Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tracon Pharmaceuticals, Inc. | tcon-8k_20210105.htm |

TRACON PHARMACEUTICALS Investor Presentation January 2021 NASDAQ: TCON Exhibit 99.1

This presentation contains statements that are, or may be deemed to be, "forward-looking statements." In some cases these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” "expects,” “plans,” "intends,” “may,” “could,” “might,” “will,” “should,” “approximately,” “potential,” or, in each case, their negatives or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. These statements relate to future events or our future financial performance or condition, business strategy, current and prospective product candidates, planned clinical trials and preclinical activities, potential events and activities under existing collaboration agreements, estimated market opportunities for product candidates, product approvals, research and development costs, current and prospective collaborations, timing and likelihood of success of development activities and business strategies, plans and objectives of management for future operations, and future results of anticipated product development efforts, including potential benefits derived therefrom. These statements involve substantial known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, risks associated with conducting clinical trials, whether any of our product candidates will be shown to be safe and effective, our ability to finance continued operations, our reliance on third parties for various aspects of our business, the potential early termination of collaboration agreements, competition in our target markets, our ability to protect our intellectual property, our ability to execute our business development strategy and in-license rights to additional pipeline assets, and other risks and uncertainties described in our filings with the Securities and Exchange Commission, including under the heading “Risk Factors”. In light of the significant uncertainties in our forward-looking statements, you should not place undue reliance on these statements or regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements contained in this presentation represent our estimates and assumptions only as of the date of this presentation and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this presentation. This presentation also contains estimates, projections and other information concerning our industry, our business, and the markets for our drug candidates, as well as data regarding market research, estimates and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Forward-Looking Statements

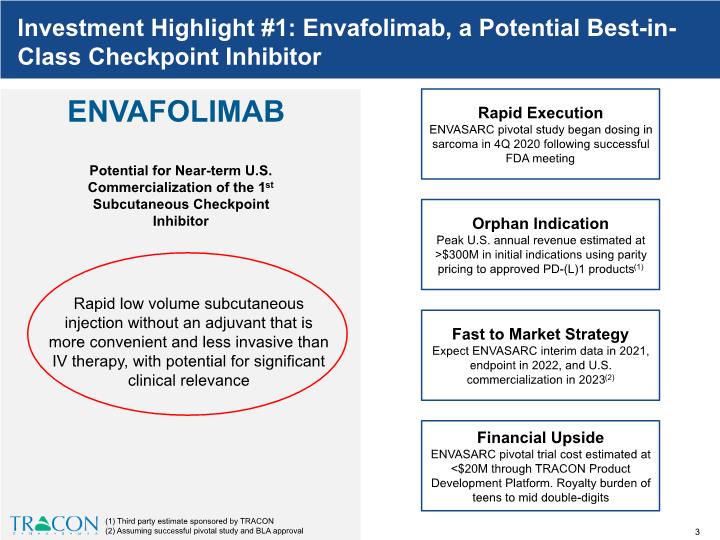

ENVAFOLIMAB Potential for Near-term U.S. Commercialization of the 1st Subcutaneous Checkpoint Inhibitor Rapid Execution ENVASARC pivotal study began dosing in sarcoma in 4Q 2020 following successful FDA meeting Orphan Indication Peak U.S. annual revenue estimated at >$300M in initial indications using parity pricing to approved PD-(L)1 products(1) Fast to Market Strategy Expect ENVASARC interim data in 2021, endpoint in 2022, and U.S. commercialization in 2023(2) Financial Upside ENVASARC pivotal trial cost estimated at <$20M through TRACON Product Development Platform. Royalty burden of teens to mid double-digits 1 (1) Third party estimate sponsored by TRACON (2) Assuming successful pivotal study and BLA approval Investment Highlight #1: Envafolimab, a Potential Best-in-Class Checkpoint Inhibitor Rapid low volume subcutaneous injection without an adjuvant that is more convenient and less invasive than IV therapy, with potential for significant clinical relevance

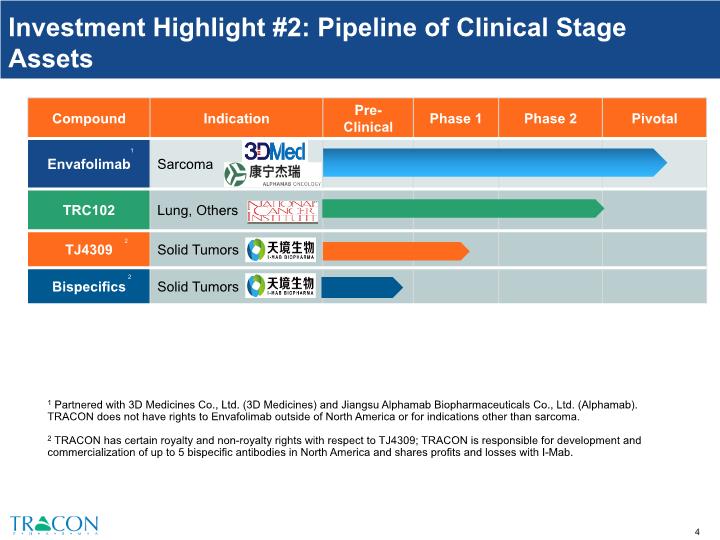

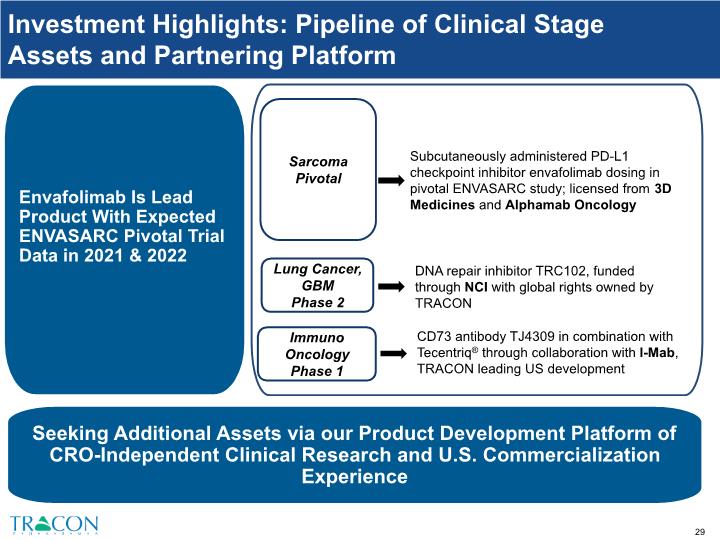

Investment Highlight #2: Pipeline of Clinical Stage Assets 1 Partnered with 3D Medicines Co., Ltd. (3D Medicines) and Jiangsu Alphamab Biopharmaceuticals Co., Ltd. (Alphamab). TRACON does not have rights to Envafolimab outside of North America or for indications other than sarcoma. 2 TRACON has certain royalty and non-royalty rights with respect to TJ4309; TRACON is responsible for development and commercialization of up to 5 bispecific antibodies in North America and shares profits and losses with I-Mab. 1 2 3 4 2

