Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MainStreet Bancshares, Inc. | mnsb-8k_20210202.htm |

MainStreet Bancshares, Inc. Nasdaq: MNSB & MNSBP Financial Highlights 4th Quarter 2020 A Russell 2000 Company February 3, 2021 Exhibit 99.1

This presentation contains forward-looking statements, including our expectations with respect to future events that are subject to various risks and uncertainties. The statements contained in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursuant,” “target,” “continue,” and similar expressions are intended to identify such forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: the impact of developments related to the novel coronavirus (COVID-19), economic conditions, competition, inflation and market rates of interest, client relationships and changes in our organization. Factors that could cause actual results to differ materially are described in our Annual Report on Form 10-K for the year ended December 31, 2019, and in other documents subsequently filed will the Securities and Exchange Commission, available at www.sec.gov and www.mstreetbank.com. We caution readers that the list of factors is not exclusive. The forward-looking statements are made as of the date of this presentation, and we may not undertake steps to update the forward-looking statements to reflect the impact of any circumstances or events that arise after the date the forward-looking statements are made. In addition, our past results of operations are not necessarily indicative of future performance. This presentation supplements information contained in the Company’s preliminary prospectus supplement dated September 10, 2020 and should be read in conjunction therewith. Unless otherwise indicated or the context otherwise requires, all references in this presentation to “we,” “our,” “us,” and “the Company” refer to MainStreet Bancshares, Inc., and its consolidated subsidiaries, after giving effect to the reorganization transaction that was completed in July 2016, pursuant to which MainStreet Bank (the “Bank”) reorganized into a holding company structure, with each outstanding share of Bank common stock being automatically converted into and exchanged for one share of the Company’s common stock. For all periods prior to the completion of such reorganization transaction, these terms refer to the Bank and its consolidated subsidiaries, and all historical financial information included in this presentation prior to the completion of the reorganization reflect that of the Bank. The accounting and reporting policies of the Company conform to U.S. GAAP and prevailing practices in the banking industry. However, certain non-GAAP measures are used by management to supplement the evaluation of the Company’s performance. Management believes that the use of non-GAAP measures provide meaningful information about operating performance by enhancing comparability with other financial periods and other financial institutions. The non-GAAP measures used by management enhance comparability by excluding the effects of items that do not reflect ongoing operating performance, including non-recurring gains or charges, that, in management’s opinion, can distort period-to-period comparisons. These non-GAAP financial measures should not be considered an alternative to U.S. GAAP-basis financial statements, and other bank holding companies may define or calculate these or similar measures differently. Where applicable, reconciliation of the non-GAAP financial measures used by the Company to evaluate and measure the Company’s performance to the most directly comparable U.S. GAAP financial measures is presented in the Appendix. Disclaimers

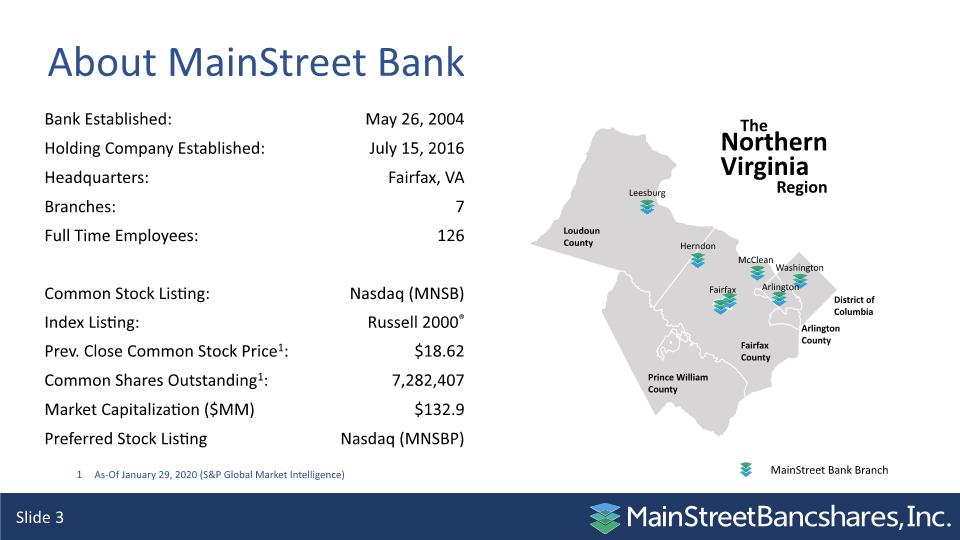

About MainStreet Bank As-Of January 29, 2020 (S&P Global Market Intelligence)

