Attached files

| file | filename |

|---|---|

| EX-4.1 - EX-4.1 - Syros Pharmaceuticals, Inc. | d44085dex41.htm |

| EX-10.2 - EX-10.2 - Syros Pharmaceuticals, Inc. | d44085dex102.htm |

| EX-2.1 - EX-2.1 - Syros Pharmaceuticals, Inc. | d44085dex21.htm |

| 8-K - 8-K - Syros Pharmaceuticals, Inc. | d44085d8k.htm |

| EX-99.3 - EX-99.3 - Syros Pharmaceuticals, Inc. | d44085dex993.htm |

| EX-99.2 - EX-99.2 - Syros Pharmaceuticals, Inc. | d44085dex992.htm |

| EX-10.1 - EX-10.1 - Syros Pharmaceuticals, Inc. | d44085dex101.htm |

| EX-4.2 - EX-4.2 - Syros Pharmaceuticals, Inc. | d44085dex42.htm |

An Expression Makes a World of Difference December 5, 2020 Exhibit 99.1

Forward-looking statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation, including statements regarding our strategy, research and clinical development plans, collaborations, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various important factors, including our ability to: advance the development of our programs, including SY-1425, SY-5609 and SY-2101, under the timelines we project in current and future clinical trials; demonstrate in any current and future clinical trials the requisite safety, efficacy and combinability of our drug candidates; replicate scientific and non-clinical data in clinical trials; successfully develop a companion diagnostic test to identify patients with the RARA biomarker; obtain and maintain patent protection for our drug candidates and the freedom to operate under third party intellectual property; obtain and maintain necessary regulatory approvals; identify, enter into and maintain collaboration agreements with third parties, including our ability to perform under our collaboration agreements with Incyte Corporation and Global Blood Therapeutics; manage competition; manage expenses; raise the substantial additional capital needed to achieve our business objectives; attract and retain qualified personnel; and successfully execute on our business strategies; risks described under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, each of which is on file with the Securities and Exchange Commission (SEC); and risks described in other filings that we may make with the SEC in the future. In addition, the extent to which the COVID-19 outbreak continues to impact our workforce and our discovery research, supply chain and clinical trial operations activities, and the operations of the third parties on which we rely, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration and severity of the outbreak, additional or modified government actions, and the actions that may be required to contain the virus or treat its impact. Any forward-looking statements contained in this presentation speak only as of the date this presentation is made, and we expressly disclaim any obligation to update any forward-looking statements, whether because of new information, future events or otherwise.

Accelerating our vision Targeted hematology therapy franchise Gene control discovery engine Selective CDK inhibitor franchise Fully integrated biopharmaceutical company

Building a leading franchise that sets new standards of care in hematology $3B+ in growing hematology markets 2 programs with planned registrational trials 3 targeted patient populations

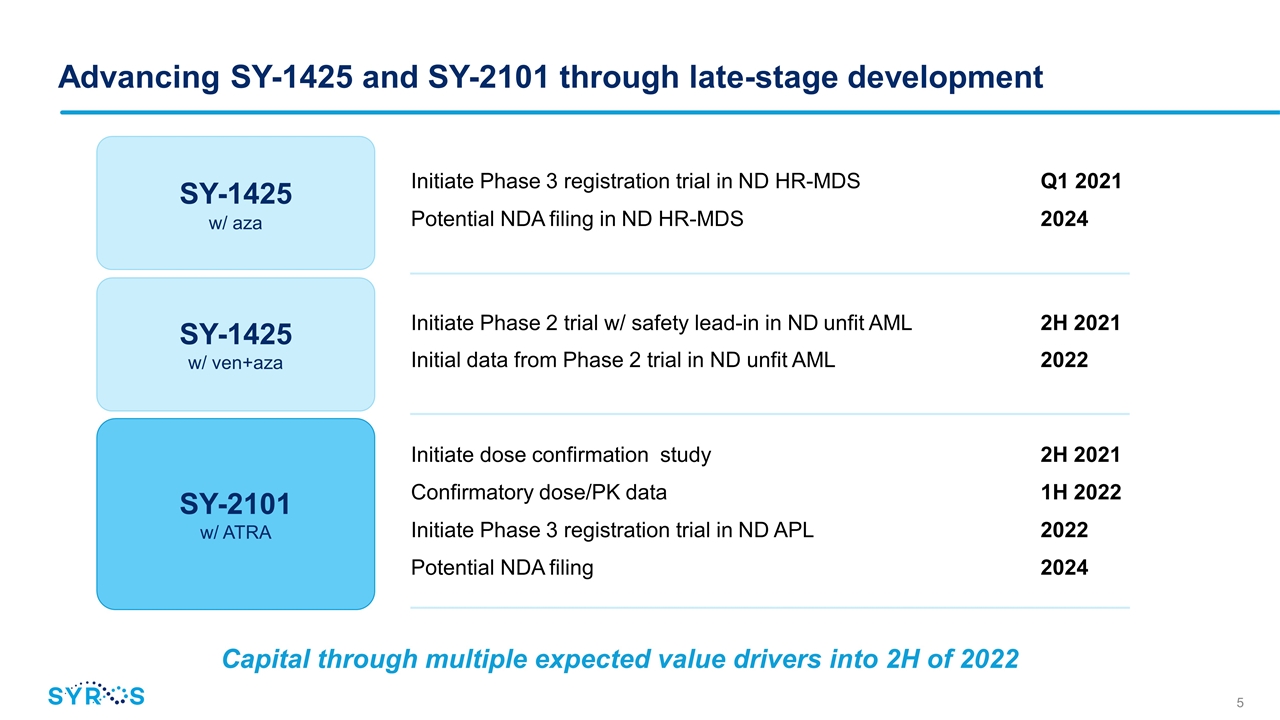

Advancing SY-1425 and SY-2101 through late-stage development SY-1425 w/ aza SY-2101 w/ ATRA SY-1425 w/ ven+aza Initiate Phase 3 registration trial in ND HR-MDSQ1 2021 Potential NDA filing in ND HR-MDS2024 Initiate Phase 2 trial w/ safety lead-in in ND unfit AML2H 2021 Initial data from Phase 2 trial in ND unfit AML2022 Initiate dose confirmation study 2H 2021 Confirmatory dose/PK data 1H 2022 Initiate Phase 3 registration trial in ND APL2022 Potential NDA filing 2024 Capital through multiple expected value drivers into 2H of 2022

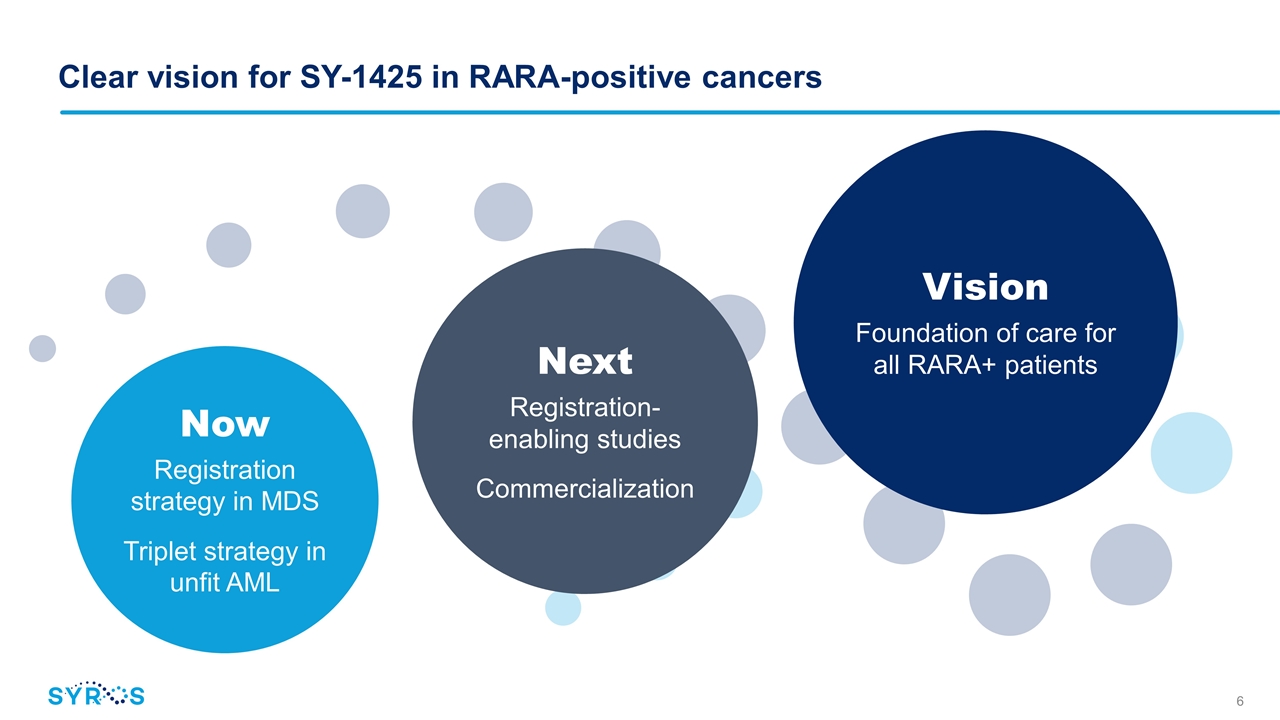

Clear vision for SY-1425 in RARA-positive cancers Now Registration strategy in MDS Triplet strategy in unfit AML Next Registration-enabling studies Commercialization Vision Foundation of care for all RARA+ patients

