Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - bluebird bio, Inc. | exhibit99220210105.htm |

| 8-K - 8-K - bluebird bio, Inc. | blue-20210105.htm |

1 NASDAQ: BLUE Recoding For The Future January 2021 Company Presentation Exhibit 99.1

2 These slides and the accompanying oral presentation contain forward-looking statements and information. The use of words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “intend,” “future,” “potential,” or “continue,” and other similar expressions are intended to identify forward-looking statements. For example, all statements we make regarding the initiation, timing, progress and results of our preclinical and clinical studies and our research and development programs, our ability to advance product candidates into, and successfully complete, clinical studies, the timing or likelihood of regulatory filings and approvals, and the timing and likelihood of entering into contracts with payors for value-based payments over time or reimbursement approvals, and our commercialization plans for approved products are forward looking. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. These statements are also subject to a number of material risks and uncertainties that are described in our most recent quarterly report on Form 10-Q, as well as our subsequent filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it was made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Forward-looking Statements

3 Our True North THE FACES THE STORIES WHY?

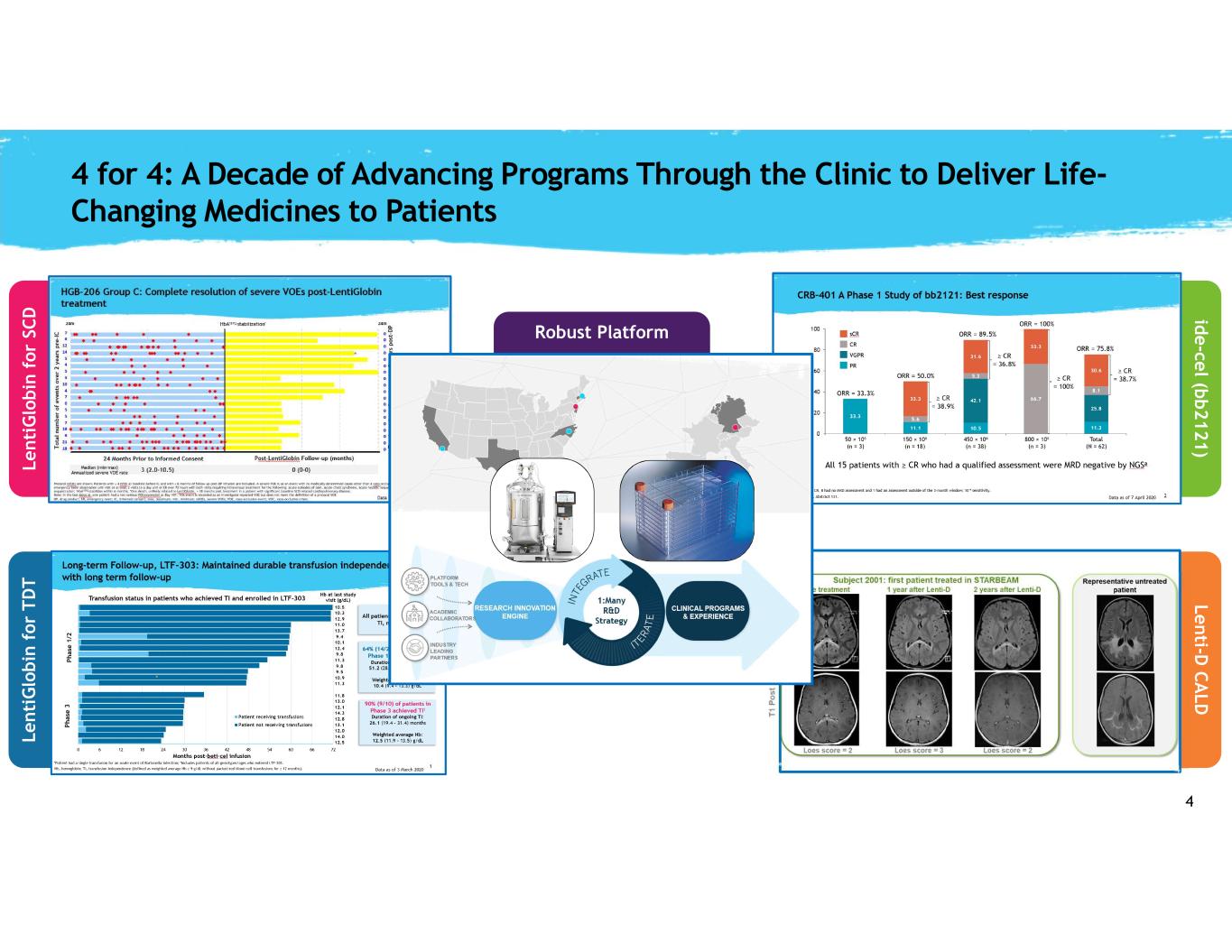

4 L e n ti G lo b in f o r T D T id e -ce l (b b 2 1 2 1 ) 4 for 4: A Decade of Advancing Programs Through the Clinic to Deliver Life- Changing Medicines to Patients Robust Platform L e n ti G lo b in f o r SC D L e n ti-D C A L D ∞ PLATFORM To discuss

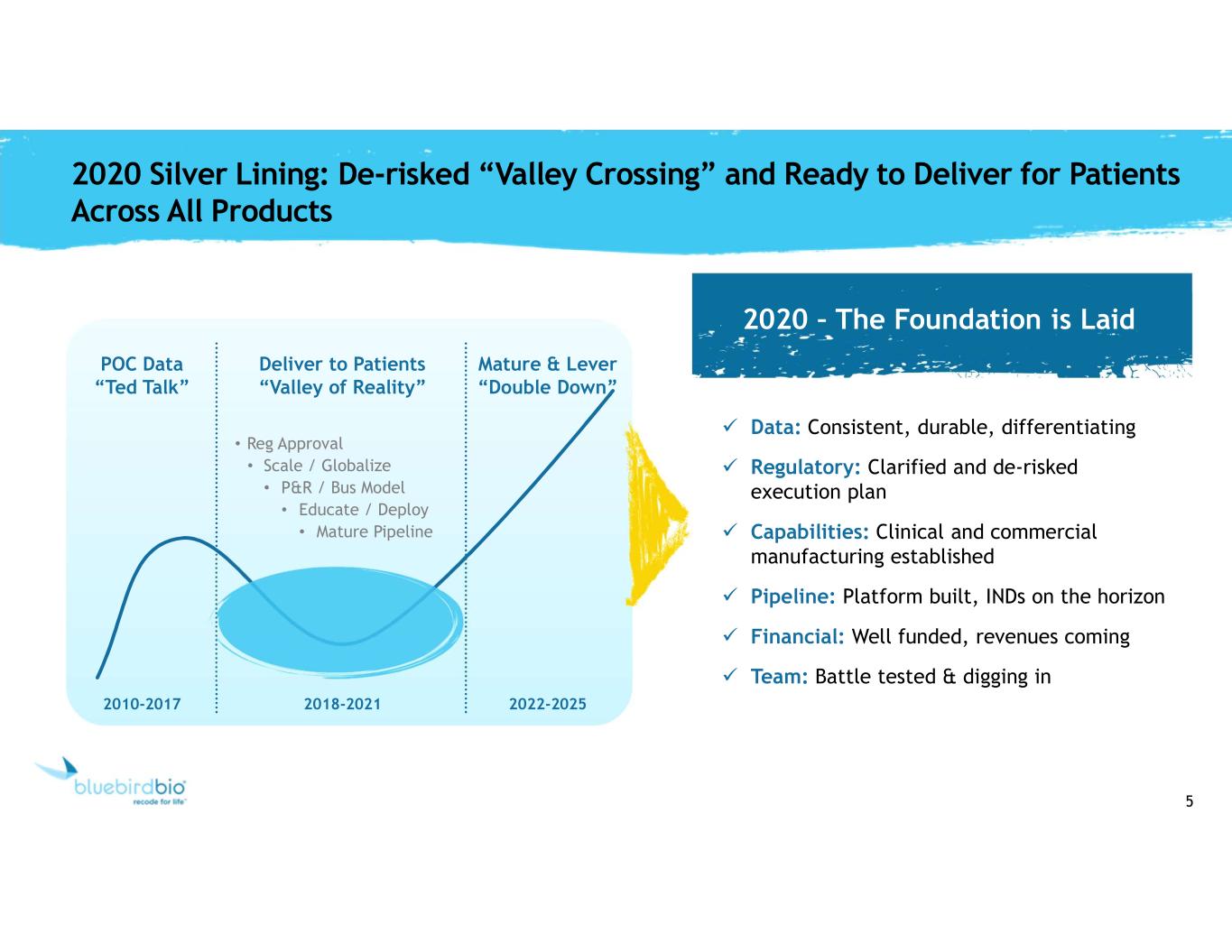

5 2020 Silver Lining: De-risked “Valley Crossing” and Ready to Deliver for Patients Across All Products POC Data “Ted Talk” Deliver to Patients “Valley of Reality” Mature & Lever “Double Down” • Reg Approval • Scale / Globalize • P&R / Bus Model • Educate / Deploy • Mature Pipeline 2010-2017 2018-2021 2022-2025 Data: Consistent, durable, differentiating Regulatory: Clarified and de-risked execution plan Capabilities: Clinical and commercial manufacturing established Pipeline: Platform built, INDs on the horizon Financial: Well funded, revenues coming Team: Battle tested & digging in 2020 – The Foundation is Laid

