Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bloom Energy Corp | be-20201216.htm |

1© 2020 Bloom Energy Corporation. All rights reserved. B L O O M E N E R G Y V I R T U AL W E D D E C 1 6 , 2 0 2 0 ANALYST DAY 2020

2© 2020 Bloom Energy Corporation. All rights reserved. FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains "forward-looking" statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include all statements other than statements of historical fact, including information or predictions concerning our future financial performance and financial outlook for fiscal year 2021; our business plans and objectives; potential growth and market opportunities in our base business as well as new international markets; potential growth and market opportunities in enabling technologies, including the carbon capture, biogas and marine markets; our expectations around hydrogen fuel cells, electrolyzers, and the hydrogen market; our competitive position; future technological or market trends; our anticipated roadmap; and statements regarding new applications across the energy landscape. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions, and other factors including, but not limited to, our limited operating history, the emerging nature of the distributed generation market and rapidly evolving market trends, the significant losses we have incurred in the past, our ability to service our existing debt obligations, our ability to succeed in the the hydrogen fuel cell market, the significant upfront costs of our Energy Servers and R&D costs of new products to address emerging markets, delays in the development and introduction of new products or updates to existing products, market acceptance and adoption of our products, our ability to continue to drive cost reductions, the risk of manufacturing defects, the accuracy of our estimates regarding the useful life of our Energy Servers, the availability of rebates, tax credits and other tax benefits, our reliance on tax equity financing arrangements, our ability to successfully enter new international markets, our reliance upon a limited number of customers, our lengthy sales and installation cycle, construction, utility interconnection and other delays and cost overruns related to the installation of our Energy Servers, potential supply chain constraints, business and economic conditions and growth trends in commercial and industrial energy markets, global economic conditions and uncertainties in the geopolitical environment, overall electricity generation market, the COVID 19 pandemic and other risks and uncertainties. Moreover, we operate in very competitive and rapidly changing environments, and new risks may emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, performance, or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we, nor any other person, assume responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations, except as required by law. These forward- looking statements should also be read in conjunction with the other cautionary statements that are included elsewhere in our public filings, including under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 and subsequent filings with the SEC filed from time-to-time. This presentation also includes certain historical, and in prospective, non-GAAP financial measures related to gross margin and operating margin. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation of the historical non- GAAP measures used in this presentation to our GAAP results for the relevant period can be found in the Appendix to this presentation. With respect to our expectations regarding “Preliminary FY2021 Financial Metrics Outlook” and other long-term financial targets, we are not able to provide a quantitative reconciliation of non-GAAP gross margin and operating margin measures to the corresponding gross profit and gross profit percentage without unreasonable efforts.

3© 2020 Bloom Energy Corporation. All rights reserved. Greg Cameron Executive Vice President Chief Financial Officer OVERVIEW FINANCIAL

4© 2020 Bloom Energy Corporation. All rights reserved. 876 $545 21.3% ($19) ($0.61) +8% (5%) +2pts +24% +$0.17 2020 YEAR-TO-DATE FINANCIAL PERFORMANCE Issued $230 Million Green Bond; Eliminated High Cost / Short Term Debt Record Number of Acceptances; Ramping Volume in the Second Half Cost Reductions Driving Improved Profitability Operating Income Gaining Momentum Note: Dollars in millions, except per share figures and percentages * See reconciliation of GAAP to non-GAAP in appendix to slide deck presentation Acceptances Revenue Non GAAP Gross Margin %* Non GAAP Operating Income* Adjusted EPS* YoY3Q YTD