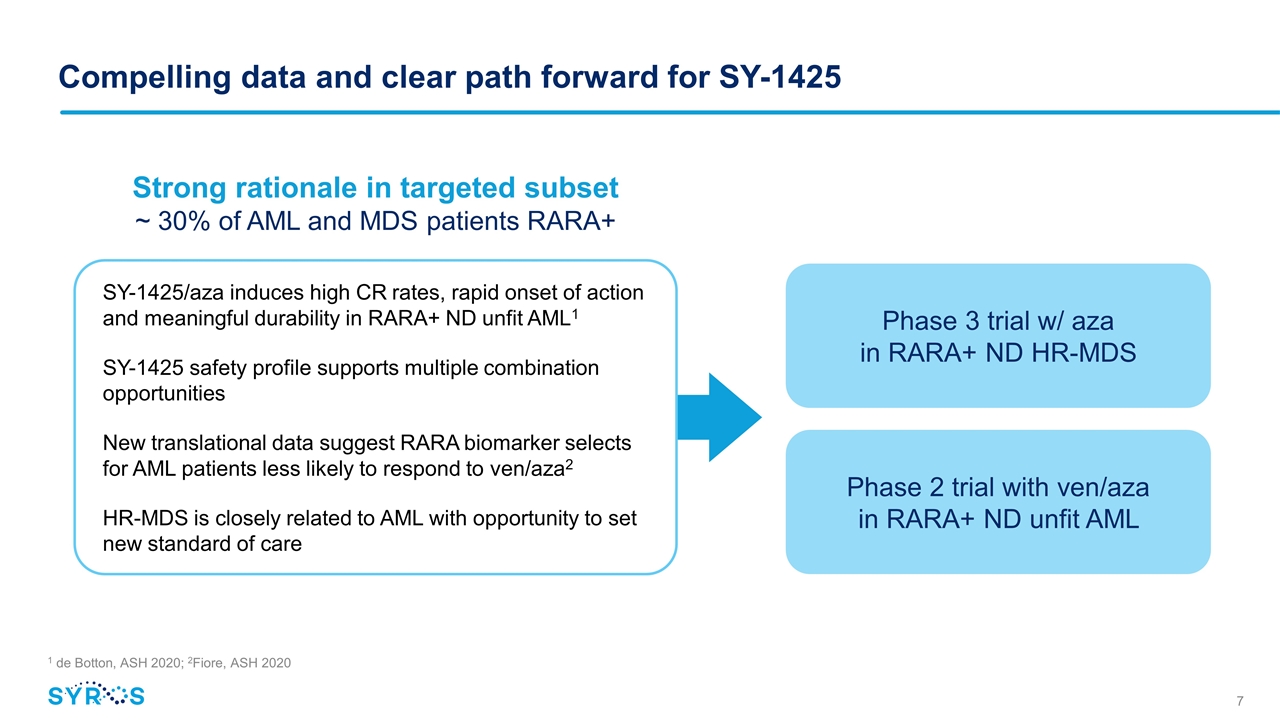

Compelling data and clear path forward for SY-1425 1 de Botton, ASH 2020; 2Fiore, ASH 2020 SY-1425/aza induces high CR rates, rapid onset of action and meaningful durability in RARA+ ND unfit AML1 SY-1425 safety profile supports multiple combination opportunities New translational data suggest RARA biomarker selects for AML patients less likely to respond to ven/aza2 HR-MDS is closely related to AML with opportunity to set new standard of care Strong rationale in targeted subset ~ 30% of AML and MDS patients RARA+ Phase 3 trial w/ aza in RARA+ ND HR-MDS Phase 2 trial with ven/aza in RARA+ ND unfit AML

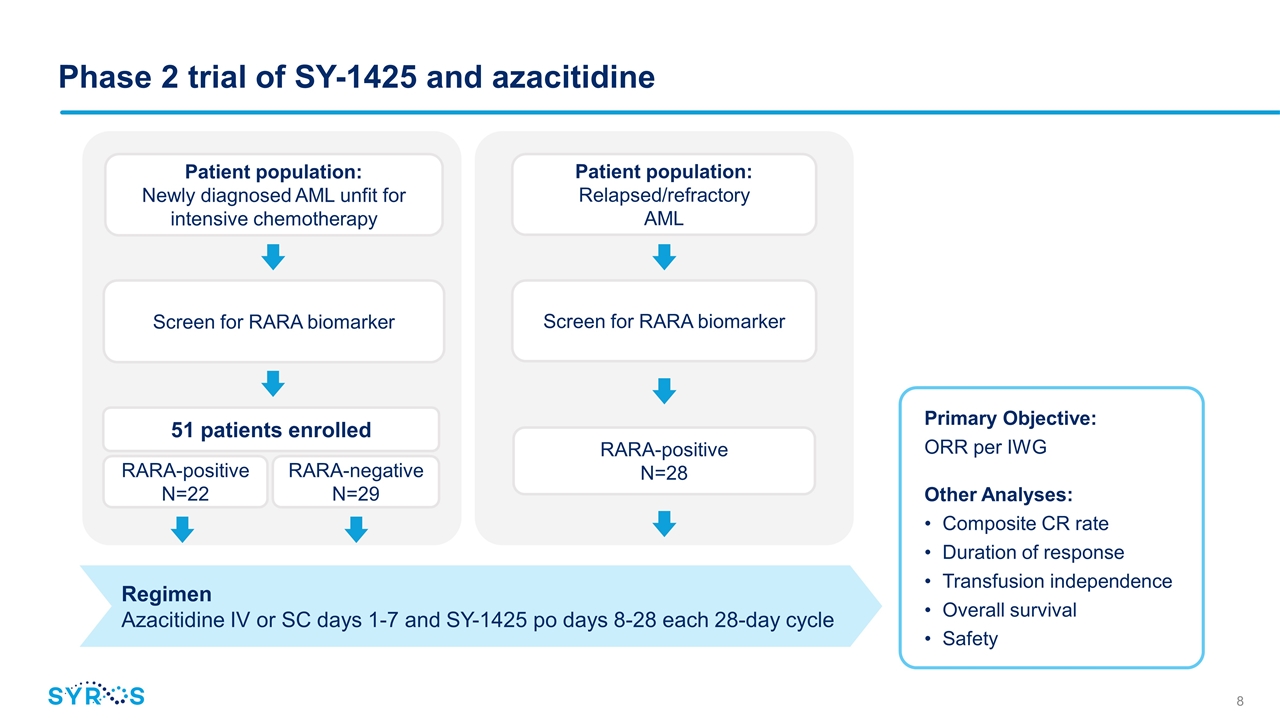

Phase 2 trial of SY-1425 and azacitidine Primary Objective: ORR per IWG Other Analyses: Composite CR rate Duration of response Transfusion independence Overall survival Safety Regimen Azacitidine IV or SC days 1-7 and SY-1425 po days 8-28 each 28-day cycle Patient population: Relapsed/refractory AML Patient population: Newly diagnosed AML unfit for intensive chemotherapy Screen for RARA biomarker 51 patients enrolled RARA-positive N=22 RARA-negative N=29 Screen for RARA biomarker RARA-positive N=28

