Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - PERKINELMER INC | d60177dex992.htm |

| 8-K - 8-K - PERKINELMER INC | d60177d8k.htm |

Exhibit 99.1 J.P. MORGAN Healthcare Conference Prahlad Singh Chief Executive Officer January 11, 2021 1Exhibit 99.1 J.P. MORGAN Healthcare Conference Prahlad Singh Chief Executive Officer January 11, 2021 1

SAFE HARBOR This presentation contains forward-looking statements which are statements relating to future events. These statements include those relating to estimates and projections of future earnings per share, cash flow and revenue growth and other financial results, developments relating to our customers and end-markets, and plans concerning business development opportunities. Words such as believes, intends, anticipates, plans, expects, projects, forecasts, will and similar expressions, and references to guidance, are intended to identify forward-looking statements. Such statements are based on management's current assumptions and expectations and no assurances can be given that our assumptions or expectations will prove to be correct. A number of important risk factors could cause actual results to differ materially from the results described, implied or projected in any forward-looking statements. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. A detailed description of these risk factors can be found under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q and in our other filings with the Securities and Exchange Commission. We disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this presentation. In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this presentation also contains non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measures is included in the embedded hyperlink and is available on the “Investor Events” section of our investor relations website at ir.perkinelmer.com. 2SAFE HARBOR This presentation contains forward-looking statements which are statements relating to future events. These statements include those relating to estimates and projections of future earnings per share, cash flow and revenue growth and other financial results, developments relating to our customers and end-markets, and plans concerning business development opportunities. Words such as believes, intends, anticipates, plans, expects, projects, forecasts, will and similar expressions, and references to guidance, are intended to identify forward-looking statements. Such statements are based on management's current assumptions and expectations and no assurances can be given that our assumptions or expectations will prove to be correct. A number of important risk factors could cause actual results to differ materially from the results described, implied or projected in any forward-looking statements. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. A detailed description of these risk factors can be found under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q and in our other filings with the Securities and Exchange Commission. We disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this presentation. In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this presentation also contains non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measures is included in the embedded hyperlink and is available on the “Investor Events” section of our investor relations website at ir.perkinelmer.com. 2

WHAT YOU’LL HEAR TODAY … Positioning Us for Future Success Continued Progress against Our Strategic Foundation … COVID-19 response validates our foundational efforts RECENT FOCUS VALUE CREATION FRAMEWORK PORTFOLIO Enhanced Diagnostics brand Add Meaningful TRANSFORMATION Scale bolsters existing positions Maximize Growth Accelerators ORGANIZATIONAL ALIGNMENT Confidence in long-term Strengthen Core Right to Win value creation opportunities Operational STRATEGIC Excellence to Drive PRIORITIES Margin & Efficiency 3WHAT YOU’LL HEAR TODAY … Positioning Us for Future Success Continued Progress against Our Strategic Foundation … COVID-19 response validates our foundational efforts RECENT FOCUS VALUE CREATION FRAMEWORK PORTFOLIO Enhanced Diagnostics brand Add Meaningful TRANSFORMATION Scale bolsters existing positions Maximize Growth Accelerators ORGANIZATIONAL ALIGNMENT Confidence in long-term Strengthen Core Right to Win value creation opportunities Operational STRATEGIC Excellence to Drive PRIORITIES Margin & Efficiency 3

PORTFOLIO TRANSFORMATION þ Positioned for more stable Attractive >80% of 2020 revenue from END MARKETS MSD+ growth Diagnostics and Life Sciences þ Improved >70% of portfolio in consumables, Supporting more consistent PRODUCT MIX services, & software and linear revenue þ Increased 33% of revenue in Revenue balanced equally across GEOGRAPHIC REACH higher growth emerging markets the globe þ Expanded into adjacencies, increasing Strengthened ~$2.5B deployed capital CAPABILITIES TAM to $70-75B over past five years* Reinforcing our solid foundation for continued success * Does not include the potential Oxford Immunotec acquistion 4PORTFOLIO TRANSFORMATION þ Positioned for more stable Attractive >80% of 2020 revenue from END MARKETS MSD+ growth Diagnostics and Life Sciences þ Improved >70% of portfolio in consumables, Supporting more consistent PRODUCT MIX services, & software and linear revenue þ Increased 33% of revenue in Revenue balanced equally across GEOGRAPHIC REACH higher growth emerging markets the globe þ Expanded into adjacencies, increasing Strengthened ~$2.5B deployed capital CAPABILITIES TAM to $70-75B over past five years* Reinforcing our solid foundation for continued success * Does not include the potential Oxford Immunotec acquistion 4

