Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COVETRUS, INC. | cvet-20210113.htm |

J.P. Morgan Healthcare Conference January 13, 2021 Presenters: Ben Wolin, President and CEO Matthew Foulston, EVP and CFO Exhibit 99.1

2 Safe harbor provision and non-GAAP reconciliation Forward-Looking Statements This presentation contains certain statements that are forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We may, in some cases use terms such as "predicts," "believes," "potential," "continue," "anticipates," "estimates," "expects," "plans," "intends," "may," "could," "might," "likely," "will," "should," or other words that convey uncertainty of the future events or outcomes to identify these forward-looking statements. Such statements are subject to numerous risks and uncertainties, and actual results could differ materially from those anticipated due to a number of factors including, but not limited to, the effect of the COVID-19 pandemic on our business and the success of any measures we have taken or may take in the future in response thereto, including our ability to continue operations at our distribution centers and pharmacies; the ability to drive growth; the ability to successfully integrate operations and employees; the ability to realize anticipated benefits and synergies of the transactions that created Covetrus; the potential impact of the consummation of the transactions on relationships, including with employees, customers and competitors; the ability to retain key personnel; the ability to achieve performance targets; changes in financial markets, interest rates and foreign currency exchange rates; changes in our market; the impact of litigation; the impact of Brexit; the impact of accounting pronouncements, seasonality of our business, leases, expenses, interest expense and debt; risks associated with sufficiency of cash and access to liquidity; cybersecurity risks including risk associated with our dependence on third party service providers as a large portion of our workforce is working from home; and those additional risks discussed under the heading "Risk Factors" in our Annual Report on Form 10-K filed on March 3, 2020, our Quarterly Report on Form 10-Q filed with the SEC on November 10, 2020, and in our other SEC filings. Our forward-looking statements are based on current beliefs and expectations of our management team and, except as required by law, we undertake no obligations to make any revisions to the forward-looking statements contained in this presentation or to update them to reflect events or circumstances occurring after the date of this presentation, whether as a result of new information, future developments or otherwise. Investors are cautioned not to place undue reliance on these forward-looking statements. Non-GAAP Reconciliation This presentation contains non-GAAP financial measures. Management uses these measures in the management of our business and believes that they are useful to investors in evaluating our ongoing operating results and trends. These non-GAAP financial measures have limitations as an analytic tool and should not be considered in isolation or as a substitute for net income or any other measure of financial performance reported in accordance with GAAP. Covetrus’ non-GAAP measures may be calculated differently than similarly named measures reported by other companies. In addition, using non-GAAP measures may have limited value as they exclude certain items that may have a material impact on reported financial results and cash flows. Reconciliation of these non-GAAP measures to the most comparable GAAP measures can be found in the appendix of this presentation, within our SEC filings and on our website at https://ir.covetrus.com. When analyzing Covetrus' performance, it is important to evaluate each adjustment in the reconciliation tables and use adjusted measures in addition to, and not as an alternative to, GAAP measures.