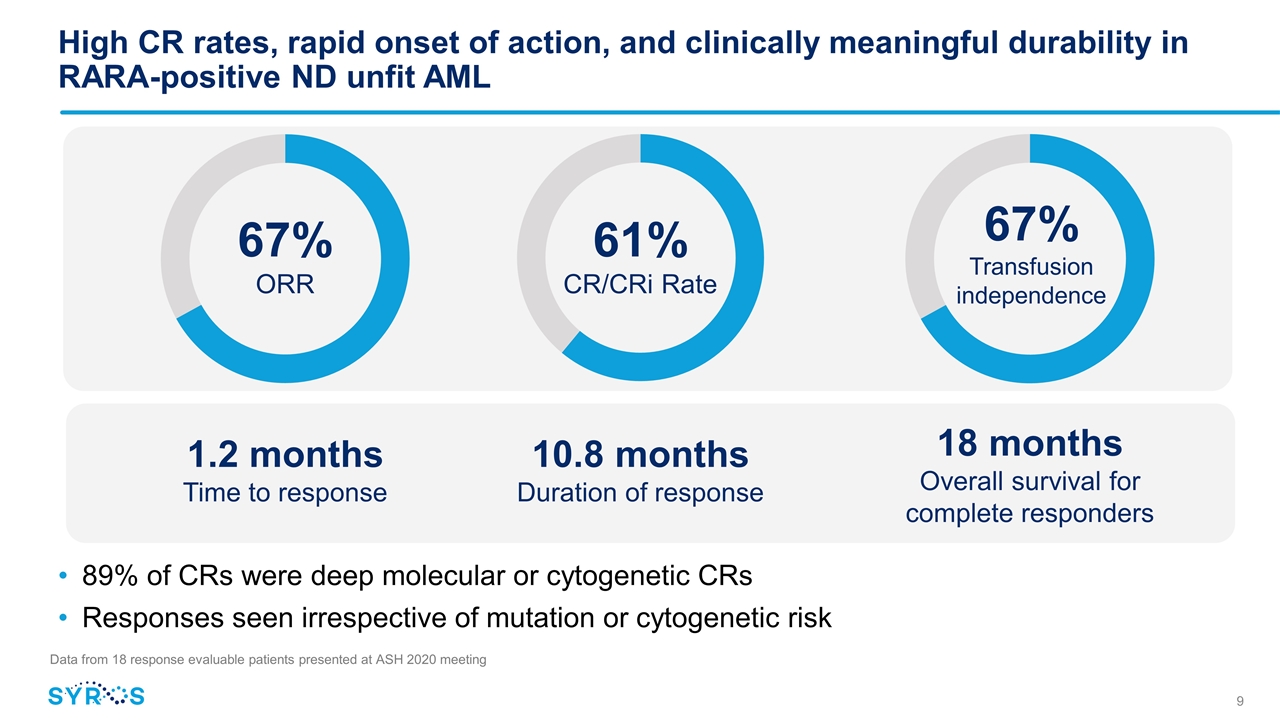

High CR rates, rapid onset of action, and clinically meaningful durability in RARA-positive ND unfit AML 89% of CRs were deep molecular or cytogenetic CRs Responses seen irrespective of mutation or cytogenetic risk 1.2 months Time to response 10.8 months Duration of response 18 months Overall survival for complete responders Data from 18 response evaluable patients presented at ASH 2020 meeting 61% CR/CRi Rate 67% Transfusion independence 67% ORR

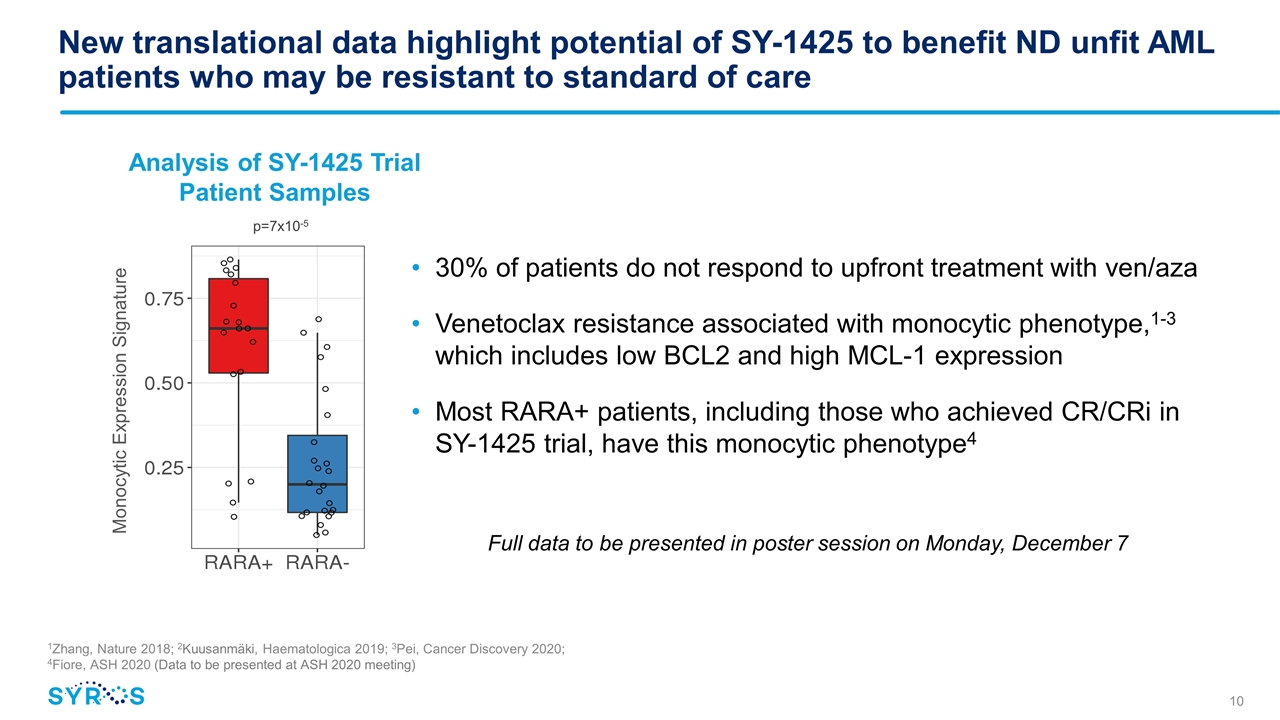

New translational data highlight potential of SY-1425 to benefit ND unfit AML patients who may be resistant to standard of care 30% of patients do not respond to upfront treatment with ven/aza Venetoclax resistance associated with monocytic phenotype,1-3 which includes low BCL2 and high MCL-1 expression Most RARA+ patients, including those who achieved CR/CRi in SY-1425 trial, have this monocytic phenotype4 Analysis of SY-1425 Trial Patient Samples Monocytic Expression Signature p=7x10-5 1Zhang, Nature 2018; 2Kuusanmäki, Haematologica 2019; 3Pei, Cancer Discovery 2020; 4Fiore, ASH 2020 (Data to be presented at ASH 2020 meeting) Full data to be presented in poster session on Monday, December 7

