Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JETBLUE AIRWAYS CORP | jblu-20210128.htm |

| EX-99.1 - EX-99.1 - JETBLUE AIRWAYS CORP | ex991-earningsreleaseq42020.htm |

4Q20 EARNINGS PRESENTATION JANUARY 28, 2020 Photo courtesy of Zachary Sheinman

2 SAFE HARBOR Statements in this presentation (or otherwise made by JetBlue or on JetBlue’s behalf) contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management’s beliefs and assumptions concerning future events. When used in this document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; our significant fixed obligations and substantial indebtedness; volatility in fuel prices, maintenance costs and interest rates; our reliance on high daily aircraft utilization; our ability to implement our growth strategy; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers, including for aircraft, aircraft engines and parts and vulnerability to delays by those suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation, including new or increased tariffs; changes in our industry due to other airlines' financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; the impact of infectious diseases that affects demand for air travel or travel behavior, such as the ongoing impact of the coronavirus (“COVID-19”); adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2019 Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. Our forward-looking statements speak only as of the date of this presentation. Other than as required by law, we undertake no obligation to update or revise forward- looking statements, whether as a result of new information, future events, or otherwise. This presentation also includes certain “non-GAAP financial measures” as defined under the Exchange Act and in accordance with Regulation G. We have included reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and provided in accordance with U.S. GAAP within the Appendix A section of this presentation.

3 4Q 2020 EARNINGS UPDATE ROBIN HAYES CHIEF EXECUTIVE OFFICER

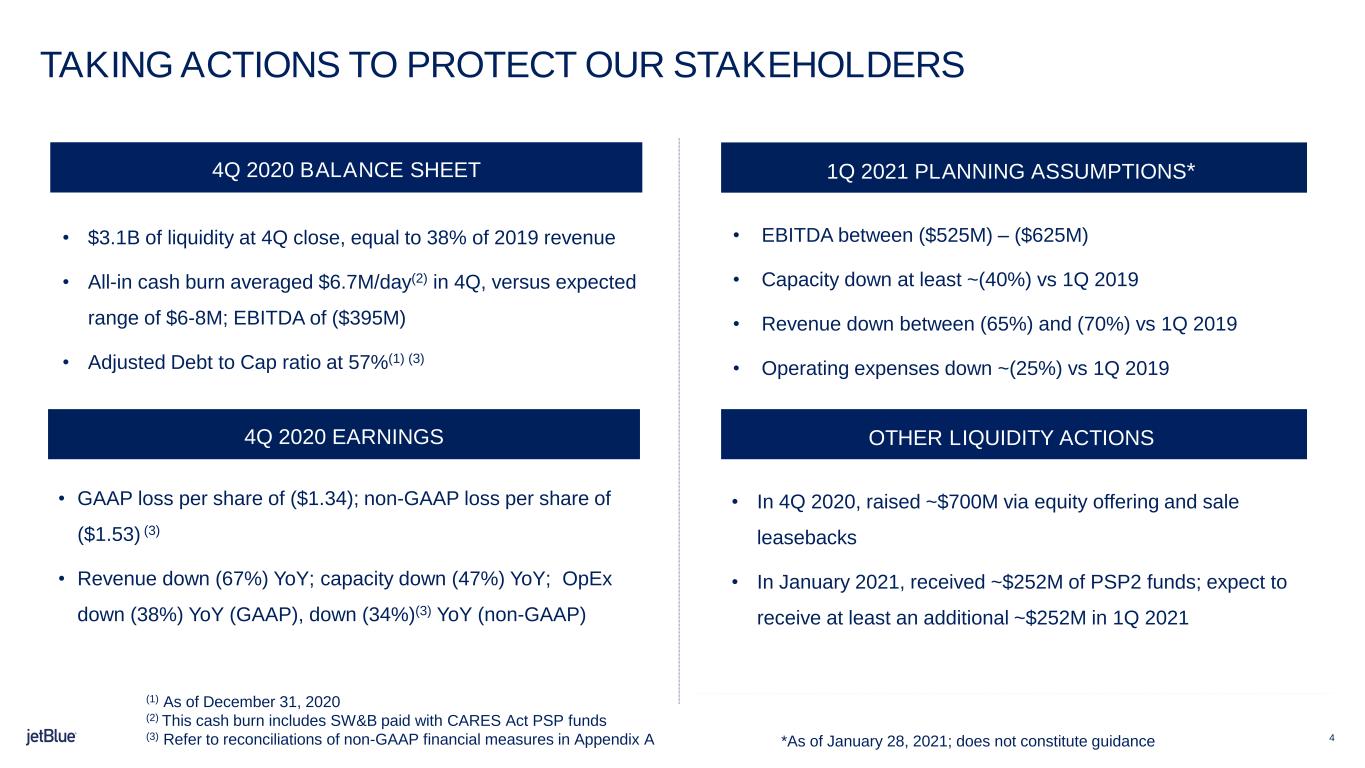

4 TAKING ACTIONS TO PROTECT OUR STAKEHOLDERS 4Q 2020 BALANCE SHEET *As of January 28, 2021; does not constitute guidance OTHER LIQUIDITY ACTIONS (1) As of December 31, 2020 (2) This cash burn includes SW&B paid with CARES Act PSP funds (3) Refer to reconciliations of non-GAAP financial measures in Appendix A • GAAP loss per share of ($1.34); non-GAAP loss per share of ($1.53) (3) • Revenue down (67%) YoY; capacity down (47%) YoY; OpEx down (38%) YoY (GAAP), down (34%)(3) YoY (non-GAAP) 4Q 2020 EARNINGS • EBITDA between ($525M) – ($625M) • Capacity down at least ~(40%) vs 1Q 2019 • Revenue down between (65%) and (70%) vs 1Q 2019 • Operating expenses down ~(25%) vs 1Q 2019 1Q 2021 PLANNING ASSUMPTIONS* • $3.1B of liquidity at 4Q close, equal to 38% of 2019 revenue • All-in cash burn averaged $6.7M/day(2) in 4Q, versus expected range of $6-8M; EBITDA of ($395M) • Adjusted Debt to Cap ratio at 57%(1) (3) • In 4Q 2020, raised ~$700M via equity offering and sale leasebacks • In January 2021, received ~$252M of PSP2 funds; expect to receive at least an additional ~$252M in 1Q 2021

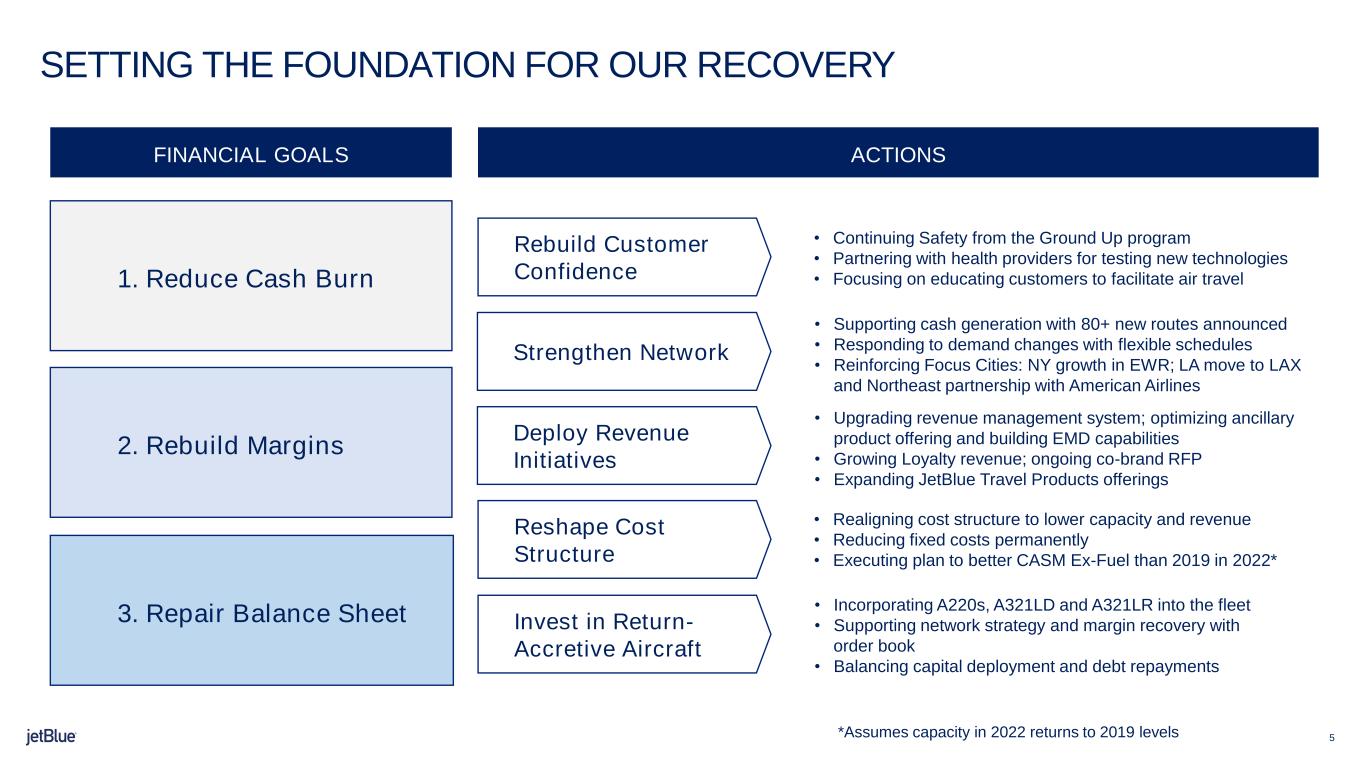

5 SETTING THE FOUNDATION FOR OUR RECOVERY FINANCIAL GOALS 2. Rebuild Margins 1. Reduce Cash Burn 3. Repair Balance Sheet ACTIONS Rebuild Customer Confidence • Continuing Safety from the Ground Up program • Partnering with health providers for testing new technologies • Focusing on educating customers to facilitate air travel • Upgrading revenue management system; optimizing ancillary product offering and building EMD capabilities • Growing Loyalty revenue; ongoing co-brand RFP • Expanding JetBlue Travel Products offerings Strengthen Network Deploy Revenue Initiatives Reshape Cost Structure Invest in Return- Accretive Aircraft • Incorporating A220s, A321LD and A321LR into the fleet • Supporting network strategy and margin recovery with order book • Balancing capital deployment and debt repayments • Realigning cost structure to lower capacity and revenue • Reducing fixed costs permanently • Executing plan to better CASM Ex-Fuel than 2019 in 2022* • Supporting cash generation with 80+ new routes announced • Responding to demand changes with flexible schedules • Reinforcing Focus Cities: NY growth in EWR; LA move to LAX and Northeast partnership with American Airlines *Assumes capacity in 2022 returns to 2019 levels