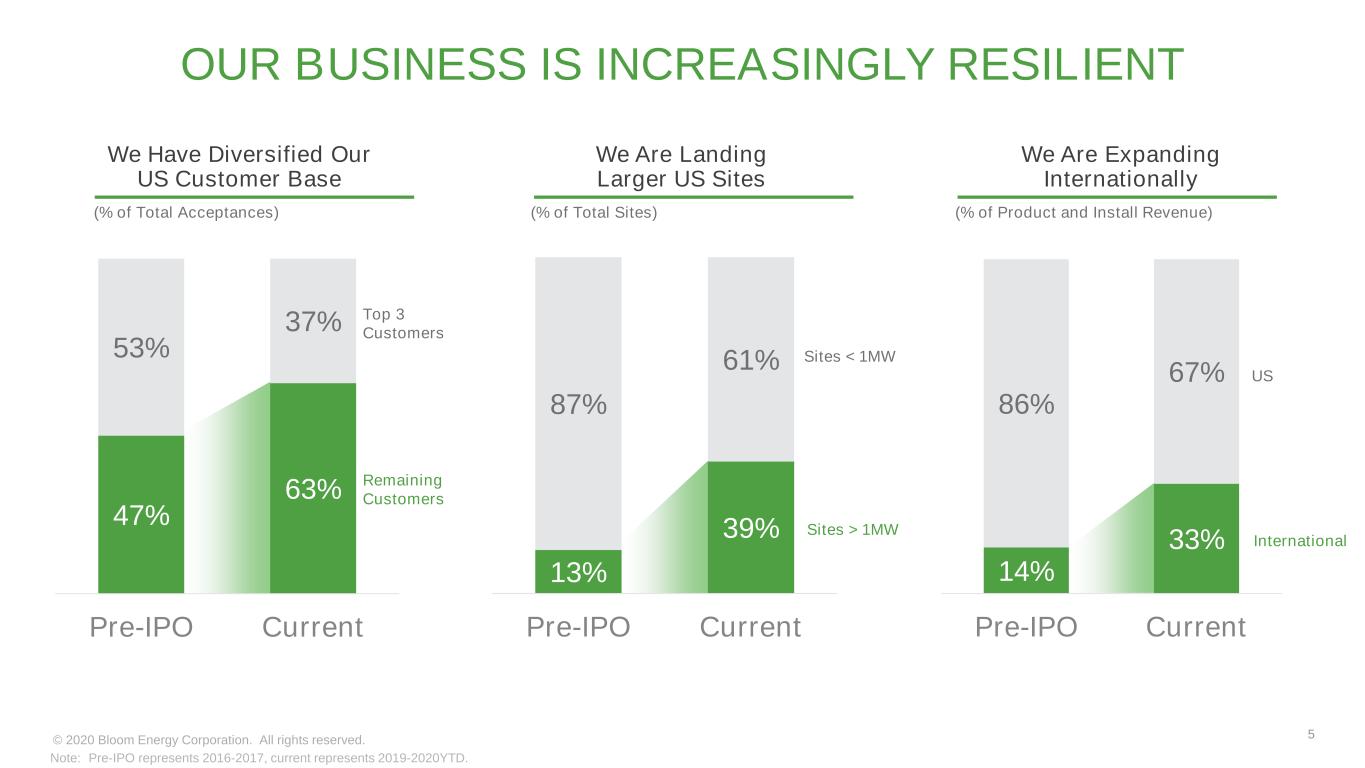

5© 2020 Bloom Energy Corporation. All rights reserved. 47% 63% 53% 37% Pre-IPO Current 13% 39% 87% 61% Pre-IPO Current 14% 33% 86% 67% Pre-IPO Current OUR BUSINESS IS INCREASINGLY RESILIENT Top 3 Customers Sites < 1MW Sites > 1MW Note: Pre-IPO represents 2016-2017, current represents 2019-2020YTD. US International Remaining Customers (% of Total Acceptances) (% of Total Sites) (% of Product and Install Revenue) We Have Diversified Our US Customer Base We Are Landing Larger US Sites We Are Expanding Internationally

6© 2020 Bloom Energy Corporation. All rights reserved. PRELIMINARY FY2021 FINANCIAL METRICS OUTLOOK Metric YoYChange Revenue $950mm to $1bn +25% Non GAAP Gross Margin %* ~25% +3pp Non GAAP Operating Margin %* ~3% Fav. Cash Flow from Operations Approaching Positive Fav. • High project visibility with backlog and pipeline • Manufacturing capacity in place to meet demand • International and product expansion opportunities * Non-GAAP financial measures exclude stock based compensation Bloom strongly positioned for ‘21

7© 2020 Bloom Energy Corporation. All rights reserved. DRIVERS OF LONG-TERM SUCCESS 1 Lower Product Cost 2 Simplify Business Model 3 Leverage Platform in New Applications 4 Valuable and Reliable Growth Company

