Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Western New England Bancorp, Inc. | wneb-8k_02121.htm |

WESTERN NEW ENGLAND BANCORP, INC. 8-K

EXHIBIT 99.1

Local banking is better than ever. INVESTOR PRESENTATION

FORWARD - LOOKING STATEMENTS 2 We may, from time to time, make written or oral “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements contained in our filings with the Securities and Exchange Commission (the “SEC”), our reports to shareholders and in other communications by us . This presentation contains “forward - looking statements” with respect to the Company’s financial condition, liquidity, results of operations, future performance, business, measures being taken in response to the coronavirus disease 2019 (“COVID - 19 ”) pandemic and the impact of COVID - 19 on the Company’s business . Forward - looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” and “potential . ” Examples of forward - looking statements include, but are not limited to, estimates with respect to our financial condition, results of operations and business that are subject to various factors which could cause actual results to differ materially from these estimates . These factors include, but are not limited to : • the duration and scope of the COVID - 19 pandemic and the local, national and global impact of COVID - 19; • actions governments, businesses and individuals take in response to the COVID - 19 pandemic; • the pace of recovery when the COVID - 19 pandemic subsides; • changes in the interest rate environment that reduce margins; • the effect on our operations of governmental legislation and regulation, including changes in accounting regulation or standa rds , the nature and timing of the adoption and effectiveness of new requirements under the Dodd - Frank Act Wall Street Reform and Consumer Protection Act of 2010 ( “Dodd - Frank Act”), Basel guidelines, capital requirements and other applicable laws and regulations; • the highly competitive industry and market area in which we operate; • general economic conditions, either nationally or regionally, resulting in, among other things, a deterioration in credit qua lit y; • changes in business conditions and inflation; • changes in credit market conditions; • the inability to realize expected cost savings or achieve other anticipated benefits in connection with business combinations an d other acquisitions; • changes in the securities markets which affect investment management revenues; • increases in Federal Deposit Insurance Corporation deposit insurance premiums and assessments; • changes in technology used in the banking business; • the soundness of other financial services institutions which may adversely affect our credit risk; • certain of our intangible assets may become impaired in the future; • our controls and procedures may fail or be circumvented; • new lines of business or new products and services, which may subject us to additional risks; • changes in key management personnel which may adversely impact our operations; • severe weather, natural disasters, acts of war or terrorism and other external events which could significantly impact our bu sin ess; and • other factors detailed from time to time in our SEC filings. Although we believe that the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially from the results discussed in these forward - looking statements . You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof . We do not undertake any obligation to republish revised forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by law .

WHO WE ARE Every day, we focus on showing Westfield Bank customers “ what better banking is all about . ” For us, the idea of better banking starts with putting customers first, while adhering to our core values . Our Core Values : • Integrity • Enhance Shareholder Value • Customer Focus • Community Focus Our Core Mission : Our purpose is to help customers succeed in our community, while creating and increasing shareholder value . The Company’s purpose drives the outcome we envision for Western New England Bancorp . 3 70 Center Street, Chicopee, MA.

SENIOR MANAGEMENT TEAM James C . Hagan, President & Chief Executive Officer Guida R . Sajdak, Executive Vice President, Chief Financial Officer & Treasurer Allen J . Miles III, Executive Vice President & Chief Lender Officer Kevin C . O’Connor, Executive Vice President & Chief Banking Officer Louis O . Gorman, Senior Vice President & Chief Credit Officer Leo R . Sagan, Jr . , Senior Vice President & Chief Risk Officer Darlene Libiszewski , Senior Vice President & Chief Information Officer John Bonini , Senior Vice President & General Counsel Christine Phillips , Senior Vice President, Human Resources Deborah J . McCarthy, Senior Vice President, Deposit Operations & Electronic Banking Cidalia Inacio , Senior Vice President, Retail Banking & Wealth Management 4

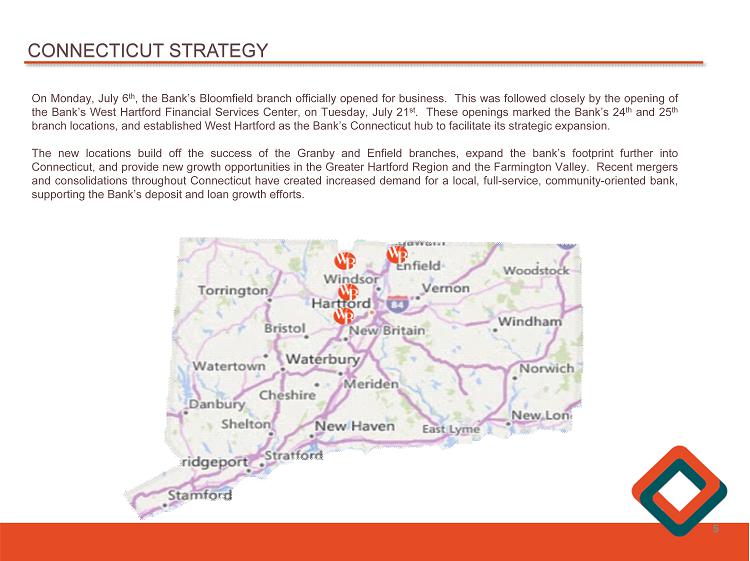

CONNECTICUT STRATEGY On Monday, July 6 th , the Bank’s Bloomfield branch officially opened for business . This was followed closely by the opening of the Bank’s West Hartford Financial Services Center, on Tuesday, July 21 st . These openings marked the Bank’s 24 th and 25 th branch locations, and established West Hartford as the Bank’s Connecticut hub to facilitate its strategic expansion . The new locations build off the success of the Granby and Enfield branches, expand the bank’s footprint further into Connecticut, and provide new growth opportunities in the Greater Hartford Region and the Farmington Valley . Recent mergers and consolidations throughout Connecticut have created increased demand for a local, full - service, community - oriented bank, supporting the Bank’s deposit and loan growth efforts . 5

CONNECTICUT STRATEGY The West Hartford Financial Services Center, located in West Hartford Center, will serve as the Bank’s regional hub in Connecticut . In addition to a full - service branch, it includes a suite of offices to support Residential Lending, Commercial Lending, Business & Government Deposit Services, and Westfield Investment Services . The Bank has assembled an experienced team of bankers to run the West Hartford Financial Services Center . Vice President and Connecticut Area Manager Matthew Cuddy will manage the branch office . Todd Navin will serve as Senior Vice President and Commercial Lender . John Pember will serve as Vice President and Commercial Lender . Cathy Turowsky will serve as Vice President and Business & Government Deposit Services Officer, and Daniel Danillowicz will serve as Assistant Vice President and Mortgage Loan Officer . The West Hartford Financial Services Center team has decades of retail and commercial banking experience in West Hartford and throughout the Capital Region, and is very familiar with the economic landscape and subtleties of the market . 6