6 COMMERCIAL UPDATE & OUTLOOK JOANNA GERAGHTY PRESIDENT & CHIEF OPERATING OFFICER

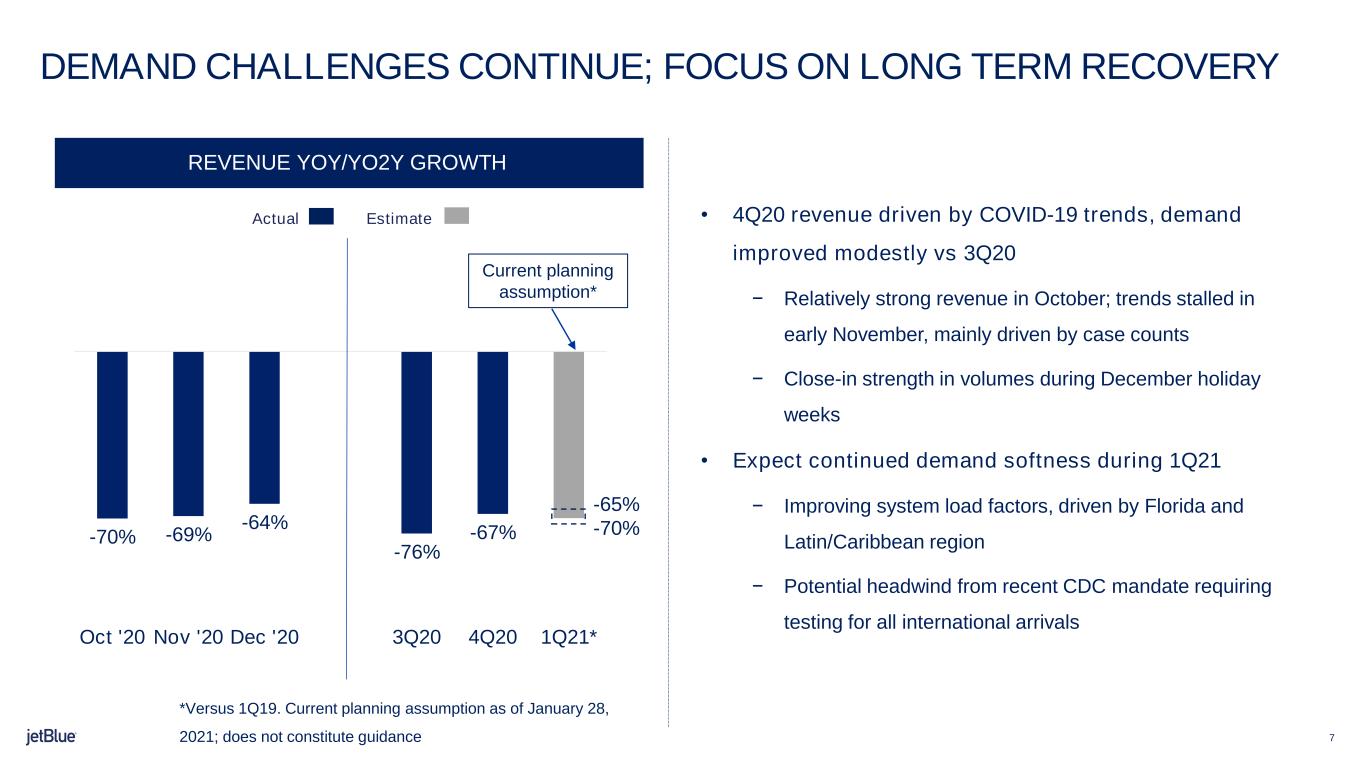

7 -65% -70% -70% -69% -64% -76% -67% Oct '20 Nov '20 Dec '20 3Q20 4Q20 1Q21* Current planning assumption* DEMAND CHALLENGES CONTINUE; FOCUS ON LONG TERM RECOVERY REVENUE YOY/YO2Y GROWTH • 4Q20 revenue driven by COVID-19 trends, demand improved modestly vs 3Q20 − Relatively strong revenue in October; trends stalled in early November, mainly driven by case counts − Close-in strength in volumes during December holiday weeks • Expect continued demand softness during 1Q21 − Improving system load factors, driven by Florida and Latin/Caribbean region − Potential headwind from recent CDC mandate requiring testing for all international arrivals EstimateActual *Versus 1Q19. Current planning assumption as of January 28, 2021; does not constitute guidance

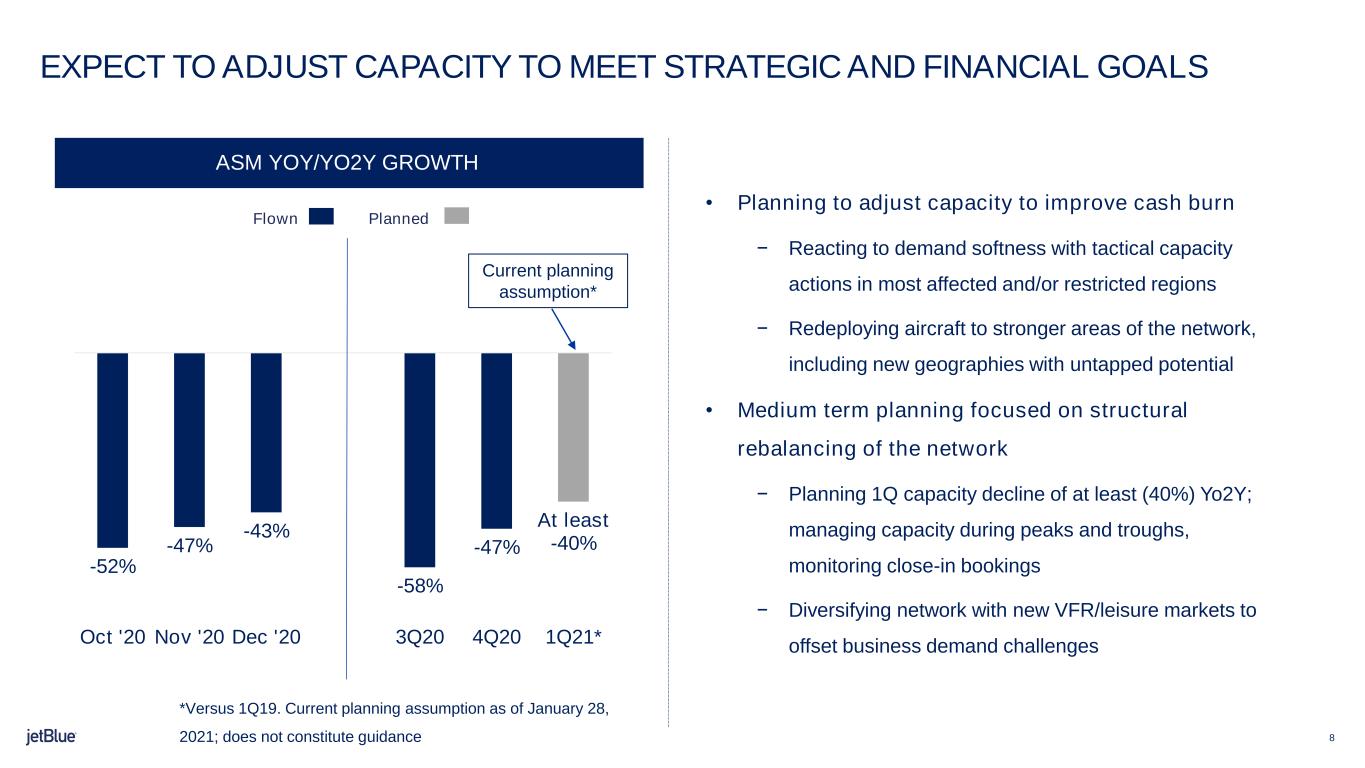

8 -52% -47% -43% -58% -47% At least -40% Oct '20 Nov '20 Dec '20 3Q20 4Q20 1Q21* EXPECT TO ADJUST CAPACITY TO MEET STRATEGIC AND FINANCIAL GOALS ASM YOY/YO2Y GROWTH PlannedFlown Current planning assumption* *Versus 1Q19. Current planning assumption as of January 28, 2021; does not constitute guidance • Planning to adjust capacity to improve cash burn − Reacting to demand softness with tactical capacity actions in most affected and/or restricted regions − Redeploying aircraft to stronger areas of the network, including new geographies with untapped potential • Medium term planning focused on structural rebalancing of the network − Planning 1Q capacity decline of at least (40%) Yo2Y; managing capacity during peaks and troughs, monitoring close-in bookings − Diversifying network with new VFR/leisure markets to offset business demand challenges

