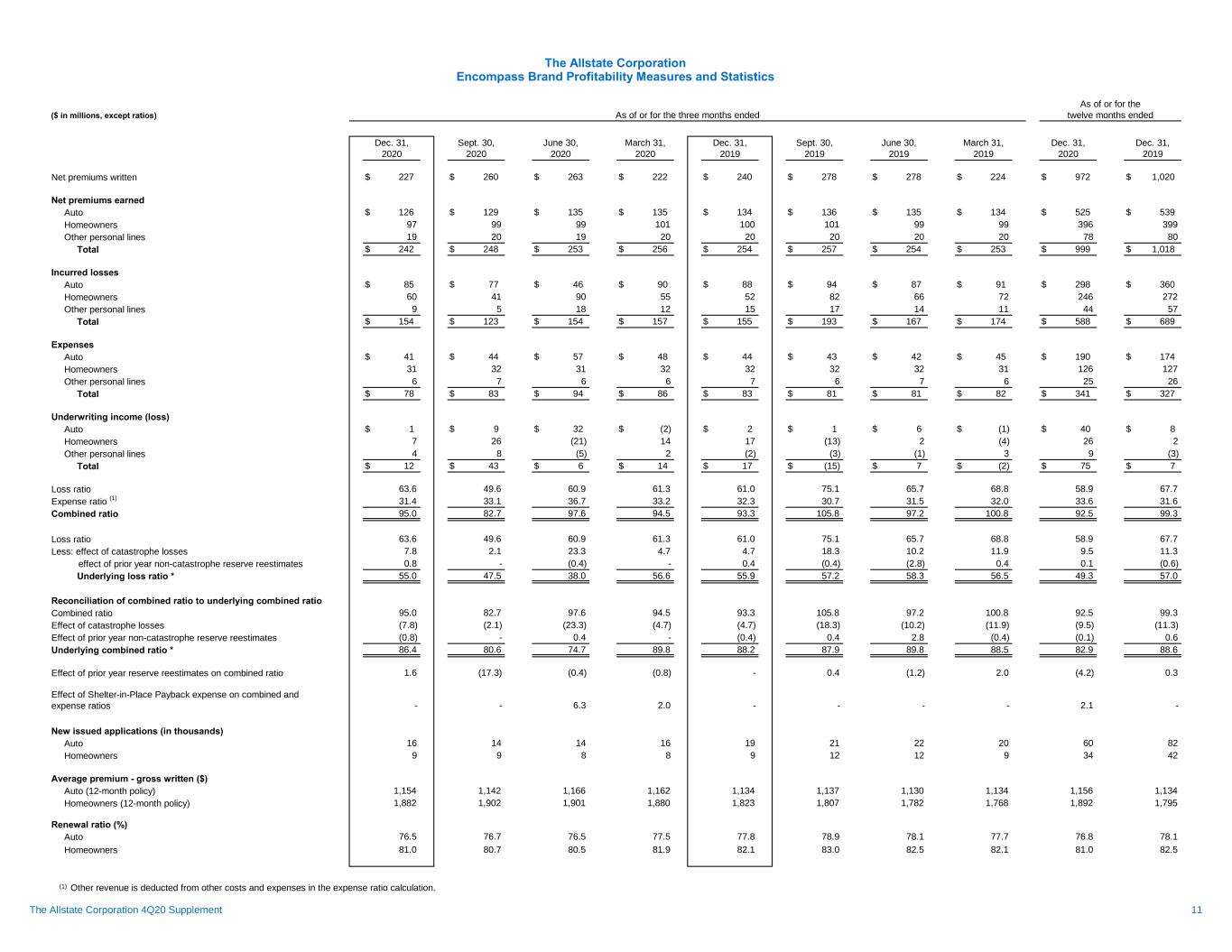

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 227 $ 260 $ 263 $ 222 $ 240 $ 278 $ 278 $ 224 $ 972 $ 1,020 $ 126 $ 129 $ 135 $ 135 $ 134 $ 136 $ 135 $ 134 $ 525 $ 539 97 99 99 101 100 101 99 99 396 399 19 20 19 20 20 20 20 20 78 80 $ 242 $ 248 $ 253 $ 256 $ 254 $ 257 $ 254 $ 253 $ 999 $ 1,018 $ 85 $ 77 $ 46 $ 90 $ 88 $ 94 $ 87 $ 91 $ 298 $ 360 60 41 90 55 52 82 66 72 246 272 9 5 18 12 15 17 14 11 44 57 $ 154 $ 123 $ 154 $ 157 $ 155 $ 193 $ 167 $ 174 $ 588 $ 689 $ 41 $ 44 $ 57 $ 48 $ 44 $ 43 $ 42 $ 45 $ 190 $ 174 31 32 31 32 32 32 32 31 126 127 6 7 6 6 7 6 7 6 25 26 $ 78 $ 83 $ 94 $ 86 $ 83 $ 81 $ 81 $ 82 $ 341 $ 327 $ 1 $ 9 $ 32 $ (2) $ 2 $ 1 $ 6 $ (1) $ 40 $ 8 7 26 (21) 14 17 (13) 2 (4) 26 2 4 8 (5) 2 (2) (3) (1) 3 9 (3) $ 12 $ 43 $ 6 $ 14 $ 17 $ (15) $ 7 $ (2) $ 75 $ 7 63.6 49.6 60.9 61.3 61.0 75.1 65.7 68.8 58.9 67.7 31.4 33.1 36.7 33.2 32.3 30.7 31.5 32.0 33.6 31.6 95.0 82.7 97.6 94.5 93.3 105.8 97.2 100.8 92.5 99.3 63.6 49.6 60.9 61.3 61.0 75.1 65.7 68.8 58.9 67.7 7.8 2.1 23.3 4.7 4.7 18.3 10.2 11.9 9.5 11.3 effect of prior year non-catastrophe reserve reestimates 0.8 - (0.4) - 0.4 (0.4) (2.8) 0.4 0.1 (0.6) 55.0 47.5 38.0 56.6 55.9 57.2 58.3 56.5 49.3 57.0 95.0 82.7 97.6 94.5 93.3 105.8 97.2 100.8 92.5 99.3 (7.8) (2.1) (23.3) (4.7) (4.7) (18.3) (10.2) (11.9) (9.5) (11.3) (0.8) - 0.4 - (0.4) 0.4 2.8 (0.4) (0.1) 0.6 86.4 80.6 74.7 89.8 88.2 87.9 89.8 88.5 82.9 88.6 1.6 (17.3) (0.4) (0.8) - 0.4 (1.2) 2.0 (4.2) 0.3 - - 6.3 2.0 - - - - 2.1 - 16 14 14 16 19 21 22 20 60 82 9 9 8 8 9 12 12 9 34 42 1,154 1,142 1,166 1,162 1,134 1,137 1,130 1,134 1,156 1,134 1,882 1,902 1,901 1,880 1,823 1,807 1,782 1,768 1,892 1,795 76.5 76.7 76.5 77.5 77.8 78.9 78.1 77.7 76.8 78.1 81.0 80.7 80.5 81.9 82.1 83.0 82.5 82.1 81.0 82.5 (1) Other personal lines ($ in millions, except ratios) Net premiums written Homeowners The Allstate Corporation Encompass Brand Profitability Measures and Statistics As of or for the three months ended Net premiums earned Auto Other personal lines Total As of or for the twelve months ended Other personal lines Total Expenses Auto Incurred losses Auto Homeowners Total Homeowners Underwriting income (loss) Auto Homeowners Other personal lines Total Loss ratio Expense ratio (1) Combined ratio Loss ratio Less: effect of catastrophe losses Underlying loss ratio * Reconciliation of combined ratio to underlying combined ratio Combined ratio Effect of catastrophe losses Effect of prior year non-catastrophe reserve reestimates Underlying combined ratio * Effect of prior year reserve reestimates on combined ratio Effect of Shelter-in-Place Payback expense on combined and expense ratios New issued applications (in thousands) Auto Homeowners Average premium - gross written ($) Auto (12-month policy) Homeowners (12-month policy) Renewal ratio (%) Auto Homeowners Other revenue is deducted from other costs and expenses in the expense ratio calculation. The Allstate Corporation 4Q20 Supplement 11

