Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Caliber Home Loans, Inc. | d103175dex231.htm |

| EX-10.124 - EX-10.124 - Caliber Home Loans, Inc. | d103175dex10124.htm |

| EX-10.123 - EX-10.123 - Caliber Home Loans, Inc. | d103175dex10123.htm |

| EX-10.122 - EX-10.122 - Caliber Home Loans, Inc. | d103175dex10122.htm |

| EX-10.121 - EX-10.121 - Caliber Home Loans, Inc. | d103175dex10121.htm |

| EX-10.120 - EX-10.120 - Caliber Home Loans, Inc. | d103175dex10120.htm |

| EX-10.119 - EX-10.119 - Caliber Home Loans, Inc. | d103175dex10119.htm |

| EX-10.118 - EX-10.118 - Caliber Home Loans, Inc. | d103175dex10118.htm |

| EX-10.117 - EX-10.117 - Caliber Home Loans, Inc. | d103175dex10117.htm |

| EX-10.116 - EX-10.116 - Caliber Home Loans, Inc. | d103175dex10116.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 21, 2021

Registration No. 333-249240

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Caliber Home Loans, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6199 | 13-6131491 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1525 S Belt Line Rd.

Coppell, TX 75019

800-401-6587

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gregg Smallwood

Executive Vice President, General Counsel

Caliber Home Loans, Inc.

1525 S Belt Line Rd.

Coppell, TX 75019

800-401-6587

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey A. Chapman Peter W. Wardle Gibson, Dunn & Crutcher LLP 2001 Ross Avenue, Suite 2100 Dallas, TX 75201 (214) 698-3100 |

David S. Bakst Phyllis G. Korff |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated January 21, 2021

Shares

Caliber Home Loans, Inc.

Common Stock

This is an initial public offering of shares of common stock of Caliber Home Loans, Inc., a Delaware corporation.

The selling stockholder identified in this prospectus is offering all of the shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholder.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between and per share.

After completion of this offering, the selling stockholder will beneficially own approximately of the outstanding shares of our common stock. As a result, we will be a “controlled company” under the corporate governance listing standards of the New York Stock Exchange, or the NYSE, following the completion of this offering. See “Management—Controlled Company Exemption.”

Our common stock has been approved for listing on the NYSE under the symbol “HOMS.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 20 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholder |

$ | $ | ||||||

The selling stockholder has granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to an additional shares of our common stock at the initial public offering price, less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2021.

| Credit Suisse | Goldman Sachs & Co. LLC | Barclays |

| BofA Securities | Citigroup | UBS Investment Bank | Wells Fargo Securities |

| Deutsche Bank Securities | Keefe, Bruyette & Woods A Stifel Company |

Drexel Hamilton | ||

| Loop Capital Markets | R. Seelaus & Co., LLC | Tigress Financial Partners |

Prospectus dated , 2021.

Table of Contents

A Letter from Sanjiv Das CEO of Caliber Home Loans I believe in the American Dream. I left my native country of India more than 30 years ago to embark upon a journey that brought me to the United States. I knew that this country afforded opportunities to those who hoped for a more prosperous life. I began my career in financial services, and I bought a house as soon as I could afford one. Owning a home gave me a strong sense of belonging, a foundation upon which to build my life, and a feeling of optimism about my future. Now as an American and as the CEO of Caliber Home Loans, I’m committed to helping others achieve their dreams of homeownership. This mission is personal to me. Owning a home is a transformational experience. Home is a sanctuary. It’s a place to raise children, where families gather and friendships develop. It’s a launching pad for building wealth and nurturing future generations. Increasingly, our homes are also our offices and workplaces. For most families buying a home is the largest, most important and complex financial decision they will make. As leaders in the purchase loans market, we know that first-time home buyers don’t just want to push buttons on an app on their phone, they want personal advice from trusted loan consultants within their community. Caliber offers them a high-touch local presence, supported by our world-class technology platform. Our relationships with our customers begin the moment they express interest in purchasing a home, but we also stay with them throughout their ownership journey. Our loan consultants live in the same communities as their customers. They serve together on Parent Teacher Association boards and in the armed forces. Our loan consultants help their customers get into the right home and stay there, offering advice and highly tailored refinancing solutions. We don’t just measure our success by how many home loans we provide, but also by the positive impact we have on our customers and communities.

Table of Contents

We set out to build a different type of mortgage company, one that creates real and lasting value for our customers, shareholders, and stakeholders. We provide an outstanding customer experience, exercise disciplined financial management, and have delivered sustainable and significant returns while growing the Caliber franchise. We remain committed to generating substantial shareholder value by concentrating our efforts on maintaining our strength in purchase mortgages and focusing our efforts on improving efficiency and profitability. Our team is among the most experienced in the industry, successfully managing through various economic cycles while at some of the world’s top financial institutions. Our experience together has taught us how to manage risk and grow profitably in any environment. We have grown through a remarkable collaboration with our dedicated employees, valued customers, and wide range of partners. I would like to thank all of them for their trust, commitment, and loyalty. If you’re reading this letter, chances are that you’re doing so under your own roof. Like millions of Americans, perhaps you’re reevaluating your living and workspace. Maybe you’re thinking about enhancing your home office, buying a new place, or refinancing your existing mortgage. We’d be happy to help you with the process. I remember the exhilaration of holding the keys to my house for the first time. At Caliber Home Loans, we want to help our customers achieve that same feeling. To our new shareholders, welcome home. In Caliber, you have a partner who is deeply committed to our mission: helping customers achieve their dreams of homeownership by acting as a trusted partner along the way. Here is my commitment to you: We will serve our customers, work to generate value for our shareholders, improve the communities in which we live and operate, support and respect each other, and strive for excellence in all that we do. Thank you for being a part of our journey. Sanjiv Das

Table of Contents

CALIBER HOME LOANS

Table of Contents

We make the dream of homeownership a reality.

Table of Contents

#2 39% Largest independent mortgage originator by purchase volume since 2016 Origination volume CAGR from 2013 through 2019 550k+ 74% Servicing customers Refinance retention rate for first six months of 2020 45% $275mm Return on equity for first six months of 2020 Net income for first six months of 2020

Table of Contents

| Page | ||||

| 1 | ||||

| 20 | ||||

| 75 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

| 81 | ||||

| 83 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

85 | |||

| 113 | ||||

| 142 | ||||

| 150 | ||||

| 165 | ||||

| 167 | ||||

| 171 | ||||

| 177 | ||||

| CERTAIN U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

179 | |||

| 183 | ||||

| 190 | ||||

| 190 | ||||

| 190 | ||||

| F-1 | ||||

We have not, and the underwriters and the selling stockholder have not, authorized any other person to provide you with information different from that contained in this prospectus and any free writing prospectus authorized by us. We, the selling stockholder and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters and the selling stockholder are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

i

Table of Contents

GENERAL INFORMATION

Basis of Presentation

Unless otherwise indicated or the context otherwise requires, references in this prospectus to (i) the “Issuer” refers to Caliber Home Loans, Inc., a Delaware corporation, (ii) the “Company,” “we,” “us,” “our” and “Caliber” refer to the Issuer and its consolidated subsidiaries, (iii) “LSF Pickens” and the “selling stockholder” refer to LSF Pickens Holdings, LLC, the sole stockholder of the Issuer prior to the consummation of our initial public offering and the principal stockholder of the Issuer after the consummation of our initial public offering, (iv) “Lone Star” or the “Sponsor” refers to Lone Star Fund V (U.S.), L.P., Lone Star Fund VI (U.S.), L.P., and certain of their affiliates and (v) “Hudson” refers to Hudson Advisors L.P., and certain of its affiliates.

Unless as otherwise indicated, all market and operational data and measures are presented as of September 30, 2020.

All financial information presented in this prospectus is derived from our combined financial statements included elsewhere in this prospectus. All financial information presented in this prospectus has been prepared in U.S. dollars in accordance with generally accepted accounting principles in the United States of America, or GAAP, except for the non-GAAP measures described further in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures.”

