Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEAPACK GLADSTONE FINANCIAL CORP | pgc-8k_20210201.htm |

Q4 2020 Investor Update (and Supplemental Financial Information) 12.31.2020 Peapack-Gladstone Bank The Q4 2020 Investor Update (and Supplemental Financial Information) should be read in conjunction with the Q4 2020 Earnings Release issued on February 1, 2021 Exhibit 99.1

Statement Regarding Forward-Looking Information This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and may include expressions about Management’s strategies and Management’s expectations about financial results, new and existing programs and products, investments, relationships, opportunities and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,” “may,” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: 1) our inability to successfully grow our business and implement our strategic plan, including an inability to generate revenues to offset the increased personnel and other costs related to the strategic plan; 2) the impact of anticipated higher operating expenses in 2020 and beyond; 3) our inability to successfully integrate wealth management firm acquisitions; 4) our inability to manage our growth; 5) our inability to successfully integrate our expanded employee base; 6) an unexpected decline in the economy, in particular in our New Jersey and New York market areas; 7) declines in our net interest margin caused by the interest rate environment (including the shape of yield curve) and our highly competitive market; 8) declines in the value in our investment portfolio; 9) higher than expected increases in our allowance for loan and lease losses; 10) higher than expected increases in loan and lease losses or in the level of nonperforming loans; 11) unexpected changes in interest rates; 12) an unexpected decline in real estate values within our market areas; 13) legislative and regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Basel III and related regulations) that may result in increased compliance costs; 14) changes in monetary policy by the Federal Reserve Board; 15) changes to legislation or policy, including tax or accounting matters; 16) successful cyberattacks against our IT infrastructure and that of our IT providers; 17) higher than expected FDIC insurance premiums; 18) adverse weather conditions; 19) our inability to successfully generate business in new geographic markets; 20) our inability to execute upon new business initiatives; 21) our lack of liquidity to fund our various cash obligations; 22) reduction in our lower-cost funding sources; 23) our inability to adapt to technological changes; 24) claims and litigation pertaining to fiduciary responsibility, environmental laws and other matters; 25) effects related to a prolonged shutdown of the federal government that could impact SBA and other government lending programs; and 26) other unexpected material adverse changes in our operations or earnings. Further, given its ongoing and dynamic nature, it is difficult to predict the full impact of the COVID-19 outbreak on our business. The extent of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated and whether the gradual reopening of businesses will result in a meaningful increase in economic activity. As the result of the COVID-19 pandemic and the related adverse local and national economic consequences, we could be subject to any of the following risks, any of which could have a material, adverse effect on our business, financial condition, liquidity, and results of operations: 1) demand for our products and services may decline, making it difficult to grow assets and income; 2) if the economy is unable to substantially reopen, and high levels of unemployment continue for an extended period of time, loan delinquencies, problem assets, and foreclosures may increase, resulting in increased charges and reduced income; 3) collateral for loans, especially real estate, may decline in value, which could cause loan losses to increase; 4) our allowance for loan losses may have to be increased if borrowers experience financial difficulties, which will adversely affect our net income; 5) the net worth and liquidity of loan guarantors may decline, impairing their ability to honor commitments to us; 6) as the result of the decline in the Federal Reserve Board’s target federal funds rate to near 0%, the yield on our assets may decline to a greater extent than the decline in our cost of interest-bearing liabilities, reducing our net interest margin and spread and reducing net income; 7) a material decrease in net income or a net loss over several quarters could result in a decrease in the rate of our quarterly cash dividend; 8) our wealth management revenues may decline with continuing market turmoil; 9) our cyber security risks are increased as the result of an increase in the number of employees working remotely; and 10) FDIC premiums may increase if the agency experience additional resolution costs. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. 2