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 5,766 $ 6,192 $ 6,054 $ 6,091 $ 5,931 $ 6,123 $ 5,940 $ 5,928 $ 24,103 $ 23,922 $ 5,977 $ 6,081 $ 6,037 $ 6,020 $ 6,009 $ 5,944 $ 5,900 $ 5,796 $ 24,115 $ 23,649 74 75 71 81 78 80 77 77 301 312 (3,593) (3,631) (2,914) (3,737) (4,117) (4,093) (4,085) (3,852) (13,875) (16,147) (1,576) (1,628) (2,228) (1,705) (1,616) (1,511) (1,497) (1,510) (7,137) (6,134) $ 882 $ 897 $ 966 $ 659 $ 354 $ 420 $ 395 $ 511 $ 3,404 $ 1,680 60.1 59.7 48.3 62.1 68.5 68.8 69.2 66.5 57.5 68.3 0.6 1.6 2.2 0.2 0.1 2.3 3.2 1.2 1.2 1.7 effect of prior year non-catastrophe reserve reestimates (0.1) (0.6) (0.8) 0.4 - (2.5) (1.5) (0.9) (0.3) (1.2) 59.6 58.7 46.9 61.5 68.4 69.0 67.5 66.2 56.6 67.8 25.1 25.5 35.7 27.0 25.6 24.1 24.1 24.7 28.4 24.6 85.2 85.2 84.0 89.1 94.1 92.9 93.3 91.2 85.9 92.9 (0.6) (1.6) (2.2) (0.2) (0.1) (2.3) (3.2) (1.2) (1.2) (1.7) 0.1 0.6 0.8 (0.4) - 2.5 1.5 0.9 0.3 1.2 - - - - (0.8) - - - - (0.2) 84.7 84.2 82.6 88.5 93.2 93.1 91.6 90.9 85.0 92.2 - - 11.9 3.4 - - - - 3.8 - $ 120 $ 134 $ 136 $ 118 $ 127 $ 147 $ 146 $ 120 $ 508 $ 540 $ 126 $ 129 $ 135 $ 135 $ 134 $ 136 $ 135 $ 134 $ 525 $ 539 1 1 - 1 - 2 - 1 3 3 (85) (77) (46) (90) (88) (94) (87) (91) (298) (360) (41) (44) (57) (48) (44) (43) (42) (45) (190) (174) $ 1 $ 9 $ 32 $ (2) $ 2 $ 1 $ 6 $ (1) $ 40 $ 8 67.5 59.7 34.1 66.7 65.7 69.1 64.5 67.9 56.8 66.8 - 2.3 3.0 - - 2.9 2.2 2.2 1.3 1.9 effect of prior year non-catastrophe reserve reestimates 3.2 1.6 (0.8) 1.5 - (0.7) (6.6) - 1.4 (1.9) 64.3 55.8 31.9 65.2 65.7 66.9 68.9 65.7 54.1 66.8 31.7 33.3 42.2 34.8 32.8 30.2 31.1 32.8 35.6 31.7 99.2 93.0 76.3 101.5 98.5 99.3 95.6 100.7 92.4 98.5 - (2.3) (3.0) - - (2.9) (2.2) (2.2) (1.3) (1.9) (3.2) (1.6) 0.8 (1.5) - 0.7 6.6 - (1.4) 1.9 96.0 89.1 74.1 100.0 98.5 97.1 100.0 98.5 89.7 98.5 - - 11.9 3.7 - - - - 4.0 - (1) ($ in millions, except ratios) Allstate brand auto The Allstate Corporation Auto Profitability Measures by Brand Three months ended Twelve months ended Combined ratio Effect of catastrophe losses Net premiums written Net premiums earned Other revenue Incurred losses Expenses Underwriting income Loss ratio Less: effect of catastrophe losses Underlying loss ratio * Expense ratio (1) Effect of prior year non-catastrophe reserve reestimates Effect of impairment of purchased intangibles Underlying combined ratio * Effect of Shelter-in-Place Payback expense on combined and expense ratios Encompass brand auto Other revenue is deducted from other costs and expenses in the expense ratio calculation. Net premiums written Net premiums earned Other revenue Incurred losses Expenses Underwriting income (loss) Loss ratio Less: effect of catastrophe losses Underlying loss ratio * Expense ratio (1) Combined ratio Effect of catastrophe losses Effect of prior year non-catastrophe reserve reestimates Underlying combined ratio * Effect of Shelter-in-Place Payback expense on combined and expense ratios The Allstate Corporation 4Q20 Supplement 12

