Attached files

| file | filename |

|---|---|

| 8-K - CONTANGO ORE, INC. 8-K - Contango ORE, Inc. | a52347452.htm |

| EX-99.1 - EXHIBIT 99.1 - Contango ORE, Inc. | a52347452ex99_1.htm |

| EX-14.1 - EXHIBIT 14.1 - Contango ORE, Inc. | a52347452ex14_1.htm |

| EX-10.4 - EXHIBIT 10.4 - Contango ORE, Inc. | a52347452ex10_4.htm |

| EX-10.3 - EXHIBIT 10.3 - Contango ORE, Inc. | a52347452ex10_3.htm |

| EX-10.2 - EXHIBIT 10.2 - Contango ORE, Inc. | a52347452ex10_2.htm |

| EX-10.1 - EXHIBIT 10.1 - Contango ORE, Inc. | a52347452ex10_1.htm |

| EX-3.1 - EXHIBIT 3.1 - Contango ORE, Inc. | a52347452ex3_1.htm |

|

|

Exhibit 99.2

|

AGM PRESENTATION DECEMBER 11, 2020

FORWARD LOOKING STATEMENT This presentation contains forward-looking statements regarding CORE that

are intended to be covered by the safe harbor "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995, based on CORE’s current expectations and includes statements regarding future results of operations,

quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using

words such as "expects", “projects”, "anticipates", "plans", "estimates", "potential", "possible", "probable", or "intends", or stating that certain actions, events or results "may", "will", "should", or "could" be taken, occur or be

achieved). Forward- looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those reflected in the

statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for, developing mineral reserves; risks and uncertainties involving geology; the

speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the

existence and extent of commercially exploitable minerals in properties acquired by CORE or the Joint Venture Company; ability to realize the anticipated benefits of the recent transactions with Kinross; disruption from the transactions and

transition of the Joint Venture Company’s management to Kinross, including as it relates to maintenance of business and operational relationships; potential delays or changes in plans with respect to exploration or development projects or

capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural

disasters); uncertainties as to the availability and cost of financing; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; extent of disruptions caused by the

COVID-19 pandemic; and the possibility that government policies may change or governmental approvals may be delayed or withheld, including the inability to obtain any mining permits. Additional information on these and other factors which

could affect CORE’s exploration program or financial results are included in CORE’s other reports on file with the Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future

performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made.

CORE does not assume any obligation to update forward-looking statements should circumstances or management's estimates or opinions change. 2

NON-GAAP MEASURES The Preliminary Economic Assessment (“PEA”) referenced herein was prepared in

accordance with Canadian National Instrument 43-101 (NI 43-101). CORE is not subject to regulation by Canadian regulatory authorities and no Canadian regulatory authority has reviewed the PEA or passed upon its accuracy or compliance with

NI43-101. The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” as used in the resource estimate, the PEA and this presentation are Canadian mining terms as defined in

accordance with NI 43-101; however, these terms are not defined terms under the U.S. Securities and Exchange Commission’s (“SEC’s”) Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with

the SEC. The estimation of measured resources and indicated resources involves greater uncertainty as to their existence and the legal and economic feasibility of extraction than the estimation of proven and probable reserves. Conversion of

mineral resources to proven and probable mineral reserves generally requires a further economic study, such as a preliminary feasibility study. The PEA is not a preliminary feasibility study and does not support an estimate of proven and

probable mineral reserves. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Investors are also cautioned not to assume that all or any part of measured

or indicated resources will ever be converted into mineral reserves. In addition, the SEC normally only permits issuers to report mineralization that does not constitute mineral reserves as in-place tonnage of mineralized material and grade

without reference to unit amounts of metal. Please see the Company’s press release dated September 24, 2018 for more detail regarding the PEA. 3 CAUTIONARY NOTE REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES This

presentation contains certain non-GAAP financial measures. A reconciliation of each such measure to the most comparable GAAP measure is presented in the Appendix hereto. Preliminary all-in sustaining cost estimates included in this

presentation exclude corporate overhead costs. This measure is not a measure of financial performance under GAAP. We strongly advise investors to review our financial statements and publicly filed reports in their entirety and not rely on any

single financial measure. See the Appendix for a reconciliation to GAAP.

Peak Gold Deposit1.3 Moz Gold – Measured plus Indicated ResourcesAverage grade =

4g/tLocated in Alaska on the Alaska HwyOn Private Land Owned by the Tetlin Alaska Native TribeBusiness Partnership with Kinross to Fast-Track Development by Using Fort Knox Milling Facilities

NEAR-TERM PRODUCTION POTENTIAL & EXCELLENT EXPLORATION UPSIDE Entered into 70/30 JV agreement

with Kinross to form new Peak Gold JV; Royal Gold retains royalty;Plan is to mine Peak Gold ore, then truck and process at Kinross’ Fort Knox Milling Complex - Simple plan and simple execution to produce 1Million GEOCapital costs for the

Project are expected to be ~US$110M (100% basis); Operations could potentially start in 2024; Contango’s share is 65,000 GEO/year at $750 AISC/GEO based on Kinross’s estimate1 $3.6 Q4 2020 Budget……….Feasibility in 2021……...Permitting in

2022……….Construction in 2023……….Production in 2024……..On-going ExplorationSignificant exploration upside on nearly 850,000 acres in the heart of the Tintina Gold Belt 2 Approximately 13,000 acres of the state mining claims are subject to a

repurchase option by the Joint Venture Company. 5 PEAK GOLD PROJECT 1 Non-GAAP financial measure; see Appendix for disclaimers regarding reconciliation. OTCQB:CTGO

6 “This is a momentous transaction for the Company and all project stakeholders. Our stockholders will

now see a clear and accelerated path to production at Peak Gold with Kinross. We look forward to working with Kinross and the Tetlin Tribe to develop Alaska’s next gold mine. Meanwhile, we have a great opportunity to find additional gold,

silver and copper resources on our 100% owned state mining claims.”Rick Van Nieuwenhuyse – Contango ORE, President & CEO “The relatively high-grade, low-cost Peak Gold project is an excellent addition to our portfolio, as it allows us to

leverage our existing mill and infrastructure at Fort Knox and strengthens our medium-term production and cash flow profile. In today’s gold price environment, Peak Gold is an attractive, high-margin project that is expected to generate

robust returns. The project is also expected to add to our strong record of socio-economic contributions to our host communities in Alaska, one of the top mining jurisdictions in the world.”J. Paul Rollinson - Kinross Gold, President &

CEO “We look forward to the safe and responsible development of the project and the positive benefits it is expected to generate for our community. We also look forward to further building a relationship with Kinross, a company with a strong

track record in Alaska, and are pleased to see further investment plans for the project.”Chief Michael Sam, Tetlin Tribe

OFFICERS & DIRECTORS OFFICERSRick Van Nieuwenhuyse – President and CEO Leah Gaines –

CFODIRECTORSBrad Juneau (Executive Chairman)Joseph S. CompofeliceJoseph G. GreenbergRichard A. ShortzRick Van Nieuwenhuyse 7 Successful track record of finding real deposits and creating real wealth for shareholdersNovaGold (US$3.7B Market

Cap): Donlin (Alaska) – In PermittingGalore Creek (BC) – Sold to NewmontTrilogy Metals (US$265M Market Cap): Arctic (Alaska) – Feasibility/Permitting Bornite, Ambler Mining District – Advanced ExplorationSandfire America Resources (US$200M

Market Cap): Black Butte (Montana) – Under constructionAlexco (US$380M Market Cap): Keno Hill Mines (Yukon) – In production STRONG MANAGEMENT WITH PROVEN TRACK RECORD

