Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Amphastar Pharmaceuticals, Inc. | amph-20210112x8k.htm |

Exhibit 99.1

| Investor Presentation January 2021 Exhibit 99.1 |

| 1 Forward Looking Statements This presentation and the accompanying oral presentation contain forward-looking statements that are based on our management’s current expectations and assumptions and on information currently available to management. Forward-looking statements include all statements other than statements of historical fact contained in this presentation, including, but not limited to, information concerning our business plans and objectives, potential growth opportunities, product development, regulatory approvals, market potential, efficiencies, competitive position, and industry environment, among other statements. All statements in this presentation that are not historical are forward-looking statements, including, among other things, statements relating to the Company’s expectations regarding future financial performance, backlog, sales and marketing of its products, market size and growth, the timing of FDA filings or approvals, including the DMFs of ANP, the timing of product launches, acquisitions and other matters related to its pipeline of product candidates, its share buyback program and other future events, such as the impact of the COVID-19 pandemic and related responses of business and governments to the pandemic on our operations and personnel, and on commercial activity and demand across our business operations and results of operations. These statements are not historical facts but rather are based on Amphastar’s historical performance and its current expectations, estimates, and projections regarding Amphastar’s business, operations and other similar or related factors. Words such as “may,” “might,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expect,” “intend,” “plan,” “project,” “believe,” “estimate,” and other similar or related expressions are used to identify these forward-looking statements, although not all forward-looking statements contain these words. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties, and assumptions that are difficult or impossible to predict and, in some cases, beyond Amphastar’s control. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described in Amphastar’s filings with the Securities and Exchange Commission, including in the Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on March 16, 2020. In particular, the extent of COVID-19’s impact on our business will depend on several factors, including the severity, duration and extent of the pandemic, as well as actions taken by governments, businesses, and consumers in response to the pandemic, all of which continue to evolve and remain uncertain at this time. You can locate these reports through the Company’s website at http://ir.amphastar.com and on the SEC’s website at www.sec.gov. The forward- looking statements in this presentation speak only as of the date of the presentation. Amphastar undertakes no obligation to revise or update information in this presentation or the conference call referenced above to reflect events or circumstances in the future, even if new information becomes available or if subsequent events cause Amphastar’s expectations to change. You should not rely upon forward-looking statements as predictions of future events. Although our management believes that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur as forward-looking statements are inherently susceptible to uncertainty and changes in circumstances as with any projections or forecasts. Moreover, neither we, nor any other person, assume responsibility for the accuracy and completeness of the forward-looking statements. Any forward-looking statements made by us in this presentation speak only as of the date of this presentation, and we undertake no obligation to update any forward-looking statements for any reason after the date of this presentation, except as required by law. |