7

CONNECTICUT STRATEGY The Bloomfield branch , located in the Copaco Shopping Center, is a full - service branch and includes drive - through teller and safe deposit services . The Copaco Shopping Center is composed of national and local brands and is a major shopping destination for the greater Bloomfield area, which offers both retail and commercial banking opportunities . The Bank has hired Assistant Vice President and Branch Manager Lindsay Allen to manage the Bloomfield branch . Lindsay has extensive banking and branch management experience, having worked for both national and community banks, and is a Bloomfield resident . The Bloomfield branch, along with the Granby and Enfield locations, will be supported by the West Hartford Financial Services Center and its expanded team . 8

4 Q2020 EARNINGS 9 ($ in thousands , except EPS) 4Q2020 3Q2020 2Q2020 1Q2020 4Q2019 Net interest income $ 18,795 $ 15,990 $ 15,092 $ 14,553 $ 14,924 Provision for loan losses 500 2,725 2,450 2,100 1,000 Non - interest income 2,462 2,177 2,087 2,525 2,406 Non - interest expense 14,338 12,853 12,245 12,314 11,905 Income before taxes 6,419 2,589 2,484 2,664 4,425 Income tax expense 1,406 488 463 584 988 Net income $ 5,013 $ 2,101 $ 2,021 $ 2,080 $ 3,437 Diluted earnings per share (EPS) $ 0.20 $ 0.08 $ 0.08 $ 0.08 $ 0.13 ROA 0.83% 0.35% 0.35% 0.38% 0.63% ROE 8.62% 3.61% 3.54% 3.62% 5.82%

10 • Revenues (1) : Total revenue of $21.3 million increased $2.7 million, or 14.5%. • Pre - provision, pre - tax income: Increased $1.6 million, or 30.2%, to $6.9 million. • Net interest income: Increased $2.8 million, or 17.5% ( e xcluding Paycheck Protection Program (“PPP”) income, purchase accounting adjustments and prepayment penalties, net interest income increased $865,000, or 6.0%). • Net interest margin: Increased 49 basis points to 3.30%. (excluding PPP income, purchase accounting adjustments and prepayment penalties in 4Q2020, the net interest margin increased 15 basis points from 2.80% in 3Q2020 to 2.95% in 4Q2020). • Core non - interest income (2) : D ecreased $119,000, or 4.6%, primarily due to a decrease of $325,000, or 81.9% in other non - interest income from swap fees on commercial loans, partially offset by an increase of $ 206,000 , or 11.7%, in service charges and fees. • Extinguishment of debt: The Company prepaid $50.0 million of Federal Home Loan Bank (“FHLB”) advances with a weighted average rate of 2.05% on December 23, 2020 . The prepayment of debt resulted in a penalty of $987,000 recognized in non - interest expense during the three months ended December 31, 2020. The earn - back on the expenses related to the prepayment is less than 12 months. • Non - interest expense: Increased $1.5 million, or 11.6%, and included the $987,000 prepayment penalty discussed above. • Efficiency ratio: 67.4% for 4Q2020, a decrease from 69.1% in 3Q2020. • Average loans: Decreased $41.1 million, or 2.1%, which includes average PPP loans . Excluding PPP loans in both periods, total average loans decreased $23.1 million, or 1.3%. • Average deposits: Increased $ 74.0 million, or 3.8%, of which, average core deposits increased $78.2 million, or 5.9%, and average time deposits decreased $4.3 million, or 0.7%. At December 31, 2020, average demand deposits represented 26.4% of total average deposits. • Asset quality : At December 31, 2020, allowance for loan losses (“ALLL”) to total loans, excluding PPP loans, and ALLL to non - performing loans was 1.20% and 269.8%, respectively. Non - performing loans to total loans, excluding PPP loans, was 0.45% at December 31, 2020 and totaled $7.8 million. • Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) modifications : Decreased $184.1 million, or 70.5%, from $261.0 million, or 14.7 % of total loans at June 30, 2020, to $76.9 million, or 4.4% of total loans, at December 31, 2020. 2020 HIGHLIGHTS: 4Q2020 VS 3Q2020 (1) Total revenues defined as net interest income and core non - interest income. (2) Core non - interest income includes service charges and fees, income from bank - owned life insurance and other income.

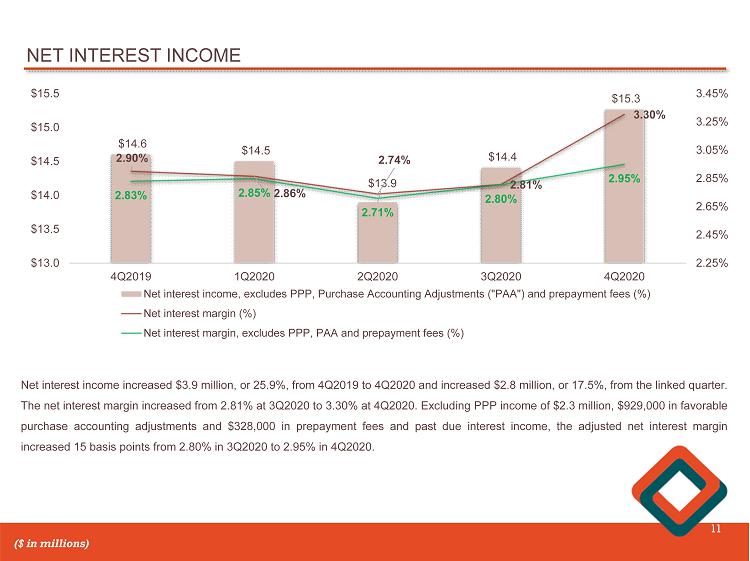

NET INTEREST INCOME 11 $14.6 $14.5 $13.9 $14.4 $15.3 2.90% 2.86% 2.74% 2.81% 3.30% 2.83% 2.85% 2.71% 2.80% 2.95% 2.25% 2.45% 2.65% 2.85% 3.05% 3.25% 3.45% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $13.0 $13.5 $14.0 $14.5 $15.0 $15.5 Net interest income, excludes PPP, Purchase Accounting Adjustments ("PAA") and prepayment fees (%) Net interest margin (%) Net interest margin, excludes PPP, PAA and prepayment fees (%) Net interest income increased $ 3 . 9 million, or 25 . 9 % , from 4 Q 2019 to 4 Q 2020 and increased $ 2 . 8 million, or 17 . 5 % , from the linked quarter . The net interest margin increased from 2 . 81 % at 3 Q 2020 to 3 . 30 % at 4 Q 2020 . Excluding PPP income of $ 2 . 3 million, $ 929 , 000 in favorable purchase accounting adjustments and $ 328 , 000 in prepayment fees and past due interest income, the adjusted net interest margin increased 15 basis points from 2 . 80 % in 3 Q 2020 to 2 . 95 % in 4 Q 2020 . ($ in millions)