Market and Industry Data

Certain market and industry data included in this prospectus have been obtained from third-party sources, including, among others, Inside Mortgage Finance, or IMF, Mortgage Bankers Association, or MBA, National Association of Realtors, or NAR, and J.D. Power and Associates, that we believe to be reliable. We have not compensated any third-party sources for the market and industry data included in this prospectus. Market estimates are calculated by using independent industry publications, government publications, reports by market research firms and third-party forecasts in conjunction with our assumptions about our markets. Some data are also based on our good faith estimates, which are derived from our review of internal surveys and from the independent sources listed above. We believe these estimates to be reasonable based on the information available to us as of the date of this prospectus. However, we have not independently verified such third-party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Forward-Looking Statements” and “Risk Factors” in this prospectus. We do not make any representations as to the accuracy of such market and industry data.

Trademarks

We own or have the rights to use various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsement or sponsorship by, us. Solely for convenience, the trademarks, service marks and trade names presented in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

ii

Table of Contents

The following is a summary of material information discussed in this prospectus. The summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including the risks discussed in the section entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the audited and unaudited financial statements and the related notes thereto, each included elsewhere in this prospectus, before making an investment decision to purchase shares of our common stock. Some of the statements in this summary constitute forward-looking statements. See “Forward-Looking Statements.”

Business Overview

| We are a proven leader in the U.S. mortgage market with a uniquely diversified, customer-centric, purchase-focused platform. We deliberately focus on the purchase market and are the second largest independent mortgage originator based on purchase volume since 2016, according to IMF. Guided by analytics and data, we have leveraged our robust platform to build impressive scale across our highly complementary channels. As a result, for the year ended December 31, 2019, we are the only player with a top 10 market position across all three channels tracked by IMF – retail, wholesale, and correspondent.

We were formed in 2013 when Lone Star combined separate origination and servicing investments to create a full-service mortgage platform, with an emphasis on the purchase market. Our high-touch Local Strategy has always been at the heart of what we do backed by our high-tech proprietary systems that help us efficiently meet the needs of our constituents. We believe this approach has earned us a reputation with realtors and brokers nationwide as a trusted partner that executes complex transactions and delivers certainty of closing quickly and reliably.

Leveraging our established Local Strategy and strength in the purchase market, we embarked on a journey four years ago to build out our Direct Strategy. Our Direct Strategy sits at the intersection of our strong position in purchase and our ongoing servicing relationships, driving new customer acquisitions and refinance opportunities. We choose to retain servicing on the vast majority of the mortgages we originate in order to meet the ongoing housing needs of our more than half a million customers and growing. |

|

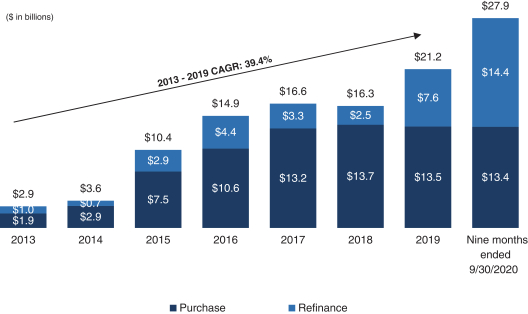

Our track-record of success in originating and servicing mortgages is supported by robust capabilities, spanning operations, technology, analytics, capital markets and risk management. These capabilities have enabled us to drive outsized growth and attractive financial results. Our origination volume has increased at a 39% compound annual growth rate, or CAGR, since 2013 to $61 billion for the year ended December 31, 2019, versus a 3% CAGR of the overall mortgage market. Our steady growth and market leadership has led to net income of $540 million and a return on equity of 56% for the nine months ended September 30, 2020.

1

Table of Contents

Go to Market Strategies

In the $2.2 trillion annual mortgage origination market as of December 31, 2019, there are two primary types of mortgage transactions: home purchase loans and refinance loans. Purchase loans generally represent the majority of mortgages. Purchasing a home is one of the most significant financial investments that most Americans will make in their lives. In order to navigate the personal and emotional process of purchasing a home, customers expect a trusted relationship and guidance throughout the process as well as confidence and certainty that their loan will close on time. Throughout the course of their homeownership journey, many look to their current lender first when there is an opportunity to refinance their loan. Refinance loans can also be transactional and are more dependent on pricing, and for some customers can be effectively delivered directly through a centralized, digitally-enabled capability.

| With this in mind, our go to market approach has two interconnected strategies: Local and Direct. Our Local Strategy, which includes our retail and wholesale channels, drives our purchase focus. Our Direct Strategy, which includes our direct-to-consumer, or DTC, and correspondent channels as well as our servicing platform, principally drives refinance activity and is an important component of our future growth. We execute our strategies and operate our channels in a fully-integrated manner allowing us to deftly deploy resources as opportunities evolve to deliver attractive and stable growth and risk-adjusted returns.

Our goal is to win in the purchase market every single day. Through our Local Strategy, we have become a preeminent purchase mortgage platform. Our strategic decision to focus on purchase loans stems from three critical aspects:

• Purchase loans are a source of stable growth – home purchases are geared to the fundamentals of household formation and are less susceptible to economic cycles. Purchase mortgages generally represent a higher share of the mortgage market, comprising approximately 54% of overall mortgage market origination volume on average since 1990 according to MBA. Purchase mortgage originations have grown in each of the last eight years. This underlying predictability brings stability to our platform, making our business less dependent on rate-driven refinance cycles. |

| |

|

• The scale of our local presence is difficult to replicate – we have a national footprint and we win at the local level, leveraging our brand and economies of scale. We believe the Caliber brand is stellar among our referral partners, including realtors and homebuilders, who have come to trust that we will deliver a predictable, timely and efficient mortgage process for the customers they introduce to us.

• Purchase loans start lifetime relationships with our customers – when we provide our customers with a best-in-class home purchase experience and maintain connectivity through servicing, we build long-lasting and loyal relationships throughout their entire homeownership journey. | ||