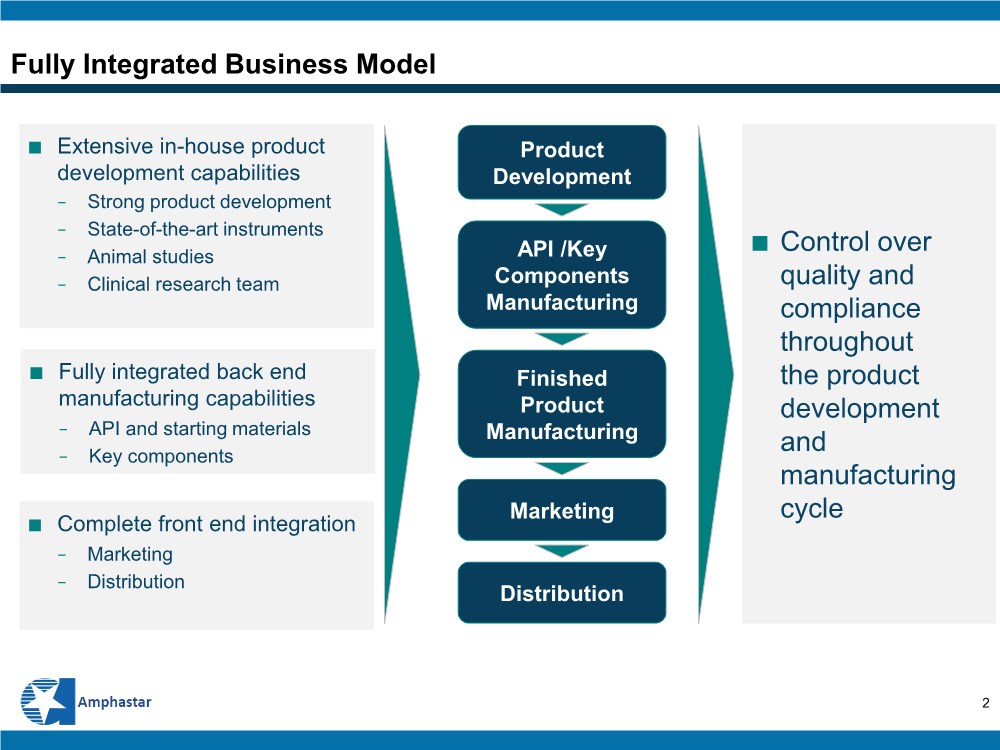

| 2 ■ Extensive in-house product development capabilities − Strong product development − State-of-the-art instruments − Animal studies − Clinical research team ■ Control over quality and compliance throughout the product development and manufacturing cycle ■ Fully integrated back end manufacturing capabilities − API and starting materials − Key components ■ Complete front end integration − Marketing − Distribution Fully Integrated Business Model Product Development API /Key Components Manufacturing Finished Product Manufacturing Marketing Distribution |

| 3 Company Overview: Amphastar Facilities Vertically integrated from R&D to clinical trials, manufacturing, marketing and distribution |

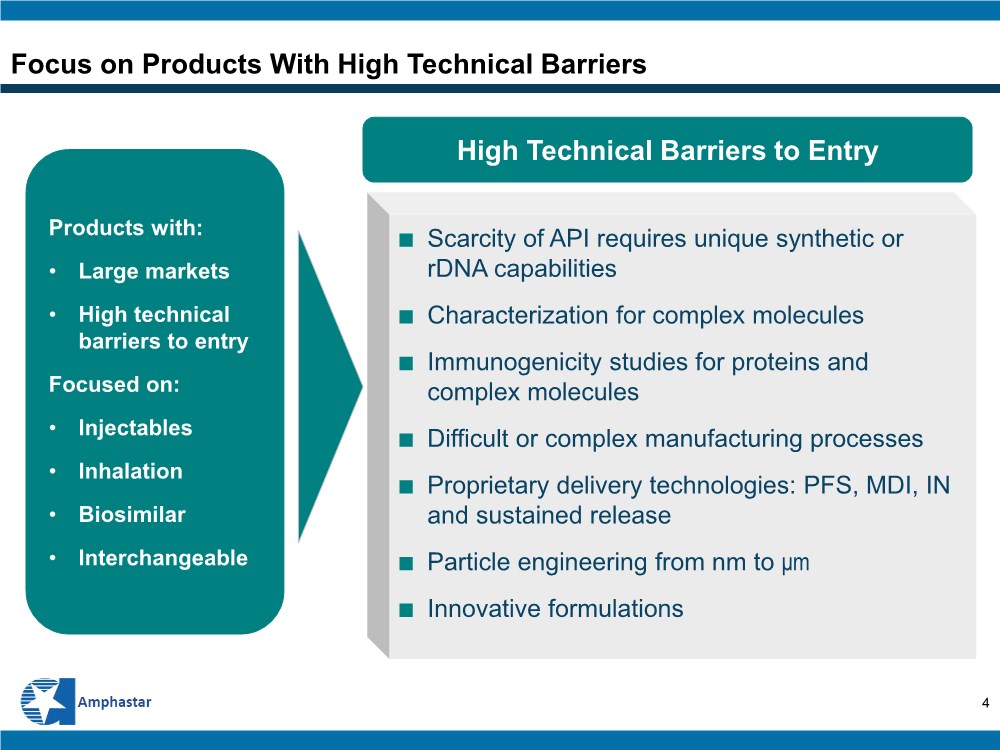

| 4 Focus on Products With High Technical Barriers ■ Scarcity of API requires unique synthetic or rDNA capabilities ■ Characterization for complex molecules ■ Immunogenicity studies for proteins and complex molecules ■ Difficult or complex manufacturing processes ■ Proprietary delivery technologies: PFS, MDI, IN and sustained release ■ Particle engineering from nm to μm ■ Innovative formulations Products with: • Large markets • High technical barriers to entry Focused on: • Injectables • Inhalation • Biosimilar • Interchangeable High Technical Barriers to Entry |

