Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99-1 - AeroVironment Inc | tm213005d1_ex99-1.htm |

| 8-K - FORM 8-K - AeroVironment Inc | tm213005d1_8k.htm |

Exhibit 99.2

|

052620Slide 1© 2021 AeroVironment, Inc. – Proprietary Information Conference Call PRESENTER NAME January 13, 2020 |

|

Safe Harbor Statement Certain statements in this presentation may constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” or words or phrases with similar meaning. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. Factors that could cause actual results to differ materially from the forward-looking statements include, but are not limited to, our ability to successfully consummate the transactions contemplated by the agreement to purchase Arcturus UAV on a timely basis, if at all, including the satisfaction of the closing conditions of such transactions; the risk that disruptions will occur from the transactions that will harm our business or any acquired business(es); any disruptions or threatened disruptions to our relationships with our distributors, suppliers, customers and employees; the ability to timely and sufficiently integrate acquired operations into our ongoing business and compliance programs, including the expansion of international aspects; reliance on sales to the U.S. government; availability of U.S. government funding for defense procurement and R&D programs; changes in the timing and/or amount of government spending; our ability to perform under existing contracts and obtain new contracts; risks related to our international business, including compliance with export control laws; potential need for changes in our long-term strategy in response to future developments; the extensive regulatory requirements governing our contracts with the U.S. Government and international customers; the consequences to our financial position, business and reputation that could result from failing to comply with such regulatory requirements; unexpected technical and marketing difficulties inherent in major research and product development efforts; the impact of potential security and cyber threats; changes in the supply and/or demand and/or prices for our products and services; the activities of competitors and increased competition; failure of the markets in which we operate to grow; uncertainty in the customer adoption rate of commercial use unmanned aircraft systems; failure to remain a market innovator and create new market opportunities; changes in significant operating expenses, including components and raw materials; failure to develop new products; the extensive regulatory requirements governing our contracts with the U.S. government; risk of litigation, including but not limited to pending litigation arising from the sale of our EES business; product liability, infringement and other claims; changes in the regulatory environment; the impact of the outbreak related to the strain of coronavirus known as COVID-19 on our business operations; and general economic and business conditions in the United States and elsewhere in the world. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. For a further list and description of such risks and uncertainties, see the reports we file with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at www.sec.gov or on our website at www.investor.avinc.com/financial-information. We do not intend, and undertake no obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. 052620 © 2021 AeroVironment, Inc. – Proprietary Information |

