Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Acacia Communications, Inc. | aciaprelimq42020ex991.htm |

| 8-K - 8-K - Acacia Communications, Inc. | acia-20210111.htm |

CONNECTING AT THE SPEED OF LIGHT © 2021 Acacia Communications, Inc. All Rights Reserved. Corporate Presentation January 11, 2021

© 2021 Acacia Communications, Inc. All Rights Reserved. 2 Safe Harbor Statement This presentation contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements regarding our preliminary unaudited financial results for the fourth fiscal quarter and fiscal year ended December 31, 2020, our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “forecast,” “target,” “vision,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements contained in this presentation reflect our current views with respect to future events, and we assume no obligation to update any forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation, and our actual future results may be materially different from what we expect. We have included important factors in the cautionary statements included in our Quarterly Report on Form 10-Q for the three months ended September 30, 2020, particularly in the Risk Factors section, and other documents we have filed with the SEC, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Preliminary Unaudited Financial Information This presentation contains preliminary unaudited financial results that are based on preliminary unaudited information and management estimates, and are inherently uncertain and subject to revision in connection with the Company’s financial closing procedures and the finalization of the Company’s financial statements for its fourth fiscal quarter and fiscal year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results and other disclosures for the fourth fiscal quarter and fiscal year ended December 31, 2020 may differ materially from these preliminary unaudited financial results. These preliminary financial results were not prepared with a view toward complying with the guidelines established by the American Institute of Certified Public Accountants with respect to projected financial information, but, in the view of the Company’s management, were prepared on a reasonable basis, reflect management’s best currently available estimates and judgments, and present, to the best of management’s knowledge and belief, the Company’s expectations for the fourth fiscal quarter and fiscal year ended December 31, 2020. Neither the Company’s independent auditors, nor any other independent accountants, have compiled, examined, or performed any procedures with respect to these preliminary financial results, nor have they expressed any opinion or any other form of assurance on such results, and assume no responsibility for, and disclaim any association with, these preliminary financial results. These preliminary financial results should not be viewed as a substitute for full financial statements prepared in accordance with generally accepted accounting principles (“GAAP”). Non-GAAP Financial Measures This presentation includes measures defined by the SEC as non-GAAP financial measures. We believe that these non-GAAP financial measures can provide useful supplemental information to investors when read in conjunction with our reported results. Reconciliations of these non-GAAP financial measures to their closest GAAP measures and descriptions of these non-GAAP financial measures are available in the Appendix to this presentation.

© 2021 Acacia Communications, Inc. All Rights Reserved. 3 Driving the Siliconization of Optical Interconnect Acacia Communications Overview Coherent Optical Interconnect Provider & Innovator Addressing Existing & Emerging Coherent Markets First to Market, Award Winning Products Proven Management Team Strong Balance Sheet Mission: Deliver silicon-based interconnects that transform cloud and communication networks by simplifying these networks, digitizing numerous complex analog functions, and providing significant improvements in speed, capacity and power consumption

© 2021 Acacia Communications, Inc. All Rights Reserved. 4 Acacia Advancing Next Generation of Optical Communications • Edge/Access, DCI, Metro, Long-haul and Submarine • Capacity, flexibility, intelligence, reach, scalability • Coherent Optics in CFP, CFP2, QSFP-DD and OSFP form factors • >500,000 coherent ports deployed • 8 DSP ASICs developed since 2009 • Leading Silicon Photonics • 3D Siliconization Technology • In-house Coherent DSP ASIC • Highly integrated Silicon Photonics • Advanced packaging for high- density coherent applications • Pluggable & Embedded coherent optical modules Coherent Portfolio Key Technologies Proven Execution Strategic Vision: • Address high-growth market segments based on low-power DSPs and integrated photonics • Broaden market penetration through increased engagement with Tier-1 NEMs • Maintain a technology leadership position with many first to market products