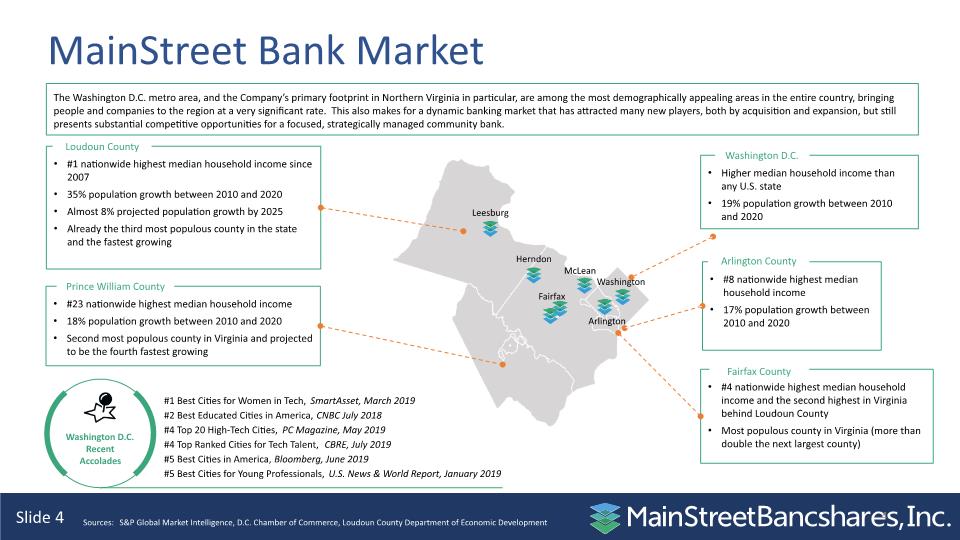

4 The Washington D.C. metro area, and the Company’s primary footprint in Northern Virginia in particular, are among the most demographically appealing areas in the entire country, bringing people and companies to the region at a very significant rate. This also makes for a dynamic banking market that has attracted many new players, both by acquisition and expansion, but still presents substantial competitive opportunities for a focused, strategically managed community bank. MainStreet Bank Market Sources: S&P Global Market Intelligence, D.C. Chamber of Commerce, Loudoun County Department of Economic Development

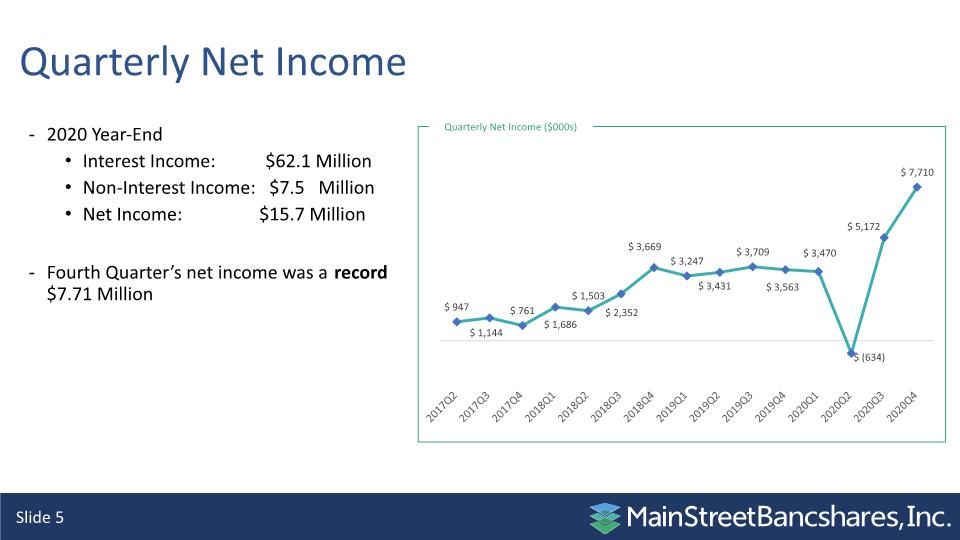

Quarterly Net Income 2020 Year-End Interest Income: $62.1 Million Non-Interest Income: $7.5 Million Net Income: $15.7 Million Fourth Quarter’s net income was a record $7.71 Million