|

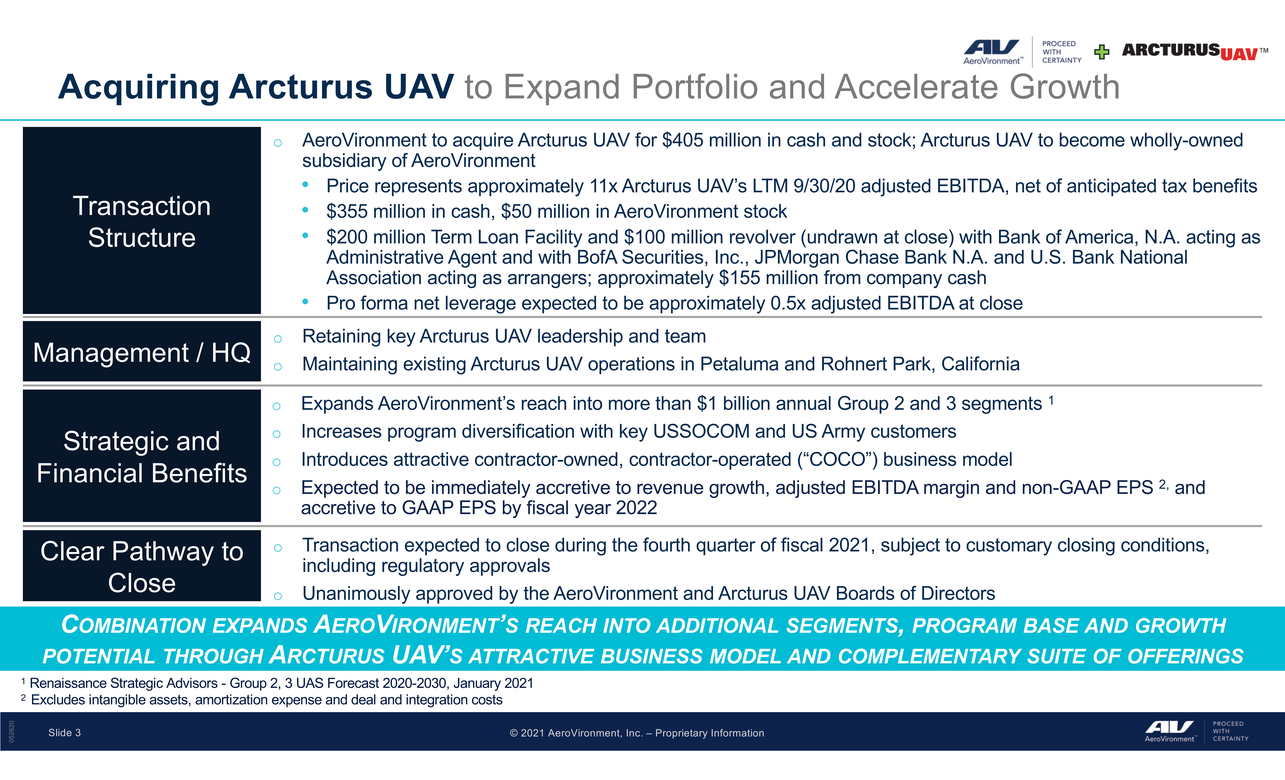

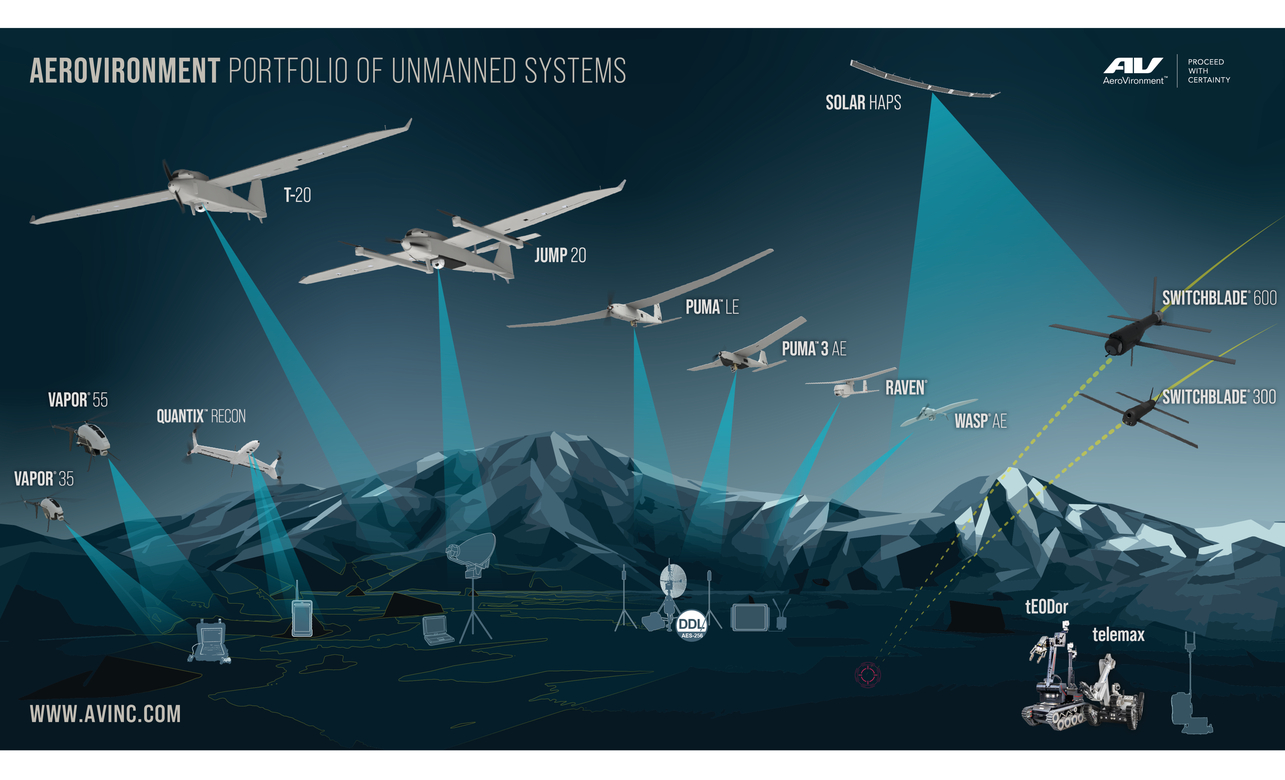

Acquiring Arcturus UAV to Expand Portfolio and Accelerate Growth Transaction Structure Management / HQ Strategic and Financial Benefits Clear Pathway to Close AeroVironment to acquire Arcturus UAV for $405 million in cash and stock; Arcturus UAV to become wholly-owned subsidiary of AeroVironment Price represents approximately 11x Arcturus UAV’s LTM 9/30/20 adjusted EBITDA, net of anticipated tax benefits $355 million in cash, $50 million in AeroVironment stock $200 million Term Loan Facility and $100 million revolver (undrawn at close) with Bank of America, N.A. acting as Administrative Agent and with BofA Securities, Inc., JPMorgan Chase Bank N.A. and U.S. Bank National Association acting as arrangers; approximately $155 million from company cash Pro forma net leverage expected to be approximately 0.5x adjusted EBITDA at close Retaining key Arcturus UAV leadership and team Maintaining existing Arcturus UAV operations in Petaluma and Rohnert Park, California Expands AeroVironment’s reach into more than $1 billion annual Group 2 and 3 segments 1 Increases program diversification with key USSOCOM and US Army customers Introduces attractive contractor-owned, contractor-operated (“COCO”) business model Expected to be immediately accretive to revenue growth, adjusted EBITDA margin and non-GAAP EPS 2, and accretive to GAAP EPS by fiscal year 2022 Transaction expected to close during