Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PATTERSON COMPANIES, INC. | d55900d8k.htm |

JP MORGAN HEALTHCARE CONFERENCE January 14, 2020 Mark Walchirk President and CEO JP MORGAN HEALTHCARE CONFERENCE January 12, 2021 Mark Walchirk President and CEO Exhibit 99

Safe Harbor Statement 2 Cautionary Language Regarding Forward-Looking Statements This presentation contains, and our officers and representatives may from time to time make, certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, and the objectives and expectations of management. Forward-looking statements often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could” or “may.” Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Any number of factors could affect our actual results and cause such results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the following: the effects of the highly competitive dental and animal health supply markets in which we compete; the COVID-19 pandemic and measures taken in response thereto; general economic conditions, including political and economic uncertainty; risks from disruption to our information systems; our ability to comply with restrictive covenants in our amended credit agreement; our dependence on relationships with sales representatives, service technicians and customers; our ability to realize the long-term strategic benefits of our acquisition of Animal Health International; potential disruption of distribution capabilities, including service issues with third-party shippers; our ability to provide our sales force and customers with the latest technology; our dependence on suppliers for the manufacture and supply of the products we sell; material changes in our purchasing relationship with suppliers; the risk that private label sales could adversely affect our relationships with suppliers; our dependence on positive perceptions of Patterson’s reputation; risks inherent in acquiring other businesses; the risk that our acquired technology or developed technology might not be successful in maintaining or gaining customers; litigation risks, including new or unanticipated litigation developments and new or unanticipated regulatory investigations; changes in consumer preferences; regulatory restrictions; the cyclicality of the livestock market; the outbreak of an infectious disease within the production animal or companion animal population; pressure from animal rights groups; adverse changes in supplier rebates; fluctuations in quarterly financial results; volatility in the price of our stock; risks from the expansion of customer purchasing power; increases in over-the-counter sales of companion animal products; the risks inherent in international operations, including currency fluctuations; the effects of health care reform; failure to comply with regulatory requirements and data privacy laws; cyberattacks or other privacy or data security breaches; the risk of the products we sell becoming obsolete or containing undetected errors; volatility in the financial markets; our dependence on our senior management; our dependence on leadership development and succession planning; disruptions from our enterprise resource planning system; risks associated with shareholder activism; the risk of being required to record impairment charges; the risk of audit by tax authorities; risks associated with interest rate fluctuations; and the risk that our governing documents and Minnesota law may discourage takeovers and business combinations. The order in which these factors appear should not be construed to indicate their relative importance or priority. We caution that these factors may not be exhaustive, accordingly, any forward-looking statements contained herein should not be relied upon as a prediction of actual results. You should carefully consider these and other relevant factors, including those risk factors in Part I, Item 1A, (“Risk Factors”) in our most recent Form 10-K, and information which may be contained in our other filings with the U.S. Securities and Exchange Commission, or SEC, when reviewing any forward-looking statement. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider the foregoing list, or the risks identified in our SEC filings, to be a complete discussion of all potential risks or uncertainties. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not undertake any obligation to release publicly any revisions to any forward-looking statements whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Non-GAAP Financial Measures In an effort to provide additional and useful information regarding Patterson Companies, Inc.’s financial results and other financial information as determined by generally accepted accounting principles (GAAP), certain materials presented during this event include non-GAAP information. A reconciliation of that information to GAAP and other related information is available in the supplemental material attached as an appendix to this presentation. These non-GAAP financial measures are presented solely for informational and comparative purposes and should not be regarded as a replacement for corresponding, similarly captioned, GAAP measures. In addition, the term “internal sales” used in this presentation represents net sales adjusted to exclude the impact of foreign currency. Foreign currency impact represents the difference in results that is attributable to fluctuations in currency exchange rates the company uses to convert results for all foreign entities where the functional currency is not the U.S. dollar. The company calculates the impact as the difference between the current period results translated using the current period currency exchange rates and using the comparable prior period's currency exchange rates. The company believes the disclosure of net sales changes in constant currency provides useful supplementary information to investors in light of significant fluctuations in currency rates.

