Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KURA SUSHI USA, INC. | krus-ex991_6.htm |

| 8-K - 8-K - KURA SUSHI USA, INC. | krus-8k_20210111.htm |

ICR Virtual Conference, January 12 & 13, 2021 Kura Sushi management presentation Exhibit 99.2

Disclaimer This presentation has been prepared for informational purposes only. No money or other consideration is being solicited, and if sent in response, will not be accepted. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The Company is not under any obligation to make an offering. It may choose to make an offering to some, but not all, of the people who indicate an interest in investing. Any such offering of securities will only be made by means of a registration statement (including a prospectus) filed with the SEC, after such registration statement becomes effective. No such registration statement has been filed as of the date of this presentation. The information included in any registration statement will be more complete than the information the Company is providing now, and could differ in important ways. This presentation, related video and oral communications made during the course of this presentation may contain forward-looking statements that involve risks and uncertainties. In some cases, you can identify forward-looking statements by terms such as “target,” “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “design,” “estimate,” “continue,” “predict,” “potential,” “plan,” “anticipate” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include but are not limited to: risks related to the COVID-19 outbreak; our ability to successfully maintain increases in our comparable restaurant sales; our ability to successfully execute our growth strategy and open new restaurants that are profitable; our ability to expand in existing and new markets; our projected growth in the number of our restaurants; macroeconomic conditions and other economic factors; our ability to compete with many other restaurants; our reliance on vendors, suppliers and distributors, including our parent company Kura Sushi, Inc.; concerns regarding food safety and foodborne illness; changes in consumer preferences and the level of acceptance of our restaurant concept in new markets; minimum wage increases and mandated employee benefits that could cause a significant increase in our labor costs; the failure of our automated equipment or information technology systems or the breach of our network security; the loss of key members of our management team; the impact of governmental laws and regulations; volatility in the price of our common stock; and other risks and uncertainties as described in our filings with the Securities and Exchange Commission (“SEC”). Given these assumptions, risks and uncertainties, you should not place undue reliance on these forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. Unless required by United States federal securities laws, we do not intend to update any of these forward-looking statements to reflect circumstances or events that occur after the statement is made. Our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. The market data and certain other statistical information used throughout this presentation are based on independent industry publications, governmental publications, reports by market research firms or other independent sources. Some data are also based on our good faith estimates. Although we believe these third-party sources are reliable, we have not independently verified the information attributed to these third-party sources and cannot guarantee its accuracy and completeness. Similarly, our estimates have not been verified by any independent source. Certain financial measures presented in this presentation, such as Adjusted EBITDA, Adjusted EBITDA margin and Restaurant-level Contribution margin, are not recognized under generally accepted accounting principles in the United States (“GAAP”) and are defined in the accompanying Appendix. Such non-GAAP measures are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. We believe that the use of such non-GAAP measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that such non-GAAP financial measures are not indicative of overall results for the Company, and Restaurant-level Contribution margin does not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measure. Because of these limitations, non-GAAP financial measures should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. See the accompanying Appendix for a reconciliation of non-GAAP measures used in this presentation. Additional financial data and other measures for the company, including Average Unit Volume (AUVs), Comparable restaurant sales growth, Number of restaurant openings and Average check, are defined in the Appendix. By attending or receiving this presentation and viewing the related video, you acknowledge that you will be solely responsible for your own assessment of the market and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of our business.