2

Table of Contents

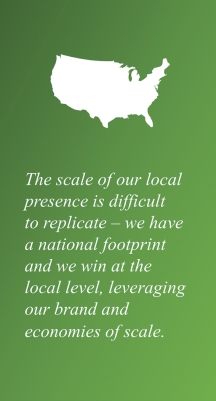

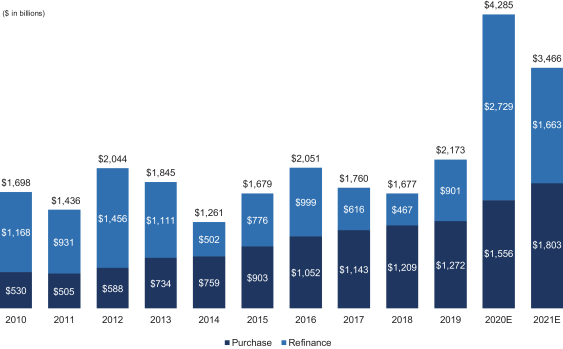

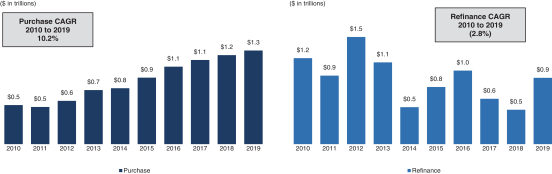

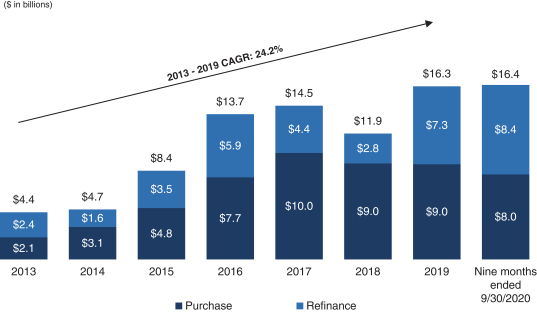

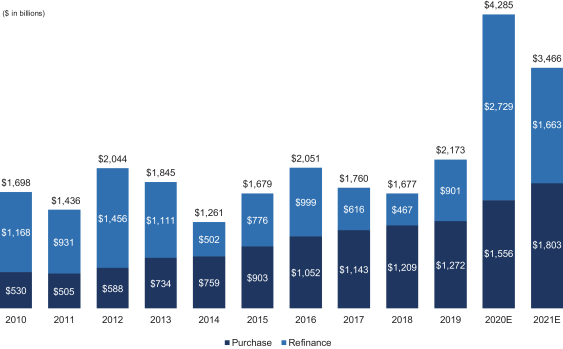

Mortgage Industry Historical Originations – Purchase and Refinance Volumes

| Source: | MBA. |

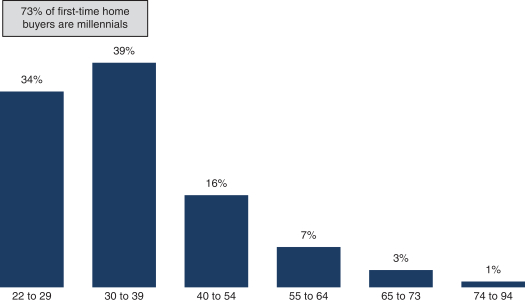

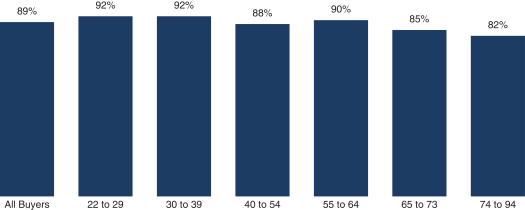

Our retail channel employs loan consultants across 46 states and 351 retail locations, including satellites. These loan consultants spend their time in their local communities at the point of sale building and deepening relationships with realtors, home builders and other referral sources. These referral relationships are integral to our success in the purchase mortgage market, as two-thirds of buyers typically rely on referrals when choosing a mortgage lender, according to a study conducted by STRATMOR Group in 2020. In addition, 92% of buyers aged 22 to 39 purchase a home through a real estate agent or broker, according to the 2020 NAR Home Buyer and Generational Trends survey.

Caliber loan consultants utilize our state-of-the-art platform with integrated technologies from loan origination through fulfillment to focus on driving loans to close. Loan consultants have dedicated local operational resources. In many cases, a loan consultant and processor sit next to each other, facilitating quick communications and a brisk operational tempo. This allows us to effectively solve complex purchase transactions.

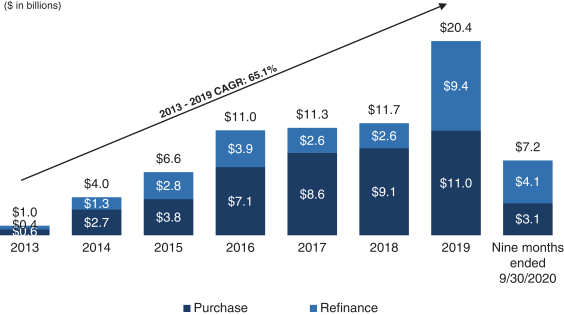

We drive further scale through our local network by partnering with wholesale brokers. We have built a highly profitable and scaled wholesale platform, making us one of the top three largest wholesale originators for the year ended December 31, 2019, according to IMF. Local loan brokers are able to leverage the full strength of our platform and reputation to offer their customers the best-in-class Caliber home purchase experience. We have also built a rapidly growing direct-to-broker, or DTB, centralized platform to expand our wholesale channel in markets where we do not currently have a local presence. Our DTB platform is highly scalable and efficient, leveraging the same centralized technology infrastructure (our proprietary H2O system) and data and analytics framework developed for our DTC channel.

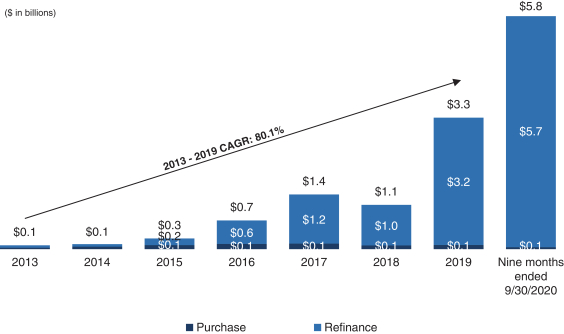

Our Direct Strategy sits at the intersection of our strong position in purchase and our ongoing servicing relationships with customers. We built our highly efficient and scalable DTC channel, and invested in predictive machine-learning based analytics, in order to optimize our customer lifetime value by providing customers with various financing options across their different life stages. Our DTC channel provides us with a cost-efficient method to refinance our existing customers. We also utilize our DTC platform to attract new customer acquisitions through advanced marketing techniques. Additionally, we opportunistically acquire high-quality customers via our correspondent channel, which we consider a valuable resource for generating future originations. Approximately 44% of our DTC volume was sourced from our correspondent channel for the year ended December 31, 2019.

We believe we are one of the few purchase-focused mortgage originators who retain customer relationships through ongoing servicing. By retaining mortgage servicing rights, we accumulate a wealth of information about

3

Table of Contents

the future financing needs of our more than half a million servicing customers. This allows us to maintain ongoing connectivity with our customers, which optimally positions us to serve their future home financing needs. Retaining mortgage servicing rights provides a significant competitive advantage to our loan consultants. Our ability to keep customers under the Caliber roof and notify our loan consultants of potential customer purchase and refinancing opportunities allows them to maintain and enhance their previously established relationships. The longer a loan consultant stays with Caliber, the larger their referral business continues to grow, serving as an effective loan consultant retention tool. In addition to the strategic benefits, our servicing portfolio generates attractive and predictable cash flows and enhances the value of our origination business. We operate an efficient servicing platform and our average per-loan servicing cost for the year ended December 31, 2019, was 28% below the industry average, according to the MBA Annual Performance Report 2020. We have taken a disciplined approach to managing our servicing portfolio through careful monitoring of relative size compared to our origination volume, allowing us to efficiently grow our platform while minimizing risk through utilizing a deliberate mortgage servicing right, or MSR, hedging strategy.

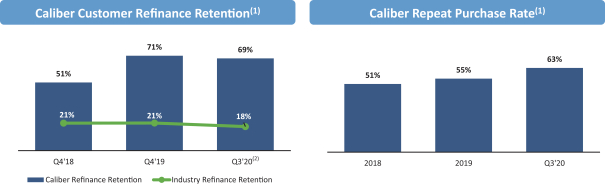

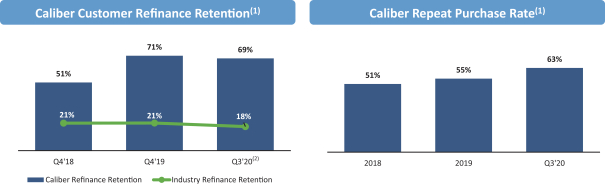

By providing our customers’ next purchase or refinance transaction, we generate attractive incremental cash margins, while extending the life of our servicing cash flows. The roll-out of our Direct Strategy has vaulted our customer refinancing retention rates to industry-leading levels. Refinancing retention rates for our retail and DTC operations have increased from 51% for the three months ended December 31, 2018 to 69% for the nine months ended September 30, 2020 compared to the industry average of 18% for the three months ended September 30, 2020. In addition to our strength in refinancing retention, we are also an industry leader in repeat purchase transactions and our local retail operations have consistently generated repeat purchases between 50% and 55% for the periods ended December 31, 2018, and December 31, 2019. Retail repeat purchases were 63% for the nine months ended September 30, 2020.

