Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Premier, Inc. | d38686dex992.htm |

| 8-K - 8-K - Premier, Inc. | d38686d8k.htm |

J.P. Morgan 39th Annual Healthcare Conference Susan DeVore Chief Executive Officer January 12, 2021 Exhibit 99.1

Forward-looking Statements and Non-GAAP Financial Measures Forward-looking statements – Statements made in this presentation and the accompanying webcast that are not statements of historical or current facts, such as those related to expected growth opportunities in each of Premier’s business segments and the ability to realize such opportunities, strategic priorities to advance Premier’s business, expected financial performance of our direct sourcing business in fiscal 2021, the expected financial and operational impacts of the COVID-19 pandemic, targeted multi-year revenue growth rate in Premier’s Performance Services segment, the expected annual growth rate for consolidated net revenue, adjusted EBITDA and adjusted EPS beginning in fiscal 2022, the payment of future dividends, and the matters discussed on the “Our Value Proposition” slide are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential factors that could affect Premier’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Premier’s periodic and current filings with the SEC, including those discussed under the “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” sections of Premier’s Form 10-K for the fiscal year ended June 30, 2020 and Form 10-Q for the quarter ended September 30, 2020, each filed with the SEC and available on Premier’s website at investors.premierinc.com. Forward-looking statements speak only as of the date they are made, and Premier undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events that occur after that date, or otherwise. Non-GAAP financial measures – This presentation and accompanying webcast includes certain “adjusted” or “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. You should carefully read Premier’s periodic and current filings with the SEC for definitions and further explanation and disclosure regarding our use of non-GAAP financial measures and such filings should be read in conjunction with this presentation.

Maintain a strong balance sheet with financial flexibility to support capital deployment priorities Well-positioned to capitalize on growth opportunities and maintain market-leading position through further penetration of supply chain and enterprise analytics markets Provide comprehensive innovative solutions using technology, services and market-leading analytics to drive clinical and financial improvement Our mission is to improve the health of communities. Through technology enablement, partnership and collaboration, we are innovating to improve and accelerate the delivery of high-quality, cost-effective healthcare. Collaborate through unique member alignment to innovate and drive meaningful change Anticipate change and well-positioned to respond to market trends Uniquely Positioned to Deliver Value

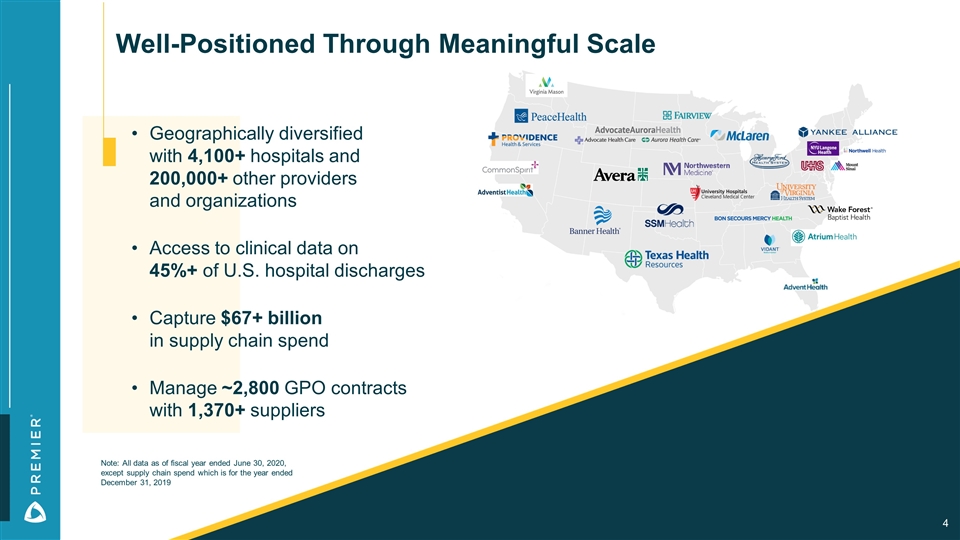

Well-Positioned Through Meaningful Scale Geographically diversified with 4,100+ hospitals and 200,000+ other providers and organizations Access to clinical data on 45%+ of U.S. hospital discharges Capture $67+ billion in supply chain spend Manage ~2,800 GPO contracts with 1,370+ suppliers Note: All data as of fiscal year ended June 30, 2020, except supply chain spend which is for the year ended December 31, 2019