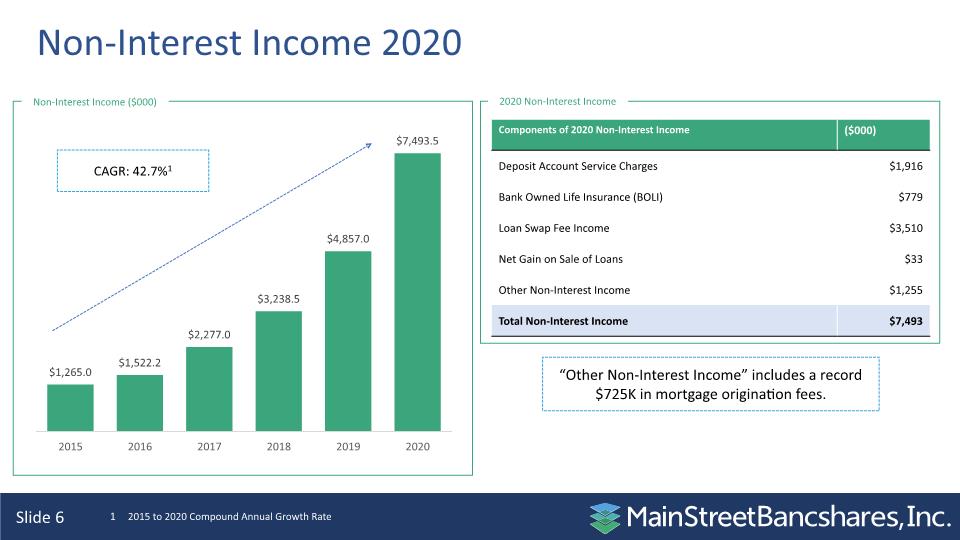

Non-Interest Income 2020 Non-Interest Income ($000) “Other Non-Interest Income” includes a record $725K in mortgage origination fees. 2015 to 2020 Compound Annual Growth Rate CAGR: 42.7%1

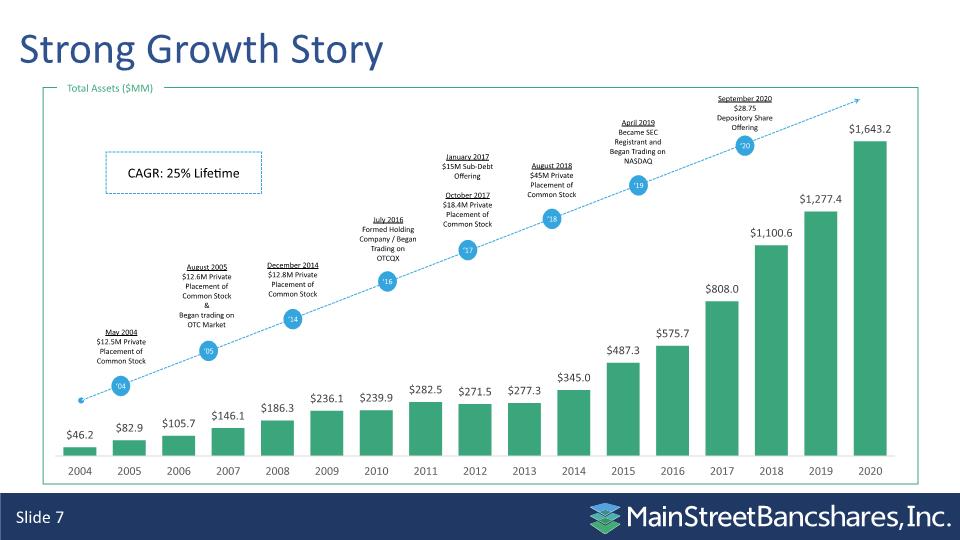

Strong Growth Story ‘04 May 2004 $12.5M Private Placement of Common Stock ‘05 August 2005 $12.6M Private Placement of Common Stock & Began trading on OTC Market ‘14 December 2014 $12.8M Private Placement of Common Stock ‘16 ‘17 ‘18 ‘19 ‘20 July 2016 Formed Holding Company / Began Trading on OTCQX January 2017 $15M Sub-Debt Offering October 2017 $18.4M Private Placement of Common Stock August 2018 $45M Private Placement of Common Stock April 2019 Became SEC Registrant and Began Trading on NASDAQ September 2020 $28.75 Depository Share Offering Total Assets ($MM) CAGR: 25% Lifetime