LOANS 12 $1,774 $1,783 $1,807 $1,771 $1,748 4.29% 4.26% 3.97% 4.02% 3.94% 4.36% 4.26% 3.92% 3.88% 4.24% 3.70% 3.90% 4.10% 4.30% 4.50% 4.70% 4.90% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 Average Loans Outstanding (excludes PPP loans ) Average Loans Outstanding Average Loan Yield without PPP, PAA and prepayment Average Loan Yield $1,776 $1,804 $1,778 $1,751 $1,760 $222 $223 $167 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $1,500 $1,600 $1,700 $1,800 $1,900 $2,000 $2,100 Period - end Loans Outstanding Loans PPP Loans Total average loans of $ 2 . 0 billion increased $ 178 . 5 million, or 10 . 1 % , year - over - year but decreased $ 41 . 1 million, or 2 . 1 % , from the linked quarter . The year - over - year increase was due to $ 204 . 8 million in average PPP loans associated with the COVID - 19 pandemic . Excluding PPP loans, average loans decreased $ 23 . 1 million, or 1 . 3 % , from the linked quarter, and decreased $ 26 . 3 million, or 1 . 5 % , from the same period in 2019 . Total average loan yield of 4 . 24 % was down 12 basis points year - over - year but up 36 basis points from the linked quarter . Excluding PPP loans, purchase accounting adjustments and prepayment penalties, the loan yield decreased 8 basis points from 4 . 02 % in 3 Q 2020 to 3 . 94 % to 4 Q 2020 . Total period - end loans outstanding of $ 1 . 9 billion increased $ 151 . 3 million , or 8 . 5 % , year - over - year, but decreased $ 47 . 0 million, or 2 . 4 % , from the linked quarter . The year - over - year increase was primarily due to PPP loans of $ 167 . 3 million . Excluding PPP loans, total loans increased $ 8 . 8 million, or 0 . 5 % , from 3 Q 2020 to 4 Q 2020 . ($ in millions)

CARES ACT MODIFICATIONS AS OF DECEMBER 31, 2020 13 Loan Segment (1)(2) Remaining Modification Balance # of Loans Modified % of Total Loan Segment Balance Modified Commercial real estate $64.0 19 7.7% Commercial and industrial ( 3 ) 9.3 10 4.4% Residential real estate ( 4 ) 3.6 16 0.5% Consumer 0.0 2 0.7% Total $76.9 47 4.4% ( 1) Data as of December 31, 2020 (2) Excludes deferred fees (3) Excludes PPP loans (4) Residential includes home equity loans and lines of credit ($ in millions) Modifications granted under the CARES Act decreased 75 % from $261.0 million, or 14.7% of total loans, at June 30, 2020, to $76.9 million, or 4.4% of total loans, at December 31, 2020.

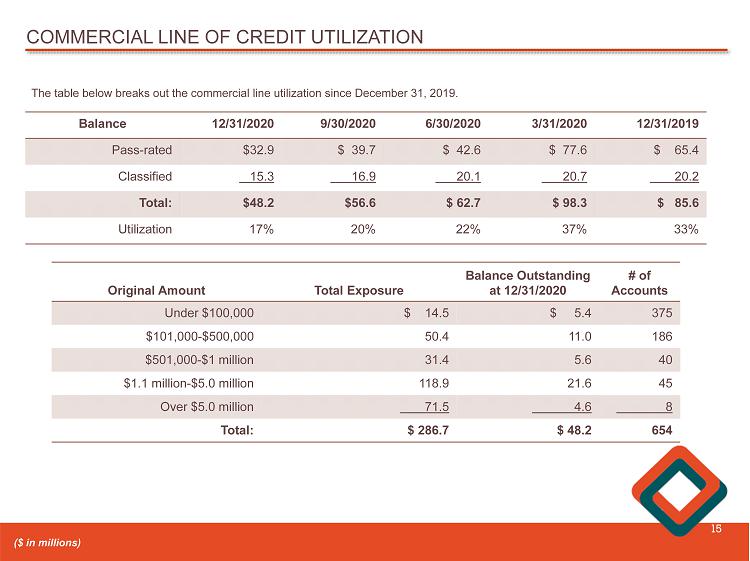

COMMERCIAL AND INDUSTRIAL LOAN TRENDS 14 $249 $257 $231 $222 212 $222 $223 $167 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $100 $150 $200 $250 $300 $350 $400 $450 $500 Commercial and Industrial Loans C&I Loans PPP Loans Commercial and industrial loans (“C&I”) of $ 379 . 1 million increased $ 130 . 2 million, or 52 . 3 % , year - over - year, but decreased $ 66 . 3 million, or 14 . 9 % , from the linked quarter . At 4 Q 2020 and 3 Q 2020 , PPP loans totaled $ 167 . 3 million and $ 223 . 1 million, respectively . Commercial line of credit usage was down to 17 % at December 31 , 2020 , representing a decrease of $ 8 . 4 million, or 14 . 8 % , from the linked quarter and $ 50 . 1 million, or 51 . 0 % , from the high point in March 2020 when certain customers secured liquidity in response to COVID - 19 . At December 31 , 2020 , there were 10 loans totaling $ 9 . 3 million remaining under CARES Act modifications, representing 4 . 4 % of total C&I loans, compared to $ 19 . 1 million, or 8 . 3 % of total C&I loans, at June 30 , 2020 . Total delinquent C&I loans totaled $ 480 , 000 , or 0 . 23 % , of the C&I portfolio, excluding PPP loans . ($ in millions)

COMMERCIAL LINE OF CREDIT UTILIZATION 15 The table below breaks out the commercial line utilization since December 31, 2019. Balance 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Pass - rated $32.9 $ 39.7 $ 42.6 $ 77.6 $ 65.4 Classified 15.3 16.9 20.1 20.7 20.2 Total: $48.2 $56.6 $ 62.7 $ 98.3 $ 85.6 Utilization 17% 20% 22% 37% 33% Original Amount Total Exposure Balance Outstanding at 12/31 /2020 # of Accounts Under $100,000 $ 14.5 $ 5.4 375 $101,000 - $500,000 50.4 11.0 186 $501,000 - $1 million 31.4 5.6 40 $1.1 million - $5.0 million 118.9 21.6 45 Over $5.0 million 71.5 4.6 8 Total: $ 286.7 $ 48.2 654 ($ in millions)