Unique Member Alignment Drives Collaboration Viewed by ~90% of members as a strategic partner or extension of their organization Three-year average GPO retention rate of 98% and SaaS institutional renewal rate of 96% Achieved Net Promoter Score of 70+ Co-develop and co-invest alongside members creating solutions to transform healthcare delivery Advisory committees with ~140 participating hospital and health system members Note: Data updated annually and as of fiscal year ended June 30, 2020

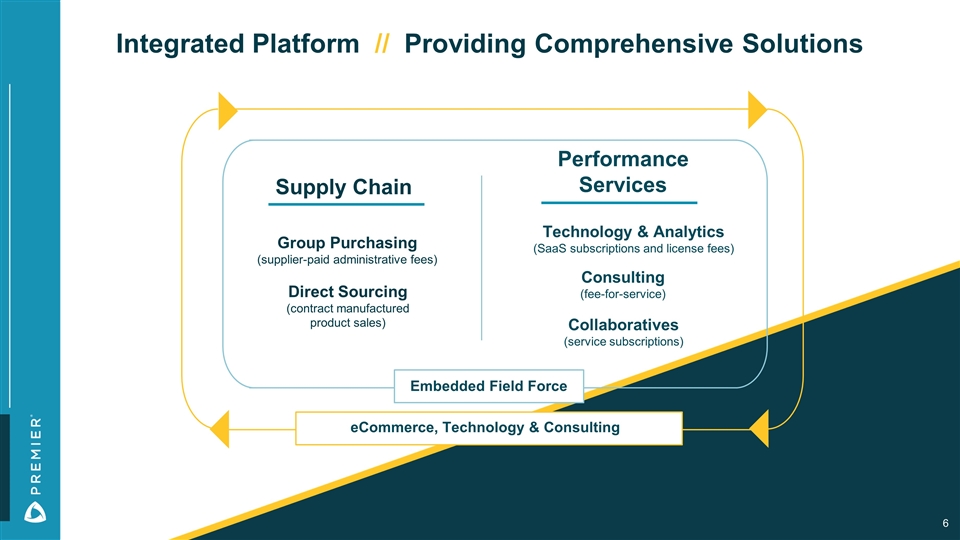

Integrated Platform // Providing Comprehensive Solutions Supply Chain Group Purchasing (supplier-paid administrative fees) Performance Services Direct Sourcing (contract manufactured product sales) Technology & Analytics (SaaS subscriptions and license fees) Collaboratives (service subscriptions) Consulting (fee-for-service) eCommerce, Technology & Consulting Embedded Field Force

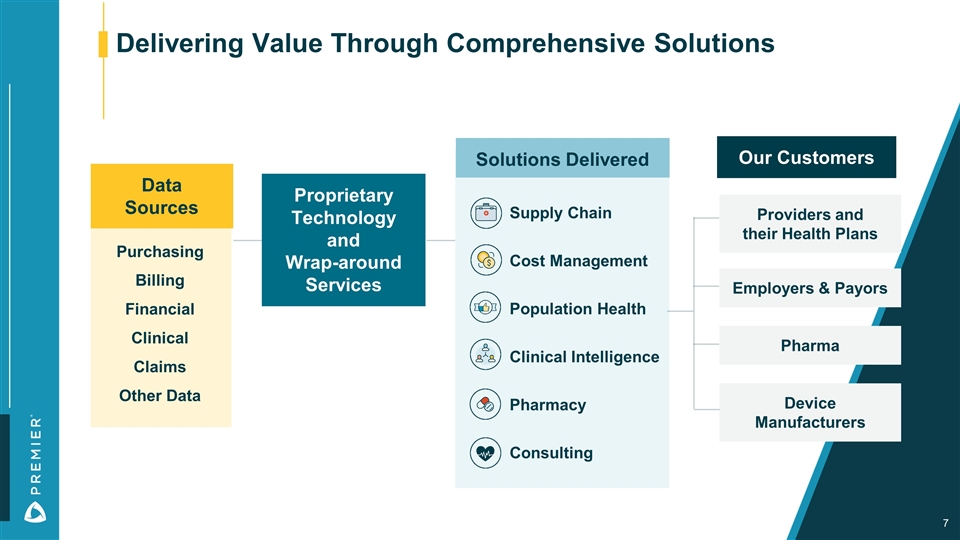

Our Customers Delivering Value Through Comprehensive Solutions Purchasing Billing Financial Clinical Claims Other Data Solutions Delivered Data Sources Device Manufacturers Providers and their Health Plans Employers & Payors Pharma Supply Chain Cost Management Population Health Clinical Intelligence Pharmacy Consulting Proprietary Technology and Wrap-around Services

