Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - ALLSTATE CORP | exhibit991-antelopepressre.htm |

| EX-2.1 - EX-2.1 - ALLSTATE CORP | exhibit21-antelopespa.htm |

| 8-K - 8-K - ALLSTATE CORP | all-20210126.htm |

The Allstate Corporation Investor Call Presentation: Disposition of Allstate Life Insurance Company January 27, 2021 ® Exhibit 99.2

1 Forward-Looking Statements and Non-GAAP Financial Information This presentation contains forward-looking statements and information. This presentation also contains non-GAAP measures that are denoted with an asterisk. You can find the reconciliation of those measures to GAAP measures within our most recent earnings release or investor supplement. Additional information on factors that could cause results to differ materially from this presentation is available in the 2019 Form 10-K, Form 10-Q for September 30, 2020, our most recent earnings release, and at the end of these slides. These materials are available on our website, www.allstateinvestors.com, under the “Financials” link.

2 Allstate Enters Into Agreement to Sell Allstate Life Insurance Company ▪ Allstate has agreed to sell Allstate Life Insurance Company for gross proceeds of $2.8 billion to entities managed by Blackstone ‒ Represents $23 billion, approximately 80%, of Allstate’s total life and annuity reserves ‒ Minimal impact on strategy to increase market share in personal property-liability and expand protection offerings ‒ Transaction represents a near culmination of deploying capital out of “investment spread” businesses ‒ Allstate agents and Exclusive Financial Specialists will continue to offer life and retirement solutions to customers through the use of non-proprietary products ‒ Redeploys $2.2 billion of capital out of lower growth and return businesses ‒ Provides increased clarity to the returns generated by Property-Liability and Service Businesses with a one percentage point improvement in Adjusted Net Income return on equity* ▪ Allstate’s Life and Annuity businesses have not grown and generate returns below Allstate’s total return ‒ Life insurance sales have declined since 2018 and annuity sales were discontinued in 2014 ‒ Allstate Life and Annuities generated 7% of total revenues with net income of $529 million (11% of total earnings) while utilizing 33% of GAAP capital in 2019 ▪ Net income declined to a loss of $207 million in the first nine months of 2020 due to lower performance-based investment income and higher mortality losses in part due to the coronavirus pandemic ‒ Allstate Life Insurance Company of New York with $5 billion of total life and annuity liabilities will be retained, until it can be sold or the risk otherwise transferred to a third party ▪ The entities managed by Blackstone are a better owner for these businesses ‒ Strong capitalization maintained to protect existing policyholders ‒ Company will not issue new business enabling a more efficient cost structure ‒ Blackstone will provide asset management expertise ‒ Capital provided by investors seeking stable long-term returns ▪ The transaction is attractive economically but results in a financial book loss ‒ Sale economics are favorable compared to continuing to issue life insurance and running off the closed block of annuities ‒ An estimated $3.1 billion loss will be recorded in the first quarter of 2021 reflecting the low return annuity business ‒ A material reduction in equity on the annuity business would have been recorded upon adoption of Long Duration Targeted Improvement accounting standard in 2022, if rates remain at or near current levels