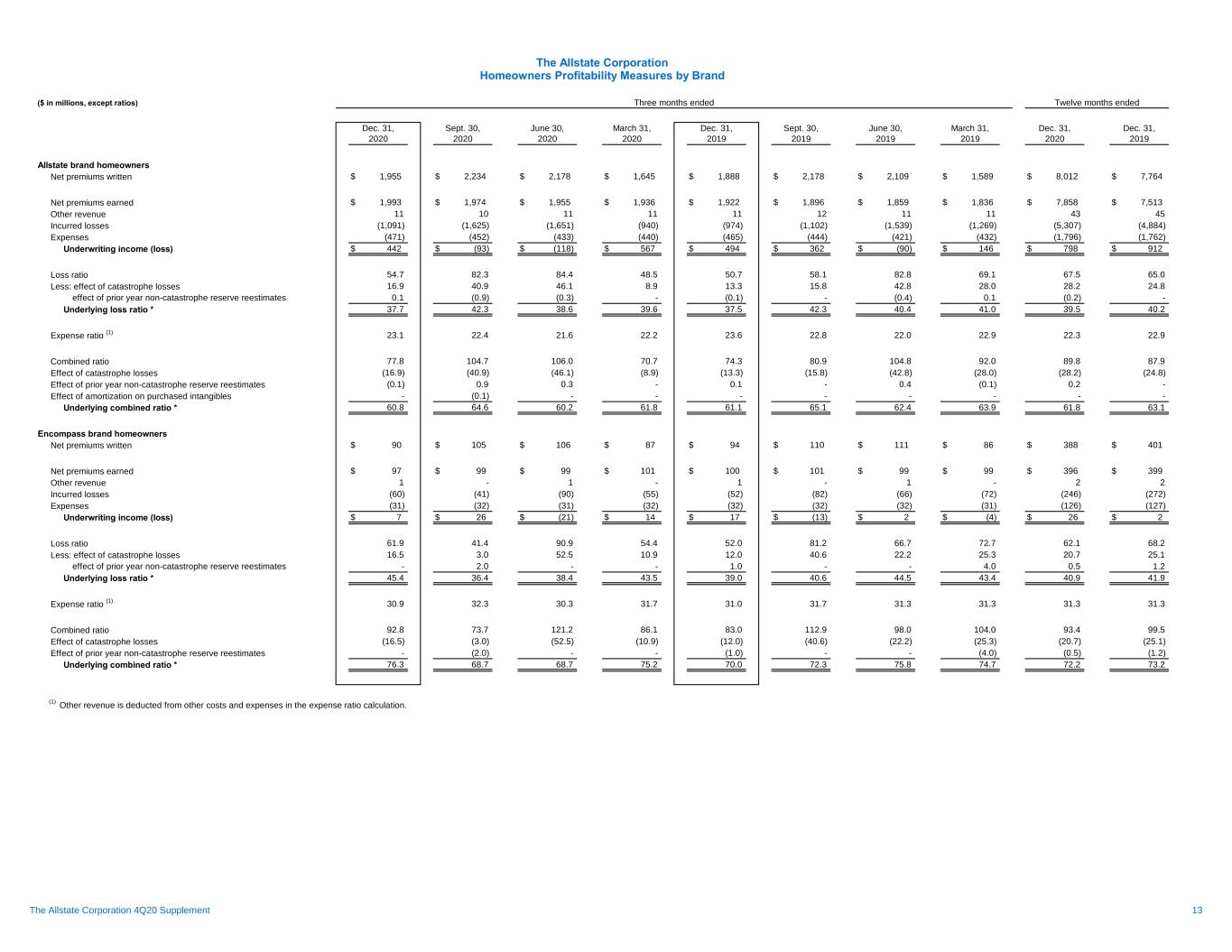

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 1,955 $ 2,234 $ 2,178 $ 1,645 $ 1,888 $ 2,178 $ 2,109 $ 1,589 $ 8,012 $ 7,764 $ 1,993 $ 1,974 $ 1,955 $ 1,936 $ 1,922 $ 1,896 $ 1,859 $ 1,836 $ 7,858 $ 7,513 11 10 11 11 11 12 11 11 43 45 (1,091) (1,625) (1,651) (940) (974) (1,102) (1,539) (1,269) (5,307) (4,884) (471) (452) (433) (440) (465) (444) (421) (432) (1,796) (1,762) $ 442 $ (93) $ (118) $ 567 $ 494 $ 362 $ (90) $ 146 $ 798 $ 912 54.7 82.3 84.4 48.5 50.7 58.1 82.8 69.1 67.5 65.0 16.9 40.9 46.1 8.9 13.3 15.8 42.8 28.0 28.2 24.8 effect of prior year non-catastrophe reserve reestimates 0.1 (0.9) (0.3) - (0.1) - (0.4) 0.1 (0.2) - 37.7 42.3 38.6 39.6 37.5 42.3 40.4 41.0 39.5 40.2 23.1 22.4 21.6 22.2 23.6 22.8 22.0 22.9 22.3 22.9 77.8 104.7 106.0 70.7 74.3 80.9 104.8 92.0 89.8 87.9 (16.9) (40.9) (46.1) (8.9) (13.3) (15.8) (42.8) (28.0) (28.2) (24.8) (0.1) 0.9 0.3 - 0.1 - 0.4 (0.1) 0.2 - - (0.1) - - - - - - - - 60.8 64.6 60.2 61.8 61.1 65.1 62.4 63.9 61.8 63.1 $ 90 $ 105 $ 106 $ 87 $ 94 $ 110 $ 111 $ 86 $ 388 $ 401 $ 97 $ 99 $ 99 $ 101 $ 100 $ 101 $ 99 $ 99 $ 396 $ 399 1 - 1 - 1 - 1 - 2 2 (60) (41) (90) (55) (52) (82) (66) (72) (246) (272) (31) (32) (31) (32) (32) (32) (32) (31) (126) (127) $ 7 $ 26 $ (21) $ 14 $ 17 $ (13) $ 2 $ (4) $ 26 $ 2 61.9 41.4 90.9 54.4 52.0 81.2 66.7 72.7 62.1 68.2 16.5 3.0 52.5 10.9 12.0 40.6 22.2 25.3 20.7 25.1 effect of prior year non-catastrophe reserve reestimates - 2.0 - - 1.0 - - 4.0 0.5 1.2 45.4 36.4 38.4 43.5 39.0 40.6 44.5 43.4 40.9 41.9 30.9 32.3 30.3 31.7 31.0 31.7 31.3 31.3 31.3 31.3 92.8 73.7 121.2 86.1 83.0 112.9 98.0 104.0 93.4 99.5 (16.5) (3.0) (52.5) (10.9) (12.0) (40.6) (22.2) (25.3) (20.7) (25.1) - (2.0) - - (1.0) - - (4.0) (0.5) (1.2) 76.3 68.7 68.7 75.2 70.0 72.3 75.8 74.7 72.2 73.2 (1) ($ in millions, except ratios) Allstate brand homeowners The Allstate Corporation Homeowners Profitability Measures by Brand Three months ended Net premiums written Net premiums earned Other revenue Incurred losses Expenses Underwriting income (loss) Loss ratio Less: effect of catastrophe losses Underlying loss ratio * Expense ratio (1) Combined ratio Effect of prior year non-catastrophe reserve reestimates Effect of catastrophe losses Effect of prior year non-catastrophe reserve reestimates Effect of amortization on purchased intangibles Underlying combined ratio * Encompass brand homeowners Underlying combined ratio * Net premiums written Twelve months ended Other revenue is deducted from other costs and expenses in the expense ratio calculation. Net premiums earned Other revenue Incurred losses Expenses Underwriting income (loss) Loss ratio Less: effect of catastrophe losses Underlying loss ratio * Expense ratio (1) Combined ratio Effect of catastrophe losses The Allstate Corporation 4Q20 Supplement 13

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 559 $ 485 $ 467 $ 379 $ 453 $ 364 $ 350 $ 368 $ 1,890 $ 1,535 $ 395 $ 384 $ 360 $ 354 $ 321 $ 312 $ 305 $ 295 $ 1,493 $ 1,233 53 52 51 52 46 47 48 47 208 188 38 36 35 38 44 44 33 33 147 154 11 12 11 10 12 11 10 9 44 42 21 14 19 (24) 11 4 9 8 30 32 (102) (107) (85) (92) (92) (93) (86) (92) (386) (363) (176) (169) (160) (153) (143) (139) (134) (127) (658) (543) (167) (160) (163) (161) (181) (171) (158) (151) (651) (661) (2) 2 (3) - - (1) 1 - (3) - (25) (28) (26) (27) (29) (31) (31) (31) (106) (122) - - - - - - (55) - - (55) (13) (6) (7) - (1) 4 12 3 (26) 18 $ 33 $ 30 $ 32 $ (3) $ (12) $ (13) $ (46) $ (6) $ 92 $ (77) (16) (11) (15) 19 (8) (4) (6) (7) (23) (25) 21 21 21 21 23 25 25 24 84 97 - - - - - - 43 - - 43 $ 38 $ 40 $ 38 $ 37 $ 3 $ 8 $ 16 $ 11 $ 153 $ 38 $ 385 $ 300 $ 310 $ 221 $ 278 $ 181 $ 167 $ 206 $ 1,216 $ 832 $ 248 $ 236 $ 219 $ 206 $ 172 $ 163 $ 153 $ 145 $ 909 $ 633 9 8 8 8 6 7 7 8 33 28 6 7 5 5 6 5 4 4 23 19 13 6 9 (19) 5 2 6 7 9 20 (69) (70) (56) (55) (49) (46) (37) (43) (250) (175) (87) (83) (75) (70) (62) (60) (56) (53) (315) (231) (61) (56) (57) (50) (56) (49) (48) (42) (224) (195) - 3 - - - - - - 3 - (15) (16) (15) (16) (18) (18) (18) (18) (62) (72) - - - - - - (55) - - (55) (15) (7) (8) (2) (2) (1) 9 (2) (32) 4 $ 29 $ 28 $ 30 $ 7 $ 2 $ 3 $ (35) $ 6 $ 94 $ (24) (9) (5) (7) 15 (4) (2) (4) (6) (6) (16) 12 13 12 12 14 14 15 14 49 57 - - - - - - 43 - - 43 $ 32 $ 36 $ 35 $ 34 $ 12 $ 15 $ 19 $ 14 $ 137 $ 60 $ 174 $ 185 $ 157 $ 158 $ 175 $ 183 $ 183 $ 162 $ 674 $ 703 $ 242 $ 241 $ 235 $ 230 $ 245 $ 241 $ 235 $ 228 $ 948 $ 949 (33) (37) (29) (37) (43) (47) (49) (49) (136) (188) (207) (203) (205) (205) (217) (215) (200) (196) (820) (828) 2 1 1 2 1 5 3 5 6 14 $ 4 $ 2 $ 2 $ (10) $ (14) $ (16) $ (11) $ (12) $ (2) $ (53) (7) (6) (8) 4 (4) (2) (2) (1) (17) (9) 9 8 9 9 9 11 10 10 35 40 $ 6 $ 4 $ 3 $ 3 $ (9) $ (7) (3) $ (3) $ 16 $ (22) (1) (2) ($ in millions) Protection Services Net premiums written The Allstate Corporation Protection Services Segment Results Three months ended Twelve months ended Restructuring and related charges Amortization of purchased intangibles Net premiums earned Other revenue Intersegment insurance premiums and service fees Net investment income Realized capital gains (losses) Claims and claims expense Amortization of deferred policy acquisition costs Operating costs and expenses Net premiums earned Net premiums written Other revenue Impairment of purchased intangibles, after-tax Adjusted net income Allstate Protection Plans Impairment of purchased intangibles Income tax (expense) benefit Net income (loss) applicable to common shareholders Realized capital (gains) losses, after-tax Amortization of purchased intangibles, after-tax Claims and claims expense Amortization of deferred policy acquisition costs Other costs and expenses Net investment income Realized capital gains (losses) Income tax (expense) benefit Net income (loss) applicable to common shareholders Restructuring and related charges Amortization of purchased intangibles Impairment of purchased intangibles Other Protection Services Net premiums written Realized capital (gains) losses, after-tax Amortization of purchased intangibles, after-tax Impairment of purchased intangibles, after-tax Adjusted net income Other costs and expenses (2) Income tax benefit Net income (loss) applicable to common shareholders Total revenue (1) Claims and claims expense Total revenue may include net premiums earned, intersegment insurance premiums and service fees, other revenue, revenue earned from external customers, net investment income and realized capital gains and losses. Other costs and expenses may include amortization of deferred policy acquisition costs, operating costs and expenses, and restructuring and related charges. Realized capital (gains) losses, after-tax Amortization of purchased intangibles, after-tax Adjusted net income (loss) The Allstate Corporation 4Q20 Supplement 14