© 2021 Acacia Communications, Inc. All Rights Reserved. 5 Key applications driving global demand Demand for Bandwidth and Network Capacity Data & Video Video accounts for over 60% of downstream traffic on the internet1 Mobile & 5G Global total mobile data traffic is projected to grow by a factor of approximately 4.5 to reach 226EB per month in 20262 Cloud Increasing cloud adoption driving hyperscale data center buildouts. By 2022, global public cloud services market revenue is forecasted to exceed 362.3 billion U.S. dollars4 Internet of Things It is projected that there will be nearly 30 billion devices/connections by 20233 Changing Traffic Patterns Increased work from home putting emphasis on residential broadband with average speeds rising from 46 Mbps to 110 Mbps3 2. Ericsson Mobility Report, Nov 2020 3. Cisco Annual Internet Report, Feb 20201. Sandvine Phenomena Report, May 2020 4. Statista, Nov 2020

© 2021 Acacia Communications, Inc. All Rights Reserved. 6 Forecasted Coherent Module Market Size and Trends Industry trends expected to drive increasing adoption of pluggable coherent modules - 500,000 1,000,000 1,500,000 2,000,000 2,500,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Total Coherent Ports1 1. Reprinted with permission: LightCounting, Oct 2020 • Increasing share of coherent ports based on pluggables •Port growth driven by 400ZR and 100G Edge/Access •Merchant modules more widely utilized

© 2021 Acacia Communications, Inc. All Rights Reserved. 7 Infrastructure to Support Traffic Growth: Coherent Market Applications EDGEMETROLONG-HAUL Acacia solutions designed to reduce complexity and cost of high speed networks • High performance • Fiber constrained • Space and power constrained • Pay as you grow model • Shorter product life cycles • Cost and power sensitive Central Office Central Office Central Office City City

© 2021 Acacia Communications, Inc. All Rights Reserved. 8 Deployed Bandwidth Growth 1 45% CAGR 2 40% CAGR 2 37% CAGR 2 Edge Metro Long-Haul 2018 2023 Forecasted Demand Increase in Long Haul/Metro/Edge 1 Reprinted with permission: Cignal AI, Sept. 2020 Most significant growth anticipated from Edge (<100km) applications

© 2021 Acacia Communications, Inc. All Rights Reserved. 9 Coherent Benefits • Higher speeds • Operational simplicity • Network resilience Coherent Technology Trends Emerging opportunities for coherent in shorter reach applications

© 2021 Acacia Communications, Inc. All Rights Reserved. 10 Trending Toward Disaggregation and IP over DWDM • Traditional telecom systems • Vendor lock-in • Longer product lifecycles • Open Line Systems (OLS) • Compact DCI transport equipment • Alien wavelengths • 400ZR optics in switch • No external transport box • IP over DWDM • Interoperability Accelerating adoption of new technology OLSBookended Transport IPoDWDM Gen 1 Gen 2 (today) Gen 3

© 2021 Acacia Communications, Inc. All Rights Reserved. 11 Acacia Products: Rapid Pace of Innovation Everest 100G LH 1.5 Inch2 32GB SiPh PIC 0.4 Inch2 45GB SiPh PIC AC100 AC100S AC40S CFP-DCO AC400 CFP2-ACO CFP2-DCO AC1200 Strong and diverse portfolio of patents and intellectual property Mauna Kea 100G LH K2 40G ULH Sky 100G Metro Denali 400G ULH/Metro Multi-core Meru 200G Metro Pico 1.2T DCI/Metro/LH Multi-core 40 nm 28 nm 16 nm 0.4 Inch2 70GB SiPh PIC Silicon PICs DSP ASICs: PIC >500PICs on single wafer Modules 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Access/400G Pluggables Greylock 400G Metro 7 nm 3D Siliconization

© 2021 Acacia Communications, Inc. All Rights Reserved. 12 Coherent Embedded Modules Evolution Increasing performance and functionality while leveraging integration to improve cost per bit Industry Trends & Challenges • Increasing baud rates • Capacity per fiber nearing maximum AC400 AC1200-SC2 AC1200-DC AC100 1.2T 400G 100G Acacia Solutions: • Increasing functionality • Innovative packaging • Vertical integration Network Operator Requirements • Increasing line-system channel width • Need for greater channel utilization