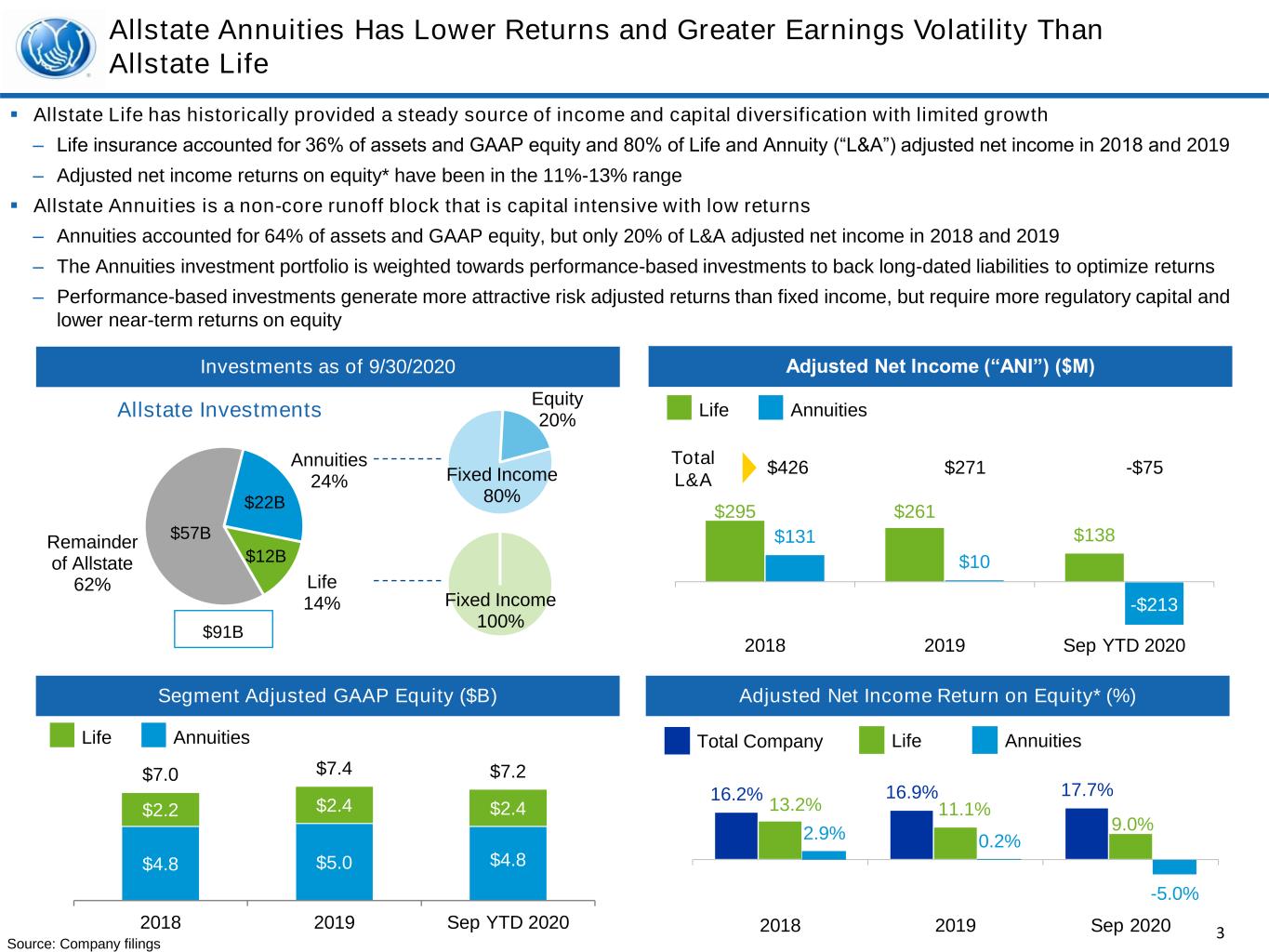

3 ▪ Allstate Life has historically provided a steady source of income and capital diversification with limited growth ‒ Life insurance accounted for 36% of assets and GAAP equity and 80% of Life and Annuity (“L&A”) adjusted net income in 2018 and 2019 ‒ Adjusted net income returns on equity* have been in the 11%-13% range ▪ Allstate Annuities is a non-core runoff block that is capital intensive with low returns ‒ Annuities accounted for 64% of assets and GAAP equity, but only 20% of L&A adjusted net income in 2018 and 2019 ‒ The Annuities investment portfolio is weighted towards performance-based investments to back long-dated liabilities to optimize returns ‒ Performance-based investments generate more attractive risk adjusted returns than fixed income, but require more regulatory capital and lower near-term returns on equity Allstate Annuities Has Lower Returns and Greater Earnings Volatility Than Allstate Life Source: Company filings Investments as of 9/30/2020 Fixed Income 80% Equity 20% Allstate Investments Annuities 24% Life 14% Remainder of Allstate 62% Adjusted Net Income (“ANI”) ($M) $295 $261 $138 $131 $10 -$213 2018 2019 Sep YTD 2020 $426 $271 -$75 Total L&A Fixed Income 100% $91B $57B $22B $12B AnnuitiesLife Adjusted Net Income Return on Equity* (%) 16.2% 16.9% 17.7% 13.2% 11.1% 9.0% 2.9% 0.2% -5.0% 2018 2019 Sep 2020 AnnuitiesLifeTotal Company $4.8 $5.0 $4.8 $2.2 $2.4 $2.4 $7.0 $7.4 $7.2 2018 2019 Sep YTD 2020 Segment Adjusted GAAP Equity ($B) AnnuitiesLife

