Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - CHIMERIX INC | tm212135d1_ex99-2.htm |

| 8-K - FORM 8-K - CHIMERIX INC | tm212135d1_8k.htm |

Exhibit 99.1

Acquisition of Oncoceutics Adds Precision Oncology Pipeline with Near - term Registration Potential

2 Forward - Looking Statements These slides contain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Forward - looking statements include those relating to, among other things, Chimerix’s ability to develop its drug candidates including ONC201, DSTAT and BCV; the sufficiency of the data from the current clinical trial of ONC201 to support accelerated regulatory approval; Chimerix’s ability to submit and/or obtain regulatory approvals for its clinical candidates; the timing and receipt of a potential procurement contract for BCV in smallpox; and the anticipated benefits of Chimerix’s acquisition of Oncoceutics . Among the factors and risks that could cause actual results to differ materially from those indicated in the forward - looking statements are risks that Chimerix’s clinical candidates, including BCV, may not obtain regulatory approval from the FDA or such approval may be delayed or conditioned; risks that development activities related to clinical candidates may not be completed on time or at all; risks that ongoing or future trials may not be successful or replicate previous trial results, or may not be predictive of real - world results or of results in subsequent trials; risks and uncertainties relating to competitive products and technological changes that may limit demand for our drugs; risks that our drugs may be precluded from commercialization by the proprietary rights of third parties; risks that Chimerix will not obtain a procurement contract for BCV in smallpox in a timely manner or at all; risks that the anticipated benefits of the acquisition of Oncoceutics may not be realized and additional risks set forth in the Company's filings with the Securities and Exchange Commission. These forward - looking statements represent the Company's judgment as of the date of this release. The Company disclaims, however, any intent or obligation to update these forward - looking statements.

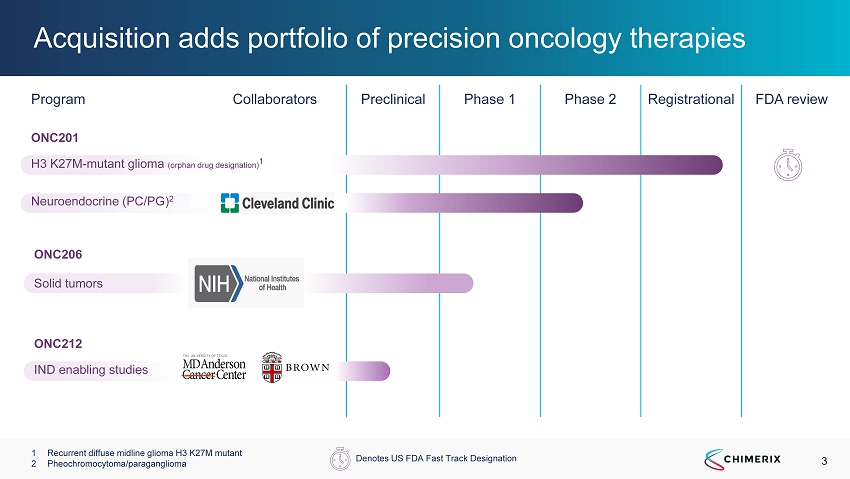

3 Program Collaborators Preclinical Phase 1 Phase 2 Registrational FDA review Acquisition adds portfolio of precision oncology therapies 1 Recurrent diffuse midline glioma H3 K27M mutant 2 Pheochromocytoma/paraganglioma IND enabling studies ONC212 ONC201 H3 K27M - mutant glioma (orphan drug designation) 1 Neuroendocrine (PC/PG) 2 Solid tumors ONC206 Denotes US FDA Fast Track Designation

4 ONC201 provides attractive near - term opportunity ▪ Unprecedented single agent activity in recurrent H3 K27M mutant glioma - Currently no effective therapeutic options for these patients ▪ Clear path to registration, pivotal data anticipated in 2021 - FDA discussions highlight path to potential accelerated approval using Overall Response Rate (ORR) in defined population - Registration cohort enrolled (diffuse midline mutant), interim data available ▪ Attractive commercial market potential - >$500M global peak sales opportunity in first indication - Extraordinary awareness of ONC201 among KOLs - Mutation already routinely identified through standard diagnostics ▪ Compelling single agent response in second indication ▪ Strong IP portfolio into mid to late 2030s ▪ Path ahead leverages organizational strengths

