Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANTARES PHARMA, INC. | atrs-8k_20210111.htm |

| EX-99.1 - EX-99.1 PRESS RELEASE - ANTARES PHARMA, INC. | atrs-ex991_26.htm |

NASDAQ: ATRS | January 2021 Investor Presentation EX 99.2

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to certain risks and uncertainties that can cause actual results to differ materially from those described. Factors that may cause such differences include, but are not limited to: the Company’s ability to achieve the 2020 and 2021 full-year revenue guidance; the uncertainty regarding the duration, scope and severity of the COVID-19 pandemic and the mitigation measures and other restrictions implemented in response to the same and the impact on demand for our products, new patients and prescriptions, future revenue, product supply, and our overall business, operating results and financial condition; successful commercialization of NOCDURNA® in the United States and market acceptance and future revenue from the same: commercial success of XYOSTED® and future revenue from the same; market acceptance of Teva’s generic epinephrine auto-injector product and future revenue from the same; whether the FDA will withdraw marketing approval for AMAG Pharmaceuticals’ Makena® subcutaneous auto injector following the recent FDA letter seeking withdrawal, whether AMAG will be granted an appeal hearing and if granted, whether Makena® will be successful and future prescriptions, market acceptance and revenue from the same; Teva’s ability to successfully commercialize VIBEX® Sumatriptan Injection USP and the amount of revenue from the same; future prescriptions and sales of OTREXUP®; Teva’s ability to successfully commercialize generic teriparatide in 11 countries in Europe, Canada and Israel and future revenue from the same, successful development including the timing and results of the clinical bridging and Phase 3 clinical trial of the drug device combination product for Selatogrel with Idorsia Pharmaceuticals and FDA and global regulatory approvals and future revenue from the same; FDA approval of Teva’s pending ANDA for generic Forteo® and future revenue from the same; the timing and results of the Company’s or its partners’ research projects or clinical trials of product candidates in development including Pfizer’s undisclosed development product; actions by the FDA or other regulatory agencies with respect to the Company’s products or product candidates of its partners; continued growth in product, development, licensing and royalty revenue; the Company’s ability to meet loan extension and interest only payment milestones and the ability to repay the debt obligation to Hercules Capital; the Company’s ability to obtain financial and other resources for its research, development, clinical, and commercial activities and other statements regarding matters that are not historical facts, and involve predictions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, achievements or prospects to be materially different from any future results, performance, achievements or prospects expressed in or implied by such forward-looking statements. In some cases you can identify forward-looking statements by terminology such as ''may'', ''will'', ''should'', ''would'', ''expect'', ''intend'', ''plan'', ''anticipate'', ''believe'', ''estimate'', ''predict'', ''potential'', ''seem'', ''seek'', ''future'', ''continue'', or ''appear'' or the negative of these terms or similar expressions, although not all forward-looking statements contain these identifying words. Additional information concerning these and other factors that may cause actual results to differ materially from those anticipated in the forward-looking statements is contained in the "Risk Factors" section of the Company's Annual Report on Form 10-K, and in the Company's other periodic reports and filings with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this presentation. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this presentation, except as required by law. ©2021 Copyright Antares Pharma, Inc. All Rights Reserved.

