Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - THOR INDUSTRIES INC | tho-ex993_6.htm |

| EX-99.1 - EX-99.1 - THOR INDUSTRIES INC | d76500dex991.htm |

| 8-K/A - 8-K/A - THOR INDUSTRIES INC | tho-8ka_20201208.htm |

FIRST QUARTER OF FISCAL 2021 FINANCIAL RESULTS Exhibit 99.2

Forward-Looking Statements This presentation includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the extent and impact from the continuation of the COVID-19 pandemic, along with the responses to contain the spread of the virus by various governmental entities or other actors, which may have negative effects on retail customer demand, our independent dealers, our supply chain, our production or other aspects of our business and which may have a negative impact on our consolidated results of operations, financial position, cash flows and liquidity; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the impact of tariffs on material or other input costs; the level and magnitude of warranty claims incurred; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations and their potential impact on the general economy and specifically on our dealers and consumers; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs to attract production personnel in times of high demand; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; increasing costs for freight and transportation; asset impairment charges; cost structure changes; competition; the impact of potential losses under repurchase or financed receivable agreements; the potential impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other regulatory standards in the various jurisdictions in which our products are produced and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt. These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2020 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2020. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

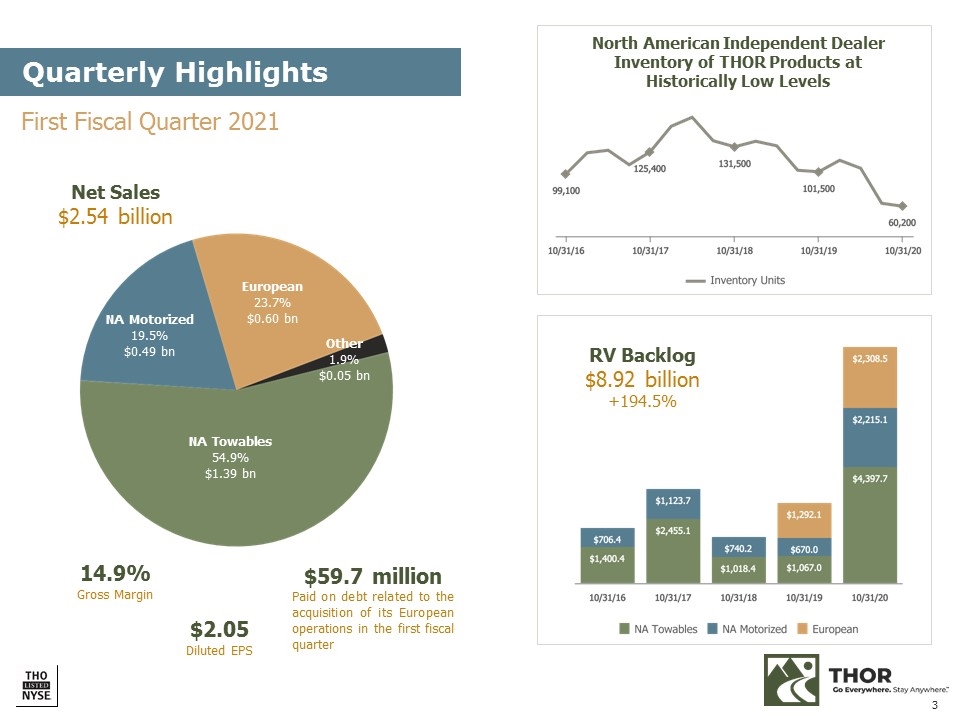

Quarterly Highlights European 23.7% $0.60 bn NA Motorized 19.5% $0.49 bn NA Towables 54.9% $1.39 bn Other 1.9% $0.05 bn 14.9% Gross Margin $2.05 Diluted EPS $59.7 million Paid on debt related to the acquisition of its European operations in the first fiscal quarter North American Independent Dealer Inventory of THOR Products at Historically Low Levels RV Backlog $8.92 billion +194.5% Net Sales $2.54 billion First Fiscal Quarter 2021