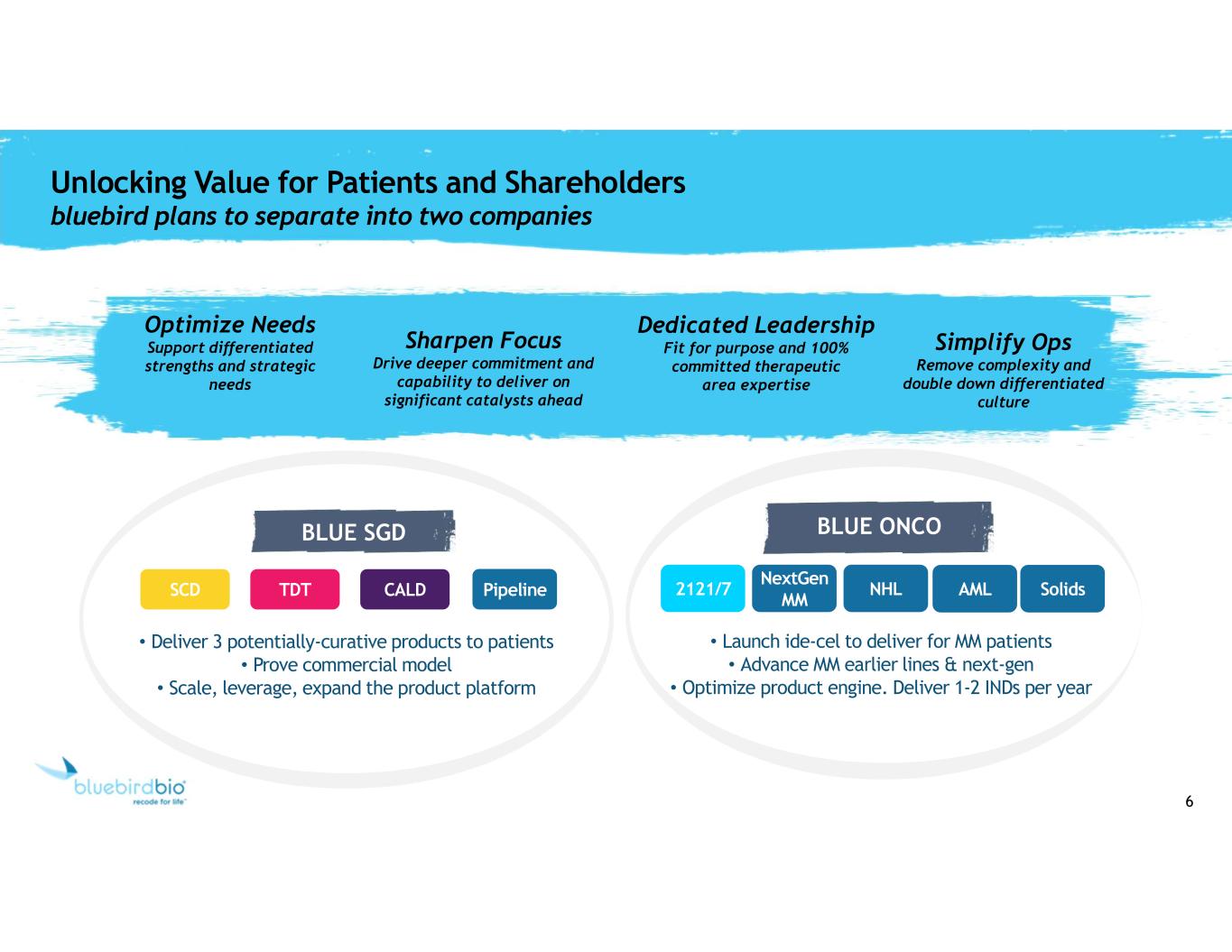

6 Unlocking Value for Patients and Shareholders bluebird plans to separate into two companies SCD TDT CALD BLUE SGD 2121/7 NextGen MM NHL AML Solids BLUE ONCO • Deliver 3 potentially-curative products to patients • Prove commercial model • Scale, leverage, expand the product platform • Launch ide-cel to deliver for MM patients • Advance MM earlier lines & next-gen • Optimize product engine. Deliver 1-2 INDs per year Optimize Needs Support differentiated strengths and strategic needs Dedicated Leadership Fit for purpose and 100% committed therapeutic area expertise Sharpen Focus Drive deeper commitment and capability to deliver on significant catalysts ahead Simplify Ops Remove complexity and double down differentiated culture Pipeline

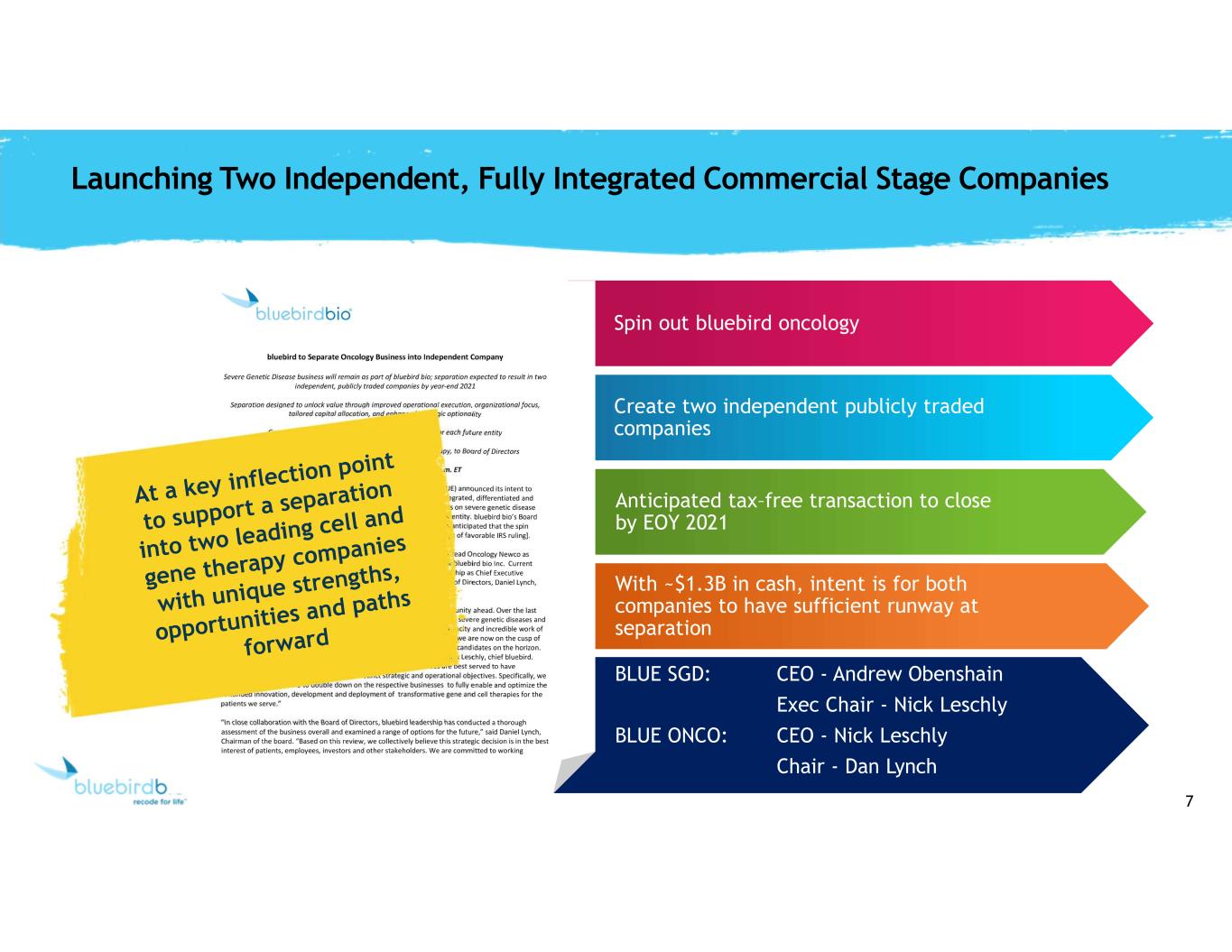

7 Spin out bluebird oncology Create two independent publicly traded companies Anticipated tax–free transaction to close by EOY 2021 With ~$1.3B in cash, intent is for both companies to have sufficient runway at separation Launching Two Independent, Fully Integrated Commercial Stage Companies BLUE SGD: CEO - Andrew Obenshain Exec Chair - Nick Leschly BLUE ONCO: CEO - Nick Leschly Chair - Dan Lynch

8 Deliver For Patients Now. SGD Snapshot

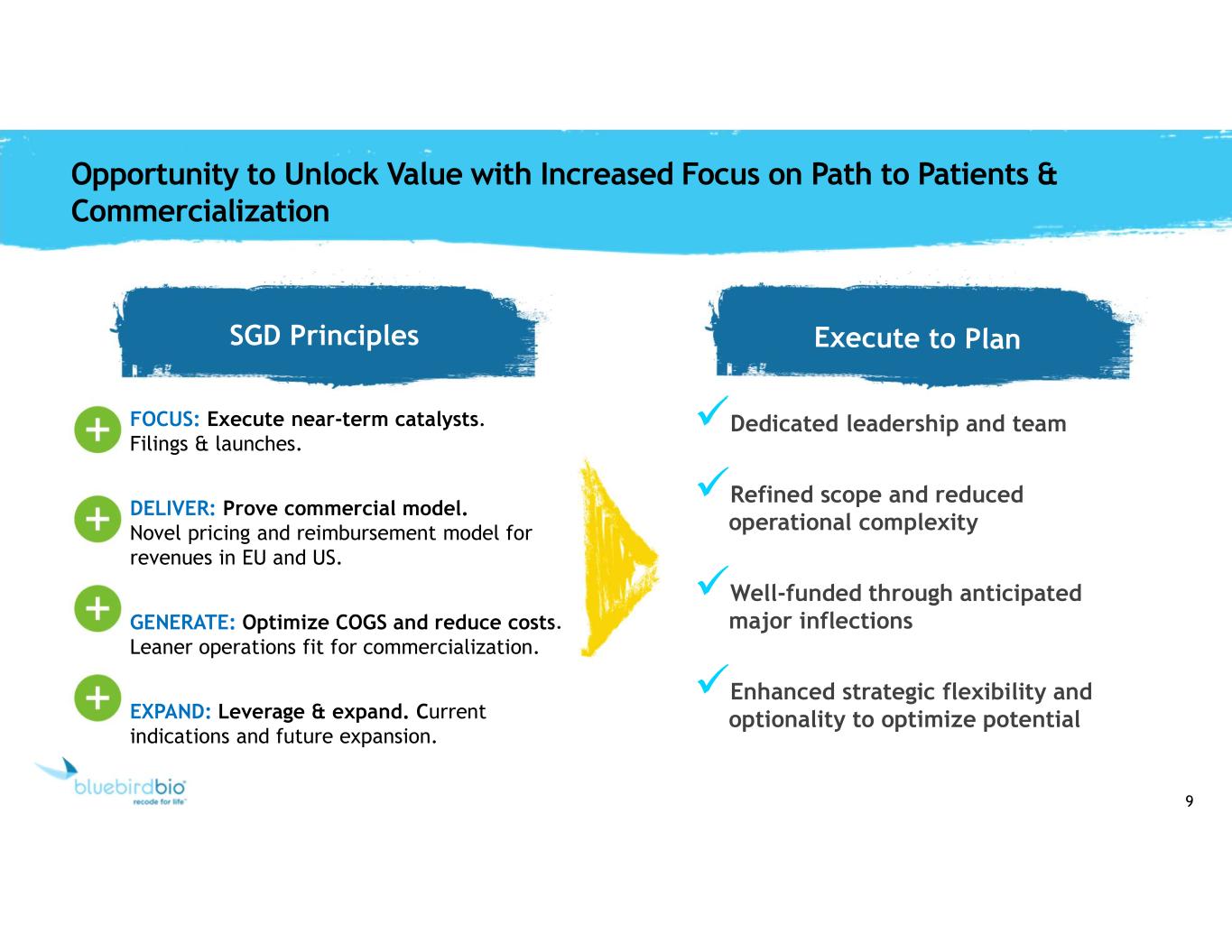

9 Opportunity to Unlock Value with Increased Focus on Path to Patients & Commercialization SGD Principles FOCUS: Execute near-term catalysts. Filings & launches. DELIVER: Prove commercial model. Novel pricing and reimbursement model for revenues in EU and US. GENERATE: Optimize COGS and reduce costs. Leaner operations fit for commercialization. EXPAND: Leverage & expand. Current indications and future expansion. Dedicated leadership and team Refined scope and reduced operational complexity Well-funded through anticipated major inflections Enhanced strategic flexibility and optionality to optimize potential