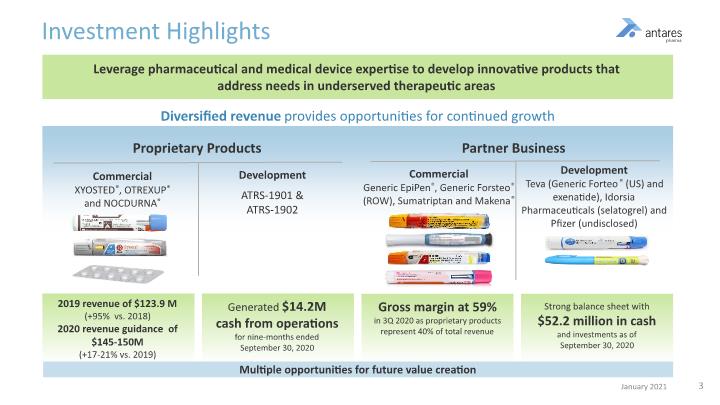

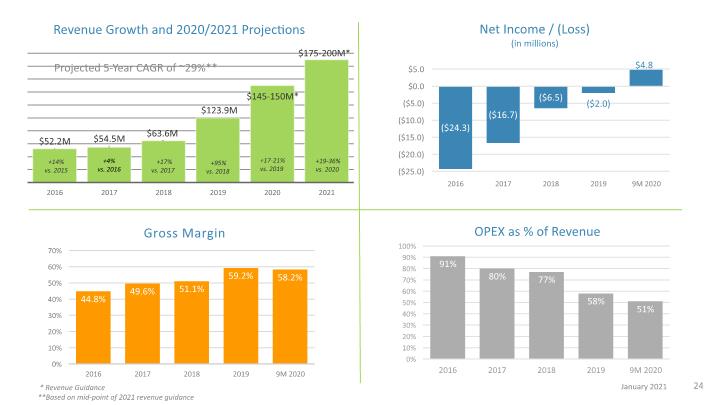

Leverage pharmaceutical and medical device expertise to develop innovative products that address needs in underserved therapeutic areas Investment Highlights Diversified revenue provides opportunities for continued growth Commercial XYOSTED®, OTREXUP® and NOCDURNA® Commercial Generic EpiPen®, Generic Forsteo® (ROW), Sumatriptan and Makena® Development Teva (Generic Forteo® (US) and exenatide), Idorsia Pharmaceuticals (selatogrel) and Pfizer (undisclosed) 2019 revenue of $123.9 M (+95% vs. 2018) 2020 revenue guidance of $145-150M (+17-21% vs. 2019) Gross margin at 59% in 3Q 2020 as proprietary products represent 40% of total revenue Strong balance sheet with $52.2 million in cash and investments as of September 30, 2020 Generated $14.2M cash from operations for nine-months ended September 30, 2020 Multiple opportunities for future value creation Partner Business Development ATRS-1901 & ATRS-1902 Proprietary Products

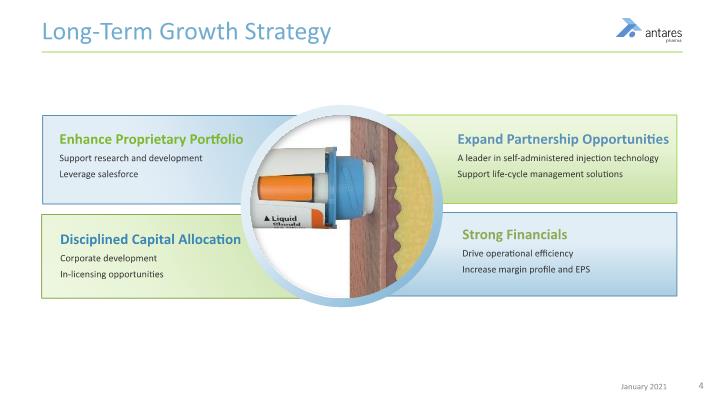

Long-Term Growth Strategy Expand Partnership Opportunities A leader in self-administered injection technology Support life-cycle management solutions Disciplined Capital Allocation Corporate development In-licensing opportunities Enhance Proprietary Portfolio Support research and development Leverage salesforce Strong Financials Drive operational efficiency Increase margin profile and EPS

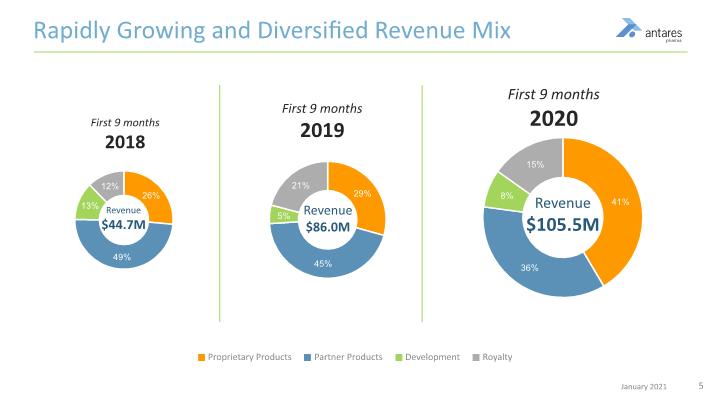

Rapidly Growing and Diversified Revenue Mix Proprietary Products Partner Products Development Royalty