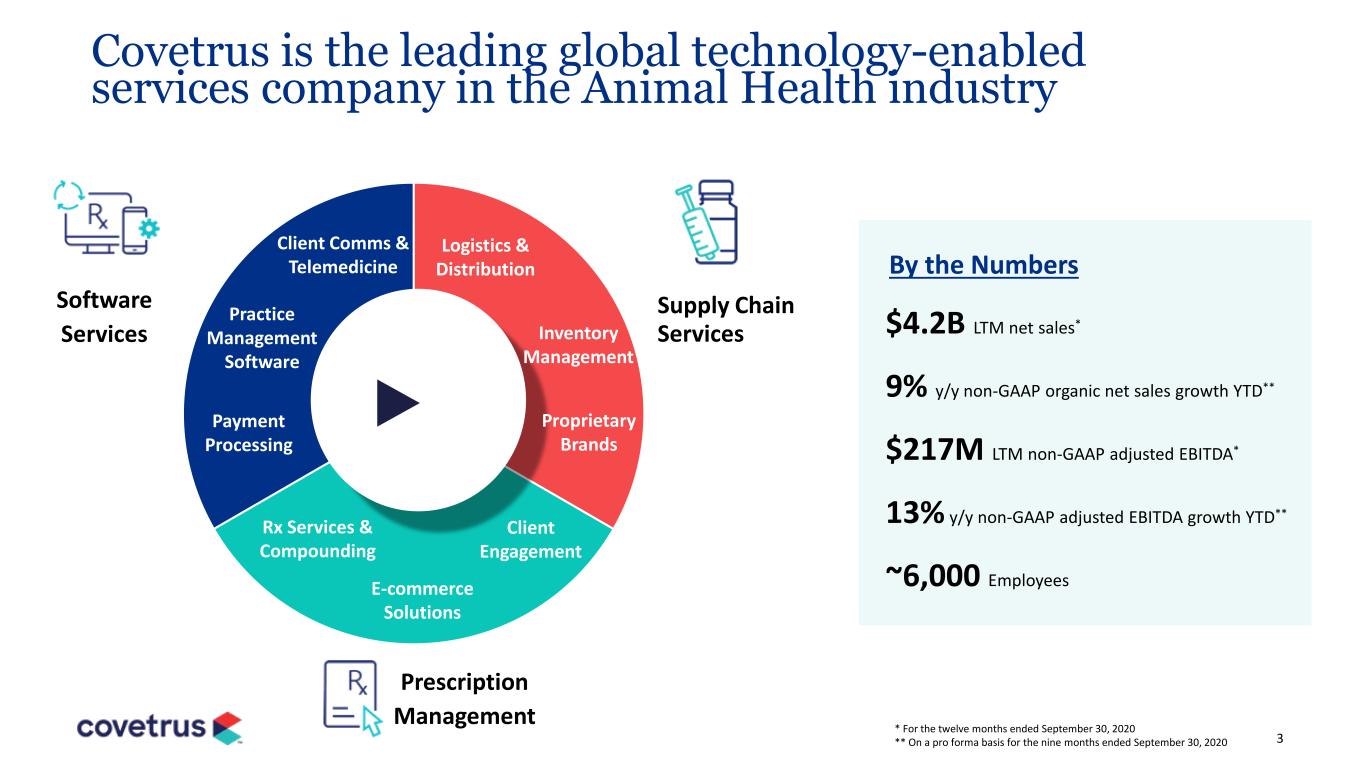

3 Covetrus is the leading global technology-enabled services company in the Animal Health industry By the Numbers $4.2B LTM net sales* 9% y/y non-GAAP organic net sales growth YTD** $217M LTM non-GAAP adjusted EBITDA* 13% y/y non-GAAP adjusted EBITDA growth YTD** ~6,000 Employees * For the twelve months ended September 30, 2020 ** On a pro forma basis for the nine months ended September 30, 2020 Software Services Logistics & Distribution Proprietary Brands Inventory Management Practice Management Software Client Comms & Telemedicine Rx Services & Compounding E-commerce Solutions Prescription Management Supply Chain Services Client Engagement Payment Processing

4 Supply Chain (~$3.7B of LTM net sales, ~100K customers)* >$350M in LTM supply chain net sales* 13% y/y organic net sales growth YTD** >$1.8B in LTM supply chain net sales* 4% y/y organic net sales growth YTD** North America Covetrus is the global leader in veterinary distribution for the companion animal market APAC & Emerging Markets * LTM defined as the last twelve months ended September 30, 2020 and excludes intercompany sales ** Through the first nine months ended September 30, 2020 Europe >$1.5B in LTM supply chain net sales* 6% y/y organic net sales growth YTD**

5 Software Services (>$95M of LTM net sales, ~22K PIMS customers)* Covetrus is the market leader in veterinary practice management software Growth Opportunities: • Additional cloud adoption • Deeper integration with Rx management • Add-on services, including client communications, credit card processing • Insights and data analytics • Enterprise reporting >50% PIMS market share in the U.S. >10% PIMS customers using cloud software * LTM defined as the last twelve months ended September 30, 2020

6 Rx Management (>$370M of LTM net sales, ~11K platform customers)* Market Differentiators: • Proactive e-prescribing • Rx refill and renewal management • PIMS-integration and workflow • AutoShip services • Client engagement • Compounding capabilities 3.6M Orders Filled YTD*** 52% Y/Y Net Sales Growth** Covetrus is the market leader in online pharmacy services for veterinarians * LTM defined as the last twelve months ended September 30, 2020 ** On a pro forma basis through the first nine months ended September 30, 2020 *** Through the first nine months ended September 30, 2020