8© 2020 Bloom Energy Corporation. All rights reserved. $5,886 $4,128 $3,402 $3,159 $2,715 $2,420 2015 2016 2017 2018 2019 Q3 2020 2021 2022 2023 2024 2025 DRIVING THE COST CURVE: ~60% REDUCTION IN COST SINCE 2015 Cost ($/kW) Note: Product Cost numbers are as of respective period ends. Cost/kWh is the cost of electricity for a 15 year PPA. All variables other than cost constant. Electricity price represents offered price for future installs. For future COE assumptions, see footnote 5 in the Appendix. 10-15% Annual Cost Reduction 12¢ / kWh 14¢ / kWh 9¢ / kWh 1 Total Product Cost

9© 2020 Bloom Energy Corporation. All rights reserved. Drive Operational AdvancementLeverage Strategic Partnership Highly-successful partnership with SK E&C provides a replicable reference point Recent innovation of preassembled, skid-mounted product to simplify installation process SIMPLIFYING OUR BUSINESS MODEL • Installation process • Go to market process • Service model profitability • Manufacturing technology & scale • Market access / local expertise • Technology co-development • Installation / service • Financing 2

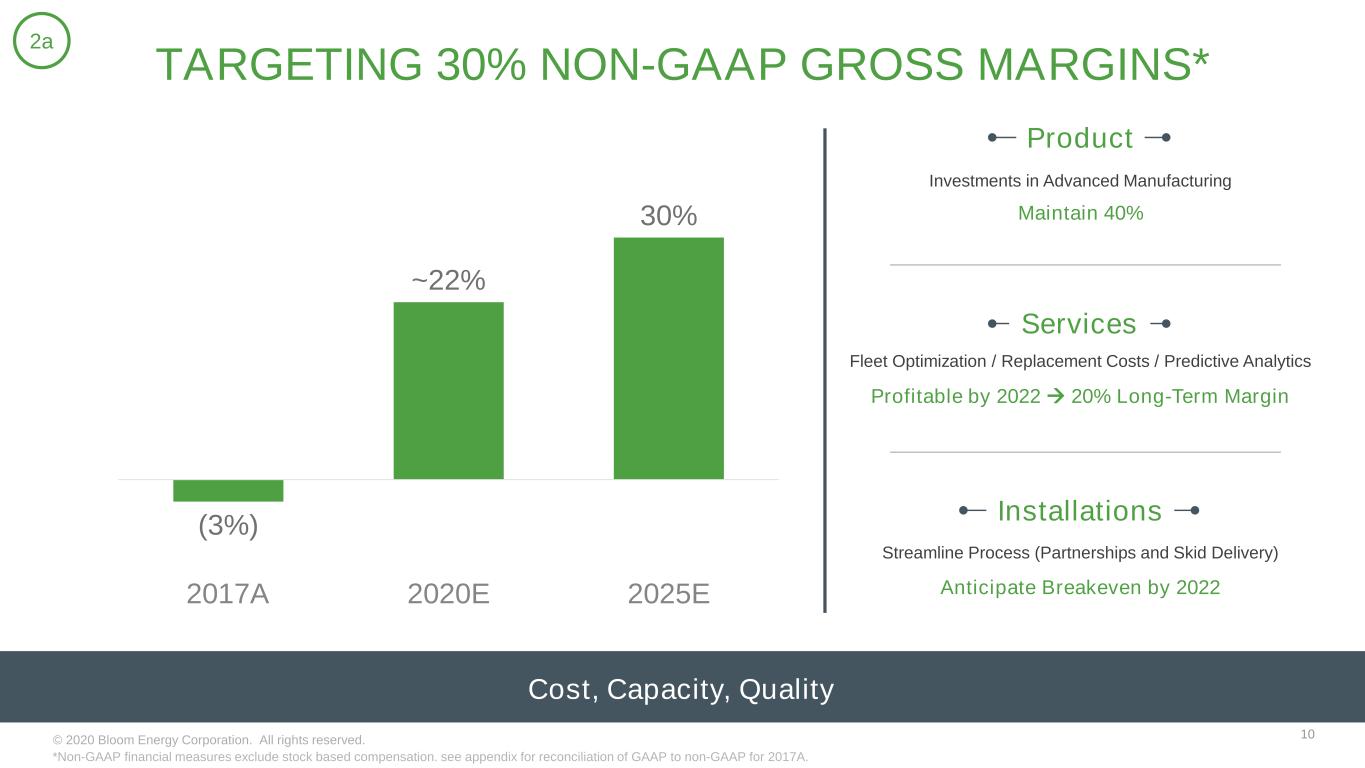

10© 2020 Bloom Energy Corporation. All rights reserved. (3%) ~22% 30% 2017A 2020E 2025E TARGETING 30% NON-GAAP GROSS MARGINS* 2a Product Services Installations Fleet Optimization / Replacement Costs / Predictive Analytics Investments in Advanced Manufacturing Streamline Process (Partnerships and Skid Delivery) Maintain 40% Profitable by 2022 20% Long-Term Margin Anticipate Breakeven by 2022 Cost, Capacity, Quality *Non-GAAP financial measures exclude stock based compensation. see appendix for reconciliation of GAAP to non-GAAP for 2017A. Cost, Ca acity, uality