9 FINANCIAL UPDATE & OUTLOOK STEVE PRIEST CHIEF FINANCIAL OFFICER

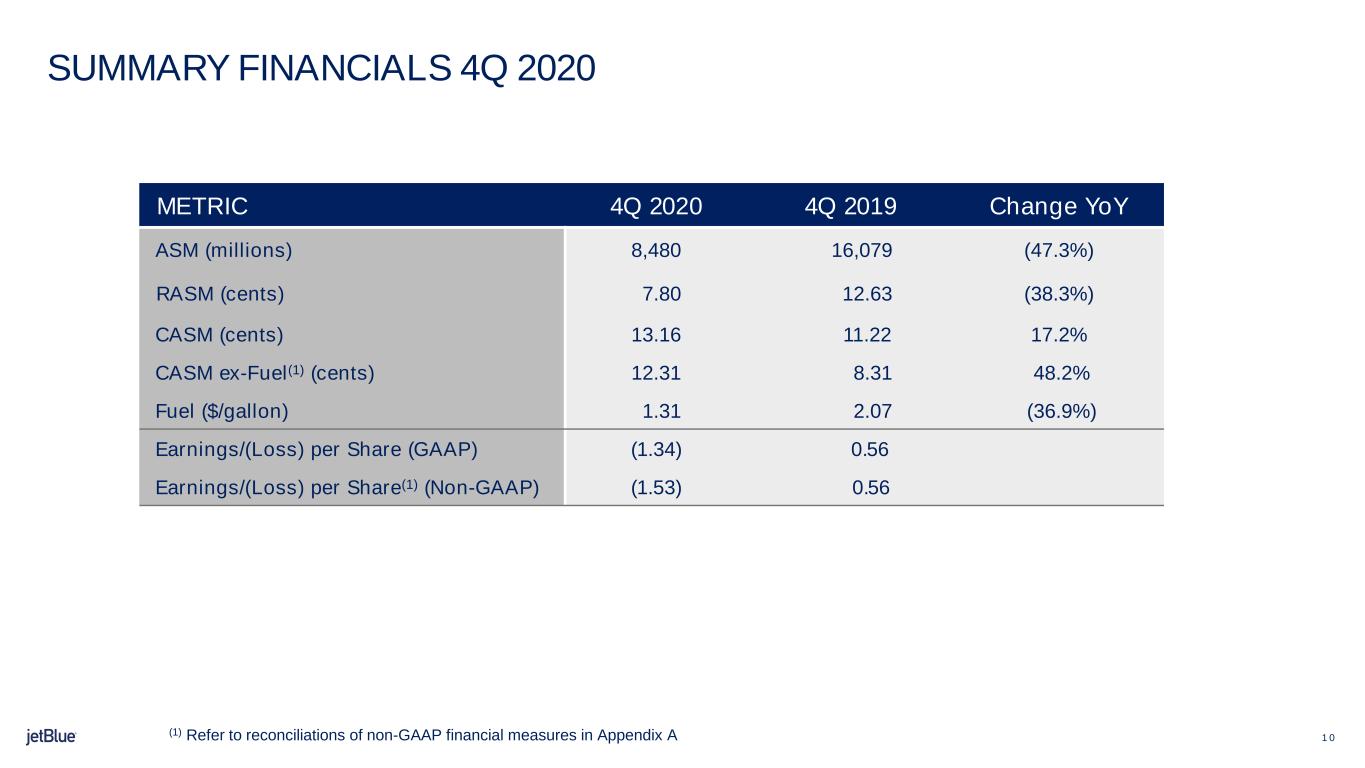

1 0 SUMMARY FINANCIALS 4Q 2020 METRIC 4Q 2020 4Q 2019 Change YoY ASM (millions) 8,480 16,079 (47.3%) RASM (cents) 7.80 12.63 (38.3%) CASM (cents) 13.16 11.22 17.2% CASM ex-Fuel(1) (cents) 12.31 8.31 48.2% Fuel ($/gallon) 1.31 2.07 (36.9%) Earnings/(Loss) per Share (GAAP) (1.34) 0.56 Earnings/(Loss) per Share(1) (Non-GAAP) (1.53) 0.56 (1) Refer to reconciliations of non-GAAP financial measures in Appendix A

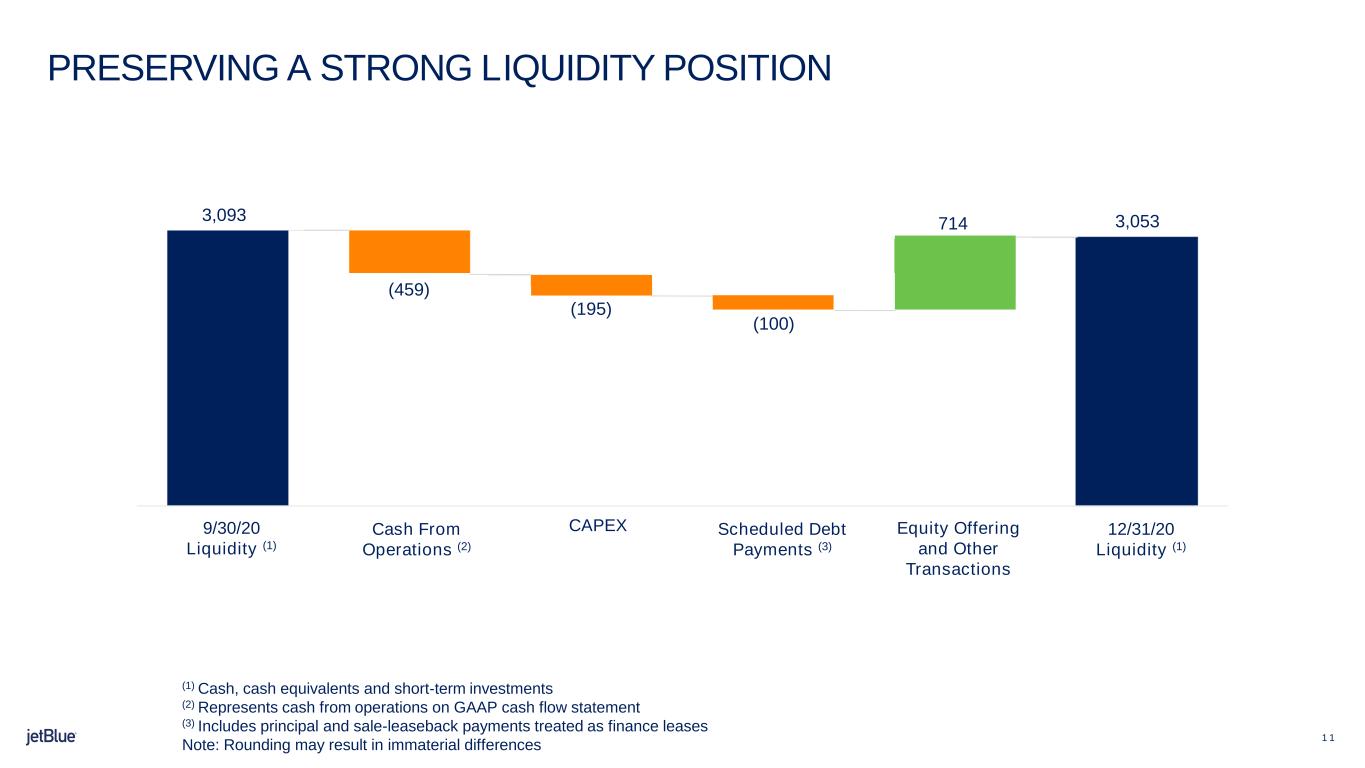

1 1 (195) (1) Cash, cash equivalents and short-term investments (2) Represents cash from operations on GAAP cash flow statement (3) Includes principal and sale-leaseback payments treated as finance leases Note: Rounding may result in immaterial differences PRESERVING A STRONG LIQUIDITY POSITION 3,093 (459) (195) (100) 3,053714 (195 ) (195) Liquidity (1) 9/30/20 i i ity (1) Cash From Operations (2) CAPEX Scheduled Debt Payments (3) Equity Offering and Other Transactions 12/31/20 Liquidity (1)

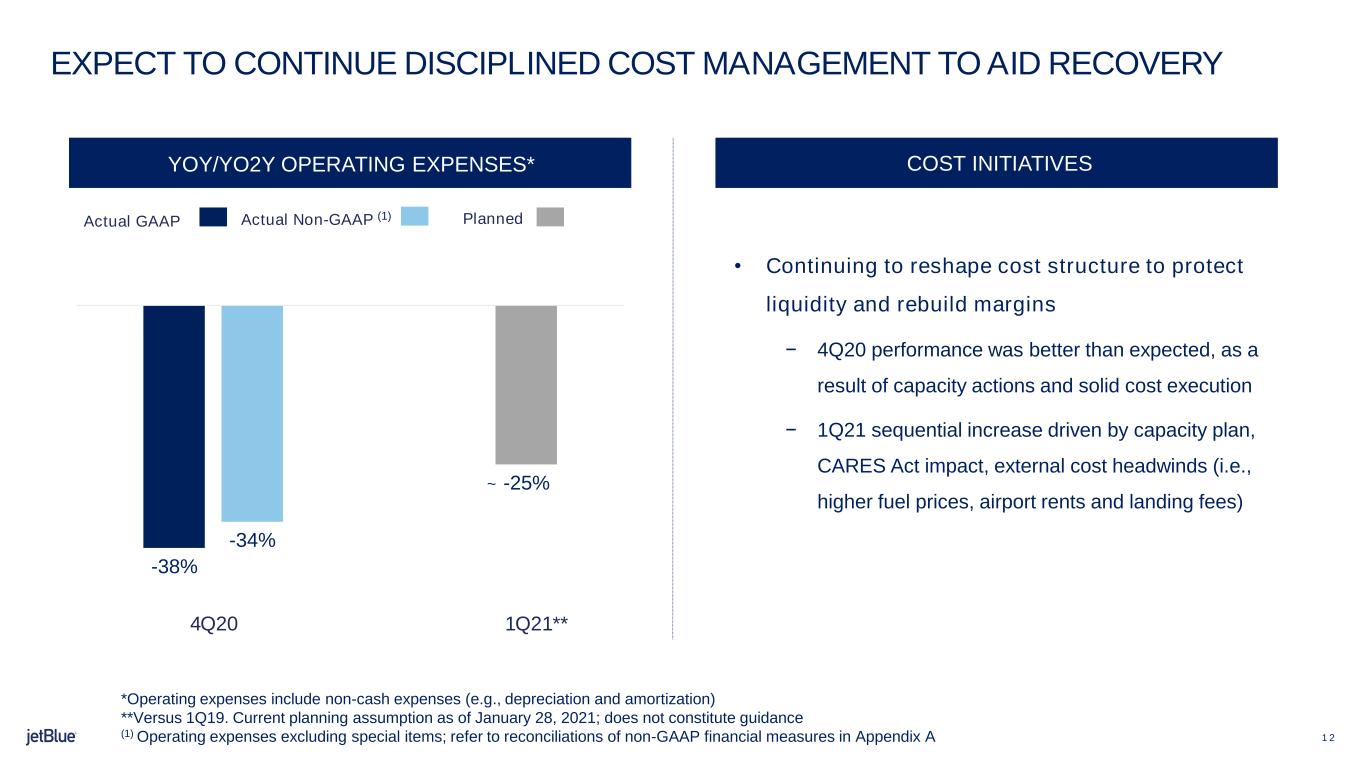

1 2 -38% -34% -25% YOY/YO2Y OPERATING EXPENSES* EXPECT TO CONTINUE DISCIPLINED COST MANAGEMENT TO AID RECOVERY COST INITIATIVES PlannedActual GAAP Actual Non-GAAP (1) *Operating expenses include non-cash expenses (e.g., depreciation and amortization) **Versus 1Q19. Current planning assumption as of January 28, 2021; does not constitute guidance (1) Operating expenses excluding special items; refer to reconciliations of non-GAAP financial measures in Appendix A • Continuing to reshape cost structure to protect liquidity and rebuild margins − 4Q20 performance was better than expected, as a result of capacity actions and solid cost execution − 1Q21 sequential increase driven by capacity plan, CARES Act impact, external cost headwinds (i.e., higher fuel prices, airport rents and landing fees) 4Q20 ~ 1Q21**