Source: Black Knight Mortgage Monitor.

| (1) | Defined as total unpaid principal balance, or UPB, of our customers that originate a mortgage with us divided by total UPB of the customers that paid off their existing mortgage and originated a new mortgage in the same period. Repeat purchase includes Retail owned loans and refinance retention includes Retail owned loans and DTC originated loans. Both metrics exclude customers to whom we did not actively market to for business reasons. |

| (2) | Industry refinance retention as of September 30, 2020. |

Our sophisticated analytics and predictive models drive customer insights, targeted marketing strategies and retention efforts across our channels. We leverage industry performance and wallet share data to identify and hire loan consultants and brokers who are most likely to succeed at Caliber.

4

Table of Contents

Transformative Technology and Investment in Platform

| Technology is at the center of everything we do, driving superior customer service, efficiencies, and regulatory compliance seamlessly from loan origination through servicing. We believe that our technology is what enables our high-touch approach to be efficient. This understanding led us to build H2O, our bespoke loan origination system, inspired by the actual people who use it – customers, loan consultants, processors, underwriters and funding support staff. H2O is a web-based, workflow-oriented solution that handles the entire loan application process, from application to funding, with robust mobile functionality, giving our customers and employees a nimble and powerful system at their fingertips.

Our loan origination system is highly scalable and built on a modern technology stack, which can flexibly be deployed across the entire business and has supported our origination volume increasing approximately five-fold over the five years ended December 31, 2019. Our technology allows us to maintain the integrity of calculations, services and data, through a micro-service enabled API layer and a single unified database.

Our servicing system is integrated with H2O and provides a quick and seamless process for on-boarding our loans from origination to servicing. This connectivity also helps us provide a seamless process for retention. We have a highly efficient workflow-driven servicing ecosystem which directs tasks and work to the right person at the right time in the process. Through automation, including Robotics Process Automation, we have been able to achieve efficiencies in our servicing operations and better serve our customers. |

|

We have made significant investments in our CRM platform to support loan originations through lead identification, prioritization, and marketing, as well as in our servicing system for superior customer retention.

Track Record of Successful Growth

Our retail presence was built through disciplined organic growth and a “buy and bolt-on” strategy which successfully expanded our footprint into new markets and gave us the critical mass in our large retail franchise. Our acquisition history includes Cobalt Mortgage in 2014, which significantly increased our presence in the Pacific Northwest. In 2016, we acquired First Priority Financial, a regional residential mortgage lender with locations and originators in California, Oregon, Washington, Idaho and Iowa to expand our base of operation in the Western states. We continued to build our presence in California and the Northwest when we acquired strategic locations from Banc Home Loans in 2017. We have a track record of seamlessly integrating these and other acquisitions, which collectively resulted in $8.3 billion in retail originations in 2019, representing 39% of our total originations in that channel.

Our growth strategy will continue to include a combination of organic investments, focused loan consultant recruiting and retention, and opportunistic M&A. Furthermore, we have incubated and scaled initiatives, such as our DTC channel where we dedicated incremental focus and resources starting in 2016 and have grown to more than $5.7 billion in originations for the nine months ended September 30, 2020.

5

Table of Contents

As a result, our origination volume has grown at an 18% CAGR since 2017, ascending from a new entrant in 2013 to the only originator in the top 10 in all three channels tracked by IMF – retail, wholesale, and correspondent. We have been able to realize this origination growth while staying focused on profitability, achieving 23 straight quarters of positive operating contribution through the third quarter of 2020. During the period from December 31, 2017 to September 30, 2020, our total indebtedness increased from $3.6 billion to $6.6 billion. For additional discussion on risks regarding our outstanding indebtedness please refer to “Risk Factors—Risks Related to Our Business—Our substantial indebtedness may limit our financial and operating activities and our ability to incur additional debt to fund future needs.”

| Our Brand and Market Position

We have built our reputation as a trusted partner among our referral network at the local level, and we believe our brand has become synonymous with consistently delivering certainty, speed and transparency in purchase transactions. While we are a nationwide player, we compete for purchase loans in local markets, where our reputation of closing on time with buyers, realtors, homebuilders and title agents is critical. As a result, our share of home purchases is significantly higher than some of the largest banks in many markets. Our origination stakeholders have come to appreciate and rely on our “high-touch, high-tech” approach to customer service, resulting in our Net Promoter Score of 96 for our retail loan consultants for the three months ended September 30, 2020. Our servicing staff is driven by the mission of home ownership. On average, our servicing staff leadership team has been with Caliber for more than 10 years and champions our gold standard customer service, which is a critical driver to retaining existing and attracting new customers.

Our Risk Management Framework

We built our robust risk management framework based on three types of controls: managing credit controls, operational and regulatory controls, and independent audit oversight. Our regulatory compliance function and full-time, in-house legal department serve as dedicated resources to strengthen our risk management framework. Our experienced management team sets the tone from the top. As a result, our emphasis on risk management is deeply embedded in every aspect of our organization and core to the fabric of our culture, spanning loan underwriting, capital markets execution, MSR hedging, compliance, financing and liquidity management. |

|

Market Opportunity

The Residential Mortgage Market is Very Large and Growing

The U.S. residential mortgage market is one of the largest markets in the world with approximately $11.0 trillion of debt outstanding as of September 30, 2020 according to the MBA. During 2019, there were $2.2 trillion of mortgages originated in the United States. The purchase mortgage market generated $1.3 trillion of annual originations in 2019 and grew at a 5.5% CAGR from 2017 through the year ended December 31, 2019. Purchase originations are expected to maintain approximately $1.5 trillion through 2021 according to Fannie Mae’s Housing Forecast. The refinance market generated between $0.5 and $0.9 trillion in annual originations for the three year period ended December 31, 2019 and is expected to reach $2.4 trillion in 2020 according to Fannie Mae’s Housing Forecast.

6

Table of Contents

U.S. Mortgage Originations

| Source: | MBA, Fannie Mae. |

| Note: | Historical period based on MBA data. Forecast period based on Fannie Mae Housing Forecast (December 2020). |

Purchase Mortgage Market is Stable

Purchase transactions typically make up the largest portion of the market, demonstrating secular growth and greater stability year-over-year. Home prices, as a key driver of purchase volumes, have steadily increased at 4% per year on average over the last 10 years according to the U.S. Census Bureau. According to the MBA, purchase originations have made up on average 62% of total residential mortgage originations since 2016. Purchase originations are expected to comprise 48% of origination volume in 2021 according to Fannie Mae’s Economic Forecast. Since 2010, purchase originations have grown by a 10% CAGR and declined in only one out of ten years, and now represent an approximately $1.3 trillion market as of December 31, 2019. Refinance originations represent an attractive market opportunity albeit with greater variability than purchase originations.

Secular Tailwinds Supporting Housing Growth

Population Demographics Driving Purchase Market Growth

More young people are buying homes. The younger demographic is driving increased homeownership rates in the U.S. According to the U.S. Census Bureau, homeownership rates for individuals who are less than 35 years old have increased 14.2% in the four year period ended September 30, 2020. Millennials in particular now account for 73% of first-time home purchases according to the 2020 NAR Home Buyer and Generational Trends survey. Furthermore, we believe trends in remote working, telecommuting and suburban / urban rebalancing will make homeownership ever more important and support the purchase mortgage market.

Low Rate Environment Boosts Attractiveness of Home Purchase vs. Renting

According to the Federal Reserve, the target level for the federal funds rate is expected to remain below 0.25% through 2022. With a lower rate environment, consumers are able to take out lower cost purchase loans

7

Table of Contents

increasing housing affordability. Despite the COVID-19 pandemic, purchase loan applications for September and October 2020 were up 29% and 13%, respectively, compared to the same periods in 2019. Caliber’s retail purchase loan applications for September and October 2020 were up 85% and 73%, respectively, compared to the same periods in 2019.

Higher Refinance Volumes in Low Interest Rate Environments

Lower interest rates tend to increase refinance volumes as consumers look to lower their borrowing costs. In a period with higher refinance volumes, platforms with the infrastructure to support these higher volumes can benefit from these elevated levels of originations without having to build out additional infrastructure. In these periods, scalable platforms are able to further differentiate as they can seamlessly handle the increased volumes. According to the Fannie Mae forecast, refinance volumes are expected to total $1.7 trillion in 2021, which is significantly above recent historical periods.