STRENGTHENED CAPABILITIES: TWO RECENT ACQUISITIONS IN ADJACENT MARKETS þ Attractive END MARKETS ~$800M capital deployed in new adjacent markets growing HSD þ Improved PRODUCT MIX þ Closed December 23 Closing 1H21 Increased GEOGRAPHIC REACH $3B TAM >$1B TAM Gene Editing Latent TB Diagnostics þ Strengthened CAPABILITIES PKI Synergies ✓ Creating value through automation expertise ✓ Increasing global channel reach 5STRENGTHENED CAPABILITIES: TWO RECENT ACQUISITIONS IN ADJACENT MARKETS þ Attractive END MARKETS ~$800M capital deployed in new adjacent markets growing HSD þ Improved PRODUCT MIX þ Closed December 23 Closing 1H21 Increased GEOGRAPHIC REACH $3B TAM >$1B TAM Gene Editing Latent TB Diagnostics þ Strengthened CAPABILITIES PKI Synergies ✓ Creating value through automation expertise ✓ Increasing global channel reach 5

ORGANIZATIONAL ALIGNMENT Unified R&D Positioned 2K+ One to Drive Product Vitality & Decrease Time Person Global R&D R&D Team to Market Global Commercial Unified 6K+ Resources Localized to Go-to- the Customer across a Global Commercial Market Resources Broad Portfolio Centralized Operations 3K+ Global to Leverage Global Operations Operations & Expertise and Scale Logistics Team 6ORGANIZATIONAL ALIGNMENT Unified R&D Positioned 2K+ One to Drive Product Vitality & Decrease Time Person Global R&D R&D Team to Market Global Commercial Unified 6K+ Resources Localized to Go-to- the Customer across a Global Commercial Market Resources Broad Portfolio Centralized Operations 3K+ Global to Leverage Global Operations Operations & Expertise and Scale Logistics Team 6

PROGRESS ON OUR STRATEGIC PRIORITIES STRONG ENHANCED FOCUSED TRANSFORMATIVE TALENT & CUSTOMER OPERATIONAL INNOVATION CULTURE EXPERIENCE EXCELLENCE ✓ Strong employee ✓ Achieved 3 FDA EUAs ✓ Unified and ✓ Improved quote-to- retention (~8% voluntary and 13 CE-marks for new personalized account delivery by ~20% turnover) Dx product launches relationships with full solution selling ✓ ~70% employees ex-US ✓ Launched Total Quality ✓ Primed >75% of DAS and increased leadership Initiative to embed product revenue for NPI ✓ New Commercial diversity to >50% systematic changes upgrades over next 12-36 Office supporting global months ✓ Launched new core sales ✓ More transparent and values ✓ Incorporating seamless efficient order ✓ Modern digital and automation and digital execution ✓ Published new CSR virtual reality tools tools across the portfolio report 7PROGRESS ON OUR STRATEGIC PRIORITIES STRONG ENHANCED FOCUSED TRANSFORMATIVE TALENT & CUSTOMER OPERATIONAL INNOVATION CULTURE EXPERIENCE EXCELLENCE ✓ Strong employee ✓ Achieved 3 FDA EUAs ✓ Unified and ✓ Improved quote-to- retention (~8% voluntary and 13 CE-marks for new personalized account delivery by ~20% turnover) Dx product launches relationships with full solution selling ✓ ~70% employees ex-US ✓ Launched Total Quality ✓ Primed >75% of DAS and increased leadership Initiative to embed product revenue for NPI ✓ New Commercial diversity to >50% systematic changes upgrades over next 12-36 Office supporting global months ✓ Launched new core sales ✓ More transparent and values ✓ Incorporating seamless efficient order ✓ Modern digital and automation and digital execution ✓ Published new CSR virtual reality tools tools across the portfolio report 7