Investment Highlight #3: Partnering Platform

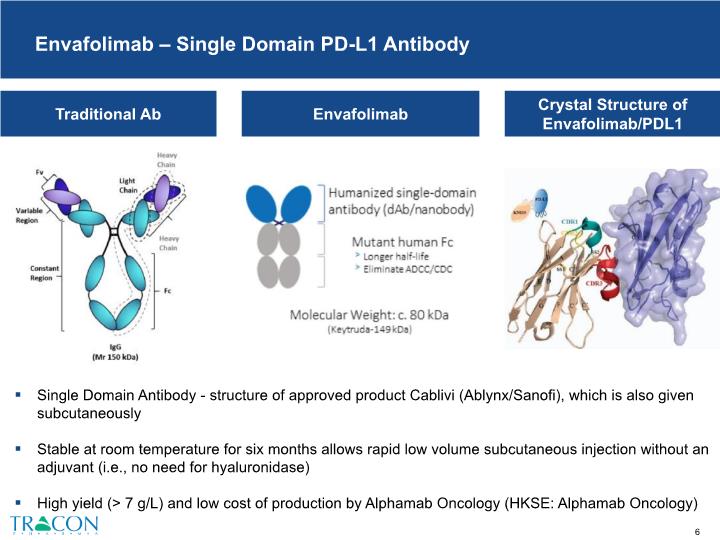

Envafolimab – Single Domain PD-L1 Antibody Envafolimab Crystal Structure of Envafolimab/PDL1 Traditional Ab Single Domain Antibody - structure of approved product Cablivi (Ablynx/Sanofi), which is also given subcutaneously Stable at room temperature for six months allows rapid low volume subcutaneous injection without an adjuvant (i.e., no need for hyaluronidase) High yield (> 7 g/L) and low cost of production by Alphamab Oncology (HKSE: Alphamab Oncology)

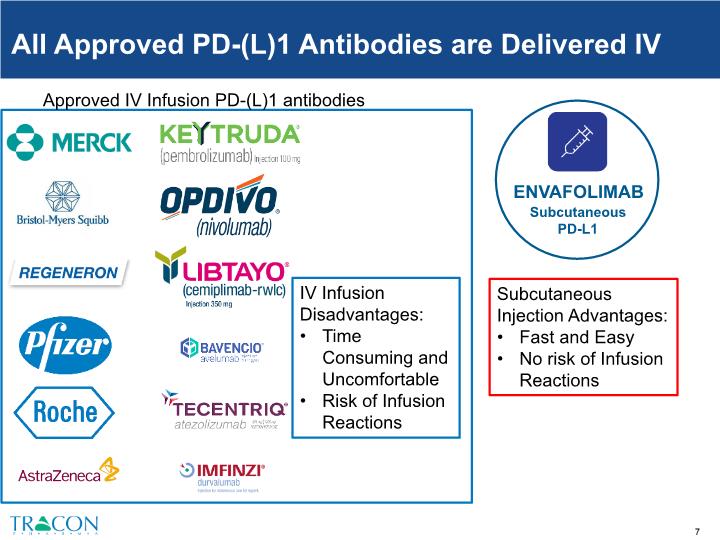

All Approved PD-(L)1 Antibodies are Delivered IV Approved IV Infusion PD-(L)1 antibodies IV Infusion Disadvantages: Time Consuming and Uncomfortable Risk of Infusion Reactions ENVAFOLIMAB Subcutaneous PD-L1 Subcutaneous Injection Advantages: Fast and Easy No risk of Infusion Reactions

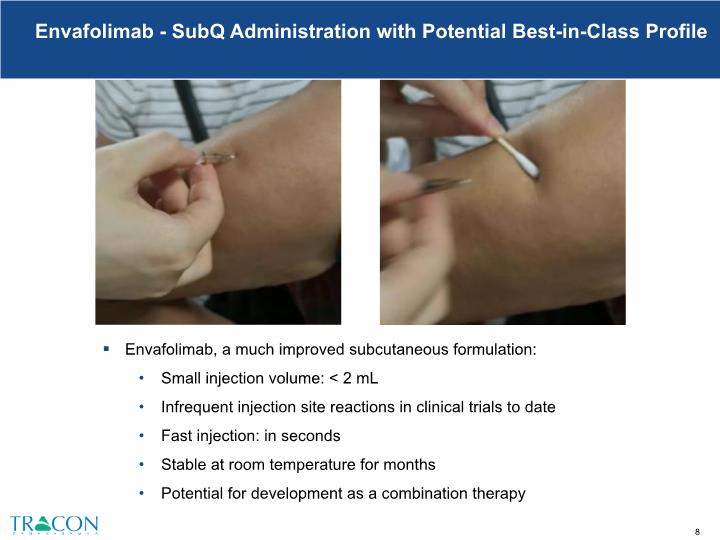

Envafolimab, a much improved subcutaneous formulation: Small injection volume: < 2 mL Infrequent injection site reactions in clinical trials to date Fast injection: in seconds Stable at room temperature for months Potential for development as a combination therapy Envafolimab - SubQ Administration with Potential Best-in-Class Profile