COMMERCIAL AND INDUSTRIAL LOANS (EXCLUDES PPP ) (1) 16 Auto Sales , 0.4% Educational Services , 0.6% Healthcare , 0.4% Heavy and Civil Engineering Construction , 0.8% Manufacturing , 2.9% Other , 3.6% Specialty Trade , 0.6% Transportation , 0.7% Wholesale Trade , 2.0% (1) % of total loans, excluding PPP, at December 31, 2020

TOTAL COVID - 19 MODIFICATIONS – C&I PORTFOLIO 17 Industry Balance (1) % of Total Loans Modified Balance Remaining # of Modified Accounts % of Segment Balance Modified Manufacturing $ 50.4 2.9% $ 143k 1 0.3% Wholesale Trade 34.6 2.0% - - - Specialty Trade 11.0 0.6% - - - Heavy and Civil Engineering Construction 13.4 0.8% 335k 1 2.4% Educational Services 10.7 0.6% 57k 1 0.5% Healthcare and Social Assistance 7.4 0.4% 1.1 1 15.4% Transportation and Warehouse 12.3 0.7% 6.8 2 55.3% Auto Sales 7.4 0.4% - - - All other C&I 64.7 3.6% 792k 4 1.3% Total commercial and industrial $ 211.9 12.0% $ 9.3 10 4.4% At December 31, 2020, there were $9.3 million, or 4.4% of the C&I portfolio, with remaining payment deferrals granted under the CARES Act, compared to $19.1 million, or 8.3% of the C&I portfolio as of June 30, 2020. Of the $9.3 million remaining under modification, $1.1 million were new modifications granted during the three months ended December 31, 2020 and $8.2 million were granted a 2 nd modification. Of the $9.3 million, $4.7 million, or 50.4%, were modified to interest only payments and the remaining balance of $4.6 million, consisting of two loans, are under full payment deferral. (1) Balances as of December 31, 2020, excluding PPP loans ( $ in millions)

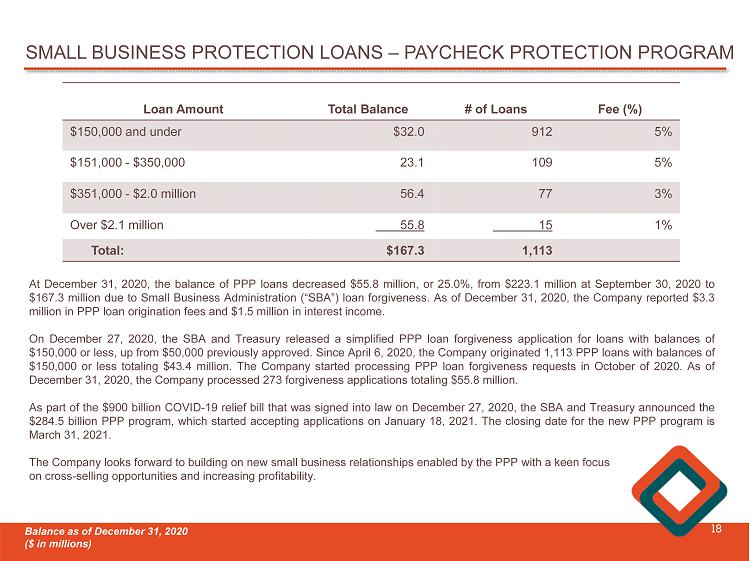

SMALL BUSINESS PROTECTION LOANS – PAYCHECK PROTECTION PROGRAM 18 Loan Amount Total Balance # of Loans Fee (%) $150,000 and under $32.0 912 5% $151,000 - $350,000 23.1 109 5% $351,000 - $2.0 million 56.4 77 3% Over $2.1 million 55.8 15 1% Total: $167.3 1,113 At December 31 , 2020 , the balance of PPP loans decreased $ 55 . 8 million, or 25 . 0 % , from $ 223 . 1 million at September 30 , 2020 to $ 167 . 3 million due to Small Business Administration (“SBA”) loan forgiveness . As of December 31 , 2020 , the Company reported $ 3 . 3 million in PPP loan origination fees and $ 1 . 5 million in interest income . On December 27 , 2020 , the SBA and Treasury released a simplified PPP loan forgiveness application for loans with balances of $ 150 , 000 or less, up from $ 50 , 000 previously approved . Since April 6 , 2020 , the Company originated 1 , 113 PPP loans with balances of $ 150 , 000 or less totaling $ 43 . 4 million . The Company started processing PPP loan forgiveness requests in October of 2020 . As of December 31 , 2020 , the Company processed 273 forgiveness applications totaling $ 55 . 8 million . As part of the $ 900 billion COVID - 19 relief bill that was signed into law on December 27 , 2020 , the SBA and Treasury announced the $ 284 . 5 billion PPP program, which started accepting applications on January 18 , 2021 . The closing date for the new PPP program is March 31 , 2021 . The Company looks forward to building on new small business relationships enabled by the PPP with a keen focus on cross - selling opportunities and increasing profitability . Balance as of December 31, 2020 ( $ in millions)

COMMERCIAL REAL ESTATE LOAN TRENDS 19 $817 $836 $833 $812 $834 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $800 $825 $850 • Commercial real estate (“CRE”) loans of $ 833 . 9 million increased $ 21 . 8 million, or 2 . 7 % , from the linked quarter, and increased $ 17 . 1 million, or 2 . 1 % , year - over - year . • At December 31 , 2020 , there were $ 64 . 0 million, or 7 . 7 % of the total CRE portfolio, under CARES Act modifications, compared to $ 200 . 0 million, or 24 . 0 % , at June 30 , 2020 . • At December 31 , 2020 , total CRE delinquency was $ 10 . 2 million, or 1 . 2 % , of the CRE portfolio . ($ in millions) Adult Care/Assisted Living , 2.0% Apartment , 9.2% Auto Sales , 2.1% Auto Service , 0.6% College/School , 1.6% Gas Station/Conv Store , 0.6% Hotel , 3.2% Industrial , 6.8% Mixed Use , 2.1% Office , 8.4% Other , 1.2% Residential non - owner , 2.6% Restaurant , 0.6% Retail , 6.4% Period - end Loans Outstanding CRE PORTFOLIO AS A % OF TOTAL LOANS, EXCLUDING PPP LOANS, AT DECEMBER 31, 2020