5 Recurrent H3 K27M+ recurrent glioma, a devastating disease where single agent responses are rare and lack durability ▪ Most frequent histone mutation in glioma - Frequent (>50%) in younger patients with midline brain tumors - Classified as grade IV by WHO, regardless of diffuse glioma histology - Mutation routinely identified via immunohistochemistry (IHC) or next generation sequencing (NGS), e.g. Foundation One ▪ No effective therapy - Often not possible to resect - Recurrence inevitable after first - line radiation - Invariably lethal; ~8 months median overall survival - Chemotherapy ineffective; objective responses by RANO - HGG 1 rarely observed 1 Response Assessment in Neuro - Oncology - High Grade Glioma 2 Data collected from 17 literature sources since 2010 with trial arms size >30 pts each reporting data on 1937 pts with recurr ent , unstratified disease. 13 trials were in post - TMZ patients and four trials with 282 pts did not explicitly declare prior TMZ, rather “radiothe rapy + chemo” GBM (Grade IV) Grade II - III Glioma Median overall survival weighted average: ~8 months in recurrent glioma 2 post TMZ Bubble size = trial size / number of patients 6 2 7 8 11 9 10 12 Weighted average mOS for historical control Median Overall Survival (Months)

6 H3 K27M - mutant glioma: market dynamics and opportunity ▪ Addressable market - U.S. incidence (annual): ~2,000 ▪ Market research - Nearly all mid - line glioma patients tested for H3 K27M - mutation; rate to increase with targeted therapy - Oncologists consider a therapy for recurrent H3 K27M - mutant gliomas to be clinically meaningful if it demonstrates ~20% ORR and/or clinically relevant durability - ONC201 use expected in >80% of H3 K27M - mutant glioma patients based on current profile - There is interest in using ONC201 in combination with radiation if possible, in the front - line setting ▪ Competitive landscape: chemotherapy and bevacizumab ineffective; targeted agents, vaccines and CAR - T therapies are in early development with limited efficacy analysis available ▪ Low barriers to adoption - No effective treatment options available - K27M already on commercial and site - specific NGS panels, oral dosing (QW), good safety profile - High unaided awareness of ONC201 among neuro - oncologists - Longer - term, potential combinable with other glioma therapies

7 -100 -75 -50 -25 0 25 50 75 100 B e s t c h a n g e i n t a r g e t l e s i o n ( s ) f r o m b a s e l i n e ( % ) Compelling ONC201 responses in recurrent H3 K27M mutant disease drives strong KOL engagement ▪ 30% ORR by BICR in first 30 patients ▪ Maturing data from the next 20 patients so far demonstrated: - 2 additional responders by investigator assessment - 4 additional patients remain on therapy >6 months ▪ ORR from full cohort supported by - Clinically relevant durability - Clinically relevant disease control in non - responders - Other clinical benefits (e.g., reduction in steroid use, improved performance status) - Complete responses - Objective responses in CNS tumors exclusive to H3 K27M mutations Assessed using RANO - HGG; T1 Contrast Enhancement Data cutoff for ONC006 study is November 17,2020, others is December 4, 2020 * Active on ONC201 * * * * * * * PR SD PD Waterfall plot reflects 47 subjects; 3 subjects do not have on - treatment tumor assessments available but were PD Some eligibility and response data is based on unlocked CRFs that are subject to change with additional monitoring Response by BICR Response by investigator (pending BICR) Active/Potential Future Responder Non - responder

8 Meaningful durability of response Expected ≥20% ORR in registration cohort (n=50) Response Summary * ▪ Subject to change with maturing data ▪ Meaningful duration of response - mPFS among responders: > 15 months ▪ 9 responses by BICR ▪ 2 new responses by investigator assessment (to be assessed by BICR) ▪ 4 patients on therapy >6 months who could still achieve response * All responses planned to be reconfirmed by a three - party adjudicated blinded independent central review in 2021 Data cutoff for ONC006 is November 17,2020, others is December 4, 2020 0 5 10 15 -100 -75 -50 -25 0 25 50 75 100 30 35 40 Months C h a n g e i n t a r g e t l e s i o n f r o m b a s e l i n e ( % ) Solid lines indicate BICR assessment Dashed lines indicate investigator assessment post - BICR Assessed using RANO - HGG; T1 Contrast Enhancement Response by BICR Response by investigator (pending BICR) Active/Potential Future Responder Non - responder PR SD PD Waterfall plot reflects 47 subjects; 3 subjects do not have on - treatment tumor assessments available but were PD Some eligibility and response data is based on unlocked CRFs that are subject to change with additional monitoring