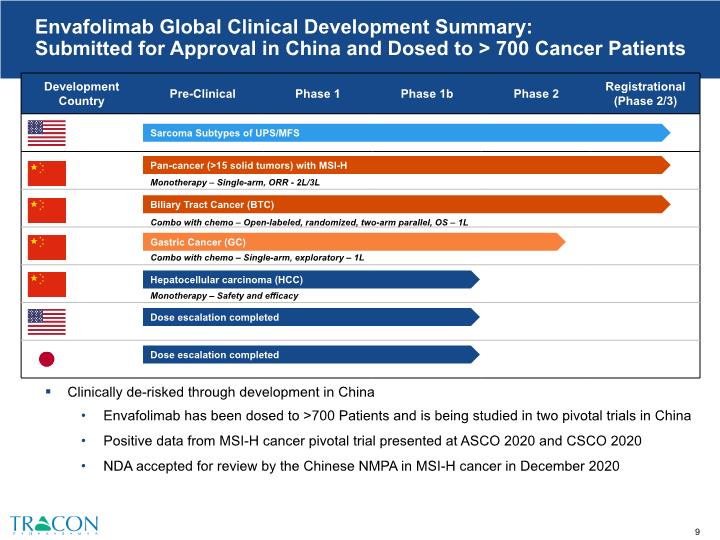

Clinically de-risked through development in China Envafolimab has been dosed to >700 Patients and is being studied in two pivotal trials in China Positive data from MSI-H cancer pivotal trial presented at ASCO 2020 and CSCO 2020 NDA accepted for review by the Chinese NMPA in MSI-H cancer in December 2020 Envafolimab Global Clinical Development Summary: Submitted for Approval in China and Dosed to > 700 Cancer Patients Sarcoma Subtypes of UPS/MFS

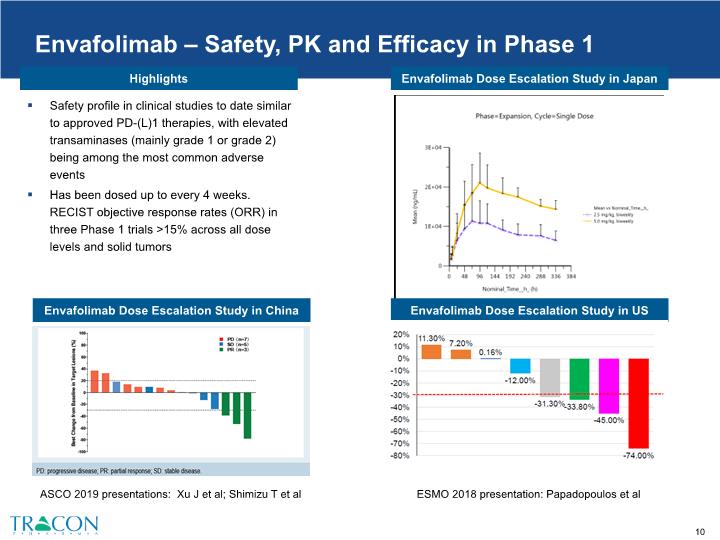

Envafolimab Dose Escalation Study in Japan Envafolimab – Safety, PK and Efficacy in Phase 1 Safety profile in clinical studies to date similar to approved PD-(L)1 therapies, with elevated transaminases (mainly grade 1 or grade 2) being among the most common adverse events Has been dosed up to every 4 weeks. RECIST objective response rates (ORR) in three Phase 1 trials >15% across all dose levels and solid tumors ESMO 2018 presentation: Papadopoulos et al Envafolimab Dose Escalation Study in China Envafolimab Dose Escalation Study in US ASCO 2019 presentations: Xu J et al; Shimizu T et al Highlights

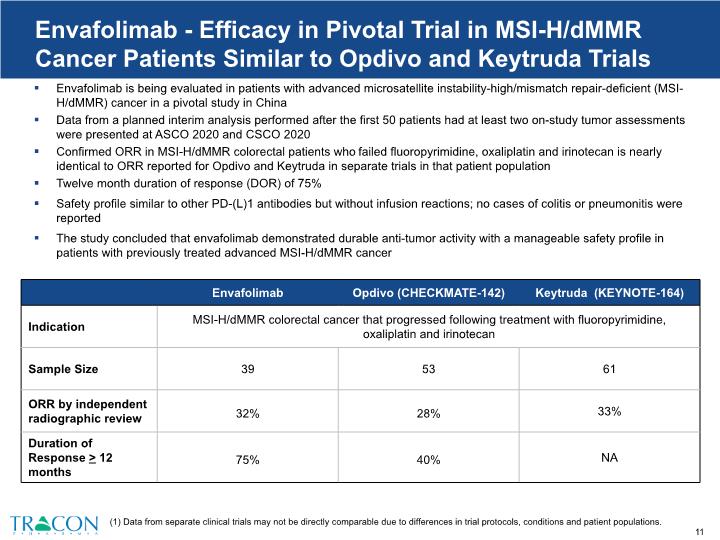

Envafolimab - Efficacy in Pivotal Trial in MSI-H/dMMR Cancer Patients Similar to Opdivo and Keytruda Trials Envafolimab is being evaluated in patients with advanced microsatellite instability-high/mismatch repair-deficient (MSI-H/dMMR) cancer in a pivotal study in China Data from a planned interim analysis performed after the first 50 patients had at least two on-study tumor assessments were presented at ASCO 2020 and CSCO 2020 Confirmed ORR in MSI-H/dMMR colorectal patients who failed fluoropyrimidine, oxaliplatin and irinotecan is nearly identical to ORR reported for Opdivo and Keytruda in separate trials in that patient population Twelve month duration of response (DOR) of 75% Safety profile similar to other PD-(L)1 antibodies but without infusion reactions; no cases of colitis or pneumonitis were reported The study concluded that envafolimab demonstrated durable anti-tumor activity with a manageable safety profile in patients with previously treated advanced MSI-H/dMMR cancer (1) Data from separate clinical trials may not be directly comparable due to differences in trial protocols, conditions and patient populations.