11© 2020 Bloom Energy Corporation. All rights reserved. Operational Efficiency and Platform Leverage (34%) ~(2%) 15% 2017A 2020E 2025E TARGETING 15% NON-GAAP OPERATING MARGINS* R&D Platform Technology Requires Little Incremental Investment Anticipate 8% of Revenue by 2025 SG&A Ramping Sales Push Offset by Prudent Spending Anticipate 7% of Revenue by 2025 Best-Practice Operational Improvements 2b * Non-GAAP financial measures exclude stock based compensation. see appendix for reconciliation of GAAP to non-GAAP for 2017A.

12© 2020 Bloom Energy Corporation. All rights reserved. $200bn NEAR-TERM INITIATIVES ACROSS NEW AND EXISTING MARKETS US C&I • Drive down product cost to expand geographic opportunity set • Improve installation speed and efficiency • Optimize go-to-market model / increase sales velocity +$1.4tn +$700bn +$300bn International Expansion • Recently hired new business development lead • Pursuing new partnerships to expand geographic reach Enabling Technologies • Anticipated demonstration of CCUS in 2021 • Anticipated deployment of biogas units in 2021 • Anticipated 300MW annual opportunity in Marine Transport Hydrogen • Deliver 100kW of hydrogen-powered fuel cells this month • Won 1.8MW RFP in South Korea, delivery beginning 2021 • Expect to deliver SOECs to power hydrogen SOFC in S. Korea in 2022 >$2tn Total Addressable Market 3 Note: for TAM sizing references, see footnotes 2, 3, 4 and 7 in the Appendix.

13© 2020 Bloom Energy Corporation. All rights reserved. Base Strong Growth in Base Fuel Cell by Expanding Map Hydrogen Significant Market Developing for Fuel Cells and Electrolyzers Enabling Technologies Marine, Biogas, Carbon Capture Accelerate Growth VALUABLE AND RELIABLE GROWTH COMPANY 2020E ~$780mm 2025E 25% - 30% CAGR 4 Growth Algorithm

14© 2020 Bloom Energy Corporation. All rights reserved. 25% - 30% 30% 15% LONG TERM GROWTH MODEL Algorithm Validated By Strong Performance Revenue Growth (through 2025) Base Revenue Growth Augmented by Hydrogen and Enabling Technologies Non-GAAP Gross Margin* (by 2025) Defend Product Profitability + Increase Contribution of Services and Installation Non-GAAP Operating Margin* (by 2025) Platform Technology Enables Asymmetric Investment to Payoff Ratio CAGR *Non-GAAP financial measures exclude stock based compensation

15© 2020 Bloom Energy Corporation. All rights reserved. KEY MILESTONES FOR 2021: OPERATIONALIZING OUR GROWTH STRATEGY Operationalize Manufacturing of Bloom 7.5 Establish a New International Partnership Deliver a Hydrogen Fuel Cell and an Electrolyzer Invest in Growth: Technology, Marketing and Sales Continue Cost Reductions: Down Another 10%-15% Build Additional Manufacturing Capacity to Support 2022+ Growth

16© 2020 Bloom Energy Corporation. All rights reserved. A VALUABLE COMPANY Bloom Energy is Poised for the Next Chapter in the Future of Energy High Growth Cash Generative Platform Technology

17© 2020 Bloom Energy Corporation. All rights reserved. GROWTH Sharelynn Moore EVP, Chief Marketing Officer ENABLING

18© 2020 Bloom Energy Corporation. All rights reserved. MASSIVE ENERGY TRANSITION IS UNDERWAY “Climate change is the defining issue of our time, and we are at a defining moment” -- United Nations trillion The biggest transformation since $69 of infrastructure investment required through 2030(1) Edison’s light bulb Notes: see Footnotes slide in the Appendix for citations.

