Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - MINISTRY PARTNERS INVESTMENT COMPANY, LLC | c130-20210106xex23_1.htm |

| EX-10.36 - EX-10.36 - MINISTRY PARTNERS INVESTMENT COMPANY, LLC | c130-20210106xex10_36.htm |

| EX-5.2 - EX-5.2 - MINISTRY PARTNERS INVESTMENT COMPANY, LLC | c130-20210106xex5_2.htm |

Registration File No. 333-250027

united states

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Ministry Partners Investment Company, LLC

________________________________________________________________________________________________________________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

|

California |

6199 |

26-3959348 |

|

(State of or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

915 West Imperial Highway, Suite 120

Brea, California 92821

(714) 671-5720

_____________________________________________________________________________________________________________________________________________________

(Address, including zip code, and telephone number,including area code, of registrant’s principal executive offices)

JOSEPH W. TURNER, JR.

Chief Executive Officer, President

915 West Imperial Highway, Suite 120

Brea, California 92821

(714) 671-5720

______________________________________________________________________________________________________________________________________________________________________________________________________________

(Name, address and telephone number of agent for service)

With copies to:

RANDY K. STERNS, ESQ.

BUSH ROSS, P.A.

1801 N. Highland Avenue

Tampa, Florida 33602

(813) 224-9255

As soon as practicable after the Registration Statement becomes effective.

_______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐Accelerated filer ☐

Non-accelerated filer ☐Smaller reporting company ☑

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

CALCULATION OF REGISTRATION FEE |

||||

|

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED |

AMOUNT TO BE REGISTERED |

PROPOSED MAXIMUM OFFERING PRICE PER SHARE (1) |

PROPOSED MAXIMUM AGGREGATE OFFERING PRICE (2) |

AMOUNT OF REGISTRATION FEE (3) |

|

2021 Class A Notes, Fixed Series |

$125,000,000 |

par |

$125,000,000 |

|

|

2021 Class A Notes, Variable Series |

$125,000,000 |

par |

$125,000,000 |

|

|

Total |

$125,000,000 |

par |

$125,000,000 |

$12,852 |

___________________________________________________

(1) The notes will be sold at their face amount.

(2) A total of $125,000,000 of the 2021 Class A Notes is being registered, consisting of a combination of the Fixed Series and/or Variable Series.

(3) The fee is based on the total of $125,000,000 of 2021 Class A Notes being registered hereby. As discussed below, pursuant to Rule 415(a)(6) under the Securities Act, this Registration Statement includes $7,197,498 of unsold securities that have been previously registered. The securities being carried forward to this Registration Statement reduce the amount of fees currently due to $12,852.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a) may determine.

Pursuant to Rule 415(a)(6) under the Securities Act of 1933, as amended, the securities registered pursuant to this Registration Statement include unsold securities previously registered for sale pursuant to the Registrant’s Registration Statement on Form S-1 (File No. 333-221954) initially filed by the Registrant on December 8, 2017 (the “Prior Registration Statement”). The Prior Registration Statement registered securities with a maximum offering price of $90 million for sale pursuant to the Registrant’s offering. Of the amount being registered by this Registration Statement, approximately $18,003,190 of offering securities remain unsold from the Prior Registration Statement. This unsold amount is being carried forward to this Registration Statement and the filing fees paid with respect to the prior registration of the unsold securities is being used to offset filing fees that would otherwise be due in connection with the filing of this Registration Statement. Pursuant to Rule 415(a)(6), the offering of unsold securities under the Prior Registration Statement will be deemed terminated as of the date of effectiveness of this Registration Statement. As of September 30, 2020, we have issued Notes with an aggregate principal amount of approximately $72.0 million under the Prior Registration Statement.

Explanatory Note

This Registration Statement is being filed to register the sale of the Company’s unsecured promissory notes as the Company’s Registration Statement for its continuous offering of its Class 1A Notes under Rule 415 expired on December 31, 2020. The 2021 Class A Notes issued under this Registration Statement will replace the Company’s current offering of Class 1A Notes, the Registration Statement for which will be withdrawn when the subject Registration Statement is declared effective.

|

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

Subject to Completion

PRELIMINARY PROSPECTUS

DATED JANUARY 6, 2021

$125,000,000

MINISTRY PARTNERS INVESTMENT COMPANY, LLC

2021 Class A Promissory Notes

We are offering our 2021 Class A Notes in two Series: the Fixed Series and the Variable Series in several Categories, each of which has a minimum required investment. The 2021 Class A Notes, which we sometimes refer to as the “Notes”, are our unsecured and unsubordinated obligations and, except as described herein, rank equal in right to payment with our existing and future unsecured creditors. Each Note Series bears interest at a rate equal to the sum of the Spread for the respective Series Category plus the applicable index rate. The Fixed Series Notes are offered with maturities of 12, 18, 24, 30, 36, 42, 48, 54 and 60 months and the Variable Series Notes are offered with a maturity of 60 months. The interest rates for each Note series will vary within the pre-determined interest rate and Spread as described in the Prospectus. Unless otherwise indicated, the words “we”, “us”, “our” or the “Company” refer to Ministry Partners Investment Company, LLC, together with four wholly owned subsidiaries.

We are offering the Notes on a best efforts basis through our wholly-owned subsidiary, Ministry Partners Securities, LLC (“MP Securities”). At any time, you may contact us or visit our website at www.ministrypartners.org to obtain our current interest rates for each Note Series. However, the information on our website is not part of this Prospectus. If there is a change in terms of the Notes that does not constitute a material and fundamental change in the offering of such Notes, this information will be included in a Rule 424(b)(3) prospectus supplement.

INVESTING IN THE NOTES INVOLVES RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL. SEE “RISK FACTORS” BEGINNING ON PAGE 19. THERE WILL BE NO PUBLIC MARKET FOR THE NOTES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO SELL SECURITIES IN ANY STATE TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER IN SUCH STATE.

|

|

Offering Price |

Maximum Commissions(1) |

Proceeds to the Company(2)(3) |

|

Minimum Purchase |

$1,000 |

$55 |

$945 |

|

Total |

$125,000,000 |

$6,875,000 |

$18,125,000 |

|

(1) |

The gross maximum compensation paid to MP Securities for serving as the Company’s selling agent will not exceed 5.5%. See “Plan of Distribution – Underwriting Compensation We Will Pay”. |

|

(2) |

We may incur an estimated $290,000 of other expenses of issuance and distribution (“Issuance and Distribution Expenses”) and up to an estimated $2,384,424 of additional expenses which may be considered additional organization and offering expenses (“Organization and Offering Expenses” by the Financial Industry Regulatory Authority (“FINRA”) under the FINRA Rules (see “Estimated Use of Proceeds” on page 40 and “Plan of Distribution” on page 135.) |

The Notes are part of up to $300 million of 2021 Class A Notes we are authorized to issue under the 2021 Class A Note Trust Indenture, which we refer to as the “Indenture.” U.S. Bank National Association, whom we refer to as “Trustee,” serves as the Trustee under the Indenture.

You should read this Prospectus and any applicable Prospectus supplement carefully before you invest in the Notes. The Notes are our general unsecured obligations and are subordinated in right of payment to all of our present and future senior debt. As of September 30, 2020, we had approximately $116.5 million in debt outstanding that ranks equal or senior to the Notes, including approximately $64.0 million in Notes issued pursuant to our prior offerings. We expect to incur additional debt in the future, including, without limitation, the Notes offered pursuant to this Prospectus and senior debt.

The Notes and other securities we offer are not deposits of, obligations of, or guaranteed by any of these credit unions. They are not insured or guaranteed by the National Credit Union Share Insurance Fund (“NCUSIF”), the Federal Deposit Insurance Corporation (“FDIC”), or any other government agency or private insurer.

We are a “smaller reporting company” under the federal securities laws and subject to reduced public company reporting requirements.

The current Rate Schedule and any other supplements to this Prospectus are placed inside this front cover.

The date of this Prospectus is January 6, 2021

Ministry Partners Securities, LLC

Table of Contents

|

Page |

|

| 1 | |

| 1 | |

| 10 | |

| 13 | |

| 18 | |

| 19 | |

| 40 | |

| 42 | |

| 48 | |

| 55 | |

| 83 | |

| 91 | |

|

DESCRIPTION OF OUR MEMBERSHIP INTERESTS AND CHARTER DOCUMENTS |

93 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

96 |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

98 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

127 |

| 132 | |

| 134 | |

| 135 | |

| 139 | |

| 140 | |

| 140 | |

| 140 | |

|

F-1 |

|

|

A-1 |

|

|

B-1 |

|

|

C-1 |

|

|

D-1 |

YOU SHOULD RELY ONLY ON INFORMATION CONTAINED IN THIS PROSPECTUS. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION DIFFERENT FROM THAT CONTAINED IN THIS PROSPECTUS. WE ARE OFFERING TO SELL AND SEEKING OFFERS TO BUY NOTES ONLY IN JURISDICTIONS WHERE OFFERS AND SALES ARE PERMITTED. THE INFORMATION CONTAINED IN THIS PROSPECTUS IS ACCURATE ONLY AS OF THE DATE OF THIS PROSPECTUS, REGARDLESS OF THE TIME THE PROSPECTUS MAY BE DELIVERED OR OF ANY SALE OF THE NOTES.

