Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HALOZYME THERAPEUTICS, INC. | halo-20210113.htm |

39th Annual J.P. Morgan Healthcare Conference Dr. Helen Torley, President and CEO January 13, 2021 1

Forward-Looking Statements In addition to historical information, the statements set forth in this presentation include forward-looking statements including, without limitation, statements concerning the Company’s expected future financial performance (including the Company’s financial outlook for 2021) and expectations for profitability, revenue, free cash flow, expenses and earnings-per-share and the Company’s plans to continue its share repurchase program and to potentially expand its platform through acquisitions. Forward-looking statements regarding the Company’s ENHANZE® drug delivery technology may include the possible activity, benefits and attributes of ENHANZE®, the possible method of action of ENHANZE ®, its potential application to aid in the dispersion and absorption of other injected therapeutic drugs and facilitating more rapid delivery of injectable medications through subcutaneous delivery, lowering the treatment burden for patients and health care system costs. Forward-looking statements regarding the Company's ENHANZE ® business may include potential growth driven by our partners' development and commercialization efforts (including expected approval and product launch of ENHANZE ® products), projections for future sales revenue of our collaborators’ products, potential new ENHANZE ® collaborations, collaborative targets and co- formulation intellectual property, and regulatory review and potential approvals of new ENHANZE ® products. These forward-looking statements are typically, but not always, identified through use of the words “believe,” “enable,” “may,” “will,” “could,” “intends,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “potential,” “possible,” “should,” “continue,” and other words of similar meaning and involve risk and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Actual results could differ materially from the expectations contained in these forward-looking statements as a result of several factors, including unexpected levels of revenues (including royalty and milestone revenue received from our collaboration partners), expenditures and costs, unexpected delays in the execution of the Company’s share repurchase program or platform expansion, unexpected results or delays in the growth of the Company’s ENHANZE ® business, obtaining new co-formulation intellectual property, or in the development, regulatory review or commercialization of ENHANZE ® products, including any potential delays caused by the current COVID-19 global pandemic, regulatory approval requirements, unexpected adverse events or patient outcomes and competitive conditions. These and other factors that may result in differences are discussed in greater detail in the Company’s most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission.

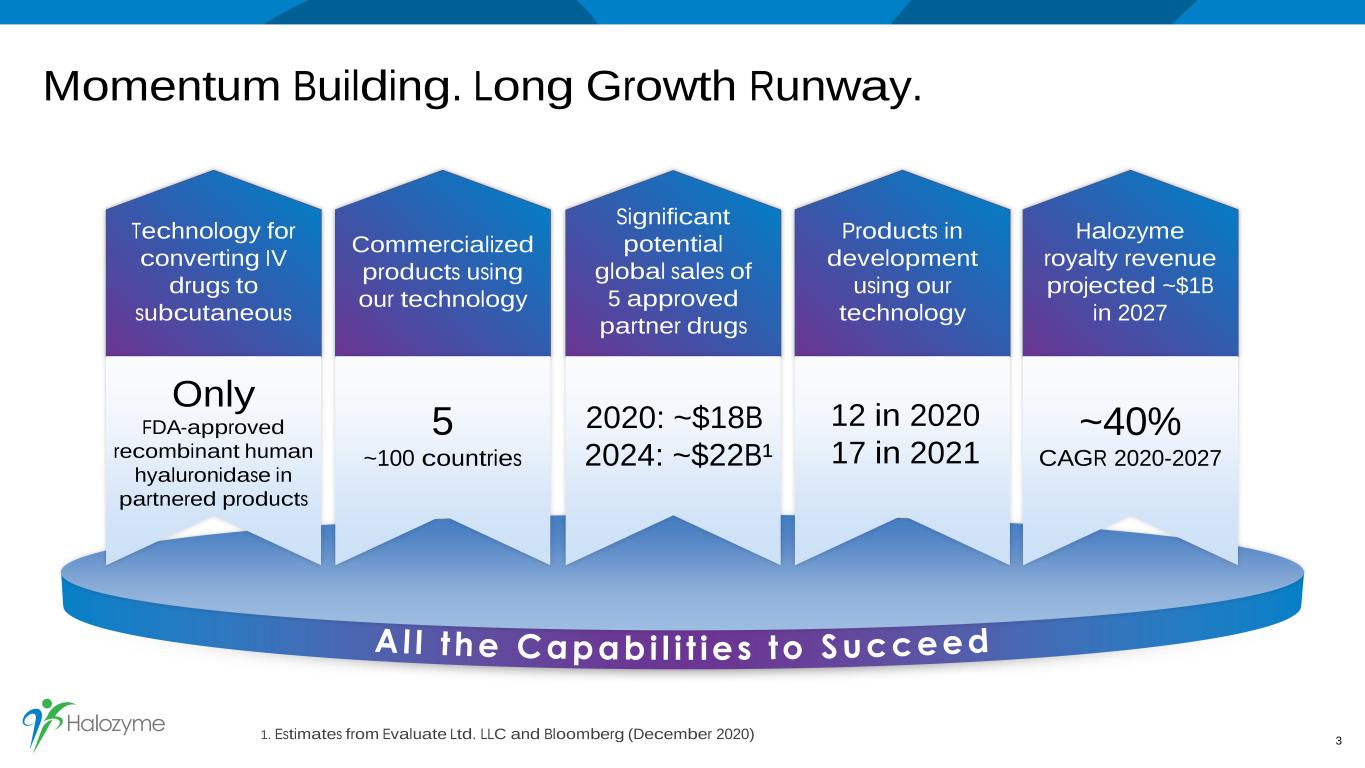

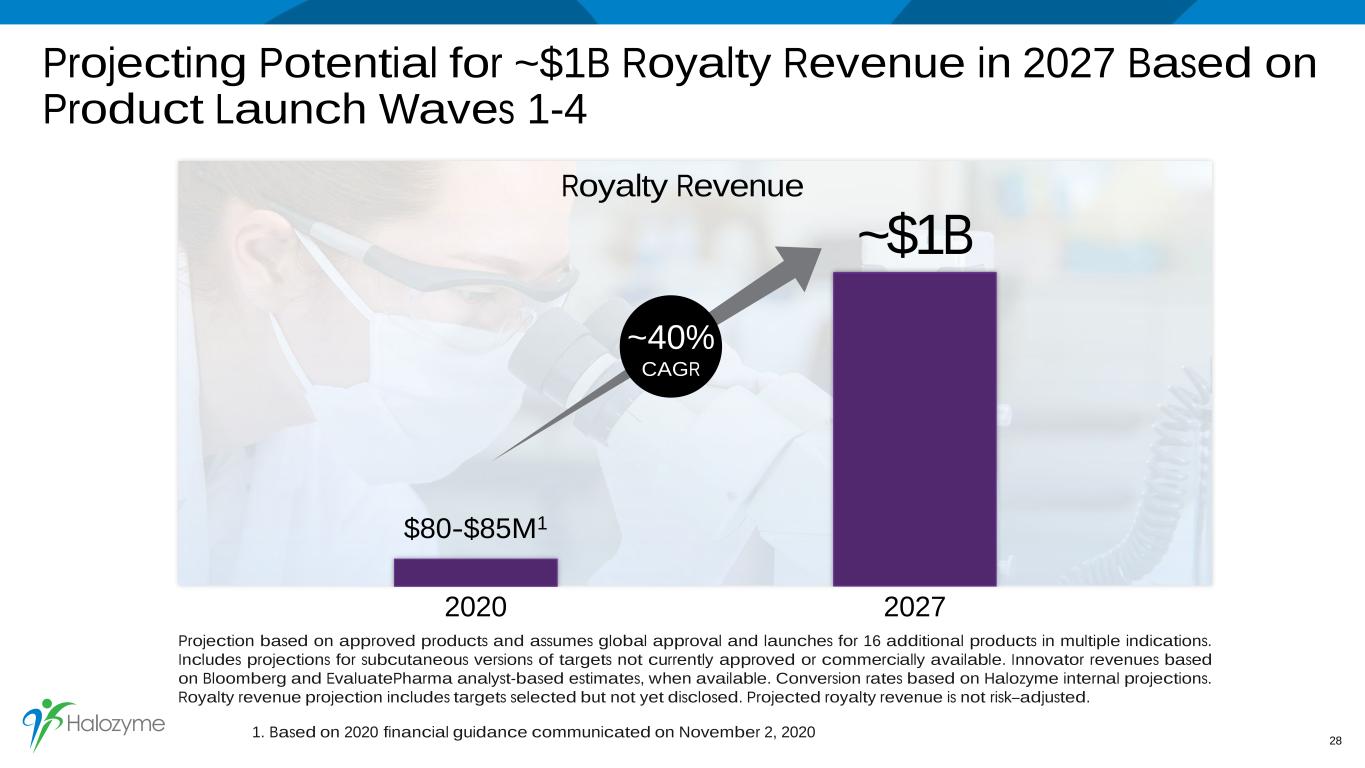

Momentum Building. Long Growth Runway. 3 Technology for converting IV drugs to subcutaneous Commercialized products using our technology Significant potential global sales of 5 approved partner drugs Halozyme royalty revenue projected ~$1B in 2027 1. Estimates from Evaluate Ltd. LLC and Bloomberg (December 2020) Products in development using our technology Only FDA-approved recombinant human hyaluronidase in partnered products 5 ~100 countries 2020: ~$18B 2024: ~$22B¹ ~40% CAGR 2020-2027 12 in 2020 17 in 2021

T H E H A L O Z Y M E S T O R Y A Repositioned Company. Long Growth Runway. 4 1 Uniquely positioned, momentum building 2 Scalable, low risk business model 3 Growing portfolio of marketed products 4 Expanding pipeline of future products 5 Strong growth trajectory