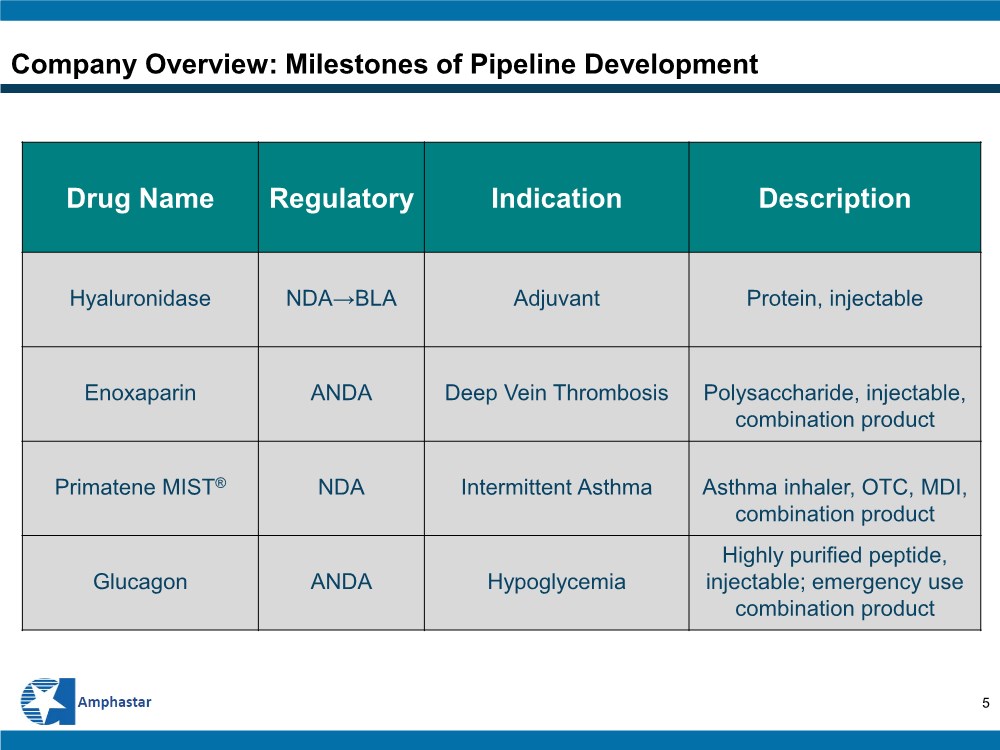

| 5 Company Overview: Milestones of Pipeline Development Drug Name Regulatory Indication Description Hyaluronidase NDA→BLA Adjuvant Protein, injectable Enoxaparin ANDA Deep Vein Thrombosis Polysaccharide, injectable, combination product Primatene MIST® NDA Intermittent Asthma Asthma inhaler, OTC, MDI, combination product Glucagon ANDA Hypoglycemia Highly purified peptide, injectable; emergency use combination product |