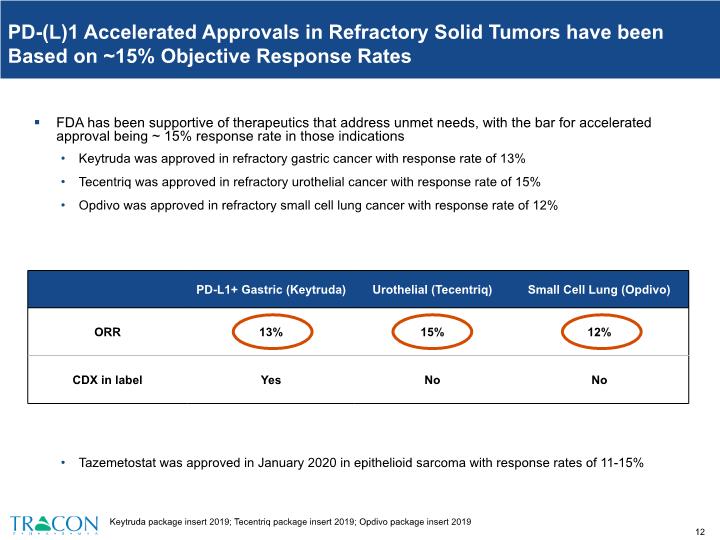

PD-(L)1 Accelerated Approvals in Refractory Solid Tumors have been Based on ~15% Objective Response Rates FDA has been supportive of therapeutics that address unmet needs, with the bar for accelerated approval being ~ 15% response rate in those indications Keytruda was approved in refractory gastric cancer with response rate of 13% Tecentriq was approved in refractory urothelial cancer with response rate of 15% Opdivo was approved in refractory small cell lung cancer with response rate of 12% Tazemetostat was approved in January 2020 in epithelioid sarcoma with response rates of 11-15% Keytruda package insert 2019; Tecentriq package insert 2019; Opdivo package insert 2019

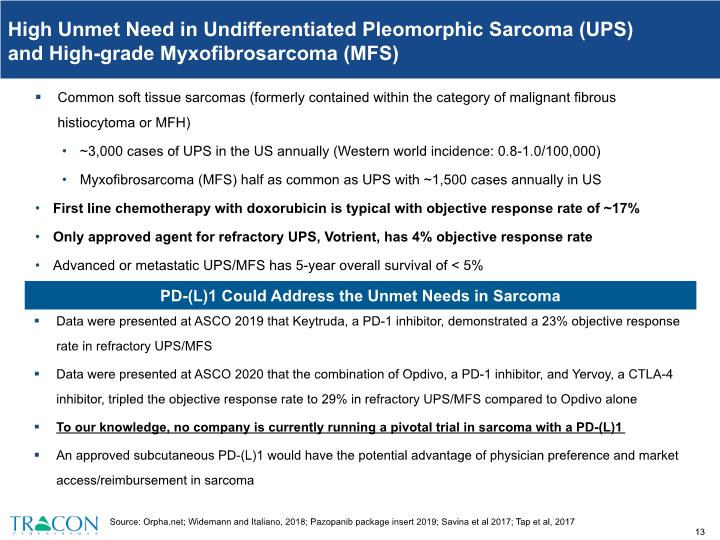

High Unmet Need in Undifferentiated Pleomorphic Sarcoma (UPS) and High-grade Myxofibrosarcoma (MFS) Common soft tissue sarcomas (formerly contained within the category of malignant fibrous histiocytoma or MFH) ~3,000 cases of UPS in the US annually (Western world incidence: 0.8-1.0/100,000) Myxofibrosarcoma (MFS) half as common as UPS with ~1,500 cases annually in US First line chemotherapy with doxorubicin is typical with objective response rate of ~17% Only approved agent for refractory UPS, Votrient, has 4% objective response rate Advanced or metastatic UPS/MFS has 5-year overall survival of < 5% Source: Orpha.net; Widemann and Italiano, 2018; Pazopanib package insert 2019; Savina et al 2017; Tap et al, 2017 Data were presented at ASCO 2019 that Keytruda, a PD-1 inhibitor, demonstrated a 23% objective response rate in refractory UPS/MFS Data were presented at ASCO 2020 that the combination of Opdivo, a PD-1 inhibitor, and Yervoy, a CTLA-4 inhibitor, tripled the objective response rate to 29% in refractory UPS/MFS compared to Opdivo alone To our knowledge, no company is currently running a pivotal trial in sarcoma with a PD-(L)1 An approved subcutaneous PD-(L)1 would have the potential advantage of physician preference and market access/reimbursement in sarcoma PD-(L)1 Could Address the Unmet Needs in Sarcoma

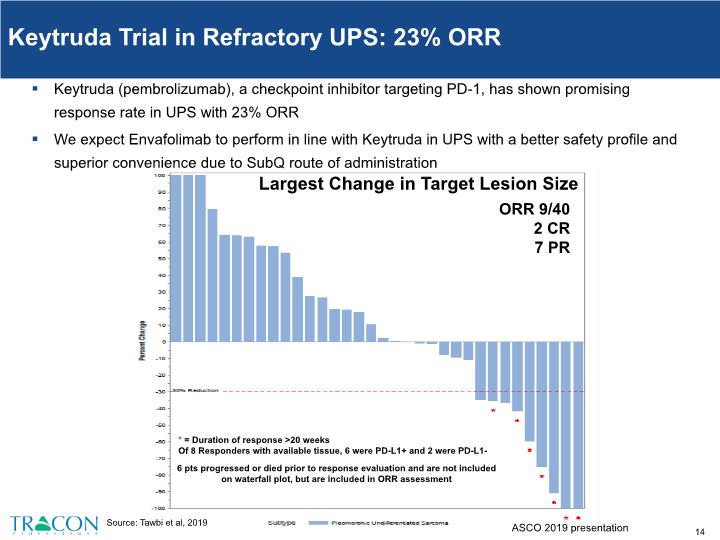

Keytruda Trial in Refractory UPS: 23% ORR Keytruda (pembrolizumab), a checkpoint inhibitor targeting PD-1, has shown promising response rate in UPS with 23% ORR We expect Envafolimab to perform in line with Keytruda in UPS with a better safety profile and superior convenience due to SubQ route of administration Largest Change in Target Lesion Size ORR 9/40 2 CR 7 PR * = Duration of response >20 weeks Of 8 Responders with available tissue, 6 were PD-L1+ and 2 were PD-L1- 6 pts progressed or died prior to response evaluation and are not included on waterfall plot, but are included in ORR assessment Source: Tawbi et al, 2019 ASCO 2019 presentation