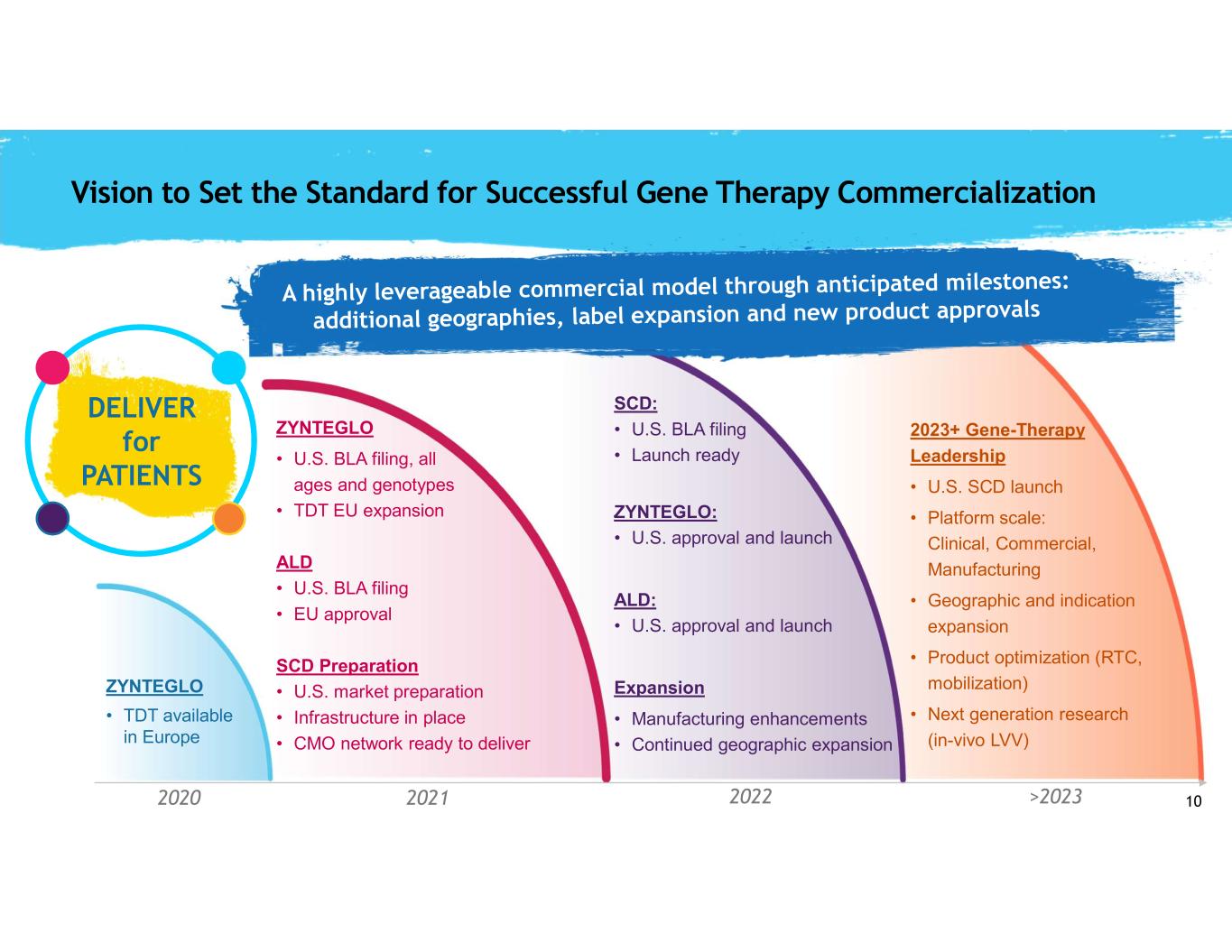

10 2023+ Gene-Therapy Leadership • U.S. SCD launch • Platform scale: Clinical, Commercial, Manufacturing • Geographic and indication expansion • Product optimization (RTC, mobilization) • Next generation research (in-vivo LVV) SCD: • U.S. BLA filing • Launch ready ZYNTEGLO: • U.S. approval and launch ALD: • U.S. approval and launch Expansion • Manufacturing enhancements • Continued geographic expansion ZYNTEGLO • U.S. BLA filing, all ages and genotypes • TDT EU expansion ALD • U.S. BLA filing • EU approval SCD Preparation • U.S. market preparation • Infrastructure in place • CMO network ready to deliver ZYNTEGLO • TDT available in Europe 2020 2021 2022 >2023 DELIVER for PATIENTS Vision to Set the Standard for Successful Gene Therapy Commercialization

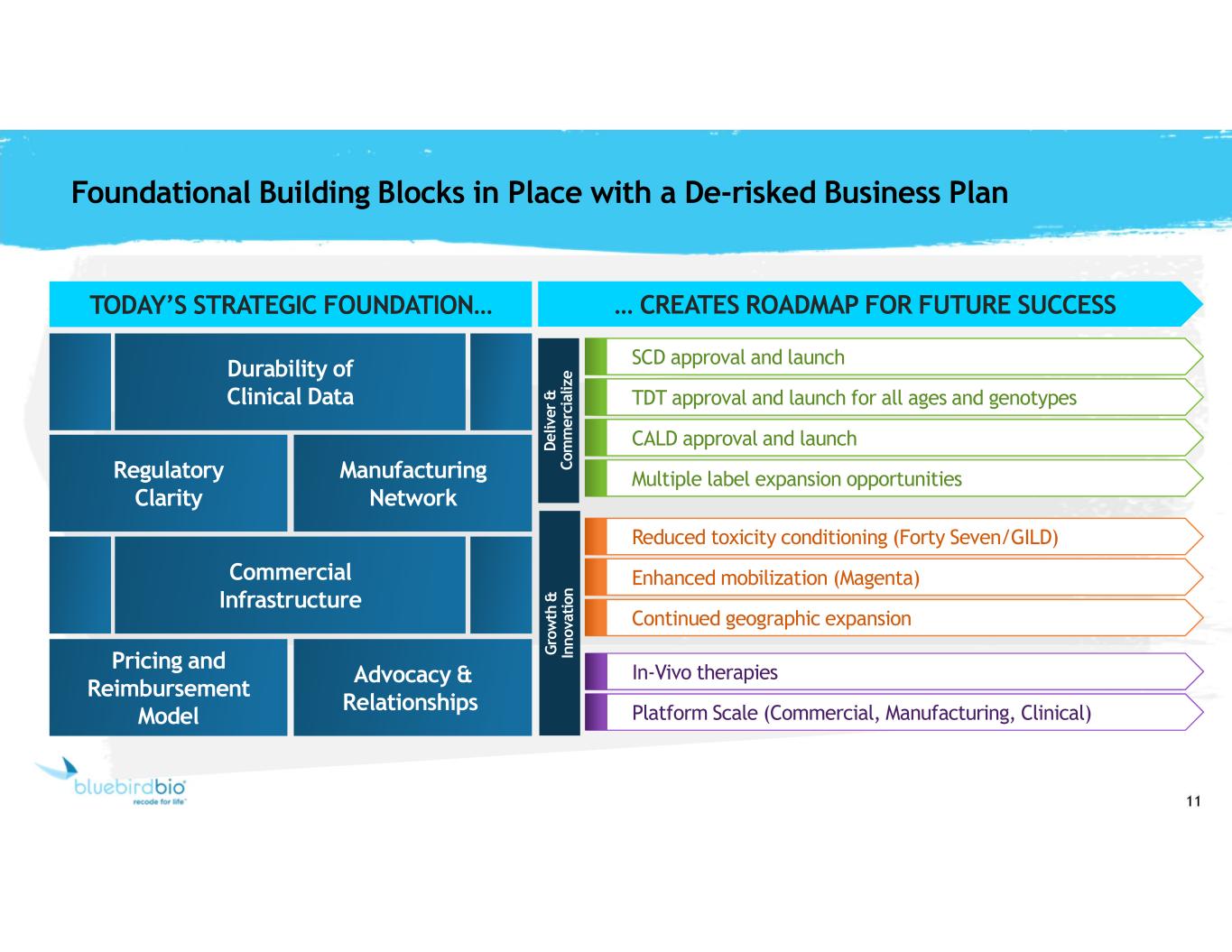

11 TODAY’S STRATEGIC FOUNDATION… Foundational Building Blocks in Place with a De-risked Business Plan Commercial Infrastructure Regulatory Clarity Durability of Clinical Data Manufacturing Network Pricing and Reimbursement Model Advocacy & Relationships Reduced toxicity conditioning (Forty Seven/GILD) Enhanced mobilization (Magenta) Continued geographic expansion In-Vivo therapies Platform Scale (Commercial, Manufacturing, Clinical) SCD approval and launch TDT approval and launch for all ages and genotypes Multiple label expansion opportunities CALD approval and launch … CREATES ROADMAP FOR FUTURE SUCCESS D e liv e r & C o m m e rc ia liz e G ro w th & In n o va ti on