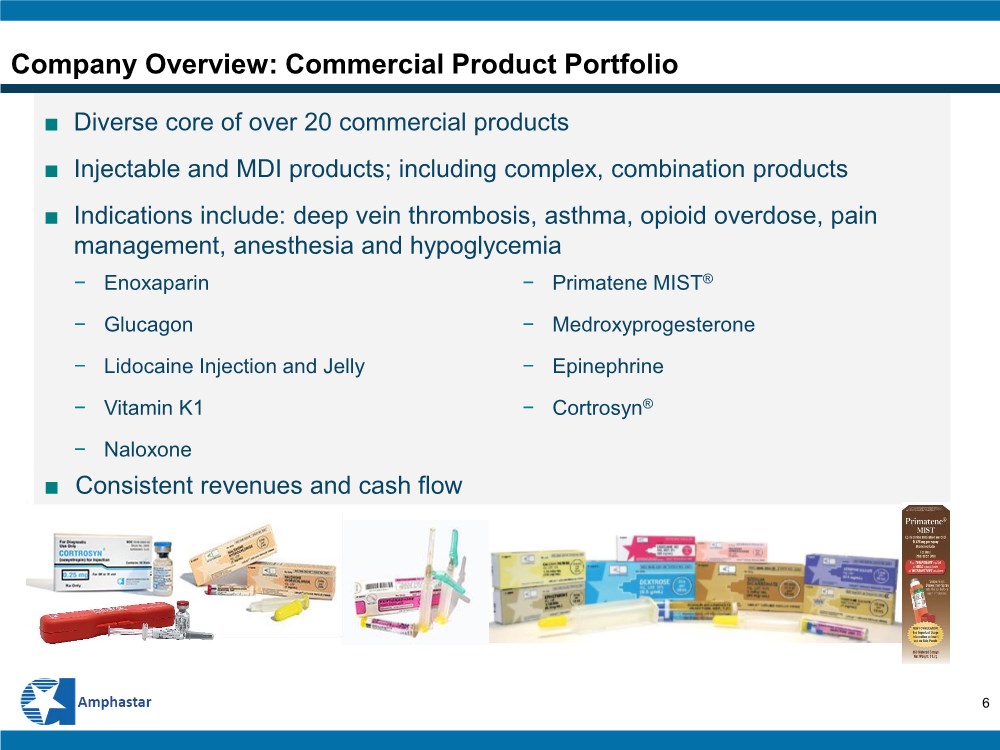

| 6 Company Overview: Commercial Product Portfolio ■ Diverse core of over 20 commercial products ■ Injectable and MDI products; including complex, combination products ■ Indications include: deep vein thrombosis, asthma, opioid overdose, pain management, anesthesia and hypoglycemia − Enoxaparin − Glucagon − Lidocaine Injection and Jelly − Vitamin K1 − Naloxone − Primatene MIST® − Medroxyprogesterone − Epinephrine − Cortrosyn® ■ Consistent revenues and cash flow |

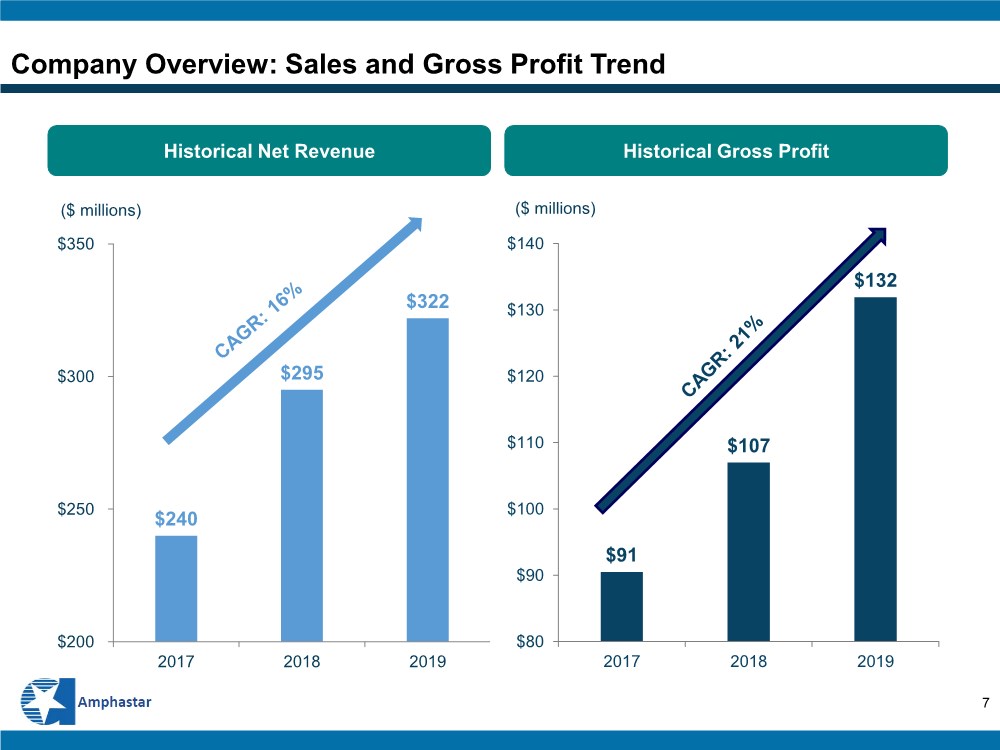

| 7 Company Overview: Sales and Gross Profit Trend $240 $295 $322 $200 $250 $300 $350 2017 2018 2019 ($ millions) Historical Net Revenue Historical Gross Profit $91 $107 $132 $80 $90 $100 $110 $120 $130 $140 2017 2018 2019 ($ millions) |