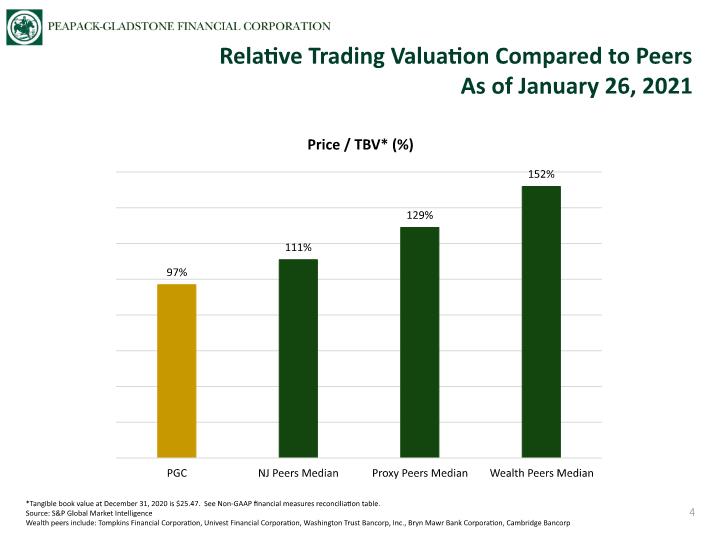

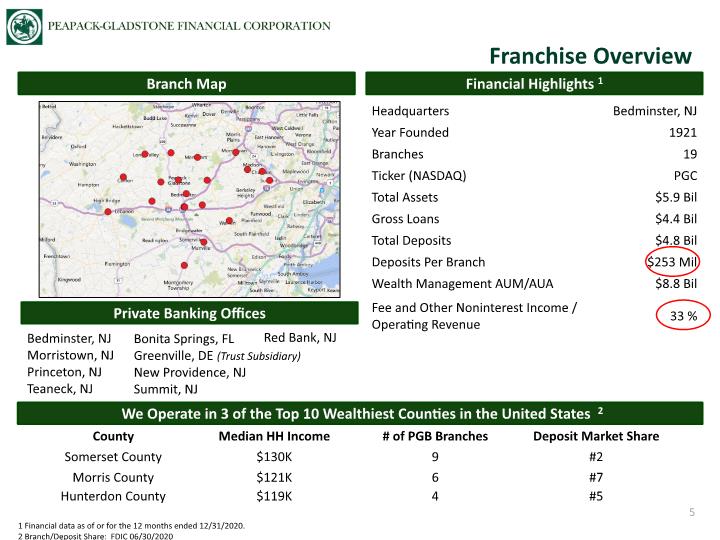

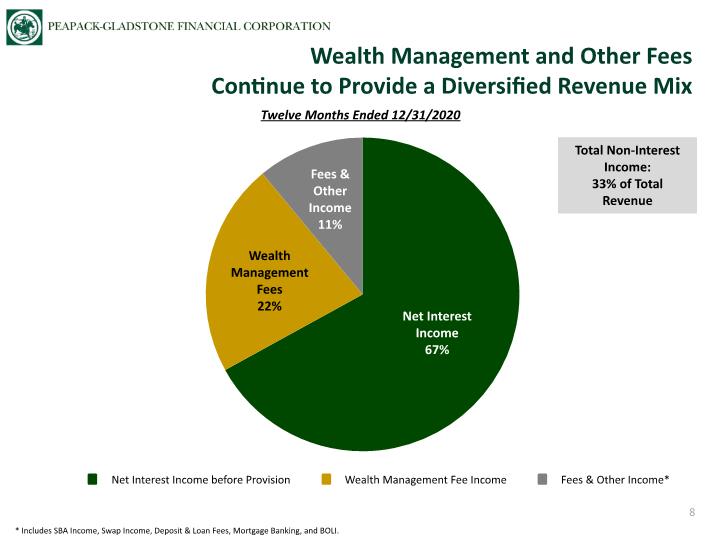

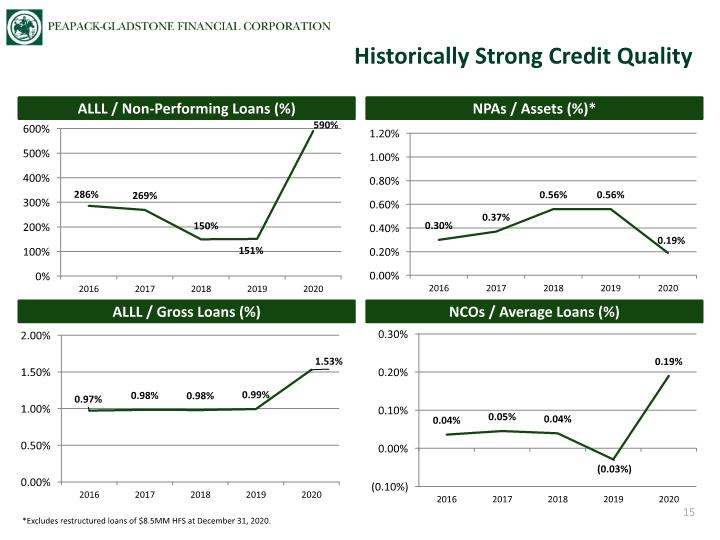

Current valuation creates a buying opportunity given its discounted valuation relative to peers. Proven management team with track record of success. Attractive geographic franchise. PGC operates in some of the most affluent counties in the U.S. Highly efficient branch network with deposit balances averaging $253MM per branch. Niche wealth management and commercial banking strategy focused on delivering strong organic growth. Diverse revenue streams with significant noninterest income from wealth management business. Total fee income 33% of total revenue for the twelve months ended December 31, 2020. Robust digital strategy launched to enable clients to conduct business when, where, and with whom they want. Stable and strong asset quality. ALLL to Total Loans of 1.61% as of December 31, 2020 (excluding PPP loans). NPAs to Assets and NPLs to Loans of 0.19% and 0.26%, respectively, as of December 31, 2020. Moody’s investment grade of Baa3; Kroll investment grade of BBB-. Investment Considerations 3

Relative Trading Valuation Compared to Peers As of January 26, 2021 4 *Tangible book value at December 31, 2020 is $25.47. See Non-GAAP financial measures reconciliation table. Source: S&P Global Market Intelligence Wealth peers include: Tompkins Financial Corporation, Univest Financial Corporation, Washington Trust Bancorp, Inc., Bryn Mawr Bank Corporation, Cambridge Bancorp Price / TBV* (%)

Financial Highlights 1 Branch Map Franchise Overview 5 Private Banking Offices Bedminster, NJ Morristown, NJ Princeton, NJ Teaneck, NJ Bonita Springs, FL Greenville, DE (Trust Subsidiary) New Providence, NJ Summit, NJ We Operate in 3 of the Top 10 Wealthiest Counties in the United States 2 1 Financial data as of or for the 12 months ended 12/31/2020. 2 Branch/Deposit Share: FDIC 06/30/2020 Red Bank, NJ

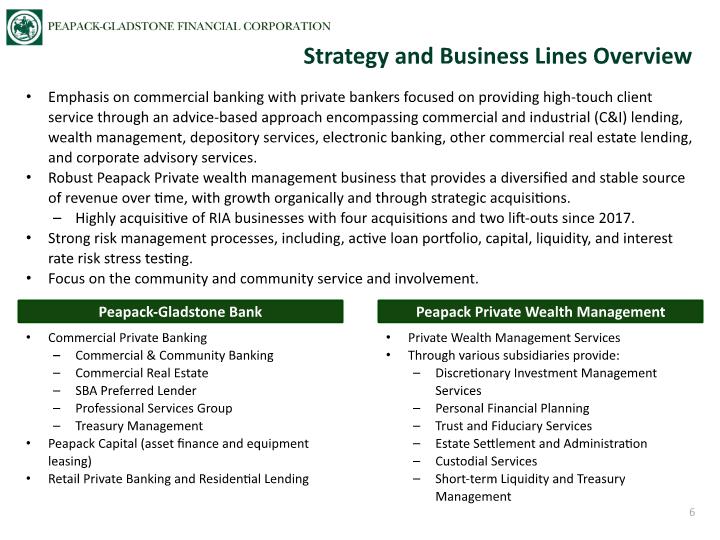

Emphasis on commercial banking with private bankers focused on providing high-touch client service through an advice-based approach encompassing commercial and industrial (C&I) lending, wealth management, depository services, electronic banking, other commercial real estate lending, and corporate advisory services. Robust Peapack Private wealth management business that provides a diversified and stable source of revenue over time, with growth organically and through strategic acquisitions. Highly acquisitive of RIA businesses with four acquisitions and two lift-outs since 2017. Strong risk management processes, including, active loan portfolio, capital, liquidity, and interest rate risk stress testing. Focus on the community and community service and involvement. Strategy and Business Lines Overview 6 Peapack-Gladstone Bank Peapack Private Wealth Management Commercial Private Banking Commercial & Community Banking Commercial Real Estate SBA Preferred Lender Professional Services Group Treasury Management Peapack Capital (asset finance and equipment leasing) Retail Private Banking and Residential Lending Private Wealth Management Services Through various subsidiaries provide: Discretionary Investment Management Services Personal Financial Planning Trust and Fiduciary Services Estate Settlement and Administration Custodial Services Short-term Liquidity and Treasury Management