Proprietary Products (desmopressin acetate) sublingual tablet

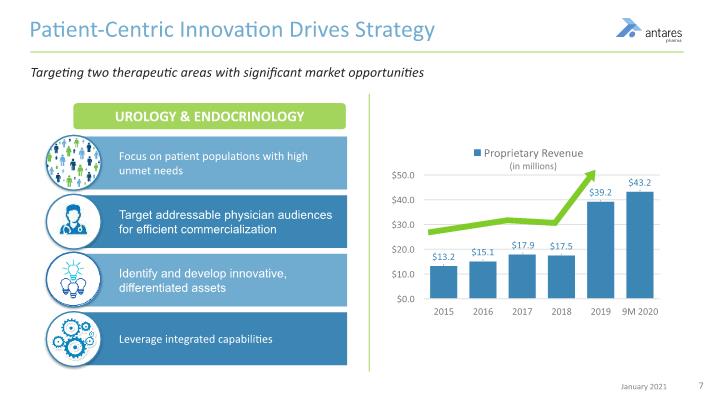

Patient-Centric Innovation Drives Strategy Targeting two therapeutic areas with significant market opportunities UROLOGY & ENDOCRINOLOGY Focus on patient populations with high unmet needs Target addressable physician audiences for efficient commercialization Identify and develop innovative, differentiated assets Leverage integrated capabilities

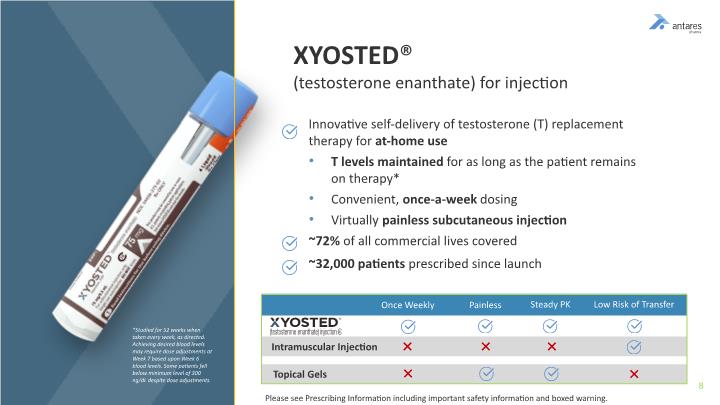

Innovative self-delivery of testosterone (T) replacement therapy for at-home use T levels maintained for as long as the patient remains on therapy* Convenient, once-a-week dosing Virtually painless subcutaneous injection ~72% of all commercial lives covered ~32,000 patients prescribed since launch XYOSTED® (testosterone enanthate) for injection *Studied for 52 weeks when taken every week, as directed. Achieving desired blood levels may require dose adjustments at Week 7 based upon Week 6 blood levels. Some patients fell below minimum level of 300 ng/dL despite dose adjustments. Once Weekly Painless Steady PK Low Risk of Transfer Intramuscular Injection Topical Gels Please see Prescribing Information including important safety information and boxed warning.

Testosterone Market Once Weekly Painless Efficacious Steady PK No Risk of Transfer IQVIA Data

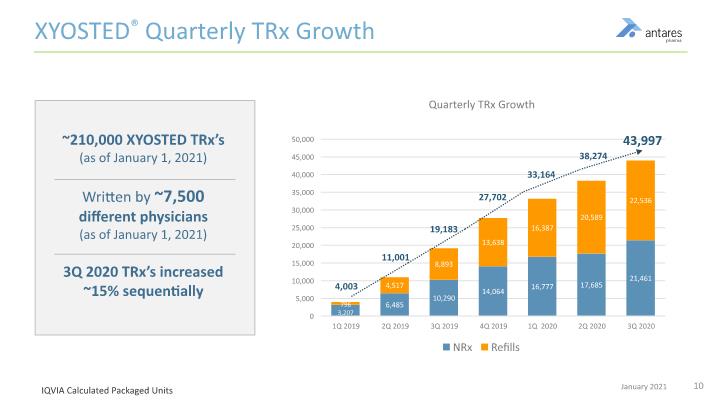

XYOSTED® Quarterly TRx Growth ~210,000 XYOSTED TRx’s (as of January 1, 2021) Written by ~7,500 different physicians (as of January 1, 2021) 3Q 2020 TRx’s increased ~15% sequentially 43,997 38,274 27,702 19,183 11,001 4,003 IQVIA Calculated Packaged Units 33,164