We Are Patterson 3 Indispensable partner serving the dental and animal health markets in North America and the United Kingdom

4

Our Commitment to Corporate Responsibility 5 Committed to compliance Increasing environmental & sustainability efforts Shaping our culture Supporting our communities

Investment Thesis Strong market positions and a compelling value proposition in attractive end markets with positive long-term fundamentals Proven track record of delivering operational excellence to drive growth and margin expansion, with continued upside opportunity Focused and experienced team with deep relationships and expertise, with continued investments to drive productivity and enhance customer value View attractive dividend as an effective means of returning cash to shareholders Improved balance sheet flexibility to support disciplined, strategic investments to accelerate future growth and value creation 6

Serving Healthy, Growing and Evolving Markets COMPANION ANIMAL COVID-19 accelerated pet adoption rates Work from home behavior leading to more attentive pet owners Essential role of the veterinarian Strong pipeline of innovative new products DENTAL Strong market rebound from COVID-19 practice closures Increased demand expected for infection control products Clear linkage between oral health and overall health further emphasized during COVID-19 Practice modernization driving equipment and technology investment PRODUCTION ANIMAL COVID-19 supply chain disruption starting to normalize Increased emphasis on biosecurity and ensuring herd health and wellness Global demand for protein forecasted to remain strong 7

Our Value Proposition Is Essential to Our Customers 8

Our Brand Promise in Action “We use every service Patterson has offered.… The biggest thing I love about Patterson is the support. Every time we have a question, we always know that we can get help – especially during the pandemic.” Dr. Anthony Le – Pensacola, FL “Ownership on its own can be overwhelming. To have someone that is so knowledgeable … and willing to share that knowledge, seemed like a breath of fresh air.” Dr. Lindy O’Neil – Rogers, AR “It’s not just a delivery service … they go above and beyond because they actually understand the industry.” Terry Heinle – Hamill, SD 9 DENTAL COMPANION ANIMAL PRODUCTION ANIMAL

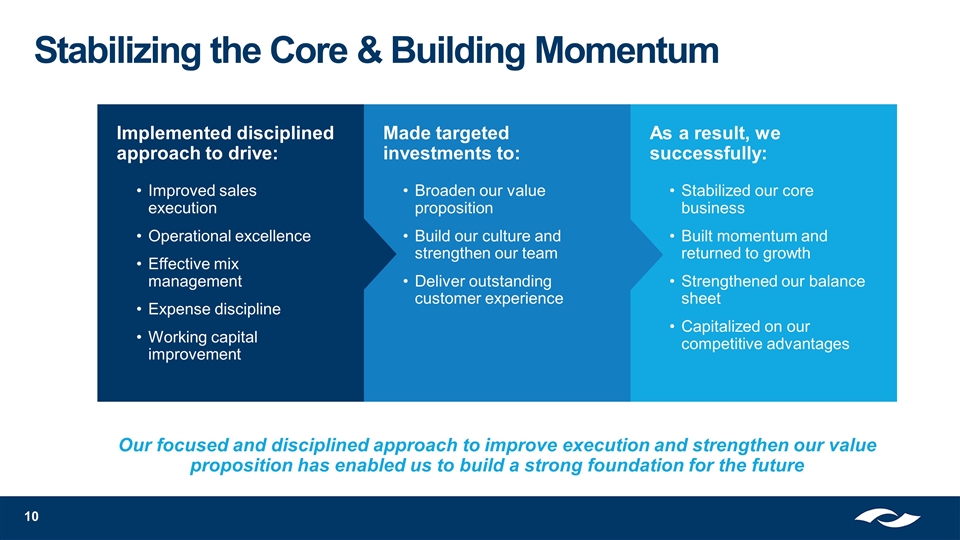

Stabilizing the Core & Building Momentum Implemented disciplined approach to drive: Improved sales execution Operational excellence Effective mix management Expense discipline Working capital improvement Made targeted investments to: Broaden our value proposition Build our culture and strengthen our team Deliver outstanding customer experience As a result, we successfully: Stabilized our core business Built momentum and returned to growth Strengthened our balance sheet Capitalized on our competitive advantages Our focused and disciplined approach to improve execution and strengthen our value proposition has enabled us to build a strong foundation for the future 10