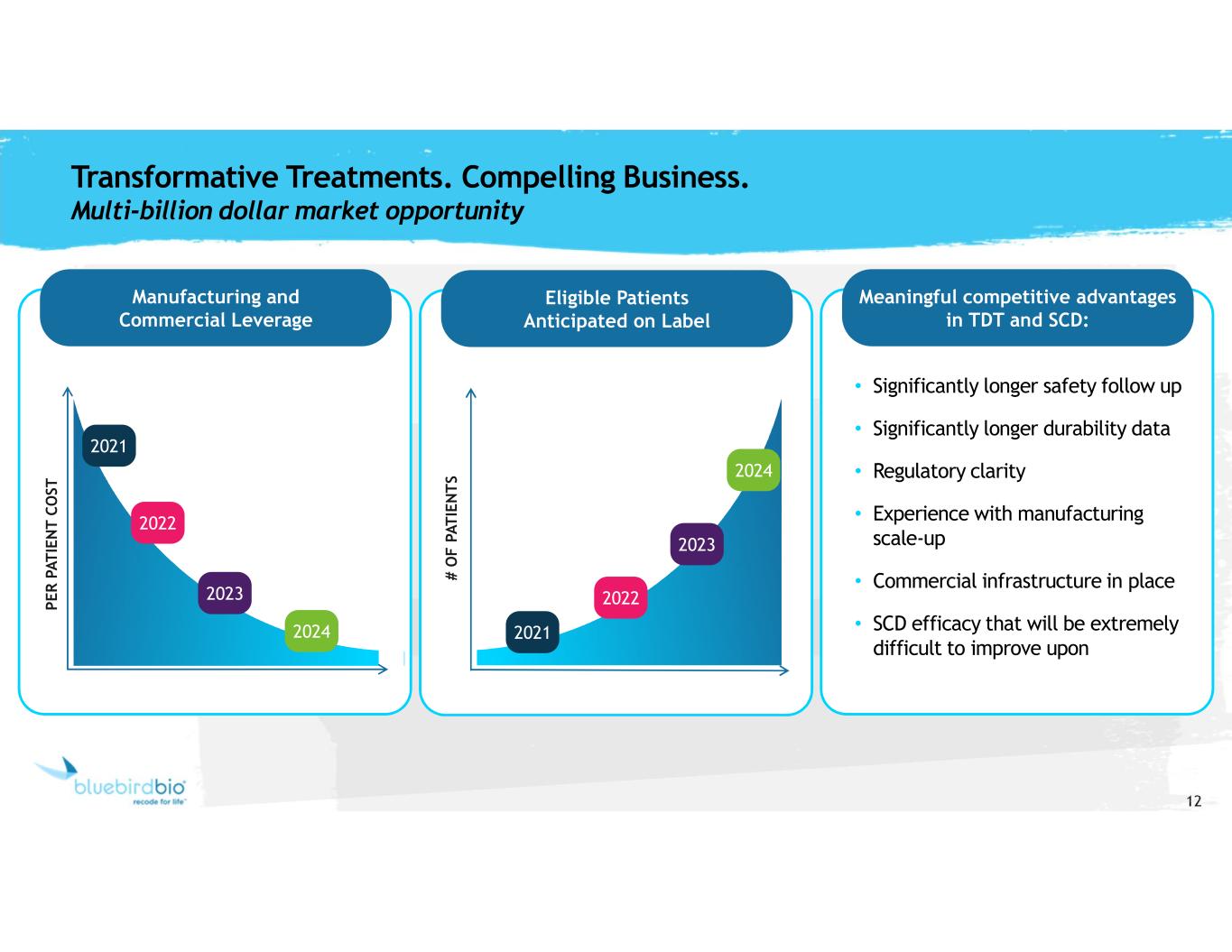

12 Manufacturing and Commercial Leverage Meaningful competitive advantages in TDT and SCD: Eligible Patients Anticipated on Label • Significantly longer safety follow up • Significantly longer durability data • Regulatory clarity • Experience with manufacturing scale-up • Commercial infrastructure in place • SCD efficacy that will be extremely difficult to improve upon Transformative Treatments. Compelling Business. Multi-billion dollar market opportunity P E R P A T IE N T C O ST 2021 2022 2023 2024 # O F P A T IE N T S 2021 2022 2023 2024

13 Launch Time. ide-cel Just The Beginning. Oncology Snapshot

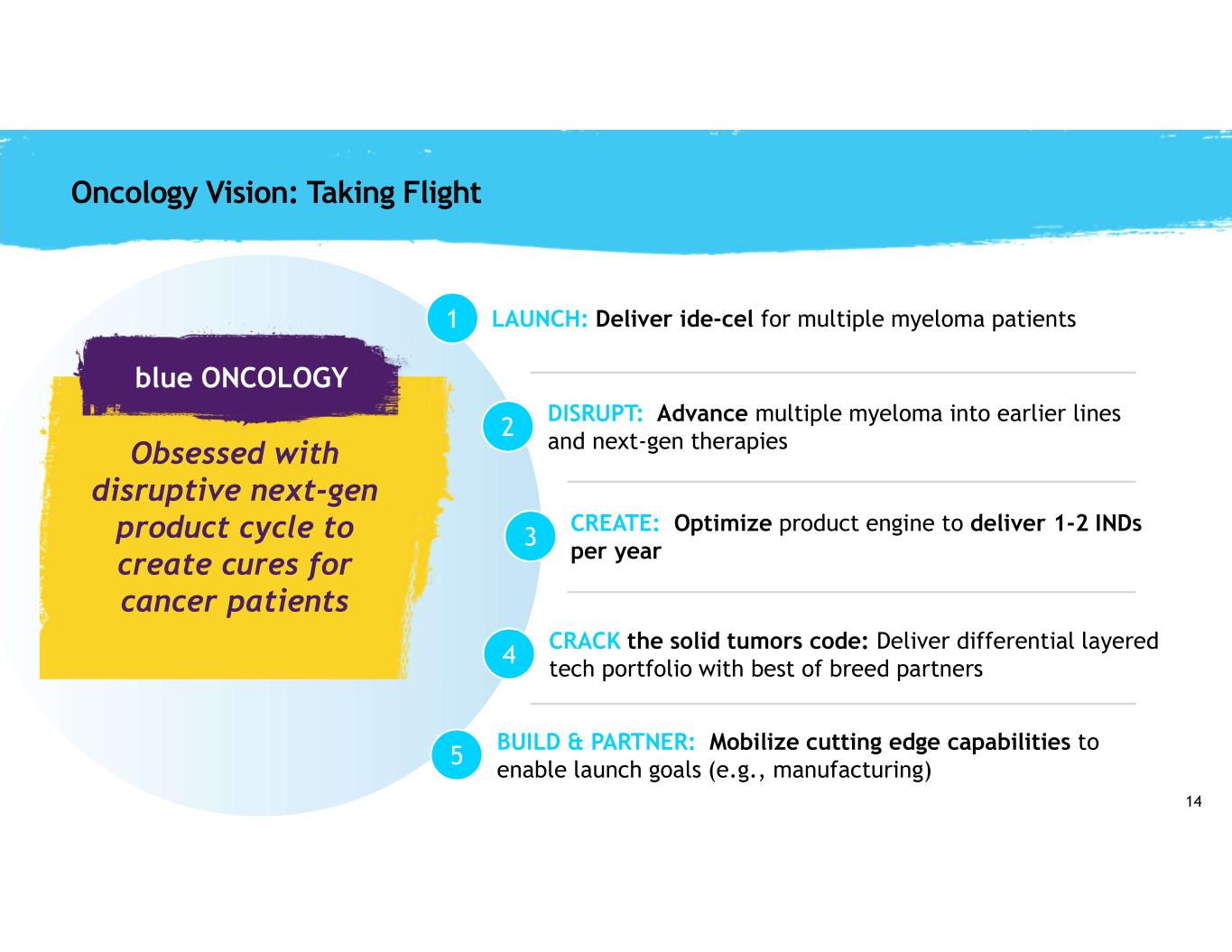

14 Oncology Vision: Taking Flight 1 2 3 BUILD & PARTNER: Mobilize cutting edge capabilities to enable launch goals (e.g., manufacturing) 4 CREATE: Optimize product engine to deliver 1-2 INDs per year 5 CRACK the solid tumors code: Deliver differential layered tech portfolio with best of breed partners LAUNCH: Deliver ide-cel for multiple myeloma patients DISRUPT: Advance multiple myeloma into earlier lines and next-gen therapiesObsessed with disruptive next-gen product cycle to create cures for cancer patients blue ONCOLOGY

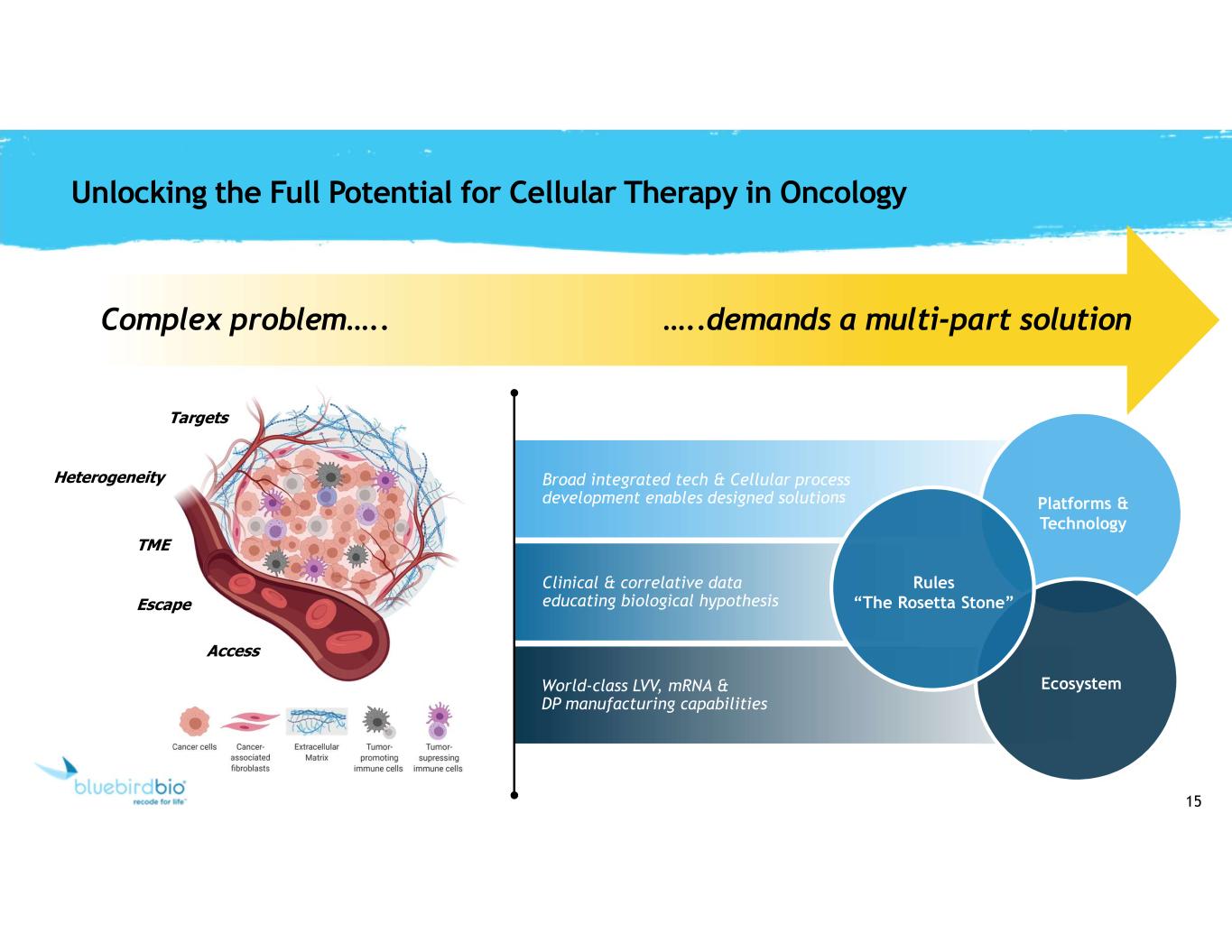

15 Clinical & correlative data educating biological hypothesis World-class LVV, mRNA & DP manufacturing capabilities Broad integrated tech & Cellular process development enables designed solutions Unlocking the Full Potential for Cellular Therapy in Oncology Complex problem….. …..demands a multi-part solution Ecosystem Platforms & Technology Rules “The Rosetta Stone” Targets Access Heterogeneity TME Escape