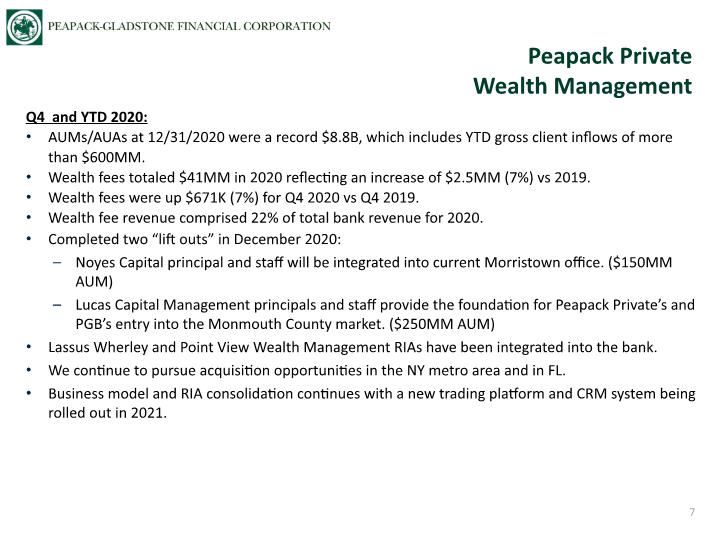

Q4 and YTD 2020: AUMs/AUAs at 12/31/2020 were a record $8.8B, which includes YTD gross client inflows of more than $600MM. Wealth fees totaled $41MM in 2020 reflecting an increase of $2.5MM (7%) vs 2019. Wealth fees were up $671K (7%) for Q4 2020 vs Q4 2019. Wealth fee revenue comprised 22% of total bank revenue for 2020. Completed two “lift outs” in December 2020: Noyes Capital principal and staff will be integrated into current Morristown office. ($150MM AUM) Lucas Capital Management principals and staff provide the foundation for Peapack Private’s and PGB’s entry into the Monmouth County market. ($250MM AUM) Lassus Wherley and Point View Wealth Management RIAs have been integrated into the bank. We continue to pursue acquisition opportunities in the NY metro area and in FL. Business model and RIA consolidation continues with a new trading platform and CRM system being rolled out in 2021. Peapack Private Wealth Management 7

* Includes SBA Income, Swap Income, Deposit & Loan Fees, Mortgage Banking, and BOLI. Net Interest Income 67% Wealth Management Fees 22% Fees & Other Income 11% Twelve Months Ended 12/31/2020 Net Interest Income before Provision Wealth Management Fee Income Fees & Other Income* 8 Total Non-Interest Income: 33% of Total Revenue Wealth Management and Other Fees Continue to Provide a Diversified Revenue Mix

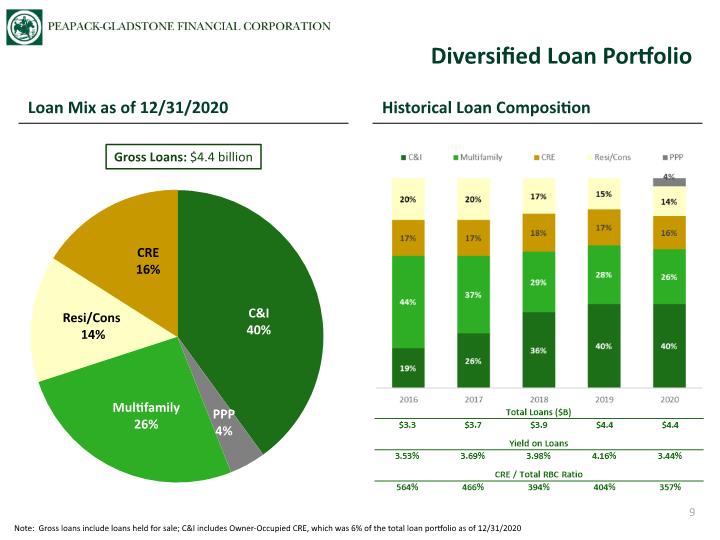

9 Diversified Loan Portfolio Gross Loans: $4.4 billion Note: Gross loans include loans held for sale; C&I includes Owner-Occupied CRE, which was 6% of the total loan portfolio as of 12/31/2020 Loan Mix as of 12/31/2020 Historical Loan Composition

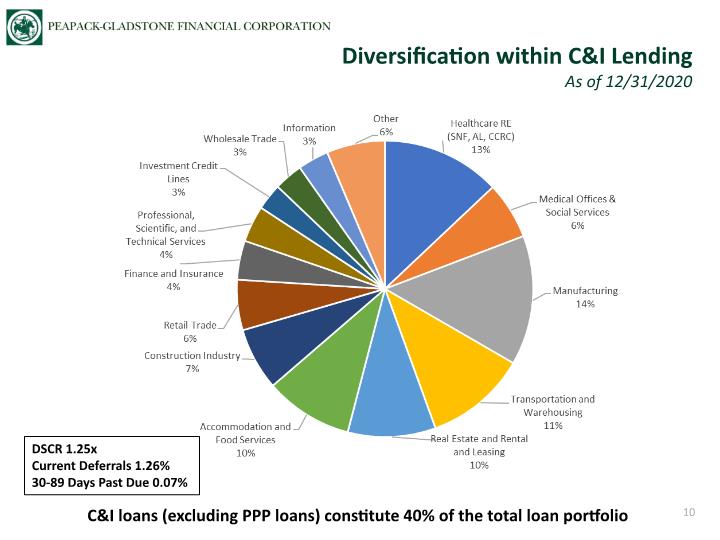

Diversification within C&I Lending As of 12/31/2020 10 C&I loans (excluding PPP loans) constitute 40% of the total loan portfolio DSCR 1.25x Current Deferrals 1.26% 30-89 Days Past Due 0.07%

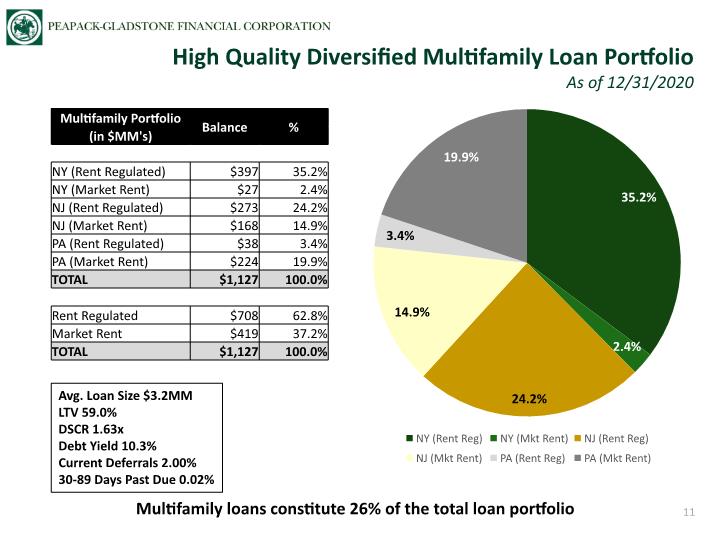

High Quality Diversified Multifamily Loan Portfolio As of 12/31/2020 11 Avg. Loan Size $3.2MM LTV 59.0% DSCR 1.63x Debt Yield 10.3% Current Deferrals 2.00% 30-89 Days Past Due 0.02% Multifamily loans constitute 26% of the total loan portfolio