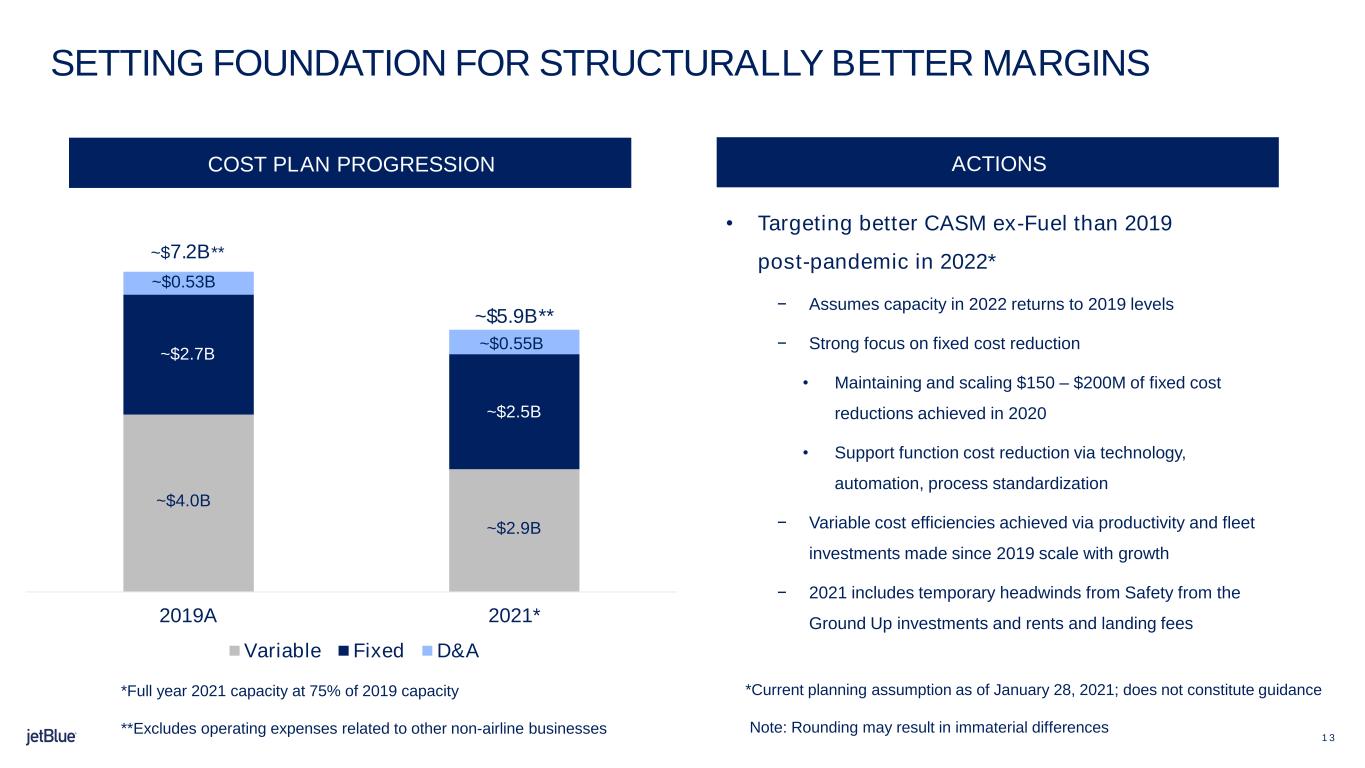

1 3 SETTING FOUNDATION FOR STRUCTURALLY BETTER MARGINS COST PLAN PROGRESSION ACTIONS 2019A 2021* Variable Fixed D&A ~$2.7B ~$2.5B ~$2.9B ~$4.0B *Current planning assumption as of January 28, 2021; does not constitute guidance Note: Rounding may result in immaterial differences • Targeting better CASM ex-Fuel than 2019 post-pandemic in 2022* − Assumes capacity in 2022 returns to 2019 levels − Strong focus on fixed cost reduction • Maintaining and scaling $150 – $200M of fixed cost reductions achieved in 2020 • Support function cost reduction via technology, automation, process standardization − Variable cost efficiencies achieved via productivity and fleet investments made since 2019 scale with growth − 2021 includes temporary headwinds from Safety from the Ground Up investments and rents and landing fees ~$7.2B** ~$5.9B** *Full year 2021 capacity at 75% of 2019 capacity **Excludes operating expenses related to other non-airline businesses ~$0.53B ~$0.55B

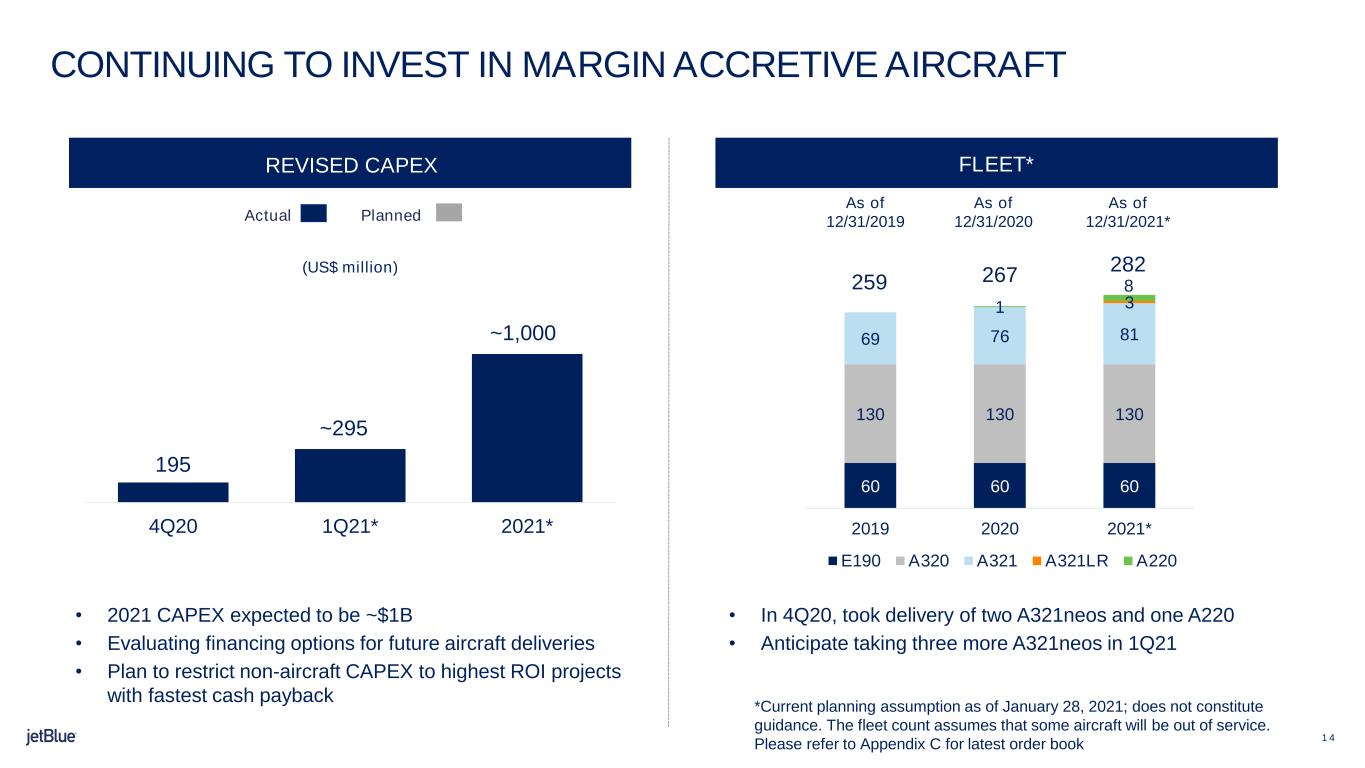

1 4 195 4Q20 1Q21* 2021* • 2021 CAPEX expected to be ~$1B • Evaluating financing options for future aircraft deliveries • Plan to restrict non-aircraft CAPEX to highest ROI projects with fastest cash payback REVISED CAPEX CONTINUING TO INVEST IN MARGIN ACCRETIVE AIRCRAFT FLEET* PlannedActual (US$ million) • In 4Q20, took delivery of two A321neos and one A220 • Anticipate taking three more A321neos in 1Q21 *Current planning assumption as of January 28, 2021; does not constitute guidance. The fleet count assumes that some aircraft will be out of service. Please refer to Appendix C for latest order book As of 12/31/2020 As of 12/31/2021* ~295 282 267 ~1,000 259 As of 12/31/2019 60 60 60 130 130 130 69 76 81 31 2019 2020 2021* E190 A320 A321 A321LR A220 8