the fourth quarter of fiscal 2021, subject to customary closing conditions, including regulatory approvals Unanimously approved by the AeroVironment and Arcturus UAV Boards of Directors COMBINATION EXPANDS AEROVIRONMENT’S REACH INTO ADDITIONAL SEGMENTS, PROGRAM BASE AND GROWTH POTENTIAL THROUGH ARCTURUS UAV’S ATTRACTIVE BUSINESS MODEL AND COMPLEMENTARY SUITE OF OFFERINGS Renaissance Strategic Advisors - Group 2, 3 UAS Forecast 2020-2030, January 2021 Excludes intangible assets, amortization expense and deal and integration costs 052620 © 2021 AeroVironment, Inc. – Proprietary Information |

|

Arcturus UAV is a Leading Provider of Group 2 and 3 UAS Highlights Key Products Leading global designer and manufacturer of Group 2 and 3 high performance unmanned aircraft systems Provider of end-to-end field services, including FSR recruiting, training and deployed operations management ~270 employees with facilities in Petaluma and Rohnert Park, California Demonstrated track record of success with over 110k flight hours between the Jump 20 and T-20 Success of multi-payload integration supports dynamic multi-mission capabilities JUMP 20 offers true Group 3 UAS runway and infrastructure independence JUMP 20 55 lb Payload Capacity High-Performance VTOL T-20 85 lb Payload Capacity 24 Hour Endurance T-15 15 lb Payload Capacity New Airframe Efficiency Key Customers LTM 9/30/20 REVENUE ~$84M ADJ. EBITDA ~$35M 052620 © 2021 AeroVironment, Inc. – Proprietary Information |