© 2021 Acacia Communications, Inc. All Rights Reserved. 13 AC1200: “Future Proof” Architecture for Transporting 100/400GbE • Adopted by 3 of the 4 largest hyperscalers • More than 30,000 ports shipped in 2020 • Deployed in applications from edge to submarine Submarine Reach 3 x 400GbE 12 x 100GbE Clients 64QAM 2 x 400GbE 8 x 100GbE Clients 16QAM 1 x 400GbE 4 x 100GbE Clients QPSK DCI Edge Metro/Regional 200G 400G 1.2T 1.6T D a ta R a te 800G Multi-haul coherent optical module designed to address network operator requirements GbE = Gigabit Ethernet

© 2021 Acacia Communications, Inc. All Rights Reserved. 14 400ZR OSFP/QSFP 400G Open ROADM CFP2-DCO 100G Access QSFP-DD CFP2-DCO 400G OpenZR+ OSFP/QSFP 2018 2019 2020 Long Haul Metro/Regional DCI/Edge Aggregation Access 3D Siliconization for dense integration & high-volume manufacturing Coherent Pluggables DCO Modules Evolution Leveraging component investments to address multiple market applications 2015 20162014 2017 CFP-DCO CFP2-DCO Long Haul/Metro/Aggregation

© 2021 Acacia Communications, Inc. All Rights Reserved. 15 Intersection of Advanced DSP, Optics and Packaging Technology 400ZR: Coherent Interfaces in Client Form Factors Design requirements • Advanced integration/packaging • Low power DSP and module design • 400G optics and RF electronics • Software and module integration DSP Radio Frequency Acacia Advantage • Track record: 1st in CFP/CFP2 DCO • 3D Siliconization • >300,000 SiPh shipped Disaggregation and IP-over-DWDM architectures leverage 400ZR modules OSFP QSFP-DD 400ZR Modules

© 2021 Acacia Communications, Inc. All Rights Reserved. 16 • Utilizes high volume manufacturing processes • Benefits from the maturity of Acacia’s silicon photonics technology and vertical integration strategy • Enabled by Acacia’s expertise and leadership in silicon photonics and low-power DSPs Acacia’s 3D Siliconization Approach High-performance, reliable, low power consumption, and cost effective

© 2021 Acacia Communications, Inc. All Rights Reserved. 17 Introduced Six Pluggable Products based on 3D Siliconization Supporting Multiple Applications in Hyperscale and Service Provider Networks Family Product QSFP-DD OSFP CFP2 100G 200G 300G 400G 400G 400ZR OpenZR+ Open ROADM Access Point-to-Point DWDM Bi-Directional

© 2021 Acacia Communications, Inc. All Rights Reserved. 18 Industry Awards & Accolades 2018 Outstanding Components Vendor 2011 New England Region 2016 Finalist2014 2016 2019 Outstanding Components Vendor

© 2021 Acacia Communications, Inc. All Rights Reserved. 19 Well Positioned to Deliver Highly Integrated Interconnects Diverse Set of Skills and Expertise Represents High Barrier to Entrance Acacia has all the pieces of the interconnect puzzle to deliver: • Superior performance • Higher density • Easy deployment and management • Lower cost • Lower power DSP Radio Frequency Software Optics Silicon Coherent PIC Dual-core DSP >1Tb DSP 100G MSA 100G CFP-DCO 400G Module 200G CFP2-DCO 1st 1st 1st We believe we were the first to introduce to the market:

© 2021 Acacia Communications, Inc. All Rights Reserved. 20 Helping to ensure sustainability despite soaring bandwidth growth • Optimizing design of DSP ASIC and SiPh PIC • Developing power efficient algorithms • Helping our service provider and cloud customers dramatically reduce energy consumption Sustainable Optical Networking Acacia has been able to reduce the power consumed by its coherent optical interconnects by as much as 85% since 2013