Section 1: company Overview

COMPANY overview Kura experience video

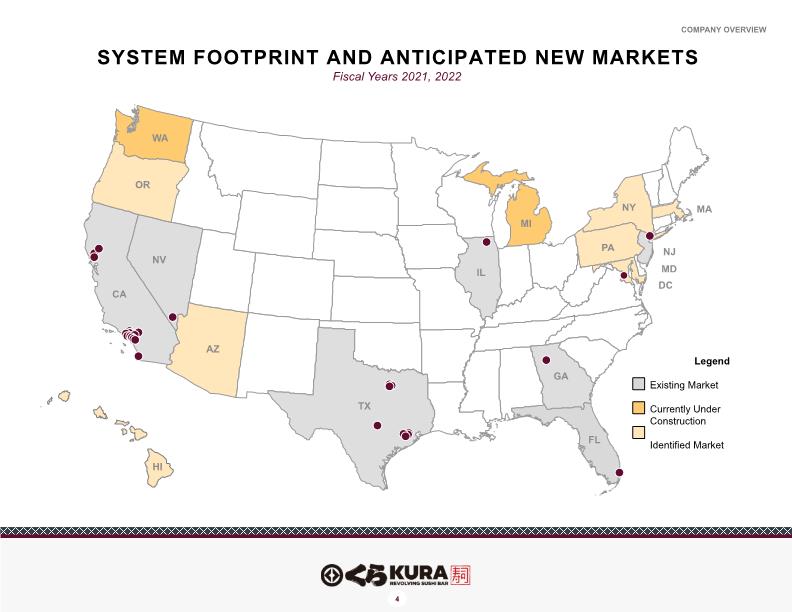

Fiscal Years 2021, 2022 Company overview System footprint and Anticipated New markets DC WA MI FL AZ OR NY PA MA MD HI Legend Existing Market Currently Under Construction Identified Market

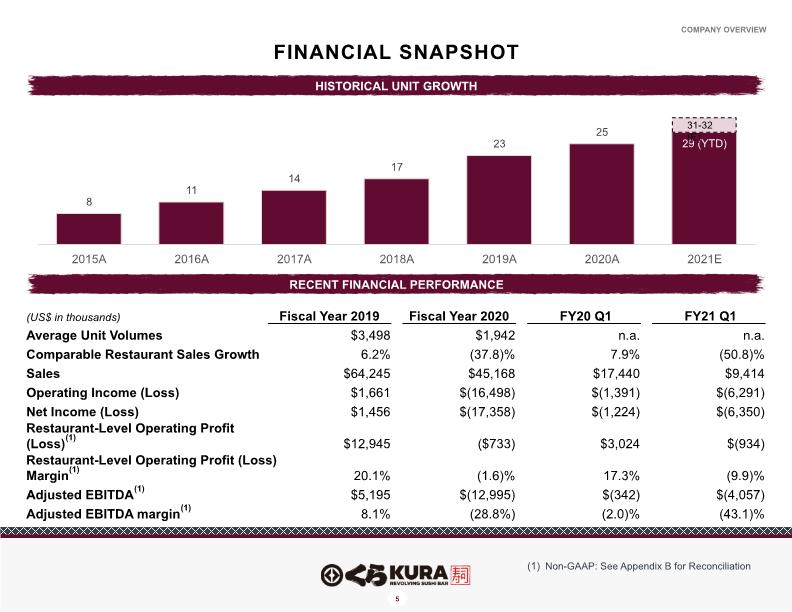

Non-GAAP: See Appendix B for Reconciliation COMPANY overview Financial snapshot Historical unit growth Recent financial performance 31-32 (E)

Section 2: growth and Near-term strategy

GROWTH AND NEAR-TERM Strategy Our sales levels, as compared to prior year, continue to track proportionately to dining room capacity restrictions, indicating strong, ongoing consumer demand. Automation-heavy restaurant model will become an increasingly meaningful competitive advantage as labor inflation continues. While the timeline is unclear, we believe that the pandemic will eventually end and will not be a permanent fact of life. We are confident that we our unit economics will recover to previous industry-leading levels once we are able to return to normalcy. Key assumptions Our business model and consumer demand remain strong Unit growth remains critical to corporate growth Capital access and parent company support Our primary strategy to improve profitability is to leverage G&A by growing revenue. At this point in our growth story, the impact of new units openings on revenue growth is far greater than other revenue drivers such as comps. By continuing to open new units, we will be able to receive their full benefit and hit the ground running upon normalcy, positioning us for a rapid recovery and significantly reducing our post-pandemic recovery timeline. We aim to take advantage of real estate opportunities unique to the sushi industry, due to the industry’s fragmentation and high proportion of individual owner-operators. We have increased our revolver from $20M to $35M, providing ample pandemic support and growth capital. Ongoing support from our parent company allows us to make capital expenditure decisions that would be impossible or considered too risky for other chains. With our capital access, we have the freedom to pursue all of the opportunities that the pandemic presents.