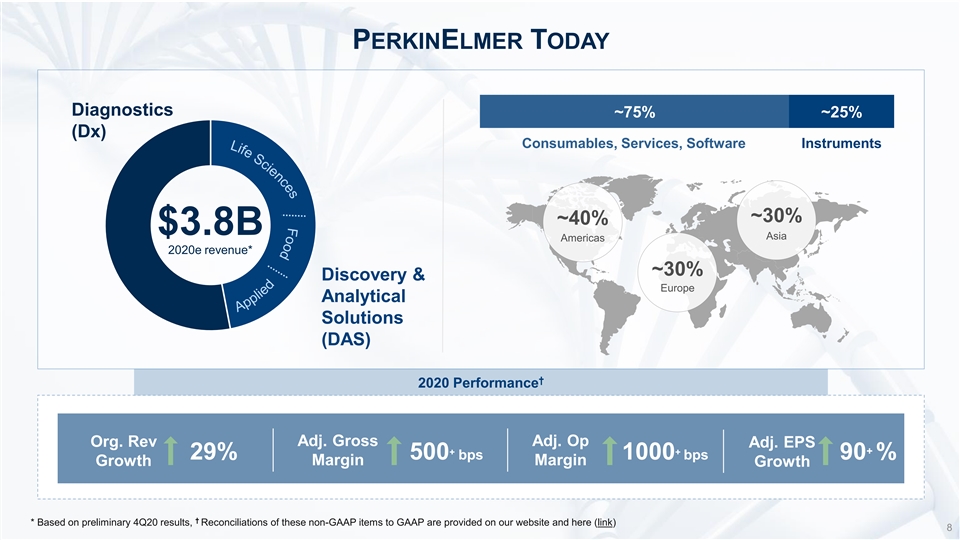

PERKINELMER TODAY Diagnostics ~75% ~25% (Dx) Consumables, Services, Software Instruments ~30% ~40% $3.8B Asia Americas 2020e revenue* ~30% Discovery & Europe Analytical Solutions (DAS) † 2020 Performance Adj. Gross Adj. Op Org. Rev Adj. EPS + + + 29% 500 bps 1000 bps 90 % Margin Margin Growth Growth † * Based on preliminary 4Q20 results, Reconciliations of these non-GAAP items to GAAP are provided on our website and here (link) 8PERKINELMER TODAY Diagnostics ~75% ~25% (Dx) Consumables, Services, Software Instruments ~30% ~40% $3.8B Asia Americas 2020e revenue* ~30% Discovery & Europe Analytical Solutions (DAS) † 2020 Performance Adj. Gross Adj. Op Org. Rev Adj. EPS + + + 29% 500 bps 1000 bps 90 % Margin Margin Growth Growth † * Based on preliminary 4Q20 results, Reconciliations of these non-GAAP items to GAAP are provided on our website and here (link) 8

DRIVING VALUE CREATION ACROSS THE PORTFOLIO VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DISCOVERY AND DIAGNOSTICS ANALYTICAL SOLUTIONS Add Meaningful Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life Science Event Strengthen Core Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 9DRIVING VALUE CREATION ACROSS THE PORTFOLIO VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DISCOVERY AND DIAGNOSTICS ANALYTICAL SOLUTIONS Add Meaningful Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life Science Event Strengthen Core Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 9

TRANSFORMATIVE DIAGNOSTICS VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DIAGNOSTICS DAS Add Meaningful 1 Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life Science Event Strengthen Core Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 10TRANSFORMATIVE DIAGNOSTICS VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DIAGNOSTICS DAS Add Meaningful 1 Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life Science Event Strengthen Core Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 10

MOST SENSITIVE SARS-COV-2 DETECTION ASSAY Scaling Molecular 25M+ $350M+ Tests Shipped 2020e Revenue Lowest Limit-of-Detection Available on the Market 90x better than industry average New Coronavirus Nucleic Acid Detection Kit Note: FDA SARS-CoV-2 Reference Panel Comparative Data (link) 11MOST SENSITIVE SARS-COV-2 DETECTION ASSAY Scaling Molecular 25M+ $350M+ Tests Shipped 2020e Revenue Lowest Limit-of-Detection Available on the Market 90x better than industry average New Coronavirus Nucleic Acid Detection Kit Note: FDA SARS-CoV-2 Reference Panel Comparative Data (link) 11