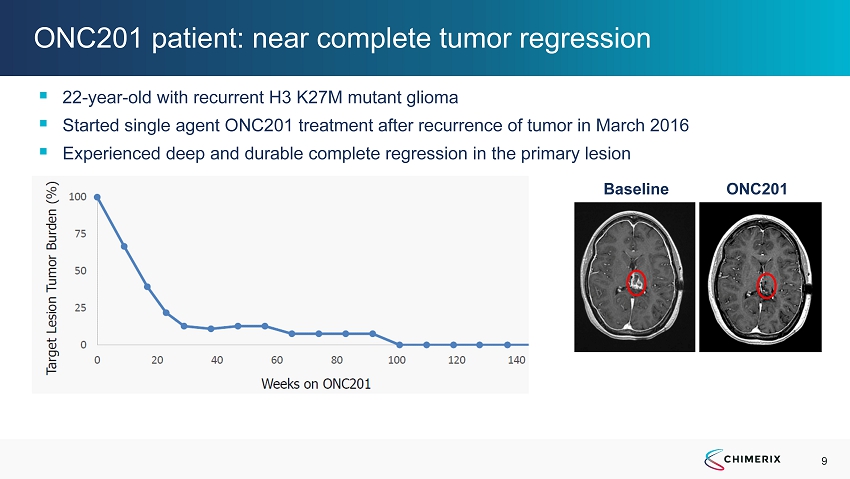

9 ONC201 patient: near complete tumor regression ▪ 22 - year - old with recurrent H3 K27M mutant glioma ▪ Started single agent ONC201 treatment after recurrence of tumor in March 2016 ▪ Experienced deep and durable complete regression in the primary lesion Baseline ONC201

10 ▪ 55 - year - old received single agent ONC201 at recurrence following radiation therapy (RT) and temozolomide (TMZ) ▪ Objective partial response was associated with normalization of neurological deficits by NANO 1 within two cycles - Improved gait - Improved facial strength - Improved language ▪ Radiographic response and neurologic response >7 months ONC201 partial responses have driven clinical benefit in recurrent H3 K27M - mutant glioma 1 Neurological Assessment in Neuro Oncology

11 Upon full maturation, ONC201 median overall survival data is expected to compare favorably to historical controls ONC201 OS by line of therapy in recurrent H3 K27M+ glioma patients ONC201 OS compares favorably with historical benchmarks in recurrent patients 1 ONC201 Registrational Cohort 2 * GBM (Grade IV) Grade II - III Glioma 1 Data collected from 17 literature sources since 2010 with trial arms size >30 pts each reporting data on 1,937 pts with recur ren t, unstratified disease. 13 trials were in post - TMZ patients while four trials with 282 pts did not explicitly declare prior TMZ, rather “radiot herapy + chemo” 2 50 K27M+ recurrent patients treated with ONC201 (38% GBM) ^ last patient is censored at 53.3 months 2 6 7 8 9 10 11 12 13 14 13.6 mos Bubble size = trial size / number of patients N= 1,937 patients Weighted average mOS for historical control Median Overall Survival (Months)

