Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - ALBEMARLE CORP | a2-2x20218xkexhibit992.htm |

| EX-99.1 - EX-99.1 - ALBEMARLE CORP | a2-2x20218xkexhibit991.htm |

| 8-K - 8-K - ALBEMARLE CORP | alb-20210202.htm |

Exhibit 99.3

In advance of the filing of its Annual Report on Form 10-K for the year ended December 31, 2020 (“2020 Form 10-K”), Albemarle Corporation is providing certain disclosures with regard to its significant mineral properties in accordance with Securities and Exchange Commission’s (“SEC”) Industry Guide 7. Unless the context otherwise indicates, the terms “Albemarle,” “we,” “us,” “our” or “the Company” mean Albemarle Corporation and its consolidated subsidiaries. This disclosure will be found in Part I, Item 2 - Properties of Albemarle’s 2020 Form 10-K.

Significant Mineral Properties

Set forth below are details regarding our significant mineral properties operated by us and our affiliates in accordance with Industry Guide 7 issued by the Securities and Exchange Commission (“SEC”). In 2018, the SEC adopted new rules relating to property disclosures by companies with significant mining operations, effective for the year beginning January 1, 2021. Thus, the Company will not be required to comply with the SEC’s new mining operation disclosure rules until the earlier of its next filing of a registration statement under the Securities Act of 1933, or the filing of its Annual Report on Form 10-K for the year ending December 31, 2021. The Company does not have current estimates of proven or probable reserves for its significant mining properties as defined by Industry Guide 7 as of this filing. However, the Company is in the process of developing these reserve estimates in accordance with the new mining operation rules adopted by the SEC.

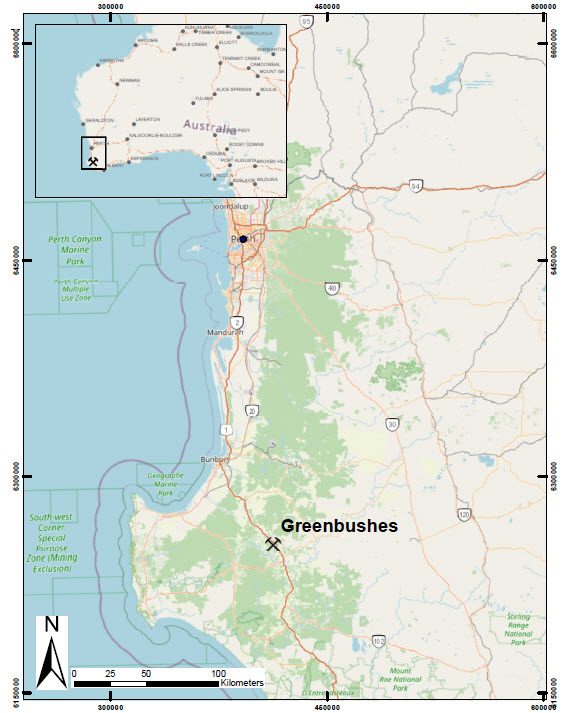

Greenbushes, Australia

The Greenbushes mine is a hard rock, open pit mine located approximately 250km south of Perth, Western Australia, 90km southeast of the port of Bunbury, a major bulk-handling port in the southwest of Western Australia. The lithium mining operation is near the Greenbushes townsite located in the Shire of Bridgetown-Greenbushes. Access to the Greenbushes Mine is via the paved South Western Highway between Bunbury and Bridgetown to Greenbushes Township and via the paved Maranup Ford Road to the Greenbushes Mine.

1

| Albemarle Corporation and Subsidiaries | ||||||||

Lithium production from the Greenbushes Mine has been undertaken continuously for more than 20 years. Modern exploration has been undertaken on the property since the mid-1980s, first by Greenbushes Limited, then by Lithium Australia Ltd and in turn by Sons of Gwalia prior to the acquisition of Greenbushes by Talison in 2007. Initial exploration focused largely on tantalum, with the emphasis changing to lithium from around 2000. In 2014, Rockwood Holdings, Inc. (“Rockwood”) and Sichuan Tianqi Lithium Industries Inc. created Windfield Holdings Pty. Ltd. (“Windfield”), a joint venture, owned 49% by Rockwood, to purchase Talison. This 49% ownership in Windfield was assumed by Albemarle in 2015 as part of the acquisition of Rockwood. We purchase lithium concentrate from Windfield, and our investment in the joint venture is reported as an unconsolidated equity investment on our balance sheet.