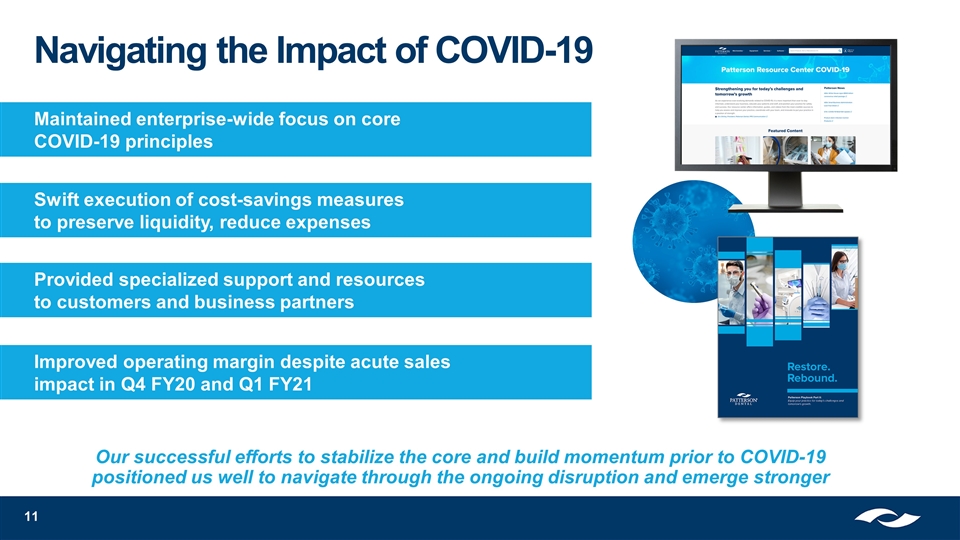

Improved operating margin despite acute sales impact in Q4 FY20 and Q1 FY21 Provided specialized support and resources to customers and business partners Swift execution of cost-savings measures to preserve liquidity, reduce expenses Maintained enterprise-wide focus on core COVID-19 principles Our successful efforts to stabilize the core and build momentum prior to COVID-19 positioned us well to navigate through the ongoing disruption and emerge stronger Navigating the Impact of COVID-19 11