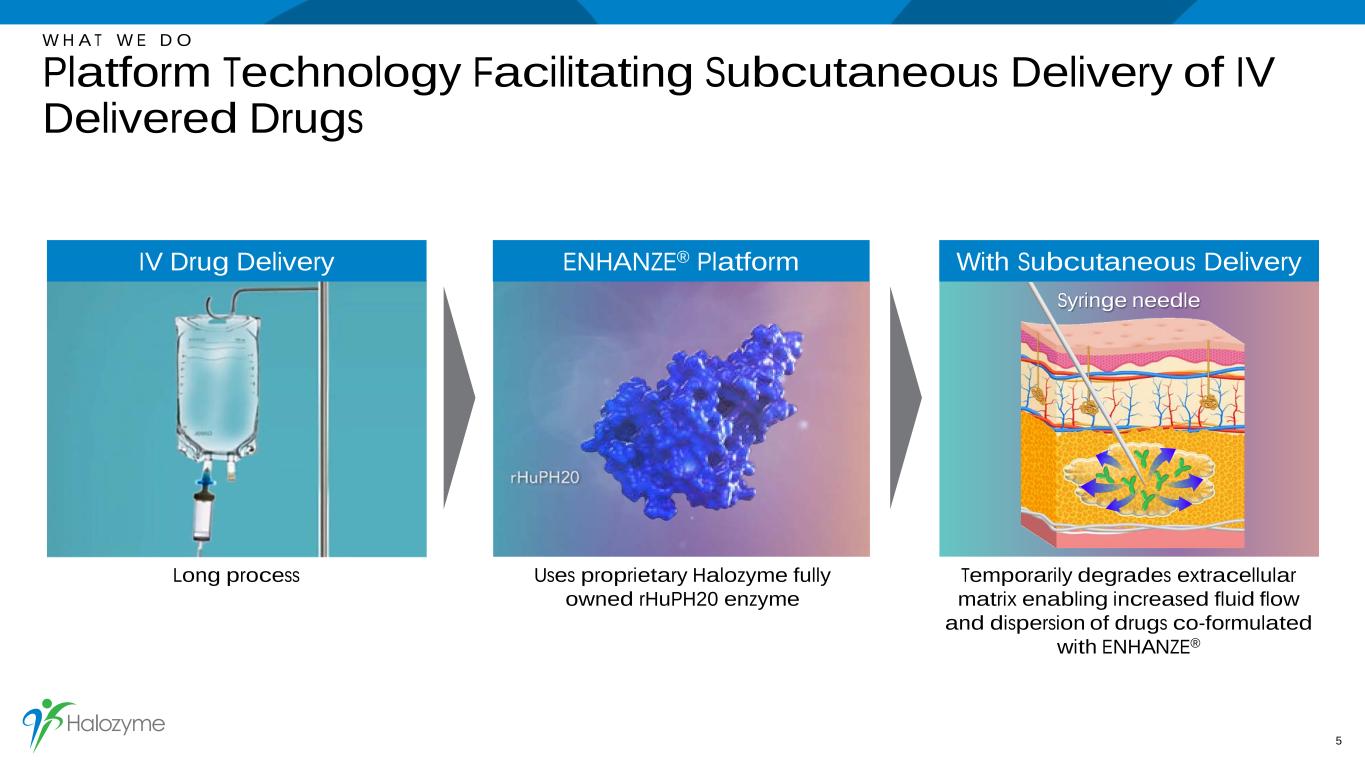

Temporarily degrades extracellular matrix enabling increased fluid flow and dispersion of drugs co-formulated with ENHANZE® W H A T W E D O Platform Technology Facilitating Subcutaneous Delivery of IV Delivered Drugs 5 Long process Uses proprietary Halozyme fully owned rHuPH20 enzyme Syringe needle ENHANZE® PlatformIV Drug Delivery With Subcutaneous Delivery

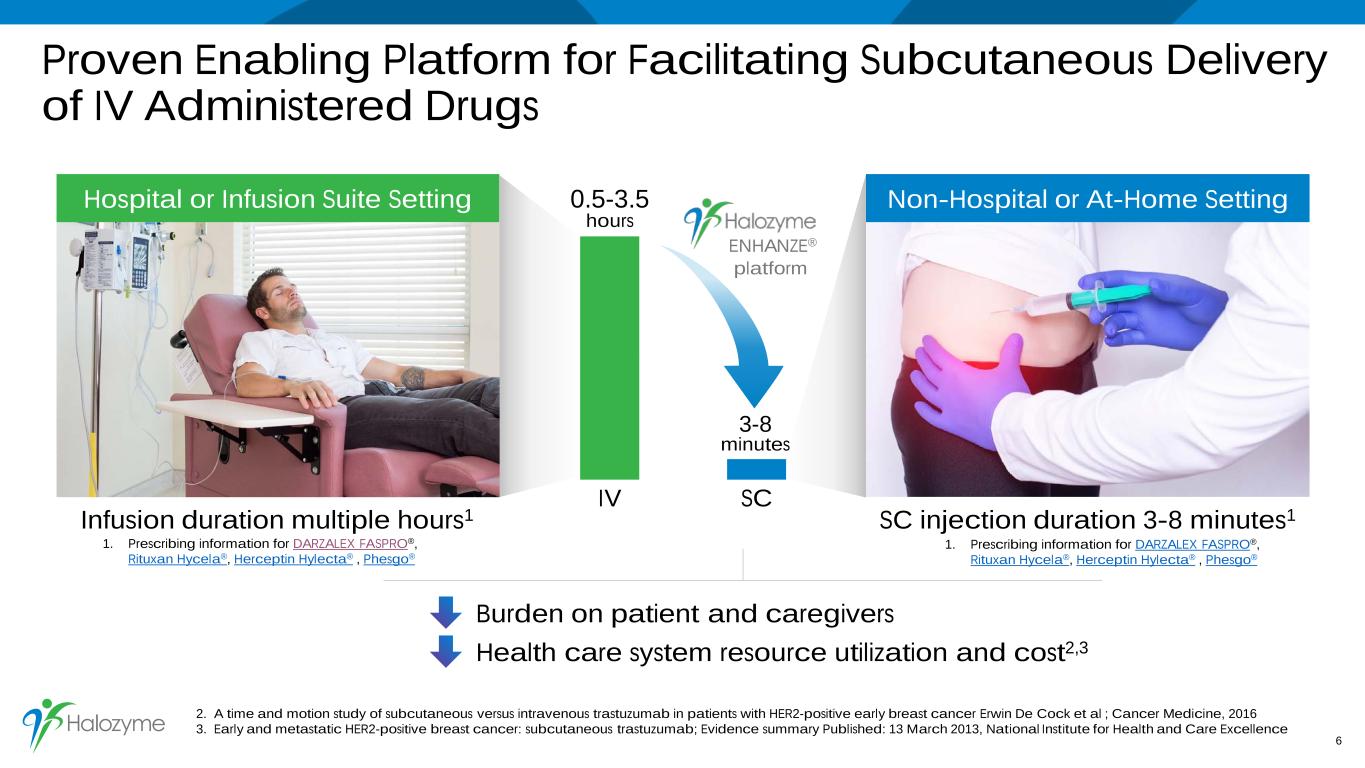

Health care system resource utilization and cost2,3 Proven Enabling Platform for Facilitating Subcutaneous Delivery of IV Administered Drugs 6 Hospital or Infusion Suite Setting IV SC 0.5-3.5 hours Infusion duration multiple hours1 SC injection duration 3-8 minutes1 ENHANZE® platform Burden on patient and caregivers 2. A time and motion study of subcutaneous versus intravenous trastuzumab in patients with HER2-positive early breast cancer Erwin De Cock et al ; Cancer Medicine, 2016 3. Early and metastatic HER2-positive breast cancer: subcutaneous trastuzumab; Evidence summary Published: 13 March 2013, National Institute for Health and Care Excellence Non-Hospital or At-Home Setting 3-8 minutes 1. Prescribing information for DARZALEX FASPRO®, Rituxan Hycela®, Herceptin Hylecta® , Phesgo® 1. Prescribing information for DARZALEX FASPRO®, Rituxan Hycela®, Herceptin Hylecta® , Phesgo®

A Repositioned Company. Long Growth Runway. 7 2005-2018 ENHANZE® Wave 1 2019-2020 ENHANZE® Wave 2 2021+ Multiple Projected Launches Foundation Built • Proprietary technology Repositioned • Restructured, sharpened focus Sustained Growth • Multiple drivers

T H E H A L O Z Y M E S T O R Y A Repositioned Company. Long Growth Runway. 8 1 Uniquely positioned, momentum building 2 Low risk business model 3 Growing portfolio of marketed products 4 Expanding pipeline of future products 5 Strong growth trajectory

Low Risk Business Model 1. Target large, attractive markets 2. Potential to deliver strong advantages to partners 5. Returning significant cash to shareholders 3. Diverse revenue streams 9 4. Growing cash flow

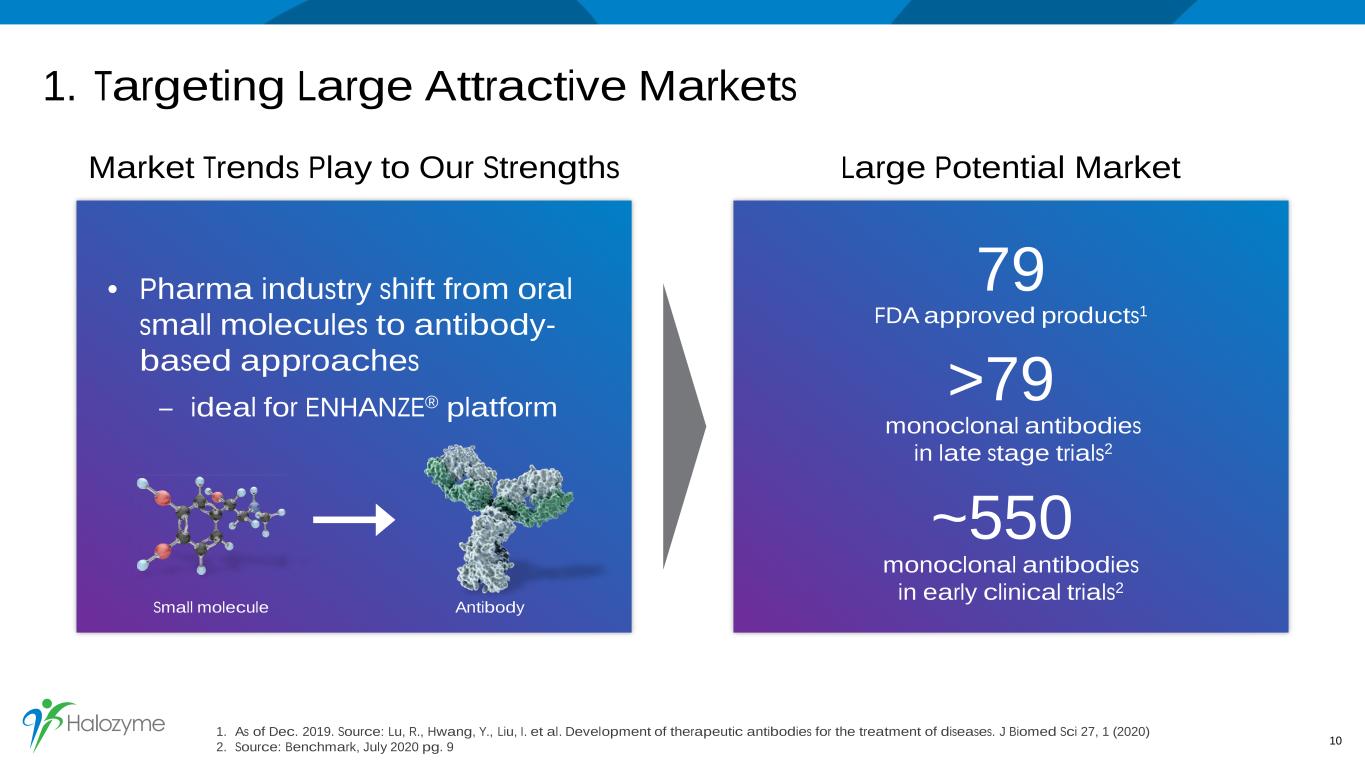

1. Targeting Large Attractive Markets Market Trends Play to Our Strengths Large Potential Market • Pharma industry shift from oral small molecules to antibody- based approaches – ideal for ENHANZE® platform 10 >79 monoclonal antibodies in late stage trials2 ~550 monoclonal antibodies in early clinical trials2 79 FDA approved products1 Small molecule Antibody 1. As of Dec. 2019. Source: Lu, R., Hwang, Y., Liu, I. et al. Development of therapeutic antibodies for the treatment of diseases. J Biomed Sci 27, 1 (2020) 2. Source: Benchmark, July 2020 pg. 9