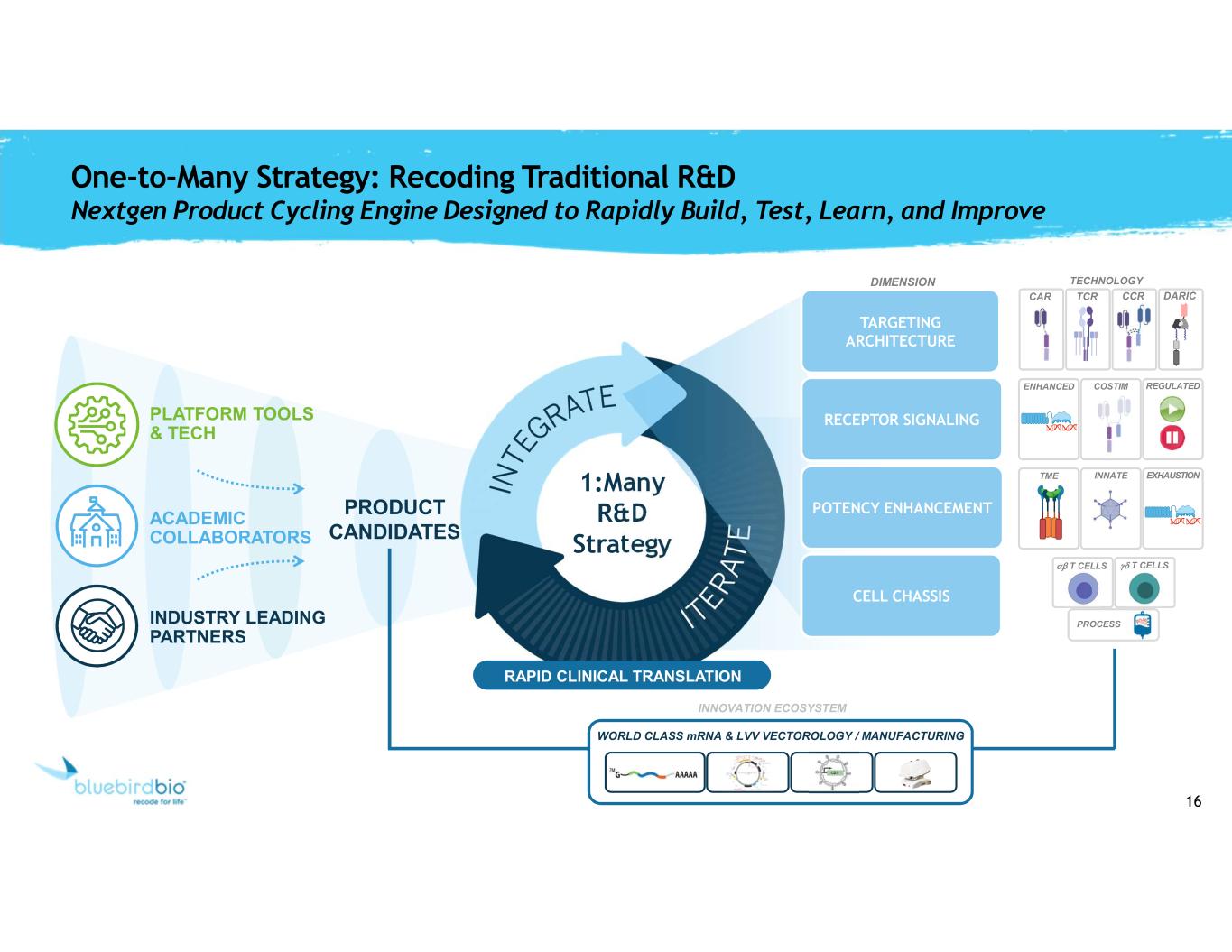

16 One-to-Many Strategy: Recoding Traditional R&D Nextgen Product Cycling Engine Designed to Rapidly Build, Test, Learn, and Improve PRODUCT CANDIDATES ACADEMIC COLLABORATORS PLATFORM TOOLS & TECH INDUSTRY LEADING PARTNERS 1:Many R&D Strategy RAPID CLINICAL TRANSLATION CAR TCR CCR DARIC ENHANCED COSTIM REGULATED TME INNATE EXHAUSTION gd T CELLSab T CELLS PROCESS TECHNOLOGY INNOVATION ECOSYSTEM WORLD CLASS mRNA & LVV VECTOROLOGY / MANUFACTURING CELL CHASSIS POTENCY ENHANCEMENT RECEPTOR SIGNALING TARGETING ARCHITECTURE DIMENSION

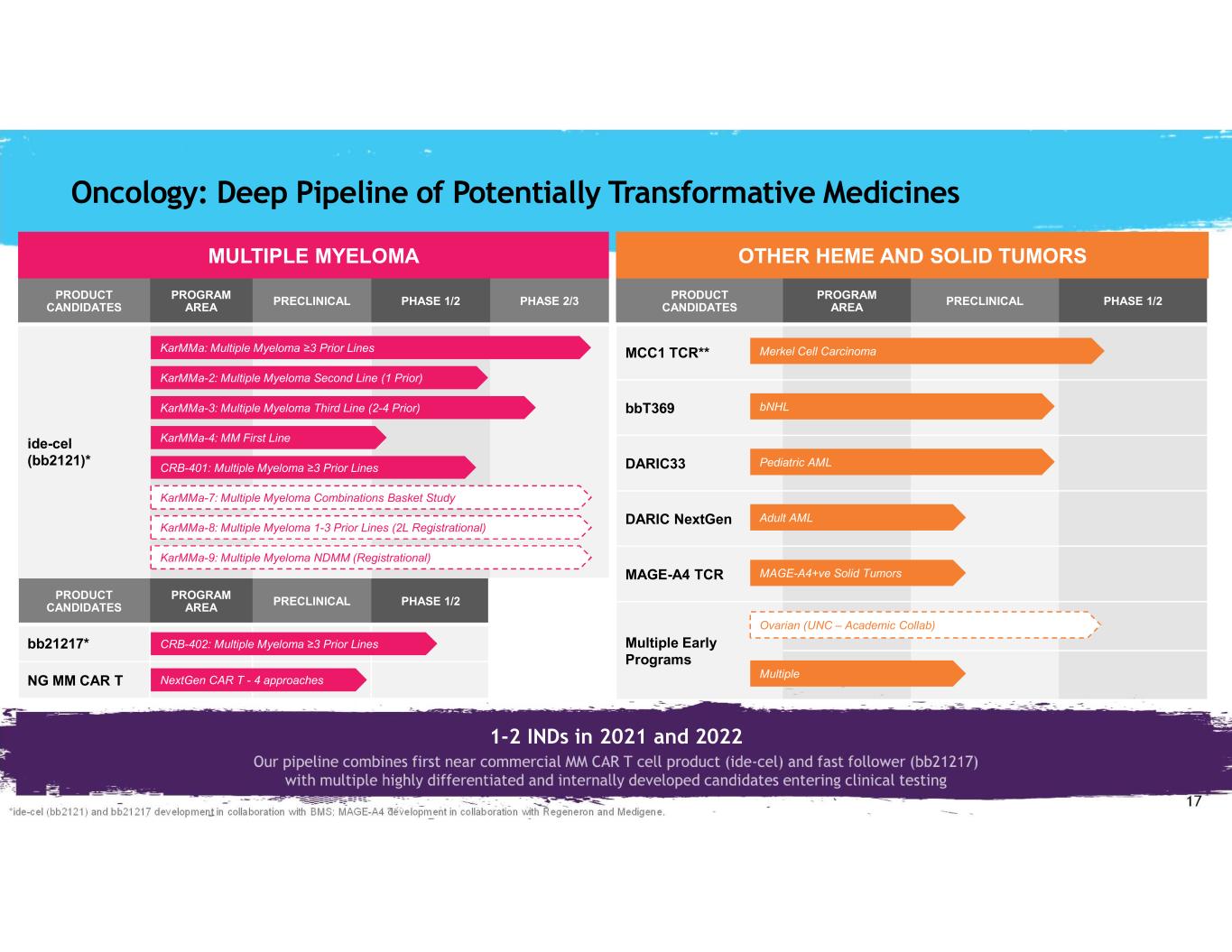

17 *ide-cel (bb2121) and bb21217 development in collaboration with BMS; MAGE-A4 development in collaboration with Regeneron and Medigene. PRODUCT CANDIDATES PROGRAM AREA PRECLINICAL PHASE 1/2 PHASE 2/3 ide-cel (bb2121)* PRODUCT CANDIDATES PROGRAM AREA PRECLINICAL PHASE 1/2 bb21217* NG MM CAR T PRODUCT CANDIDATES PROGRAM AREA PRECLINICAL PHASE 1/2 MCC1 TCR** bbT369 DARIC33 DARIC NextGen MAGE-A4 TCR Multiple Early Programs KarMMa-3: Multiple Myeloma Third Line (2-4 Prior) KarMMa-2: Multiple Myeloma Second Line (1 Prior) KarMMa: Multiple Myeloma ≥3 Prior Lines KarMMa-4: MM First Line CRB-401: Multiple Myeloma ≥3 Prior Lines KarMMa-7: Multiple Myeloma Combinations Basket Study KarMMa-8: Multiple Myeloma 1-3 Prior Lines (2L Registrational) KarMMa-9: Multiple Myeloma NDMM (Registrational) MULTIPLE MYELOMA OTHER HEME AND SOLID TUMORS CRB-402: Multiple Myeloma ≥3 Prior Lines NextGen CAR T - 4 approaches Merkel Cell Carcinoma Pediatric AML Adult AML Multiple bNHL MAGE-A4+ve Solid Tumors Oncology: Deep Pipeline of Potentially Transformative Medicines Ovarian (UNC – Academic Collab) 1-2 INDs in 2021 and 2022