19© 2020 Bloom Energy Corporation. All rights reserved. THE FLYWHEEL IN EFFECT

20© 2020 Bloom Energy Corporation. All rights reserved. MACRO FORCES AlwaysON Power Climate concerns driving decarbonization Climate Events Increasing in Intensity and Frequency Domestic and International Climate Goals Zero / Negative Carbon Over Time Climate creating resiliency need

21© 2020 Bloom Energy Corporation. All rights reserved. BLOOM SOLUTION BLOOM SOLUTION Biogas to Power Natural Gas to Bloom with CCUS Bloom Powering EV Chargers Bloom Powering Marine Shipping Air Hydrogen to Power TransportationStationary Nuclear Electric VehiclesHydrogen Marine Transport Waste to Biogas Natural Gas BLOOM SOLUTION Bloom Electrolyzes Renewables to Hydrogen BROAD SET OF APPLICATIONS ACROSS THE ENERGY LANDSCAPE Energy Fossil Fuels Renewables SeaLand Bloom Electrolyzes with Heat Integration

22© 2020 Bloom Energy Corporation. All rights reserved. EXPANDING THE BASE BUSINESS TAM(2) $1.6 Cost Reduction Expands Opportunity Focus on Resiliency to Create Additional Value Provide a Pathway to De-Carbonization Value Creation Levers TRILLION Notes: see Footnotes slide in the Appendix for citations.

23© 2020 Bloom Energy Corporation. All rights reserved. 28% Key enabler: $200+ Offered COE by Year With Resulting Number of Competitive States5 INCREASED SCALE DRIVES LOWER COSTS, WHICH OPENS NEW MARKETS 4x Increase in TAM vs. today(7) Learning Rate Billion US C&I TAM By 2025(6) COE States competitive 2021 2022 2023 2024 2025 $8.22 $7.83 $7.43 $7.11 $9.10 28 42 48 49 50 Notes: see Footnotes slide in the Appendix for citations.

24© 2020 Bloom Energy Corporation. All rights reserved. US Hazard Map(8) Natural Disasters Drastically Disrupting the Energy Grid Resiliency Drives additional value(9) SCALING OUR US BUSINESS – RESILIENCY INCREASINGLY CRITICAL 2020: 1.9 million lost power in August due to severe storm 2020: Isaias and Zeta left 6.8 and 2.6 million without power, respectively 2019: 3 million Californians without power, many for multiple days $15-$30 per MWh Premium vs. Standard Grid Costs Notes: see Footnotes slide in the Appendix for citations.

25© 2020 Bloom Energy Corporation. All rights reserved. Biogas UPGRADE CYCLE: SIMPLE MODULE ENABLES DECARBONIZATION Fuel Flexible Today Fuel Migration Tomorrow Natural Gas 50% H2 Hydrogen 100% H2 Carbon CaptureHydrogen Simple Field Upgrade

26© 2020 Bloom Energy Corporation. All rights reserved. Significant Market Opportunity Keystone Partner Early Wins in De-Carbonization Great Track Record SOUTH KOREA – A LEADER IN DECARBONIZATION 600MW Korea National (MOTIE) Target Fuel Cell Deployment by 2022 150MW Delivered to Date • Product advocates • Operations support • Installation team Our go-to market strategy leverages a resource-light, partner-led model • Shipping 100% Hydrogen-powered fuel cells this month • Expect to ship Hydrogen Electrolyzers in 2021 Changwon Won Project to Supply 100% Hydrogen-Powered Fuel Cells and Electrolyzers 400MW Annual Korea Bookings Target Once Hydrogen Fully Ramped Notes: see Footnotes slide in the Appendix for citations. (10) (11)

27© 2020 Bloom Energy Corporation. All rights reserved. ACTIVATING OUR STRATEGY THROUGH SALES AND MARKETING Sales Specialized sales team and focus on larger deals Partners Increasing pipeline and accelerating the sales cycle Brand Leadership Building CXO-Level Awareness Augmented Sales and Marketing Approach Enables Sophisticated Go-To-Market Motion

28© 2020 Bloom Energy Corporation. All rights reserved. SIMPLE ADD ON MODULE ENABLES CARBON CAPTURE + Zero or Negative Carbon Power Hardware already in operation Produces ~99% pure CO2 Carbon Capture Module Enables Zero or Negative CO2 Power Carbon Capture (Sequestered or Utilized)