BEST-IN-CLASS EXTRACTION PORTFOLIO DELIVERED AT SCALE Superior Global Performance Scale Leading >1,000 sensitivity chemagic 360 best-in-class magnetic placements in 2020 bead yield Fully- ~75 million automated chemagic tests TM high-throughput chemagic 360 and chemagic kits sold in 2020 processing Automated DNA and RNA Extraction 12BEST-IN-CLASS EXTRACTION PORTFOLIO DELIVERED AT SCALE Superior Global Performance Scale Leading >1,000 sensitivity chemagic 360 best-in-class magnetic placements in 2020 bead yield Fully- ~75 million automated chemagic tests TM high-throughput chemagic 360 and chemagic kits sold in 2020 processing Automated DNA and RNA Extraction 12

DIFFERENTIATED SARS-COV-2 SEROLOGY SOLUTIONS Combines fully-automated Leveraging newborn screening with Capabilities best-in-class antibody assay technology Easy-to-use sample collection Novel with dried blood spot cards enables point-of-care, Sample Type decentralized sample collection GSP®/DELFIA® platform DBS-based test for SARS-CoV-2 IgG High Total SARS-CoV-2 Serology: Up to 5,000 Throughput samples per day $75M Revenue $50M Backlog (2020) (2021) 13DIFFERENTIATED SARS-COV-2 SEROLOGY SOLUTIONS Combines fully-automated Leveraging newborn screening with Capabilities best-in-class antibody assay technology Easy-to-use sample collection Novel with dried blood spot cards enables point-of-care, Sample Type decentralized sample collection GSP®/DELFIA® platform DBS-based test for SARS-CoV-2 IgG High Total SARS-CoV-2 Serology: Up to 5,000 Throughput samples per day $75M Revenue $50M Backlog (2020) (2021) 13

COMPLETE WORKFLOW SOLUTION ENABLED BY UNIFIED R&D TEAM Novel Innovation End-to-end automated workstation to streamline testing workflows and eliminate errors Flexibility to scale to meet current COVID-19 and future infectious disease testing needs, with best-in-class throughput up to 10K samples / day explorer™ Workstation for SARS-CoV-2 RT-PCR Modular system provides customized degrees of automation based on customer needs Workstations Placed/Ordered* >20 * since August 2020 launch (link) 14COMPLETE WORKFLOW SOLUTION ENABLED BY UNIFIED R&D TEAM Novel Innovation End-to-end automated workstation to streamline testing workflows and eliminate errors Flexibility to scale to meet current COVID-19 and future infectious disease testing needs, with best-in-class throughput up to 10K samples / day explorer™ Workstation for SARS-CoV-2 RT-PCR Modular system provides customized degrees of automation based on customer needs Workstations Placed/Ordered* >20 * since August 2020 launch (link) 14

RECORD PERFORMANCE REVENUE INSTALLED BASE BRAND Meaningful ~1,750 >$1B Diagnostics new instruments placed Brand Recognition 2020e COVID revenue across the portfolio 15RECORD PERFORMANCE REVENUE INSTALLED BASE BRAND Meaningful ~1,750 >$1B Diagnostics new instruments placed Brand Recognition 2020e COVID revenue across the portfolio 15

DIAGNOSTICS DEEP DIVE VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DIAGNOSTICS DAS Add Meaningful Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life Science Event Strengthen Core 2 Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 16DIAGNOSTICS DEEP DIVE VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DIAGNOSTICS DAS Add Meaningful Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life Science Event Strengthen Core 2 Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 16