About 55% of the tenements held by Talison are covered by Western Austalia’s State Forest, which is under the authority of the Western Australia Department of Biodiversity, Conservation and Attractions. The majority of the remaining land is private land that covers about 40% of the surface rights. The remaining ground comprises crown land, road reserves and other miscellaneous reserves. The tenements cover a total area of approximately 10,000 hectares and include the historic Greenbushes tin, tantalum and current lithium mining areas. Talison holds the mining rights for all lithium minerals on these tenements. The operating lithium mining and processing plant area covers approximately 2,000 hectares comprising three mining leases. All lithium mining activities, including tailings storage, processing plant operations, open pits and waste rock dumps, are currently carried out within the boundaries of the three mining leases plus two general purpose leases. In order to keep the granted tenements in good standing, Talison is required to maintain permits, make an annual contribution to the statutory Mining Rehabilitation Fund and pay a royalty on concentrate sales for lithium mineral production as prescribed under the Mining Act 1978 in Western Australia. There are no private royalties that apply to the Greenbushes property. Talison reviews and renews all tenements on an annual basis.

The Greenbushes deposit consists of a main, rare-metal zoned pegmatite body, with numerous smaller footwall pegmatite dykes and pods. The primary intrusion and its subsidiary dykes and pods are concentrated within shear zones on the boundaries of granofels, ultramafic schists and amphibolites. The pegmatites are crosscut by ferrous-rich, mafic dolerite which is of paramount importance to the currant mining methods. The pegmatite body is over 3 km long (north by northwest), up to 300 meters wide (normal to dip), strikes north to northwest and dips moderately to steeply west to southwest.

The major minerals from the Greenbushes pegmatite are quartz, spodumene, albite and K-feldspar. The main lithium-bearing minerals are spodumene (containing approximately 8% lithium oxide) and varieties kunzite and hiddenite. Minor to trace lithium minerals include lepidolite mica, amblygonite and lithiophilite. Lithium is readily leached in the weathering environment and thus is virtually non-existent in weathered pegmatite. Exploration drilling at Greenbushes has been ongoing for over 40 years, including drilling in 2020, using reverse circulation and diamond drill holes.

Three lithium mineral processing plants are currently operating on the Greenbushes site, two chemical grade plants and a technical grade plant. Tailings are discharged to the tailings storage facility without the need for any neutralization process. Additional infrastructure on site includes power and water supply facilities, a laboratory, administrative offices, occupational health/safety/training offices, dedicated mines rescue area, stores, storage sheds, workshops and engineering offices. The Greenbushes site also leases production drills, excavators, trucks and various support equipment to extract the ore deposit by open pit methods. Talison’s power is delivered by a local distribution system and reticulated and metered within the site. Water is sourced from rainfall and stored in several process dams located on site. We consider the condition of all of our plants, facilities and equipment to be suitable and adequate for the businesses we conduct, and we maintain them regularly. As of December 31, 2020, the gross asset value of the facilities at the Greenbushes site was approximately $789 million. During 2020, 88,000 metric tons of lithium carbonate equivalent (“LCE”) of lithium concentrate were produced at the Greenbushes facilities. Talison currently sells the lithium concentrate only to its shareholders.

Talison ships the chemical-grade lithium concentrate in vessels to our facilities in Meishan and Xinyu, China to process into battery-grade lithium hydroxide. In addition, the output from Talison can be used by tolling entities in China to produce both lithium carbonate and lithium hydroxide. See a description of our facilities in Meishan and Xinyu below under “Other Significant Lithium Processing Facilities.”