GROWTH AND NEAR-TERM Strategy Four stores have been opened to-date in fiscal year 21, allowing us to enter three new markets. Fort Lee, NJ, opened in September and is significantly outperforming expectations Washington, D.C., opened in November. Koreatown, Los Angeles, opened in November. Aventura, FL, opened in January. Upgrading our development capabilities. Brought on first Kura Sushi USA CDO in May. Adopted Forum Analytics as our data analysis platform, which will allow for a more data-driven site selection process. Reinforced liquidity by increasing revolver from $20M to $35M. Extended payback period from 1 year to 5 years. Building our off-premises business. Expanded off-premises business through systemwide adoption of Square. Completed integration of mobile ordering into our existing app through Square. Square also offers tableside payment and in-restaurant ordering with mobile phones. These efforts grew our off-premises mix from our historical 1%, to 17% for Q4 of fiscal 20 and 13.8% for Q1 of fiscal 21. We believe that we are still very early in our off-premises life cycle, and that our off-premises has abundant room to grow. System improvements Completed systemwide Crunchtime rollout as our new BOH platform. Updates to our mobile app, to integrate waitlist check-in, mobile ordering, and rewards into a single package. RECENT EVENTS AND INITIATIVES

GROWTH AND NEAR-TERM Strategy New unit pipeline Robust pipeline for fiscal years 21 and 22 Planned markets and leases under negotiation Under construction Executed leases Sherman Oaks, CA Bellevue, WA Troy, MI Stonestown Galleria, San Francisco, CA Watertown, MA Oakbrook, IL Chandler, AZ Camelback Colonnade, AZ UTC San Diego, CA Johns Creek, GA Honolulu, HI Skokie, IL Dorcester, MA Rockville, MD Washington Square, OR Long Island, NY Philadelphia, PA King of Prussia, PA Arlington, TX San Antonio, TX Lynwood, WA Southcenter, WA

Growth and near-term strategy Historically, our focus has been on driving revenue through in-restaurant sales. As we believe a significant component of our consumer appeal is the Kura Experience, building off-premises sales were a low priority, with the off-premises sales mix representing only 1% of revenue. Indoor dining remains the biggest source of revenue, as we’ve seen revenue increases in direct proportion to relaxed indoor dining restrictions However, dining room restrictions are beyond our control, and represent a ceiling on our earning ability if we limit our sales focus to dining rooms. While we continue to believe that, after the pandemic, our guests will prefer indoor dining to off-premises dining, we have shifted gears and have made building our off-premises business one of our top priorities. Our off-premises revenue for Q1 grew to $1.3M, with the majority of off-premises orders being placed by phone or in person. In December, we completed phasing out Grubhub and moving to Square as our new off-premises platform, due to a superior fee structure and greater technological flexibility. In December, thanks to full implementation of Square, online orders outpaced in-person or telephone off-premises orders for the first time. Sales through Square during December alone were greater than the total sales through Grubhub since Grubhub’s implementation in August. Off-premises