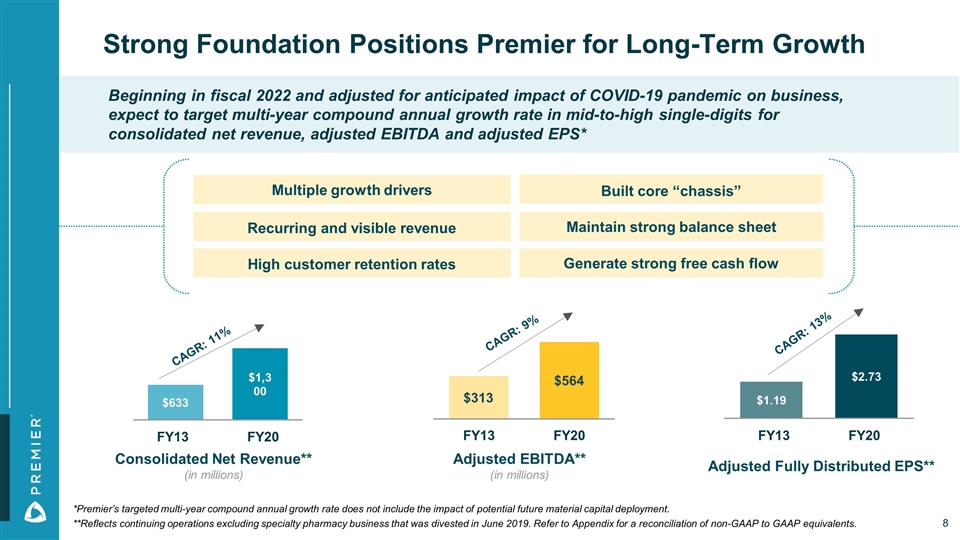

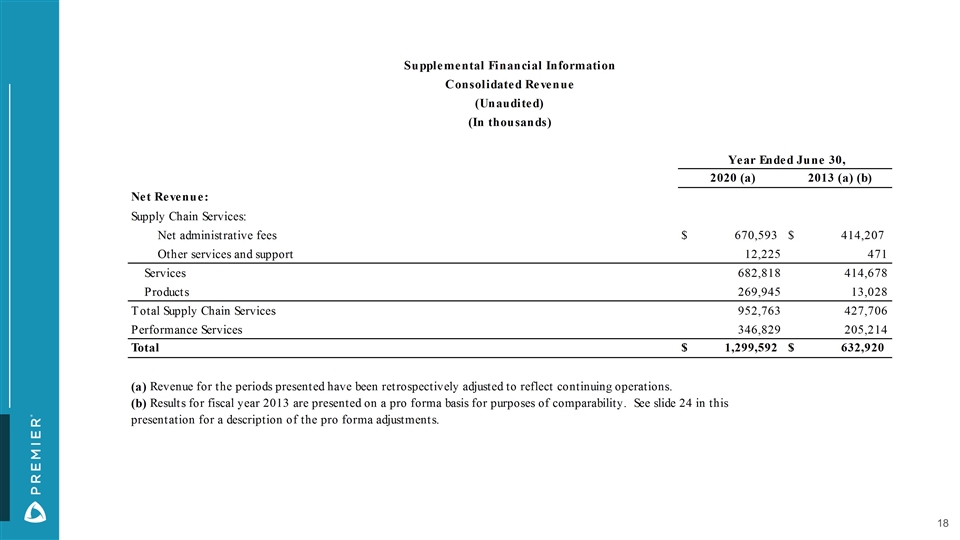

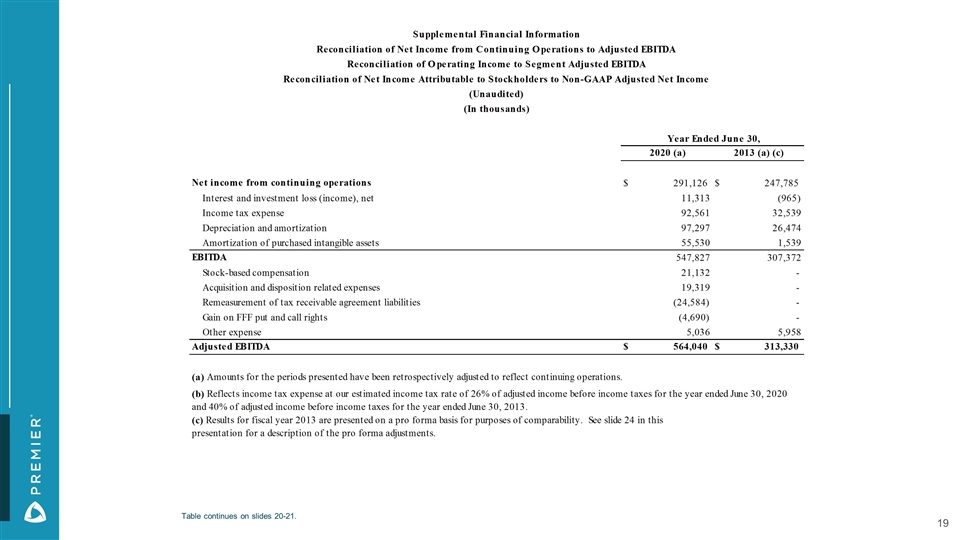

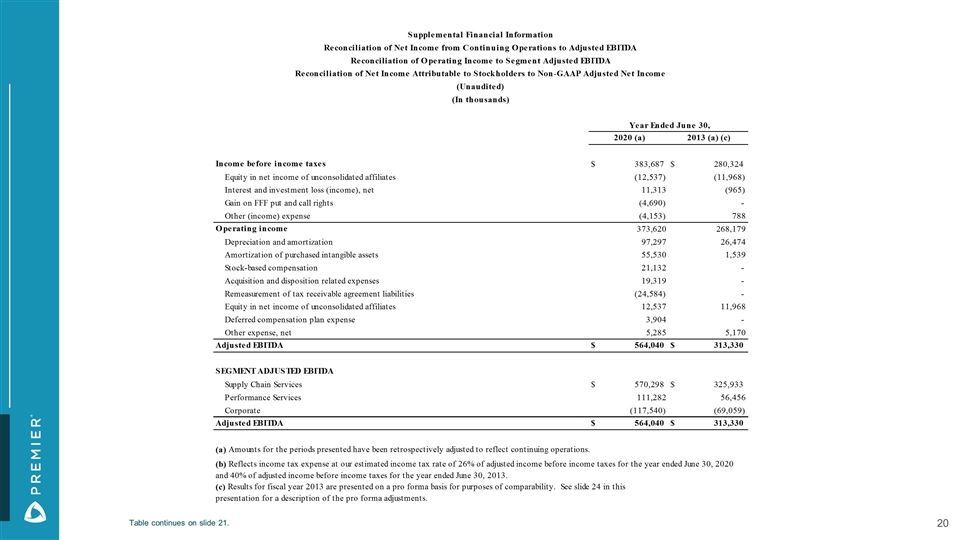

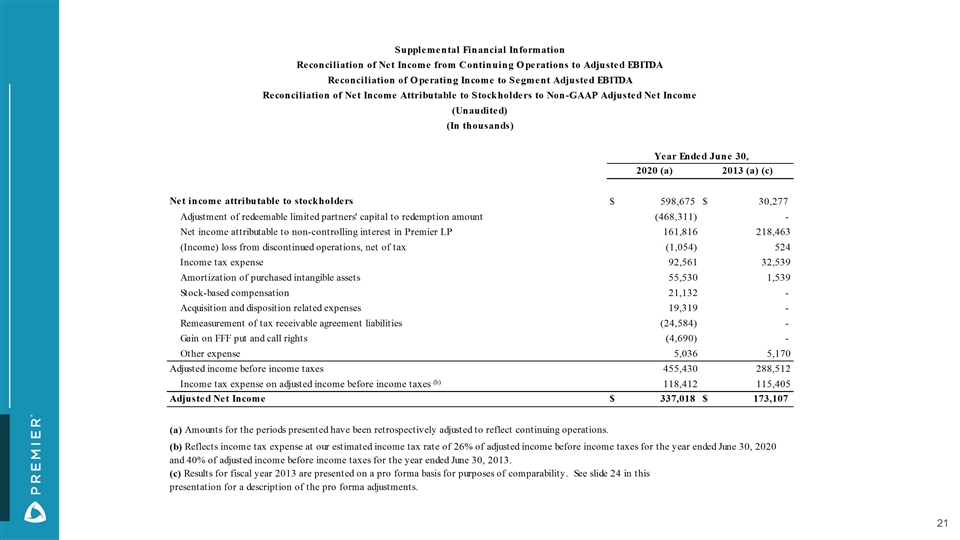

Strong Foundation Positions Premier for Long-Term Growth CAGR: 11% CAGR: 9% CAGR: 13% Consolidated Net Revenue** (in millions) Adjusted EBITDA** (in millions) Adjusted Fully Distributed EPS** *Premier’s targeted multi-year compound annual growth rate does not include the impact of potential future material capital deployment. **Reflects continuing operations excluding specialty pharmacy business that was divested in June 2019. Refer to Appendix for a reconciliation of non-GAAP to GAAP equivalents. Recurring and visible revenue High customer retention rates Generate strong free cash flow Maintain strong balance sheet Multiple growth drivers Built core “chassis” Beginning in fiscal 2022 and adjusted for anticipated impact of COVID-19 pandemic on business, expect to target multi-year compound annual growth rate in mid-to-high single-digits for consolidated net revenue, adjusted EBITDA and adjusted EPS* FY13 FY20 FY13 FY20 FY13 FY20