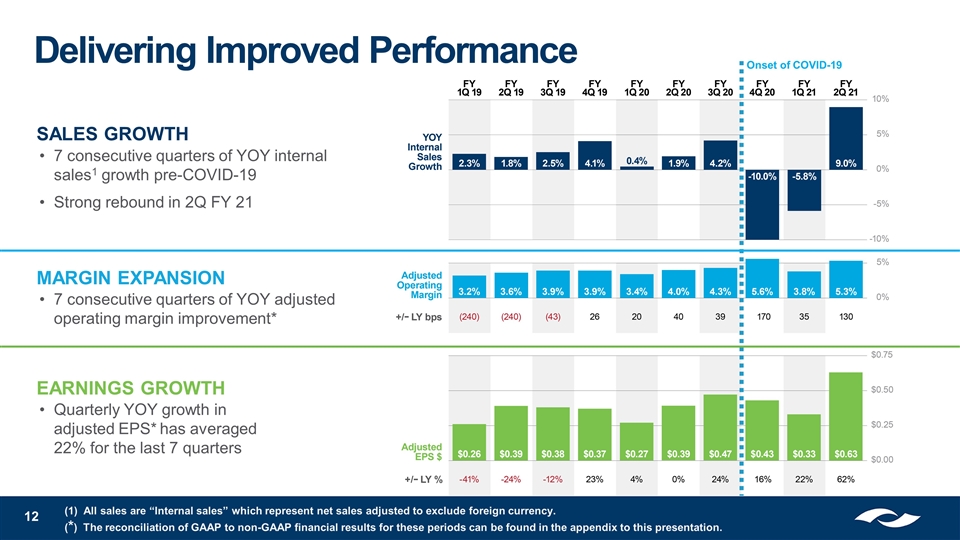

Delivering Improved Performance 12 Onset of COVID-19 (1) All sales are “Internal sales” which represent net sales adjusted to exclude foreign currency. (*) The reconciliation of GAAP to non-GAAP financial results for these periods can be found in the appendix to this presentation. MARGIN EXPANSION EARNINGS GROWTH SALES GROWTH 7 consecutive quarters of YOY internal sales1 growth pre-COVID-19 Strong rebound in 2Q FY 21 7 consecutive quarters of YOY adjusted operating margin improvement* Quarterly YOY growth in adjusted EPS* has averaged 22% for the last 7 quarters

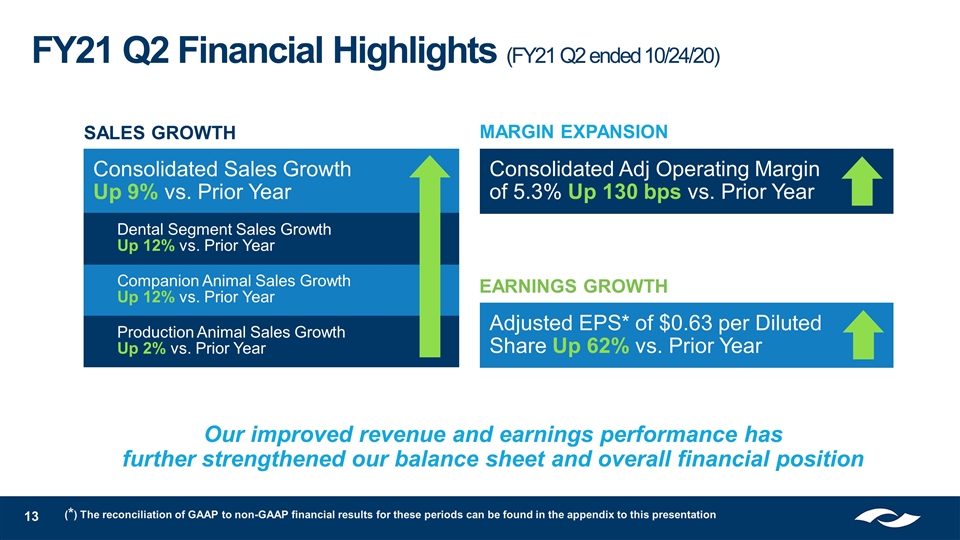

Companion Animal Sales Growth Up 12% vs. Prior Year Consolidated Sales Growth Up 9% vs. Prior Year Consolidated Adj Operating Margin of 5.3% Up 130 bps vs. Prior Year Adjusted EPS* of $0.63 per Diluted Share Up 62% vs. Prior Year Dental Segment Sales Growth Up 12% vs. Prior Year FY21 Q2 Financial Highlights (FY21 Q2 ended 10/24/20) Production Animal Sales Growth Up 2% vs. Prior Year Our improved revenue and earnings performance has further strengthened our balance sheet and overall financial position SALES GROWTH MARGIN EXPANSION EARNINGS GROWTH 13 (*) The reconciliation of GAAP to non-GAAP financial results for these periods can be found in the appendix to this presentation

2021 Market Outlook Dental Increased usage of infection control products Vaccine rollout expected to normalize patient traffic Continued practice investment in equipment, software and technology Animal Health Increased pet ownership adding incremental market growth More attentive pet owners increasing vet visits and spending Restaurant and in-person school openings expected to normalize protein and dairy demand COVID-19 supply chain disruption beginning to normalize 14

Continue to invest in core business to drive operational excellence and sales execution Driving Future Value Creation Return cash to shareholders through attractive dividend Consider strategic investments to accelerate future growth and margin expansion 15

Investment Thesis Strong market positions and a compelling value proposition in attractive end markets with positive long-term fundamentals Proven track record of delivering operational excellence to drive growth and margin expansion, with continued upside opportunity Focused and experienced team with deep relationships and expertise, with continued investments to drive productivity and enhance customer value View attractive dividend as an effective means of returning cash to shareholders Improved balance sheet flexibility to support disciplined, strategic investments to accelerate future growth and value creation 16

