Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JANUARY 2021 SHAREHOLDER PRESENTATION - InvenTrust Properties Corp. | ivtp-20210106.htm |

Essential Retail. Smart Locations. Webcast Presentation January 6, 2021

Forward-Looking Statements in this presentation, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representation, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, potential adverse effect of the COVID-19 pandemic, on the financial condition, results of operations, cash flows and performance of the Company and its tenants, the real estate market and the global economy and financial markets, market, political and economic volatility experienced by the U.S. economy or real estate industry as a whole, and the regional and local political and economic conditions in the markets in which our properties are located; competitive business market conditions experienced by our retail tenants and shadow anchor retailers, such as challenges competing with e-commerce channels; our ability to execute on our business strategy and enhance stockholder value; and our ability to manage our debt. For further discussion of factors that could materially affect the outcome of our forward-looking statements and our future results and financial condition, see the Risk Factors included in InvenTrust’s most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. InvenTrust intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. We caution you not to place undue reliance on any forward-looking statements, which are made as of the date of this presentation. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. The companies depicted in the photographs or otherwise herein may have proprietary interests in their trade names and trademarks and nothing herein shall be considered to be an endorsement, authorization or approval of InvenTrust Properties Corp. by the companies. Further, none of these companies are affiliated with InvenTrust Properties Corp. in any manner. Forward Looking Statements

Essential Retail. Smart Locations. | 2021 3 COVID-19 Update • The evolving COVID-19 pandemic continues to impact the retail real estate industry including InvenTrust • Our shopping centers remain open and play a critical role in their respective communities by providing essential retail products and services • The administration of the COVID vaccine provides a light at the end of the tunnel for the retail sector • Optimizing occupancy remains a key focal point: Tenant outreach, partnership, and assistance remains a top priority Hiring additional leasing staff to accelerate re-leasing efforts Balance short-term cash flow impact with longer-term opportunities • No immediate capital or liquidity needs for InvenTrust