Realtors Continue to Play a Central Role in the Purchase Transactions, Especially for Millennials

While the majority of consumers have increasingly started their home search online, they continue to prefer to use a realtor when purchasing a home relative to digital or other online sources. According to the 2020 NAR Home Buyer and Generational Trends survey, buyers aged 22 to 39 represent the largest portion of first-time home purchasers. In addition, 92% of all buyers within that age range purchase homes through a real estate agent or broker. Buyers rely on realtors to help them understand the important and sometimes complex process of purchasing a home, with 90% of home buyers responding that they were ‘very satisfied’ with their realtor’s knowledge of the purchase process and 90% responding that they would likely use a realtor again or recommend using a realtor to others.

Strengths of the Business

Proven Customer-focused Local Playbook Designed to Dominate Purchase Loans

We believe our scaled local presence and customer-centric, tech-enabled platform provide a significant barrier to entry for new entrants. Our platform prioritizes purchase loan excellence which continues to be ingrained in our culture to ensure we deliver certainty to our customers. We built and aligned our operations and infrastructure to support our strong purchase originators. Our platform enables strong growth in purchase volume for our loan consultants and is a robust value proposition in attracting and retaining top loan consultant talent. As a result, approximately 42% of loan consultants who joined Caliber between 2017 and 2019 experienced at least an approximately 30% increase in purchase production in their first year and approximately two-thirds of those who have left since 2016 experienced a production decline in the following year. Even when expanding our footprint, we focus on recruiting loan consultants and brokers onto our platform based largely on their history of purchase success borne from durable referral relationships.

Diversified Channel Mix with Scaled Servicing

We have expanded our business model to operate at scale in the mortgage market across our Local (retail and wholesale) and Direct (DTC and correspondent) Strategies allowing us to allocate capital among our channels dynamically and optimally in the face of changing market environment.

Our platform affords us the agility to scale up and down depending on market conditions across all channels, without incurring significant additional overhead cost. As a result, we have been able to grow our overall originations from $40 billion in 2016 to $61 billion for the year ended December 31, 2019. This agility is also fundamental to our ability to deliver positive operating contribution in each of the last 23 quarters. Based on IMF we are the only mortgage company in the top 10 across retail, wholesale and correspondent originations, and have been the only such company since 2017.

8

Table of Contents

DTC allows us to take advantage of higher refinance volumes and increases the lifetime value of all our customers. This complements the underlying stability of our purchase franchise while offering customers a range of financing options throughout their homeownership journey at a low marginal cost to us.

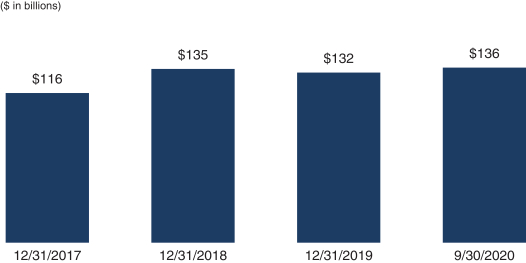

Our scaled servicing book serves as an attractive pipeline for DTC retention: our refinance retention rate of 69% for the nine months ended September 30, 2020, combined with our servicing portfolio of $136 billion of UPB as of September 30, 2020, provides a strong pipeline for future retention opportunities. We are able to monitor and enrich our understanding of our servicing customers to feed our sophisticated propensity to refinance models and route these leads to the loan consultant with the credentials and expertise to handle each transaction.

We Have a Customer-centric Culture

We have a customer-first approach that is focused on building and retaining customer relationships. Everything we do is based on the belief that our customers come first. We begin to prove this commitment by helping customers buy a home, recognizing the importance of this achievement. Throughout their homeownership journey, we make sure we are providing them the best financing options available as well as exploring every alternative to keep customers in their home even during times of financial stress. We maintain that focus on our customers by providing top-tier service and closely monitoring our customer needs. Through it all, we help our customers buy and stay in the home of their dreams. Each year, we help over 150,000 customers buy their home and maintain connections with over half a million customers through our servicing platform.

We Leverage our Technology to Provide Customers and Partners with a Best-in-class Experience

We utilize our proprietary technology platform to enable digitized fulfillment operations, drive margin improvement, and provide customers and partners with a best-in-class experience. We have streamlined processes and increased automation, which provides loan consultants access to customer information and marketing opportunities real-time, while also granting them the ability to further focus on customer engagement, relationship building and expanding their network.

We believe we have amongst the most efficient retail fulfillment capabilities in the industry. Monthly retail loans per fulfillment employee at Caliber were 7.2 in 2019, 41% higher than the industry average, according to MBA. Our technology investments in digitization and automation will continue to drive margin expansion across the fulfillment process.

We have a highly interactive online servicing portal and mobile application, with 62% of our servicing customers connecting with us digitally. We pair this with best-in-class CRM technology to ensure we are able to proactively reach our customers when better financing alternatives are available to them. We are able to leverage these interactions to deliver valuable opportunities to customers at low-cost while providing us with attractive risk-adjusted returns.

Sophisticated Management Team Sourced from the World’s Leading Financial Companies

To achieve our goals of growth and profitability, we began enhancing our executive management team in 2016 with members that previously held leadership roles at some of the largest mortgage businesses nationwide, including nationally regulated banks. We believe our executive management team has unparalleled leadership experience and expertise across every aspect of the mortgage business, including origination, servicing, technology, capital markets, fixed income and risk management spanning a variety of market environments.

Our executive management team’s experience at global organizations prepared us to run an interconnected, multi-channel originator and servicer. Our executive management team is uniquely qualified to navigate the complexities inherent in the cash flow, liquidity, balance sheet, risk and operational intricacies of our business

9

Table of Contents

model while delivering the highest possible risk-adjusted returns. Over the last few years, the Caliber executive management team has consistently executed on their vision to build what they see as a best-in-class mortgage company.

We Have a Culture of Risk Management

We built our robust risk management framework based on three levels of controls: managing credit controls, operational and regulatory controls, and independent audit oversight. Regulatory compliance functions and our full-time, in-house legal department serve as dedicated resources to strengthen our risk management framework.

Our experienced management team sets the tone from the top. Our emphasis on risk management is deeply embedded in every aspect of our organization and core to the fabric of our culture, spanning loan underwriting, capital markets execution, MSR hedging, compliance, financing and liquidity management. Our management of operational and credit risk results in high-quality production with lower delinquency. Even in the midst of the COVID-19 pandemic our 90+ day delinquency rate on our originated loan population was 3.6% as of September 30, 2020, which is below the industry average of 4.8% for the same period, according to the MBA. As of September 30, 2020, our loans in forbearance totaled 4.6%, which is below the industry average of 6.3% reported on October 4, 2020, according to the MBA. Our executive management team focuses intently on liquidity management and MSR hedging, allowing us to protect our franchise earnings comprehensively. We believe our superior capital markets and risk management practices differentiate us from most of our independent mortgage competitors in four fundamental ways: an all-in lower cost of capital, lower absolute leverage levels, longer-dated funding facilities and operational and financial hedging of our servicing assets.

| Attractive Financial Model with High Risk-adjusted Returns

Our financial model is a proven generator of attractive gain on sale margins, returns and stable growth. Our strong gain on sale margins is paired with steady servicing cash flows. Our steady growth and market leadership has led to a cumulative net income since the beginning of 2016 through the third quarter of 2020 of $934 million and a net income of $540 million and a return on equity of 56% for the nine months ended September 30, 2020.