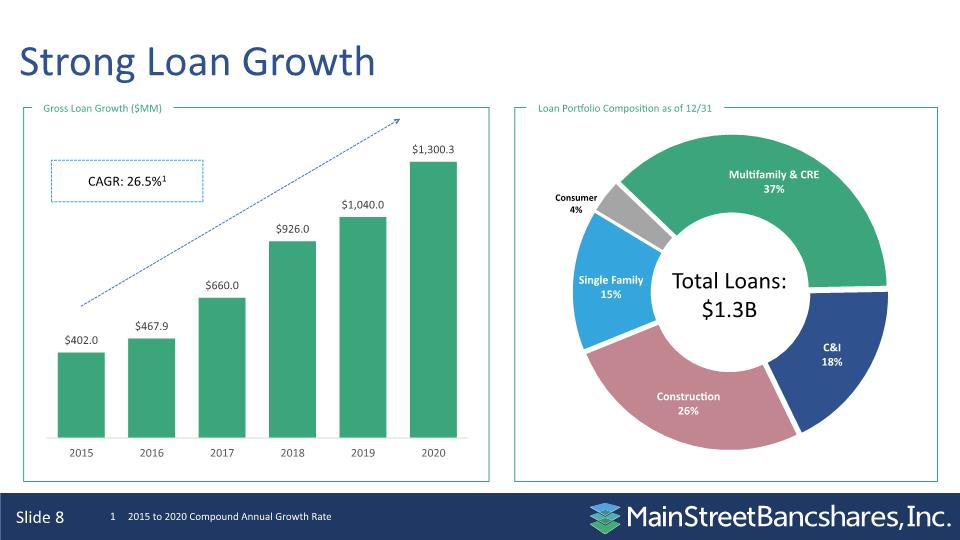

Strong Loan Growth Loan Portfolio Composition as of 12/31 Gross Loan Growth ($MM) CAGR: 26.5%1 Total Loans: $1.3B 2015 to 2020 Compound Annual Growth Rate

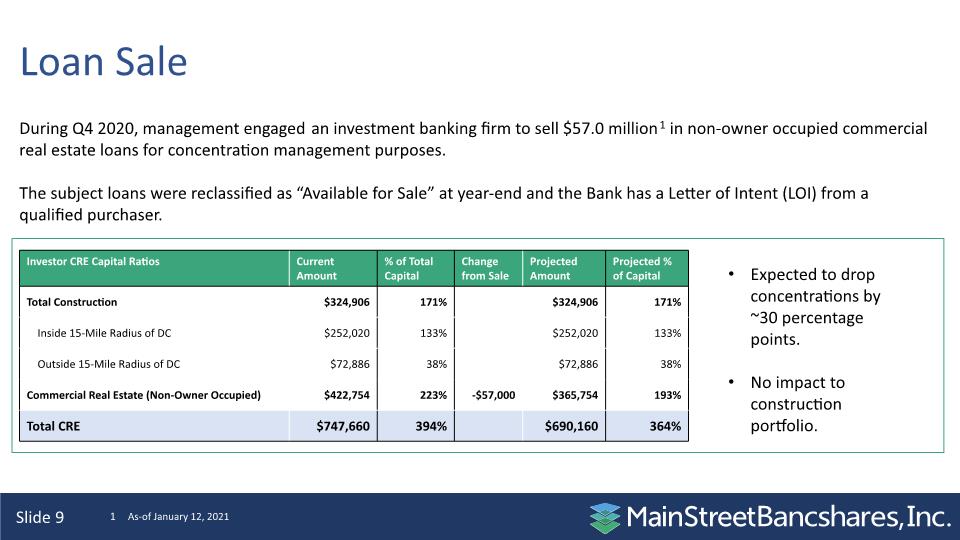

Loan Sale As-of January 12, 2021 During Q4 2020, management engaged an investment banking firm to sell $57.0 million1 in non-owner occupied commercial real estate loans for concentration management purposes. The subject loans were reclassified as “Available for Sale” at year-end and the Bank has a Letter of Intent (LOI) from a qualified purchaser. Expected to drop concentrations by ~30 percentage points. No impact to construction portfolio.

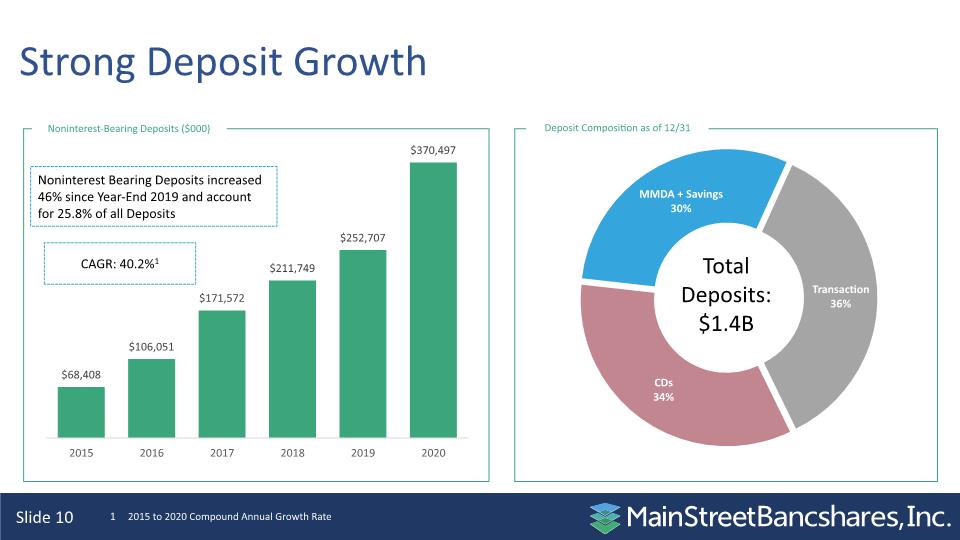

Strong Deposit Growth Deposit Composition as of 12/31 Noninterest-Bearing Deposits ($000) Total Deposits: $1.4B Noninterest Bearing Deposits increased 46% since Year-End 2019 and account for 25.8% of all Deposits CAGR: 40.2%1 2015 to 2020 Compound Annual Growth Rate