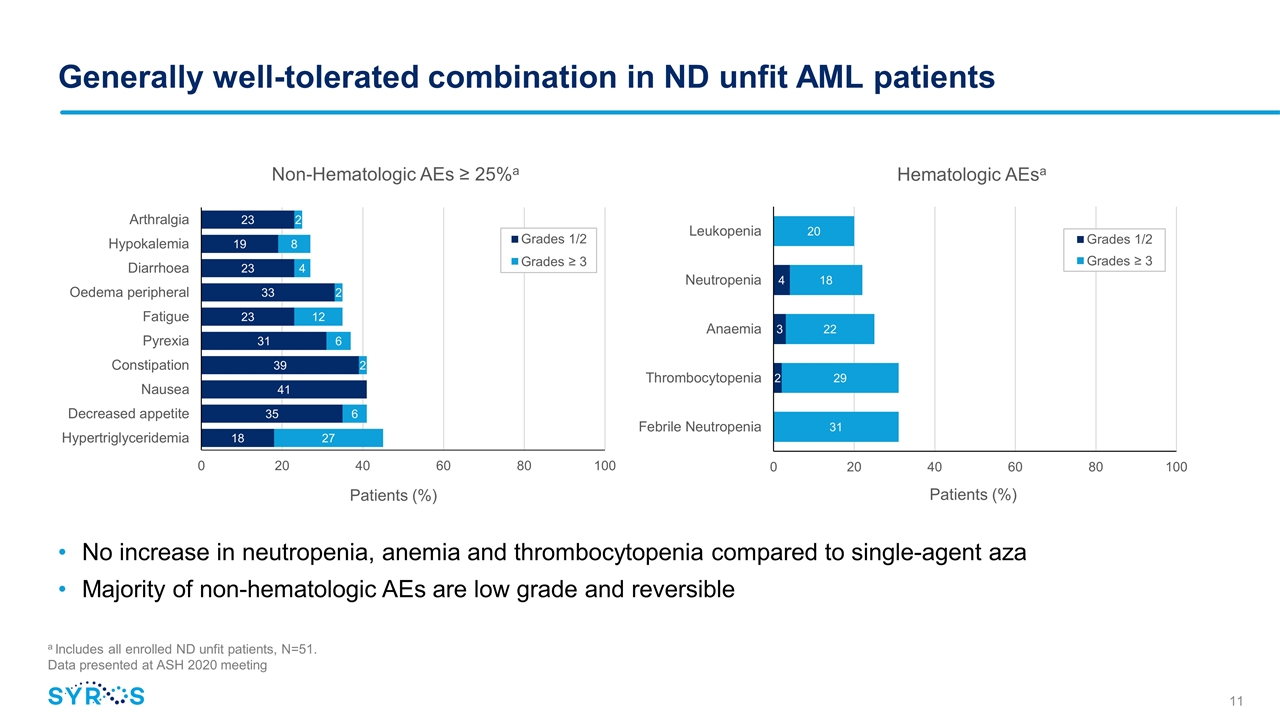

Generally well-tolerated combination in ND unfit AML patients No increase in neutropenia, anemia and thrombocytopenia compared to single-agent aza Majority of non-hematologic AEs are low grade and reversible a Includes all enrolled ND unfit patients, N=51. Data presented at ASH 2020 meeting

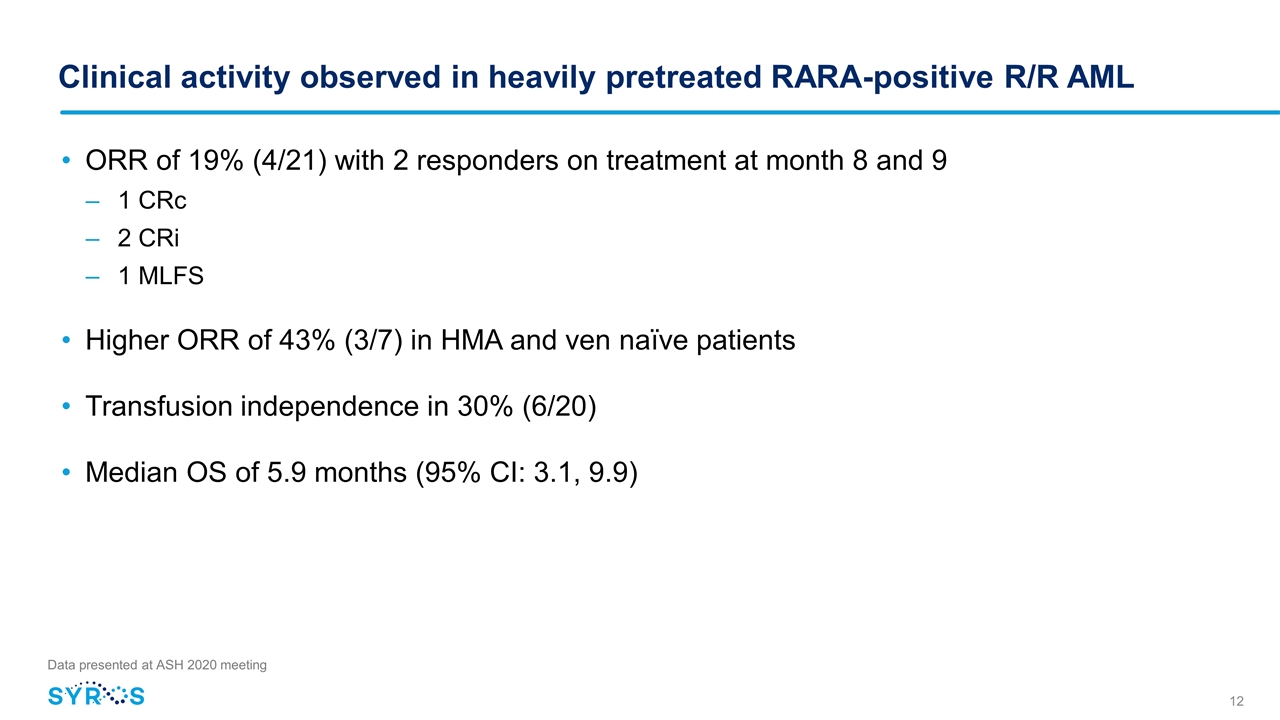

Clinical activity observed in heavily pretreated RARA-positive R/R AML ORR of 19% (4/21) with 2 responders on treatment at month 8 and 9 1 CRc 2 CRi 1 MLFS Higher ORR of 43% (3/7) in HMA and ven naïve patients Transfusion independence in 30% (6/20) Median OS of 5.9 months (95% CI: 3.1, 9.9) Data presented at ASH 2020 meeting

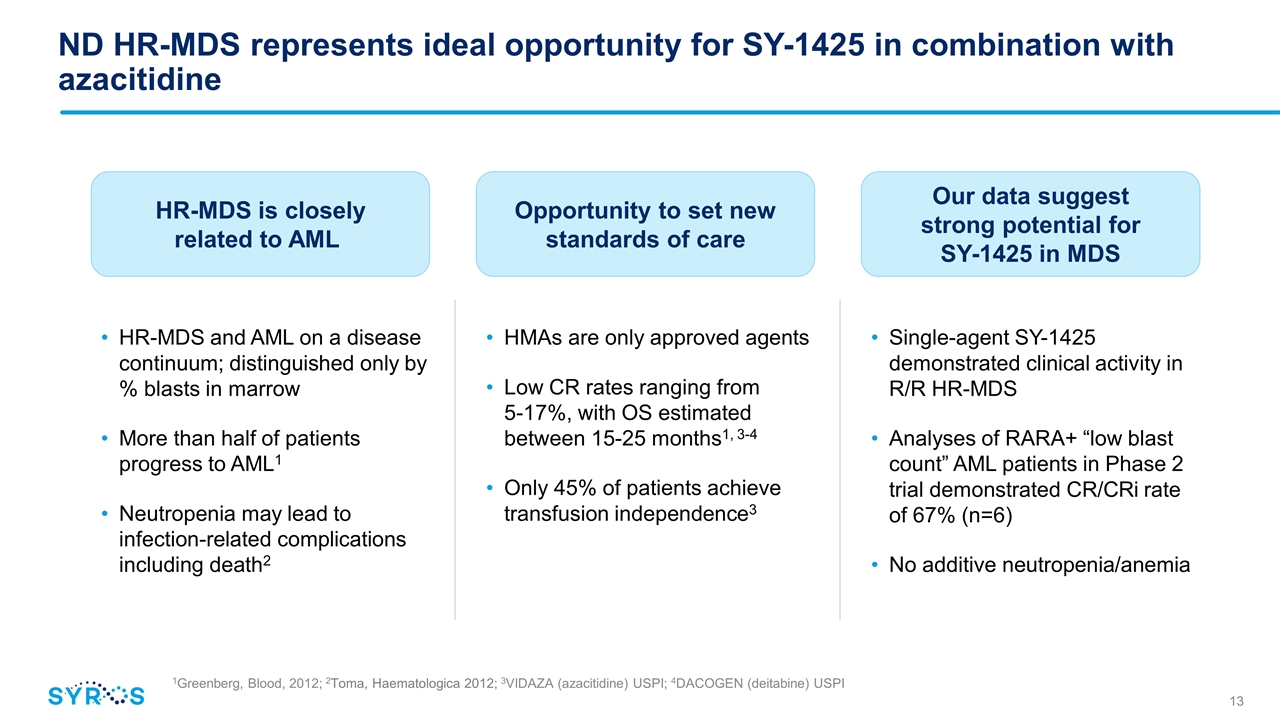

ND HR-MDS represents ideal opportunity for SY-1425 in combination with azacitidine HR-MDS and AML on a disease continuum; distinguished only by % blasts in marrow More than half of patients progress to AML1 Neutropenia may lead to infection-related complications including death2 HR-MDS is closely related to AML HMAs are only approved agents Low CR rates ranging from 5-17%, with OS estimated between 15-25 months1, 3-4 Only 45% of patients achieve transfusion independence3 Opportunity to set new standards of care Single-agent SY-1425 demonstrated clinical activity in R/R HR-MDS Analyses of RARA+ “low blast count” AML patients in Phase 2 trial demonstrated CR/CRi rate of 67% (n=6) No additive neutropenia/anemia Our data suggest strong potential for SY-1425 in MDS 1Greenberg, Blood, 2012; 2Toma, Haematologica 2012; 3VIDAZA (azacitidine) USPI; 4DACOGEN (deitabine) USPI