|

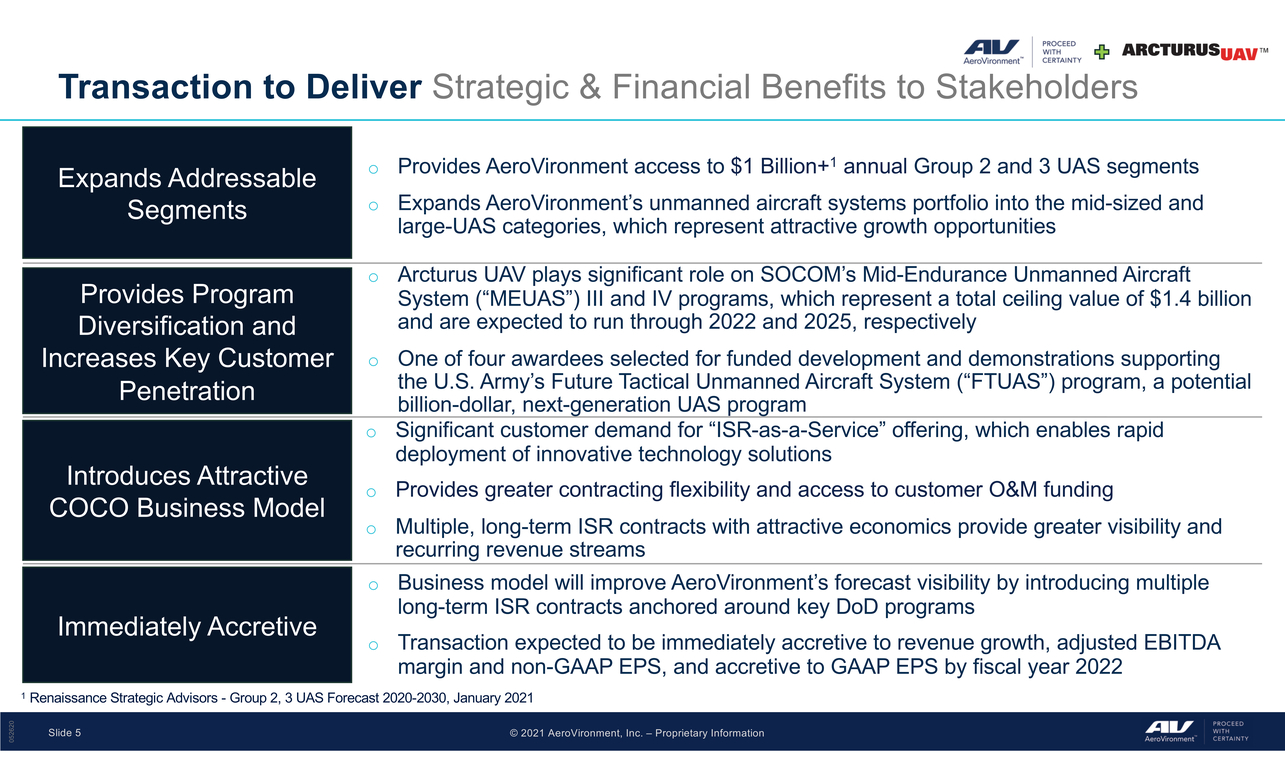

Transaction to Deliver Strategic & Financial Benefits to Stakeholders Expands Addressable Segments Provides AeroVironment access to $1 Billion+1 annual Group 2 and 3 UAS segments Expands AeroVironment’s unmanned aircraft systems portfolio into the mid-sized and large-UAS categories, which represent attractive growth opportunities Provides Program Diversification and Increases Key Customer Penetration Introduces Attractive COCO Business Model Immediately Accretive Arcturus UAV plays significant role on SOCOM’s Mid-Endurance Unmanned Aircraft System (“MEUAS”) III and IV programs, which represent a total ceiling value of $1.4 billion and are expected to run through 2022 and 2025, respectively One of four awardees selected for funded development and demonstrations supporting the U.S. Army’s Future Tactical Unmanned Aircraft System (“FTUAS”) program, a potential billion-dollar, next-generation UAS program Significant customer demand for “ISR-as-a-Service” offering, which enables rapid deployment of innovative technology solutions Provides greater contracting flexibility and access to customer O&M funding Multiple, long-term ISR contracts with attractive economics provide greater visibility and recurring revenue streams Business model will improve AeroVironment’s forecast visibility by introducing multiple long-term ISR contracts anchored around key DoD programs Transaction expected to be immediately accretive to revenue growth, adjusted EBITDA margin and non-GAAP EPS, and accretive to GAAP EPS by fiscal year 2022 1 Renaissance Strategic Advisors - Group 2, 3 UAS Forecast 2020-2030, January 2021 052620 © 2021 AeroVironment, Inc. – Proprietary Information |