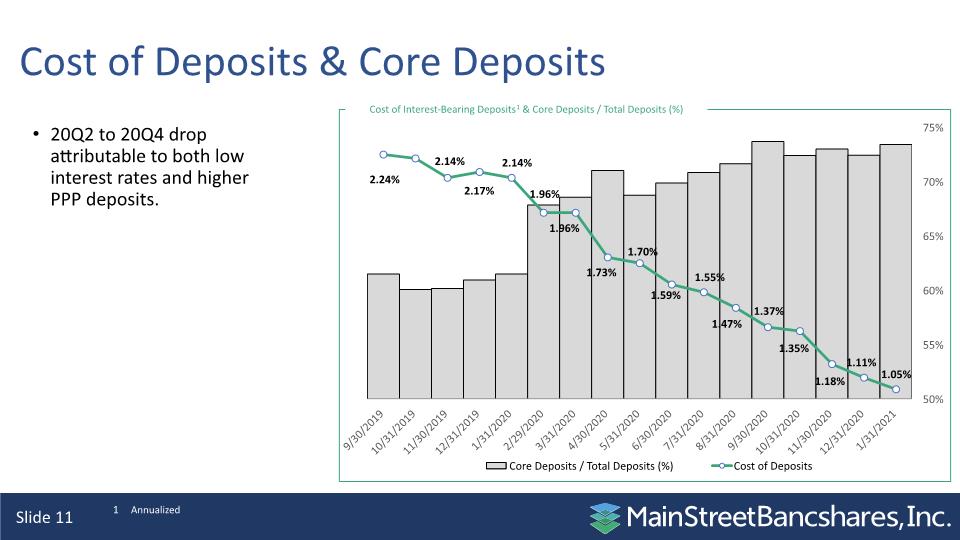

Cost of Deposits & Core Deposits 20Q2 to 20Q4 drop attributable to both low interest rates and higher PPP deposits. Annualized Cost of Interest-Bearing Deposits1 & Core Deposits / Total Deposits (%)

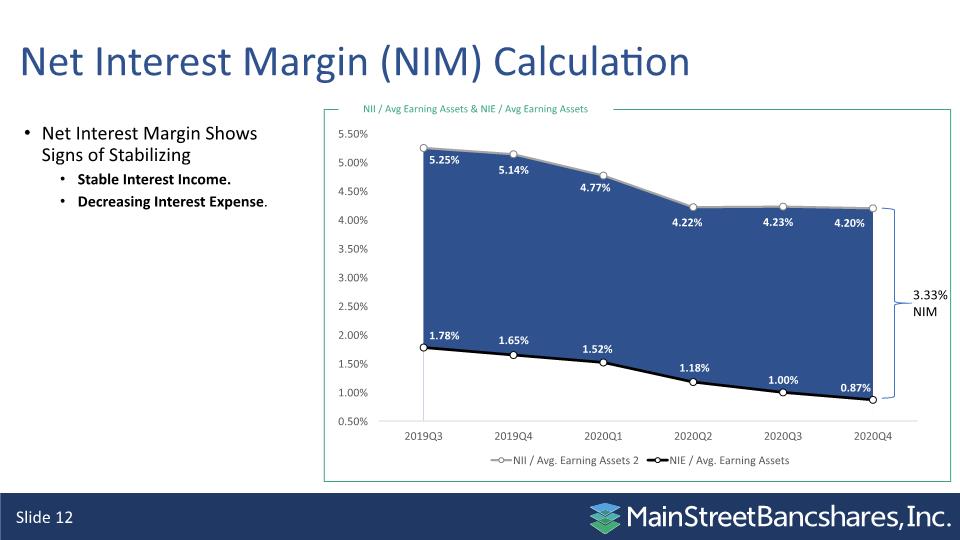

Net Interest Margin (NIM) Calculation Net Interest Margin Shows Signs of Stabilizing Stable Interest Income. Decreasing Interest Expense. NII / Avg Earning Assets & NIE / Avg Earning Assets 3.33% NIM

Profitability Non-GAAP measure.