We have prepared this Prospectus so that you will have the information necessary to make your investment decision. Please read this Prospectus carefully. It describes the Notes, the risks involved in investing in the Notes, our Company and our business, and our financial condition. We refer to the registered owner of a Note as a “Noteholder” or “Holder”.

2

FREQUENTLY ASKED QUESTIONS ABOUT THE NOTES

|

Q: |

Where can I find the definitions of the terms you use in this Prospectus? |

|

A: |

Unless otherwise defined in this Prospectus, or unless the context in which the term is used requires a different meaning, terms used in this Prospectus, whether capitalized or used in the lower case, have the meanings set forth in the Definitions section of the Indenture, which is included as Exhibit A to this Prospectus. |

|

Q: |

Who are you? |

|

A: |

We are Ministry Partners Investment Company, LLC, a California limited liability company. We were established in 1991 as a credit union service organization. We are owned by certain state and federal chartered credit unions. We are a Christian ministry that provides financial services, investment products, and financing solutions for churches, colleges, schools, and ministry organizations, individuals, and businesses. Churches and ministry related properties substantially secure all of our mortgage loans. |

|

Q: |

How would my interest rate on an investment in a Fixed Series Note be determined? |

|

A: |

Suppose you purchase a Fixed Series, Category Fixed 25 Note with a 24-month maturity when the index established for 24-month obligations was 0.13% and our Fixed Spread for Category Fixed 25 Note is 2.10%. Then the interest rate payable on your Category Fixed 25, Fixed Series Note would be the stated index set for our Fixed Series Notes plus the applicable Spread, or 2.23%. |

|

Q: |

What is the CMT Index? |

|

A: |

The CMT Index refers to the Constant Maturity Treasury rates published by the U.S. Department of the Treasury for actively traded Treasury securities in over the counter trading transactions. The CMT Index daily rates for one, two, three, and five year Treasury securities can be found at www.treasury.gov. We will use the average of the three and five year daily rates to establish the CMT Index for a four year Fixed Series 2021 Class A Note. |

3

|

Q: |

How would my investment in a Variable Series Note work? |

|

A: |

If you purchase a Variable Series Note for $78,000, you will receive a Variable 50 Note which will bear interest at a rate equal to the sum of the Variable Index interest rate then in effect plus the Variable Spread for the respective category for such Note. The interest rate on your Variable 50 Note will be adjusted monthly based on the Variable Index in effect on each adjustment date. Your Variable 50 Note will have a maturity of 60 months. However, we will repay all or part of your Variable 50 Note at your request at any time after your Note has been outstanding with an unpaid principal balance of $10,000 or more. |

|

Q: |

What is the Variable Index interest rate? |

|

A: |

The Variable Index interest rate is the then current interest rate reported by the Wall Street Journal for the LIBOR rate for three month obligations. |

|

Q: |

What is the Fixed Spread and Variable Spread? |

|

A: |

The difference or “spread” between the applicable index rate and the interest rate we agree to pay you on the Note you purchase is the fixed or variable spread (the “Fixed Spread” or “Variable Spread”). The applicable Fixed or Variable Spread is different for each Series and Category of Note. |

|

Q: |

What is the Effective Variable Spread Grid? |

|

A: |

This is the Variable Spread Grid that is in effect on the day you purchase a Note. The Effective Variable Spread Grid tells you what spread you will receive for each of the Variable Series Note Categories. The Variable Spread Grid in effect as of the date of this Prospectus can be found in the “Prospectus Summary” under the caption “The Variable Series Notes”. For example, if you purchase a Note under the Effective Variable Spread Grid in effect as of the day of this Prospectus and your Note had a balance of $10,000, your spread would be 0.60%. If the following month you deposited additional funds into your Variable Series Note and the Note balance was $100,000, the Variable Spread on your Note would be 1.10%. Once you purchase your Note, the Effective Variable Spread Grid for your Note will not change. |

|

Q: |

Can you change the Fixed Spread or Variable Spread Grid on the Notes when there is a significant change in interest rates? |

|

A: |

We reserve the right to adjust the Fixed Spread or Effective Variable Spread Grid prospectively to adjust to rapid changes in interest rates or market conditions; provided, however that such adjustment does not exceed 2.00% or 200 basis points in the applicable Fixed Spread or exceed 1.00% or 100 basis points in the applicable Variable Spread Grid. |

||

4

|

Q: |

Can you change the Fixed Spread or Effective Variable Spread Grid on my Note after I buy it? |

|

A: |

No. |

|

Q: |

How often do you pay interest? |

|

A: |

Your Note accrues interest monthly. You may choose to have interest that accrues on your Note paid monthly, quarterly, semi-annually or annually. You may also choose to elect to have payment of interest on your Note deferred and added to the principal of your Note (the “Interest Deferral Election”). Unless you specify otherwise, we will pay accrued interest on your Note monthly. |

|

Q: |

Can I require you to cash in my Note before it is due? |

|

A: |

You can require us to prepay your Variable Series Note, subject to certain restrictions. You cannot require us to pay a Fixed Note before it is due; however, in the event of an emergency, you can request early payment of all or a portion of a Fixed Note as explained in the following question and answer. |

|

Q: |

What if I have an emergency and I need to cash in my Note? |

|

A: |

You can request that we voluntarily prepay your Note in whole or in part. We are not contractually obligated to grant your request for prepayment but may do so at our discretion. Our current policy is to grant a reasonable request due to a bona fide hardship, subject to availability of funds. However, there is no assurance we will continue this policy in the future. In the event we agree to prepay all or portion of your Note, we may deduct from the amount we prepay an administrative charge of an amount equal to three months’ interest. |

|

Q: |

Do you have the right to prepay my Note? |

|

A: |

Yes, we can prepay or redeem any Note by giving you at least 30 days’ (and not more than sixty (60) days) written notice of the redemption date. On the date of redemption, we must pay you outstanding principal plus all accrued interest thereon through the redemption date. We do not have to pay you a premium if we redeem your Note early. If less than all of the Notes outstanding are redeemed, we will redeem the Notes on a pro rata basis. |

|

Q: |

What is your obligation to pay my Note? |

|

A: |

Your Note is equal in right to payment with our other unsecured creditors. Your Note is unsecured and is not guaranteed by any of our Managers (each a “Manager”, and collectively “Managers”), our equity owners, or any other person. |

5

|

Q: |

Does any Series or Category of the Notes have priority as to payment over any other Series or Category? |

|

A: |

The 2021 Class A Notes and our other unsecured debt obligations are equal in right to payment of principal and interest. We sometimes refer to this equal priority as a Note being in “pari passu” with the other 2021 Class A Notes. As of September 30, 2020, we have issued $6.5 million in secured notes (which we refer to as the “Secured Notes”). These Secured Notes are secured by certain of our mortgage loans and, to the extent of such collateral, are superior in right to payment over the 2021 Class A Notes and our other unsecured debt. |

|

Q: |

Who is responsible for making payments of principal and interest on the Notes? |

|

A: |

We act as paying agent for the Notes. We must certify to the Trustee that we are current on all payments then due on each outstanding Note. |

|

Q: |

Why is there an Indenture? |

|

A: |

We require that you execute the Indenture in order to: |

|

|

• |

establish the common terms and conditions for the Notes and a means by which the Noteholders can act in an organized manner; |

|

|

• |

provide for the appointment of an independent Trustee and allow us to deal with a single representative of the Holders with respect to matters addressed in the Indenture, including in the event of our default; and |

|

|

• |

authorize the Trustee to monitor our compliance with the Indenture, to give timely notices to the Holders, and to act for the Holders in the event of a default and in regard to other matters. |

|

|

As required by U.S. federal law, the Notes are governed by the Indenture. The Indenture constitutes an “indenture” under the Trust and Indenture Act of 1939. An Indenture is a contract between us, you as Holders and the Trustee, who is appointed to serve under and pursuant to the Indenture. |

|

Q: |

Do I have to abide by the terms of the Indenture? |

|

A: |

Yes. Your Note is issued pursuant to the terms of the Indenture and your Note is subject to its terms and conditions. As a condition to your purchase of a Note and your becoming the registered owner of the Note, you become a party to the Indenture. |

|

Q: |

What is the Trust Indenture Act of 1939? |

|

A: |

The Trust Indenture Act of 1939, or as we refer to it, the “1939 Act,” provides that unless exempt, Notes sold to the public in a registered offering must be governed by a Trust Indenture, as defined, and the Notes must be registered by the issuer under the 1939 Act. The 1939 Act further provides that the Trust Indenture must contain certain protective provisions benefiting the owners of the debt covered by the Indenture. We have registered the Notes under the 1939 Act. |