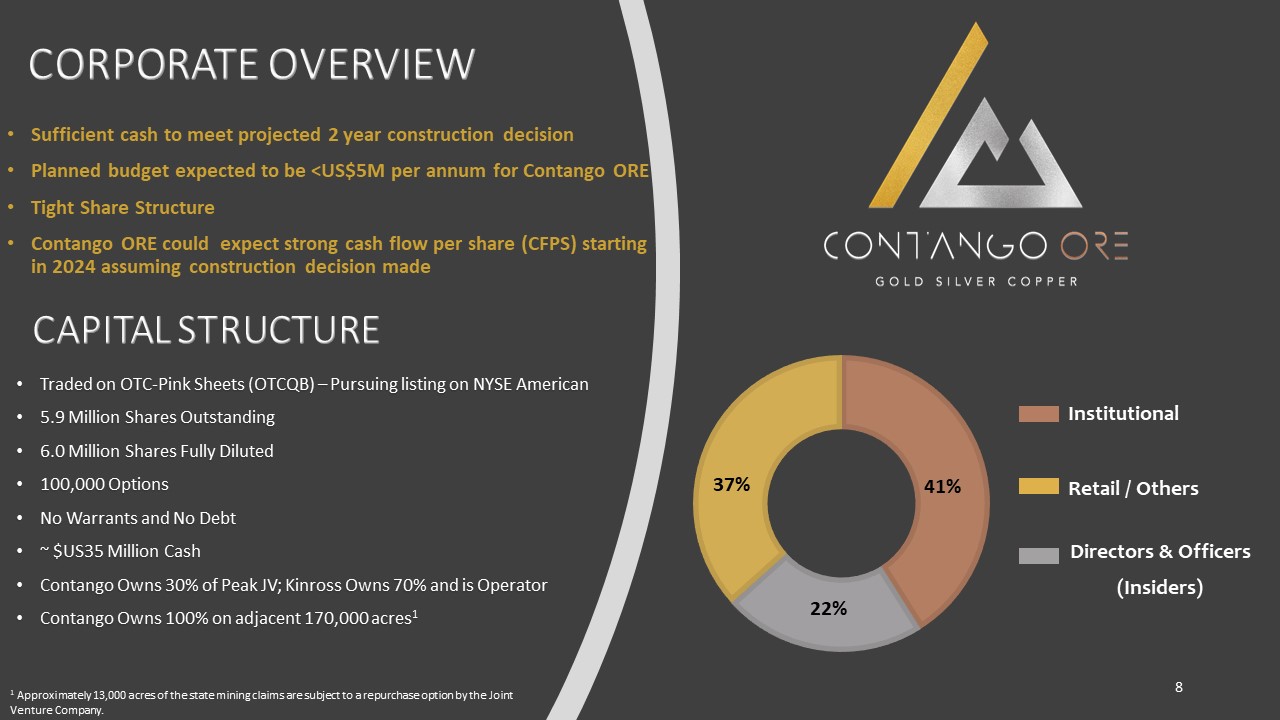

CORPORATE OVERVIEW Traded on OTC-Pink Sheets (OTCQB) – Pursuing listing on NYSE American5.9

Million Shares Outstanding6.0 Million Shares Fully Diluted100,000 OptionsNo Warrants and No Debt~ $US35 Million Cash Contango Owns 30% of Peak JV; Kinross Owns 70% and is OperatorContango Owns 100% on adjacent 170,000 acres1 1 Approximately

13,000 acres of the state mining claims are subject to a repurchase option by the Joint Venture Company. 8 Sufficient cash to meet projected 2 year construction decisionPlanned budget expected to be <US$5M per annum for Contango ORETight

Share StructureContango ORE could expect strong cash flow per share (CFPS) starting in 2024 assuming construction decision made CAPITAL STRUCTURE Institutional Retail / Others Directors & Officers (Insiders)

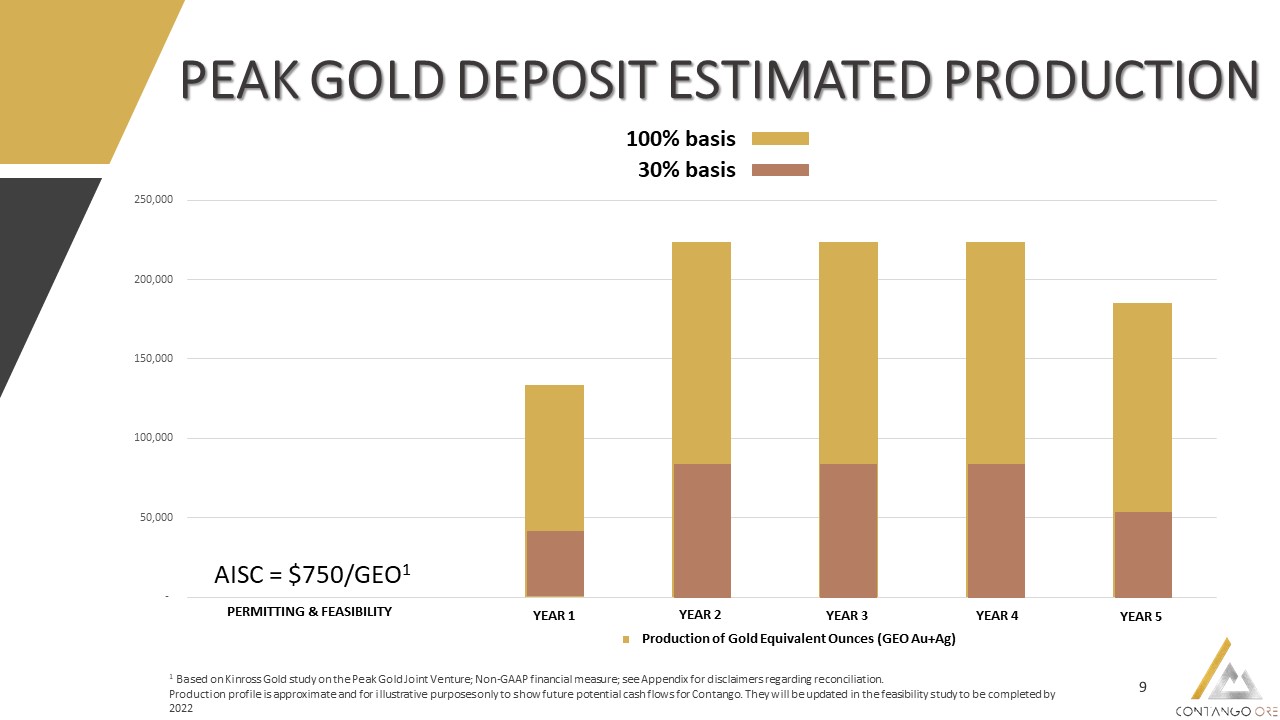

PEAK GOLD DEPOSIT ESTIMATED PRODUCTION 9 1 Based on Kinross Gold study on the Peak Gold Joint

Venture; Non-GAAP financial measure; see Appendix for disclaimers regarding reconciliation.Production profile is approximate and for illustrative purposes only to show future potential cash flows for Contango. They will be updated in the

feasibility study to be completed by 2022 Production of Gold Equivalent Ounces (GEO Au+Ag) 100% basis AISC = $750/GEO1 30% basis

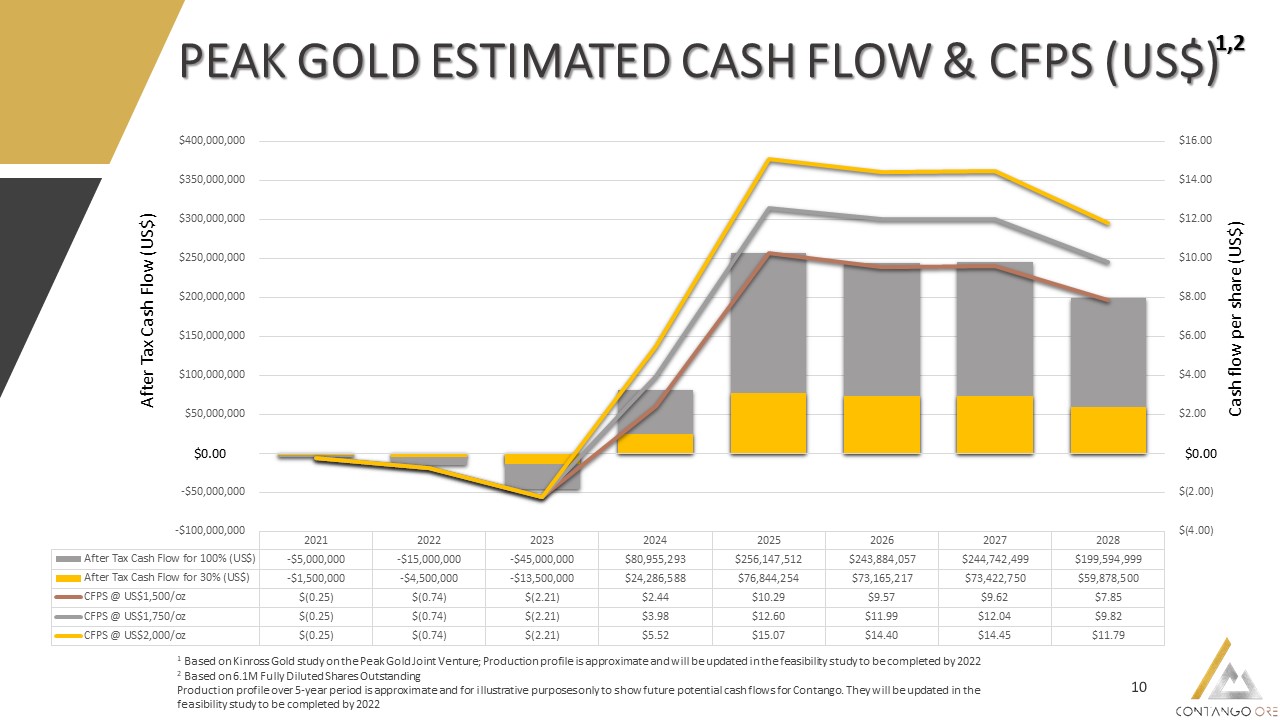

PEAK GOLD ESTIMATED CASH FLOW & CFPS (US$) 10 1 Based on Kinross Gold study on the Peak