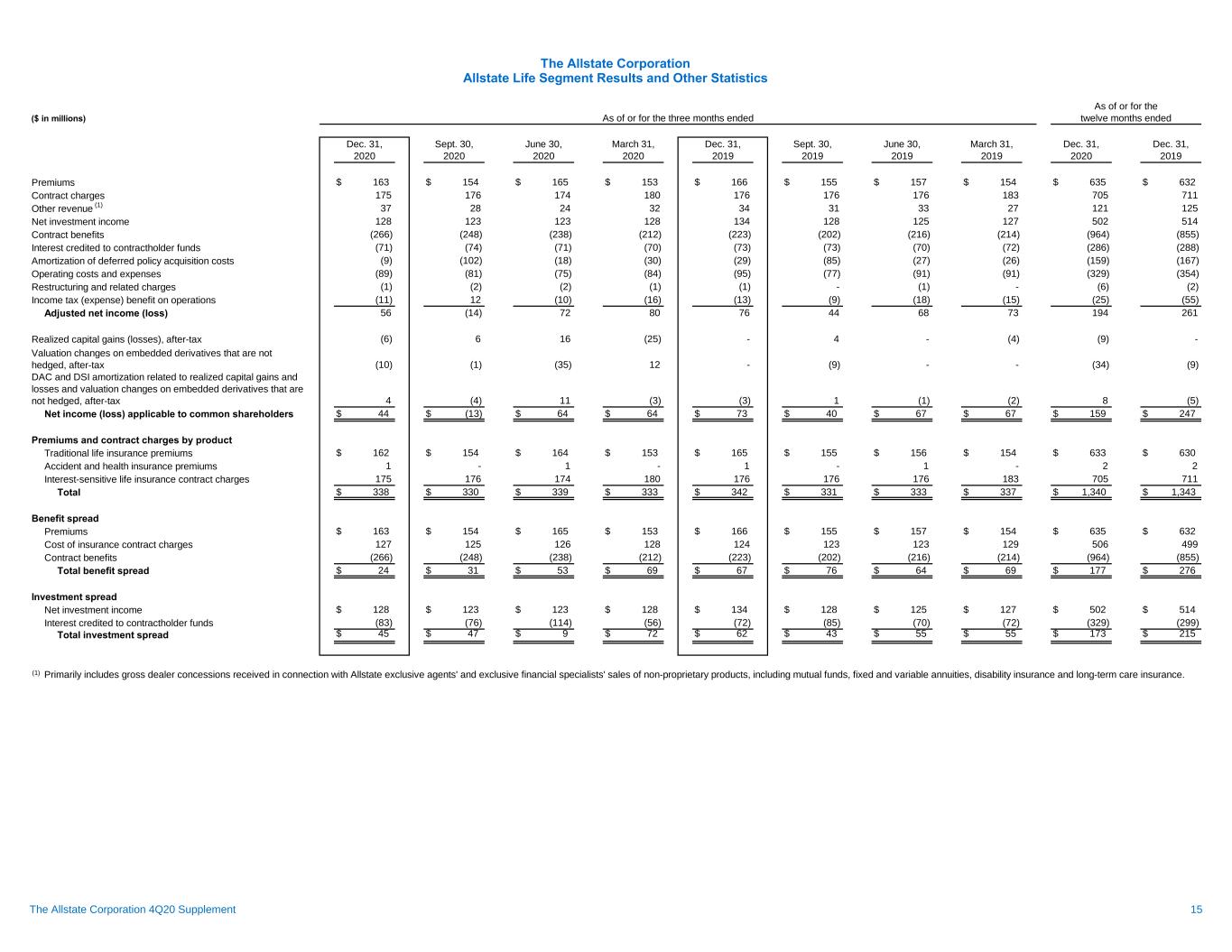

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 163 $ 154 $ 165 $ 153 $ 166 $ 155 $ 157 $ 154 $ 635 $ 632 175 176 174 180 176 176 176 183 705 711 37 28 24 32 34 31 33 27 121 125 128 123 123 128 134 128 125 127 502 514 (266) (248) (238) (212) (223) (202) (216) (214) (964) (855) (71) (74) (71) (70) (73) (73) (70) (72) (286) (288) (9) (102) (18) (30) (29) (85) (27) (26) (159) (167) (89) (81) (75) (84) (95) (77) (91) (91) (329) (354) (1) (2) (2) (1) (1) - (1) - (6) (2) (11) 12 (10) (16) (13) (9) (18) (15) (25) (55) 56 (14) 72 80 76 44 68 73 194 261 (6) 6 16 (25) - 4 - (4) (9) - (10) (1) (35) 12 - (9) - - (34) (9) 4 (4) 11 (3) (3) 1 (1) (2) 8 (5) $ 44 $ (13) $ 64 $ 64 $ 73 $ 40 $ 67 $ 67 $ 159 $ 247 $ 162 $ 154 $ 164 $ 153 $ 165 $ 155 $ 156 $ 154 $ 633 $ 630 1 - 1 - 1 - 1 - 2 2 175 176 174 180 176 176 176 183 705 711 $ 338 $ 330 $ 339 $ 333 $ 342 $ 331 $ 333 $ 337 $ 1,340 $ 1,343 $ 163 $ 154 $ 165 $ 153 $ 166 $ 155 $ 157 $ 154 $ 635 $ 632 127 125 126 128 124 123 123 129 506 499 (266) (248) (238) (212) (223) (202) (216) (214) (964) (855) $ 24 $ 31 $ 53 $ 69 $ 67 $ 76 $ 64 $ 69 $ 177 $ 276 $ 128 $ 123 $ 123 $ 128 $ 134 $ 128 $ 125 $ 127 $ 502 $ 514 (83) (76) (114) (56) (72) (85) (70) (72) (329) (299) $ 45 $ 47 $ 9 $ 72 $ 62 $ 43 $ 55 $ 55 $ 173 $ 215 (1) Premiums The Allstate Corporation Allstate Life Segment Results and Other Statistics As of or for the three months ended Accident and health insurance premiums Realized capital gains (losses), after-tax Valuation changes on embedded derivatives that are not hedged, after-tax DAC and DSI amortization related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax As of or for the twelve months ended Net income (loss) applicable to common shareholders Premiums and contract charges by product Traditional life insurance premiums Amortization of deferred policy acquisition costs Operating costs and expenses Adjusted net income (loss) Contract charges Other revenue (1) Net investment income Contract benefits Interest credited to contractholder funds Primarily includes gross dealer concessions received in connection with Allstate exclusive agents' and exclusive financial specialists' sales of non-proprietary products, including mutual funds, fixed and variable annuities, disability insurance and long-term care insurance. Total benefit spread Investment spread ($ in millions) Interest-sensitive life insurance contract charges Total Benefit spread Net investment income Interest credited to contractholder funds Total investment spread Premiums Cost of insurance contract charges Contract benefits Restructuring and related charges Income tax (expense) benefit on operations The Allstate Corporation 4Q20 Supplement 15