THANK YOU

Appendix A-1

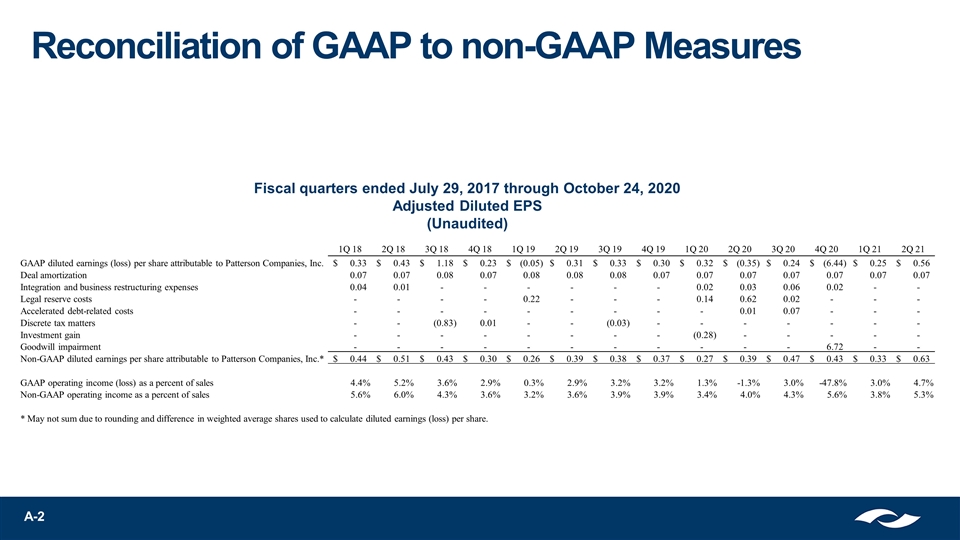

Reconciliation of GAAP to non-GAAP Measures A-2 Fiscal quarters ended July 29, 2017 through October 24, 2020 Adjusted Diluted EPS (Unaudited) 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 GAAP diluted earnings (loss) per share attributable to Patterson Companies, Inc. 0.33 $ 0.43 $ 1.18 $ 0.23 $ (0.05) $ 0.31 $ 0.33 $ 0.30 $ 0.32 $ (0.35) $ 0.24 $ (6.44) $ 0.25 $ 0.56 $ Deal amortization 0.07 0.07 0.08 0.07 0.08 0.08 0.08 0.07 0.07 0.07 0.07 0.07 0.07 0.07 Integration and business restructuring expenses 0.04 0.01 - - - - - - 0.02 0.03 0.06 0.02 - - Legal reserve costs - - - - 0.22 - - - 0.14 0.62 0.02 - - - Accelerated debt-related costs - - - - - - - - - 0.01 0.07 - - - Discrete tax matters - - (0.83) 0.01 - - (0.03) - - - - - - - Investment gain - - - - - - - - (0.28) - - - - - Goodwill impairment - - - - - - - - - - - 6.72 - - Non-GAAP diluted earnings per share attributable to Patterson Companies, Inc.* 0.44 $ 0.51 $ 0.43 $ 0.30 $ 0.26 $ 0.39 $ 0.38 $ 0.37 $ 0.27 $ 0.39 $ 0.47 $ 0.43 $ 0.33 $ 0.63 $ GAAP operating income (loss) as a percent of sales 4.4% 5.2% 3.6% 2.9% 0.3% 2.9% 3.2% 3.2% 1.3% -1.3% 3.0% -47.8% 3.0% 4.7% Non-GAAP operating income as a percent of sales 5.6% 6.0% 4.3% 3.6% 3.2% 3.6% 3.9% 3.9% 3.4% 4.0% 4.3% 5.6% 3.8% 5.3% * May not sum due to rounding and difference in weighted average shares used to calculate diluted earnings (loss) per share.