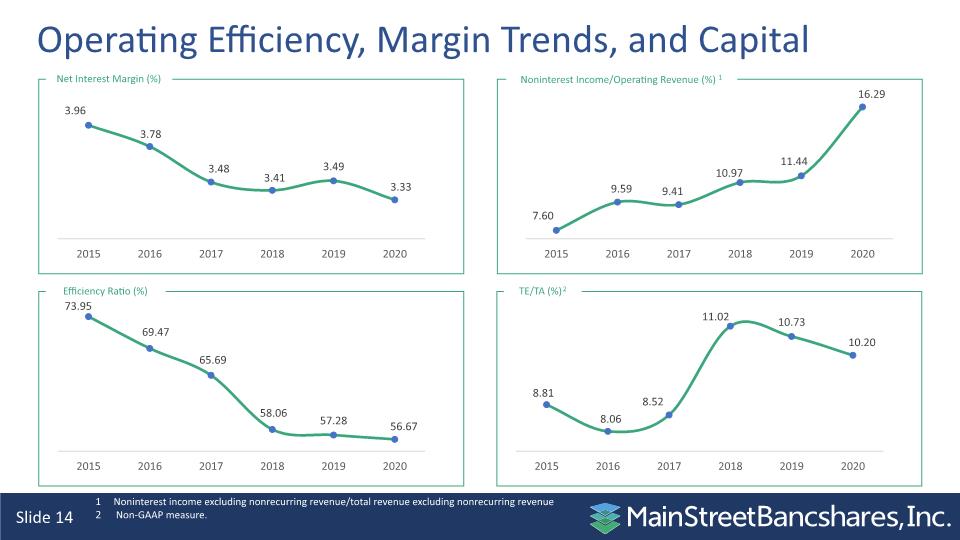

Operating Efficiency, Margin Trends, and Capital 1 Noninterest income excluding nonrecurring revenue/total revenue excluding nonrecurring revenue Non-GAAP measure.

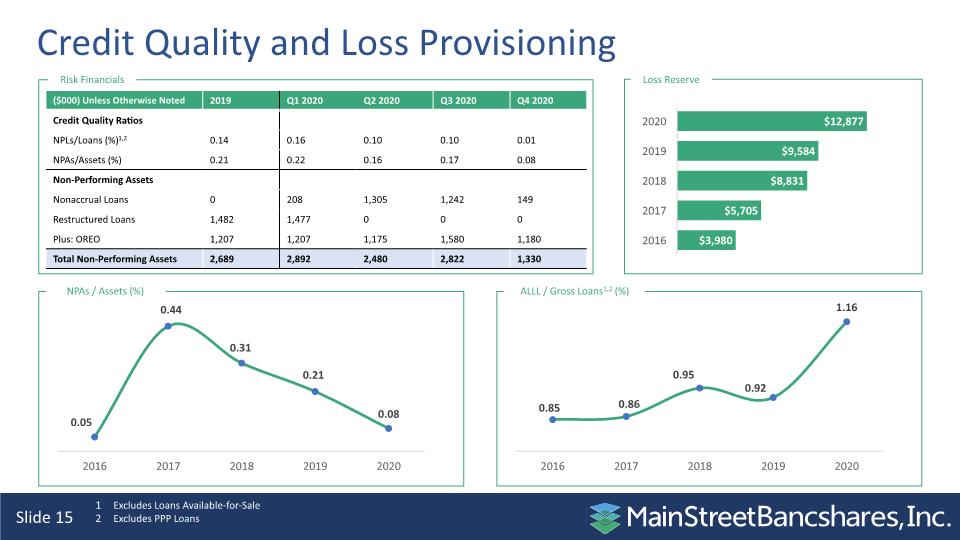

Credit Quality and Loss Provisioning Excludes Loans Available-for-Sale Excludes PPP Loans