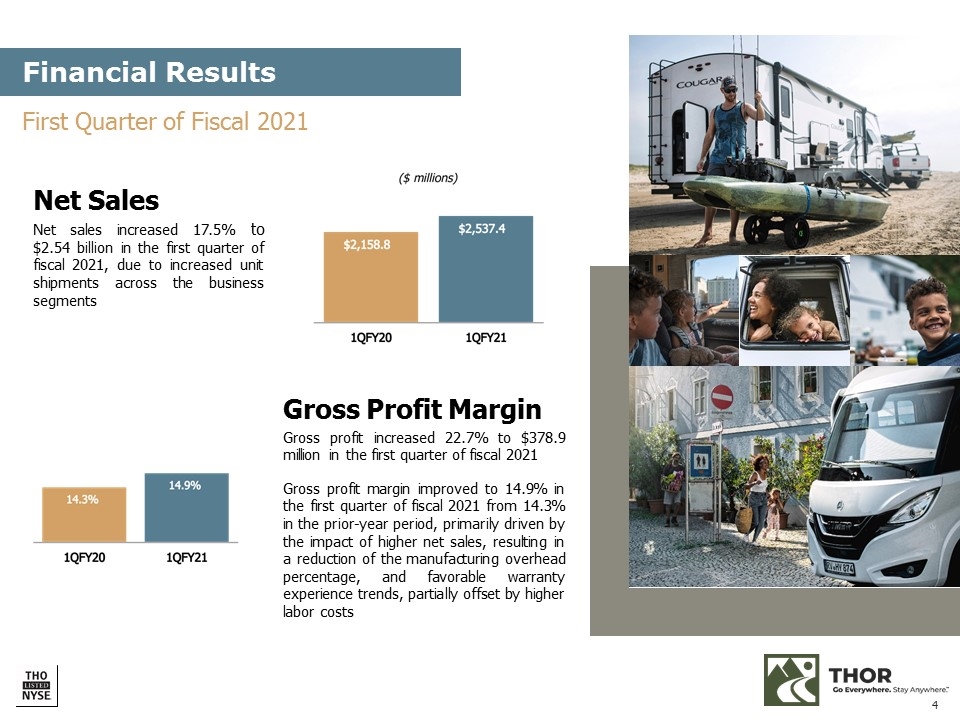

Net Sales Net sales increased 17.5% to $2.54 billion in the first quarter of fiscal 2021, due to increased unit shipments across the business segments Gross Profit Margin Gross profit increased 22.7% to $378.9 million in the first quarter of fiscal 2021 Gross profit margin improved to 14.9% in the first quarter of fiscal 2021 from 14.3% in the prior-year period, primarily driven by the impact of higher net sales, resulting in a reduction of the manufacturing overhead percentage, and favorable warranty experience trends, partially offset by higher labor costs Financial Results First Quarter of Fiscal 2021