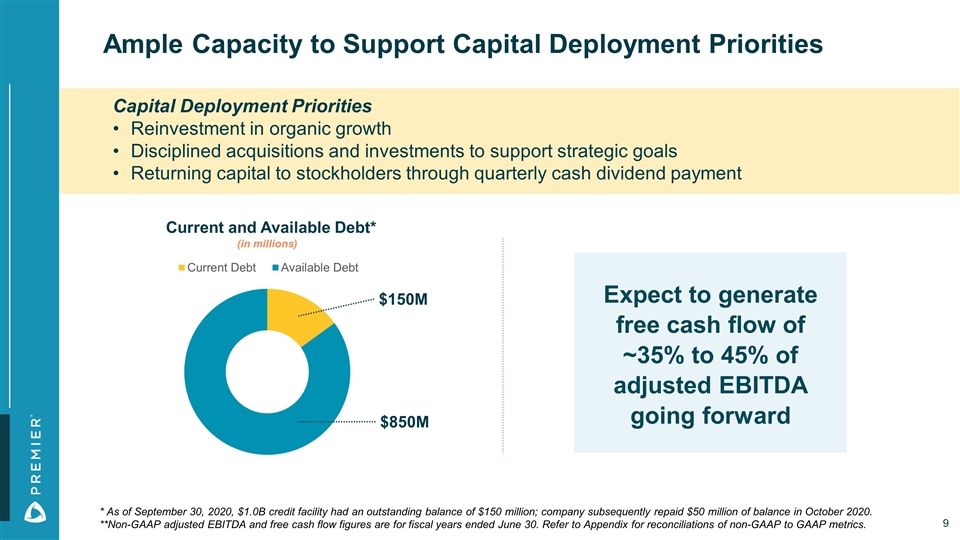

Ample Capacity to Support Capital Deployment Priorities * As of September 30, 2020, $1.0B credit facility had an outstanding balance of $150 million; company subsequently repaid $50 million of balance in October 2020. **Non-GAAP adjusted EBITDA and free cash flow figures are for fiscal years ended June 30. Refer to Appendix for reconciliations of non-GAAP to GAAP metrics. $150M $850M (in millions) Capital Deployment Priorities Reinvestment in organic growth Disciplined acquisitions and investments to support strategic goals Returning capital to stockholders through quarterly cash dividend payment Expect to generate free cash flow of ~35% to 45% of adjusted EBITDA going forward

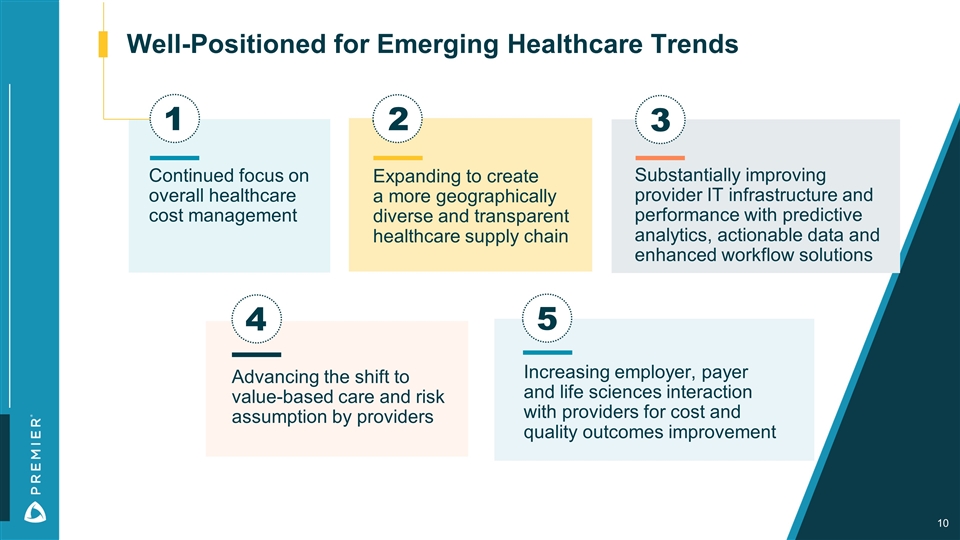

Well-Positioned for Emerging Healthcare Trends Substantially improving provider IT infrastructure and performance with predictive analytics, actionable data and enhanced workflow solutions Continued focus on overall healthcare cost management Increasing employer, payer and life sciences interaction with providers for cost and quality outcomes improvement Advancing the shift to value-based care and risk assumption by providers 1 2 3 4 5 Expanding to create a more geographically diverse and transparent healthcare supply chain