4 ▪ Customers benefit from access to industry leading solutions ‒ Contemporary product designs ‒ Larger risk pools ‒ Lower costs ‒ Enhanced customer value ▪ Allstate successfully distributes non- proprietary products ‒ Non-proprietary premiums and deposits of $2.2 billion in 2020: ▪ Mutual Funds – $985 million ▪ Variable Annuities – $724 million ▪ Deferred Annuities – $490 million Allstate’s Strategy Remains To Increase Market Share in Personal Property-Liability and Expand Protection Offerings Non-Proprietary Life and Annuity Solutions Increase Personal Property-Liability Market Share Expand Protection Businesses ▪ Circle of Protection for Customers ▪ Innovative Growth Platforms ▪ Broad Distribution Leveraging Allstate Brand, Customer Base and Capabilities Transformative Growth ▪ Expand Customer Access ▪ Improve Customer Value ▪ Invest in Technology and Marketing

5 Transaction Represents a Near Culmination of Deploying Capital Out of “Investment Spread” Businesses (1) Allstate Life Insurance Company and Allstate Life Insurance Company of New York ▪ Allstate has been exiting the annuity business over the last 15 years ‒ Reinsured variable annuity business in 2006, stopped issuance of fixed annuities, and sold Lincoln Benefit Life ▪ The Life & Annuities businesses reside primarily in ALIC(1) and ALNY(1) legal entities and are operated as one business ‒ The majority of business is in ALIC (>80%), which is being sold to entities managed by Blackstone ‒ The ALNY business, particularly the structured settlement annuities, will runoff over multiple decades and will be retained until it can be sold or the risk otherwise transferred to a third party Business Overview ALIC excl. ALNY ALNY Only Total GAAP Reserves (Life / Annuities) 9/30/2020 $23.0 ($9.5 / $13.5) $5.1 ($1.1 / $4.0) $28.1 ($10.6 / $17.5) Net Income / Loss Sep YTD 2020 -$23M -$184M -$207M Adjusted Net Income / Loss Sep YTD 2020 -$47M -$28M -$75M Policies In Force (Life / Annuities) 9/30/2020 1.7M / 152K 0.2M / 29K 1.9M / 181K Life and Annuities Legal Entities ($B, unless noted)