Gold Joint Venture; Production profile is approximate and will be updated in the feasibility study to be completed by 20222 Based on 6.1M Fully Diluted Shares OutstandingProduction profile over 5-year period is approximate and for

illustrative purposes only to show future potential cash flows for Contango. They will be updated in the feasibility study to be completed by 2022 Cash flow per share (US$) After Tax Cash Flow (US$) $0.00 $0.00 1,2

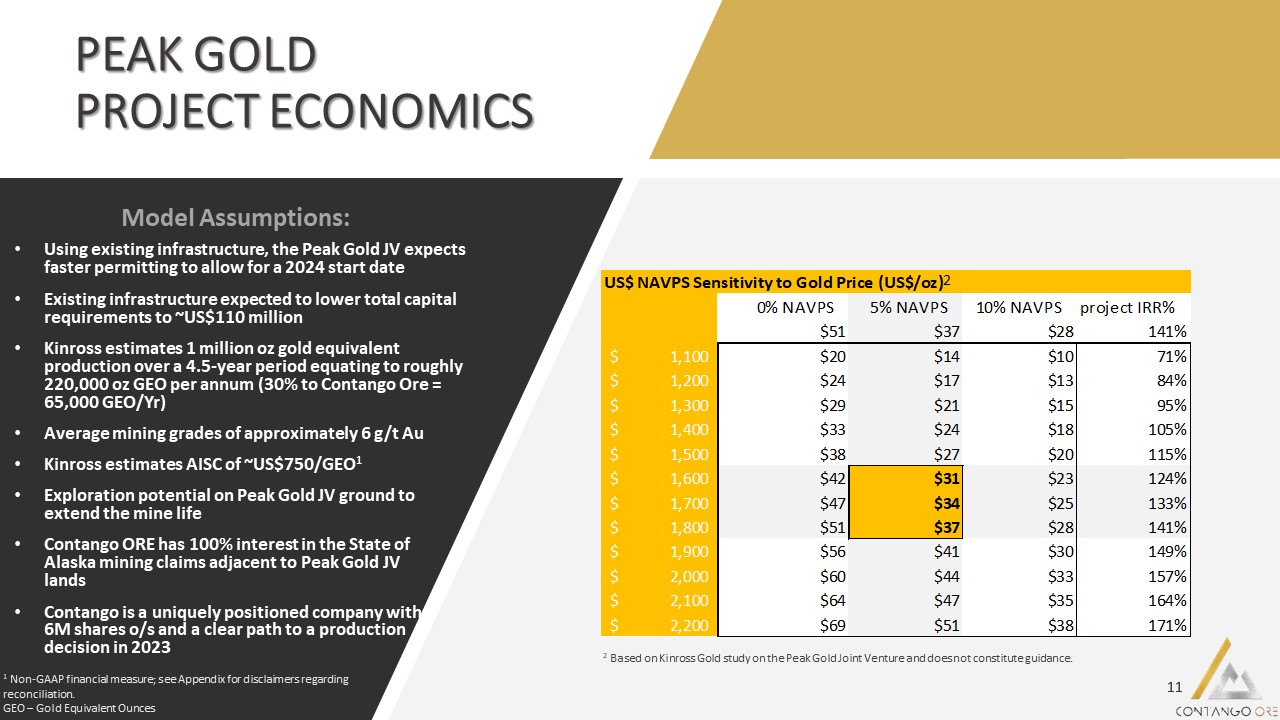

PEAK GOLD PROJECT ECONOMICS Using existing infrastructure, the Peak Gold JV expects faster

permitting to allow for a 2024 start dateExisting infrastructure expected to lower total capital requirements to ~US$110 millionKinross estimates 1 million oz gold equivalent production over a 4.5-year period equating to roughly 220,000 oz

GEO per annum (30% to Contango Ore = 65,000 GEO/Yr)Average mining grades of approximately 6 g/t AuKinross estimates AISC of ~US$750/GEO1Exploration potential on Peak Gold JV ground to extend the mine lifeContango ORE has 100% interest in the

State of Alaska mining claims adjacent to Peak Gold JV landsContango is a uniquely positioned company with 6M shares o/s and a clear path to a production decision in 2023 11 Model Assumptions: 2 Based on Kinross Gold study on the Peak Gold

Joint Venture and does not constitute guidance. 2 1 Non-GAAP financial measure; see Appendix for disclaimers regarding reconciliation.GEO – Gold Equivalent Ounces

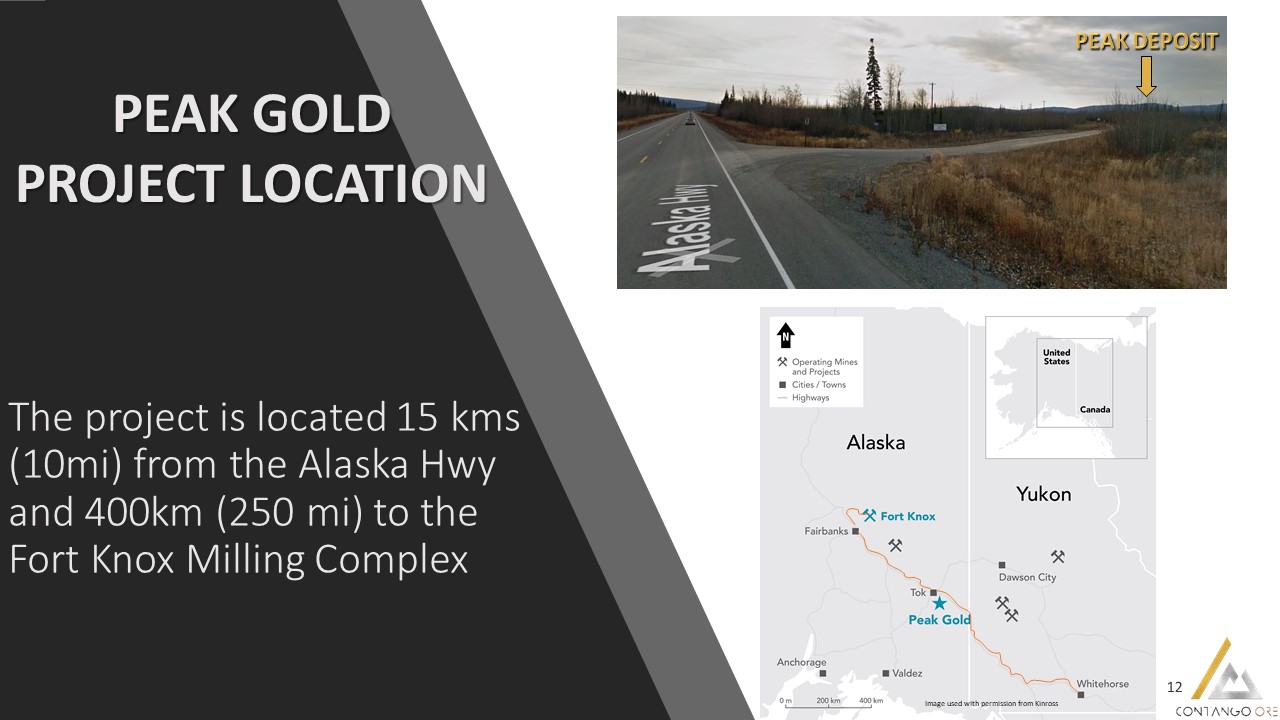

The project is located 15 kms (10mi) from the Alaska Hwy and 400km (250 mi) to the Fort Knox

Milling Complex 12 PEAK GOLDPROJECT LOCATION PEAK DEPOSIT Image used with permission from Kinross