COVID-19 // Leading through Pandemic to Deliver Long-Term Value Leveraging relationships at every level of supply chain to enable access to supplies, intelligence and technology Supporting members through: Supply chain and pharmacy Technology and data Care delivery and operations Securing critically needed PPE and other high-demand supplies for members Currently expect quarterly sequential increase of ~$60M in direct sourcing products revenue in fiscal 2Q21, and further incremental increase in fiscal 3Q21 with anticipated step down in fiscal 4Q21 Uniquely positioned as trusted partner in connecting healthcare community Providers, suppliers, manufacturers, distributors, life sciences companies and government agencies Demonstrates value of capabilities, promotes deeper and more integrated partnerships, and advances long-term positioning

Strategic Priorities to Advance Our Business Grow GPO portfolio and expand high-compliance purchasing programs Technology-enable all aspects of healthcare supply chain Co-own and co-manage member supply chain outcomes to drive further efficiencies and savings Continue to provide integrated analytics, workflow technology and advisory services Expand data and technology platform alongside machine-learning capabilities Further expansion into new markets through Contigo Health and applied sciences businesses Accelerate and support transition to value-based payment models Enable Clinical Improvement Through Data Analytics and Wrap-Around Services Extend End-to-End Supply Chain Capabilities

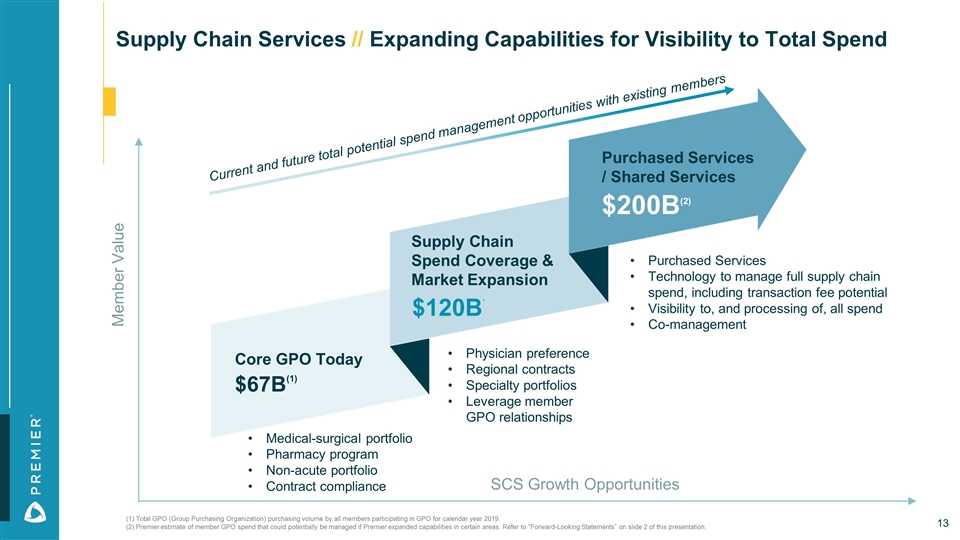

Medical-surgical portfolio Pharmacy program Non-acute portfolio Contract compliance Physician preference Regional contracts Specialty portfolios Leverage member GPO relationships Supply Chain Services // Expanding Capabilities for Visibility to Total Spend Member Value SCS Growth Opportunities Purchased Services Technology to manage full supply chain spend, including transaction fee potential Visibility to, and processing of, all spend Co-management (1) Total GPO (Group Purchasing Organization) purchasing volume by all members participating in GPO for calendar year 2019. (2) Premier estimate of member GPO spend that could potentially be managed if Premier expanded capabilities in certain areas. Refer to “Forward-Looking Statements” on slide 2 of this presentation. Core GPO Today Supply Chain Spend Coverage & Market Expansion Purchased Services / Shared Services $67B(1) $120B` $200B(2) Current and future total potential spend management opportunities with existing members