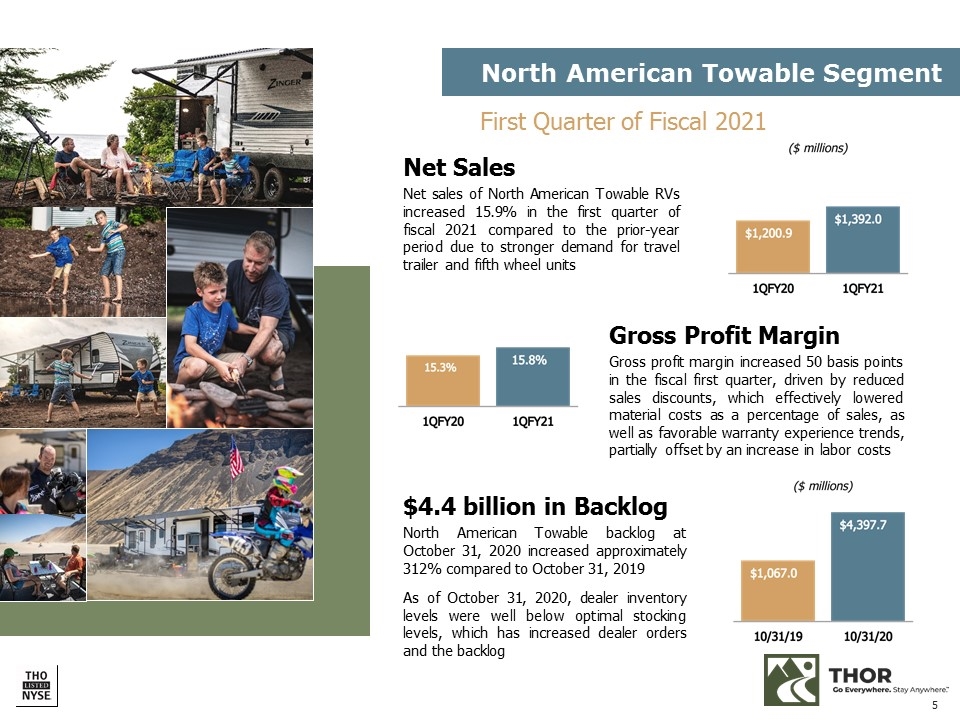

Net Sales Net sales of North American Towable RVs increased 15.9% in the first quarter of fiscal 2021 compared to the prior-year period due to stronger demand for travel trailer and fifth wheel units Gross Profit Margin Gross profit margin increased 50 basis points in the fiscal first quarter, driven by reduced sales discounts, which effectively lowered material costs as a percentage of sales, as well as favorable warranty experience trends, partially offset by an increase in labor costs $4.4 billion in Backlog North American Towable backlog at October 31, 2020 increased approximately 312% compared to October 31, 2019 As of October 31, 2020, dealer inventory levels were well below optimal stocking levels, which has increased dealer orders and the backlog First Quarter of Fiscal 2021 North American Towable Segment

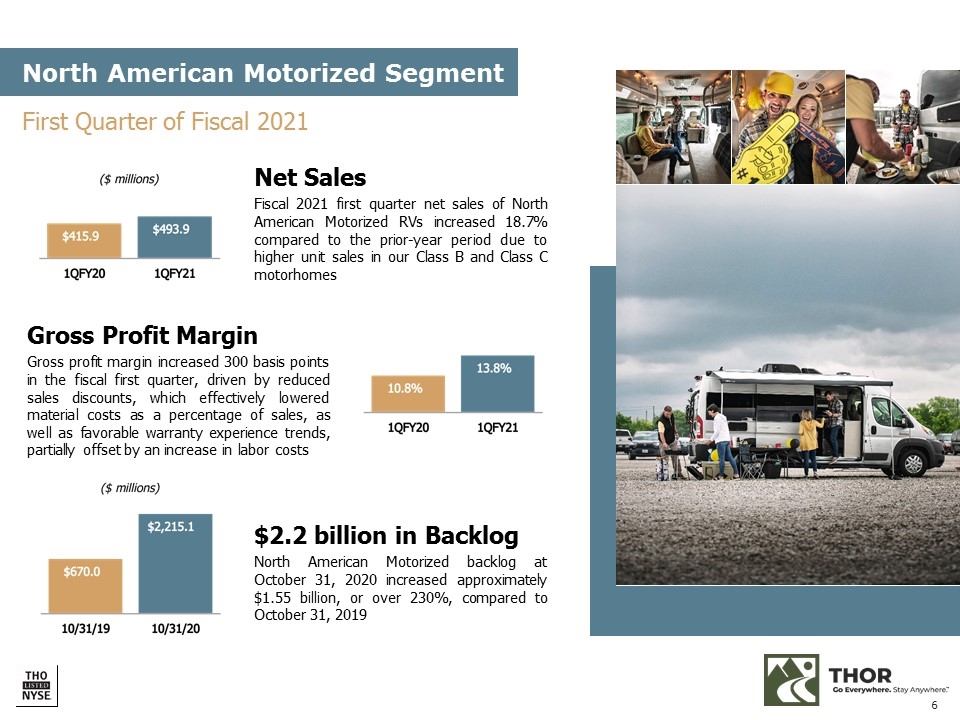

Net Sales Fiscal 2021 first quarter net sales of North American Motorized RVs increased 18.7% compared to the prior-year period due to higher unit sales in our Class B and Class C motorhomes Gross Profit Margin Gross profit margin increased 300 basis points in the fiscal first quarter, driven by reduced sales discounts, which effectively lowered material costs as a percentage of sales, as well as favorable warranty experience trends, partially offset by an increase in labor costs $2.2 billion in Backlog North American Motorized backlog at October 31, 2020 increased approximately $1.55 billion, or over 230%, compared to October 31, 2019 North American Motorized Segment First Quarter of Fiscal 2021