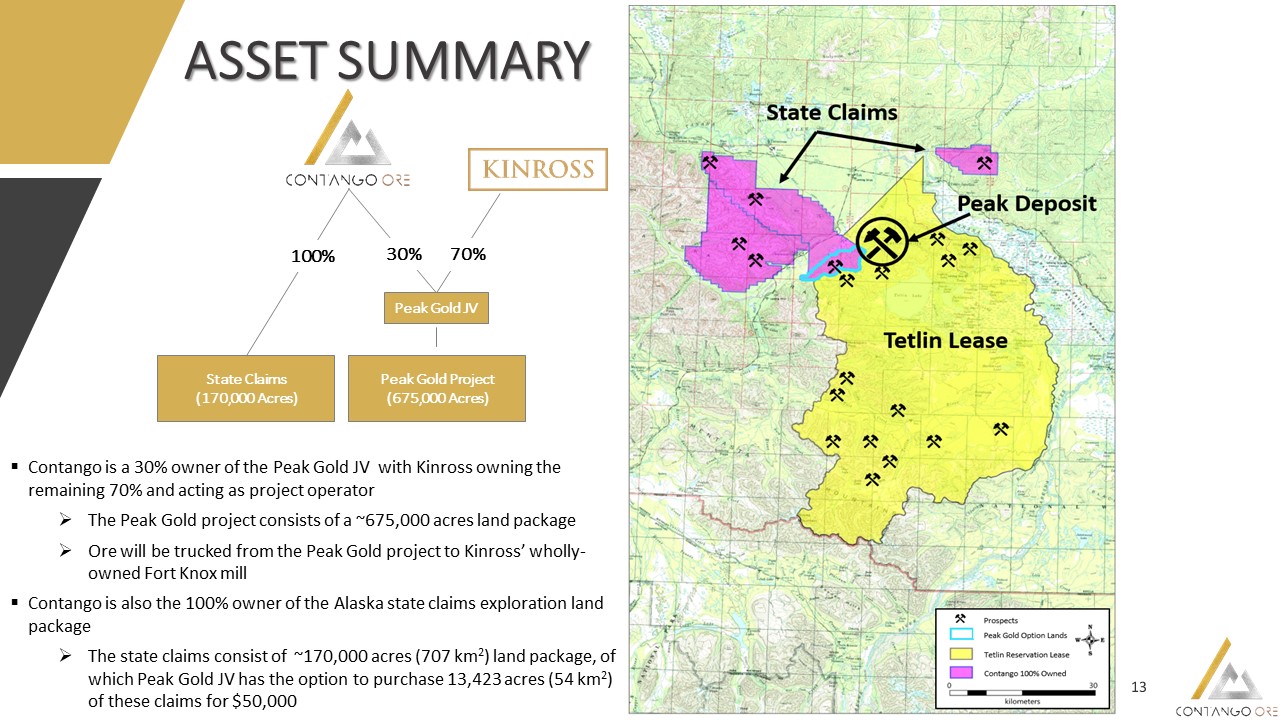

ASSET SUMMARY 13 Peak Gold Project(675,000 Acres) State Claims(170,000 Acres) Contango is a

30% owner of the Peak Gold JV with Kinross owning the remaining 70% and acting as project operatorThe Peak Gold project consists of a ~675,000 acres land packageOre will be trucked from the Peak Gold project to Kinross’ wholly-owned Fort Knox

millContango is also the 100% owner of the Alaska state claims exploration land packageThe state claims consist of ~170,000 acres (707 km2) land package, of which Peak Gold JV has the option to purchase 13,423 acres (54 km2) of these claims

for $50,000 Peak Gold JV 70% 30% 100%

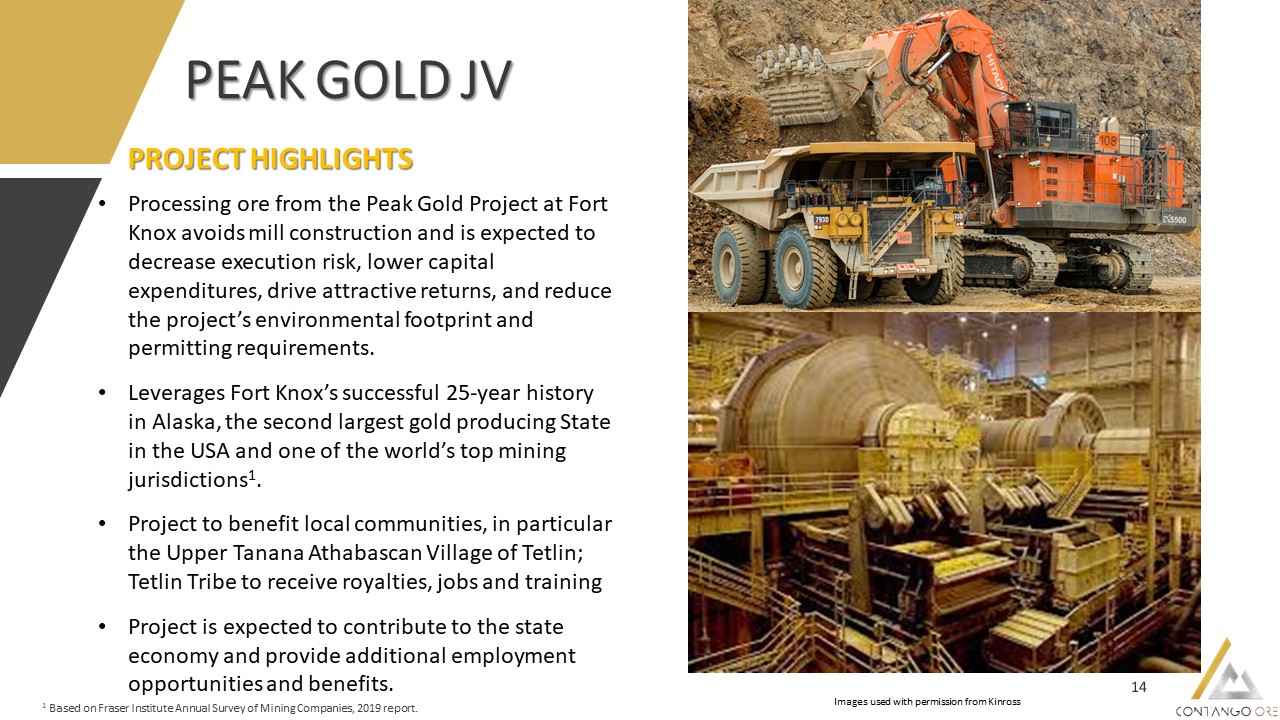

PEAK GOLD JV 14 Processing ore from the Peak Gold Project at Fort Knox avoids mill construction

and is expected to decrease execution risk, lower capital expenditures, drive attractive returns, and reduce the project’s environmental footprint and permitting requirements.Leverages Fort Knox’s successful 25-year history in Alaska, the

second largest gold producing State in the USA and one of the world’s top mining jurisdictions1.Project to benefit local communities, in particular the Upper Tanana Athabascan Village of Tetlin; Tetlin Tribe to receive royalties, jobs and

trainingProject is expected to contribute to the state economy and provide additional employment opportunities and benefits. PROJECT HIGHLIGHTS 1 Based on Fraser Institute Annual Survey of Mining Companies, 2019 report. Images used with