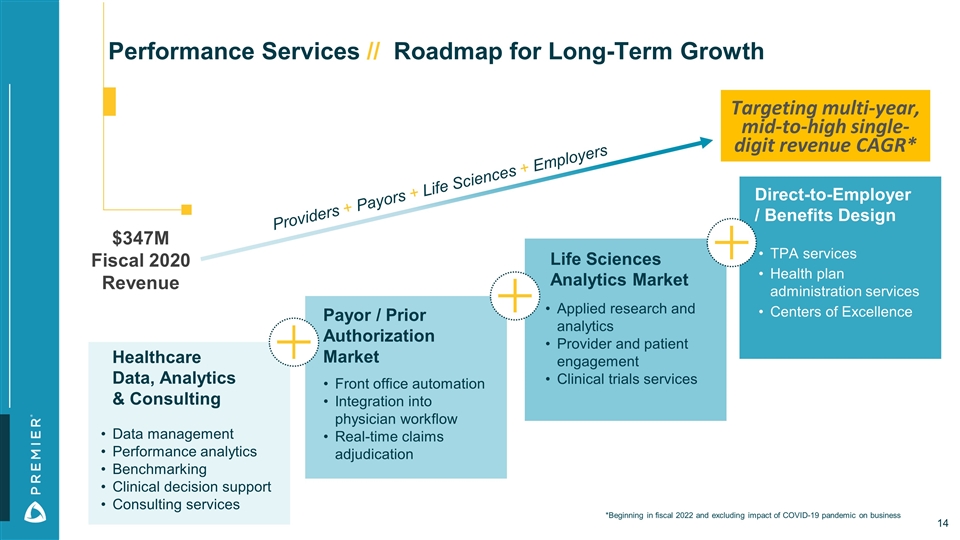

Data management Performance analytics Benchmarking Clinical decision support Consulting services Front office automation Integration into physician workflow Real-time claims adjudication Applied research and analytics Provider and patient engagement Clinical trials services Healthcare Data, Analytics & Consulting Payor / Prior Authorization Market Life Sciences Analytics Market Direct-to-Employer / Benefits Design TPA services Health plan administration services Centers of Excellence $347M Fiscal 2020 Revenue Targeting multi-year, mid-to-high single-digit revenue CAGR* Performance Services // Roadmap for Long-Term Growth Providers + Payors + Life Sciences + Employers *Beginning in fiscal 2022 and excluding impact of COVID-19 pandemic on business

Sustainable Business Practices to Drive Success Promote sound governance Enhanced Diversity, Inclusion and Belonging program for all Premier employees Long-standing, robust Supplier Diversity program Maintain income equality and enhance diversity in recruiting and promoting exceptional talent Collaborate with members to incorporate environmentally preferred purchasing and energy efficiency initiatives into products selection process Named one of World’s Most Ethical Companies* for 13 consecutive years *The Ethisphere Institute®, 2020 Furthering our mission to improve the health of our communities

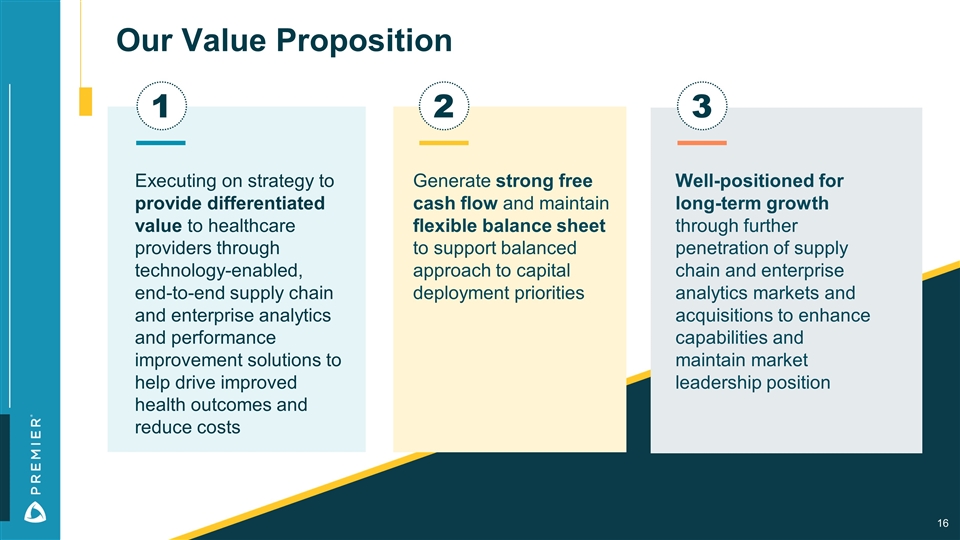

Our Value Proposition Executing on strategy to provide differentiated value to healthcare providers through technology-enabled, end-to-end supply chain and enterprise analytics and performance improvement solutions to help drive improved health outcomes and reduce costs Generate strong free cash flow and maintain flexible balance sheet to support balanced approach to capital deployment priorities Well-positioned for long-term growth through further penetration of supply chain and enterprise analytics markets and acquisitions to enhance capabilities and maintain market leadership position 2 3 1

Appendix

Table continues on slides 20-21.