2

| Albemarle Corporation and Subsidiaries | ||||||||

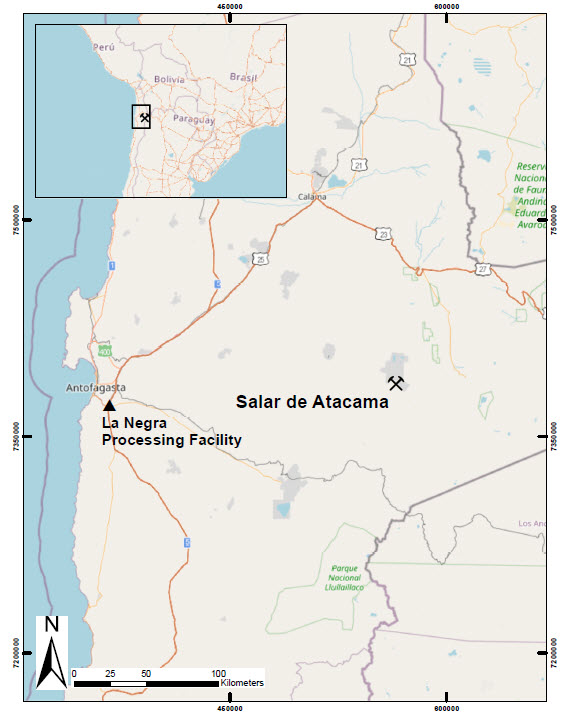

Salar de Atacama/La Negra, Chile

The Salar de Atacama is located in the commune of San Pedro de Atacama, at the eastern end of the Antofagasta Region and close to the border of Argentina and Bolivia. Access to the property is on the major four-lane paved Panamericana Route 5 north from Antofagasta, Chile approximately 60 km northeast to B-385. On B-385, a two laned paved highway, the Albemarle Salar de Atacama project is approximately 175 km to the east. The site has a small private airport that serves the project. A small paved runway airport is also located near San Pedro de Atacama and a large international airport is located in Antofagasta. The La Negra plant has direct access roads and located approximately 20 km by paved four lane highway Route 28 southeast of Antofagasta turning north approximately 3 km on Route 5.

In the early 1960s, water with high concentrations of salts was discovered in the Salar de Atacama Basin. In January 1975, one of our predecessors, Foote Mineral Company, signed a long-term contract with the Chilean government for mineral rights with respect to the Salar de Atacama consisting exclusively of the right to access lithium brine, covering an area of approximately 16,700 hectares. The contract originally permitted the production and sale of up to 200,000 metric tons of lithium metal equivalent (“LME”), a calculated percentage of LCE. In 1981, the first construction of evaporation ponds in the Salar de Atacama began. The following year, the construction of the lithium carbonate plant in La Negra began. In 1990, the facilities at the Salar de Atacama were expanded with a new well system and the capacity of the lithium carbonate plant in the La Negra plant was expanded. In 1998, the lithium chloride plant in La Negra began operating, the same year that Chemetall purchased Foote Mineral Company. Subsequently, in 2004, Chemetall was acquired by Rockwood, and in 2015, Rockwood was acquired by Albemarle. Effective January 1, 2017, the Chilean government and Albemarle entered into an annex to the original agreement through which its duration was modified, extending it until the balance of: (a) the original 200,000 metric tons of LME and an additional 262,132 metric tons of LME granted through this annex have been exploited, processed, and sold, or (b) on January 1, 2044, whichever comes first. In addition, the amended agreement provides for commission payments to the Chilean government based on sales price/metric ton on the amounts sold under the additional quota granted, our support of research and development in Chile of lithium applications and solar energy, and our support of local

3

| Albemarle Corporation and Subsidiaries | ||||||||

communities in Northern Chile. Albemarle currently operates its extraction and production facilities in Chile under this mineral rights agreement with the Chilean government.

The Salar de Atacama is a salt flat, the largest in Chile, located in the Atacama desert in northern Chile, which is the driest place on the planet and thus has an extremely high annual rate of evaporation and extremely low annual rainfall. Our extraction through evaporation process works as follows: snow in the Andes Mountains melts and flows into underground pools of water containing brine, which generally have high concentrations of lithium. We then pump the water containing brine above ground through a series of pumps and wells into a network of large evaporation ponds. Over the course of approximately eighteen months, the desert sun evaporates the water causing other salts to precipitate and leaving behind concentrated lithium brine. If weather conditions are not favorable, the evaporation process may be prolonged. After we obtain the lithium brine from the Salar de Atacama, we process it into lithium carbonate and lithium chloride at our manufacturing facilities in nearby La Negra, Chile.