6

|

Q: |

Can you modify or amend the Indenture without the consent of the Holders? |

|

A: |

Yes, but only in limited circumstances. We may amend or modify the Indenture with the Trustee without the consent of the Holders to, among other things, add covenants or new events of default for the protection of the Holders; evidence the assumption by a successor trustee under the Indenture; cure any ambiguity or correct any inconsistency in the Indenture or amend the Indenture in any other manner that we may deem necessary or desirable and that will not adversely affect the interests of the Holders of any Series of the outstanding Notes; and establish the form and terms of the Notes issued under the Indenture. |

|

Except in these limited circumstances, we and the Trustee must have the consent of the Holders holding a majority in interest of the Notes (a “Majority Vote”) of each Series and Category then outstanding and affected by the amendment. |

|

Q: |

What promises do you make to the Holders under the Indenture? |

|

A: |

Under the Indenture, we promise or “covenant” to do, among other things, the following: |

|

|

• |

Make timely interest and principal payments on the Notes; |

|

|

• |

Maintain a specified minimum net worth; |

|

|

• |

Not issue certain kinds of additional debt beyond specified limits; |

|

|

• |

Not make certain dividend and other distribution payments to our Members; |

|

|

• |

Not issue unsecured debt that is senior to the 2021 Class A Notes; and |

|

|

• |

Timely make principal and interest payments on the Notes and on our other debt, even if it is junior to the Notes. |

|

Q: |

Who is the Trustee? |

|

A: |

The Trustee is U.S. Bank National Association, a federally chartered trust company which has fiduciary powers and offers comprehensive financial services, including asset management, in all 50 states. |

|

Q: |

What does the Trustee do? |

|

A: |

The Trustee has two main roles under the Indenture: |

|

|

• |

The Trustee performs certain administrative duties for us and you, such as sending you notices; and |

|

|

• |

The Trustee may, at your direction, enforce your rights, including the rights you may have against us if we default. |

|

A: |

Under the Indenture, we agree to pay, and the Trustee agrees to look only to us for payment of, all fees, expenses and expense reimbursements payable to the Trustee under the Indenture. |

|

Q: |

What recourse do the Holders have in the event of a default? |

|

A: |

In the event of a default, the Holders of 25% of the unpaid principal amount of the outstanding Notes may give notice to us and declare the unpaid balance of the Notes immediately due and payable. A Majority Vote of the Holders is required to direct the Trustee to pursue collection of the Notes or any other remedy available under the Indenture by reason of the default. |

|

Q: |

What is an event of default? |

|

A: |

An event of default is an event defined in the Indenture, which if not timely cured, allows you to take action against us for immediate and full payment of your note. Events of default include: |

|

|

• |

Our failure to timely pay interest or principal on your note; |

|

|

• |

Our filing of bankruptcy; |

|

|

• |

Our breach of any of our covenants in the Indenture. |

|

Q: |

Does the Trustee have the right to waive any default on behalf of the Holders? |

|

A: |

Yes, but only with a Majority Vote of the Holders of each Series and Category of note affected by the default. |

|

Q: |

How can the Holders direct the Trustee to act? |

|

A: |

The Holders can direct the Trustee to act on behalf of the Holders by a Majority Vote. |

|

Q: |

What liability does the Trustee have to the Holders? |

|

A: |

The Trustee is charged to conduct itself in a manner consistent with a reasonably prudent person in taking actions directed by the Holders. However, the Trustee disclaims any responsibility with respect to the form of a note or the enforceability of the Notes or the Indenture. |

8

|

Q: |

What reports are you required to provide the Trustee? |

|

A: |

The Indenture requires us to provide the Trustee the following reports. |

|

|

• |

We must provide the Trustee a list of the names and addresses of the current owners of record of the Notes quarterly. |

|

|

• |

We must annually provide the Trustee with a certified statement that we have fulfilled all of our obligations under the Indenture with respect to each Series and Category of Notes for the preceding year. |

|

|

• |

We are required to provide the Trustee with a copy of each report we send to the Holders. |

|

|

• |

We are required to provide the Trustee with a copy of each current quarterly and annual report we file with the SEC under the 1934 Act. |

|

Q: |

For whom might an investment in the Notes be appropriate? |

|

A: |

An investment in our Notes may be appropriate for you if, in addition to meeting the suitability standards described below, you seek to receive current income and to diversify your personal portfolio with an investment in a Note. An investment in our Notes has limited liquidity and therefore is not appropriate if you may require liquidity before maturity of your Note. |

|

Q: |

May I make an investment through my IRA or other tax-deferred account? |

|

A: |

Yes. You may make an investment through your IRA or other tax-deferred account. In making these investment decisions, you should consider, at a minimum, (1) whether the investment is in accordance with the documents and instruments governing your IRA, plan or other account, (2) whether the investment would constitute a prohibited transaction under applicable law, (3) whether the investment satisfies the fiduciary requirements associated with your IRA, plan or other account, (4) whether the investment will generate unrelated business taxable income (UBTI) to your IRA, plan or other account, (5) whether there is sufficient liquidity for such investment under your IRA, plan or other account, and (6) the need to value the assets of your IRA, plan or other account annually or more frequently. You should note that an investment in our Notes will not, in itself, create a retirement plan and that in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code of 1986, as amended. Before you invest in a Note through an IRA or tax deferred account, you should consider applicable suitability standards and investment criteria to ensure that the investment meets your investment objectives for an IRA or tax deferred account. |

9

|

Q: |

Are there fees associated with my investment? |

|

A: |

Yes, but no fees will be assessed by the Company on an investment made by a purchaser in a Note or deducted from the principal balance of a Note purchased, including unpaid interest, due on a Note. Any fees assessed in connection with the purchase of a Note or applied during the period in which a Note is held will be assessed and paid solely by the Company to its wholly-owned subsidiary, MP Securities. When a 2021 Class A Note is purchased, a sales commission equal to 1.50% of the aggregate amount of the principal amount of the Note purchased will be paid to MP Securities, our wholly-owned broker dealer firm. In addition, a processing fee equal to 0.50% of the aggregate amount of a Note purchased will be paid to MP Securities. The initial sales commission and processing fee will be assessed on any new purchase of a Note, including reinvestments made by investors that may have previously purchased one of our publicly offered debt securities. Commencing one year after the purchase of a 2021 Class A Note, an account servicing fee equal to 1% per annum of the principal amount of a Note purchased (“Account Servicing Fee”) will be assessed on a monthly basis and thereafter paid to MP Securities throughout the remaining term of the Note; subject to a maximum gross dealer compensation of 5.5% assessed on any 2021 Class A Note sold. The Account Servicing Fee will be paid by the Company to MP Securities and will not be assessed against a 2021 Class A Note that is purchased by an investor. No Account Servicing Fee will be assessed on any accrued or deferred interest earned but not paid to an investor that purchases a Note. The Account Servicing Fee will not be assessed on the Company’s outstanding Class 1 Notes.

As an example, if you purchased a 2021 Class A Fixed Series Note with a 48-month term in the principal amount of $10,000, an initial sales commission of $150 would be paid on the purchase to MP Securities. In addition, a $50 processing fee would be paid to MP Securities when the investment is made. Commencing one year after the purchase of a 2021 Class A Note, a 1% per annum monthly Account Servicing Fee will be assessed on the principal amount of a Note during the remaining term of the Note. With the purchase of a $10,000, 48 month 2021 Class A Note, for example, the total amount of fees paid to MP Securities over the term of the Note, including the initial sales charge, processing fee and Account Servicing Fee would be $500. The $500 in fees assessed under this example would be paid solely by the Company to MP Securities and will not be charged against the investment made by an investor in a Note. |