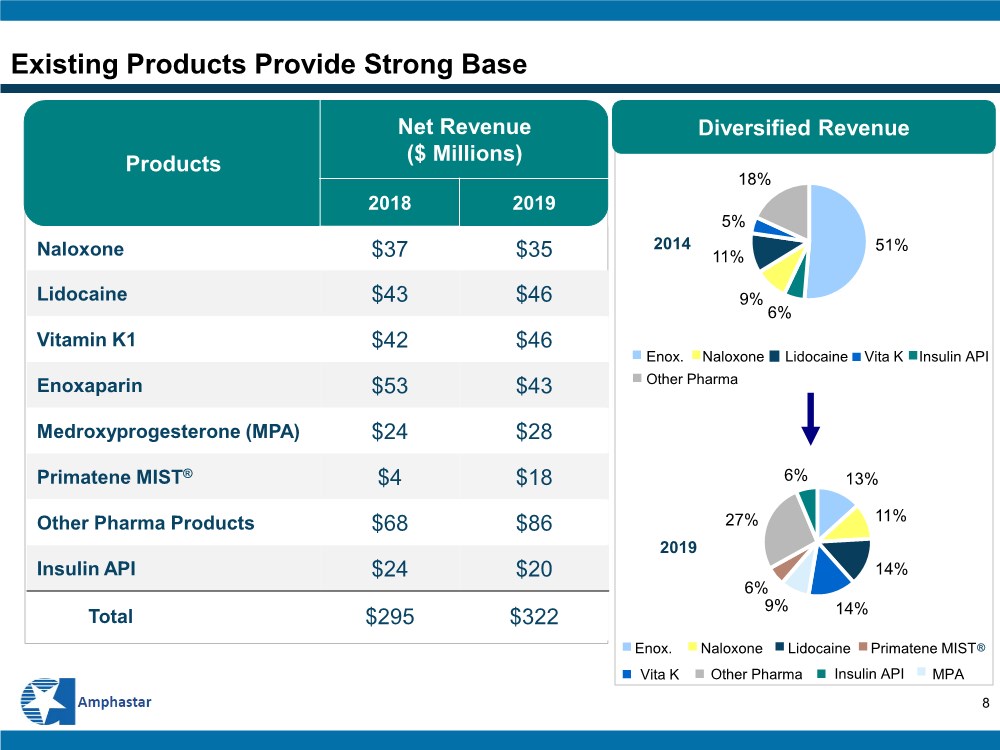

| 8 Enox. 13% 11% 14% 14% 9% 6% 27% 6% Products Net Revenue ($ Millions) 2018 2019 Naloxone $37 $35 Lidocaine $43 $46 Vitamin K1 $42 $46 Enoxaparin $53 $43 Medroxyprogesterone (MPA) $24 $28 Primatene MIST® $4 $18 Other Pharma Products $68 $86 Insulin API $24 $20 Total $295 $322 Existing Products Provide Strong Base Diversified Revenue Naloxone Insulin API Other Pharma Enox. 2019 Lidocaine Vita K Primatene MIST MPA ® 51% 6% 9% 11% 5% 18% 2014 Naloxone Insulin API Other Pharma Vita K Lidocaine |