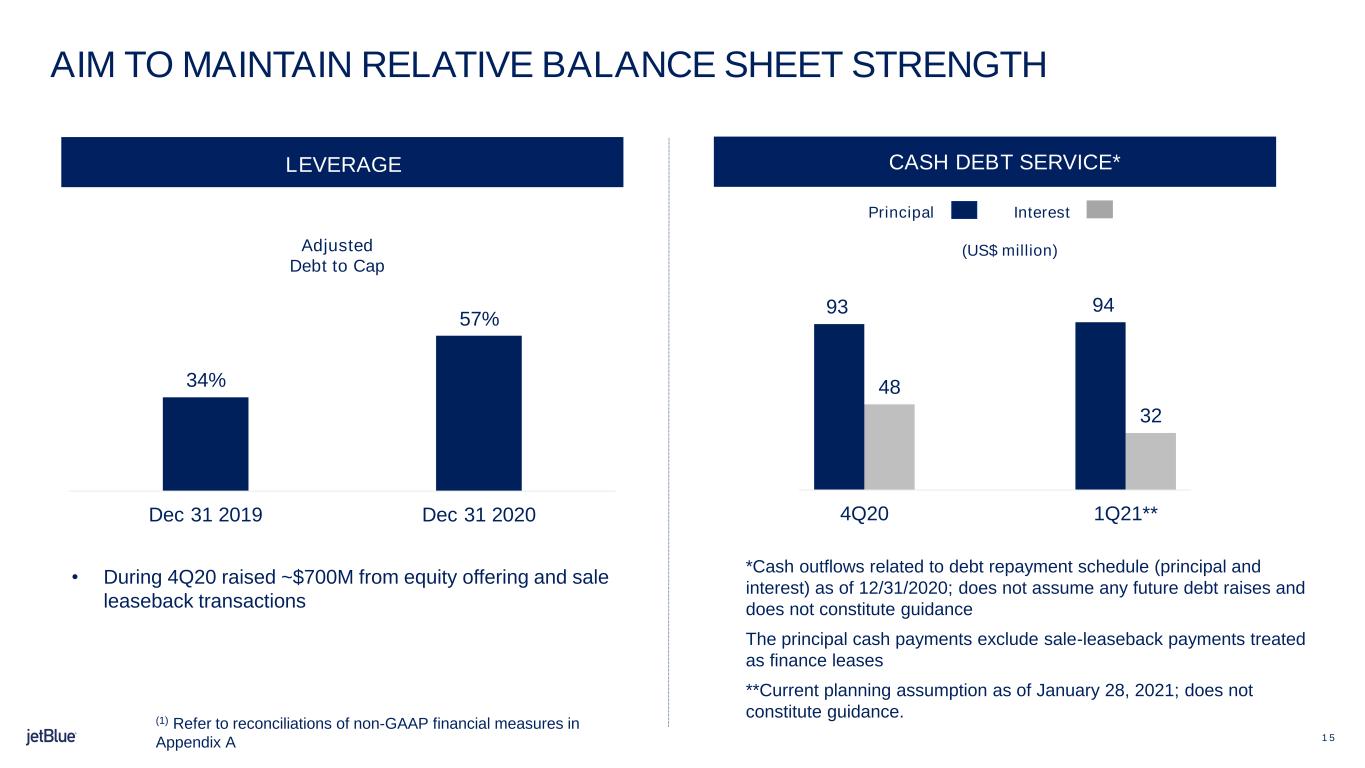

1 5 AIM TO MAINTAIN RELATIVE BALANCE SHEET STRENGTH LEVERAGE DEBT REPAYMENTS* (US$ million) *Cash outflows related to debt repayment schedule (principal and interest) as of 12/31/2020; does not assume any future debt raises and does not constitute guidance The principal cash payments exclude sale-leaseback payments treated as finance leases **Current planning assumption as of January 28, 2021; does not constitute guidance. CASH DEBT SERVICE* InterestPrincipal (1) Refer to reconciliations of non-GAAP financial measures in Appendix A Adjusted Debt to Cap • During 4Q20 raised ~$700M from equity offering and sale leaseback transactions 34% 57% Dec 31 2019 Dec 31 2020 93 94 48 32 4Q20 1Q21**

1 61 QUESTIONS?

1 7 Non-GAAP Financial Measures JetBlue sometimes uses non-GAAP financial measures in this presentation. Non-GAAP financial measures are financial measures that are derived from the consolidated financial statements, but that are not presented in accordance with generally accepted accounting principles in the United States, or GAAP. We believe these non-GAAP financial measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. The information in Appendices A and B provides an explanation of each non-GAAP financial measure and shows a reconciliation of non-GAAP financial measures used in this presentation to the most directly comparable GAAP financial measures. APPENDIX A

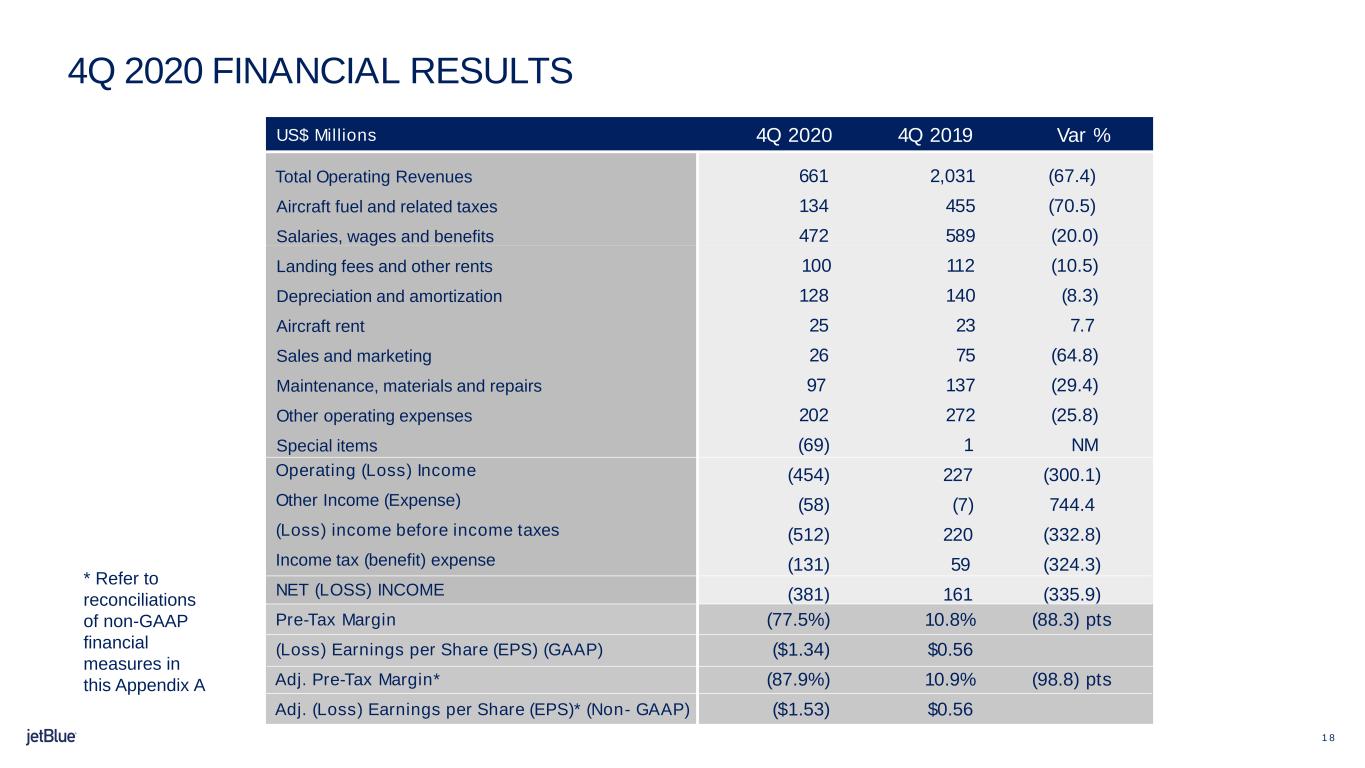

1 8 4Q 2020 FINANCIAL RESULTS US$ Millions 4Q 2020 4Q 2019 Var % Total Operating Revenues 661 2,031 (67.4) Aircraft fuel and related taxes 134 455 (70.5) Salaries, wages and benefits 472 589 (20.0) Landing fees and other rents 100 112 (10.5) Depreciation and amortization 128 140 (8.3) Aircraft rent 25 23 7.7 Sales and marketing 26 75 (64.8) Maintenance, materials and repairs 97 137 (29.4) Other operating expenses 202 272 (25.8) Special items (69) 1 NM Operating (Loss) Income (454) 227 (300.1) Other Income (Expense) (58) (7) 744.4 (Loss) income before income taxes (512) 220 (332.8) Income tax (benefit) expense (131) 59 (324.3) NET (LOSS) INCOME (381) 161 (335.9) Pre-Tax Margin (77.5%) 10.8% (88.3) pts (Loss) Earnings per Share (EPS) (GAAP) ($1.34) $0.56 Adj. Pre-Tax Margin* (87.9%) 10.9% (98.8) pts Adj. (Loss) Earnings per Share (EPS)* (Non- GAAP) ($1.53) $0.56 * Refer to reconciliations of non-GAAP financial measures in this Appendix A