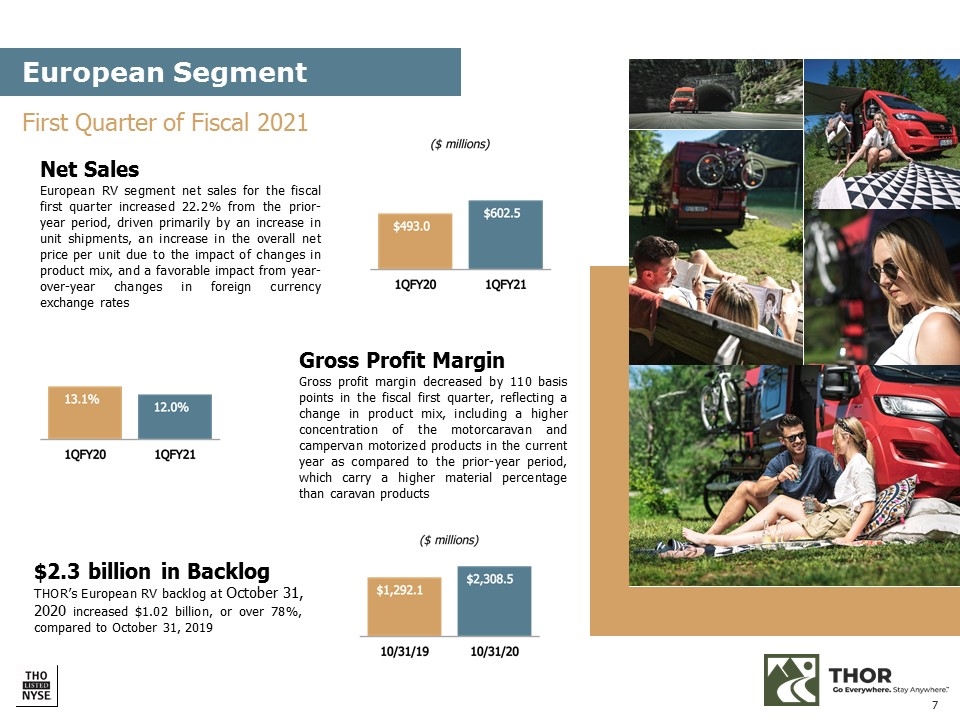

Net Sales European RV segment net sales for the fiscal first quarter increased 22.2% from the prior-year period, driven primarily by an increase in unit shipments, an increase in the overall net price per unit due to the impact of changes in product mix, and a favorable impact from year-over-year changes in foreign currency exchange rates First Quarter of Fiscal 2021 Gross Profit Margin Gross profit margin decreased by 110 basis points in the fiscal first quarter, reflecting a change in product mix, including a higher concentration of the motorcaravan and campervan motorized products in the current year as compared to the prior-year period, which carry a higher material percentage than caravan products $2.3 billion in Backlog THOR’s European RV backlog at October 31, 2020 increased $1.02 billion, or over 78%, compared to October 31, 2019 European Segment