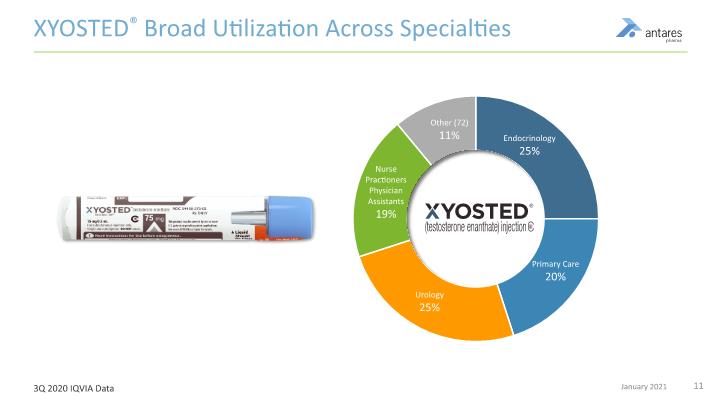

XYOSTED® Broad Utilization Across Specialties 3Q 2020 IQVIA Data

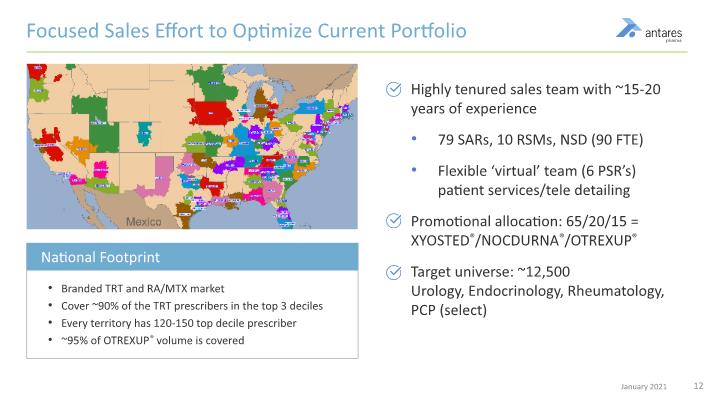

Branded TRT and RA/MTX market Cover ~90% of the TRT prescribers in the top 3 deciles Every territory has 120-150 top decile prescriber ~95% of OTREXUP® volume is covered Highly tenured sales team with ~15-20 years of experience 79 SARs, 10 RSMs, NSD (90 FTE) Flexible ‘virtual’ team (6 PSR’s) patient services/tele detailing Promotional allocation: 65/20/15 = XYOSTED®/NOCDURNA®/OTREXUP® Target universe: ~12,500 Urology, Endocrinology, Rheumatology, PCP (select) Focused Sales Effort to Optimize Current Portfolio National Footprint

FDA-approved, on market vasopressin analog indicated for the treatment of nocturia due to nocturnal polyuria in adults who awaken at least two times a night to void First and only sublingual tablet that targets the kidneys Short-acting desmopressin is considered standard-of-care but underutilized due to poor disease state and product awareness Nocturia affects ~40 million adults in U.S. 50-70% prescriber alignment overlap between NOCDURNA® and XYOSTED® ~80% commercial coverage at Tier 3 PA/SE or better In-Licensed: NOCDURNA® (desmopressin acetate)