12 ▪ Integrated safety database for NDA will consist of >350 glioma patients ▪ No discontinuations due to drug - related adverse events (AEs) ▪ Single weekly dosing until progression ▪ Safety profile and oral dosing enable: - Fixed dosing in adults - High rate of compliance - Multiple therapeutic settings - Combination therapies ONC201 demonstrates attractive safety profile, oral administration AEs in Recurrent H3 K27M - mutant Glioma Patients (N=30) All AEs reported in >10% of pts with at least one event attributed by investigator as a least possibly - related to study drug All TEAE N (%) Gr3 - 4 TEAE N (%) ONC201 - Related All TEAE N (%) Subjects with at least one TEAE 30 (100%) 18 (60%) 6 (20%) Nervous system disorders 24 (80%) 8 (26.7%) - Headache 7 (23.3%) 1 (3.3%) - Hemiparesis 7 (23.3%) 2 (6.7%) - Paraesthesia 7 (23.3%) - - Dizziness 5 (16.7%) - - Gastrointestinal disorders 19 (63.3%) - 4 (13.3%) Nausea 9 (30.0%) - 3 (10.0%) Vomiting 8 (26.7%) - 2 (6.7%) General disorders and administration site conditions 17 (56.7%) 6 (20.0%) 3 (10.0%) Fatigue 14 (46.7%) 4 (13.3%) 3 (10.0%) Gait disturbance 8 (26.7%) 3 (10.0%) - Investigations 17 (56.7%) 6 (20.0%) 3 (10.0%) Lymphocyte count decreased 6 (20.0%) 2 (6.7%) 1 (3.3%) Platelet count decreased 5 (16.7%) - 1 (3.3%) Weight increased 4 (13.3%) 1 (3.3%) - Metabolism and nutritional disorders 15 (50.0%) 4 (13.3%) 2 (6.7%) Hyperglycaemia 5 (16.7%) 1 (3.3%) 1 (3.3%) Hypoalbuminaemia 4 (13.3%) - 1 (3.3%) Infections and infestations 12 (40.0%) 2 (6.7%) - Urinary tract infection 4 (13.3%) 1 (3.3%) - Upper respiratory tract infection 3 (10.0%) - -

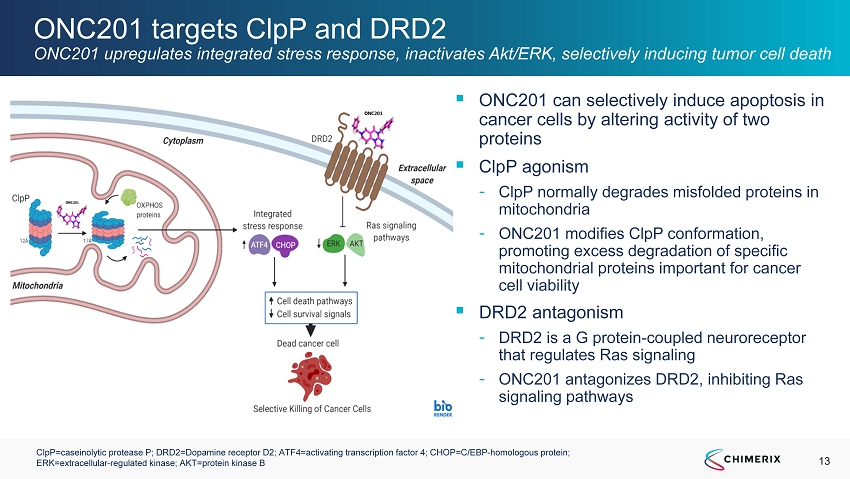

13 ONC201 targets ClpP and DRD2 ONC201 upregulates integrated stress response, inactivates Akt/ERK, selectively inducing tumor cell death ▪ ONC201 can selectively induce apoptosis in cancer cells by altering activity of two proteins ▪ ClpP agonism - ClpP normally degrades misfolded proteins in mitochondria - ONC201 modifies ClpP conformation, promoting excess degradation of specific mitochondrial proteins important for cancer cell viability ▪ DRD2 antagonism - DRD2 is a G protein - coupled neuroreceptor that regulates Ras signaling - ONC201 antagonizes DRD2, inhibiting Ras signaling pathways ClpP=caseinolytic protease P; DRD2=Dopamine receptor D2; ATF4=activating transcription factor 4; CHOP=C/EBP - homologous protein; ERK=extracellular - regulated kinase; AKT=protein kinase B

14 H3 K27M - mutant gliomas exhibit enhanced sensitivity to ONC201 Lowe et al., Cancers, 2019; Chi et al., Society of Neuro - Oncology, 2017; Kawakibi et al, Society of Neuro - Oncology, 2019; Koschmann et al., Pediatric Society of Neuro - Oncology 2019; Prabhu et al, Clinical Cancer Research, 2018; Ishizawa et al, Cancer Cell, 2019; Prabhu et al., Society of Neuro - Oncology, 2019, Piccardo et al., Eur J. Nucl Med Mol Imaging, 2019 High sensitivity to ONC201 Lysine to methionine (“K - to - M”) histone H3 mutation reduces H3 K27 methylation H3 K27M elevates DRD2 expression K27M mutants bind PRC2 which normally methylates H3 K27 via EZH1/2; binding/tethering PRC2 prevents methylation of even nonmutant H3 K27 Midline tumors occur in dopamine - rich regions of the brain 18F - DOPA PET