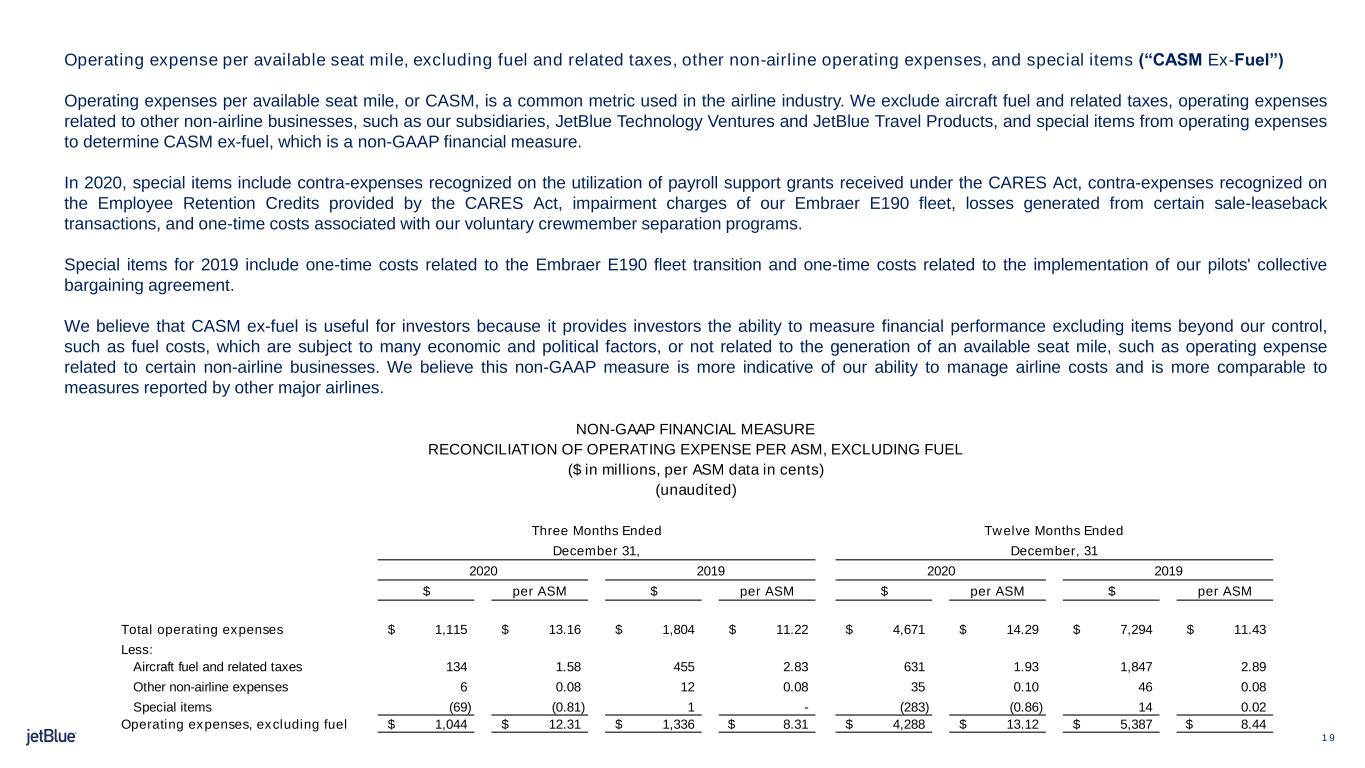

1 9 LOCATION Operating expense per available seat mile, excluding fuel and related taxes, other non-airline operating expenses, and special items (“CASM Ex-Fuel”) Operating expenses per available seat mile, or CASM, is a common metric used in the airline industry. We exclude aircraft fuel and related taxes, operating expenses related to other non-airline businesses, such as our subsidiaries, JetBlue Technology Ventures and JetBlue Travel Products, and special items from operating expenses to determine CASM ex-fuel, which is a non-GAAP financial measure. In 2020, special items include contra-expenses recognized on the utilization of payroll support grants received under the CARES Act, contra-expenses recognized on the Employee Retention Credits provided by the CARES Act, impairment charges of our Embraer E190 fleet, losses generated from certain sale-leaseback transactions, and one-time costs associated with our voluntary crewmember separation programs. Special items for 2019 include one-time costs related to the Embraer E190 fleet transition and one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe that CASM ex-fuel is useful for investors because it provides investors the ability to measure financial performance excluding items beyond our control, such as fuel costs, which are subject to many economic and political factors, or not related to the generation of an available seat mile, such as operating expense related to certain non-airline businesses. We believe this non-GAAP measure is more indicative of our ability to manage airline costs and is more comparable to measures reported by other major airlines. Three Months Ended Twelve Months Ended December 31, December, 31 $ per ASM $ per ASM $ per ASM $ per ASM Total operating expenses 1,115$ 13.16$ 1,804$ 11.22$ 4,671$ 14.29$ 7,294$ 11.43$ Less: Aircraft fuel and related taxes 134 1.58 455 2.83 631 1.93 1,847 2.89 Other non-airline expenses 6 0.08 12 0.08 35 0.10 46 0.08 Special items (69) (0.81) 1 - (283) (0.86) 14 0.02 Operating expenses, excluding fuel 1,044$ 12.31$ 1,336$ 8.31$ 4,288$ 13.12$ 5,387$ 8.44$ 2020 20192020 2019 NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE PER ASM, EXCLUDING FUEL ($ in millions, per ASM data in cents) (unaudited)

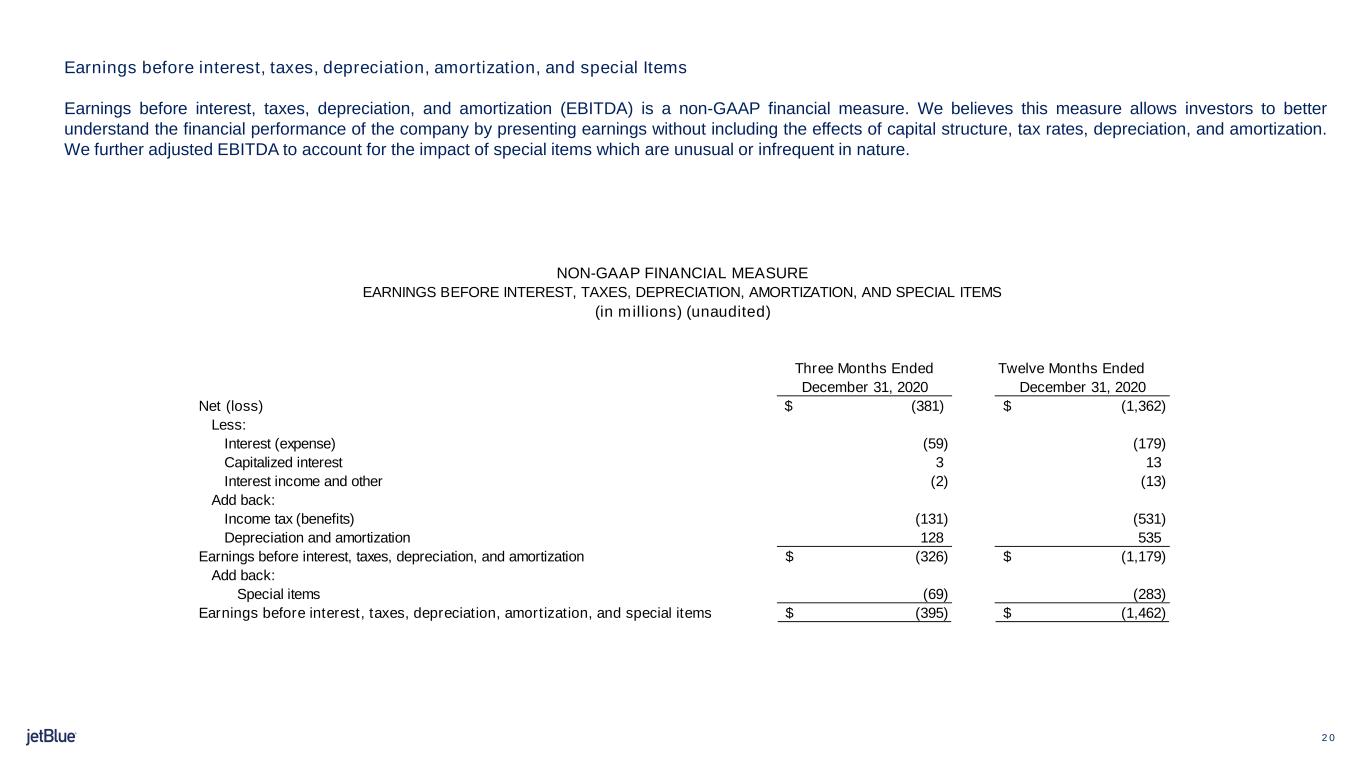

2 0 LOCATION Earnings before interest, taxes, depreciation, amortization, and special Items Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a non-GAAP financial measure. We believes this measure allows investors to better understand the financial performance of the company by presenting earnings without including the effects of capital structure, tax rates, depreciation, and amortization. We further adjusted EBITDA to account for the impact of special items which are unusual or infrequent in nature. Three Months Ended Twelve Months Ended December 31, 2020 December 31, 2020 Net (loss) $ (381) (1,362)$ Less: Interest (expense) (59) (179) Capitalized interest 3 13 Interest income and other (2) (13) Add back: Income tax (benefits) (131) (531) Depreciation and amortization 128 535 Earnings before interest, taxes, depreciation, and amortization (326)$ (1,179)$ Add back: Special items (69) (283) Earnings before interest, taxes, depreciation, amortization, and special items (395)$ (1,462)$ NON-GAAP FINANCIAL MEASURE EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AMORTIZATION, AND SPECIAL ITEMS (in millions) (unaudited)

