Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. | mdrx-8k_20210112.htm |

Allscripts Healthcare Solutions J.P. Morgan Virtual Healthcare Conference| January 2021 Exhibit 99.1

Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including the preliminary financial information included in this presentation, are based on the current beliefs and expectations of Allscripts management, only speak as of the date that they are made and are subject to significant risks and uncertainties. Such statements can be identified by the use of words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. Actual results could differ significantly from those set forth in the forward-looking statements and reported results should not be considered an indication of future performance. Certain factors that could cause Allscripts actual results to differ materially from those described in the forward-looking statements include, but are not limited to: our use of the proceeds from the sale of our EPSi business and CarePort Health business; our ability to achieve the margin targets associated with our margin improvement initiatives within the contemplated time periods, if at all; risks relevant to our share repurchase program, such as general market conditions, fluctuations in the price of our common stock or changes in our liquidity or capital allocation strategies; the magnitude, severity and duration of the COVID-19 pandemic, including the impacts of the pandemic on our business, our employees, our clients and our suppliers; security breaches resulting in unauthorized access to our or our clients’ computer systems or data, including denial-of-services, ransomware or other Internet-based attacks; the failure by Practice Fusion to comply with the terms of its settlement agreements with the U.S. Department of Justice (the “DOJ”); the costs and burdens of compliance by Practice Fusion with the terms of its settlement agreements with the DOJ; additional investigations and proceedings from governmental entities or third parties other than the DOJ related to the same or similar conduct underlying the DOJ’s investigations into Practice Fusion’s business practices; changes in interoperability or other regulatory standards; the expected financial results of businesses acquired by us; the successful integration of businesses acquired by us; the anticipated and unanticipated expenses and liabilities related to businesses acquired by us, including the civil investigation by the U.S. Attorney’s Office involving our EIS business; Allscripts ability to establish and maintain strategic relationships; Allscripts failure to compete successfully; consolidation in Allscripts industry; current and future laws, regulations and industry initiatives; increased government involvement in Allscripts industry; the failure of markets in which Allscripts operates to develop as quickly as expected; Allscripts or its customers’ failure to see the benefits of government programs; the effects of the realignment of Allscripts sales, services and support organizations; market acceptance of Allscripts products and services; the unpredictability of the sales and implementation cycles for Allscripts products and services; Allscripts ability to manage future growth; Allscripts ability to introduce new products and services; the performance of Allscripts products; Allscripts ability to protect its intellectual property rights; the outcome of legal proceedings involving Allscripts; Allscripts ability to hire, retain and motivate key personnel; performance by Allscripts content and service providers; liability for use of content; price reductions; Allscripts ability to license and integrate third party technologies; Allscripts ability to maintain or expand its business with existing customers; risks related to international operations; changes in tax rates or laws; business disruptions; Allscripts ability to maintain proper and effective internal controls; and asset and long-term investment impairment charges. Additional information about these and other risks, uncertainties, and factors affecting Allscripts business is contained in Allscripts filings with the Securities and Exchange Commission, including under the caption “Risk Factors” in the most recent Allscripts Annual Report on Form 10-K and subsequent Form 10-Qs. Allscripts does not undertake to update forward-looking statements to reflect changed assumptions, the impact of circumstances or events that may arise after the date of the forward-looking statements, or other changes in its business, financial condition or operating results over time.

2020 was our year of reset Reset our cost base Reset our portfolio Reset our balance sheet/capital structure Reset our client priorities

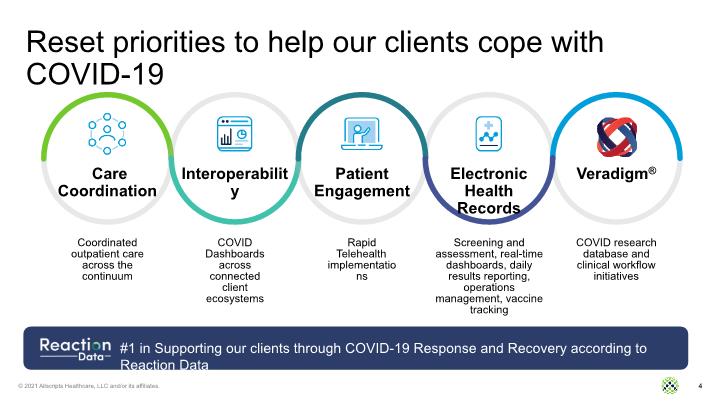

Reset priorities to help our clients cope with COVID-19 COVID research database and clinical workflow initiatives Veradigm® Coordinated outpatient care across the continuum COVID Dashboards across connected client ecosystems Rapid Telehealth implementations Screening and assessment, real-time dashboards, daily results reporting, operations management, vaccine tracking Care Coordination Interoperability Patient Engagement Electronic Health Records #1 in Supporting our clients through COVID-19 Response and Recovery according to Reaction Data