7 What we said in January 2020 2021 Synchronize Harmonize Our Capabilities 2020 Streamline Focus Our Business 2022 Accelerate Expand Our Offering Our three-year strategic plan

8 Achieved double-digit improvement in organizational health score Invested in employees and launched Global Diversity & Inclusion program Grew organic net sales growth 9% y/y and adjusted EBITDA 13% y/y* Sold scil animal care for $110M and exited all TSAs ahead of schedule Grew prescription management business 52% y/y** Invested in Veterinary Study Groups (VSG) to strengthen customer relationships Established global sourcing capabilities Created new joint venture in Spain Delivered on our Year One plan * On a pro forma organic basis and for the nine-month period ended September 30, 2020 as compared to the nine-month period ended September 30, 2019 ** On a pro forma basis through the first nine months ended September 30, 2020 Significant progress on all strategic priorities in 2020

9 Delivered 29% y/y same-store sales growth* as compared to 16% y/y growth in 2019 Drove a significant improvement in new cohort productivity, with the 2019 cohort the most productive in Company history during their full first year on the platform Sustained momentum in our top decile customers who now generate more than $135K in annual sales to Covetrus or ~4x greater than average platform customer Improved client penetration rate to ~5% of active clients (up from 4% in prior year), with top decile customers having more than 2x the average client penetration rate Increased the percentage of clients using AutoShip by 140 bps y/y, with more than 50% of our clients now using our AutoShip service 2020 was the year of engagement for Rx management * On a pro forma basis through the first nine months ended September 30, 2020 We saw notable improvements across all major metrics in 2020

10 Bringing together our Company and our solutions to win with our Customers, Manufacturers and Consumers Year 2: Synchronize

1122 Driving a differentiated value proposition L E G A C Y M O D E L A L L - I N C O V E T R U S P L AT F O R M Driving improved outcomes for stakeholders VETERINARIANS Better Business and Clinical Outcomes MANUFACTURERS Increased Growth and Market Share PET OWNERS Healthcare + Commerce = Convenience and Better Care Transactional Orientation Limited Client Engagement Low Patient Compliance Proactive Healthcare Strengthened Relationships Increased Demand

12 Laid the foundation for synchronizing in 4Q 2020 • Exited all TSAs to drive greater coordination of our global businesses • Combined our U.S. commercial organizations to provide “one face to customer” • Accelerated delivery of new technology and e-commerce solutions • Invested in consumer marketing organization on behalf of veterinarians • Leveraged shared services to maximize efficiency and talent development Driving growth for our customers and Covetrus

13 Support Prescription Compliance Streamline Technology Solutions The Covetrus Platform of the Future Simplify Pet Owner Engagement Improve Inventory Management Create Visibility to Success Investments to deliver seamless technology experience

14 We are in the early innings of driving the all-in solution • ~10% of our U.S. veterinary practice customers leveraged the entire Covetrus solution in 2020, up ~100 bps y/y • All-in customers generate nearly 5x more in annual sales to Covetrus as compared to our average distribution only customers • New cloud-based software and the roll-out of prescription management outside the U.S. will provide opportunity to drive the all-in solution globally • Significant runway for future growth Supply Chain / Distribution Compounding Services Practice Management Software (PIMS) Rx Management Platform All-in Covetrus

15 • Accelerates our strategy to strengthen customer relationships as we forge a deeper partnership with an iconic veterinary organization in North America • Adds a well-respected leadership team to the organization that will help further deliver on our efforts as the leading advocate for independent veterinarians • Enhances our membership organization capabilities following our highly successful partnerships with PSIvet in the U.S. and Premier Buying Group in the U.K. • Offers the opportunity to build upon VSG’s longstanding success in the market, driving greater value for their members and increasing their membership base • Improves our scale, offers new avenues for driving our proprietary products and solutions, and enhances the Company’s overall growth and margin profile Significant long-term opportunity with VSG investment