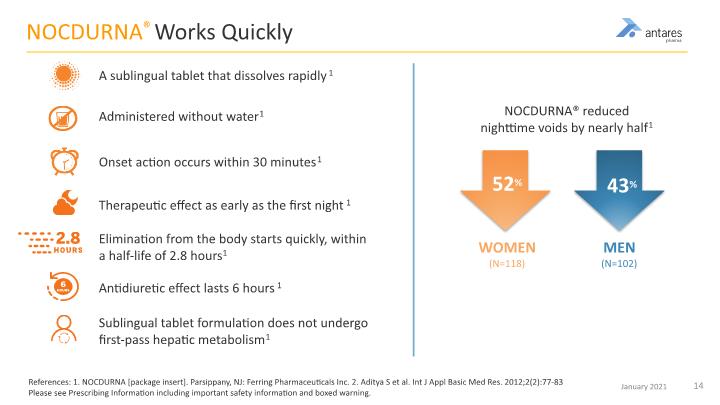

NOCDURNA® Works Quickly References: 1. NOCDURNA [package insert]. Parsippany, NJ: Ferring Pharmaceuticals Inc. 2. Aditya S et al. Int J Appl Basic Med Res. 2012;2(2):77-83 Please see Prescribing Information including important safety information and boxed warning. A sublingual tablet that dissolves rapidly1 Administered without water1 Onset action occurs within 30 minutes1 Therapeutic effect as early as the first night1 Elimination from the body starts quickly, within a half-life of 2.8 hours1 Antidiuretic effect lasts 6 hours1 Sublingual tablet formulation does not undergo first-pass hepatic metabolism1 NOCDURNA® reduced nighttime voids by nearly half1 WOMEN (N=118) MEN (N=102) 52% 43%

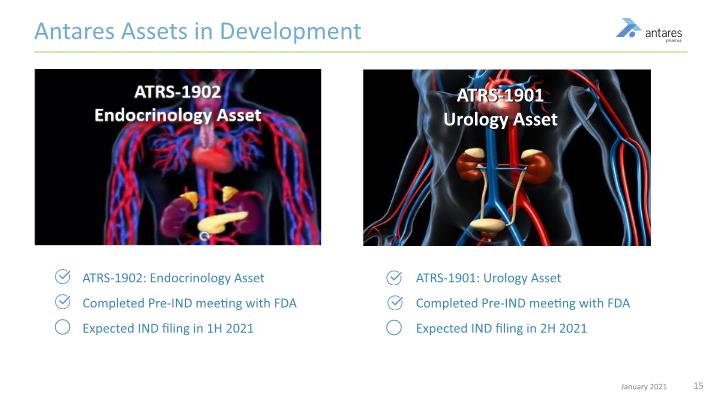

ATRS-1901 Urology Asset Antares Assets in Development ATRS-1902: Endocrinology Asset Completed Pre-IND meeting with FDA Expected IND filing in 1H 2021 ATRS-1901: Urology Asset Completed Pre-IND meeting with FDA Expected IND filing in 2H 2021

Partner Business

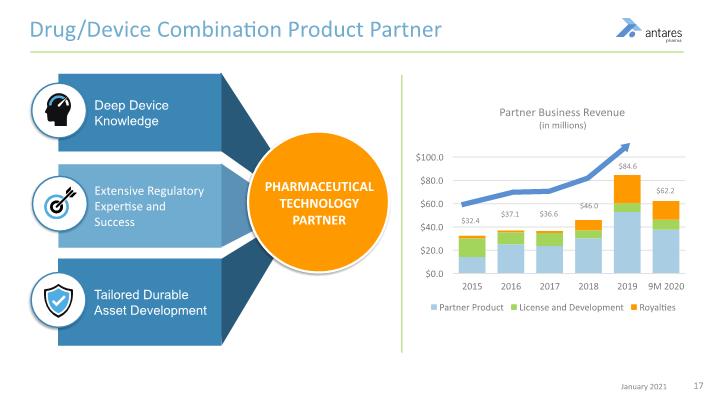

Deep Device Knowledge Drug/Device Combination Product Partner Extensive Regulatory Expertise and Success Tailored Durable Asset Development PHARMACEUTICAL TECHNOLOGY PARTNER Partner Business Revenue (in millions)