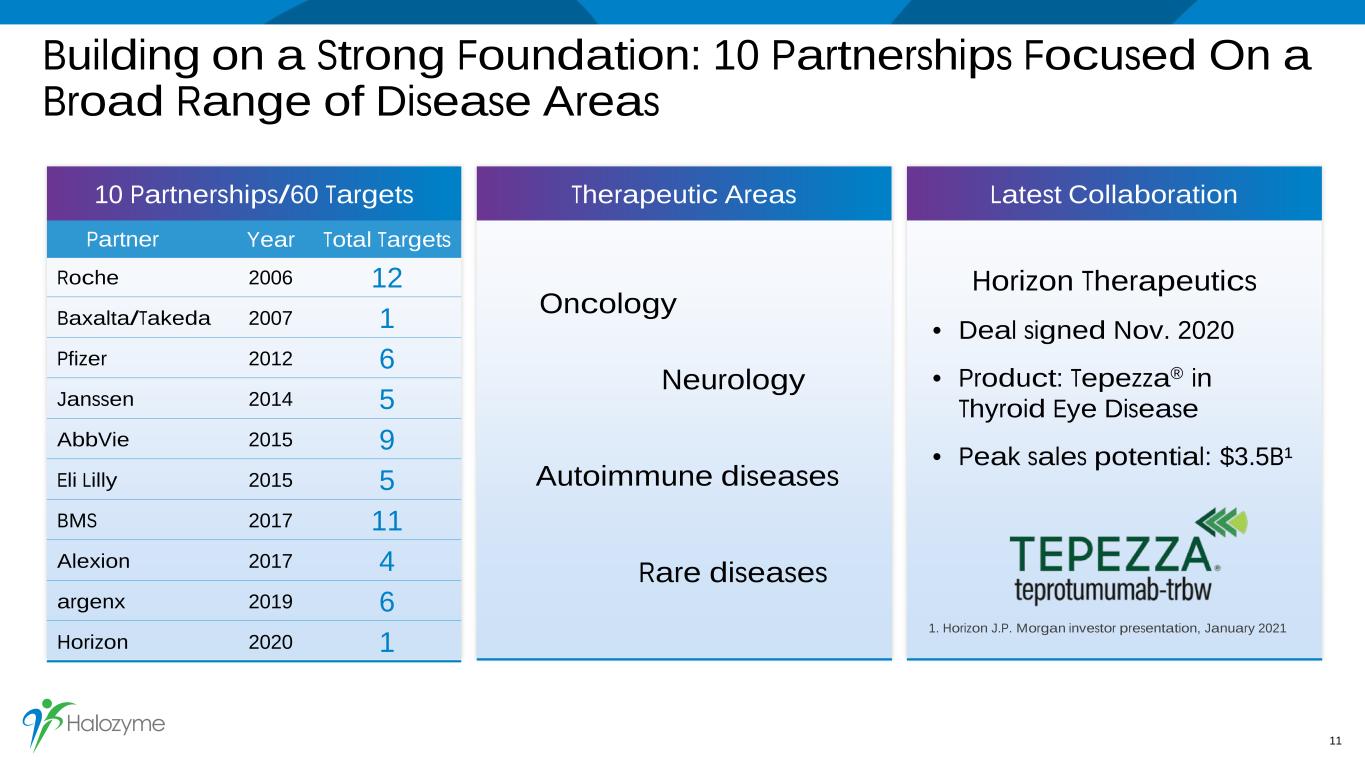

Building on a Strong Foundation: 10 Partnerships Focused On a Broad Range of Disease Areas 11 Partner Year Total Targets Roche 2006 12 Baxalta/Takeda 2007 1 Pfizer 2012 6 Janssen 2014 5 AbbVie 2015 9 Eli Lilly 2015 5 BMS 2017 11 Alexion 2017 4 argenx 2019 6 Horizon 2020 1 Oncology Neurology Autoimmune diseases Rare diseases Horizon Therapeutics • Deal signed Nov. 2020 • Product: Tepezza® in Thyroid Eye Disease • Peak sales potential: $3.5B¹ Therapeutic Areas Latest Collaboration10 Partnerships/60 Targets 1. Horizon J.P. Morgan investor presentation, January 2021

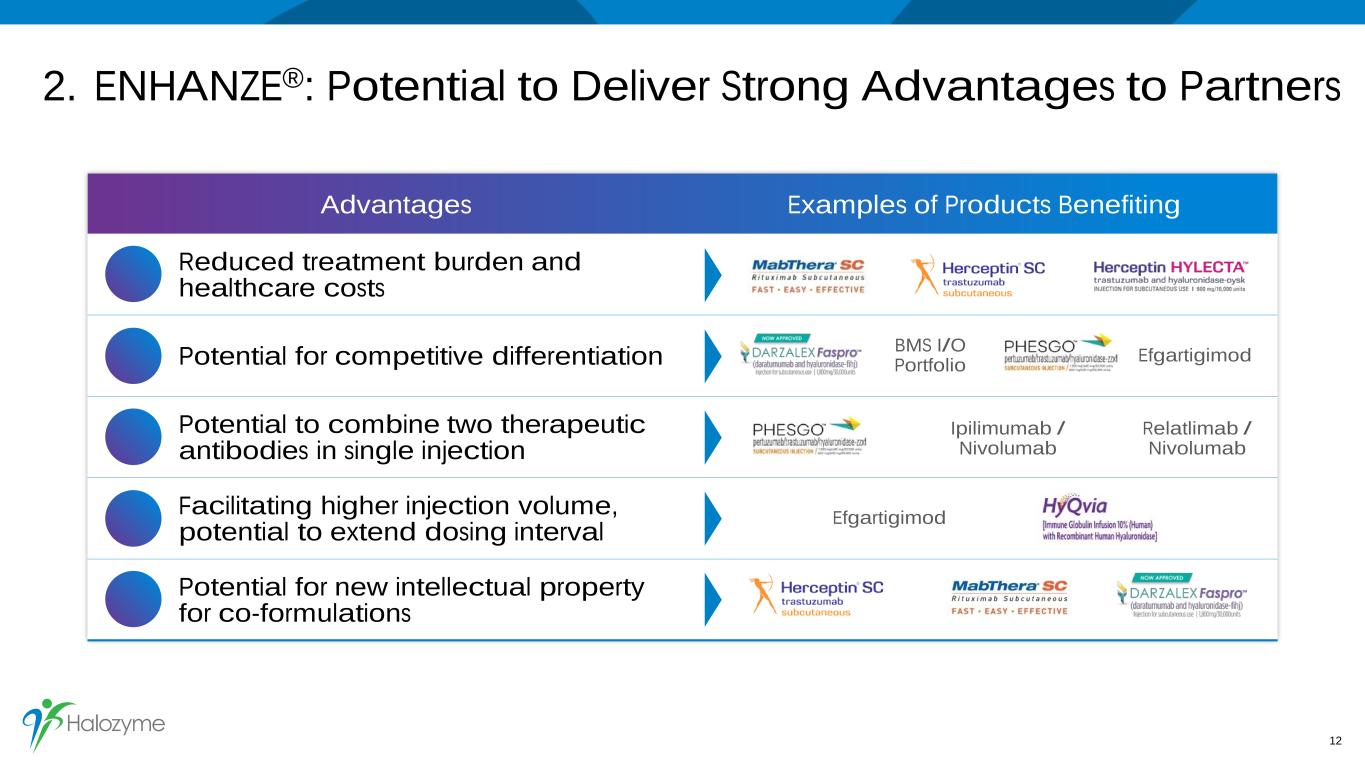

2. ENHANZE®: Potential to Deliver Strong Advantages to Partners 12 Advantages Examples of Products Benefiting Reduced treatment burden and healthcare costs Potential for competitive differentiation Potential to combine two therapeutic antibodies in single injection Facilitating higher injection volume, potential to extend dosing interval Potential for new intellectual property for co-formulations BMS I/O Portfolio Efgartigimod Ipilimumab / Nivolumab Relatlimab / Nivolumab Efgartigimod