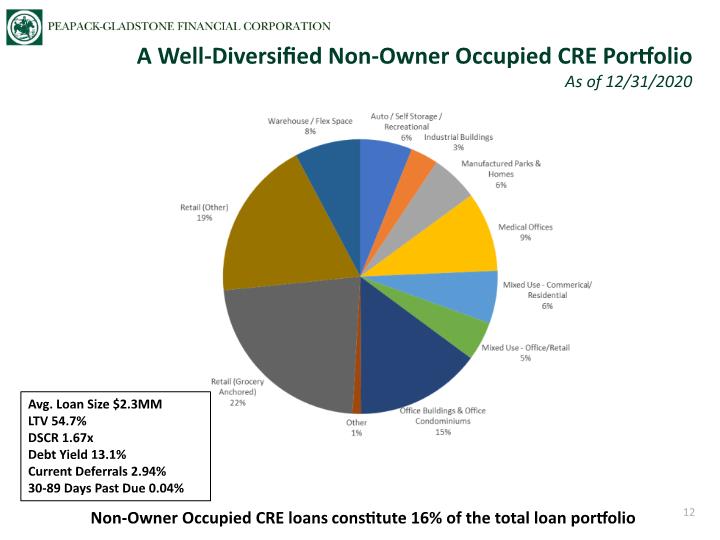

12 A Well-Diversified Non-Owner Occupied CRE Portfolio As of 12/31/2020 Non-Owner Occupied CRE loans constitute 16% of the total loan portfolio Avg. Loan Size $2.3MM LTV 54.7% DSCR 1.67x Debt Yield 13.1% Current Deferrals 2.94% 30-89 Days Past Due 0.04%

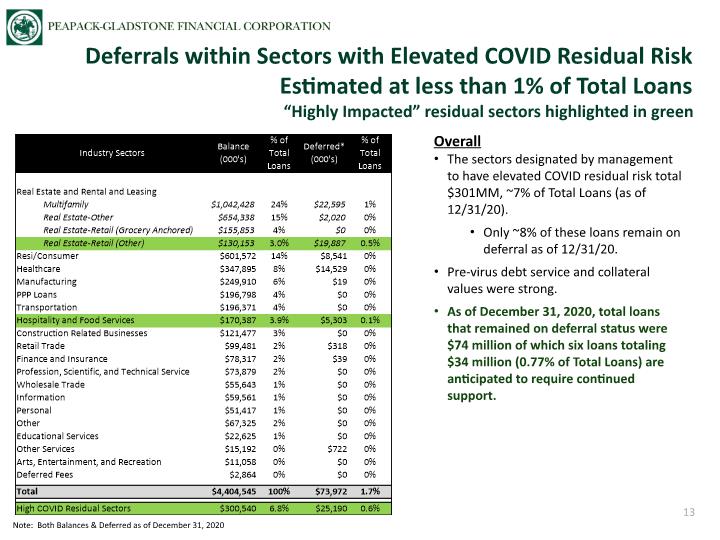

13 Deferrals within Sectors with Elevated COVID Residual Risk Estimated at less than 1% of Total Loans “Highly Impacted” residual sectors highlighted in green Overall The sectors designated by management to have elevated COVID residual risk total $301MM, ~7% of Total Loans (as of 12/31/20). Only ~8% of these loans remain on deferral as of 12/31/20. Pre-virus debt service and collateral values were strong. As of December 31, 2020, total loans that remained on deferral status were $74 million of which six loans totaling $34 million (0.77% of Total Loans) are anticipated to require continued support. Note: Both Balances & Deferred as of December 31, 2020

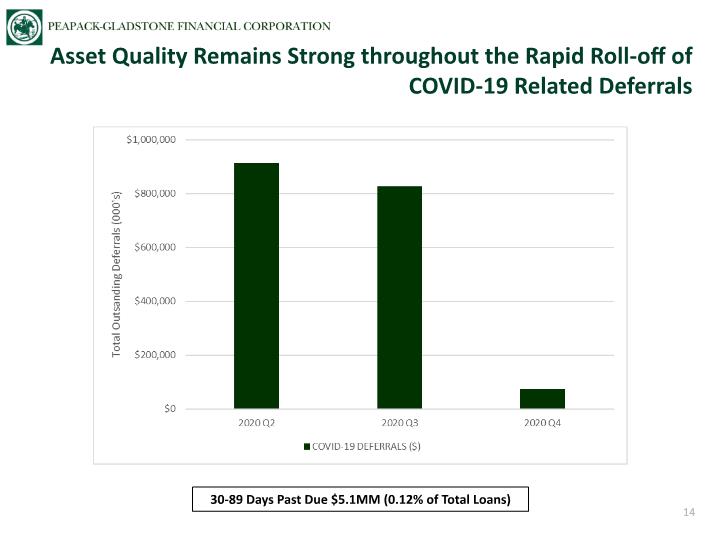

14 Asset Quality Remains Strong throughout the Rapid Roll-off of COVID-19 Related Deferrals 30-89 Days Past Due $5.1MM (0.12% of Total Loans)

NPAs / Assets (%)* ALLL / Non-Performing Loans (%) NCOs / Average Loans (%) ALLL / Gross Loans (%) Historically Strong Credit Quality 15 *Excludes restructured loans of $8.5MM HFS at December 31, 2020.

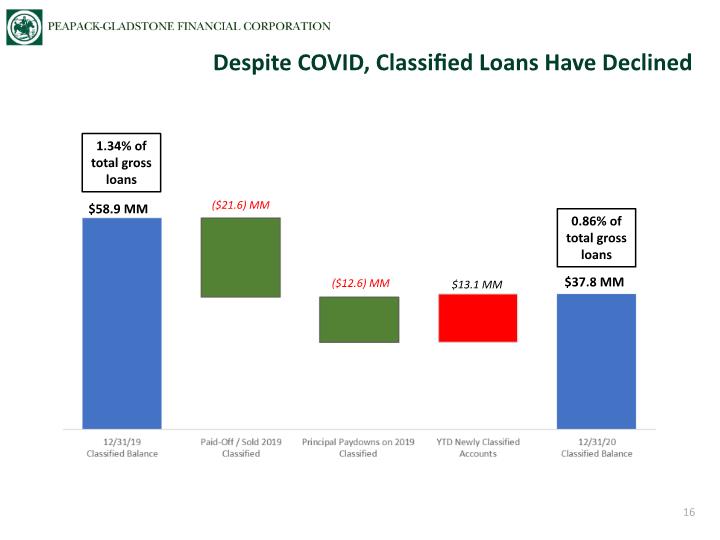

16 $58.9 MM $37.8 MM ($21.6) MM ($12.6) MM $13.1 MM Despite COVID, Classified Loans Have Declined 1.34% of total gross loans 0.86% of total gross loans