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 $ 159 $ 188 $ 241 $ 244 $ 247 $ 237 $ 252 $ 260 $ 2,944 $ 2,863 $ 2,744 $ 2,657 $ 2,474 $ 2,528 $ 2,587 $ 2,542 3,026 3,075 3,037 2,842 2,944 2,863 2,744 2,657 $ 2,985 $ 2,969 $ 2,891 $ 2,750 $ 2,709 $ 2,696 $ 2,666 $ 2,600 5.3 % 6.3 % 8.3 % 8.9 % 9.1 % 8.8 % 9.5 % 10.0 % $ 194 $ 214 $ 272 $ 268 $ 261 $ 254 $ 285 $ 297 $ 2,944 $ 2,863 $ 2,744 $ 2,657 $ 2,474 $ 2,528 $ 2,587 $ 2,542 328 350 271 168 52 75 89 142 175 175 175 175 175 175 175 175 $ 2,441 $ 2,338 $ 2,298 $ 2,314 $ 2,247 $ 2,278 $ 2,323 $ 2,225 $ 3,026 $ 3,075 $ 3,037 $ 2,842 $ 2,944 $ 2,863 $ 2,744 $ 2,657 533 484 433 183 328 350 271 168 175 175 175 175 175 175 175 175 $ 2,318 $ 2,416 $ 2,429 $ 2,484 $ 2,441 $ 2,338 $ 2,298 $ 2,314 $ 2,380 $ 2,377 $ 2,364 $ 2,399 $ 2,344 $ 2,308 $ 2,311 $ 2,270 8.2 % 9.0 % 11.5 % 11.2 % 11.1 % 11.0 % 12.3 % 13.1 % (1) (2) (3) The Allstate Corporation ($ in millions) Return on equity Allstate Life Return on Equity Twelve months ended Numerator: Net income applicable to common shareholders (1)(2) Denominator: Beginning equity Ending equity Average equity (3) Return on equity Adjusted net income return on adjusted equity Numerator: Adjusted net income (1) Denominator: Beginning equity Less: Unrealized net capital gains and losses Net income applicable to common shareholders and adjusted net income reflect a trailing twelve-month period. Includes a $16 million Tax Legislation expense for the periods ended June 30, 2019 and March 31, 2019. Average equity and average adjusted equity are determined using a two-point average, with the beginning and ending equity and adjusted equity, respectively, for the twelve-month period as data points. Goodwill Adjusted beginning equity Ending equity Less: Unrealized net capital gains and losses Goodwill Adjusted ending equity Average adjusted equity (3) Adjusted net income return on adjusted equity * The Allstate Corporation 4Q20 Supplement 16

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 235 $ 247 $ 237 $ 253 $ 254 $ 262 $ 256 $ 259 $ 972 $ 1,031 27 40 26 29 28 29 28 29 122 114 20 18 20 20 22 21 21 19 78 83 (124) (128) (123) (141) (152) (161) (143) (145) (516) (601) (7) (8) (9) (9) (8) (9) (8) (9) (33) (34) (38) (59) (35) (45) (50) (33) (35) (43) (177) (161) (69) (68) (110) (3) (75) (74) (69) (71) (71) (322) (285) - - (1) - - - - - (1) - (10) (9) - (8) (4) (9) (11) (8) (27) (32) 34 33 5 24 16 31 37 31 96 115 7 3 7 (10) 2 2 2 3 7 9 $ 41 $ 36 $ 12 $ 14 $ 18 $ 33 $ 39 $ 34 $ 103 $ 124 47.3 44.6 46.8 50.0 53.9 55.3 50.4 50.3 47.2 52.5 26.3 23.7 41.8 26.6 26.2 23.7 25.0 24.7 29.4 24.9 (1) (2) (3) The Allstate Corporation Allstate Benefits Segment Results and Other Statistics As of or for the three months ended Net investment income Contract benefits ($ in millions) Premiums As of or for the twelve months ended Operating expense ratio (2) Realized capital gains (losses), after-tax Net income applicable to common shareholders Benefit ratio (1) Operating costs and expenses Restructuring and related charges Income tax expense on operations Adjusted net income Contract charges Interest credited to contractholder funds Amortization of deferred policy acquisition costs Includes $41 million, pre-tax, write-off of capitalized software costs associated with a billing system. Benefit ratio is contract benefits divided by premiums and contract charges. Operating expense ratio is operating costs and expenses divided by premiums and contract charges. The Allstate Corporation 4Q20 Supplement 17

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 $ 103 $ 80 $ 77 $ 104 $ 124 $ 126 $ 128 $ 125 $ 949 $ 1,010 $ 969 $ 906 $ 842 $ 883 $ 848 $ 824 1,004 1,051 1,004 923 949 1,010 969 906 $ 977 $ 1,031 $ 987 $ 915 $ 896 $ 947 $ 909 $ 865 10.5 % 7.8 % 7.8 % 11.4 % 13.8 % 13.3 % 14.1 % 14.5 % $ 96 $ 78 $ 76 $ 108 $ 115 $ 125 $ 127 $ 126 $ 949 $ 1,010 $ 969 $ 906 $ 842 $ 883 $ 848 $ 824 53 52 44 21 (10) (4) (4) 8 96 96 96 96 96 96 96 96 $ 800 $ 862 $ 829 $ 789 $ 756 $ 791 $ 756 $ 720 $ 1,004 $ 1,051 $ 1,004 $ 923 $ 949 $ 1,010 $ 969 $ 906 100 89 77 14 53 52 44 21 96 96 96 96 96 96 96 96 $ 808 $ 866 $ 831 $ 813 $ 800 $ 862 $ 829 $ 789 $ 804 $ 864 $ 830 $ 801 $ 778 $ 827 $ 793 $ 755 11.9 % 9.0 % 9.2 % 13.5 % 14.8 % 15.1 % 16.0 % 16.7 % (1) (2) ($ in millions) Return on equity Allstate Benefits Return on Equity The Allstate Corporation Twelve months ended Numerator: Net income applicable to common shareholders (1) Denominator: Beginning equity Ending equity Average equity (2) Return on equity Adjusted net income return on adjusted equity Numerator: Adjusted net income (1) Denominator: Beginning equity Less: Unrealized net capital gains and losses Net income applicable to common shareholders and adjusted net income reflect a trailing twelve-month period. Average equity and average adjusted equity are determined using a two-point average, with the beginning and ending equity and adjusted equity, respectively, for the twelve-month period as data points. Goodwill Adjusted beginning equity Ending equity Less: Unrealized net capital gains and losses Goodwill Adjusted ending equity Average adjusted equity (2) Adjusted net income return on adjusted equity * The Allstate Corporation 4Q20 Supplement 18