The filling materials of the Salar de Atacama Basin are dominated by the Vilama Formation and the more recently, in geologic time, by evaporitic and clastic materials that are currently being deposited in the basin. These units house the basin's aquifer system and are composed of evaporitic chemical sediments that include carbonate, gypsum and halite intervals interrupted by volcanic deposits of large sheets of ignimbrite, volcanic ash and smaller classical deposits. Lithium-rich brines are extracted from the halite aquifer that is located within the nucleus of the salt flat. The Salar de Atacama basin contains a continental system of lithium-rich brine. These types of systems have six common (global) characteristics: arid climate; closed basin that contains a salt flat (salt crust), a salt lake, or both; igneous and/or hydrothermal activity; tectonic subsidence; suitable sources of lithium; and sufficient time to concentrate the lithium in the brine.

In the Salar de Atacama basin, lithium-rich brines are found in a halite aquifer. Carbonate and sulfates are found near the edges of the basin. The average, minimum and maximum concentrations of lithium in the Salar de Atacama basin are approximately 1,400, 900 and 7,000 mg/L, respectively. From 2017 through 2019, two drilling campaigns were carried out in order to obtain geological and hydrogeological information at the Albemarle mining concession.

The facilities at the Salar de Atacama consist of extraction wells, evaporation and concentration ponds, leaching plants, a potash plant, a drying floor, services and general areas, including salt stockpiles, as well as a fleet of owned and leased equipment. The extracted concentrated lithium brine is sent to the La Negra plant by truck for processing. The Salar de Atacama has its own powerhouse that generates the energy necessary for the entire operation of the facilities. We also have permanent and continuous groundwater exploitation rights for two wells that are for industrial use and to supply the Salar de Atacama facilities. The La Negra facilities consist of a boron removal plant, a calcium and magnesium removal plant, two lithium carbonate conversion plants, a lithium chloride plant, evaporation-sedimentation ponds, an offsite area where the raw materials are housed and the inputs that are used in the process are prepared, a dry area where the various products are prepared, as well as a fleet of owned and leased equipment. La Negra is supplied electricity from a local company and has rights to a well in the Peine community for its water supply. We are currently constructing a third lithium carbonate conversion plant expected to be completed mid-2021, followed by a six-month commissioning and qualification process. We consider the condition of all of our plants, facilities and equipment to be suitable and adequate for the businesses we conduct, and we maintain them regularly. As of December 31, 2020, the combined gross asset value of our facilities at the Salar de Atacama and in La Negra, Chile (not inclusive of construction in process) was approximately $863 million. During 2020, we produced 42,000 metric tons of LCE of primarily lithium carbonate at our La Negra facilities.

4

| Albemarle Corporation and Subsidiaries | ||||||||

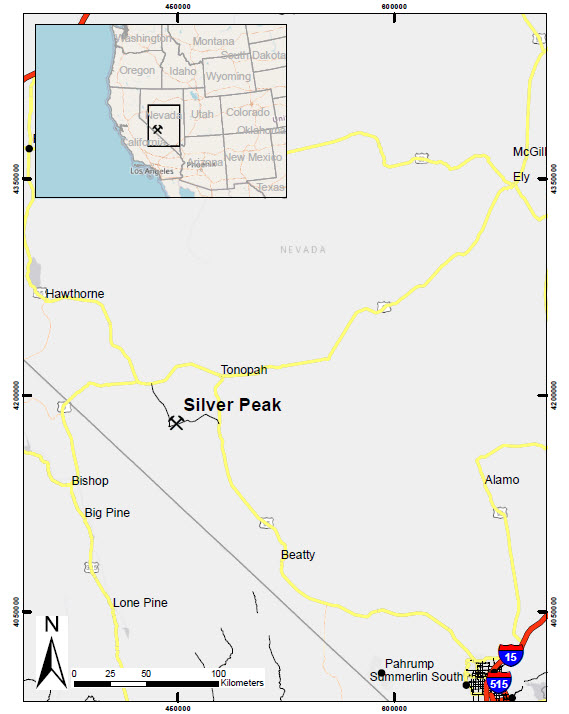

Silver Peak, Nevada

The Silver Peak site is located in a rural area approximately 30 miles southwest of Tonopah, in Esmeralda County, Nevada. It is located in the Clayton Valley, an arid valley historically covered with dry lake beds (playas). The operation borders the small unincorporated town of Silver Peak, Nevada. Albemarle uses the Silver Peak site for the production of lithium brines, which are used to make lithium carbonate and, to a lesser degree, lithium hydroxide. Access to the site is off of the paved highway SR-265 in the town of Silver Peak, Nevada. The administrative offices are located on the south side of the road. The process facility is on the north side of the road and the brine operations are located approximately three miles east of Silver Peak on Silver Peak Road and occupy both the north and south sides of the road. In addition, access to the site is also possible via gravel/dirt roads from Tonopah, Nevada and Goldfield, Nevada.