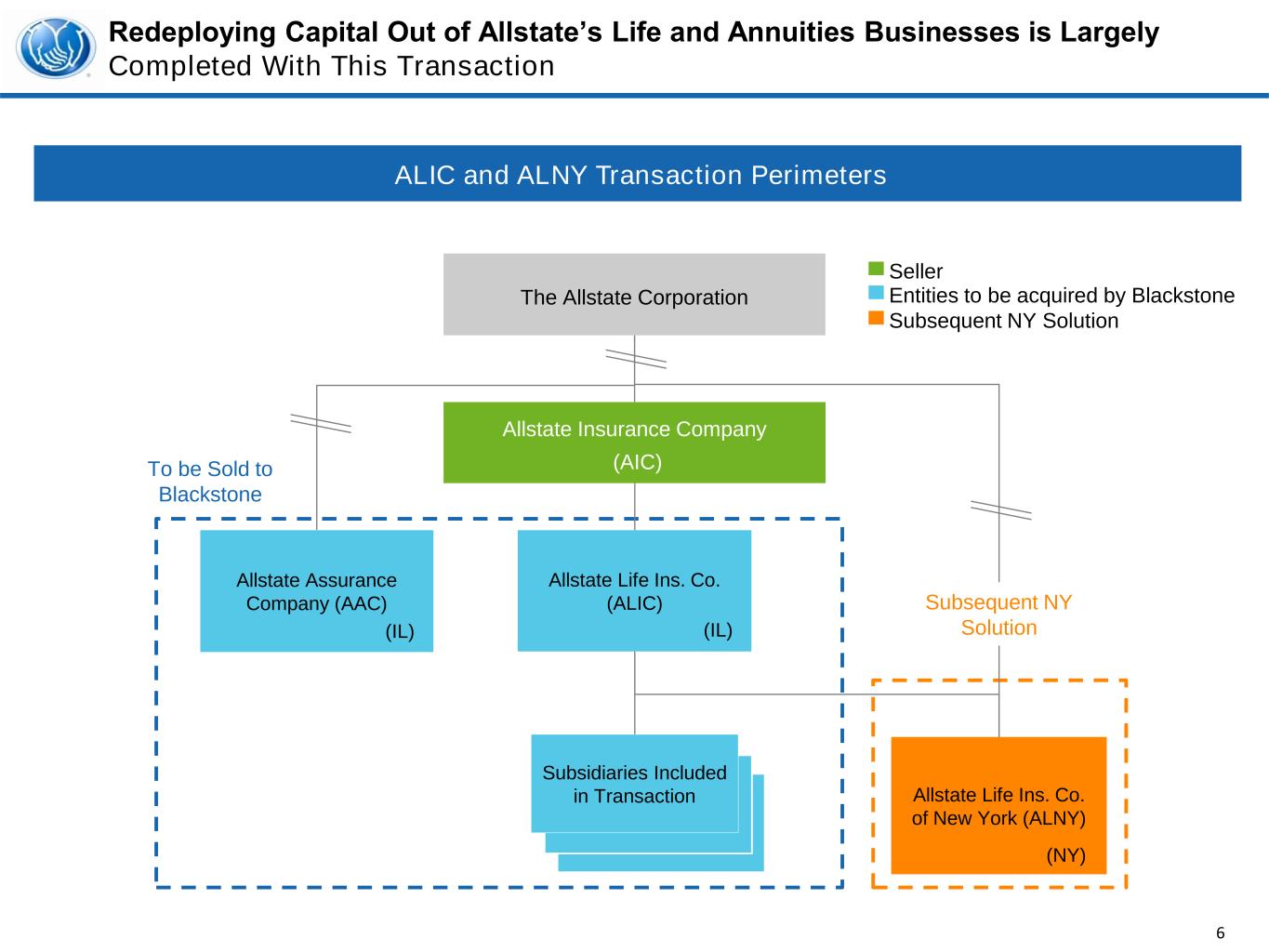

6 Redeploying Capital Out of Allstate’s Life and Annuities Businesses is Largely Completed With This Transaction ALIC and ALNY Transaction Perimeters Seller Entities to be acquired by Blackstone Subsequent NY Solution The Allstate Corporation Allstate Insurance Company (AIC) Subsidiaries Included in Transaction Allstate Assurance Company (AAC) (IL) Allstate Life Ins. Co. (ALIC) (IL) Allstate Life Ins. Co. of New York (ALNY) (NY) (IL) Subsequent NY Solution To be Sold to Blackstone