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 3 $ 3 $ 2 $ 2 $ 3 $ 3 $ 4 $ 3 $ 10 $ 13 403 245 66 47 180 251 296 190 761 917 (1) - - - - (1) 1 - (1) - (128) (126) (136) (148) (143) (150) (152) (138) (538) (583) (67) (67) (69) (70) (73) (73) (75) (78) (273) (299) (1) - (1) (2) (2) (2) (1) (2) (4) (7) (6) (6) (7) (6) (7) (7) (8) (7) (25) (29) - (2) - - (1) - - - (2) (1) (43) (10) 34 38 10 (5) (13) 7 19 (1) 160 37 (111) (139) (33) 16 52 (25) (53) 10 151 89 194 (213) 97 16 37 124 221 274 1 1 (6) 2 - (1) (2) (3) (2) (6) - (178) - - - - - - (178) - 1 - 1 1 2 - 1 1 3 4 $ 313 $ (51) $ 78 $ (349) $ 66 $ 31 $ 88 $ 97 $ (9) $ 282 $ 3 $ 3 $ 1 $ 2 $ 3 $ 2 $ 2 $ 2 $ 9 $ 9 9 (227) (21) (30) (24) (30) (33) (17) (269) (104) $ 12 $ (224) $ (20) $ (28) $ (21) $ (28) $ (31) $ (15) $ (260) $ (95) $ 403 $ 245 $ 66 $ 47 $ 180 $ 251 $ 296 $ 190 $ 761 $ 917 (137) (124) (115) (118) (119) (120) (119) (121) (494) (479) (66) (66) (77) (67) (73) (75) (78) (81) (276) (307) $ 200 $ 55 $ (126) $ (138) $ (12) $ 56 $ 99 $ (12) $ (9) $ 131 $ 243 $ 81 $ (101) $ (122) $ (5) $ 68 $ 106 $ 1 $ 101 $ 170 ($ in millions) Contract charges The Allstate Corporation Allstate Annuities Segment Results and Other Statistics Three months ended As of or for the twelve months ended Net investment income (1) Periodic settlements and accruals on non-hedge derivative instruments Contract benefits Interest credited to contractholder funds Amortization of deferred policy acquisition costs Operating costs and expenses Restructuring and related charges Income tax (expense) benefit on operations Adjusted net income (loss) Benefit spread Cost of insurance contract charges Contract benefits excluding the implied interest on immediate annuities with life contingencies Total benefit spread Realized capital gains (losses), after-tax Valuation changes on embedded derivatives that are not hedged, after-tax Premium deficiency for immediate annuities, after-tax Gain on disposition of operations, after-tax Net income (loss) applicable to common Total investment spread (1) Performance-based net investment income, a component of net investment income Investment spread Net investment income Implied interest on immediate annuities with life contingencies Interest credited to contractholder funds The Allstate Corporation 4Q20 Supplement 19

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 $ (9) $ (256) $ (174) $ (164) $ 282 $ 94 $ 194 $ 156 $ 5,625 $ 5,552 $ 5,437 $ 5,278 $ 4,949 $ 5,119 $ 5,029 $ 5,009 5,785 5,383 5,496 4,926 5,625 5,552 5,437 5,278 $ 5,705 $ 5,468 $ 5,467 $ 5,102 $ 5,287 $ 5,336 $ 5,233 $ 5,144 (0.2) % (4.7) % (3.2) % (3.2) % 5.3 % 1.8 % 3.7 % 3.0 % $ (53) $ (246) $ (267) $ (104) $ 10 $ 75 $ 79 $ 71 $ 5,625 $ 5,552 $ 5,437 $ 5,278 $ 4,949 $ 5,119 $ 5,029 $ 5,009 604 585 502 428 193 241 272 279 $ 5,021 $ 4,967 $ 4,935 $ 4,850 $ 4,756 $ 4,878 $ 4,757 $ 4,730 $ 5,785 $ 5,383 $ 5,496 $ 4,926 $ 5,625 $ 5,552 $ 5,437 $ 5,278 659 595 661 277 604 585 502 428 $ 5,126 $ 4,788 $ 4,835 $ 4,649 $ 5,021 $ 4,967 $ 4,935 $ 4,850 $ 5,074 $ 4,878 $ 4,885 $ 4,750 $ 4,889 $ 4,923 $ 4,846 $ 4,790 (1.0) % (5.0) % (5.5) % (2.2) % 0.2 % 1.5 % 1.6 % 1.5 % 9.0 % 11.3 % 12.2 % 15.1 % 14.5 % 14.2 % 13.2 % 11.7 % (1.9) % (6.4) % (7.1) % (3.7) % (1.1) % 0.3 % 0.5 % 0.4 % (1) (2) (3) ($ in millions) Return on equity Allstate Annuities Return on Equity The Allstate Corporation Twelve months ended Numerator: Net income (loss) applicable to common shareholders (1)(2) Denominator: Beginning equity Ending equity Average equity (3) Return on equity Adjusted net income return on adjusted equity Numerator: Adjusted net income (loss) (1) Denominator: Average equity and average adjusted equity are determined using a two-point average, with the beginning and ending equity and adjusted equity, respectively, for the twelve-month period as data points. Includes a $69 million Tax Legislation benefit for the periods ended June 30, 2019 and March 31, 2019. Beginning equity Less: Unrealized net capital gains and losses Net income applicable to common shareholders and adjusted net income reflect a trailing twelve-month period. Adjusted beginning equity Ending equity Less: Unrealized net capital gains and losses Adjusted ending equity Average adjusted equity (3) Adjusted net income (loss) return on adjusted equity * Adjusted net income (loss) return on adjusted equity by product: Deferred annuities Immediate annuities The Allstate Corporation 4Q20 Supplement 20