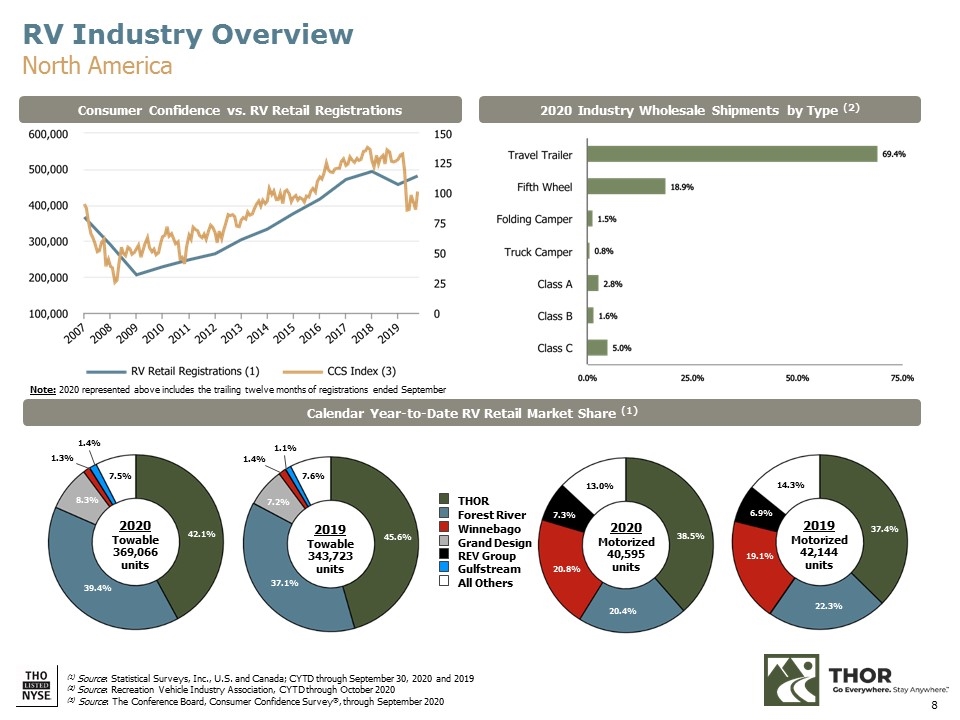

(1) Source: Statistical Surveys, Inc., U.S. and Canada; CYTD through September 30, 2020 and 2019 (2) Source: Recreation Vehicle Industry Association, CYTD through October 2020 (3) Source: The Conference Board, Consumer Confidence Survey®, through September 2020 2020 Industry Wholesale Shipments by Type (2) Consumer Confidence vs. RV Retail Registrations Calendar Year-to-Date RV Retail Market Share (1) RV Industry Overview North America THOR Forest River Winnebago Grand Design REV Group Gulfstream All Others 2020 Towable 369,066 units 2020 Motorized 40,595 units 2019 Motorized 42,144 units 2019 Towable 343,723 units 38.5% 42.1% 37.4% 45.6% 39.4% 20.4% 8.3% 1.3% 7.5% 1.4% 20.8% 7.3% 13.0% 7.6% 7.2% 37.1% 1.1% 1.4% 14.3% 22.3% 19.1% 6.9% Note: 2020 represented above includes the trailing twelve months of registrations ended September