|

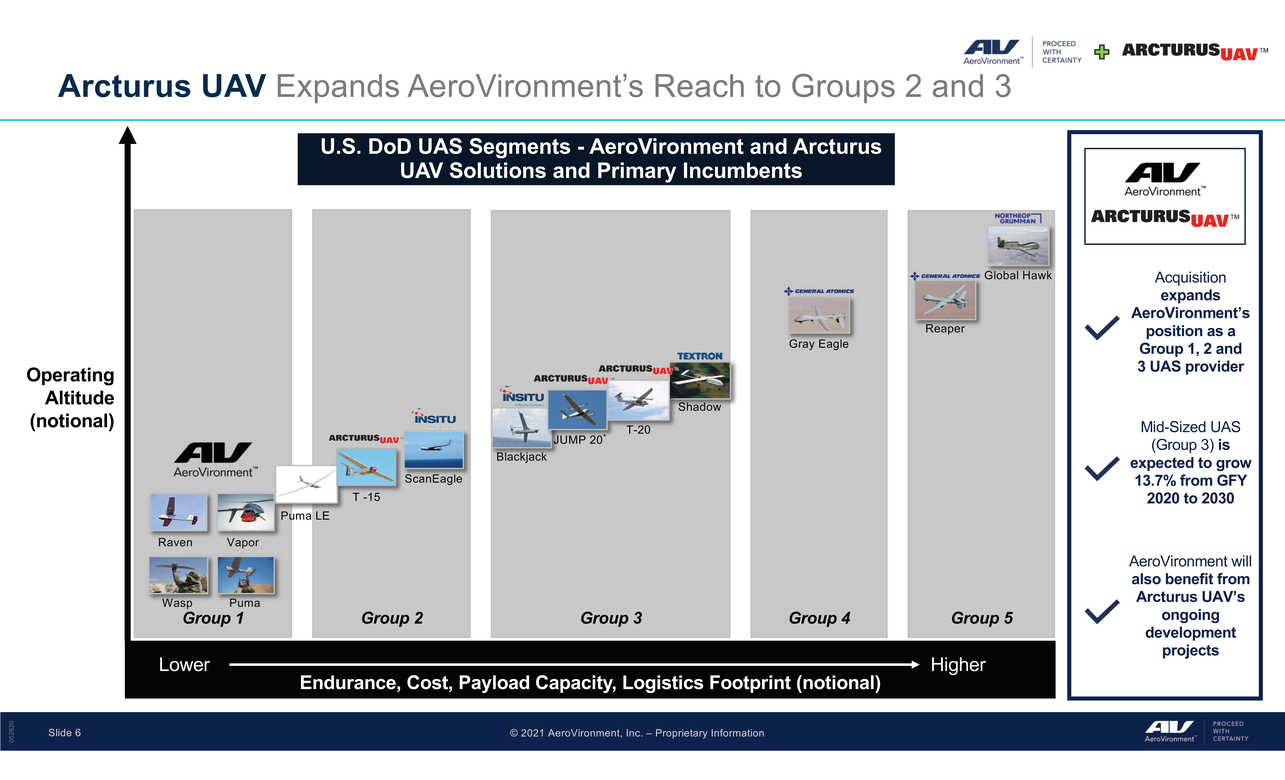

Arcturus UAV Expands AeroVironment’s Reach to Groups 2 and 3 U.S. DoD UAS Segments - AeroVironment and Arcturus UAV Solutions and Primary Incumbents Operating Altitude (notional) Puma LE T -15 ScanEagle Blackjack JUMP 20* T-20 Shadow Gray Eagle Reaper Global Hawk Acquisition expands AeroVironment’s position as a Group 1, 2 and 3 UAS provider Mid-Sized UAS (Group 3) is expected to grow 13.7% from GFY 2020 to 2030 RavenVapor WaspPuma Group 1Group 2Group 3Group 4Group 5 AeroVironment will also benefit from Arcturus UAV’s ongoing development projects Lower 052620 Higher Slide 6 © 2021 AeroVironment, Inc. – Proprietary Information |