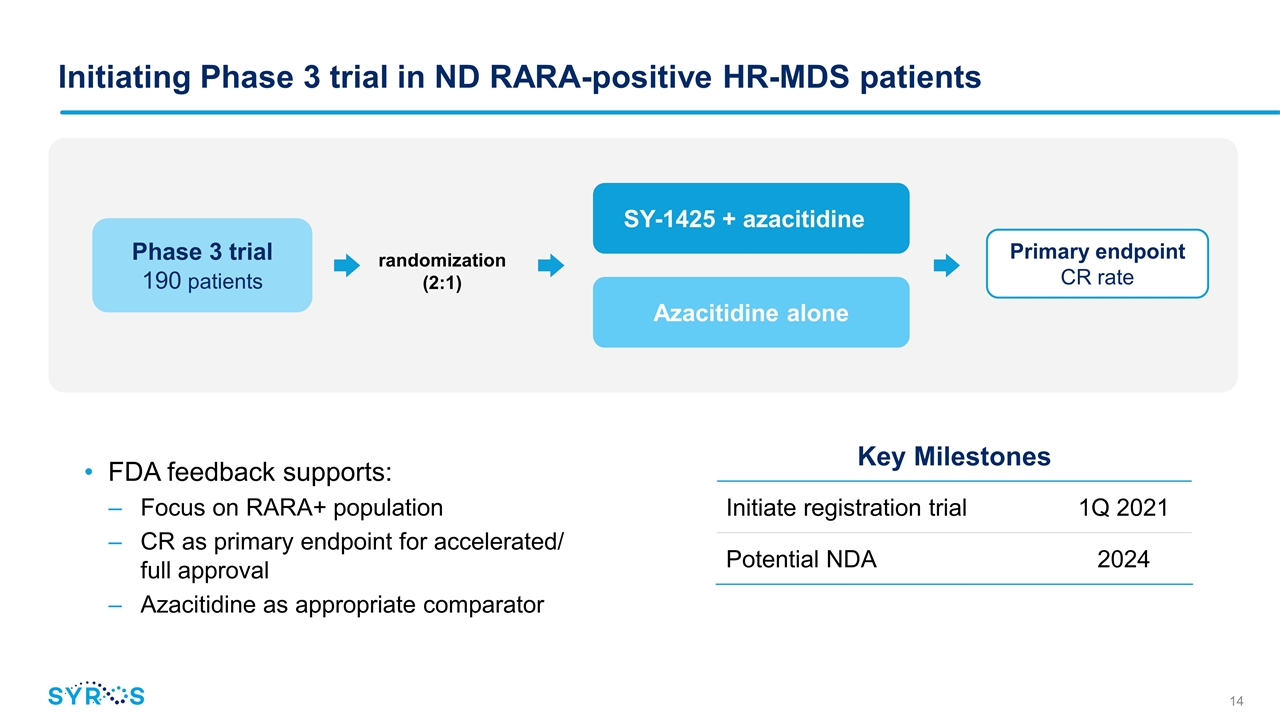

Initiating Phase 3 trial in ND RARA-positive HR-MDS patients FDA feedback supports: Focus on RARA+ population CR as primary endpoint for accelerated/ full approval Azacitidine as appropriate comparator Key Milestones Initiate registration trial 1Q 2021 Potential NDA 2024 Phase 3 trial 190 patients randomization (2:1) SY-1425 + azacitidine Azacitidine alone Primary endpoint CR rate

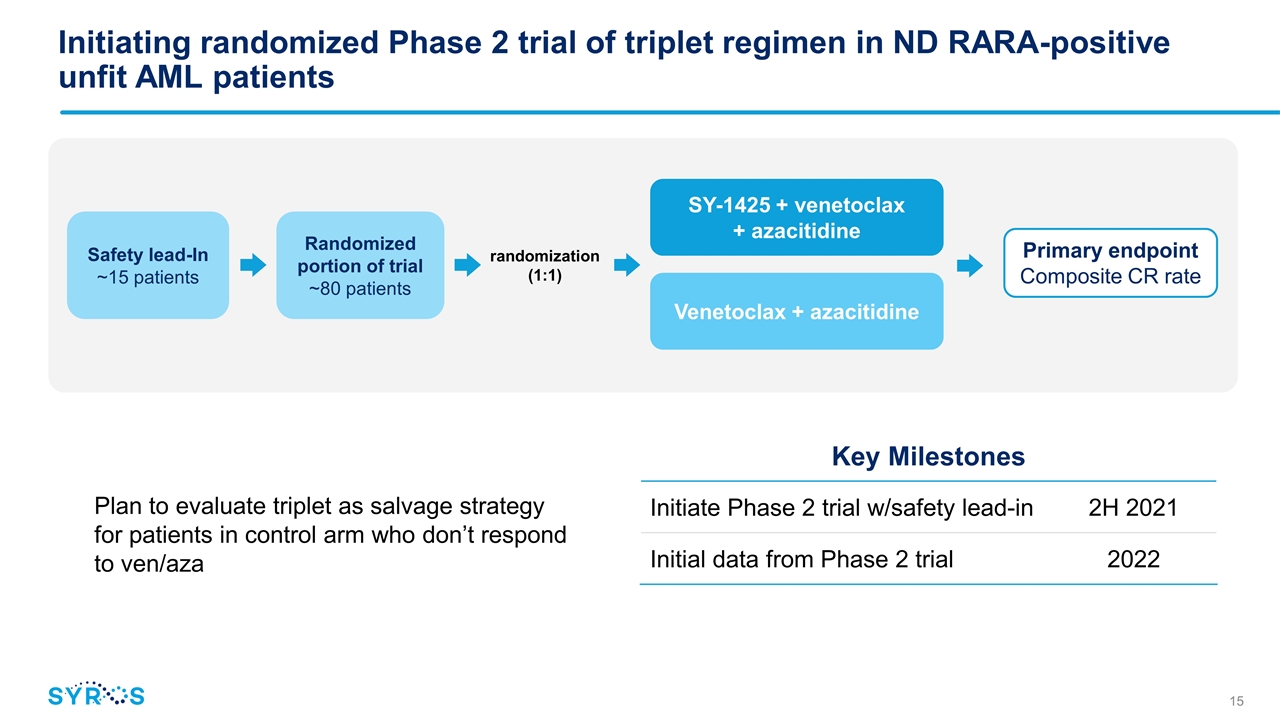

Randomized portion of trial ~80 patients SY-1425 + venetoclax + azacitidine Venetoclax + azacitidine randomization (1:1) Safety lead-In ~15 patients Initiating randomized Phase 2 trial of triplet regimen in ND RARA-positive unfit AML patients Plan to evaluate triplet as salvage strategy for patients in control arm who don’t respond to ven/aza Key Milestones Initiate Phase 2 trial w/safety lead-in 2H 2021 Initial data from Phase 2 trial 2022 Primary endpoint Composite CR rate