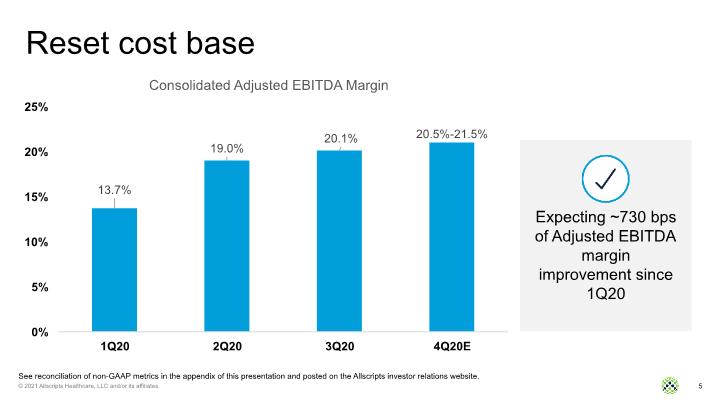

Reset cost base See reconciliation of non-GAAP metrics in the appendix of this presentation and posted on the Allscripts investor relations website. Expecting ~730 bps of Adjusted EBITDA margin improvement since 1Q20

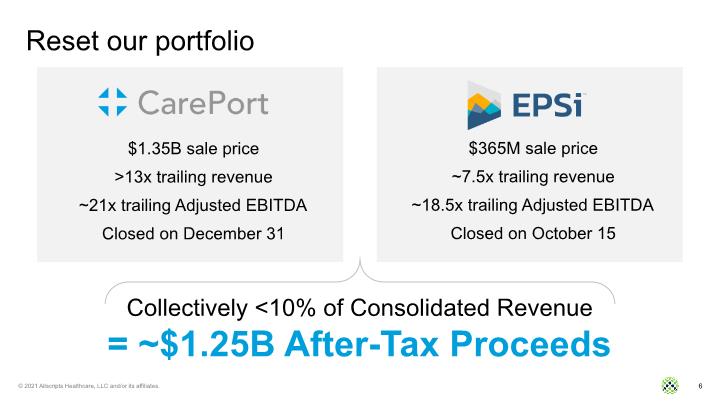

Reset our portfolio Collectively <10% of Consolidated Revenue = ~$1.25B After-Tax Proceeds $1.35B sale price >13x trailing revenue ~21x trailing Adjusted EBITDA Closed on December 31 $365M sale price ~7.5x trailing revenue ~18.5x trailing Adjusted EBITDA Closed on October 15

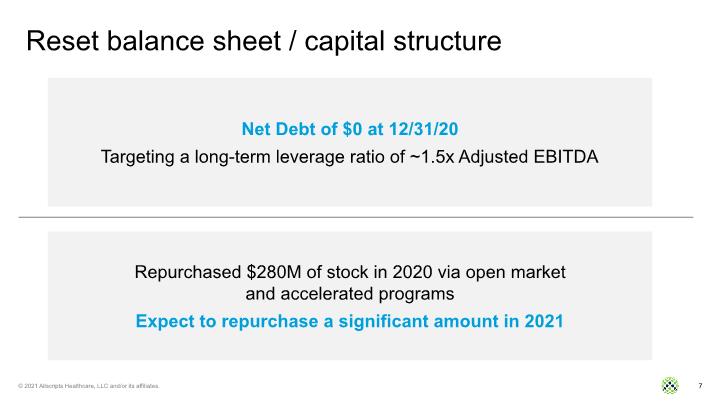

Reset balance sheet / capital structure Net Debt of $0 at 12/31/20 Targeting a long-term leverage ratio of ~1.5x Adjusted EBITDA Repurchased $280M of stock in 2020 via open market and accelerated programs Expect to repurchase a significant amount in 2021

Looking ahead to 2021

Focus on the consumer Physician burnout Inadequate interoperability Unifying care communities Genomics going mainstream Transition to value-based payment COVID-19 pandemic Allscripts is well positioned to help solve some of the most pressing issues in healthcare