permission from Kinross

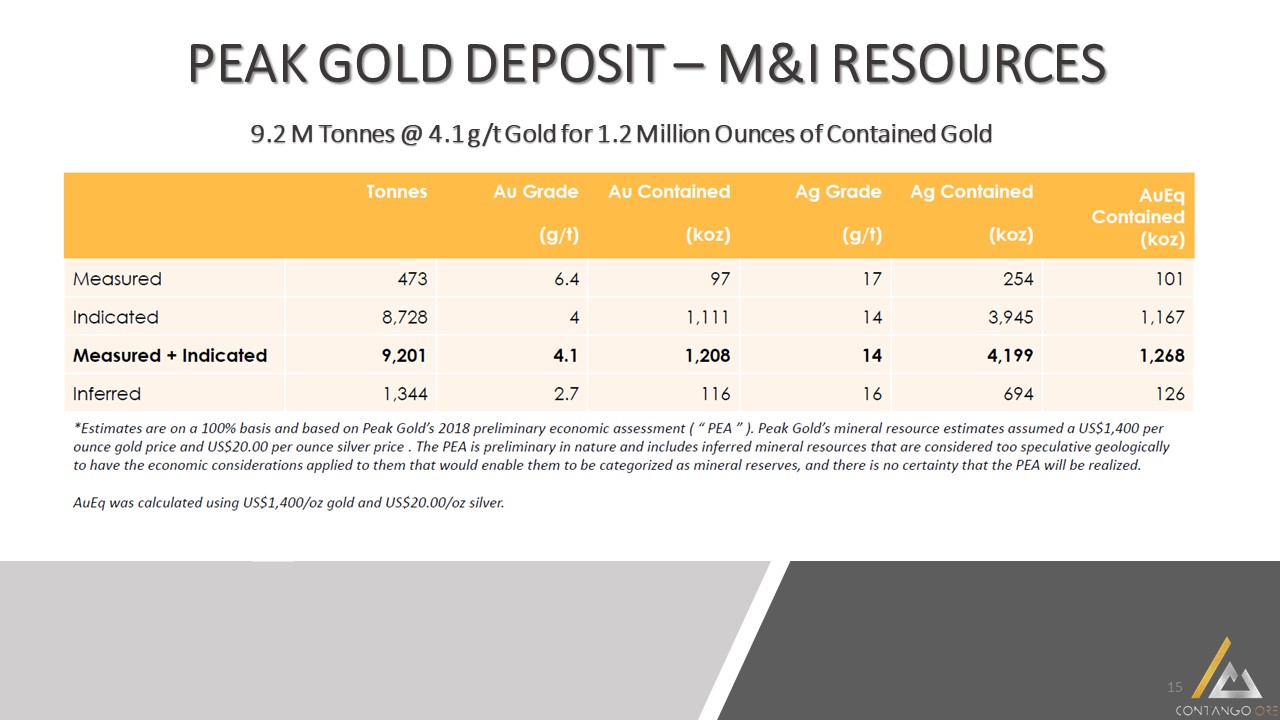

15 PEAK GOLD DEPOSIT – M&I RESOURCES 9.2 M Tonnes @ 4.1 g/t Gold for 1.2 Million Ounces of

Contained Gold

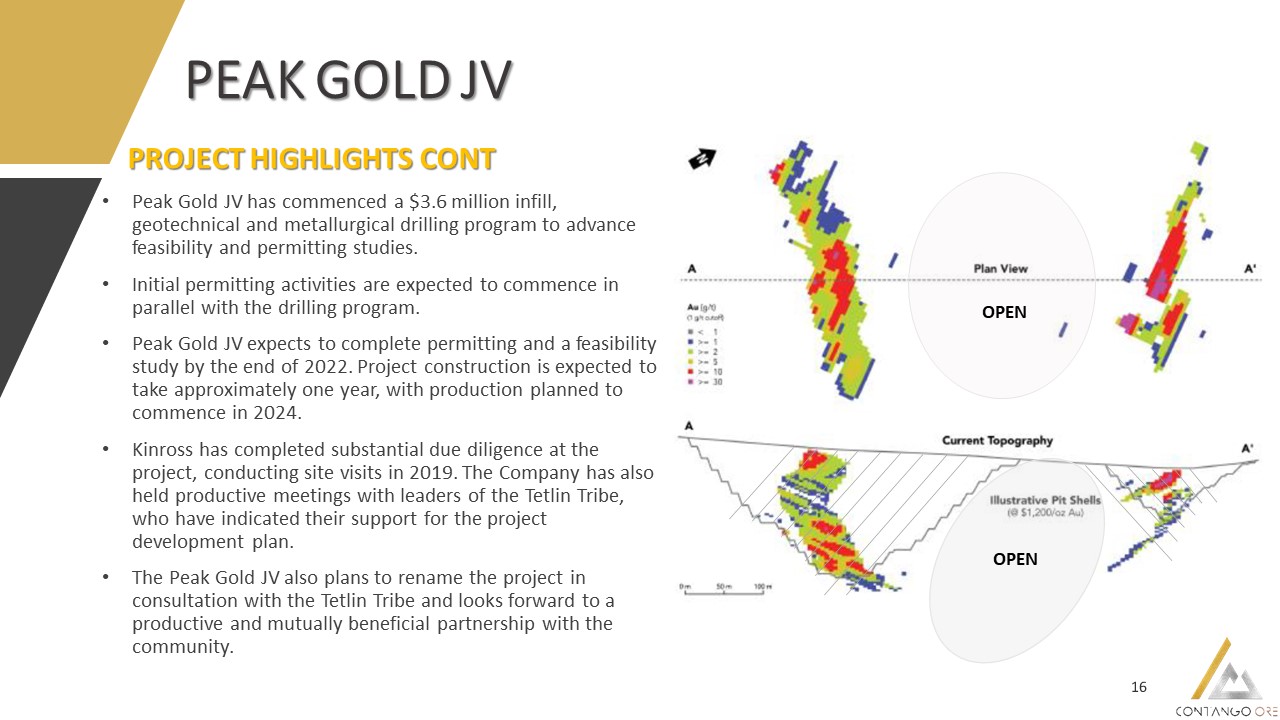

PEAK GOLD JV 16 PROJECT HIGHLIGHTS CONT Peak Gold JV has commenced a $3.6 million infill,

geotechnical and metallurgical drilling program to advance feasibility and permitting studies. Initial permitting activities are expected to commence in parallel with the drilling program. Peak Gold JV expects to complete permitting and a

feasibility study by the end of 2022. Project construction is expected to take approximately one year, with production planned to commence in 2024.Kinross has completed substantial due diligence at the project, conducting site visits in 2019.

The Company has also held productive meetings with leaders of the Tetlin Tribe, who have indicated their support for the project development plan. The Peak Gold JV also plans to rename the project in consultation with the Tetlin Tribe and

looks forward to a productive and mutually beneficial partnership with the community. OPEN OPEN