(continued) Growth and near-term strategy We have completed our pilot program with Square, and completed our systemwide rollout in December. We can also now offer mobile ordering through our existing app via Square’s ordering page (see right). These efforts have driven much stronger off-premises sales by removing customer friction and by allowing us to offer our food at the same prices as our restaurants, due to Square’s lower fees. Since adopting Square, we have launched three online ordering advertising campaigns directed towards our rewards members, which have been very well-received. While off-premises revenue is strongest in markets without indoor dining, our off-premises mix has grown even in markets like TX, which has 50% - 75% indoor dining, indicating that at least part of the off-premises growth we’re seeing during the pandemic will be incremental post-pandemic. Off-premises

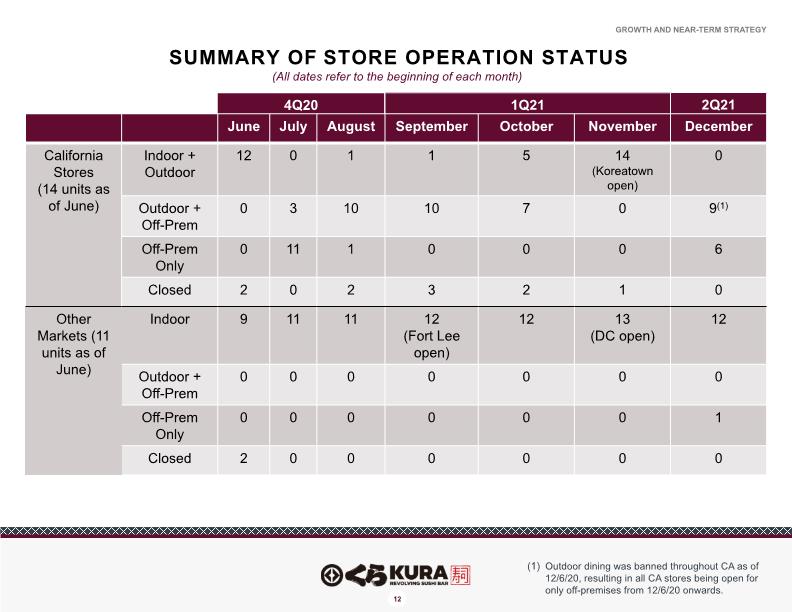

(All dates refer to the beginning of each month) Growth and near-term strategy Summary of Store operation Status Outdoor dining was banned throughout CA as of 12/6/20, resulting in all CA stores being open for only off-premises from 12/6/20 onwards.

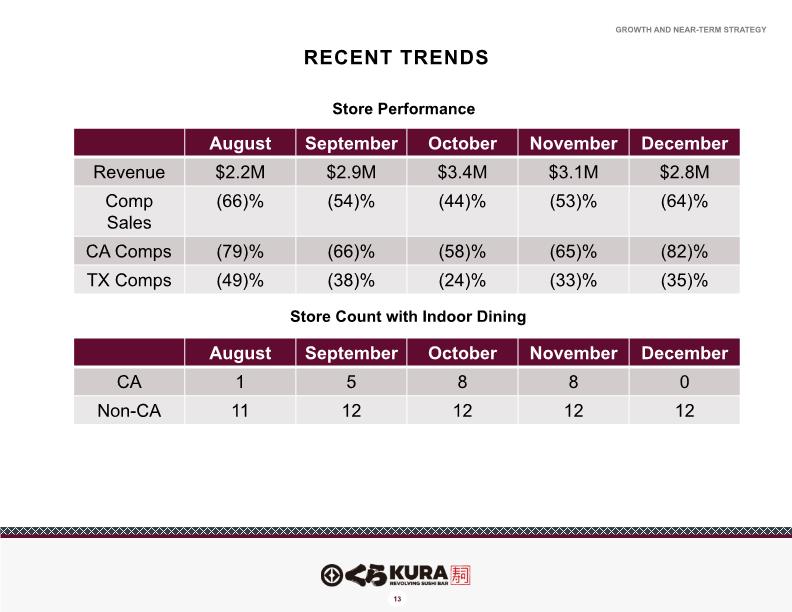

Growth and near-term strategy Recent trends Store Performance Store Count with Indoor Dining