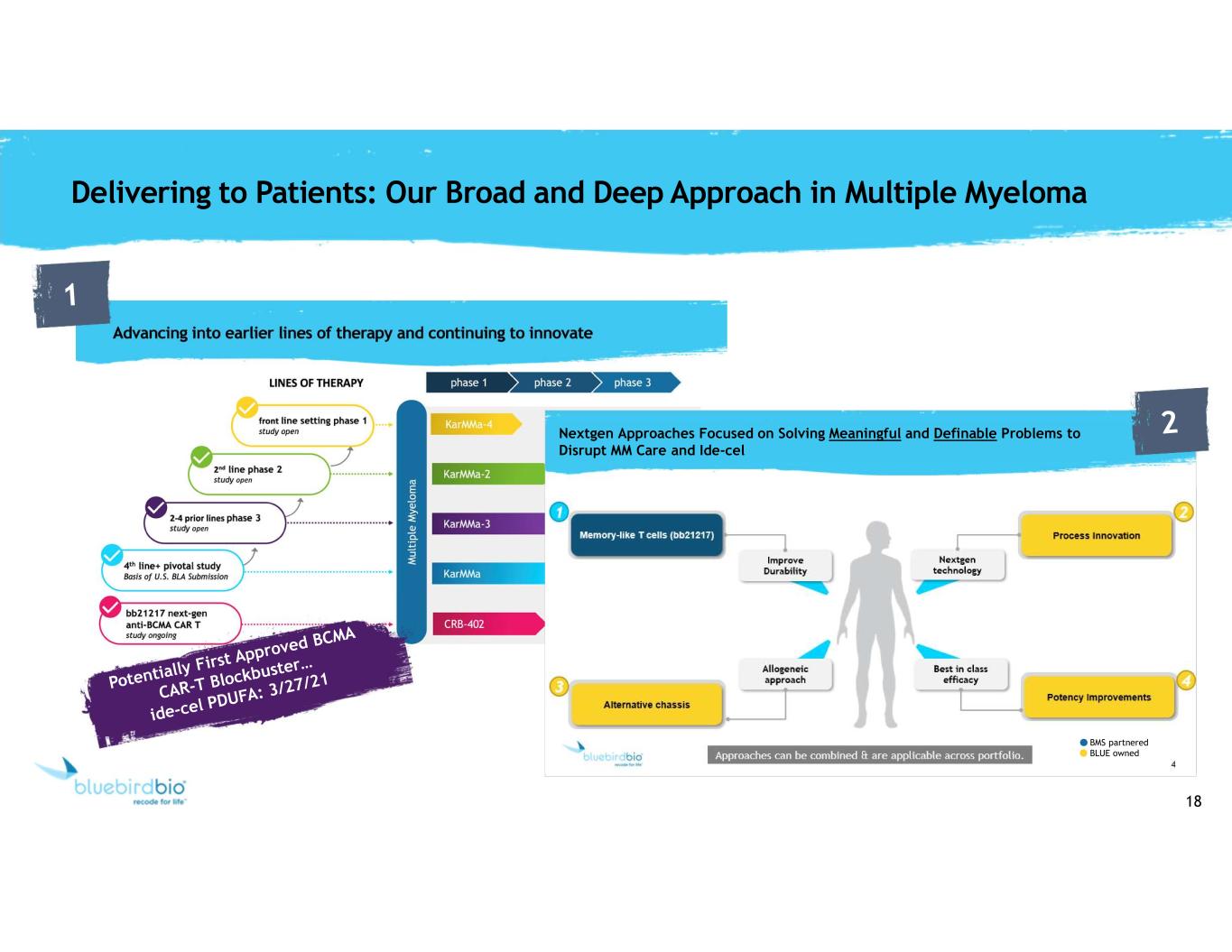

18 Delivering to Patients: Our Broad and Deep Approach in Multiple Myeloma Nextgen Approaches Focused on Solving Meaningful and Definable Problems to Disrupt MM Care and Ide-cel BMS partnered BLUE owned

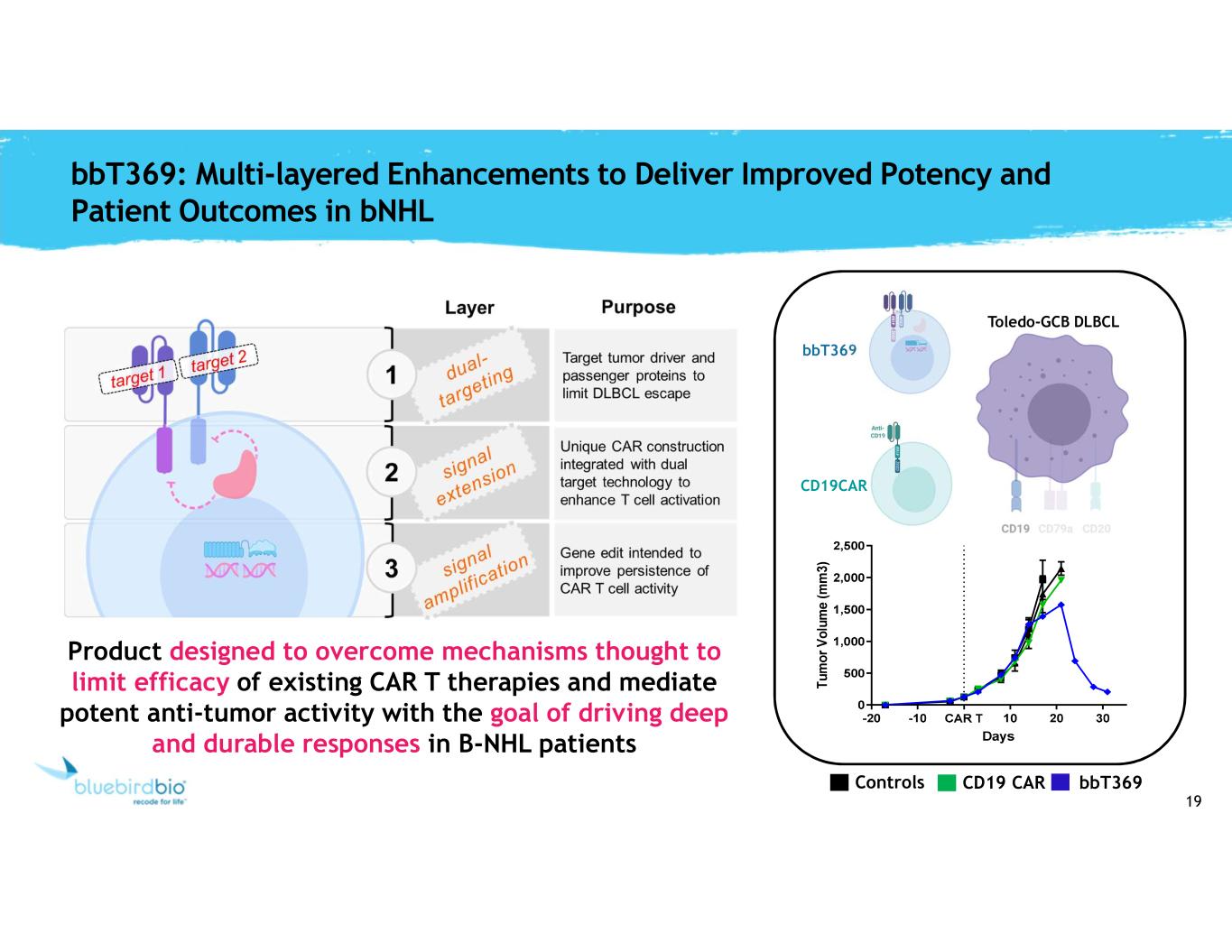

19 bbT369: Multi-layered Enhancements to Deliver Improved Potency and Patient Outcomes in bNHL Toledo-GCB DLBCL bbT369 CD19CAR Controls bbT369CD19 CAR Product designed to overcome mechanisms thought to limit efficacy of existing CAR T therapies and mediate potent anti-tumor activity with the goal of driving deep and durable responses in B-NHL patients