COMMERCIAL REAL ESTATE LOANS – COVID - 19 MODIFICATIONS GRANTED (1) 20 Property Type Balance % of Total Loans (2) Modified Balance Modified Loans (#) Balance Modified (%) Apartment $ 162.6 9.2% $ - - - Office 147.5 8.4% - - - Retail/Shopping 112.7 6.4% - - - Industrial/Warehouse 120.1 6.8% 3.0 1 2.5% Hotel 56.3 3.2% 51.0 11 90.5% Residential Non - Owner 46.6 2.6% - - - Auto Sales 36.2 2.1% - - - Adult Care/Assisted Living 35.9 2.0% 7.5 1 20.9% Mixed - use 36.8 2.1% - - - College/School 27.5 1.6% 133k 1 0.5% Other 20.6 1.2% 1.5 2 7.6% Auto Service 10.0 0.6% - - - Gas Station/Conv Store 11.0 0.6% - - - Restaurant 10.1 0.6% 792k 3 7.9% Total commercial real estate : $ 833.9 47.4% $ 64.0 19 7.7% (1) $ and % of total loans at December 31, 2020 ($ in millions) (2) Excludes PPP loans At December 31, 2020, there were $64.0 million, or 7.7% of the CRE portfolio, under CARES Act modification with payment deferrals, compared to $200.0 million, or 24.0% of the CRE portfolio as of June 30, 2020. Of the $64.0 million remaining under modification at December 31, 2020, $53.7 million were granted a 2 nd modification.

RESIDENTIAL AND CONSUMER LOAN TRENDS 21 $706 $708 $716 $718 $714 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $700 $702 $704 $706 $708 $710 $712 $714 $716 $718 $720 Residential and Consumer Loans Period - end Loans Outstanding Residential loans, including home equity loans, and consumer loans decreased $ 4 . 1 million, or 0 . 6 % , from the linked quarter, but increased $ 7 . 8 million, or 1 . 1 % , year - over - year . As of December 31 , 2020 , there were 16 residential loans totaling $ 3 . 6 million, or 0 . 5 % of residential loans, under CARES Act modification, down from $ 41 . 7 million, or 5 . 9 % of total residential loans, at June 30 , 2020 . At December 31 , 2020 , total delinquent residential and consumer loans totaled $ 2 . 8 million, or 0 . 39 % of total residential and consumer loans . Consumer loans totaled $ 5 . 2 million at December 31 , 2020 . There were 2 CARES Act modifications granted totaling $ 38 , 000 at December 31 , 2020 . Loan Segment Balance % of Residential l oans # of Loans Average Balance Residential $3.6 0.5% 16 $225K ($ in millions) Residential Real Estate CARES Act Modifications

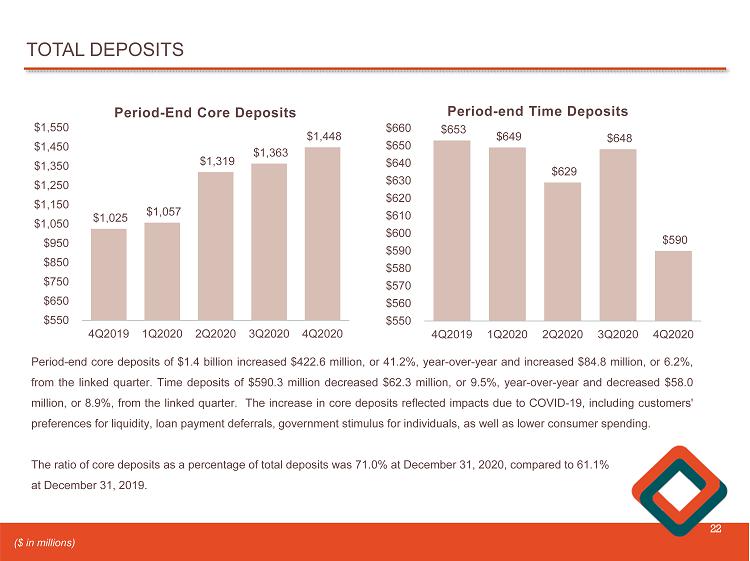

TOTAL DEPOSITS 22 $1,025 $1,057 $1,319 $1,363 $1,448 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $550 $650 $750 $850 $950 $1,050 $1,150 $1,250 $1,350 $1,450 $1,550 Period - End Core Deposits Period - end core deposits of $ 1 . 4 billion increased $ 422 . 6 million , or 41 . 2 % , year - over - year and increased $ 84 . 8 million, or 6 . 2 % , from the linked quarter . Time deposits of $ 590 . 3 million decreased $ 62 . 3 million, or 9 . 5 % , year - over - year and decreased $ 58 . 0 million, or 8 . 9 % , from the linked quarter . The increase in core deposits reflected impacts due to COVID - 19 , including customers' preferences for liquidity, loan payment deferrals, government stimulus for individuals, as well as lower consumer spending . The ratio of core deposits as a percentage of total deposits was 71 . 0 % at December 31 , 2020 , compared to 61 . 1 % at December 31 , 2019 . $653 $649 $629 $648 $590 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $550 $560 $570 $580 $590 $600 $610 $620 $630 $640 $650 $660 Period - end Time Deposits ($ in millions)

AVERAGE TOTAL DEPOSITS 23 $1,287 $1,300 $1,368 $1,421 $1,489 $388 $389 $505 $529 $535 1.05% 1.01% 0.82% 0.65% 0.44% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $300 $500 $700 $900 $1,100 $1,300 $1,500 $1,700 $1,900 $2,100 Average Deposits and Rates Interest-bearing deposits Non-interest-bearing deposits Average deposit cost Average deposits of $2.0 billion increased $349.2 million , or 20.8%, year - over - year, and increased $74.0 million, or 3.8%, from the linked quarter. Average cost of deposits decreased 21 basis points from 0.65% from the linked quarter to 0.44% at December 31 , 2020, and decreased 61 basis points year - over - year, reflecting the lower interest rate environment. ($ in millions)

AVERAGE CORE DEPOSITS 24 $1,021 $1,037 $1,233 $1,325 $1,404 0.34% 0.33% 0.27% 0.25% 0.23% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $500 $700 $900 $1,100 $1,300 $1,500 $1,700 $1,900 $2,100 Average Core Deposits and Rates Interest-bearing deposits Average deposit cost Average core deposits, including non - interest bearing deposits, increased $ 382 . 6 million, or 37 . 5 % , year - over - year, and increased $ 78 . 2 million, or 5 . 9 % , from the linked quarter . The cost of core deposits decreased 11 basis points year - over - year and decreased 2 basis points from the linked quarter, reflecting the lower interest rate environment . ($ in millions)