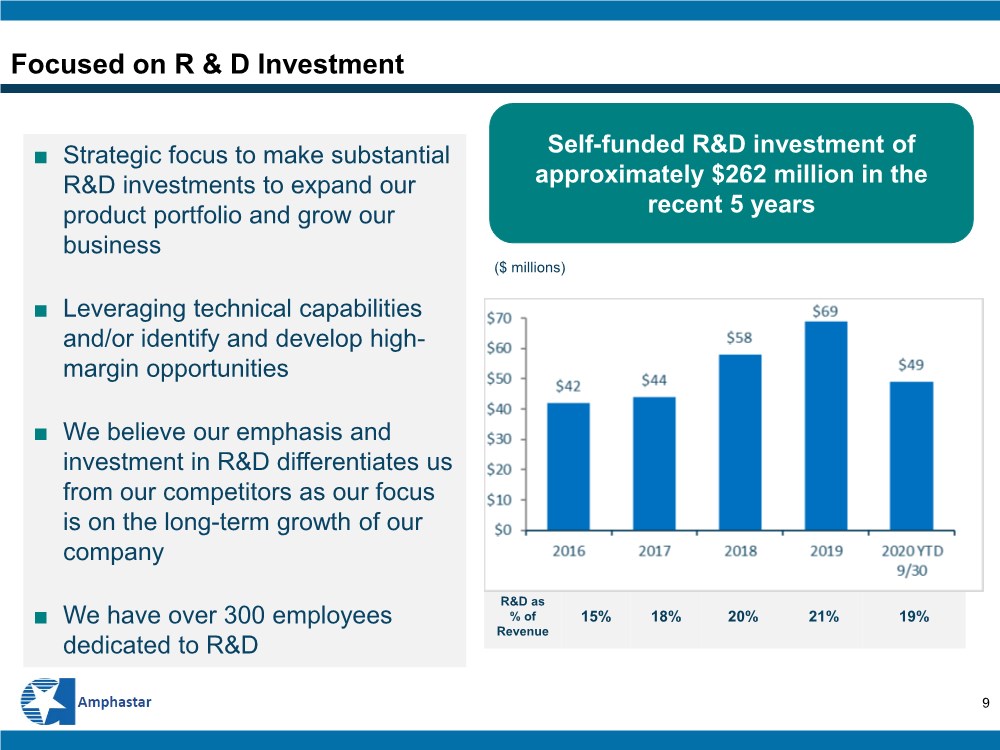

| 9 ■ Strategic focus to make substantial R&D investments to expand our product portfolio and grow our business ■ Leveraging technical capabilities and/or identify and develop high- margin opportunities ■ We believe our emphasis and investment in R&D differentiates us from our competitors as our focus is on the long-term growth of our company ■ We have over 300 employees dedicated to R&D Focused on R & D Investment Self-funded R&D investment of approximately $262 million in the recent 5 years ($ millions) R&D as % of Revenue 15% 18% 20% 21% 19% |

| 10 ■ Established to provide APIs and starting materials to Amphastar ■ Current portfolio of APIs and starting materials - 4 FDA approvals for Amphastar’s NDA/ANDA - 14 DMFs on file with the FDA for Amphastar’s pipeline candidates - Several additional DMFs in development Amphastar Nanjing Pharmaceuticals (ANP) Overview |

| 11 Amphastar Nanjing Pharmaceuticals (ANP) Development ■ Sold 42% of ANP ownership for $57 million in 2018 to fund: - ANP’s API facility including rDNA products - Manufacturing and selling API and finished product to the China market |

| 12 Pipeline – ANDA with Technical Barriers ■ Three Injectable ANDAs in development targeting products with IQVIA sales of approximately $3 Billion ■ Five Inhalation ANDAs in development targeting products with IQVIA sales of approximately $8 Billion ■ Most of them with technical barriers ■ Technical Platforms to be used: characterization, particle-engineering, sustained-release, peptide technology and immunogenicity Generic Pipeline, 12 Candidates with Technical Barriers ■ Four filed ANDAs with IQVIA* sales of approximately $1.6 Billion including: − AMP 002 – High technical barrier product with > $300 mm IQVIA sales and no approved generics − Received CRL 12/2020, and plan to respond in Q1 2021 − Currently on file for generic Lexiscan® and Vasostrict ® − AMP-006 - Injectable product with IQVIA sales > $50 mm *IQVIA sales with TTM as of September 30, 2020 |

| 13 Pipeline – Insulin and Proteins, Biologics License Applications (BLAs) ■ Three candidates of Insulins (“Insulin Program”) and Proteins ■ Significant US market: IQVIA sales ~$13 Billion, ~130 millions of units ■ Need sophisticated rDNA technology, state-of-the-art analytical technology, and significant investment on development ■ Regulatory route: Biological License Application (BLA) 351(k) (Biosimilar) and aim at Interchangeable Insulin ■ Recent FDA Guidance “… if a comparative analytical assessment based on state-of-the-art technology supports a demonstration of “highly similar” for a proposed biosimilar or interchangeable insulin product, there would be little or no residual uncertainty regarding immunogenicity; in such instances, the proposed biosimilar or interchangeable insulin product, like the reference product, would be expected to have minimal or no risk of clinical impact from immunogenicity. In such instances, a comparative clinical immunogenicity study generally would be unnecessary to support a demonstration of biosimilarity or interchangeability.” (FDA Guidance, November 2019, Emphasis Added.) Insulins and Proteins, Biosimilar and/or Interchangeable *IQVIA sales with TTM as of September 30, 2020 |

| 14 Pipeline – Insulin and Proteins, BLAs ■ FDA Guidance established regulatory route by analytical assessment based on state-of-the-art technology supports a demonstration of “highly similar” and heavy clinical study for immunogenicity would be “unnecessary” ■ API Manufacturing: rDNA technology, by AFP and ANP ■ First INDs for the Insulin Program have been filed or in the process to file; ■ Clinical program for an IND in the Insulin Program is in process ■ Cost of clinical program for Insulin products could potentially be significantly reduced Insulins and Proteins, Biosimilar and/or Interchangeable |