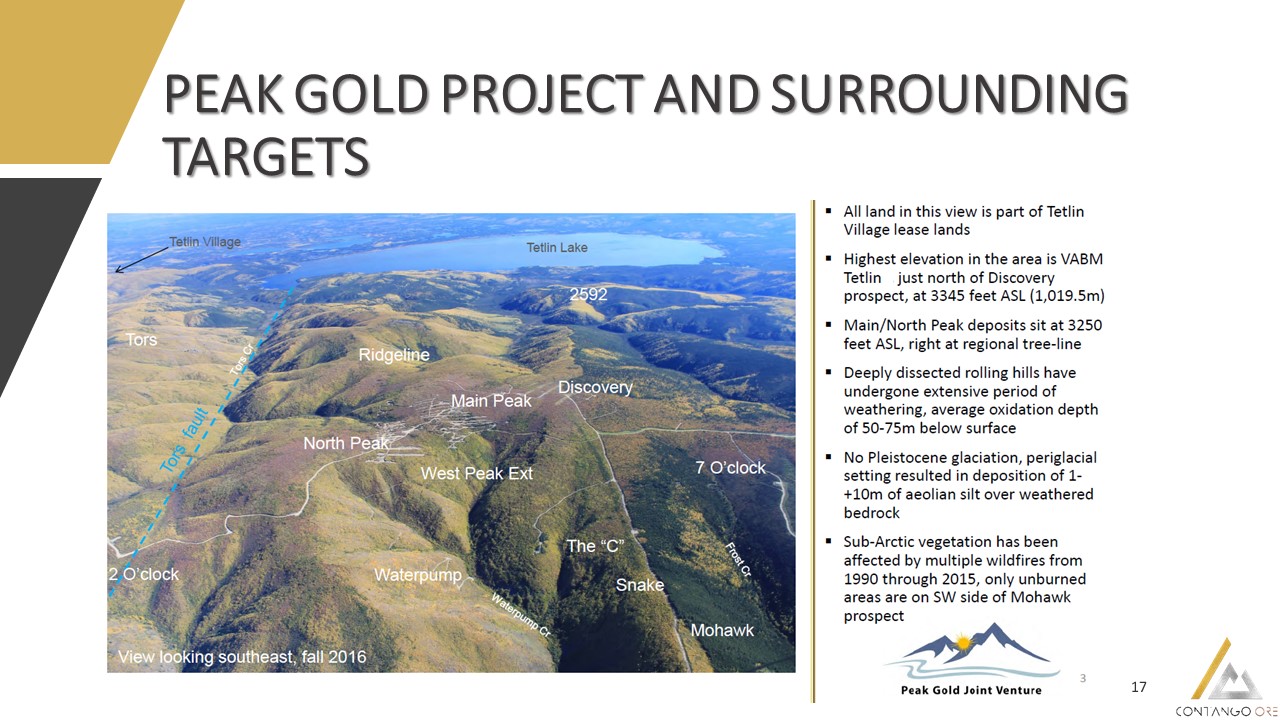

17 PEAK GOLD PROJECT AND SURROUNDING TARGETS

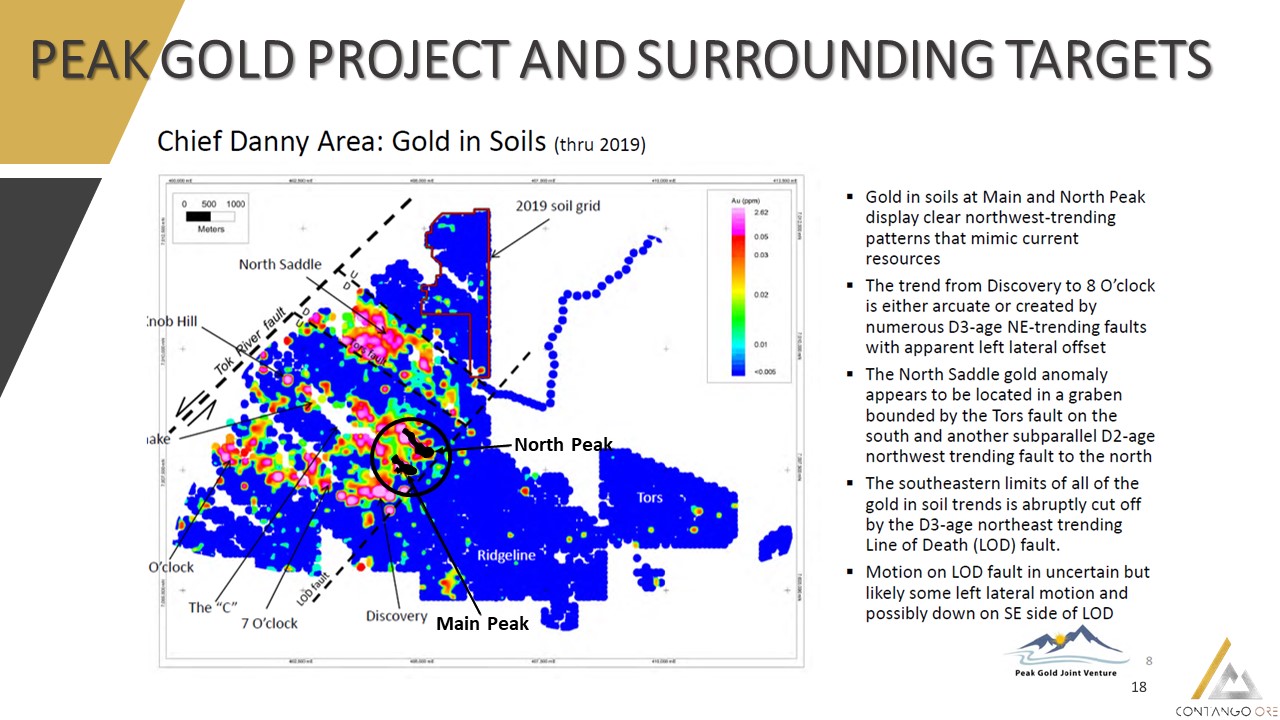

18 PEAK GOLD PROJECT AND SURROUNDING TARGETS Main Peak North Peak

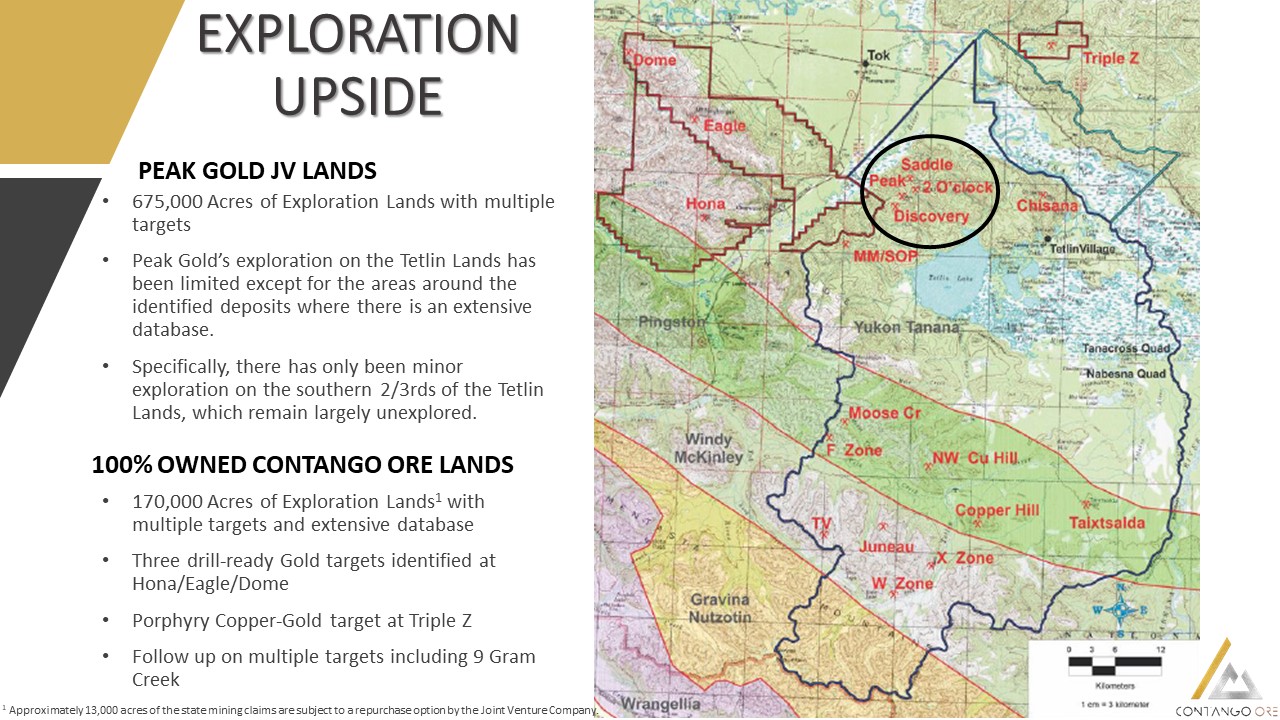

19 EXPLORATION UPSIDE 675,000 Acres of Exploration Lands with multiple targetsPeak Gold’s

exploration on the Tetlin Lands has been limited except for the areas around the identified deposits where there is an extensive database. Specifically, there has only been minor exploration on the southern 2/3rds of the Tetlin Lands, which

remain largely unexplored. PEAK GOLD JV LANDS 170,000 Acres of Exploration Lands1 with multiple targets and extensive databaseThree drill-ready Gold targets identified at Hona/Eagle/DomePorphyry Copper-Gold target at Triple ZFollow up on

multiple targets including 9 Gram Creek 100% OWNED CONTANGO ORE LANDS 1 Approximately 13,000 acres of the state mining claims are subject to a repurchase option by the Joint Venture Company.