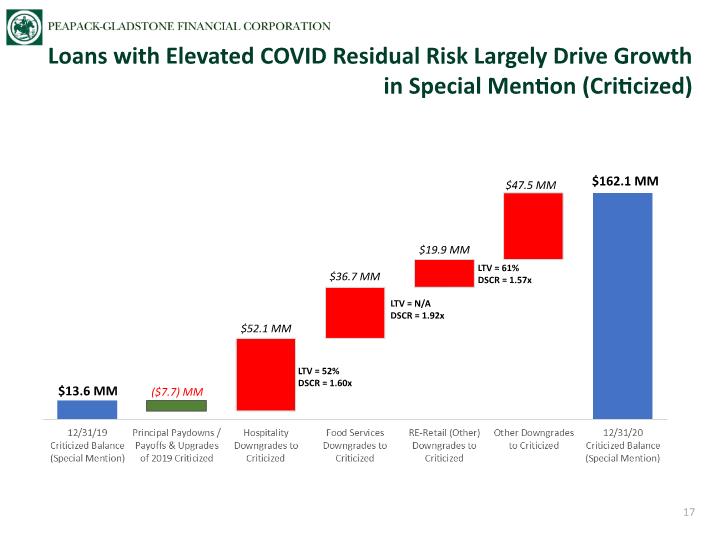

17 Loans with Elevated COVID Residual Risk Largely Drive Growth in Special Mention (Criticized) $13.6 MM $162.1 MM ($7.7) MM $36.7 MM $52.1 MM $19.9 MM $47.5 MM LTV = 52% DSCR = 1.60x LTV = N/A DSCR = 1.92x LTV = 61% DSCR = 1.57x

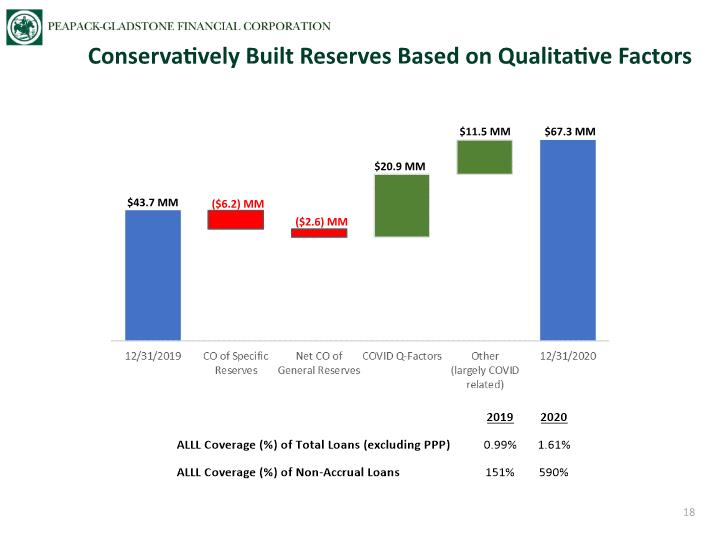

18 $43.7 MM $67.3 MM ($6.2) MM $11.5 MM $20.9 MM ($2.6) MM Conservatively Built Reserves Based on Qualitative Factors

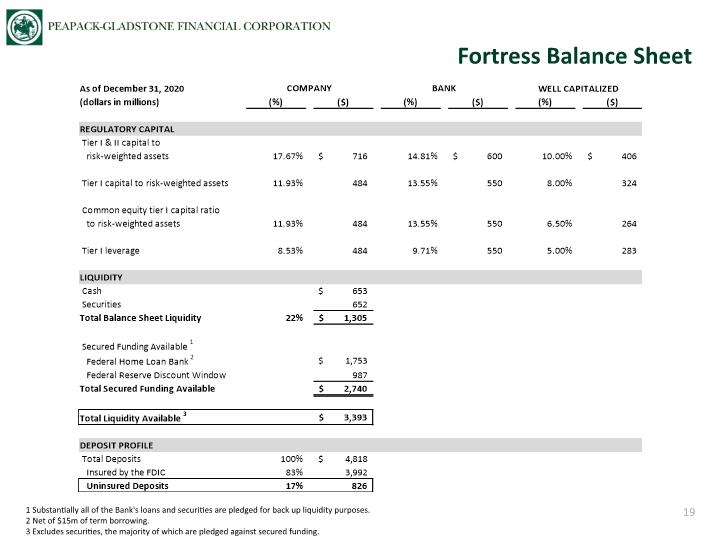

Fortress Balance Sheet 19 1 Substantially all of the Bank's loans and securities are pledged for back up liquidity purposes. 2 Net of $15m of term borrowing. 3 Excludes securities, the majority of which are pledged against secured funding.

Stock Repurchase Program Authorized 20 5% Stock Repurchase Program authorized by the Board on 01/28/2021. 948,735 shares authorized to be repurchased. Program open through 03/31/2022. Program justified by the Company’s: strong capital position (verified by Stress Test) ALLL coverage and strong and stable asset quality liquidity profile discounted valuation relative to peers

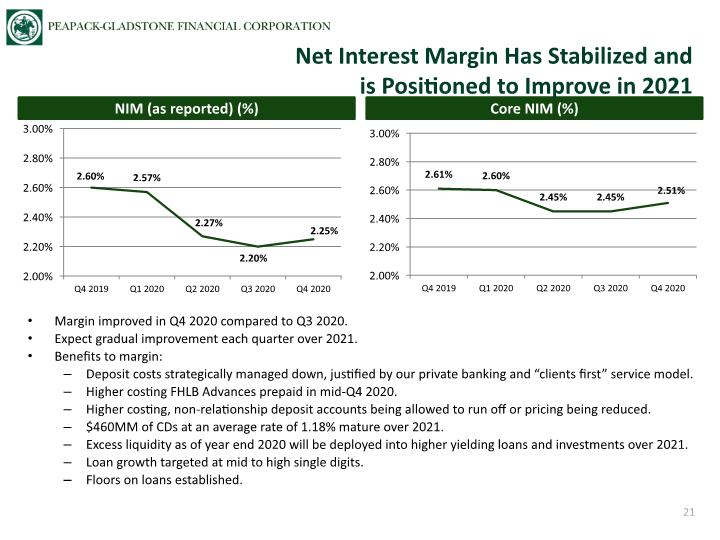

Core NIM (%) NIM (as reported) (%) 21 Net Interest Margin Has Stabilized and is Positioned to Improve in 2021 Margin improved in Q4 2020 compared to Q3 2020. Expect gradual improvement each quarter over 2021. Benefits to margin: Deposit costs strategically managed down, justified by our private banking and “clients first” service model. Higher costing FHLB Advances prepaid in mid-Q4 2020. Higher costing, non-relationship deposit accounts being allowed to run off or pricing being reduced. $460MM of CDs at an average rate of 1.18% mature over 2021. Excess liquidity as of year end 2020 will be deployed into higher yielding loans and investments over 2021. Loan growth targeted at mid to high single digits. Floors on loans established.