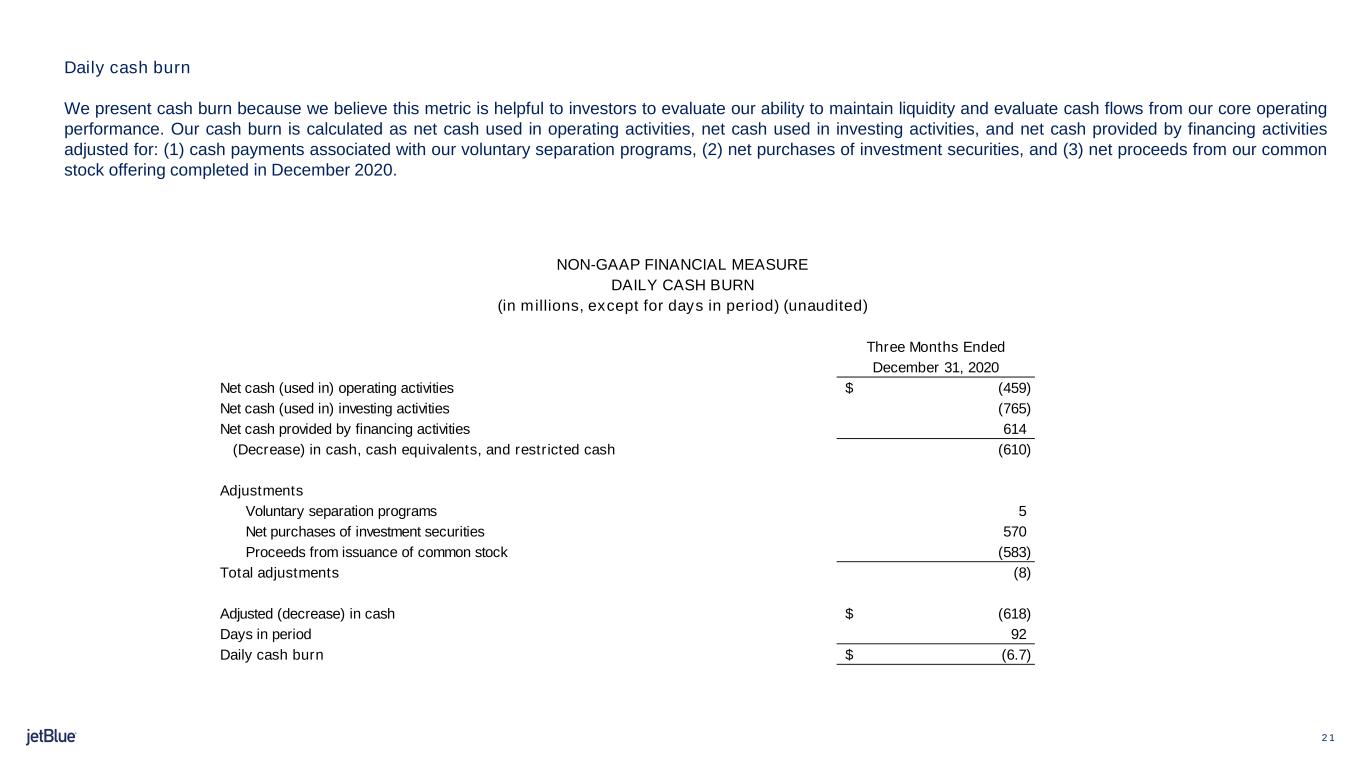

2 1 LOCATION Daily cash burn We present cash burn because we believe this metric is helpful to investors to evaluate our ability to maintain liquidity and evaluate cash flows from our core operating performance. Our cash burn is calculated as net cash used in operating activities, net cash used in investing activities, and net cash provided by financing activities adjusted for: (1) cash payments associated with our voluntary separation programs, (2) net purchases of investment securities, and (3) net proceeds from our common stock offering completed in December 2020. Three Months Ended December 31, 2020 Net cash (used in) operating activities (459)$ Net cash (used in) investing activities (765) Net cash provided by financing activities 614 (Decrease) in cash, cash equivalents, and restricted cash (610) Adjustments Voluntary separation programs 5 Net purchases of investment securities 570 Proceeds from issuance of common stock (583) Total adjustments (8) Adjusted (decrease) in cash (618)$ Days in period 92 Daily cash burn (6.7)$ NON-GAAP FINANCIAL MEASURE DAILY CASH BURN (in millions, except for days in period) (unaudited)

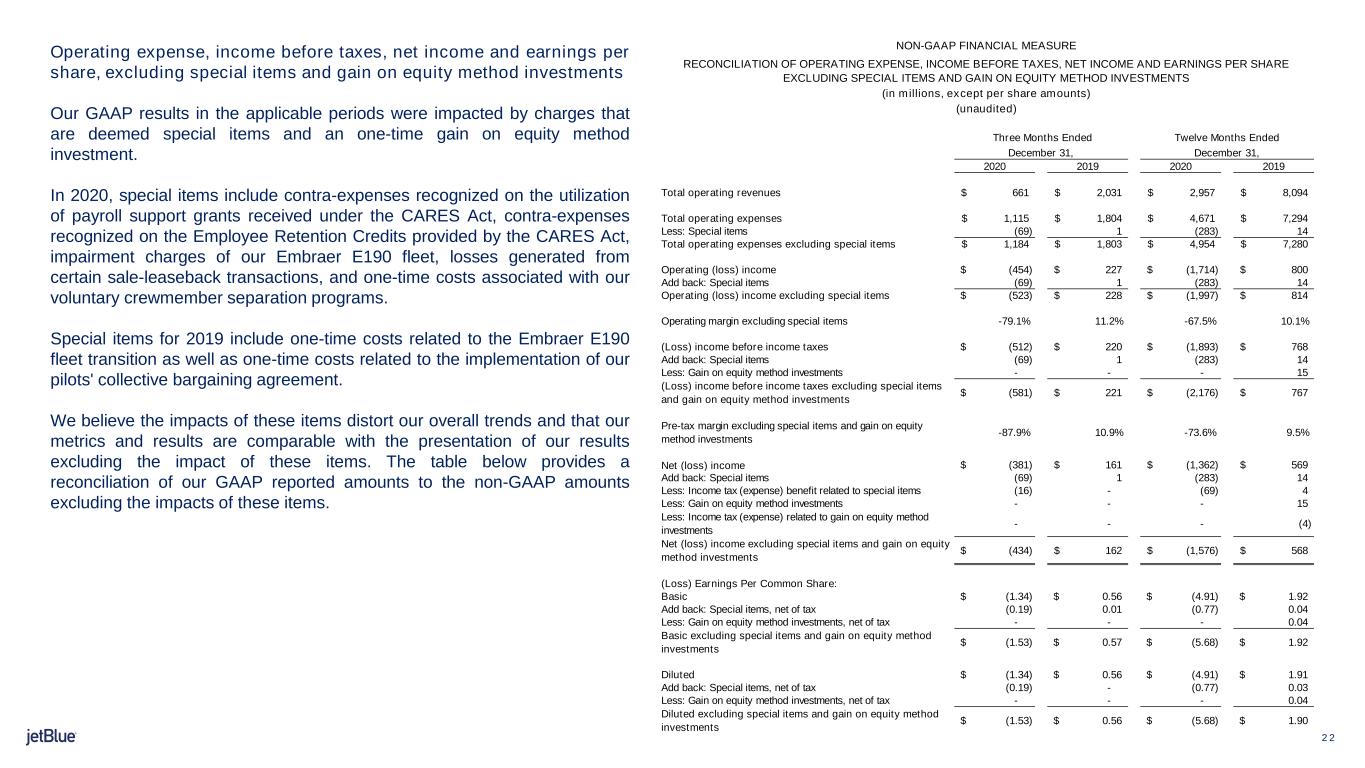

2 2 Operating expense, income before taxes, net income and earnings per share, excluding special items and gain on equity method investments Our GAAP results in the applicable periods were impacted by charges that are deemed special items and an one-time gain on equity method investment. In 2020, special items include contra-expenses recognized on the utilization of payroll support grants received under the CARES Act, contra-expenses recognized on the Employee Retention Credits provided by the CARES Act, impairment charges of our Embraer E190 fleet, losses generated from certain sale-leaseback transactions, and one-time costs associated with our voluntary crewmember separation programs. Special items for 2019 include one-time costs related to the Embraer E190 fleet transition as well as one-time costs related to the implementation of our pilots' collective bargaining agreement. We believe the impacts of these items distort our overall trends and that our metrics and results are comparable with the presentation of our results excluding the impact of these items. The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impacts of these items. 2020 2019 2020 2019 Total operating revenues 661$ 2,031$ 2,957$ 8,094$ Total operating expenses 1,115$ 1,804$ 4,671$ 7,294$ Less: Special items (69) 1 (283) 14 Total operating expenses excluding special items 1,184$ 1,803$ 4,954$ 7,280$ Operating (loss) income (454)$ 227$ (1,714)$ 800$ Add back: Special items (69) 1 (283) 14 Operating (loss) income excluding special items (523)$ 228$ (1,997)$ 814$ Operating margin excluding special items -79.1% 11.2% -67.5% 10.1% (Loss) income before income taxes (512)$ 220$ (1,893)$ 768$ Add back: Special items (69) 1 (283) 14 Less: Gain on equity method investments - - - 15 (Loss) income before income taxes excluding special items and gain on equity method investments (581)$ 221$ (2,176)$ 767$ Pre-tax margin excluding special items and gain on equity method investments -87.9% 10.9% -73.6% 9.5% Net (loss) income (381)$ 161$ (1,362)$ 569$ Add back: Special items (69) 1 (283) 14 Less: Income tax (expense) benefit related to special items (16) - (69) 4 Less: Gain on equity method investments - - - 15 Less: Income tax (expense) related to gain on equity method investments - - - (4) Net (loss) income excluding special items and gain on equity method investments (434)$ 162$ (1,576)$ 568$ (Loss) Earnings Per Common Share: Basic (1.34)$ 0.56$ (4.91)$ 1.92$ Add back: Special items, net of tax (0.19) 0.01 (0.77) 0.04 Less: Gain on equity method investments, net of tax - - - 0.04 Basic excluding special items and gain on equity method investments (1.53)$ 0.57$ (5.68)$ 1.92$ Diluted (1.34)$ 0.56$ (4.91)$ 1.91$ Add back: Special items, net of tax (0.19) - (0.77) 0.03 Less: Gain on equity method investments, net of tax - - - 0.04 Diluted excluding special items and gain on equity method investments (1.53)$ 0.56$ (5.68)$ 1.90$ Twelve Months Ended December 31, NON-GAAP FINANCIAL MEASURE RECONCILIATION OF OPERATING EXPENSE, INCOME BEFORE TAXES, NET INCOME AND EARNINGS PER SHARE EXCLUDING SPECIAL ITEMS AND GAIN ON EQUITY METHOD INVESTMENTS (in millions, except per share amounts) (unaudited) December 31, Three Months Ended