10

|

Q: |

Has the Company offered prior investor note programs? |

|

A: |

Yes. Since inception in 1991, the Company has offered and completed 13 national public offerings that were registered with the U.S. Securities and Exchange Commission (“SEC”). The Company has made all required payments of interest and principal due on the investor notes that were issued under these registration statements. Investors in these public offerings have received payment in accordance with their terms in cash or reinvested the proceeds of a note when it matured into a Company offered debt security. The Company’s most recent SEC registered offering of its Class 1A Notes will terminate effective as of December 31, 2020. As of September 30, 2020, of the $90,000,000 authorized to be issued, the Company has sold $70,269,126 of its Class 1A Notes. Each of the prior publicly offered investor note programs offered by the Company were liquidated and terminated in accordance with the terms of the offering and all required payments of principal and interest were made to investors in accordance with the terms of the investor notes. |

|

Q: |

How can I purchase a Note? |

|

A: |

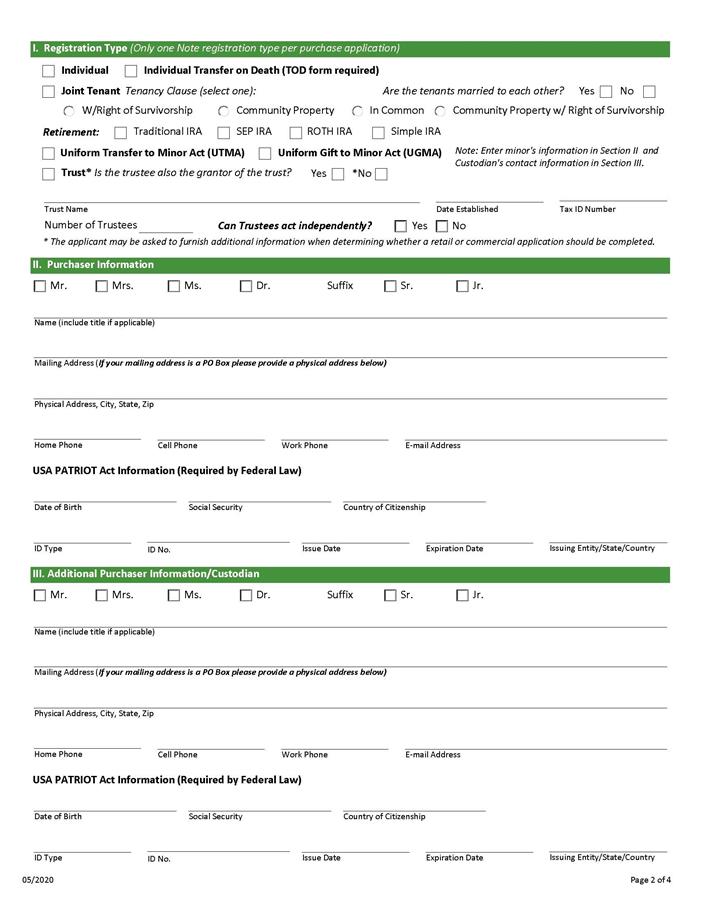

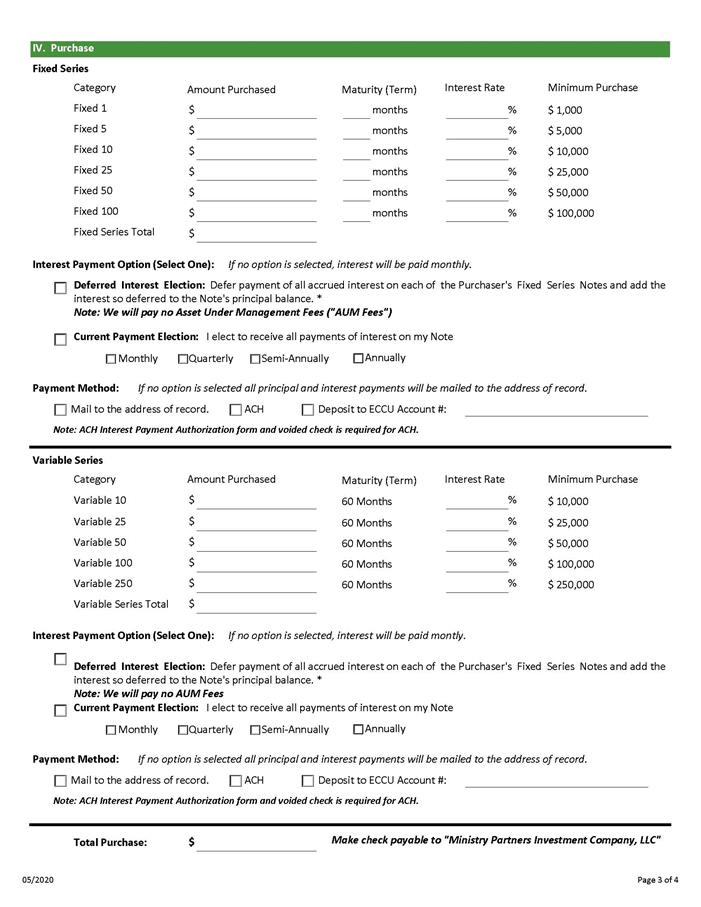

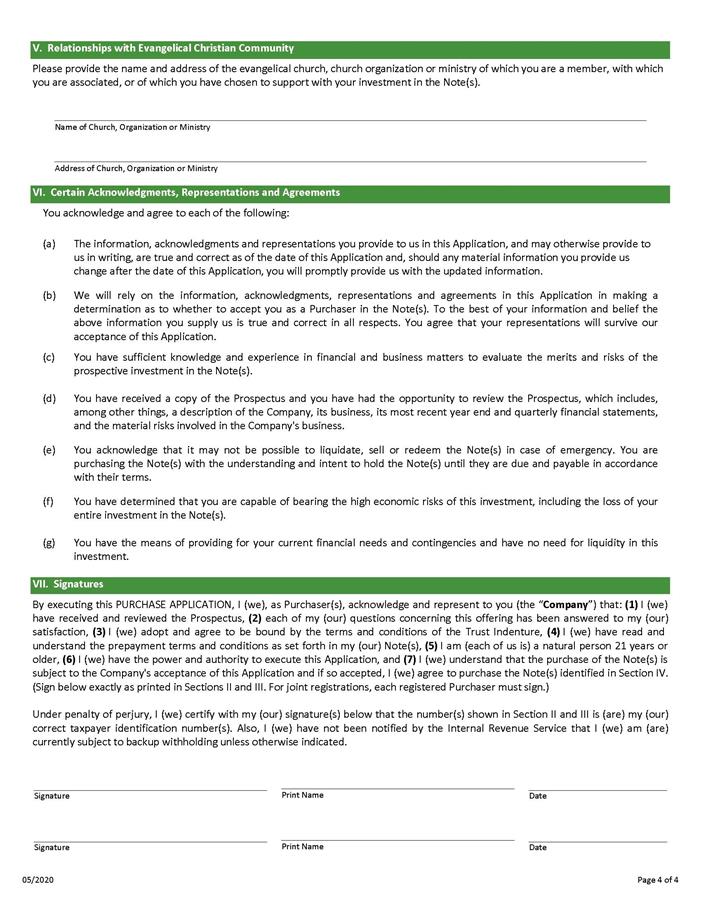

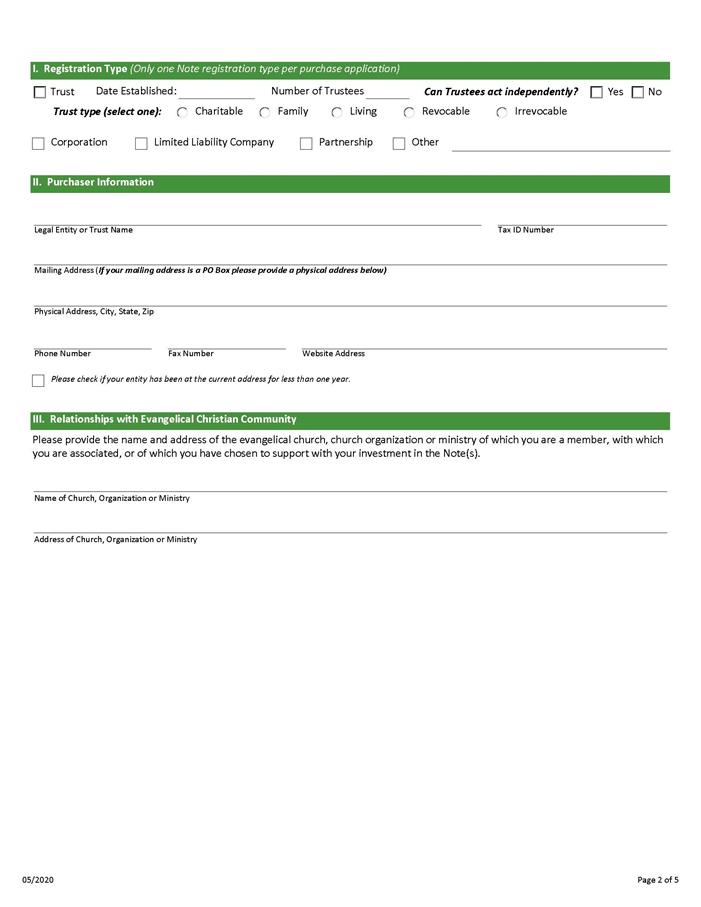

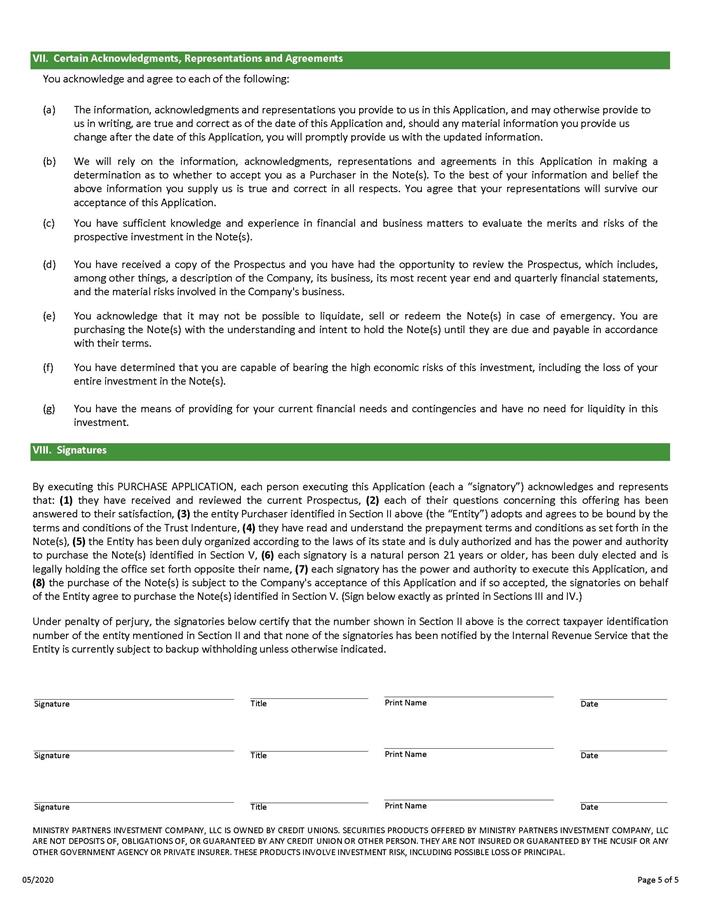

If you choose to purchase a Note in this offering, in addition to reading this Prospectus, you will need to complete and sign an applicable Purchase Application for the Note or Notes in the form attached as Exhibit D to this Prospectus, and pay for the total Notes purchased at the time you subscribe. After you become an owner of a 2021 Class A Note, you may purchase additional Notes by completing and signing an additional Purchase Application. |

|

Q: |

What will you do with the proceeds raised from the Offering? |

|

|

A: |

If all of the 2021 Class A Notes are sold, we expect to receive $117.8 million in net proceeds (after deducting selling costs and organization and offering expenses). We expect to use substantially all of the net proceeds from this Offering as follows and in the following order of priority: |

|

|

• |

Make interest payments on our outstanding investor notes, including the 2021 Class A Notes; |

|

|

• |

To pay the principal balance due on our investor notes and Ministry Impact Notes on their due date; |

|

|

• |

To make scheduled and unscheduled payments on our credit facility borrowings; |

|

|

• |

To originate and invest in secured mortgage loans made to evangelical Christian churches, ministries, and educational institutions; |

|

|

• |

To facilitate the purposeful expansion of the Company’s financial services offerings, including investing in and/or acquiring additional distribution channel partners for its wholly-owned subsidiary, MP Securities; |

|

|

• |

For working capital and other necessary Company operating expenses; and |

|

|

• |

To pay dividends to our preferred equity owners and make dividend distributions to our equity owners. |

|

11

An investment in our Notes is only suitable for persons who have adequate financial means and desire an investment in unsecured debt obligations for a term of the Note selected, from 12-months up to 60-months for the Fixed Series Notes. All of the Variable Series Notes have a term of 60-months. In addition, an investment has limited liquidity, which means that it may be difficult for you to sell your Note. Persons who may require liquidity prior to the maturity of their Note or seek a guaranteed stream of income should not invest in our Notes.

In consideration of these factors, we have established minimum suitability standards for purchasers of Notes. These minimum suitability standards require that a purchaser of Notes satisfy the following:

|

If you are a natural person (an individual): |

If you are a non-natural person (such as a church, school, parachurch ministry, corporation, or trust): |

||

|

You may invest up to ten percent (10%) of your net worth or up to ten percent (10%) of your net assets, in the Notes only if you have either: |

You may invest up to ten percent (10%) of your net assets in Notes only if you have either: |

||

|

1. |

a minimum annual gross income of at least $40,000 and a net worth of $40,000; or |

1. |

liquid assets of at least $50,000; or |

|

2. |

a net worth of at least $70,000. |

2. |

total gross assets of at least $500,000. |

|

You may invest up to twenty percent (20%) of your net worth in the Notes only if you have either: |

You may invest up to twenty percent (20%) of your net assets in Notes if you have either: |

||

|

1. |

a minimum annual gross income of at least $70,000 and a net worth of $70,000; or |

1. |

liquid assets of at least $100,000; or |

|

2. |

a net worth of at least $250,000. |

2. |

total gross assets of at least $1,000,000. |

In the case of sales to fiduciary accounts, one of the following must meet the suitability standards:

|

1. |

the fiduciary account; |

|

2. |

the person who directly or indirectly supplied the funds for the purchase of the Notes; or |

|

3. |

the beneficiary of the account. |

Our selling agent, MP Securities, and we are responsible for determining if the Note purchasers meet these suitability standards for investing in our Notes. In making this determination, the selling agent and

12

we will rely on information provided by prospective Note purchasers. In addition to the minimum suitability standards described above, we and each authorized representative or any other person selling Notes on our behalf, are required to make every reasonable effort to determine that the purchase of Notes is a suitable and appropriate investment for each Note purchaser.