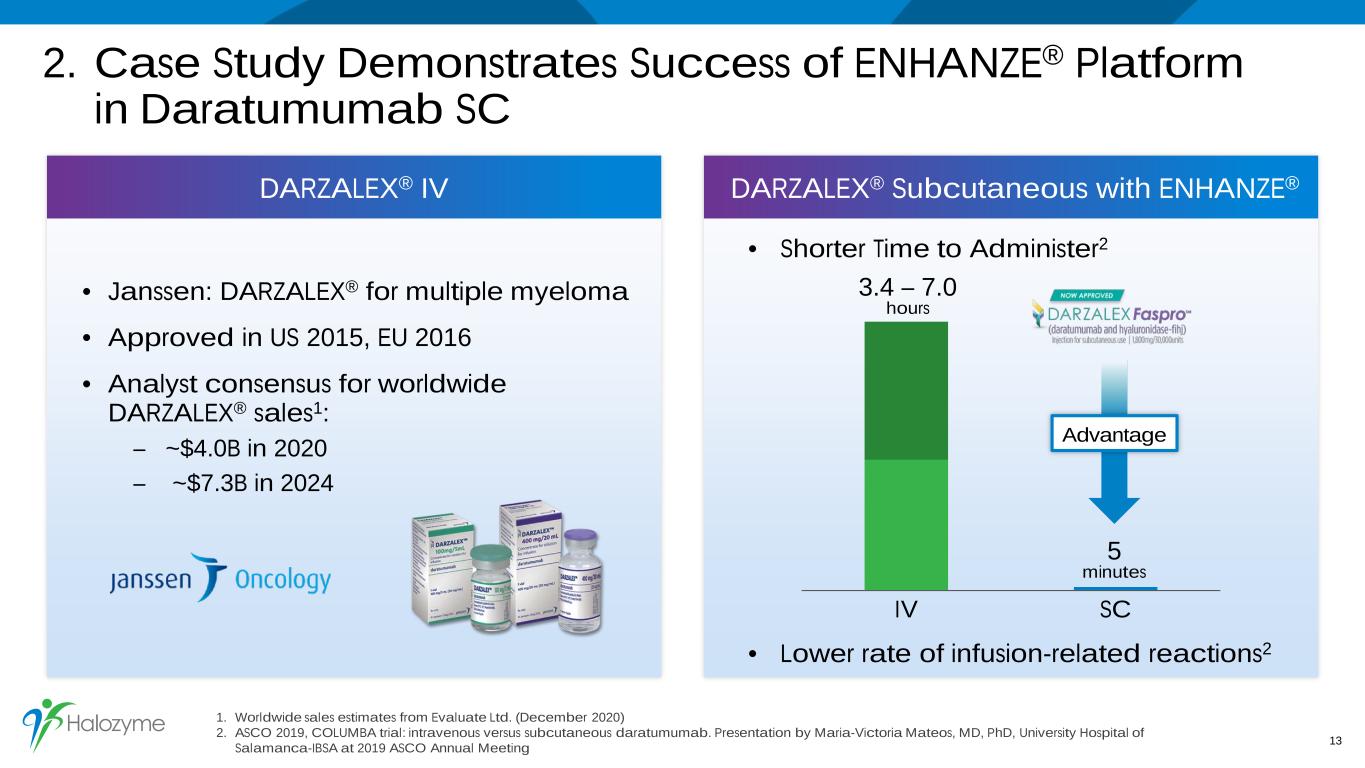

2. Case Study Demonstrates Success of ENHANZE® Platform in Daratumumab SC 1. Worldwide sales estimates from Evaluate Ltd. (December 2020) 2. ASCO 2019, COLUMBA trial: intravenous versus subcutaneous daratumumab. Presentation by Maria-Victoria Mateos, MD, PhD, University Hospital of Salamanca-IBSA at 2019 ASCO Annual Meeting 13 DARZALEX® IV DARZALEX® Subcutaneous with ENHANZE® • Janssen: DARZALEX® for multiple myeloma • Approved in US 2015, EU 2016 • Analyst consensus for worldwide DARZALEX® sales1: – ~$4.0B in 2020 – ~$7.3B in 2024 IV SC 3.4 – 7.0 hours 5 minutes Advantage • Shorter Time to Administer2 • Lower rate of infusion-related reactions2

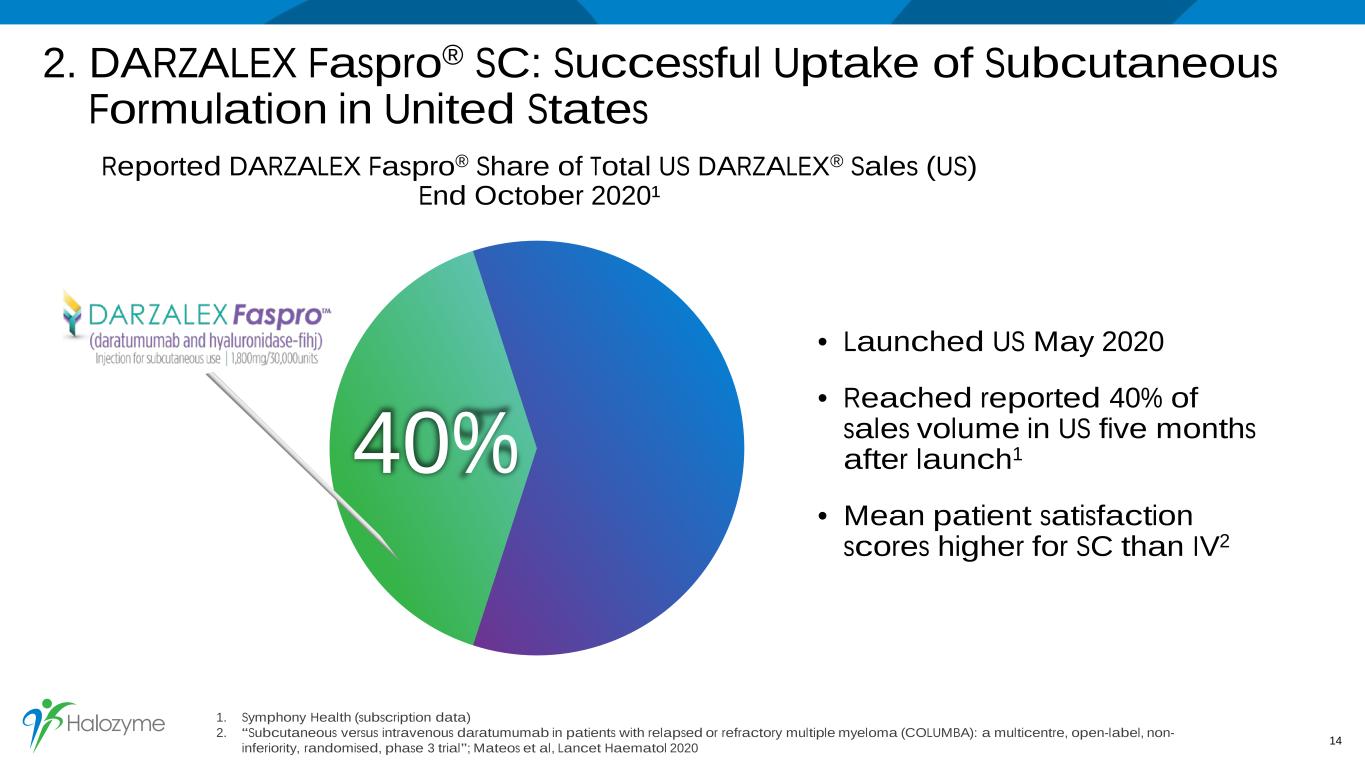

2. DARZALEX Faspro® SC: Successful Uptake of Subcutaneous Formulation in United States 1. Symphony Health (subscription data) 2. “Subcutaneous versus intravenous daratumumab in patients with relapsed or refractory multiple myeloma (COLUMBA): a multicentre, open-label, non- inferiority, randomised, phase 3 trial”; Mateos et al, Lancet Haematol 2020 14 Reported DARZALEX Faspro® Share of Total US DARZALEX® Sales (US) End October 2020¹ 40% • Launched US May 2020 • Reached reported 40% of sales volume in US five months after launch1 • Mean patient satisfaction scores higher for SC than IV2

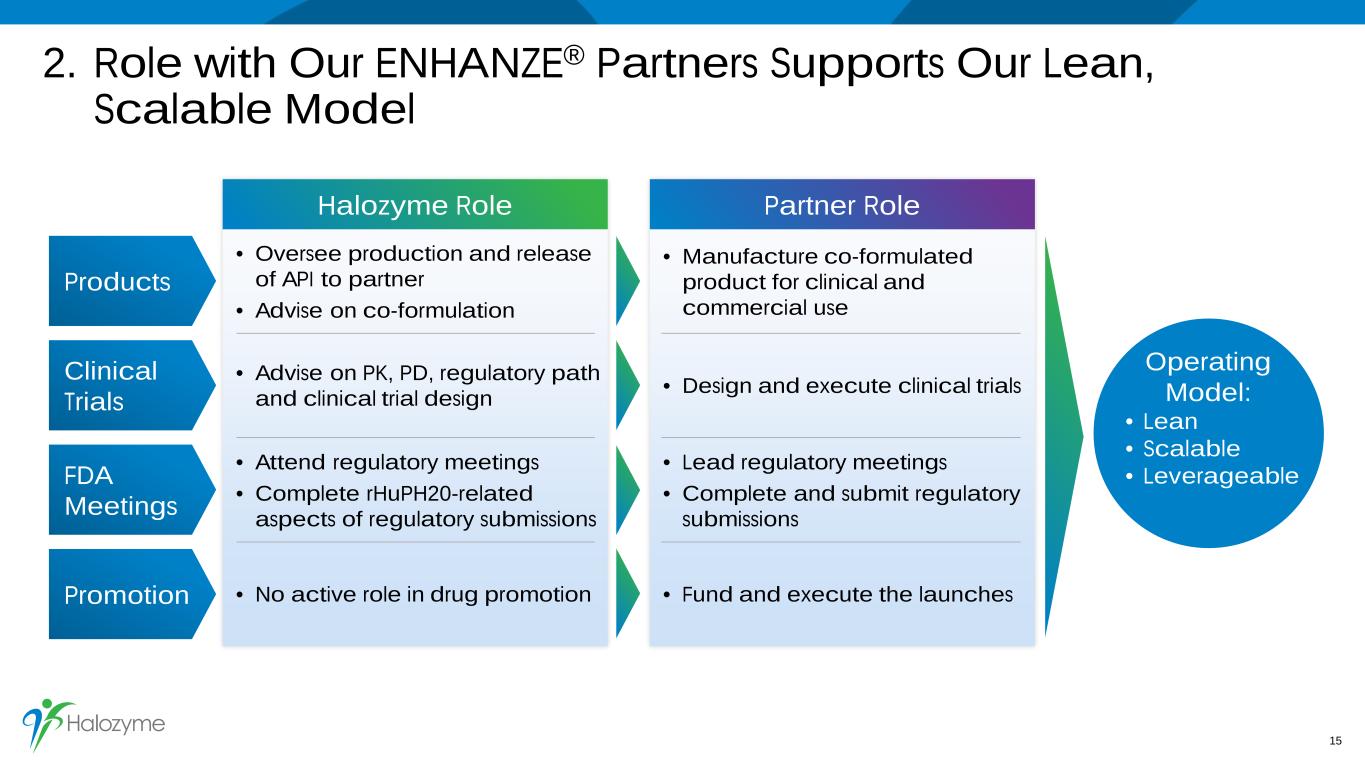

2. Role with Our ENHANZE® Partners Supports Our Lean, Scalable Model 15 • Oversee production and release of API to partner • Advise on co-formulation • Manufacture co-formulated product for clinical and commercial use • Advise on PK, PD, regulatory path and clinical trial design • Design and execute clinical trials • Attend regulatory meetings • Complete rHuPH20-related aspects of regulatory submissions • Lead regulatory meetings • Complete and submit regulatory submissions • No active role in drug promotion • Fund and execute the launches Products Clinical Trials FDA Meetings Promotion Operating Model: • Lean • Scalable • Leverageable Halozyme Role Partner Role