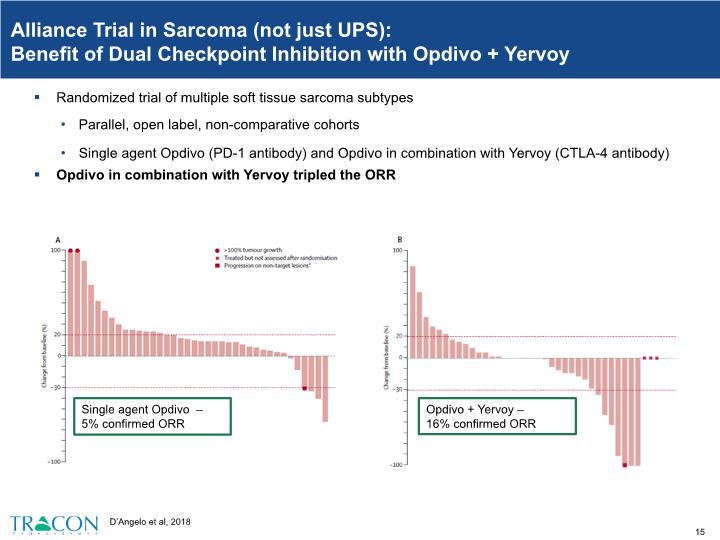

D’Angelo et al, 2018 Alliance Trial in Sarcoma (not just UPS): Benefit of Dual Checkpoint Inhibition with Opdivo + Yervoy Randomized trial of multiple soft tissue sarcoma subtypes Parallel, open label, non-comparative cohorts Single agent Opdivo (PD-1 antibody) and Opdivo in combination with Yervoy (CTLA-4 antibody) Opdivo in combination with Yervoy tripled the ORR

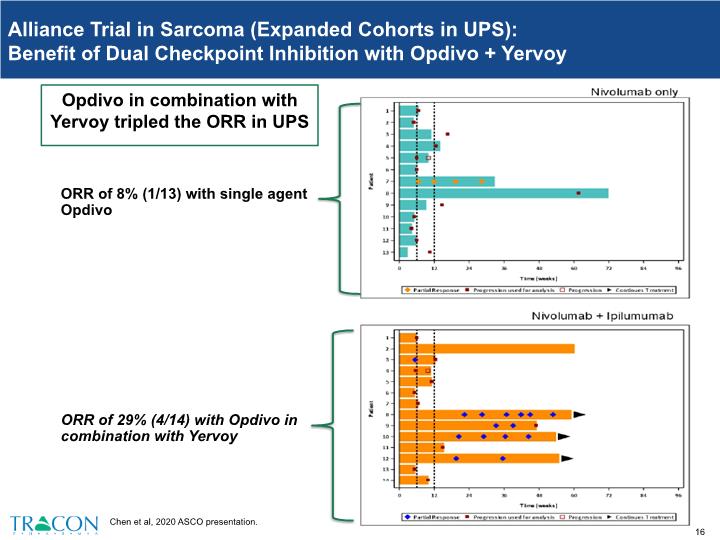

Alliance Trial in Sarcoma (Expanded Cohorts in UPS): Benefit of Dual Checkpoint Inhibition with Opdivo + Yervoy ORR of 29% (4/14) with Opdivo in combination with Yervoy Opdivo in combination with Yervoy tripled the ORR in UPS ORR of 8% (1/13) with single agent Opdivo Chen et al, 2020 ASCO presentation.

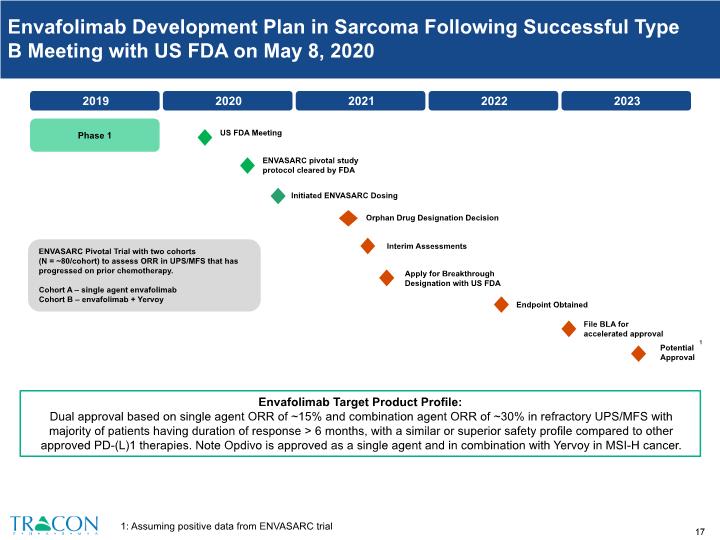

ENVASARC Pivotal Trial with two cohorts (N = ~80/cohort) to assess ORR in UPS/MFS that has progressed on prior chemotherapy. Cohort A – single agent envafolimab Cohort B – envafolimab + Yervoy Phase 1 Envafolimab Development Plan in Sarcoma Following Successful Type B Meeting with US FDA on May 8, 2020 Envafolimab Target Product Profile: Dual approval based on single agent ORR of ~15% and combination agent ORR of ~30% in refractory UPS/MFS with majority of patients having duration of response > 6 months, with a similar or superior safety profile compared to other approved PD-(L)1 therapies. Note Opdivo is approved as a single agent and in combination with Yervoy in MSI-H cancer. 1: Assuming positive data from ENVASARC trial

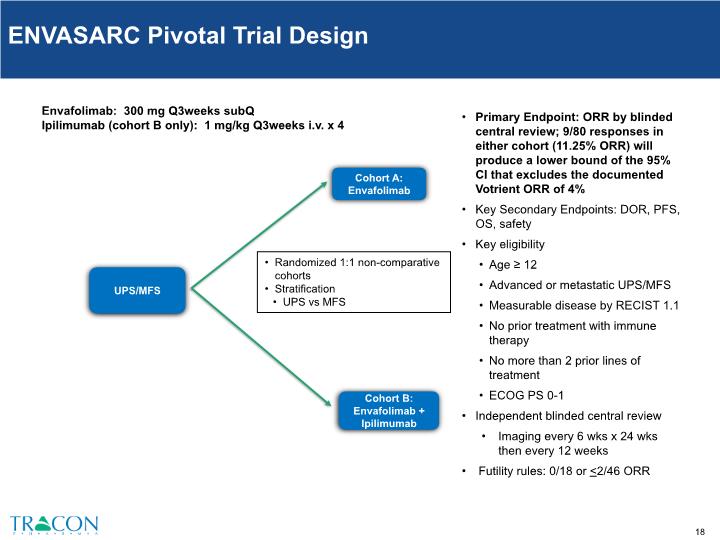

Cohort A: Envafolimab UPS/MFS Cohort B: Envafolimab + Ipilimumab Randomized 1:1 non-comparative cohorts Stratification UPS vs MFS Primary Endpoint: ORR by blinded central review; 9/80 responses in either cohort (11.25% ORR) will produce a lower bound of the 95% CI that excludes the documented Votrient ORR of 4% Key Secondary Endpoints: DOR, PFS, OS, safety Key eligibility Age ≥ 12 Advanced or metastatic UPS/MFS Measurable disease by RECIST 1.1 No prior treatment with immune therapy No more than 2 prior lines of treatment ECOG PS 0-1 Independent blinded central review Imaging every 6 wks x 24 wks then every 12 weeks Futility rules: 0/18 or <2/46 ORR Envafolimab: 300 mg Q3weeks subQ Ipilimumab (cohort B only): 1 mg/kg Q3weeks i.v. x 4 ENVASARC Pivotal Trial Design