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 539 $ 541 $ 531 $ 525 $ 548 $ 546 $ 543 $ 538 $ 2,136 $ 2,175 37 24 31 6 51 57 68 30 98 206 55 54 51 60 59 54 54 53 220 220 550 200 (220) (192) 11 197 254 9 338 471 2 2 2 17 22 28 26 26 23 102 67 59 62 63 66 66 67 63 251 262 1,250 880 457 479 757 948 1,012 719 3,066 3,436 (59) (48) (48) (58) (68) (68) (70) (71) (213) (277) $ 1,191 $ 832 $ 409 $ 421 $ 689 $ 880 $ 942 $ 648 $ 2,853 $ 3,159 $ 634 $ 637 $ 624 $ 646 $ 674 $ 676 $ 672 $ 664 $ 2,541 $ 2,686 37 24 31 6 51 57 68 30 98 206 579 219 (198) (173) 32 215 272 25 427 544 $ 1,250 $ 880 $ 457 $ 479 $ 757 $ 948 $ 1,012 $ 719 $ 3,066 $ 3,436 3.5 % 3.5 % 3.6 % 3.6 % 3.9 % 3.9 % 3.8 % 3.8 % 3.6 % 3.8 % 3.8 2.5 3.3 0.5 3.0 3.4 4.7 2.6 2.2 3.5 5.0 4.4 4.3 4.9 5.0 4.6 4.6 4.6 4.7 4.7 29.6 11.3 (12.5) (10.1) 0.5 10.0 13.3 0.5 4.6 6.1 5.6 4.0 2.1 2.2 3.5 4.4 4.8 3.4 3.5 4.0 3.4 3.4 3.4 3.7 3.9 4.0 4.0 3.9 3.5 3.9 $ 217 $ 233 $ 179 $ 388 $ 216 $ 147 $ 117 $ 95 $ 1,017 $ 575 (1) 10 (10) (79) (4) (14) (15) (14) (80) (47) 477 231 517 (859) 521 24 200 627 366 1,372 (19) (34) 18 88 (31) 40 22 (46) 53 (15) $ 674 $ 440 $ 704 $ (462) $ 702 $ 197 $ 324 $ 662 $ 1,356 $ 1,885 1.3 % 0.9 % 0.5 % 0.5 % 0.8 % 1.0 % 1.1 % 0.8 % 3.2 % 3.7 % 0.8 0.7 3.9 (1.9) (0.1) 0.8 1.5 1.7 3.5 3.8 0.6 0.2 0.6 (1.0) 0.6 0.1 0.2 0.8 0.4 1.7 2.7 % 1.8 % 5.0 % (2.4) % 1.3 % 1.9 % 2.8 % 3.3 % 7.1 % 9.2 % $ 87.4 $ 85.9 $ 84.6 $ 83.9 $ 84.5 $ 83.9 $ 82.2 $ 81.2 $ 85.6 $ 82.8 $ (21) $ (11) $ (14) $ (13) $ (22) $ (19) $ (20) $ (20) $ (59) $ (81) - - - (6) (8) (10) (11) (11) (6) (40) (38) (37) (34) (39) (38) (39) (39) (40) (148) (156) $ (59) $ (48) $ (48) $ (58) $ (68) $ (68) $ (70) $ (71) $ (213) $ (277) (1) (2) (3) (4) (5) (6) (7) (8) ($ in millions) Net investment income Fixed income securities Three months ended Equity securities Mortgage loans Limited partnership interests ("LP") (1) Short-term Other Investment income, before expense Less: Investment expense Net investment income Interest-bearing investments (2) Equity securities Interest-bearing investments Realized capital gains (losses), pre-tax by transaction type Net Investment Income, Yields and Realized Capital Gains (Losses) (Pre-Tax) The Allstate Corporation Twelve months ended Equity securities Mortgage loans Limited partnership interests Total portfolio LP and other alternative investments (3) Investment income, before expense Pre-tax yields (4)(5) Fixed income securities Average investment balances for the quarter are calculated as the average of the current and prior quarter investment balances. Year-to-date average investment balances are calculated as the average of investment balances at the beginning of the year and the end of each quarter during the year. For purposes of the average investment balances calculation, unrealized capital gains and losses on fixed income securities are excluded and equity securities investment balances are at cost. Total return on investment portfolio is calculated from GAAP results, including the total of net investment income, realized capital gains and losses, the change in unrealized net capital gains and losses, and the change in the difference between fair value and carrying value of mortgage loans, bank loans and agent loans divided by the average fair value balances. Due to the adoption of the measurement of credit losses on financial instruments accounting standard on January 1, 2020, realized capital losses previously reported as other-than-temporary impairment write-downs are presented as credit losses. Beginning January 1, 2020, depreciation previously included in investee level expenses is reported as realized capital gains or losses. Quarterly pre-tax yield is calculated as annualized quarterly investment income, before investment expense divided by the average of the ending investment balances of the current and prior quarter. Year-to-date pre-tax yield is calculated as annualized year-to-date investment income, before investment expense divided by the average of investment balances at the beginning of the year and the end of each quarter during the year. For the purposes of the pre-tax yield calculation, income for directly held real estate and other consolidated investments is net of investee level expenses (asset level operating expenses reported in investment expense). Fixed income securities investment balances exclude unrealized capital gains and losses. Equity securities investment balances use cost in the calculation. Comprise limited partnership interests and other alternative investments, including real estate investments classified as other investments. Comprise fixed income securities, mortgage loans, short-term investments, and other investments including bank and agent loans and derivatives. Income from equity method of accounting LP is generally recognized on a three-month delay due to the availability of the related financial statements from investees. Sales (5) Credit losses (6) Valuation of equity investments Valuation and settlements of derivative Total Total return on investment portfolio (7) Net investment income Valuation-interest bearing Valuation-equity investments Total Total investment expense Average investment balances (in billions) (8) Investment expense Investee level expenses (5) Securities lending expense Operating expenses The Allstate Corporation 4Q20 Supplement 21

Property- Liability Protection Services Allstate Life Allstate Benefits Allstate Annuities Corporate and Other Total $ 285 $ 10 $ 89 $ 12 $ 136 $ 7 $ 539 24 1 1 1 7 3 37 6 - 23 3 23 - 55 309 - - - 241 - 550 - 1 - - - 1 2 28 - 19 4 15 1 67 652 12 132 20 422 12 1,250 (33) (1) (4) - (19) (2) (59) $ 619 $ 11 $ 128 $ 20 $ 403 $ 10 $ 1,191 $ 497 $ 9 $ 105 $ 16 $ 318 $ 8 $ 953 $ 302 $ 11 $ 131 $ 19 $ 162 $ 9 $ 634 24 1 1 1 7 3 37 326 - - - 253 - 579 $ 652 $ 12 $ 132 $ 20 $ 422 $ 12 $ 1,250 3.1 % 2.7 % 4.5 % 3.8 % 4.1 % 2.5 % 3.5 % 4.3 4.6 3.3 3.7 2.7 4.2 3.8 3.9 - 5.8 5.6 4.6 - 5.0 27.9 - - - 32.2 14.5 29.6 5.4 2.7 4.6 4.3 8.0 1.2 5.6 3.0 2.5 4.6 4.3 4.0 0.9 3.4 $ 169 $ 12 $ (7) $ - $ 12 $ 31 $ 217 (3) - (3) - 5 - (1) 266 9 3 8 180 11 477 (13) - - - (6) - (19) $ 419 $ 21 $ (7) $ 8 $ 191 $ 42 $ 674 (1) (2) (3) (4) (5) The Allstate Corporation Three months ended December 31, 2020 Mortgage loans Limited partnership interests ("LP") Short-term ($ in millions) Net investment income Fixed income securities Equity securities Net Investment Income, Yields and Realized Capital Gains (Losses) (Pre-Tax) by Segment Other Investment income, before expense Less: Investment expense Net investment income Net investment income, after-tax Interest-bearing investments (1) Equity securities LP and other alternative investments (2) Investment income, before expense Pre-tax yields (3)(4) Fixed income securities Equity securities Mortgage loans Limited partnership interests Total portfolio Interest-bearing investments Realized capital gains (losses), pre-tax by transaction type Due to the adoption of the measurement of credit losses on financial instruments accounting standard on January 1, 2020, realized capital losses previously reported as other-than-temporary impairment write-downs are presented as credit losses. Beginning January 1, 2020, depreciation previously included in investee level expenses is reported as realized capital gains or losses. Quarterly pre-tax yield is calculated as annualized quarterly investment income, before investment expense divided by the average of the current and prior quarter investment balances. For the purposes of the pre-tax yield calculation, income for directly held real estate and other consolidated investments is net of investee level expenses (asset level operating expenses reported in investment expense). Fixed income securities investment balances exclude unrealized capital gains and losses. Equity securities investment balances use cost in the calculation. Comprised of fixed income securities, mortgage loans, short-term investments, and other investments including bank and agent loans and derivatives. Comprised of limited partnership interests and other alternative investments, including real estate investments classified as other investments. Sales (4) Credit losses (5) Valuation of equity investments Valuation and settlements of derivative instruments Total The Allstate Corporation 4Q20 Supplement 22