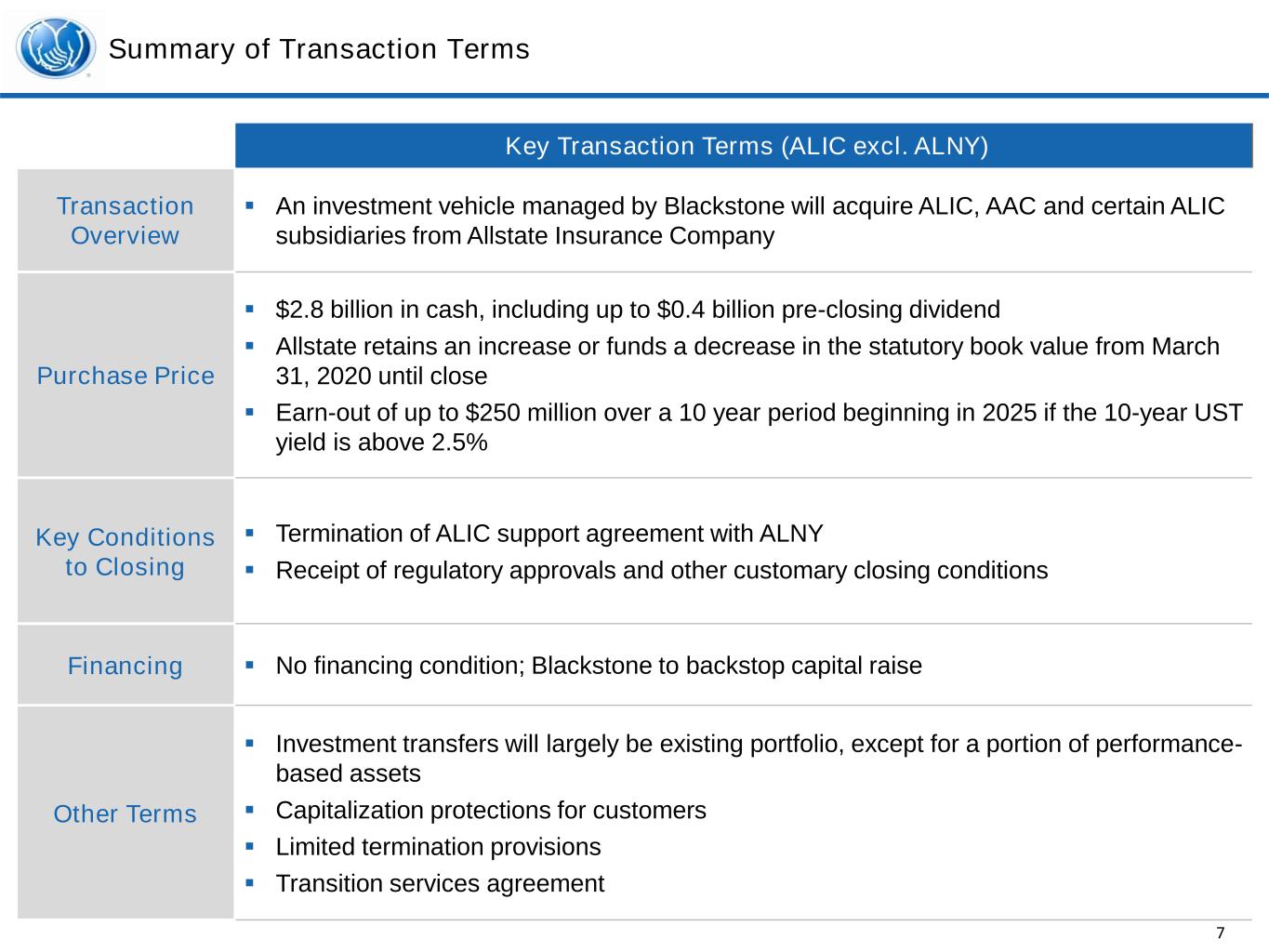

7 Summary of Transaction Terms Key Transaction Terms (ALIC excl. ALNY) Transaction Overview ▪ An investment vehicle managed by Blackstone will acquire ALIC, AAC and certain ALIC subsidiaries from Allstate Insurance Company Purchase Price ▪ $2.8 billion in cash, including up to $0.4 billion pre-closing dividend ▪ Allstate retains an increase or funds a decrease in the statutory book value from March 31, 2020 until close ▪ Earn-out of up to $250 million over a 10 year period beginning in 2025 if the 10-year UST yield is above 2.5% Key Conditions to Closing ▪ Termination of ALIC support agreement with ALNY ▪ Receipt of regulatory approvals and other customary closing conditions Financing ▪ No financing condition; Blackstone to backstop capital raise Other Terms ▪ Investment transfers will largely be existing portfolio, except for a portion of performance- based assets ▪ Capitalization protections for customers ▪ Limited termination provisions ▪ Transition services agreement