In making this determination, your authorized representative or other person selling Notes on our behalf will, based on a review of the information provided by you, including your age, investment objectives, income, net worth, financial situation and other investments held by you, consider whether you:

|

· |

meet the minimum income and net worth standards established by your state; |

|

· |

can reasonably benefit from an investment in our Notes based on your overall investment objectives and portfolio structure; |

|

· |

are able to bear economic risk of the investment based on your overall financial situation; and |

|

· |

have an apparent understanding of: |

|

o |

the fundamental risks of an investment in the Note you purchase; |

|

o |

the risk that you may lose your entire investment in your Note; |

|

o |

the lack of liquidity of the Note you purchase; |

|

o |

any restrictions on transferability of the Notes; and |

|

o |

the tax, including ERISA, consequences of an investment in our Notes. |

Such persons must maintain records for at least six years of the information used to determine that an investment in the Notes is suitable and appropriate for each investor.

Restriction Imposed by the USA PATRIOT Act and Related Acts

In accordance with the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA PATRIOT Act”), the Notes offered by this Prospectus may not be offered, sold, transferred or delivered, directly or indirectly, to any “Unacceptable Investor,” which means anyone who is:

|

· |

a “designated national,” “specially designated national,” “specially designated terrorist,” “specially designated global terrorist,” “foreign terrorist organization,” or “blocked person” within the definitions set forth in the Foreign Assets Control Regulations of the U.S. Treasury Department; |

|

· |

acting on behalf of, or an entity owned or controlled by, any government against whom the United States maintains economic sanctions or embargoes under the Regulations of the U.S. Treasury Department; |

13

|

· |

within the scope of Executive Order 13224 ― Blocking Property and Prohibiting Transactions with Persons who Commit, Threaten to Commit, or Support Terrorism, effective September 24, 2001; |

|

· |

a person or entity subject to additional restrictions imposed by any of the following statutes or regulations and executive orders issued thereunder: the Trading with the Enemy Act, the National Emergencies Act, the Antiterrorism and Effective Death Penalty Act of 1996, the International Emergency Economic Powers Act, the United Nations Participation Act, the International Security and Development Cooperation Act, the Nuclear Proliferation Prevention Act of 1994, the Foreign Narcotics Kingpin Designation Act, the Iran and Libya Sanctions Act of 1996, the Cuban Democracy Act, the Cuban Liberty and Democratic Solidarity Act and the Foreign Operations, Expert Financing and Related Programs Appropriations Act or any other law of similar import as to any non-U.S. country, as each such act or law has been or may be amended, adjusted, modified or reviewed from time to time; or |

|

· |

designated or blocked, associated or involved in terrorism, or subject to restrictions under laws, regulations, or executive orders as may apply in the future similar to those set forth above. |

14

The following summary highlights selected information we have included in this Prospectus. It does not contain all of the information that may be important to you. Additional details about the Notes, the Indenture, our business, and our operating data is contained elsewhere in this Prospectus. See also the section, “Frequently Asked Questions About The Notes” on page 1. This section does not contain all of the information that is important to your decision whether to invest in the Notes. We encourage you to read this Prospectus, including the section entitled “Risk Factors” on page 19 and our Financial Statements starting at page F-1 of this Prospectus in their entirety before making an investment decision.

We are a California limited liability company. Our principal executive offices are located at 915 West Imperial Highway, Suite 120, Brea, California, 92821 and our telephone number is 800-753-6742. Our website is located at www.ministrypartners.org. The information on our website is not part of this Prospectus.

One of our core missional purposes involves providing financial services, investment products and financing solutions for churches, colleges, schools, ministry organizations, individuals and businesses. We also make and invest in loans made to evangelical Christian churches, ministries, and related organizations. We generally secure our loan investments by a first lien on church properties and/or ministry related properties. We use the proceeds from the sale of the Notes and our other borrowings primarily to fund our mortgage loan investments. We also intend to use a portion of the proceeds received in this Offering to enhance the financial services platform of our wholly-owned subsidiary, Ministry Partners Securities, LLC. More specifically, we may invest in and/or acquire distribution partners to assist in the offering of property insurance and casualty solutions to churches, schools, and Christian ministries. We may also use some of the proceeds from the sale of the Notes to repay outstanding Notes and/or other borrowings. We refer to the Notes and other Notes we sell to investors as our debt securities.