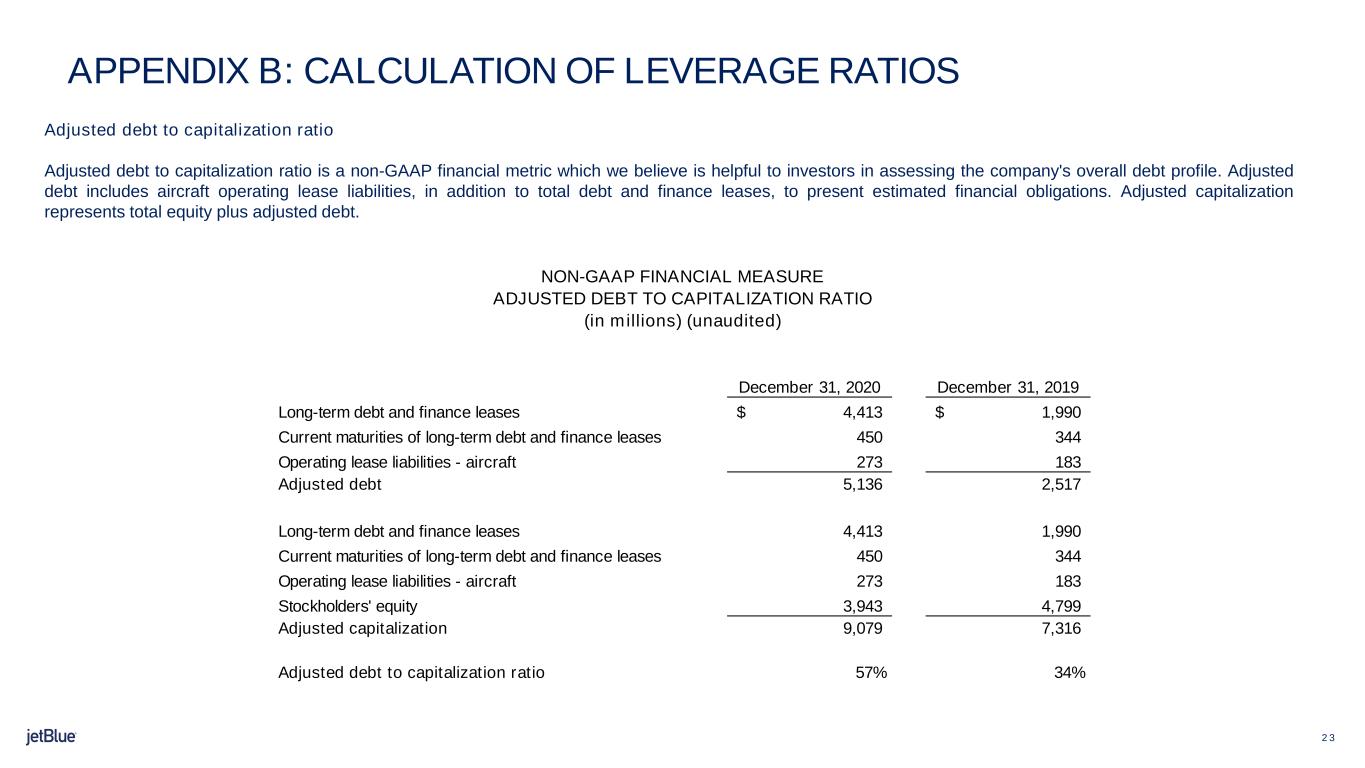

2 3 LOCATION Adjusted debt to capitalization ratio Adjusted debt to capitalization ratio is a non-GAAP financial metric which we believe is helpful to investors in assessing the company's overall debt profile. Adjusted debt includes aircraft operating lease liabilities, in addition to total debt and finance leases, to present estimated financial obligations. Adjusted capitalization represents total equity plus adjusted debt. APPENDIX B: CALCULATION OF LEVERAGE RATIOS December 31, 2020 December 31, 2019 Long-term debt and finance leases 4,413$ 1,990$ Current maturities of long-term debt and finance leases 450 344 Operating lease liabilities - aircraft 273 183 Adjusted debt 5,136 2,517 Long-term debt and finance leases 4,413 1,990 Current maturities of long-term debt and finance leases 450 344 Operating lease liabilities - aircraft 273 183 Stockholders' equity 3,943 4,799 Adjusted capitalization 9,079 7,316 Adjusted debt to capitalization ratio 57% 34% NON-GAAP FINANCIAL MEASURE ADJUSTED DEBT TO CAPITALIZATION RATIO (in millions) (unaudited)

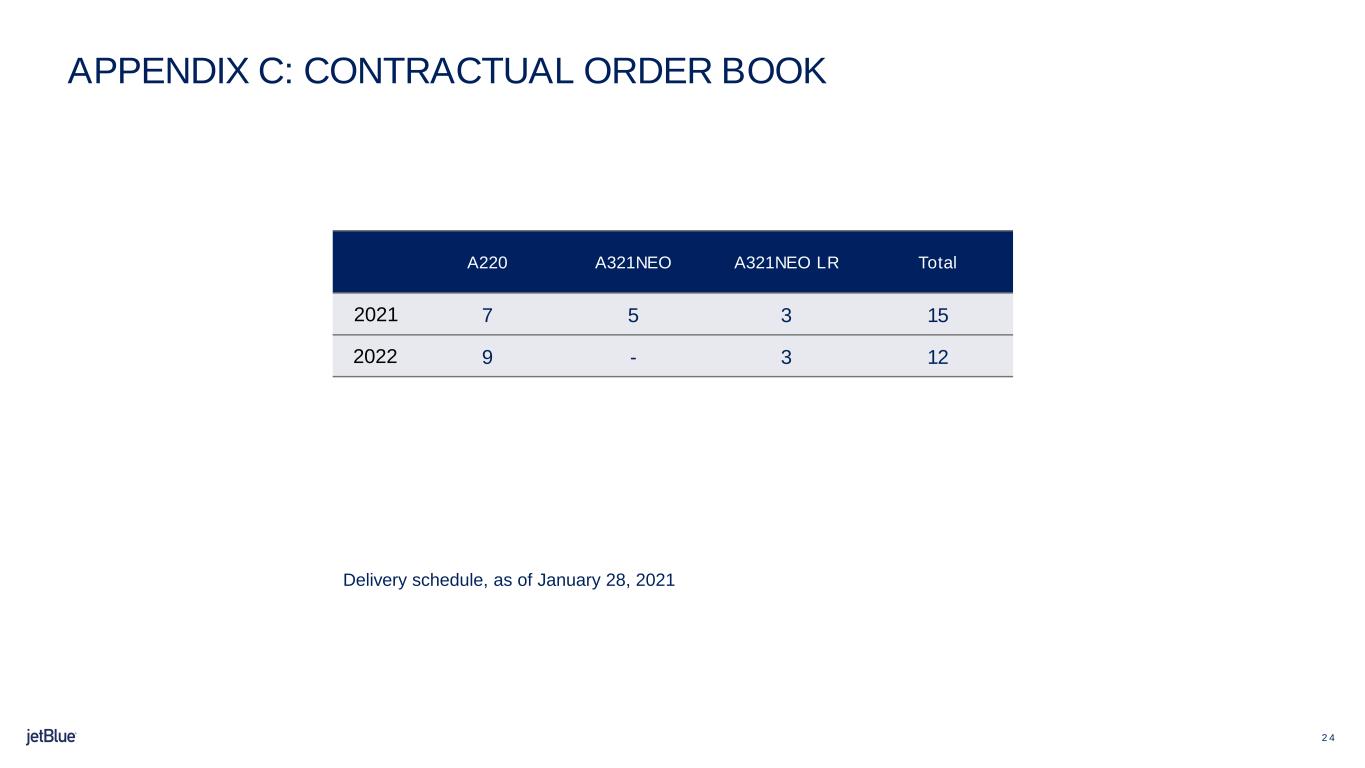

2 4 A220 A321NEO A321NEO LR Total 2021 7 5 3 15 2022 9 - 3 12 Delivery schedule, as of January 28, 2021 APPENDIX C: CONTRACTUAL ORDER BOOK

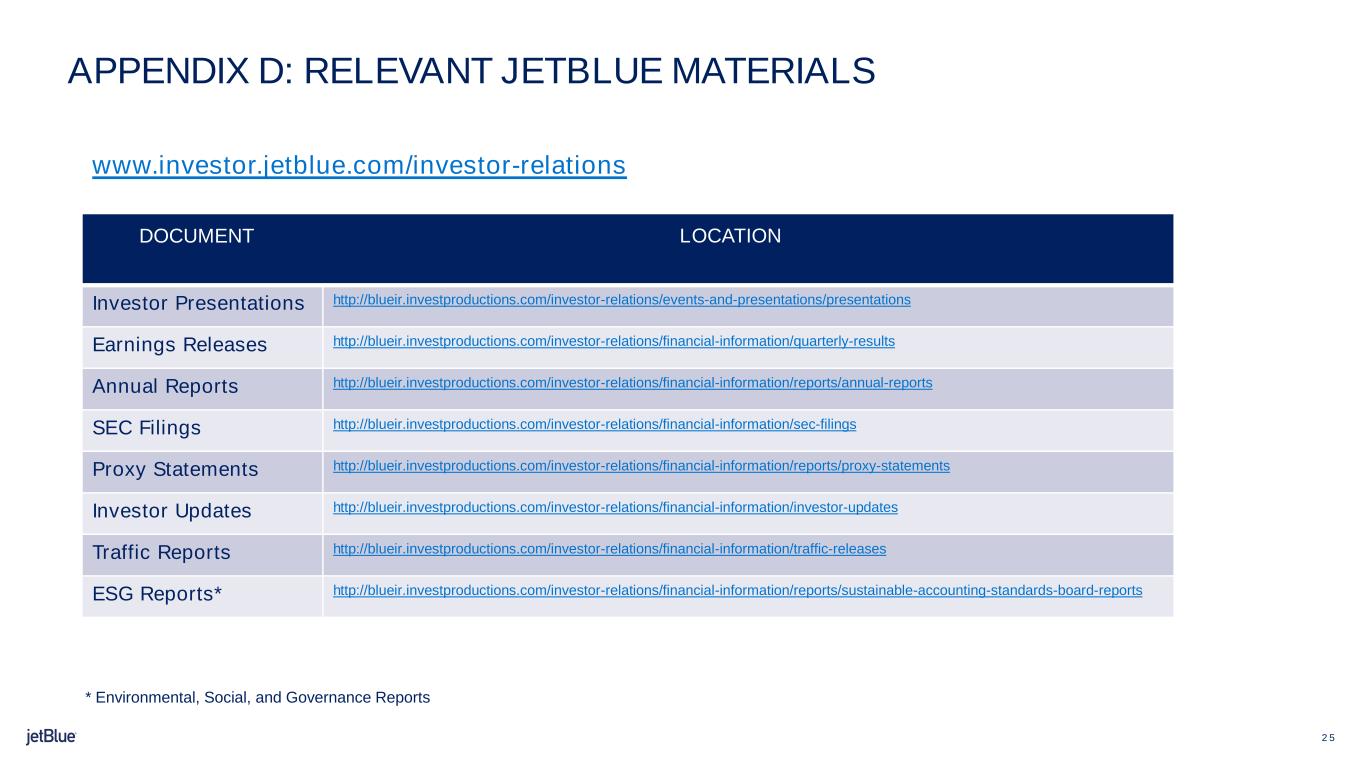

2 5 Investor Presentations http://blueir.investproductions.com/investor-relations/events-and-presentations/presentations Earnings Releases http://blueir.investproductions.com/investor-relations/financial-information/quarterly-results Annual Reports http://blueir.investproductions.com/investor-relations/financial-information/reports/annual-reports SEC Filings http://blueir.investproductions.com/investor-relations/financial-information/sec-filings Proxy Statements http://blueir.investproductions.com/investor-relations/financial-information/reports/proxy-statements Investor Updates http://blueir.investproductions.com/investor-relations/financial-information/investor-updates Traffic Reports http://blueir.investproductions.com/investor-relations/financial-information/traffic-releases ESG Reports* http://blueir.investproductions.com/investor-relations/financial-information/reports/sustainable-accounting-standards-board-reports www.investor.jetblue.com/investor-relations DOCUMENT LOCATION * Environmental, Social, and Governance Reports APPENDIX D: RELEVANT JETBLUE MATERIALS