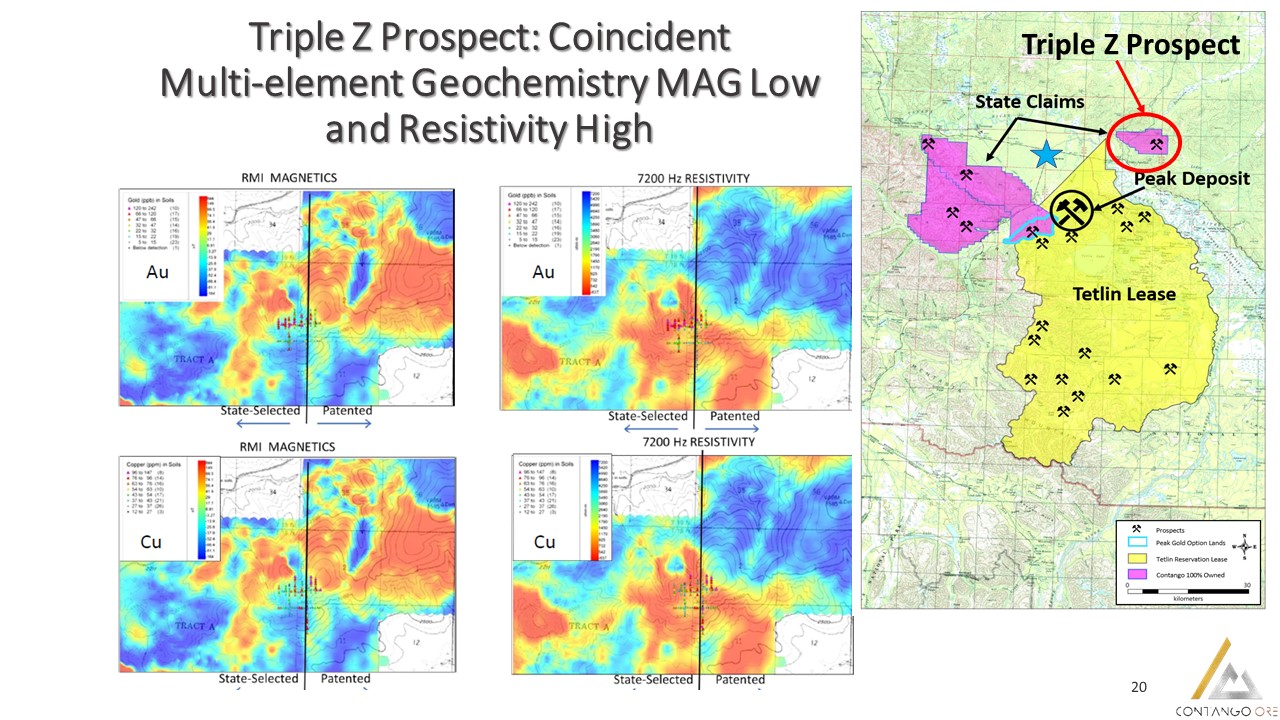

20 Triple Z Prospect: Coincident Multi-element Geochemistry MAG Low and Resistivity High Triple Z

Prospect

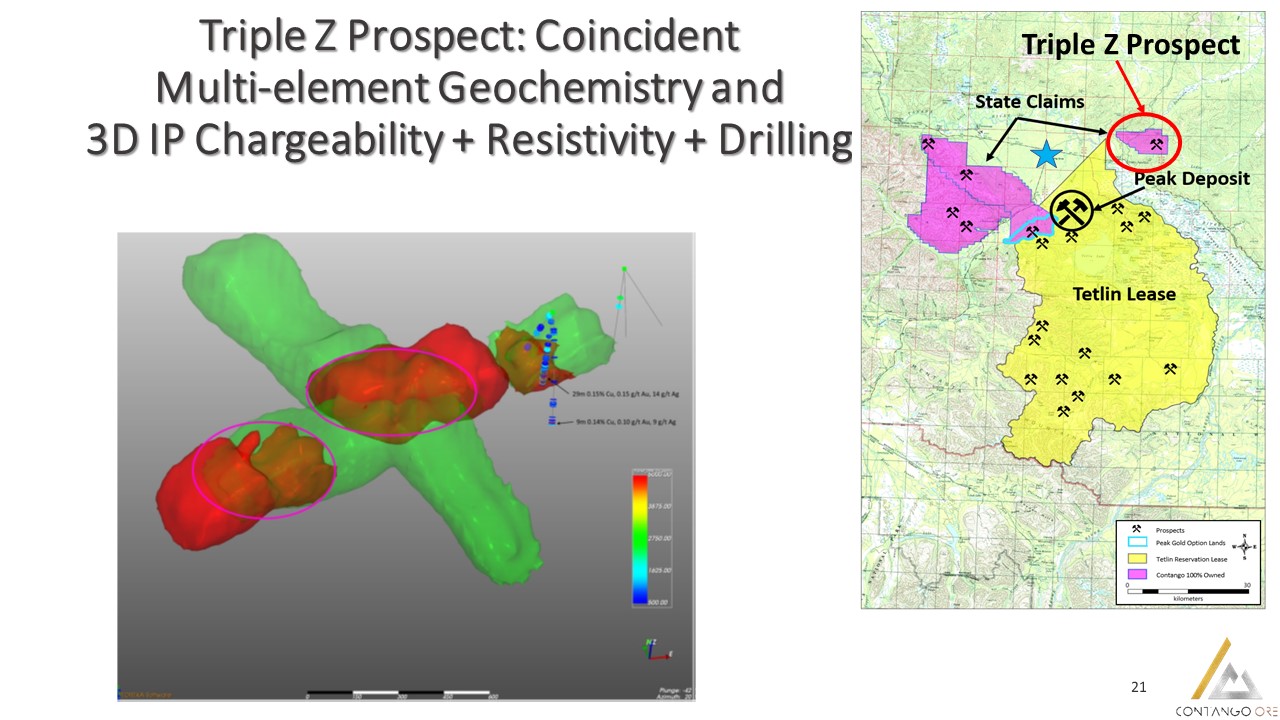

21 Triple Z Prospect: Coincident Multi-element Geochemistry and 3D IP Chargeability + Resistivity +

Drilling Triple Z Prospect

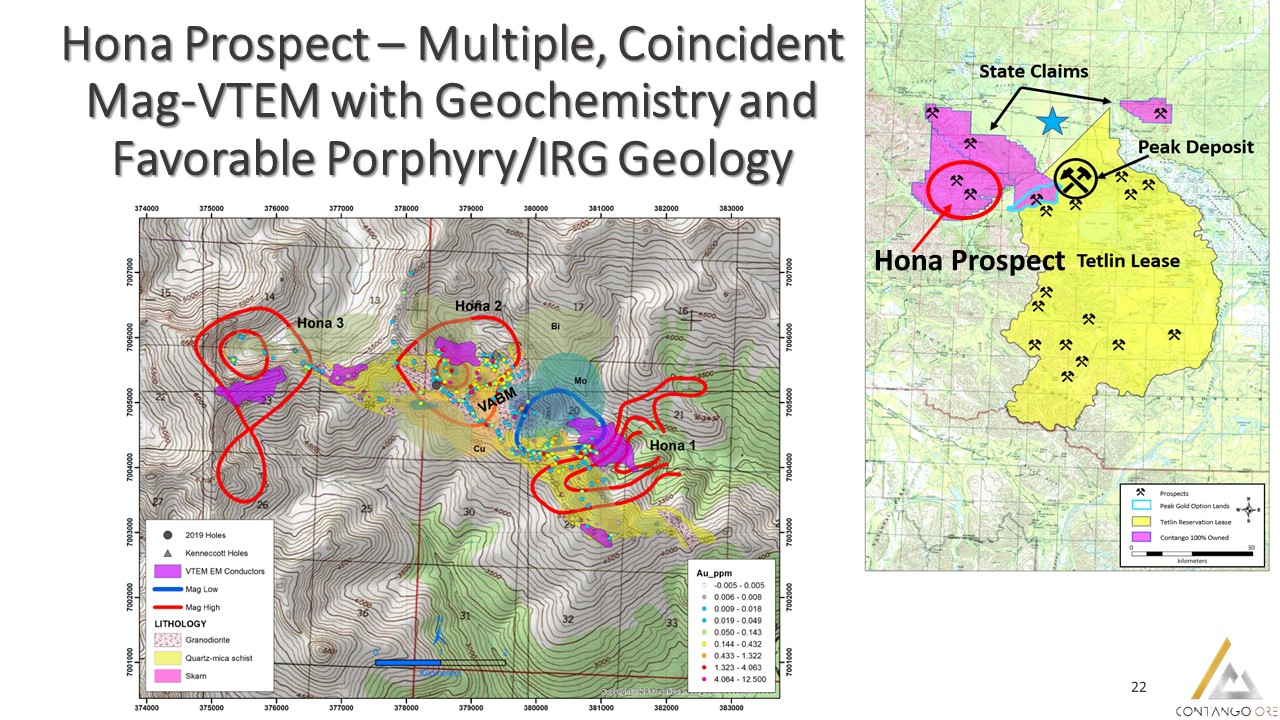

22 Hona Prospect Hona Prospect – Multiple, Coincident Mag-VTEM with Geochemistry and Favorable

Porphyry/IRG Geology

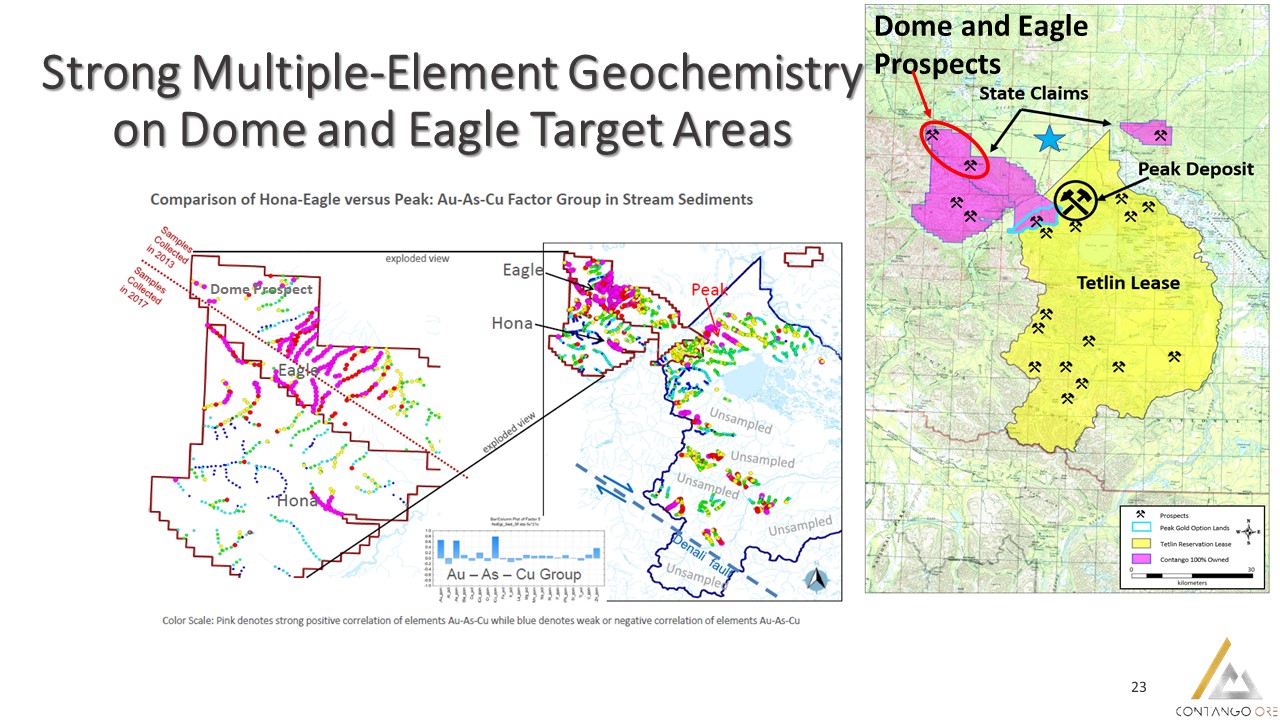

23 Dome and Eagle Prospects Strong Multiple-Element Geochemistry on Dome and Eagle Target

Areas Dome Prospect

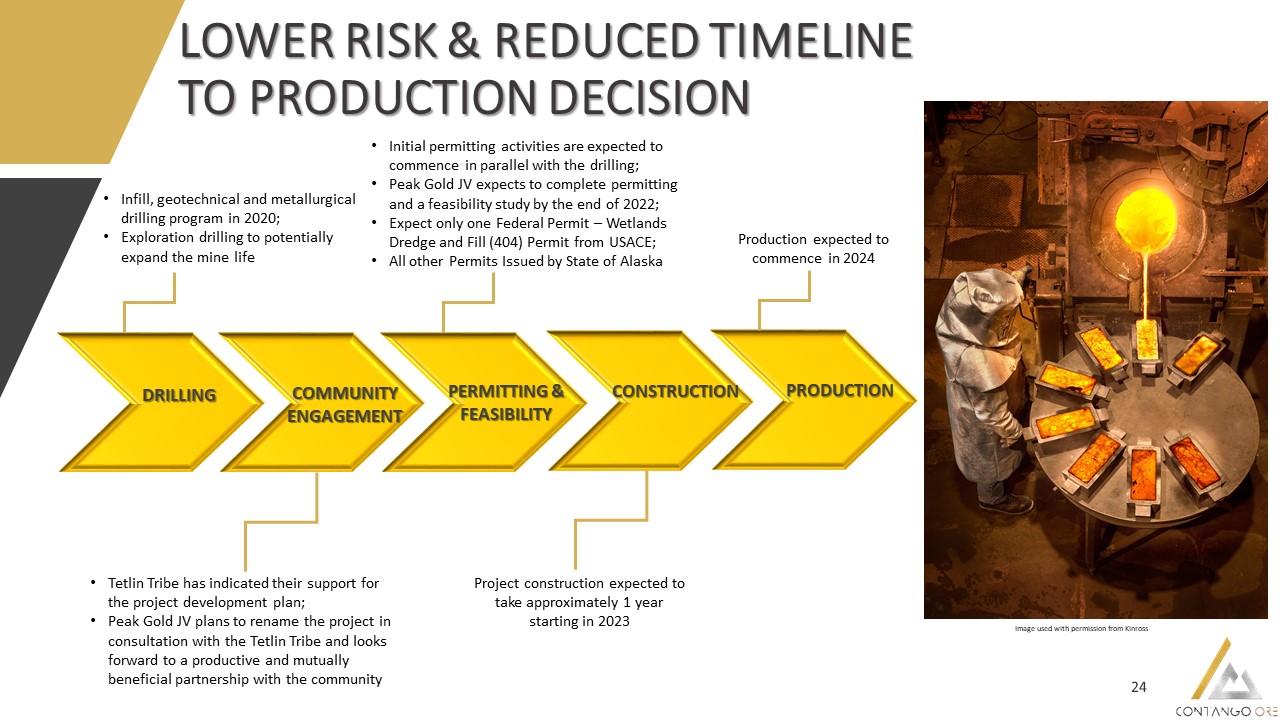

24 LOWER RISK & REDUCED TIMELINE TO PRODUCTION DECISION DRILLING COMMUNITY

ENGAGEMENT PERMITTING & FEASIBILITY PRODUCTION CONSTRUCTION Infill, geotechnical and metallurgical drilling program in 2020;Exploration drilling to potentially expand the mine life Tetlin Tribe has indicated their support for the

project development plan;Peak Gold JV plans to rename the project in consultation with the Tetlin Tribe and looks forward to a productive and mutually beneficial partnership with the community Initial permitting activities are expected to

commence in parallel with the drilling; Peak Gold JV expects to complete permitting and a feasibility study by the end of 2022;Expect only one Federal Permit – Wetlands Dredge and Fill (404) Permit from USACE; All other Permits Issued by

State of Alaska Project construction expected to take approximately 1 year starting in 2023 Production expected to commence in 2024 Image used with permission from Kinross

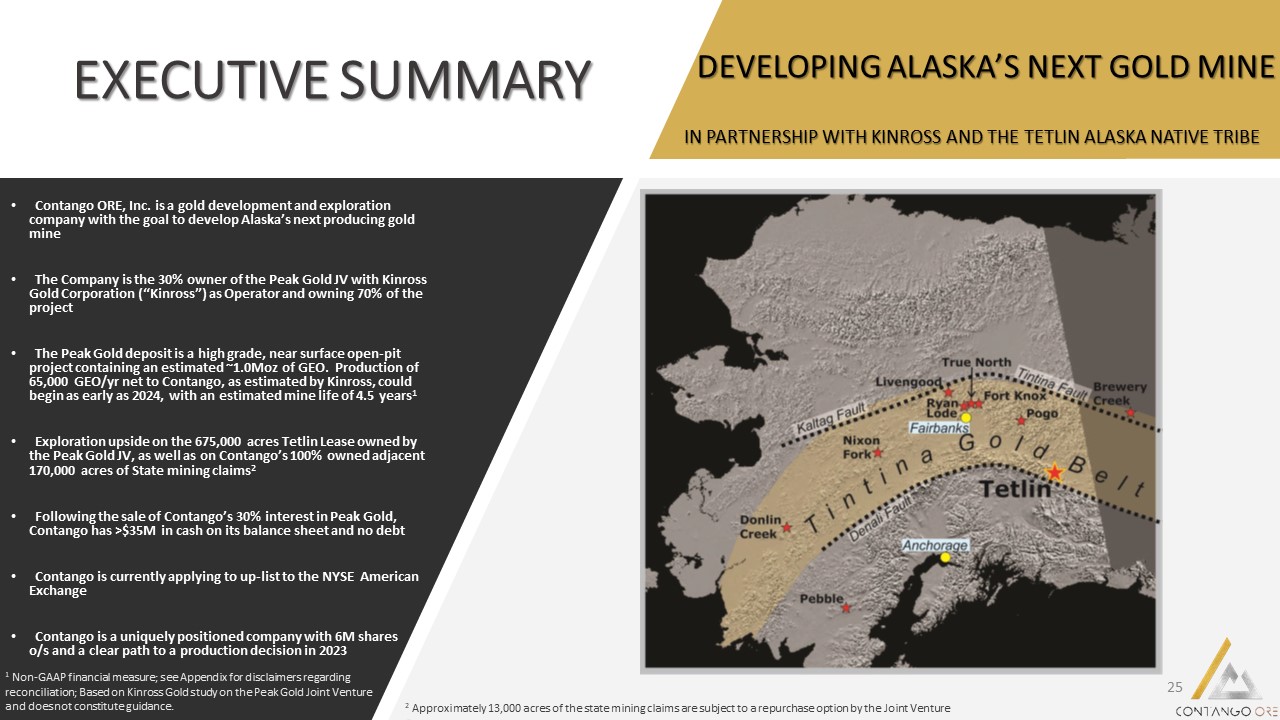

EXECUTIVE SUMMARY Contango ORE, Inc. is a gold development and exploration company with the goal

to develop Alaska’s next producing gold mine The Company is the 30% owner of the Peak Gold JV with Kinross Gold Corporation (“Kinross”) as Operator and owning 70% of the projectThe Peak Gold deposit is a high grade, near surface open-pit

project containing an estimated ~1.0Moz of GEO. Production of 65,000 GEO/yr net to Contango, as estimated by Kinross, could begin as early as 2024, with an estimated mine life of 4.5 years1Exploration upside on the 675,000 acres Tetlin Lease

owned by the Peak Gold JV, as well as on Contango’s 100% owned adjacent 170,000 acres of State mining claims2Following the sale of Contango’s 30% interest in Peak Gold, Contango has >$35M in cash on its balance sheet and no debtContango is