Growth Strategies

Direct Strategy Continues to Focus on Retaining Existing Servicing Customer Relationships

Our DTC channel has exhibited strong growth with a 102% originations CAGR over the four years ended September 30, 2020. We continue to focus on this strategy by pursuing refinance opportunities through our existing servicing relationships. Our current servicing portfolio of over half a million customers allows us to offer additional financing opportunities along our customer’s homeownership journey. We expect our technology investments in automation as well as our continued improvements in predictive modeling to drive incremental volume through our DTC channel. Our growth in DTC has contributed to our ability to efficiently retain our customers approximately 70% of the time when they choose to refinance. |

|

10

Table of Contents

Provide Incremental Growth for our Direct Strategy by Focusing on New Customer Acquisition in our DTC and Correspondent Channels

In our DTC channel, we are focused on acquiring new customers through targeted marketing campaigns and digital leads. Through the use of data analytics, we are able to identify high value marketing opportunities for new customer acquisitions. We continue to grow new customer acquisitions in DTC, with DTC originations increasing 180% year-over-year for the nine months ended September 30, 2020. We will prudently grow correspondent originations in the markets where the unit economics are attractive and where we see higher potential for future refinancing opportunities. Our correspondent channel provides us with opportunistic customer acquisitions that have the potential to drive future refinance volumes through our DTC channel.

Expand our Reach in the Local Strategy with Continued Investment in Direct-to-Broker within the Wholesale Channel

The wholesale market has had the fastest growing originations in the mortgage industry, growing at a CAGR of 18% over the four years ended December 31, 2019, according to IMF. This increase has largely been driven by the introduction of technology and digitization to independent mortgage brokers. Recognizing the power of our centralized platform and integrated technology, we invested in the development of our DTB platform to capitalize on this trend. While we believe our existing platform will allow us to continue our momentum in wholesale, DTB will accelerate growth of our wholesale channel by tapping into the fastest growing segment of the market – small to mid-sized brokers – and by allowing us to enter new geographies. Our DTB technology is an extension of our proprietary H2O system, allowing us to provide the same seamless and state-of-the-art experience that our wholesale brokers, customers and loan consultants enjoy.

Continuing our Investment in Centralized Operations to Improve our End-to-end Loan Fulfillment Processes

Our investments to date in process efficiencies and automation have allowed us to drive down our cost per loan by providing incremental operating leverage in our business. Our enhanced centralized operations specifically provides increased scale and cost efficiency for both DTC and wholesale. Our investment focuses on artificial intelligence, machine learning and advanced analytics to digitize and automate the ingestion of borrower information and create specific recommendations to improve the loan fulfillment process.

Build Upon our Local Strategy Continuing to Organically Recruit Industry-leading Loan Consultants

In our retail channel, our primary focus is recruiting new loan consultants that have demonstrated purchase production and relationships with builders, realtors and other referral sources. To enable continued growth to our Local Strategy, we leverage industry performance and wallet share data to identify and hire loan consultants and attract brokers who are most likely to succeed with Caliber. We provide them with a strong platform so they can grow their production and deliver for their referral partners. We rely on the loan consultants to build relationships with the referral partners and our role is to deliver on their commitment and close the purchase on time and provide the customer with a remarkable experience.

Focused M&A Strategy

We have historically successfully pursued M&A as a means to enhance our franchise and drive further growth. Our inorganic growth strategy prioritizes strengthening relationships in our existing markets and

11

Table of Contents

expanding our footprint by attracting high quality loan consultants. Since 2014, we have made six acquisitions that have contributed to our growth and ability to achieve economies of scale across a national footprint. We have a track record of seamlessly integrating these platforms including loan consultants and their existing referral relationships, which has resulted in $8.3 billion in retail channel originations in 2019, representing 39% of our total originations in that channel. We plan to continue to be active acquirers whenever quality opportunities arise at reasonable valuations to further enhance our platform.

Recent Developments

COVID-19 Pandemic

Business Operations and Liquidity

We continue to closely monitor the impact of the COVID-19 pandemic on our business. Our origination volume is impacted by broader residential real estate market conditions and the general economy. Housing affordability, availability and general economic conditions influence the demand for our products. Housing affordability and availability are impacted by mortgage interest rates, availability of funds to finance purchases, availability of alternative investment products and relative relationship of supply and demand. General economic conditions are impacted by unemployment rates, changes in real wages, inflation, consumer confidence and the overall economic environment and, since March 2020, have been significantly impacted by the COVID-19 pandemic.

As part of the federal response to the COVID-19 pandemic, the CARES Act was adopted. The CARES Act mandates that all mortgagors with federally-backed mortgages be allowed mortgage forbearance for up to 12 months in two-180 day forbearance periods. The 90+ day delinquency rate on our Agency and GNMA servicing portfolio was 0.5% as of February 28, 2020, and increased to 3.6% as of September 30, 2020. The increased delinquency rate may require us to make advances of principal, interest, property taxes, insurance, and other expenses to protect investor’s interests in the properties securing the loans. The increased advances, lower servicing fee revenue, and increased servicing costs related to our increase in delinquencies may impact our cash position. The servicing fee revenue that is collected under our servicing agreements is generally earned upon collections of payments from borrowers or investors. While we do not collect servicing fee revenue for loans in forbearance during the CARES Act forbearance period, we do collect servicing fee revenue on prepayments on loans serviced.

As of September 30, 2020, approximately 4.2% of the loans in our Agency and GNMA servicing portfolio had elected the forbearance option compared to the industry average of 6.8%, as reported by the MBA. Of the 4.2% of the loans in our Agency and GNMA servicing portfolio that had elected forbearance as of September 30, 2020, approximately 10.9% remained current on their September payments. Our executive management team focuses intently on liquidity management and MSR hedging, allowing us to protect our franchise earnings comprehensively. We believe our superior capital markets and risk management practices differentiate us from most of our independent mortgage competitors in four fundamental ways: an all-in lower cost of capital, lower absolute leverage levels, longer-dated funding facilities and operational and financial hedging of our servicing assets.

Remote Work and Employee Safety

Prior to the COVID-19 pandemic, we had a distributed workforce and, accordingly, some of our employees leveraged a work-from-home model. In March, we transitioned to a remote working environment for 98% of our team members. We plan to offer a flexible model that blends both in-office and remote work when it is safe for our employees to return to the office, and we expect that more of our team members will continue to work

12

Table of Contents

remotely going forward. To date, we have not reopened any of our offices. However, when we do reopen our offices, we expect to put into place safety measures and protocols to protect employees and prevent the risk of infection.

Dividend Payments to Lone Star

On September 30, 2020, we paid a dividend of $150 million in cash to LSF6 Service Operations, LLC. On October 20, 2020, we paid an additional dividend of $150 million in cash to LSF Pickens. We paid an additional dividend of $50 million in cash to LSF Pickens on December 21, 2020. See “Capitalization.”

Reorganization

Prior to October 19, 2020, all of our outstanding equity interests were held directly by LSF6 Service Operations, LLC, or LSF6 Service Operations, a wholly-owned subsidiary of LSF6 Mid-Servicer Holdings, LLC, or LSF6 Mid-Servicer. LSF6 Mid-Servicer is a wholly-owned subsidiary of LSF Pickens, an affiliate of Lone Star. On October 19, 2020, we, LSF6 Service Operations, LSF6 Mid-Servicer and LSF Pickens underwent a restructuring transaction in order to remove LSF6 Service Operations from the Caliber structure and to subsequently combine LSF6 Mid Servicer with Caliber.

In order to effect the restructuring transaction, the following steps were taken in the order set forth below:

| • | LSF6 Service Operations filed an election with the Internal Revenue Service to be classified as an entity that is disregarded as separate from its owner for U.S. federal income tax purposes; |

| • | LSF6 Service Operations distributed all of the outstanding equity interests of Caliber to LSF6 Mid-Servicer; |

| • | LSF6 Mid-Servicer distributed all of the outstanding equity interests of LSF6 Service Operations to LSF Pickens; |

| • | LSF Pickens distributed all of the outstanding equity interests of LSF6 Service Operations to an entity affiliated with Lone Star; and |

| • | LSF6 Mid-Servicer merged with and into Caliber, with Caliber as the surviving entity, and LSF Pickens received an aggregate of 119,172,000 shares of our common stock, representing 100% of our outstanding shares prior to this offering. |

Following the distribution described in the second bullet above, LSF6 Service Operations does not hold any assets related to Caliber’s business.