AVERAGE TIME DEPOSITS 25 $654 $651 $640 $625 $620 2.15% 2.08% 1.87% 1.50% 0.92% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $500 $550 $600 $650 $700 $750 $800 Average Time Deposits and Rates Interest-bearing deposits Average deposit cost Average time deposits of $ 620 . 4 million decreased $ 33 . 4 m illion , or 5 . 1 % , from 4 Q 2019 to 4 Q 2020 , and decreased $ 4 . 3 million, or 0 . 7 % , from the linked quarter . We continue to reduce our reliance on high - cost time deposits as we continue to focus on low - cost core deposits . The cost of time deposits decreased 123 basis points from 4 Q 2019 to 4 Q 2020 and decreased 58 basis points from the linked quarter, reflecting the lower interest rate environment . As of December 31 , 2020 , there were $ 503 million, or 85 % of time deposits scheduled to reprice over the next 12 month with an average weighted rate of 0 . 76 % : ($ in millions) As of December 31, 2020 1Q2021 2Q2021 3Q2021 4Q2021 Total Time Deposit Balance $187 $202 $65 $49 $503 Weighted Average Rate 0.90% 0.55% 1.08% 0.63% 0.76%

LOAN - TO - DEPOSIT RATIO 26 106% 106% 103% 98% 95% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 88% 90% 92% 94% 96% 98% 100% 102% 104% 106% 108% Loan - to - Deposit Ratio 61% 62% 68% 68% 71% 39% 38% 32% 32% 29% 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 0% 10% 20% 30% 40% 50% 60% 70% 80% Core Deposits and Time Deposits as a % of Total Deposits Core deposits/Total deposits Time deposits/Total deposits As we continue to right - size the loan - to - deposit ratio and reduce our reliance on high - cost wholesale funding, the loan - to - deposit ratio improved from 106 % at 4 Q 2019 to 95 % in 4 Q 2020 . We also continue to focus on the mix of deposits from time deposits to low - cost core deposits . Core deposits as a percentage of tota l deposits has improved from 61 % of total deposits in 4 Q 2019 to 71 % in 4 Q 2020 .

________ Source: SNL Financial as of June 30, 2020. Note: Total number of Westfield Bank branches shown includes the Big E seasonal branch and online deposit channel. Three Wes tfi eld branches are located in Hampshire County, MA and four Westfield branches are located in Hartford County, CT outside of Springfield MSA. DEPOSIT MARKET SHARE IN HAMPDEN COUNTY, MA AS OF JUNE 30, 2020 27 % Total Deposit Rank 2020 Parent Company Name Deposits in Market ($000) Market Share # of Branches 1 KeyCorp 1,957,671 14.6% 8 2 TD Bank 1,819,599 13.5% 16 3 Westfield Bank 1,762,519 13.1% 20 4 People's United 1,650,347 12.3% 14 5 Bank of America 1,594,847 11.9% 9 6 PeoplesBank 1,567,612 11.7% 14 7 Berkshire Bank 1,189,107 8.9% 13 8 Country Bank for Savings 521,342 3.9% 5 9 Citizens Bank 457,122 3.4% 15 10 Monson Savings Bank 404,309 3.0% 3

FHLB AND PAYROLL PROTECTION PROGRAM LIQUIDITY FACILITY 28 $241 $222 $197 $151 $58 $ - $ - $26 $ - $ - 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $- $50 $100 $150 $200 $250 $300 Period - end FHLB and Payroll Protection Program Liquidity Facility FHLB PPPLF ($ in millions) At December 31, 2020, FHLB advances decreased $182.7 million, or 75.9%, from $240.5 million at December 31, 2019, to $57.9 million. The increase in low cost deposits provided the opportunity to pay down approximately $ 132.7 million, or 55.2%, of high cost FHLB advances. In addition, during the three months ended December 31, 2020, the Company prepaid $50.0 million of FHLB advances that had a weighted average rate of 2.05%. The prepayment of debt resulted in a penalty of $987,000 recognized in non - interest expense during the three months ended December 31, 2020. The earn - back on the expenses related to the prepayment is less than 12 months. At December 31, 2020, the average weighted rate of the remaining $57.9 million FHLB advances was 1.17%. Of the $ 57.9 million in outstanding advances, $42.3 million, or 73.3%, are scheduled to mature by December 31, 2021, and carry a weighted average rate of 1.45 %. The remaining balance of $ 15.6 million has a remaining maturity of 2.1 years and a weighted average rate of 0.40%.

ASSET QUALITY 29 $9.9 $9.7 $10.4 $9.2 $7.8 0.56% 0.54% 0.59% 0.53% 0.45% 0.00% 0.20% 0.40% 0.60% 0.80% $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Non - performing Loans ($ in millions) Non-performing loans Non-performing loans/Total Loans Excluding PPP Loans The Company has taken actions to identify, assess and monitor its COVID - 19 related credit exposures based on asset class and borrower type . The Company implemented a customer forbearance program to assist both consumer and business borrowers that may be experiencing financial hardship due to COVID - 19 related challenges . As of June 30 , 2020 , the Company had 525 loans in forbearance under the CARES Act, representing $ 261 million, or 14 . 7 % of total loans outstanding . As of December 31 , 2020 , modifications under the CARES Act were reduced to $ 76 . 9 million, or 4 . 4 % of total loans, excluding PPP loans . Non - performing loans decreased from $ 9 . 2 million, or 0 . 53 % of total loans at September 30 , 2020 to $ 7 . 8 million, or 0 . 45 % , of total loans at December 31 , 2020 (excludes PPP loans) . $1,000 $2,100 $2,450 $2,725 $500 $170 $365 $34 $286 $35 4Q2019 1Q2020 2Q2020 3Q2020 4Q2020 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 Provision Expense and Net Charge - offs ($ in thousands) Provision expense Net charge-offs

ASSET QUALITY INDICATORS 30 4Q2020 3Q2020 2Q2020 1Q2020 4Q2019 Total loans modified under the CARES Act $76.9M $66.3M $261.0M - - Loans modified as a % of total loans (1) 4.4% 3.8% 14.7% - - Total delinquent loans $ $13.5M $6.7M $12.0M $12.4M $13.8M Delinquent loans as a % of total loans (1) 0.77% 0.38% 0.68% 0.69% 0.78% Non - performing loans $ $7.8M $9.2M $10.4M $9.7M $9.9M Non - performing loans (NPL) as a % of total loans (1) 0.45% 0.53% 0.59% 0.54% 0.56% NPL as a % of total assets (1) 0.36% 0.41% 0.47% 0.44% 0.45% Allowance for loan losses % of total loans (1) 1.20% 1.18% 1.03% 0.88% 0.79% Allowance for loan losses % of NPL 270% 225% 176% 164% 143% Net charge - offs $35K $286K $34K $365K $170K Net charge - offs as a % average loans (1) 0.00% 0.02% 0.00% 0.02% 0.01% (1) Excludes PPP loans