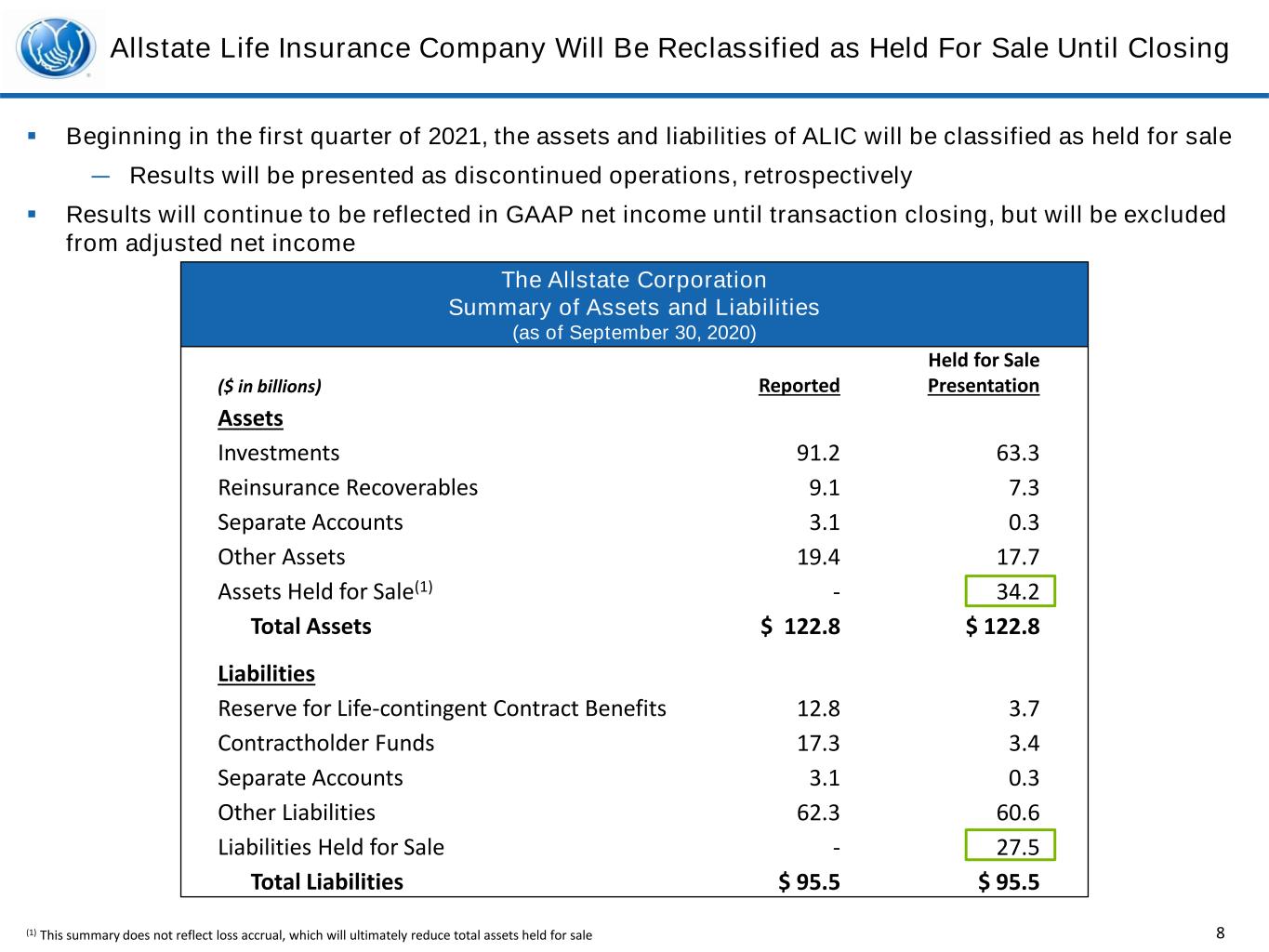

8 Allstate Life Insurance Company Will Be Reclassified as Held For Sale Until Closing ($ in billions) Reported Held for Sale Presentation Assets Investments 91.2 63.3 Reinsurance Recoverables 9.1 7.3 Separate Accounts 3.1 0.3 Other Assets 19.4 17.7 Assets Held for Sale(1) - 34.2 Total Assets $ 122.8 $ 122.8 Liabilities Reserve for Life-contingent Contract Benefits 12.8 3.7 Contractholder Funds 17.3 3.4 Separate Accounts 3.1 0.3 Other Liabilities 62.3 60.6 Liabilities Held for Sale - 27.5 Total Liabilities $ 95.5 $ 95.5 The Allstate Corporation Summary of Assets and Liabilities (as of September 30, 2020) ▪ Beginning in the first quarter of 2021, the assets and liabilities of ALIC will be classified as held for sale — Results will be presented as discontinued operations, retrospectively ▪ Results will continue to be reflected in GAAP net income until transaction closing, but will be excluded from adjusted net income (1) This summary does not reflect loss accrual, which will ultimately reduce total assets held for sale