Property- Liability Protection Services Allstate Life Allstate Benefits Allstate Annuities Corporate and Other Total $ 1,110 $ 38 $ 348 $ 51 $ 556 $ 33 $ 2,136 60 6 4 2 16 10 98 24 - 89 10 97 - 220 238 - - - 100 - 338 12 1 2 - 4 4 23 101 - 76 17 51 6 251 1,545 45 519 80 824 53 3,066 (124) (1) (17) (2) (63) (6) (213) $ 1,421 $ 44 $ 502 $ 78 $ 761 $ 47 $ 2,853 $ 1,167 $ 35 $ 417 $ 62 $ 602 $ 38 $ 2,321 $ 1,192 $ 39 $ 515 $ 78 $ 674 $ 43 $ 2,541 60 6 4 2 16 10 98 293 - - - 134 - 427 $ 1,545 $ 45 $ 519 $ 80 $ 824 $ 53 $ 3,066 3.1 % 2.7 % 4.5 % 4.0 % 4.3 % 2.9 % 3.6 % 2.3 3.7 2.8 2.5 1.5 3.1 2.2 4.1 - 5.1 4.9 4.5 - 4.7 5.4 - - - 3.3 - 4.6 3.2 2.7 4.6 4.2 3.9 1.5 3.5 3.1 2.6 4.6 4.3 4.1 1.3 3.5 $ 890 $ 43 $ (5) $ - $ 48 $ 41 $ 1,017 (31) - (15) (1) (33) - (80) 82 (13) 10 9 260 18 366 49 - - - 4 - 53 $ 990 $ 30 $ (10) $ 8 $ 279 $ 59 $ 1,356 5.03 4.92 6.38 5.34 5.29 3.66 5.26 (1) (2) (3) (4) (5) (6) The Allstate Corporation As of or for the twelve months ended December 31, 2020 Mortgage loans Limited partnership interests ("LP") Short-term ($ in millions) Net investment income Fixed income securities Equity securities Net Investment Income, Yields and Realized Capital Gains (Losses) (Pre-Tax) by Segment Other Investment income, before expense Less: Investment expense Net investment income Net investment income, after-tax Interest-bearing investments (1) Equity securities LP and other alternative investments (2) Investment income, before expense Pre-tax yields (3)(4) Fixed income securities Equity securities Mortgage loans Limited partnership interests Total portfolio Interest-bearing investments Realized capital gains (losses), pre-tax by transaction type Duration measures the price sensitivity of assets and liabilities to changes in interest rates. Due to the adoption of the measurement of credit losses on financial instruments accounting standard on January 1, 2020, realized capital losses previously reported as other-than-temporary impairment write-downs are presented as credit losses. Beginning January 1, 2020, depreciation previously included in investee level expenses is reported as realized capital gains or losses. Year-to-date pre-tax yield is calculated as annualized year-to-date investment income, before investment expense divided by the average of investment balances at the beginning of the year and the end of each quarter during the year. For the purposes of the pre-tax yield calculation, income for directly held real estate and other consolidated investments is net of investee level expenses (asset level operating expenses reported in investment expense). Fixed income securities investment balances exclude unrealized capital gains and losses. Equity securities investment balances use cost in the calculation. Comprised of fixed income securities, mortgage loans, short-term investments, and other investments including bank and agent loans and derivatives. Comprised of limited partnership interests and other alternative investments, including real estate investments classified as other investments. Sales (4) Credit losses (5) Valuation of equity investments Valuation and settlements of derivative instruments Total Fixed income securities portfolio duration (in years) (6) The Allstate Corporation 4Q20 Supplement 23

Dec. 31, 2020 Sept. 30, 2020 June 30, 2020 March 31, 2020 Dec. 31, 2019 Sept. 30, 2019 June 30, 2019 March 31, 2019 Dec. 31, 2020 Dec. 31, 2019 $ 6,125 $ 5,828 $ 5,575 $ 5,781 $ 6,131 $ 6,162 $ 5,952 $ 5,786 $ 6,125 $ 6,131 1,074 1,117 1,112 1,090 1,041 1,008 1,033 984 1,074 1,041 7,199 6,945 6,687 6,871 7,172 7,170 6,985 6,770 7,199 7,172 458 409 395 404 409 407 355 331 458 409 1,095 1,100 1,121 1,106 1,128 1,017 906 808 1,095 1,128 1,553 1,509 1,516 1,510 1,537 1,424 1,261 1,139 1,553 1,537 6,583 6,237 5,970 6,185 6,540 6,569 6,307 6,117 6,583 6,540 2,169 2,217 2,233 2,196 2,169 2,025 1,939 1,792 2,169 2,169 $ 8,752 $ 8,454 $ 8,203 $ 8,381 $ 8,709 $ 8,594 $ 8,246 $ 7,909 $ 8,752 $ 8,709 $ 498 $ 211 $ (213) $ (199) $ (6) $ 125 $ 216 $ (5) $ 297 $ 330 48 (10) (7) 7 17 71 38 12 38 138 546 201 (220) (192) 11 196 254 7 335 468 4 1 4 (21) (9) 5 10 3 (12) 9 27 18 18 17 18 19 15 14 80 66 31 19 22 (4) 9 24 25 17 68 75 502 212 (209) (220) (15) 130 226 (2) 285 339 75 8 11 24 35 90 53 26 118 204 $ 577 $ 220 $ (198) $ (196) $ 20 $ 220 $ 279 $ 24 $ 403 $ 543 $ (20) $ (10) $ (13) $ (12) $ (20) $ (18) $ (18) $ (18) $ (55) $ (74) $ 7 $ 1 $ (5) $ (2) $ 42 $ (1) $ (3) $ (3) $ 1 $ 35 13 - - (3) (3) - 1 - 10 (2) 20 1 (5) (5) 39 (1) (2) (3) 11 33 (7) (1) 26 15 (13) 17 8 28 33 40 29 (19) (7) 21 (11) 10 31 32 24 62 22 (20) 19 36 (24) 27 39 60 57 102 - - 21 13 29 16 5 25 34 75 42 (19) (7) 18 (14) 10 32 32 34 60 $ 42 $ (19) $ 14 $ 31 $ 15 $ 26 $ 37 $ 57 $ 68 $ 135 25.9 % 10.1 % (10.2) % (9.7) % - % 9.6 % 12.9 % 0.3 % 4.1 % 5.7 % 11.5 % 11.5 % 11.3 % 12.1 % 12.2 % 12.4 % 12.1 % 11.4 % 9.6 8.5 8.6 10.2 10.8 11.2 11.4 11.2 8.0 7.2 7.5 10.4 11.7 12.7 12.7 11.6 4.4 (1.1) (2.2) 6.5 7.6 9.7 9.5 6.7 (1) (2) (3) ($ in millions) Investment position Limited partnerships The Allstate Corporation Performance-Based ("PB") Investments As of or for the three months ended Real estate PB - non-LP Total Private equity Real estate PB - limited partnerships Non-LP Non-LP Private equity Real estate PB - non-LP As of or for the twelve months ended Limited partnerships Private equity Real estate PB - limited partnerships Private equity Real estate Total PB Investment income Private equity Total Private equity Real estate Total PB Investee level expenses (1) Realized capital gains (losses) (1) Limited partnerships Private equity Real estate PB - limited partnerships Non-LP Private equity Real estate PB - non-LP Total Private equity Real estate Total PB Pre-tax yield 1 Year Beginning January 1, 2020, depreciation previously included in investee level expenses is reported as realized capital gains or losses. The internal rate of return ("IRR") is one of the measures we use to evaluate the performance of these investments. The IRR represents the rate of return on the investments considering the cash flows paid and received and, until the investment is fully liquidated, the estimated value of investment holdings at the end of the measurement period. The calculated IRR for any measurement period is highly influenced by the values of the portfolio at the beginning and end of the period, which reflect the estimated fair values of the investments as of such dates. As a result, the IRR can vary significantly for different measurement periods based on macroeconomic or other events that impact the estimated beginning or ending portfolio value, such as the global financial crisis. Our IRR calculation method may differ from those used by other investors. The timing of the recognition of income in the financial statements may differ significantly from the cash distributions and changes in the value of these investments. For the three months ended March 31, 2020, IRR excludes decreases of $247 million that were recorded in consideration of intervening events. Where information was available to enable updated estimates, we recognized current period declines in the value of limited partnership interests. This included updating publicly traded investments held within limited partnerships to their March 31, 2020 values, which reduced income $52 million. Additionally, $195 million of valuation increases reported in the fourth quarter 2019 partnership financial statements were excluded from income considering the equity market decline in March. Internal rate of return (2)(3) 10 Year 5 Year 3 Year The Allstate Corporation 4Q20 Supplement 24