ASSET QUALITY 31 ALLL = $ 21 . 2 million • Management believes it prudent to proactively increase the allowance for loan losses given the significant stress experienced in the economy due to continued business shutdowns and interruptions related to COVID - 19 , coupled with the Company’s belief that these stresses will continue at some levels for the next few quarters . The allowance for loan losses and the related provision reflect the Company’s continued application of the incurred loss method for estimating credit losses as the Company is not yet required to adopt the current expected credit loss accounting standard . (1) Excludes PPP loans (2) Includes $ 26 K in unallocated (3) $ in thousands 4 Q2020 4Q2019 ALLL (3) Loans Outstanding (1)(3) ALLL/ Total Loan Segment ALLL (3) Loans Outstanding (3) ALLL/ Total Loan Segment Commercial and industrial $ 3,630 $ 211,823 1.71% $ 3,183 $ 248,893 1.28% Commercial real estate (2) 13,046 833,949 1.56% 6,807 816,886 0.83% Residential 4,240 708,624 0.60% 3,920 700,244 0.56% Consumer 241 5,192 4.64% 192 5,747 3.34% Total Loans $ 21,157 $ 1,759,588 1.20% $ 14,102 $ 1,771,770 0.79%

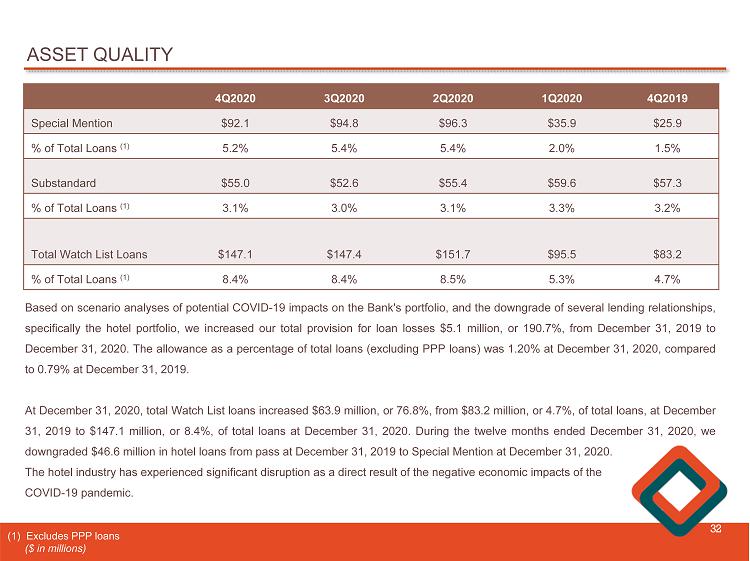

ASSET QUALITY 32 4Q2020 3Q2020 2Q2020 1Q2020 4Q2019 Special Mention $92.1 $94.8 $96.3 $35.9 $25.9 % of Total Loans (1) 5.2% 5.4% 5.4% 2.0% 1.5% Substandard $55.0 $52.6 $55.4 $59.6 $57.3 % of Total Loans (1) 3.1% 3.0% 3.1% 3.3% 3.2% Total Watch List Loans $147.1 $147.4 $151.7 $95.5 $83.2 % of Total Loans (1) 8.4% 8.4% 8.5% 5.3% 4.7% Based on scenario analyses of potential COVID - 19 impacts on the Bank's portfolio, and the downgrade of several lending relationships, specifically the hotel portfolio, we increased our total provision for loan losses $ 5 . 1 million, or 190 . 7 % , from December 31 , 2019 to December 31 , 2020 . The allowance as a percentage of total loans (excluding PPP loans) was 1 . 20 % at December 31 , 2020 , compared to 0 . 79 % at December 31 , 2019 . At December 31 , 2020 , total Watch L ist loans increased $ 63 . 9 million, or 76 . 8 % , from $ 83 . 2 million, or 4 . 7 % , of total loans, at December 31 , 2019 to $ 147 . 1 million, or 8 . 4 % , of total loans at December 31 , 2020 . During the twelve months ended December 31 , 2020 , we downgraded $ 46 . 6 million in hotel loans from pass at December 31 , 2019 to Special Mention at December 31 , 2020 . The hotel industry has experienced significant disruption as a direct result of the negative economic impacts of the COVID - 19 pandemic . (1) Excludes PPP loans ($ in millions)

HOTELS - $56.3 MILLION, OR 3.2% OF TOTAL LOANS (1) 33 The hotel industry has been significantly impacted by the pandemic and the widespread travel restrictions . We continue to maintain close contact with our borrowers and monitor industry updates . We performed a review of the hotel portfolio and the impact that COVID - 19 is having on the hotel industry . As of March 31 , 2020 , 93 % of the hotel portfolio was classified within a pass - rating category . As a result of COVID - 19 , as of December 31 , 2020 , $ 50 . 6 million of the hotel portfolio was categorized as special mention due to the prolonged shutdown and $ 5 . 7 million is categorized as pass - rated . • Many of these borrowers continue to incur a negative impact to their businesses resulting from the governmental stay - at - home orders, which became effective March 23 , 2020 , as well as travel limitations . • We continue to monitor the credits and work with the borrowers . • The average loan balance of the hotel portfolio is $ 2 . 7 million, with an average loan - to - value of 71 % . • 98 % of the hotel portfolio is with Marriott, Hyatt, Hampton Inn, and Red Roof Inn branded hotels . • At December 31 , 2020 , 90 . 6 % of the hotel portfolio has requested payment deferrals due to COVID - 19 . » 86 % were modified to interest only monthly payments (1) Excludes PPP loans; numbers as of December 31, 2020