Table continues on slide 21.

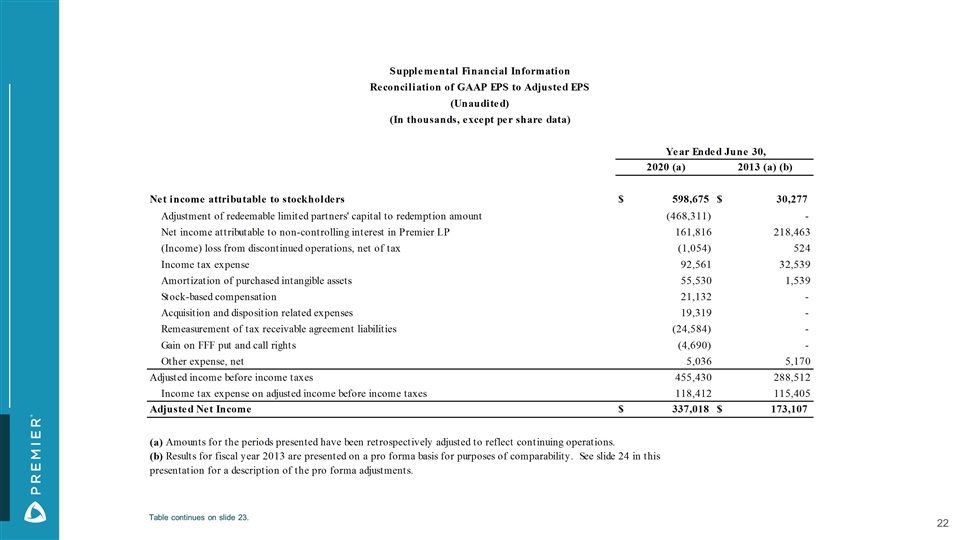

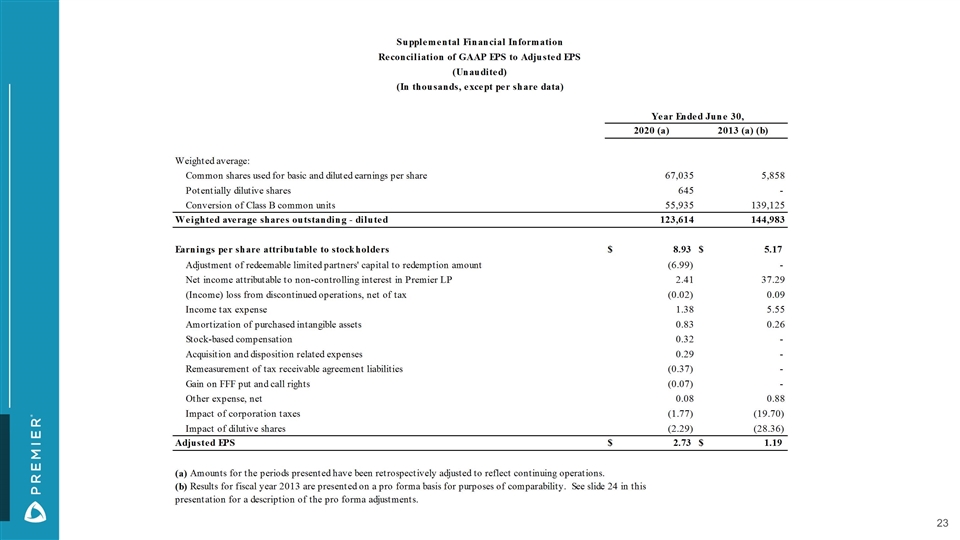

Table continues on slide 23.

Fiscal Year 2013 Pro Forma Adjustments Fiscal year 2013 results are presented on a pro forma basis to reflect the following to provide a more indicative comparison between current and prior periods: The contractual requirement under the GPO participation agreements to pay each member owner revenue share from Premier LP equal to 30% of all gross administrative fees collected by Premier LP based upon purchasing by such member owner's member facilities through Premier LP's GPO supplier contracts. Historically, Premier LP did not generally have a contractual requirement to pay revenue share to member owners participating in its GPO programs, but paid semi-annual distributions of partnership income. Additional U.S. federal, state and local income taxes with respect to its additional allocable share of any taxable income of Premier LP. A decrease in noncontrolling interest in Premier LP from 99% to approximately 78%.