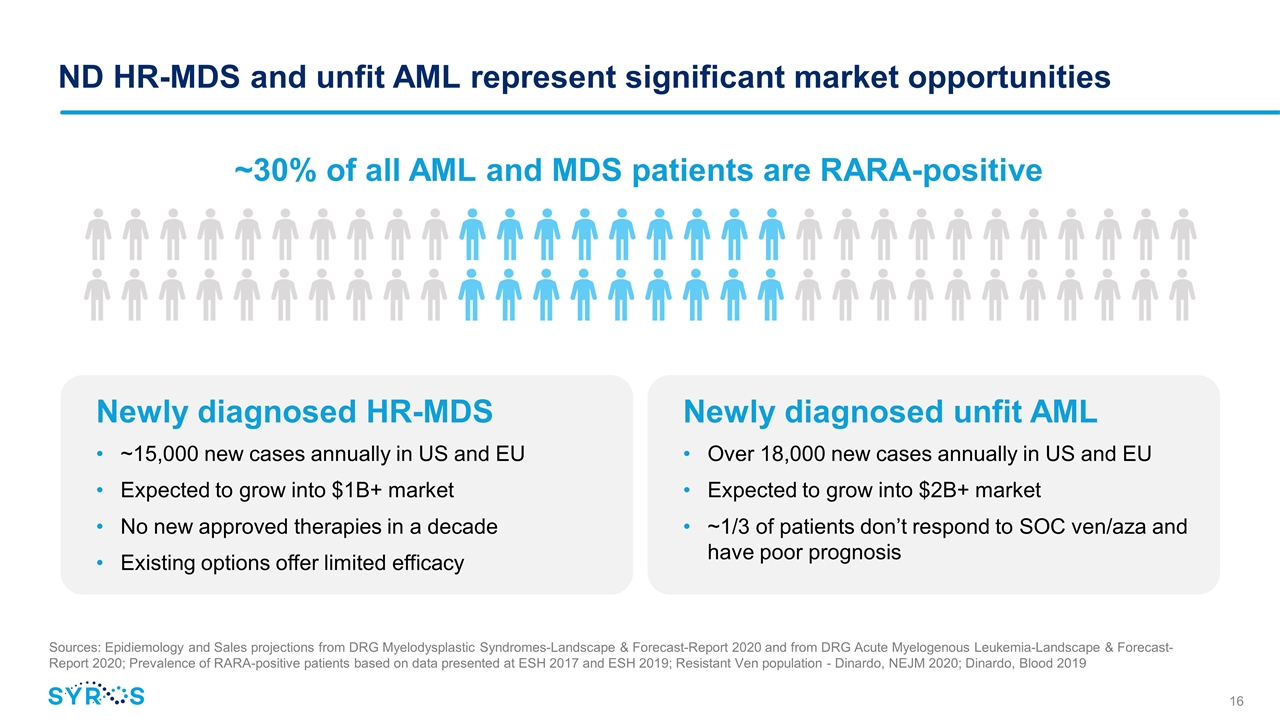

ND HR-MDS and unfit AML represent significant market opportunities ~30% of all AML and MDS patients are RARA-positive Newly diagnosed HR-MDS ~15,000 new cases annually in US and EU Expected to grow into $1B+ market No new approved therapies in a decade Existing options offer limited efficacy Sources: Epidiemology and Sales projections from DRG Myelodysplastic Syndromes-Landscape & Forecast-Report 2020 and from DRG Acute Myelogenous Leukemia-Landscape & Forecast-Report 2020; Prevalence of RARA-positive patients based on data presented at ESH 2017 and ESH 2019; Resistant Ven population - Dinardo, NEJM 2020; Dinardo, Blood 2019 Newly diagnosed unfit AML Over 18,000 new cases annually in US and EU Expected to grow into $2B+ market ~1/3 of patients don’t respond to SOC ven/aza and have poor prognosis

SY-2101: Highly synergistic with our advancing targeted heme franchise Strategic opportunity as we accelerate toward becoming a commercial-stage company Potential to become standard of care in APL Novel oral capsule of arsenic trioxide (ATO) Clinical-stage asset with opportunity for accelerated approval based on molecular CR Potential NDA filing in 2024 Orphan drug designation granted in US and EU Issued patents provide opportunity to extend exclusivity Capitalizes on our expertise to build a leadership position in targeted therapies for hematologic disorders

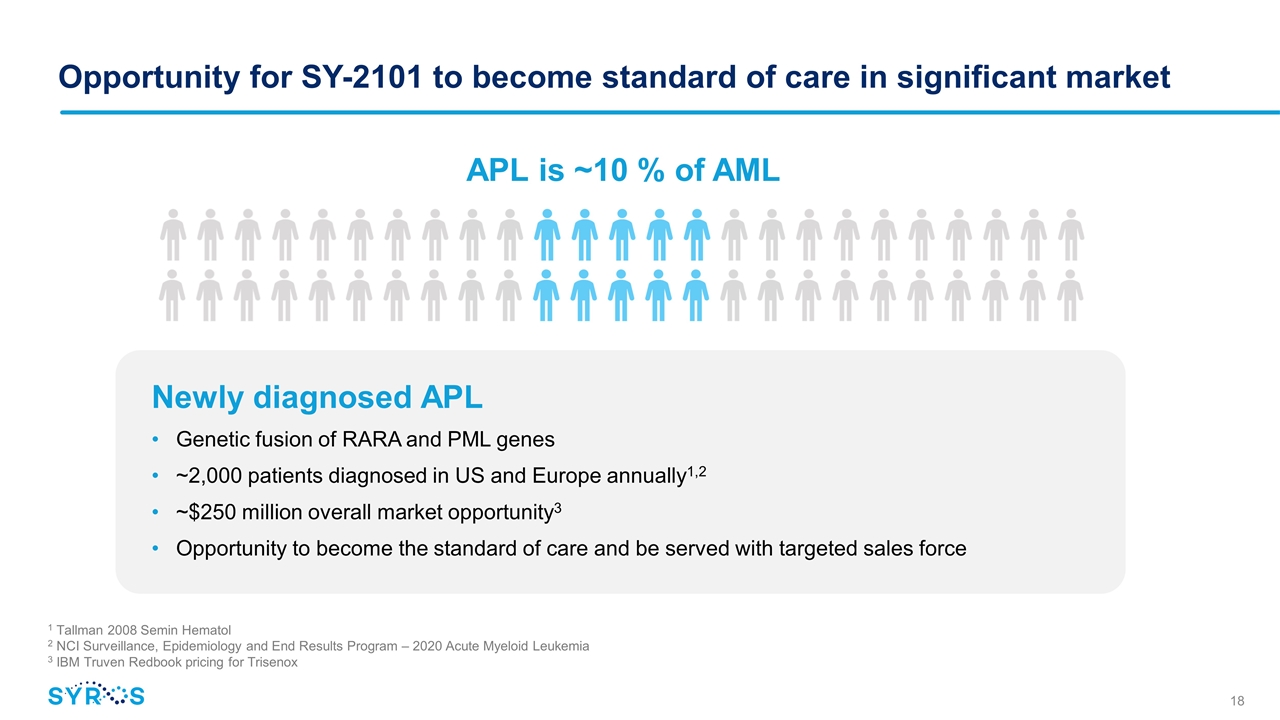

Opportunity for SY-2101 to become standard of care in significant market APL is ~10 % of AML Newly diagnosed APL Genetic fusion of RARA and PML genes ~2,000 patients diagnosed in US and Europe annually1,2 ~$250 million overall market opportunity3 Opportunity to become the standard of care and be served with targeted sales force 1 Tallman 2008 Semin Hematol 2 NCI Surveillance, Epidemiology and End Results Program – 2020 Acute Myeloid Leukemia 3 IBM Truven Redbook pricing for Trisenox