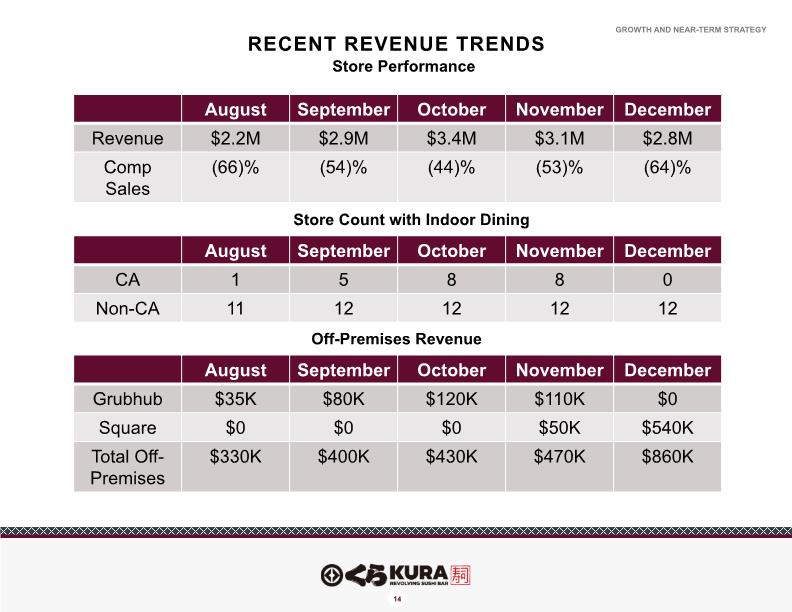

Growth and near-term strategy Recent revenue trends Off-Premises Revenue Store Performance Store Count with Indoor Dining