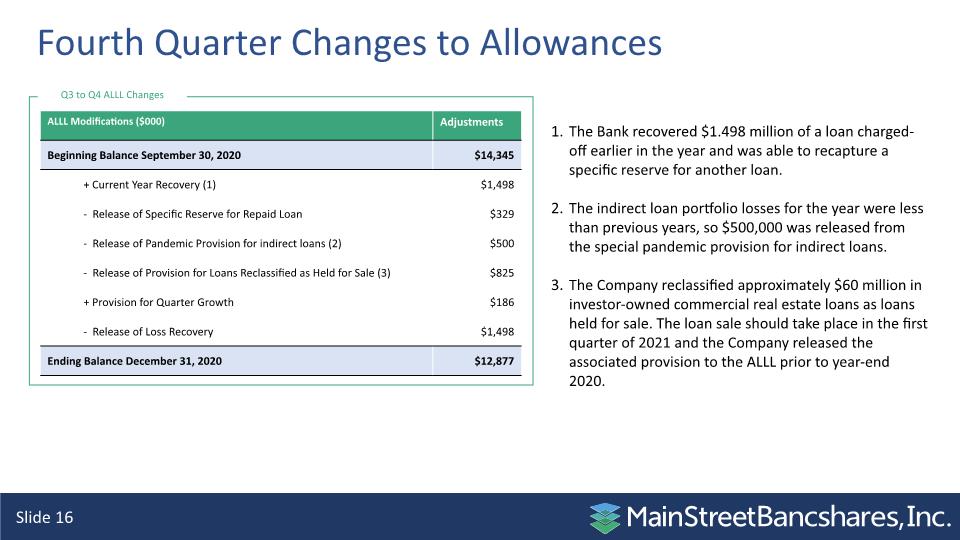

Fourth Quarter Changes to Allowances The Bank recovered $1.498 million of a loan charged-off earlier in the year and was able to recapture a specific reserve for another loan. The indirect loan portfolio losses for the year were less than previous years, so $500,000 was released from the special pandemic provision for indirect loans. The Company reclassified approximately $60 million in investor-owned commercial real estate loans as loans held for sale. The loan sale should take place in the first quarter of 2021 and the Company released the associated provision to the ALLL prior to year-end 2020.

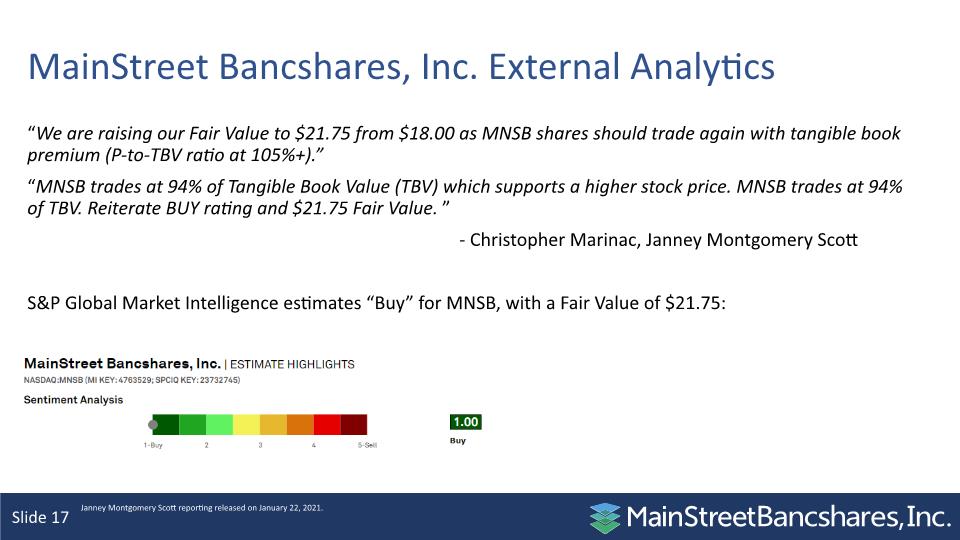

MainStreet Bancshares, Inc. External Analytics “We are raising our Fair Value to $21.75 from $18.00 as MNSB shares should trade again with tangible book premium (P-to-TBV ratio at 105%+).” “MNSB trades at 94% of Tangible Book Value (TBV) which supports a higher stock price. MNSB trades at 94% of TBV. Reiterate BUY rating and $21.75 Fair Value.” - Christopher Marinac, Janney Montgomery Scott S&P Global Market Intelligence estimates “Buy” for MNSB, with a Fair Value of $21.75: Janney Montgomery Scott reporting released on January 22, 2021.