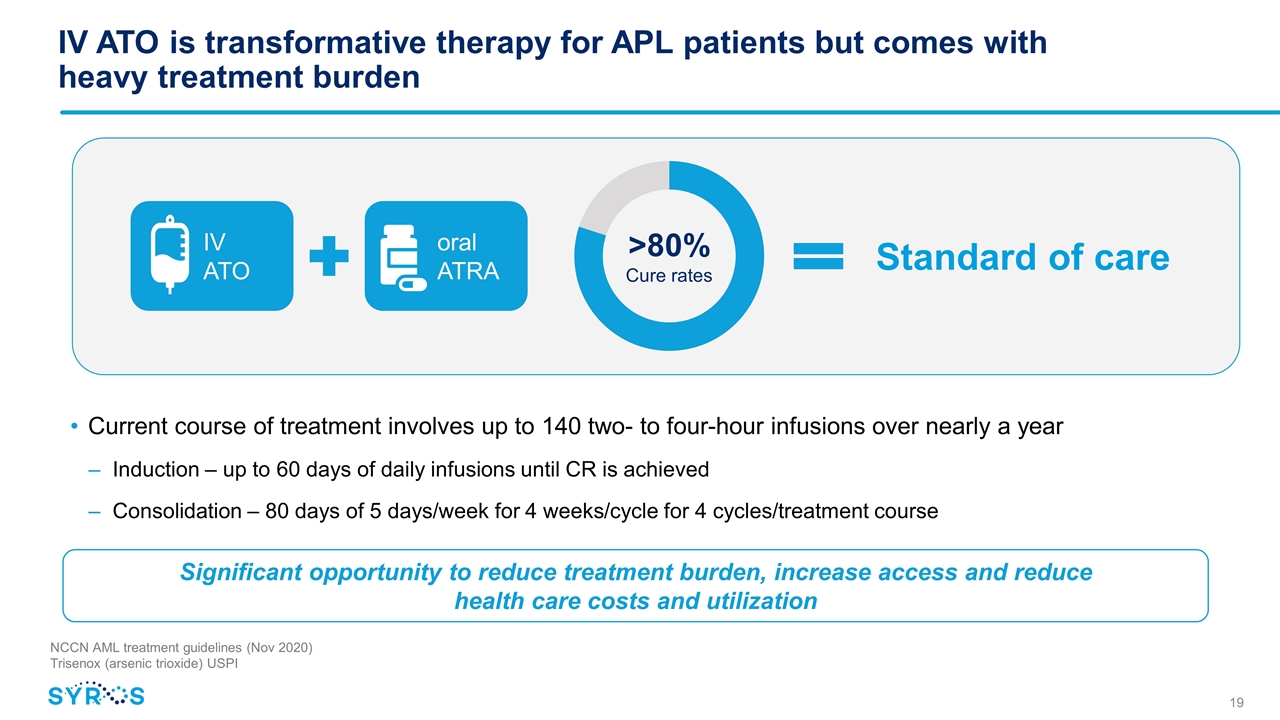

IV ATO is transformative therapy for APL patients but comes with heavy treatment burden >80% Cure rates IV ATO oral ATRA Significant opportunity to reduce treatment burden, increase access and reduce health care costs and utilization Current course of treatment involves up to 140 two- to four-hour infusions over nearly a year Induction – up to 60 days of daily infusions until CR is achieved Consolidation – 80 days of 5 days/week for 4 weeks/cycle for 4 cycles/treatment course NCCN AML treatment guidelines (Nov 2020) Trisenox (arsenic trioxide) USPI Standard of care

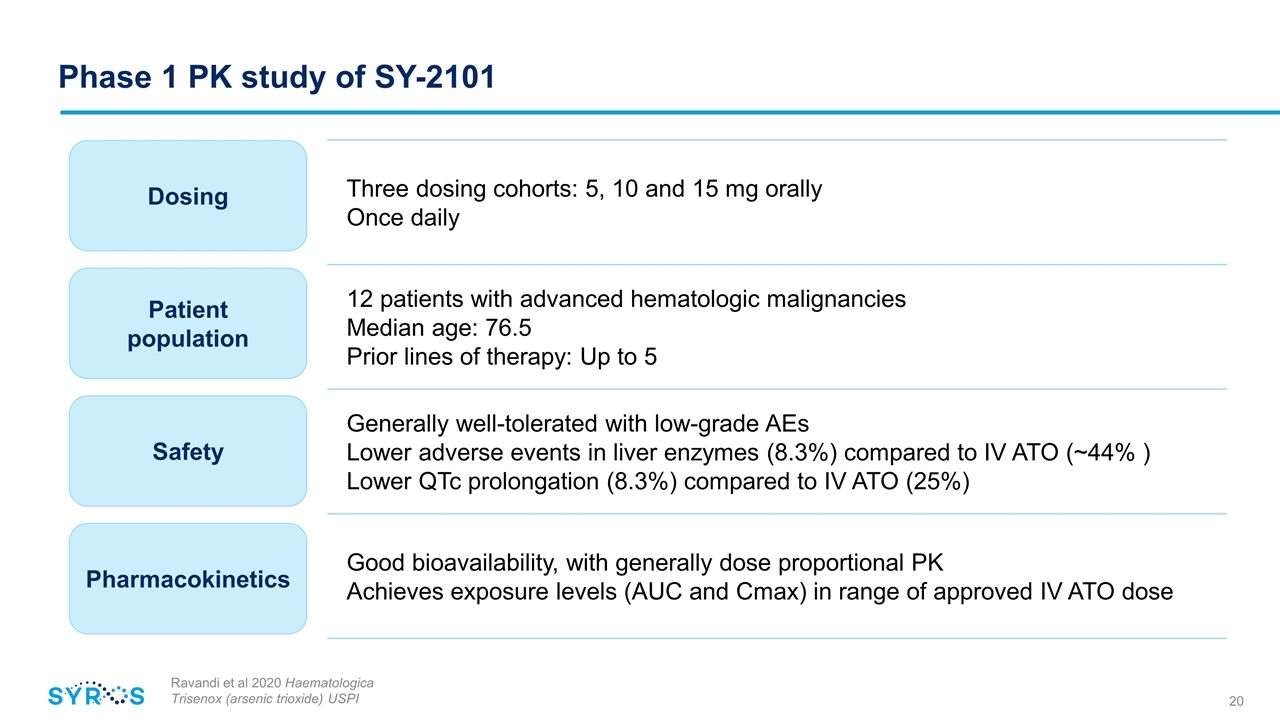

Phase 1 PK study of SY-2101 Ravandi et al 2020 Haematologica Trisenox (arsenic trioxide) USPI Three dosing cohorts: 5, 10 and 15 mg orally Once daily 12 patients with advanced hematologic malignancies Median age: 76.5 Prior lines of therapy: Up to 5 Generally well-tolerated with low-grade AEs Lower adverse events in liver enzymes (8.3%) compared to IV ATO (~44% ) Lower QTc prolongation (8.3%) compared to IV ATO (25%) Good bioavailability, with generally dose proportional PK Achieves exposure levels (AUC and Cmax) in range of approved IV ATO dose Dosing Patient population Safety Pharmacokinetics

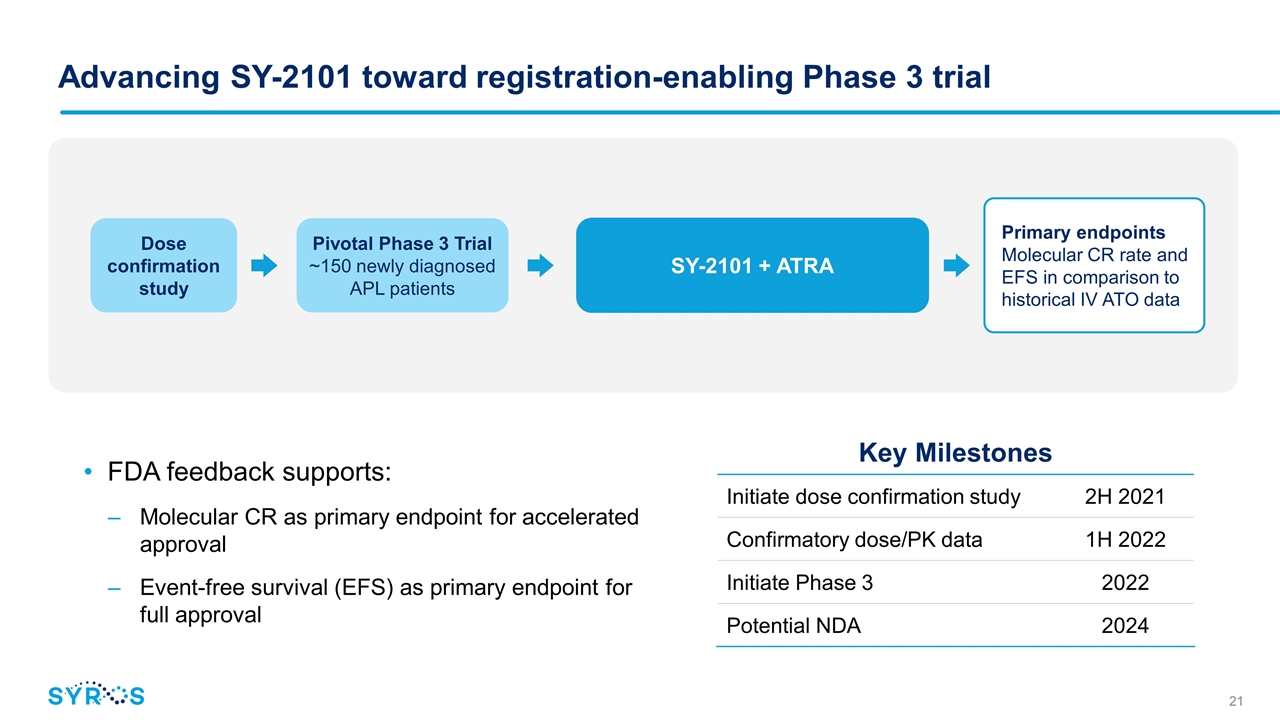

Advancing SY-2101 toward registration-enabling Phase 3 trial FDA feedback supports: Molecular CR as primary endpoint for accelerated approval Event-free survival (EFS) as primary endpoint for full approval Dose confirmation study SY-2101 + ATRA Pivotal Phase 3 Trial ~150 newly diagnosed APL patients Primary endpoints Molecular CR rate and EFS in comparison to historical IV ATO data Key Milestones Initiate dose confirmation study 2H 2021 Confirmatory dose/PK data 1H 2022 Initiate Phase 3 2022 Potential NDA 2024