9 Financial Book Loss Estimate of $3.1 Billion to be Recognized in First Quarter 2021 Source: FactSet, SNL, Company filings; Note: Market date as of 1/21/21 (1) Reflects 9/30/20 ALIC GAAP equity adjusted for pre-closing transactions and other adjustments required under the terms of the purchase agreement (2) Based on annuity-focused companies’ P/E multiples (3) Valuation for life business implied as the difference between purchase price minus implied value for annuities ▪ The loss attributable to annuities is estimated to be greater than the total financial book loss — Implied valuation of annuity business is materially below its allocated equity ▪ Moderate gain on the life business sale partially offsets the annuity loss ▪ Total estimated financial book loss of $3.1 billion is less than estimated impact associated with adoption of the Long Duration Targeted Improvement accounting standard, if rates remain at or near current levels Estimated Financial Book Impact ($B) Gap between estimated equity and purchase price results in ~$3.1 billion book loss $5.9 $2.8 Estimated ALIC GAAP Equity Loss on Annuity Business Gain on Life Business Total Purchase Price ($3.5) – ($3.3) $0.3 – $0.5 Implied Gain / Loss by Business (3)(2)(1)

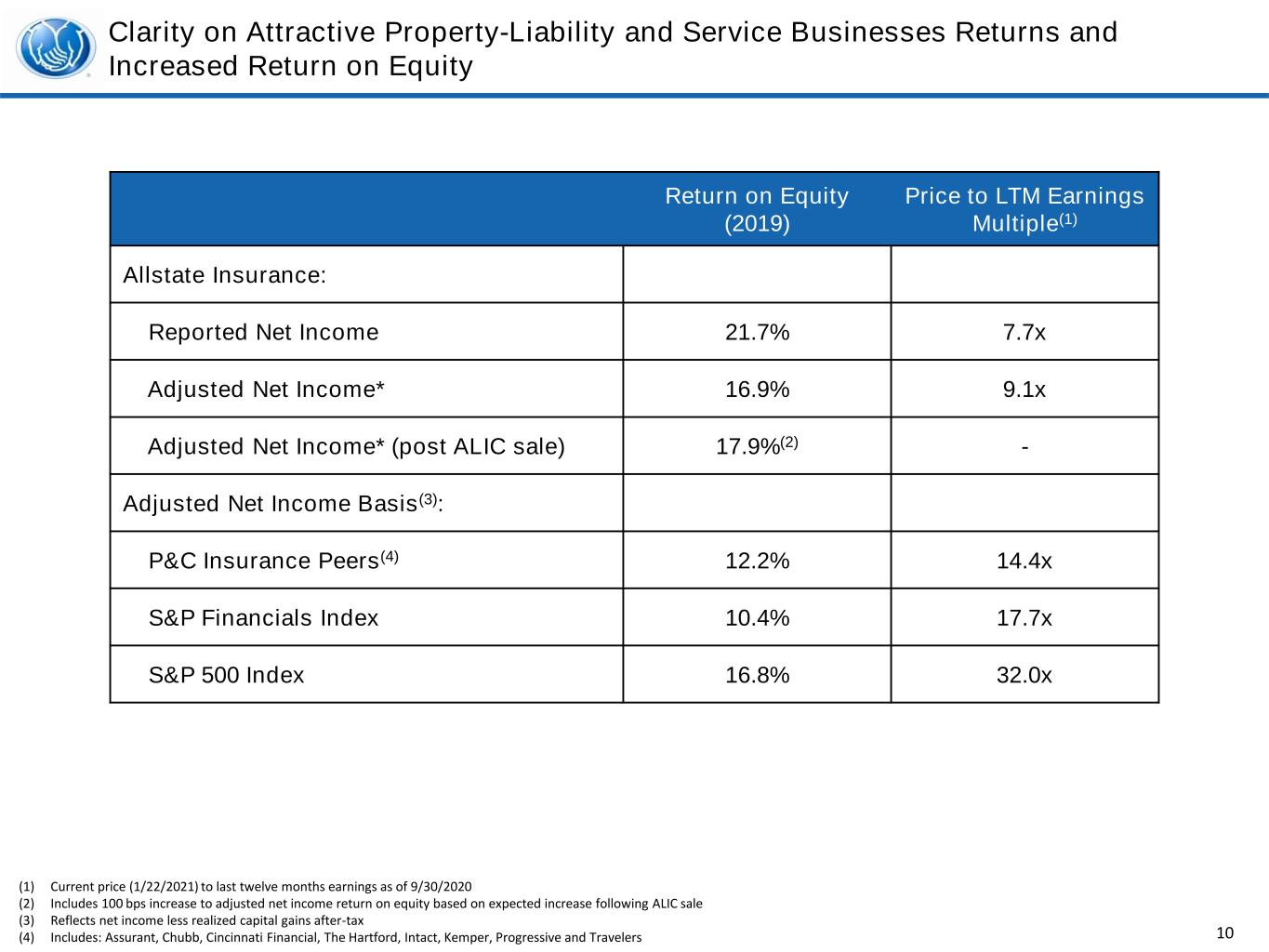

10 Clarity on Attractive Property-Liability and Service Businesses Returns and Increased Return on Equity Return on Equity (2019) Price to LTM Earnings Multiple(1) Allstate Insurance: Reported Net Income 21.7% 7.7x Adjusted Net Income* 16.9% 9.1x Adjusted Net Income* (post ALIC sale) 17.9%(2) - Adjusted Net Income Basis(3): P&C Insurance Peers(4) 12.2% 14.4x S&P Financials Index 10.4% 17.7x S&P 500 Index 16.8% 32.0x (1) Current price (1/22/2021) to last twelve months earnings as of 9/30/2020 (2) Includes 100 bps increase to adjusted net income return on equity based on expected increase following ALIC sale (3) Reflects net income less realized capital gains after-tax (4) Includes: Assurant, Chubb, Cincinnati Financial, The Hartford, Intact, Kemper, Progressive and Travelers

11 ®

12 Forward-Looking Statements • This presentation contains “forward-looking statements” that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These statements are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements do not relate strictly to historical or current facts and may be identified by their use of words like “plans,” “seeks,” “expects,” “will,” “should,” “anticipates,” “estimates,” “intends,” “believes,” “likely,” “targets” and other words with similar meanings. We believe these statements are based on reasonable estimates, assumptions and plans. If the estimates, assumptions or plans underlying the forward-looking statements prove inaccurate or if other risks or uncertainties arise, actual results could differ materially from those communicated in these forward-looking statements. Factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-looking statements include risks related to: • Insurance and Financial Services (1) unexpected increases in claim frequency and severity; (2) catastrophes