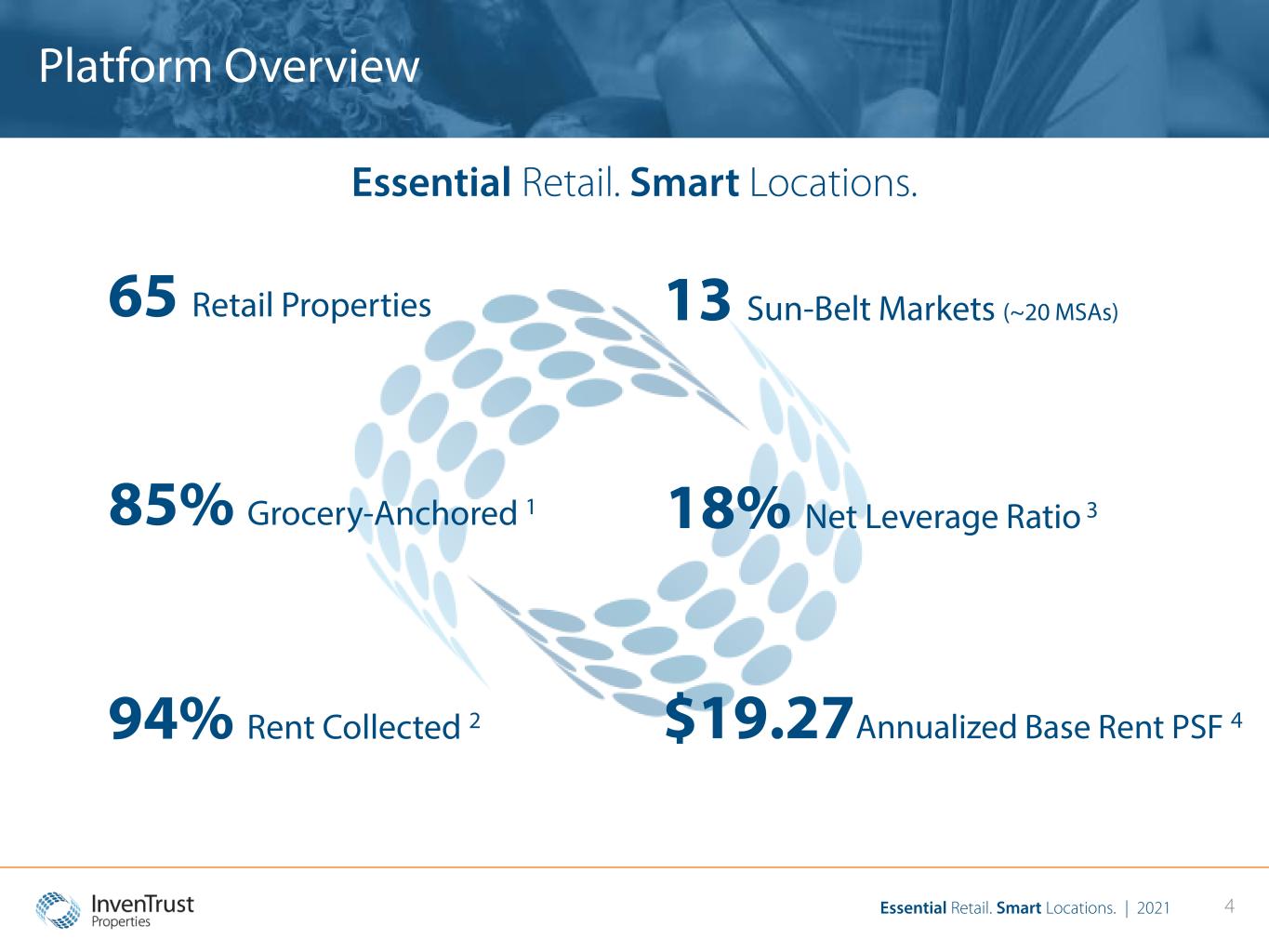

Essential Retail. Smart Locations. | 2021 4 Platform Overview Essential Retail. Smart Locations. 65 Retail Properties 13 Sun-Belt Markets (~20 MSAs) 18% Net Leverage Ratio 3 $19.27Annualized Base Rent PSF 4 85% Grocery-Anchored 1 94% Rent Collected 2

Essential Retail. Smart Locations. | 2021 5 Fifth Consecutive Annual Increase in Dividend Rate • Paid dividends in full in 2020 despite disruption from COVID-19 • Conservative dividend payout ratio at ~60% • Maintaining a stable & flexible balance sheet 1 $0.0675 $0.0695 $0.0716 $0.0737 $0.0759 $0.0782 $0.060 $0.065 $0.070 $0.075 $0.080 2016 2017 2018 2019 2020 2021

Essential Retail. Smart Locations. | 2021 6 New Estimated Share Value Announcement • On December 21, 2020, InvenTrust published our new estimated share value of $2.89 • Duff & Phelps, LLC, an independent, third-party valuation firm completed a detailed analysis of the Company’s portfolio of assets and balance sheet as of December 1, 2020 • From that analysis, Duff & Phelps provided the Audit Committee of the Board a range of per share values from $2.76 to $3.03 • From that range, the InvenTrust Board selected the mid-point of $2.89 • The negative impact of the COVID pandemic on the retail real estate industry drove the 8% decline in our value • A complete explanation of the valuation method and process is available in our Form 8-K filed on December 21, 2020

Essential Retail. Smart Locations. | 2021 7 Factors Impacting IVT’s Estimated Share Value • Disruption to the U.S. economy & rental income due to retailer hardship and bankruptcies • Interest rate changes and underlying assumptions for monetary policy • Acceleration of e-Commerce adoption driven by pandemic impacting retail tenants Shares repurchased at a discount through the SRP contributed a $0.01/share accretion May 1, 2019 Estimated Per Share Value $ 3.14 Same Property Retail 1 $ (0.19) Retail Acquisitions & Dispositions $ (0.13) Total Retail Portfolio 2 $ (0.32) Total Non-Core / Investment in Unconsolidated Entities 3 $ (0.03) Total Cash and Other Assets, net of other Liabilities 4 $ 0.10 Debt - Corporate and Property Level $ 0.00 December 1, 2020 Estimated Per Share Value 5 $ 2.89