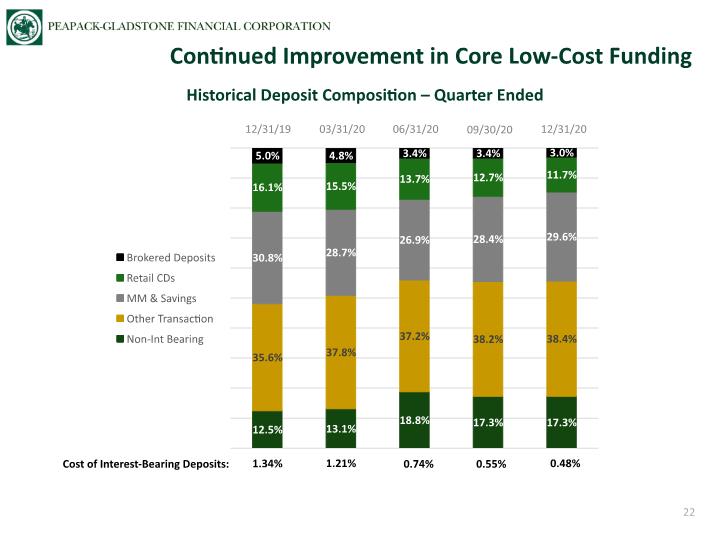

22 Continued Improvement in Core Low-Cost Funding Historical Deposit Composition – Quarter Ended 12/31/19 03/31/20 06/31/20 09/30/20 12/31/20 1.34% 1.21% 0.74% 0.55% 0.48% Cost of Interest-Bearing Deposits:

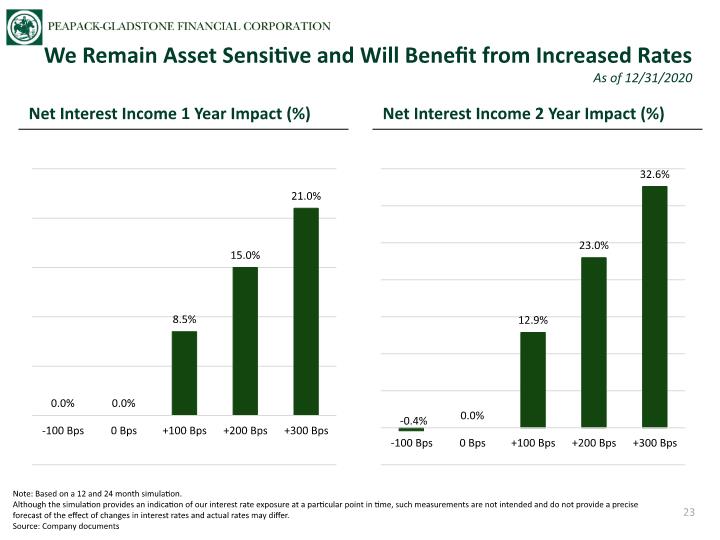

23 We Remain Asset Sensitive and Will Benefit from Increased Rates As of 12/31/2020 Net Interest Income 1 Year Impact (%) Net Interest Income 2 Year Impact (%) Note: Based on a 12 and 24 month simulation. Although the simulation provides an indication of our interest rate exposure at a particular point in time, such measurements are not intended and do not provide a precise forecast of the effect of changes in interest rates and actual rates may differ. Source: Company documents

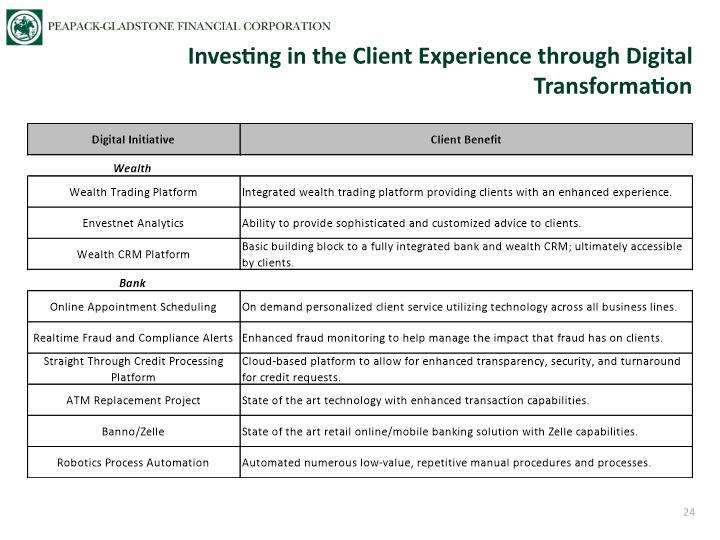

Investing in the Client Experience through Digital Transformation 24

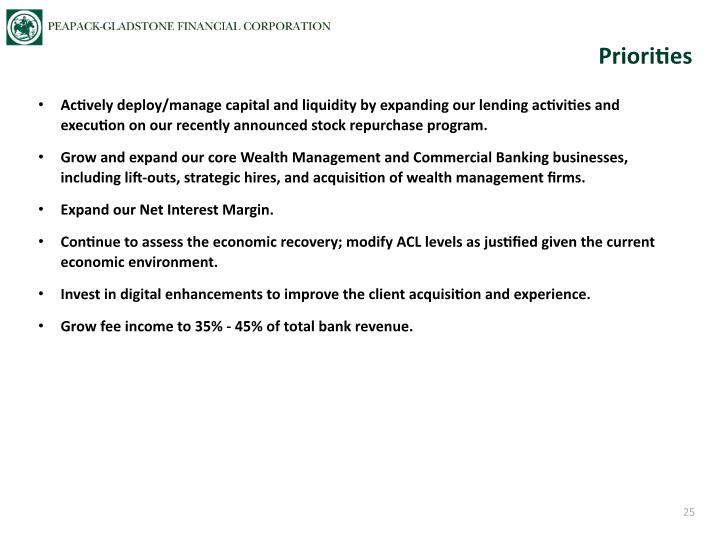

Actively deploy/manage capital and liquidity by expanding our lending activities and execution on our recently announced stock repurchase program. Grow and expand our core Wealth Management and Commercial Banking businesses, including lift-outs, strategic hires, and acquisition of wealth management firms. Expand our Net Interest Margin. Continue to assess the economic recovery; modify ACL levels as justified given the current economic environment. Invest in digital enhancements to improve the client acquisition and experience. Grow fee income to 35% - 45% of total bank revenue. Priorities 25