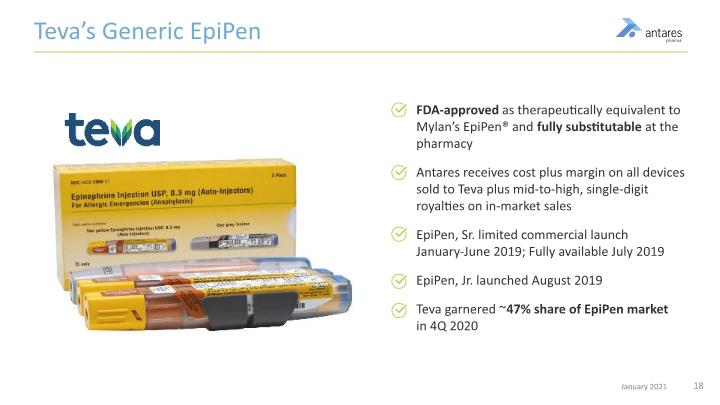

Commercial Experience Teva’s Generic EpiPen FDA-approved as therapeutically equivalent to Mylan’s EpiPen® and fully substitutable at the pharmacy Antares receives cost plus margin on all devices sold to Teva plus mid-to-high, single-digit royalties on in-market sales EpiPen, Sr. limited commercial launch January-June 2019; Fully available July 2019 EpiPen, Jr. launched August 2019 Teva garnered ~47% share of EpiPen market in 4Q 2020

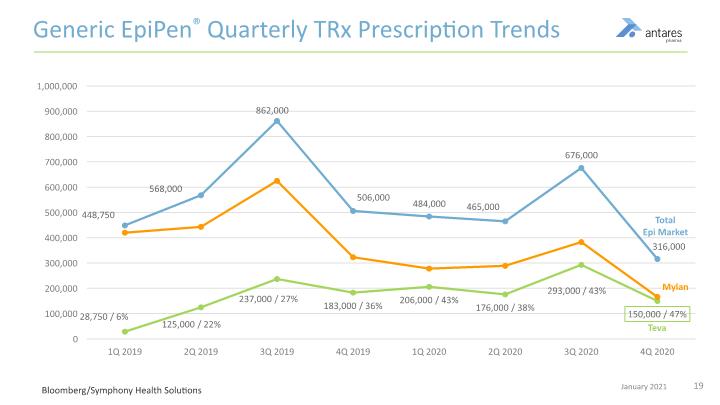

Generic EpiPen® Quarterly TRx Prescription Trends Bloomberg/Symphony Health Solutions

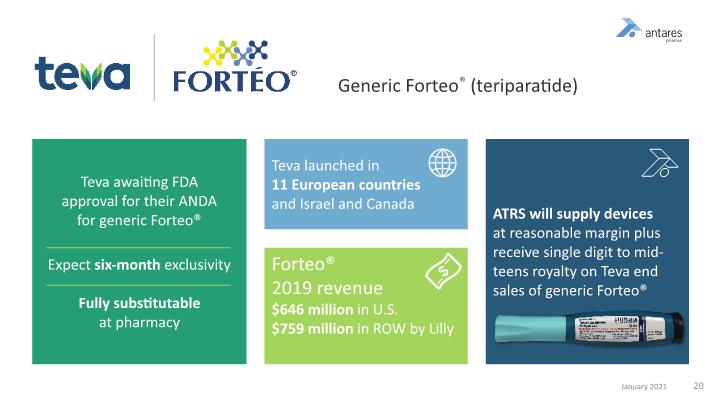

Generic Forteo® (teriparatide) Teva awaiting FDA approval for their ANDA for generic Forteo® Expect six-month exclusivity Fully substitutable at pharmacy Teva launched in 11 European countries and Israel and Canada Forteo® 2019 revenue $646 million in U.S. $759 million in ROW by Lilly ATRS will supply devices at reasonable margin plus receive single digit to mid-teens royalty on Teva end sales of generic Forteo®