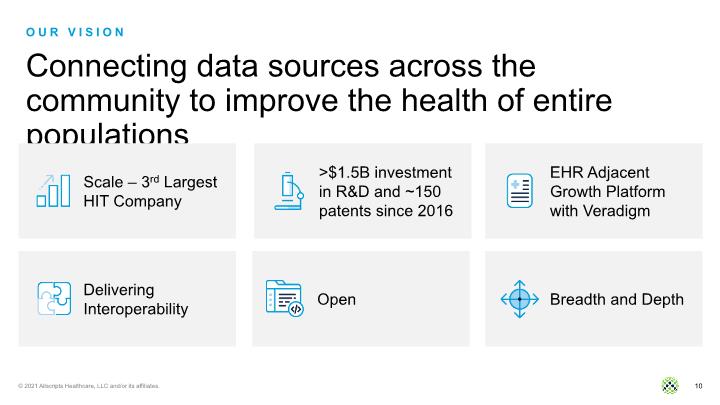

Connecting data sources across the community to improve the health of entire populations Our Vision Delivering Interoperability Scale – 3rd Largest HIT Company Open EHR Adjacent Growth Platform with Veradigm Breadth and Depth >$1.5B investment in R&D and ~150 patents since 2016

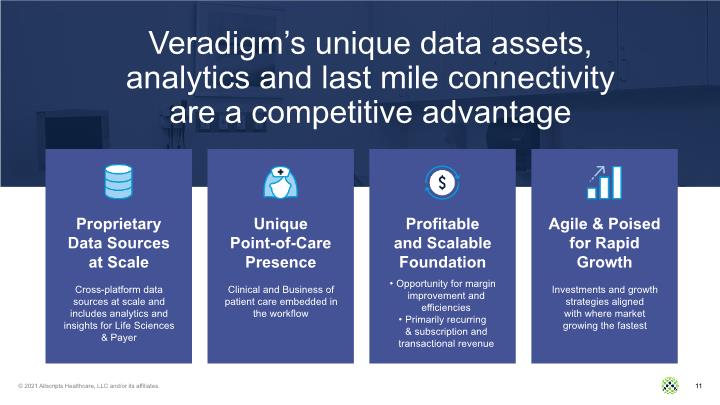

Veradigm’s unique data assets, analytics and last mile connectivity are a competitive advantage Veradigm’s unique data assets, analytics and last mile connectivity are a competitive advantage Proprietary Data Sources at Scale Cross-platform data sources at scale and includes analytics and insights for Life Sciences & Payer Unique Point-of-Care Presence Clinical and Business of patient care embedded in the workflow Profitable and Scalable Foundation Opportunity for margin improvement and efficiencies Primarily recurring & subscription and transactional revenue Agile & Poised for Rapid Growth Investments and growth strategies aligned with where market growing the fastest

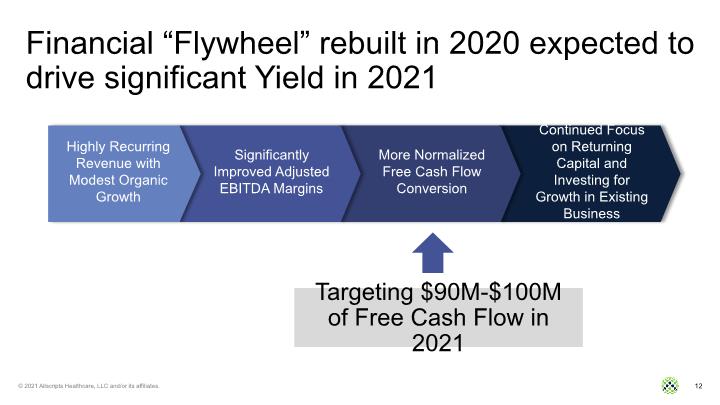

Financial “Flywheel” rebuilt in 2020 expected to drive significant Yield in 2021 Continued Focus on Returning Capital and Investing for Growth in Existing Business More Normalized Free Cash Flow Conversion Significantly Improved Adjusted EBITDA Margins Highly Recurring Revenue with Modest Organic Growth Targeting $90M-$100M of Free Cash Flow in 2021

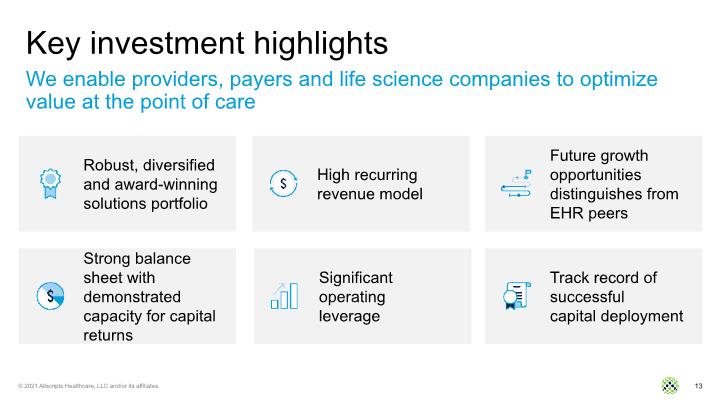

Key investment highlights We enable providers, payers and life science companies to optimize value at the point of care Robust, diversified and award-winning solutions portfolio Strong balance sheet with demonstrated capacity for capital returns High recurring revenue model Track record of successful capital deployment Future growth opportunities distinguishes from EHR peers Significant operating leverage