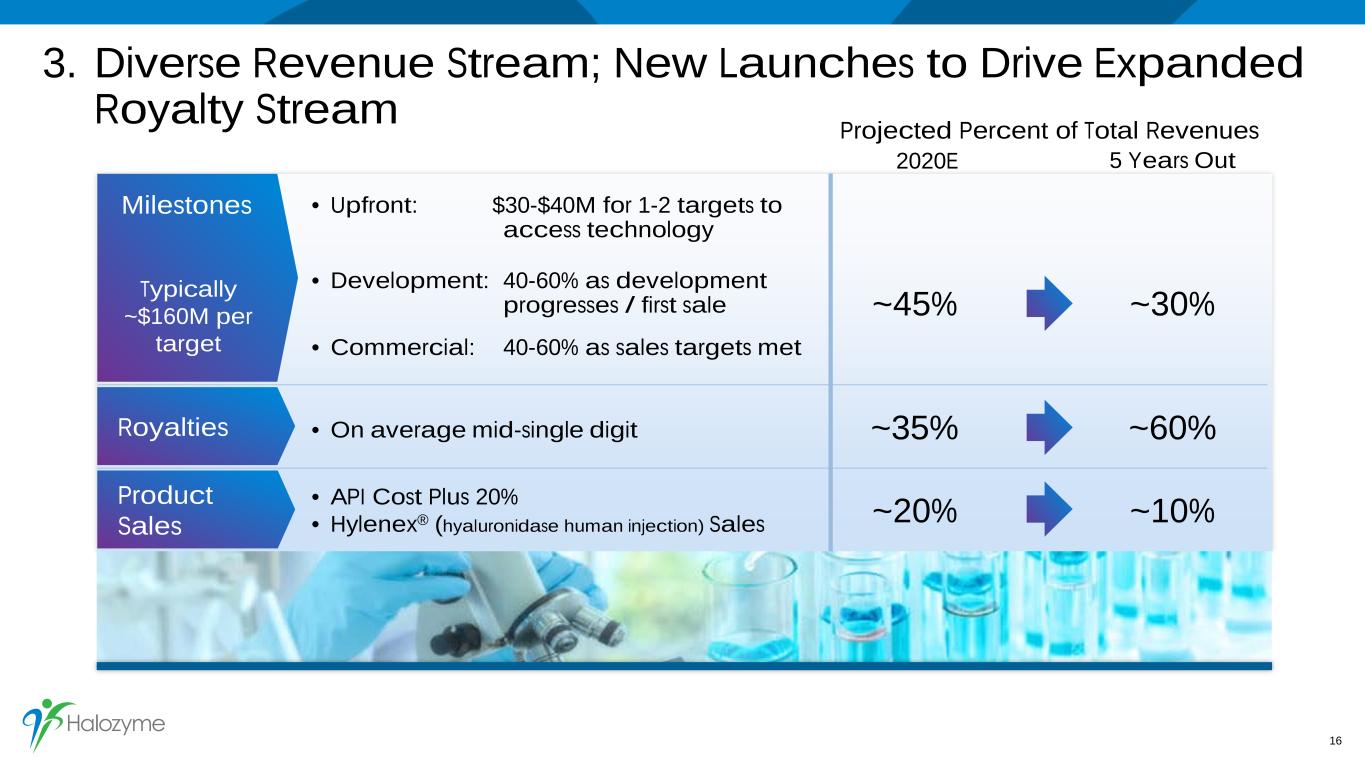

3. Diverse Revenue Stream; New Launches to Drive Expanded Royalty Stream 16 Royalties Product Sales • API Cost Plus 20% • Hylenex® (hyaluronidase human injection) Sales • On average mid-single digit • Upfront: $30-$40M for 1-2 targets to access technology • Development: 40-60% as development progresses / first sale • Commercial: 40-60% as sales targets met Milestones Typically ~$160M per target ~45% ~30% ~35% ~60% ~20% ~10% Projected Percent of Total Revenues 2020E 5 Years Out

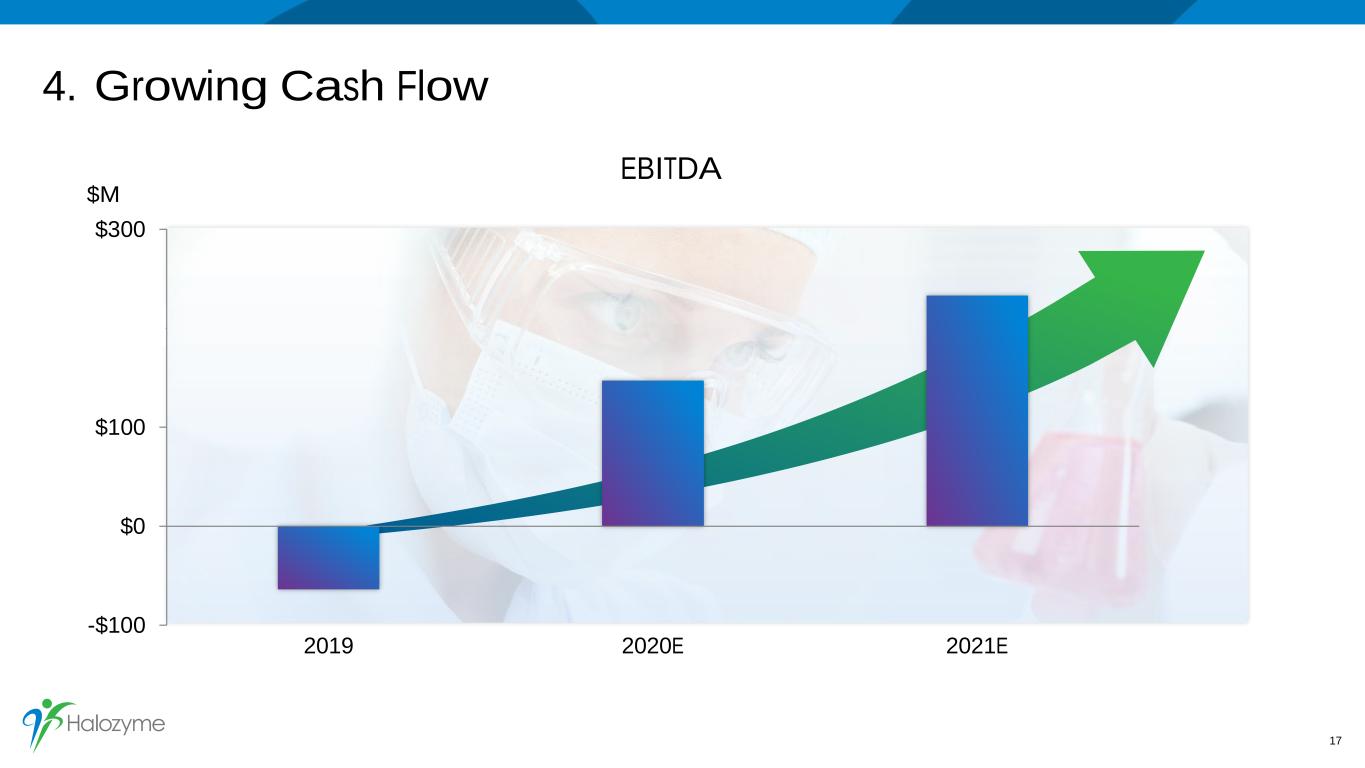

4. Growing Cash Flow 17 $M EBITDA -$100 $0 $100 $200 $300 2019 2020E 2021E

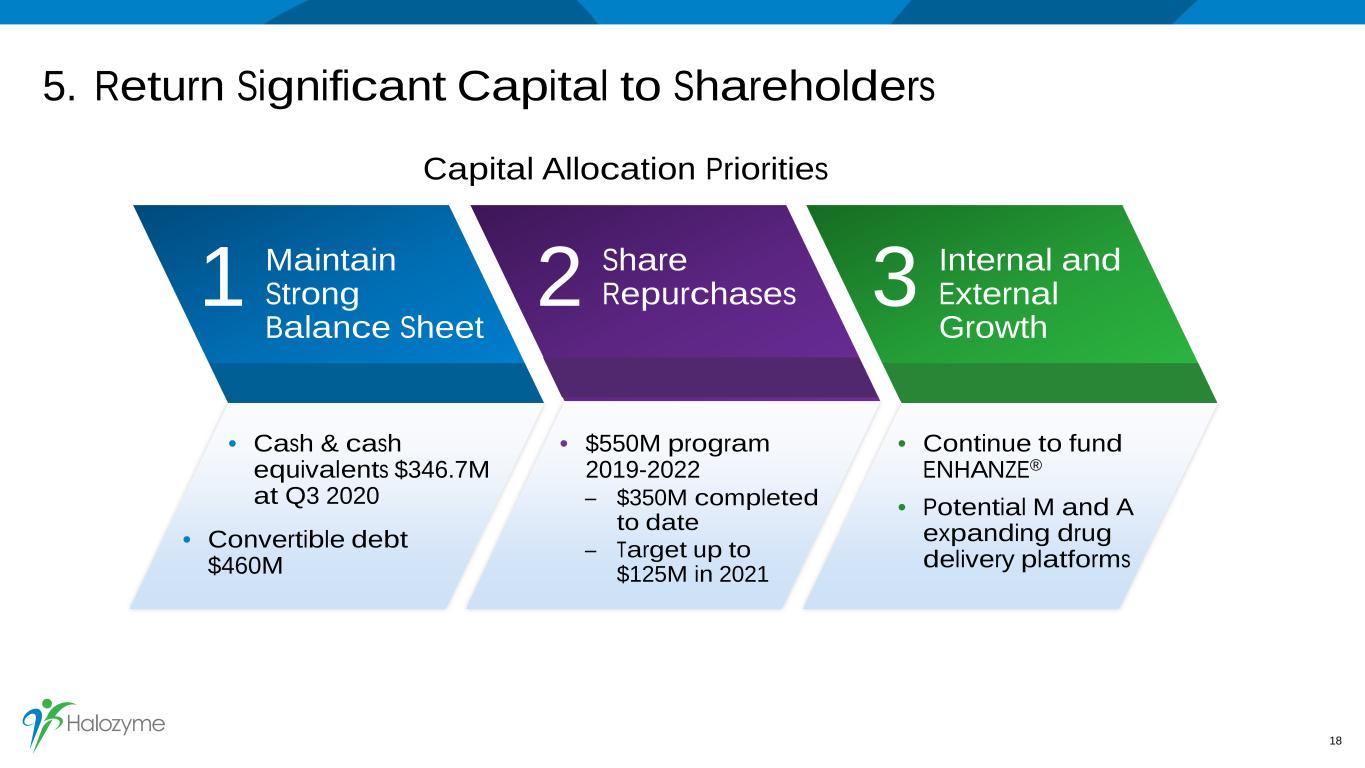

5. Return Significant Capital to Shareholders 18 Capital Allocation Priorities 1 MaintainStrong Balance Sheet 2 3ShareRepurchases Internal and External Growth • Cash & cash equivalents $346.7M at Q3 2020 • Continue to fund ENHANZE® • Potential M and A expanding drug delivery platforms • $550M program 2019-2022 – $350M completed to date – Target up to $125M in 2021 • Convertible debt $460M