Appendix Peapack-Gladstone Bank

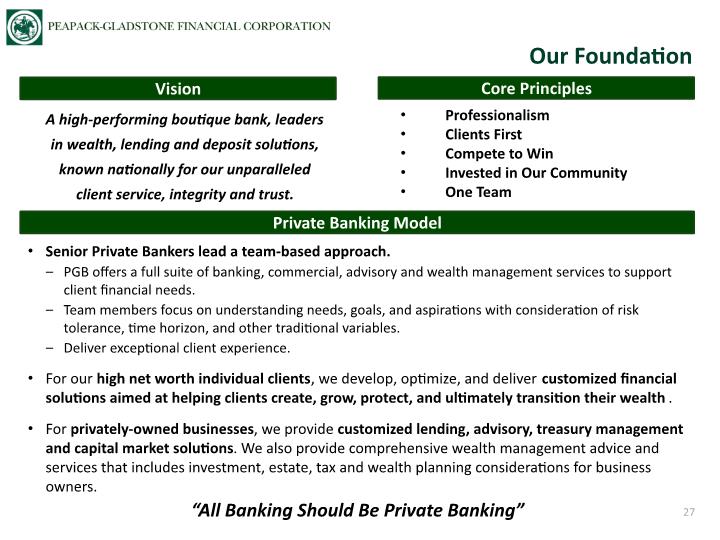

A high-performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for our unparalleled client service, integrity and trust. Professionalism Clients First Compete to Win Invested in Our Community One Team Vision 27 Senior Private Bankers lead a team-based approach. PGB offers a full suite of banking, commercial, advisory and wealth management services to support client financial needs. Team members focus on understanding needs, goals, and aspirations with consideration of risk tolerance, time horizon, and other traditional variables. Deliver exceptional client experience. For our high net worth individual clients, we develop, optimize, and deliver customized financial solutions aimed at helping clients create, grow, protect, and ultimately transition their wealth. For privately-owned businesses, we provide customized lending, advisory, treasury management and capital market solutions. We also provide comprehensive wealth management advice and services that includes investment, estate, tax and wealth planning considerations for business owners. “All Banking Should Be Private Banking” Private Banking Model Core Principles Our Foundation

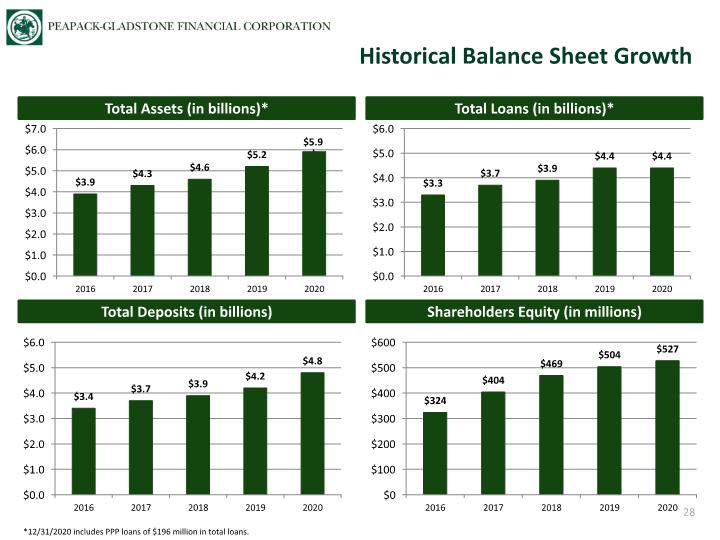

Total Loans (in billions)* Total Assets (in billions)* Shareholders Equity (in millions) Total Deposits (in billions) Historical Balance Sheet Growth 28 *12/31/2020 includes PPP loans of $196 million in total loans.

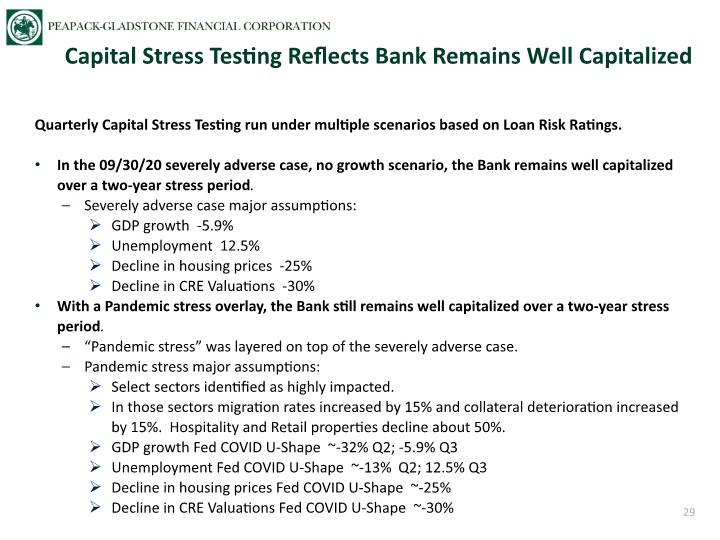

29 Quarterly Capital Stress Testing run under multiple scenarios based on Loan Risk Ratings. In the 09/30/20 severely adverse case, no growth scenario, the Bank remains well capitalized over a two-year stress period. Severely adverse case major assumptions: GDP growth -5.9% Unemployment 12.5% Decline in housing prices -25% Decline in CRE Valuations -30% With a Pandemic stress overlay, the Bank still remains well capitalized over a two-year stress period. “Pandemic stress” was layered on top of the severely adverse case. Pandemic stress major assumptions: Select sectors identified as highly impacted. In those sectors migration rates increased by 15% and collateral deterioration increased by 15%. Hospitality and Retail properties decline about 50%. GDP growth Fed COVID U-Shape ~-32% Q2; -5.9% Q3 Unemployment Fed COVID U-Shape ~-13% Q2; 12.5% Q3 Decline in housing prices Fed COVID U-Shape ~-25% Decline in CRE Valuations Fed COVID U-Shape ~-30% Capital Stress Testing Reflects Bank Remains Well Capitalized

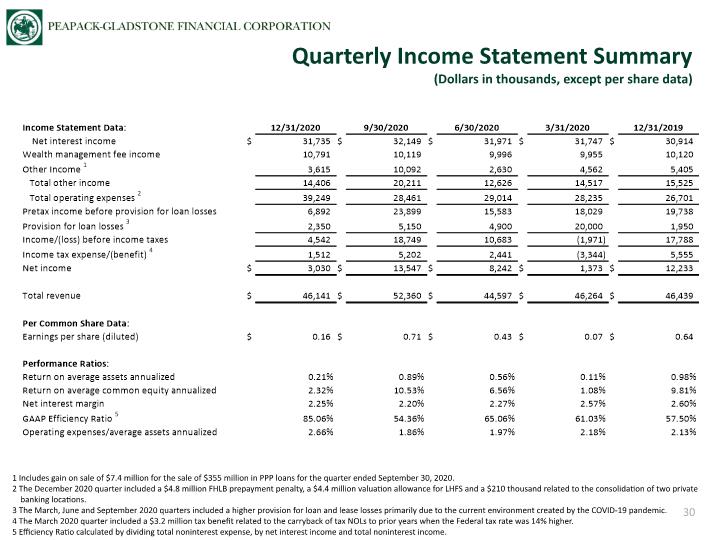

Quarterly Income Statement Summary (Dollars in thousands, except per share data) 30 1 Includes gain on sale of $7.4 million for the sale of $355 million in PPP loans for the quarter ended September 30, 2020. 2 The December 2020 quarter included a $4.8 million FHLB prepayment penalty, a $4.4 million valuation allowance for LHFS and a $210 thousand related to the consolidation of two private banking locations. 3 The March, June and September 2020 quarters included a higher provision for loan and lease losses primarily due to the current environment created by the COVID-19 pandemic. 4 The March 2020 quarter included a $3.2 million tax benefit related to the carryback of tax NOLs to prior years when the Federal tax rate was 14% higher. 5 Efficiency Ratio calculated by dividing total noninterest expense, by net interest income and total noninterest income.