Lithium brine extraction in the Clayton Valley began in the mid-1960’s by one of our predecessors, the Foote Mineral Company. Since that time, lithium brine operations have been operated on a continuous basis. In 1998, Chemetall purchased Foote Mineral Company. Subsequently, in 2004, Chemetall was acquired by Rockwood, and in 2015, Rockwood was acquired by Albemarle. Our mineral rights in Silver Peak consist of our right to access lithium brine pursuant to our permitted and certified senior water rights, a settlement agreement with the U.S. government, originally entered into in June 1991, and our patented and unpatented land claims. Pursuant to the 1991 agreement, our water rights and our land claims, we have rights to all lithium that we can remove economically from the Clayton Valley Basin in Nevada. We have been operating at the Silver Peak site since 1966. Our Silver Peak site covers a surface of over 13,500 acres, more than 10,500 acres of which we own through a subsidiary. The remaining acres are owned by the U.S. government from whom we lease the land pursuant to unpatented land claims that are renewed annually. Actual surface disturbance associated with the operations is 7,390 acres, primarily associated with the evaporation ponds. The manufacturing and administrative activities are confined to an area approximately 20 acres in size.

We extract lithium brine from our Silver Peak site through substantially the same evaporation process we use at the Salar de Atacama. We process the lithium brine extracted from our Silver Peak site into lithium carbonate at our plant in Silver Peak. It is hypothesized that the current levels of lithium dissolved in brine originate from relatively recent dissolution

5

| Albemarle Corporation and Subsidiaries | ||||||||

of halite by meteoric waters that have penetrated the playa in the last 10,000 years. The halite formed in the playa during the aforementioned climatic periods of low precipitation and that the concentrated lithium was incorporated as liquid inclusions into the halite crystals. There are no current exploration activities on the Silver Peak lithium operation. However, in January 2021, we announced that we will expand capacity in Silver Peak and begin a program to evaluate clays and other available Nevada resources for commercial production of lithium. Beginning in 2021, we plan to invest $30 million to $50 million to double the current production in Silver Peak by 2025, with the aim of making full use of the brine water rights.

The facilities at Silver Peak consist of extraction wells, evaporation and concentration ponds, a lithium carbonate plant, a lithium anhydrous plant, a lithium hydroxide plant, a liming plant, wellfield and mill maintenance, a shipping and packaging facility and administrative offices, as well as a fleet of owned and leased equipment. Silver Peak is supplied electricity from a local company and we currently have two operating fresh water wells nearby that supply water to the facilities. We consider the condition of all of our plants, facilities and equipment to be suitable and adequate for the businesses we conduct, and we maintain them regularly. As of December 31, 2020, the gross asset value of our facilities at our Silver Peak site was approximately $55 million. During 2020, we produced approximately 2,200 metric tons of LCE of lithium carbonate at our Silver Peak facilities.