T H E H A L O Z Y M E S T O R Y A Repositioned Company. Long Growth Runway. 19 1 Uniquely positioned, momentum building 2 Scalable, low risk business model 3 Growing portfolio of marketed products 4 Expanding pipeline of future products 5 Strong growth trajectory

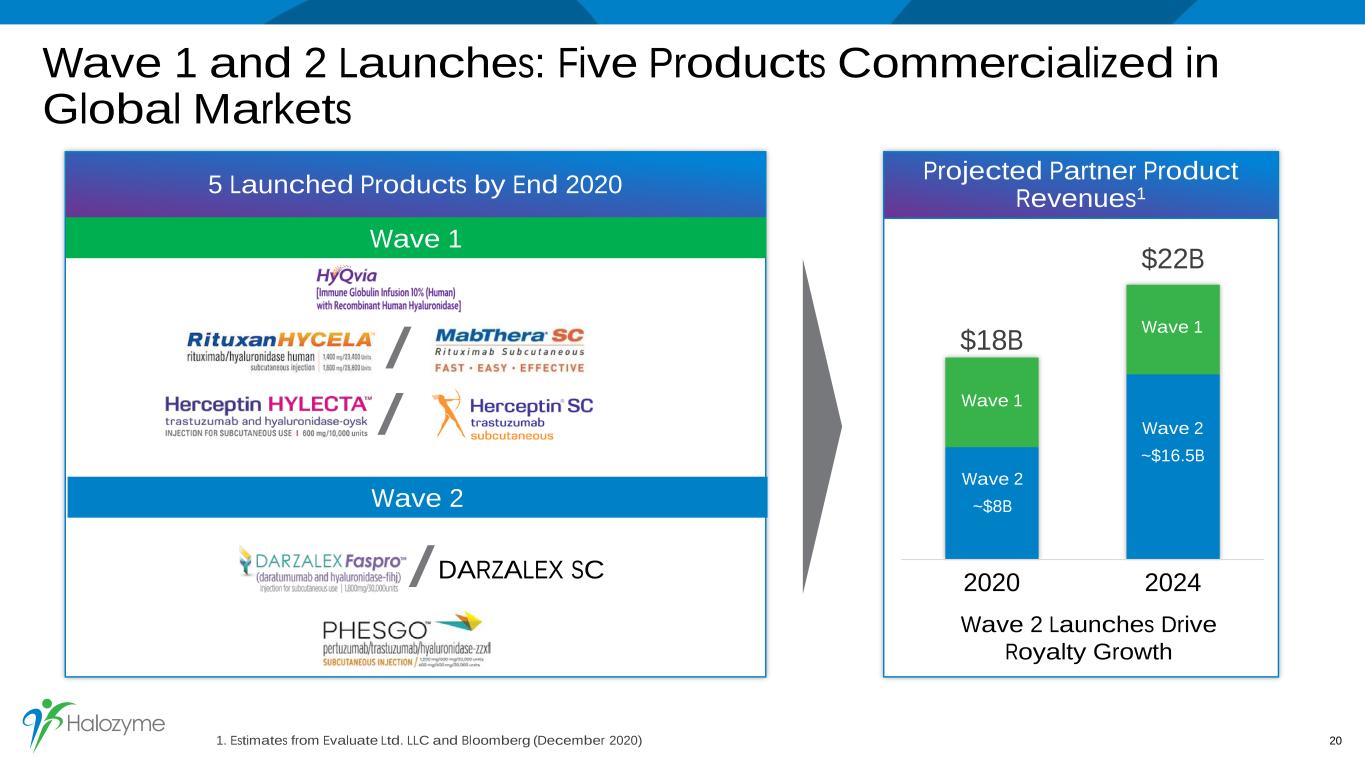

Wave 1 and 2 Launches: Five Products Commercialized in Global Markets 1. Estimates from Evaluate Ltd. LLC and Bloomberg (December 2020) 20 Projected Partner Product Revenues1 $18B $22B 2020 2024 Wave 2 Launches Drive Royalty Growth DARZALEX SC 5 Launched Products by End 2020 Wave 1 / / Wave 2 / Wave 2 ~$8B Wave 2 ~$16.5B Wave 1 Wave 1

$0M $50M $100M $150M $200M 2019 2020 2021 $80-$85M1 Significant Royalty Revenue Growth Projected in 2021 21 Royalty Revenue 3 5 5 • DARZALEX FASPRO® and SCLaunches • Phesgo® U.S. Marketed products at year end +~100% • Phesgo® EU 1. Based on 2020 financial guidance communicated on November 2, 2020

T H E H A L O Z Y M E S T O R Y A Repositioned Company. Long Growth Runway. 22 1 Uniquely positioned, momentum building 2 Scalable, low risk business model 3 Growing portfolio of marketed products 4 Expanding pipeline of future products 5 Strong growth trajectory

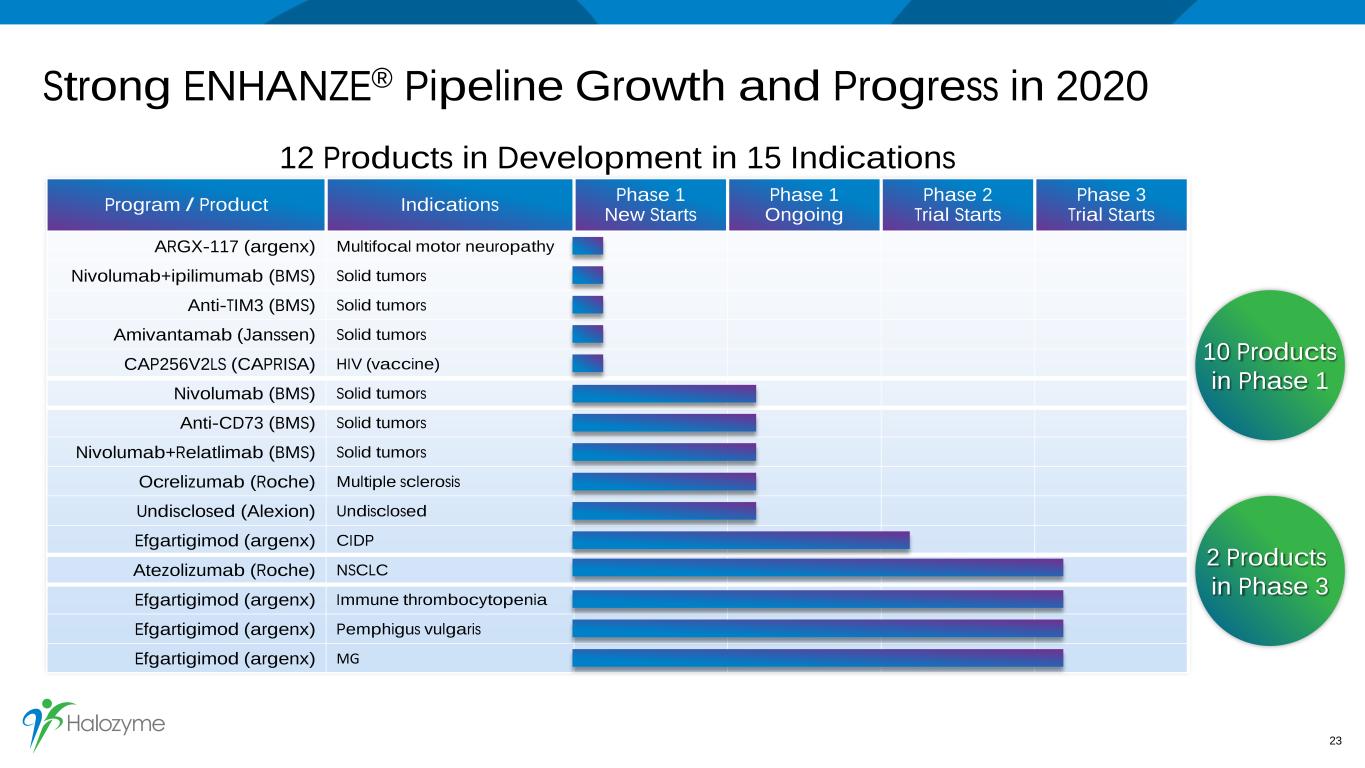

Strong ENHANZE® Pipeline Growth and Progress in 2020 23 Program / Product Indications Phase 1New Starts Phase 1 Ongoing Phase 2 Trial Starts Phase 3 Trial Starts ARGX-117 (argenx) Multifocal motor neuropathy Nivolumab+ipilimumab (BMS) Solid tumors Anti-TIM3 (BMS) Solid tumors Amivantamab (Janssen) Solid tumors CAP256V2LS (CAPRISA) HIV (vaccine) Nivolumab (BMS) Solid tumors Anti-CD73 (BMS) Solid tumors Nivolumab+Relatlimab (BMS) Solid tumors Ocrelizumab (Roche) Multiple sclerosis Undisclosed (Alexion) Undisclosed Efgartigimod (argenx) CIDP Atezolizumab (Roche) NSCLC Efgartigimod (argenx) Immune thrombocytopenia Efgartigimod (argenx) Pemphigus vulgaris Efgartigimod (argenx) MG 2 Products in Phase 3 12 Products in Development in 15 Indications 10 Products in Phase 1