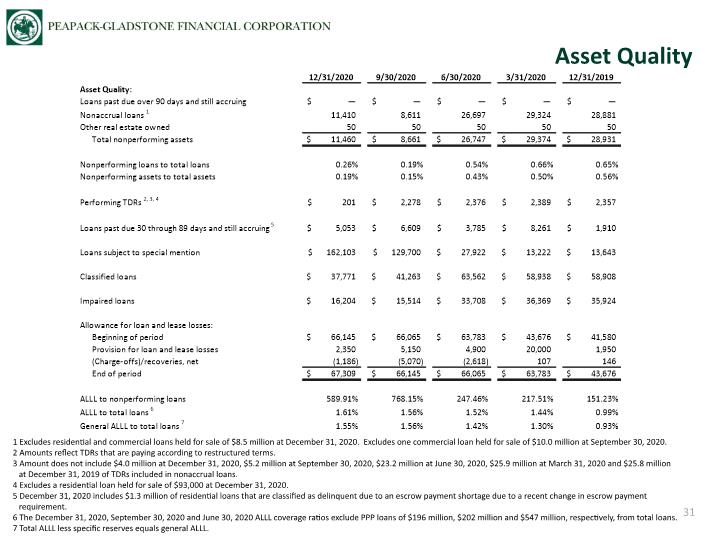

Asset Quality 31 1 Excludes residential and commercial loans held for sale of $8.5 million at December 31, 2020. Excludes one commercial loan held for sale of $10.0 million at September 30, 2020. 2 Amounts reflect TDRs that are paying according to restructured terms. 3 Amount does not include $4.0 million at December 31, 2020, $5.2 million at September 30, 2020, $23.2 million at June 30, 2020, $25.9 million at March 31, 2020 and $25.8 million at December 31, 2019 of TDRs included in nonaccrual loans. 4 Excludes a residential loan held for sale of $93,000 at December 31, 2020. 5 December 31, 2020 includes $1.3 million of residential loans that are classified as delinquent due to an escrow payment shortage due to a recent change in escrow payment requirement. 6 The December 31, 2020, September 30, 2020 and June 30, 2020 ALLL coverage ratios exclude PPP loans of $196 million, $202 million and $547 million, respectively, from total loans. 7 Total ALLL less specific reserves equals general ALLL.

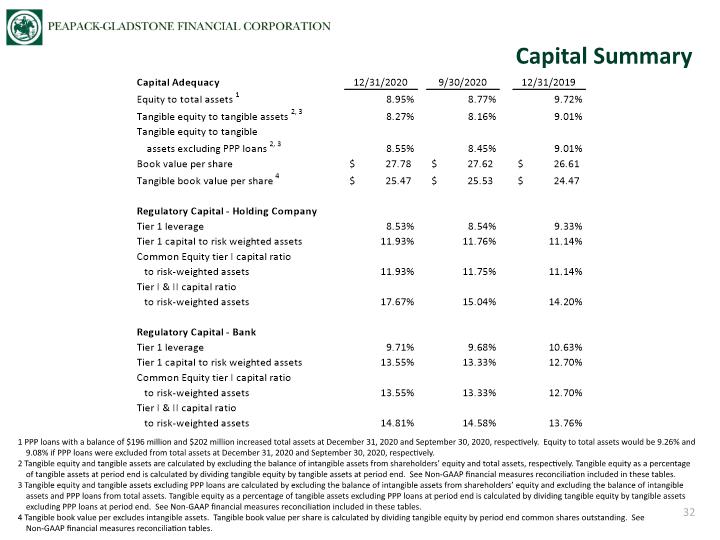

Capital Summary 32 1 PPP loans with a balance of $196 million and $202 million increased total assets at December 31, 2020 and September 30, 2020, respectively. Equity to total assets would be 9.26% and 9.08% if PPP loans were excluded from total assets at December 31, 2020 and September 30, 2020, respectively. 2 Tangible equity and tangible assets are calculated by excluding the balance of intangible assets from shareholders’ equity and total assets, respectively. Tangible equity as a percentage of tangible assets at period end is calculated by dividing tangible equity by tangible assets at period end. See Non-GAAP financial measures reconciliation included in these tables. 3 Tangible equity and tangible assets excluding PPP loans are calculated by excluding the balance of intangible assets from shareholders’ equity and excluding the balance of intangible assets and PPP loans from total assets. Tangible equity as a percentage of tangible assets excluding PPP loans at period end is calculated by dividing tangible equity by tangible assets excluding PPP loans at period end. See Non-GAAP financial measures reconciliation included in these tables. 4 Tangible book value per excludes intangible assets. Tangible book value per share is calculated by dividing tangible equity by period end common shares outstanding. See Non-GAAP financial measures reconciliation tables.

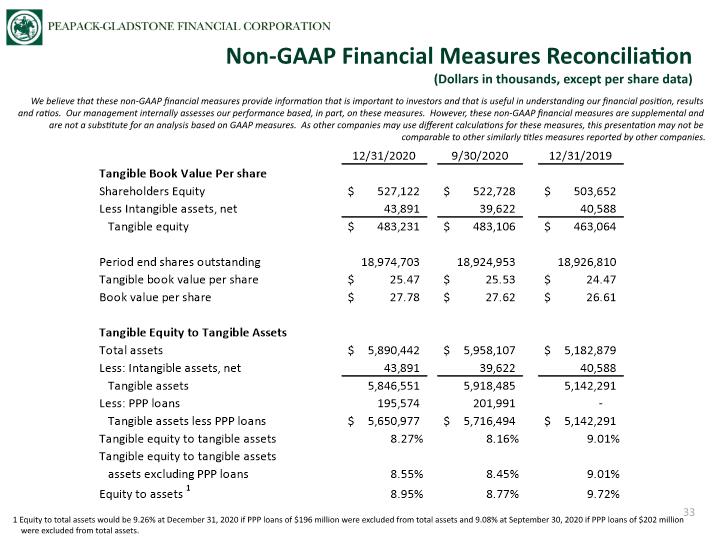

Non-GAAP Financial Measures Reconciliation (Dollars in thousands, except per share data) 33 We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titles measures reported by other companies. 1 Equity to total assets would be 9.26% at December 31, 2020 if PPP loans of $196 million were excluded from total assets and 9.08% at September 30, 2020 if PPP loans of $202 million were excluded from total assets.

Peapack-Gladstone Financial Corporation 500 Hills Drive, Suite 300 P.O. Box 700 Bedminster, New Jersey 07921 (908) 234-0700 www.pgbank.com Douglas L. Kennedy President & Chief Executive Officer (908) 719-6554 dkennedy@pgbank.com Jeffrey J. Carfora Senior EVP & Chief Financial Officer (908) 719-4308 jcarfora@pgbank.com John P. Babcock Senior EVP & President of Peapack Private Wealth Management (908) 719-3301 jbabcock@pgbank.com Contacts Corporate Headquarters Contact 34