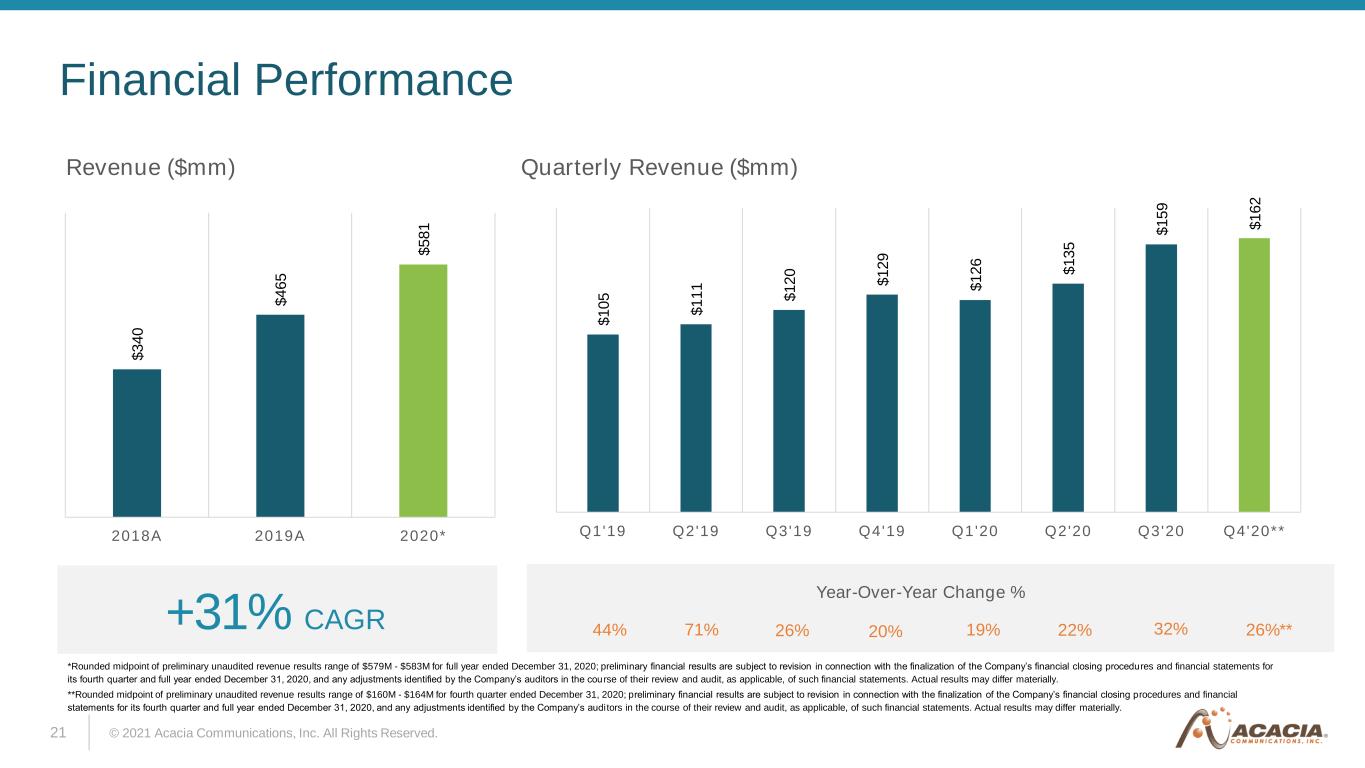

© 2021 Acacia Communications, Inc. All Rights Reserved. 21 Financial Performance Revenue ($mm) Quarterly Revenue ($mm) $ 3 4 0 $ 4 6 5 $ 5 8 1 2018A 2019A 2020* +31% CAGR Year-Over-Year Change % 44% 71% 26% 19%20% 26%** $ 1 0 5 $ 1 1 1 $ 1 2 0 $ 1 2 9 $ 1 2 6 $ 1 3 5 $ 1 5 9 $ 1 6 2 Q1 '19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20** 22% 32% *Rounded midpoint of preliminary unaudited revenue results range of $579M - $583M for full year ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the cou rse of their review and audit, as applicable, of such financial statements. Actual results may differ materially. **Rounded midpoint of preliminary unaudited revenue results range of $160M - $164M for fourth quarter ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially.