currently applying to up-list to the NYSE American ExchangeContango is a uniquely positioned company with 6M shares o/s and a clear path to a production decision in 2023 25 DEVELOPING ALASKA’S NEXT GOLD MINE IN PARTNERSHIP WITH KINROSS

AND THE TETLIN ALASKA NATIVE TRIBE 2 Approximately 13,000 acres of the state mining claims are subject to a repurchase option by the Joint Venture Company. 1 Non-GAAP financial measure; see Appendix for disclaimers regarding reconciliation;

Based on Kinross Gold study on the Peak Gold Joint Venture and does not constitute guidance.

26 Partnered with Proven OperatorPlan to truck ore to Fort Knox mill simplifies permitting and

executionKinross has proven operating experience in Alaska further reducing riskThe plan lowers the required capital and shortens timelines to production by leveraging existing infrastructureHigh grade open pit production expected to result

in strong free cash flows Believed to be UndervaluedStrong management that has created significant value for shareholdersPlanned listing on NYSE American Exchange Clear path to production decisionUniquely positioned for growth Exploration

UpsideSignificant exploration potential on the Peak Gold JV lands as well as the 100% owned State of Alaska mining claims adjacent to the future operation INVESTMENT OPPORTUNITY WHY INVEST NOW?

27 THANK YOU

Corporate Inquires:info@contangoore.com+1-778-386-6227www.contangoore.com OTCQB:CTGO Twitter:

@orecontangoLinkedIn: Contango OREInstagram: ContangoOREFacebook: Contango ORE

This presentation contains forward looking estimates of all-in sustaining cost (“AISC”), resources and

EBITDA, which are a financial measures not determined in accordance with United States generally accepted accounting principles (“GAAP”). We cannot provide a reconciliation of estimated AISC, resources, EBITDA and cash flow to estimated

costs of goods sold, assets and net income, which are the GAAP financial measures most directly comparable to such non-GAAP measures, without unreasonable efforts due to the inherent difficulty and impracticality of quantifying certain

amounts that would be required to calculate projected AISC, resources, EBITDA. In addition, the estimates of AISC, resources and EBITDA have been prepared by Kinross and are based on IFRS accounting standards and detailed information to

which the Company has not had access to at this time. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP cost of goods sold, assets and net income would vary

substantially from the amount of projected AISC, resources and EBITDA. 29 NON-GAAP RECONCILIATION DISCLAIMER APPENDIX