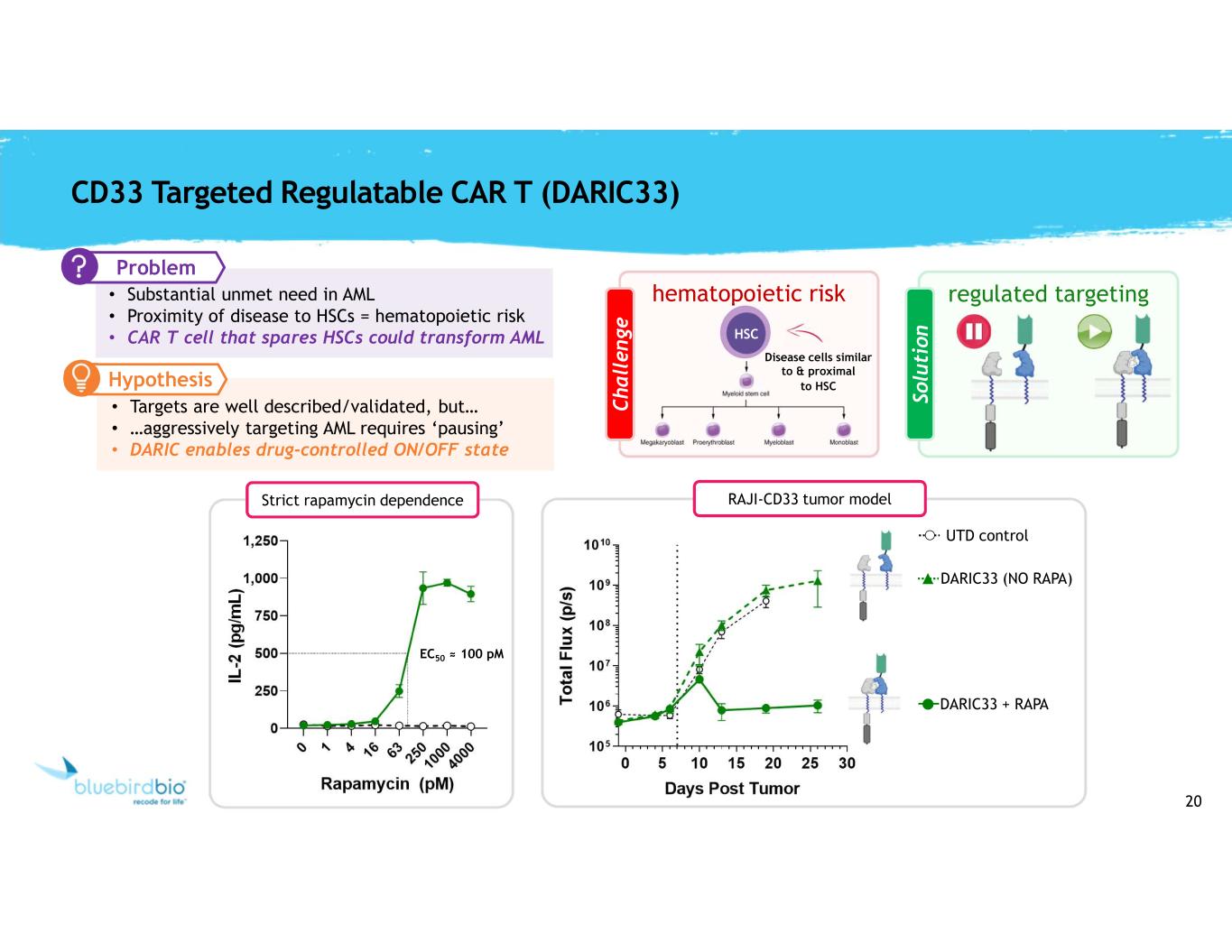

20 regulated targeting So lu ti o n CD33 Targeted Regulatable CAR T (DARIC33) hematopoietic risk HSC C h a ll e n g e Disease cells similar to & proximal to HSC Problem • Substantial unmet need in AML • Proximity of disease to HSCs = hematopoietic risk • CAR T cell that spares HSCs could transform AML • Targets are well described/validated, but… • …aggressively targeting AML requires ‘pausing’ • DARIC enables drug-controlled ON/OFF state IL -2 ( p g /m L ) Strict rapamycin dependence EC50 ≈ 100 pM T o ta l F lu x ( p /s ) RAJI-CD33 tumor model DARIC33 + RAPA DARIC33 (NO RAPA) UTD control Hypothesis

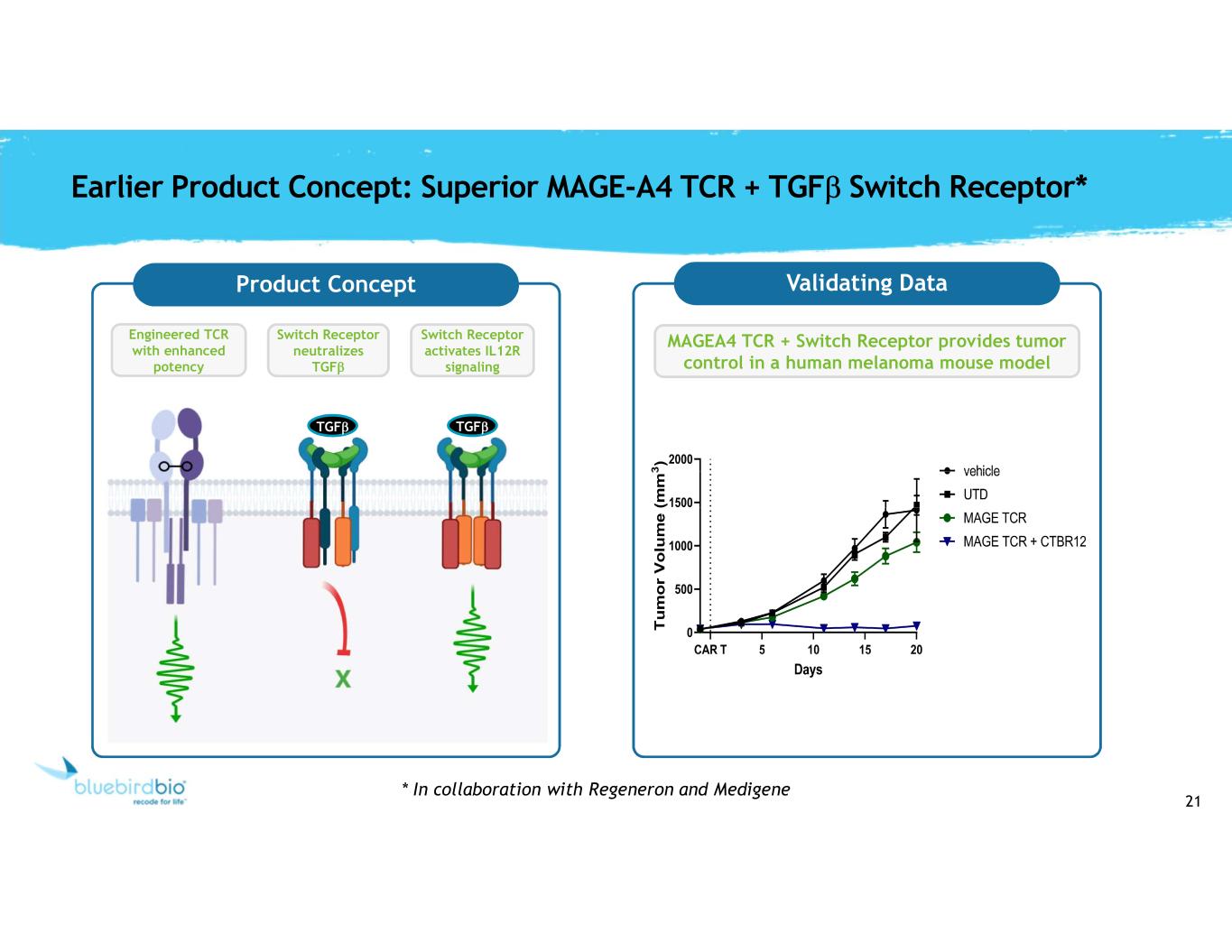

21 Earlier Product Concept: Superior MAGE-A4 TCR + TGFb Switch Receptor* Engineered TCR with enhanced potency Product Concept TGFb TGFb Switch Receptor neutralizes TGFb Switch Receptor activates IL12R signaling Validating Data MAGEA4 TCR + Switch Receptor provides tumor control in a human melanoma mouse model * In collaboration with Regeneron and Medigene

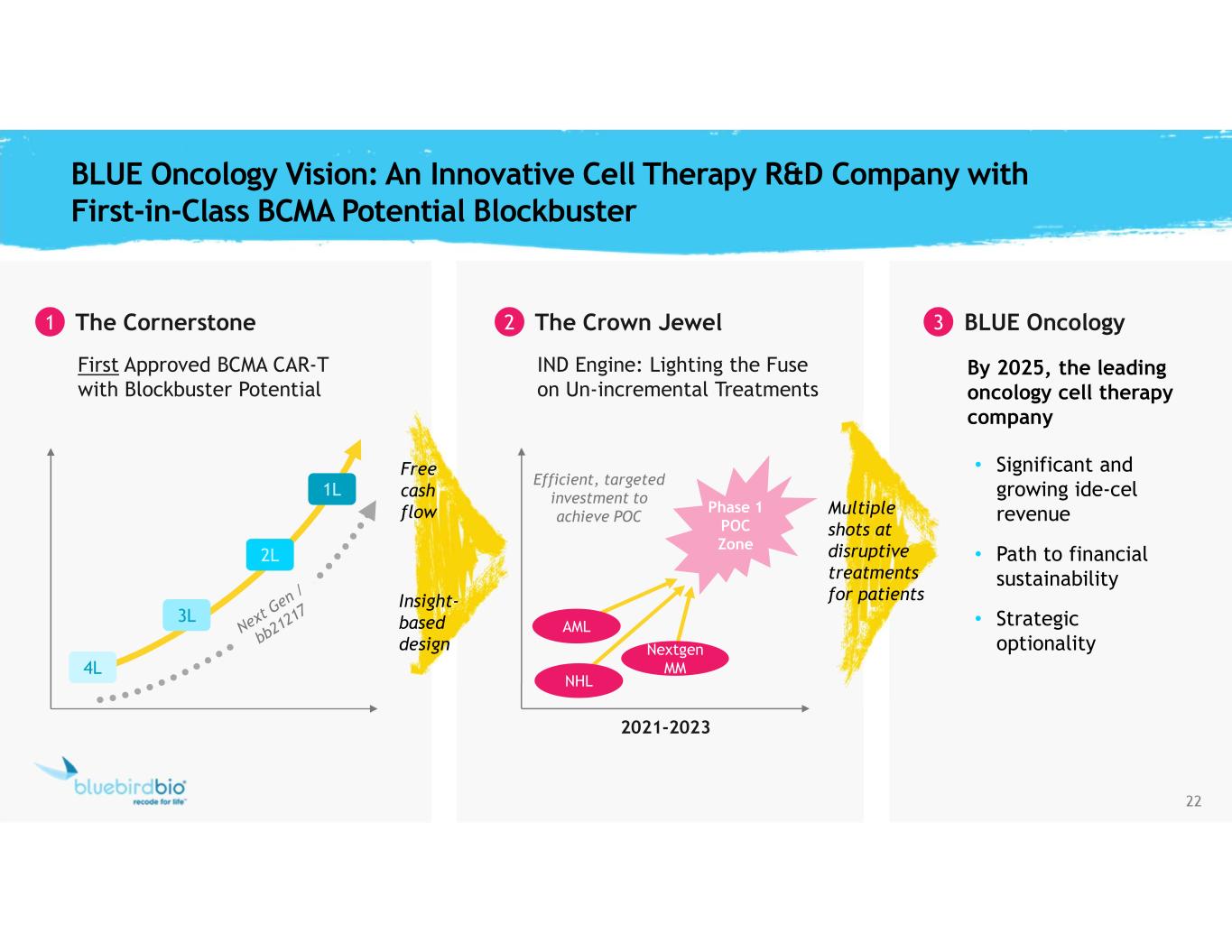

22 By 2025, the leading oncology cell therapy company • Significant and growing ide-cel revenue • Path to financial sustainability • Strategic optionality BLUE Oncology Vision: An Innovative Cell Therapy R&D Company with First-in-Class BCMA Potential Blockbuster 1 The Cornerstone First Approved BCMA CAR-T with Blockbuster Potential Efficient, targeted investment to achieve POC 2 The Crown Jewel IND Engine: Lighting the Fuse on Un-incremental Treatments 2021-2023 Multiple shots at disruptive treatments for patients BLUE Oncology Insight- based design Free cash flow Phase 1 POC Zone NHL AML Nextgen MM4L 3L 2L 1L 3