| 15 Pipeline – Proprietary Pipeline, New Drug Applications (NDAs) Proprietary Pipeline NDA ■ Development of innovative proprietary products requires sophisticated technology ■ Amphastar’s proven R&D and technical platforms support the development of proprietary pipeline candidates ■ Amphastar has expertise in clinical studies to support the NDA development; the NDA 505(b)(2) regulatory route requires clinical studies with a smaller sample size ■ Naloxone Intranasal, NDA is pending, planned response to CRL in 2021; ■ Epinephrine Intranasal, Phase I study completed with successful results ■ Two candidates are in active development phase ■ More pipeline candidates are in the early stage |

| 16 ■ The first and only FDA approved generic Glucagon for Injection in 20 years ■ Highly-purified synthetic peptide product was determined by FDA to be bioequivalent and therapeutically equivalent to Eli Lilly’s Glucagon Emergency Kit, which has recombinant DNA (rDNA) origin ■ Highlights the Company’s sophisticated characterization technology ■ Commercial launch planned within two months of approval ■ Sales of Eli Lilly’s Glucagon Emergency Kit were approximately $144 million* Glucagon for Injection Kit Launch *IQVIA 12 months ended September 30, 2020 |

| 17 Primatene MIST® History ■ Primatene MIST®, a proprietary and patent protected over- the-counter epinephrine inhalation product ■ The only FDA approved asthma inhaler available OTC ■ Purchased U.S. trademark from Wyeth in 2008 ■ Intensive cardiovascular studies >40,000 data points ■ Special label design for the OTC setting (extensive human factors label studies) ■ Approved November 2018, launched December 2018 |

| 18 Primatene MIST® Marketing Update ■ Improvements from Primatene MIST ® CFC − Higher delivery efficiency, with improved efficacy at a lower dose − Dose indicator − Aluminum container instead of glass − HFA propellant replaces CFC ■ Effective TV and Radio advertising campaign began in July 2019 with national coverage ■ Multiple scientific articles were published in support of safe and effective use *Amazon, CVS, Walgreens, Walmart, Rite Aid, and Kroger, including logos, are trademarks of their respective owners. Available OTC nationwide at: |