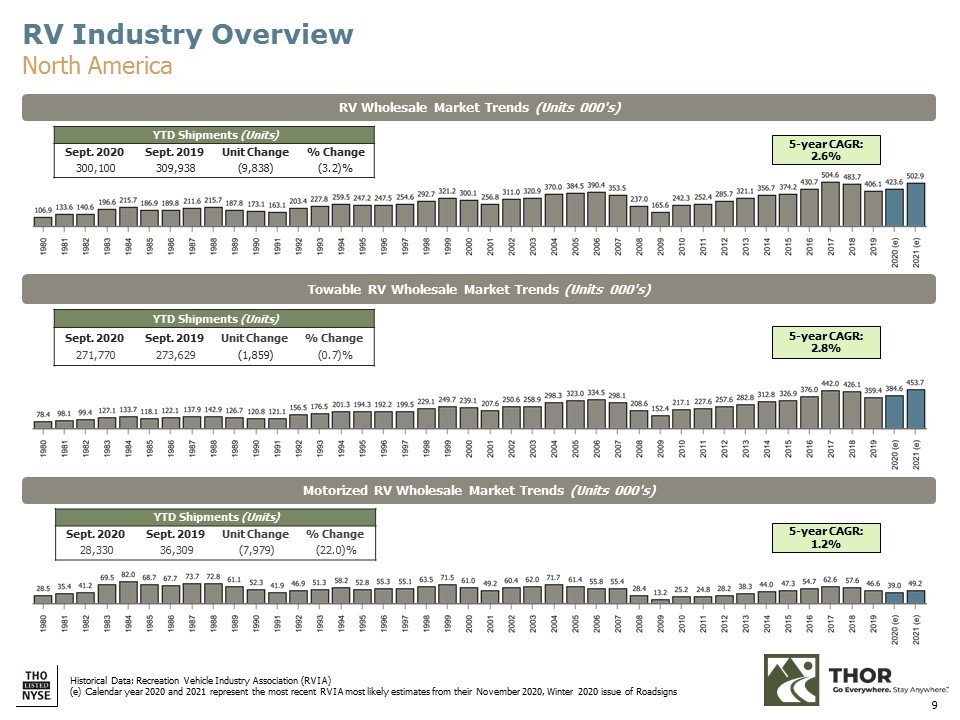

RV Wholesale Market Trends (Units 000's) Towable RV Wholesale Market Trends (Units 000's) YTD Shipments (Units) Sept. 2020 Sept. 2019 Unit Change % Change 300,100 309,938 (9,838) (3.2)% YTD Shipments (Units) Sept. 2020 Sept. 2019 Unit Change % Change 271,770 273,629 (1,859) (0.7)% Motorized RV Wholesale Market Trends (Units 000's) YTD Shipments (Units) Sept. 2020 Sept. 2019 Unit Change % Change 28,330 36,309 (7,979) (22.0)% Historical Data: Recreation Vehicle Industry Association (RVIA) (e) Calendar year 2020 and 2021 represent the most recent RVIA most likely estimates from their November 2020, Winter 2020 issue of Roadsigns 5-year CAGR: 2.6% 5-year CAGR: 2.8% 5-year CAGR: 1.2% RV Industry Overview North America