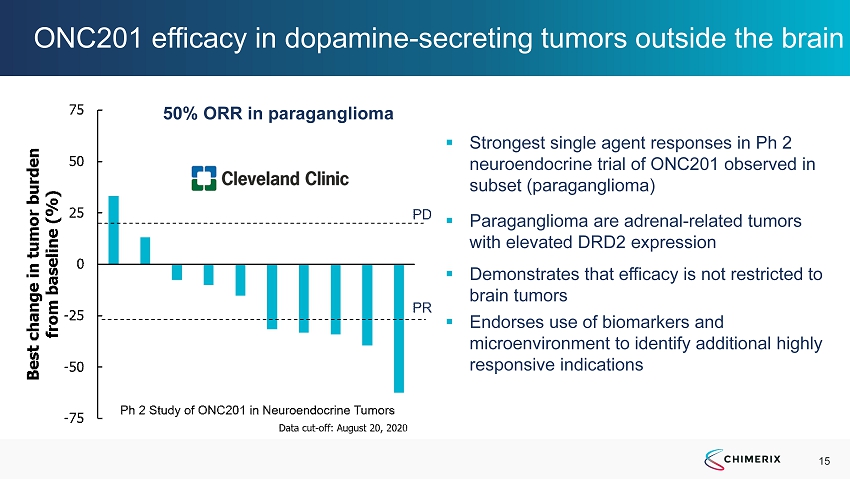

15 ONC201 efficacy in dopamine - secreting tumors outside the brain ▪ Strongest single agent responses in Ph 2 neuroendocrine trial of ONC201 observed in subset (paraganglioma) ▪ Paraganglioma are adrenal - related tumors with elevated DRD2 expression ▪ Demonstrates that efficacy is not restricted to brain tumors ▪ Endorses use of biomarkers and microenvironment to identify additional highly responsive indications 50% ORR in paraganglioma

16 Key regulatory communications: potential path to approval ▪ Homogenously defined population in recurrent diffuse midline glioma, H3 K27M - mutant, as defined by cIMPACT NOW Update 2, may be acceptable for approval ▪ FDA acknowledged that “available therapy” is considered palliative (i.e. there is no available treatment for recurrent H3 K27M mutant diffuse midline glioma) ▪ FDA acknowledged integrated safety database of approximately 350 patients ▪ Approval may be granted based on Overall Response Rate (ORR) by RANO - HGG 1 ▪ Based on FDA discussions, the registration cohort will be comprised of 50 subjects pooled across multiple company - sponsored clinical studies and expanded access ▪ Initial EMA discussions have indicated durable ORR may be an acceptable endpoint for EU marketing authorization 1 Response Assessment in Neuro - Oncology - High Grade Glioma

17 ONC201 FDA designations Orphan Drug Designation (ODD) (treatment of glioblastoma and treatment of malignant glioma) Fast Track Designation (FTD) for adult recurrent H3 K27M - mutant high - grade glioma Rare Pediatric Disease Designation for treatment of H3 K27M mutant glioma ▪ Potential to receive rare pediatric voucher 1 1 Subject to continuation of Rare Pediatric Disease Voucher Program and proceeds from voucher will be split 50/50 with legacy Oncoceutics shareholders

18 Promising pipeline in development ONC206 : ▪ Differentiated DRD2 antagonist + ClpP agonist ▪ Phase 1 for recurrent CNS tumors ONC212 : ▪ GPR132 agonist + ClpP agonist ▪ IND - enabling studies

19 Deal terms ▪ Acquisition of Oncoceutics, Inc. including ONC201, ONC206 and ONC212 ▪ Financial Terms - Upfront Consideration = $78M • $39M in equity ~8.7M shares • $39M in cash ($14M deferred for one year) - Milestones (m/s) • Efficacy m/s: $20M with ONC201 BICR 1 ORR 1 ≥ 20% • Regulatory approval (US and EU) m/s for ONC201 up to $60M 2 • Regulatory approval (US and EU) m/s for ONC206 and ONC - 212 up to $30M • Sales m/s on combined net sales of ONC201/ONC206 totaling up to $250M - Royalty: • 15% royalty on combined net sales of ONC201/ONC206 up to $750M, 20% in excess of $750M ▪ Simultaneous signing and closing 1 Blinded Independent Central Review; Overall Response Rate by RANO - HGG 2 US: $30M first indication, $10M second indication, $5M third indication. EU: $15M first indication. No milestone to be paid mo re than once