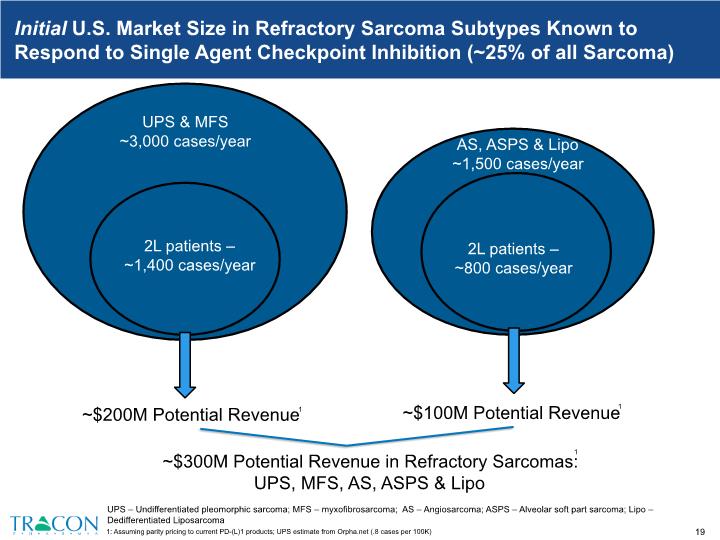

Initial U.S. Market Size in Refractory Sarcoma Subtypes Known to Respond to Single Agent Checkpoint Inhibition (~25% of all Sarcoma) UPS & MFS ~3,000 cases/year 2L patients – ~1,400 cases/year ~$200M Potential Revenue AS, ASPS & Lipo ~1,500 cases/year 2L patients – ~800 cases/year ~$100M Potential Revenue ~$300M Potential Revenue in Refractory Sarcomas: UPS, MFS, AS, ASPS & Lipo UPS – Undifferentiated pleomorphic sarcoma; MFS – myxofibrosarcoma; AS – Angiosarcoma; ASPS – Alveolar soft part sarcoma; Lipo – Dedifferentiated Liposarcoma 1 1 1 1: Assuming parity pricing to current PD-(L)1 products; UPS estimate from Orpha.net (.8 cases per 100K)

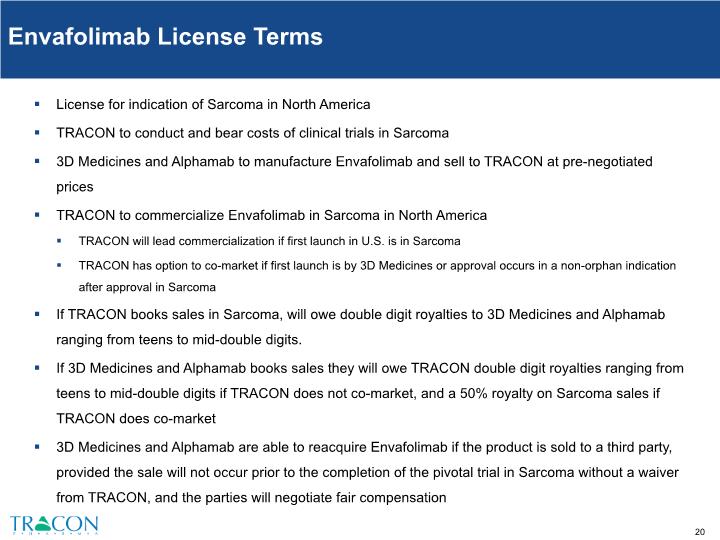

Envafolimab License Terms License for indication of Sarcoma in North America TRACON to conduct and bear costs of clinical trials in Sarcoma 3D Medicines and Alphamab to manufacture Envafolimab and sell to TRACON at pre-negotiated prices TRACON to commercialize Envafolimab in Sarcoma in North America TRACON will lead commercialization if first launch in U.S. is in Sarcoma TRACON has option to co-market if first launch is by 3D Medicines or approval occurs in a non-orphan indication after approval in Sarcoma If TRACON books sales in Sarcoma, will owe double digit royalties to 3D Medicines and Alphamab ranging from teens to mid-double digits. If 3D Medicines and Alphamab books sales they will owe TRACON double digit royalties ranging from teens to mid-double digits if TRACON does not co-market, and a 50% royalty on Sarcoma sales if TRACON does co-market 3D Medicines and Alphamab are able to reacquire Envafolimab if the product is sold to a third party, provided the sale will not occur prior to the completion of the pivotal trial in Sarcoma without a waiver from TRACON, and the parties will negotiate fair compensation