|

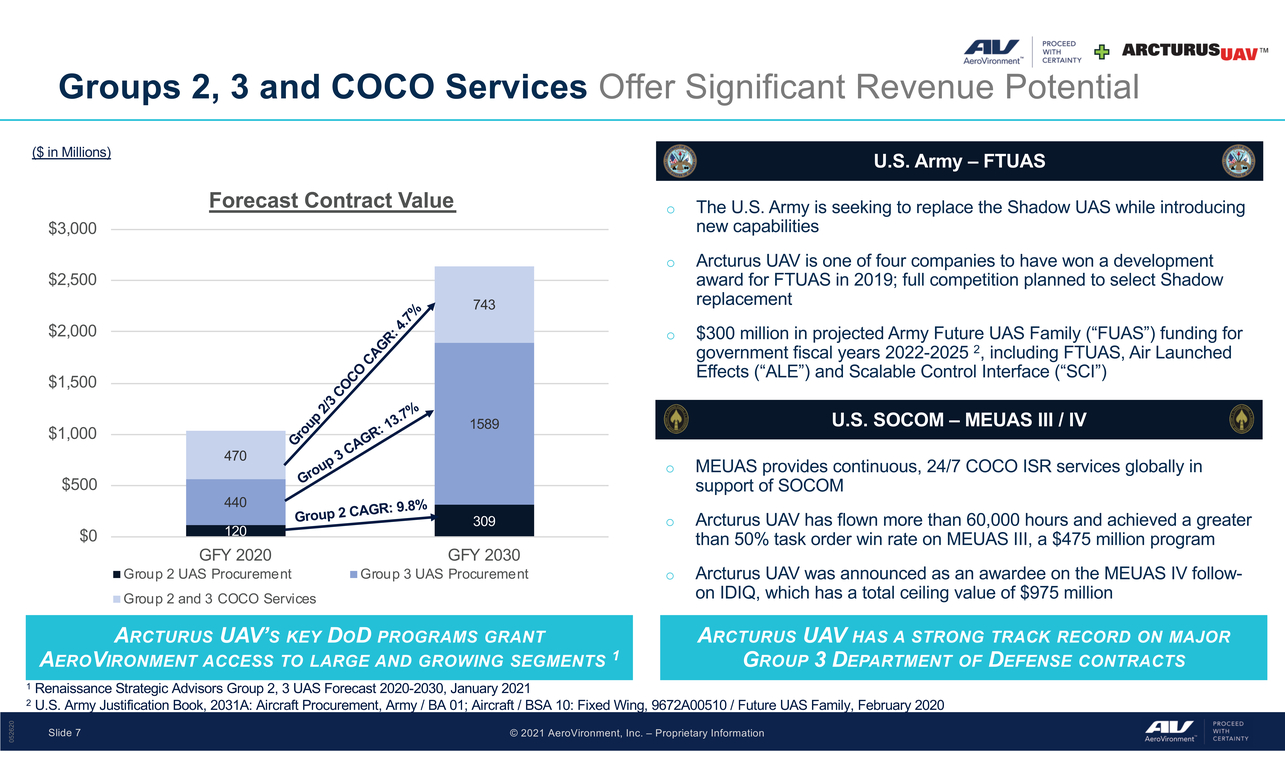

Groups 2, 3 and COCO Services Offer Significant Revenue Potential ($ in Millions) $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 Forecast Contract Value 470 440 120 743 1589 309 U.S. Army – FTUAS The U.S. Army is seeking to replace the Shadow UAS while introducing new capabilities Arcturus UAV is one of four companies to have won a development award for FTUAS in 2019; full competition planned to select Shadow replacement $300 million in projected Army Future UAS Family (“FUAS”) funding for government fiscal years 2022-2025 2, including FTUAS, Air Launched Effects (“ALE”) and Scalable Control Interface (“SCI”) U.S. SOCOM – MEUAS III / IV MEUAS provides continuous, 24/7 COCO ISR services globally in support of SOCOM Arcturus UAV has flown more than 60,000 hours and achieved a greater than 50% task order win rate on MEUAS III, a $475 million program GFY 2020GFY 2030 Group 2 UAS ProcurementGroup 3 UAS Procurement Group 2 and 3 COCO Services ARCTURUS UAV’S KEY DOD PROGRAMS GRANT AEROVIRONMENT ACCESS TO LARGE AND GROWING SEGMENTS 1 Renaissance Strategic Advisors Group 2, 3 UAS Forecast 2020-2030, January 2021 oArcturus UAV was announced as an awardee on the MEUAS IV follow-on IDIQ, which has a total ceiling value of $975 million ARCTURUS UAV HAS A STRONG TRACK RECORD ON MAJOR GROUP 3 DEPARTMENT OF DEFENSE CONTRACTS 052620 Slide 7 © 2021 AeroVironment, Inc. – Proprietary Information |

|

Transaction Creates Significant Value for All Stakeholders Shareholders Immediately accretive to revenue growth, margin profile and non-GAAP EPS Expands reach to the higher growth Group 2 and 3 UAS segments Further diversifies revenue, product and program mix with recurring revenue model that improves forecast visibility and margins Strategically deploys capital for growth and near and long-term shareholder value creation Customers