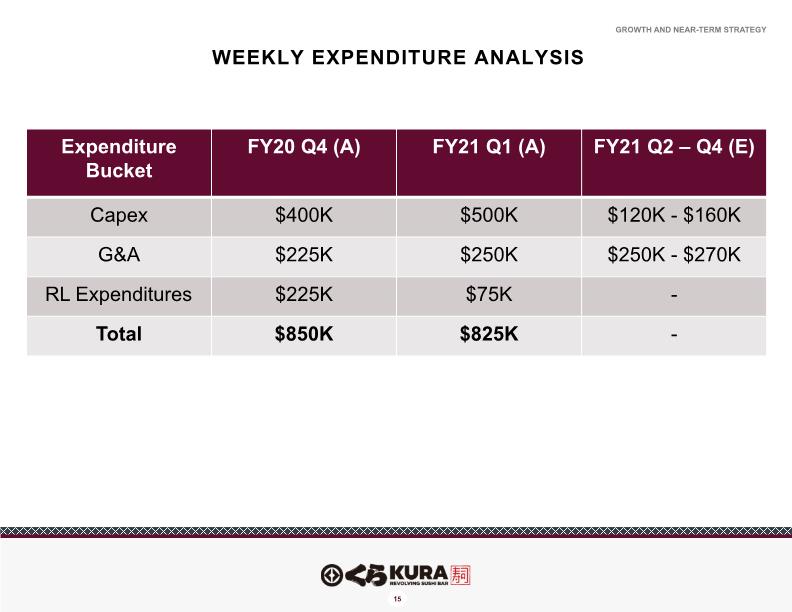

Growth and near-term strategy Weekly Expenditure analysis

Section 3: Financial

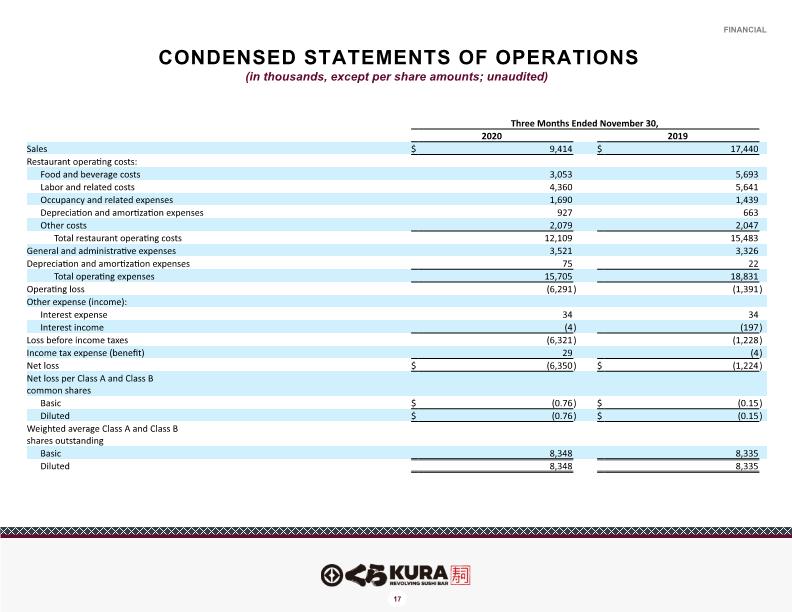

Financial Condensed statements of operations (in thousands, except per share amounts; unaudited)

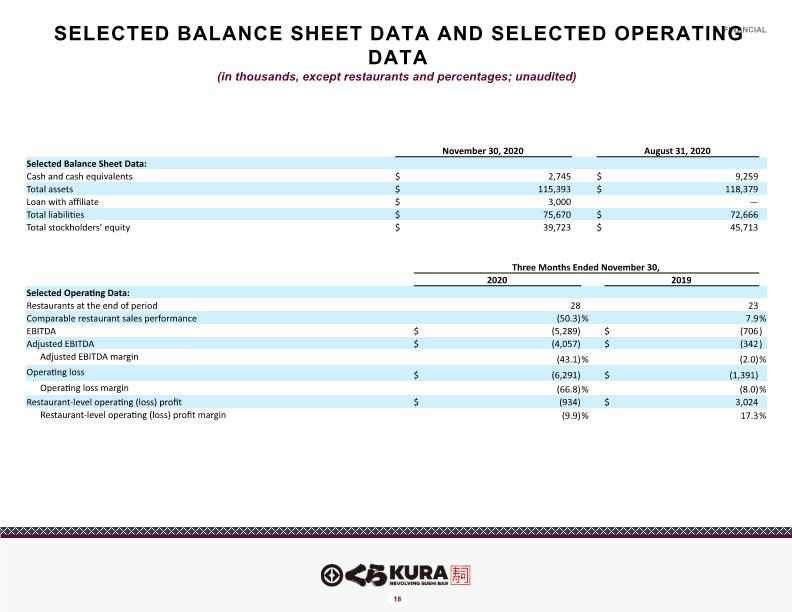

Financial Selected Balance Sheet Data and Selected Operating Data (in thousands, except restaurants and percentages; unaudited)