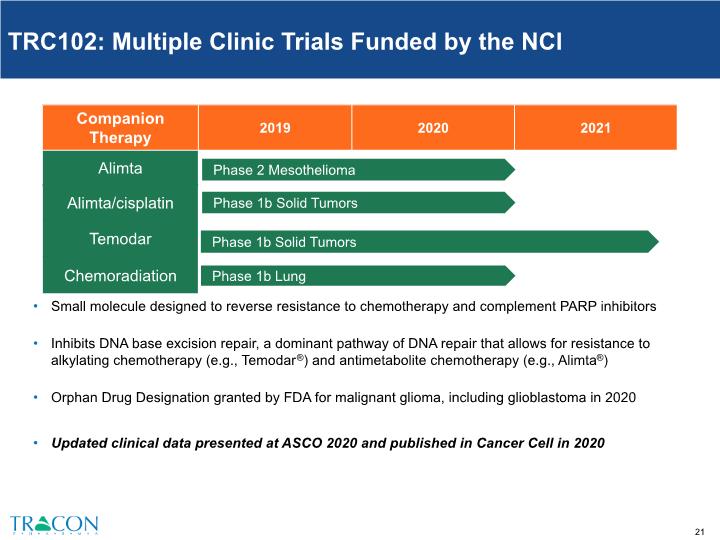

TRC102: Multiple Clinic Trials Funded by the NCI 1 Phase 1b Solid Tumors Phase 1b Solid Tumors Phase 2 wet AMD 3 Prostate Small molecule designed to reverse resistance to chemotherapy and complement PARP inhibitors Inhibits DNA base excision repair, a dominant pathway of DNA repair that allows for resistance to alkylating chemotherapy (e.g., Temodar®) and antimetabolite chemotherapy (e.g., Alimta®) Orphan Drug Designation granted by FDA for malignant glioma, including glioblastoma in 2020 Updated clinical data presented at ASCO 2020 and published in Cancer Cell in 2020 Phase 1b Lung Phase 2 Mesothelioma

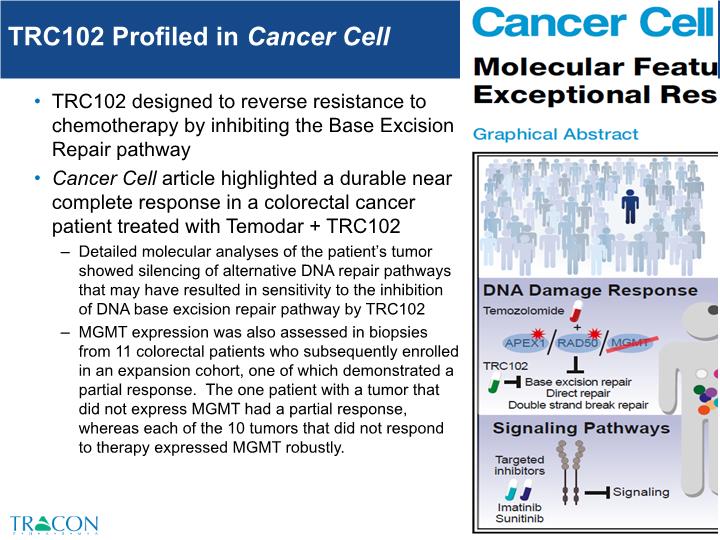

TRC102 Profiled in Cancer Cell TRC102 designed to reverse resistance to chemotherapy by inhibiting the Base Excision Repair pathway Cancer Cell article highlighted a durable near complete response in a colorectal cancer patient treated with Temodar + TRC102 Detailed molecular analyses of the patient’s tumor showed silencing of alternative DNA repair pathways that may have resulted in sensitivity to the inhibition of DNA base excision repair pathway by TRC102 MGMT expression was also assessed in biopsies from 11 colorectal patients who subsequently enrolled in an expansion cohort, one of which demonstrated a partial response. The one patient with a tumor that did not express MGMT had a partial response, whereas each of the 10 tumors that did not respond to therapy expressed MGMT robustly.

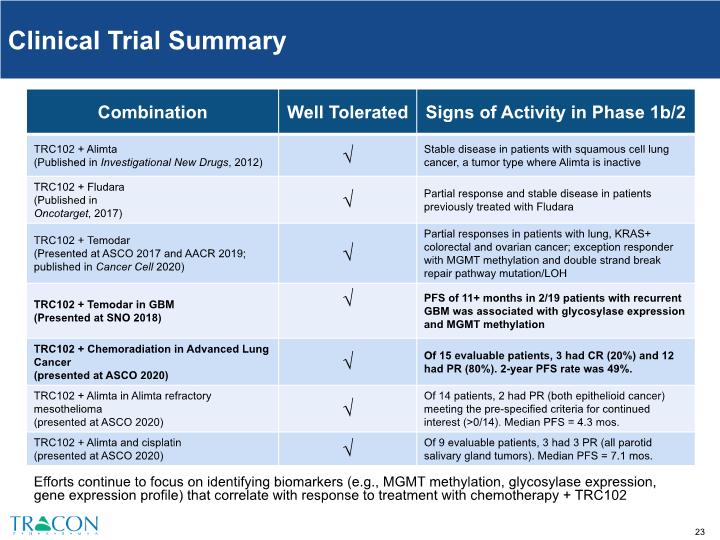

Efforts continue to focus on identifying biomarkers (e.g., MGMT methylation, glycosylase expression, gene expression profile) that correlate with response to treatment with chemotherapy + TRC102 Clinical Trial Summary

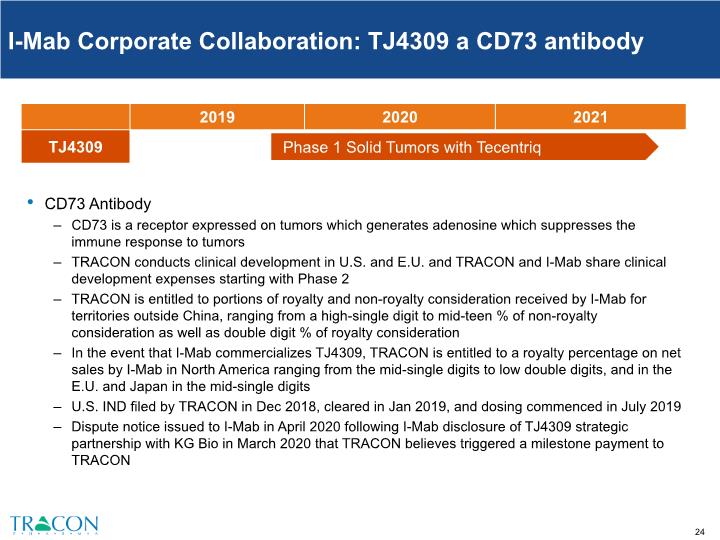

I-Mab Corporate Collaboration: TJ4309 a CD73 antibody CD73 Antibody CD73 is a receptor expressed on tumors which generates adenosine which suppresses the immune response to tumors TRACON conducts clinical development in U.S. and E.U. and TRACON and I-Mab share clinical development expenses starting with Phase 2 TRACON is entitled to portions of royalty and non-royalty consideration received by I-Mab for territories outside China, ranging from a high-single digit to mid-teen % of non-royalty consideration as well as double digit % of royalty consideration In the event that I-Mab commercializes TJ4309, TRACON is entitled to a royalty percentage on net sales by I-Mab in North America ranging from the mid-single digits to low double digits, and in the E.U. and Japan in the mid-single digits U.S. IND filed by TRACON in Dec 2018, cleared in Jan 2019, and dosing commenced in July 2019 Dispute notice issued to I-Mab in April 2020 following I-Mab disclosure of TJ4309 strategic partnership with KG Bio in March 2020 that TRACON believes triggered a milestone payment to TRACON Phase 1 Solid Tumors with Tecentriq