16 2021 strategic priorities Increase sales of Covetrus-branded and proprietary product sales by >10% y/y Deliver 30-40% y/y prescription management net sales growth Grow compounding business to >$100M in net sales, up >20% y/y Invest in product roadmap, including new cloud-based software Launch prescription management in U.K. by mid-year and prepare for the 2022 launch in Australia / New Zealand Driving profitable growth and investing in innovation

17 Delivered +9% y/y pro forma organic net sales growth, driven by healthy end-market demand despite COVID-19, strong sales execution and continued market share gains Reported $170M in adjusted EBITDA, +13% y/y on a pro forma basis, a 5.3% margin, +30 bp y/y on a pro forma basis, on positive operating leverage and business mix* Delivered accelerated growth and contribution in prescription management, including 52% y/y net sales growth and a ~20% EBITDA contribution margin on incremental sales** Recruited new talent across the organization, including several new additions to the senior management team, to drive our transformation forward Made an investment in Veterinary Study Groups, an iconic veterinary organization in North America, accelerating our strategy to strengthen customer relationships Delivered strong revenue, EBITDA growth and margin expansion through the first nine months of 2020 * Pro forma adjusted EBITDA margin defined as pro forma adjusted EBITDA divided by pro forma net sales for the nine-month period ended September 30, 2020 ** On a pro forma basis through the first nine months ended September 30, 2020

1822 Healthy growth and contribution from all segments YTD For the Nine Months Ended September 30, 2020 Net Sales Adjusted EBITDA Adjusted EBITDA Margin Actual ($ in Millions) Year-over-Year (Percentage)* Actual ($ in Millions) Year-over-Year (Percentage) Actual (Percentage) Year-over-Year (Basis Points) North America $1,771 11% (10% organic) $141 21% 8.0% +70 bps Europe $1,166 5% (6% organic) $53 6% 4.5% Flat APAC & Emerging Markets $288 7% (14% organic) $20 54% 6.9% +210 bps Highlights: • In North America, healthy underlying end-market demand, improving distribution market share and accelerating growth and contribution from prescription management drove double digit organic revenue and adjusted EBITDA growth • In Europe, mid-single digit organic net sales growth, including strong performance in Ireland, Poland and the Netherlands, and cost containment measures tied to COVID-19 more than offset lost earnings contribution from the divestiture of scil • In APAC & Emerging Markets, double digit organic net sat sales growth, improving gross margins and operating leverage tied to disciplined expense management delivered greater than 50% adjusted EBITDA growth and substantial margin expansion *North America y/y organic net sales growth is on a pro forma organic basis to normalize for the full-year impact of the Vets First Choice acquisition in 2019

19 Prescription management net sales increased 52%y/y YTD, with ~20% adjusted EBITDA contribution margin on incremental sales* Prescription management net sales $66 $72 $74 $84 $110 $104 $40 $50 $60 $70 $80 $90 $100 $110 $120 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 $ in millions 30% 36% 37% 40% 62% 66% 43% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 2Q19 3Q19 4Q19 Jan-Feb 2020 Mar-20 2Q20 3Q20 Prescription management y/y net sales growth Prescription management adjusted EBITDA and margin ($1) $2 $3 $4 $11 $6 -1.5% 2.8% 4.1% 4.8% 10.0% 5.8% -3.0% 0.0% 3.0% 6.0% 9.0% 12.0% ($2) $2 $6 $10 $14 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 M ar gi n A dj us te d EB IT D A $ in millions COVID-19 Tailwind COVID-19 tailwind COVID-19 tailwind Adjusted EBITDA contribution margin on incremental sales* 0% 5% 10% 15% 20% 25% 30% 35% 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 Rolling 12-month target range * On a pro forma basis through the first nine months ended September 30, 2020 ** Adjusted EBITDA contribution margin defined as y/y incremental dollar growth in adjusted EBITDA divided by y/y incremental dollar growth in net sales