Following the completion of the foregoing restructuring transactions, on October 20, 2020, we paid a cash dividend of $150 million to LSF Pickens. On December 21, 2020, we paid an additional cash dividend of $50 million to LSF Pickens.

13

Table of Contents

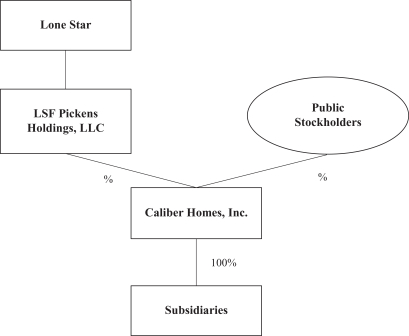

Upon the completion of this offering, Lone Star will own approximately % of our outstanding common stock, or approximately % if the underwriters exercise their option to purchase additional shares in full. See "Dilution" and "Principal and Selling Stockholder." The diagram below depicts our organizational structure immediately following this offering, assuming no exercise of the underwriters’ option to purchase additional shares. This diagram is provided for illustrative purposes only and does not purport to represent all legal entities within our organizational structure:

| Note: | Percentage ownership in the diagram above assumes completion of this offering, but no exercise of the underwriters’ option to purchase additional shares in this offering. |

Our Sponsor

Lone Star is part of a group of private equity funds organized and advised by Lone Star Global Acquisition, Ltd. Lone Star Global Acquisitions, Ltd. is a leading private equity firm that, since the establishment of its first fund in 1995, has organized 20 private equity funds with aggregate capital commitments totaling over $85.0 billion. The funds are structured as closed-end, private-equity limited partnerships, the limited partners of which include corporate and public pension funds, sovereign wealth funds, university endowments, foundations, funds of funds and high net worth individuals. Immediately prior to this offering, Lone Star owned all of our outstanding common stock, and will continue to own more than 50% of our outstanding common stock immediately following consummation of this offering, as described in greater detail above. Therefore, we expect to be a “controlled company” under the applicable stock exchange corporate governance standards and will take advantage of the related corporate governance exceptions for controlled companies. See “Management—Controlled Company Exemption.”

14

Table of Contents

Transactions with Lone Star

From time to time, we have entered into various transactions and agreements with Lone Star. Certain mortgage loans originated by us that generally do not meet the requirements of agency, government, or private label non-agency prime jumbo guidelines are sold by us to Lone Star. We retained the MSRs on the mortgage loans we sold to Lone Star prior to March 5, 2019. Lone Star subsequently securitizes the loans it purchases from us and other unaffiliated third parties under Lone Star’s COLT securitization program, or the COLT Securitizations, and we currently serve as the servicer for certain of the loans that Lone Star has securitized under the COLT Securitizations.

In addition to mortgage loans that it securitizes under the COLT Securitizations, Lone Star securitizes certain mortgage loans under its VOLT securitization program, or the VOLT Securitizations. The VOLT Securitizations are comprised of reperforming mortgage loans, or RPLs, non-performing mortgage loans, or NPLs, and real estate owned properties, or REOs, that Lone Star has acquired from third-party originators other than us.

Certain Lone Star entities own all intellectual property and other rights with respect to the VOLT, COLT, and associated names and such entities anticipate continuing to issue securitizations under both the COLT and VOLT monikers following this offering. We have no intellectual property or other rights with respect to the VOLT, COLT, and associated names.

In addition to the servicing agreements entered into for the COLT and VOLT securitizations, we have entered into a series of agreements with Lone Star pursuant to which we have agreed to follow certain servicing guidelines provided by Lone Star with respect to loans owned by Lone Star (as such guidelines may be updated by Lone Star from time to time), provide reporting and analysis on Lone Star assets and agree to certain servicing protocols in connection with acquisitions of mortgage loans by Lone Star for which we act as servicer.

We have also entered into one or more service agreements with Hudson Homes Management LLC, or HHM, a subsidiary of Hudson, and Lone Star to assist HHM in reporting and remittance requirements for the Lone Star securitizations and to provide HHM with certain administrative services.

Furthermore, LSF6 Mid-Servicer Holdings, LLC, or LSF6 Mid-Servicer, the indirect owner of Caliber prior to the restructuring transaction described under “—Reorganization,” and Hudson, or the Manager, a related party of Lone Star, are parties to an Asset Advisory Agreement, as amended, pursuant to which the Manager provides certain asset management services with respect to LSF6 Mid-Servicer, its subsidiaries (including Caliber), and certain of their respective assets. We expect to terminate the Asset Advisory Agreement in connection with the consummation of the offering.

See the section entitled “Certain Relationships and Related Party Transactions” for more information regarding the agreements and transactions with Lone Star.

Summary of Risks Associated with Our Business

Investing in our common stock involves significant risks. You should carefully consider all of the information set forth in this prospectus and, in particular, the information in the section entitled “Risk Factors” beginning on page 20 of this prospectus before making a decision to invest in our common stock. If we are unable to successfully address these risks and challenges, our business, financial condition, results of operations or prospects could be materially and adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. Below is a summary of some of the risks we face.

| • | the unique challenges posed to our business by the COVID-19 pandemic and the impact of the pandemic on our origination of mortgages, our servicing operations, our liquidity and our employees; |

15

Table of Contents

| • | changes in Ginnie Mae, Fannie Mae and Freddie Mac or the federal and state government agencies on which our business is dependent; |

| • | our dependence on macroeconomic and U.S. residential real estate market conditions; |

| • | changes in prevailing interest rates or U.S. monetary policies that affect interest rates; |

| • | our ability to sell loans in the secondary market to investors and to Freddie Mac and Fannie Mae and to securitize our loans into MBS through these GSEs and Ginnie Mae; |

| • | our reliance on our warehouse lines of credit, servicing advance facilities and mortgage servicing rights and MSR facilities to fund mortgage originations, make required servicing advances and otherwise operate our business; |

| • | disruptions in the secondary home loan market, including the MBS market, or changes in the markets in which we operate; |

| • | the success of our hedging strategies in mitigating risks associated with changes in interest rates; |

| • | technology disruptions or failures, including a failure in our operational or security systems or infrastructure; |

| • | cyberattacks and other data and security breaches; |

| • | our ability to comply with complex and continuously changing laws and regulations applicable to our business, and to avoid potentially severe sanctions for non-compliance; |

| • | our ability to maintain or grow our servicing business; |

| • | intense competition in the markets we serve; |

| • | failure to accurately predict the demand or growth of new financial products and services that we are developing; and |

| • | our relationship with Lone Star and its significant ownership of our common stock. |

Corporate Information

We were incorporated under the laws of the state of Delaware, in 1963. Our principal executive offices are located at 1525 S Belt Line Rd. Coppell, Texas 75019 and our telephone number is 800-401-6587. Our website address is www.caliberhomeloans.com. Information contained on our website or linked therein or otherwise connected thereto does not constitute part of nor is it incorporated by reference into this prospectus or the registration statement of which this prospectus forms a part.