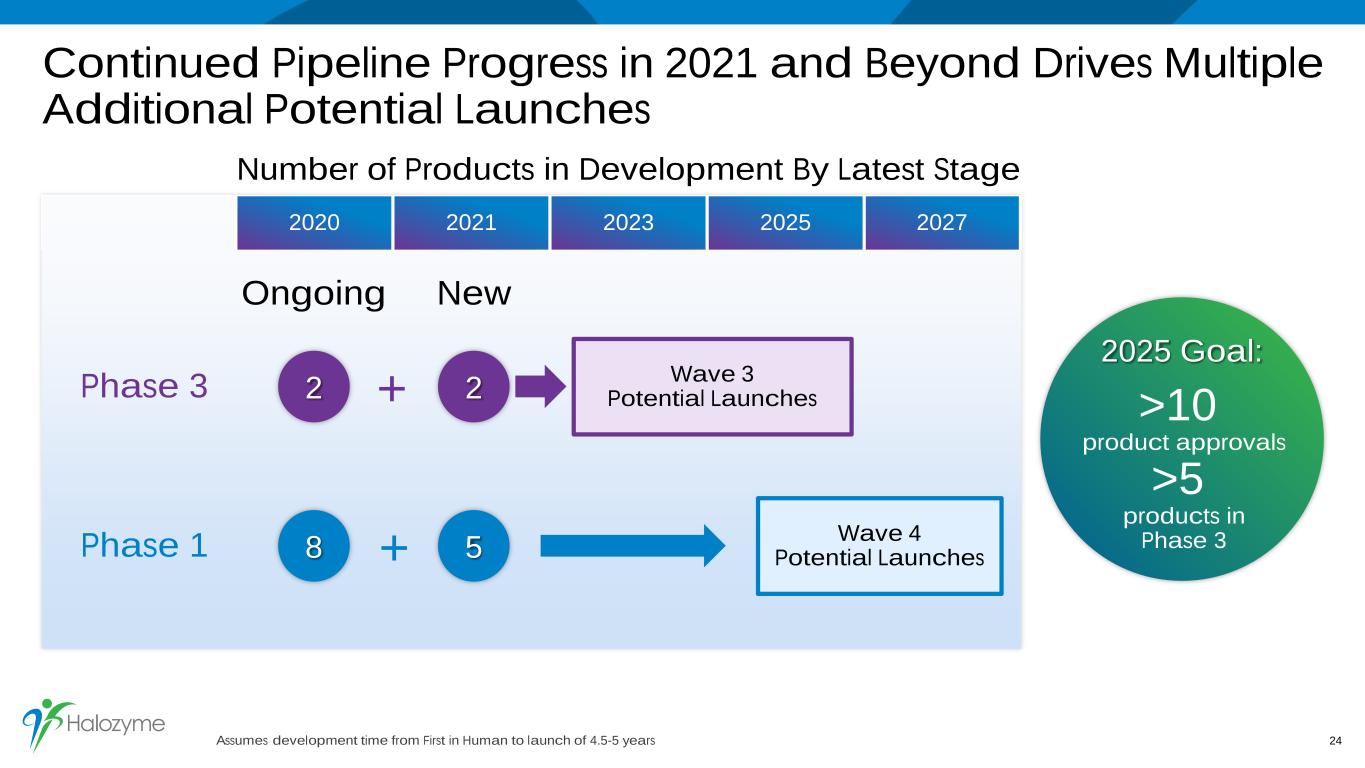

Continued Pipeline Progress in 2021 and Beyond Drives Multiple Additional Potential Launches 24 >10 product approvals >5 products in Phase 3 2025 Goal: Number of Products in Development By Latest Stage 2020 2021 2023 2025 2027 Phase 1 Phase 3 5 22 8 Ongoing New Wave 3 Potential Launches Wave 4 Potential Launches + + Assumes development time from First in Human to launch of 4.5-5 years

Additional Growth Opportunity Potential From Signing New Partner Agreements and Current Partners Selecting New Targets 25 Total Number of Targets Targets Not Yet Selected 10 Partner Agreements >20 of 60 still to be selected 60 targets in total, all agreements 22 approved or in clinic end 2021 Potential for more

T H E H A L O Z Y M E S T O R Y A Repositioned Company. Long Growth Runway. 26 1 Uniquely positioned, momentum building 2 Scalable, low risk business model 3 Growing portfolio of marketed products 4 Expanding pipeline of future products 5 Strong growth trajectory

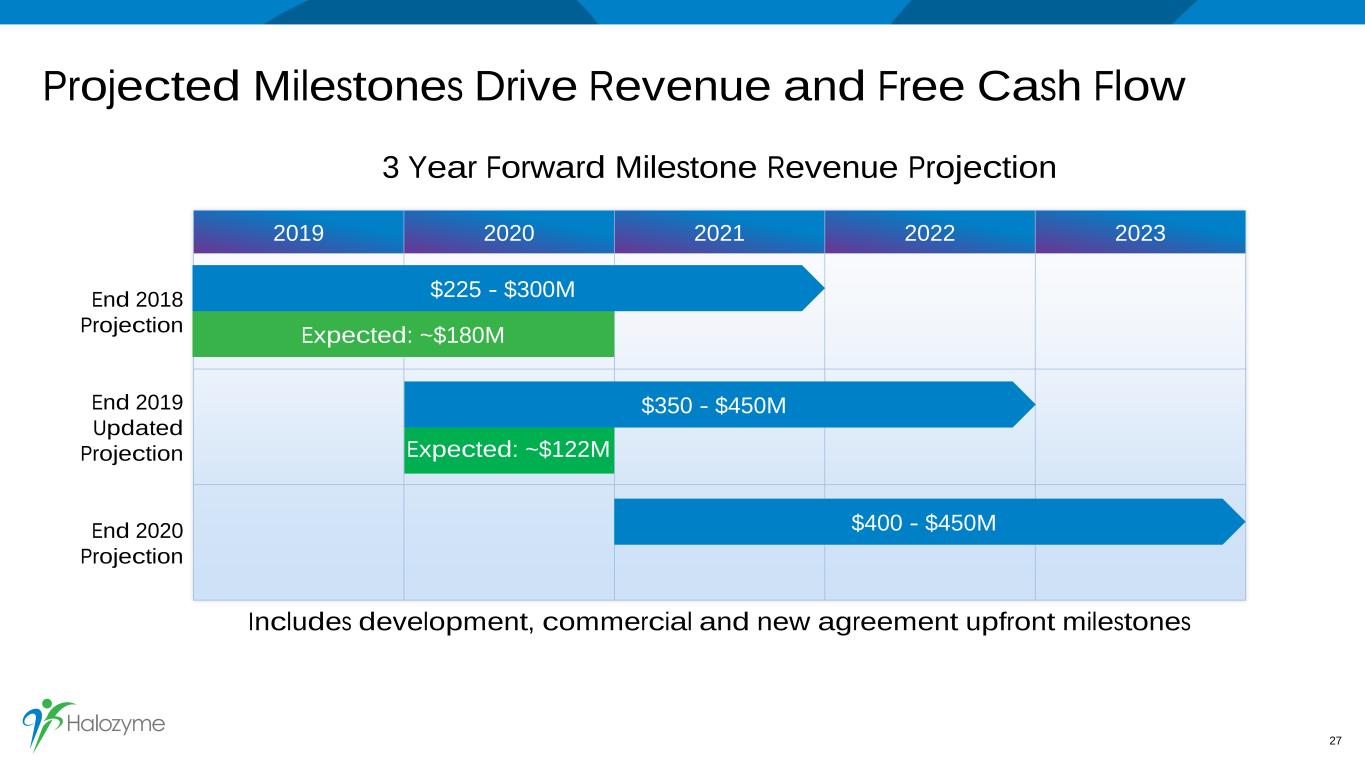

2019 2020 2021 2022 2023 End 2018 Projection End 2019 Updated Projection End 2020 Projection Projected Milestones Drive Revenue and Free Cash Flow 3 Year Forward Milestone Revenue Projection Includes development, commercial and new agreement upfront milestones 27 Expected: ~$180M $400 - $450M $225 - $300M $350 - $450M Expected: ~$122M

Projecting Potential for ~$1B Royalty Revenue in 2027 Based on Product Launch Waves 1-4 28 2020 2027 Royalty Revenue ~$1B $80-$85M1 Projection based on approved products and assumes global approval and launches for 16 additional products in multiple indications. Includes projections for subcutaneous versions of targets not currently approved or commercially available. Innovator revenues based on Bloomberg and EvaluatePharma analyst-based estimates, when available. Conversion rates based on Halozyme internal projections. Royalty revenue projection includes targets selected but not yet disclosed. Projected royalty revenue is not risk–adjusted. ~40% CAGR 1. Based on 2020 financial guidance communicated on November 2, 2020