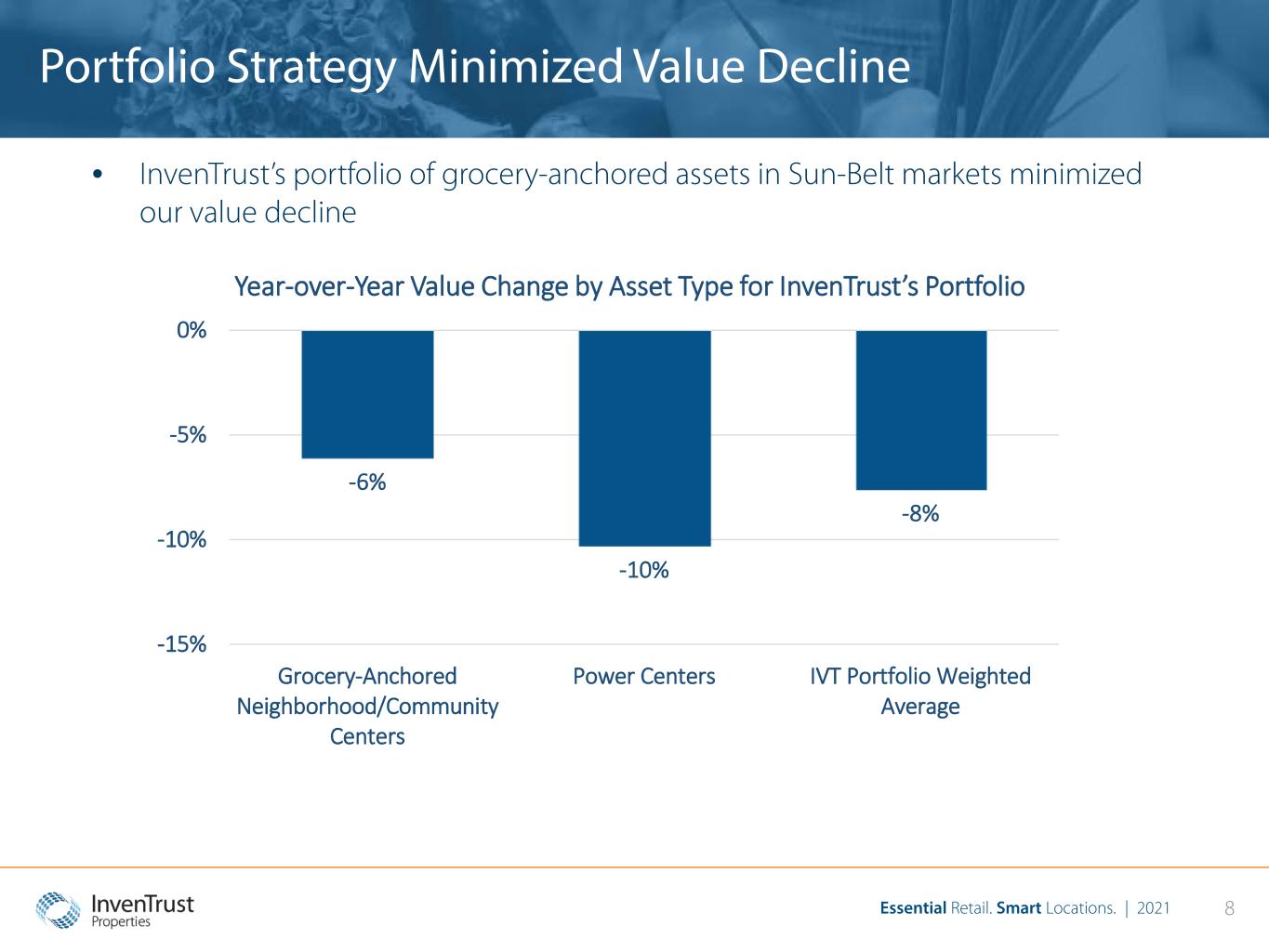

Essential Retail. Smart Locations. | 2021 8 Portfolio Strategy Minimized Value Decline • InvenTrust’s portfolio of grocery-anchored assets in Sun-Belt markets minimized our value decline -6% -10% -8% -15% -10% -5% 0% Grocery-Anchored Neighborhood/Community Centers Power Centers IVT Portfolio Weighted Average Year-over-Year Value Change by Asset Type for InvenTrust’s Portfolio

Essential Retail. Smart Locations. | 2021 9 Continued Outreach & Public Company Readiness • Maintain proactive shareholder communications by providing frequent updates on our progress through: Webcasts Shareholder newsletters Press releases Email alerts • The Board and management will continue to: Evaluate the company’s distribution rate Assess the reinstatement of a share repurchase program & dividend reinvestment plan for shareholders Improve public company readiness Evaluate and monitor retail real estate market conditions for potential final liquidity event

10 Q & A

Essential Retail. Smart Locations. | 2021 11 Commons at University Place Durham, NC Properties Predominantly grocery- anchored centers in Sun-Belt markets with favorable demographics Platform Simple, focused, and flexible in both the portfolio and capital structure Team Deep real estate expertise embedded in our markets close to our assets Culture Innovative, collegial, and accountable Essential Retail. Smart Locations. InvenTrust remains positioned to endure the economic disruption generated by the COVID-19 crisis

Essential Retail. Smart Locations. | 2021 12 Footnotes Page 4 1. 2020F pro-rata NOI percentage includes shadow-anchored grocery store tenants. Walmart, Target and warehouse clubs are considered grocers, regardless of whether the box is owned by the REIT or shadow anchored 2. Q3 2020 rent collected as of December 22, 2020 3. Net Leverage Ratio is pro-rata net debt divided by pro-rata enterprise value as of December 1, 2020 4. ABR is annualized base rent as of September 30, 2020 divided by economic occupied square footage. Ground and specialty leases are excluded. ABR calculation excludes GAAP entries Page 7 1. “Same Property Retail” refers to retail assets included in both the May 1, 2019 estimate of per share value and the December 1, 2020 estimate of per share value and excludes any dispositions and acquisitions between May 1, 2019 and December 1, 2020 2. “Total Retail Portfolio” includes (a) wholly owned retail properties and (b) properties owned by IAGM, our joint venture with PGGM Private Real Estate Fund. For the joint venture properties described in (b), the table only includes the per share value attributed to the Company based on its percentage ownership 3. Value includes the IAGM joint venture net working capital attributable to the Company based on its percentage ownership 4. Includes cash and cash equivalents and certain other assets and liabilities 5. Shares repurchased at a discount account for ~$0.01/share of accretion