20 Financial Summary ▪ Cash balance of approx. $78M at 12/31/2020 ▪ Several levers available for additional capital: - Expected significant non - dilutive proceeds from potential BCV stockpiling in 2021 - Global rights to most programs - Several 2021 catalysts provides additional optionality ▪ ~71 million shares outstanding post transaction Dollars (millions) Sept YTD 2020 R&D $ 27.5 G&A 9.5 Total operating expenses 37.0 Net income(loss) (31.8) Ending Cash balance $ 87.8 Shares outstanding 62.6

21 Corporate Summary

22 Major, near - term paths to value ▪ Final steps toward BCV (smallpox) potential commercialization - NDA filed, April 7, 2021 PDUFA date - Satisfies second mandate for 2 nd countermeasure for strategic national stockpile - Potential $80 - $100m annual cash flow for next 5 - 12 years ▪ Synergistic acquisition of precision oncology platform - Potential near - term registration path - Blinded independent central review of ONC201 data in 2021 (recurrent H3 K27M mutant glioma) - Opportunities for new indications and pipeline expansion ▪ DSTAT development in two therapeutic areas with significant unmet need - Phase 3 front - line AML trial to initiate early this year - Enrolled first cohort in COVID - 19 Phase 2 trial – preliminary data expected in 1Q2021

23 Program Collaborators Preclinical Phase 1 Phase 2 Registrational FDA review Deep pipeline across all development stages IND enabling studies ONC212 ONC201 H3 K27M - mutant glioma (orphan drug designation) 1 Neuroendocrine (PCPG) 2 DSTAT Acute Myeloid Leukemia (orphan drug designation) COVID - 19 Solid tumors ONC206 BCV Smallpox (orphan drug designation) PDUFA date April 2021 1 Recurrent diffuse midline glioma H3 K27M mutant positive 2 Pheochromocytoma/paraganglioma Denotes US FDA Fast Track Designation

24 DSTAT AML: x End of Ph2 FDA meeting x Confirm endpoint/Ph3 design COVID - 19 Acute Lung Injury: x IND; FDA alignment of Ph2/3 design, endpoint x Ph2/3 study initiation AML: ▪ Planned initiation of Ph3 study COVID - 19 Acute Lung Injury: ▪ Final data on Ph2 trial ▪ Potential initiation of Ph3 study Delivery of 2020 objectives sets stage for catalyst rich 2021 2020 2021 ▪ FDA decision on smallpox NDA in April ▪ Potential for BARDA procurement contract ▪ Potential for ~$100m of BCV for Strategic National Stockpile x Complete PK dose bridging studies x Pre - NDA Meeting with FDA x BARDA and FDA clearance to begin rolling NDA submission x Completion of rolling NDA Submissions BCV ONC201 ONC206 ONC212 ▪ BICR of ONC201 registration cohort ▪ ONC201 pre - NDA meeting preparations ▪ Potential ONC206 clinical outcomes ▪ IND preparations for ONC212 x Potential registration path defined through FDA type C meetings x ONC201 registration cohort enrollment completed x 30% PR/CR in 1 st 30 patients (blinded read) x ONC206 Ph 1 initiation

25 Accelerating development through disciplined investment Source of non - dilutive capital directed toward innovative oncology development Focus on oncology areas of high unmet need supported by strong clinical data BCV for strategic national stockpile – smallpox outbreak preparation, PDUFA date April 2021 Culture of collaboration yields better decisions, stronger execution ONC201/ONC206/ONC212 • Glioma registration opportunity • New indication & pipeline expansion DSTAT • Phase 3 front - line AML trial • Phase 2 COVID - 19 trial Targeted investments gated by objective data assessments -100 -75 -50 -25 0 25 50 75 100 B e s t c h a n g e i n t a r g e t l e s i o n ( s ) f r o m b a s e l i n e ( % )

Acquisition of Oncoceutics Adds Precision Oncology Pipeline with Near - term Registration Potential