and severe weather events; (3) limitations in analytical models used for loss cost estimates; (4) price competition and changes in underwriting standards; (5) actual claims costs exceeding current reserves; (6) market risk and declines in credit quality of our investment portfolio; (7) our subjective determination of fair value and the amount of realized capital losses recorded for impairments of our investments; (8) the impact of changes in market interest rates or performance-based investment returns on our annuity business; (9) the impact of changes in reserve estimates and amortization of deferred acquisition costs on our life, benefits and annuity businesses; (10) our participation in indemnification programs, including state industry pools and facilities; (11) our ability to mitigate the capital impact associated with statutory reserving and capital requirements; (12) a downgrade in financial strength ratings; (13) changes in tax laws; • Business, Strategy and Operations (14) competition in the insurance industry and new or changing technologies; (15) implementation of our Transformative Growth Plan; (16) our catastrophe management strategy; (17) restrictions on our subsidiaries’ ability to pay dividends; (18) restrictions under terms of certain of our securities on our ability to pay dividends or repurchase our stock; (19) the availability of reinsurance at current level and prices; (20) counterparty risk related to reinsurance; (21) acquisitions and divestitures of businesses; (22) intellectual property infringement, misappropriation and third-party claims; • Macro, Regulatory and Risk Environment (23) conditions in the global economy and capital and credit markets; (24) a large scale pandemic, such as the Novel Coronavirus Pandemic or COVID-19 and its impacts, or occurrence of terrorism or military actions; (25) the failure in cyber or other information security controls, or the occurrence of events unanticipated in our disaster recovery processes and business continuity planning; (26) changing climate and weather conditions; (27) restrictive regulations and regulatory reforms, including limitations on rate increases and requirements to underwrite business and participate in loss sharing arrangements; (28) losses from legal and regulatory actions; (29) changes in or the application of accounting standards; (30) loss of key vendor relationships or failure of a vendor to protect our data or confidential, proprietary and personal information; (31) our ability to attract, develop and retain key personnel, including availability and productivity of employees during the Coronavirus; and (32) misconduct or fraudulent acts by employees, agents and third parties. • Additional information concerning these and other factors may be found in our filings with the Securities and Exchange Commission, including the “Risk Factors” section in our most recent annual report on Form 10-K. Forward-looking statements speak only as of the date on which they are made, and we assume no obligation to update or revise any forward-looking statement.