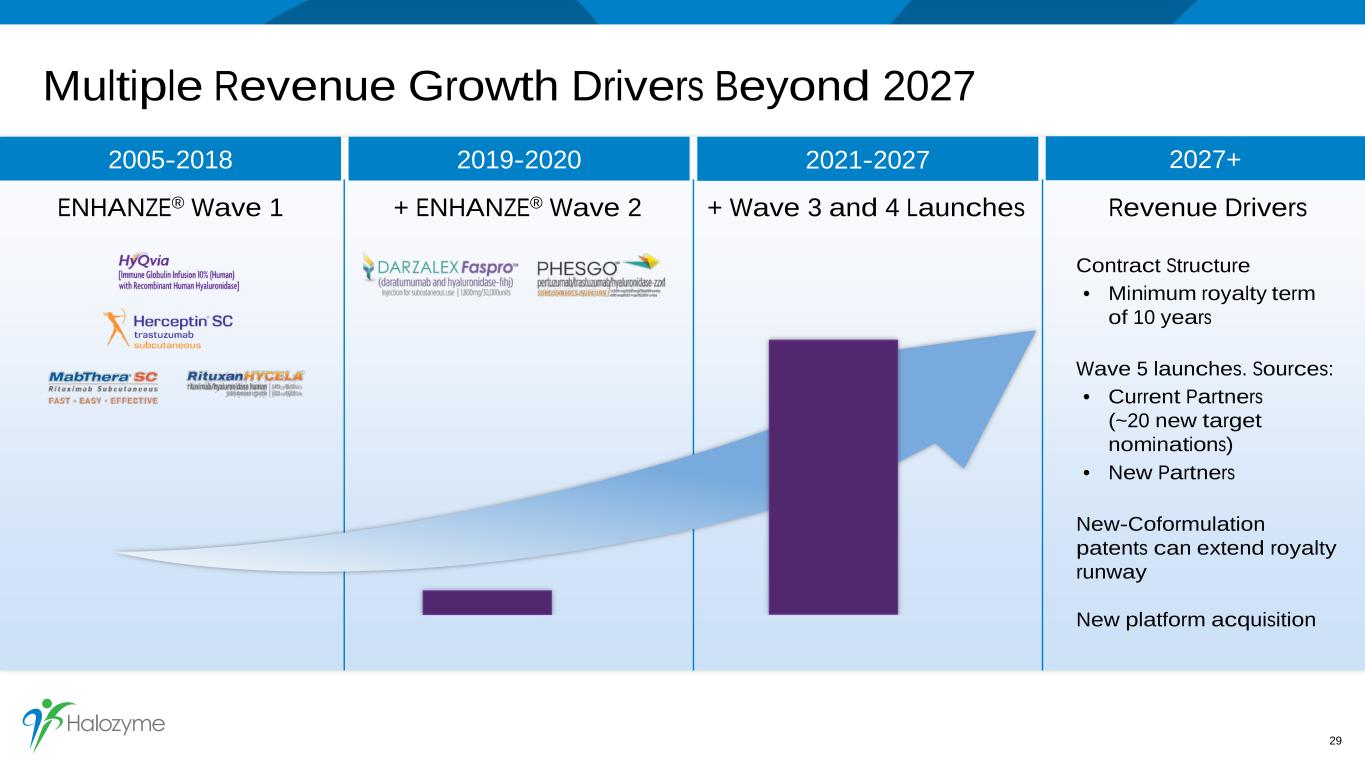

Multiple Revenue Growth Drivers Beyond 2027 29 2021-2027 + Wave 3 and 4 Launches 2027+ Revenue Drivers Contract Structure • Minimum royalty term of 10 years Wave 5 launches. Sources: • Current Partners (~20 new target nominations) • New Partners New-Coformulation patents can extend royalty runway New platform acquisition 2005-2018 2019-2020 ENHANZE® Wave 1 + ENHANZE® Wave 2

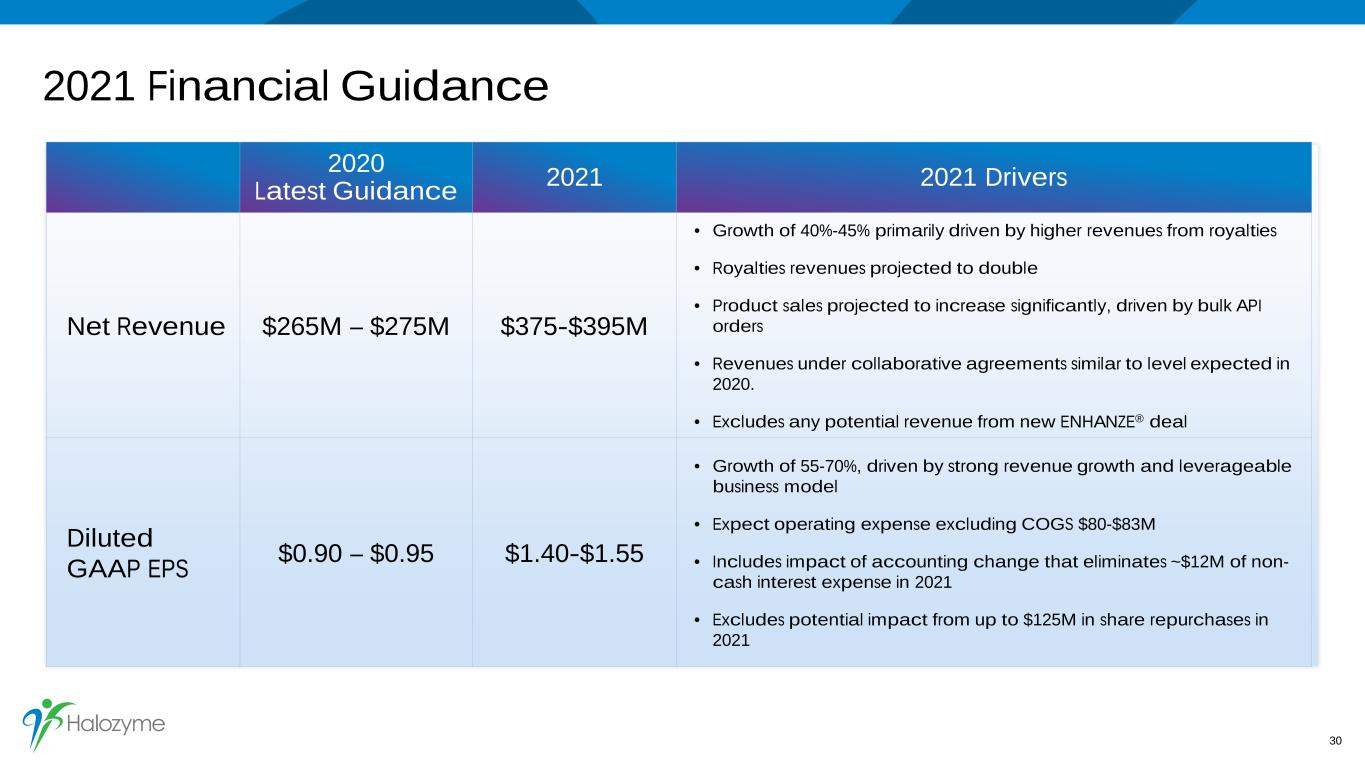

2021 Financial Guidance 2020 Latest Guidance 2021 2021 Drivers Net Revenue $265M – $275M $375-$395M • Growth of 40%-45% primarily driven by higher revenues from royalties • Royalties revenues projected to double • Product sales projected to increase significantly, driven by bulk API orders • Revenues under collaborative agreements similar to level expected in 2020. • Excludes any potential revenue from new ENHANZE® deal Diluted GAAP EPS $0.90 – $0.95 $1.40-$1.55 • Growth of 55-70%, driven by strong revenue growth and leverageable business model • Expect operating expense excluding COGS $80-$83M • Includes impact of accounting change that eliminates ~$12M of non- cash interest expense in 2021 • Excludes potential impact from up to $125M in share repurchases in 2021 30

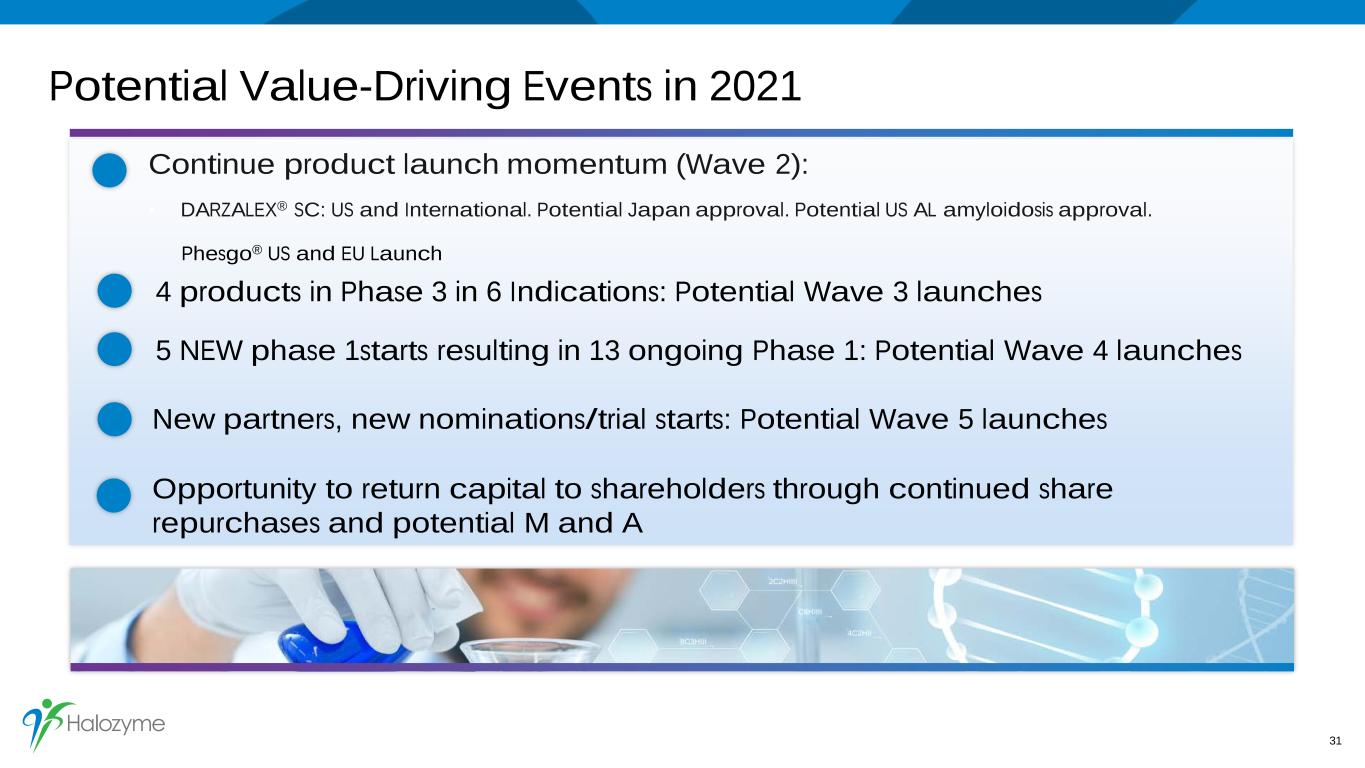

Potential Value-Driving Events in 2021 31 Continue product launch momentum (Wave 2): • DARZALEX® SC: US and International. Potential Japan approval. Potential US AL amyloidosis approval. Phesgo® US and EU Launch 4 products in Phase 3 in 6 Indications: Potential Wave 3 launches 5 NEW phase 1starts resulting in 13 ongoing Phase 1: Potential Wave 4 launches New partners, new nominations/trial starts: Potential Wave 5 launches Opportunity to return capital to shareholders through continued share repurchases and potential M and A

I N S U M M A R Y A Repositioned Company. Long Growth Runway. 32 • Impressive partnerships • Strong cash flow • Royalty growth • Multiple drivers • Line of sight 1 Uniquely positioned, momentum building 2 Scalable, low risk business model 3 Growing portfolio of marketed products 4 Expanding pipeline of future products 5 Strong growth trajectory

39th Annual J.P. Morgan Healthcare Conference Dr. Helen Torley, President and CEO January 13, 2021 3 3