29© 2020 Bloom Energy Corporation. All rights reserved. BIOGAS MARKET MOMENTUM IS BUILDING “We’re excited about our partnership with Bloom Energy. We see significant opportunity utilizing Bloom’s ultra clean and efficient technology to convert our dairy biogas to renewable electricity and low carbon electric fuel credits. Our joint development with Bloom over the past year has gone well, and we’re now constructing two dairy biogas fuel cell projects for commercial launch 2021. These initial project’s will allow us to demonstrate significant dairy benefits and investor returns enabling us to deliver dozens of additional projects throughout California and subsequently world- wide.” -- N. Ross Buckenham CEO of CalBio 1st Project Under Construction Enabling a Large Market $45 10x US Biogas Market TAM(12) Biogas Production Increase in 20 Years(13) Billion Notes: see Footnotes slide in the Appendix for citations.

30© 2020 Bloom Energy Corporation. All rights reserved. HYDROGEN Hydrogen Fuel Cells Electrolyzer $300 BILLION Notes: see Footnotes slide in the Appendix for citations. TAM(4)

31© 2020 Bloom Energy Corporation. All rights reserved. BLOOM’S HYDROGEN PLATFORM Unique Platform and Advantages Superior Cost and Performance Ready for Growth – 2025 Vision 1GW $750MM Revenue Target(15) 31% Greater <$600/kW Efficiency Potential vs. Other Technologies(14) Cost Potential based on Historical Performance(15) Capacity Potential(15) Efficiency Scale & experience Faster cost downs Unique Flexibility 1 2 3 4$ Notes: see Footnotes slide in the Appendix for citations.

32© 2020 Bloom Energy Corporation. All rights reserved. 40% by 2030 -- Initial IMO GHG strategy “Our goal is to replace all existing main engines and generator engines with these highly efficient solid oxide fuel cells...” -- Haeki Jang, Vice President, Shipbuilding & Drilling Sales Engineering, SHI Bloom’s highly efficient SOFC already aligned with the IMO’s 2050 environmental targets IMO Sets Emission Targets(16) Joint Agreement with SHI Announced June 2020 Opportunity Ahead(17) MARINE MARKET OPPORTUNITY 300MW+ “Bloom Energy and SHI estimate that replacing oil-based power generation on large cargo ships, which require up to 100 megawatts of power per ship, could reduce annual greenhouse gas emissions from shipping by 45 percent” -- Bloom Energy Notes: see Footnotes slide in the Appendix for citations.

33© 2020 Bloom Energy Corporation. All rights reserved. Azeez Mohammed EVP International Business Development INTERNATIONAL EXPANSION BEYOND SOUTH KOREA TAM Opportunity from International Expansion(2) CEO and President Power Conversion, Power Services, and Energy Services Business Prior Experience (1998 – 2019) With the international business development team under Azeez’s leadership, we are actively adding new geographies where we can replicate our successes in US and Korea Mission TRILLION +$1.4 Notes: see Footnotes slide in the Appendix for citations.

34© 2020 Bloom Energy Corporation. All rights reserved. ANTICIPATED ROADMAP International Announce new SK type partner in Europe First deployments Ramp Hydrogen Demonstration projects First commercial projects Ramp 1GW CCUS Manufacture demo systems Demonstration projects First commercial projects Ramp Biogas First commercial projects Ramp in CA Expand to additional states Marine Class Certification SHI and Bloom to present design to customer Not announced US C&I (Target Selling States) 28 42 48 49 50 2021 2022 2023 2024 2025

35© 2020 Bloom Energy Corporation. All rights reserved. THANK YOU ANALYST DAY 2020 B L O O M E N E R G Y V I R T U A L

36© 2020 Bloom Energy Corporation. All rights reserved. APPENDIX: GAAP TO NON-GAAP RECONCILIATION GROSS MARGIN AND OPERATING INCOME In $ millions 3QYTD’20 3QYTD’19 Revenue $545 $572 Gross Profit $102 $73 Stock-based compensation – COGS $14 $37 Non-GAAP Gross Profit $116 $110 Non-GAAP Gross Margin % 21.3% 19.2% OPEX ($178) ($258) Stock-based compensation – OPEX $43 $123 Non-GAAP Operating Income ($19) ($25)