CAPITAL MANAGEMENT 34 We are well - capitalized with excess capital. Consolidated Ratio Consolidated Capital Leverage Ratio 9.3% $223.3 Common Equity Tier 1 Ratio 13.4% $223.3 Tier 1 Capital Ratio 13.4% $223.3 Total Capital Ratio 14.7% $244.2 x From a regulatory standpoint, we are well - capitalized with excess capital. x We take a prudent approach to capital management. As of December 31, 2020 ($ in millions) Westfield Bank Ratio Well Capitalized Excess Bank Capital Excess Over Well - Capitalized Leverage Ratio 8.8% 5.0% 3.8% $210.7 $91.4 Common Equity Tier 1 Ratio 12.7% 6.5% 6.2% $210.7 $102.5 Tier 1 Capital Ratio 12.7% 8.0% 4.7% $210.7 $77.6 Total Capital Ratio 13.9% 10.0% 3.9% $231.5 $65.1

CAPITAL RETURN TO SHAREHOLDERS 35 Year # of Shares 2017 606,391 2018 2,189,276 2019 1,938,667 2020 1,391,496 Year Annual Dividends per Share 2017 $0.12 2018 $0.16 2019 $0.20 2020 $0.20 Share Repurchases Dividends On January 29 , 2019 , the Board of Directors authorized the 2019 Plan under which the Company was authorized to purchase up to 2 , 814 , 200 shares, or 10 % of its outstanding common stock . During the twelve months ended December 31 , 2020 , the Company repurchased 1 , 126 , 866 shares under the 2019 Plan at an average price per share of $ 7 . 75 . On October 19 , 2020 , the Company announced the completion of the 2019 Plan . On October 27 , 2020 , the Board of Directors authorized the 2020 Plan under which the Company may purchase up to 1 . 3 million shares, or approximately 5 % of its outstanding common stock . During the three months ended December 31 , 2020 , the Company repurchased 264 , 630 of common stock under the 2020 Plan at an average price per share of $ 6 . 58 . During the twelve months ended December 31 , 2020 , the Company repurchased a total of 1 , 391 , 496 shares under the 2019 and 2020 Plans . There are 1 , 035 , 370 shares remaining under the 2020 Plan .

CAPITAL MANAGEMENT 36 $8.97 $8.99 $8.95 $8.88 $8.74 $8.36 $8.39 $8.34 $8.27 $8.14 Book Value per Share Tangible Book Value per Share Book Value Tangible Book Value

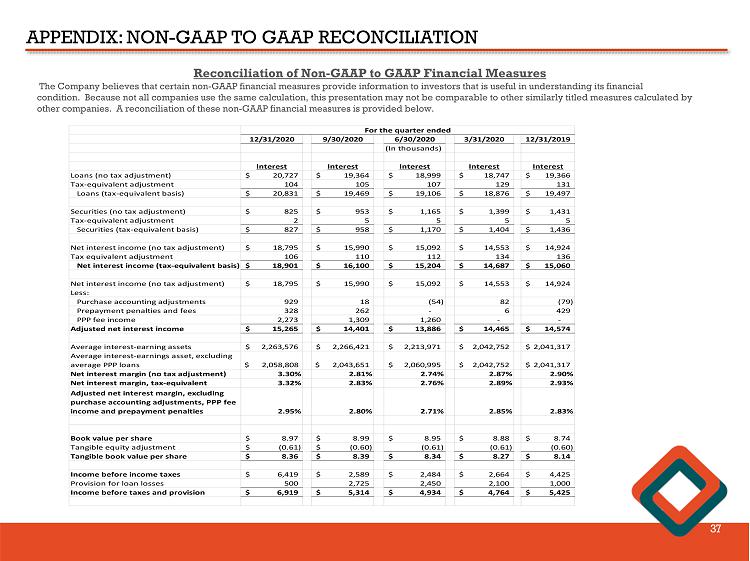

APPENDIX: NON - GAAP TO GAAP RECONCILIATION 37 Reconciliation of Non - GAAP to GAAP Financial Measures The Company believes that certain non - GAAP financial measures provide information to investors that is useful in understanding i ts financial condition. Because not all companies use the same calculation, this presentation may not be comparable to other similarly title d measures calculated by other companies. A reconciliation of these non - GAAP financial measures is provided below. 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 (In thousands) Interest Interest Interest Interest Interest Loans (no tax adjustment) 20,727$ 19,364$ 18,999$ 18,747$ 19,366$ Tax-equivalent adjustment 104 105 107 129 131 Loans (tax-equivalent basis) 20,831$ 19,469$ 19,106$ 18,876$ 19,497$ Securities (no tax adjustment) 825$ 953$ 1,165$ 1,399$ 1,431$ Tax-equivalent adjustment 2 5 5 5 5 Securities (tax-equivalent basis) 827$ 958$ 1,170$ 1,404$ 1,436$ Net interest income (no tax adjustment) 18,795$ 15,990$ 15,092$ 14,553$ 14,924$ Tax equivalent adjustment 106 110 112 134 136 Net interest income (tax-equivalent basis) 18,901$ 16,100$ 15,204$ 14,687$ 15,060$ Net interest income (no tax adjustment) 18,795$ 15,990$ 15,092$ 14,553$ 14,924$ Less: Purchase accounting adjustments 929 18 (54) 82 (79) Prepayment penalties and fees 328 262 - 6 429 PPP fee income 2,273 1,309 1,260 - - Adjusted net interest income 15,265$ 14,401$ 13,886$ 14,465$ 14,574$ Average interest-earning assets 2,263,576$ 2,266,421$ 2,213,971$ 2,042,752$ 2,041,317$ Average interest-earnings asset, excluding average PPP loans $ 2,058,808 $ 2,043,651 2,060,995$ 2,042,752$ 2,041,317$ Net interest margin (no tax adjustment) 3.30% 2.81% 2.74% 2.87% 2.90% Net interest margin, tax-equivalent 3.32% 2.83% 2.76% 2.89% 2.93% Adjusted net interest margin, excluding purchase accounting adjustments, PPP fee income and prepayment penalties 2.95% 2.80% 2.71% 2.85% 2.83% Book value per share 8.97$ 8.99$ 8.95$ 8.88$ 8.74$ Tangible equity adjustment (0.61)$ (0.60)$ (0.61) (0.61) (0.60) Tangible book value per share 8.36$ 8.39$ 8.34$ 8.27$ 8.14$ Income before income taxes 6,419$ 2,589$ 2,484$ 2,664$ 4,425$ Provision for loan losses 500 2,725 2,450 2,100 1,000 Income before taxes and provision 6,919$ 5,314$ 4,934$ 4,764$ 5,425$ For the quarter ended

WESTFIELD BANK “WHAT BETTER BANKING’S ALL ABOUT” James C. Hagan , President and Chief Executive Officer Guida R. Sajdak , Executive Vice President and Chief Financial Officer Meghan Hibner , Vice President and Investor Relations Officer 38 141 Elm Street, Westfield, MA