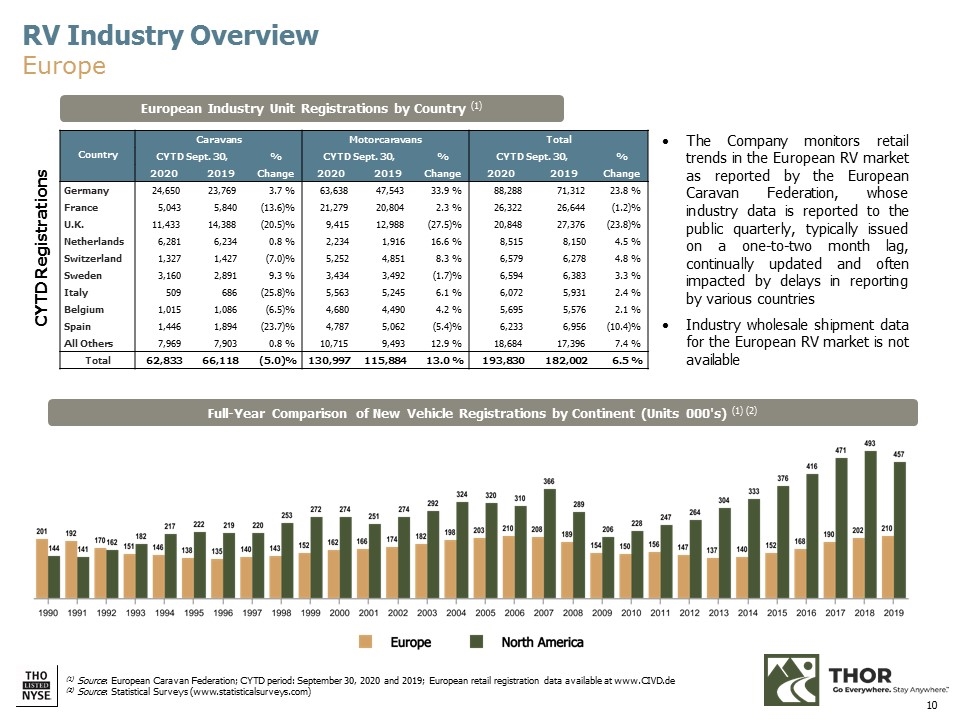

(1) Source: European Caravan Federation; CYTD period: September 30, 2020 and 2019; European retail registration data available at www.CIVD.de (2) Source: Statistical Surveys (www.statisticalsurveys.com) Country Caravans Motorcaravans Total CYTD Sept. 30, % CYTD Sept. 30, % CYTD Sept. 30, % 2020 2019 Change 2020 2019 Change 2020 2019 Change Germany 24,650 23,769 3.7 % 63,638 47,543 33.9 % 88,288 71,312 23.8 % France 5,043 5,840 (13.6) % 21,279 20,804 2.3 % 26,322 26,644 (1.2) % U.K. 11,433 14,388 (20.5) % 9,415 12,988 (27.5) % 20,848 27,376 (23.8) % Netherlands 6,281 6,234 0.8 % 2,234 1,916 16.6 % 8,515 8,150 4.5 % Switzerland 1,327 1,427 (7.0) % 5,252 4,851 8.3 % 6,579 6,278 4.8 % Sweden 3,160 2,891 9.3 % 3,434 3,492 (1.7) % 6,594 6,383 3.3 % Italy 509 686 (25.8) % 5,563 5,245 6.1 % 6,072 5,931 2.4 % Belgium 1,015 1,086 (6.5) % 4,680 4,490 4.2 % 5,695 5,576 2.1 % Spain 1,446 1,894 (23.7) % 4,787 5,062 (5.4) % 6,233 6,956 (10.4) % All Others 7,969 7,903 0.8 % 10,715 9,493 12.9 % 18,684 17,396 7.4 % Total 62,833 66,118 (5.0) % 130,997 115,884 13.0 % 193,830 182,002 6.5 % European Industry Unit Registrations by Country (1) The Company monitors retail trends in the European RV market as reported by the European Caravan Federation, whose industry data is reported to the public quarterly, typically issued on a one-to-two month lag, continually updated and often impacted by delays in reporting by various countries Industry wholesale shipment data for the European RV market is not available CYTD Registrations Full-Year Comparison of New Vehicle Registrations by Continent (Units 000's) (1) (2) RV Industry Overview Europe

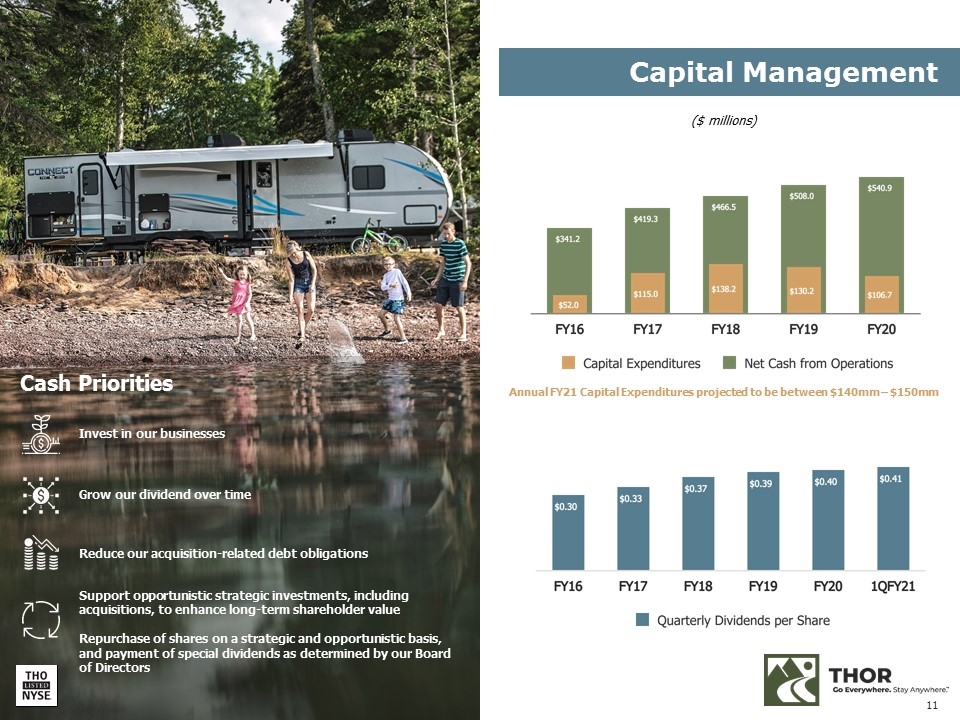

Capital Management ($ millions) Cash Priorities Support opportunistic strategic investments, including acquisitions, to enhance long-term shareholder value Repurchase of shares on a strategic and opportunistic basis, and payment of special dividends as determined by our Board of Directors Reduce our acquisition-related debt obligations Grow our dividend over time Invest in our businesses Annual FY21 Capital Expenditures projected to be between $140mm – $150mm

INVESTOR RELATIONS CONTACT: Mark Trinske Vice President of Investor Relations mtrinske@thorindustries.com (574) 970-7912