IMMUNODIAGNOSTICS AT A GLANCE Infectious Highlighted Autoimmune Allergy Other Diseases Portfolio Capabilities & Differentiators #1 #3 Leading Expanded Autoimmune Allergy Emerging Virus Neurodegenerative Testing Testing Menu Testing HOW WE WIN ~$1.0B ~85% 2020e Revenue Recurring Revenue ✓ Extensive menu with over Scientific Expertise 500 unique tests Serviceable $4.5B Addressable Market: ✓ Highly innovative global Innovative Culture ~50% R&D collaborations Europe ~20% ~30% Americas ✓ Precise detection Technology Asia capabilities for emerging Leadership diseases 17IMMUNODIAGNOSTICS AT A GLANCE Infectious Highlighted Autoimmune Allergy Other Diseases Portfolio Capabilities & Differentiators #1 #3 Leading Expanded Autoimmune Allergy Emerging Virus Neurodegenerative Testing Testing Menu Testing HOW WE WIN ~$1.0B ~85% 2020e Revenue Recurring Revenue ✓ Extensive menu with over Scientific Expertise 500 unique tests Serviceable $4.5B Addressable Market: ✓ Highly innovative global Innovative Culture ~50% R&D collaborations Europe ~20% ~30% Americas ✓ Precise detection Technology Asia capabilities for emerging Leadership diseases 17

IMMUNODIAGNOSTICS VALUE CREATION FOCUS Strengthen Share gain opportunities with random access Core Right to Win Automation instruments for any throughput Maximize Growth Accelerators SuperFlex™ (CE-IVD) Accentis Add Meaningful Scale Lower / Point of Care Higher Throughput 18IMMUNODIAGNOSTICS VALUE CREATION FOCUS Strengthen Share gain opportunities with random access Core Right to Win Automation instruments for any throughput Maximize Growth Accelerators SuperFlex™ (CE-IVD) Accentis Add Meaningful Scale Lower / Point of Care Higher Throughput 18

IMMUNODIAGNOSTICS VALUE CREATION FOCUS Strengthen Infectious Scaling menu with further expansion into Core Right to Win infectious disease Disease Maximize Growth Accelerators Add TM PKamp Respiratory SARS-CoV-2 Anti-SARS-CoV-2 QuantiVac ELISA (IgG) Meaningful Scale RT-PCR Panel Assay (CE-IVD) (CE-IVD) 19IMMUNODIAGNOSTICS VALUE CREATION FOCUS Strengthen Infectious Scaling menu with further expansion into Core Right to Win infectious disease Disease Maximize Growth Accelerators Add TM PKamp Respiratory SARS-CoV-2 Anti-SARS-CoV-2 QuantiVac ELISA (IgG) Meaningful Scale RT-PCR Panel Assay (CE-IVD) (CE-IVD) 19

APPLIED GENOMICS AT A GLANCE Liquid Nucleic NGS Handling / Highlighted Acid Sample Prep Automation Isolation Portfolio Capabilities & Differentiators #1 Platform- Top-3 Automated Full Suite of Agnostic RNA/DNA Reagents Automation Provider Extraction HOW WE WIN ~65% ~$550M 2020e Revenue Recurring Revenue ✓ 20 years of expertise in Customer Intimacy “automating science” Serviceable $3.0B Addressable Market: ✓ Scalable liquid handling Application for high-throughput Expertise ~35% applications Europe ~50% ~15% Americas Complete ✓ High quality, end-to-end Asia Workflows workflow solutions 20APPLIED GENOMICS AT A GLANCE Liquid Nucleic NGS Handling / Highlighted Acid Sample Prep Automation Isolation Portfolio Capabilities & Differentiators #1 Platform- Top-3 Automated Full Suite of Agnostic RNA/DNA Reagents Automation Provider Extraction HOW WE WIN ~65% ~$550M 2020e Revenue Recurring Revenue ✓ 20 years of expertise in Customer Intimacy “automating science” Serviceable $3.0B Addressable Market: ✓ Scalable liquid handling Application for high-throughput Expertise ~35% applications Europe ~50% ~15% Americas Complete ✓ High quality, end-to-end Asia Workflows workflow solutions 20