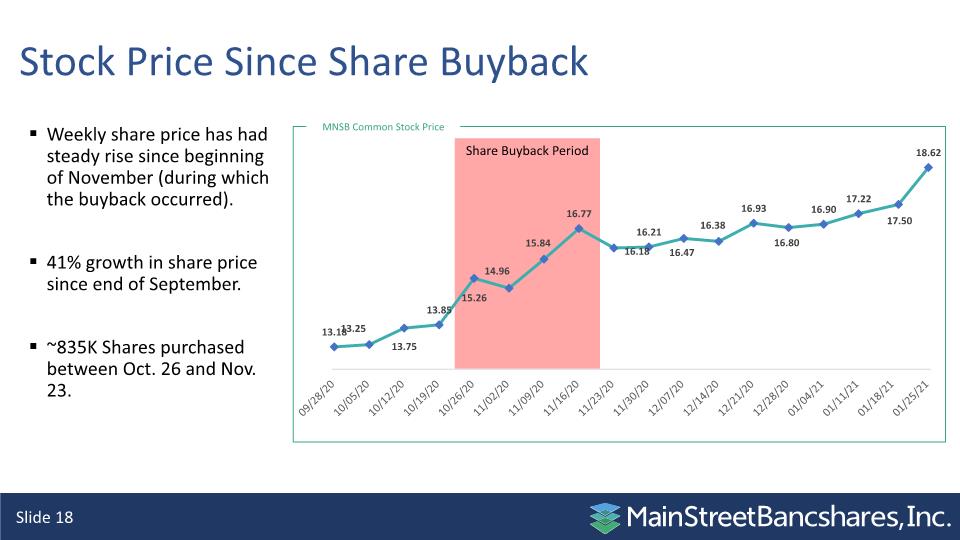

Share Buyback Period Stock Price Since Share Buyback Weekly share price has had steady rise since beginning of November (during which the buyback occurred). 41% growth in share price since end of September. ~835K Shares purchased between Oct. 26 and Nov. 23.

Excellent Board Diversity

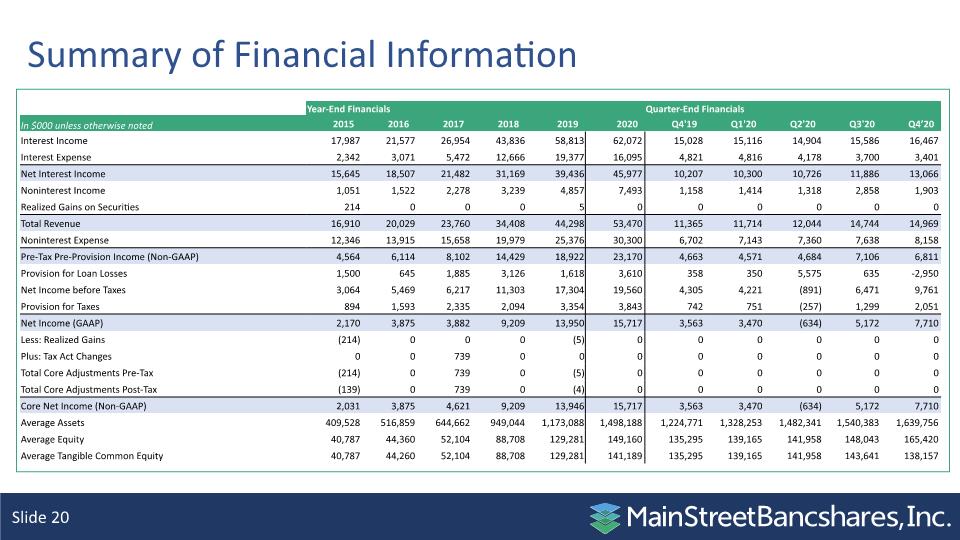

Summary of Financial Information

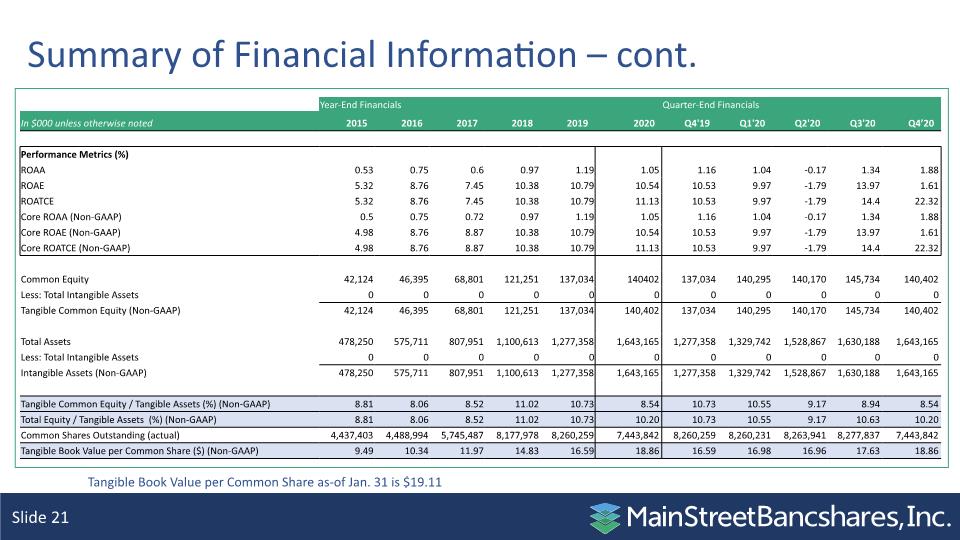

Summary of Financial Information – cont. Tangible Book Value per Common Share as-of Jan. 31 is $19.11