The Offering

|

The Offering |

This offering (the “Offering”) is for a total of $125,000,000 of our 2021 Class A Notes. |

|

|

|

|

|

The Notes may be purchased in one or more of the following Series: |

|

|

– |

Fixed Series, which pay interest at a fixed rate depending on the Category and maturity of Fixed Series Note purchased. |

|

|

– |

Variable Series, which pay at a variable rate of interest adjusted monthly depending on the Category purchased. |

15

|

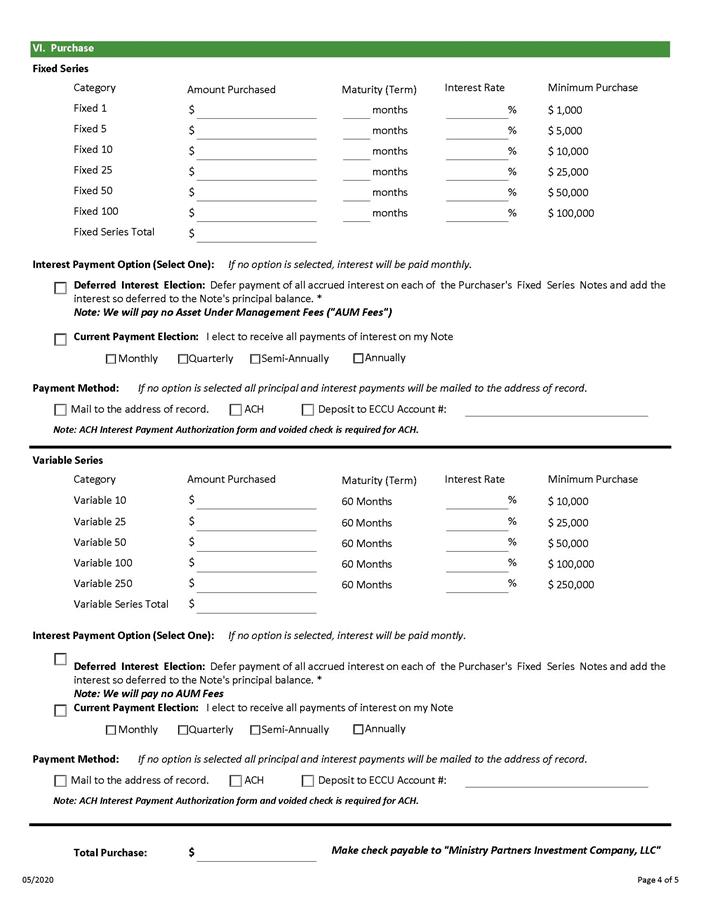

The Fixed Series Notes |

We offer the Fixed Series Notes in the following six Categories with each requiring the specified minimum purchase. The Fixed Series Notes are offered with a term (or maturity) of 12, 18, 24, 30, 36, 42, 48, 54, or 60 months. |

|

|

The Fixed Notes pay a fixed rate of interest equal to the sum of the CMT Index plus the amount of the Fixed Spread for its respective Category as set forth below. The spreads displayed below are effective as of the date of the Prospectus. We reserve the right to change the spreads either up or down, by a maximum of 200 basis points (or 2.0%, one basis point equals 0.01%). We will disclose any change in spreads in a supplement to this Prospectus. |

|

|

|

Fixed Series Note Spreads |

||||||||||||||||||||||

|

Fixed Series Note Category |

Required Minimum Purchase |

12 Month |

18 Month |

24 Month |

30 Month |

36 Month |

42 Month |

48 Month |

54 Month |

60 Month |

||||||||||||||

|

Fixed 1 |

$1,000 |

1.55% |

1.65% |

1.80% |

1.90% |

2.10% |

2.30% |

2.60% |

2.75% |

2.95% |

||||||||||||||

|

Fixed 5 |

$5,000 |

1.65% |

1.75% |

1.85% |

1.95% |

2.20% |

2.40% |

2.70% |

2.85% |

3.05% |

||||||||||||||

|

Fixed 10 |

$10,000 |

1.75% |

1.90% |

2.00% |

2.10% |

2.35% |

2.55% |

2.80% |

2.95% |

3.15% |

||||||||||||||

|

Fixed 25 |

$25,000 |

1.85% |

2.00% |

2.10% |

2.20% |

2.45% |

2.65% |

2.90% |

3.05% |

3.25% |

||||||||||||||

|

Fixed 50 |

$50,000 |

1.95% |

2.10% |

2.20% |

2.30% |

2.55% |

2.75% |

3.00% |

3.15% |

3.35% |

||||||||||||||

|

Fixed 100 |

$100,000 |

2.30% |

2.30% |

2.35% |

2.45% |

2.65% |

2.85% |

3.10% |

3.25% |

3.45% |

||||||||||||||

|

|

|

|

We offer the Variable Series Notes in five Categories, each requiring a specified minimum purchase. All Variable Series Notes have a maturity of 60 months. However, upon your request, we will prepay your Note without penalty, in whole or in part, provided your Note has had an unpaid principal balance of at least $10,000 during the preceding 90 days. |

|

|

|

|

|

|

The Variable Spread Grid displayed below is effective as of the date of the Prospectus. The Variable Series Notes pay interest that is adjusted monthly in an amount equal to the sum of the Variable Index in effect on the adjustment date, plus the amount of the Variable Spread for the respective Category shown on the Variable Spread Grid set forth in the table below. We refer to this as the “Effective Variable Spread Grid”. The Effective Variable Spread Grid on a Note that has been purchased cannot change; however, we reserve the right to change the spreads either up or down, by a maximum of 100 basis points (or 1.0%, one basis point equals 0.01%) for future investments. We will disclose any change in spreads in a supplement to this Prospectus. |

|

Variable Spread Grid* |

||||||||

|

Variable Series Note Category |

|

Required Minimum Purchase |

|

|

Variable Spread |

|

||

|

Category Variable 10 |

|

$ |

10,000 |

|

|

|

0.60% |

|

|

Category Variable 25 |

|

$ |

25,000 |

|

|

|

0.70% |

|

|

Category Variable 50 |

|

$ |

50,000 |

|

|

|

0.90% |

|

|

Category Variable 100 |

|

$ |

100,000 |

|

|

|

1.10% |

|

|

Category Variable 250 |

$ |

250,000 |

1.40% |

|||||

|

*The Variable Spread Grid shown above is effective as of the date of this Prospectus and may be updated subsequently with a supplement to the Prospectus. |

||||||||

16

The Indexes

|

The Indexes |

The interest rates we pay in the Fixed Series Notes are determined in reference to the most recently published CMT Index in effect on the date the interest rate is set. The interest rate we pay on the Variable Series Notes is determined by reference to the most recently published Variable Index in effect on the date the interest rate is set. The interest rate for both the Fixed Series Notes and the Variable Series Notes is set on the first business day of the month unless that day is a holiday, at which time the rate will be set the next business day. As described under “Description of the Notes – The Indexes,” the CMT Index is determined by the Constant Maturity Treasury rates published by the U.S. Department of Treasury for actively traded Treasury securities. The Variable Index is equal to the three‑month LIBOR rate. The three-month LIBOR rate is the London Interbank Offered Rate (“LIBOR”) interest rate for three-month obligations. In the event reporting of a current three month LIBOR rate is suspended or ended, we have the right to substitute the successor index, if any, or if there is none, the regularly reported interest rate we determine, in our sole discretion, to most likely track the three-month LIBOR rate. |