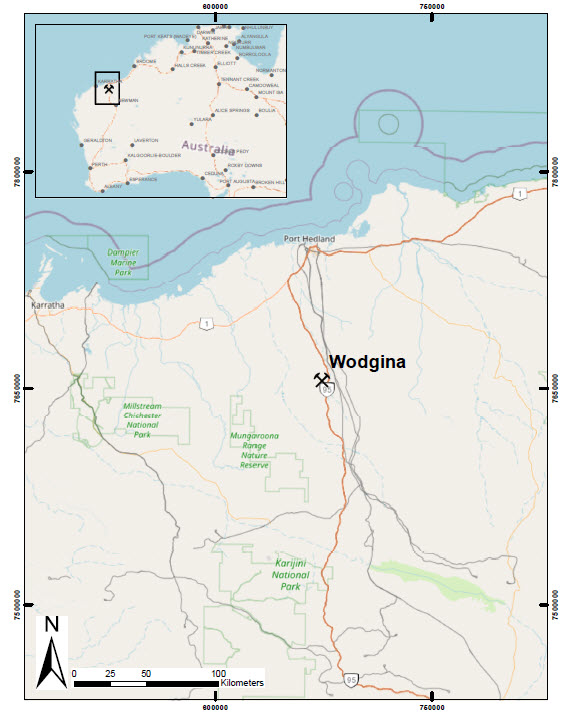

Wodgina, Australia

The Wodgina property is located approximately 110 km south-southeast of Port Hedland, Western Australia between the Turner and Yule Rivers. The area includes multiple prominent greenstone ridges up to 180 m above mean sea level surrounded by granitic plains and lowlands. The property is accessible via National Highway 1 to National highway 95 to the Wodgina camp road. All roads to site are paved. The nearest large regional airport is in Port Hedland which also hosts an international deep-water port facility. In addition, a site dedicated all-weather airstrip is located onsite capable of landing certain aircrafts.

The Wodgina pegmatite deposits were discovered in 1902. Since then, the pegmatite-hosted deposits have been mined for tin, tantalum, beryl, and lithium by various companies. Mining occurred sporadically until Goldrim Mining formed a new

6

| Albemarle Corporation and Subsidiaries | ||||||||

partnership with Pan West Tantalum Pty Ltd., who opened open pit mining at the site in 1989 and progressively expanded during the 1990s. Active mining at the Mt. Cassiterite pit has been started and stopped regularly between 2008 and the present. The mine was placed on care and maintenance in 2008, 2012, and most recently in 2019. In 2016, MRL acquired the mine and upgraded the processing facilities and site infrastructure to 750ktpa spodumene plant producing 6% spodumene concentrate, completed in 2019. On October 31, 2019, we completed the acquisition of a 60% interest in this hard rock lithium mine project and formed an unincorporated joint venture with MRL, named MARBL. We formed MARBL for the exploration, development, mining, processing and production of lithium and other minerals (other than iron ore and tantalum) from the Wodgina Project. Since the acquisition, we have idled MARBL’s production of spodumene until market demand supports bringing the mine back into production. No mining or processing operations are active.

Wodgina holds mining tenements within the Karriyarra native title claim and are subject to the Land Use Agreement dated March 2001 between the Karriyarra People and Gwalia Tantalum Ltd (now Wodgina Lithium, a 100% subsidiary of MRL, our MARBL joint venture partner). All mining and exploration land tenements are in good standing and no known impediments exist. Certain tenements are due for renewal in 2026 and another in 2030. Drilling and exploration activities have been conducted throughout the mining life of the Wodgina property.

The Wodgina mine is a pegmatite lithium deposit with spodumene the dominant mineral. The lithium mineralization occurs as 10 - 30 cm long grey-white spodumene crystals within medium grained pegmatites comprising primarily of quartz, feldspar, spodumene, and muscovite. Typically, the spodumene crystals are oriented orthogonal to the pegmatite contacts.

The facilities at Wodgina consist of a three stage crushing plant, the spodumene concentration plant, administrative offices, an accommodation camp, a power station, gas pipeline, three mature and reliable water bore fields, extension for future tailing storage and a fleet of owned and leased mine production equipment. The gas pipeline feeds the site power station to provide the power to the facilities. Water is obtained from the dedicated water bore fields. We consider the condition of all of our plants, facilities and equipment to be suitable and adequate for the businesses we conduct, and we maintain them regularly. As of December 31, 2020, our 60% portion of the gross asset value of the facilities at our Wodgina site was approximately $186 million. There was no production from the Wodgina site during the year ended December 31, 2020, as the site remains on care and maintenance until market demand supports bringing it back to production.

Other Significant Lithium Processing Facilities

We are currently constructing a high-quality spodumene conversion plant in Kemerton, Australia, approximately 17 km north-east of Bunbury, Western Australia, valued at $1.2 billion (with $480 million, or 40%, to be owned by MRL as part of the acquisition). As a result of the acquisition of 60% of the Wodgina Project from MRL, we will own 60% of the Kemerton conversion plant, with the remaining 40% owned by MRL. Construction of the plant is expected to be completed in late 2021, followed by a six month commissioning and qualification process. When completed, the plant will covert spodumene concentrate transferred from Talison and the Wodgina site (when operating) to lithium hydroxide.