37© 2020 Bloom Energy Corporation. All rights reserved. APPENDIX: GAAP TO NON-GAAP RECONCILIATION ADJUSTED EPS In $ millions 3QYTD’20 3QYTD’19 Net loss to Common Stockholders ($130) ($239) Loss for non-controlling interests ($17) ($14) Gain (loss) on extinguishment of debt $13 $0 Gain (loss) on warrant & derivatives liabilities ($2) $2 Fair Value Adjustments for certain PPA contracts ($0) $1 Stock-based compensation $57 $160 Adjusted Net Loss ($79) ($89) Adjusted EPS ($0.61) ($0.78) Pro forma weighted average shares outstanding attributable to common, Basic and Diluted 130 115

38© 2020 Bloom Energy Corporation. All rights reserved. APPENDIX: GAAP TO NON-GAAP RECONCILIATION FY’17 In $ millions FY’17 FY’17 SBC* FY’17 Non-GAAPGAAP Revenue $366 $366 COGS $382 ($6) $376 Gross Profit ($16) $6 ($10) Gross Margin % -4% -3% OPEX $139 ($23) $116 Operating Income ($155) $29 ($126) Operating Income Margin % -42% -34%

39© 2020 Bloom Energy Corporation. All rights reserved. APPENDIX: FOOTNOTES 1. Source: UN Financing Climate Futures – Rethinking Infrastructure. See https://www.oecd.org/environment/cc/climate-futures/. 2. See Bloom’s S-1: “According to data from MarketLine, the total addressable market (TAM) for electricity at the point of customer consumption was approximately $2.4 trillion in 2016. Of this market, MarketLine determined that 68% consisted of commercial, industrial and public services (CI&P), or $1.6 trillion.” Net of the $200 billion TAM in US C&I, the result for the rest of world is $1.4 trillion. 3. The total TAM of $700 billion is comprised of $140 billion for biogas, $165 billion for marine, $335 billion for carbon capture and $55 billion for BEV chargers. Calculations based on publically available data and BE estimates regarding the appropriate sales prices given estimated volumes. 4. Based on calculated prices at historical learning curve rates. See Bloom’s Hydrogen Day Teach In, dated 11/18/2020, pg. 13. 5. Based on Bloom Energy’s historical learning curve rate and growth assumptions used to calculate product and service costs; install costs assumed to decline at 10% learning rate. Assumes 20 year projects; and that ITC is extended to 2025. PPA rates escalate at 2% per annum and are inclusive of natural gas costs of $0.035/kWh. Offer price assumed to be two years ahead of acceptance given sales and installation cycle times. Cost of grid power based on EIA data; data set includes commercial and industrial cost of electricity in all 50 US States; forward years assume 4% annual growth rate in power prices; market sizing based on commercial and industrial revenues by state; market considered unlocked when Bloom starting PPA rates fall below state’s grid cost. 6. Estimate based on EIA data and reported power sales by state. 7. Increase based on the number of states in which we are competitive in 2020 (nine at a $49 billion TAM) versus a TAM of $204 billion for all 50 states. 8. Based on McKinsey Climate Risk Analytics. Source data from: NOAA, ECMWF, and US Forest Service. Hurricane and wind event data are from NOAA, snow data from ECMWF, and fire data from the USFS. 9. Based on the incremental cost required to firm grid power by buying diesel generators; higher values reflect the higher cost associated with diesels operating over multi-day outage events. 10. See the 8th Electricity Supply and Demand Plan from the South Korean Ministry of Trade, Industry, and Energy (MOTIE). 11. See: https://www.businesswire.com/news/home/20200715005286/en/Bloom-Energy-Announces-Initial-Strategy-for-Hydrogen-Market-Entry. 12. See: https://americanbiogascouncil.org/biogas-market-snapshot/ as of 12/10/2020. 13. Source: https://www.iea.org/data-and-statistics/charts/outlook-for-global-biogas-consumption-by-sector-in-the-sustainable-development-scenario-2018-2040. 14. See Bloom’s Hydrogen Day Teach In, dated 11/18/2020, pg. 4. 15. See Bloom’s Hydrogen Day Teach In, dated 11/18/2020, pg. 17. 16. See: International Maritime Organization at https://www.imo.org/en/MediaCentre/HotTopics/Pages/Reducing-greenhouse-gas-emissions-from-ships.aspx. 17. See: https://www.bloomenergy.com/newsroom/press-releases/bloom-energy-and-samsung-heavy-industries-team-up.