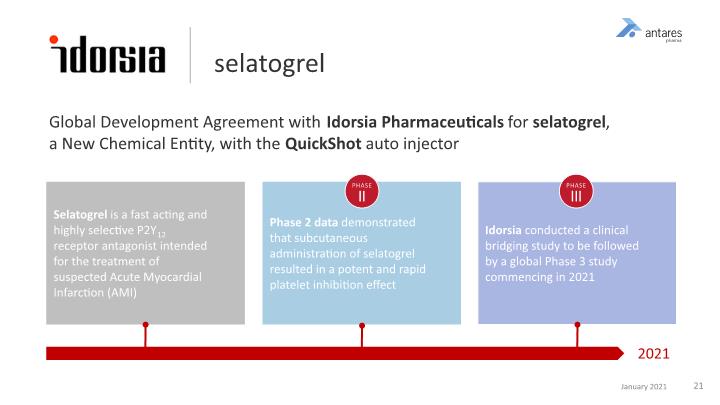

Global Development Agreement with Idorsia Pharmaceuticals for selatogrel, a New Chemical Entity, with the QuickShot auto injector selatogrel Selatogrel is a fast acting and highly selective P2Y12 receptor antagonist intended for the treatment of suspected Acute Myocardial Infarction (AMI) Phase 2 data demonstrated that subcutaneous administration of selatogrel resulted in a potent and rapid platelet inhibition effect Idorsia conducted a clinical bridging study to be followed by a global Phase 3 study commencing in 2021 2021

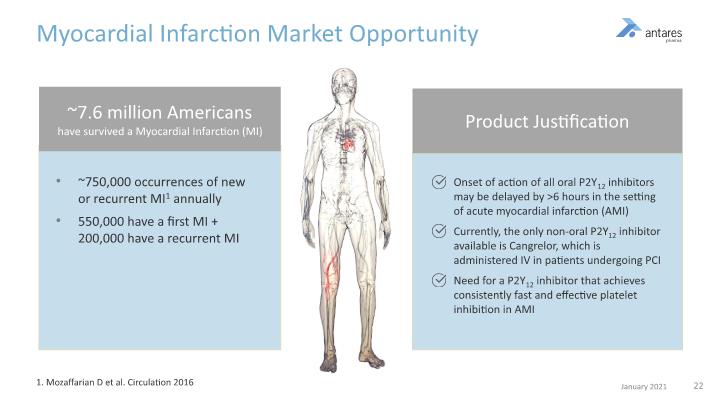

~750,000 occurrences of new or recurrent MI1 annually 550,000 have a first MI + 200,000 have a recurrent MI Myocardial Infarction Market Opportunity 1. Mozaffarian D et al. Circulation 2016 Onset of action of all oral P2Y12 inhibitors may be delayed by >6 hours in the setting of acute myocardial infarction (AMI) Currently, the only non-oral P2Y12 inhibitor available is Cangrelor, which is administered IV in patients undergoing PCI Need for a P2Y12 inhibitor that achieves consistently fast and effective platelet inhibition in AMI ~7.6 million Americans have survived a Myocardial Infarction (MI) Product Justification

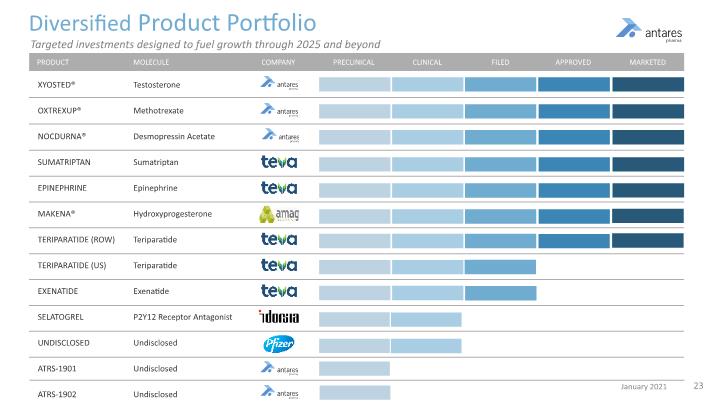

Diversified Product Portfolio Testosterone Methotrexate Desmopressin Acetate Sumatriptan Epinephrine Hydroxyprogesterone Teriparatide Teriparatide Exenatide P2Y12 Receptor Antagonist Undisclosed Undisclosed Undisclosed XYOSTED® OXTREXUP® NOCDURNA® SUMATRIPTAN EPINEPHRINE MAKENA® TERIPARATIDE (ROW) TERIPARATIDE (US) EXENATIDE SELATOGREL UNDISCLOSED ATRS-1901 ATRS-1902 PRODUCT MOLECULE PRECLINICAL CLINICAL FILED APPROVED MARKETED COMPANY Targeted investments designed to fuel growth through 2025 and beyond