Customers benefit from a one-stop shop for Group 1-3 UAS and loitering missile systems needs while leveraging the best technology across both organizations Integration of multi-domain unmanned aircraft systems and unmanned ground vehicles offer robust capability sets COCO services model provides greater contracting flexibility Employees Shared culture of innovation, teamwork and supporting the warfighter Commitment to investing in human capital across both organizations Experienced leadership team and talented work force Offers increased resources and opportunities across employee base 052620 © 2021 AeroVironment, Inc. – Proprietary Information |

|

Combination Accelerates Growth Strategy and Enhances Industry Presence Brand and Global Footprint AeroVironment can grow Arcturus UAV’s Group 2 and 3 UAS international sales through its brand and roster of international customers Rich Technology Portfolio Combine internally developed technologies in Avionics, Autonomy, Target Recognition, Gimbals, VTOL and GCS to expand capabilities Multi-Mission Solution Integration Integration of AeroVironment’s tactical missile systems with Arcturus UAV’s offerings to deliver unique and robust mission solutions Improve Scale and Process Harmonize technical, manufacturing and business resources to symbiotically grow the respective businesses Increase Customer Penetration Leverage Arcturus UAV’s program of record wins and find new opportunities to expand footprint with key strategic DoD customers Incorporate COCO Service Business Model Apply Arcturus UAV’s COCO services model to generate incremental sales for current AeroVironment products SIGNIFICANT AND COMPLEMENTARY CAPABILITIES TO DRIVE TOP AND BOTTOM LINE GROWTH 052620 © 2021 AeroVironment, Inc. – Proprietary Information |

|

ir@avinc.com 052620Slide 10© 2021 AeroVironment, Inc. – Proprietary Information+1 (805) 520-8350 |