Appendix A: definitions

Appendix a EBITDA, a non-GAAP measure, is defined as net income (loss) before interest, income taxes and depreciation and amortization. Adjusted EBITDA, a non-GAAP measure, is defined as EBITDA plus stock-based compensation expense, non-cash lease expense, asset disposals, closure costs and restaurant impairments, as well as certain items that the Company believes are not indicative of its core operating results. Adjusted EBITDA margin is defined as adjusted EBITDA divided by sales. Average Unit Volumes (“AUVs”) consist of the average annual sales of all restaurants that have been open for 18 months or longer at the end of the fiscal year presented. AUVs are calculated by dividing (x) annual sales for the fiscal year presented for all such restaurants by (y) the total number of restaurants in that base. The Company makes fractional adjustments to sales for restaurants that were not open for the entire fiscal year presented (e.g., a restaurant is closed for renovation) to annualize sales for such period of time. The Company did not make any adjustments for the temporary restaurant closures due to COVID-19. Restaurant-level Operating Profit (Loss), a non-GAAP measure, is defined as operating income (loss) plus depreciation and amortization; stock-based compensation expense; pre-opening costs and general administrative expenses which are considered normal, recurring, cash operating expenses and are essential to supporting the development and operations of our restaurants; non-cash lease expense; asset disposals, closure costs and restaurant impairments; less corporate-level stock-based compensation expense recognized within general and administrative expenses. Restaurant-level Operating Profit margin is defined as restaurant-level operating profit (loss) divided by sales. Comparable Restaurant Sales Growth refers to the change in year-over-year sales for the comparable restaurant base. The Company include restaurants in the comparable restaurant base that have been in operation for at least 18 months prior to the start of the accounting period presented, including those temporarily closed for renovations during the year. For restaurants that were temporarily closed for renovations during the year, the Company makes fractional adjustments to sales such that sales are annualized in the associated period. Growth in comparable restaurant sales represents the percent change in sales from the same period in the prior year for the comparable restaurant base. The Company did not make any adjustments for the temporary restaurant closures due to COVID-19. Key financial definitions

Appendix a To supplement the condensed financial statements presented in accordance with U.S. generally accepted accounting principles (“GAAP”), certain financial measures, such as EBITDA, adjusted EBITDA, adjusted EBITDA margin, restaurant-level operating profit (loss) and restaurant-level operating profit margin (“Non-GAAP measures”) are not recognized under GAAP. These Non-GAAP measures are intended as supplemental measures of our performance that are neither required by, nor presented in accordance with, GAAP. The Company is presenting these Non-GAAP measures because the Company believes that they provide useful information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. However, these measures may not provide a complete understanding of the operating results of the Company as a whole and such measures should be reviewed in conjunction with our GAAP financial results. Additionally, the Company presents restaurant-level operating profit because it excludes the impact of general and administrative expenses which are not incurred at the restaurant-level. The Company also uses restaurant-level operating profit to measure operating performance and returns from opening new restaurants. The Company believes that the use of these Non-GAAP measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, you should be aware that restaurant-level operating profit and restaurant-level operating profit margin are financial measures which are not indicative of overall results for the Company, and restaurant-level operating profit and restaurant-level operating profit margin do not accrue directly to the benefit of stockholders because of corporate-level expenses excluded from such measures. In addition, you should be aware when evaluating these Non-GAAP measures that in the future the Company may incur expenses similar to those excluded when calculating these measures. The Company’s presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Our computation of these Non-GAAP measures may not be comparable to other similarly titled measures computed by other companies, because all companies may not calculate these Non-GAAP measures in the same fashion. Because of these limitations, these Non-GAAP measures should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company compensates for these limitations by relying primarily on our GAAP results and using these Non-GAAP measures on a supplemental basis. Non-gaap financial measures