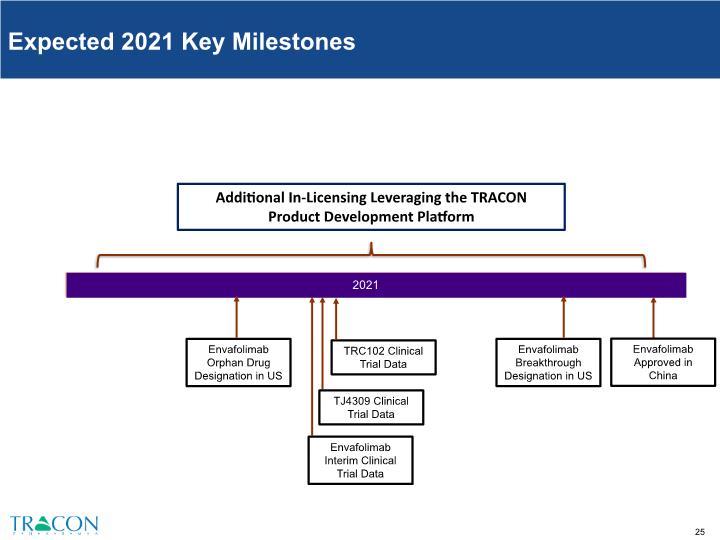

Expected 2021 Key Milestones 2021 Additional In-Licensing Leveraging the TRACON Product Development Platform TRC102 Clinical Trial Data TJ4309 Clinical Trial Data Envafolimab Interim Clinical Trial Data Envafolimab Orphan Drug Designation in US Envafolimab Breakthrough Designation in US Envafolimab Approved in China

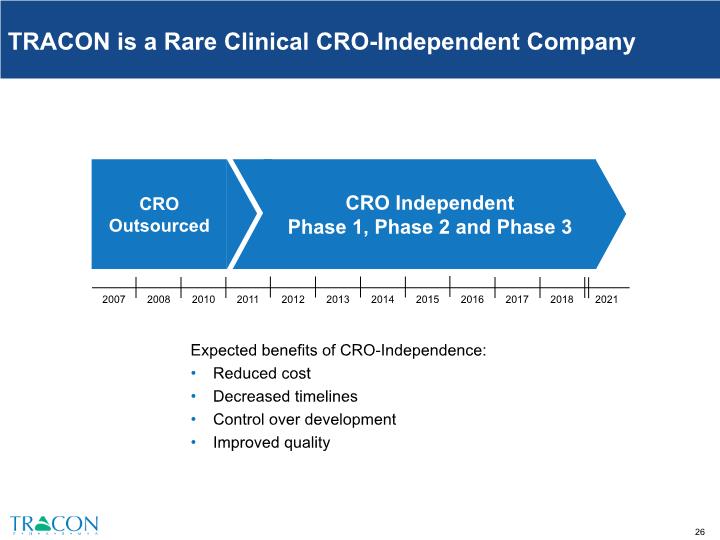

TRACON is a Rare Clinical CRO-Independent Company Expected benefits of CRO-Independence: Reduced cost Decreased timelines Control over development Improved quality CRO Independent Phase 1, Phase 2 and Phase 3 CRO Outsourced

Aligned Product Development Solution Cost, risk and profit share of partnered assets produces goal alignment Platform can be applied to develop first-in-class, best-in-class or fast-follower oncology and other physician specialist prescribed products. U.S. NDA/BLA may be leveraged for regulatory filings in all major territories Opportunity to add U.S. sites to a regional trial to generate representative populations that could facilitate global approval Industry recognition for clinical trial design (Clinical Research Excellence Award) Proven ability to leverage platform to expand pipeline and build value Subcutaneous PD-L1 antibody envafolimab from 3D Medicines and Alphamab Oncology (HKSE: ALPHAMAB ONCOLOGY) Prostate cancer asset from Johnson & Johnson, included equity investment CD73 antibody from I-Mab (NASDAQ: IMAB) Bispecific antibody collaboration with I-Mab (NASDAQ: IMAB)

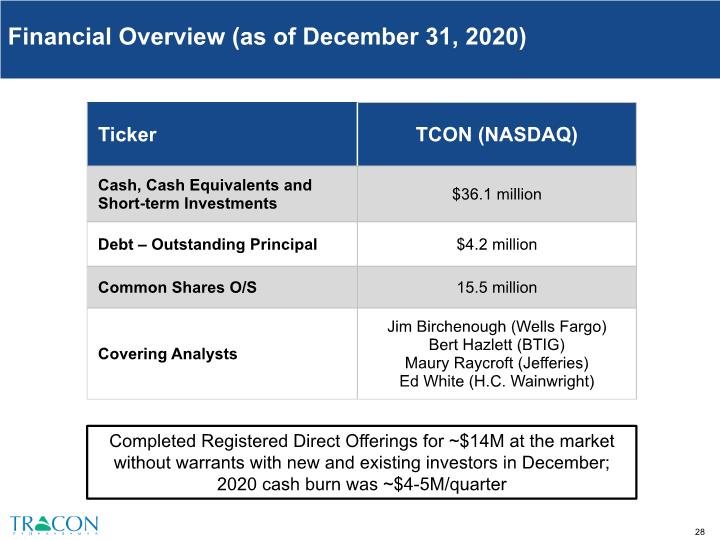

Financial Overview (as of December 31, 2020) Completed Registered Direct Offerings for ~$14M at the market without warrants with new and existing investors in December; 2020 cash burn was ~$4-5M/quarter

Investment Highlights: Pipeline of Clinical Stage Assets and Partnering Platform Seeking Additional Assets via our Product Development Platform of CRO-Independent Clinical Research and U.S. Commercialization Experience