20 Made significant progress improving the balance sheet 5.4x 3.6x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 4Q19 3Q20 LT Target Net leverage ratio approaching long-term target range of 3.0x to 3.5x * Net leverage ratio is defined as net debt (which is total debt less cash and cash equivalents) at the end of the period divided by LTM adjusted EBITDA for the same period 3.0x 3.5x • At the end of the third quarter 2020, we had in excess of $650M in available liquidity • Net debt to LTM adjusted EBITDA leverage ratio was 3.6x at end of Q3 2020 • In Q4 2020, we completed the strategic investment in VSG and prepaid our 2021 required principal amortization of $60M • EBITDA growth and declining one-time cash outlays tied to the formation of Covetrus should drive reduced net leverage in 2021 • Targeting 50% adjusted EBITDA to FCF conversion over the long-term

21 $200 $213 $240 $150 $175 $200 $225 $250 $275 $300 2019A* 2020E Guidance (as Issued on November 10, 2020) Initial 2021E Guidance Initial 2021 guidance supports positive momentum $ in millions Initial 2021 Considerations: Assumes no material incremental COVID-19 impact Tailwinds • Continued end-market strength • Growth and EBITDA conversion in our prescription management business • Commercial organization integration • Proprietary products growth • Distribution center WMS roll-out Headwinds • Labor / freight inflation • U.K. manufacturer changes / lost business • Germany 3PL launch • Higher T&E, primarily in 2H21 • Investments to support innovation and final build-out of corporate functions We are establishing initial 2021 adjusted EBITDA guidance in the range of $240M to $250M, reflective of the positive underlying momentum in the business exiting 2020. $210 $250 $218 * On a pro forma basis for the year-end December 31, 2019

22 Attractive Revenue Growth Healthy end-market and share gains Accelerate platform engagement and adoption Global approach with manufacturers Unlock demand with increased compliance Expanding Adjusted EBITDA Margins Stable core and mix shift towards higher- margin solutions 15-20% incremental EBITDA margins in Rx management Efficiencies tied to the reorganization Private brand growth and global sourcing Improving Free Cash Flow Conversion Declining one-time cash outlays No near-term debt maturities Working capital optimization and steady Capex needs Targeting 50% of adjusted EBITDA converting to FCF Capital Allocation Flexibility Long-term target of 3.0-3.5x net debt to LTM adjusted EBITDA Strategic, tuck-in M&A transactions Areas of focus: software, e- commerce, proprietary products, and compounding Drivers of long-term value creation

23 • Solid foundation in place after a great 2020 • A clear plan to deliver strong growth in 2021 • Taking next steps in our three-year plan • Positioned to win in the long term Looking ahead Delivering sustainable growth and value for all stakeholders

COVETRUS PET Watson, 2020 Q&A January 13, 2021

25 Exhibit 1: YTD Non-GAAP reconciliation to pro forma organic net sales growth * Numbers in table may not foot or cross-foot due to rounding ** Historical Vets First Choice - 2019 - from January 1, 2019 to February 7, 2019 Nine Months Ended September 30, 2020 Nine Months Ended September 30, 2019 ($ in millions) Covetrus Covetrus Historical Vets First Choice** Non-GAAP Pro Forma Combined Net sales: $3,217 $2,968 $24 $2,992 North America 1,771 1,592 24 1,616 Europe 1,166 1,114 0 1,114 APAC & Emerging Markets 288 270 0 270 Eliminations (8) (8) 0 (8) Nine Months Ended September 30, 2020 2019 Non-GAAP Pro Forma Y/Y Growth % Change from FX % Change from Acquisitions % Change from Divestitures Non-GAAP Pro Forma Organic Net Sales Growth ($ in millions) Covetrus Non-GAAP Pro Forma Combined Net sales: $3,217 $2,992 8% (1)% 1% (2)% 9% North America 1,771 1,616 10% - - - 10% Europe 1,166 1,114 5% (1)% 4% (4)% 6% APAC & Emerging Markets 288 270 7% (7)% 1% - 14% Eliminations (8) (8) Non-GAAP Pro Forma Net Sales (Unaudited)* Non-GAAP Pro Forma Organic Net Sales Growth (Unaudited)*