APPLIED GENOMICS VALUE CREATION FOCUS Strengthen Differentiating Detection, Decentralization, Core Right to Win and Digitalization through “3Ds” Driving unparalleled Supporting Increasing Digital solutions Detection across the Decentralization to to support data and drive workflow expand our SAM actionable insights Maximize Growth Accelerators Example Offerings Across Workflow Add Meaningful Scale 21APPLIED GENOMICS VALUE CREATION FOCUS Strengthen Differentiating Detection, Decentralization, Core Right to Win and Digitalization through “3Ds” Driving unparalleled Supporting Increasing Digital solutions Detection across the Decentralization to to support data and drive workflow expand our SAM actionable insights Maximize Growth Accelerators Example Offerings Across Workflow Add Meaningful Scale 21

APPLIED GENOMICS VALUE CREATION FOCUS Driving innovation through internal R&D Strengthen Emerging efforts as well as investments Core Right to Win Technologies in promising start-ups Maximize Growth Accelerators Add PKeye Honeycomb HIVE Cell Drive Meaningful Scale (In development – launch in 2021) Mobile Lab Operations Monitor 22APPLIED GENOMICS VALUE CREATION FOCUS Driving innovation through internal R&D Strengthen Emerging efforts as well as investments Core Right to Win Technologies in promising start-ups Maximize Growth Accelerators Add PKeye Honeycomb HIVE Cell Drive Meaningful Scale (In development – launch in 2021) Mobile Lab Operations Monitor 22

REPRODUCTIVE HEALTH AT A GLANCE Prenatal Newborn Rare Disease (Biochemistry (Immunoassay, Highlighted Testing & NIPT) MS & NGS) Portfolio Capabilities & Differentiators #1 in Prenatal #1 in Newborn Partner of Choice (Biochemical) Screening for Pharma HOW WE WIN ~$450M ~95% 2020e Revenue Recurring Revenue ✓ Strong Brand Recognition Brand Strength with Decades of Expertise Serviceable $3.5B Addressable Market: ✓ Global services with Application ‘OMICS portfolio for rare Breadth ~15% disease detection Europe ~65% ~20% Americas ✓ Complete solution Complete Asia provider from instruments Workflows to software 23REPRODUCTIVE HEALTH AT A GLANCE Prenatal Newborn Rare Disease (Biochemistry (Immunoassay, Highlighted Testing & NIPT) MS & NGS) Portfolio Capabilities & Differentiators #1 in Prenatal #1 in Newborn Partner of Choice (Biochemical) Screening for Pharma HOW WE WIN ~$450M ~95% 2020e Revenue Recurring Revenue ✓ Strong Brand Recognition Brand Strength with Decades of Expertise Serviceable $3.5B Addressable Market: ✓ Global services with Application ‘OMICS portfolio for rare Breadth ~15% disease detection Europe ~65% ~20% Americas ✓ Complete solution Complete Asia provider from instruments Workflows to software 23

REPRODUCTIVE HEALTH VALUE CREATION FOCUS Solidifying market leadership and Strengthen Technology customer loyalty with new molecular Core Right to Win Breadth solutions ✓ Immunoassays Maximize Growth Accelerators ✓ Mass Spec SMA SCID XLA ❑ Molecular TM ✓ EONIS PCR Reagent Kits Add (CE-IVD) Meaningful Scale 24REPRODUCTIVE HEALTH VALUE CREATION FOCUS Solidifying market leadership and Strengthen Technology customer loyalty with new molecular Core Right to Win Breadth solutions ✓ Immunoassays Maximize Growth Accelerators ✓ Mass Spec SMA SCID XLA ❑ Molecular TM ✓ EONIS PCR Reagent Kits Add (CE-IVD) Meaningful Scale 24

REPRODUCTIVE HEALTH VALUE CREATION FOCUS Strengthen Democratizing Driving our global presence, with the end Core Right to Win goal of NIPT for every woman NIPT Favorable Macros for Future Growth Expanded insurance Maximize Growth Accelerators coverage in the US Increased need for affordable NIPT testing for all pregnant women, regardless of risk profile Add Supported by 4 new & ® Meaningful Scale Vanadis View impending publications 25REPRODUCTIVE HEALTH VALUE CREATION FOCUS Strengthen Democratizing Driving our global presence, with the end Core Right to Win goal of NIPT for every woman NIPT Favorable Macros for Future Growth Expanded insurance Maximize Growth Accelerators coverage in the US Increased need for affordable NIPT testing for all pregnant women, regardless of risk profile Add Supported by 4 new & ® Meaningful Scale Vanadis View impending publications 25