+19-36% vs. 2020

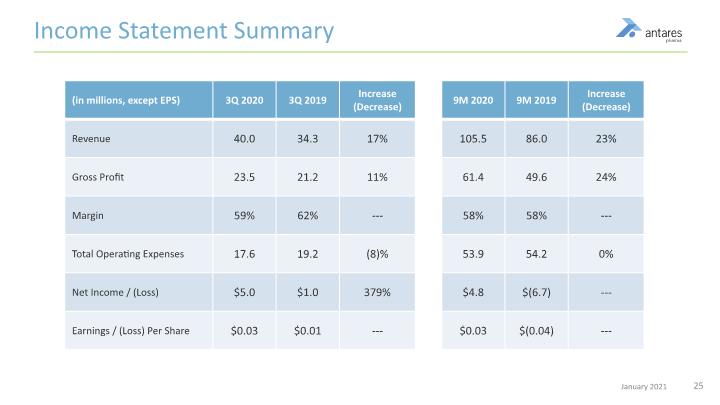

Income Statement Summary

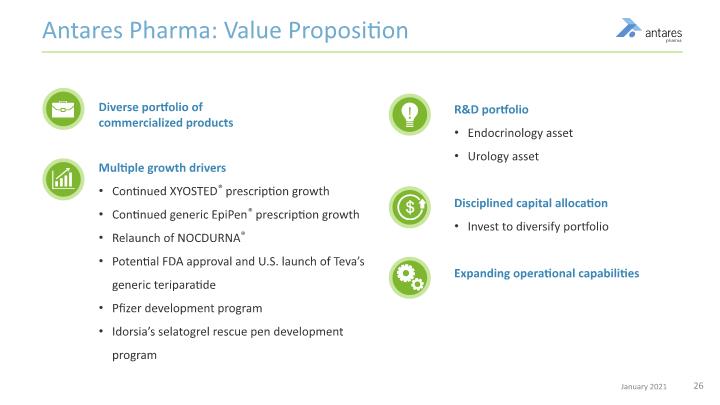

Antares Pharma: Value Proposition Diverse portfolio of commercialized products Multiple growth drivers Continued XYOSTED® prescription growth Continued generic EpiPen® prescription growth Relaunch of NOCDURNA® Potential FDA approval and U.S. launch of Teva’s generic teriparatide Pfizer development program Idorsia’s selatogrel rescue pen development program R&D portfolio Endocrinology asset Urology asset Disciplined capital allocation Invest to diversify portfolio Expanding operational capabilities

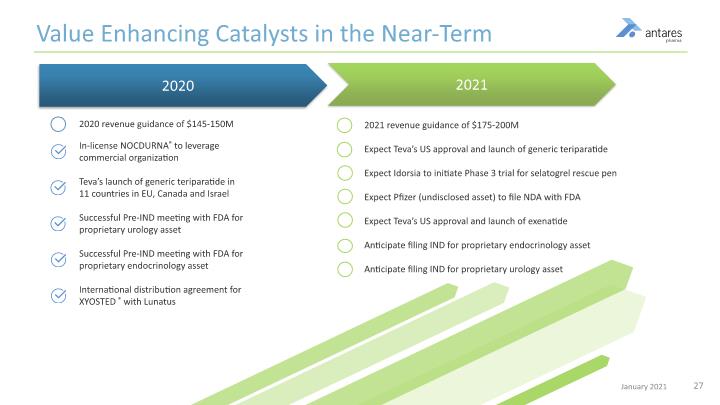

Value Enhancing Catalysts in the Near-Term 2020 revenue guidance of $145-150M In-license NOCDURNA® to leverage commercial organization Teva’s launch of generic teriparatide in 11 countries in EU, Canada and Israel Successful Pre-IND meeting with FDA for proprietary urology asset Successful Pre-IND meeting with FDA for proprietary endocrinology asset International distribution agreement for XYOSTED ® with Lunatus 2020 2021 2021 revenue guidance of $175-200M Expect Teva’s US approval and launch of generic teriparatide Expect Idorsia to initiate Phase 3 trial for selatogrel rescue pen Expect Pfizer (undisclosed asset) to file NDA with FDA Expect Teva’s US approval and launch of exenatide Anticipate filing IND for proprietary endocrinology asset Anticipate filing IND for proprietary urology asset

Thank You!