26 ($ in millions) Nine Months Ended September 30, 2020 Net income (loss) attributable to Covetrus, Inc. $(15) Plus: Depreciation and amortization 124 Plus: Interest expense, net 37 Plus: Income tax expense 6 EBITDA $152 Plus: Share-based compensation 30 Plus: Strategic consulting 13 Plus: Transaction costs (a) 8 Plus: Separation programs and executive severance 4 Plus: IT infrastructure 3 Plus: Formation of Covetrus (b) 17 Plus: Capital structure 2 Plus: Equity method investment and non-consolidated affiliates (c) 1 Plus: Operating lease right-of-use asset impairment 8 Plus: France managed exit (d) 8 Plus: Other items, net (e) (76) Adjusted EBITDA $170 Exhibit 2: YTD 2020 Non-GAAP reconciliation to adjusted EBITDA * Numbers in table may not foot or cross-foot due to rounding (a) Includes legal, accounting, tax, and other professional fees incurred in connection with acquisitions and divestitures. (b) Includes professional and consulting fees, duplicative costs associated with transition service agreements, and other costs incurred in connection with the separation from Former Parent and establishing Covetrus as an independent public company. (c) Includes the proportionate-share of the adjustments to EBITDA of consolidated and non-consolidated affiliates where Covetrus ownership is less than 100%. (d) Includes $7 million of severance and $1 million of other costs. (e) Includes a $72 million pre-tax gain on the divestiture of scil animal care and a $1 million foreign exchange adjustment on the deconsolidation of Covetrus SAHS

27 Nine Months Ended September 30, 2019 ($ in millions) Covetrus Vets First Choice (Jan. 1 to Feb. 7) Spin-Off and Other Pro Forma Adjustments Purchase Price and Related Pro Forma Adjustments Pro Forma Covetrus Net income (loss) attributable to Covetrus, Inc. $(982) $(9) $(5) $ (4) $(1,000) Plus: Depreciation and amortization 113 2 - 9 124 Plus: Interest expense, net 41 1 6 - 48 Less: Income tax benefit (7) - (1) (2) (10) EBITDA (835) (6) - 3 (838) Plus: Share-based compensation 35 - - 3 38 Plus: Transaction costs - 6 - (6) - Plus: Formation of Covetrus (a) 26 - - - 26 Plus: Separation programs and executive severance 1 - - - 1 Plus: Carve-out operating expenses 5 - - - 5 Plus: Goodwill impairment 939 - - - 939 Less: Minority interest in goodwill impairment (3) - - - (3) Plus: IT infrastructure 4 - - - 4 Plus: Other items, net (19) (2) - - (21) Adjusted EBITDA $153 $(2) $ - $ - $151 Exhibit 3: YTD 2019 Non-GAAP reconciliation to pro forma adjusted EBITDA * Numbers in table may not foot or cross-foot due to rounding (a) Includes professional and consulting fees, duplicative costs associated with transition service agreements, and other costs incurred in connection with the separation from Former Parent and establishing Covetrus as an independent public company.

28 Exhibit 4: 2019 Non-GAAP reconciliation to pro forma adjusted EBITDA Twelve Months Ended December 31, 2019 ($ in millions) Covetrus Vets First Choice (Jan. 1 to Feb. 7) Spin-Off and Other Pro Forma Adjustments Purchase Price and Related Pro Forma Adjustments Pro Forma Covetrus Net loss attributable to Covetrus, Inc. $(1,019) $(9) $(5) $ (4) $(1,038) Plus: Depreciation and amortization 155 2 - 9 166 Plus: Interest expense, net 53 1 6 - 60 Less: Income tax benefit (7) - (1) (2) (10) EBITDA (818) (6) - 3 (822) Plus: Share-based compensation 46 - - 3 49 Plus: Transaction costs 2 6 - (6) 2 Plus: Formation of Covetrus (a) 34 - - - 34 Plus: Carve-out operating expenses 5 - - - 5 Plus: IT infrastructure 6 - - - 6 Plus: Goodwill impairment 938 - - - 938 Less: Minority interest in goodwill impairment (3) - - - (3) Plus: Separation programs and executive severance 11 - - - 11 Plus: Other items, net (19) (2) - - (21) Adjusted EBITDA $202 $(2) $ - $ - $200 * Numbers in table may not foot or cross-foot due to rounding (a) Includes professional and consulting fees, duplicative costs associated with transition service agreements, and other costs incurred in connection with the separation from Former Parent and establishing Covetrus as an independent public company.