16

Table of Contents

THE OFFERING

| Issuer |

Caliber Home Loans, Inc. |

| Selling stockholder |

LSF Pickens Holdings, LLC |

| Common stock offered by the selling stockholder |

shares |

| Option to purchase additional shares from the selling stockholder |

shares |

| Common stock outstanding |

119,172,000 shares |

| Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling stockholder in this offering. See “Use of Proceeds,” “Principal and Selling Stockholder” and “Underwriting.” |

| Principal stockholder |

Upon completion of this offering, LSF Pickens will control a majority of our outstanding common stock. Accordingly, we expect to qualify as a “controlled company” within the meaning of NYSE corporate governance standards. See “Management—Controlled Company Exemption.” |

| Dividend policy |

We have no present intention to pay cash dividends on our common stock. Any determination to pay dividends to holders of our common stock will be at the discretion of our board of directors and will depend upon many factors, including our financial condition, results of operations, projections, liquidity, earnings, legal requirements, restrictions in our debt agreements and other factors that our board of directors deems relevant. See “Dividend Policy.” |

| Risk factors |

You should carefully read and consider the information set forth in the section entitled “Risk Factors” beginning on page 20, together with all of the other information set forth in this prospectus, before deciding whether to invest in our common stock. |

| Symbol |

“HOMS.” |

The number of shares of our common stock outstanding immediately after this offering as set forth above is based on 119,172,000 shares of common stock outstanding following the restructuring transactions completed on October 19, 2020 and excludes 2,300,000 shares reserved for issuance under our 2020 Stock Incentive Plan (of which restricted stock units will be granted immediately prior to the effectiveness of this registration statement (based on an initial offering price of $ per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus)).

Unless we indicate otherwise, all information in this prospectus assumes (i) that the underwriters do not exercise their option to purchase up to additional shares from the selling stockholder and (ii) an initial public offering price of $ per share (the midpoint of the estimated public offering price range set forth on the cover page of this prospectus).

17

Table of Contents

SUMMARY HISTORICAL COMBINED FINANCIAL INFORMATION

The following tables set forth, for the periods and dates indicated, certain summary historical and unaudited combined financial information. The accompanying historical financial information of the Company is derived from the audited and unaudited financial statements for the periods presented, included elsewhere in this prospectus.

The summary combined financial data as of December 31, 2019 and 2018 and for each of the three fiscal years in the period ended December 31, 2019 have been derived from our audited combined financial statements included elsewhere in this prospectus. The summary combined interim financial data presented below as of September 30, 2020 and for the nine months ended September 30, 2020 and 2019 have been derived from our unaudited condensed combined financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of future results, and the results for any interim period are not necessarily indicative of the results that may be expected for a full year. You should read the information set forth below together with “Capitalization,” “Selected Historical Combined Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the combined financial statements and the related notes thereto included elsewhere in this prospectus.

| Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||

| ($ in thousands) | 2020 | 2019 | 2019 | 2018 | 2017 | |||||||||||||||

| Combined Statement of Operations Data: |

|

|||||||||||||||||||

| Revenues |

||||||||||||||||||||

| Gain on sale, net |

$ | 1,902,373 | $ | 768,574 | $ | 1,093,233 | $ | 725,802 | $ | 840,486 | ||||||||||

| Fee income |

163,114 | 111,273 | 164,734 | 133,583 | 139,158 | |||||||||||||||

| Servicing fees, net |

379,379 | 366,709 | 490,073 | 485,514 | 479,499 | |||||||||||||||

| Change in fair value of mortgage servicing rights |

(464,291 | ) | (451,164 | ) | (565,640 | ) | (110,086 | ) | (246,859 | ) | ||||||||||

| Other income |

14,074 | 10,334 | 12,377 | 4,266 | 3,185 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

1,994,649 | 805,726 | 1,194,777 | 1,239,079 | 1,215,469 | |||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Compensation and benefits |

974,783 | 597,161 | 836,688 | 729,937 | 804,001 | |||||||||||||||

| Occupancy and equipment |

35,591 | 34,598 | 46,894 | 57,585 | 54,262 | |||||||||||||||

| General and administrative |

259,696 | 175,361 | 258,031 | 211,916 | 219,594 | |||||||||||||||

| Depreciation and amortization |

23,518 | 24,386 | 31,921 | 29,763 | 20,639 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

1,293,588 | 831,506 | 1,173,534 | 1,029,201 | 1,098,496 | |||||||||||||||

| Income (Loss) from operations |

701,061 | (25,780 | ) | 21,243 | 209,878 | 116,973 | ||||||||||||||

| Other income (expense) |

||||||||||||||||||||

| Interest income |

142,750 | 141,345 | 207,452 | 148,772 | 109,862 | |||||||||||||||

| Interest expense |

(126,408 | ) | (140,543 | ) | (199,944 | ) | (173,949 | ) | (145,318 | ) | ||||||||||

| Loss on extinguishment of debt |

(74 | ) | (519 | ) | (519 | ) | (8,454 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other (expense), net |

16,268 | 283 | 6,989 | (33,631 | ) | (35,456 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) before taxes |

717,329 | (25,497 | ) | 28,232 | 176,247 | 81,517 | ||||||||||||||

| Income tax benefit (expense) |

(176,884 | ) | 6,033 | (6,605 | ) | (47,208 | ) | 18,517 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

540,445 | (19,464 | ) | $ | 21,627 | $ | 129,039 | $ | 100,034 | |||||||||||

| Other Comprehensive income (loss) |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Comprehensive income (loss) |

$ | 540,445 | $ | (19,464 | ) | $ | 21,627 | $ | 129,039 | $ | 100,034 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

18

Table of Contents

| As of September 30, | As of December 31, | |||||||||||||||||||

| ($ in thousands) | 2020 | 2019 | 2019 | 2018 | 2017 | |||||||||||||||

| Combined Balance Sheet Data: |

||||||||||||||||||||

| Assets |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 493,642 | $ | 93,556 | $ | 90,739 | $ | 113,704 | $ | 111,148 | ||||||||||

| Restricted cash |

30,407 | 38,862 | 49,200 | 31,644 | 25,292 | |||||||||||||||

| Servicing advances, net |

96,213 | 78,829 | 119,630 | 231,377 | 238,113 | |||||||||||||||

| Mortgage loans held for sale, at fair value |

6,300,252 | 5,411,188 | 6,639,122 | 2,615,102 | 2,902,248 | |||||||||||||||

| Mortgage servicing rights, at fair value |

1,217,669 | 1,547,451 | 1,743,570 | 1,744,687 | 1,296,750 | |||||||||||||||

| Property and equipment, net |

71,819 | 69,007 | 67,352 | 85,747 | 76,753 | |||||||||||||||

| Loans eligible for repurchase from GNMA |

1,918,166 | 228,900 | 194,554 | 418,102 | 314,737 | |||||||||||||||

| Prepaid expenses and other assets |

723,846 | 596,421 | 374,947 | 281,830 | 188,859 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 10,852,014 | $ | 8,064,214 | $ | 9,279,114 | $ | 5,522,193 | $ | 5,153,900 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Liabilities and stockholder’s equity |

||||||||||||||||||||

| Accounts payable and accrued expenses |

$ | 346,432 | $ | 214,516 | $ | 234,038 | $ | 157,506 | $ | 175,897 | ||||||||||

| Servicer advance facilities, net |

42,792 | 8,703 | 46,060 | 83,297 | 100,938 | |||||||||||||||

| Warehouse credit facilities, net |

5,803,688 | 5,314,533 | 6,316,133 | 2,443,255 | 2,692,678 | |||||||||||||||

| Secured term loan, net |

— | — | — | — | 760,618 | |||||||||||||||

| MSR financing facilities, net |

789,754 | 925,732 | 1,071,224 | 1,083,288 | — | |||||||||||||||

| Liability for loans eligible for repurchase from GNMA |

1,918,166 | 228,900 | 194,554 | 418,102 | 314,737 | |||||||||||||||

| Other liabilities |

472,297 | 330,721 | 331,829 | 282,117 | 193,102 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

9,373,129 | 7,023,105 | $ | 8,193,838 | $ | 4,467,565 | $ | 4,237,970 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Stockholder’s equity |

||||||||||||||||||||

| Preferred stock – 15,000,000 shares authorized, no shares issued and outstanding, $0.0001 par value |

— | — | — | — | — | |||||||||||||||

| Common stock – 485,000,000 shares authorized, 119,172,000 shares issued and outstanding, $0.0001 par value |

12 | 12 | 12 | 12 | 12 | |||||||||||||||

| Additional paid-in capital |

659,505 | 653,264 | 656,341 | 647,320 | 637,661 | |||||||||||||||