PUTTING IT ALL TOGETHER: SCALING OUR APPROACH FOR MAXIMIZED VALUE CREATION SAM PKI Dx Revenue Mix CAGR* vs Market (2020e) Value Creation Focus (‘18-’19) (‘21+) ✓ Strong brand equity and scientific expertise in IVD ImmunoDx ✓ Expand technology offering into low- and high-throughput markets 7-9% + (51%) ✓ Whitespace opportunities in post-COVID world (e.g., MDx) ✓ Complete sample-to-answer workflow solutions Applied ✓ Best-in-class DNA/RNA extraction binding affinity and throughput 4-6% Genomics = (27%) ✓ Opportunities to bolster scale through organic & inorganic investment ✓ Category leadership across the core portfolio Reproductive ✓ Differentiated NIPT solution to address rapidly evolving market 6-8% Health = (22%) ✓ Uniquely positioned to tackle rare disease molecular testing needs 6-8% + Each business has a strong value creation path ** WAMGR PKI vs WAMGR * Internal company data; ** WAMGR = Weighted Average Market Growth Rate 26PUTTING IT ALL TOGETHER: SCALING OUR APPROACH FOR MAXIMIZED VALUE CREATION SAM PKI Dx Revenue Mix CAGR* vs Market (2020e) Value Creation Focus (‘18-’19) (‘21+) ✓ Strong brand equity and scientific expertise in IVD ImmunoDx ✓ Expand technology offering into low- and high-throughput markets 7-9% + (51%) ✓ Whitespace opportunities in post-COVID world (e.g., MDx) ✓ Complete sample-to-answer workflow solutions Applied ✓ Best-in-class DNA/RNA extraction binding affinity and throughput 4-6% Genomics = (27%) ✓ Opportunities to bolster scale through organic & inorganic investment ✓ Category leadership across the core portfolio Reproductive ✓ Differentiated NIPT solution to address rapidly evolving market 6-8% Health = (22%) ✓ Uniquely positioned to tackle rare disease molecular testing needs 6-8% + Each business has a strong value creation path ** WAMGR PKI vs WAMGR * Internal company data; ** WAMGR = Weighted Average Market Growth Rate 26

LONG-TERM FINANCIAL OUTLOOK VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DIAGNOSTICS DAS Add Meaningful Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life 3 Science Event Strengthen Core Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 27LONG-TERM FINANCIAL OUTLOOK VALUE CREATION FRAMEWORK SEGMENT DEEP DIVES: DIFFERENTIATED POSITIONS L-T OUTLOOK DIAGNOSTICS DAS Add Meaningful Scale COVID-19 response Maximize Growth validates our Accelerators foundational efforts Virtual Life 3 Science Event Strengthen Core Confidence in December 2020 Right to Win long-term value Enhanced Diagnostics creation brand bolsters existing opportunities to positions drive strong Operational shareholder Excellence to Drive returns L-T Growth Outlook L-T Growth Outlook Margin & Efficiency +MSD +HSD Focus of Today’s Discussion 27

POSITIONED FOR MORE CONSISTENT AND FASTER GROWTH Core PKI (excluding COVID-19) Pathway to $4.0B+ in 2023 3-Year Organic Growth Forecast +400M $4.0B+ DAS Dx +350M $1.7B $1.0B✓ >$2.5B Food +550M 6% additional 4-6% AG Total Core capital for ✓ $250M Applied M&A PKI 2-4% $2.7B revenue IDx 10%+ from 2020 ✓ New post- $2.7B M&A* COVID ✓ +5-7% testing organic ✓ $100M+ opportunities growth per LS durable 6%+ RH 5-10% year COVID ✓ Pent up product demand / revenue catch up in +MSD +HSD +5-7% ’21-’23 ✓ Attractive End Markets ✓ Product Innovation Growth Drivers ✓ Customer Experience ✓ Commercial Execution 28 * Includes potential Oxford Immunotec acquisitionPOSITIONED FOR MORE CONSISTENT AND FASTER GROWTH Core PKI (excluding COVID-19) Pathway to $4.0B+ in 2023 3-Year Organic Growth Forecast +400M $4.0B+ DAS Dx +350M $1.7B $1.0B✓ >$2.5B Food +550M 6% additional 4-6% AG Total Core capital for ✓ $250M Applied M&A PKI 2-4% $2.7B revenue IDx 10%+ from 2020 ✓ New post- $2.7B M&A* COVID ✓ +5-7% testing organic ✓ $100M+ opportunities growth per LS durable 6%+ RH 5-10% year COVID ✓ Pent up product demand / revenue catch up in +MSD +HSD +5-7% ’21-’23 ✓ Attractive End Markets ✓ Product Innovation Growth Drivers ✓ Customer Experience ✓ Commercial Execution 28 * Includes potential Oxford Immunotec acquisition