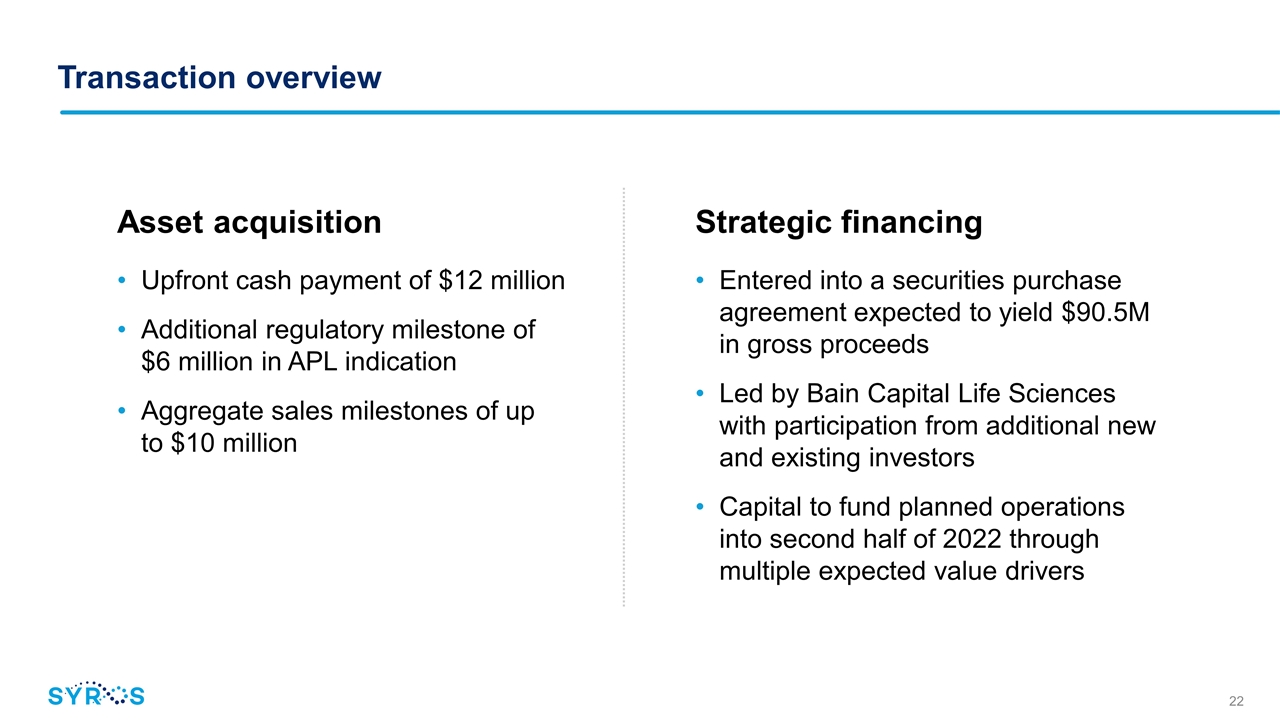

Transaction overview Asset acquisition Upfront cash payment of $12 million Additional regulatory milestone of $6 million in APL indication Aggregate sales milestones of up to $10 million Strategic financing Entered into a securities purchase agreement expected to yield $90.5M in gross proceeds Led by Bain Capital Life Sciences with participation from additional new and existing investors Capital to fund planned operations into second half of 2022 through multiple expected value drivers

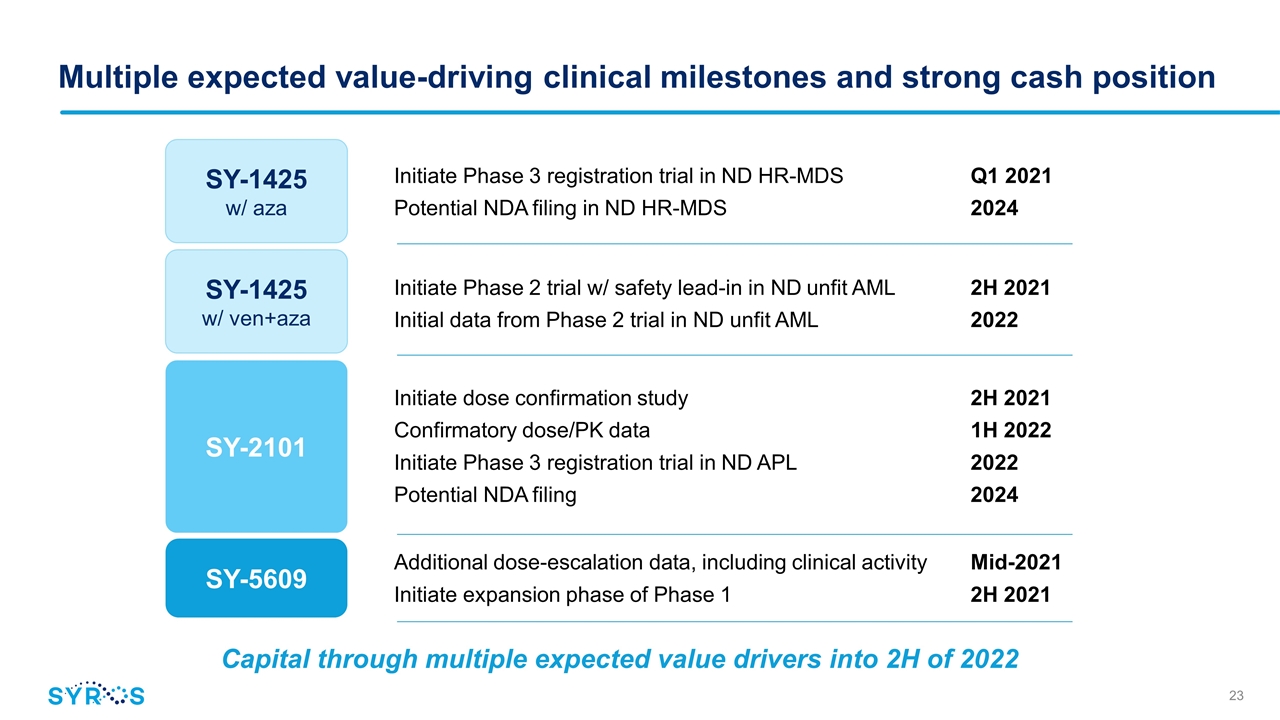

Multiple expected value-driving clinical milestones and strong cash position SY-5609 SY-2101 SY-1425 w/ aza SY-1425 w/ ven+aza Initiate Phase 3 registration trial in ND HR-MDS Q1 2021 Potential NDA filing in ND HR-MDS 2024 Initiate Phase 2 trial w/ safety lead-in in ND unfit AML2H 2021 Initial data from Phase 2 trial in ND unfit AML2022 Initiate dose confirmation study 2H 2021 Confirmatory dose/PK data 1H 2022 Initiate Phase 3 registration trial in ND APL 2022 Potential NDA filing 2024 Additional dose-escalation data, including clinical activity Mid-2021 Initiate expansion phase of Phase 1 2H 2021 Capital through multiple expected value drivers into 2H of 2022