Note Terms in General

|

|

|

|

Note Terms in General |

Certain common terms of the 2021 Class A Notes are summarized below: |

|

|

|

|

Manner of Interest Payments |

Interest is accrued on your Note monthly. You may choose to have interest that accrues on your Note paid monthly, quarterly, semi-annually or annually. You may also make the Interest Deferral Election whereby interest on your Note will be deferred and added to the principal balance of your Note. Unless you specify otherwise, we will pay accrued interest on your Note monthly. The interest rate paid for a partial month is adjusted according to the number of days the Note was outstanding. You may change the way interest is paid on your Note by written notice to us. Any accrued interest is paid along with unpaid principal when your Note matures. |

|

|

|

|

Your Interest Compounded Option |

At any time, you can direct us to retain all interest payable on your Note and pay you interest on such interest at the same rate payable on the principal of the Note. This allows you to earn interest on your interest (i.e., you earn compound interest). |

|

|

|

|

Rank of the Notes |

Our payment of the 2021 Class A Notes is not secured or guaranteed. The Notes are generally equal in priority of right to payment with our other existing and future unsecured debt obligations. |

|

|

|

|

You May Request Prepayment |

You may, due to hardship, request at any time that we prepay all or any portion of your Note prior to its maturity. We may grant the request in our sole discretion. If granted, we will pay the unpaid balance of the Note, less an administrative charge not exceeding 3-months of interest payable on the Note. |

|

Our Right to Prepay Notes |

We reserve the right to prepay a Note at our election at any time upon not less than 30 days but not more than 60 days’ prior written notice. If we elect to prepay less than all of the Notes, the Notes will be redeemed on a pro rata basis. |

|

|

|

|

Indenture |

The Indenture sets forth the rights, terms, and conditions to which all of the Notes are subject. |

|

|

|

17

|

Protective Promises |

Under the Indenture, we agree that we will: |

|

|

|

|

|

–maintain a tangible adjusted net worth of at least $4.0 million; –not incur additional indebtedness, as defined, unless our resulting fixed charge coverage ratio remains at least 1.2 to 1.0; –limit our other indebtedness, as defined, to not more than $20.0 million; –not enter into certain transactions with our Affiliates; –not consummate certain consolidations, mergers or sales of our assets, unless we are the entity surviving the transaction or the entity surviving the transaction assumes our obligations under the Notes; and –not make distributions to our Members except under specified conditions. |

|

|

|

|

|

We are in compliance with each of these promises. |

|

|

|

|

Events of Default |

If an event of default occurs, the Trustee, acting on the direction of a Majority Vote of the Holders, will accelerate payment of the Notes in full. An event of default includes the following: |

|

|

|

|

|

–our failure to make a required payment on a Note within 30 days after it is due; |

|

|

|

|

|

–our failure to observe or perform any of the covenants or agreements under the Notes or the Indenture, unless cured in a timely manner; or |

|

|

–our uncured default under the terms of any of our other indebtedness, which default is caused by our failure to pay principal or interest or results in the acceleration of payment of such indebtedness in the aggregate amount of $250,000 or more. |

|

|

|

|

Our Other Debt Securities |

Since inception, our business has relied on our sales of debt securities to investors. At September 30, 2020, we had a total of $75.3 million of investor debt securities (“Investor Debt”) outstanding, including $306 thousand of the Class A Notes, $14.3 million of the Class 1 Notes, and $42.8 million of the Class 1A Notes. All of our debt securities are unsecured and are pari passu with the 2021 Class A Notes in right of payment. |

|

|

|

|

Our Secured Borrowings |

We have an institutional term-debt credit facility originally entered into with Members United Corporate Federal Credit Union (“Members United”) as refinanced with the National Credit Union Administration (“NCUA”) (the “MU Term-Debt Credit Facility”). The MU Term Debt Credit Facility was purchased from the NCUA by OSK VII, LLC, an investment fund. The MU Term Debt Credit Facility is secured by designated mortgage loans. There are no amounts available to borrow under this facility, although we are contractually able to add new loans to the MU Debt Credit Facility to replace other loans that may have paid off earlier than expected. As of September 30, 2020, the principal balance owed on the MU Term Debt Credit Facility was $52.5 million. We also have a short term demand credit facility of $7.0 million with KCT Credit Union, an Elgin, Illinois credit union. |

|

|

|

|

Use of Proceeds |

In the event we sell all $125 million of the Notes we are offering, we expect to realize proceeds from the Offering of at least $117,835,000 after distribution expenses have been paid. In addition, we are obligated to pay an estimated $290,000 of Issuance and Distribution Expenses. In addition, we may pay up to an additional estimated $424,425 of additional issuer expenses and $2,182,023 of additional underwriting compensation. All of these payments are considered Organization and Offering Expenses under the FINRA Rules.

We intend to use the proceeds to purchase additional mortgage investments. If we deem it necessary, we may also use some of these proceeds to pay our operational expenses, and to pay interest and principal due on our currently outstanding Notes as payment becomes due. See “Estimated Use of Proceeds.” |

|

|

|

18

Plan of Distribution

|

Plan of Distribution |

We are offering the Notes on a best efforts basis through MP Securities, our wholly-owned subsidiary. There is no minimum offering. Upon our acceptance of your Purchase Agreement, we will place your subscription funds directly into our operating account for use in our business.

We will pay MP Securities a 1.50% initial sales commission on the sale of any of the Company’s Notes. MP Securities will receive an Account Servicing Fee equal to 1% per annum of the principal balance of a Note purchased, determined on a monthly basis commencing one year after the purchase of a Note; subject however, to a maximum gross fee of 5.50% over the term of a Note. The Company reserves the right to waive, reduce, or suspend payment of this Account Servicing Fee at any time. In addition, no Account Servicing Fee will be assessed on any Note purchased once the total compensation paid to MP Securities resulting from the purchase of such Note reaches 5.5%. The Account Servicing Fee will not be assessed on any outstanding Class 1 Notes.

For each sale of a Note, the Company will pay a 0.50% processing fee on the purchase of a 2021 Class A Note, payable at closing of a purchase of a Note. The Company reserves the right to waive, reduce or suspend payment of the processing fee at any time.

Because MP Securities is our wholly owned subsidiary, it faces certain conflicts of interest between the interests of our Company and those of its customers in connection with the sale of the Notes.

Unless sooner completed or we decide to terminate it sooner, the Offering will terminate on December 31, 2023. We may, without prior notice, in our sole discretion, suspend or discontinue the sale of one or more Note categories or Note category Series at any time or from time to time and we may terminate the Offering at any time. |

19

WARNING CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements in this Prospectus, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward‑looking statements are included with respect to, among other things, our current business plan, business strategy, and portfolio management. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results or outcomes to differ materially from those contained in the forward-looking statements. Important factors that we believe might cause such differences are discussed in the section entitled, “Risk Factors” or otherwise accompany the forward-looking statements contained in this Prospectus. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. In assessing all forward-looking statements, readers are urged to read carefully all cautionary statements contained in this Prospectus.

[Remainder of this page intentionally left blank.]

20

Carefully consider the risks described below before making your investment decision. Refer to the other information in this Prospectus, including our financial statements and the related Notes.

Any of the following identified risks, along with other unidentified risks, or risks we believe are immaterial or unlikely, could harm the Company. The risks and uncertainties described below are not the only risks that may have a material, adverse effect on us. Additional risks and uncertainties also could adversely affect our business, financial condition, and results of operations. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. Investors should carefully consider the risks described below in conjunction with the other information in this Prospectus and the information incorporated by reference in this Prospectus.

Risks Related to the Offering and Company

Payment of the Notes is not secured or guaranteed by any person.

Repayment of the Notes is our exclusive obligation, and the Notes are our sole responsibility and are not the obligation or responsibility of any other person. See “Description of the Notes” on page 42. In general, as a Noteholder, you will have no greater right to payment than that of our other general creditors. At September 30, 2020, we had $127.8 million of total debt obligations of which $75.3 million consisted of various types of investor debt.

The Trustee may resign in the event we are in default on the Notes.

The Trustee may resign as Trustee under the Indenture at any time upon notice, thereby requiring the appointment of a successor trustee in accordance with the Indenture. In such event, delays may result in the appointment of a successor trustee, which may, delay the Noteholders’ ability to pursue one or more remedies in the event we are declared in default under the Indenture.

The Indenture governs and restricts your rights as a Noteholder.

The Notes are subject to the Indenture, which restricts and regulates your rights as a Noteholder. For example, in the event of our default, the Indenture allows you to seek remedies against us only through action by the Trustee. The Indenture requires a vote of the Holders to take certain acts on behalf of the Holders and that vote will bind all Holders. For example, the Indenture provides that in the event of our default, the Holders of 25% of the unpaid principal amount of the outstanding Notes may declare the entire unpaid balance of the Notes immediately due and payable. The Indenture requires a Majority in Interest Vote of the Holders to pursue collection of the Notes and other remedies. The Indenture also provides that a Majority Vote of the Holders is required to adopt certain amendments and supplements to the Indenture and the Notes, and to waive certain defaults, events of default, and/or to remove and replace the Trustee. The Indenture contains cross-default provisions whereby our default on one Series of the Notes will constitute a

21

default with respect to each other Series of Notes. Thus, Holders suffering an actual default may be more inclined to take action against us than Holders who suffer only a technical default on their Notes because of these cross-default provisions. Accordingly, where there is an actual default on one or more Series of Notes constituting less than a majority of the unpaid principal balance of the outstanding Notes, such Holders may not be able to obtain the approval of the Holders required to appoint a Trustee and pursue a remedy under the Indenture. In such event, you may have no practical recourse against us. See the description of the Indenture on page 48.

BY EXECUTING YOUR PURCHASE APPLICATION, YOU AGREE TO BE BOUND BY THE TERMS AND CONDITIONS OF THE INDENTURE. YOU SHOULD CAREFULLY REVIEW THE INDENTURE WHICH IS ATTACHED AS EXHIBIT A TO THIS PROSPECTUS. YOU MAY NOT INSTITUTE OR CONTINUE ANY PROCEEDING, JUDICIAL OR OTHERWISE, WITH RESPECT TO YOUR NOTE, THE INDENTURE, OR THE APPOINTMENT OF A RECEIVER OR OTHER TRUSTEE OR FOR ANY OTHER REMEDY IN CONNECTION THEREWITH DURING THE PERIOD OF OPERATION OF THE INDENTURE, UNLESS CERTAIN CONDITIONS, AS SET FORTH IN THE INDENTURE, ARE SATISFIED.