© 2021 Acacia Communications, Inc. All Rights Reserved. 22 $5 $33 $90 $7 ($2) $15 $13 $16 $16 $24 $34 -$3 $17 $37 $57 $77 $97 2018 2019 2020* Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20** Operating Leverage Operational Scalability Leveraged Sales Model Capital Efficiency Efficient R&D GAAP Net Income (Loss) ($mm) Key Drivers % of Revenue 1% 7% 7% (2%) 13% 10% 12%15%* 15% 21%**12% *Rounded midpoint of preliminary unaudited GAAP net income results range of $88M - $91M for full year ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially. **Rounded midpoint of preliminary unaudited GAAP net income results range of $32M - $35M for fourth quarter ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially.

© 2021 Acacia Communications, Inc. All Rights Reserved. 23 $36 $79 $125 $15 $18 $26 $21 $23 $28 $34 $40 $0 $20 $40 $60 $80 $100 $120 $140 2018 2019 2020* Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20** Operating Leverage Operational Scalability Leveraged Sales Model Capital Efficiency Efficient R&D Non-GAAP Net Income1 ($mm) Key Drivers 1 This is a “non-GAAP financial measure” as defined in Regulation G and Item 10(e) of Regulation S-K under the Securities Exchange Act of 1934, as amended, and reconciliation of the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP to the non-GAAP financial measure and a description of this non-GAAP financial measure can be found in the Appendix attached hereto. % of Revenue 11% 17% 15% 16% 21% 16% 19%22%* 21% 25%**21% *Rounded midpoint of preliminary unaudited Non-GAAP net income results range of $123M - $127M for full year ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially. **Rounded midpoint of preliminary unaudited Non-GAAP net income results range of $38M - $42M for fourth quarter ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially.

© 2021 Acacia Communications, Inc. All Rights Reserved. 24 Appendix

© 2021 Acacia Communications, Inc. All Rights Reserved. 25 Reconciliation of GAAP to Non-GAAP *Rounded midpoint of preliminary unaudited results range of of $88M - $91M of GAAP net income and $123M - $127M of non-GAAP net income for full year ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially. **Rounded midpoint of preliminary unaudited results range of $32M - $35M of GAAP net income and $38M - $42M of non-GAAP net income for fourth quarter ended December 31, 2020; preliminary financial results are subject to revision in connection with the finalization of the Company’s financial closing procedures and financial statements for its fourth quarter and full year ended December 31, 2020, and any adjustments identified by the Company’s auditors in the course of their review and audit, as applicable, of such financial statements. Actual results may differ materially.

© 2021 Acacia Communications, Inc. All Rights Reserved. 26 Use of Non-GAAP Financial Information This presentation includes non-GAAP financial measures that are not prepared in accordance with, nor an alternative to, GAAP. In addition, these non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Acacia Communications believes that providing these non-GAAP financial measures to investors, in addition to providing the most directly comparable GAAP measures, provides investors the benefit of viewing the Company’s performance using the same financial metrics that its management team uses in making many key decisions and evaluating how its results of operations may look in the future. Acacia Communications’ management does not believe that items not involving cash expenditures, such as non-cash compensation related to equity awards, are part of its critical decision making process. Also, Acacia Communications’ management does not believe that items such as warranty and other charges arising from a manufacturing process quality issue, certain litigation related costs and settlement reserves outside the normal course of the Company’s business, acquisition related costs or certain adjustments to its valuation allowance against deferred tax assets are reflective of the Company’s underlying operating performance. Further, in connection with the seven-year denial of export privileges imposed on April 15, 2018 by the U.S. Department of Commerce against ZTE, which was subsequently lifted on July 13, 2018, the Company recorded inventory write-offs. Acacia Communications’ management does not believe these write-offs, and any subsequent adjustments as a result of management’s ongoing evaluation of the ZTE inventory, are reflective of the Company’s underlying operating performance. Therefore, Acacia Communications excludes those items, as applicable, from non-GAAP net income. Acacia Communications’ non-GAAP financial measures reflect adjustments based on the metrics described below, as well as the related income tax effects. The income tax effect of these non-GAAP adjustments is determined by recalculating income tax expense excluding these adjustments. Non-GAAP net income. Acacia Communications defines non-GAAP net income as net income as reported on the Company’s consolidated statements of operations, excluding the impact of stock- based compensation which is a non-cash charge, as well as warranty and other charges arising from a manufacturing process quality issue, ZTE-related inventory write-offs and subsequent adjustments, certain litigation related costs and settlement reserves, acquisition related costs, the tax effects of those excluded items and certain valuation allowance adjustments against deferred tax assets. Acacia Communications has presented non-GAAP net income because the Company believes that the exclusion of the items discussed above facilitates comparisons of its results of operations to other companies in its industry and more accurately reflects the underlying performance of our continuing business operations. Acacia Communications uses these non-GAAP financial measures to evaluate its operating performance and trends, and make planning decisions. Acacia Communications believes that each of these non-GAAP financial measures helps identify underlying trends in its business that could otherwise be masked by the effect of the items that the Company excludes. Accordingly, Acacia Communications believes that these financial measures provide useful information to investors and others in understanding and evaluating its operating results, enhancing the overall understanding of the Company’s past performance and future prospects, and allowing for greater transparency with respect to key financial metrics used by its management in its financial and operational decision- making.