WITH A CLEAR PATH FOR MARGIN EXPANSION Operating Profit Margins Diagnostics Drivers bps improvement ✓ Euroimmun gross margin 23%+ +75 20.7%✓ COVID-19 recurring increase Per year* PKI ✓ Volume leverage 30%+ Dx 27.8% DAS Drivers ✓ Analytical instruments 22%+ DAS 19.4% ✓ Services ✓ Volume leverage & mix (2.0%) (2%) Corporate 2019 2023e * Assumes 75 bps in years 2021-2023 29WITH A CLEAR PATH FOR MARGIN EXPANSION Operating Profit Margins Diagnostics Drivers bps improvement ✓ Euroimmun gross margin 23%+ +75 20.7%✓ COVID-19 recurring increase Per year* PKI ✓ Volume leverage 30%+ Dx 27.8% DAS Drivers ✓ Analytical instruments 22%+ DAS 19.4% ✓ Services ✓ Volume leverage & mix (2.0%) (2%) Corporate 2019 2023e * Assumes 75 bps in years 2021-2023 29

INCLUDING SIGNIFICANT CAPITAL DEPLOYMENT FLEXIBILITY Capital Deployed ($B) M&A & Investments (~80%) 4.0 • Prior success: $2.5B investments +2x/yr generates $0.5B+ (18%) of PKI PKI 3.3 revenue • Future focus: Diagnostics & Life Sciences, seed investments in transformative early-stage technology 3.2 M&A & 2.5 Investments Other (~20%) • Capex (8%): Step up for technology investments • Share buyback (10%): Manage float, 27% average annual return 0.8 0.8 Other • Dividend (2%): No plan to increase 2016-2020 2021e-2023e Net Debt <1.5x Leverage 3.0x 30INCLUDING SIGNIFICANT CAPITAL DEPLOYMENT FLEXIBILITY Capital Deployed ($B) M&A & Investments (~80%) 4.0 • Prior success: $2.5B investments +2x/yr generates $0.5B+ (18%) of PKI PKI 3.3 revenue • Future focus: Diagnostics & Life Sciences, seed investments in transformative early-stage technology 3.2 M&A & 2.5 Investments Other (~20%) • Capex (8%): Step up for technology investments • Share buyback (10%): Manage float, 27% average annual return 0.8 0.8 Other • Dividend (2%): No plan to increase 2016-2020 2021e-2023e Net Debt <1.5x Leverage 3.0x 30

PUTTING IT ALL TOGETHER: BY 2023, WE WILL HAVE … SCALE PERFORMANCE INVESTMENT $4B+ >$6.50 ~$4B Adjusted Deployable Revenue EPS Capital … driven by a focused value creation framework 31PUTTING IT ALL TOGETHER: BY 2023, WE WILL HAVE … SCALE PERFORMANCE INVESTMENT $4B+ >$6.50 ~$4B Adjusted Deployable Revenue EPS Capital … driven by a focused value creation framework 31

PerkinElmer will host an ANALYST DAY in Q2 2021 32 32PerkinElmer will host an ANALYST DAY in Q2 2021 32 32

Innovating for a healthier world ONE MISSION Countless Opportunities 33Innovating for a healthier world ONE MISSION Countless Opportunities 33