Appendix: Non-GAAP Financial Measures

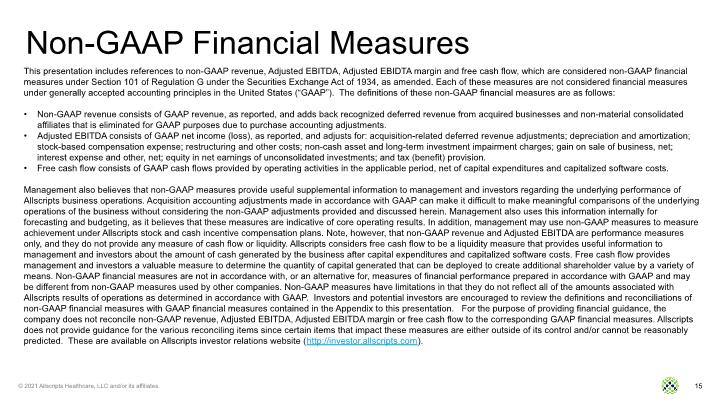

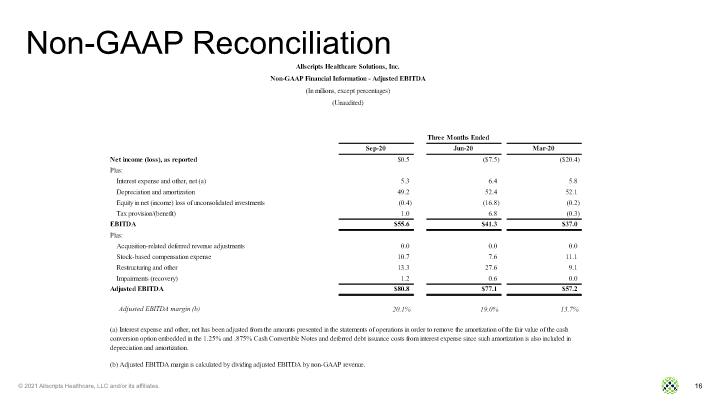

Non-GAAP Financial Measures This presentation includes references to non-GAAP revenue, Adjusted EBITDA, Adjusted EBIDTA margin and free cash flow, which are considered non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. Each of these measures are not considered financial measures under generally accepted accounting principles in the United States (“GAAP”). The definitions of these non-GAAP financial measures are as follows: Non-GAAP revenue consists of GAAP revenue, as reported, and adds back recognized deferred revenue from acquired businesses and non-material consolidated affiliates that is eliminated for GAAP purposes due to purchase accounting adjustments. Adjusted EBITDA consists of GAAP net income (loss), as reported, and adjusts for: acquisition-related deferred revenue adjustments; depreciation and amortization; stock-based compensation expense; restructuring and other costs; non-cash asset and long-term investment impairment charges; gain on sale of business, net; interest expense and other, net; equity in net earnings of unconsolidated investments; and tax (benefit) provision. Free cash flow consists of GAAP cash flows provided by operating activities in the applicable period, net of capital expenditures and capitalized software costs. Management also believes that non-GAAP measures provide useful supplemental information to management and investors regarding the underlying performance of Allscripts business operations. Acquisition accounting adjustments made in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments provided and discussed herein. Management also uses this information internally for forecasting and budgeting, as it believes that these measures are indicative of core operating results. In addition, management may use non-GAAP measures to measure achievement under Allscripts stock and cash incentive compensation plans. Note, however, that non-GAAP revenue and Adjusted EBITDA are performance measures only, and they do not provide any measure of cash flow or liquidity. Allscripts considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after capital expenditures and capitalized software costs. Free cash flow provides management and investors a valuable measure to determine the quantity of capital generated that can be deployed to create additional shareholder value by a variety of means. Non-GAAP financial measures are not in accordance with, or an alternative for, measures of financial performance prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Allscripts results of operations as determined in accordance with GAAP. Investors and potential investors are encouraged to review the definitions and reconciliations of non-GAAP financial measures with GAAP financial measures contained in the Appendix to this presentation. For the purpose of providing financial guidance, the company does not reconcile non-GAAP revenue, Adjusted EBITDA, Adjusted EBITDA margin or free cash flow to the corresponding GAAP financial measures. Allscripts does not provide guidance for the various reconciling items since certain items that impact these measures are either outside of its control and/or cannot be reasonably predicted. These are available on Allscripts investor relations website (http://investor.allscripts.com).

Non-GAAP Reconciliation