© 2021 Acacia Communications, Inc. All Rights Reserved. 27 Use of Non-GAAP Financial Information Acacia Communications’ non-GAAP financial measures are not prepared in accordance with GAAP, and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of these non-GAAP financial measures rather than net income, which is the most directly comparable GAAP measure. Some of these limitations are: • Acacia Communications excludes stock-based compensation expense from each of its non-GAAP financial measures, although it has recently been, and will continue to be for the foreseeable future, a significant recurring expense for its business and an important part of the Company’s compensation strategy; • Acacia Communications excludes the tax benefits generated from the exercise of non-qualified stock options, the disqualifying disposition of incentive stock options and ESPP shares, and the vesting of restricted stock units, including any excess tax benefits and shortfalls recognized by the Company in the year of the taxable transaction, in calculating its non-GAAP net income. The Company believes that excluding these tax benefits enables investors to see the full effect that excluding stock-based compensation expense had on the operating results. These benefits are tied to the exercise or vesting of underlying employee equity awards and the price of the Company’s common stock at the time of exercise or vesting, which factors may vary from period to period independent of the operating performance of the Company’s business. Similar to stock-based compensation expense, the Company believes that excluding these tax benefits provides investors and management with greater visibility to the underlying performance of its business operations and facilitates comparison with other periods as well as the results of other companies in its industry; • Acacia Communications excludes warranty and other charges arising from a manufacturing process quality issue from its non-GAAP net income, as management does not believe the charges are reflective of the Company’s underlying operating performance; • Acacia Communications excludes certain adjustments to its valuation allowance against deferred tax assets from its non-GAAP net income, as management does not believe the charges are reflective of the Company’s underlying operating performance; • Acacia Communications excludes ZTE-related inventory write-offs and subsequent adjustments from its non-GAAP net income, as management believes the activity is not related to the Company’s normal course of business and is not reflective of the Company’s underlying operating performance; • Acacia Communications excludes certain litigation related costs and settlement reserves from its non-GAAP net income, if management believes the activity is not related to the Company’s normal course of business and is not reflective of the Company’s underlying operating performance. These expenses may continue in the future; • Acacia Communications excludes acquisition related costs from its non-GAAP net income, as management believes the activity is not related to the Company’s normal course of business and is not reflective of the Company’s underlying operating performance; Because of these limitations, non-GAAP financial measures should be considered along with other operating and financial performance measures presented in accordance with GAAP. Acacia Communications’ use of non-GAAP financial measures, and the underlying methodology when excluding certain items, is not necessarily an indication of the results of operations that may be expected in the future, or that Acacia Communications will not, in fact, record such items in future periods. Investors should consider Acacia Communications’ non-GAAP financial measures in conjunction with the corresponding GAAP financial measures.