Appendix b: reconciliations

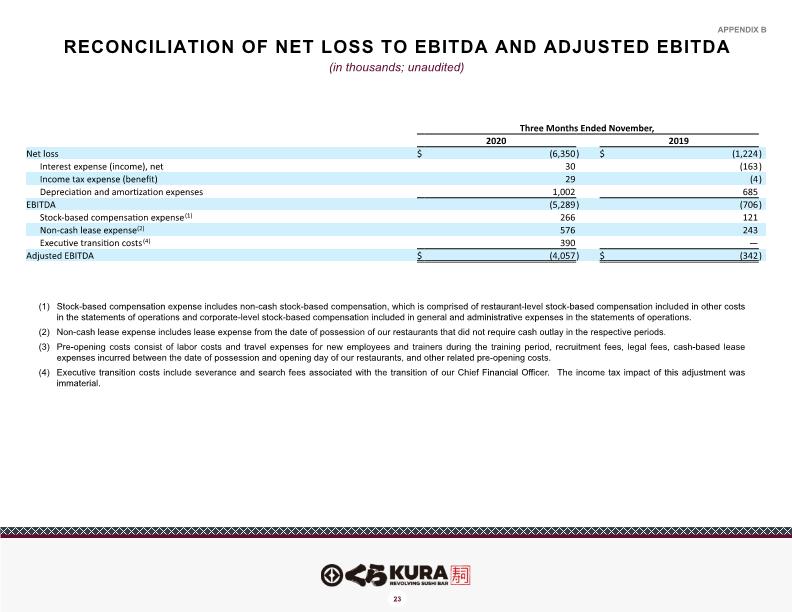

(in thousands; unaudited) Appendix B Reconciliation of Net Loss to EBITDA and Adjusted EBITDA (1) Stock-based compensation expense includes non-cash stock-based compensation, which is comprised of restaurant-level stock-based compensation included in other costs in the statements of operations and corporate-level stock-based compensation included in general and administrative expenses in the statements of operations. (2) Non-cash lease expense includes lease expense from the date of possession of our restaurants that did not require cash outlay in the respective periods. (3) Pre-opening costs consist of labor costs and travel expenses for new employees and trainers during the training period, recruitment fees, legal fees, cash-based lease expenses incurred between the date of possession and opening day of our restaurants, and other related pre-opening costs. (4) Executive transition costs include severance and search fees associated with the transition of our Chief Financial Officer. The income tax impact of this adjustment was immaterial.

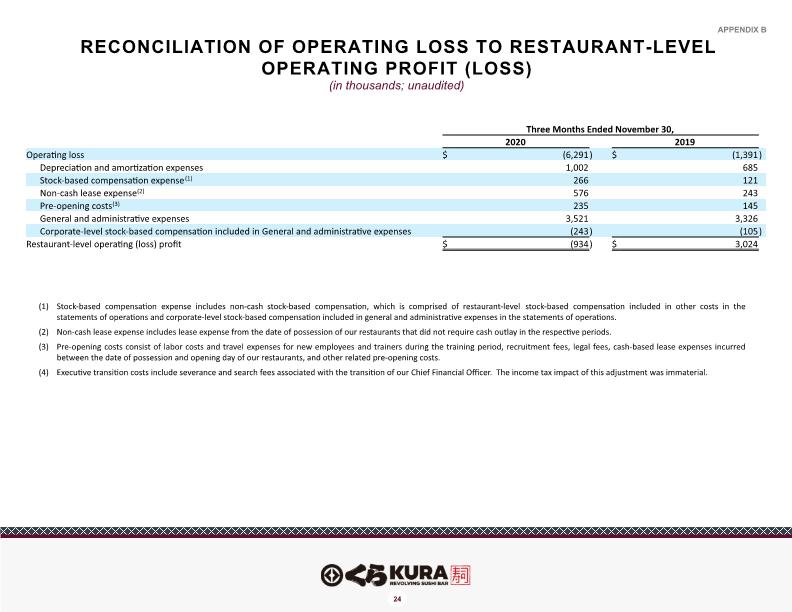

(in thousands; unaudited) Appendix B Reconciliation of Operating Loss to Restaurant-level Operating Profit (Loss) (1) Stock-based compensation expense includes non-cash stock-based compensation, which is comprised of restaurant-level stock-based compensation included in other costs in the statements of operations and corporate-level stock-based compensation included in general and administrative expenses in the statements of operations. (2) Non-cash lease expense includes lease expense from the date of possession of our restaurants that did not require cash outlay in the respective periods. (3) Pre-opening costs consist of labor costs and travel expenses for new employees and trainers during the training period, recruitment fees, legal fees, cash-based lease expenses incurred between the date of possession and opening day of our restaurants, and other related pre-opening costs. (4) Executive transition costs include severance and search fees associated with the transition of our Chief Financial Officer. The income tax impact of this adjustment was immaterial.