We offer no assurance of granting a hardship prepayment if requested.

In general, the Notes are redeemable prior to maturity upon request, but only in our sole discretion. Thus, Holders may not be able to redeem their Notes prior to maturity, particularly during times when there are a significant number of early redemption requests.

The Notes are non-negotiable and the Noteholder may not transfer the Note ownership without the Company’s prior written consent.

The Notes are non-negotiable and are payable only to the person shown as the registered Holder on the records of the Company. The Holder, or any subsequent registered Holder, may transfer his or her Note, or any interest in that Note, only upon the prior written consent of the Company, which consent will not be unreasonably withheld.

There will be no market for your Note and you must depend solely on our ability to repay your Note for liquidity of your investment.

You should be prepared to hold your Note to maturity, subject to any redemption right you may have under your particular Note. You have the right to tender your Note for prepayment at any time, for which we may charge an administrative fee of not more than three months of interest payable on the principal amount of the Note. However, our prepayment of your Note is voluntary and you should not rely on our willingness or ability to do so.

22

An independent rating agency has not rated the Notes and there will be no sinking fund for repayment of the Notes.

We have not obtained a rating for your Notes from an independent rating agency and we do not intend to request such a rating. Also, there will not be a sinking fund established for the repayment of the Notes and we must rely on our available cash resources to repay your Note when due. There is no assurance that we will have adequate cash resources available at the time the Notes are due.

The Holders may need to appoint a successor or substitute trustee before they can pursue their remedies under the Indenture.

Under the Indenture, you and the other Holders may pursue your remedies in the event of our default or otherwise exercise your rights under the Indenture only through the Trustee. U.S. Bank is the Trustee. In the event the Trustee resigns or should the Holders desire to appoint a different Trustee, they may do so only with a Majority Vote. In addition, finding a suitable Trustee and obtaining the Majority Vote of the Holders could be time consuming and completion of this appointment process could significantly delay the Holders’ ability to exercise your rights under the Indenture. See the description of the Indenture on page 48.

Under certain circumstances, a Majority Vote of the Holders may amend or supplement your Note or the Indenture without your consent.

In addition, by a Majority Vote, the Holders may approve the waiver of any default, event of default or breach of a covenant or other condition under the Note. Moreover, the Trustee has the power under the Indenture to compromise or settle any claims against us by the Holders and, if a Majority Vote of the Holders approves such compromise or settlement, the settlement or compromise would be binding on all Holders. IN ANY OF THESE EVENTS, YOU MAY BE WITHOUT PRACTICAL RECOURSE AGAINST US.

We have the right to repay your Note.

We have the right to prepay all or a portion of the Notes if we give you at least thirty (30) days but not more than sixty (60) days prior notice. If we choose to redeem less than all of the Notes, we will redeem the Notes on a pro-rata basis.

No independent appraisal or evaluation company has determined the offering price for the Notes.

We are issuing the Notes at their face amount, i.e., at par. We have not determined the price of the Notes based on any single or group of objective factors. We have not consulted an independent appraisal or evaluation company, or other expert or advisor, concerning the pricing of our Notes. Therefore, there is no assurance that the yield you will receive from your Note is not lower than that which could be obtained from similar investments from other issuers.

23

There is no minimum amount of Notes that we must sell before the Company uses the Offering proceeds.

Once an investor completes a Purchase Agreement and the subscription is accepted, the Company may immediately begin to use the funds for the purposes described in the Prospectus.

The impact of the COVID-19 pandemic could adversely affect our financial condition and results of operations.

We face risks related to an epidemic, pandemic, or health crisis. The COVID-19 pandemic has spread globally and has caused major disruptions in the U.S. economy. A key portion of our business depends on the ability of our ministry related borrowers to make loan payments. In response to the pandemic’s spread, state and local governments ordered non-essential businesses to close, public gatherings to be discontinued, and residents to shelter at home. Churches, schools, daycare centers, and other organizations that rely on public gatherings to conduct their operations were forced to discontinue the gatherings that are essential to their operations and revenue generation. Churches that typically receive weekly offerings of tithes and cash contributions have been relying on online giving options and contributions sent by mail. Church revenues are also dependent on general economic conditions, including unemployment rates and economic disruption to businesses, schools, and financial markets. While state and local restrictions in the U.S. on holding worship services have been eased, churches have been carefully reviewing and preparing new worship service guidelines that will enable them to continue to serve the needs of the communities they serve. The long-term impact of the COVID-19 virus cannot be determined at this time and could have an adverse impact on the timing of loan repayments, liquidity, cash flow, loan defaults, collateral values, loan loss reserves, compliance with loan covenants, and our financial condition. The impact of the virus on economic activity could also vary significantly throughout the U.S. With the geographic concentration of our loans in California and Maryland, our financial condition, liquidity, and results of operations could be impacted by the regional effects of the virus. Due to rapidly changing events surrounding the re-opening of businesses, schools, daycare centers, and religious gatherings, no assurances or predictions can be given with confidence as to the severity of, duration and long-term effect, if any, of the pandemic.

We have granted limited payment deferrals to certain borrowers adversely impacted by COVID-19.

As of September 30, 2020, we have offered a three-month deferral of loan payments to borrowers that have been significantly and materially impacted by the economic effects of the pandemic. For borrowers that have been granted this relief, the maturity date of the loan will not be extended and any deferred payments will be added to the principal balance due at maturity. Of the 148 mortgage loans held at September 30, 2020, we have granted short-term deferrals to 35 borrowers. As of September 30, 2020, many of these borrowers have already resumed contractual payments on their loans. However, if any or all of the remaining borrowers are unable to resume their payments, our profitability and liquidity could be materially impacted.

24

We may be unable to obtain sufficient capital to meet the financing requirements of our business.

Our ability to finance our operations and repay maturing obligations to our investors and credit facility lenders substantially depends on our ability to borrow money and raise funds from the sale of our debt securities. Several factors affect our ability to borrow money and sell our debt securities including:

|

· |

quality of the mortgage loan assets we own; |

|

· |

the profitability of our operations; |

|

· |

limitations imposed under our credit facility arrangements and trust indenture agreements that contain restrictive and negative covenants that may limit our ability to borrow additional sums or sell our publicly and privately offered debt securities; and |

|

· |

availability of attractive financing facilities from lenders willing to hold collateral in mortgage loans made to churches, ministries, and religious organizations. |

An event of default, lack of liquidity, or a general deterioration in the economy that affects the availability of credit may increase our cost of funding, make it difficult for us to renew or restructure our credit facilities, and obtain new lines of credit. Unexpected large withdrawals by investors that hold our debt securities can negatively affect our overall liquidity.

We have expanded our methods of raising funds, including selling participations in our mortgage loan investments, and expanding the sales of our debt securities to Christian ministries, institutional and retail investors, as well as faith-based organizations and ministries. If this strategy is not viable, we will need to find alternative sources of borrowing to finance our operations. If we are unable to raise the funds we need to implement our strategic objectives, we may have to sell assets, deleverage our balance sheet, and reduce operational expenses.

Our ability to raise funds and attract new investors in our debt securities depends on our ability to attract an effective sales force in our wholly-owned licensed broker-dealer firm.

Our wholly-owned subsidiary, MP Securities, a FINRA member broker-dealer, acts as a selling agent for our notes offerings, insurance products, and investment advisory services. Our ability to attract new investors in our debt securities and increase the sale of our debt securities will substantially depend on our ability to assemble an effective advisory team. If we are unable to recruit, retain, and successfully equip a qualified group of advisors at MP Securities, we may not be able to increase sales of the Company’s debt securities, strengthen our balance sheet, and effectively utilize the investment in our core data processing and information systems we have implemented.

25

We depend on repeat purchases by a significant number of investors in our debt securities to finance our business.

A significant percentage of the investors who purchase our debt securities roll their matured note into a new note. There is no assurance we will maintain our historical rate of reinvestments of maturing investor notes into new investor notes. If the rate of repeat investments declines, our ability to maintain or grow our asset base could be impaired. The table below shows the renewal rates of our maturing notes over the last two full years and the first nine months of 2020:

|

|

|

|

2020 |

52% |

|

2019 |

75% |

|

2018 |

62% |

Some of our debt securities investors may be unable to purchase our public offering notes due to FINRA’s investor suitability standards.

When handling sales of our investor notes, we must comply with FINRA’s “know your customer” and “suitability” guidelines. Some investors may not qualify under suitability guidelines. These guidelines help ensure that investors make appropriate investments given the:

|

· |

age; |

|

· |

investment experience; |

|

· |

net worth; |

|

· |

need for liquidity; and |

|

· |

the mix of the investor’s portfolio. |