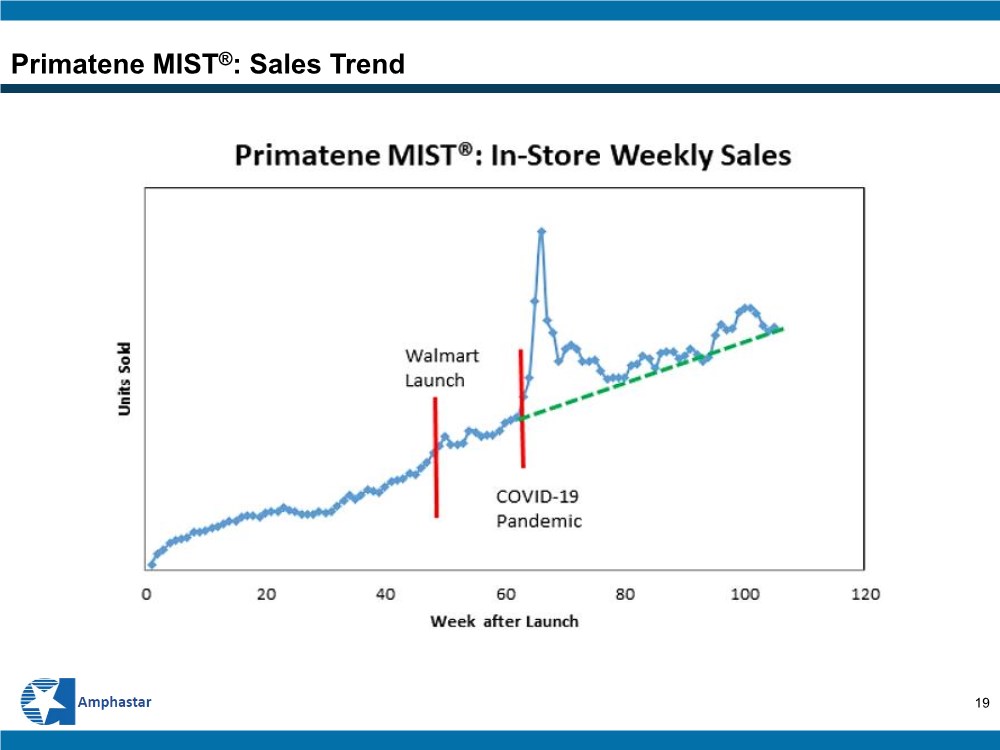

| 19 Primatene MIST®: Sales Trend |

| 20 Near-Term Growth Points in 2021 Glucagon Injection Kit launch planned February 2021 Primatene MIST® indicated for “intermittent asthma” - Adult asthma patients: 19.2 million per CDC* - Intermittent adult asthma patients: ~35% (per CDC**), or 6.7 million Epinephrine multi-dose vials launched May 2020 *https://www.cdc.gov/asthma/most_recent_national_asthma_data.htm; **https://www.cdc.gov/asthma/asthma_stats/severity_adult.htm |

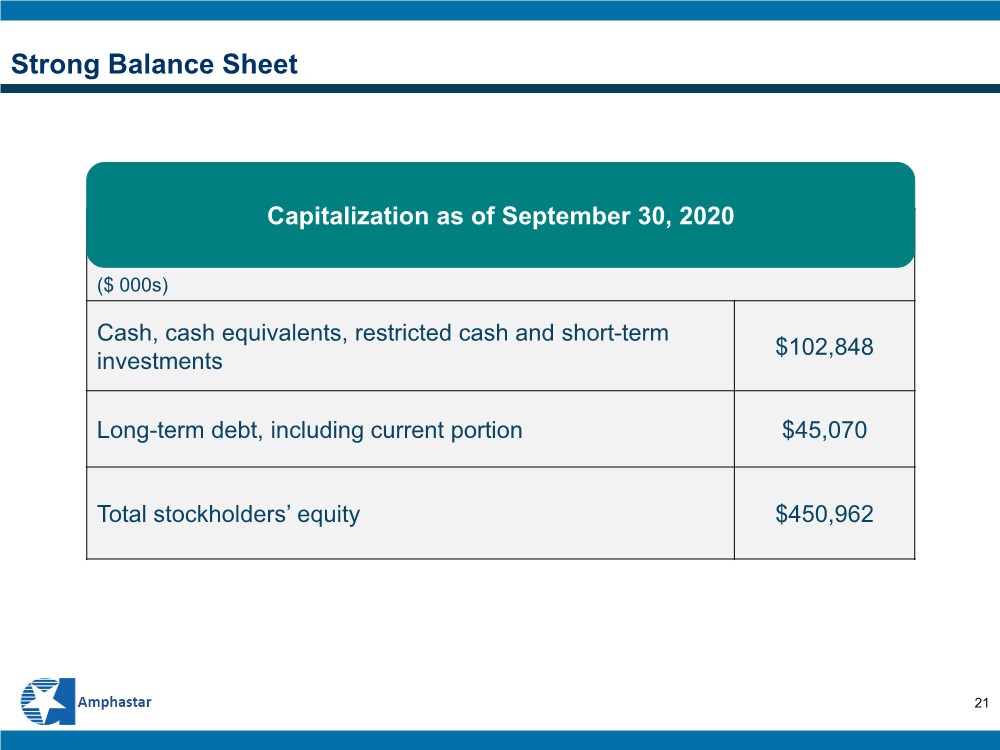

| 21 Strong Balance Sheet ($ 000s) Cash, cash equivalents, restricted cash and short-term investments $102,848 Long-term debt, including current portion $45,070 Total stockholders’ equity $450,962 Capitalization as of September 30, 2020 |

| 22 Investment Highlights ■ Biopharmaceutical company focused on development and manufacturing of technically- challenging BLAs, NDAs, and ANDAs in injectable, inhalable and intranasal formulations ■ Strong base business with approximately $322 million in 2019 revenue and approximately $132 million in 2019 gross profit ■ Robust pipeline of over 20 product candidates, including the insulin products, in markets with barriers to entry ■ Advanced technical capabilities and multiple delivery technologies proven through the successful development and launch of enoxaparin, glucagon, medroxyprogesterone and Primatene MIST® ■ Vertically integrated infrastructure and technical expertise for products with high barriers to market entry ■ ANP (Nanjing) development strengthens our vertically integrated infrastructure and technical expertise for products with high barriers to market entry ■ Successful track record of company and product acquisitions ■ Experienced management team with deep scientific experience |