23 Time to Run in 2021…

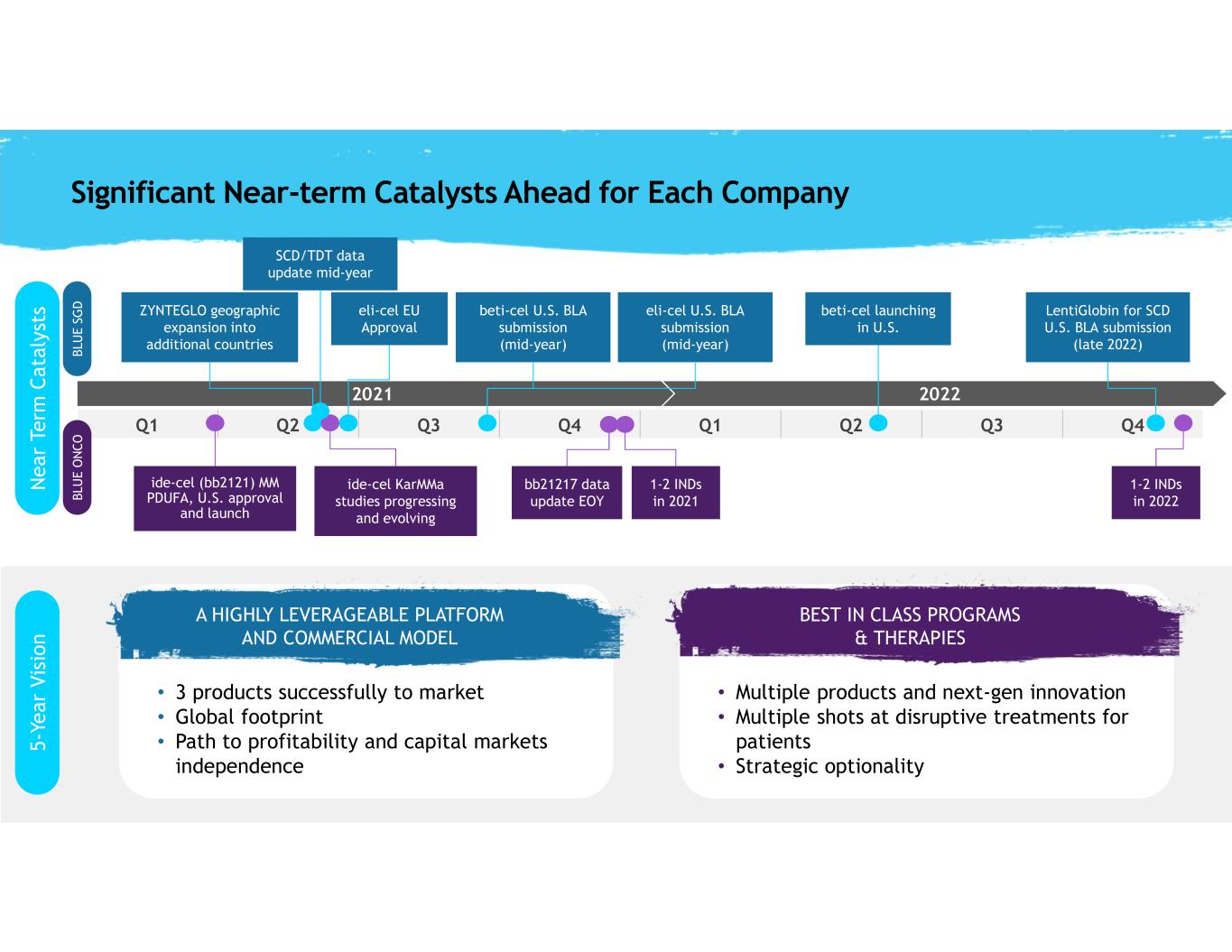

24 2022 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2021 Significant Near-term Catalysts Ahead for Each Company beti-cel U.S. BLA submission (mid-year) ide-cel KarMMa studies progressing and evolving ide-cel (bb2121) MM PDUFA, U.S. approval and launch eli-cel U.S. BLA submission (mid-year) LentiGlobin for SCD U.S. BLA submission (late 2022) ZYNTEGLO geographic expansion into additional countries 1-2 INDs in 2021 1-2 INDs in 2022 beti-cel launching in U.S. eli-cel EU Approval A HIGHLY LEVERAGEABLE PLATFORM AND COMMERCIAL MODEL • 3 products successfully to market • Global footprint • Path to profitability and capital markets independence BEST IN CLASS PROGRAMS & THERAPIES • Multiple products and next-gen innovation • Multiple shots at disruptive treatments for patients • Strategic optionality A HIGHLY LEVERAGEABLE PLATF RM AND COMMERCIAL MODEL BEST IN CLASS PROGRAMS & THERAPIES N e a r Te rm C a ta ly st s 5 -Y e a r V is io n SCD/TDT data update mid-year bb21217 data update EOY B LU E S G D B LU E O N C O

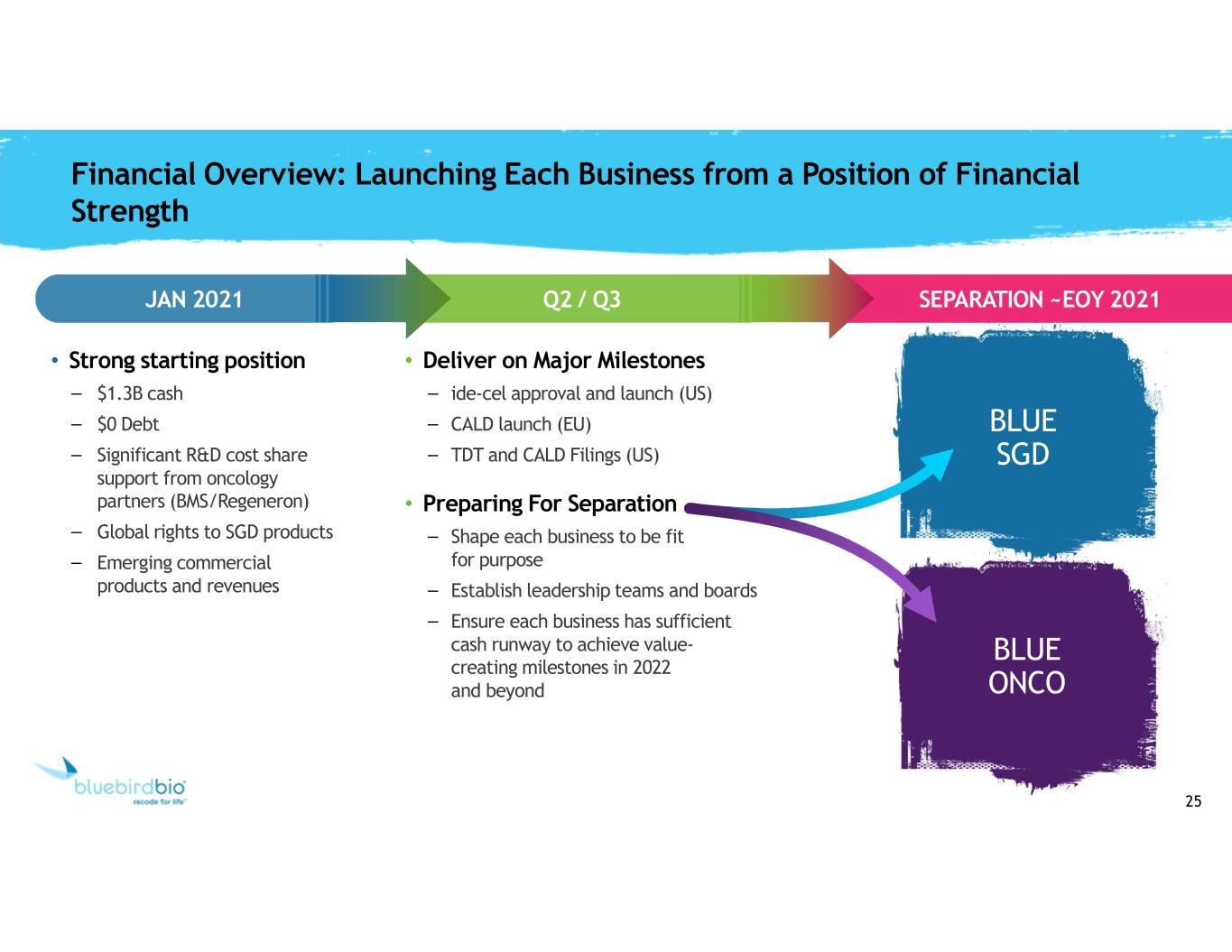

25 Financial Overview: Launching Each Business from a Position of Financial Strength JAN 2021 SEPARATION ~EOY 2021 • Strong starting position – $1.3B cash – $0 Debt – Significant R&D cost share support from oncology partners (BMS/Regeneron) – Global rights to SGD products – Emerging commercial products and revenues • Deliver on Major Milestones – ide-cel approval and launch (US) – CALD launch (EU) – TDT and CALD Filings (US) • Preparing For Separation – Shape each business to be fit for purpose – Establish leadership teams and boards – Ensure each business has sufficient cash runway to achieve value- creating milestones in 2022 and beyond Q2 / Q3 BLUE SGD BLUE ONCO

26 Re-shaping bluebird to Deliver over Next Five Years MAXIMIZE IMPACT • Deliver deeper therapeutic expertise • Disruption and focus favors patients PATIENTS ENGAGE AND ENABLE • Optimize diverging business needs • Operational simplification & focus • Rejuvenated and committed EMPLOYEES (“birds”) DELIVER VALUE • Strategy clarity and optionality • Dedicated value creation SHAREHOLDERS The Next 5 YEARS

27 Simple Vision; Profound Mission R AD I C AL C AR E We care in a way that’s intense and truly sets us apart. T H I S I S P E R S O N AL Gene therapy is about saving lives one person at a time. And we are, each of us, personally all in. P I O N E E R S W I T H P U R P O S E We’re exploring new frontiers for the sake of patients.