Once construction is complete, the Kemerton facility will consist of a front-end and back-end processing areas to produce lithium hydroxide on two product processing trains. The front-end portion of the plant includes the following sections - calcination and acid roasting of lithium spodumene and leaching/pulping of the resultant lithium solution. The back-end portion of the plant will include solution crystallization, evaporation and drying/packaging areas where the finished product lithium hydroxide will prepared for shipment to our customers via truck, rail or boat. Kemerton is expected to have an initial capacity of about 50,000 metric tons (25,000 metric tons per processing train) of LCE of lithium hydroxide, with an ability to expand to 100,000 metric tons LCE over time.

The facilities at our Meishan and Xinyu consist of a front-end and back-end processing areas to produce lithium hydroxide. At each site, the front-end portion of the plant includes the following sections - calcination and acid roasting of lithium spodumene and leaching/pulping of the resultant lithium solution. The back-end portion of the plants include solution crystallization, evaporation and drying/packaging areas where the finished product lithium hydroxide is prepared for shipment to our customers via truck, rail or boat. We consider the condition of all of our plants and equipment to be suitable and adequate for the businesses we conduct, and we maintain them regularly. As of December 31, 2020, the combined gross asset value of our facilities at our Meishan and Xinyu sites was approximately $120 million. During 2020, we produced approximately 35,000 metric tons of LCE of lithium hydroxide at our Meishan and Xinyu facilities.

7

| Albemarle Corporation and Subsidiaries | ||||||||

Magnolia, Arkansas

Magnolia is located in the southwest Arkansas, north of the center of Columbia County, approximately 50 miles east of Texarkana and 135 miles south of Little Rock. Our facilities include two separate production plants, the South Plant and the West Plant. The South Plant is accessible via U.S. Route 79 and paved local roads. The West Plant is accessible by U.S. Route 371 and paved local roads. The decentralized well sites around the brine fields are accessed via paved Arkansas Highway 19, 98, 160 and 344.

In Magnolia, bromine is recovered from underground brine wells and then processed into a variety of end products at the plant on location. Albemarle has a total of 25 brine production wells and 35 production brine injection wells that are currently active on the property. Albemarle’s area of bromine operation is comprised of over 9,500 individual leases with local landowners comprising a total area of over 98,500 acres. The leases have been acquired over time as field development extended across the field. Each lease continues for a period of 25 years or longer until after a two year period where brine is not injected or produced from/to a well within two miles of lease land areas, as long as lease rentals are continuing to be paid.

Bromine extraction began in Magnolia in 1965 as the first brine supply well was drilled, and additional wells were put into production over the next few years. In 1987, a predecessor company took over operations of certain brine supply and injection wells, which Albemarle continues to operate to this day. In 2019, Albemarle completed, and put into production, two new brine production supply wells in Magnolia.

In Magnolia, bromine exists as sodium bromide in the formation waters or brine of the Jurassic age Smackover Formation, a geological formation in Arkansas, in the subsurface at 7,000 to 8,500 feet below sea level. The mineralization occurs within the highly saline Smackover Formation waters or brine where the bromide has an abnormally rich composition. The bromine concentration is more than twice as high as that found in normal evaporated sea water. The bromine mineralization of the brine is distributed throughout the porous intervals of the upper and middle Smackover on the property. The strong permeability and porosity of the Smackover grainstones provide excellent continuity of the bromine mineralization within the brine.

The facilities at Magnolia consist of brine production and injection wells, brine ponds, two bromine processing plants, pipelines between the plants and wells, a laboratory, storage and warehouses, administrative offices, as well as a fleet of owned and leased equipment. Our Magnolia facilities are supplied electricity from a local company and we currently have several operating freshwater wells nearby that supply water to the facilities. In addition, both plants have dedicated rail spurs that provide access to several rail lines to transport product throughout the country. We consider the condition of all of our plants, facilities and equipment to be suitable and adequate for the businesses we conduct, and we maintain them regularly. As of December 31, 2020, the gross asset value of our facilities at our Magnolia site was approximately $747 million. During 2020, we produced approximately 74,000 metric tons of bromine at our Magnolia facilities.

8